UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10183

MET INVESTORS SERIES TRUST

(Exact name of registrant as specified in charter)

5 Park Plaza, Suite 1900

Irvine, CA 92614

(Address of principal executive offices)(Zip code)

Elizabeth M. Forget

President

Met Investors Series Trust

5 Park Plaza, Suite 1900 Irvine, CA 92614

(Name and Address of Agent for Service)

Copy to:

Robert N. Hickey, Esq.

Sullivan & Worcester LLP

1666 K Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (800) 848-3854

Date of fiscal year end: December 31

Date of reporting period: June 30, 2009

Item 1: Report to Shareholders.

| | |

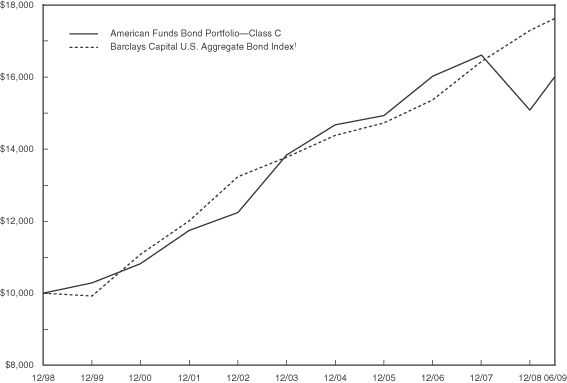

| American Funds Balanced Allocation Portfolio | | For the period ended 6/30/09 |

| Managed by MetLife Advisers, LLC | | |

Portfolio Manager Commentary

Performance

For the six-month period ended June 30, 2009, the Class B and C shares of the Portfolio returned 9.68% and 9.68%, respectively, compared to the 7.11% return of its primary index, the Dow Jones Moderate Index.

Market Environment/Conditions

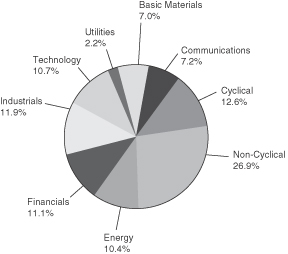

The worst economic downturn since the 1930s—dubbed “The Great Recession” by some pundits—showed few signs of sustained improvement; although at least the rapid rate of descent appeared to have slowed during the first half of 2009. The Unemployment Rate reached 9.5% in June as more than six million jobs were lost over the past twelve months. Other economic statistics were more ambiguous: Consumer Confidence, although still well below its level of two years ago, recovered from the level reached in March and Existing Home Sales improved modestly in response to lower house prices and improved availability of credit.

The Barclays Capital U.S. Aggregate Bond Index produced a modest, but positive total return of 1.9% for the first six months of 2009. The increase in Treasury yields that lowered the price of Treasury bonds was offset by a narrowing of yield spreads, which boosted credit based securities as investors became more positive on the prospects for the economy. The Barclays Capital U.S. Treasury Index was down 4.3% for the six months ending June, while the Barclays Capital U.S. Corporate Investment Grade Index was up 8.3%. Although the Barclays U.S. Corporate High Yield Index was up over 30% for the six-month period, it was still down 2.4% over the previous twelve months. The yield on Three Month Treasury Bills stayed close to 0.2% as the Federal Reserve kept their target rate in the 0.00% to 0.25% range.

The Standard & Poor’s 500 Index, buoyed by a robust 15.9% return for the second quarter, returned 3.2% for the six months ending in June. The rout in stocks that began last summer continued into the first quarter of this year as the severity of the recession became apparent. A turnaround began in early March on improving sentiment and stocks surged over 35% from the low in early March to the end of June. Although small cap stocks had better performance in the second quarter, they were up slightly less than large cap stocks for the full six-month period as measured by the 2.6% rise of the Russell 2000® Index. Growth outperformed Value stocks during the first half of 2009 primarily due to the strength of technology companies compared to the relative weakness in traditional value stocks such as those in the Financials sector. Technology and Basic Materials were the best performing sectors over the six-month period. The Financials sector, despite a nearly 100% return from the middle of March to the end of June, was still among the worst performing sectors for the six-month period (-3.4%). The MSCI EAFE® Index was up nearly 8% for the six months ending in June, slightly more than the local return due to a weaker dollar that made foreign securities more valuable to the U.S. dollar based investor. Emerging Market equities and international small cap equities were both up more than the large cap stocks from developed countries.

Portfolio Review/Current Positioning

The Portfolio is structured to be broadly diversified across and within a wide variety of fixed income and equity asset classes to add value and control risk over the long term. The Portfolio strives to achieve its objectives through investment in the various funds of the American Funds Insurance Series (AFIS). Although the Portfolio’s broad asset allocation goal of 35% to fixed income and 65% to equities did not change, there were several very modest changes to the narrower asset class goals. These changes included the elimination of a formal goal for cash, although we still expect the Portfolio will hold some residual cash through the underlying portfolios, and a slight reduction in the goals for the riskier, non-core fixed income securities, such as high-yield bonds. To achieve these new asset class goals and to improve the overall diversification of the Portfolio, several adjustments to the underlying portfolio targets were made as part of the May 1, 2009 restructuring.

In the first quarter, the cumulatively high cash position (approximately 10%) of the Portfolio served as a buffer to the turbulent capital markets and helped both relative and absolute returns. However, the cash position hurt relative performance during the second quarter when both stocks and corporate bonds posted strong positive returns. Overall, the cash position was a detractor from performance during the first six months of 2009. While the percentage held in high yield bonds was slightly below the stated goal of 5%, the Portfolio’s higher overall exposure to credit based bonds (including investment grade corporate bonds) helped relative performance, especially in the second quarter. Among the fixed income underlying portfolios, the six month returns were directly related to the level of credit exposure: the higher the credit exposure and less held in the safety of U.S. Treasury Securities, the better the performance. The AFIS High Income Bond Fund was the best absolute performer among the underlying bond portfolios, while the AFIS Government/AAA Securities Fund posted a nearly flat return in response to the rise in treasury yields.

The underlying equity portfolios that invest primarily in foreign securities were the best absolute performers over the first six months of 2009, they benefitted from both good local returns and a weaker dollar that made foreign securities more valuable to a U.S. based investor. The Portfolio especially benefitted from its foreign equity exposure outside of the large cap, developed market universe that makes up the MSCI EAFE Index: small cap foreign stocks and emerging market stocks. Within domestic equities, a modest overall tilt to growth style stocks helped both absolute and relative performance. The AFIS Growth Fund had the biggest contribution to relative performance due to a large weighting and very good relative performance. It bettered the broad equity market despite its significant cash position because of its growth style, exposure to foreign stocks and overall good stock selection, particularly in the Energy sector. Because of the Portfolio’s 65% goal for equities, the benefits attributable to the equity segment of the Portfolio was more important than the benefits that came from the fixed income segment of the Portfolio.

1

| | |

| American Funds Balanced Allocation Portfolio | | For the period ended 6/30/09 |

| Managed by MetLife Advisers, LLC | | |

Portfolio Manager Commentary (continued)

MetLife Advisers, LLC

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the advisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Portfolio’s trading intent. Information about the Portfolio’s holdings, asset allocation or country diversification is historical and is not an indication of future Portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the portfolio may pay. If these additional fees were reflected, performance would have been lower.

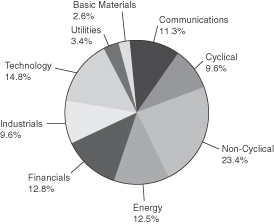

Holdings by Market Value

As of 6/30/09

| | |

| Description | | Percent of

Net Assets |

American Funds Growth-Income Fund (Class 1) | | 38.99% |

American Funds Growth Fund (Class 1) | | 21.26% |

American Funds U.S. Government /AAA—Rated Securities Fund (Class 1) | | 12.17% |

American Funds Bond Fund (Class 1) | | 6.80% |

American Funds International Fund (Class 1) | | 6.29% |

American Funds High-Income Bond Fund (Class 1) | | 6.18% |

American Funds Global Small Capitalization Fund (Class 1) | | 3.24% |

American Funds New World Fund (Class 1) | | 3.18% |

American Funds Global Bond Fund (Class 1) | | 1.98% |

2

| | |

| American Funds Balanced Allocation Portfolio | | For the period ended 6/30/09 |

| Managed by MetLife Advisers, LLC | | |

Portfolio Manager Commentary (continued)

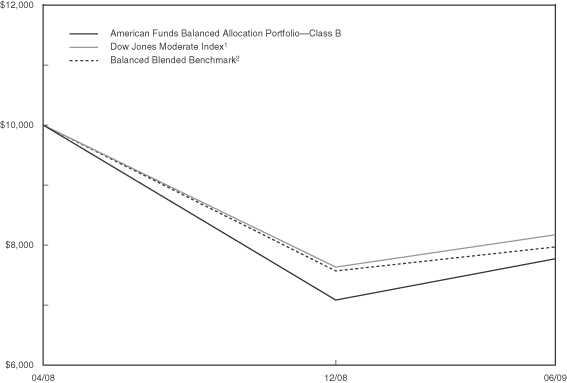

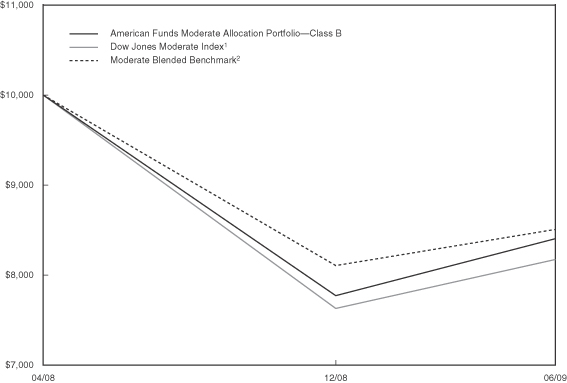

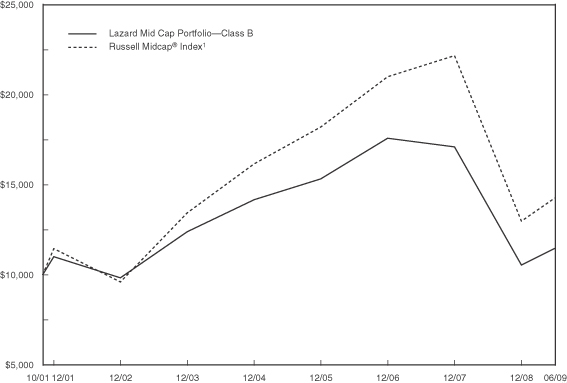

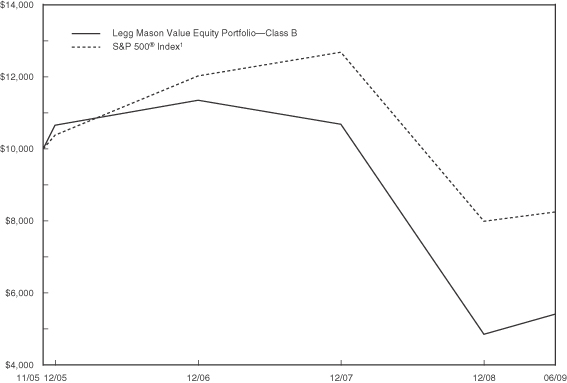

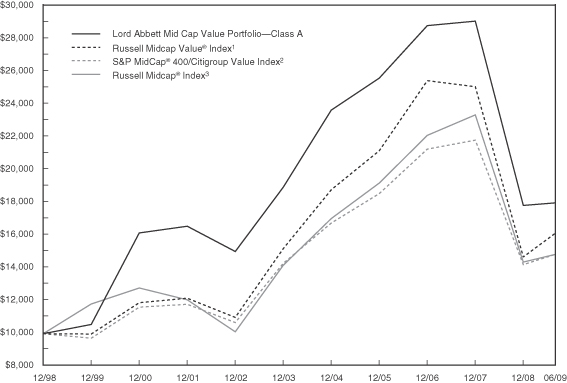

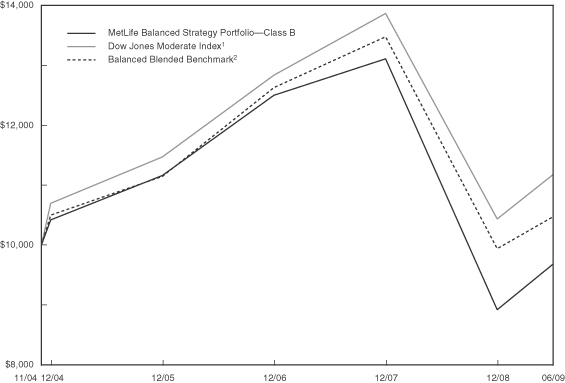

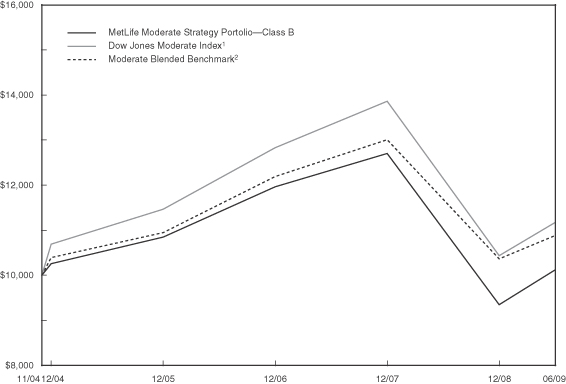

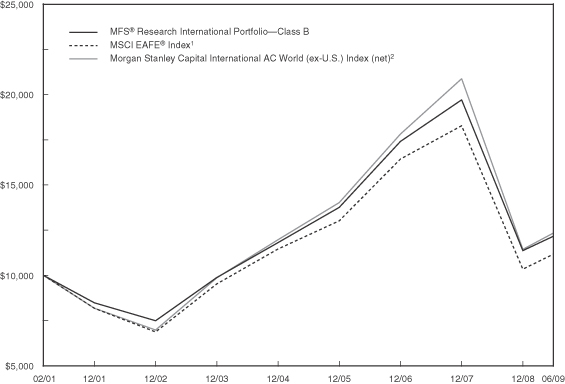

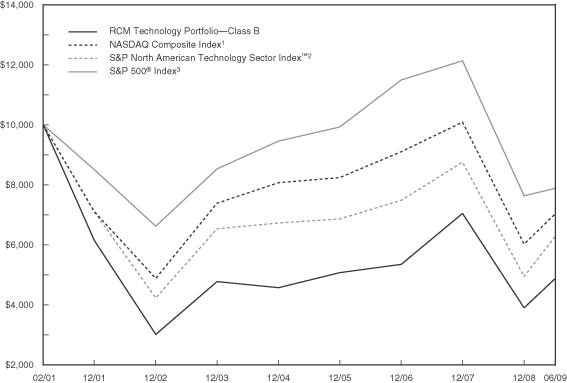

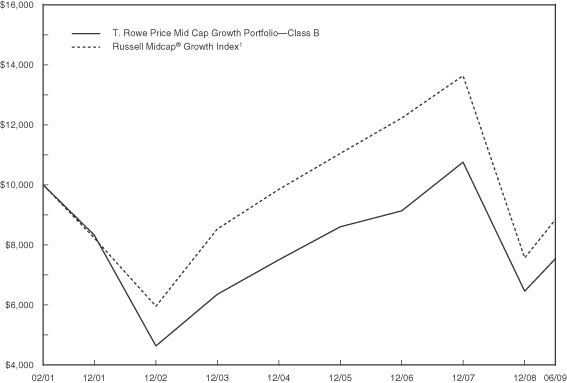

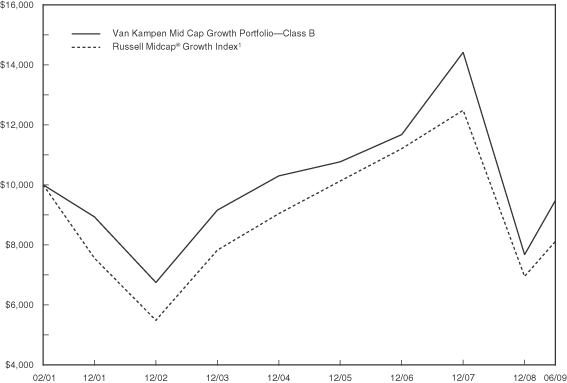

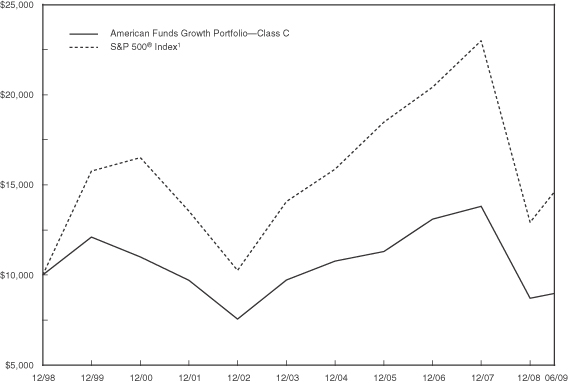

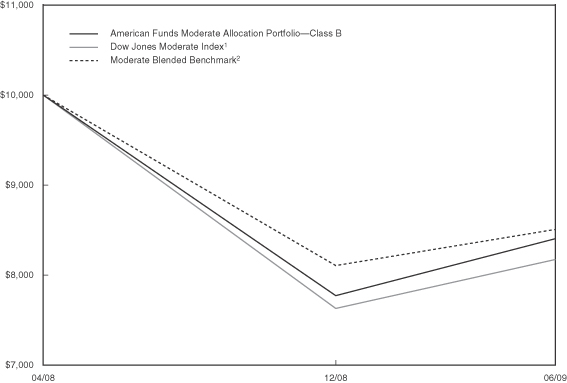

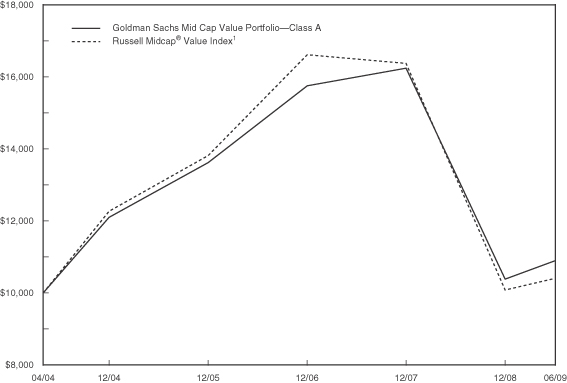

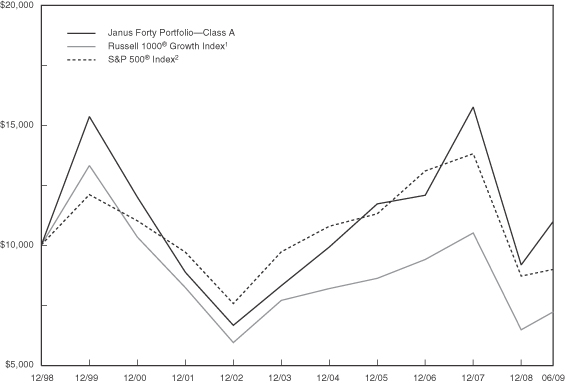

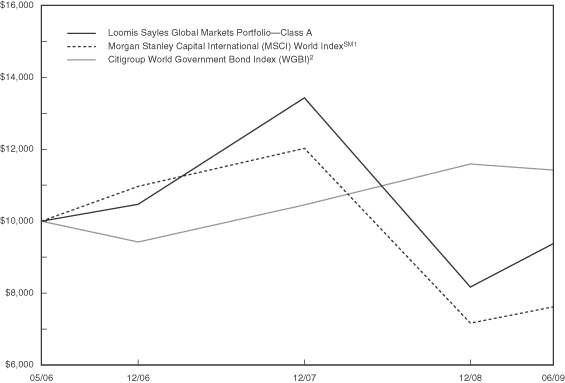

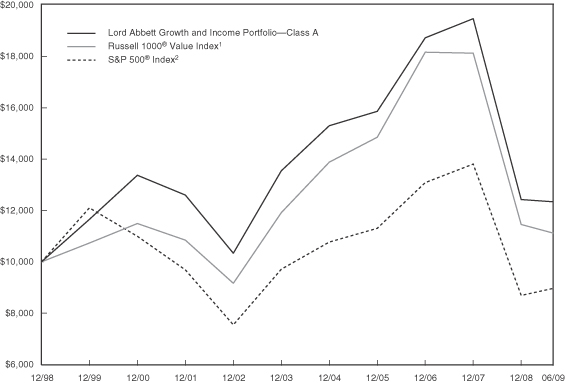

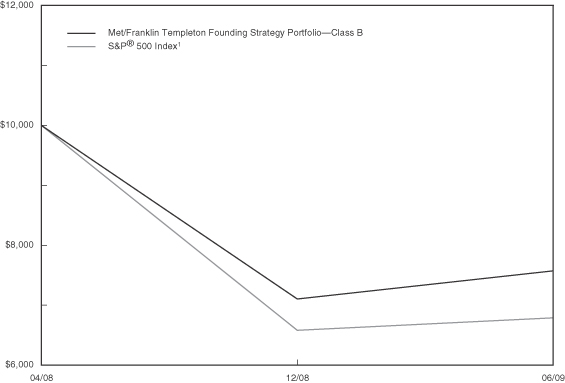

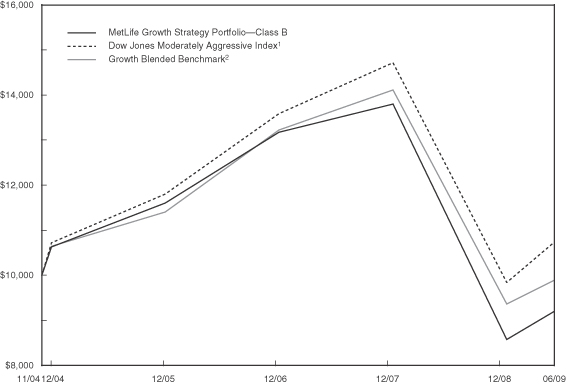

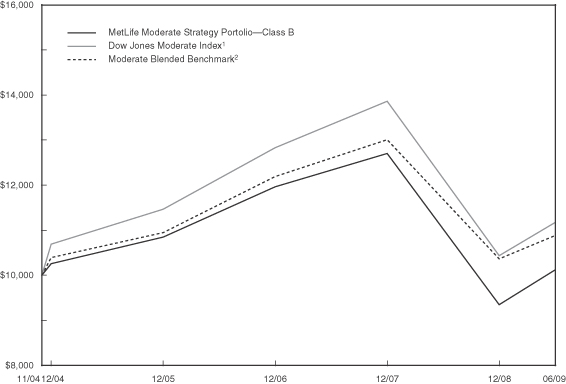

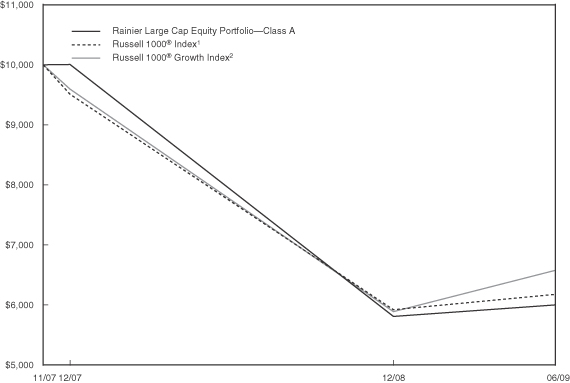

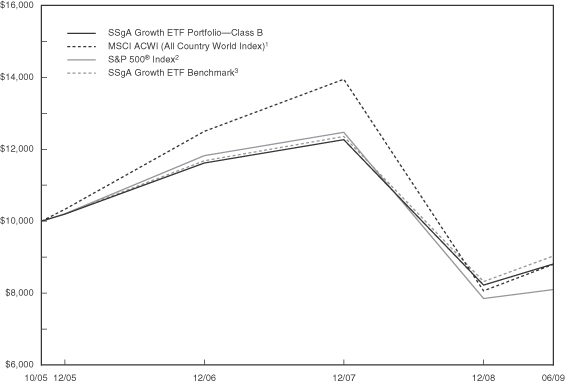

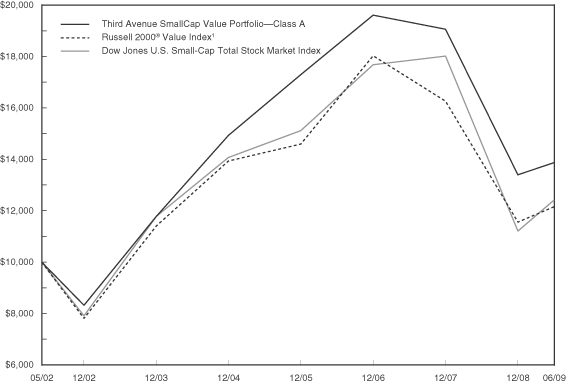

American Funds Balanced Allocation Portfolio managed by

MetLife Advisers, LLC vs. Dow Jones Moderate Index1 and

Balanced Blended Benchmark2

Growth Based on $10,000+

| | | | | | | | |

| | | | | Average Annual Return

(for the period ended 6/30/09)3 |

| | | | | 6 Months | | 1 Year | | Since

Inception4 |

| — | | American Funds Balanced Allocation

Portfolio—Class B | | 9.68% | | -18.86% | | -19.36% |

| | Class C | | 9.68% | | -18.86% | | -19.37% |

| — | | Dow Jones Moderate Index1 | | 7.11% | | -14.71% | | -15.80% |

| - - | | Balanced Blended Benchmark2 | | 5.32% | | -16.60% | | -17.59% |

+The chart reflects the performance of Class B shares of the Portfolio. The performance of Class B shares will differ from that of the other class because of the difference in expenses paid by policyholders investing in the different share classes.

1The Dow Jones Moderate Index is a benchmark designed for asset allocation strategists who are willing to take 60% of the risk of an all equity portfolio. It is a total returns index that is a time-varying weighted average of stocks, bonds, and cash using a combination of various indices (both domestic and foreign) from Barclays and Dow Jones. The index has held an average of 58% in equities over the past three years ending in June 2009.

2The Balanced Blended Benchmark is comprised of 48% Dow Jones U.S. Total Full Cap Index, 35% Barclays Capital U.S. Universal Index, and 17% Morgan Stanley Capital International Europe Australasia and Far East Index.

The Dow Jones U.S. Total Full Cap Index measures the performance of all U.S. equity securities with readily available price data.

The Barclays Capital U.S. Universal Index represents the union of the U.S. Aggregate Bond Index, the U.S. High-Yield Corporate Index, the Investment Grade 144A Index, the Eurodollar Index, the U.S. Emerging Markets Index and the non-EIRSA portion of the Commercial Mortgage Backed Securities Index.

The Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE® Index”) is an unmanaged free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada.

3“Average Annual Return” is calculated including reinvestment of all income dividends and capital gain distributions.

4Inception of the Class B and Class C shares is 4/28/08. Index returns are based on an inception date of 4/28/08.

Past performance does not guarantee future results. The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, on any given day or when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administration charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower. The Indexes do not include fees or expenses and are not available for direct investment.

3

Met Investors Series Trust

Understanding Your Portfolio’s Expenses

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2009 through June 30, 2009.

Actual Expenses

The first line for each share class of the Portfolio in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the particular share class of the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class of the Portfolio in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | Beginning

Account Value

1/1/09 | | Ending

Account Value

6/30/09 | | Expenses Paid

During Period*

1/1/09-6/30/09 |

| | | | | | | | | | | |

| American Funds Balanced Allocation Portfolio | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | |

Class B(a)(b) | | | | | | | | | | | |

Actual | | 0.74% | | $ | 1,000.00 | | $ | 1,096.80 | | $ | 1.82 |

Hypothetical | | 0.74% | | | 1,000.00 | | | 1,023.06 | | | 1.76 |

| | | | | | | | | | | |

| | | | |

| | | | | | | | | | | |

Class C(a)(b) | | | | | | | | | | | |

Actual | | 1.04% | | $ | 1,000.00 | | $ | 1,096.80 | | $ | 3.38 |

Hypothetical | | 1.04% | | | 1,000.00 | | | 1,021.57 | | | 3.26 |

| | | | | | | | | | | |

* Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the one-half year period.)

(a) The annualized expense ratio shown reflects an expense limitation agreement between MetLife Advisers, LLC and the Portfolio as described in Note 3 of the Notes to Financial Statements.

(b) The annualized expense ratio reflects the expenses of both the Portfolio and the Underlying Portfolios in which it invests.

4

Met Investors Series Trust

American Funds Balanced Allocation Portfolio

PORTFOLIO OF INVESTMENTS (Unaudited)

June 30, 2009

(Percentage of Net Assets)

| | | | | | |

Security

Description | | Shares | | Value | |

| | | | | | |

|

| Investment Company Securities - 100.1% | |

American Funds Bond Fund (Class 1)(a) | | 8,041,587 | | $ | 80,013,790 | |

American Funds Global Bond Fund (Class 1)(a) | | 2,119,061 | | | 23,182,529 | |

American Funds Global Small Capitalization Fund (Class 1)(a) | | 2,675,972 | | | 38,052,315 | |

American Funds Growth Fund (Class 1)(a) | | 6,615,251 | | | 249,990,344 | |

American Funds Growth-Income Fund (Class 1)(a) | | 17,583,607 | | | 458,404,627 | |

American Funds High-Income Bond Fund (Class 1)(a) | | 7,723,269 | | | 72,598,726 | |

American Funds International Fund (Class 1)(a) | | 5,288,376 | | | 73,931,504 | |

American Funds New World Fund (Class 1)(a) | | 2,298,658 | | | 37,330,208 | |

American Funds U.S. Government/AAA - Rated Securities Fund (Class 1)(a) | | 11,723,404 | | | 143,025,533 | |

| | | | | | |

Total Investment Company Securities (Cost $1,197,006,348) | | | | | 1,176,529,576 | |

| | | | | | |

| | |

TOTAL INVESTMENTS - 100.1%

(Cost $1,197,006,348) | | | | | 1,176,529,576 | |

| | | | | | |

| | |

| Other Assets and Liabilities (net) - (0.1)% | | | | | (654,316 | ) |

| | | | | | |

| | |

| NET ASSETS - 100.0% | | | | $ | 1,175,875,260 | |

| | | | | | |

| | | | | | |

Portfolio Footnotes:

| (a) | | A Portfolio of the American Funds Insurance Series. |

See accompanying notes to financial statements

5

Met Investors Series Trust

American Funds Balanced Allocation Portfolio

The Portfolio is subject to the provisions of Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (FAS 157). FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements. The three levels of the hierarchy under FAS 157 are described below:

| Level 1—quoted | | prices in active markets for identical securities |

| Level 2—other | | significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.) |

| Level 3—significant | | unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Portfolio’s investments as of June 30, 2009 by security type as required by FAS 157-4:

ASSETS VALUATION INPUT

| | | | | | | | | | | | |

| Description | | Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

Investment Company Securities | | $ | 1,176,529,576 | | $ | — | | $ | — | | $ | 1,176,529,576 |

TOTAL INVESTMENTS | | $ | 1,176,529,576 | | $ | — | | $ | — | | $ | 1,176,529,576 |

See accompanying notes to financial statements

6

MET INVESTORS SERIES TRUST

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2009 (Unaudited)

| | | | |

| American Funds Balanced Allocation Portfolio | | | |

| Assets | | | | |

Investments, at value (a) | | $ | 1,176,529,576 | |

Receivable for Trust shares sold | | | 1,603,465 | |

Receivable from Manager | | | 12,993 | |

| | | | |

Total assets | | | 1,178,146,034 | |

| | | | |

| Liabilities | | | | |

Payables for: | | | | |

Investments purchased | | | 1,578,140 | |

Trust shares redeemed | | | 25,325 | |

Distribution and services fees—Class B | | | 46 | |

Distribution and services fees—Class C | | | 511,322 | |

Management fee | | | 92,986 | |

Administration fee | | | 2,000 | |

Custodian and accounting fees | | | 3,720 | |

Deferred trustee fees | | | 3,427 | |

Accrued expenses | | | 53,808 | |

| | | | |

Total liabilities | | | 2,270,774 | |

| | | | |

| Net Assets | | $ | 1,175,875,260 | |

| | | | |

| Net Assets Represented by | | | | |

Paid in surplus | | $ | 1,205,509,301 | |

Accumulated net realized loss | | | (11,680,380 | ) |

Unrealized depreciation on investments | | | (20,476,772 | ) |

Undistributed net investment income | | | 2,523,111 | |

| | | | |

Total | | $ | 1,175,875,260 | |

| | | | |

| Net Assets | | | | |

Class B | | $ | 233,605 | |

| | | | |

Class C | | | 1,175,641,655 | |

| | | | |

| Capital Shares Outstanding | | | | |

Class B | | | 31,216 | |

| | | | |

Class C | | | 157,269,841 | |

| | | | |

| Net Asset Value and Offering Price Per Share | | | | |

Class B | | $ | 7.48 | |

| | | | |

Class C | | | 7.48 | |

| | | | |

| | | | | |

(a) Investments at cost | | $ | 1,197,006,348 | |

See accompanying notes to financial statements

7

MET INVESTORS SERIES TRUST

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2009 (Unaudited)

| | | | |

| American Funds Balanced Allocation Portfolio | | | |

| Investment Income | | | | |

Dividends from Underlying Portfolios | | $ | 5,124,912 | |

| | | | |

Total investment income | | | 5,124,912 | |

| | | | |

| Expenses | | | | |

Management fee | | | 398,922 | |

Administration fees | | | 11,985 | |

Custodian and accounting fees | | | 12,138 | |

Distribution and services fees—Class B | | | 207 | |

Distribution and services fees—Class C | | | 2,193,616 | |

Audit and tax services | | | 13,890 | |

Legal | | | 16,734 | |

Trustee fees and expenses | | | 9,299 | |

Shareholder reporting | | | 24,058 | |

Insurance | | | 1,526 | |

Other | | | 2,241 | |

| | | | |

Total expenses | | | 2,684,616 | |

Less expenses reimbursed by the Manager | | | (82,815 | ) |

| | | | |

Net expenses | | | 2,601,801 | |

| | | | |

Net investment income | | | 2,523,111 | |

| | | | |

| Net Realized and Unrealized Gain (Loss) on Investments | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | (9,725,655 | ) |

Capital gain distributions from Underlying Portfolios | | | 1,598,752 | |

| | | | |

Net realized loss on investments and capital gain distributions from Underlying Portfolios | | | (8,126,903 | ) |

| | | | |

Net change in unrealized appreciation on: | | | | |

Investments | | | 105,258,705 | |

| | | | |

Net change in unrealized appreciation on investments | | | 105,258,705 | |

| | | | |

Net realized and unrealized gain on investments | | | 97,131,802 | |

| | | | |

| Net Increase in Net Assets from Operations | | $ | 99,654,913 | |

| | | | |

See accompanying notes to financial statements

8

MET INVESTORS SERIES TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| American Funds Balanced Allocation Portfolio | | | | | | |

| | | Period Ended

June 30, 2009

(Unaudited) | | | Period Ended

December 31,

2008* | |

| Increase (Decrease) in Net Assets: | | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 2,523,111 | | | $ | 12,565,377 | |

Net realized gain (loss) on investments and capital gain distribution from Underlying Portfolios | | | (8,126,903 | ) | | | 3,478,867 | |

Net change in unrealized appreciation (depreciation) on investments | | | 105,258,705 | | | | (125,735,477 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 99,654,913 | | | | (109,691,233 | ) |

| | | | | | | | |

| Distributions to Shareholders | | | | | | | | |

From net investment income | | | | | | | | |

Class B | | | — | | | | (4,914 | ) |

Class C | | | — | | | | (19,689,491 | ) |

From net realized gains | | | | | | | | |

Class B | | | — | | | | (8 | ) |

Class C | | | — | | | | (30,709 | ) |

| | | | | | | | |

Net decrease in net assets resulting from distributions | | | — | | | | (19,725,122 | ) |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | | | | | | |

Class B | | | 111,514 | | | | 1,153,811 | |

Class C | | | 558,328,503 | | | | 691,107,710 | |

Net asset value of shares issued through dividend reinvestment | | | | | | | | |

Class B | | | — | | | | 4,922 | |

Class C | | | — | | | | 19,720,200 | |

Cost of shares repurchased | | | | | | | | |

Class B | | | (30,727 | ) | | | (875,467 | ) |

Class C | | | (27,739,817 | ) | | | (36,143,947 | ) |

| | | | | | | | |

Net increase in net assets from capital share transactions | | | 530,669,473 | | | | 674,967,229 | |

| | | | | | | | |

| Net Increase in Net Assets | | | 630,324,386 | | | | 545,550,874 | |

Net assets at beginning of period | | | 545,550,874 | | | | — | |

| | | | | | | | |

Net assets at end of period | | $ | 1,175,875,260 | | | $ | 545,550,874 | |

| | | | | | | | |

Net assets at end of period includes undistributed net investment income | | $ | 2,523,111 | | | $ | — | |

| | | | | | | | |

| * | | For the period 4/28/08 (Commencement of operations) through 12/31/08. |

See accompanying notes to financial statements

9

MET INVESTORS SERIES TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | |

| | |

| Selected Per Share Data for the Period Ended: | | | | | | |

| | |

| | | | | | | |

| American Funds Balanced Allocation Portfolio | | Class B | |

| | | For the Period

Ended

June 30, 2009

(Unaudited) | | | For the

Period Ended

December 31,

2008(b) | |

| | | |

| Net Asset Value, Beginning of Period | | $ | 6.82 | | | $ | 10.00 | |

| | | | | | | | |

| Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income(a) | | | 0.03 | | | | 0.08 | |

Net Realized/Unrealized Gain (Loss) on Investments | | | 0.63 | | | | (3.00 | ) |

| | | | | | | | |

Total From Investment Operations | | | 0.66 | | | | (2.92 | ) |

| | | | | | | | |

| Less Distributions | | | | | | | | |

Dividends from Net Investment Income | | | — | | | | (0.26 | ) |

Distributions from Net Realized Capital Gains | | | — | | | | (0.00 | )+ |

| | | | | | | | |

Total Distributions | | | — | | | | (0.26 | ) |

| | | | | | | | |

| Net Asset Value, End of Period | | $ | 7.48 | | | $ | 6.82 | |

| | | | | | | | |

| Total Return | | | 9.68 | % | | | (29.20 | )% |

Ratio of Expenses to Average Net Assets After Reimbursement(c) | | | 0.35 | %* | | | 0.35 | %* |

Ratio of Expenses to Average Net Assets Before Reimbursement and Rebates(d) | | | 0.37 | %* | | | 0.78 | %* |

Ratio of Net Investment Income to Average Net Assets(e) | | | 0.86 | %* | | | 1.32 | %* |

Portfolio Turnover Rate | | | 4.9 | % | | | 12.1 | % |

Net Assets, End of Period (in millions) | | $ | 0.2 | | | $ | 0.1 | |

| |

| | | Class C | |

| | | For the Period

Ended

June 30, 2009

(Unaudited) | | | For the

Period Ended

December 31,

2008(b) | |

| | | |

| Net Asset Value, Beginning of Period | | $ | 6.82 | | | $ | 10.00 | |

| | | | | | | | |

| Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income(a) | | | 0.02 | | | | 0.36 | |

Net Realized/Unrealized Gain (Loss) on Investments | | | 0.64 | | | | (3.28 | ) |

| | | | | | | | |

Total From Investment Operations | | | 0.66 | | | | (2.92 | ) |

| | | | | | | | |

| Less Distributions | | | | | | | | |

Dividends from Net Investment Income | | | — | | | | (0.26 | ) |

Distributions from Net Realized Capital Gains | | | — | | | | (0.00 | )+ |

| | | | | | | | |

Total Distributions | | | — | | | | (0.26 | ) |

| | | | | | | | |

| Net Asset Value, End of Period | | $ | 7.48 | | | $ | 6.82 | |

| | | | | | | | |

| Total Return | | | 9.68 | % | | | (29.20 | )% |

Ratio of Expenses to Average Net Assets After Reimbursement(c) | | | 0.65 | %* | | | 0.65 | %* |

Ratio of Expenses to Average Net Assets Before Reimbursement and Rebates(d) | | | 0.67 | %* | | | 0.70 | %* |

Ratio of Net Investment Income to Average Net Assets(e) | | | 0.63 | %* | | | 6.70 | %* |

Portfolio Turnover Rate | | | 4.9 | % | | | 12.1 | % |

Net Assets, End of Period (in millions) | | $ | 1,176 | | | $ | 545.4 | |

| + | | Rounds to less than $0.005 per share. |

| (a) | | Per share amounts based on average shares outstanding during the period. |

| (b) | | Commencement of operations—04/28/2008. |

| (c) | | The ratio of operating expenses to average net assets does not include expenses of the Underlying Portfolios in which the Portfolio invests. |

| (d) | | See Note 3 of the Notes to Financial Statements. |

| (e) | | Recognition of net investment income by the Portfolio is affected by the timing of the declaration of dividends by the Underlying Portfolios in which it invests. |

See accompanying notes to financial statements

10

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

1. Organization

Met Investors Series Trust (the “Trust”) is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently offers forty-eight Portfolios (the “Portfolios”), each of which operates as a distinct investment vehicle of the Trust. As of June 30, 2009, the Portfolio included in this report is American Funds Balanced Allocation Portfolio (the “Portfolio”), which is non-diversified. Shares in the Trust are not offered directly to the general public and are currently available only to separate accounts established by certain affiliated life insurance companies.

The Trust is managed by MetLife Advisers, LLC (the “Manager”), an affiliate of MetLife, Inc.

The Trust has registered four classes of shares: Class B and C Shares are currently offered by the Portfolio. Class A and E Shares are not currently offered by the Portfolio. Shares of each Class of the Portfolio represent an equal pro rata interest in the Portfolio and generally give the shareholder the same voting, dividend, liquidation, and other rights. Investment income, realized and unrealized capital gains and losses, the common expenses of the Portfolio and certain Portfolio-level expense reductions, if any, are allocated on a pro rata basis to each Class based on the relative net assets of each Class to the total net assets of the Portfolio. Each Class of shares differs in its respective distribution expenses.

The Portfolio is designed on established principles of asset allocation and risk tolerance. The Portfolio will invest substantially all of its assets in certain funds of the American Funds Insurance Series (“AFIS”), which invest either in equity securities or fixed income securities, as applicable (“Underlying Portfolios”). AFIS is an open-end diversified investment management company advised by Capital Research and Management Company (“CRMC”), an indirect, wholly owned subsidiary of The Capital Group Companies, Inc.

2. Significant Accounting Policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements. The policies are in conformity with GAAP.

A. Security Valuation - Investments in the Underlying Portfolios are valued at their closing daily net asset value. The net asset value of the Portfolio is calculated based on the net asset values of the Underlying Portfolios in which the Portfolio invests. For information about the use of fair value pricing by the Underlying Portfolios that are funds of AFIS, please refer to the prospectus of the Underlying Portfolios.

B. Security Transactions - Security transactions are recorded on a trade date basis. Realized gains and losses are determined on investments and unrealized appreciation and depreciation are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

C. Investment Income and Expenses - Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Income and capital gain distributions from the Underlying Portfolios are recorded on the ex-dividend date.

D. Income Taxes - It is the Portfolio’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies. Accordingly, the Portfolio intends to distribute substantially all of its taxable income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Portfolio’s financial statements. The Portfolio files U.S. Federal and various state tax returns. No income tax returns are currently under examination. The 2008 tax year remains subject to examination by U.S. Federal and most tax authorities. It is also the Portfolio’s policy to comply with the diversification requirements of the Code so that variable annuity and variable life insurance contracts investing in the Portfolio will not fail to qualify as annuity and life insurance contracts for tax purposes. Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

E. Distribution of Income and Gains - Distributions of net investment income and capital gains are recorded on the ex-dividend date.

3. Investment Management Agreement and Other Transactions with Affiliates

The Trust has entered into a management agreement (the “Management Agreement”) with the Manager for investment management services in connection with the investment management of the Portfolios. The Manager is subject to the supervision and direction of the Board of Trustees (the “Board”) and has overall responsibility for the general management and administration of the Trust.

11

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

3. Investment Management Agreement and Other Transactions with Affiliates - continued

Under the terms of the Portfolio’s Management Agreement, the Portfolio pays the Manager a monthly fee based upon annual rates applied to the Portfolio’s average daily net assets as follows:

| | | | | |

Management Fees

earned by the Manager

for the period ended

June 30, 2009 | | % per annum | | | Average Daily Net Assets |

| | |

| $398,922 | | 0.10 | % | | ALL |

Metropolitan Life Insurance Company (“MLIC”) serves as the transfer agent for the Trust. MLIC is an affiliate of the Manager. MLIC receives no fees for its services to the Trust.

The Manager has entered into an expense limitation agreement with the Trust (“Expense Limitation Agreement”) in the interest of limiting expenses of the Portfolio of the Trust. The Expense Limitation Agreement shall continue in effect with respect to the Portfolio until April 30, 2010. Pursuant to that Expense Limitation Agreement, the Manager has agreed to waive or limit its fees and to assume other expenses so that the total annual operating expenses of the Portfolio other than interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with accounting principles generally accepted in the United States of America, other extraordinary expenses not incurred in the ordinary course of the Portfolio’s business, and Underlying Portfolios’ fees and expenses, but including amounts payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act, are limited to the following expense ratios as a percentage of the Portfolio’s average daily net assets:

| | | | | | | | | | |

Maximum Expense Ratio under current

Expense Limitation Agreement | | | Expenses Deferred in |

| | 2008 | | 2009 |

| | Subject to repayment until

December 31, |

| Class B | | | Class C | | | 2013 | | 2014 |

| | | |

| 0.35 | % | | 0.65 | % | | $ | 100,635 | | $ | 82,815 |

The expenses reimbursed for the period ended June 30, 2009 are shown as expenses reimbursed in the Statement of Operations of the Portfolio.

If in any year in which the Management Agreement is still in effect, the estimated aggregate portfolio operating expenses of the Portfolio for the fiscal year are less than the Maximum Expense Ratios for that year, subject to approval by the Trust’s Board, the Manager shall be entitled to reimbursement by the Portfolio to the extent that the charge does not cause the expenses in such subsequent year to exceed the Maximum Expense Ratios as stated above. The Portfolio is not obligated to repay any expense paid by the Manager more than five years after the end of the fiscal year in which such expense was incurred.

The Trust has distribution agreements with MetLife Investors Distribution Company (“MIDC” or the “Distributor”) in which MIDC serves as the Distributor for the Trust’s Class B and Class C Shares. MIDC is a wholly-owned subsidiary of MetLife Investors Group, Inc., an affiliate of the Manager. The Class B and Class C distribution plans provide that the Trust, on behalf of the Portfolio, may pay annually up to 0.50% and 1.00%, respectively, of the average net assets of the Portfolio attributable to its Class B and Class C Shares in respect to activities primarily intended to result in the sale of Class B and Class C Shares. However, under the Class B and Class C distribution agreements, payments to the Distributor for activities pursuant to the Class B and Class C distribution plans are currently limited to payments at an annual rate equal to 0.25% and 0.55% of average daily net assets of the Portfolio, attributable to its Class B and Class C Shares, respectively.

Under terms of the Class B and Class C distribution plans and distribution agreements, the Portfolio is authorized to make payments monthly to the Distributor that may be used to pay or reimburse entities providing distribution and shareholder servicing with respect to the Class B and Class C Shares for such entities’ fees or expenses incurred.

Each Trustee of the Trust who is not currently an employee of the Manager or any of its affiliates receives compensation from the Trust. A deferred compensation plan (the “Plan”) is available to the Trustees on a voluntary basis. Deferred amounts remain in the Trust until distributed in accordance with the provisions of the Plan. The value of a participating Trustee’s deferral account is based on theoretical investments of deferred amounts, on the normal payment dates, in certain portfolios of the Trust or Metropolitan Series Fund, Inc. as designated by the participating Trustee. Changes in the value of participants’ deferral accounts are reflected as Trustees’ fees and expenses in the Statement of Operations. The portions of the accrued obligations allocated to the Portfolio, if any, under the Plan are reflected as Deferred Trustees’ fees in the Statement of Assets and Liabilities.

12

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

4. Shares of Beneficial Interest

Transactions in shares of beneficial interest for the periods ended noted below were as follows:

| | | | | | | | | | | | | |

| | | Beginning

Shares | | Sales | | Reinvestments | | Redemptions | | | Net Increase

in Shares

Outstanding | | Ending

Shares |

| | | | | | |

Class B | | | | | | | | | | | | | |

| | | | | | |

6/30/2009 | | 19,873 | | 15,932 | | — | | (4,589 | ) | | 11,343 | | 31,216 |

| | | | | | |

04/28/2008-12/31/2008 | | — | | 117,726 | | 727 | | (98,580 | ) | | 19,873 | | 19,873 |

| | | | | | |

Class C | | | | | | | | | | | | | |

| | | | | | |

6/30/2009 | | 79,942,996 | | 81,418,980 | | — | | (4,092,135 | ) | | 77,326,845 | | 157,269,841 |

| | | | | | |

04/28/2008-12/31/2008 | | — | | 81,432,735 | | 2,908,584 | | (4,398,323 | ) | | 79,942,996 | | 79,942,996 |

5. Investment Transactions

Aggregate cost of purchases and proceeds of sales of investment securities, excluding short-term securities, for the period ended June 30, 2009 were as follows:

| | | | | | | | | |

| Purchases | | Sales |

| U.S. Government | | Non-Government | | U.S. Government | | Non-Government |

| | | |

| $— | | $ | 574,991,382 | | $ | — | | $ | 39,858,779 |

At June 30, 2009, the cost of securities for federal income tax purposes and the unrealized appreciation (depreciation) of investments for federal income tax purposes for the Portfolio were as follows:

| | | | | | | | | | | |

Federal

Income Tax

Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | | Net Unrealized

Depreciation | |

| | | |

| $1,197,006,348 | | $ | 9,850,730 | | $ | (30,327,502 | ) | | $ | (20,476,772 | ) |

6. Distributions to Shareholders

The tax character of distributions paid for the year ended December 31, 2008 was as follows:

| | | | | | |

Ordinary Income | | Long-Term Capital Gains | | Total |

2008 | | 2008 | | 2008 |

| | |

| $13,532,500 | | $ | 6,192,622 | | $ | 19,725,122 |

As of December 31, 2008, the components of distributable earnings (accumulated losses) on a federal income tax basis were as follows:

| | | | | | | | | | | | |

Undistributed

Ordinary

Income | | Undistributed

Long-Term

Gain | | Net

Unrealized

Depreciation | | | Total | |

| | | |

| $ | — | | $ | — | | $ | (129,288,954 | ) | | $ | (129,288,954 | ) |

7. Contractual Obligations

The Trust has a variety of indemnification obligations under contracts with its service providers. The Trust’s maximum exposure under these arrangements is unknown. However, the Trust has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

8. Market, Credit and Counterparty Risk

In the normal course of business, the Underlying Portfolios, in which the Portfolio invests, invest in securities and enter into transactions where risks exist due to fluctuations in the market (market risk) or failure of the other party to a transaction to perform (credit risk). The value of

13

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

8. Market, Credit and Counterparty Risk - continued

securities held by the Underlying Portfolios may decline in response to certain events, including those directly involving the companies whose securities are owned by the Underlying Portfolios; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency and interest rate and price fluctuations. Similar to credit risk, the Underlying Portfolios may be exposed to counterparty risk, or the risk that an entity with which the Underlying Portfolios have unsettled or open transactions may default. Financial assets, which potentially expose the Underlying Portfolios to credit and counterparty risks, consist principally of investments and cash due from counterparties. The extent of the Underlying Portfolios’ exposure to credit and counterparty risks in respect to these financial assets approximates their value as recorded in the Underlying Portfolios’ Statements of Assets and Liabilities.

9. Transactions in Securities of Affiliated Issuers

Transactions in the Underlying Portfolios during the period ended June 30, 2009 in which the Portfolio had ownership of at least 5% of the outstanding voting securities at the end of the period are as follows:

| | | | | | | | | |

Security Description | | Number of shares

held at December 31,

2008 | | Shares purchased

during the period | | Shares sold

during the period | | | Number of shares

held at June 30,

2009 |

| | | | |

American Funds Global Bond Fund (Class1) | | 1,609,077 | | 1,315,695 | | (805,711 | ) | | 2,119,061 |

| | | | |

American Funds Global Small Capitalization Fund (Class 1) | | 1,442,273 | | 1,371,318 | | (137,619 | ) | | 2,675,972 |

| | | | |

American Funds Growth-Income Fund (Class 1) | | 8,268,900 | | 9,314,707 | | — | | | 17,583,607 |

| | | | |

American Funds High-Income Bond Fund (Class 1) | | 4,492,743 | | 4,118,313 | | (887,787 | ) | | 7,723,269 |

| | | | |

American Funds New World Fund (Class 1) | | 1,246,738 | | 1,116,600 | | (64,680 | ) | | 2,298,658 |

| | | | |

American Funds U.S. Government/AAA—Rated Securities Fund (Class 1) | | 6,729,277 | | 6,182,150 | | (1,188,023 | ) | | 11,723,404 |

| | | | | | | | | | | | | |

Security Description | | Net Realized Loss on

Investments during

the period | | | Net Realized Gain

on Capital Gain

Distributions from

Affiliates during the

period | | Income earned from

affiliate during the

period | | Ending Value |

| | | | |

American Funds Global Bond Fund (Class1) | | $ | (558,104 | ) | | $ | — | | $ | 74,114 | | $ | 23,182,529 |

| | | | |

American Funds Global Small Capitalization Fund (Class 1) | | | (1,747,743 | ) | | | — | | | — | | | 38,052,315 |

| | | | |

American Funds Growth-Income Fund (Class 1) | | | (2,946,449 | ) | | | — | | | 1,860,561 | | | 458,404,627 |

| | | | |

American Funds High-Income Bond Fund (Class 1) | | | (2,424,332 | ) | | | — | | | 863,439 | | | 72,598,726 |

| | | | |

American Funds New World Fund (Class 1) | | | (719,012 | ) | | | — | | | 116,304 | | | 37,330,208 |

| | | | |

American Funds U.S. Government/AAA—Rated Securities Fund (Class 1) | | | — | | | | 1,266,128 | | | 713,605 | | | 143,025,533 |

10. Subsequent Events

Management’s evaluation of the impact of all subsequent events on the Portfolio’s financial statements was completed through August 24, 2009, the date the financial statements were issued, and management has determined that as of that date there were no subsequent events requiring adjustments or disclosure in the Portfolio’s financial statements.

11. Recent Accounting Pronouncement

The Portfolio adopted the provisions of Statement of Financial Accounting Standards No. 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FAS 157-4”) effective June 30, 2009. FAS 157-4 provides additional guidance for estimating fair value in accordance with FAS 157 when the volume and level of activity has significantly decreased in relation to normal market activity for the asset or liability. FAS 157-4 also provides additional guidance on circumstances that may indicate that a transaction is not orderly and requires additional disclosures in annual and interim reporting periods. FAS 157-4 is effective for fiscal periods and interim periods ending after June 15, 2009. Management has evaluated the impact of FAS 157-4 and has concluded that FAS 157-4 has no material impact on these financial statements.

14

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

Quarterly Portfolio Schedule

The Trust files Form N-Q for the first and third quarters of each fiscal year. The Trust’s Forms N-Q will be available on the Securities and Exchange Commission’s website at http://www.sec.gov. The Trust’s Forms N-Q may be reviewed and copied at the Securities and Exchange Commission’s Public Reference Room in Washington, D.C. and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. Once filed, the most recent Form N-Q will be available without charge, upon request, by calling (800) 848-3854.

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling (800) 848-3854 and on the Securities and Exchange Commission’s website at http://www.sec.gov.

Proxy Voting Record

The Trust, on behalf of each of its Portfolios, has filed with the Securities and Exchange Commission its proxy voting record for the 12-month period ending June 30 on Form N-PX. Form N-PX must be filed by the Trust each year by August 31. Once filed, the most recent Form N-PX will be available without charge, upon request, by calling (800) 848-3854 or on the Securities and Exchange Commission’s website at http://www.sec.gov.

15

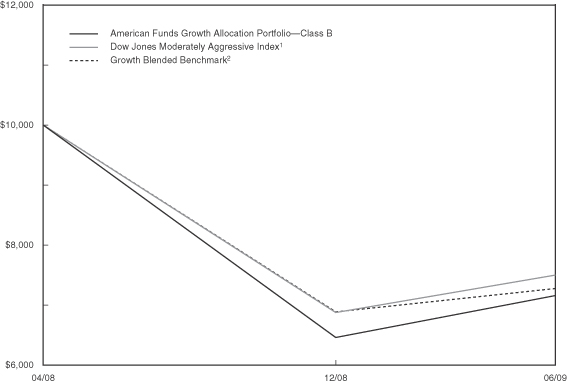

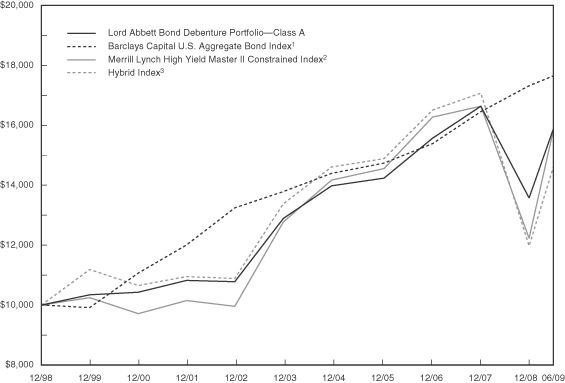

| | |

| American Funds Bond Portfolio | | For the period ended 6/30/09 |

| Managed by MetLife Advisers, LLC | | |

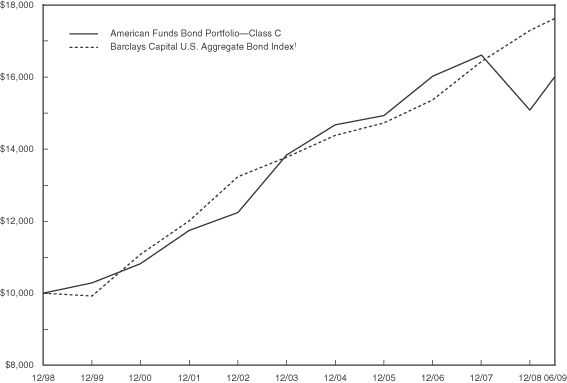

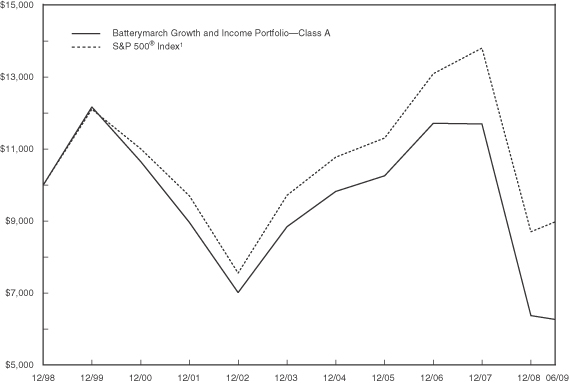

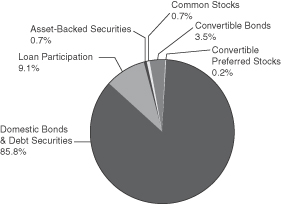

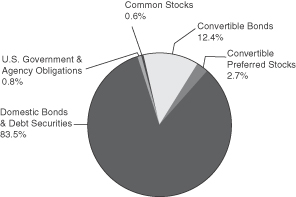

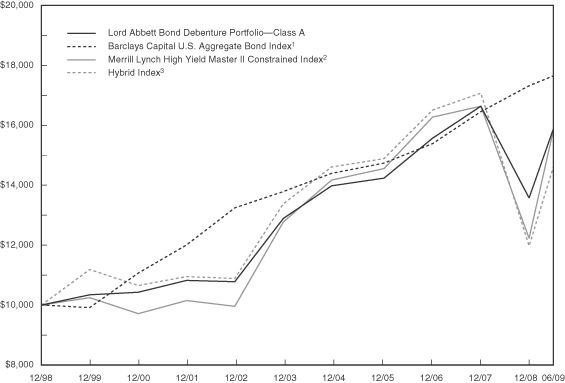

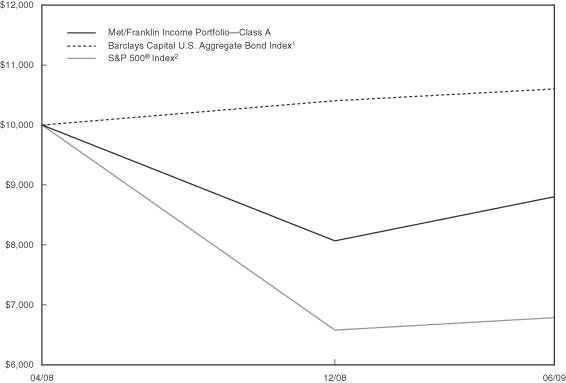

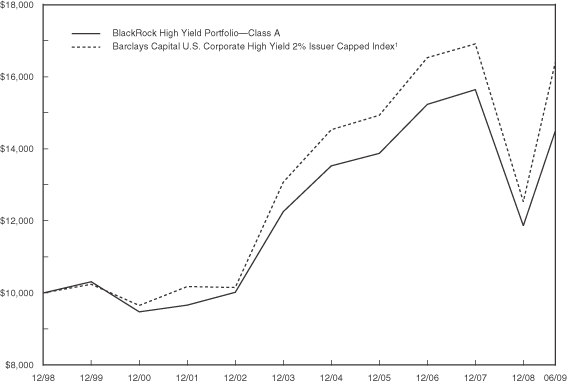

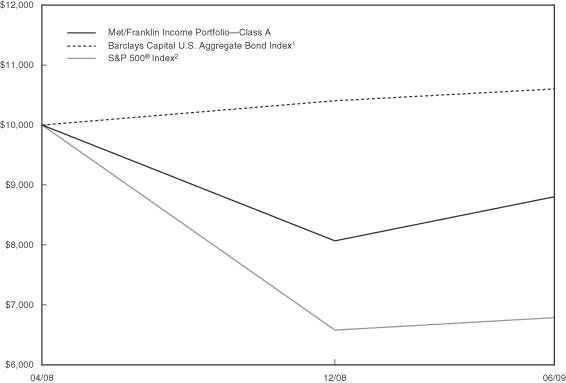

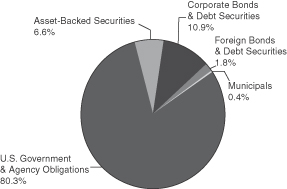

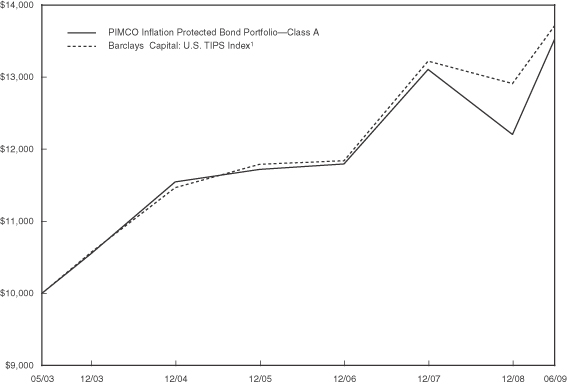

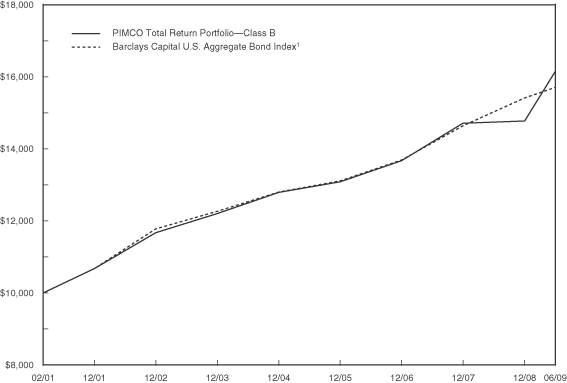

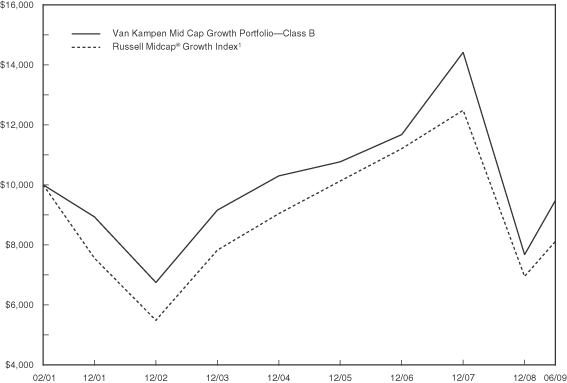

Performance Summary

During the period ended June 30, 2009, the Portfolio had a return of 5.83% for Class C versus 1.90% for its benchmark, the Barclays Capital U.S. Aggregate Bond Index1.

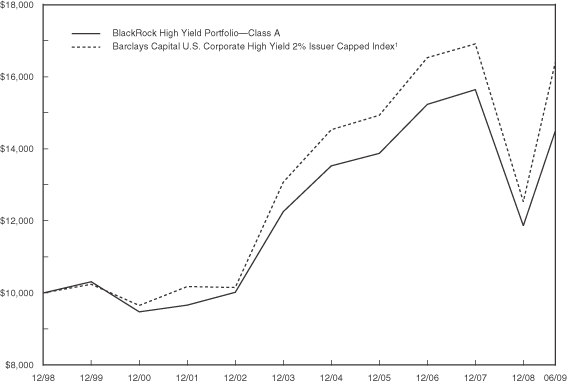

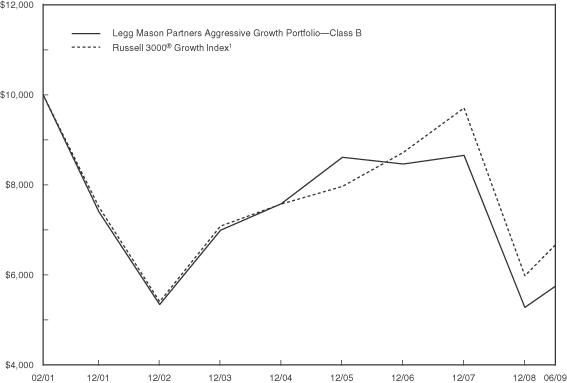

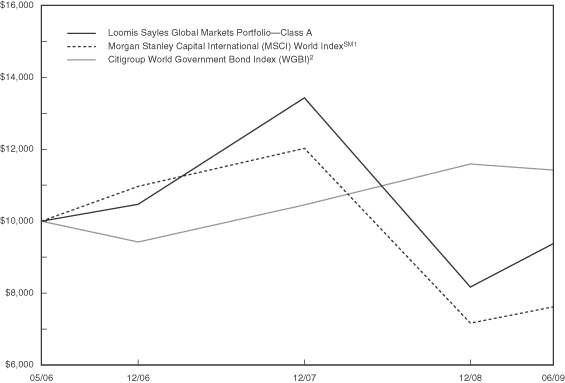

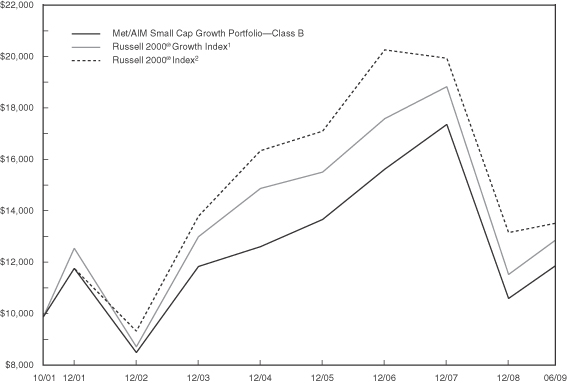

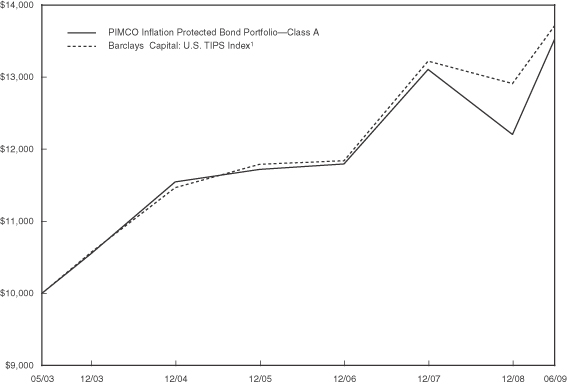

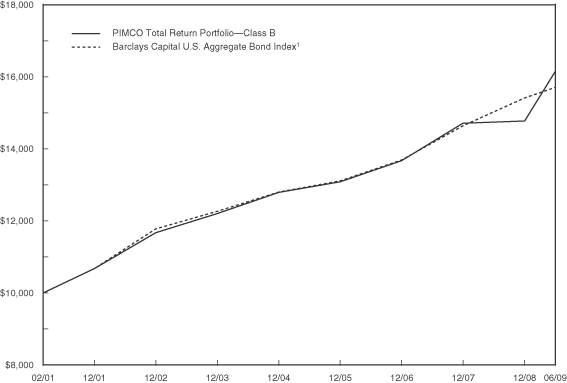

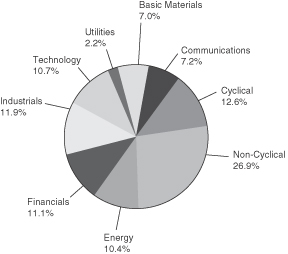

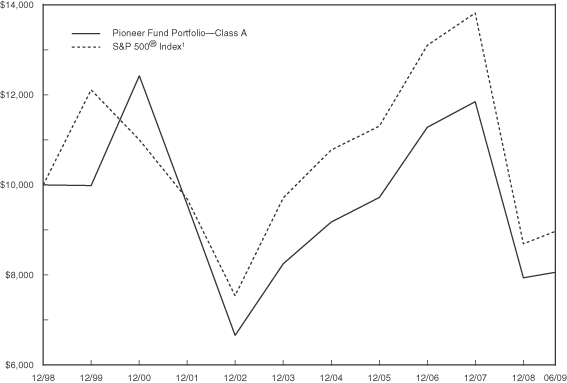

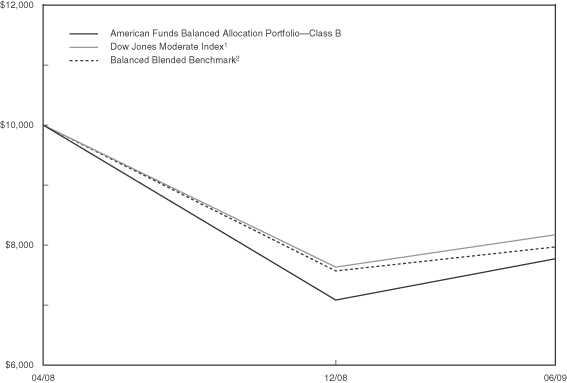

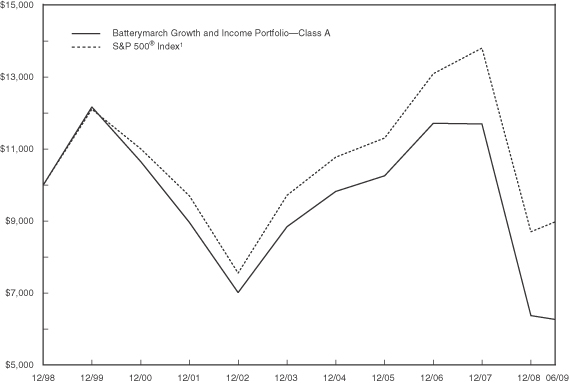

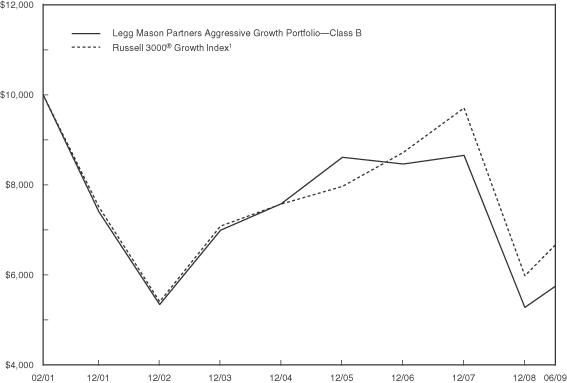

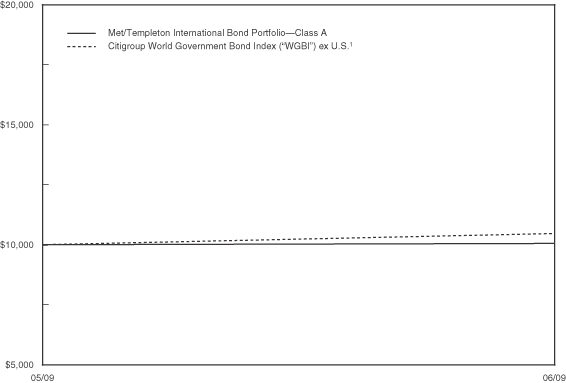

American Funds Bond Portfolio managed by

MetLife Advisers, LLC vs. Barclays Capital U.S. Aggregate Bond Index1

Growth Based on $10,000+

| | | | | | | | | | | | |

| | | | | Average Annual Return2 (for the period ended 6/30/09) |

| | | | | 6 Months | | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| — | | American Funds Bond

Portfolio—Class C | | 5.83% | | -3.97% | | 1.14% | | 2.14% | | 4.00% |

| - - | | Barclays Capital U.S. Aggregate Bond Index1 | | 1.90% | | 6.05% | | 6.43% | | 5.01%

| | 5.98% |

+The chart reflects the performance of Class C shares of the Portfolio.

1The Barclays Capital U.S. Aggregate Bond Index includes most obligations of the U.S. Treasury, agencies and quasi-federal corporations, most publicly issued investment grade corporate bonds and most bonds backed by mortgage pools of GNMA, FNMA and FHLMC.

2“Average Annual Return” is calculated including reinvestment of all income dividends and capital gain distributions.

The Portfolio and its corresponding Master Fund have essentially the same investment objectives, policies, and strategies. Since the Portfolio commenced operations on April 28, 2008, it does not have a significant operating history. However, hypothetical performance information regarding the Portfolio is presented because the Portfolio’s performance is based on the performance of the Master Fund for the period ended June 30, 2009, adjusted to reflect the Portfolio’s expenses for the period ended June 30, 2009 (including contractual expense waivers).

Past performance does not guarantee future results. The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, on any given day or when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administration charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower. The Index does not include fees or expenses and is not available for direct investment.

1

Met Investors Series Trust

Understanding Your Portfolio’s Expenses

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2009 through June 30, 2009.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | Beginning

Account Value

1/1/09 | | Ending

Account Value

6/30/09 | | Expenses Paid

During Period*

1/1/09-6/30/09 |

| | | | | | | | | | | |

| American Funds Bond Portfolio | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | |

Class C | | | | | | | | | | | |

Actual | | 0.65% | | $ | 1,000.00 | | $ | 1,057.10 | | $ | 3.32 |

Hypothetical | | 0.65% | | | 1,000.00 | | | 1,021.57 | | | 3.26 |

| | | | | | | | | | | |

* Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent six month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 365 (to reflect the one-half year period.)

2

Met Investors Series Trust

American Funds Bond Portfolio

PORTFOLIO OF INVESTMENTS (Unaudited)

June 30, 2009

(Percentage of Net Assets)

| | | | | | |

Security

Description | | Shares | | Value | |

| | | | | | |

| | | | | | |

|

| Investment Company Security - 100.1% | |

American Funds Bond Fund (Class 1)(a) (Cost $101,980,793) | | 10,246,835 | | $ | 101,956,013 | |

| | | | | | |

| | |

TOTAL INVESTMENTS - 100.1%

(Cost $101,980,793) | | | | | 101,956,013 | |

| | | | | | |

| | |

| Other Assets and Liabilities (net) - (0.1)% | | | | | (60,797 | ) |

| | | | | | |

| | |

| NET ASSETS - 100.0% | | | | $ | 101,895,216 | |

| | | | | | |

Portfolio Footnotes:

| (a) | | A Portfolio of the American Funds Insurance Series. |

See accompanying notes to financial statements

3

Met Investors Series Trust

American Funds Bond Portfolio

The Portfolio is subject to the provisions of Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (FAS 157). FAS 157 establishes a framework for measuring fair value and expands disclosures about fair value measurements in financial statements. The three levels of the hierarchy under FAS 157 are described below:

| Level 1—quoted | prices in active markets for identical securities |

| Level 2—other | significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.) |

| Level 3—significant | unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Portfolio’s investments as of June 30, 2009 by security type as required by FAS 157-4:

ASSETS VALUATION INPUT

| | | | | | | | | | | | |

| Description | | Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

Investment Company Security | | $ | 101,956,013 | | $ | — | | $ | — | | $ | 101,956,013 |

TOTAL INVESTMENTS | | $ | 101,956,013 | | $ | — | | $ | — | | $ | 101,956,013 |

See accompanying notes to financial statements

4

MET INVESTORS SERIES TRUST

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2009 (Unaudited)

| | | | |

| American Funds Bond Portfolio | | | |

| Assets | | | | |

Investments, at value (a) | | $ | 101,956,013 | |

Receivable for Trust shares sold | | | 174,297 | |

Receivable from Manager | | | 1,369 | |

| | | | |

Total assets | | | 102,131,679 | |

| | | | |

| Liabilities | | | | |

Payables for: | | | | |

Investments purchased | | | 162,598 | |

Trust shares redeemed | | | 11,699 | |

Distribution and services fees—Class C | | | 42,201 | |

Administration fee | | | 2,000 | |

Custodian and accounting fees | | | 3,720 | |

Deferred trustee fees | | | 3,427 | |

Accrued expenses | | | 10,818 | |

| | | | |

Total liabilities | | | 236,463 | |

| | | | |

| Net Assets | | $ | 101,895,216 | |

| | | | |

| Net Assets Represented by | | | | |

Paid in surplus | | $ | 101,393,293 | |

Accumulated net realized loss | | | (78,639 | ) |

Unrealized depreciation on investments | | | (24,780 | ) |

Undistributed net investment income | | | 605,342 | |

| | | | |

Total | | $ | 101,895,216 | |

| | | | |

| Net Assets | | | | |

Class C | | $ | 101,895,216 | |

| | | | |

| Capital Shares Outstanding | | | | |

Class C | | | 11,227,953 | |

| | | | |

| Net Asset Value and Offering Price Per Share | | | | |

Class C | | $ | 9.08 | |

| | | | |

| | | | | |

(a) Investments at cost | | $ | 101,980,793 | |

See accompanying notes to financial statements

5

MET INVESTORS SERIES TRUST

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2009 (Unaudited)

| | | | |

| American Funds Bond Portfolio | | | |

| Investment Income | | | | |

Dividends from Master Fund | | $ | 804,220 | |

| | | | |

Total investment income | | | 804,220 | |

| | | | |

| Expenses | | | | |

Administration fees | | | 11,985 | |

Custodian and accounting fees | | | 12,138 | |

Distribution and services fees—Class C | | | 168,277 | |

Audit and tax services | | | 13,890 | |

Legal | | | 16,734 | |

Trustee fees and expenses | | | 444 | |

Shareholder reporting | | | 3,525 | |

Insurance | | | 3,119 | |

Other | | | 2,255 | |

| | | | |

Total expenses | | | 232,367 | |

Less expenses reimbursed by the Manager | | | (33,493 | ) |

| | | | |

Net expenses | | | 198,874 | |

| | | | |

Net investment income | | | 605,346 | |

| | | | |

| Net Realized and Unrealized Gain on Investments | | | | |

Net change in unrealized appreciation on: | | | | |

Investments | | | 3,809,821 | |

| | | | |

Net change in unrealized appreciation on investments | | | 3,809,821 | |

| | | | |

Net realized and unrealized gain on investments | | | 3,809,821 | |

| | | | |

| Net Increase in Net Assets from Operations | | $ | 4,415,167 | |

| | | | |

See accompanying notes to financial statements

6

MET INVESTORS SERIES TRUST

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| American Funds Bond Portfolio | | | | | | |

| | | Period Ended

June 30, 2009

(Unaudited) | | | Period Ended

December 31,

2008* | |

| Increase (Decrease) in Net Assets: | | | | | | | | |

| Operations | | | | | | | | |

Net investment income | | $ | 605,346 | | | $ | 1,797,336 | |

Net realized loss on investments and capital gain distribution from Master Fund | | | — | | | | (56,697 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 3,809,821 | | | | (3,834,601 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 4,415,167 | | | | (2,093,962 | ) |

| | | | | | | | |

| Distributions to Shareholders | | | | | | | | |

From net investment income | | | | | | | | |

Class C | | | (8 | ) | | | (1,828,551 | ) |

From net realized gains | | | | | | | | |

Class C | | | — | | | | — | |

| | | | | | | | |

Net decrease in net assets resulting from distributions | | | (8 | ) | | | (1,828,551 | ) |

| | | | | | | | |

| Capital Share Transactions | | | | | | | | |

Proceeds from shares sold | | | | | | | | |

Class C | | | 66,042,253 | | | | 44,951,952 | |

Net asset value of shares issued through dividend reinvestment | | | | | | | | |

Class C | | | 8 | | | | 1,828,551 | |

Cost of shares repurchased | | | | | | | | |

Class C | | | (4,671,517 | ) | | | (6,748,677 | ) |

| | | | | | | | |

Net increase in net assets from capital share transactions | | | 61,370,744 | | | | 40,031,826 | |

| | | | | | | | |

| Net Increase in Net Assets | | | 65,785,903 | | | | 36,109,313 | |

Net assets at beginning of period | | | 36,109,313 | | | | — | |

| | | | | | | | |

Net assets at end of period | | $ | 101,895,216 | | | $ | 36,109,313 | |

| | | | | | | | |

Net assets at end of period includes undistributed net investment income | | $ | 605,342 | | | $ | 4 | |

| | | | | | | | |

| * | | For the period 4/28/08 (Commencement of Operations) through 12/31/2008. |

See accompanying notes to financial statements

7

MET INVESTORS SERIES TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | |

| | |

| Selected Per Share Data for the Period Ended: | | | | | | |

| | |

| | | | | | | |

| American Funds Bond Portfolio | | Class C | |

| | | For the Period

Ended

June 30, 2009

(Unaudited) | | | For the

Period Ended

December 31,

2008(b) | |

| | | |

| Net Asset Value, Beginning of Period | | $ | 8.58 | | | $ | 10.00 | |

| | | | | | | | |

| Income from Investment Operations: | | | | | | | | |

Net Investment Income(a) | | | 0.09 | | | | 0.87 | |

Net Realized/Unrealized Gain (Loss) on Investments | | | 0.41 | | | | (1.83 | ) |

| | | | | | | | |

Total From Investment Operations | | | 0.50 | | | | (0.96 | ) |

| | | | | | | | |

| Less Distributions | | | | | | | | |

Dividends from Net Investment Income | | | (0.00 | )+ | | | (0.46 | ) |

Distributions from Net Realized Capital Gains | | | — | | | | — | |

| | | | | | | | |

Total Distributions | | | (0.00 | )+ | | | (0.46 | ) |

| | | | | | | | |

| Net Asset Value, End of Period | | $ | 9.08 | | | $ | 8.58 | |

| | | | | | | | |

| Total Return | | | 5.83 | % | | | (9.61 | )% |

Ratio of Expenses to Average Net Assets After Reimbursement | | | 0.65 | %* | | | 0.65 | %* |

Ratio of Expenses to Average Net Assets Before Reimbursement and Rebates | | | 0.76 | %* | | | 1.05 | %* |

Ratio of Net Investment Income to Average Net Assets | | | 1.98 | %* | | | 13.82 | %* |

Portfolio Turnover Rate | | | 0.0 | %(c) | | | 6.3 | % |

Net Assets, End of Period (in millions) | | $ | 101.9 | | | $ | 36.1 | |

| + | | Rounds to less than $0.005 per share. |

| (a) | | Per share amounts based on average shares outstanding during the period. |

| (b) | | Commencement of operations—4/28/08. |

| (c) | | For the period ended 6/30/2009, the portfolio turnover is zero, due to no sales activity. |

See accompanying notes to financial statements

8

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

1. Organization

Met Investors Series Trust (the “Trust”) is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently offers forty-eight Portfolios (the “Portfolios”), each of which operates as a distinct investment vehicle of the Trust. As of June 30, 2009, the Portfolio included in this report is American Funds Bond Portfolio (the “Portfolio”), which is diversified. Shares in the Trust are not offered directly to the general public and are currently available only to separate accounts established by certain affiliated life insurance companies.

The Trust is managed by MetLife Advisers, LLC (the “Manager”), an affiliate of MetLife, Inc. (“MetLife”).

The Trust has registered four classes of shares: Class C Shares are currently offered by the Portfolio. Class A, B and E Shares are not currently offered by the Portfolio. Shares of each Class of the Portfolio represent an equal pro rata interest in the Portfolio and generally give the shareholder the same voting, dividend, liquidation, and other rights. Investment income, realized and unrealized capital gains and losses, the common expenses of the Portfolio and certain Portfolio-level expense reductions, if any, are allocated on a pro rata basis to each Class based on the relative net assets of each Class to the total net assets of the Portfolio. Each Class of shares differs in its respective distribution expenses.

The Portfolio, a feeder fund, seeks to achieve its investment objective by investing all of its investable assets in a master fund, the Bond Fund (the “Master Fund”), a fund of the American Funds Insurance Series (“AFIS”). AFIS is an open-end diversified investment management company advised by Capital Research and Management Company (“CRMC"), an indirect, wholly owned subsidiary of The Capital Group Companies, Inc. The financial statements of the Master Fund, including the summary investment portfolio, are included elsewhere in this report and should be read with the Portfolio’s financial statements. As of June 30, 2009, the Portfolio owned approximately 1.47% of the Master Fund.

2. Significant Accounting Policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements. The policies are in conformity with GAAP.

A. Security Valuation - Investments in the Master Fund are valued at its closing daily net asset value. The net asset value of the Portfolio is calculated based on the net asset value of the Master Fund in which the Portfolio invests. For information about the use of fair value pricing by the Master Fund, please refer to the prospectus for the Master Fund.

B. Security Transactions - Security transactions are recorded on a trade date basis. Realized gains and losses are determined on investments and unrealized appreciation and depreciation are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

C. Investment Income and Expenses - Interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Income and capital gain distributions from the Master Fund are recorded on the ex-dividend date.

D. Income Taxes - It is the Portfolio’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies. Accordingly, the Portfolio intends to distribute substantially all of its taxable income and net realized gains on investments, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Portfolio’s financial statements. The Portfolio files U.S. Federal and various state tax returns. No income tax returns are currently under examination. The 2008 tax year remains subject to examination by U.S. Federal and most tax authorities. It is also the Portfolio’s policy to comply with the diversification requirements of the Code so that variable annuity and variable life insurance contracts investing in the Portfolio will not fail to qualify as annuity and life insurance contracts for tax purposes. Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

E. Distribution of Income and Gains - Distributions of net investment income and capital gains are recorded on the ex-dividend date.

9

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

3. Investment Management Agreement and Other Transactions with Affiliates

The Trust has entered into a management agreement with the Manager (the “Management Agreement”) for investment management services in connection with the investment management of the Portfolios. The Manager is subject to the supervision and direction of the Board of Trustees (the “Board”) and has overall responsibility for the general management and administration of the Trust. The Manager selects the Master Fund in which the Portfolio will invest and monitors the Master Fund investment program. The Manager is an affiliate of MetLife. The Manager currently receives no compensation for its services to the Portfolio. In the event that the Portfolio were to withdraw from the Master Fund and invest its assets directly in investment securities, the Manager would retain the services of an investment adviser and would receive a management fee at an annual rate of percentage of the assets of the Portfolio as follows:

| | |

% per annum | | Average Daily Net Assets |

| |

| 0.55% | | ALL |

Metropolitan Life Insurance Company (“MLIC”) serves as the transfer agent for the Trust. MLIC is an affiliate of the Manager. MLIC receives no fees for its services to the Trust.

The Manager has entered into an expense limitation agreement with the Trust (“Expense Limitation Agreement”) in the interest of limiting expenses of the Portfolio of the Trust. The Expense Limitation Agreement shall continue in effect with respect to the Portfolio until April 30, 2010. Pursuant to that Expense Limitation Agreement, the Manager has agreed to waive or limit its fees and to assume other expenses so that the total annual operating expenses of the Portfolio other than interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with accounting principles generally accepted in the United States of America, other extraordinary expenses not incurred in the ordinary course of the Portfolio’s business, and Master Fund fees and expenses, but including amounts payable pursuant to a plan adopted in accordance with Rule 12b-1 under the 1940 Act, are limited to the following expense ratio as a percentage of the Portfolio’s average daily net assets:

| | | | | | | |

Maximum Expense Ratio under current

Expense Limitation Agreement | | | Expenses Deferred in |

| | 2008 | | 2009 |

| | Subject to repayment until

December 31, |

Class C | | | 2013 | | 2014 |

| | |

| 0.65 | % | | $ | 51,953 | | $ | 33,493 |

The expenses reimbursed for the period ended June 30, 2009 are shown as expenses reimbursed in the Statement of Operations of the Portfolio.

If in any year in which the Management Agreement is still in effect, the estimated aggregate portfolio operating expenses of the Portfolio for the fiscal year are less than the Maximum Expense Ratio for that year, subject to approval by the Trust’s Board, the Manager shall be entitled to reimbursement by the Portfolio to the extent that the charge does not cause the expenses in such subsequent year to exceed the Maximum Expense Ratio as stated above. The Portfolio is not obligated to repay any expense paid by the Manager more than five years after the end of the fiscal year in which such expense was incurred.

The Trust has a distribution agreement with MetLife Investors Distribution Company (“MIDC” or the “Distributor”) in which MIDC serves as the Distributor for the Trust’s Class C Shares. MIDC is a wholly-owned subsidiary of MetLife Investors Group, Inc., an affiliate of the Manager. The Class C distribution plan provides that the Trust, on behalf of the Portfolio, may pay annually up to 1.00% of the average net assets of the Portfolio attributable to its Class C Shares in respect to activities primarily intended to result in the sale of Class C Shares. However, under the Class C distribution agreement, payments to the Distributor for activities pursuant to the Class C distribution plan are currently limited to payments at an annual rate equal to 0.55% of average daily net assets of the Portfolio, attributable to its Class C Shares.

Under terms of the Class C distribution plan and distribution agreement, the Portfolio is authorized to make payments monthly to the Distributor that may be used to pay or reimburse entities providing distribution and shareholder servicing with respect to the Class C Shares for such entities’ fees or expenses incurred.

Each Trustee of the Trust who is not currently an employee of the Manager or any of its affiliates receives compensation from the Trust. A deferred compensation plan (the “Plan”) is available to the Trustees on a voluntary basis. Deferred amounts remain in the Trust until distributed in accordance with the provisions of the Plan. The value of a participating Trustee’s deferral account is based on theoretical investments of deferred amounts, on the normal payment dates, in certain portfolios of the Trust or Metropolitan Series Fund, Inc. as designated by the participating Trustee. Changes in the value of participants’ deferral accounts are reflected as Trustees’ fees and expenses in the Statement of Operations. The portions of the accrued obligations allocated to the Portfolio, if any, under the Plan are reflected as Deferred Trustees’ fees in the Statement of Assets and Liabilities.

10

MET INVESTORS SERIES TRUST

Notes to Financial Statements

June 30, 2009 (Unaudited)

4. Shares of Beneficial Interest

Transactions in shares of beneficial interest for the periods ended noted below were as follows:

| | | | | | | | | | | | | |

| | | Beginning

Shares | | Sales | | Reinvestments | | Redemptions | | | Net Increase

in Shares

Outstanding | | Ending

Shares |

| | | | | | |

Class C | | | | | | | | | | | | | |

| | | | | | |

6/30/2009 | | 4,206,415 | | 7,556,687 | | 1 | | (535,150 | ) | | 7,021,538 | | 11,227,953 |

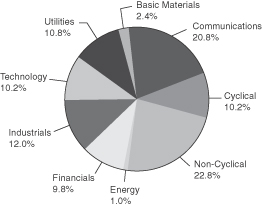

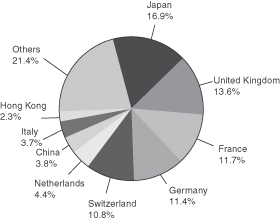

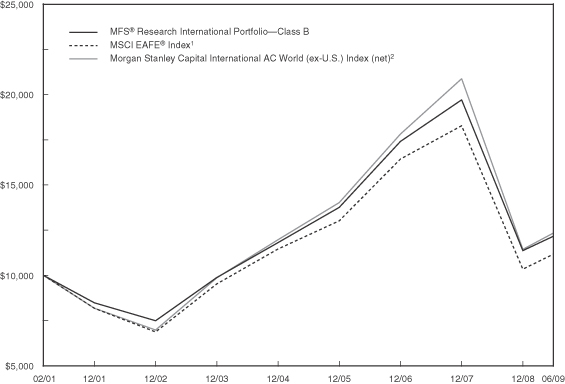

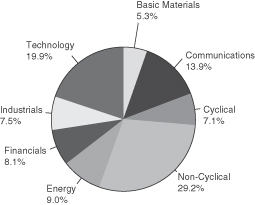

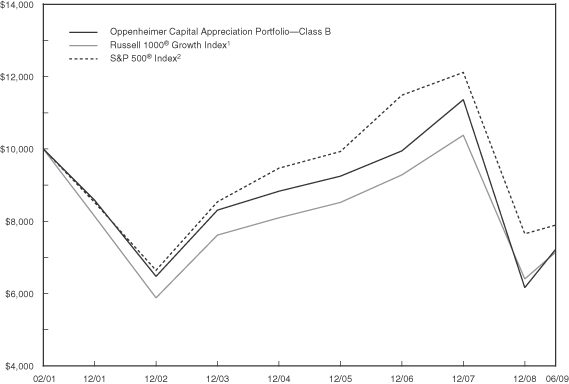

| | | | | | |