As filed with the Securities and Exchange Commission on March 25, 2005

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| £ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| OR |

| | | |

| S | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004 |

| | | |

| OR |

| | | |

| £ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

GIVEN IMAGING LTD.

(Exact name of Registrant as specified in its charter)

Israel

(Jurisdiction of incorporation or organization)

13 Ha'Yetzira Street

Yoqneam 20692, Israel

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, par value NIS 0.05 per share

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

The number of outstanding shares of each of the issuer's classes of capital or

common stock as of December 31, 2004:

27,621,386 Ordinary Shares, par value NIS 0.05 per share

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes S No £

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 £ Item 18 S

TABLE OF CONTENTS

The GIVEN logo, GIVEN, PillCam, PILLCAM, the PillCam logo, ORDERWIN, ORDER WHEN I NEED, RAPID, PILLCAM IMAGING CAPSULE and design, FINGERS HOLDING A CAPSULE logo and, FINGERS HOLDING PILLCAM CAPSULE logo, are our trademarks or registered trademarks. All other registered trademarks appearing herein are owned by their holders.

i

PART I

Item 1. Identity of Directors, Senior Management and Advisors

Not Applicable.

Item 2. Offer Statistics and Expected Timetable

Not Applicable.

Item 3. Key Information

The selected consolidated statements of operations data for the years ended December 31, 2002, 2003 and 2004, and the selected consolidated balance sheet data as of December 31, 2003 and 2004, have been derived from our audited consolidated financial statements set forth elsewhere in this Form 20-F. These financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America. The selected consolidated statements of operations data for the years ended December 31, 2000 and 2001, and the selected consolidated balance sheet data as of December 31, 2000, 2001 and 2002, have been derived from our audited consolidated financial statements not included in this Form 20-F and have also been prepared in accordance with generally accepted accounting principles in the United States of America. You should read the selected consolidated financial information set forth below in conjunction with our consolidated financial statements and the related notes as well as Item 5 “Operating and Financial Review and Prospects” included elsewhere in this Annual Report on Form 20-F.

| | | Year ended December 31,

|

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

| | | (in thousands, except share and per share data) |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | — | | | $ | 4,733 | | | $ | 28,904 | | | $ | 40,539 | | | $ | 65,020 | |

Cost of revenues | | | — | | | | 2,476 | | | | 11,907 | | | | 13,551 | | | | 17,734 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Gross profit | | | — | | | | 2,257 | | | | 16,997 | | | | 26,988 | | | | 47,286 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Research and development, gross | | | (4,137 | ) | | | (6,156 | ) | | | (8,609 | ) | | | (7,037 | ) | | | (7,363 | ) |

Royalty-bearing participation | | | 312 | | | | 44 | | | | — | | | | 1,303 | | | | 1,140 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Research and development, net | | | (3,825 | ) | | | (6,112 | ) | | | (8,609 | ) | | | (5,734 | ) | | | (6,223 | ) |

Sales and marketing | | | (2,923 | ) | | | (12,902 | ) | | | (22,681 | ) | | | (26,804 | ) | | | (33,652 | ) |

General and administrative | | | (1,224 | ) | | | (2,664 | ) | | | (4,749 | ) | | | (5,312 | ) | | | (6,916 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Total operating expenses | | | (7,972 | ) | | | (21,678 | ) | | | (36,039 | ) | | | (37,850 | ) | | | (46,791 | ) |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Operating profit (loss) | | | (7,972 | ) | | | (19,421 | ) | | | (19,042 | ) | | | (10,862 | ) | | | 495 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Financing income, net | | | 433 | | | | 764 | | | | 1,469 | | | | 995 | | | | 956 | |

Other expenses, net | | | — | | | | — | | | | (711 | ) | | | — | | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Profit (loss) before taxes on income | | | (7,539 | ) | | | (18,657 | ) | | | (18,284 | ) | | | (9,867 | ) | | | 1,451 | |

Taxes on income | | | — | | | | — | | | | — | | | | — | | | | 690 | |

Profit (loss) before minority share | | | (7,539 | ) | | | (18,657 | ) | | | (18,284 | ) | | | (9,867 | ) | | | 2,141 | |

Minority share in losses (profits) of subsidiary | | | — | | | | — | | | | (26 | ) | | | 258 | | | | 747 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Net profit (loss) | | $ | (7,539 | ) | | $ | (18,657 | ) | | $ | (18,310 | ) | | $ | (9,609 | ) | | $ | 2,888 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Basic profit (loss) per ordinary share(1) | | $ | (1.14 | ) | | $ | (1.60 | ) | | $ | (0.73 | ) | | $ | (0.38 | ) | | $ | 0.11 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Diluted profit (loss) per ordinary share(1) | | $ | (1.14 | ) | | $ | (1.60 | ) | | $ | (0.73 | ) | | $ | (0.38 | ) | | $ | 0.10 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Ordinary shares used in computing basic profit (loss) per ordinary share(1) | | | 8,804,188 | | | | 12,879,369 | | | | 25,182,563 | | | | 25,493,073 | | | | 26,633,964 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

Ordinary shares used in computing diluted profit (loss) per ordinary share(1) | | | 8,804,188 | | | | 12,879,369 | | | | 25,182,563 | | | | 25,493,073 | | | | 29,353,448 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

1

| | | As of December 31,

|

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

| | | (in thousands) |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 21,360 | | | $ | 61,230 | | | $ | 35,792 | | | $ | 25,367 | | | $ | 80,861 | |

Working capital | | | 20,584 | | | | 62,891 | | | | 43,972 | | | | 34,970 | | | | 92,987 | |

Total assets | | | 25,530 | | | | 75,923 | | | | 68,728 | | | | 55,569 | | | | 124,224 | |

Long-term liabilities, net of current portion | | | 317 | | | | 522 | | | | 882 | | | | 1,192 | | | | 10,984 | |

Total liabilities | | | 2,455 | | | | 6,590 | | | | 12,969 | | | | 8,847 | | | | 28,430 | |

Accumulated deficit | | | (12,059 | ) | | | (30,716 | ) | | | (49,026 | ) | | | (58,635 | ) | | | (55,747 | ) |

Total shareholders' equity | | | 23,075 | | | | 69,333 | | | | 53,577 | | | | 44,798 | | | | 94,617 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | See Notes 1K and 10 of the notes to our consolidated financial statements for an explanation of the number of shares used in computing per share data. |

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F contains forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These statements include but are not limited to:

| • | the adequacy of our cash balances and cash flow from operations to support our operations or future growth, in general or for specified periods of time; |

| |

| • | expectations as to raising additional financing; |

| |

| • | statements as to the potential or expected expansion in acceptance of our current and future products by the medical community, particularly gastroenterologists; |

| |

| • | statements as to expected increases in sales, operating results and certain expenses, including research and development and sales and marketing expenses; |

| |

| • | statements as to anticipated reimbursement from U.S. and non-U.S. healthcare payors for our products; |

| |

| • | expectations as to the development of our products and technology, and the timing of enhancements to our products and new product launches; |

| |

| • | expectations as to the market opportunities for the Given System and other products, including capsule endoscopes, for visualizing other sections of the gastrointestinal tract, such as the esophagus, stomach and the colon, as well as our ability to take advantage of those opportunities; |

| |

| • | expectations as to the timing and content of future clinical studies and publications; |

| |

| • | statements as to the expected outcome of legal and patent proceedings in which we are involved; |

| |

| • | expectations as to the receipt and timing of regulatory clearances and approvals, and the anticipated timing of sales of the Given System in new markets or for new indications; |

| |

| • | estimates of the impact of changes in currency exchange rates on our operating results; |

| |

| • | expectations as to the adequacy of our inventory of critical components and finished products; |

| |

| • | expectations as to the adequacy of our manufacturing facilities and the timing of any expansion; and |

| |

| • | statements as to our expected treatment under Israeli and U.S. federal tax legislation and the impact that new Israeli tax and corporate legislation may have on our operations. |

2

In addition, statements that use the terms “believe”, “expect”, “plan”, “intend”, “estimate”, “anticipate” and similar expressions are intended to identify forward-looking statements. All forward-looking statements in this Form 20-F reflect our current views about future events and are based on assumptions and are subject to risks and uncertainties that could cause our actual results to differ materially from future results expressed or implied by the forward-looking statements. Many of these factors are beyond our ability to control or predict. You should not put undue reliance on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements.

3

RISK FACTORS

If we are unable to achieve broader penetration of the Given System among gastroenterologists, we may not be able to maintain our current growth rate.

Our principal product is the Given System, consisting of the PillCam capsule and the related data recorder and computer workstation. In 2004, we sold 654 Given Systems and approximately 90,400 PillCam SB capsules compared to 631 Given Systems and approximately 51,400 PillCam SB capsules in 2003. At the end of November 2004, we began marketing our new PillCam ESO capsule following receipt of marketing clearance from the U.S. Food and Drug Administration, or FDA. As of December 31, 2004, we had sold approximately 2,290 systems and 172,000 PillCam SB capsules. Growth in our installed base of Given Systems has contributed to our revenue growth. If we are unable to continue to achieve broad penetration among gastroenterologists, we may be unable to maintain our current growth rate. Our success in making sales of the Given System depends on a number of factors. First, we must demonstrate that the Given System is clinically-effective and cost-effective in diagnosing a range of disorders of the gastrointestinal tract, and we must inform and educate both physicians and the third-party payors responsible for providing reimbursement coverage about the clinical and economic benefits of using the Given System. Second, we must broaden the indications for which the use of the Given System is reimbursed, expand the number of lives with such reimbursement coverage and educate healthcare providers as to the clinical and economic benefits of using the Given System for such broader indications so that they are encouraged to adopt the Given System. Third, we must convince third party payors to provide reimbursement coverage for capsule endoscopy as a primary diagnostic tool and not only after a previous procedure, such as endoscopy or radiology, has been performed. If we are unable to increase reimbursement coverage, expand the indications for which reimbursement is granted and convince more physicians to adopt the Given System, future penetration of the Given System among gastroenterologists may not be sufficient to maintain our current growth rate.

If we are unable to increase PillCam capsule usage rates among gastroenterologists, we may not be able to maintain our current growth rate.

A substantial portion of our revenue growth to date has resulted from increased sales of the PillCam SB capsule. Sales of the PillCam SB capsule contributed $10.9 million, or 37.7%, in 2002, $22.9 million, or 56.4%, in 2003, and $41.6 million, or 64%, in 2004. While growth in the installed base of Given Systems is one factor that contributes to growth in sales of the PillCam capsules, another factor is the number of capsules that are used during a given time period on each Given System, referred to as the usage rate. The usage rate per system in 2004 was approximately 1.15 PillCam SB capsules per system per week in the United States and 0.9 PillCam SB capsules per system per week globally (including the United States). The usage rate per system during the last three years has varied slightly but has generally been in the range of 0.9 to 1.2 PillCam SB capsules per system per week in the United States and in the range of between 0.6 to 0.9 PillCam SB capsule per system per week globally (including the United States). The usage rate outside the United States has historically been lower than in the United States. We are seeking to increase the usage rate by a number of methods, including increased selling and marketing activities, more frequent contact with our customers, attaining reimbursement coverage for broader indications, educating physicians regarding the clinical benefits of the PillCam capsule, increasing operating efficiencies of our sytem to the benefit of physicians and collaborating with strategic industry participants, such as InScope, a division of Ethicon Endo-Surgery, a Johnson & Johnson company, to market our new PillCam ESO capsule. Increasing the usage rate of our customers is also important to attracting new customers to purchase and use the Given System. If we are unable to increase the usage rate of the Given System, we may not be able to generate the revenues necessary to maintain our growth.

4

We may be unable to maintain or increase our profitability.

We were formed in 1998 and recorded our initial sales of the Given System in the third quarter of 2001. We achieved positive cash flow in the fourth quarter of 2003 and became profitable in the second quarter of 2004; however, we have significant operating expenses and must continue increasing our revenues from sales of the Given System and of the PillCam capsules at a higher rate than the increase in our expenses in order to maintain and grow our profits. If we fail to do so, we may be unable to maintain or increase our profitability.

If we are unable to expand reimbursement coverage from third-party healthcare payors for procedures using the Given System, or if reimbursement is insufficient to cover the costs of purchasing or using the Given System when compared to alternative procedures, demand for the Given System may not continue to grow.

Demand for the Given System depends significantly on the eligibility of the procedures performed using the Given System for reimbursement through government-sponsored healthcare payment systems and private third-party payors. In general, the process of obtaining reimbursement coverage approvals has been slower outside of the United States. Reimbursement practices vary significantly from country to country and within some countries, by region, and we must obtain reimbursement approvals on a country-by-country and region-by-region basis. Historically, we have experienced higher sales in territories in which we have received reimbursement for capsule endoscopy using the Given System and in territories in which health authorities and regulators approved the marketing or use of capsule endoscopy. We may not be able to obtain further approvals in a timely manner or at all. If physicians, hospitals and other healthcare providers are unable to obtain sufficient coverage and reimbursement from third-party payors for procedures using the Given System, or if reimbursement is insufficient to cover the costs of purchasing or using our product or does not adequately compensate physicians and health care providers compared to the other procedures they offer, we may be unable to generate sufficient sales to continue to grow.

Our future growth depends in part on our ability to market the Given System and the PillCam SB capsule for a variety of disorders of the small intestine.

The Given System and the PillCam SB capsule have been cleared for marketing by the FDA for the detection of disorders of the small intestine. However, in order to achieve sustained long-term growth we must successfully market the Given System for detection of a variety of disorders of the small intestine with high prevalence. Use of the Given System is highly dependent on the availability of third party reimbursement. Initially, most reimbursement policies issued for the Given System in the United States by third party payors covered its use only for detection of suspected bleeding in the small intestine, which represents a small part of the total population with suspected disorders of the small intestine. Currently, however, most reimbursement policies cover other prevalent indications in the small intestine, such as suspected Crohn's disease. As of December 31, 2004, the total insured population in the United States covered for capsule endoscopy for these expanded indications was approximately 179 million. Our ability to further expand the use of the Given System depends substantially on our ability to demonstrate to additional governmental and private third-party payors the diagnostic and cost-effectiveness of the Given System for other disorders of the small intestine. If third-party payors do not accept our data as supporting coverage and reimbursement for the detection of other disorders of the small intestine, our ability to sell the Given System for the detection of these disorders would be harmed and our growth would be adversely affected.

5

We currently depend on the Given System and the PillCam SB and our new PillCam ESO capsules for substantially all of our revenues. If we are unable to manufacture, market or sell the Given System or the PillCam capsules, our financial condition and results of operations would be materially adversely affected.

Sales of the Given System and our PillCam SB capsule for visualization of the small intestine currently account for substantially all of our revenues. In addition, in the third quarter of 2004, we launched our new PillCam ESO video capsule in Europe and in the fourth quarter of 2004 we launched this product in the United States. If we are unable to manufacture, market or sell the Given System or the PillCam SB and PillCam ESO video capsules, our financial condition and results of operations would be materially adversely affected.

Our future growth also depends in part on the success of Ethicon Endo-Surgery in marketing our new PillCam ESO video capsule, particularly in the United States.

In May 2004, we entered into an exclusive sales representation and co-promotion agreement with Ethicon Endo-Surgery, a Johnson & Johnson company. InScope, a division of Ethicon Endo-Surgery established to market products to the gastroenterology market, has exclusive rights to market our PillCam ESO capsule. The alliance initially is worldwide, excluding Japan. InScope has begun marketing PillCam ESO capsule in the United States but has not yet commenced marketing activities in other territories, which may subsequently be excluded if we do not reach agreement with InScope regarding the marketing activities of InScope in these other territories by March 31, 2005 or a later date that may be agreed upon by the parties. Under the agreement, InScope is responsible for the marketing of PillCam ESO capsule, as well as for obtaining reimbursement coverage for the PillCam ESO capsule. In September 2004, we launched PillCam ESO capsule in Europe and in November 2004 we received FDA clearance. Consequently, we depend on the success of InScope in marketing the PillCam ESO capsule and obtaining reimbursement coverage for this capsule. If InScope is not successful, our sales of the PillCam ESO capsule may be lower than expected and our revenues may suffer.

Any disruption in the United States, our primary market for our products, may result in a material reduction in our revenues and negatively affect our results of operations.

Since we began selling the Given System in 2001, most of our revenues have been generated from sales in the United States. Sales in the United States accounted for 15.6 million, or 54%, of our revenues in 2002, 26.2 million, or 65%, of our revenues in 2003 and 46.7 million, or 72%, of our revenues in 2004. Any disruption to our market in the United States resulting from adverse changes in reimbursement policies, regulatory requirements, macro-economic changes and other events, many of which are outside our control, may result in a material reduction in our revenues and negatively affect our results of operations.

We may be unable to introduce other products for use in other parts of the gastrointestinal tract.

Our objective is to expand the use of the Given System by developing and introducing new capsules for visualizing other parts of the gastrointestinal tract, including the stomach and the colon. There can be no assurance of widespread market acceptance of the Given System as superior to existing technologies for detection of abnormalities in other parts of the gastrointestinal tract or that we will succeed in marketing and selling capsules for use in other parts of the gastrointestinal tract. In addition, we will be required to obtain FDA clearance in the United States and other regulatory approvals outside of the United States before commercially distributing the Given System for use in other parts of the gastrointestinal tract or introducing new products for use in the gastrointestinal tract. These regulatory processes can be lengthy and expensive and we cannot be sure that FDA clearance or other regulatory approvals will be granted. In order to obtain FDA clearance and other regulatory approvals, and to obtain reimbursement coverage for use of the Given System in other parts of the gastrointestinal tract, we will be required to conduct additional clinical trials to demonstrate the diagnostic and cost-effectiveness of the Given System.

6

If future clinical trials indicate that the Given System is not as clinically-effective or cost-effective in these parts of the gastrointestinal tract as current methods, or that it causes unexpected complications or other unforeseen negative effects, we may not obtain regulatory clearance to market and sell the Given System for use in other parts of the gastrointestinal tract or obtain reimbursement coverage, and our growth would be adversely affected.

Changes in healthcare system policies may make it difficult for physicians, hospitals and other healthcare providers to obtain adequate reimbursement for procedures using the Given System, which could adversely affect demand for the Given System.

Many healthcare payors have adopted a managed care system in which they contract to provide comprehensive healthcare for a fixed cost per person, irrespective of the amount of care actually provided. Therefore, the amount of reimbursement provided may not be sufficient to encourage physicians to purchase or utilize the Given System. We are unable to predict what changes will be made in the reimbursement policies of third-party payors. We could be adversely affected by changes in reimbursement policies of governmental or private healthcare payors to the extent any such changes affect reimbursement amounts or methods for procedures in which the Given System is used.

Because of the importance of our patent portfolio to our business, we may lose market share to our competitors if we fail to protect our intellectual property rights.

Protection of our patent portfolio is key to our future success. We rely on patent protection, as well as a combination of copyright, trade secret, design and trademark laws, nondisclosure and confidentiality agreements and other contractual restrictions to protect our proprietary technology. However, these legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep any competitive advantage. Currently, many of our patent applications are still pending and we will be able to use them to protect our technology against potential competitors only when they are issued. The process of issuing a patent may sometimes be lengthy and may not always result in issued patents in a form that will be advantageous to us or at all. In addition, once issued, patents may be challenged, invalidated or circumvented by third parties. Our patents and applications cover particular aspects of our products and technology and may be challenged, invalidated or circumvented by third parties. There may be more effective technologies, designs or methods. If the most effective method is not covered by our patents or applications and our competitors are able to commercialize products using these methods, it could have an adverse effect on our sales. We may not be able to prevent the unauthorized disclosure or use of our technical knowledge or other trade secrets by former employees. The laws and judiciary systems of foreign countries also may not protect or enable enforcement of our intellectual property rights to the same extent as the laws of the United States. Even if we adequately protect our intellectual property rights, litigation may be necessary to enforce these rights. This litigation could be lengthy, result in substantial costs to us and a substantial diversion of management attention and allow our competitors to gain significant market position in the meantime. If we do not adequately protect our intellectual property, our competitors or other parties could use the intellectual property that we have developed to enhance their products or make products similar to ours and compete more efficiently with us, which could result in a decrease in our market share.

Because the medical device industry is litigious, we are susceptible to intellectual property suits that could cause us to incur substantial costs or pay substantial damages or prohibit us from selling our products.

There is a substantial amount of litigation over patent and other intellectual property rights in the medical device industry. Whether a product infringes a patent involves complex legal and factual issues, the determination of which is often uncertain. While we have attempted to ensure that the Given System does not infringe other parties' valid patents and proprietary rights, searches typically performed to identify potentially infringed patents of third parties are not always conclusive and, because patent applications can take many years to issue, there may be

7

applications now pending of which we are unaware, which may later result in issued patents which our current or future products may infringe. In addition, our competitors or other parties may assert that our product and the methods it employs may be covered by patents held by them. If our products infringe a valid patent, we could be prevented from selling them unless we can obtain a license or redesign the product to avoid infringement. A license may not always be available or may require us to pay substantial royalties. We also may not be successful in any attempt to redesign our product to avoid any infringement. Infringement and other intellectual property claims, with or without merit, can be expensive and time-consuming to litigate and can divert management's attention from operating our business.

We face competition from large, well-established manufacturers of existing technologies for detecting gastrointestinal disorders, as well as from gastrointestinal products in general which compete for the limited capital expenditure budgets of customers.

We consider the current competition for the Given System to be existing technologies for detecting gastrointestinal disorders and diseases. Existing technologies include traditional endoscopy and radiological imaging. The principal manufacturers of gastrointestinal endoscopes are Olympus, Asahi Optical Co., which manufactures and markets cameras and other imaging equipment under the Pentax brand, and Fujinon. The principal manufacturers of equipment for radiological imaging are General Electric Healthcare Systems, Siemens Medical Solutions, a division of Siemens AG, Philips Medical Systems Ltd., Toshiba Corporation, Shimadzu Corporation and Trex Medical Corporation for x-ray equipment. These companies have substantially greater financial resources than we do, and they have established reputations as well as worldwide distribution channels for medical instruments to physicians. If we are unable to convince physicians to adopt the Given System over the current technologies marketed by our competitors, our results of operations will suffer. We are aware of research and development efforts by some of these companies, including Olympus, and other individuals and companies to develop and bring to market imaging capsules or other less invasive imaging techniques that may be competitive with the Given System. In addition to competition from products performing similar clinical functions to the Given System, there is also competition for the limited capital expenditure budgets of customers. Another capital equipment item for gastroenterology that is priced similarly to our system may compete with our system for the same hospital capital budget, which is typically limited, and therefore the potential purchaser may be required to choose between the two items of capital equipment. If we are unable to market the Given System more effectively than other products which could be purchased using the same budget as the Given System, we may be unable to maintain our current growth rate.

We will be required to increase manufacturing quantities of the Given System and could encounter manufacturing problems or delays that could result in lost revenue.

As of December 31, 2004, we had manufactured and sold approximately 172,000 PillCam SB capsules and approximately 3,400 PillCam ESO capsules, which we started to manufacture and sell in the fall of 2004 following FDA clearance. In 2005, we expect to increase the sales of PillCam SB capsules and will have the first full year of production of PillCam ESO capsules. We are using two semi-automatic production lines to manufacture PillCam SB capsules and one semi-automated production line to manufacture PillCam ESO capsules. We expect to complete the construction of a second production line for PillCam ESO capsules in the second quarter of 2005. These four production lines are installed at our manufacturing facilities in Yoqneam, Israel. Each semi-automatic production line has the capacity to manufacture approximately 180,000 PillCam capsules per year. However, if demand for the PillCam capsule continues to grow we may have to manufacture PillCam capsules in quantities that we have not manufactured to date. We have installed a back-up semi-automatic production line for PillCam SB capsules at the facilities of Pemstar, Inc. in Ireland and are constructing another backup line for PillCam ESO capsules in this facility. We may be unable to establish or maintain reliable, high-volume manufacturing capacity and may encounter difficulties in scaling up production of the Given System, whether by installing

8

one or more fully-automated production lines, or otherwise. If demand for the Given System exceeds our manufacturing capacity, we could develop a substantial backlog of customer orders and our ability to generate revenues will be limited and our reputation in the marketplace may be harmed.

We are subject to extensive regulation by the FDA which could restrict the sale and marketing of the Given System and could cause us to incur significant costs.

The U.S. Food and Drug Administration, or FDA, regulations prohibit us from promoting or advertising the Given System, or any other devices that the FDA may clear in the future, for uses not within the scope of our clearances or making unsupported safety and effectiveness claims. Currently, the Given System has been cleared by the FDA for the detection of abnormalities of the small intestine and the esophagus. These determinations can be subjective, and the FDA may disagree with our promotional claims. Noncompliance with applicable regulatory requirements can result in enforcement action which may include recalling products, ceasing product marketing, paying significant fines and penalties, and similar FDA actions which could limit product sales, delay or halt product shipment, delay new product clearance or approval, and materially adversely affect our financial condition and results of operations. Unanticipated changes in existing regulatory requirements or adoption of new requirements could materially adversely affect our financial condition and results of operations.

We are required to adhere to the FDA's Medical Device Reporting regulation, which requires that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur. The FDA also requires us to adhere to the Quality System Regulation, which covers the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging and shipping of the Given System. The FDA enforces the Quality System Regulation through inspections. Our quality system has passed four audits, including a re-certification audit, pursuant to the Medical Devices Directive of the European Union, the International Standard Organization's standard ISO 9001:2000, ISO 13485:1996 and ISO 13485:2003, which are quality standards setting forth requirements for medical device manufacturers that are more specific than the general requirements specified in ISO 9001. While these quality standards contain requirements which are generally similar to the Quality System Regulation required by the FDA, we have never been through a Quality System Regulation inspection by the FDA and cannot assure you that we would pass. If we fail a Quality System Regulation inspection, our operations could be disrupted and our manufacturing delayed. Failure to take adequate corrective action in response to a Quality System Regulation inspection could force a shutdown of our manufacturing operations and a recall of the Given System, which would have a material adverse effect on our product sales, financial condition and results of operations.

If we or our distributors do not obtain and maintain the necessary regulatory approvals in a specific country or region, we will not be able to market and sell the Given System in that country or region.

In addition to the United States, Germany, France, Australia and Israel, where we market and sell the Given System directly with our own direct sales and marketing organizations, we sell the Given System in more than 50 other countries. To be able to market and sell the Given System in a specific country or region, we or our distributors must comply with the regulations of that country or region. While the regulations of some countries do not impose barriers to marketing and selling the Given System or only require notification, others require that we or our distributors obtain the approval of a specified regulatory body. These regulations, including the requirements for approvals, and the time required for regulatory review vary from country to country. Obtaining regulatory approvals is expensive and time-consuming, and we cannot be certain that we or our distributors will receive regulatory approvals in each country or region in which we plan to market our products. If we modify the Given System, we or our distributors may need to

9

apply for new regulatory approvals before we are permitted to sell it. We may not continue to meet the quality and safety standards required to maintain the authorizations that we or our distributors have received. If we or our distributors are unable to maintain our authorizations in a particular country or region, we will no longer be able to sell our products in that country or region, and our ability to generate revenues will be materially adversely affected.

Our failure to comply with radio frequency regulations in a specific country or region could impair our ability to commercially distribute and market the Given System in that country or region.

The Given System includes a wireless radio frequency transmitter and receiver, and is therefore subject to equipment authorization requirements in a number of countries and regions. In the United States, the Federal Communications Commission, or FCC, requires advance clearance of all radio frequency devices before they can be sold or marketed in the United States. The FCC granted our equipment certification application for the Given System in March 2001 based on the current system design and specifications. Modifications to the Given System may require new or further FCC approval before we are permitted to market and sell a modified system, and it could take several months to obtain any necessary FCC approval.

In Europe, the frequency range in which the Given System operates is subject to technical standards for radio frequency use developed by the Short Range Device Maintenance Group of the European Conference of Postal and Telecommunications Administrations. In February 2002, the Short Range Device Maintenance Group modified the technical standards for the specific radio frequency that the Given System uses to redefine the period of time during which any device can operate continuously in that frequency, known as the “duty cycle.” This change permits the Given System to transmit for more than 10% of the time that it is in operation, which is necessary for the Given System to function. On March 19, 2004, the Electronics Communications Commission of the European Conference of Postal and Telecommunications Administration adopted this technical standard as a decision. The Short Range Device Maintenance Group standards and European Conference of Postal and Telecommunications Administrations decisions generally are not legally binding, and must be implemented into national laws by European governments to become binding. As of December 31, 2004, records of the European Conference of Postal and Telecommunications Administrations indicate that only two European governments, Italy and Poland, have indicated that they will not implement the new technical standards for the duty cycle. Prior to the implementation of the new technical standards change described above or if the technical standards are not implemented in a timely manner, we will seek to obtain waivers or separate authorizations to operate our system in each individual European country, either in advance or if our compliance with spectrum requirements is questioned. If those countries do not implement the technical standards, or we are unable to receive such a waiver or a separate authorization or to redesign our transmitter to operate on a radio frequency that is not subject to a limit on the duty cycle, an enforcement action could be brought to prevent the sale or use of the Given System in these countries. Any such action could negatively affect our results of operations.

Some of our activities may subject us to risks under federal and state laws prohibiting “kickbacks” and false or fraudulent claims.

A federal law commonly known as the Medicare/Medicaid anti-kickback law, and several similar state laws, prohibit payments that are intended to induce physicians or others either to refer patients or to acquire or arrange for or recommend the acquisition of health care products or services. While the federal law applies only to referrals, products or services for which payment may be made by a federal health care program, state laws often apply regardless of whether federal funds may be involved. These laws constrain the sales, marketing and other promotional activities of manufacturers of medical devices, such as us, by limiting the kinds of financial arrangements, including sales programs, we may have with hospitals, physicians, and other potential purchasers of medical devices. Other federal and state laws generally prohibit individuals or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare,

10

Medicaid, or other third-party payors that are false or fraudulent, or are for items or services that were not provided as claimed. Since we provide some coding and billing advice to purchasers of our products, and since we cannot be sure that the government will regard any billing errors that may be made as inadvertent, these laws are potentially applicable to us. Anti-kickback and false claims laws prescribe civil and criminal penalties for noncompliance that can be substantial. Even an unsuccessful challenge could cause adverse publicity and be costly to respond to, and thus could have a material adverse effect on our business, results of operations and financial condition.

We have experienced rapid growth and our failure to manage this growth could harm our business.

Our revenues have grown rapidly and we face significant challenges and risks in building and managing our sales and marketing team, including managing geographically dispersed sales efforts and hiring and adequately training our sales people in the use and benefits of the Given System. To succeed in the implementation of our business strategy and maintain our growth, our management team must diligently plan and rapidly execute our sales and marketing strategy, while continuing our research and development, regulatory, clinical and manufacturing activities, as well as manage our continued growth by implementing effective long term planning. If we are unable to effectively plan, manage and execute these efforts, our business may be harmed.

We rely on local distributors to market and distribute the Given System in most of the territories in which we sell it.

With the exception of Australia, France, Germany, Israel and the United States, we rely on distributors for the marketing and distribution of the Given System. Under most of our agreements with local distributors, a distributor is granted the right to market the Given System for an initial period of approximately three years in a particular country or region, subject to the attainment of minimum sales targets. In 2003, we extended the initial term of some of our distributors by an additional two years, subject to updated minimum sales commitments. The distributor is required to prepare and submit to us for our approval a sales plan for the Given System and to obtain the requisite regulatory and reimbursement approvals for the Given System. Our success in generating sales in countries or regions where we have engaged local distributors depends in part on the efforts of others whom we do not control. In 2004, we derived $9.8 million, or 15%, of our revenues from sales to local distributors, compared to $7.3 million, or 18%, from sales to local distributors in 2003. To date, we have changed a small number of our distributors due to a failure to meet minimum sales targets. If a distributor is terminated by us or goes out of business, it may take us a period of time to locate an alternative distributor and to train its personnel to market the Given System and our ability to sell the Given System in that distributor's country or region could be adversely affected.

Our reliance on single source suppliers could harm our ability to meet demand for the Given System in a timely manner or within budget.

We depend on single source suppliers for some of the components necessary for the production of the Given System. Specifically, Micron Technology, Inc., through its Micron Imaging Group and other wholly-owned subsidiaries, is currently the sole supplier of the imaging sensor and the packaging for the sensor, and Zarlink Semiconductors is currently the sole supplier of the transmitter that is integrated into the PillCam capsules. If the supply of these components is disrupted or terminated, or if these suppliers are unable to supply the quantities of components that we require, we may not be able to find alternative sources for these key components. Although we maintain a strategic inventory of key components, the inventory many not be sufficient to satisfy the demand for our products if supply is interrupted, and is subject to risk of loss due to catastrophic events such as fire at a storage facility. As a result, we may be unable to meet demand for our products, which could harm our ability to generate revenues, lead to customer dissatisfaction and damage our reputation. If we are required to change the manufacturer of any of these key components of the Given System, there may be a significant delay in locating a suitable alternative manufacturer. Additionally, we may be required to verify that the new

11

manufacturer maintains facilities and procedures that comply with FDA and other applicable quality standards and with all applicable regulations and guidelines. The delays associated with the verification of a new manufacturer could delay our ability to manufacture our product in a timely manner or within budget. Furthermore, in the event that the manufacturer of a key component of our product ceases operations or otherwise ceases to do business with us, we may not have access to the information necessary to enable another supplier to manufacture the component. The occurrence of any of these events could harm our ability to meet demand for the Given System in a timely manner or within budget.

Conditions in Israel affect our operations and may limit our ability to produce and sell our product which could decrease our revenues.

Our corporate offices, our manufacturing facilities (other than our backup production lines in Ireland), and our research and development facilities are located in Israel. Political, economic and military conditions in Israel directly affect our operations. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors and a state of hostility, varying in degree and intensity, has led to security and economic problems for Israel. Since October 2000, there has been a significant increase in terrorist violence in Israel, the West Bank and the Gaza Strip, including armed hostilities between Israel, the Palestinian Authority and other groups in the West Bank and Gaza Strip. Any further escalation in these hostilities or any future armed conflict, political instability or violence in the region, could have a negative effect on our business condition, harm our results of operations and adversely affect the share price of publicly traded Israeli companies such as us.

If we lose our key personnel or are unable to attract and retain additional personnel, our business and ability to compete will be harmed.

We are dependent on the principal members of our management and scientific staff. In order to implement our business strategy, we will need to keep our key personnel with expertise in research and development, clinical testing, government regulation, manufacturing, sales, marketing and finance. Our product development plans depend in part on our ability to retain engineers with expertise in a variety of technical fields. The loss of a number of these persons or our inability to attract and retain qualified personnel could harm our business and our ability to compete.

Our operations could be disrupted as a result of the obligation of key personnel in Israel to perform military service.

Generally, all male adult citizens and permanent residents of Israel are, unless exempt, obligated to take part in up to 30 days (and sometimes as many as 36 days) of military reserve duty annually. Many of our male employees are currently obligated to perform annual reserve duty, as are two of our executive officers. Additionally, all Israeli residents who perform reserve duty are subject to being called to active duty at any time under emergency circumstances. Our operations could be disrupted by the absence for a significant period of one or more of our officers or employees due to military service. Any such disruption to our operations could adversely affect the development of our business and our financial condition.

Our international operations will expose us to the risk of fluctuations in currency exchange rates.

In 2004, we derived 75.1% of our revenues in U.S. dollars and 20.5% in the Euro, with the remainder denominated in other currencies. The currency denomination of our revenues depends on the location of the customer or the distributor used to fulfill our customers' orders. Conversely, in 2004, in addition to our U.S. dollar and Euro-denominated liabilities, 28.0% of our expenses were denominated in New Israeli Shekels, or shekels. Our shekel-denominated liabilities consist principally of salaries and related personnel expenses. We anticipate that for the foreseeable future a material portion of our liabilities will continue to be denominated in shekels. If the value of a currency in which our receivables are denominated devalues against the value of a currency in

12

which our liabilities are denominated, there will be a negative impact on our profit margin for sales of the Given System. Our revenues and expenses may not always be fully hedged against our currency exposure through financial instruments. In addition, if we wish to maintain the dollar-denominated value of our product in non-U.S. markets, devaluation in the local currencies of our customers relative to the U.S. dollar could cause our customers to cancel or decrease orders or default on payment. In addition, as of December 31, 2004, 10.1% of our cash and cash equivalents were denominated in currencies other than the U.S. dollar and we are therefore subject to the risk of exchange rate fluctuations between the Yen, the New Israeli Shekel, the dollar and the Euro.

The use of the Given System, including ingestion of the PillCam capsules, could result in product liability claims that could be expensive, damage our reputation and harm our business.

Our business exposes us to an inherent risk of potential product liability claims related to the manufacturing, marketing and sale of medical devices. The medical device industry has historically been litigious, and we face financial exposure to product liability claims if the use of our product were to cause or contribute to injury or death, whether by aggravating existing patient symptoms or otherwise. There is also the possibility that defects in the design or manufacture of the Given System might necessitate a product recall. Although we maintain product liability insurance for the Given System, the coverage limits of these policies may not be adequate to cover future claims. Particularly as sales of the Given System increase, we may be unable to maintain product liability insurance on acceptable terms or at reasonable costs and such insurance may not provide us with adequate coverage against potential liabilities. A successful claim brought against us in excess of, or outside of, our insurance coverage could have a material adverse effect on our financial condition and results of operations. A product liability claim, regardless of merit or ultimate outcome, or any product recall could result in substantial costs to us and a substantial diversion of management attention.

Our quarterly financial performance is likely to vary in the future, and may not meet our guidance or the expectations of analysts or investors, which may lead to additional volatility in our share price.

Our ordinary shares commenced trading on the Nasdaq National Market in October 2001 and on the Tel Aviv Stock Exchange in March 2004. In 2004, the closing price of our shares has ranged from $17.87 to $44.08 per share on the Nasdaq National Market and NIS 123.90 to NIS 194.60 on the Tel Aviv Stock Exchange. The price of our shares could fluctuate significantly for, among other things, the following reasons: future announcements concerning us or our competitors, changes in third-party reimbursement practices, regulatory developments, and new clinical or economic data regarding our current or future products. In addition, it is our practice to provide guidance to the market as to our expected revenues and earnings per share based on information available to us at the time of the guidance. If our quarterly operating results do not meet our guidance or the expectations of securities analysts or investors, the price of our shares would likely decline. In addition, based on our experience to date, we believe that many of our customers delay purchasing systems until the end of the fiscal quarter because they believe this will enable them to negotiate more favorable terms. Therefore, revenues from system sales may be concentrated at the end of each fiscal quarter making it difficult for us to determine the success of each quarter until its end and resulting in lower than expected quarterly revenues if external or other events cause a large number of potential customers to defer their purchasing decisions even for a short period of time. Furthermore, we believe that demand for systems and capsules may be materially affected by seasonal factors during the summer months when physicians and administrators are more likely to postpone purchasing decisions relating to systems due to summer vacations and patients are more likely to postpone less urgent diagnostic procedures until later in the year. Both of these factors may result in slower sales during the summer. Share price fluctuations may be exaggerated by low trading volume of our ordinary shares and changes in trading practices in our ordinary shares, such as short buying and selling. Securities class action litigation has often been brought against companies following periods of volatility. Any securities

13

litigation claims brought against us could result in substantial expense and divert management's attention from our business.

The two largest beneficial owners of our shares, IDB Holding Corporation Ltd., which is controlled by four individuals, and certain funds affiliated with OrbiMed Advisors, Inc., which we refer to as the OrbiMed investors and which are controlled by Samuel D. Isaly, have significant influence over matters requiring shareholder approval, which could, among other things, delay or prevent a change of control.

The largest beneficial owners of our shares, four individuals in Israel through IDB Holding Corporation Ltd., beneficially own 37.2% of our ordinary shares, and the principal of the OrbiMed investors beneficially owns approximately 13.2% of our ordinary shares. As a result, these shareholders, if they were to act together, could exercise a controlling influence over our operations and business strategy and have sufficient voting power to control the outcome of matters requiring shareholder approval. These matters may include

| • | the composition of our board of directors which has the authority to direct our business and to appoint and remove our officers; |

| |

| • | approving or rejecting a merger, consolidation or other business combination; |

| |

| • | raising future capital; and |

| |

| • | amending our articles of association which govern the rights attached to our ordinary shares. |

This concentration of ownership of our ordinary shares could delay or prevent proxy contests, mergers, tender offers, open-market purchase programs or other purchases of our ordinary shares that might otherwise give our other shareholders the opportunity to realize a premium over the then-prevailing market price of our ordinary shares. This concentration of ownership may also adversely affect our share price.

Future sales of our ordinary shares in the public market and low trading volume could adversely affect our share price.

As of December 31, 2004, we had 27.6 million ordinary shares outstanding. Approximately 50% of these shares are “restricted securities” available for resale on the Nasdaq National Market subject, however, to volume limitations under Rule 144. In addition, all of our ordinary shares are available for resale on the Tel Aviv Stock Exchange, subject to compliance with Regulation S under the Securities Act of 1933. Future sales of these restricted shares, or the perception that these sales could occur, could adversely affect the market price of our ordinary shares. We have periodically experienced a low trading volume of our ordinary shares, and if one or a small number of parties buys or sells a large number of our ordinary shares, we may experience volatility in our share price and our share price may be adversely affected. In addition, the holders of approximately 13 million ordinary shares are entitled to request that we register their ordinary shares under the Securities Act of 1933 and have the right to request that we include their shares in any registration statement that we file, in each case, subject to exclusion for marketing reasons. Registration of these shares would result in them becoming freely tradable without restriction immediately upon the effectiveness of such registration, except for shares purchased by affiliates, which may be sold subject to the volume limitations of Rule 144. These factors could also make it more difficult for us to raise additional funds through future offerings of our ordinary shares or other securities.

Our ordinary shares are traded on more than one market and this may result in price variations.

Our ordinary shares are traded on the Nasdaq National Market and the Tel Aviv Stock Exchange. Trading in our ordinary shares on these markets is made in different currencies (dollars on the Nasdaq National Market, and Israeli shekels on the Tel Aviv Stock Exchange) and at different times (due to different time zones, trading days and public holidays in the United States and Israel). The trading prices of our ordinary shares on these two markets may differ due to

14

these and other factors. Any decrease in the trading price of our ordinary shares on one of these markets could cause a decrease in the trading price of our ordinary shares on the other market.

If we are characterized as a passive foreign investment company, our U.S. shareholders may suffer adverse tax consequences.

If, for any taxable year, our passive income, or our assets which produce passive income, exceed specified levels, we may be characterized as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences for our U.S. shareholders, which may include having gains realized on the sale of our ordinary shares treated as ordinary income, rather than as capital gains income, having potentially punitive interest charges apply to those gains, and the denial of the taxation of certain dividends paid by us at the lower rates applicable to long-term capital gains. We believe we were not a PFIC for the fiscal year ended December 31, 2004. However, the tests for determining PFIC status are applied annually and are based in part on reference to the market value of our shares and valuing our intangible assets using the methods prescribed for publicly traded corporations, and it is difficult to make accurate predictions of future income and assets, which are relevant to this decision. Accordingly, we cannot give any assurance that we will not become a PFIC, in particular, since the value of our shares is likely to fluctuate. For a more detailed discussion of the consequences of our being classified as a PFIC, see “Taxation and Government Programs—United States Federal Income Taxation—Passive Foreign Investment Company Considerations.” U.S. shareholders are urged to consult with their own U.S. tax advisors with respect to the U.S. tax consequences of investing in our ordinary shares.

The government grants we have received for research and development expenditures limit our ability to manufacture products and transfer technologies outside of Israel and require us to satisfy specified conditions. If we fail to satisfy these conditions, we may be required to refund grants previously received together with interest and penalties, and may be subject to criminal charges.

From 1998 through 2004, we received grants totaling $3.6 million from the government of Israel through the Office of the Chief Scientist of the Ministry of Industry and Trade for the financing of a portion of our research and development expenditures in Israel. The terms of the Chief Scientist grants prohibit us from manufacturing products developed using these grants outside of Israel without special approvals and completely prohibit the transferring of our technologies and related intellectual property rights outside of Israel. Even if we receive approval to manufacture the Given System outside of Israel, we would be required to pay an increased total amount of royalties, which may be up to 300% of the grant amount plus interest, depending on the manufacturing volume that is performed outside of Israel, as well as a possible increased rate or royalties. This restriction may impair our ability to outsource manufacturing, engage in change in control transactions or otherwise transferring our technology outside Israel. We currently hold an approval from the Office of the Chief Scientist to manufacture limited quantities of the PillCam SB capsule in Pemstar's facilities in Ireland without an increase in royalty rates and we will be required to obtain an approval before manufacturing the PillCam ESO capsule outside of Israel. In addition, if we fail to comply with any of the conditions imposed by the Office of the Chief Scientist, we may be required to refund any grants previously received together with interest and penalties, and may be subject to criminal charges. In recent years, the government of Israel has accelerated the rate of repayment of Chief Scientist grants and may further accelerate them in the future.

We receive significant tax benefits that may be reduced or eliminated in the future.

Our investment program in leasehold improvements and equipment at our manufacturing facility in Yoqneam, Israel has been granted approved enterprise status and we are therefore eligible for significant tax benefits under the Israeli Law for Encouragement of Capital Investments. From time to time, the government of Israel has considered reducing or eliminating the tax benefits available to approved enterprise programs such as ours. These tax benefits may

15

not be continued in the future at their current levels or at all. If these tax benefits were reduced or eliminated, the amount of taxes that we pay would likely increase. In addition, our approved enterprise status imposes certain requirements on us, such as the location of our manufacturing facility, location of certain subcontractors and the extent to which we may outsource portions of our production process. If we do not meet these requirements, the law permits the authorities to cancel the tax benefits retroactively. See Item 10 “Additional Information—Taxation.”

It may be difficult to enforce a U.S. judgment against us, our officers and directors or to assert U.S. securities laws claims in Israel or serve process on our officers and directors.

We are incorporated in Israel. The majority of our executive officers and directors are not residents of the United States, and the majority of our assets and the assets of these persons are located outside the United States. Therefore, it may be difficult for an investor, or any other person or entity, to enforce a U.S. court judgment based upon the civil liability provisions of the U.S. federal securities laws in an Israeli court against us or any of these persons or to effect service of process upon these persons in the United States. Additionally, it may be difficult for an investor, or any other person or entity, to assert U.S. securities law claims in original actions instituted in Israel. Israeli courts may refuse to hear a claim based on a violation of U.S. securities laws because Israel is not the most appropriate forum to bring such a claim. In addition, even if an Israeli court agrees to hear a claim, it may determine that Israeli law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proved as a fact which can be a time-consuming and costly process. Certain matters of procedure will also be governed by Israeli law. There is little binding case law in Israel addressing the matters described above.

Under current Israeli law, we may not be able to enforce covenants not to compete and therefore may be unable to prevent competitors from benefiting from the expertise of some of our former employees involved in research and development activities.

We currently have non-competition agreements with substantially all of our employees who are involved in research and development, nearly all of whom are located in Israel. These agreements prohibit our employees, if they cease working for us, from directly competing with us or working for our competitors for a limited period of time following termination of employment. Israeli courts have required employers seeking to enforce non-compete undertakings of a former employee to demonstrate that the competitive activities of the former employee will harm one of a limited number of material interests of the employer which have been recognized by the courts, such as the secrecy of a company's confidential commercial information or its intellectual property. If we cannot demonstrate that harm would be caused to us, we may be unable to prevent our competitors from benefiting from the expertise of our former employees.

16

Item 4. Information on the Company

A. History and Development of the Company

We were incorporated by RDC Rafael Development Corporation under the laws of the State of Israel in January 1998. We are registered with the Israeli registrar of companies in Jerusalem. Our registration number is 51-257802-2. Our address is 13 Ha' Yetzira Street, Yoqneam 20692, Israel. Our telephone number is (011) 972-4-909-7777. Our agent in the United States is our subsidiary Given Imaging, Inc. Given Imaging, Inc.'s address is Oakbrook Technology Center, 5555 Oakbrook Parkway, No. 355, Norcross, GA 30093.

See Items 5 and 18 for a description of capital expenditures by us for the past three fiscal years. We have not made any divestitures during the same time period.

B. Business Overview

We develop, manufacture and market innovative diagnostic products for disorders of the gastrointestinal tract. We pioneered capsule endoscopy, a proprietary approach to visual examination of the gastrointestinal tract through the use of a miniaturized video camera contained in a disposable capsule. Our principal product, which incorporates our core technology, is the Given System, a proprietary wireless imaging system that uses our disposable video capsules, which we refer to as the PillCam capsules. The PillCam video capsules are easily ingested by the patient and move naturally through the gastrointestinal tract without discomfort while wirelessly transmitting high quality color images and data to a portable recorder. We believe that capsule endoscopy provides a patient-friendly solution that addresses a significant market opportunity and overcomes many of the shortcomings of traditional diagnostic tools for gastrointestinal disorders. In 2001, we commenced marketing the Given System, our capsule endoscopy platform, with the M2A capsule (which we rebranded in 2004 as the PillCam Small Bowel capsule, or PillCam SB), for detection of disorders of the small bowel. As of December 31, 2004, we had an installed base of approximately 2,290 Given Systems and had sold approximately 172,000 PillCam SB capsules in over 50 countries worldwide. In November 2004, we received FDA marketing clearance for our second PillCam capsule, the PillCam ESO capsule, for visualizing the esophagus. We market the PillCam ESO video capsule through a strategic marketing and sales alliance we formed in May 2004 with InScope, a division of Ethicon Endo-Surgery, a Johnson & Johnson company. We have also developed the Patency Capsule and system, which is a dissolvable capsule that enables physicians to determine whether there are obstructions or strictures in the gastrointestinal tract. We launched the Patency Capsule and system in Europe in November 2003 and are conducting clinical trials for the Patency Capsule and system in the United States and, if results are favorable, we plan to pursue FDA clearance.

We are continuing to work on enhancements to the Given System. For example, in November 2004, simultaneously with the launch of our new PillCam ESO video capsule, we launched RAPID 3.0, an advanced version of our RAPID software and DR 2.0, an advanced version of our data recorder. The new RAPID software and data recorder provide further efficiencies to the physician, including increased reliability of the data recorder, shortening the download time from the data recorder to the workstation and improving physician productivity. We believe that the efficiencies created by these improvements will increase PillCam capsule utilization by users of the Given System and provide us with a significant competitive advantage. We intend to continue developing and bringing to market enhancements to the Given System that further improve system performance and assist users in the diagnostic process.

Our long-term objective, subject to further development and receipt of regulatory clearances and/or approvals, is to establish the Given System as the first tool administered to patients with suspected disorders of the small intestine, the esophagus or other parts of the gastrointestinal tract, such as the stomach and the colon. We believe that each such segment of the gastrointestinal tract presents meaningful opportunities for patient-friendly diagnostic procedures. In furtherance of this objective, we intend to continue our research and development activities and clinical trials to

17

expand the applications for our capsule endoscopy platform, including to the stomach and the colon, and, if the results are positive, pursue regulatory clearance and/or approvals in the United States and elsewhere.

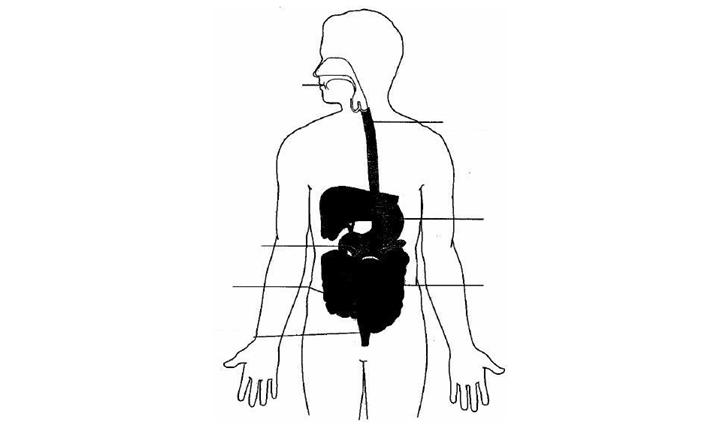

Disorders of the Gastrointestinal Tract

The gastrointestinal tract is a series of organs in the body responsible for digesting food. These organs principally include the mouth, esophagus, stomach, small intestine and colon. The following is an illustration of the gastrointestinal tract:

Duodenum

Ileum

Anal canal

Jejunum

Stomach

Esophagus

Oral cavity

Large Intestine

Small

Intestine

The upper gastrointestinal tract consists of the mouth, esophagus, stomach and duodenum, which is the first portion of the small intestine. The esophagus is an approximately ten inch long tube that connects the throat and the stomach. The stomach is a sac-like organ that produces enzymes to break down food. The small intestine is an approximately 21 foot long hollow organ that is primarily responsible for digesting food. The three parts of the small intestine are the duodenum, the jejunum and the ileum. The small intestine is located in the abdominal cavity between the stomach and the large intestine, or colon. The lower gastrointestinal tract consists of the lower two-thirds of the small intestine (the jejunum and the ileum) and the colon. The colon is the final portion of the gastrointestinal tract and is primarily responsible for absorbing water before waste is excreted.

The gastrointestinal tract is susceptible to various disorders. Typical symptoms of such disorders include heartburn, upper or lower abdominal pain, bleeding, diarrhea, constipation, anemia, weight loss and nausea. Some of these symptoms are not specific to any particular disorder, but may be common to more than one underlying disorder, often requiring the gastroenterologist to make a differential diagnosis. We believe that PillCam capsule endoscopy can have a significant role in assisting gastroenterologists in making an evidence-based diagnosis. The disorders causing the above-mentioned symptoms may include:

| • | inflammatory bowel disease, including Crohn's disease and ulcerative colitis, both of which inflame the lining of the digestive tract; |

| |

| • | celiac disease, which causes damage to the intestine due to an allergic reaction to gluten in the diet; |

18

| • | Gastro-esophageal reflux disease, which is the flow-back of acidic stomach content into the esophagus, causing esophagitis, which is inflammation of the esophageal lining, or Barrett's esophagus, a pre-cancerous condition; |

| |

| • | gastritis, which is inflammation of the lining of the stomach; |

| |

| • | irritable bowel syndrome, which is a functional disorder characterized by abdominal pain or cramping and changes in bowel function without any organic manifestation; |

| |

| • | peptic ulcer disease, which occurs when the lining of the stomach or duodenum is worn away by stomach acid; and |

| |

| • | growths, such as tumor or polyps, which may be cancerous. |

Our products currently assist in the diagnosis of disorders of the small intestine and the esophagus.

| • | Small intestine disorders. According to data from the American Gastroenterology Association, or AGA, approximately 19 million Americans suffer from numerous disorders of the small intestine, including bleeding, Crohn's disease, celiac disease, chronic diarrhea, irritable bowel syndrome and small bowel cancer. Based on SMG Marketing Group research, it is estimated that more than one million diagnostic procedures to examine the small intestine were performed in 2001. Prior to the development of capsule endoscopy, there was no convenient and effective method for visualizing the interior of the entire small intestine. As a result, we believe that many gastroenterologists first examine the colon or stomach before ordering an examination of the small intestine. |

| |

| • | Esophageal disorders. GERD is the frequent backward flow, or reflux, of stomach contents into the esophagus due to an improperly functioning valve between the stomach and esophagus. Stomach acid, enzymes and bile irritate the esophagus and cause a wide range of symptoms and complications, most commonly persistent, severe heartburn and chest pain. According to AGA data, an estimated 61 million Americans suffer from heartburn at least once a month and there are approximately 9 million physician office visits each year diagnosing GERD. If left untreated, GERD can lead to ulceration of the esophagus, respiratory problems or esophageal cancer. It is estimated that approximately 10% to 15% of patients with GERD symptoms have Barrett's esophagus, a pre-cancerous condition with an associated risk for esophageal cancer. In the United States alone, according to the American Cancer Society, there were expected to be approximately 14,250 new cases of esophageal cancer in 2004. Another serious disorder of the esophagus is known as esophageal varices, a life-threatening complication caused by severe bleeding from small veins in the eshophagus, usually associated with chronic liver disease. Esophageal varices are present in about 40% of patients with cirrhosis of the liver, which has been reported to affect 400,000 Americans based on data from the National Digestive Disease Information Clearinghouse. The risk of death with the first variceal bleed is approximately 20%-25%. Thus, it is very important to screen patients with cirrhosis of the liver for the presence of varices and to monitor those patients with known varices. We believe that the PillCam ESO capsule may provide an effective method for screening for and detecting esophageal varices. |

Current Detection Methods for Gastrointestinal Disorders

The most common methods for detection of gastrointestinal disorders, including disorders of the small intestine, are endoscopy and radiological imaging.

Traditional Endoscopy

A traditional endoscope is a device consisting of a flexible tube and an optical system. There are several types of endoscopic procedures used to identify disorders in the gastrointestinal tract. The basic endoscopic procedures available include: