| Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, D.C. 20006 Telephone 202-822-9611 Fax 202-822-0140 www.stradley.com |

Jessica D. Burt, Esq.

(202) 419-8409

jburt@stradley.com

April 22, 2020

VIA EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, N.E.

Washington, D.C. 20549-9303

Attention: Ms. Rebecca Marquigny, Esquire

Re: GuideStone Funds

File Nos. 333-53432 and 811-10263

Dear Ms. Marquigny:

On behalf of GuideStone Funds (the “Registrant”) below you will find the Registrant’s responses to the comments conveyed by you on April 13, 2020, with regard to Post-Effective Amendment No. 79 (the “Amendment”) to the Registrant’s registration statement on Form N-1A. The Amendment was filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 28, 2020, pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 485(a)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

Below we have provided your comments and the Registrant’s response to each comment. These responses will be incorporated into a post-effective amendment filing to be made pursuant to Rule 485(b) of the Securities Act. Capitalized terms not otherwise defined in this letter have the meanings assigned to the terms in the Registration Statement.

U.S. Securities and Exchange Commisssion

Page 2

Prospectus

1) Comment: Significant market events have occurred since the Amendment was filed. Please consider whether each Fund’s disclosures, including risk disclosures, should be revised based on how these events are impacting both debt and equity markets as well as the specific industries likely to impact the performance of each Fund, based on each Fund’s unique portfolio. If the Registrant believes no additional disclosure is warranted, please explain supplementally why not. Please avoid vague or overbroad explanations and provide fund-specific responses.

Response: The Registrant has updated “Market Risk” in Item 4 of the prospectus as follows to address the pandemic crisis:

Market Risk: The Fund’s value will go up and down in response to changes in the market value of its investments, sometimes rapidly and unpredictably. Market value will change due to business developments concerning a particular issuer or industry, as well as general market and economic conditions. Changes in the financial condition of a single issuer can impact the market as a whole. Geopolitical risks, including terrorism, tensions or open conflict between nations, or political or economic dysfunction within some nations that are major players on the world stage, may lead to instability in world economies and markets, may lead to increased market volatility and may have adverse long-term effects. Local, regional or global events such the spread of infectious illnesses or other public health issues, recessions, natural disasters or other events could have a significant impact on the Fund and its investments. In addition, markets and market participants are increasingly reliant upon information data systems. Data imprecision, software or other technology malfunctions, programming inaccuracies, unauthorized use or access and similar circumstances may have an adverse impact upon a single issuer, a group of issuers or the market at-large.

Additionally, Registrant has added the following disclosure to the SAI under “Description of Investment Risks – Recent Market Conditions”:

Global economies and financial markets are increasingly interconnected, which increases the possibilities that political, economic and other conditions (including, but not limited to, natural disasters, pandemics, epidemics and social unrest) in one country or region might adversely impact issuers in a different country or region.

U.S. Securities and Exchange Commisssion

Page 3

The recent outbreak of the novel coronavirus, first detected in December 2019, rapidly became a pandemic and has resulted in disruptions to the economies of many nations, individual companies and the markets in general, the impact of which cannot necessarily be

foreseen at the present time. This has created closed borders, quarantines, supply chain disruptions and general anxiety, negatively impacting global markets in an unforeseeable manner. The impact of the novel coronavirus and other such future infectious diseases in certain regions or countries may be greater or less due to the nature or level of their public health response or due to other factors. Health crises caused by the recent coronavirus outbreak or future infectious diseases may exacerbate other pre-existing political, social and economic risks in certain countries. The impact of such health crises may be quick, severe and of unknowable duration. This pandemic and other epidemics and pandemics that may arise in the future could result in continued volatility in the financial markets and lead to increased levels of Fund redemptions, which could have a negative impact on the Funds and could adversely affect a Fund’s performance.

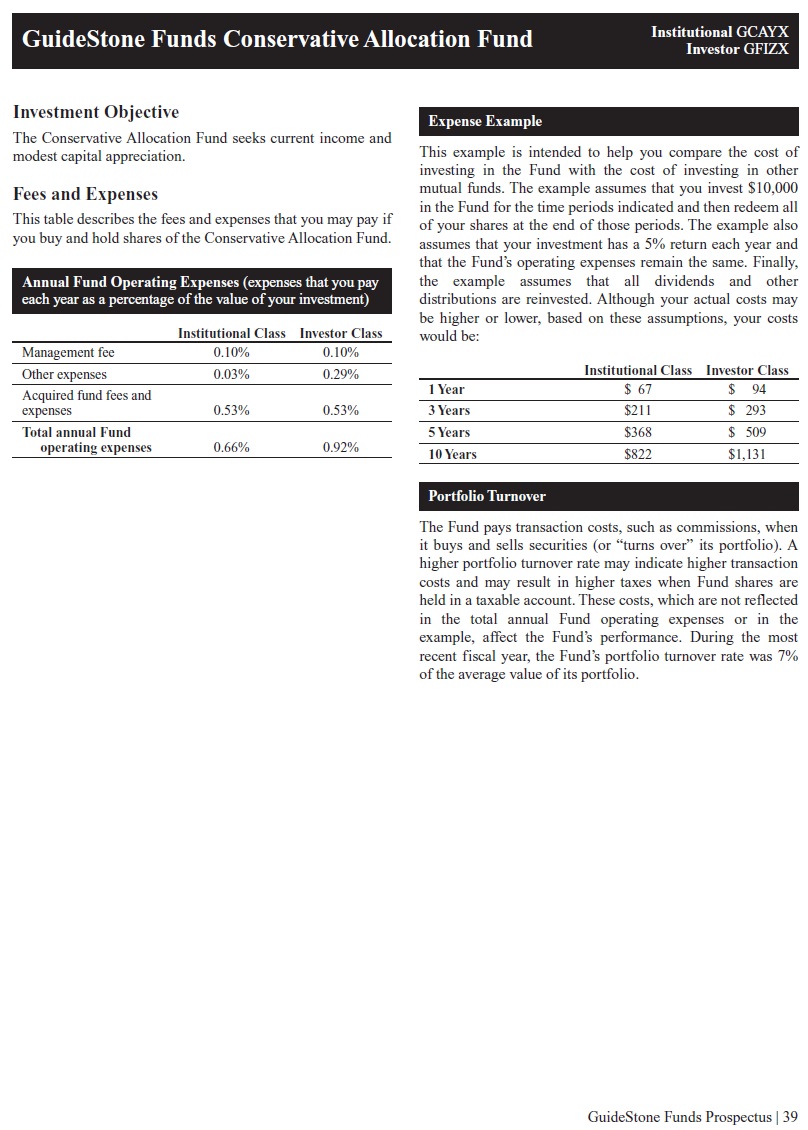

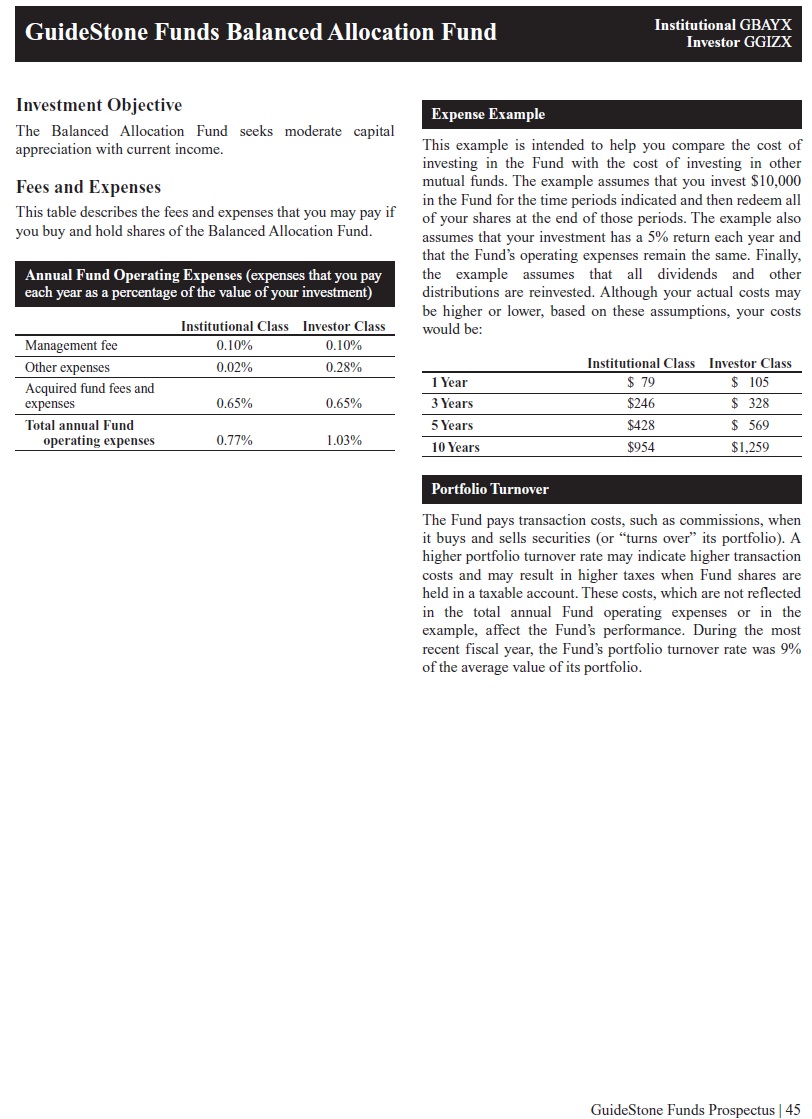

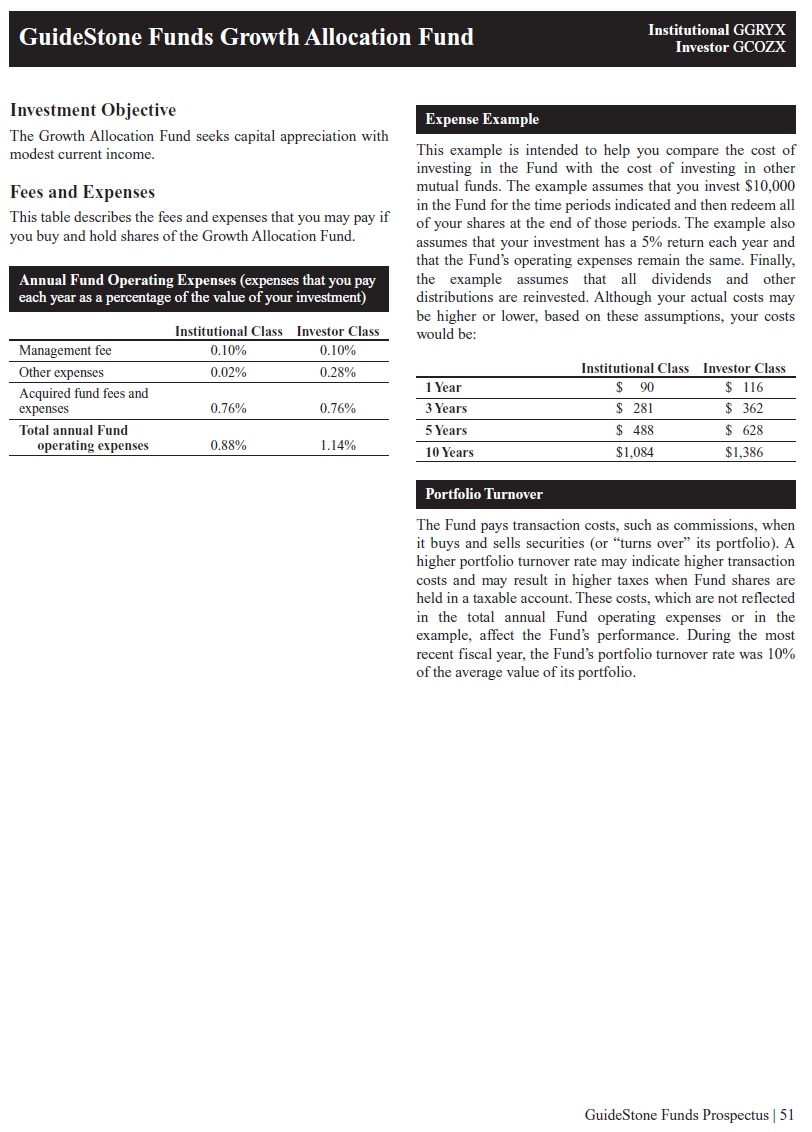

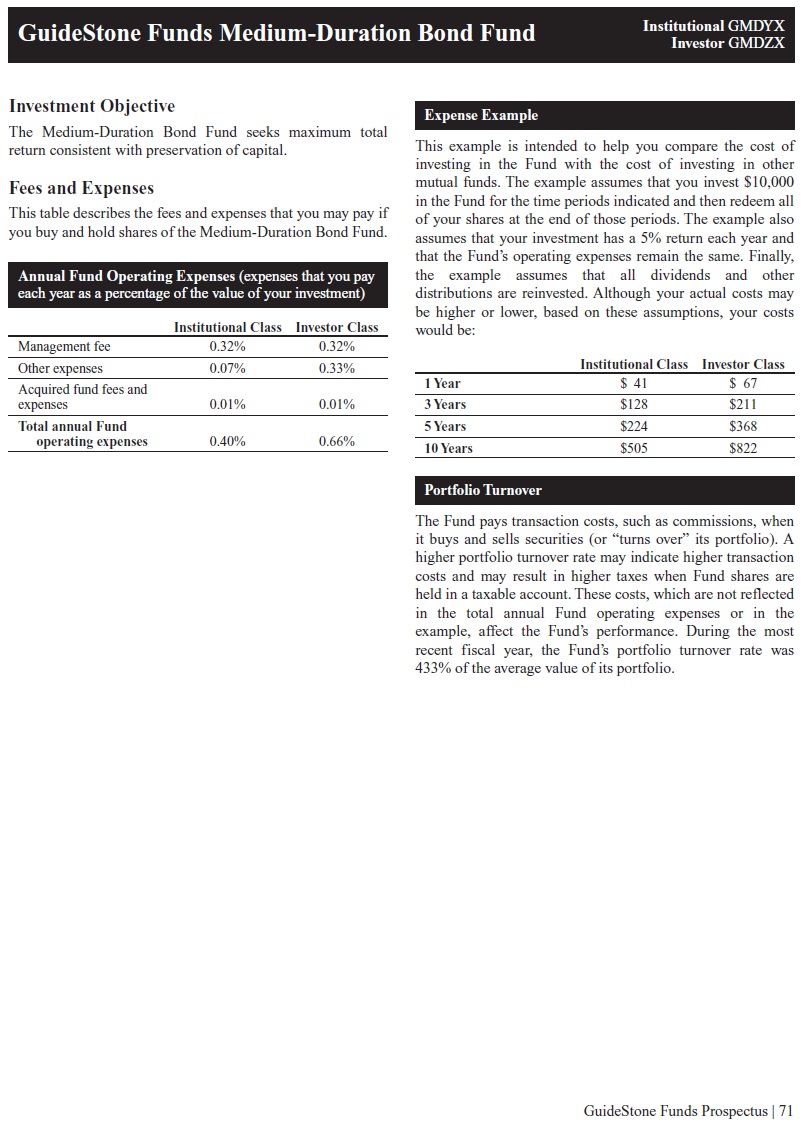

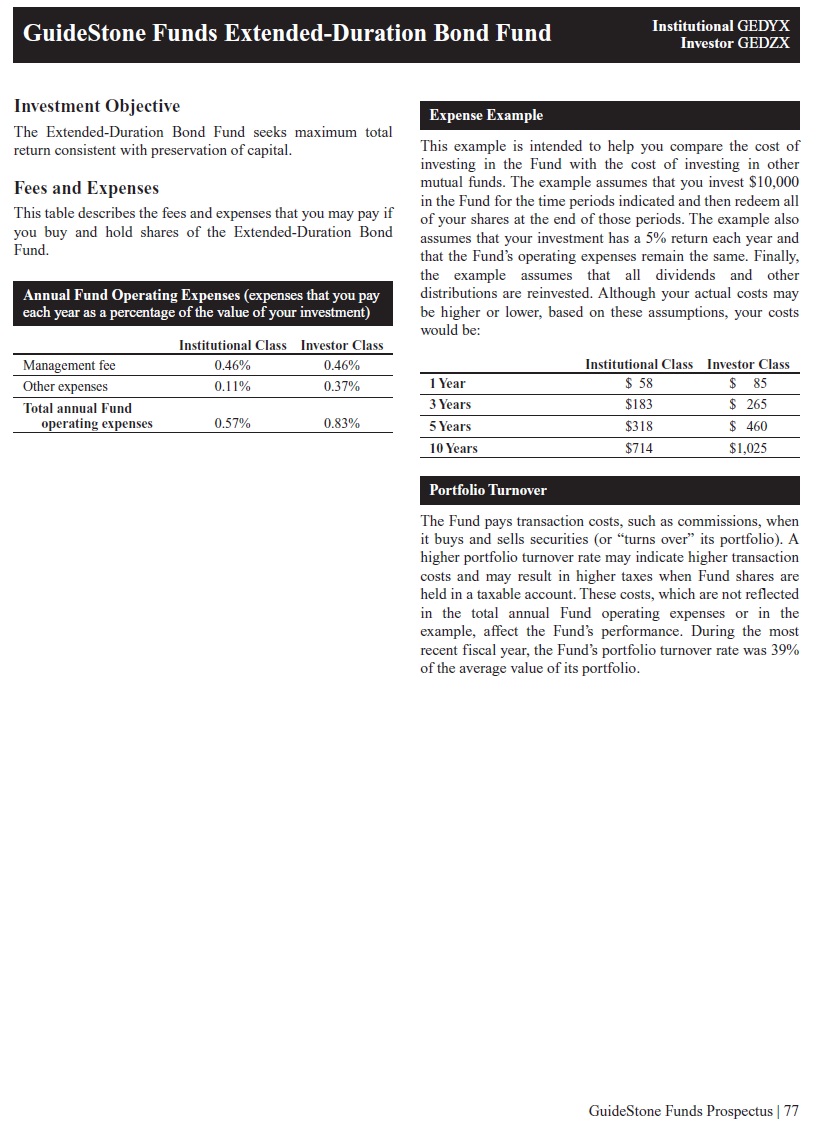

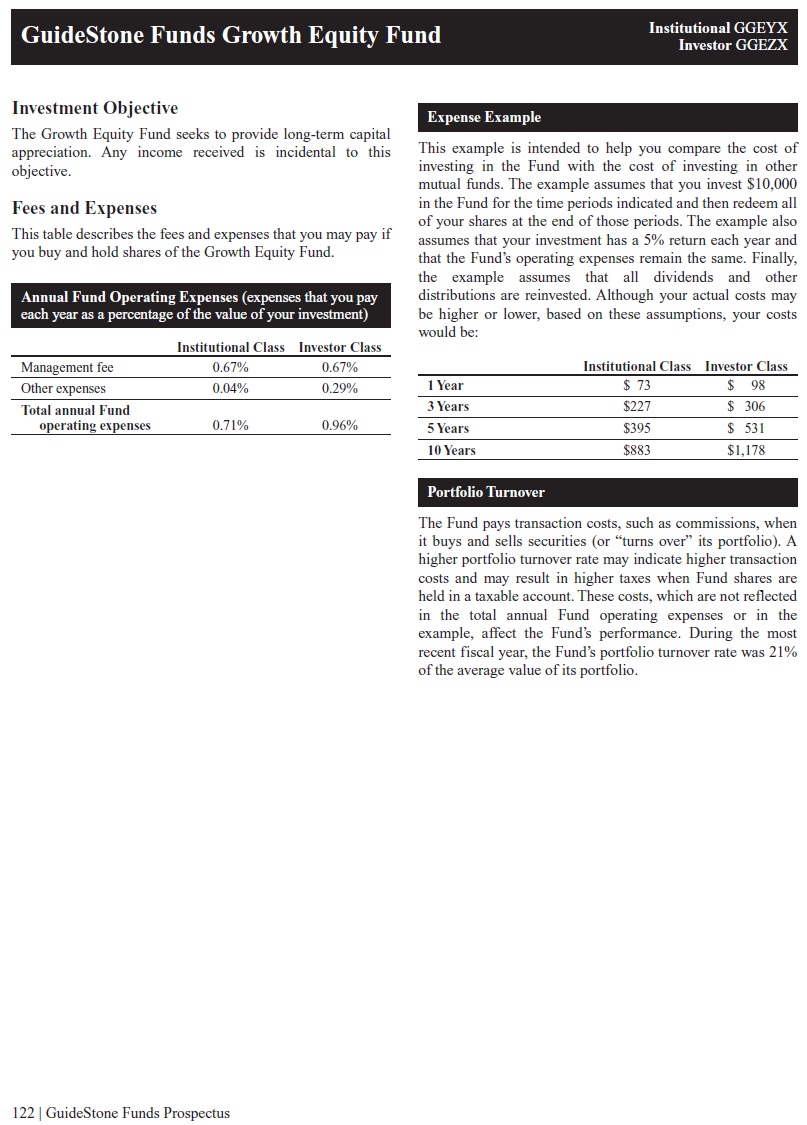

2) Comment: The SEC Staff takes the position that fee tables and expense examples are material and should not be added to the 485(b) filing without Staff review; please provide as EDGAR correspondence the completed fee tables and expense examples for each Fund at least five days prior to the effective date.

Response: The Registrant has included the completed fee tables and expense examples as an attachment to this filing.

3) Comment: In the footnote to the expense tables of the MyDestination Funds and any other applicable Fund, the reference to “three years after the Adviser has made such payment, waiver or assumption” could be read to refer to calendar years, fiscal years, or a 36-month period. For clarity, please revise the phrase “during the year in which repayment would be made” to clarify that the rolling recoupment period is limited to the 36 months beginning on the date an expense was waived or reimbursed.

Response: The Registrant has revised the disclosure as described herein. The Registrant believes that the revised disclosure makes clearer that the rolling recoupment period is limited to the 36 month-period beginning on the date an expense was waived or reimbursed. The first part of the footnote (as revised), “If expenses fall below the levels noted above within three years from the date on which the Adviser made such payment, waiver or assumption, the Fund may reimburse the Adviser,” refers to the applicable three-year time period. The second part of the current disclosure, “so long as the reimbursement does not cause the Fund to exceed the Expense Limitation on the date on which: (i) the expenses were paid, waived or assumed; or (ii) the reimbursement would be made, whichever is lower,” is a separate idea that is a condition for a reimbursement to be made and clarifies that the reimbursement can cause the Fund to exceed neither the Expense Limitation in place on the date of the original waiver nor the current Expense Limitation.

U.S. Securities and Exchange Commisssion

Page 4

4) Comment: We note that the introduction to the “Principal Investment Risks” section now includes the most salient risks for each Fund. Please consider presenting the names of these risks more prominently to capture investor attention.

Response: The Registrant has capitalized the risks included in the introduction to the “Principal Investment Risks” section as requested.

5) Comment: With respect to the Aggressive Allocation Fund, we note that duration risk is no longer identified as a principal risk for this Fund. However, the Fund still principally invests in foreign and domestic fixed income securities for which the principal investment strategy summary does not state a duration range. Please disclose whether the Fund is managed for any duration or replace the deleted duration risk disclosure.

Response: The Registrant confirms that the Fund is not managed to any particular duration or maturity, and notes that the Fund’s fixed income allocation range is between 0% and 10% of Fund assets and is limited to government securities and short-term investments. Accordingly, the Registrant has revised the description of fixed income securities in which the Fund may principally invest to remove reference to instruments issued by foreign governments, and domestic and foreign investment grade securities.

6) Comment: With respect to the Global Bond Fund, we note that the Fund has added contingent convertible securities risk to its Item 4 risk disclosure; however, the principal investment strategy disclosure does not appear to identify convertible securities as principal to achieving the Fund’s objective. Please reconcile, and, if appropriate, please add the corresponding contingent convertible securities disclosure to the Fund’s principal investment strategy and the risk descriptions included in Item 9.

Response: The Registrant has revised the Fund’s principal investment strategies as follows:

“The Fund invests in globally diversified fixed income securities and rotates portfolio allocations among global sectors, including: . . . contingent convertible securities.”

7) Comment: With respect to the Value Equity Fund, there does not appear to be a principal strategy that would give rise to the addition of “banking industry risk.” Please remove this risk from Items 4 and 9 or add corresponding principal investment strategy disclosure to these sections, expressly noting the strategic basis for this risk.

Response: The Registrant confirms that investing in the banking industry is not a principal investment strategy of the Fund. Therefore, the Registrant has removed banking industry risk from the Fund’s principal risk disclosure.

U.S. Securities and Exchange Commisssion

Page 5

8) Comment: With respect to the Growth Equity Fund, there does not appear to be a principal strategy that would give rise to the addition of “information technology sector risk.” Please remove this risk from Items 4 and 9 or add corresponding principal investment strategy disclosure to these sections that describes the Fund’s strategy of investing principally in the information technology sector.

Response: The Registrant respectfully declines to revise its disclosure as it believes the current disclosure is satisfactory and consistent with Form N-1A. The Fund’s current disclosure states, “The Fund invests mainly (at least, and typically more than, 80% of its net assets, plus borrowings for investment purposes, if any) in equity securities” and “In pursuing its investment strategy, the Fund may at times focus its investments in one or a few particular economic sectors.” In following its principal investment strategies, the Fund has a significant amount of its assets invested in the information technology sector at this point in time (please refer to the December 31, 2019 annual report, for reference), which is not reasonably expected to change over the next 12 months. Thus, while it is not a principal investment strategy of the Fund to invest in any one sector, as a result of implementing its security type and style, it may nevertheless have significant exposure to a given sector, and in this case where the performance of securities in the information technology sector could have a material impact on the Fund’s return, we believe information technology sector risk is a principal risk of the Fund. As such, we believe that our current disclosure appropriately reflects the Fund’s principal investment strategies and risks.

9) Comment: With respect to the Emerging Markets Equity Fund, there does not appear to be a principal strategy that would give rise to the addition of “semiconductor industry risk.” Please remove this risk from Items 4 and 9 or add corresponding principal investment strategy disclosure to these sections that describes the Fund’s strategy of investing principally in the semiconductor industry.

Response: The Registrant confirms that investing in the semiconductor industry is not a principal investment strategy of the Fund. Therefore, the Registrant has removed semiconductor industry risk from the Fund’s principal risk disclosure.

10) Comment: Please consider defining the term “Completion Portfolios” under the “Additional Investment & Risk Information” section.

Response: The Registrant has revised the disclosure as follows:

Completion Portfolios: The Adviser and the Trust have entered into a Sub-Advisory Agreement with Parametric on behalf of the Low-Duration Bond Fund, Medium-Duration Bond Fund, Extended-Duration Bond Fund, Value Equity Fund, Growth Equity Fund, Small Cap Equity Fund and International Equity Fund. Under this Sub-Advisory Agreement, Parametric may be responsible for implementing temporary investment portfolios designed to ensure that a Fund maintains its desired risk exposure. Each Fund has a well-defined risk/return

U.S. Securities and Exchange Commisssion

Page 6

profile. When a Fund’s actual level and composition of risk varies from the Fund’s desired risk exposure, the Adviser may allocate Fund assets to Parametric to implement one or more of its proprietary “completion portfolios.” These “completion portfolios” are designed to be held alongside a Fund’s long-term strategic investments and bring the Fund’s risk exposure to desired levels, as defined by the Adviser. A completion portfolio may be employed used, for example, if a Sub-Adviser exhibits style drift, thereby causing a Fund’s risk/return profile and style orientation to be inconsistent with the Fund’s stated objective out of line with the Adviser’s risk target range for the Fund. In such a situation, the Adviser may direct Parametric to apply the appropriate completion portfolio to restore the Fund to its desired portfolio alignment Fund’s risk characteristics to the desired state.

11) Comment: With respect to the Equity Index Fund, under the “Management of the Funds” section, please clarify what is meant by “North American mandates,” and what entity it is associated with

Response: The term “North American mandates,” as used in reference to LGIMA portfolio managers in the Prospectus, indicates the area of focus within LGIMA for the referenced portfolio manager.

12) Comment: In the “Glossary” section, please consider restoring the prior definition of “Duration” in addition to the definition of “Effective Duration.”

Response: The Registrant respectfully declines to restore the prior definition of “Duration”, as the definition of “Effective Duration” in the glossary effectively describes the meaning of each use of the term “duration” in the prospectus. The Registrant also notes that the section entitled “Additional Information About Principal Strategies and Risks” includes an extensive discussion of the meaning and effects of duration.

13) Comment: In the “Glossary” section, rather than removing the definition of “High Yield Bonds (Junk Bonds),” please consider adding that definition to the term “Junk Bonds.”

Response: The Registrant respectfully notes that the definition previously deleted from “High Yield Bonds” has already been moved to the term “Below-Investment Grade Bond (High Yield or Junk Bonds).”

Statement of Additional Information

14) Comment: In your response to the Staff, please explain why the following sentence was deleted from the “Illiquid Investments and Restricted Securities” section: “The Board of Trustees will review periodically any determination by the Adviser or Sub-Adviser to treat a restricted security as liquid, including the Adviser’s or the Sub-Adviser’s assessment of current trading activity and the availability of reliable price

U.S. Securities and Exchange Commisssion

Page 7

information.” Please also confirm that the Funds have a compliant liquidity risk management program pursuant to Rule 22e-4.

Response: The Registrant notes that disclosure referenced above was originally added to be consistent with prior SEC liquidity guidance. The disclosure was removed because Rule 22e-4 superseded prior SEC guidance and the need for Advisers to deem securities as liquid. Under the prior guidance the Board previously reviewed the Adviser or a Sub-Adviser’s determination to treat a restricted security as liquid, however, now, in compliance with Rule 22e-4, the Board oversees the liquidity risk management program. The Registrant confirms that the Funds have a compliant liquidity risk management program.

15)

Comment: In your response to the Staff, please explain why the disclosure regarding Northern Trust under the “Securities Lending” section has been deleted or confirm that Northern Trust no longer serves as custodian, securities lending agent or in any other capacity to the Funds for which the deleted disclosure may be material to investors.

Response: The Registrant confirms that the Funds no longer rely, and have no present intention of relying, on the affiliated securities lending exemptive order that permitted the Funds to compensate Northern Trust for its services as securities lending agent, when Northern Trust’s affiliate also served as a sub-adviser to certain Funds of the Registrant.

16) Comment: Please delete the following sentence from the sixth paragraph under the “Non-Fundamental Investment Restrictions” section: “Consistent with the purpose of Rule 35d-1 of the 1940 Act, a Fund may use the notional value of a derivative when notional value is the best measure of the economic exposure the derivative provides to investments that are consistent with the Fund’s name” as this sentence is inconsistent with the SEC’s interpretation of requirement of Rule 35d-1.

Response: The above-referenced sentence has been deleted.

U.S. Securities and Exchange Commisssion

Page 8

In connection with the Registrant’s responses to the SEC Staff’s comments on the Registration Statement, as requested by the Staff, the Registrant acknowledges that the Registrant is responsible for the adequacy of the disclosure in the Registrant’s filings, notwithstanding any review, comments, action, or absence of action by the Staff.

Please do not hesitate to contact me at (202) 419-8409, or Jessica L. Patrick at (202) 419-8423, if you have any questions or wish to discuss any of the responses presented above.

Respectfully submitted,

/s/ Jessica D. Burt

Jessica D. Burt, Esquire

cc: | Melanie Childers Matthew A. Wolfe, Esquire Jessica L. Patrick, Esquire |