Exhibit 99.3

|

| | | | | | |

| UNITED STATES BANKRUPTCY COURT |

| FOR THE DISTRICT OF |

| | | | | | | |

| IN RE: | | | | } | CASE NUMBER | |

| | | | | } | 13-11458 | |

| | | | | } | | |

| | | | | } | | |

| | | | | } | | |

| DEBTOR(S) | Endeavor Pipeline Inc. | } | CHAPTER 11 | |

| | | | | | | |

| | | | | | | |

| DEBTOR'S STANDARD MONTHLY OPERATING REPORT (BUSINESS) |

| | | | | | | |

| FOR THE PERIOD |

| | | FROM | June 1, 2013 | TO | June 30, 2013 | |

| | | | | | | |

| Comes now the above-named debtor and files its Monthly Operating Reports in accordance with the Guidelines established by the United States Trustee and FRBP 2015. |

| | | | | | | |

| | | | | | /s/ William H. Hoch |

| | | | | | Attorney for Debtor's Signature |

| | | | | | | |

|

| |

| Debtor's Address and Phone Number: | Attorney's Address and Phone Number: |

| Endeavor Pipeline Inc. | Crowe & Dunlevy |

| 9400 N. Broadway, Suite 600 | 20 North Broadway, Suite 1800 |

| Oklahoma City, OK 73114 | Oklahoma City, OK 73102 |

| 405-600-0711 | 405-235-7700 |

|

| | | | |

| Note: The original Monthly Operating Report is to be filed with the court and a copy simultaneously provided to the United States Trustee Office. Monthly Operating Reports must be filed by the 21st day of the following month. |

| | | | | |

| For assistance in preparing the Monthly Operating Report, refer to the following resources on the United States Trustee Program Website, http://www.justice.gov/ust/r20/index.htm. |

| | | | | |

| 1. | Instructions for Preparations of Debtor’s Chapter 11 Monthly Operating Report |

| 2. | Initial Filing Requirements |

| 3. | Frequently Asked Questions (FAQs) |

SCHEDULE OF RECEIPTS AND DISBURSEMENTS

FOR THE PERIOD BEGINNING June 1, 2013 AND ENDING June 30, 2013

Name of Debtor: Endeavor Pipeline Inc. Case Number 13-11458

Date of Petition: April 1, 2013

|

| | | | | | |

|

| CURRENT MONTH |

| CUMULATIVE PETITION TO DATE |

| 1. | FUNDS AT BEGINNING OF PERIOD | 4,781,508 |

|

| 1,361,471 |

|

| 2. | RECEIPTS: |

|

|

|

| A. Cash Sales | — |

|

| — |

|

| Minus: Cash Refunds | — |

|

| — |

|

| Net Cash Sales | — |

|

| — |

|

| B. Accounts Receivable | 3,763,951 |

|

| 12,035,356 |

|

| C. Other Receipts (See MOR-3) | 1,569,698 |

|

| 1,572,513 |

|

| 3. | TOTAL RECEIPTS (Lines 2A+2B+2C) | 5,333,649 |

|

| 13,607,869 |

|

| 4. | TOTAL FUNDS AVAILABLE FOR OPERATIONS (Line 1 + Line 3) | 10,115,157 |

|

| 14,969,340 |

|

| 5. | DISBURSEMENTS |

|

|

|

| A. Advertising | — |

|

| — |

|

| B. Bank Charges | — |

|

| — |

|

| C. Contract Labor | — |

|

| — |

|

| D. Fixed Asset Payments (not incl. in “N”) | — |

|

| — |

|

| E. Insurance | — |

|

| — |

|

| F. Inventory Payments (See Attach. 2) | — |

|

| — |

|

| G. Leases | — |

|

| — |

|

| H. Manufacturing Supplies | — |

|

| — |

|

| I. Office Supplies | — |

|

| — |

|

| J. Payroll - Net (See Attachment 4B) | 48,043 |

|

| 179,359 |

|

| K. Professional Fees (Accounting & Legal) | — |

|

| — |

|

| L. Rent | — |

|

| — |

|

| M. Repairs & Maintenance | — |

|

| — |

|

| N. Secured Creditor Payments (See Attach. 2) | — |

|

| — |

|

| O. Taxes Paid - Payroll (See Attachment 4C) | 20,236 |

|

| 75,492 |

|

| P. Taxes Paid - Sales & Use (See Attachment 4C) | — |

|

| — |

|

| Q. Taxes Paid - Other (See Attachment 4C) | — |

|

| — |

|

| R. Telephone | — |

|

| — |

|

| S. Travel & Entertainment | — |

|

| — |

|

| Y. U.S. Trustee Quarterly Fees | — |

|

| — |

|

| U. Utilities | — |

|

| — |

|

| V. Vehicle Expenses | — |

|

| — |

|

| W. Other Operating Expenses (See MOR-3) | 3,993,239 |

|

| 8,660,850 |

|

| 6. | TOTAL DISBURSEMENTS (Sum of 5A thru W) | 4,061,518 |

|

| 8,915,701 |

|

| 7. | ENDING BALANCE (Line 4 Minus Line 6) | 6,053,639 |

|

| 6,053,639 |

|

I declare under penalty of perjury that this statement and the accompanying documents and reports are true and correct to the best of my knowledge and belief.

|

| |

This 25th day of July, 2013 | /s/ James A. Merrill |

| | James A. Merrill, Vice President and Secretary |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This figure will not change from month to month. It is always the amount of funds on hand as of the date of the petition.

(c)These two amounts will always be the same if form is completed correctly.

MONTHLY SCHEDULE OF RECEIPTS AND DISBURSEMENTS (cont’d)

Detail of Other Receipts and Other Disbursements

OTHER RECEIPTS:

Describe Each Item of Other Receipt and List Amount of Receipt. Write totals on Page MOR-2, Line 2C.

|

| | | | | | | |

| Description | | CURRENT MONTH |

| CUMULATIVE PETITION TO DATE |

| Miscellaneous refunds | |

|

| $ | 2,815 |

|

| Reimbursement from GMX Resources Inc. | | 1,569,698 |

|

| 1,569,698 |

|

| Total | |

|

| $ | 1,572,513 |

|

| | |

|

|

|

| | |

|

|

|

| | |

|

|

|

“Other Receipts” includes Loans from Insiders and other sources (i.e. Officer/Owner, related parties directors, related corporations, etc.). Please describe below:

|

| | | | | | |

| Loan Amount | | Source of Funds | | Purpose | | Repayment Schedule |

| N/A | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

OTHER DISBURSEMENTS:

Describe Each Item of Other Disbursement and List Amount of Disbursement. Write totals on Page MOR-2, Line 5W.

|

| | | | | |

| Description | CURRENT MONTH |

| CUMULATIVE PETITION TO DATE |

| Distribution to Endeavor Gathering LLC for services and contractual fees | 246,260 |

|

| 841,171 |

|

| Payment of monthly Volumetric Production Payment | 875,363 |

|

| 1,809,409 |

|

| Payment to Texas Railroad Commisstion in lieu of letter of credit | 25,000 |

|

| 25,000 |

|

| Intercompany transfer to GMX Resources Inc. | — |

|

| 857,840 |

|

| Intercompany transfer to GMX Resources Inc. ("GMX") for natural gas sales | 2,846,616 |

|

| 5,127,430 |

|

| Total | 3,993,239 |

|

| 8,660,850 |

|

NOTE: Attach a current Balance Sheet and Income (Profit & Loss) Statement. See Exhibit I Attached

ATTACHMENT 1

MONTHLY ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

ACCOUNTS RECEIVABLE AT PETITION DATE: $(14,819,192)

ACCOUNTS RECEIVABLE RECONCILIATION

(Include all accounts receivable, pre-petition and post-petition, including charge card sales which have not been received):

|

| | | | | | | | | | | | | | | | | | | |

| Oil & Gas Sales |

| Joint Interest Billing |

| Other Accounts Receivable (1) |

| Intercompany Receivable/Payable (2) |

| Total |

| Beginning of Month Balance (a) | $ | 4,139,175 |

|

| $ | — |

|

| $ | 65,572 |

|

| $ | 2,236,997 |

|

| $ | 6,441,744 |

|

| Plus: Current Month New Billings (b) | $ | 3,928,303 |

|

| $ | — |

|

| $ | 20,626 |

|

| $ | (37,426 | ) |

| $ | 3,911,503 |

|

| Minus: Collection During Month | $ | (3,763,951 | ) |

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | (3,763,951 | ) |

| Minus: Revenue Netting | $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| Plus/Minus: Adjustments or Writeoffs | $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| End of Month Balance (c) | $ | 4,303,527 |

|

| $ | — |

|

| $ | 86,198 |

|

| $ | 2,199,571 |

|

| $ | 6,589,296 |

|

(1) Other accounts receivable contains accounts receivable due from/due to a third party for salt water disposal involving and other miscellaneous receivables/payables.

(2) Intercompany Receivable/Payable includes amounts due to or due from Endeavor Gathering LLC, which is a subsidiary of the Company that is not part of the consolidated bankruptcy filing.

*For any adjustments or Write-offs provide explanation and supporting documentation, if applicable: N/A

Adjustments include reclass of intercompany accounts.

POST PETITION ACCOUNTS RECEIVABLE AGING

(Show the total for each aging category for all accounts receivable)

|

| | | | | | | | | | | | | | | | | | | | |

| | 0-30 Days |

| 31-60 Days |

| 61-90 Days |

| Over 90 Days |

| Total |

| Oil & Gas Sales - For the current reporting month | | $ | 3,908,877 |

|

| $ | 389,751 |

|

| $ | — |

|

| $ | — |

|

| $ | 4,298,628 |

|

| Other Accounts Receivable | | $ | 15,997 |

|

| $ | 20,385 |

|

| $ | 15,856 |

|

| $ | — |

|

| $ | 52,238 |

|

| Intercompany Receivable/Payable | | $ | 1,678 |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | 1,678 |

|

For any receivables in the “Over 90 Days” category, please provide the following:

|

| | | | |

| Customer |

| Receivable Date |

| Status |

| N/A |

| N/A |

| N/A |

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)This must equal the number reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 2B).

(c)These two amounts must equal.

ATTACHMENT 2

MONTHLY ACCOUNTS PAYABLE AND SECURED PAYMENTS REPORT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

In the space below list all invoices or bills incurred and not paid since the filing of the petition. Do not include amounts owed prior to filing the petition. In the alternative, a computer generated list of payables may be attached provided all information requested below is included.

POST-PETITION ACCOUNTS PAYABLE

Date Days

| |

Incurred | Outstanding Vendor Description Amount |

N/A - All disbursements other than payroll flow through the GMX operating account and any outstanding payables or related payments are reflected in the intercompany balances between GMX and Endeavor Pipeline Inc.

þ Check here if pre-petition debts have been paid. Attach an explanation and copies of supporting documentation.

The Company paid $2,280,814 in pre-petition debts to GMX Resources Inc. for the purchase of natural gas and natural gas liquids ("NGL") production.

ACCOUNTS PAYABLE RECONCILIATION (Post Petition Unsecured Debt Only)

|

| |

| Opening Balance (a) | $— |

| PLUS: New Indebtedness Incurred This Month | $— |

| MINUS: Amount Paid on Post Petition Accounts Payable This Month | $— |

| PLUS/MINUS: Adjustments * | $— |

| Ending Month Balance (c) | $— |

*For any adjustments provide explanation and supporting documentation, if applicable.

SECURED PAYMENTS REPORT

List the status of Payments to Secured Creditors and Lessors (Post Petition Only). If you have entered into a modification agreement with a secured creditor/lessor, consult with your attorney and the United States Trustee Program prior to completing this section).

|

| | | | | | | | |

| Secured Creditor/Lessor |

| Date Payment Due This Month |

| Amount Paid This Month |

| Number of Post Petition Payments Delinquent |

| Total Amount of Post Petition Payments Delinquent |

| N/A | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL (d) | | | | | | | | |

(a)This number is carried forward from last month’s report. For the first report only, this number will be zero.

(b, c)The total of line (b) must equal line (c).

(d)This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements (Page MOR-2, Line 5N).

ATTACHMENT 3

INVENTORY AND FIXED ASSETS REPORT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

INVENTORY REPORT

Note: EPL does not have inventory.

|

| |

| Inventory Balance at Petition Date: | N/A |

| Inventory Reconciliation: | N/A |

| Inventory Balance at Beginning of Month | |

| Plus: Inventory Purchased During Month | |

| Minus: Inventory Used or Sold | |

| Plus/Minus: Adjustments or Write-downs | |

| Inventory on Hand at End of Month | N/A |

METHOD OF COSTING INVENTORY: N/A

*For any adjustments or write-downs provide explanation and supporting documentation, if applicable. N/A

INVENTORY AGING

|

| | | | | | | | |

| Less than 6 months old | | 6 months to 2 years old | | Greater than 2 years old | | Considered Obsolete | | Total Inventory |

| N/A | | N/A | | N/A | | N/A | | N/A |

* Aging Percentages must equal 100%.

o Check here if inventory contains perishable items.

Description of Obsolete Inventory: N/A

FIXED ASSET REPORT

FIXED ASSETS FAIR MARKET VALUE AT PETITION DATE (b): Fair market value of fixed assets at petition date is not available.

(Includes Property, Plant and Equipment)

BRIEF DESCRIPTION (First Report Only): Fixed assets include the Company's property, equipment and pipe used for salt water disposal and delivery of fresh water.

|

| | | |

| Fixed Asset Reconciliation: |

|

|

| Fixed Asset Book Value at Beginning of Month (a) (b) | $ | 4,095,752 |

|

| Minus: Depreciation Expense | $ | (59,693 | ) |

| Plus: New Purchases | $ | — |

|

| Plus/Minus: Adjustments or Write-downs * | $ | — |

|

| Ending Monthly Balance | $ | 4,036,059 |

|

*For any adjustments or write-downs, provide explanation and supporting documentation, if applicable. N/A

BRIEF DESCRIPTION OF FIXED ASSETS PURCHASED OR DISPOSED OF DURING THE REPORTING PERIOD: N/A

(a)This number is carried forward from last month’s report. For the first report only, this number will be the balance as of the petition date.

(b)Fair Market Value is the amount at which fixed assets could be sold under current economic conditions. Book Value is the cost of the fixed assets minus accumulated depreciation and other adjustments.

ATTACHMENT 4A

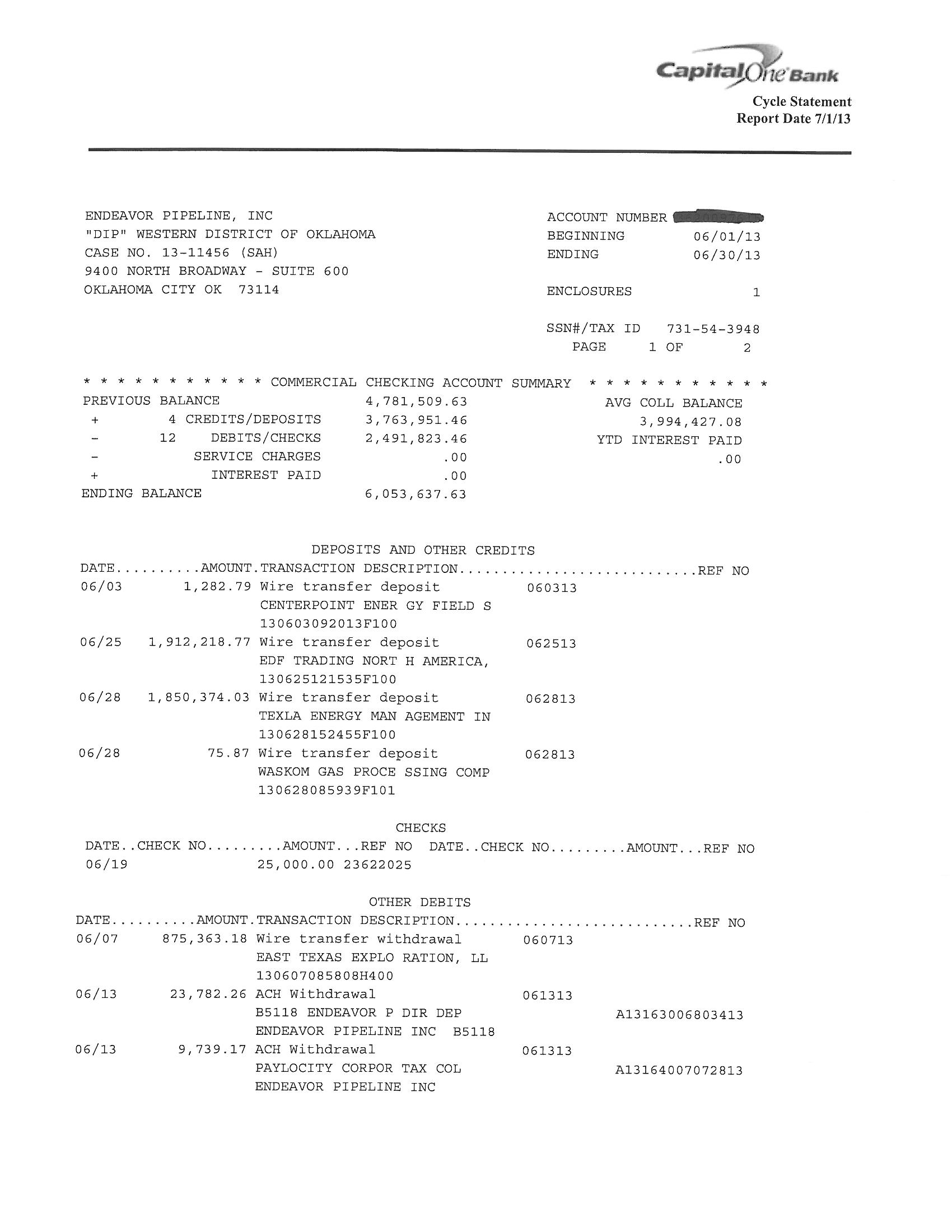

MONTHLY SUMMARY OF BANK ACTIVITY - OPERATING ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity (See Exhibit III). A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm. If bank accounts other than the three required by the United States Trustee Program are necessary, permission must be obtained from the United States Trustee prior to opening the accounts. Additionally, use of less than the three required bank accounts must be approved by the United States Trustee.

|

| | | |

| Name of Bank: | Capital One Bank | Branch: | N/A |

| Account Name: | EPL Operating Account | Account Number: | XXXXXX7615 |

PURPOSE OF ACCOUNT: OPERATING

|

| |

| Ending Balance per Bank Statement | $6,053,638 |

| Plus: Total Amount of Outstanding Deposits | — |

| Minus: Total Amount of Outstanding Checks and Other Debits * | — |

| Minus Service Charges | — |

| Ending Balance per Check Register **(a) | $6,053,638 |

*Debit cards are used by: N/A

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid in Cash (do not includes items reported as Petty Cash on Attachment 4D: ( o Check here if cash disbursements were authorized by United States Trustee)

Date Amount Payee Purpose Reason for Cash Disbursement

N/A - No disbursements were paid in Cash

TRANSFERS BETWEEN DEBTOR IN POSSESSION ACCOUNTS

“Total Amount of Outstanding Checks and other debits”, listed above, includes:

$____N/A________Transferred to Payroll Account

$____N/A________Transferred to Tax Account

(a) The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5A

CHECK REGISTER - OPERATING ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

NAME OF BANK: Capital One Bank BRANCH: N/A

ACCOUNT NAME: EPL Operating Account

ACCOUNT NUMBER: XXXXXXX7615

PURPOSE OF ACCOUNT: OPERATING

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

ATTACHMENT 4B

MONTHLY SUMMARY OF BANK ACTIVITY - PAYROLL ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found at http://www.justice.gov/ust/r20/index.htm.

Note: The Company uses a payroll service (Paylocity) to provide payroll and does not have a separate payroll account. Total bi-weekly payroll amounts for the Company are drafted from the operating account by the payroll service and those withdrawals are included in the disbursements section of the Company's operating account.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: PAYROLL

Ending Balance per Bank Statement $ N/A

| |

| Plus Total Amount of Outstanding Deposits | $ N/A |

| |

| Minus Total Amount of Outstanding Checks and other debits | $ N/A * |

| |

| Minus Service Charges | $ N/A |

Ending Balance per Check Register $ N/A **(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid by Cash: ( o Check here if cash disbursements were authorized by United States Trustee)

Date Amount Payee Purpose Reason for Cash Disbursement

N/A

The following non-payroll disbursements were made from this account:

Date Amount Payee Purpose Reason for disbursement from this account

N/A

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5B

CHECK REGISTER - PAYROLL ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Note: The Company uses a payroll service (Paylocity) to service payroll and does not have a separate payroll account. The total funds are drafted from the parent company operating account by the payroll service and those withdrawals are included as an intercompany payable to the parent company.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A

ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: PAYROLL

Account for all disbursements, including voids, lost payments, stop payment, etc. In the alternative, a computer generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

ATTACHMENT 4C

MONTHLY SUMMARY OF BANK ACTIVITY - TAX ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Attach a copy of current month bank statement and bank reconciliation to this Summary of Bank Activity. A standard bank reconciliation form can be found on the United States Trustee website, http://www.justice.gov/ust/r20/index.htm.

Note: The Company does not have a separate check register related to taxes. Payroll taxes are paid through the operating account. See taxes paid below.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT NUMBER: N/A

PURPOSE OF ACCOUNT: TAX

| |

| Ending Balance per Bank Statement | $ N/A |

Plus Total Amount of Outstanding Deposits $ N/A

Minus Total Amount of Oustanding Checks and other debits $ N/A *

Minus Service Charges $ N/A

Ending Balance per Check Register $ N/A **(a)

*Debit cards must not be issued on this account.

**If Closing Balance is negative, provide explanation: N/A

The following disbursements were paid by Cash: ( ☐ Check here if cash disbursements were authorized by

United States Trustee)

| |

| Date | Amount Payee Purpose Reason for Cash Disbursement |

N/A

The following non-tax disbursements were made from this account:

| |

| Date | Amount Payee Purpose Reason for disbursement from this account |

N/A

(a)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as

“Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 5C

CHECK REGISTER - TAX ACCOUNT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Note: The Company does not have a separate check register related to taxes. Payroll taxes are paid through the operating account. See taxes paid below.

NAME OF BANK: N/A BRANCH: N/A

ACCOUNT NAME: N/A ACCOUNT # N/A

PURPOSE OF ACCOUNT: TAX

Account for all disbursements, including voids, lost checks, stop payments, etc. In the alternative, a computer-generated check register can be attached to this report, provided all the information requested below is included.

CHECK

DATE NUMBER PAYEE PURPOSE AMOUNT

SUMMARY OF TAXES PAID

|

| |

| Payroll Taxes Paid (a) | $33,557 |

| Sales & Use Taxes Paid (b) | $— |

| Other Taxes Paid (c) | $— |

| Total (d) | $33,557 |

(a) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5O).

(b) This number is reported in the “Current Month” column of Schedule or Receipts and Disbursements

(Page MOR-2, Line 5P).

(c) This number is reported in the “Current Month” column of Schedule of Receipts and Disbursements

(Page MOR-2, Line 5Q).

(d) These two lines must be equal.

ATTACHMENT 4D

INVESTMENT ACCOUNTS AND PETTY CASH REPORT

INVESTMENT ACCOUNTS

Each savings and investment account, i.e. certificates of deposits, money market accounts, stocks and bonds, etc., should be listed separately. Attach copies of account statements.

|

| | | | | | | | |

| Instrument | | Face Value | | Purchase Price | | Date of Purchase | | Current Market Value |

| N/A | | | | | | | | |

| | | | | | | | | |

| Total (a) | | | | | | | | |

PETTY CASH REPORT

The following Petty Cash Drawers/Accounts are maintained:

|

| | | | | | |

| | | (Column 2) | | (Column 3) | | (Column 4) |

| Location of Box/Account | | Maximum Amount of Cash in Drawer/Acct | | Amount of Petty Cash on Hand at End of Month | | Difference between (Column 2) and (Column 3) |

| N/A | | | | | | |

| Total (b) | | | | | | |

For any Petty Cash Disbursements over $100 per transaction, attach copies of receipts. If there are no receipts, provide an explanation:

N/A

|

| | |

| Total Investments Accounts and Petty Cash (a + b) (c) | | N/A |

(c)The total of this line on Attachment 4A, 4B and 4C plus the total of 4D must equal the amount reported as “Ending Balance” on Schedule of Receipts and Disbursements (Page MOR-2, Line 7).

ATTACHMENT 6

MONTHLY TAX REPORT

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

TAXES OWED AND DUE

Report all unpaid post-petition taxes including Federal and State withholding FICA, State sales tax, property tax, unemployment tax, State workmen's compensation, etc.

|

| | | | | | | | | | |

| Name of Taxing Authority |

| Date Payment Due |

| Description |

| Amount |

| Date Last Tax Return File |

| Tax Return Period |

| Harrison Central |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| Unknown |

| 4/15/2013 |

| Year of 2013 |

| Harrison County |

| 1/31/2014 |

| Estimated Ad Valorem Taxes |

| Unknown |

| 4/15/2013 |

| Year of 2013 |

ATTACHMENT 7

SUMMARY OF OFFICER OR OWNER COMPENSATION

SUMMARY OF PERSONNEL AND INSURANCE COVERAGES

Name of Debtor: Endeavor Pipeline Inc. Case Number: 13-11458

Reporting Period beginning June 1, 2013 Period ending June 30, 2013

Report all forms of compensation received by or paid on behalf of the Officer or Owner during the month. Include car allowances, payments to retirement plans, loan repayments, payments of Officer/Owner’s personal expenses, insurance premium payments, etc. Do not include reimbursement for business expenses Officer or Owner incurred and for which detailed receipts are maintained in the accounting records.

|

| | | | | | | | |

| Name of Officer or Owner |

| Title |

| Description |

| Amount Paid |

| Gilbert Keith Leffel |

| President Endeavor Pipeline |

| Salary |

| $ | 19,375 |

|

|

|

|

| Non-Cash Restricted Stock Vesting |

| $ | 240 |

|

PERSONNEL REPORT

|

| | | | |

|

| Full Time |

| Part Time |

| Number of employees at beginning of period |

| 8 |

| — |

| Number hired during the period |

| — |

| — |

| Number terminated or resigned during the period |

| — |

| — |

| Number of employees on payroll at end of period |

| 8 |

| — |

CONFIRMATION OF INSURANCE

List all policies of insurance in effect, including but not limited to workers' compensation, liability, fire, theft, comprehensive, vehicle, health and life. For the first report, attach a copy of the declaration sheet for each type of insurance. For subsequent reports, attach a certificate of insurance for any policy in which a change occurs during the month (new carrier, increased policy limits, renewal, etc.).

|

| | | | | | | | | | |

| Agent and/or Carrier |

| Phone Number |

| Policy Number |

| Coverage Type |

| Expiration Date |

| Premium Due Date |

| Chubb Group of Insurance Companies (Federal Insurance Company) 15 Mountain View Road Warren NJ 07059 |

| 908-903-2000 |

| 35863507 |

| Insurance policy covering property, general liability, inland marine, pollution, commercial auto and umbrella liability |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| Great American Insurance Company 301 E. 4th Street Cincinnati, OH 45202 |

| 513-369-5000 |

| IMP847592804 |

| Insurance Policy covering equipment floater on owned pipe |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| First Mercury Insurance Company 26600 Telegraph Road Southfield MI 48033 |

| 248-358-4010 |

| TXEX000000598201 |

| Insurance policy covering commerical excess liability |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| National Union Fire Ins. Co. C/O Chartis 175 Water Street, 9th Floor NY, NY 10038 |

| 212-770-7000 |

| 17180256 |

| Directors and officers liability insurance |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| US Speciality Insurance Company 8144 Walnut Hill Lane Dallas TX 75231 |

| 713-744-3700 |

| 14MGU13A28644 |

| Excess directors and officers liability insurance |

| 2/17/2014 |

| N/A, all premiums have been paid in full |

| Zurich American Insurance Co. 1400 American Lane Schaumburg, IL 60195 |

| 1-800-987-3373 |

| WC9280982 |

| Workers compensation and employers liability |

| 12/22/2013 |

| N/A, all premiums have been paid in full |

| Travelers Casualty and Surety Company of America One Town Square, Hartford, CT 06183 |

| 1-800-842-5075 |

| 105536833 |

| Crime, fidelity insurance, employment practices & fiduciary liability |

| 12/22/2013 |

| N/A, all premiums have been paid in full |

| Lincoln National Life Insurance Company 8801 Indian Hills Drive Omaha NE 68114 |

| 402-361-7300 |

| 403001143 |

| Group term life; accidental death & dismemberment and short-term disability |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| Vision Services Plan, Inc. Oklahoma |

| 918-398-2600 |

| 30010641 |

| Employee vision insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| BlueCross BlueShield of Oklahoma |

| 1-800-942-5837 |

| Y01585 |

| Group health insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

| Delta Dental |

| 405-607-2100 |

| 939600001 |

| Group dental insurance |

| 10/31/2013 |

| N/A, all premiums have been paid in full |

The following lapse in insurance coverage occurred this month:

|

| | | | | | |

| Policy Type | | Date Lapsed | | Date Reinstated | | Reason for Lapse |

| N/A | | | | | | |

Check here if U. S. Trustee has been listed as Certificate Holder for all insurance policies.

ATTACHMENT 8

SIGNIFICANT DEVELOPMENTS DURING REPORTING PERIOD

Information to be provided on this page, includes, but is not limited to: (1) financial transactions that are not reported on this report, such as the sale of real estate (attach closing statement); (2) non-financial transactions, such as the substitution of assets or collateral; (3) modifications to loan agreements; (4) change in senior management, etc. Attach any relevant documents.

N/A

We anticipate filing a Plan of Reorganization and Disclosure Statement on or before (see note below) .

Note: The Company is conducting a 363 asset sale. The Asset Purchase Agreement was signed May 15, 2013.

Exhibit I

Endeavor Pipeline Inc.

Balance Sheet

|

| | | |

| ASSETS | |

| | June 30, 2013 |

| CURRENT ASSETS: | |

| Cash and cash equivalents | $ | 6,053,638 |

|

| Accounts receivable - interest owners | 86,198 |

|

| Accounts receivable - oil and natural gas revenues | 4,303,526 |

|

| Accounts receivable - intercompany | 2,199,571 |

|

| Prepaid expenses and deposits | 26,144 |

|

| Total current assets | 12,669,077 |

|

| | |

| PROPERTY AND EQUIPMENT, AT COST, NET | 4,036,059 |

|

| | |

| TOTAL ASSETS | $ | 16,705,136 |

|

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| CURRENT LIABILITIES | |

| Accounts payable - Intercompany | $ | 31,792,139 |

|

| Other Accrued Expenses | 4,233,967 |

|

| Total current liabilities | 36,026,106 |

|

| | |

| Shareholders' equity | (19,320,970 | ) |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 16,705,136 |

|

Endeavor Pipeline Inc.

Income Statement

|

| | | |

| | Month Ending |

| | June 30, 2013 |

| | |

| REVENUES | |

| Gas Marketing | $ | 57,463 |

|

| Salt Water Disposal | 26,514 |

|

| Gathering | 1,910 |

|

| Compression Income | 5,695 |

|

| TOTAL REVENUES | 91,582 |

|

| | |

| COSTS AND EXPENSES | |

| Lease operating | 636,075 |

|

| Transportation and gathering | 15,479 |

|

| Production taxes | — |

|

| Depreciation, depletion and amortization | 59,693 |

|

| Impairment of natural gas and oil properties and other fixed assets | — |

|

| General and administrative | 85,586 |

|

| Total expenses | 796,833 |

|

| | |

| OPERATING INCOME | (705,251 | ) |

| | |

| NON-OPERATING INCOME (EXPENSE) | |

| Interest expense | — |

|

| Interest and other income | — |

|

| Total non-operating expense | — |

|

| | |

| Income (loss) before income taxes | (705,251 | ) |

| | |

| PROVISION (BENEFIT) FOR INCOME TAXES | — |

|

| | |

| NET INCOME (LOSS) | $ | (705,251 | ) |

Exhibit II

|

| | | | | | |

| DATE | CHECK NUMBER | PAYEE | PURPOSE | AMOUNT |

| 6/7/2013 | WIRE | EAST TEXAS EXPLORATION | APRIL 2013 GAS PURCHASES | 875,363.18 |

|

| 6/13/2013 | WIRE | PAYLOCITY | PAYROLL | 23,782.26 |

|

| 6/13/2013 | WIRE | PAYLOCITY | TAXES & TRUST | 9,739.17 |

|

| 6/13/2013 | WIRE | PAYLOCITY | TAXES & TRUST | $ | 276.92 |

|

| 6/14/2013 | WIRE | PAYLOCITY | TAXES & TRUST | 191.96 |

|

| 6/17/2013 | WIRE | XFER TO GMX | INTERCO. TRANSFER | $ | 1,276,919.00 |

|

| 6/19/2013 | Cashiers Check | TEXAS RAILROAD COMMISSON | CASH DEPOSIT IN LIEU OF LOC | 25,000.00 |

|

| 6/27/2013 | WIRE | PAYLOCITY | PAYROLL | 24,260.82 |

|

| 6/27/2013 | WIRE | PAYLOCITY | TAXES & TRUST | 9,653.72 |

|

| 6/27/2013 | WIRE | PAYLOCITY | TAXES & TRUST | $ | 276.92 |

|

| 6/28/2013 | WIRE | XFER TO EGG | | 246,259.83 |

|

| 6/28/2013 | WIRE | PAYLOCITY | TAXES & TRUST | 100.00 |

|

| | | | | |

| | | | | $ | 2,491,823.78 |

|

Bank Reconciliation and Copy of Bank Statement

Exhibit III

|

| |

| ENDEAVOR PIPELINE INC. BANK RECONCILIATION |

| OPERATING ACCOUNT |

| Ending Balance per Bank Statement | $6,053,638 |

| Plus: Total Amount of Outstanding Deposits | — |

| Minus: Total Amount of Outstanding Checks and Other Debits * | — |

| Minus Service Charges | — |

| Ending Balance per Check Register **(a) | $6,053,638 |

The summary page of the Company's bank statement for the operating account is provided below.

Bank Reconciliation and Copy of Bank Statement