ANNUAL INFORMATION FORM

For the year ended December 31, 2016

February 24, 2017

| |

| Page |

| |

Glossary of Terms | 1 |

Abbreviations and Conversions | 3 |

Presentation of Oil and Gas Reserves, Contingent Resources, and Production Information | 4 |

Note to Reader Regarding Oil and Gas Information, Definitions and National Instrument 51‑101 | 4 |

Disclosure of Reserves and Production Information | 4 |

Barrels of Oil and Cubic Feet of Gas Equivalent | 5 |

Interests in Reserves, Contingent Resources, Production, Wells and Properties | 5 |

Reserves Categories and Levels of Certainty for Reported Reserves | 5 |

Development and Production Status | 6 |

Description of Price and Cost Assumptions | 6 |

Presentation of Financial Information | 6 |

Forward‑Looking Statements and Information | 6 |

Corporate Structure | 10 |

Enerplus Corporation | 10 |

Material Subsidiaries | 10 |

Organizational Structure | 10 |

General Development of the Business | 11 |

Developments in the Past Three Years | 11 |

Business of the Corporation | 12 |

Overview | 12 |

Summary of Principal Production Locations | 12 |

Capital Expenditures and Costs Incurred | 13 |

Exploration and Development Activities | 14 |

Oil and Natural Gas Wells and Unproved Properties | 14 |

Description of Properties | 15 |

Quarterly Production History | 17 |

Quarterly Netback History | 18 |

Tax Horizon | 19 |

Marketing Arrangements and Forward Contracts | 19 |

Oil and Natural Gas Reserves | 21 |

Summary of Reserves | 21 |

Forecast Prices and Costs | 24 |

Undiscounted Future Net Revenue by Reserves Category | 24 |

Net Present Value of Future Net Revenue by Reserves Category and Product Type | 25 |

Estimated Production for Gross Reserves Estimates | 26 |

Future Development Costs | 28 |

Reconciliation of Reserves | 28 |

Undeveloped Reserves | 30 |

Significant Factors or Uncertainties | 31 |

Proved and Probable Reserves not on Production | 31 |

Supplemental Operational Information | 32 |

Safety and Social Responsibility | 32 |

Insurance | 34 |

Personnel | 34 |

Description of Capital Structure | 35 |

Common Shares | 35 |

Preferred Shares | 35 |

Shareholder Rights Plan | 35 |

Senior Unsecured Notes | 36 |

Bank Credit Facility | 36 |

Dividends | 37 |

Dividend Policy and History | 37 |

Stock Dividend Program | 37 |

Industry Conditions | 38 |

Overview | 38 |

Pricing and Marketing of Crude Oil and Natural Gas | 38 |

Royalties and Incentives | 39 |

Land Tenure | 39 |

Environmental Regulation | 40 |

Worker Safety | 43 |

Risk Factors | 44 |

Market for Securities | 56 |

Directors and Officers | 57 |

Directors of the Corporation | 57 |

Officers of the Corporation | 59 |

Common Share Ownership | 60 |

Conflicts of Interest | 60 |

Audit & Risk Management Committee Disclosure | 60 |

Legal Proceedings and Regulatory Actions | 60 |

Interest of Management and Others in Material Transactions | 60 |

Material Contracts and Documents Affecting the Rights of Securityholders | 60 |

Interests of Experts | 61 |

Transfer Agent and Registrar | 61 |

Additional Information | 61 |

Appendix A – Contingent Resources Information | A-1 |

Appendix B – Report on Reserves Data and Contingent Resources Data by Independent Qualified Reserves Evaluator or Auditor | B-1 |

Appendix C – Report of Management and Directors on Oil and Gas Disclosure | C-1 |

Appendix D – Audit & Risk Management Committee Disclosure Pursuant to National Instrument 52‑110 | D-1 |

Glossary of Terms

Unless the context otherwise requires, in this Annual Information Form, the following terms and abbreviations have the meanings set forth below. Additional terms relating to oil and natural gas reserves, resources and operations have the meanings set forth under "Presentation of Oil and Gas Reserves, Contingent Resources and Production Information" in this Annual Information Form and under “Note to Reader Regarding Disclosure of Contingent Resources Information” in Appendix A. All references to “Annual Information Form” include this Annual Information Form of the Corporation dated February 24, 2017 for the year ended December 31, 2016 and all appendices hereto.

"ABCA" means the Business Corporations Act (Alberta), as amended;

"AECO" means the physical storage and trading hub for natural gas on the TransCanada Alberta Transmission System (NOVA) which is the delivery point for the various benchmark Alberta index prices;

"Bank Credit Facility" means, as at December 31, 2016, the Corporation's $800 million unsecured, covenant‑based revolving credit facility with a syndicate of financial institutions. See “Description of Capital Structure – Bank Credit Facility” and "Material Contracts and Documents Affecting the Rights of Securityholders";

"COGE Handbook" means the Canadian Oil and Gas Evaluation Handbook prepared jointly by the Society of Petroleum Evaluation Engineers (Calgary Chapter) Canada and the Canadian Institute of Mining, Metallurgy and Petroleum (Petroleum Society), as amended from time to time;

"Common Shares" means the common shares in the capital of the Corporation;

"Conversion" means the conversion of Enerplus' business from an income trust structure (with the parent entity being the Fund) to a corporate structure (with the parent entity being the Corporation) effective January 1, 2011 by way of a plan of arrangement under the ABCA, pursuant to which, among other things, the former trust units of the Fund, each of which represented an equal undivided beneficial interest in the Fund, were exchanged on a one‑for‑one basis for Common Shares;

"Corporation" means Enerplus Corporation, a corporation amalgamated under the ABCA, and, where the context requires, its subsidiaries, taken as a whole;

"Credit Facilities" means, collectively, the Bank Credit Facility and the Senior Unsecured Notes. See "Material Contracts and Documents Affecting the Rights of Securityholders";

"CSA Notice 51‑324" means Canadian Securities Administrators Staff Notice 51‑324 (Revised) – Glossary to NI 51‑101 Standards of Disclosure for Oil and Gas Activities, issued by the Canadian securities regulatory authorities;

"Enerplus" means (i) on and after January 1, 2011, the Corporation and, where the context requires, its subsidiaries, taken as a whole, and (ii) prior to January 1, 2011, the Fund and its subsidiaries, taken as a whole;

"Enerplus USA" means Enerplus Resources (USA) Corporation, a corporation organized under the laws of Delaware and a wholly‑owned subsidiary of the Corporation;

"Fund" means Enerplus Resources Fund, formerly a trust formed pursuant to the laws of Alberta that was dissolved on January 1, 2011 in connection with the Conversion, and which was the predecessor issuer to the Corporation;

"IFRS" means International Financial Reporting Standards, as issued by the International Accounting Standards Board, as amended from time to time;

"McDaniel" means McDaniel & Associates Consultants Ltd., independent petroleum consultants;

"McDaniel Reports" means, collectively, the independent engineering evaluations of the Corporation's oil, natural gas liquids and natural gas reserves in Canada and the Corporation's oil, natural gas liquids and natural gas reserves in the United States prepared by McDaniel effective December 31, 2016, utilizing commodity price forecasts of McDaniel as of January 1, 2017;

"MD&A" means management's discussion and analysis;

"NI 51‑101" means National Instrument 51‑ 101 – Standards of Disclosure for Oil and Gas Activities, adopted by the Canadian securities regulatory authorities;

ENERPLUS 2016 ANNUAL INFORMATION FORM 1

"NSAI" means Netherland, Sewell & Associates, Inc., independent petroleum consultants;

"NSAI Report" means the independent engineering evaluation of the Corporation's shale gas reserves and contingent resources in the Marcellus properties prepared by NSAI effective December 31, 2016, utilizing commodity price forecasts of McDaniel (for internal consistency in the Corporation's reserves reporting) as of January 1, 2017;

"NYSE" means the New York Stock Exchange;

"SEC" means the United States Securities and Exchange Commission;

"Senior Unsecured Notes" means, as at December 31, 2016, the US$533 million principal amount and CDN$30 million principal amount of outstanding senior unsecured notes issued by Enerplus. See "Description of Capital Structure – Senior Unsecured Notes" and "Material Contracts and Documents Affecting the Rights of Securityholders";

"Shareholder Rights Plan" means the amended and restated shareholder rights plan agreement between the Corporation and Computershare Trust Company of Canada, as rights agent, dated as of May 6, 2016. See “Description of Capital Structure – Shareholder Rights Plan” and "Material Contracts and Documents Affecting the Rights of Securityholders";

"Tax Act" means the Income Tax Act (Canada), R.S.C. 1985, c.1 (5th Supp.), as amended, including the regulations promulgated thereunder, as amended from time to time;

"TSX" means the Toronto Stock Exchange; and

"U.S. GAAP" means generally accepted accounting principles in the United States.

2 ENERPLUS 2016 ANNUAL INFORMATION FORM

Abbreviations and Conversions

In this Annual Information Form, the following abbreviations have the meanings set forth below:

| | |

API | | American Petroleum Institute gravity, a measure of how heavy or light a petroleum liquid is compared to water |

bbls | | barrels, with each barrel representing 34.972 imperial gallons or 42 U.S. gallons |

bbls/day | | barrels per day |

Bcf | | billion cubic feet |

BcfGE(1) | | one billion cubic feet of natural gas equivalent |

BOE(1) | | barrels of oil equivalent |

BOE/day | | barrels of oil equivalent per day |

GJ | | gigajoule; equal to one thousand million joules |

Mbbls | | one thousand barrels |

MBOE(1) | | one thousand barrels of oil equivalent |

Mcf | | one thousand cubic feet |

Mcf/day | | one thousand cubic feet per day |

MMBOE(1) | | one million barrels of oil equivalent |

MMbtu | | one million British Thermal Units |

MMcf | | one million cubic feet |

NGLs | | natural gas liquids |

NPV | | net present value of future net revenue, discounted at 10% |

NYMEX | | the New York Mercantile Exchange |

Tcf | | trillion cubic feet |

WTI | | West Texas Intermediate crude oil that serves as the benchmark crude oil for the NYMEX crude oil contract delivered in Cushing, Oklahoma |

Note: (1) The Corporation has adopted the standard of 6 Mcf of natural gas: 1 bbl of oil when converting natural gas to BOEs, MBOEs and MMBOEs, and 1 bbl of oil and NGLs: 6 Mcf of natural gas when converting oil and NGLs to BcfGEs. For further information, see "Presentation of Oil and Gas Reserves, Contingent Resources and Production Information – Barrels of Oil and Cubic Feet of Gas Equivalent".

In this Annual Information Form, unless otherwise indicated, all dollar amounts are in Canadian dollars and all references to "$" and "CDN$" are to Canadian dollars. References to "US$" are to U.S. dollars. On December 30, 2016, the exchange rate for one U.S. dollar, expressed in Canadian dollars and based upon the noon buying rate of the Bank of Canada, was CDN$1.3427.

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

| | | | |

| | | | Multiply |

To Convert From | | To | | By |

Mcf | | cubic metres | | 28.174 |

cubic metres | | cubic feet | | 35.494 |

bbls | | cubic metres | | 0.159 |

cubic metres | | bbls | | 6.293 |

feet | | metres | | 0.305 |

metres | | feet | | 3.281 |

miles | | kilometres | | 1.609 |

kilometres | | miles | | 0.621 |

acres | | hectares | | 0.4047 |

hectares | | acres | | 2.471 |

ENERPLUS 2016 ANNUAL INFORMATION FORM 3

Presentation of Oil and Gas Reserves, Contingent Resources, and Production Information

Note to Reader Regarding Oil and Gas Information, Definitions and National Instrument 51‑101

The oil and gas reserves and operational information of the Corporation contained in this Annual Information Form contains the information required to be included in the Statement of Reserves Data and Other Oil and Gas Information pursuant to NI 51‑101 adopted by the Canadian securities regulatory authorities. Readers should also refer to the Report on Reserves Data and Contingent Resources Data by McDaniel and NSAI attached as Appendix B and the Report of Management and Directors on Oil and Gas Disclosure attached hereto as Appendix C. The effective date for the Statement of Reserves Data and Contingent Resources and Other Oil and Gas Information contained in this Annual Information Form is December 31, 2016 and the preparation dates for such information are January 25, 2017 for the McDaniel Reports and February 3, 2017 for the NSAI Report.

Certain of the following definitions and guidelines are contained in the Glossary to NI 51‑101 contained in CSA Notice 51‑324, which incorporates certain definitions from the COGE Handbook. Readers should consult CSA Notice 51‑324 and the COGE Handbook for additional explanation and guidance.

For information regarding contingent resources of the Corporation and its presentation, see Appendix A.

Disclosure Of Reserves And Production Information

Presentation of Information

In this Annual Information Form, all oil and natural gas production and realized product prices information is presented on a "company interest" basis (as defined below), unless expressly indicated that it is being presented on a "gross" or "net" basis. "Company interest" means, in relation to the Corporation's interest in production, its working interest (operating or non‑operating) share before deduction of royalties, plus the Corporation's royalty interests in production. "Company interest" is not a term defined or recognized under NI 51‑101 and does not have a standardized meaning under NI 51‑101. Therefore, the "company interest" production of the Corporation may not be comparable to similar measures presented by other issuers, and investors are cautioned that "company interest" production should not be construed as an alternative to "gross" or "net" production calculated in accordance with NI 51‑101.

In this Annual Information Form, all crude oil and natural gas information includes tight oil and shale gas, respectively, unless expressly indicated that it is being presented on a separate basis. The Corporation's actual oil and natural gas reserves and future production may be greater than or less than the estimates provided in this Annual Information Form. The estimated future net revenue from the production of such oil and natural gas reserves does not represent the fair market value of such reserves. See "Oil and Natural Gas Reserves – Summary of Reserves" for additional information.

Notice to U.S. Readers

Data on oil and natural gas reserves contained in this Annual Information Form has generally been prepared in accordance with Canadian disclosure standards, which are not comparable in all respects to United States or other foreign disclosure standards. For example, although the SEC now generally permits oil and gas issuers, in their filings with the SEC, to disclose both proved reserves and probable reserves (each as defined in the SEC rules), the SEC definitions of proved reserves and probable reserves may differ from the definitions of "proved reserves" and "probable reserves" under Canadian securities laws. In addition, under Canadian disclosure requirements and industry practice, reserves and production are reported using gross (or, as noted above with respect to production information, "company interest") volumes, which are volumes prior to deduction of applicable royalties and similar payments. The practice in the United States is to report reserves and production using net volumes, after deduction of applicable royalties and similar payments. Moreover, in accordance with Canadian disclosure requirements, the Corporation has determined and disclosed estimated future net revenue from its reserves using forecast prices and costs, whereas the SEC generally requires that reserves estimates be prepared using an unweighted average of the closing prices for the applicable commodity on the first day of each of the twelve months preceding the company's fiscal year‑end, with the option of also disclosing reserves estimates based upon future or other prices. As a consequence of the foregoing, the Corporation's reserves estimates and production volumes may not be comparable to those made by companies utilizing United States reporting and disclosure standards. Additionally, the SEC prohibits disclosure of oil and gas resources in SEC filings, including contingent resources, whereas Canadian securities regulatory authorities allow disclosure of oil and gas resources. Resources are different than, and should not be construed as, reserves. For a description of the definition of, and the risks and uncertainties surrounding the disclosure of, contingent resources, see "Note to Reader Regarding Disclosure of Contingent Resources Information" in Appendix A.

4 ENERPLUS 2016 ANNUAL INFORMATION FORM

Barrels of Oil and Cubic Feet of Gas Equivalent

The Corporation has adopted the standard of 6 Mcf of natural gas: 1 bbl of oil when converting natural gas to BOEs, MBOEs and MMBOEs, and 1 bbl of oil and NGLs: 6 Mcf of natural gas when converting oil and NGLs to and BcfGEs. BOEs, MBOEs, MMBOEs, and BcfGEs may be misleading, particularly if used in isolation. The foregoing conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value.

Interests in Reserves, Contingent Resources, Production, Wells and Properties

In addition to the terms having defined meanings set forth in CSA Notice 51‑324, the terms set forth below have the following meanings when used in this Annual Information Form:

"gross" means:

| (i) | | in relation to the Corporation's interest in production, reserves or contingent resources, its working interest (operating or non‑operating) share before deduction of royalties and without including any royalty interests of the Corporation; |

| (ii) | | in relation to wells, the total number of wells in which the Corporation has an interest; and |

| (iii) | | in relation to properties, the total area in which the Corporation has an interest. |

"net" means:

| (i) | | in relation to the Corporation's interest in production, reserves or contingent resources, its working interest (operating or non‑operating) share after deduction of royalty obligations, plus the Corporation's royalty interests in production or reserves; |

| (ii) | | in relation to the Corporation's interest in wells, the number of wells obtained by aggregating the Corporation's working interest in each of its gross wells; and |

| (iii) | | in relation to the Corporation's interest in a property, the total area in which the Corporation has an interest multiplied by the working interest owned by the Corporation. |

"working interest" means the percentage of undivided interest held by the Corporation in the oil and/or natural gas or mineral lease granted by the mineral owner (Crown or freehold), which interest gives the Corporation the right to "work" the property (lease) to explore for, develop, produce and market the leased substances.

Reserves Categories and Levels of Certainty for Reported Reserves

In this Annual Information Form, the following terms have the meaning assigned thereto in CSA Notice 51‑324 and the COGE Handbook:

"reserves" are estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on: analysis of drilling, geological, geophysical and engineering data; the use of established technology; and specified economic conditions, which are generally accepted as being reasonable, and shall be disclosed. Reserves may be divided into proved and probable categories according to the degree of certainty associated with the estimates.

"proved reserves" are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves.

"probable reserves" are those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves.

The qualitative certainty levels referred to in the definitions above are applicable to individual reserves entities (which refers to the lowest level at which reserves calculations are performed) and to reported reserves (which refers to the highest‑level

ENERPLUS 2016 ANNUAL INFORMATION FORM 5

sum of individual entity estimates for which reserves estimates are presented). Reported reserves should target the following levels of certainty under a specific set of economic conditions:

| · | | at least a 90% probability that the quantities actually recovered will equal or exceed the estimated proved reserves; and |

| · | | at least a 50% probability that the quantities actually recovered will equal or exceed the sum of the estimated proved plus probable reserves. |

Development and Production Status

Each of the reserves categories reported by the Corporation (proved and probable) may be divided into developed and undeveloped categories:

"developed reserves" are those reserves that are expected to be recovered from existing wells and installed facilities or, if facilities have not been installed, that would involve a low expenditure (for example, when compared to the cost of drilling a well) to put the reserves on production. The developed category may be subdivided into producing and non‑producing.

| · | | "developed producing reserves" are those reserves that are expected to be recovered from completion intervals open at the time of the estimate. These reserves may be currently producing or, if shut‑in, they must have previously been on production, and the date of resumption of production must be known with reasonable certainty. |

| · | | "developed non‑producing reserves" are those reserves that either have not been on production, or have previously been on production, but are shut‑in, and the date of resumption of production is unknown. |

"undeveloped reserves" are those reserves that are expected to be recovered from known accumulations where a significant expenditure (for example, when compared to the cost of drilling a well) is required to render them capable of production. They must fully meet the requirements of the reserves classification (proved or probable) to which they are assigned.

Description of Price and Cost Assumptions

"Forecast prices and costs" means future prices and costs that are:

| (i) | | generally accepted as being a reasonable outlook of the future; and |

| (ii) | | if, and only to the extent that, there are fixed or presently determinable future prices or costs to which the Corporation is legally bound by a contractual or other obligation to supply a physical product, including those for an extension period of a contract that is likely to be extended, those prices or costs rather than the prices or costs referred to in paragraph (i). |

Presentation of Financial Information

The Corporation has converted its financial reporting from IFRS to U.S. GAAP as (i) over 50% of the book value of the assets (as previously calculated under IFRS) was in the United States, and (ii) over 50% of the Common Shares are held by U.S. residents. Reporting under U.S. GAAP began with the financial statements for the year ended December 31, 2013.

The Corporation continues to qualify as a foreign private issuer for its U.S. securities filings as less than 50% of the book value of its assets is in the United States, as calculated under U.S. GAAP as at June 30, 2016. The Corporation is required to reassess this annually, at the end of the second quarter. See "Risk Factors – Government regulations and required regulatory approvals and compliance may adversely impact the Corporation's operations and result in increased operating and capital costs".

Forward‑Looking Statements and Information

This Annual Information Form contains certain forward‑looking statements and forward‑looking information (collectively, "forward‑looking information") within the meaning of applicable securities laws which are based on the Corporation's current internal expectations, estimates, projections, assumptions, and beliefs. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "plan", "intend", "guidance", "objective", "strategy", "should", "believe" and similar expressions are intended to identify forward‑looking statements and forward‑looking information. These statements are not guarantees of future performance, and involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward‑looking information. The

6 ENERPLUS 2016 ANNUAL INFORMATION FORM

Corporation believes the expectations reflected in such forward‑looking information are reasonable but no assurance can be given that these expectations will prove to be correct, and such forward‑looking information included in this Annual Information Form should not be unduly relied upon. Such forward‑looking information speaks only as of the date of this Annual Information Form and the Corporation does not undertake any obligation to publicly update or revise any forward‑looking information, except as required by applicable laws.

In particular, this Annual Information Form contains forward‑looking information pertaining to the following:

| · | | the quantity of, and future net revenues from, the Corporation's reserves and/or contingent resources; |

| · | | crude oil, NGLs and natural gas production levels; |

| · | | commodity prices, foreign currency exchange rates and interest rates; |

| · | | current capital expenditure programs, drilling programs, development plans and other future expenditures, including the planned allocation of capital expenditures among the Corporation's properties and the sources of funding for such expenditures; |

| · | | supply and demand for oil, NGLs and natural gas; |

| · | | the Corporation's business strategy, including its asset and operational focus; |

| · | | future acquisitions and divestments and future growth potential; |

| · | | expectations regarding the Corporation's ability to raise capital and to continually add to reserves and/or resources through acquisitions and development; |

| · | | schedules for and timing of certain projects and the Corporation's strategy for growth; |

| · | | the Corporation's future operating and financial results; |

| · | | future dividends that may be paid by the Corporation; |

| · | | the Corporation's tax pools and the time at which the Corporation may incur certain income or other taxes; and |

| · | | treatment under governmental and other regulatory regimes and tax, environmental and other laws and expectations |

| · | | regarding the Corporation’s compliance therewith. |

The forward‑looking information contained in this Annual Information Form reflects several material factors and expectations and assumptions made by the Corporation including, without limitation, that: the Corporation's current commodity price and other cost assumptions will generally be accurate; the Corporation will have sufficient cash flow, debt or equity sources or other financial resources required to fund its capital and operating expenditures and requirements as needed; the Corporation's conduct and results of operations will be consistent with its expectations; the Corporation and its industry partners will have the ability to develop the Corporation's oil and gas properties in the manner currently contemplated; a lack of infrastructure does not result in the Corporation curtailing its production and/or receiving reductions to its realized prices; current or, where applicable, proposed assumed industry conditions, laws and regulations will continue in effect or as anticipated as described herein; the estimates of the Corporation's reserves and resources volumes and the assumptions related thereto (including commodity prices and development costs) are accurate in all material respects; and there will be sufficient availability of services and labour to conduct the Corporation's operations as planned.

The Corporation’s current 2017 capital expenditure budget contained in this Annual Information Form assumes: WTI price of US$55.00/bbl; NYMEX gas price of US$3.00/Mcf; AECO gas price of $2.75/GJ; and a foreign exchange rate of USD/CDN 1.35.

The Corporation believes the material factors, expectations and assumptions reflected in the forward‑looking information are reasonable at this time but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

ENERPLUS 2016 ANNUAL INFORMATION FORM 7

The Corporation's actual results could differ materially from those anticipated in this forward‑looking information as a result of both known and unknown risks, including the risk factors set forth under "Risk Factors" in this Annual Information Form and risks relating to:

| · | | volatility, including further decline, in market prices for oil, NGLs and natural gas, including changes in supply or demand for those products; |

| · | | actions, by governmental or regulatory authorities, including different interpretations of applicable laws, treaties or administrative positions, as well as changes in income tax laws or changes in royalty regimes and incentive programs relating to the oil and gas industry; |

| · | | unanticipated operating results, including changes or fluctuations in oil, NGLs and natural gas production levels; |

| · | | changes in foreign currency exchange rates, including Canadian currency compared to U.S., and its impact on the Corporation’s operations and financial condition; |

| · | | changes in interest rates; |

| · | | changes in development plans by the Corporation or third party operators; |

| · | | the ability of the Corporation to comply with debt covenants under the Credit Facilities; |

| · | | the ability of the Corporation to access required capital; |

| · | | changes in capital and other expenditure requirements and debt service requirements; |

| · | | liabilities and unexpected events inherent in oil and gas operations, including geological, technical, drilling and processing risks, as well as unforeseen title defects or litigation; |

| · | | actions of and reliance on industry partners; |

| · | | uncertainties associated with estimating reserves and resources; |

| · | | competition for, among other things, capital, acquisitions of reserves and resources, undeveloped lands, access to third party processing capacity, and skilled personnel; |

| · | | incorrect assessments of the value of acquisitions or divestments, or the failure to complete divestments; |

| · | | constraints on, or the unavailability of, adequate infrastructure, including pipeline and other transportation capacity, to deliver the Corporation's production to market; |

| · | | the Corporation's success at the acquisition, exploitation and development of reserves and resources; |

| · | | changes in general economic, market (including credit market) and business conditions in Canada, North America and worldwide; and |

| · | | changes in tax, environmental, regulatory, or other legislation applicable to the Corporation and its operations, and the Corporation's ability to comply with current and future environmental legislation and regulations and other laws and regulations, including those impacting financial institutions that could limit commodity market liquidity. |

Many of these risk factors and other specific risks and uncertainties are discussed in further detail throughout this Annual Information Form and in the Corporation's MD&A for the year ended December 31, 2016, which is available on the internet on the Corporation's SEDAR profile at www.sedar.com, on the Corporation's EDGAR profile at www.sec.gov as part of the annual report on Form 40‑F filed with the SEC together with this Annual Information Form, and on the Corporation's website at www.enerplus.com. Readers are also referred to the risk factors described in this Annual Information Form under "Risk Factors" and in other documents the Corporation files from time to time with securities regulatory authorities. Copies of these documents are available without charge from the Corporation or electronically on the internet on the Corporation's SEDAR profile at www.sedar.com, on the Corporation's EDGAR profile at www.sec.gov and on the Corporation's website at www.enerplus.com.

8 ENERPLUS 2016 ANNUAL INFORMATION FORM

Corporate Structure

Enerplus Corporation

The Corporation was incorporated on August 12, 2010 under the ABCA for the purposes of participating in the Conversion under which the business of the Fund, as the Corporation's predecessor, was transitioned to the Corporation. As part of the plan of arrangement under the ABCA pursuant to which the Conversion was effected, the Corporation was amalgamated with several other former direct and indirect subsidiaries of the Fund on January 1, 2011 and continued as the Corporation. Prior to the Conversion, the business of the Corporation was carried on by the Fund and its subsidiaries as an income trust since 1986.

Effective May 11, 2012, the Corporation amended and restated its articles of amalgamation in connection with the implementation of a stock dividend program. The Corporation amended the rights, privileges, restrictions and conditions in respect of Common Shares to set forth the terms and conditions pursuant to which the Corporation may issue Common Shares as payment of all or any portion of dividends declared on the Common Shares for those shareholders who elect to receive stock dividends instead of cash dividends. The Corporation's board of directors suspended the stock dividend program effective September 19, 2014. See "Description of Capital Structure – Common Shares" and "Dividends – Stock Dividend Program".

The head, principal and registered office of the Corporation is located at The Dome Tower, 3000, 333 ‑ 7th Avenue S.W., Calgary, Alberta, T2P 2Z1. The Corporation also has a U.S. office located at 950 ‑ 17th Street, Suite 2200, Denver, Colorado, 80202‑2805. The Common Shares are currently traded on the TSX and the NYSE under the symbol "ERF".

Material Subsidiaries

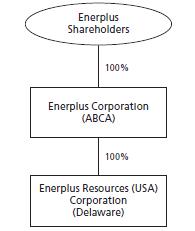

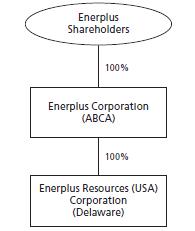

As of December 31, 2016, Enerplus USA was the only material subsidiary of Enerplus Corporation. All of the issued and outstanding securities of Enerplus USA are owned by the Corporation.

Organizational Structure

The simplified organizational structure of Enerplus Corporation and its material subsidiary as of December 31, 2016 is set forth below.

ENERPLUS 2016 ANNUAL INFORMATION FORM 9

General Development of the Business

Developments in the Past Three Years

Developments in 2014

FINANCING

On September 3, 2014, the Corporation completed a private placement offering of 3.79% Senior Unsecured Notes in an aggregate principal amount of US$200 million due September 3, 2026. The Corporation used the net proceeds of this offering to reduce its outstanding indebtedness under the Bank Credit Facility. See "Description of Capital Structure – Senior Unsecured Notes".

SALE OF ASSETS

In 2014, the Corporation realized proceeds of over $200 million from divestment activities involving certain of the Corporation's Deep Basin assets in Canada and its gross overriding royalty interest in the Jonah natural gas property in the United States. These divestments included in aggregate approximately 3,500 BOE/day of production. The proceeds from the Corporation's divestment activities were used to fund the Corporation's capital program and to reduce indebtedness under the Bank Credit Facility.

SUCCESSION OF CHAIRMAN OF THE BOARD OF DIRECTORS

Mr. Doug Martin, the former Chairman of the board of directors of the Corporation, retired from this position effective June 1, 2014 and as a director of the Corporation effective November 30, 2014. Mr. Elliott Pew succeeded Mr. Martin as the Chairman of the board of directors of the Corporation effective June 1, 2014. Mr. Pew has been a director of the Corporation since September 2010. See "Directors and Officers".

Developments in 2015

SALE OF ASSETS

In 2015, the Corporation realized proceeds of approximately $286.6 million from divestment activities involving certain of the Corporation's assets. These divestments included approximately 6,200 BOE/day of production, in aggregate, from non-core shallow gas assets and Pembina waterflood assets in Canada, as well as certain non-operated North Dakota assets and operated Marcellus assets in the United States. The proceeds from the Corporation's divestment activities were used to fund the Corporation's capital program as well as the principal instalments due on its Senior Unsecured Notes.

SUCCESSION OF SENIOR VICE PRESIDENT & CHIEF FINANCIAL OFFICER

Ms. Jodine J. Jenson Labrie succeeded Mr. Robert J. Waters as the Senior Vice President & Chief Financial Officer effective September 15, 2015. Prior thereto, Ms. Jenson Labrie held the position of Vice President, Finance of the Corporation. See "Directors and Officers".

Developments in 2016

SENIOR Notes repurchase

The Corporation repurchased a total of US$267 million aggregate principal amount of the Senior Unsecured Notes between 90% of par and par during the first half of 2016, resulting in a gain of $19.3 million being recorded for the year. The repurchases were funded through asset divestment proceeds and the Bank Credit Facility.

FInancing

On May 31, 2016, the Corporation completed a bought-deal offering of 33,350,000 Common Shares (including 4,300,000 Common Shares issued pursuant to the exercise in full of the over-allotment option granted to the underwriters), at $6.90 per Common Share, for total proceeds of $230,115,000. The net proceeds from the offering were used by the Corporation to reduce indebtedness under the Bank Credit Facility, to fund its capital expenditures and for general corporate purposes.

10 ENERPLUS 2016 ANNUAL INFORMATION FORM

SALE OF ASSETS

In 2016, the Corporation realized proceeds of approximately $670 million from the divestment of certain of its non-strategic crude oil and natural gas assets. These divestments included approximately 13,500 BOE/day of production, in aggregate, from crude oil and natural gas assets in Canada, as well as certain non-operated North Dakota assets in the United States. The proceeds from the Corporation's divestment activities were used to fund the Corporation's capital program, repurchase a portion of its Senior Unsecured Notes, as described above, and to reduce amounts outstanding under the Bank Credit Facility.

Business of the Corporation

Overview

The Corporation's oil and natural gas property interests are located in the United States, primarily in North Dakota, Montana, and Pennsylvania, as well as in western Canada in the provinces of Alberta, British Columbia and Saskatchewan. Capital spending on these assets in 2016 totaled approximately $209 million with over 85% of this focused on the Corporation’s crude oil assets in North Dakota and waterflood projects in Canada.

In the United States, capital spending on the Bakken and Three Forks assets in North Dakota totaled $136 million during 2016. In Canada, capital spending of approximately $44 million in 2016 was directed to crude oil waterflood projects at Cadogan, Giltedge, Medicine Hat and southeast Saskatchewan. Capital spending on the Corporation’s natural gas interests in northeast Pennsylvania was approximately $24 million, about 25% less than in 2015, due to low regional natural gas prices. Canadian natural gas assets received a minimal amount of maintenance capital during 2016; the Corporation’s focus was on retaining value and reducing operating costs for these assets.

During 2016, the Corporation continued to concentrate its portfolio, divesting of certain crude oil and natural gas assets in Canada and the United States for total proceeds of approximately $670 million, after closing adjustments. These assets had associated production of approximately 13,500 BOE/day (60% natural gas). In November 2016, the Corporation acquired a waterflood asset in Northern Alberta’s Ante Creek area, with associated average production of 3,800 BOE/day, for approximately $110 million, after closing adjustments.

The Corporation's major producing properties generally have related field facilities and infrastructure to accommodate its production. Production volumes for the year ended December 31, 2016 from the Corporation's properties consisted of approximately 46% crude oil and NGLs and 54% natural gas, on a BOE basis. The Corporation's 2016 average daily production was 93,125 BOE/day, comprised of 38,353 bbls/day of crude oil, 4,903 bbls/day of NGLs and 299,214 Mcf/day of natural gas, a decrease of approximately 13% compared to 2015 average daily production of 106,524 BOE/day, comprised of 41,639 bbls/day of crude oil, 4,763 bbls/day of NGLs and 360,733 Mcf/day of natural gas. The decrease in average daily production during 2016 is largely attributable to a reduction in capital spending during 2016, combined with the divestment of non-strategic crude oil and natural gas assets mentioned previously. The Corporation’s 2016 production in the United States was approximately 71% of its total production, with the remaining 29% from Canada. Approximately 53% of the Corporation’s 2016 production was operated by the Corporation, with the remainder operated by industry partners.

As at December 31, 2016, the oil and natural gas property interests held by the Corporation were estimated to contain proved plus probable gross reserves of approximately 14.3 MMbbls of light and medium crude oil, 39.0 MMbbls of heavy crude oil, 123.0 MMbbls of tight oil, 18.1 MMbbls of NGLs, 126.3 Bcf of conventional natural gas and 1,002.8 Bcf of shale gas, for a total of 382.5 MMBOE. The Corporation's proved reserves represented approximately 70% of total proved plus probable reserves, with approximately 51% of the Corporation's proved plus probable reserves weighted to crude oil and NGLs. See "Oil and Natural Gas Reserves".

Unless otherwise noted, (i) all production and operational information in this Annual Information Form is presented as at or, where applicable, for the year ended, December 31, 2016, (ii) all production information represents the Corporation's company interest in production from these properties, which includes overriding royalty interests of the Corporation but is calculated before deduction of royalty interests owned by others, and (iii) all references to reserves volumes represent gross reserves using forecast prices and costs. See "Presentation of Oil and Gas Reserves, Contingent Resources, and Production Information".

Summary of Principal Production Locations

During the year ended December 31, 2016, on a BOE basis, approximately 71% of the Corporation's production was derived from the United States (31% from North Dakota, 35% from Pennsylvania and 5% from Montana) and approximately 29%

ENERPLUS 2016 ANNUAL INFORMATION FORM 11

from Canada (21% from Alberta, 6% from Saskatchewan and 2% from British Columbia). The following table describes the average daily production from the Corporation's principal producing properties and regions during the year ended December 31, 2016.

2016 Average Daily Production from Principal Properties and Regions

| | | | | | | | | | | | | | |

| | Products | | |

| | Crude Oil | | | | | | | | |

| | | | | | | | | | Conventional | | | | |

| | Light and | | | | | | | | Natural | | Shale | | |

Property/Region | | Medium | | Heavy | | Tight | | NGLs | | Gas | | Gas | | Total |

| | (bbls/day) | | (bbls/day) | | (bbls/day) | | (bbls/day) | | (Mcf/day) | | (Mcf/day) | | (BOE/day) |

United States | | | | | | | | | | | | | | |

Marcellus, Pennsylvania | | - | | - | | - | | - | | - | | 195,317 | | 32,553 |

Fort Berthold, North Dakota(1) | | - | | - | | 22,114 | | 3,490 | | - | | 17,798 | | 28,570 |

Sleeping Giant, Montana | | - | | - | | 3,150 | | 5 | | - | | 7,042 | | 4,329 |

Total United States | | - | | - | | 25,264 | | 3,495 | | - | | 220,157 | | 65,452 |

| | | | | | | | | | | | | | |

Canada | | | | | | | | | | | | | | |

Medicine Hat Glauconitic "C" East Unit, Alberta | | - | | 3,423 | | - | | - | | 322 | | - | | 3,476 |

Brooks, Alberta | | - | | 2,155 | | - | | 39 | | 6,389 | | - | | 3,259 |

Freda Lake, Saskatchewan | | 3,002 | | - | | - | | - | | - | | - | | 3,002 |

Tommy Lakes, British Columbia | | 70 | | - | | - | | 196 | | 10,789 | | - | | 2,064 |

Shackleton, Saskatchewan | | - | | - | | - | | - | | 12,357 | | - | | 2,060 |

Giltedge, Alberta | | - | | 1,594 | | - | | - | | 58 | | - | | 1,604 |

Willesden North, Alberta | | 3 | | - | | - | | 229 | | 3,633 | | - | | 837 |

Hanna Garden, Alberta | | - | | - | | - | | - | | 4,595 | | - | | 766 |

Cadogan, Alberta | | - | | 722 | | - | | 10 | | 191 | | - | | 764 |

Pine Creek, Alberta | | 2 | | - | | - | | 144 | | 3,508 | | - | | 731 |

Medicine Hat, Alberta | | - | | - | | - | | - | | 4,124 | | - | | 687 |

Joarcam, Alberta | | 367 | | - | | - | | 23 | | 1,231 | | - | | 595 |

Kaybob South, Alberta | | 1 | | - | | - | | 167 | | 1,874 | | - | | 480 |

Ante Creek, Alberta(2) | | 194 | | - | | - | | 10 | | 1,165 | | - | | 398 |

Other Canada(3) | | 1,173 | | 383 | | - | | 590 | | 28,074 | | 747 | | 6,950 |

Total Canada | | 4,812 | | 8,277 | | - | | 1,408 | | 78,310 | | 747 | | 27,673 |

| | | | | | | | | | | | | | |

Total | | 4,812 | | 8,277 | | 25,264 | | 4,903 | | 78,310 | | 220,904 | | 93,125 |

Notes:

| (1) | | North Dakota non-operated assets were sold on December 30, 2016. These assets had associated production of approximately 5,000 BOE/day, which is included in the table above. |

| (2) | | Acquired on November 15, 2016. |

| (3) | | A portion was sold during 2016, the largest of which included the Wilrich asset, as well as Pouce Coupe, Progress and Valhalla properties in the Peace River Arch area. Total production associated with these divestments was approximated at 8,500 BOE/day, which is not included in the table above. |

For additional information on the Corporation's oil and natural gas properties, see "Description of Properties".

Capital Expenditures and Costs Incurred

The Corporation invested approximately $209 million in its capital program during 2016, approximately 92% of which was directed to oil-related projects, compared to total capital spending in 2015 of approximately $493 million. Capital investment during 2016 was focused on the Corporation’s U.S. North Dakota Bakken crude oil property, where it invested $136 million, its U.S. Marcellus assets with investment of $24 million, as well as in its Canadian waterflood properties where it invested $44 million.

In the financial year ended December 31, 2016, the Corporation made the following expenditures in the categories noted, as prescribed by NI 51‑101:

| | | | | | | | | | | | |

| | Property Acquisition | | | | |

| | Costs | | Exploration | | Development |

| | Proved | | Unproved | | Costs | | Costs |

| | ($ in millions) |

Canada | | $ | 49.0 | | $ | 65.4 | | $ | 0.7 | | $ | 43.7 |

United States | | | 1.8 | | | 9.9 | | | 2.2 | | | 162.5 |

Total | | $ | 50.8 | | $ | 75.3 | | $ | 2.9 | | $ | 206.2 |

12 ENERPLUS 2016 ANNUAL INFORMATION FORM

Based on the commodity price environment as of the date hereof, the Corporation currently expects its 2017 exploration and development capital spending to be approximately $450 million, with approximately 87% of this spending projected to be invested in the Corporation's U.S. and Canadian crude oil projects. The Corporation currently expects to invest approximately 74% of its planned 2017 capital spending on its Fort Berthold property in the United States and 13% on its Canadian oil assets. In addition, the Corporation intends to spend approximately 13% of its 2017 capital on its Marcellus properties in the northeast region of Pennsylvania.

The Corporation intends to finance its 2017 capital expenditure program through a combination of internally generated cash flow and debt. The Corporation will review its 2017 capital investment plans throughout the year in the context of prevailing economic conditions, commodity prices and potential acquisitions and divestments, making adjustments as it deems necessary. See “Forward-Looking Statements and Information”.

For further information regarding the Corporation's properties and its 2016 exploration and development activities see "Description of Properties" below.

Exploration and Development Activities

The following table summarizes the number and type of wells that the Corporation drilled or participated in the drilling of for the year ended December 31, 2016, in each of Canada and the United States. Wells have been classified in accordance with the definitions of such terms in NI 51‑101.

| | | | | | | | | | | | | | | | |

| | Canada | | United States |

| | Development Wells | | Exploratory Wells | | Development Wells | | Exploratory Wells |

Category of Well | | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net |

Crude oil wells | | 7 | | 5 | | - | | - | | 25 | | 16 | | - | | - |

Natural gas wells | | - | | - | | - | | - | | 14 | | 1 | | - | | - |

Service wells | | 4 | | 4 | | - | | - | | - | | - | | - | | - |

Dry and abandoned wells | | - | | - | | - | | - | | - | | - | | - | | - |

Total | | 11 | | 9 | | - | | - | | 39 | | 17 | | - | | - |

For a description of the Corporation’s 2017 development plans and the anticipated sources of funding these plans, see "Capital Expenditures and Costs Incurred", above.

Oil and Natural Gas Wells and Unproved Properties

The following table summarizes, as at December 31, 2016, the Corporation's interests in producing wells and in non‑producing wells which were not producing but which may be capable of production, along with the Corporation's interests in unproved properties (as defined in NI 51‑101). Although many wells produce both oil and natural gas, a well is categorized as an oil well or a natural gas well based upon the proportion of oil or natural gas production that constitutes the majority of production from that well.

| | | | | | | | | | | | | | | | | | | | |

| | Producing Wells | | Non-Producing Wells | | Unproved Properties |

| | Oil | | Natural Gas | | Oil | | Natural Gas | | (acres) |

| | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net |

Canada | | | | | | | | | | | | | | | | | | | | |

Alberta | | 943 | | 532 | | 2,689 | | 1,372 | | 536 | | 251 | | 507 | | 182 | | 304,600 | | 200,100 |

Saskatchewan | | 751 | | 110 | | 1,521 | | 1,460 | | 283 | | 43 | | 750 | | 713 | | 119,200 | | 107,500 |

British Columbia | | - | | - | | 160 | | 147 | | - | | - | | 17 | | 11 | | 38,200 | | 30,900 |

United States | | | | | | | | | | | | | | | | | | | | |

Colorado | | - | | - | | - | | - | | - | | - | | - | | - | | 27,728 | | 27,728 |

Montana | | 243 | | 164 | | - | | - | | 20 | | 18 | | - | | - | | - | | - |

North Dakota | | 155 | | 128 | | - | | - | | 15 | | 12 | | - | | - | | - | | - |

Pennsylvania | | - | | - | | 732 | | 80 | | - | | - | | 90 | | 8 | | 82,119 | | 23,141 |

Total | | 2,092 | | 934 | | 5,102 | | 3,059 | | 854 | | 325 | | 1,364 | | 913 | | 571,847 | | 389,369 |

The Corporation expects its rights to explore, develop and exploit on approximately 21,200 net acres of unproved properties in Canada and the United States to expire, in the ordinary course, prior to December 31, 2017. The Corporation has no material work commitments on such properties and, where the Corporation determines appropriate, it can extend expiring leases by either making the necessary applications to extend or performing the necessary work.

ENERPLUS 2016 ANNUAL INFORMATION FORM 13

Description of Properties

Outlined below is a description of the Corporation's Canadian and U.S. crude oil and natural gas properties and assets.

For additional information on contingent resources associated with certain of the Corporation’s United States and Canadian crude oil and natural gas properties, including estimated volumes of economic contingent resources, see “Appendix A – Contingent Resources Information”.

U.S. Crude Oil Properties

OVERVIEW

The Corporation’s primary U.S. crude oil properties are located in the Fort Berthold region of North Dakota and in Richland County, Montana. The Corporation has approximately 65,500 net acres of land in Fort Berthold, primarily in Dunn and McKenzie counties and, on a production basis, operated approximately 81% of its Fort Berthold asset (prior to the divestment of its non-operated assets described below). The Corporation’s Fort Berthold property produces a light sweet crude oil (42° API), with some associated natural gas and NGLs, from both the Bakken and Three Forks formations. Fort Berthold production averaged approximately 28,570 BOE/day in 2016.

During the fourth quarter of 2016, the Corporation announced the sale of non-operated North Dakota Bakken assets having associated production of approximately 5,000 BOE/day and proved plus probable reserves of 12.0 MMBOE. On December 30, 2016, the Corporation closed this sale for proceeds of approximately $392 million, after closing adjustments.

Approximately 17.5 MMBOE of proved plus probable reserves were added at Fort Berthold during 2016, including due to technical revisions; however, after adjusting for the non-operated divestments of 12.0 MMBOE and 2016 production of 10.4 MMBOE, total proved plus probable reserves associated with this property as at December 31, 2016 were 138.7 MMBOE, 3% lower than as at December 31, 2015.

The Corporation also has working interests in Sleeping Giant, a mature, light oil property located in the Elm Coulee field in Richland County, Montana. Sleeping Giant produced approximately 4,329 BOE/day on average from the Bakken formation in 2016. The Corporation believes there is additional upside potential at the Sleeping Giant property through production optimization, refracs, limited infill drilling and the potential for Enhanced Oil Recovery (“EOR”) techniques.

Overall, the Corporation's U.S. Williston Basin crude oil properties produced an average of approximately 32,900 BOE/day in 2016. On a BOE basis, this represents 76% of the Corporation’s crude oil and NGLs production, and 35% of the Corporation's 2016 average daily production.

The Corporation spent approximately $140 million on its U.S. crude oil assets in 2016, with approximately $136 million of that spending directed to its operated assets in North Dakota where the Corporation continued to advance its completions techniques. During 2016, the Corporation drilled approximately 16 net horizontal wells in the Fort Berthold region, targeting both the Bakken and Three Forks formations (consisting of 4.0 short lateral wells and 12.0 long lateral wells) with approximately 16.1 net wells brought on-stream.

The Corporation had 156.0 MMBOE of proved plus probable reserves associated with its U.S. crude oil assets at December 31, 2016, representing approximately 41% of its total proved plus probable reserves.

U.S. Natural Gas Properties

OVERVIEW

The Corporation's U.S. natural gas properties consist entirely of its non‑operated Marcellus shale gas interests located in northeastern Pennsylvania, where the Corporation holds an interest in approximately 39,100 net acres. The Corporation's Marcellus shale gas production averaged 195,317 Mcf/day in 2016, representing approximately 65% of the Corporation's total natural gas production. While 2016 regional demand growth and the addition of incremental interstate pipeline capacity helped reduce infrastructure constraints, for both the Corporation and other producers in northeast Pennsylvania, the Corporation’s production was curtailed at times due to low regional spot pricing. See "Risk Factors – Lack of adequately developed infrastructure may result in a decline in the Corporation's ability to market oil and natural gas production".

In 2016, approximately $24 million was invested in the Corporation's interests in the Marcellus. The Corporation participated in the drilling of a total of approximately 1.4 net wells, and a total of approximately 5.2 net wells were brought on-stream. The Corporation currently has 80.0 net producing wells in the Marcellus, and 4.2 net wells waiting on completion or tie‑in.

14 ENERPLUS 2016 ANNUAL INFORMATION FORM

Proved plus probable Marcellus shale gas reserves were 894.6 Bcf as at December 31, 2016, an increase of 53.6 Bcf from 2015, and represented approximately 39% of the Corporation's total proved plus probable reserves.

The Corporation has entered into long‑term agreements for the gathering, dehydration, processing, compression and transportation of the Corporation's share of production from its Marcellus properties. These agreements are intended to provide the Corporation with cost certainty and access to the northeastern United States and broader U.S. natural gas markets through connections with major interstate pipelines.

Canadian Crude Oil Properties

OVERVIEW

Production from the Corporation’s Canadian crude oil properties comes primarily from mature, low decline assets under waterflood and EOR techniques. In traditional waterflooding, water is injected into the formation through injection wells to supplement reservoir pressure and provide a drive mechanism to move additional oil to producing wells. Pressure maintenance and the production of oil from water injection can result in a production profile with more predictable and stable declines and higher recovery of reserves. Infill drilling, well injection optimization and EOR techniques are effective methods of improving recovery of reserves even further. These properties have associated crude oil production facilities for emulsion treatment and injection, or water disposal.

The Canadian waterflood assets provide a stable production base with free cash flow to support the Corporation’s investment in growth plays, as well as its dividend. Canadian crude oil properties production averaged 16,160 BOE/day during 2016, or 33% of the Corporation’s crude oil properties production during the year. The Canadian crude oil properties where the Corporation invested its capital in 2016 included Mannville oil production in Medicine Hat and Cadogan in Alberta, as well as southeast Saskatchewan, which produces from the Mississippian Ratcliffe formation. On a production basis, the Corporation operated over 89% of its Canadian crude oil properties.

In 2016, the Corporation invested approximately $44 million in its Canadian crude oil properties, with approximately 50% directed to drilling and completions and the remainder on plant and facility enhancements to support future activities. The Corporation drilled 8.0 net crude oil wells (inclusive of water injection wells) in its Canadian waterflood assets in 2016, advancing projects targeting the Mannville and Ratcliffe plays. At Medicine Hat, polymer injection continued on the Corporation’s second polymer pilot with results in line with expectations.

In November 2016, the Corporation acquired a waterflood property in Northern Alberta’s Ante Creek area with associated average production of 3,800 BOE/day, for approximately $110 million, net of closing adjustments. At December 31, 2016, proved plus probable reserves associated with this property were 4.8 MMBOE.

Of the 59.9 MMBOE of proved plus probable reserves associated with the Corporation’s Canadian crude oil properties at December 31, 2016, 59.5 MMBOE (or approximately 16% of the Corporation’s total proved plus probable reserves) were associated with the Canadian crude oil waterflood properties, including those acquired at Ante Creek.

Canadian Natural Gas Properties

OVERVIEW

The Corporation's Canadian natural gas properties are located in Alberta, Saskatchewan and British Columbia. During 2016, the Corporation focused on divesting non-strategic assets within its Canadian natural gas portfolio.

Production from the Corporation's Canadian natural gas properties averaged 69,144 Mcf/day in 2016. The Corporation's largest producing Canadian natural gas properties in 2016 were Shackleton, Tommy Lakes and Brooks.

The Corporation spent a minimal amount of capital on its Canadian natural gas assets during 2016, where the focus was on maintenance and optimization of operations. The Corporation spent approximately $7 million on abandonment and reclamation activities on these assets in 2016.

Canadian natural gas properties proved plus probable reserves totaled 105 BcfGE as at December 31, 2016. Canadian natural gas proved plus probable reserves represent approximately 5% of the Corporation's total proved plus probable reserves, measured on a BOE basis, at December 31, 2016.

During 2016, the Corporation divested assets in the Alberta Deep Basin (Ansell area) in two separate transactions for aggregate consideration of approximately $186 million, net of closing adjustments. Production associated with these assets was 5,400 BOE/day (97% natural gas). In addition to the divestment of its Deep Basin assets, the Corporation divested of

ENERPLUS 2016 ANNUAL INFORMATION FORM 15

some high operating cost shallow gas assets in southeast Alberta, as well as its Pouce Coupe, Progress and Valhalla assets in the Peace River Arch area of Alberta. Combined, these assets were expected to produce approximately 3,100 BOE/day. The Corporation received total proceeds of approximately $94 million in respect of these two divestments, net of closing adjustments.

Quarterly Production History

The following table sets forth the Corporation's average daily production volumes, on a company interest basis, by product type, for each fiscal quarter in 2016 and for the entire year, separately for production in Canada and the United States, and in total.

| | | | | | | | | | |

| | Year Ended December 31, 2016 |

| | First | | Second | | Third | | Fourth | | |

Country and Product Type | | Quarter | | Quarter | | Quarter | | Quarter | | Annual |

United States | | | | | | | | | | |

Light and medium oil (bbls/day) | | - | | - | | - | | - | | - |

Heavy oil (bbls/day) | | - | | - | | - | | - | | - |

Tight oil (bbls/day) | | 25,322 | | 25,582 | | 25,444 | | 24,711 | | 25,264 |

Total crude oil (bbls/day) | | 25,322 | | 25,582 | | 25,444 | | 24,711 | | 25,264 |

Natural gas liquids (bbls/day) | | 3,690 | | 3,411 | | 3,627 | | 3,253 | | 3,495 |

Total liquids (bbls/day) | | 29,012 | | 28,993 | | 29,071 | | 27,964 | | 28,759 |

Conventional natural gas (Mcf/day) | | - | | - | | - | | - | | - |

Shale gas (Mcf/day) | | 217,611 | | 218,625 | | 228,271 | | 216,078 | | 220,157 |

Total United States (BOE/day) | | 65,280 | | 65,431 | | 67,116 | | 63,977 | | 65,452 |

| | | | | | | | | | |

Canada | | | | | | | | | | |

Light and medium oil (bbls/day) | | 5,607 | | 5,044 | | 3,970 | | 4,640 | | 4,812 |

Heavy oil (bbls/day) | | 8,579 | | 8,453 | | 8,303 | | 7,777 | | 8,277 |

Tight oil (bbls/day) | | - | | - | | - | | - | | - |

Total crude oil (bbls/day) | | 14,186 | | 13,497 | | 12,273 | | 12,417 | | 13,089 |

Natural gas liquids (bbls/day) | | 1,804 | | 1,418 | | 1,254 | | 1,160 | | 1,408 |

Total liquids (bbls/day) | | 15,990 | | 14,915 | | 13,527 | | 13,577 | | 14,497 |

Conventional natural gas (Mcf/day) | | 98,610 | | 78,950 | | 68,048 | | 67,861 | | 78,310 |

Shale gas (Mcf/day) | | 929 | | 928 | | 557 | | 576 | | 747 |

Total Canada (BOE/day) | | 32,580 | | 28,228 | | 24,961 | | 24,983 | | 27,673 |

| | | | | | | | | | |

Total | | | | | | | | | | |

Light and medium oil (bbls/day) | | 5,607 | | 5,044 | | 3,970 | | 4,640 | | 4,812 |

Heavy oil (bbls/day) | | 8,579 | | 8,453 | | 8,303 | | 7,777 | | 8,277 |

Tight oil (bbls/day) | | 25,322 | | 25,582 | | 25,444 | | 24,711 | | 25,264 |

Total crude oil (bbls/day) | | 39,508 | | 39,079 | | 37,717 | | 37,128 | | 38,353 |

Natural gas liquids (bbls/day) | | 5,494 | | 4,829 | | 4,881 | | 4,413 | | 4,903 |

Total liquids (bbls/day) | | 45,002 | | 43,908 | | 42,598 | | 41,541 | | 43,256 |

Conventional natural gas (Mcf/day) | | 98,610 | | 78,950 | | 68,048 | | 67,861 | | 78,310 |

Shale gas (Mcf/day) | | 218,540 | | 219,553 | | 228,828 | | 216,654 | | 220,904 |

Total (BOE/day) | | 97,860 | | 93,659 | | 92,077 | | 88,960 | | 93,125 |

16 ENERPLUS 2016 ANNUAL INFORMATION FORM

Quarterly Netback History

The following tables set forth the Corporation's average netbacks received for each fiscal quarter in 2016 and for the entire year, separately for production in Canada and the United States. Netbacks are calculated on the basis of prices received, which are net of transportation costs but before the effects of commodity derivative instruments, less related royalties and production costs. For multiple product wells, production costs are entirely attributed to that well's principal product type. As a result, no production costs are attributed to the Corporation's NGLs production as those costs have been attributed to the applicable wells' principal product type.

| | | | | | | | | | | | | | | |

| | Year Ended December 31, 2016 |

Light and Medium Crude Oil ($ per bbl) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Annual |

Canada | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 30.14 | | $ | 46.73 | | $ | 47.50 | | $ | 52.76 | | $ | 43.55 |

Royalties(2) | | | (4.84) | | | (8.14) | | | (11.05) | | | (10.80) | | | (8.44) |

Production costs(3) | | | (14.79) | | | (7.90) | | | (15.31) | | | (14.25) | | | (12.97) |

Netback | | $ | 10.51 | | $ | 30.69 | | $ | 21.14 | | $ | 27.71 | | $ | 22.14 |

| | | | | | | | | | | | | | | |

| | Year Ended December 31, 2016 |

| | First | | Second | | Third | | Fourth | | |

Heavy Oil ($ per bbl) | | Quarter | | Quarter | | Quarter | | Quarter | | Annual |

Canada | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 22.88 | | $ | 38.89 | | $ | 38.77 | | $ | 43.98 | | $ | 35.94 |

Royalties(2) | | | (4.32) | | | (6.36) | | | (7.09) | | | (8.23) | | | (6.47) |

Production costs(3) | | | (12.44) | | | (11.64) | | | (17.43) | | | (17.18) | | | (14.61) |

Netback | | $ | 6.12 | | $ | 20.89 | | $ | 14.25 | | $ | 18.57 | | $ | 14.86 |

| | | | | | | | | | | | | | | |

| | Year Ended December 31, 2016 |

Tight Oil ($ per bbl) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Annual |

United States | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 31.79 | | $ | 45.51 | | $ | 47.75 | | $ | 54.15 | | $ | 44.78 |

Royalties(2) | | | (9.17) | | | (12.55) | | | (13.31) | | | (16.43) | | | (12.85) |

Production costs(3) | | | (12.02) | | | (12.66) | | | (10.74) | | | (11.94) | | | (11.84) |

Netback | | $ | 10.60 | | $ | 20.30 | | $ | 23.70 | | $ | 25.78 | | $ | 20.09 |

| | | | | | | | | | | | | | | |

Natural Gas Liquids ($ per bbl) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Annual |

Canada | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 24.21 | | $ | 24.37 | | $ | 24.98 | | $ | 35.43 | | $ | 26.75 |

Royalties(2) | | | (4.60) | | | (6.08) | | | (5.67) | | | (7.59) | | | (5.83) |

Production costs(3) | | | - | | | - | | | - | | | - | | | - |

Netback | | $ | 19.61 | | $ | 18.29 | | $ | 19.31 | | $ | 27.84 | | $ | 20.92 |

| | | | | | | | | | | | | | | |

United States | | | | | | | | | | | | | | | |

Sales price(1) | | $ | (0.33) | | $ | 6.81 | | $ | 4.37 | | $ | 11.04 | | $ | 5.29 |

Royalties(2) | | | (0.35) | | | (1.69) | | | (1.45) | | | (2.75) | | | (1.52) |

Production costs(3) | | | - | | | - | | | - | | | - | | | - |

Netback | | $ | (0.68) | | $ | 5.12 | | $ | 2.92 | | $ | 8.29 | | $ | 3.77 |

| | | | | | | | | | | | | | | |

| | Year Ended December 31, 2016 |

Conventional Natural Gas ($ per Mcf) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Annual |

Canada | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 1.74 | | $ | 1.13 | | $ | 2.19 | | $ | 2.84 | | $ | 1.92 |

Royalties(2) | | | 0.04 | | | (0.07) | | | (0.12) | | | (0.02) | | | (0.03) |

Production costs(3) | | | (2.94) | | | (2.48) | | | (1.78) | | | (1.86) | | | (2.34) |

Netback | | $ | (1.16) | | $ | (1.42) | | $ | 0.29 | | $ | 0.96 | | $ | (0.45) |

ENERPLUS 2016 ANNUAL INFORMATION FORM 17

| | | | | | | | | | | | | | | |

| | Year Ended December 31, 2016 |

Shale Gas ($ per Mcf) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | | Annual |

United States | | | | | | | | | | | | | | | |

Sales price(1) | | $ | 0.99 | | $ | 0.87 | | $ | 1.14 | | $ | 1.88 | | $ | 1.22 |

Royalties(2) | | | (0.39) | | | (0.36) | | | (0.44) | | | (0.58) | | | (0.44) |

Production costs(3) | | | (0.06) | | | (0.03) | | | (0.05) | | | (0.07) | | | (0.05) |

Netback | | $ | 0.54 | | $ | 0.48 | | $ | 0.65 | | $ | 1.23 | | $ | 0.73 |

| | | | | | | | | | | | | | | |

Canada | | $ | 1.68 | | $ | 1.61 | | $ | 2.84 | | $ | 3.65 | | $ | 2.26 |

Royalties(2) | | | (0.11) | | | (0.07) | | | (0.13) | | | (0.16) | | | (0.11) |

Production costs(3) | | | (1.38) | | | (1.34) | | | (1.69) | | | (2.52) | | | (1.65) |

Netback | | $ | 0.19 | | $ | 0.20 | | $ | 1.02 | | $ | 0.97 | | $ | 0.50 |

Notes:

| (1) | | Net of transportation costs but before the effects of commodity derivative instruments. |

| (2) | | Includes production taxes. |

| (3) | | Production costs are costs incurred to operate and maintain wells and related equipment and facilities, including operating costs of support equipment used in oil and gas activities and other costs of operating and maintaining those wells and related equipment and facilities. Examples of production costs include items such as field staff labour costs, costs of materials, supplies and fuel consumed and supplies utilized in operating the wells and related equipment (such as power (including gains and losses on electricity contracts), chemicals and lease rentals), repairs and maintenance costs, property taxes, insurance costs, costs of workovers, net processing and treating fees, overhead fees, taxes (other than income, capital, withholding or U.S. state production taxes) and other costs. |

Tax Horizon

The Corporation is subject to standard applicable corporate income taxes. Based on existing tax legislation, the Corporation’s available tax pools, expected capital expenditures and forecasted net income, the Corporation does not anticipate paying material cash taxes in either Canada or the United States in 2017. These expectations may vary depending on numerous factors, including fluctuations in commodity prices, and the Corporation's capital spending, changes in governing tax laws, and the nature and timing of the Corporation's acquisitions and divestments. As a result, the Corporation emphasizes that it is difficult to give guidance on future taxability as it operates within an industry that constantly changes. See "Risk Factors – Changes in laws, including those affecting tax, royalties and other financial matters, and interpretations of those laws, may adversely affect the Corporation and its securityholders”.

For additional information, see Notes 2(i) and 13 to the Corporation's audited consolidated financial statements for the year ended December 31, 2016 and the information under the heading "Taxes" in the Corporation's MD&A for the year ended December 31, 2016.

Marketing Arrangements and Forward Contracts

Crude Oil and NGLs

The Corporation's crude oil and NGLs production is marketed to a diverse portfolio of intermediaries and end users, generally on 30‑day continuously renewing contracts for crude oil in Canada, 30-day negotiated contracts for crude oil in the United States, and yearly contracts for NGLs in Canada, where terms fluctuate with the monthly spot markets. NGL contracts in the United States are processing arrangement-linked contracts with pricing linked to the monthly spot markets. The Corporation received an average price (before transportation costs, royalties, and the effects of commodity derivative instruments) of $44.84/bbl for its crude oil and $15.29/bbl for its NGLs for the year ended December 31, 2016, compared to $48.43/bbl for its crude oil and $18.06/bbl for its NGLs for the year ended December 31, 2015.

In Canada, the Corporation typically transports its Canadian crude oil production to its buyers by pipeline and/or truck. The Corporation may occasionally sell a portion of its crude oil production to buyers who may use rail transportation after title is transferred into the buyer’s name. The Corporation has approximately 2,700 BOE/day of crude oil and NGLs firm take-or-pay pipeline transportation agreements in place for 2017, and then approximately 1,800 BOE/day on average for 2018 through 2027 for its Alberta crude oil and condensate production. Additionally, the Corporation had contracted firm NGLs fractionation agreements for 825 BOE/day at the end of 2016, and this increases to 1,125 BOE/day from April 2017 through 2026.

In the United States, the Corporation transports its U.S. crude oil production to its buyers by pipeline and/or truck, in addition to selling a portion of its crude oil production to buyers who may utilize rail transportation after title is transferred into the

18 ENERPLUS 2016 ANNUAL INFORMATION FORM

buyer’s name. The Corporation has a mix of approximately 12,500 bbls/day of firm sales contracts on average during 2017 for its U.S. oil production. The Corporation’s NGLs associated with its U.S. crude oil production volumes are marketed on its behalf by midstream companies in North Dakota and Montana.

Natural Gas

In marketing its natural gas production, the Corporation strives for a mix of contracts and customers. In Canada, the Corporation sells its natural gas production at a mix of fixed and floating prices for a variety of terms ranging from spot sales to one year or longer. The Corporation's monthly sales portfolio reflected a mix of the daily and monthly AECO market indices, as well as the basis differential to NYMEX gas prices in 2016. Approximately 26% of the Corporation's total natural gas production originated in Canada in 2016 and received an average price, before transportation, royalties, and the effects of commodity derivative instruments, of $2.20/Mcf during the year. As at December 31, 2016, the Corporation held firm service natural gas transportation contracts for its natural gas production in Canada for 2017 totalling 99 MMcf/day.

In 2016, approximately 74% of the Corporation's natural gas production originated in the United States. The Corporation delivered approximately 47% of its Marcellus production in 2016 onto the Transco Leidy Pipeline, with the majority of the remaining volumes delivered onto the Tennessee Gas Pipeline 300 Line, in Pennsylvania, a portion of which is then transported to the Kentucky/Tennessee border. The Corporation has firm "must‑take" sales contracts for up to 65 MMcf/day of natural gas production in the Marcellus for terms of up to nine years with buyers holding pipeline capacity on these and other pipelines in the region. The Corporation also has firm transportation agreements for approximately 66 MMcf/day, with terms ending between 2020 and 2036. The Corporation also holds a contract for five years of firm transportation capacity for 30 MMcf/day on the PennEast pipeline project. This project has an expected in-service date of late 2018, depending on regulatory approvals.

The Corporation received an average price differential for its U.S. Marcellus shale gas production of US$0.93/Mcf below NYMEX prices. Approximately 11% of the Corporation's U.S. natural gas production was associated natural gas production from its crude oil operations in North Dakota and Montana. The Corporation does not market these volumes directly, as they are marketed on Enerplus’ behalf by midstream companies.