Our consolidated statements of operations data for the years ended December 31, 2001, 2002 and 2003 are set forth below:

Our historical operating results as a percentage of net revenues for the years ended December 31, 2001, 2002 and 2003 are set forth below:

Year Ended December 31, 2003 compared to Year Ended December 31, 2002.

Revenues. Revenues increased by $11.6 million, or 40.3%, to $40.5 million in 2003 from $28.9 million in 2002. This increase was primarily due to an increase of $12.0 million, or 110%, in capsule sales and an increase of $1.0 million, or 126.7%, in service contract revenues, offset by a decrease of $1.4 million, or 7.8%, in workstation and data recorder sales. We estimate that approximately 70% of the increase of $11.6 million in revenues was attributable to the increase in product sales, approximately 17% of the increase was attributable to currency gains due to the strengthening of the Euro and the Australian dollar against the U.S. dollar, and approximately 13% of the increase was attributable to higher average selling prices resulting from a higher percentage of direct sales compared to sales through distributors and an increase in selling prices during the year. We believe that the decrease in workstation and data recorder sales resulted primarily from our decision to permit our distributors, principally in the Far East, not to comply with minimum purchase requirements in order to reduce their inventory levels.

Cost of revenues and gross margin. Cost of revenues increased by $1.6 million, or 13.8%, to $13.6 million in 2003 from $11.9 million in 2002, compared to an increase of 40.3% in revenues during the same period. This increase occurred due to the increase in sales of the M2A capsule in 2003 and primarily resulted from an increase of $2.1 million related to the cost of materials and components, an increase of $130,000 related to manufacturing expenses, including depreciation, offset by a decrease of $490,000 in royalties payable to the Office of the Chief Scientist. The smaller increase in cost of revenues compared to revenues resulted primarily from a decrease in the cost of components for the Given System as we increased manufacturing volumes from the smaller quantities we had manufactured in 2002 and an increase in manufacturing efficiencies achieved by moving to a semi-automated production line. Gross margin was 66.6% in 2003 compared to 58.8% in 2002.

During 2003, we implemented a plan to reduce our operating costs in order to achieve our profitability targets. This plan included a reduction in force of approximately 40 employees, or 15% percent of our workforce at the time, principally from our manufacturing facilities, as well as from other departments. It also included deferring non-essential expenditures. The implementation of this plan contributed to the smaller increase in our cost of revenues and operating expenses compared to the increase in our revenues.

Research and development. Research and development expenses decreased by $1.6 million, or 18.3%, to $7.0 million in 2003 from $8.6 million in 2002. This decrease was primarily due to a write down of obsolete components in connection with production modifications and redesign in 2002, which did not recur in 2003.

Research and development expenses, net of grants received from the Office of the Chief Scientist, decreased by $2.9 million, or 33.4%, to $5.7 million in 2003 from $8.6 million in 2002. Grants totaling $1.3 million were received in 2003 compared to no grants in 2002. In 2003, we received grants for new products under development. In 2002, we did not receive any grants due to completion of our program to develop the Given System for which we had previously received grants from the Office of the Chief Scientist.

Sales and marketing. Sales and marketing expenses increased by $4.1 million, or 18.2%, to $26.8 million in 2003 from $22.7 million in 2002. This increase was primarily due to an increase of $3.5 million due to the hiring of additional sales and marketing personnel, principally in the United States and Europe, and an increase of $810,000 due to sales and marketing activities in Japan of our Japanese subsidiary, Given Imaging K.K.

General and administrative. General and administrative expenses increased by $563,000, or 11.9%, to $5.3 million in 2003 from $4.7 million in 2002. This increase was primarily due to an increase of $180,000 related to insurance expenses, $240,000 related to additional general and administrative expenses, and $120,000 related to depreciation expenses.

Financing income, net. Financing income, net, decreased by $474,000, or 32.3%, to $1.0 million in 2003 from $1.5 million in 2002. Financing income in 2003 was derived primarily from currency translation gains of $840,000, interest income of $280,000 offset by bank expenses of $120,000. Financing income in 2002 was derived primarily from interest income of $760,000 and currency translation gains of $750,000. The decrease was primarily due to reduction of $490,000 in interest income.

Minority share in losses (profits) of subsidiary. Minority share in losses of subsidiary was $258,000 in 2003 compared to minority share in profits of subsidiary of $26,000 in 2002. Given Imaging K.K. did not derive any revenues in 2003.

-39-

Year Ended December 31, 2002 compared to Year Ended December 31, 2001.

Revenues. Revenues increased by $24.2 million, or approximately 510%, to $28.9 million in 2002 from $4.7 million in 2001. This increase was primarily due to an increase of $13.9 million, or approximately 420%, in workstation and data recorder sales and an increase of $9.5 million, or approximately 700%, in capsule sales, from 2001. Approximately 90% of the increase of $24.2 million in revenues from sales was attributable to the increase in product sales and approximately 10% of the increase was attributable to higher average selling prices resulting from a higher percentage of direct sales compared to sales through distributors, an increase in selling prices during the year and currency gains due to the strengthening of the Euro against the U.S. dollar.

Cost of revenues and gross margin. Cost of revenues increased by $9.4 million, or 380.9%, to $11.9 million in 2002 from $2.5 million in 2001 compared to an increase of 510% in revenues during the same period. This increase occurred due to the increase in sales of the Given System in 2002 and primarily resulted from $6.8 million related to the cost of materials and components, $2.4 million related to manufacturing expenses including depreciation, $1.8 million related to salaries and related expenses and $900,000 of royalties payable to the Office of the Chief Scientist. The smaller increase in cost of revenues compared to revenues resulted from a decrease in the cost of components for the Given System and an increase in manufacturing efficiencies by moving to a semi-automated production line, and the manufacture of a greater volume of M2A capsules. Gross margin was 58.8% in 2002 compared to 47.7% in 2001.

Research and development. Research and development expenses increased by $2.5 million, or 39.8%, to $8.6 million in 2002 from $6.1 million in 2001. This increase was primarily due to an increase of $800,000 related to materials and subcontractors, an increase of $900,000 related to the hiring of additional research and development staff, and $200,000 for fees to consultants and clinical trials.

Research and development expenses, net of grants received from the Office of the Chief Scientist, increased by $2.5 million, or 40.8%, to $8.6 million in 2002 from $6.2 million in 2001. No grants were received in 2002. Grants totaled $44,000 in 2001. The decrease of $44,000 in grants was due to completion of our program to develop the Given System for which we received grants from the Office of the Chief Scientist.

Sales and marketing. Sales and marketing expenses increased by $9.8 million, or 75.8%, to $22.7 million in 2002 from $12.9 million in 2001. This increase was primarily due to an increase of $5.3 million related to the hiring of additional marketing staff, principally in the United States and Europe, an increase of $1.7 million due to participation in trade shows and associated travel, an increase of $700,000 due to education and workshops for our customers, and $600,000 related to office expenses of our marketing and sales facilities.

General and administrative. General and administrative expenses increased by $2.1 million, or 78.3%, to $4.7 million in 2002 from $2.7 million in 2001. This increase was primarily due to an increase of $670,000 related to the hiring of additional administrative staff at our global headquarters in Israel, an increase of $550,000 related to fees paid for legal, accounting, consulting services and insurance, and $500,000 related to additional office expenses.

Financing income, net. Financing income, net, increased by $705,000, or 92.3%, to $1.5 million in 2002 from $764,000 in 2001. This increase was primarily due to $746,000 of income earned from currency conversion gains related to the Euro and the Yen.

Other expenses, net. Other expenses, net, increased to $711,000 in 2002 from zero in 2001. This increase was primarily due to expenses incurred in connection with a proposed equity offering in 2002, which we did not complete, net of other income we recorded during the year.

Minority share in profits of subsidiary. Minority share in profits of subsidiary increased to $26,000 from zero in 2001. This increase resulted from the issuance in May 2002 of 49% of the equity of our Japanese subsidiary, Given Imaging K.K., to third parties. Given Imaging K.K. did not derive any revenues in 2002 and the profits were attributable to currency translation gains.

-40-

Quarterly Results of Operations

We believe that many of our customers delay purchasing systems until the end of the fiscal quarter because they believe this will enable them to negotiate more favorable terms. Therefore, revenues from system sales are frequently concentrated at the end of each fiscal quarter making it difficult for us to determine the success of each quarter until its end and resulting in lower than expected quarterly revenues if external or other events cause a large number of potential customers to defer their purchasing decisions even for a short period of time. To date, revenues from sales of the M2A capsule have been spread more evenly throughout the quarter.

The tables below set forth unaudited consolidated statement of operations data in dollars for each of the eight consecutive quarters ended December 31, 2003. In management’s opinion, the unaudited consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements contained elsewhere in this Form 20-F and include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of such financial information.

| | Three months ended | |

| | March 31,

2002 | | June 30,

2002 | | Sept. 30,

2002 | | Dec. 31,

2002 | | March 31,

2003 | | June 30,

2003 | | Sept. 30,

2003 | | Dec. 31,

2003 | |

| | | | | | | | (unaudited)

(in thousands) | | | | | | | |

Revenue | | $ | 5,216 | | $ | 7,179 | | $ | 7,459 | | $ | 9,050 | | $ | 8,629 | | $ | 9,694 | | $ | 9,682 | | $ | 12,534 | |

Cost of revenues | | | (2,503 | ) | | (3,271 | ) | | (3,081 | ) | | (3,052 | ) | | (2,827 | ) | | (3,363 | ) | | (3,581 | ) | | (3,780 | ) |

Gross profit | | | 2,713 | | | 3,908 | | | 4,378 | | | 5,998 | | | 5,802 | | | 6,331 | | | 6,101 | | | 8,754 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | |

Research and development, net | | | (1,993 | ) | | (2,316 | ) | | (2,261 | ) | | (2,039 | ) | | (1,834 | ) | | (1,213 | ) | | (1,212 | ) | | (1,475 | ) |

Sales and marketing | | | (4,831 | ) | | (5,993 | ) | | (5,287 | ) | | (6,570 | ) | | (6,521 | ) | | (6,998 | ) | | (6,219 | ) | | (7,066 | ) |

General and administrative | | | (1,084 | ) | | (1,230 | ) | | (970 | ) | | (1,465 | ) | | (1,366 | ) | | (1,425 | ) | | (1,233 | ) | | (1,288 | ) |

Total operating expenses | | | (7,908 | ) | | (9,539 | ) | | (8,518 | ) | | (10,074 | ) | | (9,721 | ) | | (9,636 | ) | | (8,664 | ) | | (9,829 | ) |

Operating loss | | | (5,195 | ) | | (5,631 | ) | | (4,140 | ) | | (4,076 | ) | | (3,919 | ) | | (3,305 | ) | | (2,563 | ) | | (1,075 | ) |

Financing income (expenses), net | | | 281 | | | 725 | | | 105 | | | 358 | | | 228 | | | (174 | ) | | 573 | | | 368 | |

Other income (expenses) | | | (836 | ) | | 109 | | | 20 | | | (4 | ) | | — | | | — | | | — | | | — | |

Minority share in (profits) losses of subsidiary | | | — | | | (118 | ) | | 65 | | | 27 | | | 68 | | | 129 | | | (67 | ) | | 128 | |

Net loss | | $ | (5,750 | ) | $ | (4,915 | ) | $ | (3,950 | ) | $ | (3,695 | ) | $ | (3,623 | ) | $ | (3,350 | ) | $ | (2,057 | ) | $ | (579 | ) |

Impact of Currency Fluctuations

Currency Risk. Our sales to our customers in 2003 were denominated 70% in U.S. dollars, 28% in Euros and 2% in other currencies, depending on the location of the customer or the distributor used to fulfill our customers’ orders. In 2003, 23% of our expenses, principally salaries and related personnel expenses were denominated in shekels, and we expect this level of shekel expenses to continue for the foreseeable future. If the value of a currency in which our revenues are denominated weakens against the value of a currency in which our expenses are denominated, there will be a negative impact on the profit margin for sales of the Given System. In addition, as of December 31, 2003, 15% of our cash and cash equivalents were denominated in Yen and we are therefore subject to the risk of exchange rate fluctuations between the Yen, the Dollar and the Euro. We have covered an expected surplus of Euros during 2004 against the devaluation of the Euro compared to the U.S. dollar by purchasing options to sell Euros and buy U.S. dollars at a pre-determined price. In addition, if we wish to maintain the dollar-denominated value of our product in non-U.S. markets, devaluation in the local currencies of our customers relative to the U.S. dollar could cause our customers to cancel or decrease orders or default on payment.

Translation Effect. The U.S. dollar is our functional currency, and our consolidated financial statements included elsewhere in this annual report are prepared in U.S. dollars.

-41-

B. LIQUIDITY AND CAPITAL RESOURCES

Since our inception and until we commenced sales in 2001, we financed our operations primarily with the proceeds of sales of our equity securities. From our inception through December 31, 2003, we raised a total of $97.7 million through public and private sales of our equity securities. Since we commenced sales in 2001, we have collected more than $70.0 million in receivables. As of December 31, 2003, we had $25.4 million in cash and cash equivalents, and our working capital, which we calculate by subtracting our current liabilities from our current assets, was $35.0 million. We achieved positive cashflow from operations in the fourth quarter of 2003.

We believe that our cash reserves and expected cash from operations will be sufficient to meet our anticipated cash needs for working capital and capital expenditures in 2004, including in connection with the launch of our esophageal capsule and the Patency System. If our estimates of revenues, expenses or capital or liquidity requirements change or are inaccurate or if cash generated from operations is insufficient to satisfy our liquidity requirements, we may seek to sell additional equity or arrange debt financing, which could include establishing a line of credit. In addition, we may seek to sell additional equity or arrange debt financing to give us financial flexibility to pursue opportunities that may arise in the future if an opportunity that we consider attractive arises to raise additional funding. We have also applied to the Office of Chief Scientist for a grant to support our research and development activities in 2004. If our expectations as to revenues and expenses are not met and if we are unable to obtain additional financing when we need it or if we cannot obtain it on commercially reasonable terms, we may be required to reduce the scope of our planned product development and marketing efforts, which could potentially harm our business, financial condition and operating results.

The following table sets forth the components of our cash flows for the periods indicated:

| | Year ended December 31, | |

| | 2001 | | 2002 | | 2003 | |

| | (in thousands) | |

Net cash used in operating activities | | $ | (19,198 | ) | | $ | (22,233 | ) | | $ | (8,548 | ) | |

Net cash used in investing activities | | | (5,005 | ) | | | (7,560 | ) | | | (2,647 | ) | |

Net cash provided by financing activities | | | 64,131 | | | | 4,419 | | | | 653 | | |

Effect of exchange rate changes on cash | | | (58 | ) | | | (64 | ) | | | 117 | | |

Increase (decease) in cash and cash equivalents | | $ | 39,870 | | | $ | (25,438 | ) | | $ | (10,425 | ) | |

Net cash used in operating activities was $8.5 million in 2003, $22.2 million in 2002 and $19.2 million in 2001. The decrease from 2002 to 2003 resulted primarily from a $8.7 million decrease in our net loss, a decrease of $1.8 million in inventories (compared to an increase of $7.4 million in 2002) and a decrease of $940,000 in our accounts receivable (compared to an increase of $5.0 million in 2002). This was offset by a decrease of $4.7 million in accounts payable (compared to an increase of $5.5 million in 2002). The decrease in accounts payable resulted principally from our decision in 2003 to decrease our inventories. During 2002, as we increased sales of the Given System, we increased the amount of our inventories to $10.7 million as of December 31, 2002 and we further increased our inventories during the first quarter of 2003 in anticipation of the war in Iraq. In the second half of 2003, we reduced our inventories and as of December 31, 2003, our inventories were $8.5 million. The increase in net cash used in operating activities from 2001 to 2002 resulted primarily from a increase of $7.4 million in inventories (compared to an increase of $2.6 million in 2001) and an increase of $5.0 million in accounts receivable (compared to an increase of $3.0 million in 2001), partially offset by an increase of $5.5 million in accounts payable (compared to an increase of $3.8 million in 2001). The increase in accounts payable resulted principally from our decision in 2002 to increase our inventories as we increased sales of the Given System. We expect that net cash used in operating activities will decrease during 2004.

Net cash used in investing activities was $2.6 million in 2003, $7.6 million in 2002 and $5.0 million in 2001. Investing activities consist primarily of capital expenditures and the capitalization of costs associated with our patents and trademarks, and the development of our web site. Our principal capital expenditures in 2003 were $1.5 million for machinery and equipment and $472,000 for patents. Our principal capital expenditures in 2002 were $4.8 million for machinery and equipment for our semi-automated production line and the back-up line. We expect that net cash used in investing activities will remain at approximately the same level in 2004 due to our planned investment in patents and in production lines for the esophageal capsule and our Patency System.

-42-

Net cash provided by financing activities was $653,000 in 2003, $4.4 million in 2002 and $64.1 million in 2001. The decrease from 2001 to 2002 was primarily attributable to the completion of our initial public offering in October 2001. In 2003, net cash provided by financing activities resulted primarily from the payment of the exercise price for employee stock options.

Our net cash expenditures for operating and investing activities in 2003 were approximately $11.2 million. We expect to decrease net cash expenditures as our sales develop and we achieve profitability.

The following table of our material contractual obligations as of December 31, 2003, summarizes the aggregate effect that these obligations are expected to have on our cash flows in the periods indicated:

| | Payments due by period | |

Contractual obligations | | Total | | 2004 | | 2005 | | 2006 | | 2007 | | Later Years | |

| | | | | | (unaudited)

(in thousands) | | | | | |

Capital leases(1) | | $ | 31 | | $ | 27 | | $ | 4 | | $ | — | | $ | — | | $ | — | |

Operating leases(2) | | | 4,100 | | | 1,731 | | | 1,449 | | | 655 | | | 142 | | | 123 | |

Total | | $ | 4,131 | | $ | 1,758 | | $ | 1,453 | | $ | 655 | | $ | 142 | | $ | 123 | |

______________

| (1) | Consists of capital leases for motor vehicles. |

| (2) | Consists of operating leases for office, manufacturing space and motor vehicles. |

Market Risk

We invest our excess cash in bank accounts and deposits located with a number of banks inside and outside of Israel, principally in Europe. These instruments have maturities of three months or less when acquired. Due to the short-term nature of these investments, we believe that there is no material exposure to interest rate risk arising from our investments.

Corporate Tax

Israeli companies are generally subject to income tax at the corporate rate of 36%. As of December 31, 2003, our net operating loss carry-forwards for Israeli tax purposes amounted to $29.5 million. Under Israeli law, net operating losses can be carried forward indefinitely and offset against certain future taxable income.

In addition, our investment program in leasehold improvements and equipment at our manufacturing facility in Yoqneam, Israel has been granted approved enterprise status and we are, therefore, eligible for tax benefits under the Law for the Encouragement of Capital Investments, 1959. Subject to compliance with applicable requirements, the portion of our undistributed income derived from our approved enterprise program will be exempt from corporate tax for a period of ten years commencing in the first year in which we generate taxable income. To date, we have not generated taxable income. The ten-year period may not extend beyond the later of 14 years from the year in which approval was granted or 12 years from the year in which operations or production by the enterprise began. We received our approved enterprise status in 1999. As we continue to expand our production facilities, we have applied, and received, in 2002, an approval for the expansion of our production facilities during the subsequent two years under the alternative benefits track. The investments are expected to amount to $4.9 million and will be invested in Yoqneam, Israel. The plan is subject to certain terms set forth in the approval letter. We cannot assure you that we will receive approvals in the future for approved enterprise status or that tax benefits for approved enterprises will continue at current levels.

The period of tax benefits for our approved enterprise programs has not yet commenced, because we have yet to realize taxable income. However, we expect that a substantial portion of the income we derive in the future will be from this approved enterprise program. These benefits should result in income recognized by us being tax exempt for a specified period after we begin to report taxable income and exhaust any net operating loss carry-forwards. These benefits may not be applied to reduce the tax rate for any income that is not derived from sales of our product manufactured at our facility in Yoqneam, Israel.

Our approved enterprise status imposes certain requirements on us, such as the location of our manufacturing facility, location of certain subcontractors and the extent to which we may outsource portions of our production process.

-43-

These requirements limit our freedom to pursue production arrangements that may otherwise be more favorable to us if we want to maintain these tax benefits. Therefore, we may be required to weigh the possible loss of these benefits against other benefits from pursuing arrangements which are not, or which may not be considered by the relevant Israeli authorities to be, in compliance with these requirements. If we do not meet these requirements, the law permits the authorities to cancel the tax benefits retroactively.

As of December 31, 2003, the net operating loss carry-forwards of our subsidiaries for tax purposes amounted to $23.9 million. A subsidiary’s net operating loss carry-forwards for tax purposes relating to a jurisdiction are generally available to offset future taxable income of such subsidiary in that jurisdiction, subject to applicable expiration dates.

Government Grants

Our research and development efforts have been financed, in part, through grants from the Office of the Chief Scientist of the Israeli Ministry of Industry and Commerce. We have applied and received approval for grants totaling $2.5 million from the Office of the Chief Scientist, including $1.3 million, which was provided by the Office of Chief Scientist to support our 2003 research and development.

Under Israeli law, royalties on the revenues derived from sales of the Given System or any part of the Given System are payable to the Israeli government, generally at the rate of 3.0% during the first three years, 4.0% over the following three years and 5.0% in or after the seventh year and the maximum aggregate royalties paid generally cannot exceed 100%.

The government of Israel does not own proprietary rights in technology developed using its funding and there is no restriction on the export of products manufactured using the technology. The technology is, however, subject to other legal restrictions, including the obligation to manufacture the product based on this technology in Israel and to obtain the Office of the Chief Scientist’s consent to transfer the technology or product rights to a third party. These restrictions may impair our ability to outsource manufacturing or enter into similar arrangements for those products or technologies and they continue to apply even after we have paid the full amount of royalties payable for the grants. If the Office of the Chief Scientist consents to the manufacture of the products outside Israel, the regulations allow the Office of the Chief Scientist to require the payment of increased royalties, ranging from 120% to 300% of the amount of the grant plus interest, depending on the percentage of foreign manufacture. If the manufacturing is performed outside of Israel by us, the rate of royalties payable by us on revenues from the sale of products manufactured outside of Israel will increase by 1% over the regular rates. If the manufacturing is performed outside of Israel by a third party, the rate of royalties payable by us on those revenues will be a percentage equal to the percentage of our total investment in the Given System that was funded by grants. Following our request, the Office of the Chief Scientist has approved the manufacture of limited quantities of the M2A capsule in Pemstar’s facilities in Ireland without increasing royalty rates.

C. RESEARCH AND DEVELOPMENT

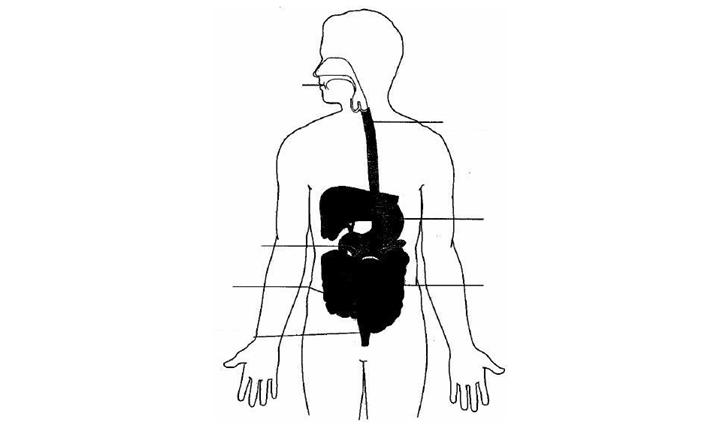

Our research and development expenditures, excluding grants received from the Office of the Chief Scientist, were $7.0 million for the year ended December 31, 2003, $8.6 million for the year ended December 31, 2002, and $6.2 million for the year ended December 31, 2001. Our research and development activities are conducted internally by our research and development and regulatory affairs staff primarily at our headquarters in Israel. As of December 31, 2003, our research and development staff consisted of 34 employees, as well as consultants and subcontractors. Our research and development efforts are focused primarily on developing new capsules to be used in the detection of abnormalities in other parts of the gastrointestinal tract, including the esophagus, the stomach and the colon.

D. TREND INFORMATION

See discussion in Parts A and B of Item 5 “Operating Results and Financial Review and Prospects.”

-44-

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. DIRECTORS AND SENIOR MANAGEMENT

Our executive officers and directors and their ages and positions as of the date of this annual report are as follows:

Name | | Age | | Position |

| | | | |

Executive Officers: | | | | |

Gavriel D. Meron | | 51 | | President, Chief Executive Officer and Director |

Kevin Rubey | | 46 | | Chief Operations Officer |

Zvi Ben David | | 43 | | Corporate Vice President and Chief Financial Officer |

Yoram Ashery | | 37 | | Corporate Vice President—Business Development |

Shoshana Friedman | | 50 | | Corporate Vice President—Regulatory and Medical Affairs |

Mark Gilreath | | 37 | | Corporate Vice President—Marketing Strategy |

Nancy L. S. Sousa | | 47 | | Corporate Vice President and President of Given Imaging, Inc. |

Manfred Gehrtz | | 53 | | Corporate Vice President, General Manager for Europe |

Pablo Halpern(1) | | 53 | | Corporate Vice President, General Manager for Japan and Rest of World |

Sharon Koninksy | | 32 | | Director of Corporate Human Resources |

| | | | |

Directors: | | | | |

Doron Birger(2) | | 52 | | Chairman of the Board of Directors |

James M. Cornelius(2)(3)(4) | | 60 | | Director |

Michael Grobstein(2)(3)(4) | | 61 | | Director |

Jonathan Silverstein(2) | | 37 | | Director |

Reuven Baron | | 60 | | Director |

Dr. Dalia Megiddo(3) | | 52 | | Director |

Chen Barir | | 45 | | Director |

Eyal Lifschitz | | 36 | | Director |

______________

| (1) | Mr. Halpern has resigned his position effective April 30, 2004. |

| (2) | Member of our compensation and nominating committee. |

| (3) | Member of our audit committee and independent director under Nasdaq National Market listing requirements. |

| (4) | Outside director under the Israeli Companies Law. |

Gavriel D. Meron founded Given Imaging in 1998 and has served as our President and Chief Executive Officer since that time. Mr. Meron became a director in August 2002. Prior to founding us, from 1995 to 1997, Mr. Meron served as Chief Executive Officer of APPLItec Ltd., an Israeli designer and manufacturer of video cameras and systems primarily for the medical endoscopy market. From 1993 to 1995, Mr. Meron was General Manager and Chief Operating Officer of Optibase Ltd., an Israeli manufacturer of hardware and software products that compress and playback digital video and sound for multimedia applications. From 1988 to 1993, Mr. Meron was Chief Financial Officer of InterPharm Laboratories Ltd., an Israeli company listed on the Nasdaq National Market and a subsidiary of the Ares-Serono Group, a Swiss ethical pharmaceutical company. From 1983 to 1987, Mr. Meron held various management positions at the Tadiran Group, an Israeli telecommunications and semiconductor manufacturer. From 1973 to 1983, Mr. Meron served as an officer in the Israeli army overseeing the budgets of a range of military industries. Mr. Meron holds an M.B.A. from Tel Aviv University and a B.A. in economics and statistics from the Hebrew University, Jerusalem.

Kevin Rubey has served as our Chief Operations Officer since June 2001. Prior to joining us, from 1998 to May 2001, Mr. Rubey worked at Eastman Kodak Company, a consumer and professional photographic and information imaging company where he led manufacturing and operations for the Health Imaging Business Unit. From 1996 to 1998, Mr. Rubey was Manufacturing Director of the Medical Imaging Business Unit of Imation Corporation, a U.S. information technology company specializing in data storage and color image management. Prior to that, from 1977 to 1996, Mr. Rubey worked at the 3M Corporation in a variety of positions in the health, consumer and information technology businesses. Mr. Rubey holds a B.Sc. in mechanical engineering and an M.B.A. from the University of Minnesota.

-45-

Zvi Ben David has served as our Corporate Vice President and Chief Financial Officer since July 2000 and served as a director since our establishment in 1998 to June 2000. From 1995 to June 2000, Mr. Ben David was Vice President and Chief Financial Officer of RDC Rafael Development Corporation, one of our principal shareholders. From 1994 to 1995, Mr. Ben David was manager of the finance division of Electrochemical Industries (Frutarom) Ltd., an Israeli company traded on the Tel-Aviv Stock Exchange and American Stock Exchange that produces petrochemical products. Prior to that, from 1989 to 1993, Mr. Ben David was manager of the economy and control department of Electrochemical Industries (Frutarom) Ltd. From 1984 to 1988, Mr. Ben David worked at Avigosh & Kerbs, an accounting firm in Haifa, Israel. Mr. Ben David is a certified public accountant in Israel and holds a B.A. in economics and accounting from the University of Haifa.

Yoram Ashery has served as our Corporate Vice President – Business Development since April 2001. Prior to joining us, from 1995 to April 2001, Mr. Ashery was a corporate attorney, practicing in the fields of technology and medical devices and privatizations as an associate and, from January 2000, as a partner, with the law firm of Zellermayer, Pelossof & Co., who are also our legal counsel. Prior to that, Mr. Ashery served at the Office of the Attorney General of the Government of Israel, from 1993 to 1994, during which period he also completed his internship under the direct supervision of the Israeli Attorney General. From 1992 to 1996, Mr. Ashery also served as a junior lecturer in Tax Law at the Buchman Faculty of Law of the Tel-Aviv University. Mr. Ashery holds an LL.B. from the Buchman Faculty of Law of the Tel-Aviv University and a B.A. in Economics from the School of Social Sciences of the Tel-Aviv University.

Shoshana Friedman has served as our Corporate Vice President-Regulatory and Medical Affairs since January 2002. Ms. Friedman served as a consultant to us and as a member of our advisory board to our Chief Executive Officer from 1998 to January 2002. Prior to joining us, from 1996 to 2002, Ms. Friedman served as the Managing Director of PuSH-med Ltd., a regulatory consulting firm that she founded, which provided consulting services to medical device and biotechnology companies. From 1993 to 1996, Ms. Friedman was Regulatory, Clinical and Quality Assurance Director at InStent Ltd., an Israeli medical device company that was acquired by Medtronic, Inc. in 1996. Ms. Friedman holds a Quality Assurance Lead Assessor certificate from Bywater, Inc. and a Regulatory Affairs Certificate from the Regulatory Affairs Professional Society. Ms. Friedman holds a B.Sc. in mathematics and physics from Haifa University and an M.B.A. from the Hebrew University, Jerusalem.

Mark Gilreath has served as Corporate Vice President – Marketing Strategy since January 2003. He previously served as President of Given Imaging, Inc. since April 2001. Prior to that, he served as our Vice President – Global Business Development since September 2000 and as a consultant to us from October 1999 to September 2000. In 1999, Mr. Gilreath founded VortexMed, Inc., a developer of internet sites for healthcare professionals, where he served as Chief Executive Officer until September 2000. From 1992 to 1999, Mr. Gilreath held various management positions with PENTAX Precision Instrument Corporation including Product Manager, Director of Marketing, Area Sales Manager and Director of Business Development. Prior to joining PENTAX, from 1989 to 1992, Mr. Gilreath served as an officer in the U.S. Navy. He holds a B.Sc. in business finance from Winthrop University and a M.B.A. from the Fuqua School of Business at Duke University.

Nancy L. S. Sousa has served as Corporate Vice President since May 2003 and President, Given Imaging, Inc. since January 2003. Prior to joining us, she held several positions at Eastman Kodak Company from 1980 through 2002, including Director, System Concepts Center, and prior to that, as Vice President, New Business Development, Health Imaging. In addition, to those positions, she previously served as Vice President, OEM Products, Consumer Imaging, Director, Strategic Business Planning, Consumer Imaging, and Product Manager, Projectors and Cameras. Ms. Sousa holds an M.Sc. in mathematics from University of Notre Dame and an M.A. in mathematics from The State University of New York.

Manfred Gehrtz has served as our Corporate Vice President, General Manager for Europe since January 2004. From 1995 to January 2004, Dr. Gehrtz was Managing Director, the head of the Endoscope Division and Vice President of Medical Systems Europe at Olympus Optical Co. (Europa) GmbH, a developer of products in the fields of photography, endoscopy, microscopy, communication and diagnostics. From 1990 to 1995, Dr. Gehrtz was Managing Director and CEO of Aesculap Meditec GmbH, a German company that develops and manufactures medical laser systems. Prior to that, from 1986 to 1990, Dr. Gehrtz was a Specialist, Lab Manager and Production Facility Manager at IBM Deutschland GmbH. Dr. Manfred holds a Ph. D. in Physical Chemistry and a M.Sc. in Physics from the University of Munich, Germany. From 1983 to 1985 Dr. Gehrtz was a Post-Doctoral Fellow at the IBM Research Laboratory in San Jose, California.

Sharon Koninsky has served as Director of Corporate Human Resources since 2002 and, prior to that, as Human Resources Manager. She has served as Executive Assistant to the President and Chief Executive Officer since 1998. Prior to joining us, from 1997 until 1998, Ms. Koninsky worked in the marketing department of Geotek Technologies Ltd., an

-46-

Israeli telecommunications company. In 1996 Ms. Koninsky was responsible for placing personnel in administrative positions while employed at a manpower organization in Haifa. Ms. Koninsky holds a B.A. in social work and an M.A. in public administration, both from Haifa University.

Pablo Halpern has served as our Corporate Vice President, General Manager for Japan and Rest of Word since 2003 and, prior to that, as our Corporate Vice President – Global Sales and Marketing since 1999. Prior to joining us, from 1994 to 1999, he served as General Manager of Ultramind International Ltd. (now Ultrasys plc), a British company that manufactures personal computer-based products for the medical professional market. From 1991 to 1994, Mr. Halpern was an international marketing consultant with the Israeli Export Institute. From 1989 to 1991, Mr. Halpern served as General Manager of Barspec Ltd., an Israeli company that manufactured products for the analytical instrumentation market. Mr. Halpern holds a B.Sc. in electro-mechanical engineering and an M.Sc. in electrical engineering from the faculty of engineering, Buenos Aires National University.

Doron Birger has served as Chairman of the board of directors since August 2002 and as a director since June 2000. Mr. Birger has served as Chief Executive Officer of Elron Electronic Industries since August 2002, President since 2001, Chief Financial Officer from 1994 to August 2002, and Corporate Secretary from 1994 to 2001. Mr. Birger is a director of RDC Rafael Development Corporation and Elbit Systems Ltd. From 1991 to 1994, Mr. Birger was Vice President-Finance at North Hills Electronics Ltd., an advanced electronics company. From 1990 to 1991, Mr. Birger served as Chief Financial Officer of Middle-East Pipes Ltd., a manufacturer in the metal industry. From 1988 to 1990, Mr. Birger served as Chief Financial Officer of Maquette Ltd., a manufacturer and exporter of fashion items. From 1981 to 1988, Mr. Birger was Chief Financial Officer and director at Bateman Engineering Ltd. and I.D.C. Industrial Development Company Ltd. Mr. Birger holds a B.A. and an M.A. in economics from the Hebrew University, Jerusalem.

James M. Cornelius has served as a director since October 2001 and was elected as an outside director in December 2001. Mr. Cornelius currently serves as the non-executive Chairman of the board of directors of Guidant Corporation, a U.S. cardiac and vascular medical device company. From 1994 until 2000, Mr. Cornelius served as the Senior Executive and Chairman of Guidant Corporation. From 1983 to 1994, Mr. Cornelius was a director, a member of the Executive Committee and Chief Financial Officer of Eli Lilly and Company. From 1980 to 1982, Mr. Cornelius served as President and Chief Executive Officer of IVAC Corporation, formerly part of Eli Lilly’s Medical Device and Diagnostics Division, and from 1978 to 1980, Mr. Cornelius was Director of Acquisitions for Eli Lilly’s Medical Device and Diagnostics Division. Mr. Cornelius currently also serves as a director of The Chubb Corporation, Hughes Electronics and The National Bank of Indianapolis. Mr. Cornelius holds an M.B.A. and a B.A. in accounting from Michigan State University.

Michael Grobstein has served as a director since October 2001 and was elected as an outside director in December 2001. Mr. Grobstein has served as a director of Guidant Corporation since 1999, and is currently chairman of Guidant’s audit committee and a member of its corporate governance committee. Mr. Grobstein worked with Ernst & Young LLP from 1964 to 1998, and was admitted as a partner in 1975. At Ernst & Young, Mr. Grobstein served as a Vice Chairman-International Operations from 1993 to 1998, as Vice Chairman-Planning, Marketing and Industry Services from 1987 to 1993, and Vice Chairman-Accounting and Auditing Services from 1984 to 1987. In these positions, Mr. Grobstein, among other things, oversaw the global strategic planning of the firm, was responsible for developing and implementing the firm’s worldwide audit service delivery process and consulted with multinational corporations on a wide variety of financial reporting matters. Mr. Grobstein is a certified public accountant in the United States and holds a B.Sc. in accounting from the University of Illinois.

Jonathan Silverstein has served as a director since September 2000. Mr. Silverstein joined OrbiMed Advisors LLC in 1999 and is currently a managing director. From 1996 to 1999, Mr. Silverstein was the Director of Life Sciences in the Investment Banking Department at the Sumitomo Bank Limited. From 1994 to 1996, Mr. Silverstein was an associate at Hambro Resource Development. Mr. Silverstein serves as a director of DOV Pharmaceuticals, Auxilium Pharmaceuticals and Predix Pharmaceuticals, and is a former director for Orthovita, Inc. and LifeCell Corporation. Mr. Silverstein has a B.A. in economics from Denison University and a J.D. and an M.B.A. from the University of San Diego.

Reuven Baron has served as a director since July 2000. Mr. Baron has served as President and Chief Executive Officer of RDC Rafael Development Corporation since June 2000. Prior to that, from 1993 to 2000, he was President of Galram Technology Industries, the business division of Rafael Armament Development Authority, and from 1994 to 2000, he was Chairman of Opgal Industries Ltd., an Israeli manufacturer of thermal imaging products. From 1990 to 1993, Mr. Baron was Director of Business Development for the Electronics Systems Division of Rafael. Mr. Baron holds a B.Sc. and an M.Sc. in electrical engineering from the Israel Institute of Technology.

-47-

Dr. Dalia Megiddo has served as a director since October 2001. Dr. Megiddo is Managing Partner of InnoMed Medical Device Innovations, a Israeli venture capital fund in the field of medical devices and the life sciences, and was recently appointed a director of Elron Electronic Industries, one of our shareholders. Since 1994, Dr. Megiddo has also served a Chief Editor of Academia Medica, a multimedia medical teaching program in Israel and since 1996 as Editor of the Israeli medical audio magazine, The Journal Club. Dr. Megiddo also currently serves as a director of Elron Electronic Industries. From 1981 to 1986, Dr. Megiddo practiced family medicine at the Hebrew University Hadassah Medical Health Center. Dr. Megiddo holds an M.D. in medicine from Hebrew University, Jerusalem and an M.B.A. from Kellogg Recanati International Executive M.B.A. program of Tel Aviv University and North Western University.

Chen Barir has served as director since August 2002. Mr. Barir is Chairman of Berman & Co. Trading and Investments Ltd. and subsidiaries, a private investment company specializing in seed and early stage venture investments and management focusing primarily on medical devices, investments in emerging markets and real estate. Mr. Barir is Chairman of Galil Medical Ltd. and Sunlight Medical Ltd., and a director of Optonol, Inc. and Elron Electronic Industries Ltd. Mr. Barir holds an M.B.A. from the European Institute of Business Administration (INSEAD) in Fontainebleau, France, and a Doctorate in Law and Economics from Harvard Law School, Cambridge, Massachusetts.

Eyal Lifschitz has served as a director since December 2003. Since 2001, Mr. Lifschitz has served as Chief Executive Officer and General Manager of Peregrine Ventures, a venture capital fund focused on the technology industry in Israel. Prior to that, Mr. Lifschitz was co-founder of a number of medical technology and biotech companies, including Becontree Systems, Inc., where he served as Director of Business Development from 1999 to 2001, Vision Care Ophthalmic Technologies, Inc., where he served as Director of Business Development from 1997 to 2001, ECR Ltd., where he served as General Manager from 1994 to 2001, and Pharmacies, Inc., where he served as Director of Business Development from 1990 to 1994. Mr. Lifschitz holds an LL.B. from Shearei Mishpat, Israel.

B. COMPENSATION

The aggregate compensation paid by us and our subsidiaries to our directors and executive officers, including stock-based compensation, for the year ended December 31, 2003 was $1.8 million (excluding director fees detailed below). This amount includes approximately $230,000 set aside or accrued to provide pension, severance, retirement or similar benefits or expenses, but does not include business travel, relocation, professional and business association dues and expenses reimbursed to office holders, and other benefits commonly reimbursed or paid by companies in Israel.

During the first half of 2003, we paid each director (excluding Gavriel Meron) a quarterly fee of $3,750 for their service on our board of directors, and a $1,500 fee for attending and participating in each meeting of the board of directors or any committee of the Board of Directors. We paid an additional quarterly fee of $1,250 to the chairman of the audit committee. During the second half of 2003, as part of our plan to reduce operating costs, director compensation was reduced to 50% of these amounts. The total amount of these payments in 2003 was $170,000. The directors fees in respect of service by our director, Doron Birger, are paid to Elron Electronics Industries, where he serves as President and Chief Executive Officer, and in respect of service by our director, Reuben Baron, are paid to RDC Rafael Development Corporation, where he serves as President and Chief Executive Officer. In addition, all of our directors were reimbursed for their expenses for each board of directors meeting attended. In addition, in 2003, we granted options to purchase 25,000 ordinary shares to each of our directors, Michael Grobstein, James Cornelius and Eyal Lifschitz, options to purchase 11,000 ordinary shares to each of our directors, Jonathan Silverstein and Dalia Megiddo and options to purchase 8,000 ordinary shares to Chen Barir. The exercise price of these options was equal to the fair market value of our ordinary shares on the date of grant.

In 2003, the base salary of Gavriel Meron, our President and Chief Executive Officer, who is also a director, was $220,000. This base salary was subject to a 17.4% reduction as part of measures that we took in July 2003 to reduce our operating costs which will remain in effect until March 31, 2004. In 2003, our shareholders approved (1) a lump sum bonus of $100,000 in respect of Mr. Meron’s performance during 2002, and (2) a grant of options to purchase 50,000 ordinary shares at an exercise price equal to the fair market value of our ordinary shares on the date of grant, vesting in four equal annual installments commencing on the date of the grant. Mr. Meron also has the use of an automobile and 22 days of paid vacation per year, as well as other benefits commonly paid by companies in Israel. Please see Item 7 “Major Shareholders and Related Party Transactions—Agreements with Directors and Officers—Employment Agreements” for information regarding Mr. Meron’s employment agreement and compensation subject to shareholder approval.

-48-

C. BOARD PRACTICE

Board of Directors and Officers

Our articles of association provide that we may have up to 12 directors, each of whom is elected at an annual general meeting of our shareholders by a vote of the holders of a majority of the voting power present and voting at that meeting. Our board of directors currently consists of nine directors. Each director listed above will hold office until the next annual general meeting of our shareholders which is currently scheduled to occur on April 27, 2004, except for our outside directors who were elected in December 2001 for an initial three-year term which will expire in December 2004 pursuant to the Companies Law and may be extended to one additional three-year term. Other than Gavriel Meron, our President and Chief Executive Officer, none of our directors are our employees or are party to a service contract with us.

A simple majority of our shareholders at a general meeting may remove any of our directors from office, elect directors in their stead or fill any vacancy, however created, in our board of directors. In addition, vacancies on the board of directors, other than vacancies created by an outside director, may be filled by a vote of a majority of the directors then in office. Our board of directors may also appoint additional directors up to the maximum number permitted under our articles of association. A director so chosen or appointed will hold office until the next general meeting of our shareholders.

Each of our executive officers serves at the discretion of the board of directors and holds office until his or her successor is elected or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers. All of our executive officers have signed employment agreements.

Outside and Independent Directors

Under Israel’s Companies Law, companies incorporated under the laws of the State of Israel whose shares are listed on an exchange including the Nasdaq National Market are required to appoint two outside directors. Outside directors are required to meet standards of independence set forth in the Israeli companies law. Outside directors are elected by a majority vote at a shareholders’ meeting, provided that either (1) the majority of shares voted at the meeting, including at least one-third of the shares of non-controlling shareholders voted at the meeting, vote in favor of the election of the outside director, or (2) the total number of shares voted against the election of the outside director does not exceed one percent of the aggregate voting rights in the company. The initial term of an outside director is three years and he or she may be reelected to one additional term of three years by a majority vote at a shareholders’ meeting, subject to the conditions described above for election of outside directors. Outside directors may only be removed by the same percentage of shareholders as is required for their election, or by a court, and then only if the outside directors cease to meet the statutory requirements for their appointment or if they violate their duty of loyalty to the company. If an outside directorship becomes vacant, a company’s board of directors is required under the Companies Law to call a shareholders’ meeting immediately to appoint a new outside director. Our two outside directors are James Cornelius and Michael Grobstein.

Each committee of a company’s board of directors is required to include at least one outside director and our audit committee is required to include both outside directors. An outside director is entitled to compensation as provided in regulations adopted under the Companies Law and is otherwise prohibited from receiving any other compensation, directly or indirectly, in connection with services provided as an outside director.

In addition to the requirements of the Companies Law, we must comply with the Nasdaq National Market listing requirements, under which our board of directors must have at least three independent directors as defined in those rules. Commencing on July 31, 2005, a majority of the members of our board of directors (including all members of our audit committee) will be required to be independent under the rules of the Nasdaq National Market.

Audit Committee

Under the Companies Law, the board of directors of any company whose shares are listed on any exchange must also appoint an audit committee comprised of at least three directors including all of the outside directors. The audit committee may not include the chairman of the board of directors, the general manager, the chief executive officer, a director employed by the company or who provides services to the company on a regular basis, or a controlling shareholder or a relative of a controlling shareholder. Under the rules of the Nasdaq National Market listing requirements, we are required to have an audit committee consisting of at least three independent directors, all of whom are financially literate and one of

-49-

whom has accounting or related financial management expertise. We believe that our directors, Michael Grobstein, James Cornelius and Dalia Megiddo, meet these independence requirements. Commencing on July 31, 2005, the members of our audit committee will be required to meet more stringent independence requirements under Nasdaq National Market rules, including minimum standards set forth in rules of the Securities and Exchange Commission and adopted by the Nasdaq National Market.

Under the Companies Law, the role of the audit committee is to identify irregularities in the business management of the company, in consultation with the internal auditor and the company’s independent accountants, and suggest an appropriate course of action. Under the Nasdaq National Market listing requirements, our audit committee has adopted an audit committee charter setting forth its responsibilities. In December 2003, we amended our audit committee charter to reflect new rules of the Nasdaq National Market, which will become effective with respect to us on July 31, 2005. The audit committee charter governing the actions of our audit committee states that in fulfilling this role the committee is entitled to rely on interviews and consultations with our management, our internal auditor and our independent public accountant, and is not obligated to conduct any independent investigation or verification. The charter also states that the audit committee is required to nominate the company’s independent accountants, which the shareholders subsequently are required to approve.

Internal Auditor

Under the Companies Law, the board of directors must appoint an internal auditor nominated by the audit committee. The role of the internal auditor is to examine whether a company’s actions comply with the law and orderly business procedure. Under the Companies Law, the internal auditor may be an employee of the company but not an interested party or an office holder, or affiliate, or a relative of an interested party or an office holder, nor may the internal auditor be the company’s independent accountant or its representative. An interested party is defined in the Companies Law as a 5% or greater shareholder, any person or entity who has the right to designate one director or more or the chief executive officer of the company or any person who serves as a director or as a chief executive officer. We have appointed Dr. Naftaly Fried of Kost Forer & Gabai, a member firm of Ernst & Young International, as our internal auditor.

Compensation and Nominating Committee

Our compensation and nominating committee consists of our directors James Cornelius, Doron Birger, Michael Grobstein and Jonathan Silverstein. In December 2003, in accordance with new Nasdaq National Market rules which will become effective with respect to us on July 31, 2005, our compensation and nominating committee adopted a charter, which sets forth its responsibilities. Pursuant to the charter, the compensation and nominating committee is authorized to make decisions regarding executive compensation and terms and conditions of employment, as well as to recommend that the board of directors issue options under our stock option plans. The compensation and nominating committee is also responsible for recommending to the board of directors nominees for board membership. The charter requires that the composition of the committee must satisfy the Nasdaq National Market’s independent director requirements.

D. EMPLOYEES

As of December 31, 2003, we and our subsidiaries had 232 employees of whom 133 were based in Israel, 63 in the United States, 34 in Europe and two in Australia. This reflects a 9% decrease in the number of employees since December 31, 2002, and reflected a 15% reduction in our workforce at the time, principally from our manufacturing facilities. This reduction in our workforce was the result of efficiency measures initiated to reduce our operating costs in order to achieve our profitability targets. The breakdown of our employees by department is as follows:

| | Year ended December 31, | |

Department | | 2001 | | 2002 | | 2003 | |

| | | | | | | |

Research and development | | 33 | | 45 | | 34 | |

Sales and marketing | | 84 | | 115 | | 131 | |

Manufacturing | | 36 | | 71 | | 49 | |

Management and administration | | 16 | | 21 | | 18 | |

Under law, we and our employees are subject to protective labor provisions, including restrictions on working hours, minimum wages, minimum vacation, minimal termination notice, sick pay, severance pay and social security as well as equal

-50-

opportunity and anti-discrimination laws. Orders issued by the Israeli Ministry of Labor and Welfare make certain industry-wide collective bargaining agreements and collective bargaining agreements in the electricity, steel and electronics industries applicable to us. These agreements affect matters such as cost of living adjustments to salaries, length of working hours and week, recuperation, travel expenses, and pension rights. Our employees are not represented by a labor union . We provide our employees with benefits and working conditions above the required minimum and which we believe are competitive with benefits and working conditions provided by similar companies in Israel. We have written employment agreements with all of our Israeli employees and with our senior non-Israeli employees. Competition for qualified personnel in our industry is intense and we dedicate significant resources to employee retention. We have never experienced labor-related work stoppages and believe that our relations with our employees are good.

E. SHARE OWNERSHIP

Share Ownership by Directors and Executive Officers

For information regarding ownership of our ordinary shares by our directors and executive officers, and regarding options to purchase our ordinary shares granted to Gavriel Meron, our President and Chief Executive Officer, see Item 7 “Major Shareholders and Related Party Transactions.”

Stock Option Plans

2003 Stock Option Plan

Our 2003 stock option plan provides for a grant of options to our directors, employees and consultants, including members of our medical advisory committee, and to the directors, employees or consultants of our subsidiaries. We initially reserved a total of 1,500,000 ordinary shares for issuance under the plan. In addition, we have reserved for issuance under the plan any ordinary shares underlying unvested options granted under our 1998 and 2000 Stock Option Plans that expire without exercise. As of December 31, 2003, we had outstanding options to purchase 1,913,680 shares under the 2003 stock option plan. On February 10, 2004, our board of directors approved an increase of 1,000,000 ordinary shares available under the 2003 stock option plan, subject to shareholder approval.

The plan is substantially similar to our 2000 Stock Option Plan. Generally, where a grant of options under the plan is our first grant of options to that person, the options are not exercisable before the second anniversary of the date of grant, at which time 50% of the options become exercisable with 25% to become exercisable on each of the third and fourth anniversaries of the date of the grant. However, under the 2003 Stock Option Plan, in cases where we have granted options to a grantee under previous plans, 25% of the options will be exercisable at the time of the grant and 25% will be exercisable on the first, second and third anniversaries of the date of the grant. Our compensation and nominating committee has the authority to accelerate the time periods for exercising options. Unexercised options expire ten years after the date of grant. To the extent the options have been vested, they may be exercised in whole or in part from time to time until their expiry. Upon the termination of the employment of an employee other than for cause the employee may exercise all vested options. If the employment of an employee is terminated for cause, all of his or her vested and unvested options will expire.

In the event of an acquisition or merger, we will endeavor to ensure that the rights of the holders of outstanding options are maintained. If we are unable to do so or if our board of directors resolves otherwise, all outstanding, but unvested, stock options will be accelerated and exercisable, ten days prior to the acquisition or merger. In addition, if the employment of a holder of outstanding options is terminated in anticipation of or during the 12 month period following an acquisition or merger, all outstanding but unvested stock options will be accelerated and exercisable, subject to certain adjustments and exceptions.

Options granted under the plan to Israeli residents may be granted under Section 102 of the Israeli Income Tax Ordinance pursuant to which the options or the ordinary shares issued upon their exercise must be deposited with a trustee for at least two years following the end of the calendar year in which the options are granted. Under Section 102 (1) any tax payable by an employee from the grant or exercise of the options is deferred until the transfer of the options or ordinary shares by the trustee to the employee or upon the sale of the options or ordinary shares, (2) gains are subject to capital gains tax of 25%.

-51-

2000 Stock Option Plan

Our 2000 stock option plan provides for the grant of options to our directors, employees or consultants, including members of our medical advisory committee, and to the directors, employees or consultants of our subsidiaries. As of December 31, 2003, we had granted options to purchase 1,703,713 shares under the 2002 stock option plan. Ordinary shares underlying options which expire without exercise under the 2000 stock option plan become available for issuance under the 2003 stock option plan.

The plan is administered by our compensation and nominating committee which makes recommendations to our board of directors regarding grantees of options and the terms of the grant, including exercise prices, vesting schedules, acceleration of vesting and other matters necessary in the administration of the plan. Upon the recommendation of our compensation and nominating committee, options granted under the plan to Israeli residents may be granted under Section 102 of the Israeli Income Tax Ordinance pursuant to which the options or the ordinary shares issued upon their exercise must be deposited with a trustee for at least two years. Any tax payable by an employee from the grant or exercise of the options is deferred until the transfer of the options or ordinary shares by the trustee to the employee or upon the sale of the options or ordinary shares. Options granted under the plan to U.S. residents may also qualify as incentive stock options within the meaning of Section 422 of the U.S. Internal Revenue Code of 1986. The exercise price for incentive stock options must not be not less than the fair market value on the date the option is granted, or 110% of the fair market value if the option holder holds more than 10% of our share capital.

Generally, options issued under the plan are not exercisable before the second anniversary of the date of grant at which time 50% of the options become exercisable and 25% on each of the third and fourth anniversaries of the date of grant. Unexercised options expire ten years after the date of grant. If the employment of an employee is terminated for cause, all of his or her vested and unvested options will expire.

In the event of an acquisition or merger, we will endeavor to ensure that the rights of the holders of outstanding options are maintained. If we are unable to do so or if our board of directors resolves otherwise, all outstanding, but unvested, stock options will be accelerated and exercisable, ten days prior to the acquisition or merger.

1998 Stock Option Plan

Our 1998 stock option provides for the grant of options to our directors, employees, or consultants, including members of our medical advisory committee. Our 1998 stock option plan has been superseded by our 2000 stock option plan and we have ceased issuing options under our 1998 stock option plan. As of December 31, 2003, we had granted options to purchase 808,273 shares under the 1998 stock option plan. Ordinary shares underlying options which expire without exercise under the 1998 stock option plan become available for issuance under the 2003 stock option plan.

Generally, options issued under the plan are not exercisable before the second anniversary of the date of grant at which time 50% of the options become exercisable and 25% on each of the third and fourth anniversaries of the date of grant. Unexercised options expire ten years after the date of grant. If the employment of an employee is terminated for cause, all of his or her vested and unvested options will expire.

-52-

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. MAJOR SHAREHOLDERS

The following table sets forth certain information regarding the beneficial ownership of our outstanding ordinary shares as of the date of this Form 20-F for: (1) each person who we believe beneficially owns 5% or more of the outstanding ordinary shares, (2) each of our directors individually, (3) each of our executive officers individually, and (4) all of our directors and executive officers as a group. Beneficial ownership of shares is determined under rules of the Securities and Exchange Commission and generally includes any shares over which a person exercises sole or shared voting or investment power. The table also includes the number of shares underlying options that are exercisable within 60 days of the date of this annual report. Ordinary shares subject to these options are deemed to be outstanding for the purpose of computing the ownership percentage of the person holding these options, but are not deemed to be outstanding for the purpose of computing the ownership percentage of any other person.

The shareholders listed below do not have any different voting rights from our other shareholders. Unless otherwise noted below, each shareholder’s address is c/o Given Imaging Ltd., P.O. Box 258, Yoqneam 20692, Israel.

Name and Address | | Number of Shares Beneficially

Owned | | Percentage of

Shares

Beneficially Owned | |

Principal shareholders: | | | | | |

IDB Holding Corporation Ltd. (1) | | 9,425,972 | | 36.6 | % |

OrbiMed Advisors LLC, OrbiMed Capital LLC and OrbiMed Advisors Inc., Samuel D. Isaly (2) | | 4,052,649 | | 15.8 | |

Directors and executive officers: | | | | | |

Gavriel D. Meron (3) | | 688,231 | | 2.6 | |

Zvi Ben David (4) | | 202,976 | | * | |

Kevin Rubey (5) | | 75,915 | | * | |

Yoram Ashery (6) | | 109,299 | | * | |

Shoshana Friedman (7) | | 64,382 | | * | |

Mark Gilreath (8) | | 78,263 | | * | |

Nancy L. S. Sousa (9) | | 10,000 | | * | |

Manfred Gehrtz | | — | | — | |

Pablo Halpern (10) | | 144,026 | | * | |

Sharon Koninsky (11) | | 31,719 | | * | |

Doron Birger (12) | | 5,963,531 | | 23.2 | |

James M. Cornelius (13) | | 204,125 | | * | |

Michael Grobstein (14) | | 71,500 | | * | |

Jonathan Silverstein (15) | | 4,098,149 | | 15.9 | |

Reuven Baron (16) | | 3,233,310 | | 12.6 | |

Dr. Dalia Megiddo (17) | | 10,300 | | * | |

Chen Barir (18) | | 12,500 | | * | |

Eyal Lifshitz | | — | | — | |

All directors and executive officers as a group (19) | | 15,228,357 | | 56.1 | % |

______________

| (1) | Based on a Schedule 13D filed on May 19, 2003 and amended on September 4, 2003 and on information provided to us supplementally, consists of 3,462,441 ordinary shares owned by Discount Investment Corporation Ltd. (“DIC”), 3,232,310 ordinary shares owned by RDC Rafael Development Corporation Ltd. (“RDC”) and 2,731,221 ordinary shares owned by Elron Electronics Industries Ltd. (“Elron”). As of the date of this Form 20-F, Elron owned all of the outstanding shares of DEP Technology Holdings Ltd. which, in turn, hold 50.1% of the voting power of RDC. As a result, Elron may be deemed to be the beneficial owner of the ordinary shares owned by RDC. As of the date of this Form 20-F, DIC owned approximately 38.5% of the outstanding shares of Elron and, as a result, DIC may be deemed to be the beneficial owner of the ordinary shares owned by RDC and by Elron. The address of Discount Investment Corporation is The Triangular Tower, 43rd Floor, 3 Azrieli Center, |

-53-

| | Tel Aviv 67023, Israel. The address of RDC Rafael Development Corporation is P.O. Box 14, Haifa 31000. The address of Elron Electronic Industries is The Triangular Tower, 42nd Floor, 3 Azrieli Center, Tel Aviv 67023, Israel. As of the date of this Form 20-F, IDB Holding Corporation (“IDBH”) owned approximately 58% of the outstanding shares of IDB Development Corporation (“IDBD”) which, in turn, owned approximately 69% of the outstanding shares of DIC. As a result, IDBH may be deemed to be the beneficial owner of the ordinary shares owned by DIC, RDC and Elron. IDBH is a public company traded on the Tel Aviv Stock Exchange. Approximately 51.7% of the outstanding share capital of IDBH is owned by a group comprised of (i) Ganden Investments I.D.B. Ltd. (“Ganden”), a private Israeli company controlled by Nochi Dankner and his sister, Shelly Dankner-Bergman, which holds 31.02% of the equity of and voting power in IDBH; (ii) Manor Investments-IDB Ltd. (“Manor”), a private Israeli company controlled by Ruth Manor, which holds 10.34% of the equity of and voting power in IDBH; and (iii) Avraham Livnat Investments (2002) Ltd. (“Livnat”), a private Israeli company controlled by Avraham Livnat, which holds 10.34% of the equity of and voting power in IDBH. Ganden, Manor and Livnat, owning in the aggregate approximately 51.7% of the equity of and voting power in IDBH, entered into a Shareholders Agreement relating, among other things, to their joint control of IDBH, the term of which is until May 19, 2023. In addition, Shelly Dankner-Bergman holds approximately 4.75% of the equity of and voting power in IDBH. The address of Nochi Dankner is The Triangle Tower, 44th floor, 3 Azrieli Center, Tel Aviv 67023, Israel. The address of Shelly Dankner-Bergman is 12 Recanati Street, Ramat Aviv Gimmel, Tel Aviv, Israel. The address of Ruth Manor is 26 Hagderot Street, Savyon, Israel. The address of Mr. Avraham Livnat is Taavura Junction, Ramle, Israel. These individuals disclaim beneficial ownership of the shares owned by the foregoing entities except to the extent of their pecuniary interest therein. On September 29, 2003, Elron and DIC entered into a voting agreement pursuant to which, among other things, DIC agreed to vote all of its ordinary shares in favor of nominees to our Board of Directors proposed by Elron. The voting agreement is for a term of one year and renews automatically each year thereafter unless terminated by notice of either party to the other party no later than August 30 in each year, unless terminated by agreement of both parties thereto. |

| (2) | Based on a Schedule 13D filed on May 15, 2002 and on information provided to us supplementally, consists of 2,475,736 ordinary shares and options to purchase 2,157 ordinary shares owned by Caduceus Private Investments L.P. (“Caduceus”); 485,000 ordinary shares and options to purchase 771 ordinary shares owned by Eaton Vance Worldwide Health Sciences Portfolio (“Eaton Vance”); 485,000 ordinary shares and options to purchase 771 ordinary shares owned by Finsbury Worldwide Pharmaceutical Trust (“Finsbury”); 500,000 ordinary shares owned by PW Juniper Crossover Fund LLC (“Juniper”); 92,173 ordinary shares and options to purchase 144 ordinary shares owned by OrbiMed Associates LLC (“OrbiMed Associates”); 2,820 ordinary shares owned by OrbiMed Capital LLC (“OrbiMed Capital”); options to purchase 2,157 ordinary shares owned by OrbiMed Advisors LLC; 1480 ordinary shares owned by Samuel D. Isaly; 1,480 ordinary shares owned by Sven Borho; 1,480 ordinary shares owned by Michael Sheffery; 1,480 ordinary shares owned by Carl L. Gordon. OrbiMed Capital is the general partner of Caduceus, OrbiMed Advisors LLC acts as managing member of OrbiMed Associates, OrbiMed Advisors Inc. acts as investment manager of Juniper, OrbiMed Advisors LLC acts as investment advisor to Finsbury and OrbiMed Advisors LLC acts as investment adviser to Eaton Vance. As a result, OrbiMed Advisors LLC, OrbiMed Capital and OrbiMed Advisors, Inc. have discretionary investment management authority with respect to the assets of Caduceus, OrbiMed Associates and Juniper. Samual D. Isaly owns all of the outstanding stock of, and controls the management and operation of OrbiMed Advisors Inc. Samual D. Isaly also owns a controlling interest in OrbiMed Advisors LLC and OrbiMed Capital. Samuel D. Isaly, Sven Borho, Michael Sheffery and Carl L. Gordon, share ownership and control of OrbiMed Associates, OrbiMed Capital and OrbiMed Advisors LLC. The address of OrbiMed Advisors LLC, OrbiMed Capital, OrbiMed Advisors, Inc., Samuel D. Isaly, Sven Borho, Michael Sheffery and Carl L. Gordon is 767 Third Avenue, 30th Floor, New York, NY 10017. These individuals each disclaim beneficial ownership of the shares owned by the foregoing entities except to the extent of his pecuniary interest therein. |

| (3) | Consists of 11,416 ordinary shares and options to purchase 676,815 ordinary shares. |

| (4) | Consists of 19,026 ordinary shares, options to purchase 113,750 ordinary shares from Given Imaging and options to purchase 70,200 ordinary shares from RDC Rafael Development Corporation. |

| (5) | Consists of 415 ordinary shares owned by a family member of Mr. Rubey and options to purchase 75,500 ordinary shares. |

-54-

| (6) | Consists of 38,049 ordinary shares owned by Yoram Ashery Ltd., a company owned and controlled by Mr. Ashery, and options to purchase 71,250 ordinary shares. |

| (7) | Consists of 19,026 ordinary shares owned by Ms. Friedman, 19,800 ordinary shares owned by PuSH J. Sh. Holding Ltd., a company owned and controlled by Ms. Friedman, options to purchase 22,500 ordinary shares owned by Ms. Friedman and options to purchase 3,056 ordinary shares owned by PuSH. J. Sh. Holding Ltd. |

| (8) | Consists of 9,513 ordinary shares and options to purchase 68,750 ordinary shares. |

| (9) | Consists of options to purchase 10,000 ordinary shares. |

| (10) | Consists of 19,026 ordinary shares and options to purchase 125,000 ordinary shares. |

| (11) | Consists of 15,219 ordinary shares and options to purchase 16,500 ordinary shares. |

| (12) | Consists of 3,232,310 ordinary shares owned by RDC Rafael Development Corporation and 2,731,221 ordinary shares owned by Elron Electronic Industries. Mr. Birger is a director of RDC Rafael Development Corporation and President and Chief Executive Officer of Elron Electronic Industries and by virtue of his position may be deemed to have voting and investment power, and thus beneficial ownership with respect to the shares that Elron Electronic Industries and RDC Rafael Development Corporation own. Mr. Birger disclaims such beneficial ownership except to the extent of his pecuniary interest therein. |

| (13) | Consists of 120,000 ordinary shares owned by Mr. Cornelius, 20,125 ordinary shares held by Twilight Venture Partners, 11,500 ordinary shares held by the Cornelius Family Foundation, and options to purchase 52,500 ordinary shares. |

| (14) | Consists of 19,000 ordinary shares and options to purchase 52,500 ordinary shares. |

| (15) | Consists of options to purchase 45,500 ordinary shares and 4,056,649 ordinary shares beneficially owned by the OrbiMed investors. Mr. Silverstein is a principal of OrbiMed Advisors LLC and by virtue of his position may be deemed to have voting and investment power, and thus beneficial ownership with respect to the shares which the OrbiMed investors owns or over which they exercise voting and investment power. Mr. Silverstein disclaims such beneficial ownership except to the extent of his pecuniary interest therein. |

| (16) | Consists of 1,000 ordinary shares owned by Mr. Baron and 3,232,310 ordinary shares beneficially owned by RDC Rafael Development Corporation. Mr. Baron is the President and Chief Executive Officer of RDC Rafael Development Corporation and by virtue of his position may be deemed to have voting and investment power, and thus beneficial ownership with respect to the shares beneficially owned by RDC Rafael Development Corporation. Mr. Baron disclaims such beneficial ownership except to the extent of his pecuniary interest therein. |

| (17) | Consists of options to purchase 10,300 ordinary shares. |

| (18) | Consists of options to purchase 12,500 ordinary shares. |