Exhibit 99.1

|

| | | | | | |

| UNITED STATES BANKRUPTCY COURT |

| FOR THE DISTRICT OF |

| | | | | | | |

| IN RE: | | | | } | CASE NUMBER | |

| | | | | } | 13-11456 | |

| | | | | } | | |

| | | | | } | | |

| | | | | } | | |

| DEBTOR(S) | GMX Resources Inc. | } | CHAPTER 11 | |

| | | | | | | |

| | | | | | | |

| DEBTOR'S STANDARD MONTHLY OPERATING REPORT (BUSINESS) |

| | | | | | | |

| FOR THE PERIOD |

| | | FROM | June 1, 2013 | TO | June 30, 2013 | |

| | | | | | | |

| Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines established by the United States Trustee and FRBP 2015. |

| | | | | | | |

| | | | | | /s/ William H. Hoch |

| | | | | | Attorney for Debtor's Signature |

| | | | | | | |

|

| |

| Debtor's Address and Phone Number: | Attorney's Address and Phone Number: |

| GMX Resources Inc. | Crowe & Dunlevy |

| 9400 N. Broadway, Suite 600 | 20 North Broadway, Suite 1800 |

| Oklahoma City, OK 73114 | Oklahoma City, OK 73102 |

| 405-600-0711 | 405-235-7700 |

|

| | | | |

| Note: The original Monthly Operating Report is to be filed with the court and a copy simultaneously provided to the United States Trustee Office. Monthly Operating Reports must be filed by the 21st day of the following month. |

| | | | | |

| For assistance in preparing the Monthly Operating Report, refer to the following resources on the United States Trustee Program Website, http://www.justice.gov/ust/r20/index.htm. |

| | | | | |

| 1. | Instructions for Preparations of Debtor’s Chapter 11 Monthly Operating Report |

| 2. | Initial Filing Requirements |

| 3. | Frequently Asked Questions (FAQs) |

SCHEDULE OF RECEIPTS AND DISBURSEMENTS

FOR THE PERIOD BEGINNING June 1, 2013 AND ENDING June 30, 2013

Name of Debtor: GMX Resources Inc. Case Number 13-11456

Date of Petition: April 1, 2013

|

| | | | | | |

|

| CURRENT MONTH |

| CUMULATIVE PETITION TO DATE |

| 1. | FUNDS AT BEGINNING OF PERIOD | 6,509,805 |

|

| 945,484 |

|

| 2. | RECEIPTS: |

|

|

|

| A. Cash Sales | — |

|

| — |

|

| Minus: Cash Refunds | — |

|

| — |

|

| Net Cash Sales | — |

|

| — |

|

| B. Accounts Receivable | 4,698,946 |

|

| 15,756,168 |

|

| C. Other Receipts (See MOR-3) | 99,986 |

|

| 10,291,034 |

|

| 3. | TOTAL RECEIPTS (Lines 2A+2B+2C) | 4,798,932 |

|

| 26,047,202 |

|

| 4. | TOTAL FUNDS AVAILABLE FOR OPERATIONS (Line 1 + Line 3) | 11,308,737 |

|

| 26,992,686 |

|

| 5. | DISBURSEMENTS |

|

|

|

| A. Advertising | — |

|

| — |

|

| B. Bank Charges | 1,303 |

|

| 10,333 |

|

| C. Contract Labor | 52,628 |

|

| 87,805 |

|

| D. Fixed Asset Payments (not incl. in “N”) | 720,164 |

|

| 4,943,587 |

|

| E. Insurance | 157,001 |

|

| 1,310,812 |

|

| F. Inventory Payments (See Attach. 2) | 478 |

|

| 36,838 |

|

| G. Leases | 497,040 |

|

| 1,816,897 |

|

| H. Manufacturing Supplies | — |

|

| — |

|

| I. Office Supplies | 22,885 |

|

| 103,417 |

|

| J. Payroll - Net (See Attachment 4B) | 338,138 |

|

| 1,401,584 |

|

| K. Professional Fees (Accounting & Legal) | 1,845,915 |

|

| 2,101,020 |

|

| L. Rent | 100,703 |

|

| 282,298 |

|

| M. Repairs & Maintenance | 25,152 |

|

| 33,080 |

|

| N. Secured Creditor Payments (See Attach. 2) | 574,597 |

|

| 1,814,389 |

|

| O. Taxes Paid - Payroll (See Attachment 4C) | 114,586 |

|

| 472,564 |

|

| P. Taxes Paid - Sales & Use (See Attachment 4C) | — |

|

| 4,408 |

|

| Q. Taxes Paid - Other (See Attachment 4C) | 2,965 |

|

| 16,618 |

|

| R. Telephone | 20,682 |

|

| 52,582 |

|

| S. Travel & Entertainment | 5,614 |

|

| 46,307 |

|

| Y. U.S. Trustee Quarterly Fees | — |

|

| — |

|

| U. Utilities | 7,999 |

|

| 93,315 |

|

| V. Vehicle Expenses | — |

|

| — |

|

| W. Other Operating Expenses (See MOR-3) | 3,100,947 |

|

| 8,644,892 |

|

| 6. | TOTAL DISBURSEMENTS (Sum of 5A thru W) | 7,588,797 |

|

| 23,272,746 |

|

| 7. | ENDING BALANCE (Line 4 Minus Line 6) | 3,719,940 |

|

| 3,719,940 |

|

I declare under penalty of perjury that this statement and the accompanying documents and reports are true and correct to the best of my knowledge and belief.

|

| |

This 25th day of July, 2013 | /s/ Michael J. Rohleder |

| | Michael J. Rohleder, President |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This figure will not change from month to month. It is always the amount of funds on hand as of the date of the petition.

(c)These two amounts will always be the same if form is completed correctly.

MONTHLY SCHEDULE OF RECEIPTS AND DISBURSEMENTS (cont’d)

Detail of Other Receipts and Other Disbursements

OTHER RECEIPTS:

Describe Each Item of Other Receipt and List Amount of Receipt. Write totals on Page MOR-2, Line 2C.

|

| | | | | | | | |

| Description | | CURRENT MONTH |

| CUMULATIVE PETITION TO DATE |

| Debtor In Possession ("DIP") Loan | | $ | — |

|

| $ | 9,540,000 |

|

| Cash distribution from Endeavor Gathering LLC | | 77,600 |

|

| 432,130 |

|

| Return of excess insurance deposit | | — |

|

| 170,698 |

|

| Miscellaneous refunds | | 22,386 |

|

| 148,206 |

|

| Total | | $ | 99,986 |

|

| $ | 10,291,034 |

|

“Other Receipts” includes Loans from Insiders and other sources (i.e. Officer/Owner, related parties directors, related corporations, etc.). Please describe below:

|

| | | | | | |

| Loan Amount (1) |

| Source of Funds |

| Purpose |

| Repayment Schedule |

| N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER DISBURSEMENTS:

Describe Each Item of Other Disbursement and List Amount of Disbursement. Write totals on Page MOR-2, Line 5W.

|

| | | | | | | | |

| Description | CURRENT MONTH |

| Previous Month(s) |

| CUMULATIVE PETITION TO DATE |

| Return of erroneous joint interest payment received | — |

|

| 621,265 |

|

| 621,265 |

|

| Monthly gathering and transportation fee to Endeavor Gathering | 104,321 |

|

| 1,396,150 |

|

| 1,500,471 |

|

| Reimbursement to Endeavor Pipeline | 1,569,698 |

|

| — |

|

| 1,569,698 |

|

| Volumetric production payment | — |

|

| 857,840 |

|

| 857,840 |

|

| Monthly distribution to royalty and working interest owners | 1,336,284 |

|

| 2,592,239 |

|

| 3,928,523 |

|

| Miscellaneous disbursements | 90,644 |

|

| 76,451 |

|

| 167,095 |

|

| Total | 3,100,947 |

|

| 5,543,945 |

|

| 8,644,892 |

|

NOTE: Attach a current Balance Sheet and Income (Profit & Loss) Statement. See Exhibit I Attached

ATTACHMENT 1

MONTHLY ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

ACCOUNTS RECEIVABLE AT PETITION DATE: $50,089,238

ACCOUNTS RECEIVABLE RECONCILIATION

(Include all accounts receivable, pre-petition and post-petition, including charge card sales which have not been received):

|

| | | | | | | | | | | | | | | | | | | | |

| | Oil & Gas Sales |

| Joint Interest Billing |

| Other Accounts Receivable (1) |

| Intercompany Receivable/Payable (2) |

| Total |

| Beginning of Month Balance (a) | | $ | 8,031,603 |

|

| $ | 1,684,548 |

|

| $ | 6,615,446 |

|

| $ | 20,843,630 |

|

| $ | 37,175,227 |

|

| Plus: Current Month New Billings | | $ | 4,804,013 |

|

| $ | 127,937 |

|

| $ | 18,309 |

|

| $ | 2,021,831 |

|

| $ | 6,972,090 |

|

| Minus: Collection During Month (b) | | $ | (4,356,766 | ) |

| $ | (320,180 | ) |

| $ | (9,500 | ) |

| $ | (12,500 | ) |

| $ | (4,698,946 | ) |

| Minus: Revenue Netting | | $ | — |

|

| $ | (108,012 | ) |

| $ | — |

|

| $ | — |

|

| $ | (108,012 | ) |

| Plus/Minus: Adjustments or Writeoffs | | $ | — |

|

| $ | — |

|

| $ | (213,079 | ) |

| $ | — |

|

| $ | (213,079 | ) |

| End of Month Balance (c) | | $ | 8,478,850 |

|

| $ | 1,384,293 |

|

| $ | 6,411,176 |

|

| $ | 22,852,961 |

|

| $ | 39,127,280 |

|

(1) Other Accounts Receivable contains Accounts Receivable due from a third party involving the Cotton Valley asset sale, and other Miscellaneous Receivables.

(2) Intercompany Receivable/Payable includes amounts due to or due from Endeavor Gathering LLC, which is a subsidiary of the Company that is not part of the consolidated bankruptcy filing.

*For any adjustments or Write-offs provide explanation and supporting documentation, if applicable:

Adjustment in Other Accounts Receivable relates to a revision of estimated high-cost tax exemption refund to the actual refund.

POST PETITION ACCOUNTS RECEIVABLE AGING

(Show the total for each aging category for all accounts receivable)

|

| | | | | | | | | | | | | | | | | | | | |

| | 0-30 Days |

| 31-60 Days |

| 61-90 Days |

| Over 90 Days |

| Total |

| Oil & Gas Sales - For the current reporting month | | $ | 3,360,619 |

|

| $ | 1,907,284 |

|

| $ | 2,638 |

|

| $ | — |

|

| $ | 5,270,541 |

|

| Joint Interest Billing | | $ | 48,348 |

|

| $ | 135,294 |

|

| $ | 649,676 |

|

| $ | — |

|

| $ | 833,318 |

|

| Other Accounts Receivable | | $ | 4,167 |

|

| $ | 4,167 |

|

| $ | — |

|

| $ | — |

|

| $ | 8,334 |

|

| Intercompany Receivable/Payable | | $ | 741,017 |

|

| $ | 588,870 |

|

| $ | — |

|

| $ | — |

|

| $ | 1,329,887 |

|

For any receivables in the “Over 90 Days” category, please provide the following:

|

| | | | |

| Customer |

| Receivable Date |

| Status |

| N/A |

| N/A |

| N/A |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This must equal the number reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 2B).

(c)These two amounts must equal.

ATTACHMENT 2

MONTHLY ACCOUNTS PAYABLE AND SECURED PAYMENTS REPORT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

In the space below list all invoices or bills incurred and not paid since the filing of the petition. Do not include amounts owed prior to filing the petition. In the alternative, a computer generated list of payables may be attached provided all information requested below is included.

POST-PETITION ACCOUNTS PAYABLE

|

| | | | | | | | |

| Date Incurred | | Days Outstanding | | Vendor | | Description | | Amount (b) |

| See note below | | | | | | | | |

See Exhibit II attached. Note that the listing does not include accruals for invoices not yet received as of the closing of the financial statements for the current month.

R Check here if pre-petition debts have been paid. Attach an explanation and copies of supporting

documentation. The Company was given the authority to pay approximately $6.9 million in pre-petition debts. The court order providing authorization to pay these debts was previously provided with the filing of the April 2013 operating report. See Exhibit III attached, which is the schedule of pre-petition debts paid in the current reporting period.

ACCOUNTS PAYABLE RECONCILIATION (Post Petition Unsecured Debt Only)

|

| | | |

| Opening Balance (a) | $ | 3,293,995 |

|

| PLUS: New Indebtedness Incurred This Month | 3,203,719 |

|

| MINUS: Amount Paid on Post Petition Accounts Payable This Month | (4,539,598 | ) |

| PLUS/MINUS: Adjustments * | — |

|

| Ending Month Balance (c) | $ | 1,958,116 |

|

*For any adjustments provide explanation and supporting documentation, if applicable.

SECURED PAYMENTS REPORT

List the status of Payments to Secured Creditors and Lessors (Post Petition Only). If you have entered into a modification agreement with a secured creditor/lessor, consult with your attorney and the United States Trustee Program prior to completing this section).

|

| | | | | | | | |

| Secured Creditor/Lessor |

| Date Payment Due This Month |

| Amount Paid This Month |

| Number of Post Petition Payments Delinquent |

| Total Amount of Post Petition Payments Delinquent |

| DIP Loan Agreement Interest |

| 6/30/2013 |

| $574,597 |

| $— |

| $— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL (d) |

|

|

| $574,597 |

|

|

|

|

(a)This number is carried forward from last month’s report. For the first report only, this number will be zero.

(b, c)The total of line (b) must equal line (c).

(d)This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5N).

ATTACHMENT 3

INVENTORY AND FIXED ASSETS REPORT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

INVENTORY REPORT

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Inventory Balance at Petition Date |

| Inventory Balance @ Beginning of Month |

| Inventory Purchased During the Month |

| Inventory Used |

| Adjustments |

| Ending Inventory |

| Material Inventories | $ | 3,299,079 |

|

| $ | 3,207,241 |

|

| $ | 1,269 |

|

| $ | 14,556 |

|

| $ | — |

|

| $ | 3,193,954 |

|

| Oil Inventory | $ | 69,600 |

|

| $ | 41,110 |

|

| $ | 2,739 |

|

| $ | — |

|

| $ | — |

|

| $ | 43,849 |

|

| Total Inventory | $ | 3,368,679 |

|

| $ | 3,248,351 |

|

| $ | 4,008 |

|

| $ | 14,556 |

|

| $ | — |

|

| $ | 3,237,803 |

|

METHOD OF COSTING INVENTORY: Method of Costing Inventory: Inventory consist of Materials used to maintain on Oil & Gas properties and crude oil in tanks. The cost of materials are based upon the purchase price of the item using FIFO method of valuation. Cost of Oil Inventory is based upon the lift cost of producing the oil.

*For any adjustments or write-downs provide explanation and supporting documentation, if applicable. N/A

INVENTORY AGING

Note: This section is not applicable. Other than oil in tanks, which is sold on a daily or weekly basis, the Company's inventory is held for oil and gas properties and not for resale.

|

| | | | | | | | | | |

| Less than 6 months old |

| 6 months to 2 years old |

| Greater than 2 years old |

| Considered Obsolete |

| Total Inventory |

| N/A - See Note Above |

| N/A - See Note Above |

| N/A - See Note Above |

| N/A - See Note Above |

| $ | 3,237,803 |

|

* Aging Percentages must equal 100%.

o Check here if inventory contains perishable items.

Description of Obsolete Inventory: N/A

FIXED ASSET REPORT

FIXED ASSETS FAIR MARKET VALUE AT PETITION DATE (b): Fair market value of fixed assets at petition date is not available.

(Includes Property, Plant and Equipment)

BRIEF DESCRIPTION (First Report Only): Fixed assets include the Company's oil and natural gas properties, pipeline and related facilities, drilling rigs, machinery and equipment, buildings, leasehold improvements, office equipment and land.

|

| | | |

| Fixed Asset Reconciliation: |

|

|

| Fixed Asset Book Value at Beginning of Month (a) (b) | $ | 244,956,642 |

|

| Minus: Depreciation Expense | (1,162,335 | ) |

| Plus: New Purchases | 1,716,660 |

|

| Plus/Minus: Adjustments or Write-downs * | (22,487 | ) |

| Ending Monthly Balance | $ | 245,488,480 |

|

*For any adjustments or write-downs, provide explanation and supporting documentation, if applicable. The Company sold vehicles, computer equipment and wrote down the value of inventory during the reporting period.

BRIEF DESCRIPTION OF FIXED ASSETS PURCHASED OR DISPOSED OF DURING THE REPORTING PERIOD: Capitalized interest, leasehold costs, capitalized G&A, intangible drilling costs, and well equipment.

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)Fair Market Value is the amount at which fixed assets could be sold under current economic conditions. Book Value is the cost of the fixed assets minus accumulated depreciation and other adjustments.

ATTACHMENT 4A

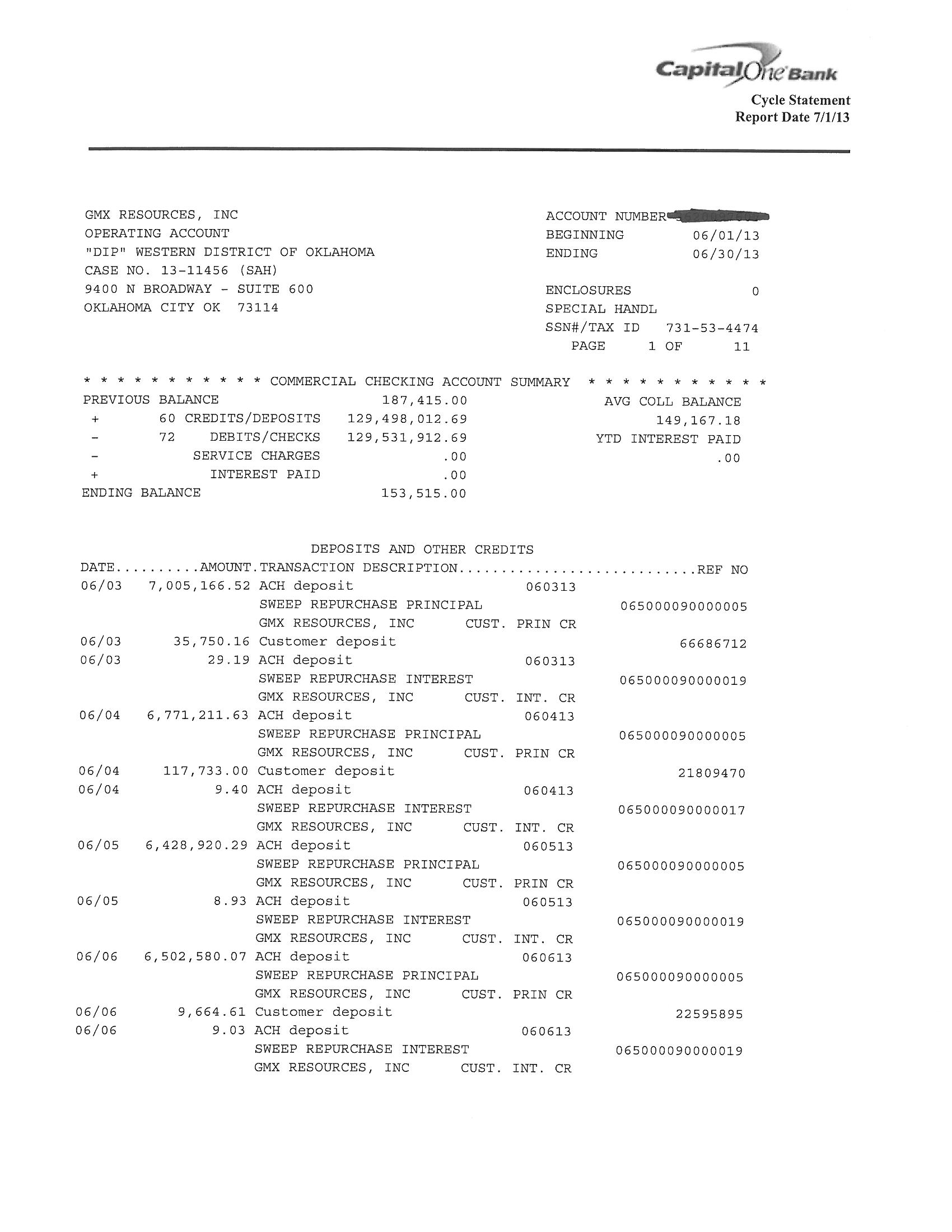

MONTHLY SUMMARY OF BANK ACTIVITY - OPERATING ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity (See Exhibit V). A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm. If bank accounts other than the three required by the United States Trustee Program are necessary, permission must be obtained from the United States Trustee prior to opening the accounts. Additionally, use of less than the three required bank accounts must be approved by the United States Trustee.

|

| | | |

| Name of Bank: | Capital One Bank | Branch: | N/A |

| Account Name: | GMX Resources Inc. Operating Account and Controlled Disbursement Account | Account Number: | XXXXXX7607 (Operating Account)

XXXXX1752 (Disbursements Account) |

PURPOSE OF ACCOUNT: OPERATING

|

| | | |

| Ending Balance per Bank Statement | $ | 4,413,027 |

|

| Plus: Total Amount of Outstanding Deposits | — |

|

| Minus: Total Amount of Outstanding Checks and Other Debits * | (693,087 | ) |

| Minus Service Charges | — |

|

| Ending Balance per Check Register **(a) | $ | 3,719,940 |

|

*Debit cards are used by: N/A

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid in Cash (do not includes items reported as Petty Cash on Attachment 4D: ( o Check here if cash disbursements were authorized by United States Trustee)

Date Amount Payee Purpose Reason for Cash Disbursement

N/A - No disbursements were paid in Cash

TRANSFERS BETWEEN DEBTOR IN POSSESSION ACCOUNTS

“Total Amount of Outstanding Checks and other debits”, listed above, includes:

$____N/A________Transferred to Payroll Account

$____N/A________Transferred to Tax Account

(a) The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

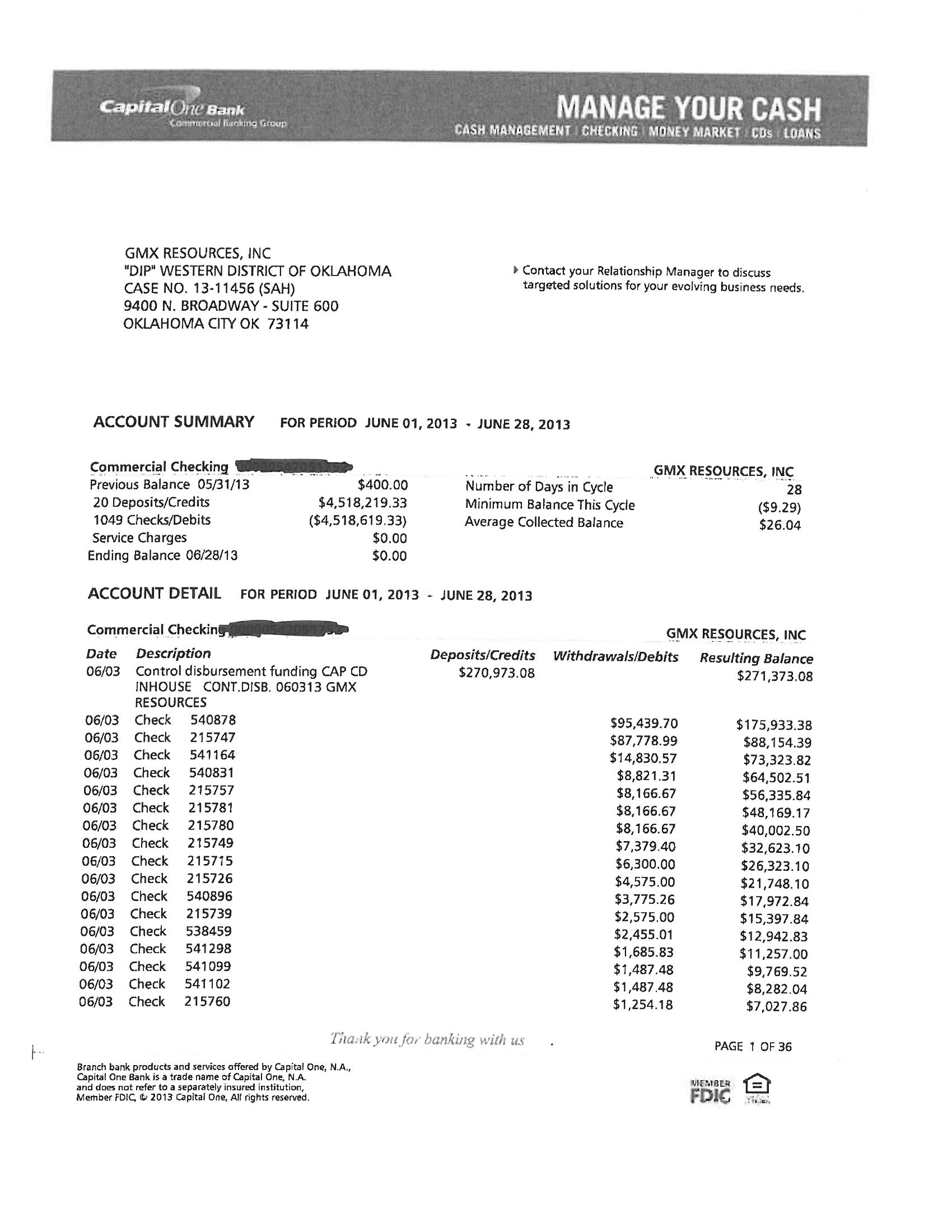

ATTACHMENT 5A

CHECK REGISTER - OPERATING ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

NAME OF BANK: Capital One Bank BRANCH: N/A

ACCOUNT NAME: GMX Resources Inc. Operating Account and Controlled Disbursement Account

ACCOUNT NUMBER: XXXXXX7607 (Operating Account)

XXXXX1752 (Disbursements Account)

PURPOSE OF ACCOUNT: OPERATING

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

ATTACHMENT 4B

MONTHLY SUMMARY OF BANK ACTIVITY - PAYROLL ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm.

Note: The Company uses a payroll service (Paylocity) to provide payroll and does not have a separate payroll account. Total bi-weekly payroll amounts for the Company are drafted from the operating account by the payroll service and those withdrawals are included in the disbursements section of the Company's operating account.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: PAYROLL

Ending Balance per Bank Statement $ N/A

| |

| Plus Total Amount of Outstanding Deposits | $ N/A |

| |

| Minus Total Amount of Outstanding Checks and other debits | $ N/A * |

| |

| Minus Service Charges | $ N/A |

Ending Balance per Check Register $ N/A **(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid by Cash: ( o Check here if cash disbursements were authorized by United States Trustee)

Date Amount Payee Purpose Reason for Cash Disbursement

N/A

The following non-payroll disbursements were made from this account:

Date Amount Payee Purpose Reason for disbursement from this account

N/A

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5B

CHECK REGISTER - PAYROLL ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Note: The Company uses a payroll service (Paylocity) to service payroll and does not have a separate payroll account. The total funds are drafted from the operating account by the payroll service and those withdrawals are included in the disbursements section of the Company's operating account.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A

ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: PAYROLL

Account for all disbursements, including voids, lost payments, stop payment, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

ATTACHMENT 4C

MONTHLY SUMMARY OF BANK ACTIVITY - TAX ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found on the United States Trustee website, http://www.justice.gov/ust/r20/index.htm.

Note: The Company does not have a separate bank account related to taxes. Taxes are withdrawn from the Company's operating account. See "Attachment 5c" below for taxes paid and "Attachment 6" below for taxes owed and due for the period.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: TAX

| |

| Ending Balance per Bank Statement | $ N/A |

Plus Total Amount of Outstanding Deposits $ N/A

Minus Total Amount of Oustanding Checks and other debits $ N/A *

Minus Service Charges $ N/A

Ending Balance per Check Register $ N/A **(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by

United States Trustee)

| |

| Date | Amount Payee Purpose Reason for Cash Disbursement |

N/A

The following non-tax disbursements were made from this account:

| |

| Date | Amount Payee Purpose Reason for disbursement from this account |

N/A

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5C

CHECK REGISTER - TAX ACCOUNT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Note: The Company does not have a separate check register related to taxes. Taxes are withdrawn from the Company's operating account. See below for taxes paid and "Attachment 6" below for taxes owed and due for the period.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT # N/A

PURPOSE OF ACCOUNT: TAX

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer-generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

SUMMARY OF TAXES PAID

|

| | | |

| Payroll Taxes Paid (a) | $ | 114,586 |

|

| Sales & Use Taxes Paid (b) | — |

|

| Other Taxes Paid (c) | 2,965 |

|

| Total (d) | $ | 117,551 |

|

(a) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5O).

(b) This number is reported in the “Current Month” column of Schedule or Receipts and Disbursements

(Page MOR-2, Line 5P).

(c) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5Q).

(d) These two lines must be equal.

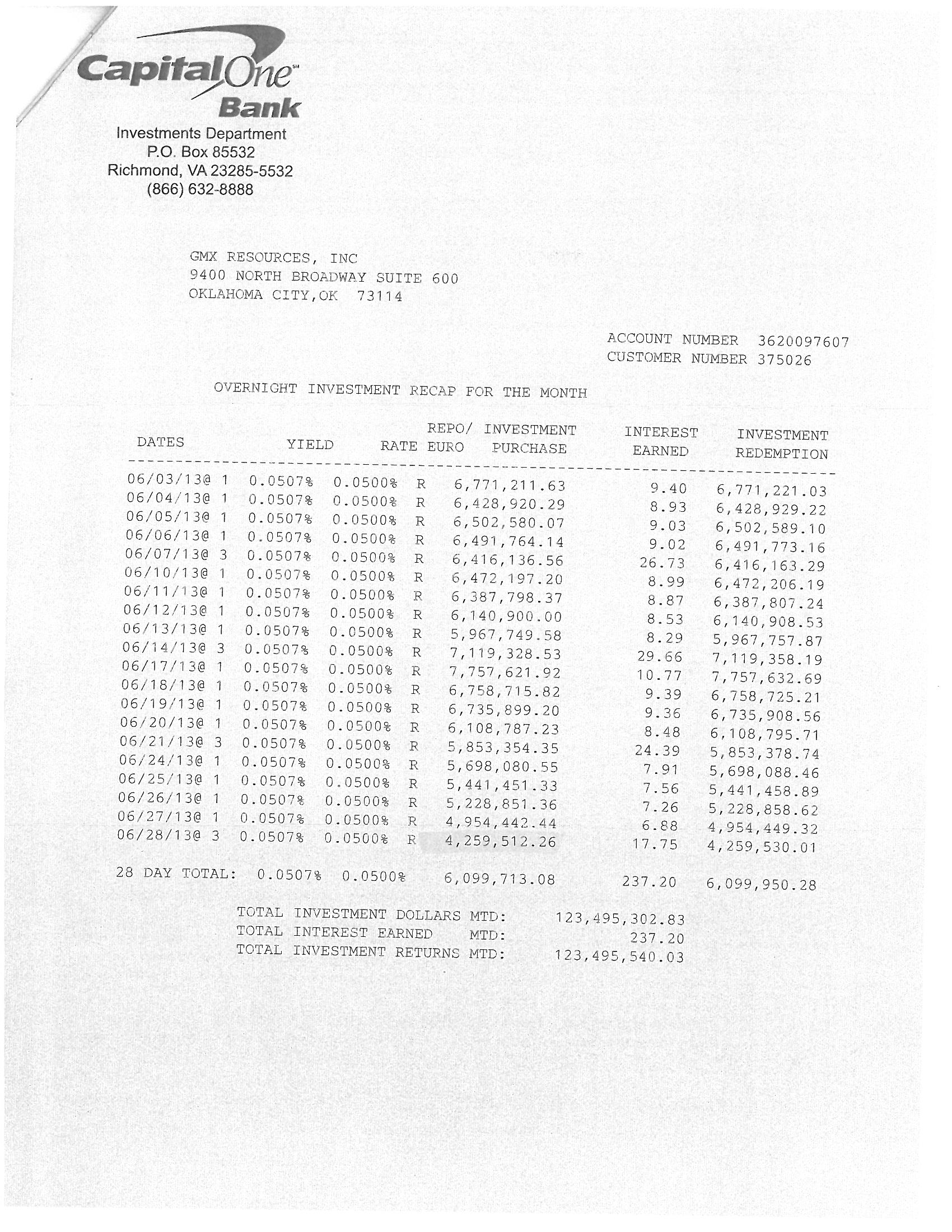

ATTACHMENT 4D

INVESTMENT ACCOUNTS AND PETTY CASH REPORT

INVESTMENT ACCOUNTS

Each savings and investment account, i.e. certificates of deposits, money market accounts, stocks and bonds, etc., should be listed separately. Attach copies of account statements.

|

| | | | | | | | |

| Instrument |

| Face Value |

| Purchase Price |

| Date of Purchase |

| Current Market Value |

| Capital One Money Market Account |

| N/A |

| N/A |

| N/A |

| $25,107 |

| Morgan Stanley Money Market Account |

| N/A |

| N/A |

| N/A |

| $50,049 |

| Total (a) |

|

|

|

|

|

|

| $75,156 |

PETTY CASH REPORT

The following Petty Cash Drawers/Accounts are maintained:

|

| | | | | | |

|

| (Column 2) |

| (Column 3) |

| (Column 4) |

| Location of Box/Account |

| Maximum Amount of Cash in Drawer/Acct |

| Amount of Petty Cash on Hand at End of Month |

| Difference between (Column 2) and (Column 3) |

| Oklahoma City Office |

| N/A |

| $2,786 |

| N/A |

| Total (b) |

|

|

| $2,786 |

|

|

For any Petty Cash Disbursements over $100 per transaction, attach copies of receipts. If there are no receipts, provide an explanation:

|

| | |

| Total Investments Accounts and Petty Cash (a + b) (c) |

| $77,942 |

(c)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 6

MONTHLY TAX REPORT

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

TAXES OWED AND DUE

Report all unpaid post-petition taxes including Federal and State withholding FICA, State sales tax, property tax, unemployment tax, State workmen's compensation, etc.

|

| | | | | | | | | | | | |

| Name of Taxing Authority |

| Date Payment Due |

| Description |

| Amount |

| Date Last Tax Return File |

| Tax Return Period |

| Texas State Comptroller |

| 7/19/2016 |

| Production & Severance Tax |

| $ | 1,256 |

|

| 6/19/2013 |

| May-13 |

| Texas State Comptroller |

| 8/19/2013 |

| Estimated Production & Severance Tax |

| $ | 1,838 |

|

| 6/19/2013 |

| June-13 |

| Barber County Treasurer |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 192 |

|

| No filings - Billed from County |

| Year of 2013 |

| Cass County Tax Collector |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 173 |

|

| 4/15/2013 |

| Year of 2013 |

| Harrison Central |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 153,563 |

|

| 4/15/2013 |

| Year of 2013 |

| Harrison County |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 54,154 |

|

| 4/15/2013 |

| Year of 2013 |

| Marion County, Karen Jones |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 1,483 |

|

| 4/15/2013 |

| Year of 2013 |

| Panola County Clerk - Tax Assesor |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| $ | 1,258 |

|

| 4/15/2013 |

| Year of 2013 |

| Louisiana Dept of Revenue |

| 9/15/2013 |

| Estimated 2012 Income Tax |

| $ | 500 |

|

| Not yet filed. |

| Year of 2012 |

| Total |

|

|

|

|

| $ | 214,417 |

|

|

|

|

|

ATTACHMENT 7

SUMMARY OF OFFICER OR OWNER COMPENSATION

SUMMARY OF PERSONNEL AND INSURANCE COVERAGES

Name of Debtor: GMX Resources Inc. Case Number: 13-11456

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Report all forms of compensation received by or paid on behalf of the Officer or Owner during the month. Include car allowances, payments to retirement plans, loan repayments, payments of Officer/Owner’s personal expenses, insurance premium payments, etc. Do not include reimbursement for business expenses Officer or Owner incurred and for which detailed receipts are maintained in the accounting records.

|

| | | | | | | | | | |

| Name of Officer or Owner |

| Title |

| Description |

| Amount Paid |

| Company |

| Michael Rohleder |

| President |

| Salary |

| $ | 32,454 |

|

| GMX |

|

|

|

| Non-Cash Restricted Stock Vesting |

| $ | 240 |

|

| GMX |

| James Merrill |

| Chief Financial Officer |

| Salary |

| $ | 25,840 |

|

| GMX |

|

|

|

| Non-Cash Restricted Stock Vesting |

| $ | 240 |

|

| GMX |

| Gary Jackson |

| Executive Vice President Land |

| Salary |

| $ | 25,000 |

|

| GMX |

|

|

|

| Gas Allowance |

| $ | 1,750 |

|

| GMX |

|

|

|

| Non-Cash Restricted Stock Vesting |

| $ | 240 |

|

| GMX |

| Harry Stahel |

| Executive Vice President Finance |

| Salary |

| $ | 23,077 |

|

| GMX |

|

|

|

| Non-Cash Restricted Stock Vesting |

| $ | 52 |

|

| GMX |

| Steve Craig |

| Director |

| Director fee |

| $ | 4,167 |

|

| GMX |

| Jon "Tucker" McHugh |

| Director |

| Director fee |

| $ | 4,167 |

|

| GMX |

PERSONNEL REPORT

|

| | | | |

|

| Full Time |

| Part Time |

| Number of employees at beginning of period |

| 47 |

| — |

| Number hired during the period |

| — |

| — |

| Number terminated or resigned during the period |

| 2 |

| — |

| Number of employees on payroll at end of period |

| 45 |

| — |

CONFIRMATION OF INSURANCE

List all policies of insurance in effect, including but not limited to workers' compensation, liability, fire, theft, comprehensive, vehicle, health and life. For the first report, attach a copy of the declaration sheet for each type of insurance. For subsequent reports, attach a certificate of insurance for any policy in which a change occurs during the month (new carrier, increased policy limits, renewal, etc.).

|

| | | | | | | | | | |

| Agent and/or Carrier |

| Phone Number |

| Policy Number |

| Coverage Type |

| Expiration Date |

| Premium Due Date |

| Chubb Group of Insurance Companies (Federal Insurance Company) 15 Mountain View Road Warren NJ 07059 |

| 908-903-2000 |

| 35863507 |

| Insurance policy covering property, general liability, inland marine, pollution, commercial auto and umbrella liability |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| Great American Insurance Company 301 E. 4th Street Cincinnati, OH 45202 |

| 513-369-5000 |

| IMP847592804 |

| Insurance Policy covering equipment floater on owned pipe |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| First Mercury Insurance Company 26600 Telegraph Road Southfield MI 48033 |

| 248-358-4010 |

| TXEX000000598201 |

| Insurance policy covering commerical excess liability |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| National Union Fire Ins. Co. C/O Chartis 175 Water Street, 9th Floor NY, NY 10038 |

| 212-770-7000 |

| 17180256 |

| Directors and officers liability insurance |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| US Speciality Insurance Company 8144 Walnut Hill Lane Dallas TX 75231 |

| 713-744-3700 |

| 14MGU13A28644 |

| Excess directors and officers liability insurance |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| Zurich American Insurance Co. 1400 American Lane Schaumburg, IL 60195 |

| 1-800-987-3373 |

| WC9280982 |

| Workers compensation and employers liability |

| 12/22/2013 |

| N/A, all premiums have been paid in full |

| Travelers Casualty and Surety Company of America One Town Square, Hartford, CT 06183 |

| 1-800-842-5075 |

| 105536833 |

| Crime, fidelity insurance, employment practices & fiduciary liability |

| 12/22/2013 |

| N/A, all premiums have been paid in full |

|

| | | | | | | | | | |

| Lloyd's of London c/o Continental Energy Specialist, L.P P.O. Box 689 Fulshear TX 77441 |

| 281-533-9067 |

| CESEP12290 |

| Operators extra expense policy |

| 8/8/2013 |

| N/A, all premiums have been paid in full |

| Lincoln National Life Insurance Company 8801 Indian Hills Drive Omaha NE 68114 |

| 402-361-7300 |

| 403001143 |

| Group term life; accidental death & dismemberment and short-term disability |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| Vision Services Plan, Inc. Oklahoma |

| 918-398-2600 |

| 30010641 |

| Employee vision insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| BlueCross BlueShield of Oklahoma |

| 1-800-942-5837 |

| Y01585 |

| Group health insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| Delta Dental |

| 405-607-2100 |

| 939600001 |

| Group dental insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

The following lapse in insurance coverage occurred this month:

|

| | | | | | |

| Policy Type |

| Date Lapsed |

| Date Reinstated |

| Reason for Lapse |

| N/A for this period |

|

|

|

|

|

|

Check here if U. S. Trustee has been listed as Certificate Holder for all insurance policies.

ATTACHMENT 8

SIGNIFICANT DEVELOPMENTS DURING REPORTING PERIOD

Information to be provided on this page, includes, but is not limited to: (1) financial transactions that are not reported on this report, such as the sale of real estate (attach closing statement); (2) non-financial transactions, such as the substitution of assets or collateral; (3) modifications to loan agreements; (4) change in senior management, etc. Attach any relevant documents.

N/A for this period

We anticipate filing a Plan of Reorganization and Disclosure Statement on or before (see note below) .

Note: The Company is conducting a 363 asset sale. The Asset Purchase Agreement was signed May 15, 2013

Exhibit I

GMX Resources Inc.

Balance Sheet

|

| | | |

| ASSETS | June 30, 2013 |

| CURRENT ASSETS: | |

| Cash and cash equivalents | $ | 3,719,940 |

|

| Short term investments | — |

|

| Accounts receivable - interest owners | 7,795,468 |

|

| Accounts receivable - oil and natural gas revenues | 8,478,850 |

|

| Accounts receivable - intercompany | 22,852,961 |

|

| Inventories | 43,849 |

|

| Prepaid expenses and deposits | 2,933,646 |

|

| Assets held for sale | 409,579 |

|

| Total current assets | 46,234,293 |

|

| | |

| OIL AND NATURAL GAS PROPERTIES, BASED ON THE FULL COST METHOD | |

| Properties being amortized | 705,898,962 |

|

| Properties not subject to amortization | 136,858,249 |

|

| Less accumulated depreciation, depletion and impairment | (610,399,341 | ) |

| | 232,357,871 |

|

| | |

| PROPERTY AND EQUIPMENT, AT COST, NET | 13,130,610 |

|

| DERIVATIVE INSTRUMENTS | — |

|

| OTHER ASSETS | 9,791,429 |

|

| Investment in Sub/Intercompany | 26,791,002 |

|

| TOTAL ASSETS | $ | 328,305,204 |

|

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | June 30, 2013 |

| CURRENT LIABILITIES | |

| Accounts payable | $ | 22,726,183 |

|

| Accounts payable - Intercompany | 14,656,947 |

|

| Other Accrued Expenses | 12,268,964 |

|

| Accrued interest | 31,225,643 |

|

| Revenue distribution payable | 2,436,343 |

|

| Short-term derivative instruments | 1,942,069 |

|

| Current maturities of long-term debt | 10,025,750 |

|

| Total current liabilities | 95,281,900 |

|

| | |

| LONG-TERM DEBT, LESS CURRENT MATURITIES | 410,693,296 |

|

| OTHER LIABILITIES | 2,661,290 |

|

| | |

| SHAREHOLDERS' EQUITY | |

| 9.25% Series B Cumulative Preferred Stock | 3,177 |

|

| Common Stock | 98,062 |

|

| Additonal paid-in capital | 718,143,403 |

|

| Retained earnings (Accumulated deficit) | (900,029,026 | ) |

| Accumulated other comprehensive income, net of taxes | 1,453,101 |

|

| Total GMX shareholders' equity | (180,331,283 | ) |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 328,305,204 |

|

GMX Resources Inc.

Income Statement

|

| | | |

| | June 30, 2013 |

| | |

| O&G sales | $ | 2,608,956 |

|

| Derivatives | 364,170 |

|

| TOTAL REVENUES | 2,973,126 |

|

| | |

| COSTS AND EXPENSES | |

| Lease operating | 2,086,801 |

|

| Production taxes | 362,776 |

|

| Depreciation, depletion and amortization | 1,170,760 |

|

| General and administrative | 2,311,293 |

|

| Total expenses | 5,931,631 |

|

| | |

| OPERATING INCOME | (2,958,505 | ) |

| | |

| NON-OPERATING INCOME (EXPENSE) | |

| Interest expense | (4,504,218 | ) |

| Interest and other income | 249 |

|

| Total non-operating expense | (4,503,969 | ) |

| | |

| Income (loss) before income taxes | (7,462,474 | ) |

| | |

| PROVISION (BENEFIT) FOR INCOME TAXES | 123,818 |

|

| | |

| NET INCOME (LOSS) | (7,586,292 | ) |

| Net income attributable to noncontrolling interest | 1,076,517 |

|

| | |

| NET INCOME APPLICABLE TO GMX | (8,662,809 | ) |

| Preferred stock dividends | 612,183 |

|

| | |

| NET INCOME APPLICABLE TO COMMON SHAREHOLDERS | $ | (9,274,992 | ) |

Post Petition Accounts Payable in the Current Reporting Month

Exhibit II

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 4/1/2013 | 90 | IHS Global Inc. | Prepaid Expense | $ | 83,756.00 |

|

| 4/1/2013 | 90 | IHS Global Inc. | Prepaid Expense | 6,200.00 |

|

| 4/2/2013 | 89 | Netjets Aviation, Inc | Travel Meals & Entertainment | 55,318.00 |

|

| 4/2/2013 | 89 | The CIT Group/Equipment | Travel Meals & Entertainment | 24,390.08 |

|

| 4/3/2013 | 88 | National Oilwell Varco, LP | 8.8 Intang Completion Costs | 86,213.74 |

|

| 4/3/2013 | 88 | National Oilwell Varco, LP | 8.8 Workover Expense | 5,749.19 |

|

| 4/9/2013 | 82 | Helmerich & Payne | 8.8 Intang Completion Costs | 20,986.25 |

|

| 4/9/2013 | 82 | National Oilwell Varco, LP | 8.8 Tangible Completion Costs | (65,636.83 | ) |

| 4/10/2013 | 81 | BUSY BEES HOT OIL, INC | 8.8 Workover Expense | 1,025.00 |

|

| 4/11/2013 | 80 | National Oilwell Varco, LP | 8.8 Tang Completion Cost | 17,858.73 |

|

| 4/12/2013 | 79 | Trotter Construction, Inc. | 8.8 Workover Expense | 20,471.00 |

|

| 4/17/2013 | 74 | Bank Of America Lockbox Serv. | Intercompany Accounts | 31,000.00 |

|

| 4/22/2013 | 69 | Direct Report Corporation | Investor and Director Expense | 796.50 |

|

| 4/22/2013 | 69 | SUPER HEATERS OF NORTH DAKOTA, | 8.8 Intang Completion Costs | 25,032.00 |

|

| 4/25/2013 | 66 | National Oilwell Varco, LP | 8.8 Tang Completion Cost | (15,159.76 | ) |

| 4/30/2013 | 61 | Netjets Aviation, Inc | Travel Meals & Entertainment | 701.50 |

|

| 5/1/2013 | 60 | Basin Concrete Trucking | 8.8 Intang Completion Costs | 13,315.00 |

|

| 5/1/2013 | 60 | Globenewswire, Inc | Investor and Director Expense | 3,750.00 |

|

| 5/1/2013 | 60 | Moody's Investors Service | Consulting and Prof Fees | 14,500.00 |

|

| 5/2/2013 | 59 | Netjets Aviation, Inc | Travel Meals & Entertainment | 55,318.00 |

|

| 5/6/2013 | 55 | Gulf States Transmission Corp | Intercompany Accounts | 23,405.00 |

|

| 5/8/2013 | 53 | Devon Energy Production Co. LP | 8/8 Lease Operating Expense | 965.50 |

|

| 5/13/2013 | 48 | Continental Resources, Inc. | 8/8 Lease Operating Expense | 22,826.00 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 5/13/2013 | 48 | Roughrider Picker & Trucking | 8.8 Workover Expense | 1,520.00 |

|

| 5/14/2013 | 47 | 1SOURCE INTERNATIONAL, LLC | Telecomm and Computing | — |

|

| 5/14/2013 | 47 | Bob's Oilfield Service, Inc. | 8/8 Lease Operating Expense | 519.00 |

|

| 5/14/2013 | 47 | MLB Consulting, LLC | 8.8 Intang Completion Costs | 4,850.00 |

|

| 5/15/2013 | 46 | Bank Of America Lockbox Serv. | Gas Transportation | 30,000.00 |

|

| 5/15/2013 | 46 | HOLE SEEKERS, INC. | 8.8 Workover Expense | 2,234.45 |

|

| 5/15/2013 | 46 | SBG GREEN RIVER, LLC | 8/8 Lease Operating Expense | 1,582.50 |

|

| 5/16/2013 | 45 | Bob's Oilfield Service, Inc. | 8.8 Intang Completion Costs | 141.00 |

|

| 5/16/2013 | 45 | Regency Intrastate Gas LP | Gas Transportation | 450,000.00 |

|

| 5/20/2013 | 41 | Andrews Kurth, LLP | Consulting and Prof Fees | 100,617.20 |

|

| 5/20/2013 | 41 | BLACKHAWK ENERGY SERVICES, INC | 8.8 Intang Completion Costs | 31,875.00 |

|

| 5/20/2013 | 41 | Crowe & Dunlevy, P.C. | Consulting and Prof Fees | 15,936.24 |

|

| 5/20/2013 | 41 | Estill, Hardwick, Gable Hall | Consulting and Prof Fees | 6,264.00 |

|

| 5/20/2013 | 41 | Tervita LLC | 8.8 Intang Completion Costs | 485.00 |

|

| 5/21/2013 | 40 | Central Hydraulic, Inc. | 8.8 Tang Completion Cost | 45,112.20 |

|

| 5/21/2013 | 40 | SBG GRASSY BUTTE LLC | 8/8 Lease Operating Expense | 4,034.75 |

|

| 5/21/2013 | 40 | Wren Oilfield Services, Inc | 8.8 Workover Expense | 6,705.00 |

|

| 5/22/2013 | 39 | BLACKHAWK ENERGY SERVICES, INC | 8.8 Intang Completion Costs | 18,825.00 |

|

| 5/22/2013 | 39 | SBG GREEN RIVER, LLC | 8/8 Lease Operating Expense | 2,703.75 |

|

| 5/23/2013 | 38 | National Oilwell Varco, LP | 8.8 Tang Completion Cost | (4,563.71 | ) |

| 5/23/2013 | 38 | Stillwell Enterprises, Inc. | 8.8 Intang Completion Costs | 17,687.50 |

|

| 5/23/2013 | 38 | Wren Oilfield Services, Inc | 8.8 Workover Expense | 4,963.90 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 5/24/2013 | 37 | C & C Oilfield Services, LLC | 8/8 Lease Operating Expense | 2,559.89 |

|

| 5/24/2013 | 37 | C & C Oilfield Services, LLC | Intercompany Accounts | 1,446.84 |

|

| 5/24/2013 | 37 | J-W Measurement Company | 8/8 Lease Operating Expense | 1,364.00 |

|

| 5/24/2013 | 37 | Shred-It USA, Inc. | General Office Expense | 96.32 |

|

| 5/25/2013 | 36 | Mary Ann Grove | Rent and Utilities | 125.00 |

|

| 5/27/2013 | 34 | M&K Hotshot & Trucking, Inc. | 8.8 Workover Expense | 3,071.25 |

|

| 5/28/2013 | 33 | Bob's Oilfield Service, Inc. | 8.8 Workover Expense | 7,498.20 |

|

| 5/28/2013 | 33 | Direct Report Corporation | Investor and Director Expense | 550.00 |

|

| 5/29/2013 | 32 | Bob's Oilfield Service, Inc. | 8.8 Workover Expense | 1,856.00 |

|

| 5/29/2013 | 32 | MLB Consulting, LLC | 8.8 Intang Completion Costs | 1,548.00 |

|

| 5/30/2013 | 31 | Asset Risk Management, LLC | General and Administrative | 22,185.59 |

|

| 5/30/2013 | 31 | Bob's Oilfield Service, Inc. | 8/8 Lease Operating Expense | 370.00 |

|

| 5/30/2013 | 31 | HPC Acquisition Corp. | 8/8 Lease Operating Expense | 6,512.24 |

|

| 5/30/2013 | 31 | JNS Trucking, Inc. | 8/8 Lease Operating Expense | 3,969.00 |

|

| 5/30/2013 | 31 | MBI Energy Rentals | 8.8 Intang Completion Costs | 2,372.48 |

|

| 5/30/2013 | 31 | Tammy B. Rodgers | 8.8 Workover Expense | 545.79 |

|

| 5/30/2013 | 31 | Wilson Industries, LP | 8.8 Tang Completion Cost | 1,005.53 |

|

| 5/31/2013 | 30 | Astro-Chem Lab, Inc. | 8/8 Lease Operating Expense | 550.00 |

|

| 5/31/2013 | 30 | Bob's Oilfield Service, Inc. | 8.8 Intang Completion Costs | 1,274.34 |

|

| 5/31/2013 | 30 | Elite Power LLC | 8/8 Lease Operating Expense | 22,260.00 |

|

| 5/31/2013 | 30 | Globe Energy Services, LLC | 8/8 Lease Operating Expense | 4,552.80 |

|

| 5/31/2013 | 30 | Largo Gas Compression, Inc. | Intercompany Accounts | 1,500.00 |

|

| 5/31/2013 | 30 | SBG GRASSY BUTTE LLC | 8/8 Lease Operating Expense | 6,112.50 |

|

| 5/31/2013 | 30 | Solium Capital LLC | Telecomm and Computing | 1,156.95 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 5/31/2013 | 30 | WellEz Information | 8.8 Workover Expense | 675.00 |

|

| 6/1/2013 | 29 | SBG GREEN RIVER, LLC | 8/8 Lease Operating Expense | 1,458.75 |

|

| 6/2/2013 | 28 | The CIT Group/Equipment | Travel Meals & Entertainment | 24,390.08 |

|

| 6/3/2013 | 27 | Bob's Oilfield Service, Inc. | 8.8 Workover Expense | 888.00 |

|

| 6/3/2013 | 27 | Bob's Oilfield Service, Inc. | 8/8 Lease Operating Expense | 740.00 |

|

| 6/3/2013 | 27 | DAIOHS, USA Inc | Travel Meals & Entertainment | 312.79 |

|

| 6/3/2013 | 27 | Nehls Chevrolet | Intercompany Accounts | 14.50 |

|

| 6/3/2013 | 27 | Netjets Aviation, Inc | Travel Meals & Entertainment | 55,318.00 |

|

| 6/3/2013 | 27 | Shred-It USA, Inc. | General Office Expense | 118.19 |

|

| 6/3/2013 | 27 | Thurmond-McGlothlin, Inc. | 8/8 Lease Operating Expense | 160.00 |

|

| 6/3/2013 | 27 | Thurmond-McGlothlin, Inc. | Intercompany Accounts | 320.00 |

|

| 6/4/2013 | 26 | Bob's Oilfield Service, Inc. | 8.8 Workover Expense | 2,727.00 |

|

| 6/4/2013 | 26 | Mclain-Chitwood Office Prods | General Office Expense | 88.74 |

|

| 6/4/2013 | 26 | MLB Consulting, LLC | 8.8 Intang Completion Costs | 3,096.00 |

|

| 6/4/2013 | 26 | Randy Williams | Travel Meals & Entertainment | 260.10 |

|

| 6/4/2013 | 26 | Whiting Oil and Gas Corporatn | 8/8 Lease Operating Expense | 21,878.79 |

|

| 6/5/2013 | 25 | AT&T Datacomm, Inc. | Prepaid Expense | 9,593.95 |

|

| 6/5/2013 | 25 | Bob's Oilfield Service, Inc. | 8.8 Workover Expense | 1,758.00 |

|

| 6/5/2013 | 25 | Landmark Graphics Corporation | Telecomm and Computing | 3,013.91 |

|

| 6/5/2013 | 25 | Lee Graphics, Inc. | General Office Expense | 205.68 |

|

| 6/6/2013 | 24 | Black Hills Trucking, Inc | General Office Expense | 500.00 |

|

| 6/6/2013 | 24 | Bob's Oilfield Service, Inc. | 8.8 Intang Completion Costs | 2,587.00 |

|

| 6/6/2013 | 24 | JNS Trucking, Inc. | 8.8 Intang Completion Costs | 2,725.00 |

|

| 6/6/2013 | 24 | JNS Trucking, Inc. | 8/8 Lease Operating Expense | 4,206.50 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 6/6/2013 | 24 | Nehls Chevrolet | Intercompany Accounts | 14.50 |

|

| 6/6/2013 | 24 | Netjets Aviation, Inc | Prepaid Expense | (183,698.92 | ) |

| 6/7/2013 | 23 | Bob's Oilfield Service, Inc. | 8/8 Lease Operating Expense | 322.83 |

|

| 6/7/2013 | 23 | C & C Oilfield Services, LLC | 8.8 Workover Expense | 2,832.82 |

|

| 6/7/2013 | 23 | C & C Oilfield Services, LLC | 8/8 Lease Operating Expense | 5,441.67 |

|

| 6/7/2013 | 23 | C & C Oilfield Services, LLC | Intercompany Accounts | 1,853.26 |

|

| 6/7/2013 | 23 | Devon Energy Production Co. LP | 8/8 Lease Operating Expense | 1,024.43 |

|

| 6/7/2013 | 23 | East Texas Copy Systems, Inc. | General Office Expense | 54.68 |

|

| 6/7/2013 | 23 | James P. Hill Distributor Inc. | Intercompany Accounts | 3,763.94 |

|

| 6/7/2013 | 23 | Looper Reed & McGraw P.C. | Consulting and Prof Fees | 13,613.10 |

|

| 6/7/2013 | 23 | MLB Consulting, LLC | 8.8 Workover Expense | 3,096.00 |

|

| 6/7/2013 | 23 | Nehls Chevrolet | Intercompany Accounts | 14.50 |

|

| 6/7/2013 | 23 | SBG GRASSY BUTTE LLC | 8/8 Lease Operating Expense | 5,262.50 |

|

| 6/8/2013 | 22 | SBG GREEN RIVER, LLC | 8/8 Lease Operating Expense | 847.50 |

|

| 6/10/2013 | 20 | FLORES PRODUCTION SERVICES, | 8.8 Intang Completion Costs | 4,400.00 |

|

| 6/10/2013 | 20 | JNS Trucking, Inc. | 8/8 Lease Operating Expense | 6,576.50 |

|

| 6/10/2013 | 20 | Shred-It USA, Inc. | General Office Expense | 95.89 |

|

| 6/11/2013 | 19 | Computershare, Inc. | General and Administrative | 932.10 |

|

| 6/11/2013 | 19 | Dynanomics Inc. | 8/8 Lease Operating Expense | 535.00 |

|

| 6/11/2013 | 19 | Gulf States Transmission Corp | Gas Transportation | 23,405.00 |

|

| 6/11/2013 | 19 | Mclain-Chitwood Office Prods | General Office Expense | 118.39 |

|

| 6/11/2013 | 19 | Missouri Valley Petroleum | 8/8 Lease Operating Expense | 2,201.47 |

|

| 6/11/2013 | 19 | MLB Consulting, LLC | 8.8 Workover Expense | 3,265.00 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 6/11/2013 | 19 | Nehls Chevrolet | Travel Meals & Entertainment | 14.50 |

|

| 6/11/2013 | 19 | Slawson Exploration Co., Inc. | 8/8 Lease Operating Expense | 6,481.94 |

|

| 6/12/2013 | 18 | McJunkin Red Man Corporation | 8.8 Tang Completion Cost | 655.74 |

|

| 6/13/2013 | 17 | Continental Resources, Inc. | 8/8 Lease Operating Expense | 28,135.22 |

|

| 6/13/2013 | 17 | Elynx Technologies, LLC | 8/8 Lease Operating Expense | 1,284.60 |

|

| 6/13/2013 | 17 | Elynx Technologies, LLC | Intercompany Accounts | 945.00 |

|

| 6/13/2013 | 17 | JNS Trucking, Inc. | 8.8 Intang Completion Costs | 680.40 |

|

| 6/13/2013 | 17 | JNS Trucking, Inc. | 8.8 Workover Expense | 556.50 |

|

| 6/13/2013 | 17 | JNS Trucking, Inc. | 8/8 Lease Operating Expense | 3,955.25 |

|

| 6/14/2013 | 16 | Globe Energy Services, LLC | 8/8 Lease Operating Expense | 4,591.60 |

|

| 6/14/2013 | 16 | IHS Global Inc. | Telecomm and Computing | 9.00 |

|

| 6/14/2013 | 16 | Piceance Well Service, Inc | 8.8 Workover Expense | 18,795.00 |

|

| 6/14/2013 | 16 | SBG GRASSY BUTTE LLC | 8/8 Lease Operating Expense | 6,666.50 |

|

| 6/17/2013 | 13 | 1SOURCE INTERNATIONAL, LLC | Telecomm and Computing | 109.07 |

|

| 6/17/2013 | 13 | DAIOHS, USA Inc | Travel Meals & Entertainment | 284.07 |

|

| 6/17/2013 | 13 | JNS Trucking, Inc. | 8.8 Workover Expense | 1,200.00 |

|

| 6/17/2013 | 13 | JNS Trucking, Inc. | 8/8 Lease Operating Expense | 3,590.40 |

|

| 6/17/2013 | 13 | Regency Intrastate Gas LP | Gas Transporation | 465,000.00 |

|

| 6/18/2013 | 12 | B&B HOT OIL SERVICE | 8.8 Workover Expense | 570.00 |

|

| 6/18/2013 | 12 | Estill, Hardwick, Gable Hall | Consulting and Prof Fees | 29,128.85 |

|

| 6/18/2013 | 12 | Mclain-Chitwood Office Prods | General Office Expense | 79.83 |

|

| 6/18/2013 | 12 | Missouri Valley Petroleum | 8/8 Lease Operating Expense | 5,008.05 |

|

| 6/18/2013 | 12 | Randy Williams | Travel Meals & Entertainment | 173.40 |

|

Post Petition Accounts Payable in the Current Reporting Month

|

| | | | | | |

| InvDate | Days Outstanding | Vendor Name | Account Category | Balance Due |

| 6/18/2013 | 12 | Reed Elsevier Inc. | General Office Expense | 270.83 |

|

| 6/19/2013 | 11 | BORSHEIM BUILDERS SUPPLY INC | 8.8 Workover Expense | 650.00 |

|

| 6/20/2013 | 10 | South Gateway Tire Co. Inc. | Intercompany Accounts | 98.87 |

|

| 6/21/2013 | 9 | Globe Energy Services, LLC | 8/8 Lease Operating Expense | 4,180.50 |

|

| 6/24/2013 | 6 | Bank Of America Lockbox Serv. | Gas Transportation | 31,000.00 |

|

| 6/24/2013 | 6 | MLB Consulting, LLC | 8.8 Workover Expense | 26,000.85 |

|

| 6/24/2013 | 6 | Nehls Chevrolet | Intercompany Accounts | 14.50 |

|

| 6/24/2013 | 6 | South Gateway Tire Co. Inc. | Intercompany Accounts | 17.50 |

|

| 6/25/2013 | 5 | Mclain-Chitwood Office Prods | General Office Expense | 212.00 |

|

| 6/26/2013 | 4 | MBI Energy Logistics LLC | 8.8 Intang Completion Costs | 471.25 |

|

| 6/26/2013 | 4 | South Gateway Tire Co. Inc. | Intercompany Accounts | 69.99 |

|

| 6/26/2013 | 4 | South Gateway Tire Co. Inc. | Travel Meals & Entertainment | 1,301.06 |

|

| 6/27/2013 | 3 | Mimecast North America, Inc. | Telecomm and Computing | 1,300.00 |

|

| 6/30/2013 | (1) | Hub Properties Trust | Rent and Utilities | 12,849.62 |

|

| | | | | $ | 1,958,116.43 |

|

Pre-petition Accounts Payable Paid in the Current Reporting Month

Exhibit III

|

| | | | | |

| Check Date | Check No | Vendor Name | Transaction Amt on Check |

| 6/7/2013 | 215820 | CenterPoint Energy Gas Process | 6,974.01 |

|

| 6/7/2013 | 215823 | Crowe & Dunlevy, P.C. | 780.00 |

|

| 6/7/2013 | 215847 | RGD Trucking, Inc. | 7,334.50 |

|

| 6/7/2013 | 215865 | W.D. Von Gonten & Co. | 20,492.00 |

|

| 6/28/2013 | 215975 | Expedited Logistics and Freigh | 420.00 |

|

| Total Pre-petition Accounts Payable paid in June 2013 | $ | 36,000.51 |

|

All Disbursements for the Current Reporting Month

Exhibit IV

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/7/2013 | 215785 | Gary A. Lebsack & Barbara | Lease Extensions | 1,800.00 |

|

| 6/7/2013 | 215786 | John K. Lebsack & Ruth Lebsack | Lease Extensions | 1,800.00 |

|

| 6/7/2013 | 215790 | Rose O'Brien, a widow | Lease Extensions | 27,000.00 |

|

| 6/7/2013 | 215791 | James O'Brien | Lease Extensions | 2,000.00 |

|

| 6/7/2013 | 215792 | Dennis O'Brien | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215793 | Jennifer L. Kessel | Lease Extensions | 666.69 |

|

| 6/7/2013 | 215794 | Sherry O'Brien, as AIF | Lease Extensions | 666.69 |

|

| 6/7/2013 | 215795 | Darby O'Brien | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215796 | Darnell O'Brien | Lease Extensions | 2,000.00 |

|

| 6/7/2013 | 215797 | Timothy O'Brien | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215798 | Maureen Wolf | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215799 | Laureen Barnhart | Lease Extensions | 2,000.00 |

|

| 6/7/2013 | 215800 | Sandra Rixen | Lease Extensions | 2,000.00 |

|

| 6/7/2013 | 215801 | Larry J. & Marlys J. O'Brien | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215802 | William O'Brien, a married man | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215803 | Denise Person | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215804 | Barbara Boltz, a married woman | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215805 | Jeffrey O'Brien, a married man | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215806 | Donovan O'Brien, a married man | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215807 | Danielle R. Valle | Lease Extensions | 666.69 |

|

| 6/7/2013 | 215808 | Aaron O'Brien, a married man | Lease Extensions | 750.00 |

|

| 6/7/2013 | 215809 | Shelly Ewoniuk | Lease Extensions | 2,000.00 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | PUT CLAMP ON | 131.61 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REBUILD BIG JOE ON | 131.61 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REBUILD PG 150 ON | 263.23 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REPLACE CHOKE AT | 219.36 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REPLACE FILTERS | 131.61 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REPLACE FILTERS, | 1,739.14 |

|

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REPLACE SEAT & TRIM | 394.83 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/7/2013 | 215819 | C & C Oilfield Services, LLC | REPLACE SEAT AND | 131.61 |

|

| 6/10/2013 | 215868 | Marsh and Ellis Ranch, LLC | Lease Extensions | 65,353.42 |

|

| 6/11/2013 | 215869 | REGUS CORPORATION | 1ST MONTH RENT FOR | 2,348.00 |

|

| 6/11/2013 | 215869 | REGUS CORPORATION | DEPOSIT FOR 1745 | 4,696.00 |

|

| 6/11/2013 | 215870 | Indian Meadows Ranches, Inc. | Lease Extensions | 49,833.37 |

|

| 6/11/2013 | 215871 | Harding & Kirkbride Livestock | Lease Extensions | 17,625.70 |

|

| 6/12/2013 | 215872 | Mid West Crane Service Inc. | CRANE RENTAL TO | 1,640.00 |

|

| 6/14/2013 | 215874 | Ark-la-tex Electric, Inc. | ELECTRICAL WORK - | 3,656.79 |

|

| 6/14/2013 | 215874 | Ark-la-tex Electric, Inc. | ELECTRICAL WORK ON | 3,498.54 |

|

| 6/14/2013 | 215875 | BILLINGS COUNTY RECORDER | RECORDING FEES | 13.00 |

|

| 6/14/2013 | 215876 | Bowie Cass Electric | ELECTRIC 05/03-06/04 | 658.14 |

|

| 6/14/2013 | 215877 | C & C Oilfield Services, LLC | FABBED 3" X 4" | 722.50 |

|

| 6/14/2013 | 215878 | Century Link | PHONE SERVICE | 123.03 |

|

| 6/14/2013 | 215879 | Cox Communications, Inc. | CABLE | 92.38 |

|

| 6/14/2013 | 215880 | PNC Bank C/O Heat Waves Hot | LOAD 60 BBLS H20, | 750.00 |

|

| 6/14/2013 | 215881 | East Texas Copy Systems, Inc. | COPIER EXPENSE | 55.18 |

|

| 6/14/2013 | 215882 | Globe Energy Services, LLC | 110 BBLS SWD | 132.00 |

|

| 6/14/2013 | 215882 | Globe Energy Services, LLC | 130 BBLS SWD | 624.00 |

|

| 6/14/2013 | 215882 | Globe Energy Services, LLC | 240 BBLS SWD | 288.00 |

|

| 6/14/2013 | 215882 | Globe Energy Services, LLC | 260 BBLS SWD | 923.00 |

|

| 6/14/2013 | 215883 | Globenewswire, Inc | PRESS RELEASES | 3,750.00 |

|

| 6/14/2013 | 215884 | Jon William (Tucker) Mchugh | MONTHLY RETAINER | 4,166.67 |

|

| 6/14/2013 | 215885 | L & L Engine And Compressor | 212 SMT DB PO W/TI | 342.07 |

|

| 6/14/2013 | 215885 | L & L Engine And Compressor | ALKALINE 9V | 77.21 |

|

| 6/14/2013 | 215885 | L & L Engine And Compressor | CONDUIT FOR AT&T | 179.42 |

|

| 6/14/2013 | 215885 | L & L Engine And Compressor | SUPERVISION MAY 2013 | 25,500.00 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/14/2013 | 215885 | L & L Engine And Compressor | VINTROL GATE VALVE, | 8,165.82 |

|

| 6/14/2013 | 215886 | Landtel Communications | STAR NET 01/25-31 | 183.75 |

|

| 6/14/2013 | 215887 | Lee Graphics, Inc. | 6-PK 24# ULTRA | 276.04 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 6,750.00 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 22,765.41 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 6,750.00 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 5,240.00 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 8,246.33 |

|

| 6/14/2013 | 215888 | MLB Consulting, LLC | Completions Consulting | 6,113.31 |

|

| 6/14/2013 | 215889 | Mclain-Chitwood Office Prods | OFFICE SUPPLIES | 44.37 |

|

| 6/14/2013 | 215890 | Mike Rohleder | Dues | 997.98 |

|

| 6/14/2013 | 215891 | Music Mountain Water Co. | BOTTLED WATER | 22.73 |

|

| 6/14/2013 | 215892 | Nehls Chevrolet | VEHICLE | 61.29 |

|

| 6/14/2013 | 215893 | Nick A. Sommer | Geological Consulting | 15,732.50 |

|

| 6/14/2013 | 215894 | QUINN PUMPS NORTH DAKOTA, INC. | PUMP REPAIR | 9,365.20 |

|

| 6/14/2013 | 215895 | Roughrider Electric | Utilities | 3,108.88 |

|

| 6/14/2013 | 215896 | SBG GRASSY BUTTE LLC | HAUL PRODUCTION | 2,689.50 |

|

| 6/14/2013 | 215897 | SBG GREEN RIVER, LLC | HAUL PRODUCTION | 1,086.75 |

|

| 6/14/2013 | 215898 | Shred-It USA - Denver | SHREDDING | 97.18 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | CONNECTIONS/MISC | 104.42 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | ELECTRICITY | 4.70 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | FUEL | 78.24 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | OIL & LUBRICANT | 23.33 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | OIL RESTORATION FEE | 0.34 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | OVERHEAD | 344.51 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | PUMP/VACUUM TRUCK | 2,560.90 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | PUMPER | 4.76 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | PUMPING LABOR | 150.00 |

|

| 6/14/2013 | 215899 | Smith Operating & Management | SWD | 644.49 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/14/2013 | 215899 | Smith Operating & Management | WORKOVER RIG EXPENSE | 1,381.25 |

|

| 6/14/2013 | 215900 | South Gateway Tire Co. Inc. | VEHICLE REPAIR - | 1,138.79 |

|

| 6/14/2013 | 215901 | Stephen C. Leath | IT WORK | 800.00 |

|

| 6/14/2013 | 215902 | Steven Craig | Monthly Director Fees | 4,166.67 |

|

| 6/14/2013 | 215903 | Stillwell Enterprises, Inc. | HAUL DERRICK, | 6,050.00 |

|

| 6/14/2013 | 215904 | Teresa Jacobs | FLOWERS/PHIL WILLITS | 74.95 |

|

| 6/14/2013 | 215904 | Teresa Jacobs | REPAIR FAUCET IN | 520.25 |

|

| 6/14/2013 | 215905 | Tervita LLC | MUD DISPOSAL | 10,725.00 |

|

| 6/14/2013 | 215906 | Thurmond-McGlothlin, Inc. | CDMA MODEM | 80.00 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | BLADE ROAD | 1,653.50 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | HAUL SCORIA | 1,766.00 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | HAUL SCORIA TO SITE | 552.00 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | PLOW ROAD & LOCATION | 891.50 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | WATSON A S24-11 - Location | 1,003.50 |

|

| 6/14/2013 | 215907 | Trotter Construction, Inc. | WATSON B N34-11 - Location | 1,003.50 |

|

| 6/14/2013 | 215908 | United Parcel Service, Inc. | POSTAGE | 271.14 |

|

| 6/17/2013 | 215909 | James Patrick Gladney | FOR ELECTRONIC | 10.00 |

|

| 6/18/2013 | 215910 | US BANKRUPTCY COURT, DISTRICT | COPY OF PSA OF PPMI | 74.50 |

|

| 6/21/2013 | 215911 | 1SOURCE INTERNATIONAL, LLC | CONFERENCE CALLS | 50.97 |

|

| 6/21/2013 | 215912 | AAPL | MEMBERSHIP DUES | 100.00 |

|

| 6/21/2013 | 215913 | ALTERNATIVE WRECKER SERVICE, | WRECKER CALLED TO | 775.00 |

|

| 6/21/2013 | 215914 | AT&T Corp | PHONE SERVICES - TX | 600.25 |

|

| 6/21/2013 | 215915 | AT&T Corp | Telephone | 7,624.00 |

|

| 6/21/2013 | 215916 | AT&T Mobility II, LLC | MOBILE PHONE | 4,166.06 |

|

| 6/21/2013 | 215917 | Black Hills Trucking, Inc | HAUL PIPE | 5,878.10 |

|

| 6/21/2013 | 215918 | Bob's Oilfield Service, Inc. | HAUL PIPE | 692.00 |

|

| 6/21/2013 | 215918 | Bob's Oilfield Service, Inc. | PLUMB IN BACK SIDE | 740.00 |

|

| 6/21/2013 | 215919 | Brian Pollman | AIRFARE | 789.60 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACE FILTERS | 817.84 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACE SEAT & TRIM | 307.10 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACE 2" NIPPLE | 350.98 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACE PIPING | 219.36 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | RE-RUN SUPPLY LINE | 438.71 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | A JUMPER LINE FROM | 482.58 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | WORK ON CHEMICAL | 159.77 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACED FILTERS, | 775.97 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | REPLACE 1" DUMP | 175.49 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | TIE CASING INTO | 263.23 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | START BACK PSI | 701.95 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | FINISH BACK PSI | 263.23 |

|

| 6/21/2013 | 215920 | C & C Oilfield Services, LLC | FILL IN HOLES ON | 142.33 |

|

| 6/21/2013 | 215921 | C.L. Frates & Company | INSURANCE | 9,744.00 |

|

| 6/21/2013 | 215922 | CAMERON SURFACE SYSTEMS | GATE VALVE ASSY, H2 | 47,244.04 |

|

| 6/21/2013 | 215923 | Canon Financial Services, Inc. | GRAPHICS EQUIPMENT | 268.46 |

|

| 6/21/2013 | 215924 | Century Link | LONG DISTANCE | 402.19 |

|

| 6/21/2013 | 215925 | Chapter 13 Office | GARNISHMENT | 808.62 |

|

| 6/21/2013 | 215926 | Cintas Corporation | FLOOR MATS | 155.38 |

|

| 6/21/2013 | 215926 | Cintas Corporation | UNIFORMS | 305.67 |

|

| 6/21/2013 | 215927 | Citrix Online, LLC | GOTOMEETING | 195.00 |

|

| 6/21/2013 | 215928 | Comcast Cable | CABLE - 06/20-07/19 | 93.26 |

|

| 6/21/2013 | 215929 | Consolidated Tax Service, LLP | 3RD QTR 2013 | 1,250.00 |

|

| 6/21/2013 | 215930 | Crowe & Dunlevy, P.C. | EMPLOYMENT PRACTICES | 116.00 |

|

| 6/21/2013 | 215931 | DAIOHS, USA Inc | COFFEE, SUGAR & | 247.11 |

|

| 6/21/2013 | 215932 | Darrell Hardy | MEALS | 38.56 |

|

| 6/21/2013 | 215932 | Darrell Hardy | OSCPA DUES FOR | 230.00 |

|

| 6/21/2013 | 215932 | Darrell Hardy | Mgmt mtg | 293.35 |

|

| 6/21/2013 | 215933 | Estill, Hardwick, Gable Hall | PROFESSIONAL | 25,845.55 |

|

| 6/21/2013 | 215934 | Federal Express Corporation | POSTAGE | 26.37 |

|

| 6/21/2013 | 215935 | Globe Energy Services, LLC | 130 BBLS SWD | 1,869.10 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/21/2013 | 215935 | Globe Energy Services, LLC | 240 BBLS SWD | 564.00 |

|

| 6/21/2013 | 215935 | Globe Energy Services, LLC | 260 BBLS SWD | 1,560.00 |

|

| 6/21/2013 | 215935 | Globe Energy Services, LLC | HAUL LOAD OF S/W TO | 87.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 140 BBLS SWD | 154.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 250 BBLS SWD | 1,062.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | SITE WORK | 240.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 375 BBLS SWD | 1,312.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 500 BBLS SWD | 550.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | CLEAN UP | 570.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 265 BBLS SWD | 291.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 795 BBLS SWD | 874.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 935 BBLS SWD | 1,028.50 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 670 BBLS SWD | 871.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 530 BBLS SWD | 1,113.00 |

|

| 6/21/2013 | 215936 | JNS Trucking, Inc. | 545 BBLS SWD | 572.25 |

|

| 6/21/2013 | 215937 | James Merrill | OSCPA DUES | 230.00 |

|

| 6/21/2013 | 215937 | James Merrill | DINNER W/ MARK | 933.40 |

|

| 6/21/2013 | 215937 | James Merrill | AIRFARE & HOTEL FOR | 1,389.30 |

|

| 6/21/2013 | 215938 | Jennifer Mrozinski | REIMBURSE TUITION | 2,500.00 |

|

| 6/21/2013 | 215939 | MBI Energy Rentals | TANK RENTAL APRIL | 3,465.00 |

|

| 6/21/2013 | 215940 | MCKENZIE ELECTRIC | Utilities | 407.44 |

|

| 6/21/2013 | 215941 | MDU Resources Group, Inc. | ELECTRIC | 372.69 |

|

| 6/21/2013 | 215942 | McJunkin Red Man Corporation | MISC FITTINGS | 188.84 |

|

| 6/21/2013 | 215943 | McKENZIE COUNTY COURTHOUSE | RECORDING | 47.00 |

|

| 6/21/2013 | 215944 | Mclain-Chitwood Office Prods | OFFICE SUPPLIES | 121.91 |

|

| 6/21/2013 | 215945 | Michael L. Young | OSCPA DUES & CO | 260.00 |

|

| 6/21/2013 | 215946 | Mimecast North America, Inc. | UEM ENTERPRISE, | 1,300.00 |

|

| 6/21/2013 | 215947 | NCH Corporation | CORROSION INHIBITOR | 5,772.76 |

|

| 6/21/2013 | 215947 | NCH Corporation | CORROSION INHIBITOR | 11,466.90 |

|

| 6/21/2013 | 215947 | NCH Corporation | FOAMING AGENT | 1,008.57 |

|

| 6/21/2013 | 215947 | NCH Corporation | H2S SCAVENGER | 3,014.98 |

|

| 6/21/2013 | 215947 | NCH Corporation | PARAFFIN CONTROL | 1,828.99 |

|

All Disbursements for the Current Reporting Month

|

| | | | | |

| Check Date | Check No | Vendor Name | Description | Transaction Amt on Check |

| 6/21/2013 | 215947 | NCH Corporation | SCALE INHIBITOR | 5,429.84 |

|

| 6/21/2013 | 215947 | NCH Corporation | SURFACTANT | 626.93 |

|

| 6/21/2013 | 215948 | North Dakota Department of | PROCESSING FEE | 40.00 |

|

| 6/21/2013 | 215949 | Petroleum Club | JUNE 2013 DUES - | 37.50 |

|

| 6/21/2013 | 215950 | Pitney Bowes Global Financial | POSTAGE MACHINE | 160.24 |

|

| 6/21/2013 | 215951 | QUINN PUMPS NORTH DAKOTA, INC. | SERVICE CHARGE | 250.00 |

|

| 6/21/2013 | 215951 | QUINN PUMPS NORTH DAKOTA, INC. | REPAIR PUMP | 7,159.86 |

|

| 6/21/2013 | 215951 | QUINN PUMPS NORTH DAKOTA, INC. | 1-1/2" DURA GOLD | 2,450.81 |

|

| 6/21/2013 | 215952 | Railroad Commission Of Texas | P-5 ANNUAL REFILING | 562.50 |

|

| 6/21/2013 | 215953 | Lexisnexis | ONLINE & RELATED | 84.00 |

|

| 6/21/2013 | 215954 | Rollie G. Farris | Geological Consulting | 8,550.00 |

|

| 6/21/2013 | 215955 | SBG GRASSY BUTTE LLC | HAUL PRODUCTION | 5,280.00 |

|

| 6/21/2013 | 215956 | SBG GREEN RIVER, LLC | HAUL PRODUCTION | 1,636.50 |

|

| 6/21/2013 | 215957 | STATE OF NORTH DAKOTA | PENALTY | 54.80 |

|

| 6/21/2013 | 215958 | Shred-It USA - Denver | SHREDDING | 96.32 |

|

| 6/21/2013 | 215959 | Solium Capital LLC | SELF-SERVE PRIMARY | 1,148.42 |

|

| 6/21/2013 | 215960 | Toledo Automotive Supply, Inc. | VEHICLE MAINT - | 167.45 |

|

| 6/21/2013 | 215960 | Toledo Automotive Supply, Inc. | STICK HOSE | 22.46 |

|

| 6/21/2013 | 215961 | Tres Management Inc. | ENGINEERING | 7,786.94 |

|

| 6/21/2013 | 215962 | United Parcel Service, Inc. | POSTAGE | 215.52 |

|

| 6/21/2013 | 215963 | GE Capital | COPIER RENTALS | 11,149.64 |

|

| 6/21/2013 | 215964 | Victoria Foster | WEBSTER PARISH | 54.00 |

|

| 6/21/2013 | 215965 | WOLF PETROLEUM SERVICES, LLC | SWABBING | 5,604.00 |

|

| 6/28/2013 | 215966 | AT&T Corp | Telephone | 79.85 |

|

| 6/28/2013 | 215967 | Answer Phone | ANSWERING SERVICE | 75.00 |

|

| 6/28/2013 | 215968 | BLACKHAWK ENERGY SERVICES, INC | W/O RIG | 3,975.00 |

|

| 6/28/2013 | 215968 | BLACKHAWK ENERGY SERVICES, INC | WORKOVER RIG | 41,583.20 |

|

| 6/28/2013 | 215969 | Century Link | Telephone | 75.70 |

|

| 6/28/2013 | 215970 | Cintas Corporation | UNIFORMS | 611.32 |

|

| 6/28/2013 | 215971 | Denny's Electric and Motor | PRODUCTION PANEL | 15,330.00 |

|

| 6/28/2013 | 215972 | Eastern Colorado Well | N/UP RIH GET ON | 31,231.00 |

|