UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10183

MET INVESTORS SERIES TRUST

(Exact name of registrant as specified in charter)

5 Park Plaza, Suite 1900

Irvine, CA 92614

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Elizabeth M. Forget President Met Investors Series Trust 5 Park Plaza, Suite 1900

Irvine, CA 92614 | | Stacy H. Louizos, Esq.

David C. Mahaffey, Esq. Sullivan & Worcester LLP 1666 K Street, N.W. Washington, D.C. 20006 |

Registrant’s telephone number, including area code: (800) 848-3854

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Explanatory Note:

Met Investors Series Trust (the “Registrant”) is filing this amendment to its Form N-CSR for the period ended June 30, 2011, originally filed with the Securities and Exchange Commission on September 6, 2011, to add to or revise certain information in the semiannual reports for each of AllianceBernstein Global Dynamic Allocation Portfolio, American Funds® Balanced Allocation Portfolio, AQR Global Risk Balanced Portfolio, BlackRock Global Tactical Strategies Portfolio, Legg Mason ClearBridge Aggressive Growth Portfolio, Met/Franklin Low Duration Total Return Portfolio, Met/Franklin Mutual Shares Portfolio, MetLife Balanced Plus Portfolio, PIMCO Inflation Protected Bond Portfolio, PIMCO Total Return Portfolio, T. Rowe Price Mid Cap Growth Portfolio and Third Avenue Small Cap Value Portfolio of the Registrant. This amendment does not modify in any way the semiannual reports for any other Portfolio of the Registrant.

| Item 1: | Report to Shareholders. |

Simplify your life…

with MetLife eDelivery® while helping MetLife preserve the planet’s natural resources.

(see details on inside cover)

| | |

Met Investors Series Trust AllianceBernstein Global Dynamic Allocation Portfolio Semiannual Report | | June 30, 2011, as amended December 16, 2011 |

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Managed By AllianceBernstein L.P.

Portfolio Manager Commentary*

Performance

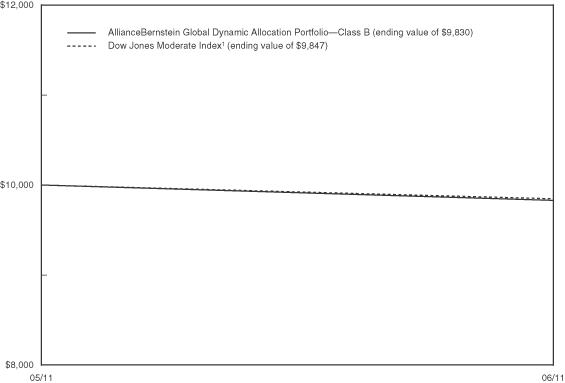

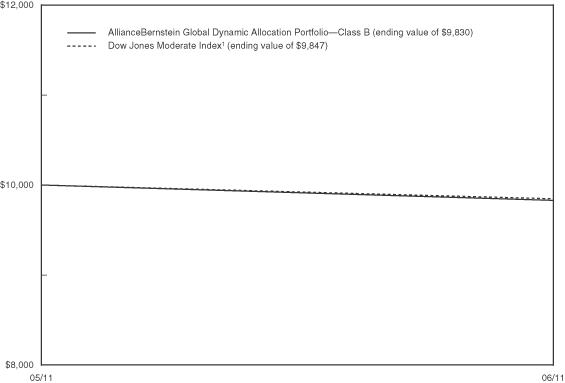

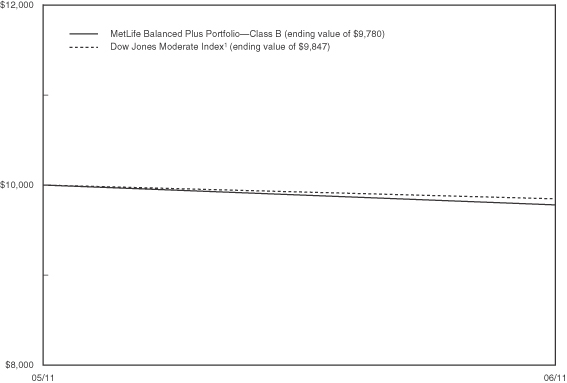

Since its May 2, 2011 inception, the Class B shares of the AllianceBernstein Global Dynamic Allocation Portfolio returned -1.70%, compared to the -1.53% return of its benchmark, the Dow Jones Moderate Index1.

Market Environment/Conditions

Since the inception of the Portfolio in May there have been renewed fears about the sustainability of economic growth. This follows two major shocks from early 2011. First, unrest in the Middle East and North Africa triggered a sharp rise in oil prices. Second, the effects of the earthquake in Japan caused significant disruptions in the global supply chain. These shocks were compounded by other ongoing uncertainties, which include rising default risk on Greek sovereign debt and the end of the US Federal Reserve’s second round of quantitative easing. Equities rallied toward the latter part of June on optimism around the European debt crisis as the Greek Prime Minister survived a confidence vote and the Greek Parliament passed a package of austerity measures.

Global equity markets (US equities, Developed Foreign, and Emerging Markets) were all negative for most of the period under review. In fixed income, both US Treasuries and global sovereigns (ex US) had positive returns and returns for the three month Treasury bill was flat for the period.

Portfolio Review/Current Positioning

The Portfolio underperformed the Dow Jones Global Moderate Index benchmark slightly since inception on May 2. Exposure to developed US and international equities detracted from performance due to renewed fears about the sustainability of economic growth. Global equity markets underperformed for most of the period under review. The allocation to bonds, both domestic and international, contributed positively to performance, while the interest rate swap also added to performance. Interest rates fell over the period, so both bond exposure and the interest rate swap exposure had positive impacts on performance. Contributions were 29 and 40 basis points (bps), respectively. Additionally, performance was also helped by the opportunistic allocation to REITs and currency exposures, which added approximately 20 bps.

The Portfolio’s equity holdings were at a near-neutral position. Volatility rose over the last couple of months of the period, but the rise was still fairly modest. While risks were elevated, strong corporate fundamentals continued to make equity valuations attractive, particularly compared to the low level of bond yields. In addition, we took steps to further diversify equity holdings by reducing positions in US equities and increasing positions in Developed International equities, Emerging Market equities, and Real Estate equities.

Daniel Loewy, CFA

Co-Chief Investment Officer and Research Director—Dynamic Asset Allocation

Seth Masters

Co-Chief Investment Officer—Dynamic Asset Allocation, Chief Investment Officer—Asset Allocation and Bernstein Global Wealth Management

AllianceBernstein L.P.

*This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Portfolio, market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and the subadvisory firm undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed above (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Portfolio’s trading intent. Information about the Portfolio’s holdings, asset allocation or country diversification is historical and is not an indication of future Portfolio composition, which may vary. Direct investment in any index is not possible. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses, and sales charges applicable to mutual fund investments. In addition, the returns do not reflect additional fees charged by separate accounts or variable insurance contracts that an investor in the Portfolio may pay. If these additional fees were reflected, performance would have been lower.

1

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Portfolio Composition as of June 30, 2011

Top Issuers

| | | | |

| | |

% of

Net Assets | |

U.S. Treasury Notes | | | 11.1 | |

U.S. Treasury Bonds | | | 3.9 | |

Vanguard MSCI Emerging Markets ETF | | | 3.7 | |

Midcap SPDR Trust Series I | | | 2.0 | |

iShares Russell 2000 Index Fund | | | 2.0 | |

Federal Home Loan Mortgage Corp. | | | 1.5 | |

Federal Home Loan Banks | | | 0.9 | |

Federal National Mortgage Association | | | 0.9 | |

Exxon Mobil Corp. | | | 0.3 | |

Nestle S.A. | | | 0.2 | |

Top Equity Sectors

| | | | |

| | | % of

Market Value of

Total Investments | |

Cash & Equivalents | | | 52.5 | |

Investment Company Securities | | | 7.8 | |

Non-Cyclical | | | 4.3 | |

Financials | | | 4.1 | |

Industrials | | | 2.5 | |

Fixed Income Sectors

| | | | |

| | | % of

Market Value of

Total Investments | |

U.S. Treasury & Government Agencies | | | 18.6 | |

2

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

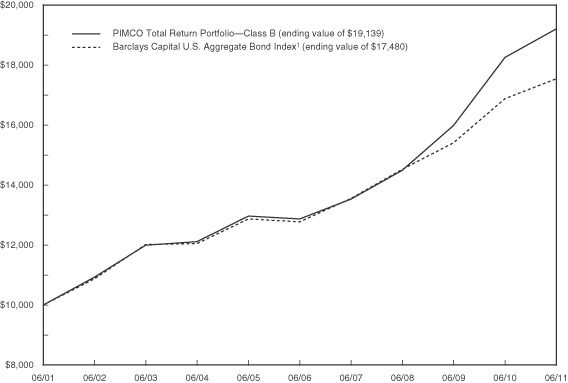

AllianceBernstein Global Dynamic Allocation Portfolio managed by

AllianceBernstein L.P. vs. Dow Jones Moderate Index1

| | | | |

| | | Cumulative Return2 (for the period ended June 30, 2011) | |

| | | Since

Inception3 | |

| AllianceBernstein Global Dynamic Allocation Portfolio—Class B | | | -1.70% | |

| Dow Jones Moderate Index1 | | | -1.53% | |

1The Dow Jones Moderate Index is a total returns index designed to provide asset allocation strategists with a target risk benchmark. Each month, the index adjusts its weightings of stocks, bonds, and cash indices (both domestic and foreign) from Barclays and Dow Jones such that the risk of that combination will have 60% of the risk of an all equity portfolio.

2“Cumulative Return” is calculated including reinvestment of all income dividends and capital gain distributions.

3 Inception of the Class B shares is 5/02/11. Index returns are based on an inception date of 5/02/11.

Past performance does not guarantee future results. The investment return and principal value of an investment in the Portfolio will fluctuate, so that shares, on any given day or when redeemed, may be worth more or less than their original cost. Performance numbers are net of all Portfolio expenses but do not include any insurance, sales, or administration charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower. The Index does not include fees or expenses and is not available for direct investment.

3

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Understanding Your Portfolio’s Expenses

Shareholder Expense Example

As a shareholder of the Portfolio, you incur ongoing costs, including management fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) (referred to as “expenses”) of investing in the Portfolio and compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, May 2, 2011 through June 30, 2011.

Actual Expenses

The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested in the Portfolio, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees or charges of your variable insurance product or any additional expenses that participants in certain eligible qualified plans may bear relating to the operations of their plan. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these other costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

May 2, 2011**

| | | Ending

Account Value

June 30, 2011 | | | Expenses Paid

During Period***

May 2, 2011

to June 30, 2011 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Class B(a)(b) | | | | | | | | | | | | | | | | |

Actual | | | 1.06% | | | $ | 1,000.00 | | | $ | 998.30 | | | $ | 1.77 | |

Hypothetical* | | | 1.06% | | | | 1,000.00 | | | | 1,006.58 | | | | 1.78 | |

| | | | | | | | | | | | | | | | |

* Hypothetical assumes a rate of return of 5% per year before expenses.

** Commencement of operations—May 2, 2011.

*** Expenses paid are equal to the Portfolio’s annualized expense ratio for the most recent two month period, as shown above, multiplied by the average account value over the period, multiplied by the number of days (60 days) in the most recent fiscal period, divided by 365 (to reflect the two month period).

(a) The annualized expense ratio shown reflects an expense limitation agreement between MetLife Advisers, LLC and the Portfolio as described in Note 3 of the Notes to Financial Statements.

(b) The annualized expense ratio reflects the impact of the management fee waiver as described in Note 3 to the Financial Statements.

4

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—20.7% of Net Assets

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Aerospace & Defense—0.3% | |

BAE Systems plc | | | 13,628 | | | $ | 69,743 | |

Boeing Co. (The) | | | 1,995 | | | | 147,490 | |

Cobham plc | | | 4,615 | | | | 15,691 | |

Elbit Systems, Ltd. | | | 94 | | | | 4,455 | |

European Aeronautic Defence and Space Co. N.V. | | | 1,632 | | | | 54,705 | |

Finmeccanica S.p.A. | | | 1,618 | | | | 19,610 | |

General Dynamics Corp. | | | 1,000 | | | | 74,520 | |

Goodrich Corp. | | | 370 | | | | 35,335 | |

Honeywell International, Inc. | | | 2,120 | | | | 126,331 | |

ITT Corp. | | | 500 | | | | 29,465 | |

L-3 Communications Holdings, Inc. | | | 305 | | | | 26,672 | |

Lockheed Martin Corp. | | | 805 | | | | 65,181 | |

Northrop Grumman Corp. | | | 805 | | | | 55,827 | |

Precision Castparts Corp. | | | 425 | | | | 69,976 | |

Raytheon Co. | | | 995 | | | | 49,601 | |

Rockwell Collins, Inc. | | | 435 | | | | 26,835 | |

Rolls-Royce Holdings plc* | | | 7,483 | | | | 77,553 | |

Safran S.A. | | | 667 | | | | 28,529 | |

Singapore Technologies Engineering, Ltd. | | | 6,000 | | | | 14,713 | |

Textron, Inc. | | | 750 | | | | 17,708 | |

Thales S.A. | | | 398 | | | | 17,188 | |

United Technologies Corp. | | | 2,545 | | | | 225,258 | |

| | | | | | | | |

| | | | | | | 1,252,386 | |

| | | | | | | | |

|

| Air Freight & Logistics—0.1% | |

C.H. Robinson Worldwide, Inc. | | | 440 | | | | 34,690 | |

Deutsche Post AG | | | 3,383 | | | | 65,101 | |

Expeditors International of Washington, Inc. | | | 565 | | | | 28,922 | |

FedEx Corp. | | | 870 | | | | 82,520 | |

PostNL N.V. | | | 1,354 | | | | 11,508 | |

TNT Express N.V.* | | | 1,408 | | | | 14,625 | |

Toll Holdings, Ltd. | | | 2,683 | | | | 13,965 | |

United Parcel Service, Inc.—Class B | | | 2,680 | | | | 195,452 | |

Yamato Holdings Co., Ltd. | | | 1,600 | | | | 25,018 | |

| | | | | | | | |

| | | | | | | 471,801 | |

| | | | | | | | |

|

| Airlines—0.0% | |

Air France-KLM* | | | 540 | | | | 8,301 | |

All Nippon Airways Co., Ltd. | | | 3,000 | | | | 9,746 | |

Cathay Pacific Airways, Ltd. | | | 5,000 | | | | 11,553 | |

Deutsche Lufthansa AG | | | 915 | | | | 19,967 | |

International Consolidated Airlines Group S.A.* | | | 3,708 | | | | 15,074 | |

Qantas Airways, Ltd.* | | | 4,436 | | | | 8,759 | |

| | | | | | | | |

|

| Airlines—(Continued) | |

Ryanair Holdings plc, ADR | | | 300 | | | $ | 8,802 | |

Singapore Airlines, Ltd. | | | 2,000 | | | | 23,170 | |

Southwest Airlines Co. | | | 2,125 | | | | 24,268 | |

| | | | | | | | |

| | | | | | | 129,640 | |

| | | | | | | | |

|

| Auto Components—0.1% | |

Aisin Seiki Co., Ltd. | | | 800 | | | | 30,752 | |

Bridgestone Corp. | | | 2,600 | | | | 59,515 | |

Cie Generale des Etablissements Michelin—Class B | | | 706 | | | | 69,150 | |

Continental AG* | | | 320 | | | | 33,671 | |

Denso Corp. | | | 1,900 | | | | 70,256 | |

Goodyear Tire & Rubber Co. (The)* | | | 630 | | | | 10,565 | |

Johnson Controls, Inc. | | | 1,815 | | | | 75,613 | |

Koito Manufacturing Co., Ltd. | | | 1,000 | | | | 17,373 | |

NGK Spark Plug Co., Ltd. | | | 1,000 | | | | 13,727 | |

NHK Spring Co., Ltd. | | | 1,000 | | | | 10,156 | |

NOK Corp. | | | 400 | | | | 6,810 | |

Nokian Renkaat OYJ | | | 438 | | | | 22,010 | |

Pirelli & C S.p.A. | | | 951 | | | | 10,290 | |

Stanley Electric Co., Ltd. | | | 600 | | | | 10,453 | |

Sumitomo Rubber Industries, Ltd. | | | 700 | | | | 8,420 | |

Toyoda Gosei Co., Ltd. | | | 200 | | | | 4,516 | |

Toyota Boshoku Corp. | | | 300 | | | | 4,951 | |

Toyota Industries Corp. | | | 700 | | | | 22,959 | |

| | | | | | | | |

| | | | | | | 481,187 | |

| | | | | | | | |

|

| Automobiles—0.4% | |

Bayerische Motoren Werke (BMW) AG | | | 1,323 | | | | 132,216 | |

Daihatsu Motor Co., Ltd. | | | 1,000 | | | | 16,914 | |

Daimler AG | | | 3,620 | | | | 272,865 | |

Fiat S.p.A. | | | 3,056 | | | | 33,599 | |

Ford Motor Co.* | | | 10,335 | | | | 142,520 | |

Fuji Heavy Industries, Ltd. | | | 2,000 | | | | 15,426 | |

Harley-Davidson, Inc. | | | 625 | | | | 25,606 | |

Honda Motor Co., Ltd. | | | 6,500 | | | | 248,651 | |

Isuzu Motors, Ltd. | | | 5,000 | | | | 23,498 | |

Mazda Motor Corp.* | | | 6,000 | | | | 15,698 | |

Mitsubishi Motors Corp.* | | | 15,000 | | | | 18,228 | |

Nissan Motor Co., Ltd. | | | 9,900 | | | | 103,364 | |

Peugeot S.A. | | | 608 | | | | 27,259 | |

Renault S.A. | | | 768 | | | | 45,603 | |

Suzuki Motor Corp. | | | 1,300 | | | | 29,097 | |

Toyota Motor Corp. | | | 11,000 | | | | 450,121 | |

Volkswagen AG | | | 118 | | | | 21,713 | |

Yamaha Motor Co., Ltd.* | | | 1,100 | | | | 20,078 | |

| | | | | | | | |

| | | | | | | 1,642,456 | |

| | | | | | | | |

See accompanying notes to financial statements.

5

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Beverages—0.5% | |

Anheuser-Busch InBev N.V. | | | 3,208 | | | $ | 186,366 | |

Asahi Group Holdings, Ltd. | | | 1,500 | | | | 30,039 | |

Brown-Forman Corp.—Class B | | | 305 | | | | 22,780 | |

Carlsberg A.S.—Class B | | | 428 | | | | 46,629 | |

Coca Cola Hellenic Bottling Co. S.A.* | | | 732 | | | | 19,689 | |

Coca-Cola Amatil, Ltd. | | | 2,266 | | | | 27,771 | |

Coca-Cola Co. (The) | | | 6,285 | | | | 422,918 | |

Coca-Cola Enterprises, Inc. | | | 880 | | | | 25,678 | |

Coca-Cola West Co., Ltd. | | | 200 | | | | 3,819 | |

Constellation Brands, Inc.—Class A* | | | 445 | | | | 9,265 | |

Diageo plc | | | 10,009 | | | | 204,730 | |

Dr Pepper Snapple Group, Inc. | | | 620 | | | | 25,996 | |

Foster’s Group, Ltd. | | | 7,736 | | | | 42,755 | |

Heineken Holding N.V. | | | 461 | | | | 23,621 | |

Heineken N.V. | | | 1,036 | | | | 62,397 | |

Kirin Holdings Co., Ltd. | | | 3,000 | | | | 41,627 | |

Molson Coors Brewing Co.—Class B | | | 435 | | | | 19,462 | |

PepsiCo, Inc. | | | 4,355 | | | | 306,723 | |

Pernod Ricard S.A. | | | 792 | | | | 78,183 | |

SABMiller plc | | | 3,805 | | | | 138,877 | |

| | | | | | | | |

| | | | | | | 1,739,325 | |

| | | | | | | | |

|

| Biotechnology—0.1% | |

Actelion, Ltd.* | | | 440 | | | | 21,656 | |

Amgen, Inc.* | | | 2,550 | | | | 148,792 | |

Biogen Idec, Inc.* | | | 680 | | | | 72,706 | |

Celgene Corp.* | | | 1,250 | | | | 75,400 | |

Cephalon, Inc.* | | | 190 | | | | 15,181 | |

CSL, Ltd. | | | 2,164 | | | | 76,775 | |

Gilead Sciences, Inc.* | | | 2,175 | | | | 90,067 | |

Grifols S.A.* | | | 553 | | | | 11,116 | |

| | | | | | | | |

| | | | | | | 511,693 | |

| | | | | | | | |

| | |

| Building Products—0.1% | | | | | | | | |

Asahi Glass Co., Ltd. | | | 4,000 | | | | 46,426 | |

Assa Abloy AB—Class B | | | 1,250 | | | | 33,717 | |

Cie de St-Gobain | | | 1,591 | | | | 103,184 | |

Daikin Industries, Ltd. | | | 900 | | | | 31,672 | |

Geberit AG* | | | 156 | | | | 36,935 | |

JS Group Corp. | | | 1,100 | | | | 28,208 | |

Masco Corp. | | | 945 | | | | 11,368 | |

Nippon Sheet Glass Co., Ltd. | | | 3,000 | | | | 9,263 | |

TOTO, Ltd. | | | 1,000 | | | | 7,725 | |

| | | | | | | | |

| | | | | | | 308,498 | |

| | | | | | | | |

| | |

| Capital Markets—0.5% | | | | | | | | |

3i Group plc | | | 3,880 | | | | 17,525 | |

| | | | | | | | |

| | |

| Capital Markets—(Continued) | | | | | | | | |

Ameriprise Financial, Inc. | | | 685 | | | $ | 39,511 | |

Bank of New York Mellon Corp. | | | 3,365 | | | | 86,211 | |

BlackRock, Inc. | | | 300 | | | | 57,543 | |

Charles Schwab Corp. (The) | | | 2,685 | | | | 44,168 | |

Credit Suisse Group AG* | | | 4,504 | | | | 175,053 | |

Daiwa Securities Group, Inc. | | | 7,000 | | | | 30,640 | |

Deutsche Bank AG | | | 3,715 | | | | 219,866 | |

E*Trade Financial Corp.* | | | 685 | | | | 9,453 | |

Federated Investors, Inc.—Class B | | | 250 | | | | 5,960 | |

Franklin Resources, Inc. | | | 427 | | | | 56,061 | |

GAM Holding AG* | | | 955 | | | | 15,664 | |

Goldman Sachs Group, Inc. (The) | | | 1,430 | | | | 190,319 | |

ICAP plc | | | 2,243 | | | | 17,047 | |

Invesco, Ltd. | | | 1,250 | | | | 29,250 | |

Investec plc | | | 1,932 | | | | 15,661 | |

Janus Capital Group, Inc. | | | 500 | | | | 4,720 | |

Julius Baer Group, Ltd.* | | | 826 | | | | 34,096 | |

Legg Mason, Inc. | | | 380 | | | | 12,449 | |

Macquarie Group, Ltd. | | | 1,386 | | | | 46,481 | |

Man Group plc | | | 7,511 | | | | 28,603 | |

Mizuho Securities Co., Ltd.* | | | 2,000 | | | | 4,786 | |

Morgan Stanley | | | 4,180 | | | | 96,182 | |

Nomura Holdings, Inc. | | | 14,100 | | | | 69,237 | |

Northern Trust Corp. | | | 680 | | | | 31,253 | |

Ratos AB—B Shares | | | 766 | | | | 14,767 | |

SBI Holdings, Inc. | | | 80 | | | | 7,371 | |

Schroders plc | | | 452 | | | | 11,235 | |

State Street Corp. | | | 1,370 | | | | 61,773 | |

T Rowe Price Group, Inc. | | | 690 | | | | 41,635 | |

UBS AG* | | | 14,546 | | | | 265,039 | |

| | | | | | | | |

| | | | | | | 1,739,559 | |

| | | | | | | | |

| | |

| Chemicals—0.6% | | | | | | | | |

Air Liquide S.A. | | | 1,136 | | | | 163,073 | |

Air Products & Chemicals, Inc. | | | 615 | | | | 58,782 | |

Air Water, Inc. | | | 1,000 | | | | 11,991 | |

Airgas, Inc. | | | 190 | | | | 13,308 | |

Akzo Nobel N.V. | | | 926 | | | | 58,502 | |

Arkema S.A. | | | 221 | | | | 22,786 | |

Asahi Kasei Corp. | | | 5,000 | | | | 33,480 | |

BASF SE | | | 3,671 | | | | 360,255 | |

CF Industries Holdings, Inc. | | | 190 | | | | 26,917 | |

Daicel Chemical Industries, Ltd. | | | 1,000 | | | | 6,572 | |

Denki Kagaku Kogyo KK | | | 2,000 | | | | 9,573 | |

Dow Chemical Co. (The) | | | 3,180 | | | | 114,480 | |

E.I. du Pont de Nemours & Co. | | | 2,495 | | | | 134,855 | |

See accompanying notes to financial statements.

6

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

| | |

| Chemicals—(Continued) | | | | | | | | |

Eastman Chemical Co. | | | 190 | | | $ | 19,393 | |

Ecolab, Inc. | | | 625 | | | | 35,237 | |

FMC Corp. | | | 190 | | | | 16,344 | |

Givaudan S.A.* | | | 33 | | | | 34,888 | |

Hitachi Chemical Co., Ltd. | | | 400 | | | | 7,891 | |

Incitec Pivot, Ltd. | | | 6,510 | | | | 26,967 | |

International Flavors & Fragrances, Inc. | | | 245 | | | | 15,739 | |

Israel Chemicals, Ltd. | | | 1,776 | | | | 28,199 | |

Israel Corp., Ltd. (The) | | | 9 | | | | 9,791 | |

Johnson Matthey plc | | | 858 | | | | 27,104 | |

JSR Corp. | | | 700 | | | | 13,471 | |

K+S AG | | | 688 | | | | 52,958 | |

Kaneka Corp. | | | 1,000 | | | | 6,535 | |

Kansai Paint Co., Ltd. | | | 1,000 | | | | 9,064 | |

Koninklijke DSM N.V. | | | 616 | | | | 40,040 | |

Kuraray Co., Ltd. | | | 1,500 | | | | 21,855 | |

Lanxess AG | | | 333 | | | | 27,374 | |

Linde AG | | | 676 | | | | 118,698 | |

Makhteshim-Agan Industries, Ltd.* | | | 918 | | | | 5,128 | |

Mitsubishi Chemical Holdings Corp. | | | 5,500 | | | | 38,738 | |

Mitsubishi Gas Chemical Co., Inc. | | | 1,000 | | | | 7,279 | |

Mitsui Chemicals, Inc. | | | 3,000 | | | | 10,862 | |

Monsanto Co. | | | 1,490 | | | | 108,085 | |

Nitto Denko Corp. | | | 600 | | | | 30,244 | |

Novozymes A.S.—B Shares | | | 185 | | | | 30,152 | |

Orica, Ltd. | | | 1,452 | | | | 41,978 | |

PPG Industries, Inc. | | | 435 | | | | 39,494 | |

Praxair, Inc. | | | 815 | | | | 88,338 | |

Sherwin-Williams Co. (The) | | | 250 | | | | 20,967 | |

Shin-Etsu Chemical Co., Ltd. | | | 1,600 | | | | 85,213 | |

Showa Denko KK | | | 6,000 | | | | 12,350 | |

Sigma-Aldrich Corp. | | | 315 | | | | 23,115 | |

Sika AG | | | 8 | | | | 19,274 | |

Solvay S.A. | | | 237 | | | | 36,675 | |

Sumitomo Chemical Co., Ltd. | | | 6,000 | | | | 29,760 | |

Syngenta AG* | | | 378 | | | | 127,505 | |

Taiyo Nippon Sanso Corp. | | | 1,000 | | | | 7,924 | |

Teijin, Ltd. | | | 4,000 | | | | 17,509 | |

Toray Industries, Inc. | | | 6,000 | | | | 44,045 | |

Tosoh Corp. | | | 2,000 | | | | 7,986 | |

Ube Industries, Ltd. | | | 4,000 | | | | 11,954 | |

Umicore S.A. | | | 456 | | | | 24,908 | |

Wacker Chemie AG | | | 63 | | | | 13,642 | |

Yara International ASA | | | 758 | | | | 42,827 | |

| | | | | | | | |

| | | | | | | 2,452,074 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Commercial Banks—1.7% | | | | | | | | |

Alpha Bank AE* | | | 2,029 | | | $ | 10,225 | |

Aozora Bank, Ltd. | | | 2,000 | | | | 4,613 | |

Australia & New Zealand Banking Group, Ltd. | | | 10,377 | | | | 244,994 | |

Banca Carige S.p.A. | | | 2,584 | | | | 5,866 | |

Banca Monte dei Paschi di Siena S.p.A. | | | 9,975 | | | | 7,569 | |

Banco Bilbao Vizcaya Argentaria S.A. | | | 17,053 | | | | 200,364 | |

Banco Comercial Portugues S.A.* | | | 12,964 | | | | 7,720 | |

Banco de Sabadell S.A. | | | 4,445 | | | | 18,399 | |

Banco Espirito Santo S.A. | | | 2,098 | | | | 7,831 | |

Banco Popolare SC | | | 7,049 | | | | 16,267 | |

Banco Popular Espanol S.A. | | | 3,848 | | | | 21,689 | |

Banco Santander S.A. | | | 33,736 | | | | 390,159 | |

Bank Hapoalim BM | | | 4,239 | | | | 21,089 | |

Bank Leumi Le-Israel BM | | | 4,712 | | | | 22,168 | |

Bank of Cyprus plc | | | 3,398 | | | | 10,018 | |

Bank of East Asia, Ltd. | | | 6,200 | | | | 25,536 | |

Bank of Kyoto, Ltd. (The) | | | 1,000 | | | | 9,164 | |

Bank of Yokohama, Ltd. (The) | | | 5,000 | | | | 24,862 | |

Bankinter S.A. | | | 851 | | | | 5,788 | |

Barclays plc | | | 46,262 | | | | 190,629 | |

BB&T Corp. | | | 1,875 | | | | 50,325 | |

Bendigo and Adelaide Bank, Ltd. | | | 1,458 | | | | 13,863 | |

BNP Paribas S.A. | | | 3,833 | | | | 296,324 | |

BOC Hong Kong Holdings, Ltd. | | | 15,000 | | | | 43,468 | |

Chiba Bank, Ltd. (The) | | | 3,000 | | | | 18,674 | |

Chugoku Bank, Ltd. (The) | | | 1,000 | | | | 12,313 | |

Comerica, Inc. | | | 445 | | | | 15,384 | |

Commerzbank AG* | | | 14,303 | | | | 61,675 | |

Commonwealth Bank of Australia | | | 6,191 | | | | 347,474 | |

Credit Agricole S.A. | | | 3,840 | | | | 57,834 | |

Danske Bank A.S.* | | | 2,607 | | | | 48,353 | |

DBS Group Holdings, Ltd. | | | 7,000 | | | | 83,604 | |

Dexia S.A.* | | | 2,337 | | | | 7,287 | |

DnB NOR ASA | | | 3,906 | | | | 54,646 | |

EFG Eurobank Ergasias S.A.* | | | 1,292 | | | | 6,061 | |

Erste Group Bank AG | | | 756 | | | | 39,692 | |

Fifth Third Bancorp. | | | 2,495 | | | | 31,811 | |

First Horizon National Corp. | | | 690 | | | | 6,583 | |

Fukuoka Financial Group, Inc. | | | 3,000 | | | | 12,462 | |

Gunma Bank, Ltd. (The) | | | 1,000 | | | | 5,258 | |

Hachijuni Bank, Ltd. (The) | | | 2,000 | | | | 11,185 | |

Hang Seng Bank, Ltd. | | | 3,100 | | | | 49,518 | |

Hiroshima Bank, Ltd. (The) | | | 2,000 | | | | 8,680 | |

Hokuhoku Financial Group, Inc. | | | 5,000 | | | | 9,858 | |

See accompanying notes to financial statements.

7

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Commercial Banks—(Continued) | |

HSBC Holdings plc | | | 70,774 | | | $ | 703,242 | |

Huntington Bancshares, Inc. | | | 2,315 | | | | 15,186 | |

Intesa Sanpaolo S.p.A. | | | 40,273 | | | | 107,388 | |

Intesa Sanpaolo S.p.A.—RSP | | | 3,727 | | | | 8,060 | |

Israel Discount Bank, Ltd.—Class A* | | | 3,160 | | | | 6,207 | |

Iyo Bank, Ltd. (The) | | | 1,000 | | | | 9,164 | |

Joyo Bank, Ltd. (The) | | | 2,000 | | | | 8,358 | |

KBC Grope N.V. | | | 644 | | | | 25,347 | |

KeyCorp. | | | 2,560 | | | | 21,325 | |

Lloyds TSB Group plc* | | | 163,256 | | | | 128,537 | |

M&T Bank Corp. | | | 365 | | | | 32,102 | |

Marshall & Ilsley Corp. | | | 1,435 | | | | 11,437 | |

Mitsubishi UFJ Financial Group, Inc. | | | 50,900 | | | | 246,153 | |

Mizrahi Tefahot Bank, Ltd. | | | 492 | | | | 5,209 | |

Mizuho Financial Group, Inc. | | | 82,000 | | | | 134,218 | |

Mizuho Trust & Banking Co., Ltd. | | | 6,000 | | | | 5,282 | |

National Australia Bank, Ltd. | | | 8,672 | | | | 238,429 | |

National Bank of Greece S.A.* | | | 3,821 | | | | 27,359 | |

Natixis | | | 3,487 | | | | 17,523 | |

Nishi-Nippon City Bank, Ltd. (The) | | | 3,000 | | | | 8,816 | |

Nordea Bank AB | | | 10,503 | | | | 113,322 | |

Oversea-Chinese Banking Corp., Ltd. | | | 10,000 | | | | 76,256 | |

PNC Financial Services Group, Inc. | | | 1,435 | | | | 85,540 | |

Raiffeisen Bank International AG | | | 195 | | | | 10,064 | |

Regions Financial Corp. | | | 3,425 | | | | 21,235 | |

Resona Holdings, Inc. | | | 7,500 | | | | 35,154 | |

Royal Bank of Scotland Group plc* | | | 70,159 | | | | 43,356 | |

Seven Bank, Ltd. | | | 2 | | | | 3,985 | |

Shinsei Bank, Ltd. | | | 5,000 | | | | 4,960 | |

Shizuoka Bank, Ltd. (The) | | | 2,000 | | | | 18,302 | |

Skandinaviska Enskilda Banken AB—Class A | | | 5,638 | | | | 46,249 | |

Societe Generale S.A. | | | 2,536 | | | | 150,715 | |

Standard Chartered plc | | | 9,386 | | | | 247,034 | |

Sumitomo Mitsui Financial Group, Inc. | | | 5,400 | | | | 165,258 | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 12,000 | | | | 41,515 | |

SunTrust Banks, Inc. | | | 1,440 | | | | 37,152 | |

Suruga Bank, Ltd. | | | 1,000 | | | | 8,668 | |

Svenska Handelsbanken AB—A Shares | | | 1,956 | | | | 60,550 | |

Swedbank AB—A Shares | | | 3,235 | | | | 54,563 | |

U.S. Bancorp. | | | 5,235 | | | | 133,545 | |

UniCredit S.p.A. | | | 53,925 | | | | 114,344 | |

Unione di Banche Italiane SCPA | | | 3,175 | | | | 17,901 | |

United Overseas Bank, Ltd. | | | 5,000 | | | | 80,166 | |

| | | | | | | | |

|

| Commercial Banks—(Continued) | |

Wells Fargo & Co. | | | 14,380 | | | $ | 403,503 | |

Westpac Banking Corp. | | | 12,026 | | | | 287,281 | |

Wing Hang Bank, Ltd. | | | 500 | | | | 5,478 | |

Yamaguchi Financial Group, Inc. | | | 1,000 | | | | 9,288 | |

Zions Bancorporation | | | 500 | | | | 12,005 | |

| | | | | | | | |

| | | | | | | 6,584,013 | |

| | | | | | | | |

|

| Commercial Services & Supplies—0.1% | |

Aggreko plc* | | | 1,097 | | | | 34,002 | |

Avery Dennison Corp. | | | 260 | | | | 10,044 | |

Babcock International Group plc | | | 1,434 | | | | 16,406 | |

Brambles, Ltd. | | | 5,798 | | | | 44,924 | |

Cintas Corp. | | | 320 | | | | 10,570 | |

Dai Nippon Printing Co., Ltd. | | | 2,000 | | | | 22,394 | |

Edenred | | | 632 | | | | 19,312 | |

G4S plc | | | 5,638 | | | | 25,347 | |

Iron Mountain, Inc. | | | 510 | | | | 17,386 | |

Pitney Bowes, Inc. | | | 510 | | | | 11,725 | |

Republic Services, Inc. | | | 815 | | | | 25,143 | |

RR Donnelley & Sons Co. | | | 510 | | | | 10,001 | |

Secom Co., Ltd. | | | 800 | | | | 38,142 | |

Securitas AB—B Shares | | | 1,252 | | | | 13,300 | |

Serco Group plc | | | 1,972 | | | | 17,507 | |

Societe BIC S.A. | | | 115 | | | | 11,130 | |

Stericycle, Inc.* | | | 245 | | | | 21,834 | |

Suez Environnement Co. | | | 1,077 | | | | 21,515 | |

Toppan Printing Co., Ltd. | | | 2,000 | | | | 15,426 | |

Waste Management, Inc. | | | 1,305 | | | | 48,637 | |

| | | | | | | | |

| | | | | | | 434,745 | |

| | | | | | | | |

|

| Communications Equipment—0.3% | |

Alcatel-Lucent* | | | 9,266 | | | | 53,669 | |

Cisco Systems, Inc. | | | 15,070 | | | | 235,243 | |

F5 Networks, Inc.* | | | 245 | | | | 27,011 | |

Harris Corp. | | | 320 | | | | 14,419 | |

JDS Uniphase Corp.* | | | 570 | | | | 9,496 | |

Juniper Networks, Inc.* | | | 1,440 | | | | 45,360 | |

Motorola Mobility Holdings, Inc.* | | | 760 | | | | 16,750 | |

Motorola Solutions, Inc.* | | | 930 | | | | 42,817 | |

Nokia OYJ | | | 14,969 | | | | 97,179 | |

QUALCOMM, Inc. | | | 4,485 | | | | 254,703 | |

Telefonaktiebolaget LM Ericsson—B Shares | | | 12,037 | | | | 174,182 | |

Tellabs, Inc. | | | 945 | | | | 4,357 | |

| | | | | | | | |

| | | | | | | 975,186 | |

| | | | | | | | |

See accompanying notes to financial statements.

8

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Computers & Peripherals—0.4% | |

Apple, Inc.* | | | 2,545 | | | $ | 854,280 | |

Dell, Inc.* | | | 4,555 | | | | 75,932 | |

EMC Corp.* | | | 5,610 | | | | 154,555 | |

Fujitsu, Ltd. | | | 7,000 | | | | 39,754 | |

Hewlett-Packard Co. | | | 5,920 | | | | 215,488 | |

Lexmark International, Inc.—Class A* | | | 190 | | | | 5,559 | |

NEC Corp.* | | | 10,000 | | | | 22,692 | |

NetApp, Inc.* | | | 1,000 | | | | 52,780 | |

SanDisk Corp.* | | | 625 | | | | 25,938 | |

Seiko Epson Corp. | | | 500 | | | | 8,606 | |

Toshiba Corp. | | | 16,000 | | | | 83,725 | |

Western Digital Corp.* | | | 625 | | | | 22,738 | |

| | | | | | | | |

| | | | | | | 1,562,047 | |

| | | | | | | | |

|

| Construction & Engineering—0.1% | |

ACS Actividades de Construccion y Servicios S.A. | | | 566 | | | | 26,732 | |

Balfour Beatty plc | | | 2,744 | | | | 13,602 | |

Bouygues S.A. | | | 950 | | | | 41,826 | |

Chiyoda Corp. | | | 1,000 | | | | 11,445 | |

Eiffage S.A. | | | 162 | | | | 10,736 | |

Ferrovial S.A. | | | 1,466 | | | | 18,558 | |

Fluor Corp. | | | 495 | | | | 32,007 | |

Fomento de Construcciones y Contratas S.A. | | | 203 | | | | 6,199 | |

Hochtief AG | | | 169 | | | | 14,138 | |

Jacobs Engineering Group, Inc.* | | | 320 | | | | 13,840 | |

JGC Corp. | | | 1,000 | | | | 27,218 | |

Kajima Corp. | | | 3,000 | | | | 8,556 | |

Kinden Corp. | | | 1,000 | | | | 8,519 | |

Koninklijke Boskalis Westminster N.V. | | | 283 | | | | 13,401 | |

Leighton Holdings, Ltd. | | | 604 | | | | 13,515 | |

Obayashi Corp. | | | 2,000 | | | | 8,680 | |

Quanta Services, Inc.* | | | 565 | | | | 11,413 | |

Shimizu Corp. | | | 2,000 | | | | 8,283 | |

Skanska AB—B Shares | | | 1,598 | | | | 28,702 | |

Taisei Corp. | | | 4,000 | | | | 9,126 | |

Vinci S.A. | | | 1,777 | | | | 113,995 | |

| | | | | | | | |

| | | | | | | 440,491 | |

| | | | | | | | |

|

| Construction Materials—0.1% | |

Boral, Ltd. | | | 2,896 | | | | 13,674 | |

Cimpor Cimentos de Portugal SGPS S.A. | | | 806 | | | | 6,168 | |

CRH plc | | | 2,835 | | | | 63,141 | |

Fletcher Building, Ltd. | | | 2,712 | | | | 19,365 | |

| | | | | | | | |

|

| Construction Materials—(Continued) | |

HeidelbergCement AG | | | 562 | | | $ | 35,934 | |

Holcim, Ltd.* | | | 981 | | | | 73,982 | |

Imerys S.A. | | | 136 | | | | 9,598 | |

James Hardie Industries SE* | | | 1,744 | | | | 10,967 | |

Lafarge S.A. | | | 801 | | | | 51,123 | |

Vulcan Materials Co. | | | 320 | | | | 12,330 | |

| | | | | | | | |

| | | | | | | 296,282 | |

| | | | | | | | |

|

| Consumer Finance—0.1% | |

Aeon Credit Service Co., Ltd. | | | 300 | | | | 4,085 | |

American Express Co. | | | 2,860 | | | | 147,862 | |

Capital One Financial Corp. | | | 1,245 | | | | 64,329 | |

Credit Saison Co., Ltd. | | | 600 | | | | 10,022 | |

Discover Financial Services | | | 1,445 | | | | 38,654 | |

SLM Corp. | | | 1,435 | | | | 24,122 | |

| | | | | | | | |

| | | | | | | 289,074 | |

| | | | | | | | |

|

| Containers & Packaging—0.0% | |

Amcor, Ltd. | | | 4,898 | | | | 37,845 | |

Ball Corp. | | | 440 | | | | 16,922 | |

Bemis Co., Inc. | | | 260 | | | | 8,783 | |

Owens-Illinois, Inc.* | | | 440 | | | | 11,356 | |

Rexam plc | | | 3,505 | | | | 21,559 | |

Sealed Air Corp. | | | 435 | | | | 10,349 | |

Toyo Seikan Kaisha, Ltd. | | | 600 | | | | 10,022 | |

| | | | | | | | |

| | | | | | | 116,836 | |

| | | | | | | | |

|

| Distributors—0.0% | |

Genuine Parts Co. | | | 415 | | | | 22,576 | |

Jardine Cycle & Carriage, Ltd. | | | 1,000 | | | | 35,032 | |

Li & Fung, Ltd. | | | 22,000 | | | | 43,821 | |

| | | | | | | | |

| | | | | | | 101,429 | |

| | | | | | | | |

|

| Diversified Consumer Services—0.0% | |

Apollo Group, Inc.—Class A* | | | 315 | | | | 13,759 | |

Benesse Holdings, Inc. | | | 300 | | | | 12,853 | |

DeVry, Inc. | | | 185 | | | | 10,939 | |

H&R Block, Inc. | | | 815 | | | | 13,072 | |

| | | | | | | | |

| | | | | | | 50,623 | |

| | | | | | | | |

|

| Diversified Financial Services—0.5% | |

ASX, Ltd. | | | 700 | | | | 22,874 | |

Bank of America Corp. | | | 27,640 | | | | 302,934 | |

CaixaBank | | | 3,360 | | | | 23,487 | |

Citigroup, Inc. | | | 7,910 | | | | 329,372 | |

CME Group, Inc. | | | 185 | | | | 53,944 | |

Deutsche Boerse AG | | | 779 | | | | 59,284 | |

See accompanying notes to financial statements.

9

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Diversified Financial Services—(Continued) | |

Eurazeo | | | 122 | | | $ | 8,927 | |

Exor S.p.A. | | | 256 | | | | 8,012 | |

Groupe Bruxelles Lambert S.A. | | | 322 | | | | 28,681 | |

Hong Kong Exchanges and Clearing, Ltd. | | | 4,100 | | | | 85,988 | |

Industrivarden AB—C Shares | | | 471 | | | | 7,825 | |

ING Groep N.V.* | | | 15,309 | | | | 188,745 | |

IntercontinentalExchange, Inc.* | | | 190 | | | | 23,695 | |

Investor AB—B Shares | | | 1,821 | | | | 41,896 | |

JPMorgan Chase & Co. | | | 10,890 | | | | 445,837 | |

Kinnevik Investment AB—Class B | | | 822 | | | | 18,325 | |

Leucadia National Corp. | | | 505 | | | | 17,221 | |

London Stock Exchange Group plc | | | 596 | | | | 10,161 | |

Mitsubishi UFJ Lease & Finance Co., Ltd. | | | 230 | | | | 8,841 | |

Moody’s Corp. | | | 555 | | | | 21,284 | |

NASDAQ OMX Group, Inc. (The)* | | | 380 | | | | 9,614 | |

NYSE Euronext | | | 690 | | | | 23,646 | |

ORIX Corp. | | | 420 | | | | 40,570 | |

Pargesa Holding S.A. | | | 210 | | | | 19,444 | |

Pohjola Bank plc—A Shares | | | 552 | | | | 7,151 | |

Singapore Exchange, Ltd. | | | 3,000 | | | | 18,404 | |

| | | | | | | | |

| | | | | | | 1,826,162 | |

| | | | | | | | |

|

| Diversified Telecommunication Services—0.7% | |

AT&T, Inc. | | | 16,125 | | | | 506,486 | |

Belgacom S.A. | | | 608 | | | | 21,718 | |

Bezeq The Israeli Telecommunication Corp., Ltd. | | | 6,971 | | | | 17,574 | |

BT Group plc | | | 31,027 | | | | 100,456 | |

CenturyLink, Inc. | | | 1,620 | | | | 65,497 | |

Deutsche Telekom AG | | | 11,227 | | | | 176,344 | |

Elisa OYJ | | | 565 | | | | 12,186 | |

France Telecom S.A. | | | 7,411 | | | | 157,845 | |

Frontier Communications Corp. | | | 2,685 | | | | 21,668 | |

Hellenic Telecommunications Organization S.A. | | | 979 | | | | 9,142 | |

Iliad S.A. | | | 76 | | | | 10,213 | |

Inmarsat plc | | | 1,841 | | | | 16,447 | |

Koninklijke KPN N.V. | | | 6,286 | | | | 91,569 | |

Nippon Telegraph & Telephone Corp. | | | 1,900 | | | | 91,060 | |

PCCW, Ltd. | | | 16,000 | | | | 6,909 | |

Portugal Telecom SGPS S.A. | | | 2,687 | | | | 26,681 | |

Singapore Telecommunications, Ltd. | | | 32,000 | | | | 82,121 | |

Swisscom AG | | | 93 | | | | 42,612 | |

TDC A.S.* | | | 1,484 | | | | 13,564 | |

Tele2 AB—B Shares | | | 1,267 | | | | 25,129 | |

| | | | | | | | |

|

| Diversified Telecommunication Services—(Continued) | |

Telecom Corp. of New Zealand, Ltd. | | | 7,693 | | | $ | 15,644 | |

Telecom Italia S.p.A. | | | 37,514 | | | | 52,277 | |

Telecom Italia S.p.A.—RSP | | | 24,086 | | | | 28,073 | |

Telefonica S.A. | | | 16,418 | | | | 402,021 | |

Telekom Austria AG | | | 1,328 | | | | 16,973 | |

Telenor ASA | | | 2,982 | | | | 49,014 | |

TeliaSonera AB | | | 8,654 | | | | 63,713 | |

Telstra Corp., Ltd. | | | 17,407 | | | | 53,986 | |

Verizon Communications, Inc. | | | 7,720 | | | | 287,416 | |

Windstream Corp. | | | 1,370 | | | | 17,755 | |

| | | | | | | | |

| | | | | | | 2,482,093 | |

| | | | | | | | |

|

| Electric Utilities—0.5% | |

Acciona S.A. | | | 102 | | | | 10,842 | |

American Electric Power Co., Inc. | | | 1,310 | | | | 49,361 | |

Cheung Kong Infrastructure Holdings, Ltd. | | | 2,000 | | | | 10,358 | |

Chubu Electric Power Co., Inc. | | | 2,700 | | | | 52,564 | |

Chugoku Electric Power Co., Inc. (The) | | | 1,200 | | | | 20,713 | |

CLP Holdings, Ltd. | | | 7,500 | | | | 66,503 | |

Contact Energy, Ltd.* | | | 1,395 | | | | 6,194 | |

Duke Energy Corp. | | | 3,615 | | | | 68,070 | |

E.On AG | | | 7,198 | | | | 204,742 | |

EDF S.A. | | | 961 | | | | 37,831 | |

Edison International | | | 875 | | | | 33,906 | |

EDP—Energias de Portugal S.A. | | | 7,628 | | | | 27,131 | |

Enel S.p.A. | | | 26,310 | | | | 172,104 | |

Entergy Corp. | | | 495 | | | | 33,799 | |

Exelon Corp. | | | 1,805 | | | | 77,326 | |

FirstEnergy Corp. | | | 1,125 | | | | 49,669 | |

Fortum OYJ | | | 1,775 | | | | 51,481 | |

Hokkaido Electric Power Co., Inc. | | | 700 | | | | 11,605 | |

Hokuriku Electric Power Co. | | | 700 | | | | 13,315 | |

Iberdrola S.A. | | | 15,126 | | | | 134,819 | |

Kansai Electric Power Co., Inc. (The) | | | 3,000 | | | | 59,520 | |

Kyushu Electric Power Co., Inc. | | | 1,600 | | | | 28,709 | |

NextEra Energy, Inc. | | | 1,175 | | | | 67,515 | |

Northeast Utilities | | | 445 | | | | 15,651 | |

Pepco Holdings, Inc. | | | 570 | | | | 11,189 | |

Pinnacle West Capital Corp. | | | 310 | | | | 13,820 | |

Power Assets Holdings, Ltd. | | | 5,500 | | | | 41,454 | |

PPL Corp. | | | 1,505 | | | | 41,884 | |

Progress Energy, Inc. | | | 810 | | | | 38,888 | |

Public Power Corp. S.A. | | | 464 | | | | 6,658 | |

Red Electrica Corp. S.A. | | | 432 | | | | 26,116 | |

Scottish & Southern Energy plc | | | 3,724 | | | | 83,353 | |

See accompanying notes to financial statements.

10

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Electric Utilities—(Continued) | |

Shikoku Electric Power Co., Inc | | | 700 | | | $ | 15,841 | |

Southern Co. | | | 2,305 | | | | 93,076 | |

SP AusNet | | | 5,586 | | | | 5,665 | |

Terna Rete Elettrica Nazionale S.p.A. | | | 4,807 | | | | 22,382 | |

Tohoku Electric Power Co., Inc | | | 1,800 | | | | 25,914 | |

Tokyo Electric Power Co., Inc (The) | | | 5,800 | | | | 23,446 | |

Verbund AG | | | 272 | | | | 11,851 | |

| | | | | | | | |

| | | | | | | 1,765,265 | |

| | | | | | | | |

|

| Electrical Equipment—0.2% | |

ABB, Ltd.* | | | 8,762 | | | | 227,030 | |

Alstom S.A. | | | 823 | | | | 50,824 | |

Bekaert S.A. | | | 155 | | | | 11,819 | |

Emerson Electric Co. | | | 2,055 | | | | 115,594 | |

Fuji Electric Co., Ltd. | | | 2,000 | | | | 6,200 | |

Furukawa Electric Co., Ltd. | | | 2,000 | | | | 8,283 | |

GS Yuasa Corp. | | | 1,000 | | | | 6,634 | |

Legrand S.A. | | | 789 | | | | 33,283 | |

Mabuchi Motor Co., Ltd. | | | 100 | | | | 5,022 | |

Mitsubishi Electric Corp. | | | 8,000 | | | | 92,256 | |

Nidec Corp. | | | 400 | | | | 36,902 | |

Prysmian S.p.A. | | | 815 | | | | 16,417 | |

Rockwell Automation, Inc. | | | 375 | | | | 32,535 | |

Roper Industries, Inc. | | | 250 | | | | 20,825 | |

Schneider Electric S.A. | | | 978 | | | | 163,630 | |

Sumitomo Electric Industries, Ltd. | | | 3,000 | | | | 43,412 | |

Ushio, Inc. | | | 400 | | | | 7,852 | |

Vestas Wind Systems A.S.* | | | 814 | | | | 18,941 | |

| | | | | | | | |

| | | | | | | 897,459 | |

| | | | | | | | |

|

| Electronic Equipment, Instruments & Components—0.2% | |

Amphenol Corp.—Class A | | | 495 | | | | 26,725 | |

Citizen Holdings Co., Ltd. | | | 1,000 | | | | 5,939 | |

Corning, Inc. | | | 4,240 | | | | 76,956 | |

FLIR Systems, Inc. | | | 435 | | | | 14,664 | |

Foxconn International Holdings, Ltd.* | | | 9,000 | | | | 3,967 | |

FUJIFILM Holdings Corp. | | | 1,800 | | | | 55,778 | |

Hamamatsu Photonics KK | | | 300 | | | | 12,890 | |

Hirose Electric Co., Ltd. | | | 100 | | | | 10,193 | |

Hitachi High-Technologies Corp. | | | 200 | | | | 4,355 | |

Hitachi, Ltd. | | | 18,000 | | | | 105,574 | |

Hoya Corp. | | | 1,700 | | | | 37,396 | |

Ibiden Co., Ltd. | | | 500 | | | | 15,531 | |

Jabil Circuit, Inc. | | | 505 | | | | 10,201 | |

Keyence Corp. | | | 200 | | | | 56,395 | |

Kyocera Corp. | | | 600 | | | | 60,636 | |

Molex, Inc. | | | 375 | | | | 9,664 | |

| | | | | | | | |

|

| Electronic Equipment, Instruments & Components—(Continued) | |

Murata Manufacturing Co., Ltd. | | | 800 | | | $ | 53,072 | |

Nippon Electric Glass Co., Ltd. | | | 1,000 | | | | 12,722 | |

Omron Corp. | | | 800 | | | | 22,102 | |

Shimadzu Corp. | | | 1,000 | | | | 9,102 | |

TDK Corp. | | | 500 | | | | 27,342 | |

Yaskawa Electric Corp. | | | 1,000 | | | | 11,135 | |

Yokogawa Electric Corp.* | | | 800 | | | | 6,775 | |

| | | | | | | | |

| | | | | | | 649,114 | |

| | | | | | | | |

|

| Energy Equipment & Services—0.3% | |

Aker Solutions ASA | | | 657 | | | | 13,201 | |

AMEC plc | | | 1,329 | | | | 23,233 | |

Baker Hughes, Inc. | | | 1,185 | | | | 85,984 | |

Cameron International Corp.* | | | 680 | | | | 34,197 | |

Cie Generale de Geophysique—Veritas* | | | 575 | | | | 21,212 | |

Diamond Offshore Drilling, Inc. | | | 185 | | | | 13,026 | |

FMC Technologies, Inc.* | | | 630 | | | | 28,218 | |

Fugro N.V. | | | 273 | | | | 19,713 | |

Halliburton Co. | | | 2,490 | | | | 126,990 | |

Helmerich & Payne, Inc. | | | 305 | | | | 20,167 | |

Nabors Industries, Ltd.* | | | 755 | | | | 18,603 | |

National Oilwell Varco, Inc. | | | 1,175 | | | | 91,897 | |

Noble Corp. | | | 685 | | | | 26,996 | |

Petrofac, Ltd. | | | 1,036 | | | | 25,203 | |

Rowan Cos., Inc.* | | | 320 | | | | 12,419 | |

Saipem S.p.A. | | | 1,058 | | | | 54,702 | |

SBM Offshore N.V. | | | 674 | | | | 17,855 | |

Schlumberger, Ltd. | | | 3,730 | | | | 322,272 | |

Seadrill, Ltd. | | | 1,240 | | | | 43,808 | |

Subsea 7 SA* | | | 1,125 | | | | 28,883 | |

Technip S.A. | | | 393 | | | | 42,197 | |

Tenaris S.A. | | | 1,887 | | | | 43,164 | |

Transocean, Ltd. | | | 1,275 | | | | 82,893 | |

WorleyParsons, Ltd. | | | 769 | | | | 23,305 | |

| | | | | | | | |

| | | | | | | 1,220,138 | |

| | | | | | | | |

|

| Food & Staples Retailing—0.5% | |

Aeon Co., Ltd. | | | 2,400 | | | | 28,808 | |

Carrefour S.A. | | | 2,308 | | | | 94,929 | |

Casino Guichard Perrachon S.A. | | | 221 | | | | 20,863 | |

Colruyt S.A. | | | 303 | | | | 15,182 | |

Costco Wholesale Corp. | | | 1,185 | | | | 96,269 | |

CVS Caremark Corp. | | | 3,735 | | | | 140,361 | |

Delhaize Group S.A. | | | 406 | | | | 30,485 | |

FamilyMart Co., Ltd. | | | 200 | | | | 7,316 | |

J Sainsbury plc | | | 4,848 | | | | 25,659 | |

See accompanying notes to financial statements.

11

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Food & Staples Retailing—(Continued) | |

Jeronimo Martins SGPS S.A. | | | 880 | | | $ | 16,922 | |

Kesko OYJ | | | 267 | | | | 12,440 | |

Koninklijke Ahold N.V. | | | 4,764 | | | | 64,111 | |

Kroger Co. (The) | | | 1,690 | | | | 41,912 | |

Lawson Inc | | | 200 | | | | 10,453 | |

Metcash, Ltd. | | | 3,073 | | | | 13,686 | |

Metro AG | | | 518 | | | | 31,439 | |

Olam International, Ltd. | | | 5,000 | | | | 11,080 | |

Safeway, Inc. | | | 1,000 | | | | 23,370 | |

Seven & I Holdings Co., Ltd. | | | 3,000 | | | | 80,241 | |

SUPERVALU, Inc. | | | 565 | | | | 5,317 | |

Sysco Corp. | | | 1,565 | | | | 48,797 | |

Tesco plc | | | 32,162 | | | | 207,745 | |

Wal-Mart Stores, Inc. | | | 5,355 | | | | 284,565 | |

Walgreen Co. | | �� | 2,495 | | | | 105,938 | |

Wesfarmers, Ltd. | | | 4,018 | | | | 137,335 | |

Wesfarmers, Ltd.—PPS | | | 607 | | | | 21,008 | |

Whole Foods Market, Inc. | | | 380 | | | | 24,111 | |

WM Morrison Supermarkets plc | | | 9,030 | | | | 43,194 | |

Woolworths, Ltd. | | | 4,848 | | | | 144,373 | |

| | | | | | | | |

| | | | | | | 1,787,909 | |

| | | | | | | | |

| | |

| Food Products—0.6% | | | | | | | | |

Ajinomoto Co., Inc. | | | 3,000 | | | | 35,452 | |

Archer-Daniels-Midland Co. | | | 1,845 | | | | 55,627 | |

Aryzta AG | | | 178 | | | | 9,531 | |

Associated British Foods plc | | | 1,424 | | | | 24,780 | |

Campbell Soup Co. | | | 500 | | | | 17,275 | |

ConAgra Foods Inc | | | 1,070 | | | | 27,617 | |

Danone | | | 2,331 | | | | 174,180 | |

Dean Foods Co.* | | | 500 | | | | 6,135 | |

General Mills, Inc. | | | 1,740 | | | | 64,763 | |

Golden Agri-Resources, Ltd. | | | 27,000 | | | | 14,958 | |

H.J. Heinz Co. | | | 875 | | | | 46,620 | |

Hershey Co. (The) | | | 435 | | | | 24,730 | |

Hormel Foods Corp. | | | 375 | | | | 11,179 | |

J.M. Smucker Co. (The) | | | 315 | | | | 24,079 | |

Kellogg Co. | | | 685 | | | | 37,894 | |

Kerry Group plc—Class A | | | 561 | | | | 23,343 | |

Kikkoman Corp. | | | 1,000 | | | | 10,478 | |

Kraft Foods, Inc.—Class A | | | 4,740 | | | | 166,990 | |

Lindt & Spruengli AG | | | 5 | | | | 15,570 | |

Lindt & Spruengli AG—PC | | | 1 | | | | 36,424 | |

McCormick & Co., Inc. | | | 370 | | | | 18,341 | |

Mead Johnson Nutrition Co. | | | 560 | | | | 37,828 | |

MEIJI Holdings Co., Ltd. | | | 300 | | | | 12,592 | |

Nestle S.A. | | | 13,850 | | | | 860,121 | |

| | | | | | | | |

|

| Food Products—(Continued) | |

Nippon Meat Packers Inc | | | 1,000 | | | $ | 14,260 | |

Nisshin Seifun Group, Inc. | | | 500 | | | | 6,212 | |

Nissin Foods Holdings Co., Ltd. | | | 200 | | | | 7,259 | |

Parmalat S.p.A.* | | | 4,855 | | | | 18,291 | |

Sara Lee Corp. | | | 1,565 | | | | 29,719 | |

Suedzucker AG | | | 265 | | | | 9,431 | |

Toyo Suisan Kaisha, Ltd. | | | 1,000 | | | | 23,560 | |

Tyson Foods, Inc.—Class A | | | 810 | | | | 15,730 | |

Unilever N.V. | | | 6,511 | | | | 213,759 | |

Unilever plc | | | 5,130 | | | | 165,352 | |

Wilmar International, Ltd. | | | 7,439 | | | | 32,848 | |

Yakult Honsha Co., Ltd. | | | 400 | | | | 11,517 | |

Yamazaki Baking Co., Ltd. | | | 1,000 | | | | 13,342 | |

| | | | | | | | |

| | | | | | | 2,317,787 | |

| | | | | | | | |

| | |

| Gas Utilities—0.1% | | | | | | | | |

Enagas S.A. | | | 716 | | | | 17,376 | |

Gas Natural SDG S.A. | | | 1,289 | | | | 27,042 | |

Hong Kong & China Gas Co., Ltd. | | | 19,000 | | | | 43,169 | |

Nicor Inc. | | | 125 | | | | 6,843 | |

ONEOK, Inc. | | | 310 | | | | 22,943 | |

Osaka Gas Co., Ltd. | | | 8,000 | | | | 30,256 | |

Snam Rete Gas S.p.A. | | | 6,423 | | | | 38,097 | |

Toho Gas Co., Ltd. | | | 2,000 | | | | 10,788 | |

Tokyo Gas Co., Ltd. | | | 10,000 | | | | 45,012 | |

| | | | | | | | |

| | | | | | | 241,526 | |

| | | | | | | | |

|

| Health Care Equipment & Supplies—0.3% | |

Baxter International, Inc. | | | 1,560 | | | | 93,116 | |

Becton, Dickinson & Co. | | | 620 | | | | 53,425 | |

Boston Scientific Corp.* | | | 4,120 | | | | 28,469 | |

C.R. Bard, Inc. | | | 245 | | | | 26,916 | |

CareFusion Corp.* | | | 570 | | | | 15,487 | |

Cie Generale d’Optique Essilor International S.A. | | | 804 | | | | 65,309 | |

Cochlear, Ltd. | | | 227 | | | | 17,540 | |

Coloplast A.S.—Class B | | | 91 | | | | 13,839 | |

Covidien plc | | | 1,365 | | | | 72,659 | |

DENTSPLY International, Inc. | | | 375 | | | | 14,280 | |

Edwards Lifesciences Corp.* | | | 310 | | | | 27,026 | |

Getinge AB—B Shares | | | 800 | | | | 21,554 | |

Intuitive Surgical, Inc.* | | | 120 | | | | 44,653 | |

Medtronic, Inc. | | | 2,925 | | | | 112,700 | |

Olympus Corp. | | | 900 | | | | 30,143 | |

Smith & Nephew plc | | | 3,566 | | | | 38,104 | |

Sonova Holding AG* | | | 196 | | | | 18,287 | |

St. Jude Medical, Inc. | | | 875 | | | | 41,720 | |

See accompanying notes to financial statements.

12

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Health Care Equipment & Supplies—(Continued) | |

Straumann Holding AG | | | 37 | | | $ | 8,905 | |

Stryker Corp. | | | 930 | | | | 54,582 | |

Synthes, Inc. | | | 261 | | | | 45,881 | |

Sysmex Corp. | | | 300 | | | | 11,234 | |

Terumo Corp. | | | 700 | | | | 37,628 | |

Varian Medical Systems, Inc.* | | | 315 | | | | 22,056 | |

William Demant Holding A.S.* | | | 94 | | | | 8,497 | |

Zimmer Holdings, Inc.* | | | 505 | | | | 31,916 | |

| | | | | | | | |

| | | | | | | 955,926 | |

| | | | | | | | |

|

| Health Care Providers & Services—0.2% | |

Aetna, Inc. | | | 1,055 | | | | 46,515 | |

Alfresa Holdings Corp. | | | 100 | | | | 3,869 | |

AmerisourceBergen Corp. | | | 745 | | | | 30,843 | |

Cardinal Health, Inc. | | | 940 | | | | 42,695 | |

Celesio AG | | | 340 | | | | 6,790 | |

CIGNA Corp. | | | 745 | | | | 38,315 | |

Coventry Health Care, Inc.* | | | 380 | | | | 13,859 | |

DaVita, Inc.* | | | 250 | | | | 21,653 | |

Express Scripts, Inc.* | | | 1,435 | | | | 77,461 | |

Fresenius Medical Care AG & Co. KGaA | | | 785 | | | | 58,772 | |

Fresenius SE & Co. KGaA | | | 454 | | | | 47,461 | |

Humana, Inc. | | | 490 | | | | 39,465 | |

Laboratory Corp. of America Holdings* | | | 305 | | | | 29,521 | |

McKesson Corp. | | | 685 | | | | 57,300 | |

Medco Health Solutions, Inc.* | | | 1,115 | | | | 63,020 | |

Medipal Holdings Corp. | | | 600 | | | | 5,297 | |

Miraca Holdings, Inc. | | | 200 | | | | 8,072 | |

Patterson Cos., Inc. | | | 250 | | | | 8,223 | |

Quest Diagnostics, Inc. | | | 435 | | | | 25,708 | |

Ramsay Health Care, Ltd. | | | 525 | | | | 10,243 | |

Sonic Healthcare, Ltd. | | | 1,475 | | | | 20,372 | |

Suzuken Co., Ltd. | | | 300 | | | | 6,893 | |

Tenet Healthcare Corp.* | | | 1,310 | | | | 8,174 | |

UnitedHealth Group, Inc. | | | 2,990 | | | | 154,224 | |

WellPoint, Inc. | | | 1,050 | | | | 82,708 | |

| | | | | | | | |

| | | | | | | 907,453 | |

| | | | | | | | |

|

| Health Care Technology—0.0% | |

Cerner Corp.* | | | 380 | | | | 23,222 | |

| | | | | | | | |

|

| Hotels, Restaurants & Leisure—0.3% | |

Accor S.A. | | | 589 | | | | 26,377 | |

Autogrill S.p.A. | | | 458 | | | | 6,020 | |

Carnival Corp. | | | 1,180 | | | | 44,403 | |

| | | | | | | | |

|

| Hotels, Restaurants & Leisure—(Continued) | |

Carnival plc | | | 731 | | | $ | 28,342 | |

Chipotle Mexican Grill, Inc.* | | | 115 | | | | 35,442 | |

Compass Group plc | | | 7,560 | | | | 73,006 | |

Crown, Ltd. | | | 1,808 | | | | 17,326 | |

Darden Restaurants, Inc. | | | 375 | | | | 18,660 | |

Echo Entertainment Group, Ltd.* | | | 2,738 | | | | 12,076 | |

Galaxy Entertainment Group, Ltd.* | | | 4,900 | | | | 10,428 | |

Genting Singapore plc* | | | 24,000 | | | | 37,737 | |

Intercontinental Hotels Group plc | | | 1,159 | | | | 23,744 | |

International Game Technology | | | 810 | | | | 14,240 | |

Marriott International, Inc.—Class A | | | 755 | | | | 26,795 | |

McDonald’s Corp. | | | 2,860 | | | | 241,155 | |

McDonald’s Holdings Co. Japan, Ltd. | | | 300 | | | | 7,618 | |

OPAP S.A. | | | 892 | | | | 13,927 | |

Oriental Land Co., Ltd. | | | 200 | | | | 16,914 | |

Sands China, Ltd.* | | | 9,600 | | | | 25,784 | |

Shangri-La Asia, Ltd. | | | 6,000 | | | | 14,712 | |

SJM Holdings, Ltd. | | | 6,600 | | | | 15,674 | |

Sky City Entertainment Group, Ltd. | | | 2,299 | | | | 6,894 | |

Sodexo | | | 377 | | | | 29,600 | |

Starbucks Corp. | | | 2,000 | | | | 78,980 | |

Starwood Hotels & Resorts Worldwide, Inc. | | | 505 | | | | 28,300 | |

TABCORP. Holdings, Ltd. | | | 2,738 | | | | 9,667 | |

Tatts Group, Ltd. | | | 5,200 | | | | 13,393 | |

TUI AG* | | | 604 | | | | 6,562 | |

TUI Travel plc | | | 2,011 | | | | 7,251 | |

Whitbread plc | | | 708 | | | | 18,372 | |

Wyndham Worldwide Corp. | | | 445 | | | | 14,974 | |

Wynn Macau, Ltd. | | | 6,200 | | | | 20,237 | |

Wynn Resorts, Ltd. | | | 240 | | | | 34,450 | |

Yum! Brands, Inc. | | | 1,300 | | | | 71,812 | |

| | | | | | | | |

| | | | | | | 1,050,872 | |

| | | | | | | | |

|

| Household Durables—0.1% | |

Casio Computer Co., Ltd. | | | 900 | | | | 6,305 | |

D.R. Horton, Inc. | | | 750 | | | | 8,640 | |

Electrolux AB—Series B | | | 959 | | | | 22,961 | |

Fortune Brands, Inc. | | | 435 | | | | 27,740 | |

Harman International Industries, Inc. | | | 190 | | | | 8,658 | |

Husqvarna AB—B Shares | | | 1,768 | | | | 11,751 | |

Leggett & Platt, Inc. | | | 380 | | | | 9,264 | |

Lennar Corp.—Class A | | | 435 | | | | 7,895 | |

Newell Rubbermaid, Inc. | | | 755 | | | | 11,914 | |

Panasonic Corp. | | | 8,800 | | | | 106,938 | |

PulteGroup, Inc.* | | | 880 | | | | 6,741 | |

Rinnai Corp. | | | 100 | | | | 7,192 | |

See accompanying notes to financial statements.

13

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Household Durables—(Continued) | |

Sekisui Chemical Co., Ltd. | | | 2,000 | | | $ | 16,988 | |

Sekisui House, Ltd. | | | 2,000 | | | | 18,501 | |

Sharp Corp. | | | 4,000 | | | | 36,258 | |

Sony Corp. | | | 4,000 | | | | 105,004 | |

Stanley Black & Decker, Inc. | | | 440 | | | | 31,702 | |

Whirlpool Corp. | | | 190 | | | | 15,451 | |

| | | | | | | | |

| | | | | | | 459,903 | |

| | | | | | | | |

|

| Household Products—0.2% | |

Clorox Co. (The) | | | 375 | | | | 25,290 | |

Colgate-Palmolive Co. | | | 1,365 | | | | 119,315 | |

Henkel AG & Co. KGaA | | | 519 | | | | 29,793 | |

Kimberly-Clark Corp. | | | 1,115 | | | | 74,214 | |

Procter & Gamble Co. (The) | | | 7,655 | | | | 486,628 | |

Reckitt Benckiser Group plc | | | 2,467 | | | | 136,361 | |

Unicharm Corp. | | | 400 | | | | 17,410 | |

| | | | | | | | |

| | | | | | | 889,011 | |

| | | | | | | | |

|

| Independent Power Producers & Energy Traders—0.0% | |

AES Corp. (The)* | | | 1,805 | | | | 22,996 | |

Constellation Energy Group, Inc. | | | 510 | | | | 19,360 | |

EDP Renovaveis S.A.* | | | 872 | | | | 5,761 | |

Electric Power Development Co., Ltd. | | | 500 | | | | 13,485 | |

Enel Green Power S.p.A. | | | 6,995 | | | | 19,323 | |

Iberdrola Renovables S.A. | | | 3,377 | | | | 14,939 | |

International Power plc | | | 6,106 | | | | 31,562 | |

NRG Energy, Inc.* | | | 635 | | | | 15,608 | |

| | | | | | | | |

| | | | | | | 143,034 | |

| | | | | | | | |

|

| Industrial Conglomerates—0.4% | |

3M Co. | | | 1,935 | | | | 183,535 | |

Delek Group, Ltd. | | | 18 | | | | 4,030 | |

Fraser and Neave, Ltd. | | | 3,000 | | | | 14,151 | |

General Electric Co. | | | 29,005 | | | | 547,034 | |

Hutchison Whampoa, Ltd. | | | 8,000 | | | | 86,358 | |

Keppel Corp., Ltd. | | | 5,000 | | | | 45,134 | |

Koninklijke Philips Electronics N.V. | | | 3,941 | | | | 101,367 | |

NWS Holdings, Ltd. | | | 5,000 | | | | 6,695 | |

Orkla A.S.A. | | | 3,084 | | | | 29,433 | |

SembCorp. Industries, Ltd. | | | 4,000 | | | | 16,261 | |

Siemens AG | | | 3,289 | | | | 452,361 | |

Smiths Group plc | | | 1,567 | | | | 30,240 | |

Tyco International, Ltd. | | | 1,305 | | | | 64,506 | |

Wendel S.A. | | | 131 | | | | 16,132 | |

| | | | | | | | |

| | | | | | | 1,597,237 | |

| | | | | | | | |

| | | | | | | | |

|

| Insurance—0.8% | |

ACE, Ltd. | | | 930 | | | $ | 61,213 | |

Admiral Group plc | | | 805 | | | | 21,485 | |

Aegon N.V.* | | | 6,870 | | | | 46,935 | |

Aflac, Inc. | | | 1,255 | | | | 58,583 | |

Ageas | | | 8,843 | | | | 24,029 | |

AIA Group, Ltd.* | | | 31,300 | | | | 108,602 | |

Allianz SE | | | 1,814 | | | | 253,788 | |

Allstate Corp. (The) | | | 1,435 | | | | 43,811 | |

American International Group, Inc.* | | | 1,185 | | | | 34,744 | |

AMP, Ltd. | | | 11,258 | | | | 59,079 | |

Aon Corp. | | | 930 | | | | 47,709 | |

Assicurazioni Generali S.p.A. | | | 4,667 | | | | 98,622 | |

Assurant, Inc. | | | 255 | | | | 9,249 | |

Aviva plc | | | 11,272 | | | | 79,511 | |

AXA S.A. | | | 7,120 | | | | 162,039 | |

Baloise Holding AG | | | 190 | | | | 19,591 | |

Berkshire Hathaway, Inc.—Class B* | | | 4,730 | | | | 366,055 | |

Chubb Corp. (The) | | | 810 | | | | 50,714 | |

Cincinnati Financial Corp. | | | 440 | | | | 12,839 | |

CNP Assurances | | | 594 | | | | 12,971 | |

Dai-ichi Life Insurance Co., Ltd. (The) | | | 36 | | | | 50,131 | |

Delta Lloyd N.V. | | | 402 | | | | 9,569 | |

Genworth Financial, Inc.—Class A* | | | 1,315 | | | | 13,518 | |

Gjensidige Forsikring ASA | | | 799 | | | | 9,885 | |

Hannover Rueckversicherung AG | | | 241 | | | | 12,588 | |

Hartford Financial Services Group, Inc. (The) | | | 1,190 | | | | 31,380 | |

Insurance Australia Group, Ltd. | | | 8,310 | | | | 30,321 | |

Legal & General Group plc | | | 23,450 | | | | 44,537 | |

Lincoln National Corp. | | | 820 | | | | 23,362 | |

Loews Corp. | | | 870 | | | | 36,618 | |

Mapfre S.A. | | | 3,010 | | | | 11,191 | |

Marsh & McLennan Cos., Inc. | | | 1,440 | | | | 44,914 | |

MetLife, Inc. | | | 565 | | | | 24,787 | |

MS&AD Insurance Group Holdings | | | 2,300 | | | | 53,504 | |

Muenchener Rueckversicherungs AG | | | 753 | | | | 115,322 | |

NKSJ Holdings, Inc. | | | 6,000 | | | | 39,358 | |

Old Mutual plc | | | 21,806 | | | | 46,740 | |

Principal Financial Group, Inc. | | | 875 | | | | 26,617 | |

Progressive Corp. (The) | | | 1,755 | | | | 37,522 | |

Prudential Financial, Inc. | | | 1,310 | | | | 83,303 | |

Prudential plc | | | 10,175 | | | | 117,714 | |

QBE Insurance Group, Ltd. | | | 4,204 | | | | 77,824 | |

Resolution, Ltd. | | | 5,806 | | | | 27,427 | |

RSA Insurance Group plc | | | 13,981 | | | | 30,305 | |

Sampo OYJ—A Shares | | | 1,679 | | | | 54,305 | |

See accompanying notes to financial statements.

14

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

|

| Insurance—(Continued) | |

SCOR SE | | | 675 | | | $ | 19,215 | �� |

Sony Financial Holdings, Inc. | | | 695 | | | | 12,487 | |

Standard Life plc | | | 9,126 | | | | 30,867 | |

Suncorp. Group, Ltd. | | | 5,122 | | | | 44,743 | |

Swiss Life Holding AG* | | | 122 | | | | 19,996 | |

Swiss Re, Ltd.* | | | 1,408 | | | | 79,006 | |

T&D Holdings, Inc. | | | 1,150 | | | | 27,165 | |

Tokio Marine Holdings, Inc. | | | 2,900 | | | | 80,730 | |

Torchmark Corp. | | | 240 | | | | 15,394 | |

Travelers Cos., Inc. (The) | | | 1,180 | | | | 68,888 | |

Tryg A.S. | | | 102 | | | | 5,893 | |

Unum Group | | | 815 | | | | 20,766 | |

Vienna Insurance Group AG Wiener Versicherung Gruppe | | | 154 | | | | 8,477 | |

XL Group plc | | | 815 | | | | 17,914 | |

Zurich Financial Services AG* | | | 582 | | | | 147,065 | |

| | | | | | | | |

| | | | | | | 3,222,917 | |

| | | | | | | | |

| | |

| Internet & Catalog Retail—0.1% | | | | | | | | |

Amazon.com, Inc.* | | | 970 | | | | 198,355 | |

Dena Co., Ltd. | | | 392 | | | | 16,794 | |

Expedia, Inc. | | | 530 | | | | 15,365 | |

Home Retail Group plc | | | 3,251 | | | | 8,551 | |

Netflix, Inc.* | | | 143 | | | | 37,565 | |

Priceline.com, Inc.* | | | 145 | | | | 74,230 | |

Rakuten Inc | | | 29 | | | | 29,883 | |

| | | | | | | | |

| | | | | | | 380,743 | |

| | | | | | | | |

| | |

| Internet Software & Services—0.1% | | | | | | | | |

Akamai Technologies, Inc.* | | | 500 | | | | 15,735 | |

eBay, Inc.* | | | 3,115 | | | | 100,521 | |

Google, Inc.—Class A* | | | 685 | | | | 346,870 | |

Gree, Inc. | | | 366 | | | | 7,947 | |

Monster Worldwide, Inc.* | | | 320 | | | | 4,691 | |

United Internet AG | | | 450 | | | | 9,473 | |

VeriSign, Inc. | | | 445 | | | | 14,890 | |

Yahoo Japan Corp. | | | 58 | | | | 19,850 | |

Yahoo!, Inc.* | | | 3,555 | | | | 53,467 | |

| | | | | | | | |

| | | | | | | 573,444 | |

| | | | | | | | |

| | |

| IT Services—0.3% | | | | | | | | |

Amadeus IT Holding S.A.—A Shares* | | | 984 | | | | 20,451 | |

Atos | | | 196 | | | | 11,090 | |

Automatic Data Processing, Inc. | | | 1,365 | | | | 71,908 | |

Cap Gemini S.A. | | | 591 | | | | 34,677 | |

Cognizant Technology Solutions Corp.—Class A* | | | 815 | | | | 59,772 | |

| | | | | | | | |

| | |

| IT Services—(Continued) | | | | | | | | |

Computer Sciences Corp. | | | 435 | | | $ | 16,513 | |

Computershare, Ltd. | | | 1,777 | | | | 16,915 | |

Fidelity National Information Services, Inc. | | | 695 | | | | 21,399 | |

Fiserv, Inc.* | | | 380 | | | | 23,799 | |

Indra Sistemas S.A. | | | 394 | | | | 8,143 | |

International Business Machines Corp. | | | 3,355 | | | | 575,550 | |

Itochu Techno-Solutions Corp. | | | 100 | | | | 3,530 | |

Mastercard, Inc.—Class A | | | 300 | | | | 90,402 | |

Nomura Research Institute, Ltd. | | | 400 | | | | 8,705 | |

NTT Data Corp. | | | 5 | | | | 16,498 | |

Otsuka Corp. | | | 100 | | | | 6,194 | |

Paychex, Inc. | | | 875 | | | | 26,880 | |

SAIC, Inc.* | | | 760 | | | | 12,783 | |

Teradata Corp.* | | | 440 | | | | 26,488 | |

Total System Services, Inc. | | | 435 | | | | 8,082 | |

Visa, Inc.—Class A | | | 1,310 | | | | 110,381 | |

Western Union Co. | | | 1,750 | | | | 35,053 | |

| | | | | | | | |

| | | | | | | 1,205,213 | |

| | | | | | | | |

|

| Leisure Equipment & Products—0.0% | |

Hasbro, Inc. | | | 375 | | | | 16,474 | |

Mattel, Inc. | | | 935 | | | | 25,703 | |

Namco Bandai Holdings, Inc. | | | 800 | | | | 9,583 | |

Nikon Corp. | | | 1,400 | | | | 32,793 | |

Sankyo Co., Ltd. | | | 200 | | | | 10,279 | |

Sega Sammy Holdings, Inc. | | | 800 | | | | 15,366 | |

Shimano, Inc. | | | 300 | | | | 16,424 | |

Yamaha Corp. | | | 600 | | | | 6,793 | |

| | | | | | | | |

| | | | | | | 133,415 | |

| | | | | | | | |

|

| Life Sciences Tools & Services—0.1% | |

Agilent Technologies, Inc.* | | | 935 | | | | 47,788 | |

Life Technologies Corp.* | | | 495 | | | | 25,775 | |

Lonza Group AG* | | | 234 | | | | 18,301 | |

PerkinElmer, Inc. | | | 260 | | | | 6,997 | |

QIAGEN N.V.* | | | 932 | | | | 17,894 | |

Thermo Fisher Scientific, Inc.* | | | 1,060 | | | | 68,253 | |

Waters Corp.* | | | 250 | | | | 23,935 | |

| | | | | | | | |

| | | | | | | 208,943 | |

| | | | | | | | |

| | |

| Machinery—0.6% | | | | | | | | |

Alfa Laval AB | | | 1,349 | | | | 29,174 | |

Amada Co., Ltd. | | | 1,000 | | | | 7,638 | |

Atlas Copco A.B.—A Shares | | | 2,684 | | | | 70,907 | |

Atlas Copco A.B.—B Shares | | | 1,560 | | | | 36,856 | |

See accompanying notes to financial statements.

15

MET INVESTORS SERIES TRUST

| | |

AllianceBernstein Global Dynamic Allocation Portfolio | | |

Schedule of Investments as of June 30, 2011 (Unaudited)

Common Stocks—(Continued)

| | | | | | | | |

| Security Description | |

Shares | | | Value | |

| | | | | | | | |

| | |

| Machinery—(Continued) | | | | | | | | |

Caterpillar, Inc. | | | 1,745 | | | $ | 185,773 | |

Cosco Corp. Singapore, Ltd. | | | 4,000 | | | | 6,355 | |

Cummins, Inc. | | | 555 | | | | 57,437 | |

Danaher Corp. | | | 1,490 | | | | 78,955 | |

Deere & Co. | | | 1,175 | | | | 96,879 | |

Dover Corp. | | | 500 | | | | 33,900 | |

Eaton Corp. | | | 935 | | | | 48,106 | |

FANUC Corp. | | | 800 | | | | 132,730 | |

Fiat Industrial S.p.A.* | | | 3,056 | | | | 39,502 | |

Flowserve Corp. | | | 180 | | | | 19,780 | |

GEA Group AG | | | 698 | | | | 25,024 | |

Hexagon AB—B Shares | | | 1,013 | | | | 25,042 | |

Hino Motors, Ltd. | | | 1,000 | | | | 5,791 | |

Hitachi Construction Machinery Co., Ltd. | | | 400 | | | | 8,898 | |

IHI Corp. | | | 5,000 | | | | 12,834 | |

Illinois Tool Works, Inc. | | | 1,370 | | | | 77,391 | |

Ingersoll-Rand plc | | | 875 | | | | 39,734 | |

Invensys plc | | | 3,236 | | | | 16,737 | |

Japan Steel Works, Ltd. (The) | | | 1,000 | | | | 6,808 | |

Joy Global, Inc. | | | 305 | | | | 29,048 | |

JTEKT Corp. | | | 900 | | | | 13,158 | |

Kawasaki Heavy Industries, Ltd. | | | 6,000 | | | | 23,734 | |

Komatsu, Ltd. | | | 3,800 | | | | 117,659 | |

Kone OYJ—Class B | | | 622 | | | | 39,143 | |

Kubota Corp. | | | 5,000 | | | | 43,958 | |

Kurita Water Industries, Ltd. | | | 400 | | | | 11,864 | |

Makita Corp. | | | 400 | | | | 18,501 | |

MAN SE | | | 423 | | | | 56,495 | |

Metso OYJ | | | 511 | | | | 29,070 | |

Minebea Co., Ltd. | | | 1,000 | | | | 5,295 | |

Mitsubishi Heavy Industries, Ltd. | | | 12,000 | | | | 56,098 | |

Mitsui Engineering & Shipbuilding Co., Ltd. | | | 3,000 | | | | 6,510 | |

Nabtesco Corp. | | | 1,000 | | | | 24,031 | |

NGK Insulators, Ltd. | | | 1,000 | | | | 18,501 | |

NSK, Ltd. | | | 2,000 | | | | 19,815 | |

NTN Corp. | | | 2,000 | | | | 11,309 | |

PACCAR, Inc. | | | 995 | | | | 50,835 | |

Pall Corp. | | | 310 | | | | 17,431 | |

Parker Hannifin Corp. | | | 435 | | | | 39,037 | |

Sandvik AB | | | 4,030 | | | | 70,913 | |

Scania AB—B Shares | | | 1,279 | | | | 29,771 | |

Schindler Holding AG | | | 159 | | | | 19,295 | |

Schindler Holding AG—PC | | | 194 | | | | 23,565 | |

SembCorp. Marine, Ltd. | | | 3,000 | | | | 12,954 | |

| | | | | | | | |

| | |

| Machinery—(Continued) | | | | | | | | |

SKF AB—B Shares | | | 1,558 | | | $ | 45,239 | |

SMC Corp. | | | 200 | | | | 35,811 | |

Snap-On, Inc. | | | 180 | | | | 11,246 | |

Sulzer AG | | | 58 | | | | 9,431 | |

Sumitomo Heavy Industries, Ltd. | | | 2,000 | | | | 13,838 | |

THK Co., Ltd. | | | 500 | | | | 12,648 | |

Vallourec S.A. | | | 448 | | | | 54,648 | |

Volvo AB | | | 5,509 | | | | 96,588 | |

Wartsila OYJ | | | 670 | | | | 22,663 | |

Weir Group plc (The) | | | 842 | | | | 28,777 | |

Yangzijiang Shipbuilding Holdings, Ltd. | | | 7,700 | | | | 9,159 | |

Zardoya Otis S.A. | | | 559 | | | | 8,248 | |

| | | | | | | | |

| | | | | | | 2,198,537 | |

| | | | | | | | |

| | |

| Marine—0.0% | | | | | | | | |

A.P. Moller-Maersk A.S.—Class A | | | 2 | | | | 16,575 | |

A.P. Moller-Maersk A.S.—Class B | | | 5 | | | | 43,190 | |

Kawasaki Kisen Kaisha, Ltd. | | | 3,000 | | | | 10,416 | |

Kuehne & Nagel International AG | | | 216 | | | | 32,759 | |

Mitsui OSK Lines, Ltd. | | | 4,000 | | | | 21,378 | |

Neptune Orient Lines, Ltd. | | | 3,000 | | | | 3,739 | |

Nippon Yusen KK | | | 6,000 | | | | 22,171 | |

Orient Overseas International, Ltd. | | | 1,000 | | | | 6,457 | |

| | | | | | | | |

| | | | | | | 156,685 | |

| | | | | | | | |

| | |

| Media—0.5% | | | | | | | | |

Axel Springer AG | | | 158 | | | | 7,816 | |

British Sky Broadcasting Group plc | | | 4,554 | | | | 61,942 | |