UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended January 31, 2008

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-31989

CONVERA CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | | 54-1987541 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | 1921 Gallows Road, Suite 200, Vienna, Virginia | 22182 |

| | (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (703) 761 - 3700

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to the filing requirements for the past 90 days. Yes ü No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. __

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer Accelerated Filer ü Non-Accelerated Filer Smaller reporting company__

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No ü

The aggregate market value of the voting stock held by non-affiliates of the registrant as of July 31, 2007 (based on the closing sales price as reported on the NASDAQ National Market System) was $101,792,183.

The number of shares outstanding of the registrant's Class A common stock as of March 12, 2008 was 53,291,194.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2008 Annual Meeting of Shareholders are incorporated by reference into Part III.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JANUARY 31, 2008

TABLE OF CONTENTS

| | | Page |

| | PART I | |

| Item 1. | | 1 |

| Item 1A. | | 6 |

| Items 1B. | | 12 |

| Item 2. | | 12 |

| Item 3. | | 12 |

| Item 4. | | 12 |

| | PART II | |

| Item 5. | | 13 |

| Item 6. | | 15 |

| Item 7. | | 16 |

| Item 7A. | | 25 |

| Item 8. | | 25 |

| Item 9 | | 25 |

| Item 9A. | | 25 |

| Item 9B. | | 28 |

| | PART III | |

| Item 10. | | 28 |

| Item 11. | | 28 |

| Item 12 | | 28 |

| Item 13. | | 28 |

| Item 14. | | 28 |

| | PART IV | |

| Item 15. | | 29 |

FORWARD-LOOKING STATEMENTS

The statements contained in this annual report on 10-K that are not purely historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 (“Exchange Act”), including without limitation statements about the expectations, beliefs, intentions or strategies regarding the future of Convera Corporation (hereinafter referred to as “Convera,” “we,” “us” and “our” through this document). Words such as “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” and similar expressions are used to identify these forward-looking statements. These include, among others, statements regarding our future expectations, performance, plans and prospects as well as assumptions about future events. All forward-looking statements included in this annual report are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. The forward-looking statements contained herein involve risks and uncertainties discussed under the heading “Risk Factors” below. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of such factors, including those set forth in this annual report.

OVERVIEW

Convera provides vertical search services to trade publishers. Our technology and services help publishers to build a loyal online community and increase their internet advertising revenues. With the use of our vertical search services, our customers can create search engines customized to meet the specialized information needs of their audience by combining publisher proprietary content with an authoritative subset of the World Wide Web (“the Web”.) The result is a more relevant and comprehensive search experience for the user designed to drive traffic to the publishers’ websites. We generate our revenues by receiving a percentage of publishers’ advertising revenues earned by the search sites and by charging minimum fees for our vertical search services. Many of our contracts with publishers contain minimum fees that we are entitled to receive until website advertising revenue generated by the publishers’ search sites exceeds these minimum amounts. We can also generate revenues from hosting publisher websites and from providing technical staff training. We offer professional services to customize publisher websites and optimize search engines, as well as website monetization consulting.

The first publisher search site using our vertical search services was launched in November 2006. With the sale of our RetrievalWare Enterprise Search business (“Enterprise Search”) completed, we are now focused exclusively on executing our vertical search services (previously entitled our Excalibur web hosting product) business strategy. Our sales and marketing efforts are targeting the top 50 business-to-business (“B2B”) publishers in both the United States and United Kingdom, with the goal of building the largest collection of search-based professional user websites on the internet.

On March 31, 2007, we agreed to sell the assets of our Enterprise Search business to Fast Search & Transfer (“FAST”) for $23.0 million. The transaction closed on August 9, 2007, with FAST assuming certain obligations of the business and retaining certain employees serving our Enterprise Search customers. More information about the transaction can be found in Note 2, “Discontinued Operations” of our Consolidated Financial Statements.

Convera was formed through the merger of the former Excalibur Technologies and the Intel Interactive Media Services Division on December 21, 2000. Convera is traded on the NASDAQ stock market (CNVR) and is headquartered at 1921 Gallows Road, Vienna, VA 22182. Our main corporate telephone number is (703) 761-3700.

As of January 31, 2008 and 2007, Allen Holding, Inc., together with Allen & Company Incorporated, Herbert A Allen and certain related parties (collectively “Allen & Company”) beneficially owned approximately 42% of the voting power of Convera and hold three seats on the Board of Directors, and would therefore be able to influence the outcome of matters requiring a stockholder vote.

BUSINESS STRATEGY

The information needs of business, professional and enthusiast communities are typically serviced by specialist publishers. The B2B publisher market has thousands of printed periodicals that are distributed to industry professionals. As these communities migrate online, the publishing industry will need to transition its revenues away from a primary dependence on print advertising and subscriptions to online advertising revenue. Our vertical search and advertising services are designed to help publishers attract and build a loyal user base for the publisher’s online vertical community and generate additional advertising revenues, thereby assisting them with this transition.

A more relevant and precise search alternative to the general consumer search engines, our vertical search services address the unique vocabulary and authoritative content requirements of vertical audiences, such as professional, medical, scientific and technical communities. We work with the editorial team of a publication to develop a whitelist of authoritative websites that are highly relevant to each vertical market. These can include public, private, government, trade association, social, community and subscription sites. Our Web Search Platform deeply mines all the sites and adjusts the crawl strategies to keep content updated as required by the publisher. The content is then enhanced with taxonomies and other navigation tools that are seamlessly integrated into the publisher’s website. These features allow the Web search results using our vertical search services to be extremely focused, relevant search results for topics of significant interest to the target audience of each publication. Professional users of these sites are consequently able to become more efficient and effective in performing their work.

As B2B publishers transition from traditional media to online media, so will advertising spending. Ad agencies and planners need to be able to reach high-value, unique users within an online professional community, particularly as consumer search engines are transforming media advertising revenues to commodity levels. Our vertical search services enhance a publisher’s advertising proposition by delivering to advertisers a highly specific target audience. In addition, the advertising services incorporated into our vertical search offering allow publishers to directly manage and pursue search-based advertising revenues for their websites.

Our revenue strategy is to execute vertical search services agreements wherein we receive a percentage of customer search-related advertising revenue (typically between 20% and 50% of net advertising revenues). Our new and renewal publisher contracts will typically contain a monthly minimum fee for each vertical market served that we will be entitled to receive until our share of the website’s advertising revenues surpasses the minimum fee. We can also generate professional services fees from delivering consulting and training to our customers, and from website hosting services.

PRODUCTS AND SERVICES

We provide publishers with our vertical search technology on a “software as a service” basis. Our vertical search service is designed to help publishers deliver unique value to their online community by customizing the search experience to meet the specialized information needs of the publisher’s audience. The targeted search solution enables publishers to further engage their audiences and increase online advertising revenue. We provide the technical infrastructure, search expertise and best practice advice required to build vertical search applications. The publisher provides the insight into the information needs of the target community, which is used to customize the look, feel and functionality of the search experience to the needs of that community. The result is a search application that yields a blended result to a user query - incorporating information from the Web at large, as well as from an authoritative subset of Web content and multiple proprietary sources. End users are presented with more relevant search results in a comprehensive, consolidated manner, regardless of the repository source or location. Search results can be presented to the user through an intuitive and dynamic page layout that is designed, controlled and branded by the publisher. Our vertical search offering can be integrated into one or more of the publisher’s existing websites or used to establish a new brand or product. As an option, we can host the search results but still present the results under the publisher’s brand. Our advertising server capabilities, which are built into our Web Search Platform, allow us to serve any type of ad and measure all key analytics.

We offer the following services:

Vertical Search Service

Our vertical search service is an integrated suite of the following components:

Convera Web Search Platform

Leveraging our fifteen years of search customization experience in the secure government sector, our Web Search Platform was built using semantic processing technologies to enhance the search experience. It incorporates a large set of commercially recognized taxonomies in addition to privately compiled taxonomies and thesauri to create a large and very granular Web index. This core design feature allows the platform to draw dynamic connections between topically or contextually related content, resulting in a better understanding of the nature of the query along with the relevancy of the content. Our platform is capable of supporting hundreds of simultaneous vertical search applications provided under 24X7 service level agreements. The plan is to extend our vertical search capabilities across multiple lingual content including Spanish, French, German, Dutch, Portuguese, Chinese, Japanese, and Korean. This is facilitated through a large-scale translation operation that translates concepts and terminology into their cross-lingual equivalents. This means that the millions of categories and related semantic resources applied to understanding content in one language are reproduced and consistently applied to understanding the content of other languages - uniformly and reliably delivering authoritative results across multiple languages. Our Web Search Platform incorporates multimedia search of Adobe Systems Portable Document Format (PDF), image files and other data formats. Our multimedia image crawler also identifies images and associated descriptive information (meta data) to enable highly relevant search results across various media types available on the Web. This insures that the crawler retrieves and displays relevant information from news or video archives, as well as other multimedia repositories.

Publisher Control Panel (PCP)

Our Publisher Control Panel is a self-service application that provides the publisher with the ability to control and tailor the Convera Web Search Platform and the Convera Ad Service for each vertical search site from a single interface. Each publisher’s initial vertical search site is readied for launch by the publisher team using the PCP. Each initial vertical application launch is managed and mentored by a member of our implementation team. The publisher receives hands-on training from the Convera implementation team on the use, management and customization of the vertical search site using the PCP tools. This hands-on training allows a publisher to easily set-up additional vertical search sites and administer a combined website and best-of-Web search experience designed to meet the specific information needs of the publisher’s audience.

Using the PCP, publishers can customize search categories, manage the look and feel of their vertical search sites, manage whitelists containing the index of websites to search, customize relevance ranking schemes and the presentation of search results each employing the easy to use tools and interfaces. The publisher also uses the PCP to insert advertisements into the vertical search sites using the Convera Ad Service. The PCP also serves as a dashboard for each vertical site, containing search analytics and content analytics tools. It provides the publisher with various usage and other reports to help them steer each online vertical community to optimize the publisher’s goal for its online community supported by the vertical site.

Convera Ad Service (CAS)

Our Convera Ad Service allows publishers to directly manage and pursue search-based advertising revenues for their vertical search websites. CAS connects the publisher websites directly with the providers of advertising inventory, enhancing publishers’ abilities to increase their web advertising revenues, supporting the insertion, tracking and billing of a variety of ad pricing models including banner ads, tenancy ads, search term ads and click-through advertisements.

Professional Services

We offer a range of professional services aimed at ensuring the publisher’s vertical search application is a success in terms of increasing website traffic and generating online advertising revenue. The services include website customization; search engine optimization, marketing services and training; and advertising sales kit development and training.

MARKETING AND DISTRIBUTION

Our vertical search offering is sold as a hosted service through a direct sales force located in the United States and United Kingdom. We are also exploring the prospect of strategic partners such as large advertising agencies or resellers who may provide increased distribution capabilities, access to incremental human resources and possible hosting facility alternatives. As previously disclosed above, our sales efforts are focused principally on the top 50 B2B publishers in the United States and United Kingdom. The top 50 publishers have an estimated 2,000-plus relevant magazine titles that could be converted to search-based sites and subscribers totaling more than two million professionals.

Our marketing efforts focus on building brand awareness and establishing demand for our vertical search services through public relations campaigns, trade association memberships and electronic marketing campaigns. As our customer references and reputation in the vertical search market increase, we expect word-of-mouth to accelerate our growth. Our website, www.convera.com, is an integral part of our marketing and sales efforts, but information on our website is not a part of this Form 10-K. Through the website, prospective customers can learn about our vertical search services and be connected to the websites of current customers utilizing our services.

RESEARCH AND DEVELOPMENT

Our research and development program focuses on enhancing and expanding the capabilities of our vertical search services to address emerging markets and customer requirements. Certain elements of our developed technologies are provided to us pursuant to license agreements with other independent software vendors. The technologies acquired by the Company in this manner include a language processor, spell checker and FAST Ad Momentum advertising platform. These license agreements have varying terms for which we have made a prepaid royalty payment or purchased a perpetual license.

Our research and development expenses were $4.7 million, $11.0 million, and $3.2 million for the years ended January 31, 2008, 2007, and 2006, respectively.

INTELLECTUAL PROPERTY AND PROPRIETARY TECHNOLOGY

We regard our software as proprietary and rely primarily on a combination of patents, copyright, trademark and trade secret laws of general applicability, employee confidentiality and invention assignment agreements, and other intellectual property protection methods to safeguard our technology. We hold one patent related to our current business strategy. This patent, which concerns multimedia document retrieval, expires on August 24, 2018. We are actively engaged in seeking additional patents specifically related to our vertical search offering. We have undertaken to protect all significant marks used to identify our core services. We own U.S. trademark registrations or pending applications for our material trademarks, including CONVERA and THE VERTICAL SEARCH COMPANY. Renewals are due at various dates between July 2008 and August 2013. In addition, we own numerous foreign applications and registrations for our material trademarks.

COMPETITION

Our business environment is characterized by rapid change and intense competition. We compete primarily within the internet search market. Within this market, there are current competitors who are larger and more established than we are and have significantly greater financial, technical, marketing and other resources. These competitors include established significant technology providers focused on search advertising like Google (CSE) and Yahoo! and those that are moving from a strong industry presence elsewhere into search like Microsoft Live Search. We also face competition from enterprise search software and enterprise search appliance vendors selling their solutions to publishers who are determined to build their own online solution. There are also potential and emerging competitors entering the market with increasingly differentiated technologies.

We believe relevance of search results and implementation ease to be the principal evaluation criteria of potential publisher customers. We consider our principal competitive advantages to be that our vertical search service provides more accurate results due to an extensive semantic network contained in our Web Platform and offers the ability to produce authoritative results through exhaustive ingestion of content sources. Additionally, our Publishers Control Panel offers an easy-to-use, self-service solution to publishers. Virtually no technical expertise is required of the customer. We believe we are currently the only company that offers a complete suite of vertical search capabilities that includes hosting, semantic vertical search, traffic building tools and professional services. There can be no assurance that we will be able to compete successfully against current or future competitors and that competition will not have a material adverse effect on our operating results and financial condition in the future.

SEGMENT AND GEOGRAPHIC AREA FINANCIAL INFORMATION

We have one reportable segment. Prior to our agreement on March 31, 2007 to sell the assets of the Enterprise Search business to FAST, we operated under two reportable segments: the Enterprise Search segment and the vertical search segment (previously entitled our Excalibur web hosting product). Financial information is located in the financial statements beginning on page F-2. The assets and liabilities of the Enterprise Search business have been reported as “assets held for sale” and “liabilities held for sale” on the Consolidated Balance Sheets. Revenue, expenses and cash flows related to the Enterprise Search business have been reflected as discontinued operations in the Consolidated Statements of Operations and of Cash Flows.

All of our revenues are from third-party customers. In the fiscal year ended January 31, 2008, one customer, CMP Information Ltd., accounted for 82% of our revenues. In the fiscal year ended January 31, 2007, three customers accounted for 53%, 29%, and 17% of total revenues, respectively. A single customer accounted for 100% of revenues in fiscal year 2006.

To date, our revenues have been earned principally from customers located in the United Kingdom. For geographic area revenues and long-lived assets information, see Note 12, “Segment Reporting” in the Notes to Consolidated Financial Statements.

EMPLOYEES

We had 76 employees at January 31, 2008. See Item 1A. “Risk Factors” for a discussion of some of the risks we face related to our employees.

AVAILABLE INFORMATION

Our website address is www.convera.com. Through our website, we make available free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material is filed with, or furnished to, the U.S. Securities and Exchange Commission (“SEC”). The contents of our website are not part of, or incorporated into, this document. The SEC also maintains a website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

An investment in our common stock involves substantial risks and uncertainties and our actual results and future trends may differ materially from our past performance due to a variety of factors, including, without limitation, the risk factors identified below. The risks and uncertainties described below are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks actually occur, our business, results of operations and financial condition would suffer. In that event, the trading price of our common stock could decline, and our stockholders may lose part or all of their investment in our common stock. The discussion below and elsewhere in this report also includes forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements as a result of the risks discussed below.

We have had a history of operating losses and will likely incur future losses; if our losses continue and we are unable to achieve profitability, our stock price will likely suffer.

As of January 31, 2008, we had an accumulated deficit of approximately $1.1 billion. We have operated at a loss for each of the past three fiscal years. For the fiscal years ended January 31, 2008, 2007 and 2006, our net losses were approximately $9.1 million, $44.8 million, and $14.3 million, respectively. These financial results include revenues and expenses associated with the Enterprise Search business, the sale of which was completed on August 9, 2007. The loss from continuing operations for the fiscal years ended January 31, 2008, 2007 and 2006 was $27.0 million, $45.3 million and $19.0 million, respectively. We expect that the Company will continue the trend of significant operating losses and uses of cash at least for the short term until the revenue base for our vertical search services grows to sufficient levels to support its expenses. We have a short operating history in the vertical search business; the first Convera supported vertical search site was launched into production in November 2006. Previously, our market strength had been in the government sector, whereas we now compete solely within the commercial sector. In addition, our revenue contracts generally stipulate that we will receive a percentage of website advertising revenues, and online advertising is an immature and rapidly evolving industry. Accordingly, we cannot assure you that we will generate the revenues required to achieve or maintain profitability in the future. You should assess our business in light of the risks, difficulties, uncertainties, and expenses associated with managing and growing a relatively new business in a rapidly evolving market. Our failure to achieve and sustain our profitability will negatively impact the market price of our common stock.

Our ability to achieve profitability is dependent on our vertical search business and if it fails to achieve market acceptance we will be unable to grow our business and achieve profitability.

Our future profitability will depend on our ability to successfully market and achieve market acceptance for our vertical search services offering. The degree of market acceptance will depend upon a number of factors, including:

| · | the advantages of our vertical search services over competing products; |

| · | our ability to innovate and develop new features for our vertical search offering; |

| · | customer needs for search products; |

| · | the price and cost-effectiveness of our vertical search offering; and |

| · | the strength of sales, marketing and distribution support. |

We are aware of a significant number of competing well-established search products offered by companies with significantly greater financial and marketing resources than us. Even if our vertical search services achieve market acceptance, we may not be able to maintain that market acceptance over time if competing products or services are introduced that are viewed as more effective or are more favorably received. If our vertical search services do not achieve and maintain market acceptance, we will not be able to generate sufficient revenue to attain profitability.

While we believe we will have sufficient funds for our operations for at least the next twelve months, it is possible that we will need additional capital during or after that time. If such additional capital is not available to us on acceptable terms or at all, it could harm our financial condition and future prospects.

As of January 31, 2008, our balances of cash and cash equivalents were approximately $36.7 million. We believe our current balance of cash and cash equivalents will be sufficient to meet our working capital and capital expenditure requirements for at least the next twelve months based upon our estimates of funds required to operate our business during such period. However, during or after that time, we may need to raise additional funds for the following purposes:

| | · | to fund our operations, including sales, marketing and research and development programs; |

| | · | to fund any growth we may experience; |

| | · | to enhance and/or expand the range of products and services we offer; |

| | · | to increase our promotional and marketing activities; or |

| | · | to respond to competitive pressures and/or perceived opportunities, such as investment, acquisition and international expansion activities. |

We cannot reassure our investors that if we need additional capital that it will be available, and if so, on terms beneficial to us. Historically, we have obtained external financing primarily from sales of our common stock. To the extent we raise additional capital by issuing equity securities, our stockholders may experience substantial dilution. If we are unable to obtain additional capital, we may then attempt to preserve our available resources by various methods including deferring the creation or satisfaction of commitments, reducing expenditures on our research and development programs or otherwise scaling back our operations. If we were unable to raise such additional capital or defer certain costs as described above, that inability would have an adverse effect on our financial position, results of operations and prospects.

We experience quarterly fluctuations in our operating results, which may adversely affect our stock price.

Our quarterly operating results have varied substantially in the past and will likely continue to vary. With the completion of the FAST transaction and resulting exit of the enterprise search market, our business is evolving as we focus all of our financial and management resources on the vertical search business. Historical operating results may not be useful in predicting our future operating results. The vertical search business has yet to generate revenues in excess of its expenses and is not anticipated to do so for at least the near term. We expect that expenditures will continue to be significant. Our quarterly operating results are likely to continue to vary substantially from quarter to quarter in the future due to a variety of factors including the following:

| · | the ability of our vertical search services to achieve market acceptance; |

| · | the mix in our revenues between subscription fees and contractual minimum revenue amounts and revenues generated as a percentage of publisher website advertising revenues; |

| · | the level of customer demand for our hosting and professional services; |

| · | an increase in competition in the internet search industry; |

| · | the size and timing of individual transactions; |

| · | changes in operating expenses and personnel; |

| · | changes in accounting principles; |

| · | changes in general economic and geo-political conditions and specific economic conditions in the internet search industry; |

| · | fluctuations in the internet advertising budgets of advertisers; and |

| · | seasonality in the spending of internet advertisers. |

We are in an extremely competitive market, and if we fail to compete effectively or respond to rapid technological change, our revenues and market share will be adversely affected.

Our business environment and the search industry in general are characterized by intense competition, rapid technological changes, changes in customer requirements and emerging new market segments. Our competitors include many companies that are larger and more established and have substantially more resources than us and may include start-ups as well. Current and potential competitors have established or may establish cooperative relationships among themselves or with third parties to increase the ability of their products to address the needs of the markets which we serve. Accordingly, it is possible that new competitors or alliances among competitors may emerge and rapidly acquire significant market share.

In order for our strategy to succeed and to remain competitive, we must provide vertical search services that meet the needs of the B2B and specialized publishing companies. We will need to invest significant resources in research and development to provide the publishers with leading-edge search technology to help them deliver unique value to their online community and increase online advertising revenues. To effectively compete we will need to continually improve our current service offerings and innovate by introducing new services that are responsive to the needs of our users. The development efforts required for this are expensive, and we plan to fund these developments with our existing capital resources, and other sources, such as equity issuances and borrowings, which may be available to us. If these developments do not generate substantial revenues, our business and results of operations will be adversely affected. We cannot assure you that we will successfully develop any new products or services, complete them on a timely basis or at all, achieve market acceptance or generate significant revenues with them.

We depend on international sales, particularly in the United Kingdom, and any economic downturn, changes in laws, changes in currency exchange rates or political unrest in the United Kingdom or in other countries could have a material adverse effect on our business.

To date, the majority of revenues related to our business have been derived from publishers in the United Kingdom. For the year ended January 31, 2008, total revenue derived from international sales was approximately $1.0 million, representing approximately 88% of total revenue. For the year ended January 31, 2007, revenue derived from international sales was approximately $0.1 million, representing approximately 53% of total revenue. Our international operations have historically exposed us to longer accounts receivable and payment cycles and fluctuations in currency exchange rates. International sales are made mostly from our U.K. subsidiary and are denominated in British pounds or Euros. As of January 31, 2008, approximately 97% of our total consolidated accounts receivable were denominated in British pounds. Additionally, our exposure to foreign exchange rate fluctuations arises in part from intercompany accounts in which royalties on our foreign subsidiary’s sales are charged to our foreign subsidiary and recorded as intercompany receivables on our books. We are also exposed to foreign exchange rate fluctuations as the financial results of our foreign subsidiary are translated into U.S. dollars in consolidation. Since exchange rates vary, those results when translated may vary from expectations and adversely impact overall expected profitability.

Our international operations expose us to a variety of other risks that could seriously impede our financial condition and growth. These risks include the following:

| | · | potentially adverse tax consequences; |

| | · | difficulties in complying with regulatory requirements and standards; |

| | · | trade restrictions and changes in tariffs; |

| | · | import and export license requirements and restrictions; and |

| | · | uncertainty of the effective protection of our intellectual property rights in certain foreign countries. |

If any of these risks described above materialize, our international sales could decrease and our foreign operations could suffer.

Our vertical search offering relies on a third party hosting facility, and any failure or interruption in the services provided by this third party could harm our ability to operate our business and damage our reputation.

We rely on AT&T to host our vertical search offering. We do not control the operation of the AT&T facility, which may be subject to damage or interruption from earthquakes, floods, fires, power loss, telecommunications failures or similar events. The facility may also be subject to break-ins, sabotage, intentional acts of vandalism or similar misconduct. Despite precautions taken at the facility, the occurrence of a natural disaster, cessation of operations by our third-party web hosting provider or its decision to close the facility without adequate notice or other unanticipated problems at the facility could result in lengthy interruptions in our service. In addition, the failure by the facility to provide our required data communications capacity could result in interruptions in our service. Interruptions in our service may cause us to lose revenue, cause us to issue credits or refunds and cause customers to terminate their contracts with us. Our business and reputation will be adversely affected if our customers and potential customers believe our vertical search service is unreliable.

Because of the technical nature of our business, our intellectual property is extremely important to our business, and adverse changes to our intellectual property could harm our ability to compete.

We believe that our success depends, in part, on our ability to protect our proprietary rights and technology. Historically, we have relied on a combination of copyright, patents, trademark and trade secret laws, employee confidentiality and invention assignment agreements, and other methods to safeguard our technology and software products and services. Risks associated with our intellectual property include the following:

| | · | pending patent applications may not be issued; |

| | · | intellectual property laws may not protect our intellectual property rights; |

| | · | third parties may challenge, invalidate, or circumvent any patent issued to us; |

| | · | rights granted under patents issued to us may not provide competitive advantages to us; |

| | · | unauthorized parties may attempt to obtain and use information that we regard as proprietary despite our efforts to protect our proprietary rights; |

| | · | others may independently develop similar technology or design around any patents issued to us; and |

| | · | effective protection of intellectual property rights may be limited or unavailable in some foreign countries in which we operate. |

We may in the future be subject to intellectual property rights claims, which are costly to defend and could require us to pay damages and could limit our ability to use certain technologies in the future.

Companies in the internet, search and technology industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. We face the possibility of intellectual property rights claims against us. Our technologies may not be able to withstand any third-party claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming, expensive to litigate or settle and could divert management resources and attention.

With respect to any intellectual property rights claim, we may have to pay damages or stop using technology if it is ultimately found by a court to be in violation of a third party’s rights. We may have to seek a license for the technology, which may not be available on reasonable terms and may significantly increase our operating expenses. The technology also may not be available for license to us at all. As a result, we may also be required to develop alternative non-infringing technology, which could require significant effort and expense. If we cannot license or develop technology for the infringing aspects of our business, we may be forced to limit our product and service offerings and may be unable to compete effectively. Any of these results could harm our operating results.

We depend on highly skilled personnel, the loss of whom would adversely affect our ability to effectively grow our business and we may have difficulty attracting and retaining skilled employees.

Our success depends to a significant degree upon the continued contributions of our key management and other highly skilled individuals. We generally do not utilize employment agreements for our key employees. The loss of the services of one or more key employees could have a material adverse effect on our ability to grow our business. We also believe that our future success will depend in large part upon our ability to attract and retain additional highly skilled personnel for all areas of our business. Competition for personnel within the internet and search industries is intense. There can be no assurance that we will be successful in attracting and retaining such personnel.

Our stock price may fluctuate which may make it difficult to resell shares of our stock.

The market price of our common stock has been highly volatile. For example, in the fiscal year ended January 31, 2008, the market price per share of our common stock ranged from $2.00 to $4.75. This volatility may adversely affect the price of our common stock, and our stockholders may not be able to resell their shares of common stock following periods of volatility because of the market's adverse reaction to this volatility. We anticipate that this volatility, which frequently affects the stock of technology companies, will continue. Our stock price may fluctuate and you may not be able to resell shares of our stock for a profit as a result of a number of factors including:

| | · | future announcements concerning us or our competitors; |

| | · | quarterly variations in our operating results; |

| | · | actual or anticipated announcements of technical innovations or new product or service developments by us or our competitors; |

| | · | general conditions in our industry; |

· concentrated holdings of our common stock;

· sales of stock by us or by our stockholders;

| · | the low trading volume of our common stock, which means that small changes in the volume of trades may have a disproportionate impact on our stock price; |

| | · | developments concerning litigation; and |

| | · | worldwide economic and financial conditions. |

On occasion, the equity markets, and in particular the markets for technology companies, have experienced significant price and volume fluctuations. These fluctuations have affected the market price for many companies' securities and may be unrelated to the companies' operating performance.

We may not be able to use net operating loss carryforwards.

As of January 31, 2008, we had net operating loss carryforwards of approximately $208 million. The deferred tax assets representing the benefits of these carryforwards have been offset completely by a valuation allowance due to our lack of an earnings history. The realization of the benefits of these carryforwards depends on sufficient taxable income in future years. Lack of future earnings could adversely affect our ability to utilize these carryforwards. Additionally, past or future changes in our ownership and control could limit the ability to utilize these carryforwards. Despite the carryforwards, we may have income tax liability in future years due to the application of the alternative minimum tax rules of the United States Internal Revenue Code.

Our amended and restated certificate of incorporation, bylaws, ownership and Delaware law contain provisions that could discourage a third party from acquiring us and consequently decrease the market value of an investment in our stock.

Some provisions of our amended and restated certificate of incorporation and bylaws, and of Delaware law, as well as our ownership structure, could delay or prevent a change of control or changes in our management that a stockholder might consider favorable. Any delay or prevention of a change of control or change in management could cause the market price of our common stock to decline. These provisions include:

| · | Our Board of Directors has the authority to issue up to 5,000,000 shares of preferred stock and to determine the price, rights, preferences, privileges and restrictions, including voting rights, of those shares without any further vote or action by the stockholders. The issuance of preferred stock may delay, defer or prevent a change in control, as the terms of the preferred stock that might be issued could potentially prohibit our consummation of any merger, reorganization, sale of substantially all of our assets, liquidation or other extraordinary corporate transaction without the approval of the holders of the outstanding shares of preferred stock. |

| · | Our Board of Directors may alter our bylaws without obtaining stockholder approval. |

| · | We are subject to the provisions of Section 203 of the Delaware General Corporation Law which prohibits a Delaware corporation from engaging in certain business combinations with any interested stockholder for a period of three years, unless specific conditions are met. |

Allen Holding Inc. and related parties exercise voting control over a significant percentage of our outstanding shares, and our other stockholders may not have an effective say in any matters upon which our stockholders vote.

As of January 31, 2008, Allen & Company beneficially owned approximately 42% of our voting power and held three seats on the Board of Directors, and would therefore be able to influence the outcome of matters requiring a stockholder vote. These matters could include offers to acquire us and elections of directors. Allen & Company may have interests which are different than the interests of our other stockholders.

Legislative actions and potential new accounting pronouncements are likely to impact our future financial position or results of operations.

Future changes in financial accounting standards may cause adverse, unexpected revenue fluctuations and affect our financial position or results of operations. New pronouncements and varying interpretations of pronouncements have occurred with frequency in the past and may occur again in the future and as a result we may be required to make changes in our accounting policies. For example, the recent requirement to expense stock options in accordance with SFAS No. 123(R) resulted in recording $1.2 million and $4.1 million of stock-based compensation expense in continuing operations for the fiscal years ended January 31, 2008 and 2007, respectively. Compliance with new regulations regarding corporate governance and public disclosure may result in additional expenses. As a result, we intend to invest all reasonably necessary resources to comply with evolving standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from science and business activities to compliance activities. For example, we have incurred and expect to continue to incur substantial costs and expend significant resources to comply with the regulations promulgated under Section 404 of the Sarbanes-Oxley Act of 2002.

Our internal controls may not be sufficient to achieve all stated goals and objectives.

Our internal controls and procedures were developed through a process in which our management applied its judgment in assessing the costs and benefits of such controls and procedures, which, by their nature, can provide only reasonable assurance regarding the control objectives. The design of any system of internal controls and procedures is based in part upon various assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

We may be subject to regulatory scrutiny and sustain a loss of public confidence if we are unable to satisfy regulatory requirements relating to our internal controls over financial reporting and/or we have internal control weaknesses which result in material financial reporting errors.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to perform an evaluation of our internal controls over financial reporting and have our independent registered public accounting firm attest to such evaluation on an annual basis. Compliance with these requirements can be expensive and time-consuming. While we believe that we will be able to meet the required deadlines, no assurance can be given that we will meet the required deadlines in future years. If we fail to timely complete this evaluation, or if our auditors cannot timely attest to our evaluation, we may be subject to regulatory scrutiny and a loss of public confidence in our internal controls.

The Sarbanes-Oxley Act of 2002 ensures that companies are reporting accurate revenue numbers and revenue recognition policies have been under particular scrutiny. Any weaknesses in our internal controls on our financial reporting of revenue could cause prospective revenue adjustments or changes in our future revenue recognition policies. Either result could cause unexpected changes to current and/or anticipated future operating results and have a material adverse effect on our financial condition and stock price.

As of January 31, 2007, we identified material weaknesses in internal controls over our accounting close and reporting and revenue recognition processes. We determined that we lacked a sufficient number of trained accounting and finance personnel with knowledge of our accounting close and financial reporting processes and adequate technical expertise in the application of U.S. generally accepted accounting principles. This inadequate level of skilled resources resulted in accounting processes which were completed neither effectively nor on a timely basis. Subsequent to January 31, 2007, we took several steps to remediate the material weaknesses and we have concluded that we maintained effective internal control over financial reporting as of January 31, 2008, based on the criteria established in the Committee of Sponsoring Organizations of the Treadway Commission’s Internal Control - Integrated Framework. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to risks that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

There are no material unresolved SEC staff comments as of the date of this report.

We occupy our corporate headquarters under an extended lease agreement that expires on August 31, 2009 for a total of approximately 14,186 square feet of space in an office building in Vienna, Virginia.

We also lease offices in Carlsbad, California, and Bracknell, United Kingdom. We have subleased space to tenants at our former offices in Columbia, Maryland and Montreal, Canada. We utilize a hosting facility located in Dallas, Texas operated under a master hosting arrangement with AT&T that expires in July 2009.

None.

None.

PART II

Our Class A common stock is listed on the NASDAQ Global Market under the symbol “CNVR.”

The following table sets forth the high and low sale prices for our Class A common stock on the NASDAQ Global Market for the period from February 1, 2006 through January 31, 2008. The number of stockholders of record of our Class A common stock as of January 31, 2008 was 917. There were no shares of our Class B common stock issued or outstanding at January 31, 2008. We have never declared or paid dividends on our common stock and do not expect to do so for the foreseeable future.

| | | High | | Low | |

| Fiscal 2008 (February 1, 2007 - January 31, 2008) | | | | | | | |

| | | | | | | | |

First Quarter | | $ | 3.98 | | $ | 2.50 | |

Second Quarter | | | 4.75 | | | 3.08 | |

Third Quarter | | | 3.98 | | | 2.72 | |

Fourth Quarter | | | 3.89 | | | 2.00 | |

| | | | | | | | |

| Fiscal 2007 (February 1, 2006 - January 31, 2007) | | | | | | | |

| | | | | | | | |

First Quarter | | $ | 10.25 | | $ | 7.40 | |

Second Quarter | | | 8.50 | | | 5.40 | |

Third Quarter | | | 6.80 | | | 4.56 | |

Fourth Quarter | | | 5.57 | | | 3.50 | |

The following table sets forth, as of January 31, 2008, information with respect to our equity compensation plans:

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (1) (b) | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) |

| Equity compensation plans approved by security holders: | | | | | |

| Convera Employee Stock Purchase Plan | 5,354,756 | | $4.79 | | 11,307,962 |

| Equity compensation plans not approved by security holders: | None | | N/A | | N/A |

(1) For purposes of calculating the weighted-average exercise price, deferred shares have been excluded because there is no exercise price.

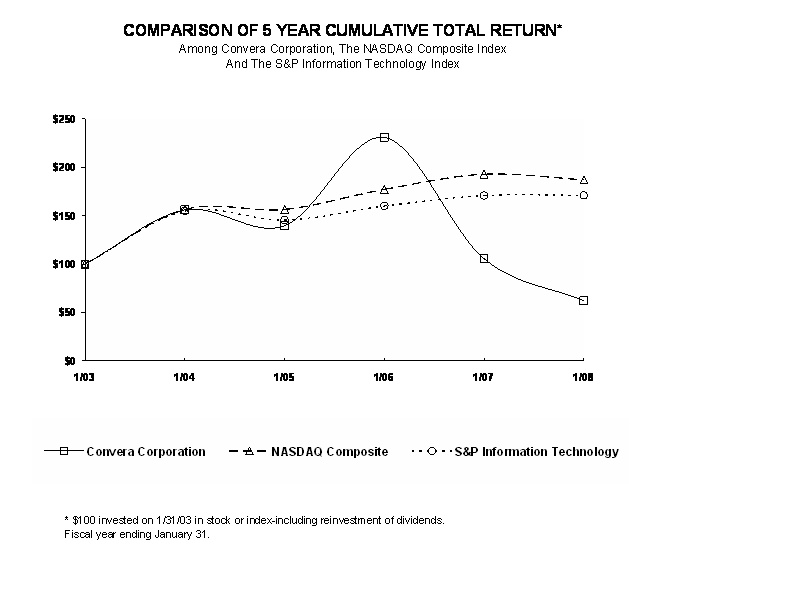

Performance Graph

The following graph is a comparison of the cumulative total return to stockholders of our Class A common stock at January 31, 2008 since January 31, 2003 to the cumulative total return over such period of (i) the NASDAQ Stock Market-U.S., and (ii) the Standard & Poor's Information Technology Index, assuming an investment in each of $100 on January 31, 2003 and the reinvestment of dividends.

Recent Sales of Unregistered Securities; Uses of Proceeds from Registered Securities

None.

The selected financial data presented below have been derived from our consolidated financial statements. The balance sheet data as of January 31, 2008 and 2007, and the statement of operations data for the fiscal years ended January 31, 2008, 2007, and 2006 should be read in conjunction with the consolidated financial statements and notes thereto included elsewhere in this Annual Report on Form 10-K.

| | | Fiscal Years Ended January 31, | |

| | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

| Statement of Operations Data: | | | |

| | | | | | | | | | | | |

Continuing Operations(1): | | | | | | | | | | | |

| Revenues | | $ | 1,118 | | $ | 269 | | $ | 20 | | $ | - | | $ | - | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| Cost of revenues | | | 9,660 | | | 8,138 | | | 1,797 | | | - | | | - | |

| Sales and marketing | | | 3,880 | | | 4,386 | | | 2,804 | | | - | | | - | |

| Research and product development | | | 4,652 | | | 11,010 | | | 3,198 | | | 4,164 | | | - | |

| General and administrative | | | 11,179 | | | 14,833 | | | 10,860 | | | - | | | - | |

| Amortization of capitalized research and development costs | | | - | | | 3,045 | | | 1,012 | | | - | | | - | |

| Impairment of long-lived assets | | | 603 | | | 6,407 | | | - | | | - | | | - | |

| | | | 29,974 | | | 47,819 | | | 19,671 | | | 4,164 | | | - | |

| Operating loss | | | (28,856 | ) | | (47,550 | ) | | (19,651 | ) | | (4,164 | ) | | - | |

| Other income, net | | | 1,815 | | | 2,267 | | | 602 | | | 175 | | | - | |

| Loss from continuing operations | | $ | (27,041 | ) | $ | (45,283 | ) | $ | (19,049 | ) | $ | (3,989 | ) | $ | - | |

| | | | | | | | | | | | | | | | | |

Discontinued Operations: | | | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations | | | 20 | | | 456 | | | 4,788 | | | (15,831 | ) | | (18,059 | ) |

| Gain on sale of discontinued operations | | | 17,925 | | | - | | | - | | | - | | | - | |

| Income (loss) from discontinued operations | | | 17,945 | | | 456 | | | 4,788 | | | (15,831 | ) | | (18,059 | ) |

| | | | | | | | | | | | | | | | | |

| Net loss | | $ | (9,096 | ) | $ | (44,827 | ) | $ | (14,261 | ) | $ | (19,820 | ) | $ | (18,059 | ) |

| Net income (loss) per common share - basic and diluted: | | | | | | | | | | | | | | | | |

| Continuing Operations | | $ | (0.51 | ) | $ | (0.87 | ) | $ | (0.44 | ) | $ | (0.11 | ) | $ | 0.00 | |

| Discontinued Operations | | | 0.34 | | | 0.01 | | | 0.11 | | | (0.45 | ) | | (0.57 | ) |

| Net loss per common share - basic and diluted | | $ | (0.17 | ) | $ | (0.86 | ) | $ | (0.33 | ) | $ | (0.56 | ) | $ | (0.57 | ) |

| Weighted-average number of common shares outstanding - basic and diluted | | | 53,146 | | | 52,222 | | | 43,089 | | | 35,433 | | | 31,486 | |

| | | | | | | | | | | | | | | | | |

| Balance Sheet Data (at end of period) | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 36,641 | | $ | 47,433 | | $ | 37,741 | | $ | 17,766 | | $ | 30,530 | |

| Total assets | | | 46,367 | | | 59,281 | | | 64,217 | | | 36,294 | | | 45,695 | |

| Long-term obligations | | | - | | | - | | | 3,717 | | | - | | | - | |

| Accumulated deficit | | | (1,124,629 | ) | | (1,115,533 | ) | | (1,070,706 | ) | | (1,056,445 | ) | | (1,036,625 | ) |

| Total shareholders’ equity (2) | | | 42,735 | | | 51,097 | | | 50,841 | | | 25,149 | | | 31,368 | |

| | | | | | | | | | | | | | | | | |

(1) Research and development for our current business began in fiscal 2005 and accordingly is included in Continuing Operations in this presentation of selected financial data. Prior to fiscal 2005, all of our financial information is considered Discontinued Operations.

(2) No dividends have been declared or paid on our common stock.

Forward Looking Statements

The statements contained in the following discussion that are not purely historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including without limitation statements about the expectations, beliefs, intentions or strategies regarding the future of our business. Words such as “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” and similar expressions are used to identify these forward-looking statements. These include, among others, statements regarding our future expectations, performance, plans and prospects as well as assumptions about future events. All forward-looking statements included in this annual report are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. The forward-looking statements contained herein involve risks and uncertainties discussed in Item 1A. “Risk Factors” of this annual report. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of such factors, including those set forth in this annual report.

The following discussion should be read in conjunction with our Consolidated Financial Statements and the Notes to those statements included elsewhere in the Annual Report on Form 10-K.

Overview

We provide vertical search services to trade publishers. Our technology and services help publishers to build a loyal online community and increase their internet advertising revenues. With the use of our vertical search services, our customers can create search engines customized to meet the specialized information needs of their audience by combining publisher proprietary content with an authoritative subset of the Web. On March 31, 2007, we agreed to sell the assets of our Enterprise Search business for $23.0 million in cash to FAST. This transaction closed on August 9, 2007 with FAST assuming certain obligations of the business and retaining certain employees serving its Enterprise Search customers. Accordingly, revenues and expenses and cash flows related to the Enterprise Search business have been reflected as discontinued operations in the accompanying Consolidated Statements of Operations and of Cash Flows. The assets and liabilities of the Enterprise Search business are reported as “assets held for sale” and “liabilities held for sale” on the accompanying Consolidated Balance Sheet. See further discussion in Note 2, “Discontinued Operations” in the Notes to Consolidated Financial Statements.

Our principal source of revenue is provided through sales of our vertical search services to the websites of publishers of trade business and specialist publications. Our vertical search technology is a hosted application sold as a service to the publishers. We generate our revenues by receiving a percentage of publishers’ advertising revenues earned by the search sites and by charging minimum fees for our vertical search and advertising services. Many of our contracts with publishers contain monthly minimum fees that we are entitled to receive until website advertising revenue generated by the publishers’ search sites exceeds these monthly minimum amounts. We can also generate revenues from hosting publisher web sites and from providing technical staff training. We offer professional services to customize publisher web sites and optimize search engines, as well as web site monetization consulting.

We use an AT&T facility to host our vertical search offering. This facility, located in Dallas, TX, is operated under a master hosting arrangement that expires in July 2009. We also maintained a hosting facility in San Diego, CA, which was vacated on January 31, 2008 in an effort to appropriately scale our hosting infrastructure. We believe that our hosting center environment has sufficient equipment capacity and redundancy to host vertical search websites for 200 trade publications each with an average community of 40,000 users at competitive search performance levels, which is enough capacity to meet our current needs.

Trends

As of January 31, 2008, a total of 39 Convera supported websites were in production and a total of 37 vertical search websites were in development awaiting launch. This represents a steady increase from November 2006 when the first site was launched into production. In fiscal year 2009, our strategy is to continue to target the top 50 B2B publishers in the United States and United Kingdom, which have an estimated 2,000 plus relevant magazine titles that could be converted to search-based websites. For both newly signed and current customers, our expectation is that the publishers will launch vertical search-based websites in a much shorter period of time than was typical in fiscal 2008 due to the release of version 2 of our Publisher Control Panel. The Publisher Control Panel shortens the time required to launch a site from six months to less than a month, which should translate into our receiving advertising based revenues sooner. The majority of the revenues earned for fiscal year 2008 represented contract minimum amounts for hosted services. We expect continued growth in hosted service fee revenues, as our new and renewal contracts with publishers will typically contain a minimum service fee for our vertical search services. We expect advertising share based revenue growth as new and existing websites build traffic and subsequently increase their advertising sales. We also have launched the Convera Ad Service (“CAS”) as an integral part of our vertical search services, which should result in additional advertising share revenues for us. CAS will enable publishers to better manage the monetization of their professional communities’ search experiences and increase the effectiveness of search-based revenues on their websites. CAS can also connect the publisher websites directly with the providers of advertising inventory, increasing the opportunities for the websites to grow their advertising revenues.

As a result of restructuring actions taken throughout fiscal 2008, we have reduced our quarterly expense run rate and expect the full impact of these actions to become apparent in the first quarter of fiscal year 2009. The combined reduction in expenses and increase in revenues should result in a decrease in the net loss from continuing operations in fiscal 2009.

Critical Accounting Policies

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States. For a comprehensive discussion of our significant accounting policies, see Note 1 in the accompanying consolidated financial statements included in this Form 10-K. We do not have any material ownership interest in any entities that are not wholly owned and consolidated subsidiaries. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We base those estimates on historical experience and other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets, liabilities and equity that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe the following accounting policies reflect the more significant judgments and estimates used in the preparation of this discussion of our financial condition and results of operations.

Revenue Recognition

Revenue from our vertical search service offering can consist of hosted services, professional services and advertising revenue shares. Our vertical search services revenues are recognized in accordance with SEC Staff Accounting Bulletin No. 104 (SAB 104) “Revenue Recognition”. We evaluate vertical search services arrangements that have multiple deliverables, in accordance with Emerging Issues Task Force (“EITF”) Abstract Issue No. 00-21 “Revenue Arrangements with Multiple Deliverables.” Judgment is required in interpreting a revenue contract to determine the appropriate accounting for the transaction. Multiple deliverable arrangements that contain elements that do not qualify as separate units of accounting are recognized ratably over the term of the hosting arrangement. Our vertical search service contracts typically include advertising share revenue agreements, and may include monthly contract minimum service fees. Monthly contract minimums and other hosting fees or set-up fees are recognized ratably over the term of the hosting agreement. Advertising share revenues are recognized when earned under the provisions of the hosting agreement. Revenue from training and professional services is recognized when the services are performed. In addition, in all cases, to recognize revenue we need to assess whether the price is fixed and determinable, whether persuasive evidence of an arrangement exists, whether the service has been delivered and whether collection of the receivable is reasonably assured.

Provision for Doubtful Accounts

A considerable amount of judgment is required in assessing the ultimate realization of individual accounts receivable balances and determining whether a provision for doubtful accounts is warranted. Our determination is based on an analysis of our historical collection experience and our portfolio of customers taking into consideration the general economic environment as well as the industry in which we operate. To the extent we do not recognize deterioration in our customers’ financial condition in the period it occurs, or to the extent we do not accurately estimate our customers’ ability to pay, the amount of bad debt expense recognized in a given reporting period will be impacted. Our vertical search services have yet to achieve significant revenues and consequently as of January 31, 2008 we do not maintain a provision for estimated losses resulting from the inability of our customers to make required payments. As revenues increase, we will periodically review whether a provision is required.

Impairment of Long-Lived Assets

We evaluate all of our long-lived assets for impairment in accordance with the provisions of SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets.” SFAS No. 144 requires that we review our long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable based on expected undiscounted cash flows attributable to that asset. This review requires significant judgments both in assessing events and circumstances as well as estimating future cash flows. Should events indicate that any of our assets are impaired, the amount of such impairment will be measured as the difference between the carrying value and the fair value of the impaired asset and the impairment will be recorded in earnings during the period of such impairment. The determination of fair value is inherently an estimate and requires significant judgment. See Note 3, “Impairment of Long-Lived Assets” in the accompanying consolidated financial statements included in this Form 10-K for information about the impairment charges we have taken.

Research and Product Development Costs

We follow Statement of Financial Accounting Standards No. 86, “Accounting for the Cost of Computer Software to be Sold, Leased or Otherwise Marketed.” Our software development costs are included in research and product development and are expensed as incurred. Our judgment is required in determining the point at which our software development projects enter the stage at which costs should be capitalized, determining the estimated useful lives over which the capitalized costs should be amortized and assessing the recoverability of the capitalized software development costs. Previously, we capitalized software development costs related to our Excalibur web hosting product beginning in the first quarter of fiscal year 2006. We continued to do so until such time as “commercial availability” was determined. Amortization of the previously capitalized software development costs began in the third quarter of fiscal year 2006 and was to continue over a twenty-four month period. In the third quarter of fiscal 2007, we recorded an impairment charge for the unamortized balance of the capitalized research and development costs. For more information regarding the impairment determination, see Note 3, “Impairment of Long-Lived Assets” in the accompanying consolidated financial statements included in this Form 10-K.

Accounting for Income Taxes

We follow Statement of Financial Accounting Standards No. 109, "Accounting for Income Taxes" ("SFAS 109"). Under the asset and liability method of SFAS 109, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax laws and tax rates in each jurisdiction where we operate, and applied to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities due to a change in tax rates is recognized in income in the period that includes the enactment date. In addition, the amounts of any future tax benefits are reduced by a valuation allowance to the extent such benefits are not expected to be realized on a more-likely-than-not basis. We calculate estimated income taxes in each of the jurisdictions in which we operate. This process involves estimating actual current tax expense along with assessing temporary differences resulting from differing treatment of items for both book and tax purposes.

We record a valuation allowance to reduce our deferred tax assets to the amount that is more likely than not to be realized. Realization of the deferred tax assets is principally dependent upon the achievement of projected future taxable income. If the estimates and related assumptions change in the future we may be required to adjust our valuation allowance against our deferred tax assets, resulting in a benefit or a charge to income in the period such determination is made. As of January 31, 2008, we have recorded a full valuation allowance against the net deferred tax asset.

We adopted the provisions of the Financial Accounting Standards Board (“FASB”) Interpretation No. 48, "Accounting for Uncertainty in Income Taxes" (“FIN 48”), on February 1, 2007. FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109. FIN 48 also prescribes a recognition threshold and measurement standard for the financial statement recognition and measurement of an income tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosures and transitions. We previously recognized income tax positions based on management’s estimate of whether it was reasonably possible that a liability had been incurred for unrecognized tax benefits by applying SFAS No. 5, Accounting for Contingencies. The provisions of FIN 48 became effective for the Company on February 1, 2007.

Significant judgment is required in evaluation of our uncertain tax positions and determining the valuation allowance applied to deferred tax assets. We have concluded that there are no uncertain tax positions requiring recognition in our consolidated financial statements.

Stock-Based Compensation

On February 1, 2006, we adopted the provisions of and accounted for stock-based compensation in accordance with Statement of Financial Accounting Standards No. 123 (Revised 2004), Share-Based Payment (“SFAS 123(R)”), that addresses the accounting for stock-based compensation. SFAS 123(R) requires that stock based compensation be accounted for using a fair value based method. We use the Black-Scholes-Merton (“Black-Scholes”) option pricing model to determine the fair value of stock-based awards under SFAS 123(R). We are required to make significant judgments and estimates in the application of SFAS 123(R), in particular with regards to forfeiture rates, volatility and expected life assumptions. If any of the assumptions used in the Black-Scholes model change, stock based compensation expense could differ materially in the future from that recorded in the current period.

Results of Operations

For the fiscal year ended January 31. 2008, total revenues from continuing operations were $1.1 million, as compared to revenues of $0.3 million in fiscal year 2007. The loss from continuing operations for fiscal 2008 was $27.0 million, or $(0.51) per common share, compared to a loss from continuing operations of $45.3 million, or $(0.87) per common share, in fiscal 2007. Income from discontinued operations, including the gain from the sale of discontinued operations of $17.9 million, was $17.9 million, or $0.34 per share in fiscal 2008. Income from discontinued operations was $0.5 million, or $0.01 per common share in fiscal 2007. The net loss for fiscal 2008 was $9.1million or $(0.17) per common share as compared to a net loss of $44.8 million or $(0.86) per common share in fiscal 2007.

For the fiscal year ended January 31, 2006, total revenues from continuing operations were $20 thousand. The loss from continuing operations was $19.0 million, or $(0.44) per common share, in fiscal year 2006. Income from discontinued operations was $4.8 million or $0.11 per share in fiscal 2006. The net loss was $14.3 million, or $(0.33) per common share in fiscal 2006.

Throughout fiscal 2008, we undertook actions to restructure and realign the cost structure of our business to focus resources on our strategy to expand our presence in the online B2B publishing market. These restructurings reduced headcount by approximately 54 individuals, principally in research and product development, and closed facilities in Montreal, Canada and Lyon, France. These reductions were made in order to more appropriately align the number of our personnel to our business plan. In the fourth quarter of fiscal 2008, we terminated our hosting agreement with AT&T for our San Diego data center in order to appropriately scale our hosting capabilities. In addition, we recorded an impairment charge on the hosting assets that were formerly located in the San Diego facility and became idle with the termination of the hosting agreement. For the year ended January 31, 2008, we incurred total expenses of approximately $2.0 million related to these restructuring actions, including severance costs of $1.0 million, estimated facility related closing costs of $0.2 million, and AT&T contract termination costs of $0.8 million. The impairment charge recorded on the hosting assets was $0.6 million. During the second quarter of fiscal 2008, we entered into a sublease agreement for the Montreal, Canada facility and subsequently reduced the restructuring liability related to this facility by approximately $0.2 million. The total expenses reported above include this credit.