UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-10267

GPS Funds I

(Exact name of registrant as specified in charter)

1655 Grant Street, 10th Floor

Concord, CA 94520

(Address of principal executive offices) (Zip code)

Patrick R Young

AssetMark, Inc.

1655 Grant Street, 10th Floor

Concord, CA 94520

(Name and address of agent for service)

800-664-5345

Registrant’s telephone number, including area code

Date of fiscal year end: March 31, 2020

Date of reporting period: April 1, 2019 through March 31, 2020

Item 1. Reports to Stockholders.

GuideMark® Funds

GuidePath® Funds

Investment Advisor

AssetMark, Inc.

March 31, 2020

GUIDEMARK® LARGE CAP CORE FUND

GUIDEMARK® EMERGING MARKETS FUND

GUIDEMARK® SMALL/MID CAP CORE FUND

GUIDEMARK® WORLD EX-US FUND

GUIDEMARK® CORE FIXED INCOME FUND

GUIDEMARK® TAX-EXEMPT FIXED INCOME FUND

GUIDEMARK® OPPORTUNISTIC FIXED INCOME FUND

GUIDEPATH® GROWTH ALLOCATION FUND

GUIDEPATH® CONSERVATIVE ALLOCATION FUND

GUIDEPATH® TACTICAL ALLOCATION FUND

GUIDEPATH® ABSOLUTE RETURN ALLOCATION FUND

GUIDEPATH® MULTI-ASSET INCOME ALLOCATION FUND

GUIDEPATH® FLEXIBLE INCOME ALLOCATION FUND

GUIDEPATH® MANAGED FUTURES STRATEGY FUND

GUIDEPATH® CONSERVATIVE INCOME FUND

GUIDEPATH® INCOME FUND

GUIDEPATH® GROWTH AND INCOME FUND

Notice to Shareholders

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Funds’ shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, these reports will be made available online.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you do not need to take any action. If you receive shareholder reports by mail, you will be sent a single-page document that includes the web address to access the full report with instructions to request a printed copy at no charge. You may elect to receive shareholder reports and other communications electronically from the Fund anytime by contacting your financial advisor or institution.

You may elect to receive all future shareholder reports in paper free of charge. If you’d like to continue to receive a paper copy of the full report, visit www.fundreports.com any time prior to January 1, 2021. Your election will apply to all funds held in your account.

5/29/2020

Dear Shareholder:

Enclosed is the Annual Report for the GuideMark® and GuidePath®Funds covering the period from April 1, 2019 to March 31, 2020.

Market Review

During the twelve months ended March 31, 2020, the equity markets generally rallied, with the S&P 500® Index rising to anall-time high on February 16, 2020. But conditions dramatically turned and global equity markets tumbled into bear market territory by the end of the first quarter of 2020. For the twelve month period, the US equity market returned-7.0%1, the international developed equity market returned-13.9%2 and emerging market equities returned-17.4%3. As the spread ofCOVID-19 accelerated in the first quarter of 2020, parts of the global economy started to shut down as the world began sheltering in place. This caused the equity markets to fall precipitously.

Surprisingly, it wasn’t a defensive equity sector that held up best in the downturn. Technology was the best performing sector during the first quarter of 2020, returning-11.9%4 and was the only sector that had a positive return for the twelve month period ending March 31, 2020.Mega-cap, cash-rich technology companies benefitted from the new environment of working from home, home schooling and online-shopping. At the opposite end of the scale was the energy sector, which was adversely impacted by not only the Saudi/Russia oil price conflict, but also lower demand for gasoline as people stayed home. Oil prices dropped over 50%5 during the first quarter of 2020, causing much of the-52.4%6 return seen by the energy sector for the twelve month period.

The divergent performance of specific equity sectors also led to the spread seen between growth and value across the globe. For the12-month period, the spread between growth and value was 17.4 percentage points7 – one of the widest spreads recorded. Smaller capitalization equities experienced relatively weak returns during the market fall in the first quarter of 2020 due to their lower levels of profitability and higher leverage. This weighed on their12-month returns, with small cap index returns trailing the broader market by almost 12 percentage points8 as of the end of the reporting period.

Real Estate Investment Trusts (“REITs”) and equities with high dividend yields trailed the broad markets during the market decline in the first quarter of 2020, negatively impacting12-month performance returns. REITs fell 23.4% in the first quarter, seeing the weakest returns from malls, hotels, and retail industries, all of which were impacted by shelter in place orders. This led to a return of-15.9%9 for REITs for the reporting period. Dividend-yielding equities fell almost 30% in the first quarter of 2020, leading to a return of-21.7%10 for the12-month period. Companies within the high dividend equity universe in sectors such as energy were at high risk of dividend cuts and had low interest coverage ratios, resulting in weaker relative returns.

The US bond market returned 8.9% for the12-months ended March 31, 2020, including a 3.2%11 return in the first quarter of 2020. Treasuries rallied in the investor flight to safety during the market downturn, with longer duration Treasuries returning 20.9% for the quarter. However, these gains masked significant deterioration in certain segments of the bond market in the first quarter of 2020. Due to the sensitivity of high-yield bonds to the equity markets, the high yield sector registered double-digit losses of-12.7% for the first quarter of 2020, leading to a 12-month return of-6.9%12. Other credit sectors that underperformed in the first quarter of 2020 include bank loans, which also saw double-digit losses, returning-12.0%13 for the quarter as the U.S. Federal Reserve (the “Federal Reserve”) lowered interest rates to zero, and thenon-agency mortgage backed security (“MBS”) market, which returned-13.4%14 for the quarter.

As liquidity dried up in US bond markets with investors selling anything they could, the Federal Reserve stepped in to help limit any further carnage in the bond market. As the Federal Reserve lowered rates and initiated substantial quantitative easing programs, bond sectors supported by expansive Federal Reserve monetary policy started to recover and regain ground at the end of the first quarter of 2020. This effect was particularly pronounced in the agency MBS market, with returns of 2.8% for the quarter and 7.01%15 for the12-month period.

International bond markets also saw weakness in the first quarter, partially attributable to the strength of the U.S. dollar, but returned 2.0%16 for the12-month period. Emerging markets bonds returned-2.9% for the12-month period, having been impacted more significantly in the first quarter with a return of-9.5%17 due to the higher risk associated with emerging markets.

| 1 | | US equities represented by the S&P 500® Index |

| 2 | | International developed market equities represented by the MSCI EAFE Index |

| 3 | | Emerging market equities represented by the MSCI Emerging Markets Index |

| 4 | | Technology sector represented by the S&P 500®Information Technology (Sector) Index |

| 5 | | Represented by WTI Crude Oil prices |

| 6 | | Energy sector represented by S&P 500® Energy (Sector) Index |

| 7 | | Spread represented as difference between MSCI ACWI Growth and MSCI ACWI Value indices |

| 8 | | Spread represented as difference between MSCI ACWI and MSCI ACWI Small Cap indices |

| 9 | | REITs represented by FTSE Nareit All Equity REITs Index |

| 10 | | Dividend equities represented by Dow Jones US Select Dividend Index |

| 11 | | US bonds represented by Bloomberg Barclays US Aggregate Bond Index |

| 12 | | High yield bonds represented by Bloomberg Barclays US Corporate High Yield Index |

| 13 | | Bank loans represented by S&P/LSTA US Leveraged Loan 100 Index |

| 14 | | Non-agency MBS represented by Markit iBoxx Non-Agency RMBS Index |

| 15 | | Agency MBS represented by Bloomberg Barclays US MBS Index |

| 16 | | International bonds represented by Bloomberg Barclays Global Treasury ex US Index |

| 17 | | Emerging market bonds represented by Blomberg Barclays EM USD Aggregate Index |

1

Fund Review

Looking across the fund family it was a very difficult period, resulting in most of the funds trailing their benchmarks for the12-month period.

All of the GuideMark® funds trailed their respective benchmarks during the reporting period. Biases toward value and smaller capitalization issuers, which are intended to offer value over the long term, were the primary detractors for each of the GuideMark® Large Cap Core Fund, GuideMark® Emerging Markets Fund, GuideMark® Small/Mid Cap Core Fund and GuideMark® World ex-US Fund during the12-month period. The GuideMark®CoreFixed Income Fund trailed its benchmark for the reporting period due to shorter relative duration positioning during a time when long-term Treasuries rallied over 30%. Exposure to lower-quality credit sectors in the first quarter of 2020 hurt the GuideMark®Tax Exempt Fixed Income Fund’s performance for the quarter and significantly detracted from the full period results. The GuideMark®Opportunistic Fixed Income Fund’s significant underweight exposure to Treasuries and shorter duration as well as the Fund’s overweight exposure to foreign bonds relative to its benchmark detracted from the Fund’s returns for the period, given the flight to quality and strengthening of the US dollar over the reporting period.

Across the GuidePath® allocation funds, two funds outperformed and the remaining funds trailed their benchmarks for the period. The GuidePath® Multi-Asset Income Allocation Fund’s exposure to intermediate- and longer-term Treasuries contributed positively to the Fund’s returns, and helped the Fund outperform the benchmark for the reporting period. The GuidePath®Managed Futures Strategy Fund uses derivatives to implement its investment strategy, specifically index futures contracts. Futures positioning within bonds benefitted the GuidePath®Managed Futures Strategy Fund’s returns during the period. Specifically, long positions in longer maturity bonds contributed to the Fund’s outperformance relative to the benchmark for the period.

The GuidePath®Growth Allocation Fund, GuidePath®Conservative Allocation Fund, and GuidePath®Flexible Income Fundunderperformed their respective benchmarks for the reporting period. Broader diversification, including exposure to US small capitalization stocks, and an emphasis on high yield credit exposure within fixed income positioning relative to benchmark weightings detracted from the Funds’ returns. The GuidePath®Tactical Allocation Fund trailed its benchmark due to underperformance in the first quarter of 2020, as the Fund had higher exposure to equities relative to its benchmark. The GuidePath®Absolute Return Fund also trailed its benchmark for the period as a result of the Fund’s relative underperformance in the first quarter of 2020 due to the Fund’s exposure to credit, specifically, high yield, emerging markets,non-agency mortgages and loans.

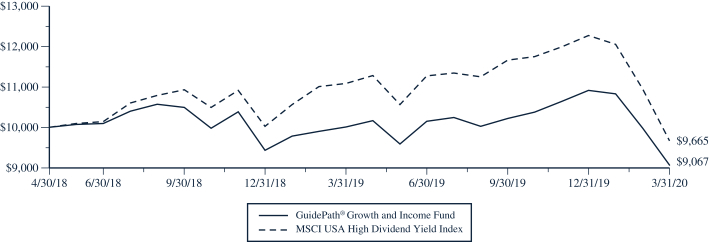

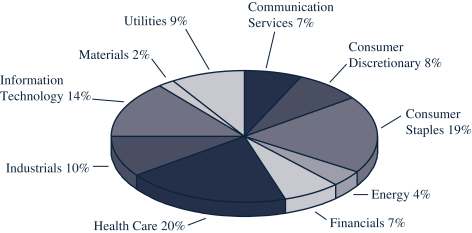

The GuidePath® Growth and Income Fund outperformed its benchmark for the twelve months ending March 31, 2020. The Fund’s volatility targeting component enabled the Fund to navigate both the strong up market of the fourth quarter of 2019 and steep down market of the first quarter of 2020 and maintain healthy relative returns during the market volatility. In addition to purchasing and selling futures contracts, the Fund engaged in a strategy of selling (writing) put options on indexes and ETFs in pursuing its investment objective. The Fund’s investments in futures and options contracts contributed positively to the Fund’s performance for the reporting period. The GuidePath® Conservative Income Fund trailed the benchmark as of the period end due to its lower duration positioning during a time when longer duration Treasuries rallied. Exposure to credit markets hurt the GuidePath® Income Fund’s returns relative to its benchmark in the market downturn during the first quarter of 2020 as the full effects of the coronavirus global pandemic led to panic selling and significant widening of spreads on corporate credits.

Looking Ahead

Given the current economic and market environment uncertainties, AssetMark does not believe that investors should try to make market-timing calls. Rebounds from market bottoms have often been quick and sharp, and we believe removing equity exposure from portfolios has a high opportunity cost under current market conditions. We believe investors should emphasize capital protection and prepare for sudden market trend reversals by broadly diversifying across risk assets and strategies. Positioning for an uncertain environment is different from de-risking—it entails broad diversification that seeks to spread portfolio risk across a variety of markets and risk factors.

Please contact your financial advisor to discuss any questions about your investment strategy or changes in your financial goals. We thank you for including the funds in your portfolio and appreciate the trust you have placed in us.

Sincerely,

Carrie E. Hansen

Trustee, Chairperson and President of the Funds

Important Information

All index returns are sourced from Morningstar and Bloomberg. It is not possible to invest directly in any index.

Past performance is no guarantee of future results.

The AssetMark platform providesfee-based investment advisory programs. Investors are advised to refer to the appropriate Disclosure Brochure, which can be obtained from your financial advisor, for a full description of services provided, including all applicable fees.

The prospectus includes additional information about the GuideMark® and GuidePath® Funds including investment objectives, risk factors, fees and charges as well as other important information that should be carefully read and considered before investing. You may obtain a prospectus by contacting your registered representative.

AssetMark, Inc. is an investment advisor registered with the Securities and Exchange Commission. The Principal Underwriter for the GuideMark® and GuidePath® Funds is AssetMark Brokerage™, LLC, a member of the Financial Industry Regulatory Authority, Inc. AssetMark Brokerage™, LLC is an affiliate of AssetMark, Inc. and shares its address.©2020 AssetMark, Inc. All rights reserved.

2

Investment Terms

Currency Hedged Indicesseek to mitigate the currency exposures in an index compared to a ‘home’ currency (e.g., the US dollar). A currency hedged index may experience higher or lower returns than an unhedged index, depending on relative currency fluctuations. Currency hedges employed by hedged indices may be imperfect.

Market Capitalizationrefers to the total value of an issuer’s shares of stock. It is calculated by multiplying the price of a stock by its total number of outstanding shares.

Volatilityis a statistical measure of the dispersion of returns for a given security or market index.

Index Definitions

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based index that measures the investment-grade, U.S. dollar-denominated, fixed rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage- and asset-backed securities. All securities contained in the Bloomberg Barclays U.S. Aggregate Bond Index have a minimum term to maturity of one year.

Bloomberg Barclays U.S. Corporate High Yield Index measures the U.S. dollar denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

Bloomberg Barclays US MBS Index measures fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Bloomberg Barclays Global Treasury ex US Indexmeasures returns of investment grade, fixed-rate bonds issued by governments in their local currencies, excluding US debt.

Blomberg Barclays EM USD Aggregate Indexmeasures hard currency emerging markets debt that includesUSD-denominated debt from sovereign, quasi-sovereign, and corporate emerging markets issuers.

FTSE Nareit All Equity REITs Indexis a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include alltax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

Markit iBoxxNon-Agency RMBS Indicesmeasures the U.S.non-agency residential MBS market.

MSCI EAFE (Europe, Australasia, Far East) Index measures the equity market performance of countries considered to represent developed markets, excluding the U.S. and Canada.

MSCI Emerging MarketsIndex measures the equity market performance of countries considered to represent emerging markets.

S&P 500®Index focuses on thelarge-cap segment of the US equity market. It includes 500 leading companies in leading industries of the U.S. economy, capturing approximately 75% coverage of US equities.

S&P 500® Energy (Sector)Index comprises those companies included in the S&P 500® Index that are classified as members of the GICS® energy sector.

S&P 500® Information Technology (Sector) Index comprises those companies included in the S&P 500® Index that are classified as members of the GICS® information technology sector.

S&P/LSTA US Leveraged Loan 100 Index measures the performance of the largest facilities in the leveraged loan market.

3

GuideMark® Large Cap Core Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

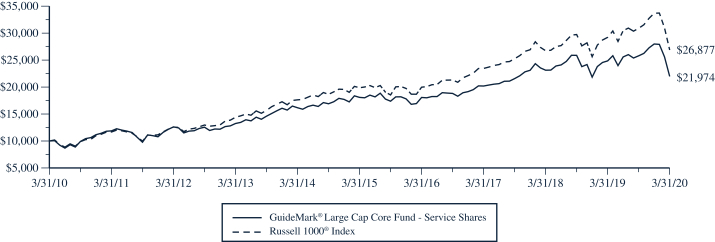

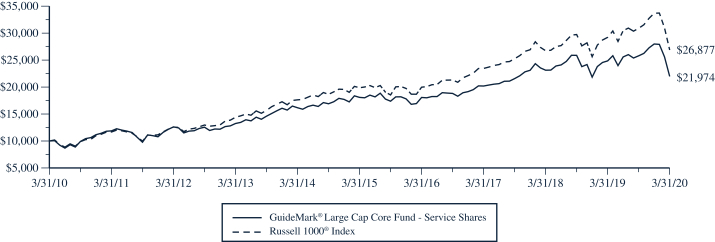

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 1000® INDEX – The Russell 1000® Index measures the performance of thelarge-cap segment of the U.S. equity universe. As of May 10, 2019, the market capitalization of the companies in the Russell 1000® Index ranged from $2.4 billion to $974.2 billion.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | | | | | | | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark® Large Cap Core Fund | | | | | | | | | | | | | | | | |

Service Shares | | | -11.59 | % | | | 3.97 | % | | | 8.19 | % | | | 3.75 | % |

Institutional Shares | | | -11.07 | % | | | 4.57 | % | | | N/A | | | | 7.37 | % |

Russell 1000® Index | | | -8.03 | % | | | 6.22 | % | | | 10.39 | % | | | 6.32 | %(2) |

| (1) | Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| (2) | The return shown for the Russell 1000® Index is from the inception date of the Service Shares. The Russell 1000® Index return from the inception date of the Institutional Shares is 9.44%. |

4

GuideMark® Large Cap Core Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -11.6%, underperforming the Russell 1000® Index at -8.0%. |

| • | | As part of the Fund’s three-factor investment approach, the Fund’s dedicated allocation to the value factor was a detractor as cheaper stocks significantly underperformed during the 12-month period. |

| • | | The Fund saw positive contributions from the quality and momentum factors, as well as favorable sector weightings including an overweight allocation to technology and underweight exposure to energy and financials relative to the benchmark. |

| • | | Fund results were also hurt by a tilt toward stocks with smaller market capitalizations and higher volatility relative to the benchmark. |

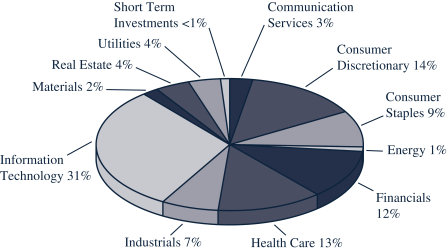

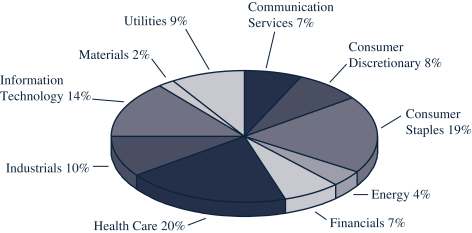

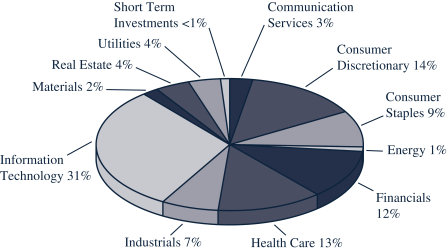

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Microsoft Corp. | | | 4.70 | % |

| | 2 | | | Apple, Inc. | | | 4.35 | % |

| | 3 | | | Vanguard S&P 500 ETF | | | 3.73 | % |

| | 4 | | | Amazon.com, Inc. | | | 2.97 | % |

| | 5 | | | Facebook, Inc. – Class A | | | 1.53 | % |

| | 6 | | | Johnson & Johnson | | | 1.40 | % |

| | 7 | | | Alphabet, Inc. – Class A | | | 1.19 | % |

| | 8 | | | Alphabet, Inc. – Class C | | | 1.19 | % |

| | 9 | | | Berkshire Hathaway, Inc. – Class B | | | 1.15 | % |

| | 10 | | | JPMorgan Chase & Co. | | | 0.98 | % |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P, and has been licensed for use by U.S. Bancorp Fund Services, LLC.

5

GuideMark® Emerging Markets Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

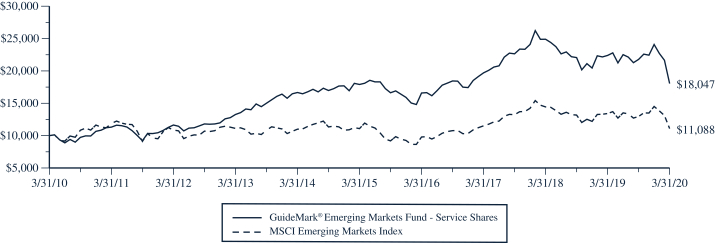

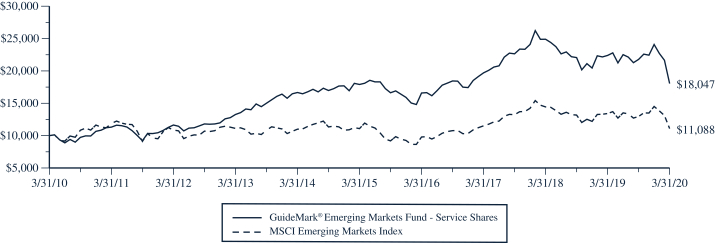

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

MSCI EMERGING MARKETS INDEX – The MSCI Emerging Markets Index measures the equity market performance of countries considered to represent emerging markets. The emerging market country indices included are: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark®Emerging Markets Fund | | | | | | | | | | | | | | | | |

Service Shares | | | -19.40 | % | | | 0.16 | % | | | 6.08 | % | | | 3.29 | % |

Institutional Shares(2) | | | -18.91 | % | | | 0.33 | % | | | N/A | | | | 5.44 | % |

MSCI Emerging Markets Index | | | -17.36 | % | | | 0.01 | % | | | 1.04 | % | | | 8.17 | %(3) |

| (1) | Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| (2) | During the period August 3, 2017 through September 25, 2017, there were no Institutional Shares of the Fund outstanding. Performance information provided for the Institutional Shares during that period reflects the last calculated net asset value of the Institutional Shares on August 2, 2017, without any adjustments. Had there been Institutional Shares outstanding during the period August 3, 2017 through September 25, 2017, their annual returns would have been substantially similar to those of the Service Shares of the Fund because they would have been invested in the same portfolio securities, but would have differed to the extent that the classes have different expenses. Because the Service Shares have higher expenses than the Institutional Shares, the returns of the Service Shares would have been lower than the returns of the Institutional Shares during the same period. |

| (3) | The return shown for the MSCI Emerging Markets Index is from the inception date of the Service Shares. The MSCI Emerging Markets Index return from the inception date of the Institutional Shares is-1.11%. |

6

GuideMark® Emerging Markets Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -19.4%, underperforming the MSCI Emerging Markets Index at-17.4%. |

| • | | As part of the Fund’s equal weighted three-factor investment approach, the Fund’s dedicated allocation to the value factor was a detractor, as cheaper stocks significantly underperformed during the 12-month period. |

| • | | The Fund saw positive contributions from the quality and momentum factors, as well as favorable sector weightings including an underweight allocation to financials relative to the benchmark. |

| • | | Fund results were also hurt by a tilt toward stocks with smaller market capitalizations and higher volatility relative to the benchmark. |

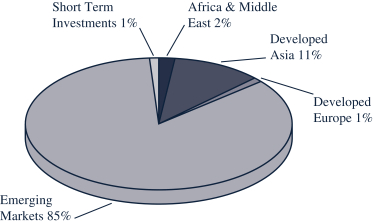

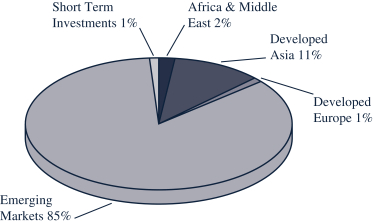

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Alibaba Group Holding, Ltd. – ADR | | | 5.50 | % |

| | 2 | | | Tencent Holdings Ltd. | | | 5.08 | % |

| | 3 | | | KraneShares Bosera MSCI China ETF – Class A | | | 4.58 | % |

| | 4 | | | Taiwan Semiconductor Manufaccturing Co., Ltd. | | | 4.34 | % |

| | 5 | | | Samsung Electronics Co., Ltd. | | | 3.72 | % |

| | 6 | | | iShares Core MSCI Emerging Markets ETF | | | 3.10 | % |

| | 7 | | | iShares MSCI Saudi Arabia ETF | | | 2.15 | % |

| | 8 | | | China Construction Bank Corp. – Series H | | | 1.20 | % |

| | 9 | | | Ping An Insurance Group Co. of China, Ltd. – Series H | | | 1.16 | % |

| | 10 | | | LUKOIL PJSC – ADR | | | 0.78 | % |

7

GuideMark®Small/Mid Cap Core Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

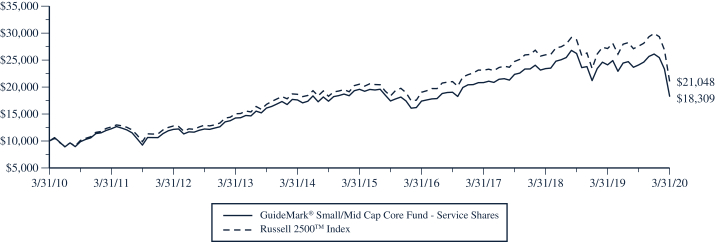

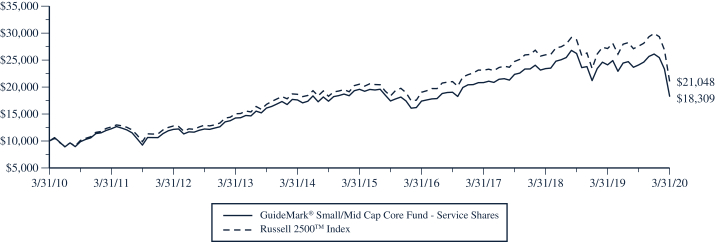

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

RUSSELL 2500TM INDEX – The Russell 2500TM Index measures the performance of the small- tomid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership. As of May 10, 2019, the market capitalization of the companies in the Russell 2500TM Index ranged from $152.3 million to $12.2 billion.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark®Small/Mid Cap Core Fund | | | | | | | | | | | | | | | | |

Service Shares | | | -24.10 | % | | | -1.34 | % | | | 6.23 | % | | | 5.27 | % |

Russell 2500TM Index | | | -22.47 | % | | | 0.49 | % | | | 7.73 | % | | | 6.79 | % |

| (1) | Inception date is 6/29/01. |

8

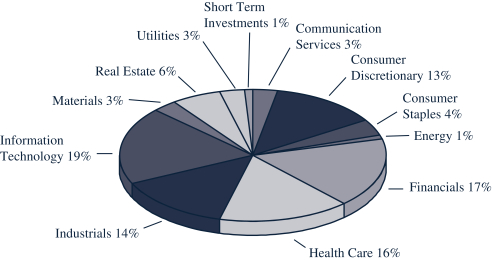

GuideMark®Small/Mid Cap Core Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -24.1%, underperforming the Russell 2500TM Index at -22.5%. |

| • | | As part of the Fund’s equal weighted three-factor investment approach, the Fund’s dedicated allocation to the value factor was a detractor as cheaper stocks significantly underperformed during the 12-month period. |

| • | | The Fund saw positive contributions from the quality and momentum factors, as well as favorable sector weightings including an overweight allocation to technology and underweight exposure to energy and financials relative to the benchmark. |

| • | | Fund results were also hurt by a tilt toward stocks with smaller market capitalizations and higher volatility relative to the benchmark. |

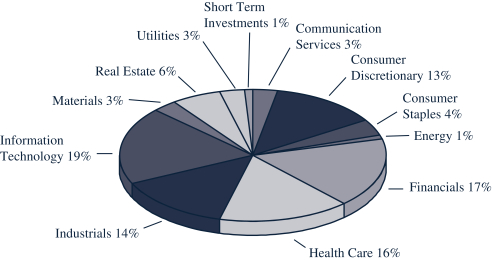

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Vanguard Extended Market ETF | | | 4.03 | % |

| | 2 | | | DexCom, Inc. | | | 0.57 | % |

| | 3 | | | RingCentral, Inc. – Class A | | | 0.51 | % |

| | 4 | | | Domino’s Pizza, Inc. | | | 0.34 | % |

| | 5 | | | Amedisys, Inc. | | | 0.32 | % |

| | 6 | | | Leidos Holdings, Inc. | | | 0.31 | % |

| | 7 | | | DocuSign, Inc. | | | 0.30 | % |

| | 8 | | | Booz Allen Hamilton Holding Corp. | | | 0.29 | % |

| | 9 | | | Seattle Genetics, Inc. | | | 0.29 | % |

| | 10 | | | Pool Corp. | | | 0.28 | % |

9

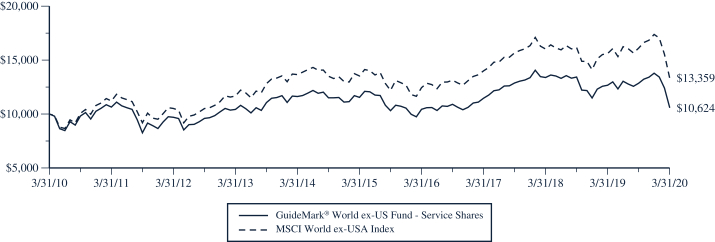

GuideMark®Worldex-US Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

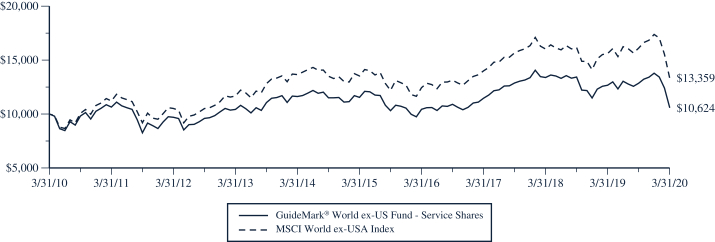

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

MSCI WORLDEX-USA INDEX – The MSCI Worldex-USA Index captures large andmid-cap representation across 22 of 23 developed markets countries excluding the U.S. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark®Worldex-US Fund | | | | | | | | | | | | | | | | |

Service Shares | | | -16.16 | % | | | -1.65 | % | | | 0.61 | % | | | 1.48 | % |

Institutional Shares(2) | | | -15.69 | % | | | -0.89 | % | | | N/A | | | | 0.16 | % |

MSCI Worldex-USA Index | | | -14.42 | % | | | -0.25 | % | | | 2.94 | % | | | 4.37 | %(3) |

| (1) | Inception date is 6/29/01 for Service Shares and 4/29/11 for Institutional Shares. |

| (2) | During the period August 3, 2017 through September 5, 2017, there were no Institutional Shares of the Fund outstanding. Performance information provided for the Institutional Shares during that period reflects the last calculated net asset value of the Institutional Shares on August 2, 2017, without any adjustments. Had there been Institutional Shares outstanding during the period August 3, 2017 through September 5, 2017, their annual returns would have been substantially similar to those of the Service Shares of the Fund because they would have been invested in the same portfolio securities, but would have differed to the extent that the classes have different expenses. Because the Service Shares have higher expenses than the Institutional Shares, the returns of the Service Shares would have been lower than the returns of the Institutional Shares during the same period. |

| (3) | The return shown for the MSCI Worldex-USA Index is from the inception date of the Service Shares. The MSCI Worldex-USA Index return from the inception date of the Institutional Shares is 1.37%. |

10

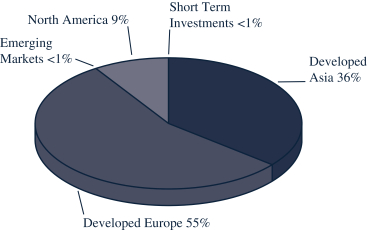

GuideMark®Worldex-US Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -16.2%, underperforming the MSCI World ex-USA Index at -14.4%. |

| • | | As part of the Fund’s equal weighted three-factor investment approach, the Fund’s dedicated allocation to the value factor was a detractor as cheaper stocks significantly underperformed during the 12-month period. |

| • | | The Fund saw positive contributions from the quality and momentum factors, as well as favorable sector weightings including underweight allocations to energy and financials relative to the benchmark. |

| • | | Fund results were also hurt by a tilt toward stocks with smaller market capitalizations and higher volatility relative to the benchmark. |

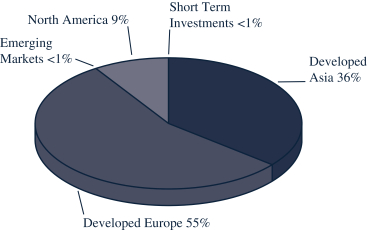

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | iShares MSCI EAFE ETF | | | 2.99 | % |

| | 2 | | | Nestle SA | | | 2.35 | % |

| | 3 | | | Roche Holdings AG | | | 2.15 | % |

| | 4 | | | Novartis AG | | | 1.40 | % |

| | 5 | | | LVMH Moet Hennessy Louis Vuitton SE | | | 0.86 | % |

| | 6 | | | GlaxoSmithKline PLC | | | 0.82 | % |

| | 7 | | | Novo Nordisk AS – Series B | | | 0.77 | % |

| | 8 | | | AstraZeneca PLC | | | 0.73 | % |

| | 9 | | | Nippon Telegraph & Telephone Corp. | | | 0.71 | % |

| | 10 | | | AIA Group, Ltd. | | | 0.65 | % |

11

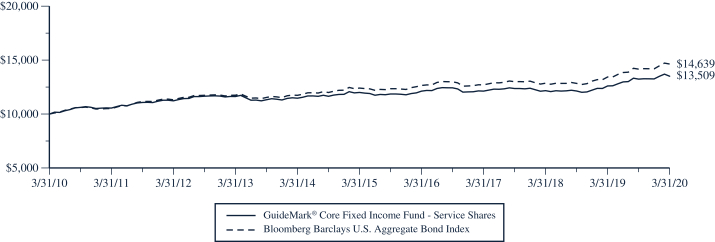

GuideMark®Core Fixed Income Fund

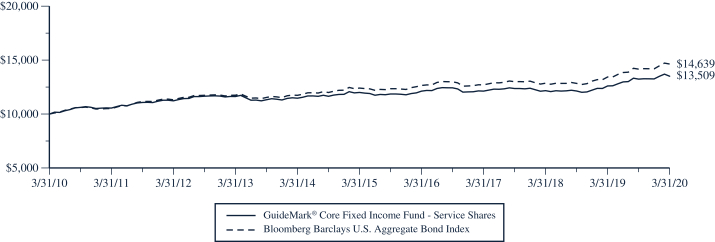

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BLOOMBERG BARCLAYS U.S. AGGREGATE BOND INDEX – The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate debt securities, mortgage- and asset-backed securities. All securities contained in the Bloomberg Barclays U.S. Aggregate Bond Index have a minimum term to maturity of one year.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | | | | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark®Core Fixed Income Fund | | | | | | | | | | | | | | | | |

Service Shares | | | 7.16 | % | | | 2.39 | % | | | 3.05 | % | | | 3.86 | % |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 8.93 | % | | | 3.36 | % | | | 3.88 | % | | | 4.73 | % |

| (1) | Inception date is 6/29/01. |

12

GuideMark®Core Fixed Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned 7.2%, underperforming the Bloomberg Barclays U.S. Aggregate Bond Index at 8.9%. |

| • | | Exposure to securitized credit sectors including non-agency residential mortgage-backed securities, consumer asset-backed securities, and commercial mortgage-backed securities was a headwind to Fund returns for the 12-month period. |

| • | | Favorable positioning within corporate credit, including an overweight allocation to financials relative to the benchmark and security selection within the industrials sector proved beneficial to Fund returns for the 12-month period. |

| • | | Positioning within U.S. Treasuries, including exposure to Treasury Inflation Protected Securities (“TIPS”) and a tactical underweight to duration in the second quarter of 2019, also weighed on the Fund’s returns for the 12-month period. |

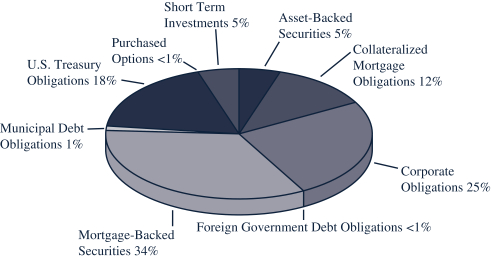

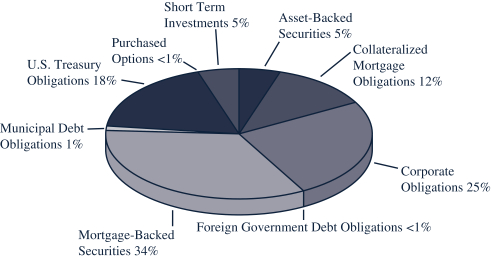

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Percentages expressed exclude derivative instruments, such as futures, options written and swap contracts.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Government National Mortgage Association, Pool #TBA, 2.500%, 4/15/2050 | | | 4.71 | % |

| | 2 | | | Federal National Mortgage Association, Pool #TBA, 2.500%, 5/15/2050 | | | 3.36 | % |

| | 3 | | | U.S. Treasury Note, 2.375%, 8/15/2024 | | | 2.71 | % |

| | 4 | | | Federal National Mortgage Association, Pool #TBA, 3.000%, 4/15/2027 | | | 2.47 | % |

| | 5 | | | Federal National Mortgage Association, Pool #TBA, 3.500%, 4/15/2041 | | | 2.34 | % |

| | 6 | | | U.S. Treasury Bond, 2.500%, 5/15/2046 | | | 2.20 | % |

| | 7 | | | U.S. Treasury Bond, 3.750%, 11/15/2043 | | | 2.04 | % |

| | 8 | | | U.S. Treasury Note, 2.625%, 2/15/2029 | | | 2.01 | % |

| | 9 | | | U.S. Treasury Note, 2.875%, 5/31/2025 | | | 1.82 | % |

| | 10 | | | Federal National Mortgage Association, Pool #BN5279, 4.000%, 2/1/2049 | | | 1.81 | % |

13

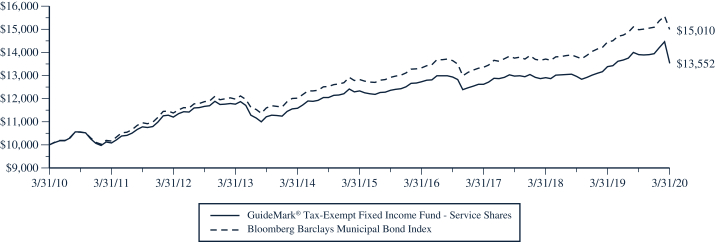

GuideMark®Tax-Exempt Fixed Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

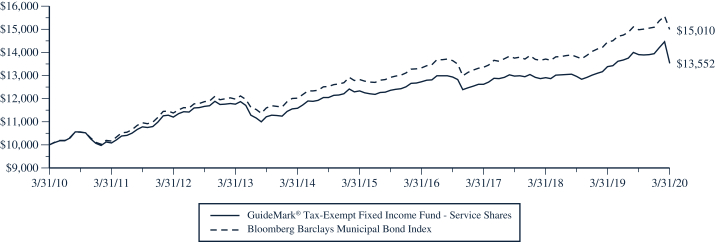

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on March 31, 2010. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BLOOMBERG BARCLAYS MUNICIPAL BOND INDEX – The Bloomberg Barclays Municipal Bond Index is a market-value-weighted index for the long-termtax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, andpre-refunded bonds.

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | | | | |

| | | One Year

| | | Five Year

| | | Ten Year

| | | Since Inception(1)

| |

GuideMark®Tax-Exempt Fixed Income Fund | | | | | | | | | | | | | | | | |

Service Shares | | | 1.16 | % | | | 1.90 | % | | | 3.09 | % | | | 3.26 | % |

Bloomberg Barclays Municipal Bond Index | | | 3.85 | % | | | 3.19 | % | | | 4.15 | % | | | 4.57 | % |

| (1) | Inception date is 6/29/01. |

14

GuideMark®Tax-Exempt Fixed Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned 1.2%, underperforming the Bloomberg Barclays Municipal Bond Index at 3.9%. |

| • | | An overweight position in BBB-rated bonds relative to the benchmark was a detractor from the Fund’s performance, due to weakness seen in the BBB-rated bonds sector and longer duration bonds within the corporate credit segment. |

| • | | The Fund’s out-of-benchmark exposure to below investment grade bonds was also a detractor, as a sell off driven by the coronavirus pandemic and fund outflows led to weakness within municipal credit markets. |

| • | | Security selection within Industry Development Revenue and Pollution Control Revenue bonds positively contributed to Fund returns during the 12-month period, along with an overweight in this sector relative to the benchmark. |

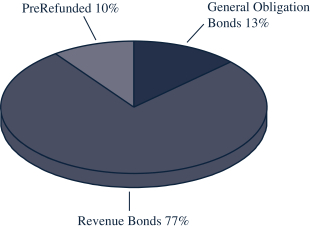

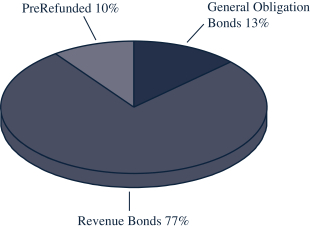

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | New York Environmental Facilities Corp., Series B, Prerefunded, Revenue Bond, 5.500%, 10/15/2027 | | | 2.86 | % |

| | 2 | | | Wisconsin, Series 2, Unrefunded, GO, 5.000%, 05/01/2025 | | | 2.36 | % |

| | 3 | | | Utah Associated Municipal Power Systems San Juan Project, Refunding, Revenue Bond, 5.500%, 06/01/2022 | | | 2.33 | % |

| | 4 | | | Charleston Educational Excellence Financing Corp., Refunding, Revenue Bond, 5.000%, 12/01/2025 | | | 2.01 | % |

| | 5 | | | Virginia College Building Educational Facilities Authority, Revenue Bond, 5.750%, 01/01/2034 | | | 1.96 | % |

| | 6 | | | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Series A1, Revenue Bond, 4.750%, 07/01/2053 | | | 1.70 | % |

| | 7 | | | Illinois, GO, 5.000%, 01/01/2029 | | | 1.58 | % |

| | 8 | | | M-S-R Energy Authority, Revenue Bond, 6.500%, 11/01/2039 | | | 1.56 | % |

| | 9 | | | Mississippi Business Finance Corp., Series H, Revenue Bond, 0.650%, 11/01/2035 | | | 1.56 | % |

| | 10 | | | Central Puget Sound Regional Transit Authority, Series P-1, Refunding, Revenue Bond, 5.000%, 02/01/2027 | | | 1.55 | % |

15

GuideMark®Opportunistic Fixed Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

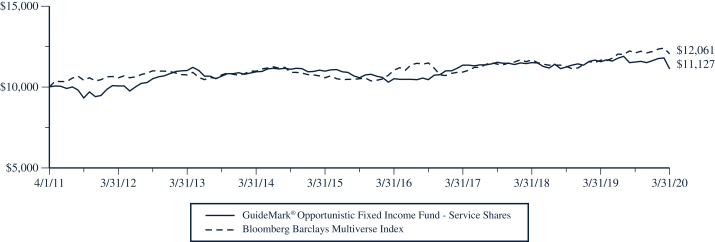

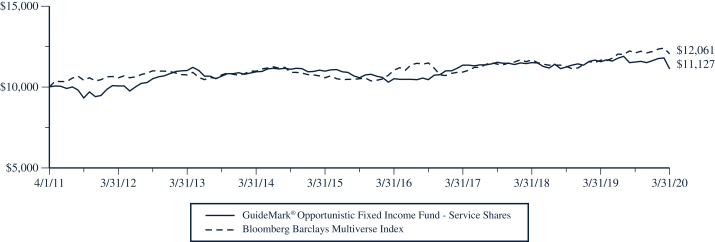

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 1, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BLOOMBERG BARCLAYS MULTIVERSE INDEX – The Bloomberg Barclays Multiverse Index provides a broad-based measure of the global fixed-income bond market, and captures investment grade and high yield securities in all eligible currencies.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Since Inception(1)

| |

GuideMark®Opportunistic Fixed Income Fund | | | | | | | | | | | | |

Service Shares(3) | | | -3.89 | % | | | 0.26 | % | | | 1.19 | % |

Institutional Shares(3) | | | -3.30 | % | | | 1.03 | % | | | 1.80 | % |

Bloomberg Barclays Multiverse Index | | | 3.47 | % | | | 2.67 | % | | | 2.10 | %(2) |

| (1) | Inception date is 4/1/11 for Service Shares and 4/29/11 for Institutional Shares. |

| (2) | The return shown for the Bloomberg Barclays Multiverse Index is from the inception date of the Service Shares. The Bloomberg Barclays Multiverse Index return from the inception date of the Institutional Shares is 1.73%. |

| (3) | The returns reflect the actual performance for each period and do not include the impact of any adjustments made for financial reporting required by Generally Accepted Accounting Principles (GAAP). |

16

GuideMark®Opportunistic Fixed Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -3.9%, underperforming the Bloomberg Barclays Multiverse Index at 3.5%. |

| • | | Maintaining an underweight to Treasury duration was a major detractor from the Fund’s returns for the 12-month period, as U.S. Treasury bonds rallied strongly in the first quarter of 2020 with the flight to safety. |

| • | | Narrow spreads throughout most of the period and the backstop of the Federal Reserve expansive monetary policy in March prompting investment grade credit to rally after falling precipitously was a noticeable detractor from the Fund’s returns due to the Fund’s underweight positioning in the sector relative to the benchmark in favor of sovereign and securitized credit. |

| • | | Duration exposure in select emerging market regions contributed to the Fund’s absolute returns. |

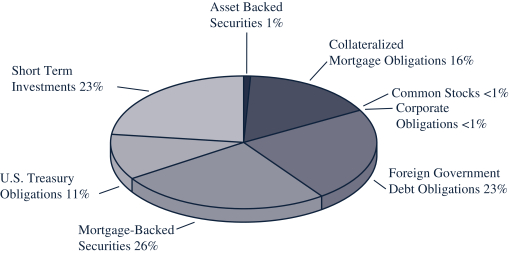

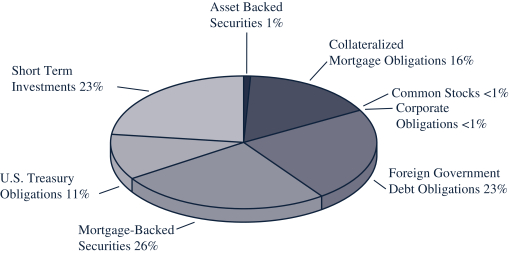

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio.

Percentages expressed exclude derivative instruments, such as forward currency contracts.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | U.S. Treasury Note, 1.750%, 12/31/2024 | | | 8.65 | % |

| | 2 | | | Indonesia Treasury Bond, 8.375%, 9/15/2026 | | | 2.98 | % |

| | 3 | | | Mexican Bonos, 7.250%, 12/9/2021 | | | 2.12 | % |

| | 4 | | | Mexican Bonos, 6.500%, 6/9/2022 | | | 1.96 | % |

| | 5 | | | Federal National Mortgage Association, Pool #2014-95, 3.000%, 4/25/2041 | | | 1.92 | % |

| | 6 | | | Mexican Bonos, 8.000%, 12/7/2023 | | | 1.82 | % |

| | 7 | | | Government National Mortgage Association, Pool #2012-40, 4.000%, 1/20/2042 | | | 1.57 | % |

| | 8 | | | Indonesia Treasury Bond, 8.250%, 7/15/2021 | | | 1.46 | % |

| | 9 | | | Federal Home Loan Mortgage Corp., Series 4868, 4.000%, 3/15/2049 | | | 1.42 | % |

| | 10 | | | Columbia TES, 7.750%, 9/18/2030 | | | 1.22 | % |

17

GuidePath®Growth Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

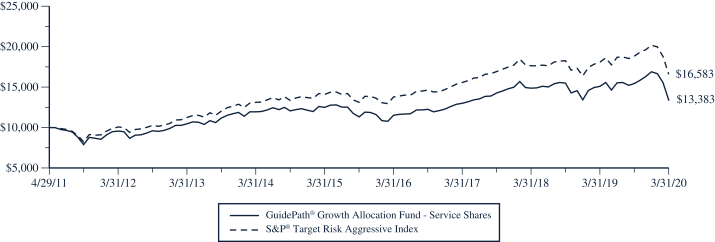

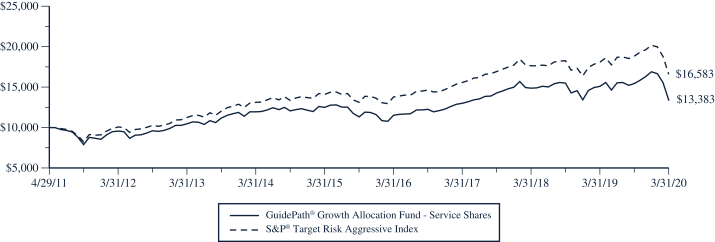

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P® TARGET RISK AGGRESSIVE INDEX – The S&P® Target Risk Aggressive Index is designed to measure the performance of an investment benchmark strategy which seeks to emphasize exposure to equity securities, maximizing opportunities for long-term capital accumulation, while also allocating a portion of exposure to fixed income to enhance portfolio efficiency.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Since Inception(1)

| |

GuidePath®Growth Allocation Fund | | | | | | | | | | | | |

Service Shares | | | -11.35 | % | | | 1.41 | % | | | 3.32 | % |

Institutional Shares | | | -10.82 | % | | | 2.01 | % | | | 4.92 | % |

S&P® Target Risk Aggressive Index | | | -8.31 | % | | | 3.35 | % | | | 5.83 | %(2) |

| (1) | Inception date is 4/29/11 for Service Shares and 9/13/12 for Institutional Shares. |

| (2) | The return shown for the S&P® Target Risk Aggressive Index is annualized from the inception date of the Service Shares. The S&P® Target Risk Aggressive Index average annual return from the inception date of the Institutional Shares is 6.36%. |

18

GuidePath®Growth Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -11.4% underperforming the S&P® Target Risk Aggressive Index at-8.3%. |

| • | | Exposure to small capitalization equity was the largest detractor from the Fund’s returns, as economic concerns dramatically increased in the first quarter of 2020 and investors moved to asset classes perceived to be safer. |

| • | | Global REITs exposure detracted from the Fund’s returns as forced sales and liquidation in the underlying securities resulted in poor price discovery at the end of the period, particularly in malls, hotels and retail industries. |

| • | | Small, country-specific exposure to Switzerland and China through investment in ETFs benefitted the Fund’s relative returns for the period. |

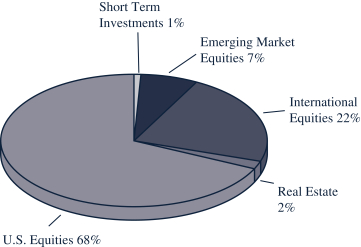

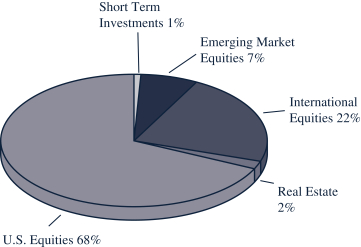

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Vanguard S&P 500 ETF | | | 16.55 | % |

| | 2 | | | Vanguard FTSE Developed Markets ETF | | | 11.20 | % |

| | 3 | | | Schwab U.S.Large-Cap ETF | | | 10.06 | % |

| | 4 | | | American Funds EuroPacific Growth Fund – Class F3 | | | 7.50 | % |

| | 5 | | | iShares Core MSCI Emerging Markets ETF | | | 5.36 | % |

| | 6 | | | American Funds – The Growth Fund of America – Class F3 | | | 5.02 | % |

| | 7 | | | iShares Core S&PSmall-Cap ETF | | | 4.98 | % |

| | 8 | | | American Funds – Fundamental Investors – Class F3 | | | 4.97 | % |

| | 9 | | | AMCAP Fund – Class F3 | | | 4.97 | % |

| | 10 | | | Schwab U.S.Large-Cap Growth ETF | | | 4.96 | % |

19

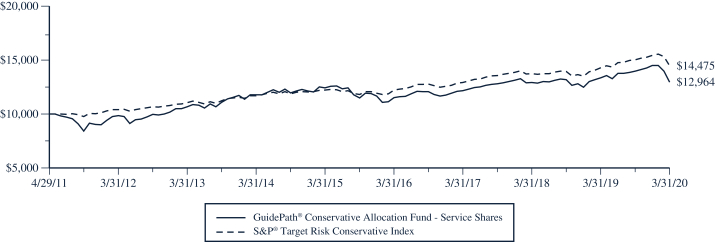

GuidePath® Conservative Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

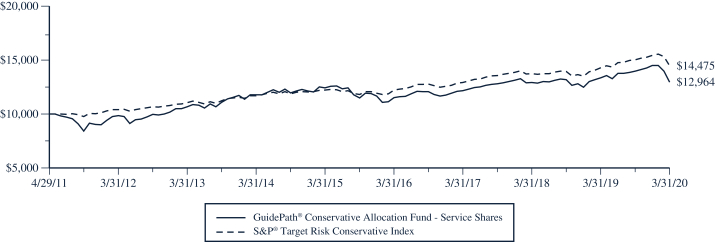

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P® TARGET RISK CONSERVATIVE INDEX – The S&P® Target Risk Conservative Index seeks to emphasize exposure to fixed income securities in order to produce a current income stream and avoid excessive volatility of returns. Equity securities are included to protect long-term purchasing power.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Since Inception(1)

| |

GuidePath® Conservative Allocation Fund | | | | | | | | | | | | |

Service Shares | | | -2.99 | % | | | 0.86 | % | | | 2.95 | % |

Institutional Shares | | | -2.41 | % | | | 1.48 | % | | | 4.03 | % |

S&P® Target Risk Conservative Index | | | 1.24 | % | | | 3.47 | % | | | 4.23 | %(2) |

| (1) | Inception date is 4/29/11 for Service Shares and 9/13/12 for Institutional Shares. |

| (2) | The return shown for the S&P® Target Risk Conservative Index is annualized from the inception date of the Service Shares. The S&P® Target Risk Conservative Index average annual return from the inception date of the Institutional Shares is 4.07%. |

20

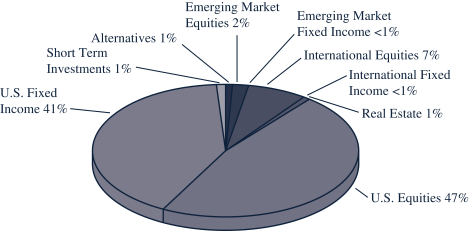

GuidePath® Conservative Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -3.0% underperforming the S&P® Target Risk Conservative Index at 1.2%. |

| • | | Exposure to small capitalization equities detracted from the Fund’s performance, as economic concerns dramatically increased in the first quarter of 2020 and investors moved to asset classes perceived to be safer. Holdings in U.S. REITs also detracted from the Fund’s returns due to forced sales and liquidation in the underlying securities at the end of the period. |

| • | | Exposure to high yield and emerging market bonds detracted from the Fund’s returns as credit spreads widened and investors sought the safety of U.S. Treasuries specifically during the first quarter of 2020. |

| • | | Exposure to long-term bonds, particularly U.S. Treasuries, lifted the Fund’s returns in the flight to safety during the first quarter of 2020. |

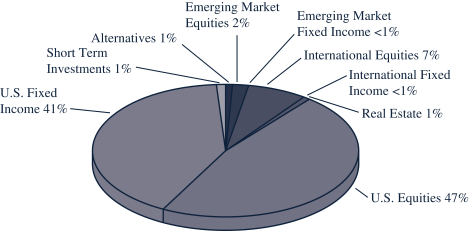

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Vanguard Mortgage-Backed Securities ETF | | | 7.64 | % |

| | 2 | | | iShares Core Growth Allocation ETF | | | 6.49 | % |

| | 3 | | | American Funds – Capital Income Builder – Class F3 | | | 6.23 | % |

| | 4 | | | American Funds – The Income Fund of America – Class F3 | | | 6.17 | % |

| | 5 | | | Vanguard S&P 500 ETF | | | 5.45 | % |

| | 6 | | | iShares Core Aggressive Allocation ETF | | | 5.05 | % |

| | 7 | | | American Funds – Mutual Fund – Class F3 | | | 4.91 | % |

| | 8 | | | Vanguard High Dividend Yield ETF | | | 4.75 | % |

| | 9 | | | Vanguard FTSE Developed Markets ETF | | | 4.16 | % |

| | 10 | | | SPDR Bloomberg Barclays High Yield Bond ETF | | | 4.12 | % |

21

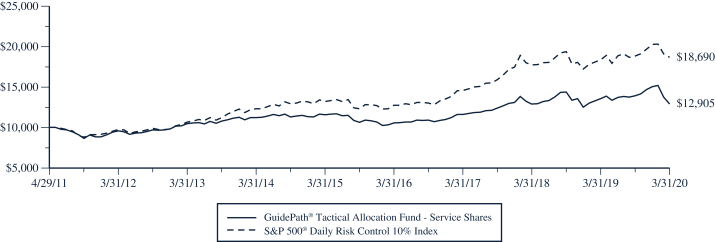

GuidePath® Tactical Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

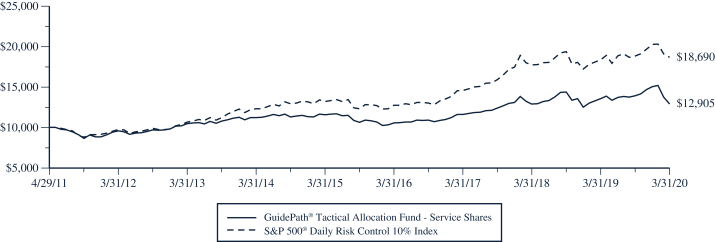

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P 500® DAILY RISK CONTROL 10% INDEX – The S&P 500® Daily Risk Control 10% Index represents a portfolio of the S&P 500® Low Volatility Index plus an interest accruing cash component. The index is dynamically rebalanced to target a 10% level of volatility. Volatility is calculated as a function of historical returns.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Since Inception(1)

| |

GuidePath® Tactical Allocation Fund | | | | | | | | | | | | |

Service Shares | | | -4.83 | % | | | 2.20 | % | | | 2.90 | % |

Institutional Shares | | | -4.27 | % | | | 2.80 | % | | | 4.33 | % |

S&P 500® Daily Risk Control 10% Index | | | 1.85 | % | | | 7.15 | % | | | 7.26 | %(2) |

| (1) | Inception date is 4/29/11 for Service Shares and 9/13/12 for Institutional Shares. |

| (2) | The return shown for the S&P 500® Daily Risk Control 10% Index is annualized from the inception date of the Service Shares. The S&P 500® Daily Risk Control 10% Index average annual return from the inception date of the Institutional Shares is 8.65%. |

22

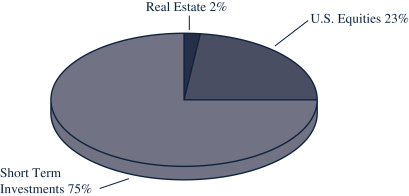

GuidePath® Tactical Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -4.8% underperforming the S&P® 500 Daily Risk Control 10% Index at 1.9%. |

| • | | Larger relative equity exposure compared to the Fund’s benchmark during the bear market fall in the first quarter of 2020 was the largest detractor from the Fund’s returns. The reduction in the Fund’s equity exposure lagged the benchmark in response to the sharp and sudden downturn in equity markets, dampening the Fund’s relative returns. |

| • | | Positioning in intermediate and long-term U.S. Treasuries benefited the Fund’s relative returns as the Federal Reserve lowered interest rates and investors sought safety toward the end of the 12-month period. |

| • | | Within equities, exposure to the technology sector benefitted the Fund’s relative returns, as mega-cap, cash rich technology companies were able to weather the market downturn in the first quarter of 2020 while also benefiting from greater use of technology in response to Shelter in Place orders. |

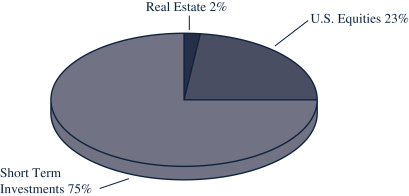

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | | | 23.05 | % |

| | 2 | | | Goldman Sachs Access Treasury 0-1 Year ETF | | | 19.94 | % |

| | 3 | | | FactSet Research Systems, Inc. | | | 1.29 | % |

| | 4 | | | Bristol-Myers Squibb Co. | | | 1.28 | % |

| | 5 | | | Clorox Co. | | | 1.11 | % |

| | 6 | | | Zoetis, Inc. | | | 1.07 | % |

| | 7 | | | Scotts Miracle Grow Co. | | | 0.92 | % |

| | 8 | | | MarketAxess Holdings, Inc. | | | 0.83 | % |

| | 9 | | | Hershey Co. | | | 0.81 | % |

| | 10 | | | RenaissanceRe Holdings Ltd. | | | 0.79 | % |

23

GuidePath® Absolute Return Allocation Fund

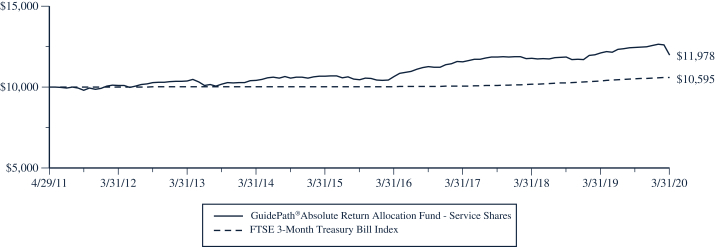

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

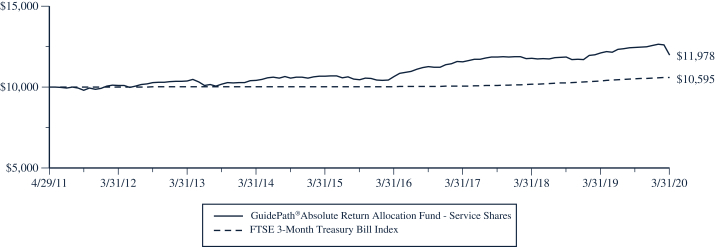

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 29, 2011 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

FTSE 3-MONTH TREASURY BILL INDEX – The FTSE 3-Month Treasury Bill Index tracks the performance of U.S. Treasury Bills with a remaining maturity of three months.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Year

| | | Since Inception(1)

| |

GuidePath® Absolute Return Allocation Fund | | | | | | | | | | | | |

Service Shares | | | -1.11 | % | | | 2.33 | % | | | 2.05 | % |

Institutional Shares | | | -0.53 | % | | | 2.96 | % | | | 2.71 | % |

FTSE 3-Month Treasury Bill Index | | | 2.04 | % | | | 1.12 | % | | | 0.65 | %(2) |

| (1) | Inception date is 4/29/11 for Service Shares and 9/13/12 for Institutional Shares. |

| (2) | The return shown for the FTSE 3-Month Treasury Bill Index is annualized from the inception date of the Service Shares. The FTSE 3-Month Treasury Bill Index average annual return from the inception date of the Institutional Shares is 0.76%. |

24

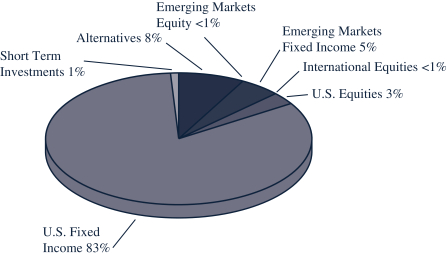

GuidePath® Absolute Return Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -1.1% underperforming the FTSE 3-Month Treasury Bill Index at 2.0%. |

| • | | Exposure to global equities dampened the Fund’s returns as economic concerns dramatically increased in the first quarter of 2020 and equity markets faced a sharp and sudden downturn. |

| • | | Exposure to high yield bonds, floating rate loans and emerging markets bonds detracted from the Fund’s performance specifically during the first quarter or 2020, as credit spreads widened and investors sought the safety of U.S. Treasuries. |

| • | | Positioning in U.S. Treasuries lifted the Fund’s relative returns in light of the investor flight to safety during the first quarter of 2020. |

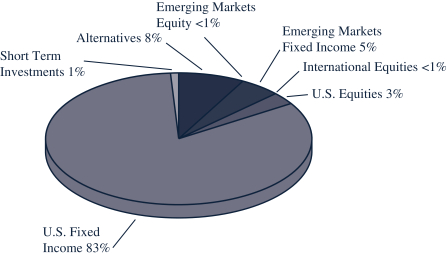

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Vanguard Mortgage-Backed Securities ETF | | | 19.94 | % |

| | 2 | | | DoubleLine Total Return Bond Fund – Institutional Shares | | | 10.08 | % |

| | 3 | | | BlackRock Low Duration Bond Portfolio – Institutional Shares | | | 9.51 | % |

| | 4 | | | DoubleLine Low Duration Bond Fund – Institutional Shares | | | 9.22 | % |

| | 5 | | | ProShares Investment Grade-Interest Rate Hedged ETF | | | 7.61 | % |

| | 6 | | | Schwab Short-Term U.S. Treasury ETF | | | 7.27 | % |

| | 7 | | | iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 7.25 | % |

| | 8 | | | Vanguard Emerging Markets Government Bond ETF | | | 5.42 | % |

| | 9 | | | Vanguard Intermediate-Term Corporate Bond ETF | | | 5.26 | % |

| | 10 | | | DoubleLine Flexible Income Fund – Institutional Shares | | | 4.71 | % |

25

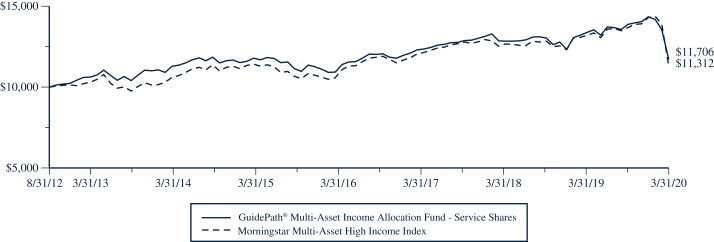

GuidePath® Multi-Asset Income Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

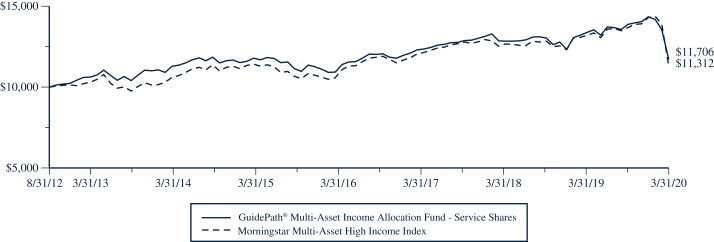

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on August 31, 2012 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

MORNINGSTAR MULTI-ASSET HIGH INCOME INDEX – The Morningstar Multi-Asset High Income Index is a broadly diversified index that seeks to deliver high current income while maintaining long-term capital appreciation.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Years

| | | Since Inception(1)

| |

GuidePath® Multi-Asset Income Allocation Fund | | | | | | | | | | | | |

Service Shares | | | -12.53 | % | | | 0.01 | % | | | 2.10 | % |

Morningstar Multi-Asset High Income Index | | | -14.35 | % | | | 0.03 | % | | | 1.64 | % |

| (1) | Inception date is 8/31/12. |

26

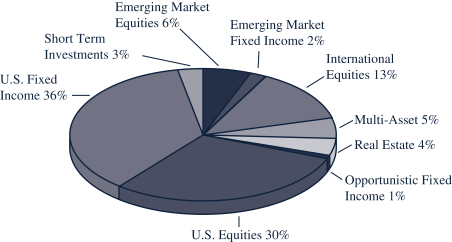

GuidePath® Multi-Asset Income Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned -12.5% outperforming the Morningstar Multi-Asset High Income Index at -14.4%. |

| • | | Positioning in intermediate and long-term U.S. Treasuries benefited the Fund’s relative returns as the Federal Reserve lowered interest rates and investors sought safety toward the end of the 12-month period. |

| • | | Exposure to small capitalization equities detracted from Fund returns, as economic concerns dramatically increased in the first quarter of 2020 and investors moved to asset classes perceived to be safer. |

| • | | Global REITs exposure detracted from the Fund’s returns as forced sales and liquidation in the underlying securities resulted in poor price discovery at the end of the period, particularly in malls, hotels and retail industries. |

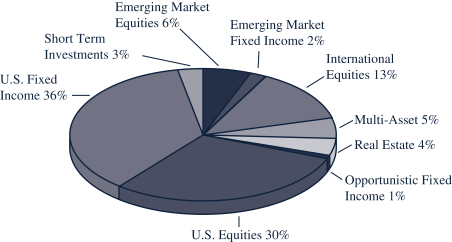

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio, less securities lending collateral.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | iShares 0-5 Year High Yield Corporate Bond ETF | | | 6.14 | % |

| | 2 | | | T. Rowe Price Institutional Floating Rate Fund | | | 6.09 | % |

| | 3 | | | iShares Emerging Markets Dividend ETF | | | 5.88 | % |

| | 4 | | | SPDR S&P International Dividend ETF | | | 5.74 | % |

| | 5 | | | Loomis Sayles Global Allocation Fund – Y Shares | | | 4.94 | % |

| | 6 | | | WisdomTree U.S. LargeCap Dividend Fund | | | 4.52 | % |

| | 7 | | | iShares Select Dividend ETF | | | 4.51 | % |

| | 8 | | | iShares International Select Dividend ETF | | | 4.35 | % |

| | 9 | | | Schwab U.S. Dividend Equity ETF | | | 4.18 | % |

| | 10 | | | Vanguard High Dividend Yield ETF | | | 4.18 | % |

27

GuidePath® Flexible Income Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

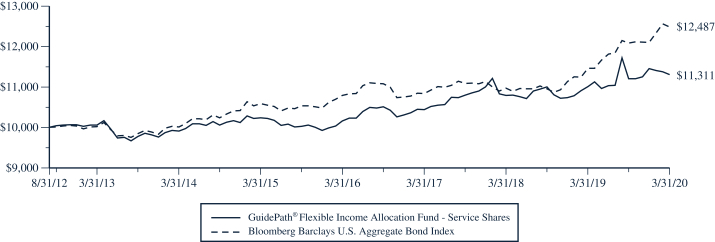

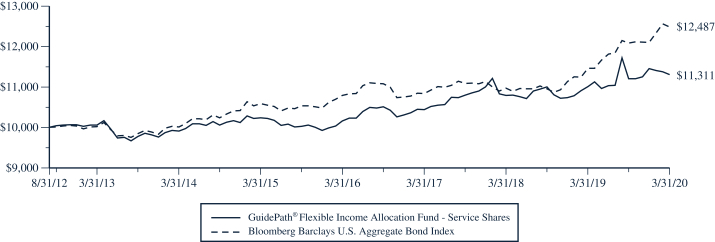

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on August 31, 2012 (commencement of the Fund’s Service Shares operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BLOOMBERG BARCLAYS U.S. AGGREGATE BOND INDEX – The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate debt securities, mortgage- and asset-backed securities. All securities contained in the Bloomberg Barclays U.S. Aggregate Bond Index have a minimum term to maturity of one year.

| | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Five Years

| | | Since Inception(1)

| |

GuidePath® Flexible Income Allocation Fund | | | | | | | | | | | | |

Service Shares | | | 2.76 | % | | | 2.01 | % | | | 1.64 | % |

Institutional Shares | | | 3.38 | % | | | 2.77 | % | | | 2.33 | % |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 8.93 | % | | | 3.36 | % | | | 2.97 | %(2) |

| (1) | Inception date is 8/31/12 for Service Shares and 9/13/12 for Institutional Shares. |

| (2) | The return shown for the Bloomberg Barclays U.S. Aggregate Bond Index is from the inception date of the Service Shares. The Bloomberg Barclays U.S. Aggregate Bond Index return from the inception date of the Institutional Shares is 3.04%. |

28

GuidePath® Flexible Income Allocation Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned 2.8% underperforming the Bloomberg Barclays U.S. Aggregate Bond Index at 8.9%. |

| • | | Positions in high yield bonds in late February through early March were the main detractors from the Fund’s performance, as credit spreads widened and investors sought out the safety of U.S. Treasuries during the 12-month period. |

| • | | Exposure to long-term and intermediate-term U.S. Treasuries during the third quarter of 2019 was additive to the Fund’s returns as the Federal Reserve lowered interest rates during the 12-month period. |

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | SPDR Bloomberg Barclays High Yield Bond ETF | | | 24.12 | % |

| | 2 | | | iShares iBoxx high Yield Corporate Bond ETF | | | 23.38 | % |

| | 3 | | | iShares Broad USD High Yield Corporate Bond ETF | | | 14.80 | % |

| | 4 | | | iShares 0-5 Year High Yield Corporate Bond ETF | | | 12.41 | % |

| | 5 | | | X-Trackers USD High Yield Corporate Bond ETF | | | 10.08 | % |

| | 6 | | | BlackRock High Yield Portfolio – Institutional Shares | | | 9.79 | % |

| | 7 | | | Vanguard High-Yield Corporate Fund – Admiral Shares | | | 4.81 | % |

29

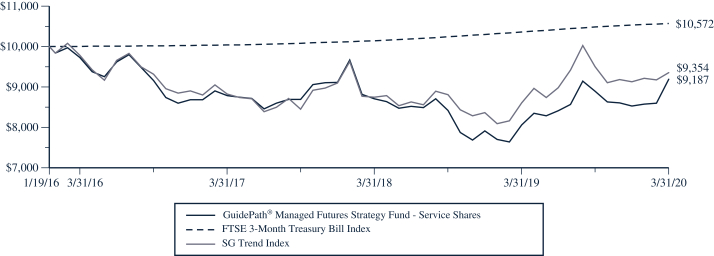

GuidePath® Managed Futures Strategy Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

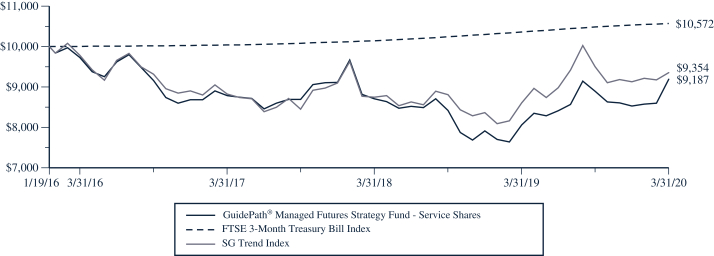

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on January 19, 2016 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

FTSE 3-MONTH TREASURY BILL INDEX – The FTSE 3-Month Treasury Bill Index tracks the performance of U.S. Treasury Bills with a remaining maturity of three months.

SG TREND INDEX – The SG Trend Index is designed to track the 10 largest (by AUM) trend following commodity trading advisors and be representative of the trend followers in the managed futures space. Managers must meet the following criteria: must be open to new investment, must report returns on a daily basis, must be an industry recognized trend follower as determined at the discretion of the SG Index Committee, and must exhibit significant correlation to trend following peers and the SG Trend Indicator.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Since Inception(1)

| |

GuidePath® Managed Futures Strategy Fund | | | | | | | | |

Service Shares | | | 14.03 | % | | | -2.00 | % |

Institutional Shares | | | 14.70 | % | | | -1.41 | % |

FTSE 3-Month Treasury Bill Index | | | 2.04 | % | | | 1.33 | % |

SG Trend Index | | | 8.75 | % | | | -1.58 | % |

| (1) | Inception date is 1/19/16 for Service Shares and Institutional Shares. |

30

GuidePath® Managed Futures Strategy Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund’s Service Shares returned 14.0%, outperforming the SG Trend Index at 8.8%. |

| • | | Long positions in bonds, specifically longer-term U.S. Treasuries, were a significant driver of the Fund’s returns as investors fled to the safety of Treasuries causing interest rates to decline to historic lows in light of the uncertainty caused by the coronavirus pandemic. |

| • | | With the turn in equity trends in the first quarter of 2020, equity exposure shifted from long to net short by the end of the first quarter of 2020, which helped to limit the Fund’s losses relative to the benchmark. |

| • | | Positions in grain commodities including corn were a headwind to Fund returns during the period, due to trade tensions causing grain prices to swing up and down significantly. |

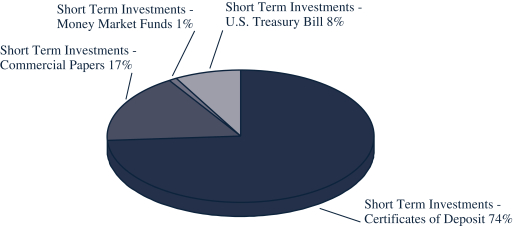

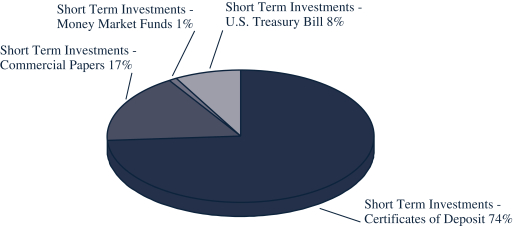

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio.

Percentages expressed exclude derivative instruments, such as forward currency contracts and futures contracts.

Top Ten Holdings

| | | | |

| Rank | | Security/Holding | | % of Net

Assets |

| The GuidePath® Managed Futures Strategy Fund did not hold any long term investments as of March 31, 2020. |

31

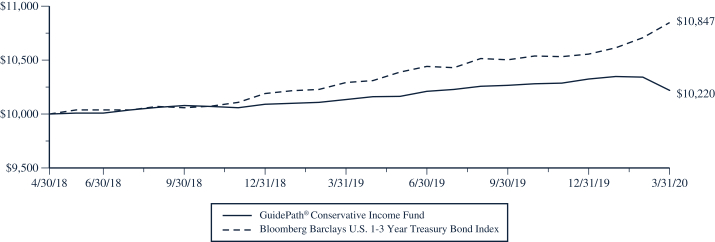

GuidePath® Conservative Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

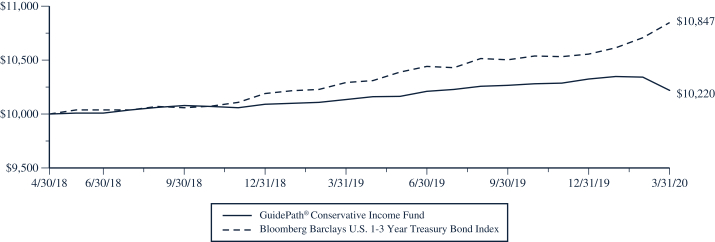

TOTAL RETURN BASED ON A $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on April 30, 2018 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

BLOOMBERG BARCLAYS U.S. 1-3 YEAR TREASURY BOND INDEX – The Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index measures the performance of the U.S. government bond market and includes public obligations of the U.S. Treasury with a maturity between 1 and up to (but not including) 3 years. Certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. Separate trading of registered interest and principal securities (STRIPS) are excluded from the Index because their inclusion would result indouble-counting.

| | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN (for periods ended March 31) | |

| | | One Year

| | | Since Inception(1)

| |

GuidePath® Conservative Income Fund | | | | | | | | |

Shares | | | 0.85 | % | | | 1.14 | % |

Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index | | | 5.41 | % | | | 4.33 | % |

| (1) | Inception date for the Fund is 4/30/18. |

32

GuidePath® Conservative Income Fund

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Continued) (Unaudited)

| • | | For the 12 months ended March 31, 2020, the Fund returned 0.9% trailing the Bloomberg Barclays U.S. 1-3 Year Treasury Bond Index at 5.4%. |

| • | | Exposure to corporate credit in the first quarter of 2020, both investment grade and high yield, detracted from the Fund’s returns for the 12-month period. |

| • | | A target allocation of 50% to cash equivalents dampened the Fund’s returns, as the Federal Reserve reversed course from tightening to easing monetary policy, and bond yields across the curve fell. |

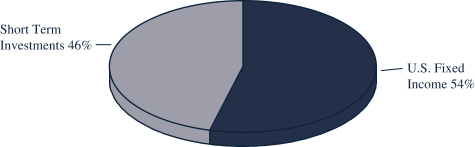

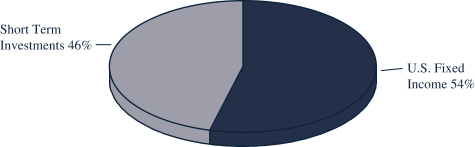

Components of Portfolio Holdings*

* Pie chart represents percentages of total portfolio.

Top Ten Holdings

| | | | | | | | |

| Rank | | | Security/Holding | | % of Net

Assets | |

| | 1 | | | Schwab Short-Term U.S. Treasury ETF | | | 52.61 | % |

33

GuidePath® Income Fund

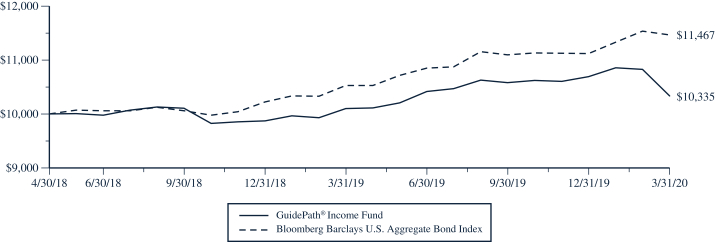

MANAGER’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

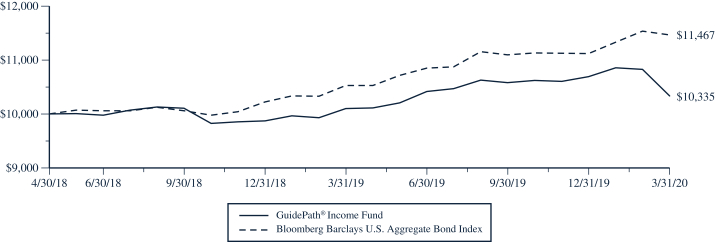

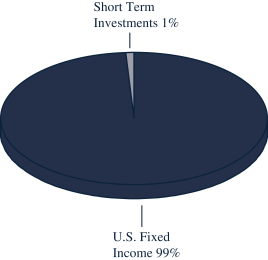

TOTAL RETURN BASED ON A $10,000 INVESTMENT

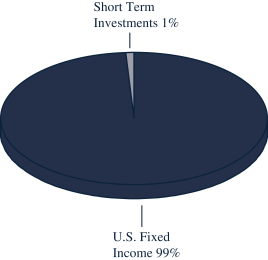

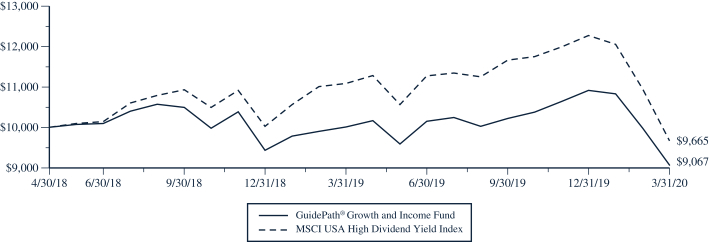

This chart assumes an initial gross investment of $10,000 made on April 30, 2018 (commencement of the Fund’s operations). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements, when they are necessary to keep expenses at the expense cap, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than the original cost. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.