| | |

| Item 7.01 Regulation FD Disclosure | |

| |

| The following information is being furnished under Item 7.01 "Regulation FD Disclosure." This |

| information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of |

| 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall |

| it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or |

| the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. |

| |

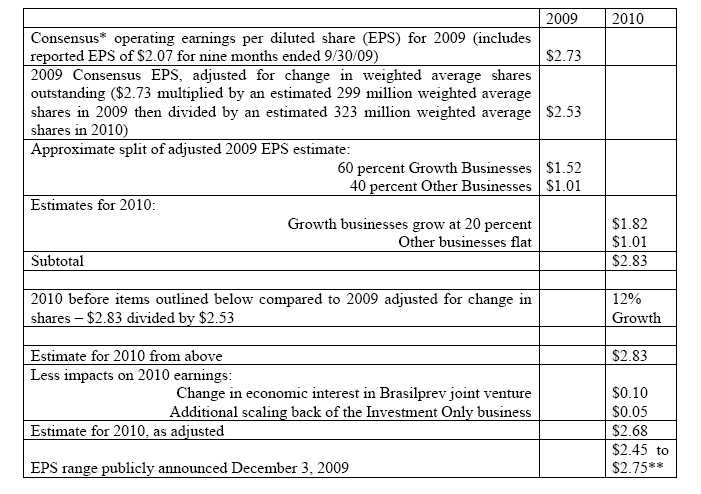

| At its investor conference on December 3, 2009, Principal Financial Group, Inc. announced its |

| outlook for 2010 operating earnings per diluted share. In an attempt to provide greater clarity on |

| the outlook and further insight into expected performance of the company’s growth businesses in |

| 2010, detail is included herewith as Exhibit 99. | |

| |

| Item 9.01 Financial Statements and Exhibits |

| |

| Exhibit 99 Detail Concerning 2010 Outlook Dated December 3, 2009 |

| |

| |

| SIGNATURE |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused |

| this report to be signed on its behalf by the undersigned thereunto duly authorized. |

| |

| |

| PRINCIPAL FINANCIAL GROUP, INC. |

| |

| |

| By: /s/ Tom Graf |

| Name: Tom Graf |

| Title: Senior Vice President – Investor Relations |

| |

| |

| Date: December 4, 2009 | |

|

| *Consensus is as of December 3, 2009. For illustration purposes only – the company is not |

| endorsing consensus, or the estimates derived therefrom. |

|

| **Guidance speaks only as of the date it is made. The company does not undertake to update |

| annual guidance during the year, but may do so if significant changes occur in general business |

| conditions or company operations. |

| |

| EPS, which is not measured in accordance with U.S. generally accepted accounting principles |

| (U.S. GAAP), should not be viewed as a substitute for net income available to common |

| stockholders (net income) per diluted share determined in accordance with U.S. GAAP. EPS is |

| calculated by dividing operating earnings by weighted average shares outstanding. Operating |

| earnings are determined by adjusting net income for the effect of net realized capital gains and |

| losses, as adjusted, and other after-tax adjustments. After-tax adjustments have occurred in the |

|

| past and could recur in future reporting periods. While these items may be significant components |

| in understanding and assessing the company's consolidated financial performance, management |

| believes the presentation of operating earnings per diluted share enhances the understanding of |

| results of operations by highlighting earnings attributable to the normal, ongoing operations of the |

| company's businesses. |

| |

| The range of $1.75 to $2.05 for net income available to common stockholders per diluted share |

| announced December 3, 2009 reflects the company's estimate for 2010 mortgage and credit losses |

| only. There are a number of items the company does not predict that could significantly affect net |

| income per diluted share, including, but not limited to: mark-to-market on derivatives; changes to |

| laws, regulations, or accounting standards; and gains or losses from discontinued operations. |

| |

| The company’s estimate of mortgage and credit losses for 2010 ranges from 65 cents to 75 cents |

| per diluted share. The company’s outlook for net income per diluted share is based on the mid- |

| point of that range. |

| |

| Forward looking and cautionary statements |

| This press release contains forward-looking statements, including, without limitation, statements as |

| to operating earnings, net income available to common stockholders, net cash flows, realized and |

| unrealized losses, capital and liquidity positions, sales and earnings trends, and management's |

| beliefs, expectations, goals and opinions. The company does not undertake to update or revise |

| these statements, which are based on a number of assumptions concerning future conditions that |

| may ultimately prove to be inaccurate. Future events and their effects on the company may not be |

| those anticipated, and actual results may differ materially from the results anticipated in these |

| forward-looking statements. The risks, uncertainties and factors that could cause or contribute to |

| such material differences are discussed in the company's annual report on Form 10-K for the year |

| ended December 31, 2008, and in company’s quarterly report on Form 10-Q for the quarter ended |

| September 30, 2009, filed by the company with the Securities and Exchange Commission, as |

| updated or supplemented from time to time in subsequent filings. These risks and uncertainties |

| include, without limitation: adverse capital and credit market conditions that may significantly |

| affect the company’s ability to meet liquidity needs, access to capital and cost of capital; a |

| continuation of difficult conditions in the global capital markets and the general economy that may |

| materially adversely affect the company’s business and results of operations; the actions of the U.S. |

| government, Federal Reserve and other governmental and regulatory bodies for purposes of |

| stabilizing the financial markets might not achieve the intended effect; the risk from acquiring new |

| businesses, which could result in the impairment of goodwill and/or intangible assets recognized at |

| the time of acquisition; impairment of other financial institutions that could adversely affect the |

| company; investment risks which may diminish the value of the company’s invested assets and the |

| investment returns credited to customers, which could reduce sales, revenues, assets under |

| management and net income; requirements to post collateral or make payments related to declines |

| in market value of specified assets may adversely affect company liquidity and expose the |

| company to counterparty credit risk; changes in laws, regulations or accounting standards that may |

| reduce company profitability; fluctuations in foreign currency exchange rates that could reduce |

| company profitability; Principal Financial Group, Inc.’s primary reliance, as a holding company, |

| on dividends from its subsidiaries to meet debt payment obligations and regulatory restrictions on |

| the ability of subsidiaries to pay such dividends; competitive factors; volatility of financial |