Exhibit 99.1

March 22, 2016 Investor Conference Presentation

Forward Looking Statements 1 This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8 - K, and our regular reports on Forms 10 - Q and 10 - K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. This presentation contains Non - GAAP measures, and we may reference Non - GAAP measures in our remarks and discussions. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10 - Q and 10 - K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor .ProAssurance.com, and in the related Current Report s on Form 8K . N on - GAAP Measures

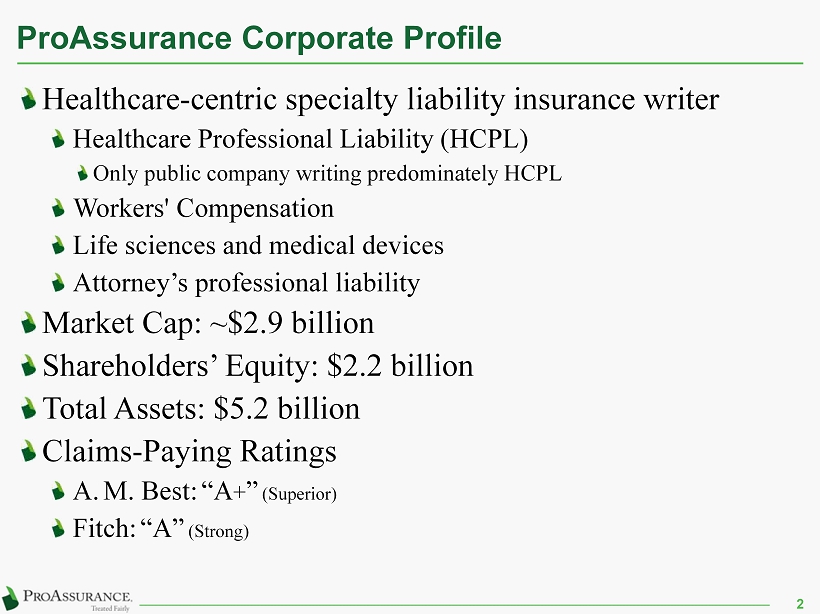

ProAssurance Corporate Profile Healthcare - centric specialty liability insurance writer Healthcare Professional Liability (HCPL) Only public company writing predominately HCPL Workers' Compensation Life sciences and medical devices Attorney’s professional liability Market Cap: ~$2.9 billion Shareholders’ Equity: $2.2 billion Total Assets: $5.2 billion Claims - Paying Ratings A . M. Best: “A + ” (Superior) Fitch: “A” (Strong) 2

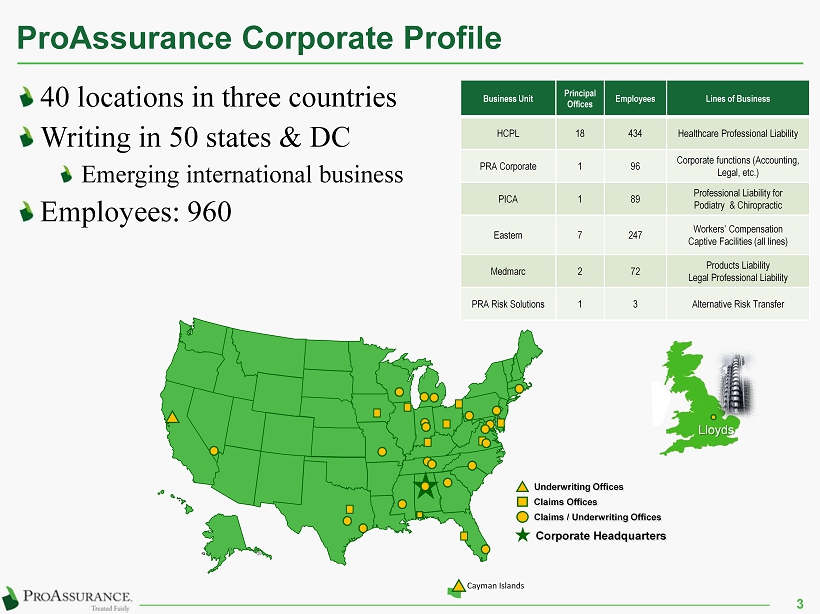

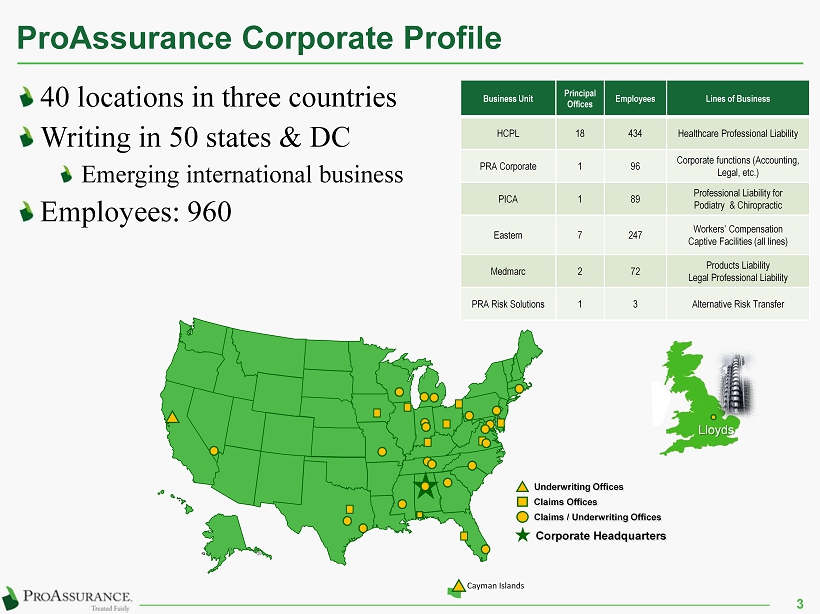

ProAssurance Corporate Profile 40 locations in three countries Writing in 50 states & DC Emerging international business Employees: 960 Corporate Headquarters Claims Offices Claims / Underwriting Offices Underwriting Offices Lloyds Cayman Islands 3 Business Unit Principal Offices Employees Lines of Business HCPL 18 434 Healthcare Professional Liability PRA Corporate 1 96 Corporate functions (Accounting, Legal, etc.) PICA 1 89 Professional Liability for Podiatry & Chiropractic Eastern 7 247 Workers’ Compensation Captive Facilities (all lines) Medmarc 2 72 Products Liability Legal Professional Liability PRA Risk Solutions 1 3 Alternative Risk Transfer

ProAssurance Brand Profile 4 Specialty P&C Workers’ Comp Healthcare Professional Liability Medical Technology & Life Sciences Products Liability Legal Professional Liability Alternative Risk Transfer

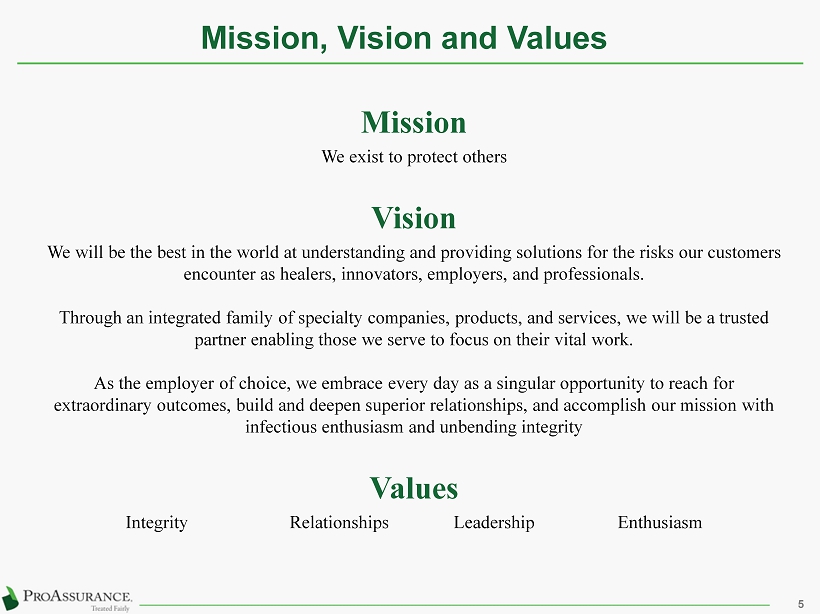

Mission, Vision and Values 5 Mission We exist to protect others Vision We will be the best in the world at understanding and providing solutions for the risks our customers encounter as healers, innovators, employers, and professionals. Through an integrated family of specialty companies, products, and services, we will be a trusted partner enabling those we serve to focus on their vital work. As the employer of choice, we embrace every day as a singular opportunity to reach for extraordinary outcomes, build and deepen superior relationships, and accomplish our mission with infectious enthusiasm and unbending integrity Values Integrity Relationships Leadership Enthusiasm

Strategic Review

Key High - Level Strategies We have built a platform to address the challenges of the evolution of healthcare The creation of new delivery systems and entities is changing the competitive landscape in healthcare professional liability Financial strength and broad geographic reach are now simply “table stakes” Coverage flexibility and alternative risk solutions are the differentiators We will remain healthcare - centric as we address a broad array of liability risks for our insureds We will continue to enhance shareholder value thought effect capital management 7

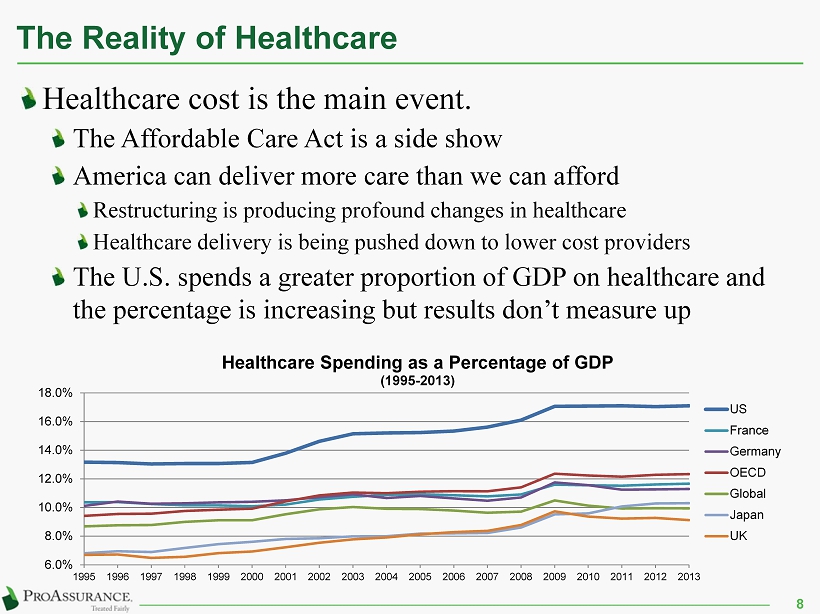

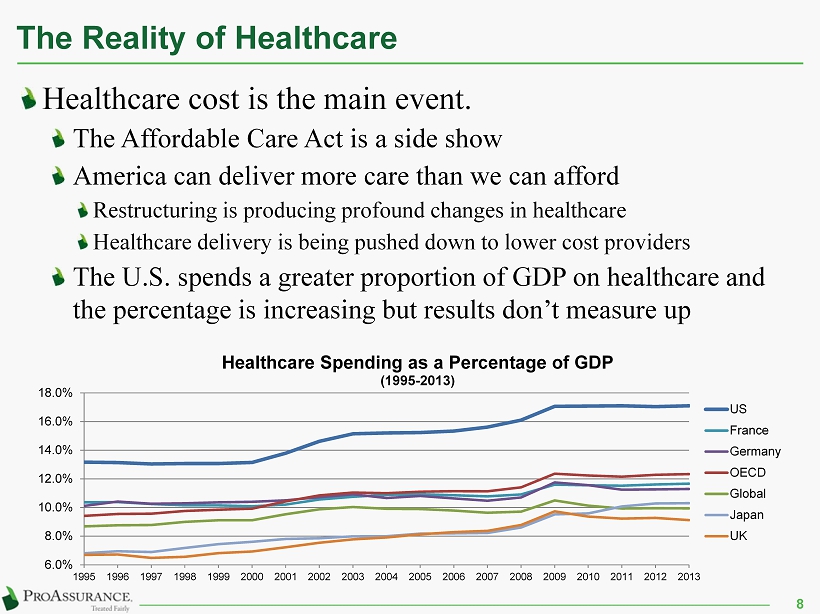

The Reality of Healthcare Healthcare cost is the main event. The Affordable Care Act is a side show America can deliver more care than we can afford Restructuring is producing profound changes in healthcare Healthcare delivery is being pushed down to lower cost providers The U.S. spends a greater proportion of GDP on healthcare and the percentage is increasing but results don’t measure up 8 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Healthcare Spending as a Percentage of GDP (1995 - 2013) US France Germany OECD Global Japan UK

The Reality of Insurance 9 Insurance companies are awash in capital Pressure is mounting to “do something” with it Chase market share with low prices but disastrous long - term consequences Appease investors or policyholders with unwise capital - return strategies M&A will emerge, but may be more critical for smaller competitors seeking the size and scope to address the market For many traditional MPL companies, it is “the fork in the road,”

Establishing our Platform 10 Early M&A built out our medical professional liability business by building scope and size We added capabilities through subsequent M&A PICA: podiatric and related specialties Medmarc: life sciences and medical technology ProAssurance Mid - Continent Underwriters: ancillary healthcare New product development to support emerging risks for our healthcare insureds The acquisition of Eastern Insurance Alliance allows us to provide workers’ compensations solutions and provides proven alternative market solutions through segregated cell capabilities The other pillar of liability for healthcare organizations

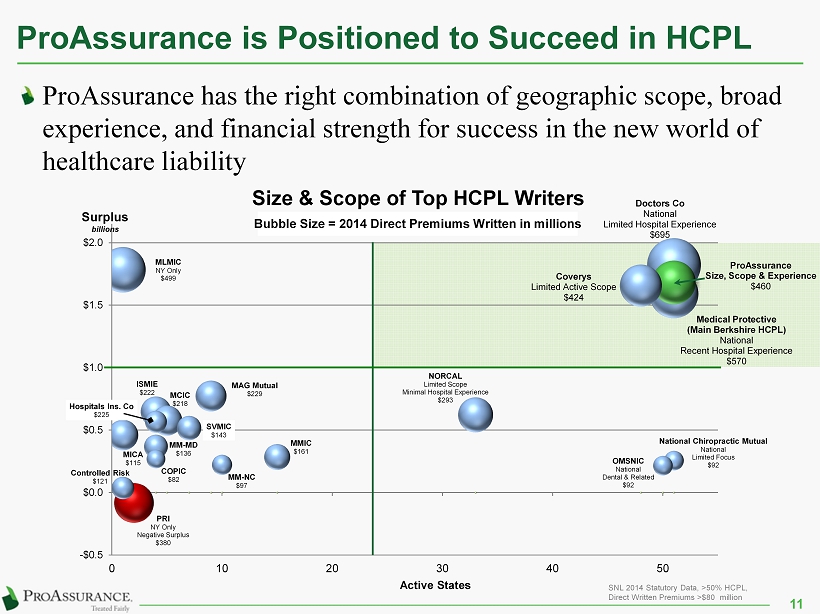

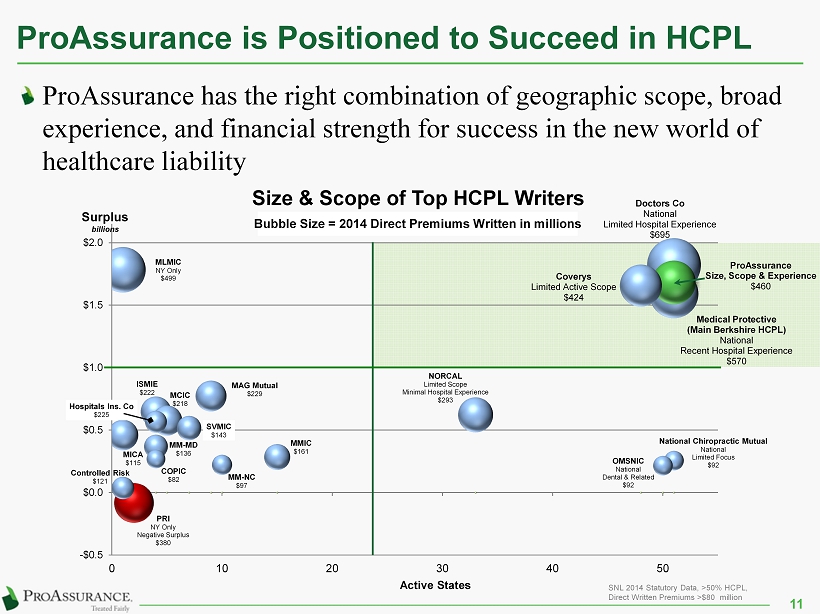

ProAssurance is Positioned to Succeed in HCPL 11 ProAssurance has the right combination of geographic scope, broad experience, and financial strength for success in the new world of healthcare liability Medical Protective (Main Berkshire HCPL) National Recent Hospital Experience $570 Doctors Co National Limited Hospital Experience $695 MLMIC NY Only $499 ProAssurance Size, Scope & Experience $460 Coverys Limited Active Scope $424 PRI NY Only Negative Surplus $380 NORCAL Limited Scope Minimal Hospital Experience $293 MAG Mutual $229 Hospitals Ins. Co $225 ISMIE $222 MCIC $218 MMIC $161 SVMIC $143 MM - MD $136 Controlled Risk $121 MICA $115 MM - NC $97 National Chiropractic Mutual National Limited Focus $92 OMSNIC National Dental & Related $92 COPIC $82 -$0.5 $0.0 $0.5 $1.0 $1.5 $2.0 0 10 20 30 40 50 Size & Scope of Top HCPL Writers Surplus billions Active States Bubble Size = 2014 Direct Premiums Written in millions SNL 2014 Statutory Data, >50% HCPL, Direct Written Premiums >$80 million

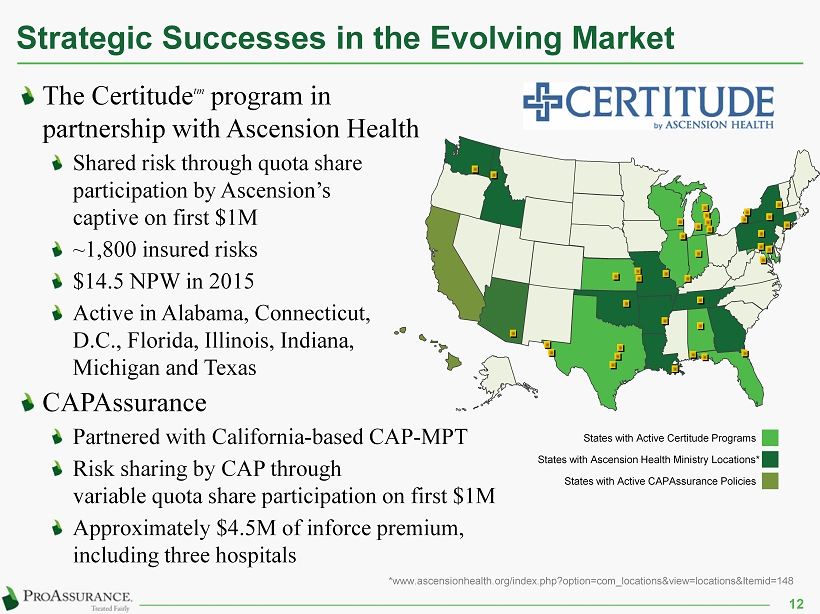

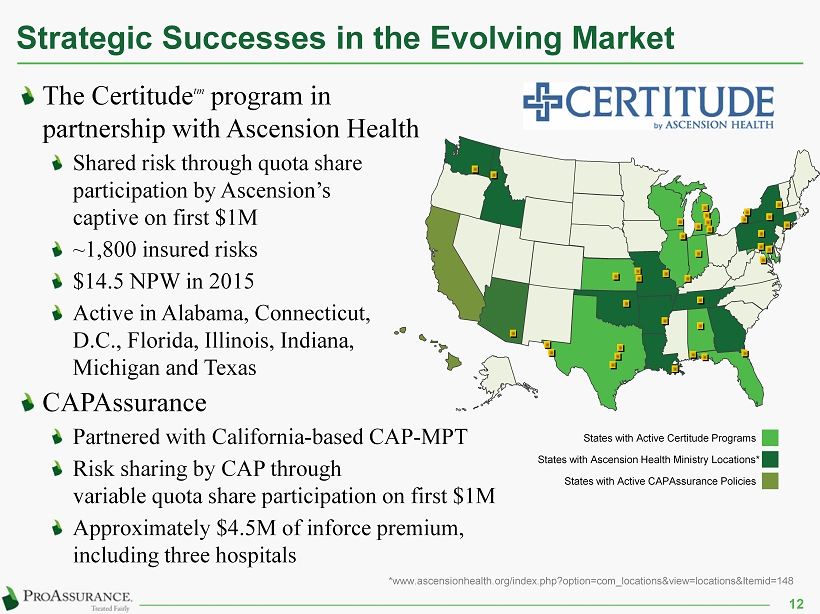

Strategic Successes in the Evolving Market The Certitude tm program in partnership with Ascension Health Shared risk through quota share participation by Ascension’s captive on first $ 1M ~ 1,800 insured risks $14.5 NPW in 2015 Active in Alabama, Connecticut , D.C ., Florida, Illinois, Indiana, Michigan and Texas CAPAssurance Partnered with California - based CAP - MPT Risk sharing by CAP through variable quota share participation on first $ 1M Approximately $ 4.5M of inforce premium, including three hospitals 12 *www.ascensionhealth.org/index.php?option=com_locations&view=locations&Itemid=148 States with Active Certitude Programs States with Ascension Health Ministry Locations* States with Active CAPAssurance Policies

Strategic Successes in an Evolving Market 13 Cross - selling / Cross - licensing is working Approximately $5.5 million of new business in 2015 $ 1 million in 2014 Alternative risk and self - insurance opportunities Allows large, sophisticated healthcare and workers’ compensation customers to control their own insurance programs Eastern Re brings proven experience and expertise in establishing and operating captives through segregated cells Risk sharing/high deductible programs Risk Purchasing Groups for specific specialties or regions Physician/hospital insurance products addressing the unique risk tolerance and claims expectations of each insured

Additional Strategic Opportunities 14 Internal product expansion for insureds only — not available as a standalone product Cyber liability D&O — primarily for larger organizations Provider excess for entities accepting population - based payments ProAssurance Risk Solutions sm Proven expertise to address complex risk financing challenges in both healthcare and workers’ compensation ProAssurance Complex Medicine (ProCxM) Program for larger entities with self - insured retentions allows us to participate in markets we have not previously addressed

Strategic Opportunities for Workers Compensation The Eastern acquisition cements our commitment to medical professional liability We now can provide a single source for the two most difficult coverages bought by healthcare institutions This transaction is part of our push to become a larger force with the broker community Brokers are favored by larger institutions Provides important cross - selling and differentiating opportunities for our specialist independent agents who remain important in our distribution to existing business Adds significant profitable business Do not paint Eastern with a broad workers’ compensation brush 15

Strategic Opportunities Through Lloyd’s Syndicate 1729 is an investment opportunity with significant insurance benefits Potentially provides access to international medical professional liability opportunities Leverage Medmarc’s expertise to underwrite international medical technology and life sciences risks Increases flexibility for ProAssurance when working with complex risks Primary and excess business can be written 16

Strategic Opportunities Through Medmarc Medmarc is a market - leader in medical products and life sciences liability Increasing presence in device and drug development by larger healthcare organizations Increasing globalization of testing and development efforts are a natural fit with Lloyd’s Syndicate 1729 Provides ProAssurance and our agents with another arrow in our product quiver at the complex end of the healthcare delivery continuum 17

Strategic Opportunities Through Mid - Continent ProAssurance Mid - Continent Underwriters addresses the needs of ancillary healthcare providers This market is increasing rapidly as the push to reduce healthcare costs drives care through lower cost providers who are an important part of the healthcare continuum 18

Capital Management Strategies We focus on the creation of meaningful shareholder value through a disciplined approach to capital management

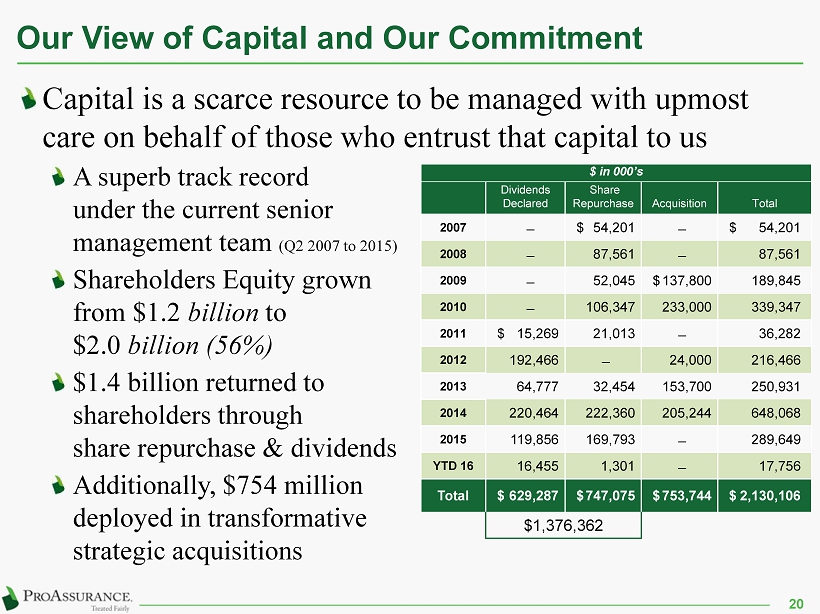

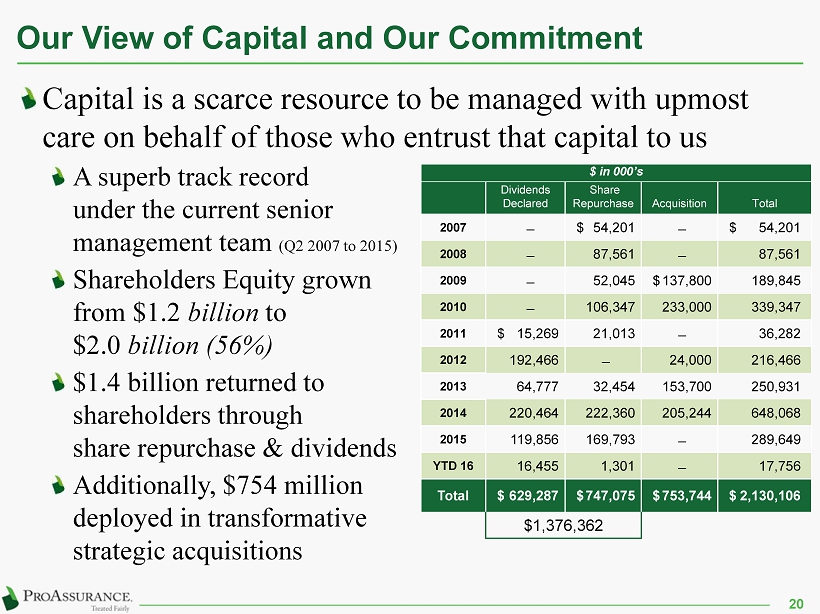

Our View of Capital and Our Commitment Capital is a scarce resource to be managed with upmost care on behalf of those who entrust that capital to us A superb track record under the current senior management team ( Q2 2007 to 2015) Shareholders Equity grown from $1.2 billion to $2.0 billion (56%) $1.4 billion returned to shareholders through share repurchase & dividends Additionally, $754 million deployed in transformative strategic acquisitions 20 $ in 000’s Dividends Declared Share Repurchase Acquisition Total 2007 ̶ $ 54,201 ̶ $ 54,201 2008 ̶ 87,561 ̶ 87,561 2009 ̶ 52,045 $ 137,800 189,845 2010 ̶ 106,347 233,000 339,347 2011 $ 15,269 21,013 ̶ 36,282 2012 192,466 ̶ 24,000 216,466 2013 64,777 32,454 153,700 250,931 2014 220,464 222,360 205,244 648,068 2015 119,856 169,793 ̶ 289,649 YTD 16 16,455 1,301 ̶ 17,756 Total $ 629,287 $ 747,075 $ 753,744 $ 2,130,106 $1,376,362

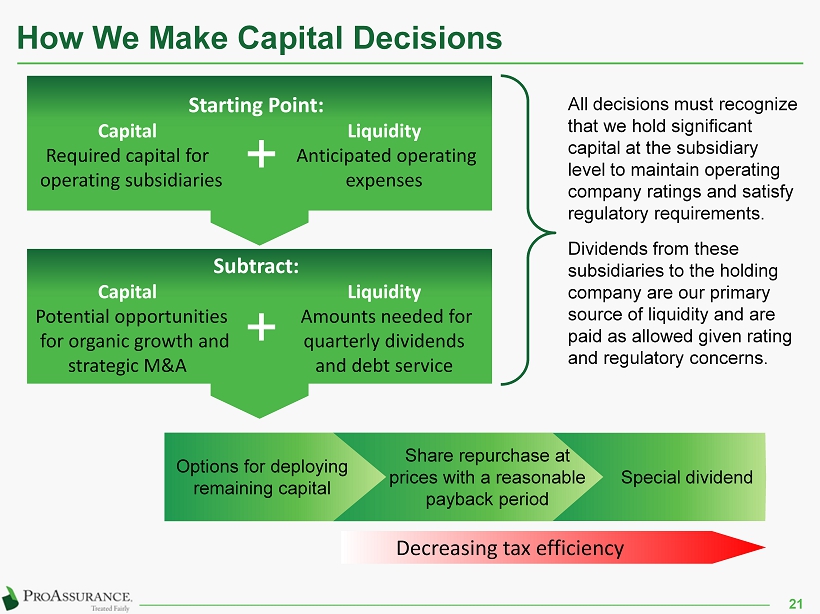

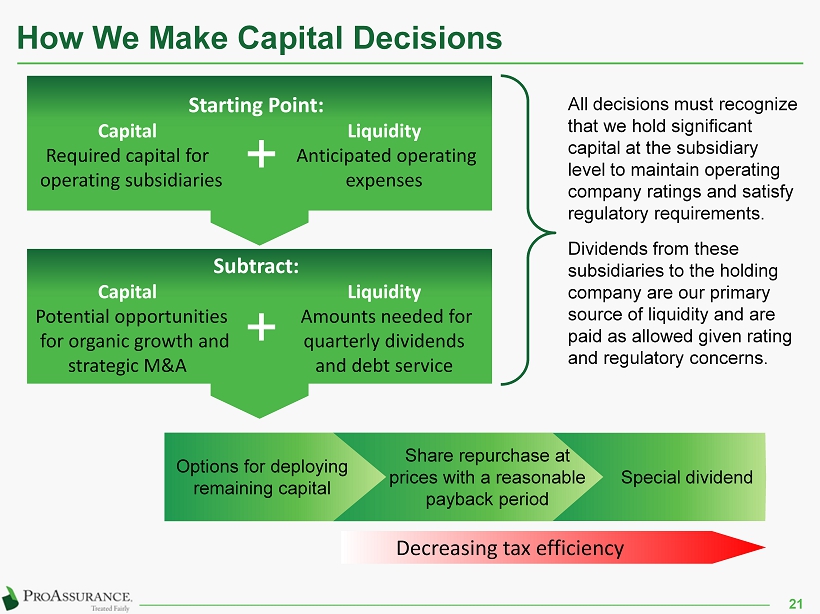

Share repurchase at prices with a reasonable payback period Options for deploying remaining capital How We Make Capital Decisions 21 All decisions must recognize that we hold significant capital at the subsidiary level to maintain operating company ratings and satisfy regulatory requirements. Dividends from these subsidiaries to the holding company are our primary source of liquidity and are paid as allowed given rating and regulatory concerns. Special dividend Decreasing tax efficiency Starting Point : Capital Liquidity Required capital for Anticipated operating operating subsidiaries expenses Subtract: Capital Liquidity Potential opportunities Amounts needed for for organic growth and quarterly dividends strategic M&A and debt service