UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

£ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

S ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

£ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

£ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number 0-32255

BALATON POWER INC.

(Exact name of Registrant specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

16678 77th Avenue

Surrey, British Columbia

Canada V3S 8G1

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of each exchange on which registered |

None | Not applicable |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

COMMON SHARES WITHOUT PAR VALUE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of the Company's only class of capital or common stock as at December 31, 2007 was 83,453,737 common shares without par value.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES [ ] NO [X]

If this is an annual report or a transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES [ ] NO [X]

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

U.S. GAAP [X] | International Financial Reporting Standards as issued [ ]

by the International Accounting Standards Board | Other [ ] |

If "other" has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES [ ] NO [X]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by checkmark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YES [ ] NO [ ] N/A

ii

TABLE OF CONTENTS |

| | | Page |

Glossary | | 1 |

Cautionary Note to U.S. Investors concerning estimates of Measured and Indicated Resources | 4 |

Cautionary Note to U.S. Investors concerning estimates of Inferred Resources | 4 |

Forward-Looking Statements | 4 |

PART I | | 6 |

Item 1. | Identity of Directors, Senior Management and Advisers | 6 |

Item 2. | Offer Statistics and Expected Timetable | 6 |

Item 3. | Key Information | 6 |

Item 4. | Information on the Company | 12 |

Item 4A. | Unresolved Staff Comments | 32 |

Item 5. | Operating And Financial Review And Prospects | 32 |

Item 6. | Directors, Senior Management and Employees | 37 |

Item 7. | Major Shareholders and Related Party Transactions | 42 |

Item 8. | Financial Information | 44 |

Item 9. | The Offer and Listing | 45 |

Item 10. | Additional Information | 46 |

Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 58 |

Item 12. | Description of Securities Other Than Equity Securities | 58 |

PART II | | 58 |

Item 13. | Defaults, Dividend Arrearages and Delinquencies | 58 |

Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 59 |

Item 15. | Controls and Procedures | 59 |

Item 16. | [Reserved] | 59 |

Item 16A. | Audit Committee Financial Expert | 59 |

Item 16B. | Code of Ethics | 60 |

Item 16C. | Principal Accountant Fees and Services | 60 |

Item 16D. | Exemptions from the Listing Standards for Audit Committees | 60 |

Item 16E. | Purchases of Equity SecuritIES by the Issuer and Affiliated Purchasers | 61 |

PART III | | 62 |

Item 17. | Financial Statements | 62 |

Item 18. | Financial Statements | 62 |

Item 19. | Exhibits | 63 |

iii

Glossary

Term | Definition |

Acquisition | The Company's acquisition of CRL in October 2002 |

Balco | Bharat Aluminium Co. |

Bayer Process | A method of producing alumina from bauxite by heating it in a sodium hydroxide solution |

BRIMAC | Balaton Remote Integrated Monitoring and Control System |

BSA | Balaton Power Corporation S.A. |

CDN GAAP | Generally accepted accounting principles in Canada |

CFC | Controlled foreign corporation |

CIMM | Canadian Institute of Mining and Metallurgy |

Code | Internal Revenue Code |

Committee | Board of directors of the Company who will be Plan administrators |

Company | Balaton Power Inc. |

COMPL | Continental Orissa Mining Private Limited |

Continental | Continental Resources Ltd., a company incorporated under the laws of Québec |

CRA | Canada Revenue Agency |

CRL | Continental Resources (USA) Ltd., a wholly-owned subsidiary of the Company |

EDTA | Ethylene-diamene-tetra-acetic acid technique, industry standard for analyses for radicals |

Essar | Essar Aluminium Orissa Limited, an Indian resource development corporation |

Essar Agreement | Agreement between CRL and Essar dated May 8, 2007 |

Exchange Act | Securities Exchange Act of 1934, as amended (United States) |

FERC | United States Federal Energy Regulatory Commission |

Gandhamardan Project | The Company's mineral project, situated in the Gandhamardan Hill, Duragali, State of Orissa, India |

GSI | Geological Survey of India |

1

Term | Definition |

ICA | Investment Canada Act |

Investor | A person who acquires one or more Common Shares of the Company |

IRS | United States Internal Revenue Service |

ISO Options | Incentive stock options |

Joint Venture Agreement | The joint venture agreement between Continental and OMC dated April 18, 1997 |

Lease | The mining lease issued in the name of OMC for over 285 hectares named Block 7 of the Gandhamardan Project |

MECL | Mineral Exploration Corp. Ltd. |

NQSO Options | Non-qualified stock options |

ODM | Orissa Directorate of Mines |

OMC | Orissa Mining Corporation Limited, an Orissa State owned government corporation, the Company's joint venture partner |

Perial | Perial Ltd., a company incorporated under the laws of the Province of Ontario, a major shareholder of the Company |

PFIC | Passive foreign investment companies |

Pisces Process | Fish protective water inlet device |

Plan | The Company's 2004 incentive stock option plan |

QEF | Qualified electing fund |

Report | A report prepared by E.A. Gallo, P. Geo, titled "Summary Report Gandhamardan Bauxite Deposit Sambalpur and Bolangir Districts, State of Orissa, India", dated April 8, 2003 and amended January 19, 2007, and February 9, 2007 |

Proposed Revised Joint Venture Agreement | The Proposed Revised Joint Venture Agreement is between CRL and OMC |

SEC | United States Securities and Exchange Commission |

System | Low-impact run-of-the-river hydroelectric power production system |

Tax Act | Income Tax Act (Canada) |

Treaty | Canada-United States Income Tax Convention, 1980 |

2

Term | Definition |

US GAAP | Generally accepted accounting principles in the United States of America |

U.S. Securities Act | Securities Actof 1933, as amended (United States) |

Resource Category (Classification) Definitions |

Mineral Reserve | The SEC's Industry Guide 7 - "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" defines "reserve" as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: (1)Proven (Measured) Reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. (2)Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

Mineral Resource | Canadian National Instrument 43-101, "Standards of Disclosure for Mineral Projects" ("NI 43-101") defines a "Mineral Resource" as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Resource has a lower level of confidence than that applied to an Indicated Resource. An Indicated Resource has a higher level of confidence than an Inferred Resource but has a lower level of confidence than a Measured Resource. (1)Inferred Resource. That part of the Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

3

| (2)Indicated Resource. That part of the Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. (3)Measured Resource. That part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. The SEC's Industry Guide 7 - "Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations" does not define or recognize resources. As used in this Annual Report, "resources" are as defined in Canadian NI 43-101. |

CAUTIONARY NOTE TO U.S. INVESTORS

CONCERNING ESTIMATES OF MEASURED AND INDICATED RESOURCES

This Annual Report uses the terms "Measured Resources" and "Indicated Resources". We advise U.S. investors that while these terms are recognized and required by Canadian regulations, the SEC does not recognize them.U.S. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

CAUTIONARY NOTE TO U.S. INVESTORS

CONCERNING ESTIMATES OF INFERRED RESOURCES

This Annual Report uses the term "inferred resources". We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. Inferred resources have a great amount of uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not guarantees of the Company's future operational or financial performance and are subject to risks and uncertainties. When used in this Annual Report, the words "estimate", "intend", "expect", "anticipate" and similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on these statements, which speak only as of the date of this Annual Report. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in such forward-looking statements.

4

Actual operational and financial results may differ materially from the Company's expectations contained in the forward-looking statements due to various factors, many of which are beyond the control of the Company. These factors include, but are not limited to, the need for additional financing to pursue the Company's business plan, risks involved in conducting business outside of the United States, changes in Canadian or U.S. tax or other laws or regulations, material changes in capital expenditures, as well as the risks and uncertainties described in the section entitled "Risk Factors" set forth in Item 3 of this Annual Report.

5

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following selected financial is data derived from and should be read in conjunction with the audited financial statements of the Company for the last five fiscal years ended December 31, 2007, as well as the sections of this Annual Report entitled "Information on the Company" and "Operating and Financial Review and Prospectus". The financial statements are presented in United States dollars and have been prepared in accordance with CDN GAAP. Note 13 to the financial statements provides a summary of the material differences between CDN GAAP and US GAAP as they relate to the Company's financial statements included herein.

Amounts presented for the year ended December 31, 2004, have been restated to make certain adjustments as described in Note 16 to the December 31, 2005 annual financial statements included the Company's Annual Report on Form 20-F for the year ended December 31, 2006, as filed with the SEC on July 17, 2007.

(US$) | December 31,

2007 | December 31,

2006 | December 31,

2005 | December 31,

2004

Restated | December 31,

2003 |

Balance Sheet Data | | | | | |

Total assets (CDN GAAP) | $ 144,076 | $ 230,254 | $ 602,464 | $ 733,976 | $ 1,632,818 |

Total assets (US GAAP) | 144,076 | 230,254 | 602,464 | 733,976 | 1,632,818 |

Total liabilities | 699,017 | 1,039,037 | 336,898 | 488,617 | 1,727,812 |

Share capital | 5,537,404 | 4,958,884 | 4,958,884 | 4,130,154 | 2,738,402 |

Retained earnings (deficit) (CDN GAAP) | (8,344,055) | (7,196,173) | (6,121,824) | (4,972,337) | (2,910,886) |

Retained earnings (deficit) (US GAAP) | (8,344,055) | (7,196,173) | (6,121,824) | (4,972,337) | (2,910,886) |

Period End Balances (as at) | | | | | |

6

(US$) | December 31,

2007 | December 31,

2006 | December 31,

2005 | December 31,

2004

Restated | December 31,

2003 |

Working capital (deficit) | (552,335) | (839,484) | 64,390 | 44,183 | 1,664,886 |

Resource properties | -0- | -0- | -0- | -0- | 1,145,163 |

Shareholders' equity | (554,941) | (808,783) | 265,566 | 245,359 | (94,994) |

Statement of Operations Data | | | | | |

Revenue | $ - | $ - | $ - | $ - | $ - |

Production costs | - | - | - | - | - |

Write-down of resource properties | 126,176 | - | - | | - |

General and administrative expenses | 449,488 | 476,028 | 914,749 | 1,239,605 | 195,286 |

Consulting fees and commissions | 435,000 | 425,124 | 63,000 | 245,882 | 72,000 |

Professional fees | 137,218 | 173,769 | 171,738 | 207,376 | 34,980 |

Interest expense | - | - | - | 13,040 | 11,931 |

Write down of loan receivable | - | - | - | 355,548 | - |

Oil income | - | 5,793 | - | - | - |

Interest income | - | 1,366 | - | - | - |

Oil expense | - | 6,587 | - | - | - |

Income (loss) (CDN GAAP) | (1,147,882) | (1,074,349) | (1,149,487) | (2,061,451) | (314,197) |

Loss per common share (CDN GAAP) 2 | (0.01) | (0.01) | (0.02) | (0.03) | (0.01) |

Loss per common share (US GAAP)2 | (0.01) | (0.01) | (0.02) | (0.03) | (0.01) |

Number of outstanding shares | 83,453,737 | 76,025,117 | 76,025,117 | 73,795,260 | 66,762,2141 |

Notes:

(1) During 2003, a shareholder subscribed for 1,200,000 common shares for net cash proceeds of $77,490 to the Company. Such shares were not issued to the shareholder until after the year-end. As such, the number of issued and outstanding shares and retained earnings as at December 31, 2003 do not reflect this transaction.

(2) Stock options and warrants outstanding were not included in the computation of diluted loss per share as their inclusion would be anti-dilutive.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following provides a discussion of certain risks facing the Company. Additional risks that are currently unknown or that are currently deemed immaterial may also materially adversely affect the Company's business, results of operations, financial condition and cash flows. You could lose all or part of your investment due to any of these risks.

7

The Company has no history of earnings and is subject to the risks inherent in a start-up company.The Company has no operating history, no revenues and is subject to all the risks inherent in a start-up business enterprise including lack of cash flow and no source of revenue. The Company does not currently generate any revenue from the sale of its products and will require significant additional capital to place its property into production.

The Company will require additional funding to continue operations. Historically, the Company has funded its operations through the sale of equity capital and will require additional funding to continue operations. The Company has had and will continue to have capital requirements in excess of its currently available resources and may not be able to meet its financial commitments as they become due. The Company is dependent on the proceeds of future financing to finance CRL's operations. To the extent that any such financing involves the sale of equity capital, the interests of the Company's then existing shareholders could be substantially diluted. There is no assurance the Company will be successful in raising additional financing.

The loss of any directors or officers would adversely affect the Company. The loss of any directors or officers would adversely affect the results of the Company. The Company is wholly dependent at present upon the personal efforts and abilities of its officers and directors, who exercise control over the day-to-day affairs of the Company. The loss of any director or officer could have an adverse effect on the Company.

The issuance of additional shares would dilute the interests of existing shareholders. The Company is authorized to issue an unlimited number of common shares. On December 31, 2007, the Company had 83,453,737 common shares issued and outstanding as described in Note 7 of the audited annual financial statements included herein. The Board of Directors has the power to issue additional shares and may in the future issue shares to acquire products, equipment or properties, or for other corporate purposes. Any additional issuance by the Company from its authorized but unissued share capital would have the effect of diluting the interest of existing shareholders.

The Company's officers and directors may be indemnified against certain securities liabilities.The laws of the Province of British Columbia provide that the Company can indemnify any director, officer, agent and/or employee as to those liabilities and on those terms and conditions as are specified in theBritish Columbia Business Corporations Act. Further, the Company may purchase and maintain insurance on behalf of any such persons whether or not the Company has the power to indemnify such person against the liability insured. The foregoing could result in substantial expenditures by the Company and prevent any recovery from such officers, directors, agents and employees for losses incurred by the Company as a result of their actions. The Company has been advised that in the opinion of the SEC, indemnification is against public policy as expressed in theU.S. Securities Act, and is, therefore, unenforceable.

The Company's management may not be subject to U.S. legal process. As Canadian citizens and residents, certain of the Company's directors and officers may not be subject to U.S. legal proceedings,a result of which is that recovery on judgments issued by U.S. courts may be difficult or impossible. While reciprocal enforcement of judgment legislation exists between Canada and the U.S., the Company's insiders may have defences available to avoid, in Canada, the effect of U.S. judgments under Canadian law, making enforcement difficult or impossible. The Company's management may not have any personal assets available in the U.S. to satisfy judgments of U.S. courts. Therefore, the Company's shareholders in the United States may have to avail themselves of remedies under Canadian corporate and securities laws for perceived oppression, breach of fiduciary duty and like legal complaints. Canadian law may not provide for remedies equivalent to t hose available under U.S. law.

8

Exploration and development of natural resources involves a high degree of risk. The Company is required to obtain the approval from the State of Orissa for the agreement with OMC, which has been superseded and replaced with a further Proposed Revised Joint Venture Agreement between CRL and OMC, before it will have the opportunity for exploration and future development of CRL's Gandhamardan Project in Orissa State, India. The terms of the Proposed Revised Joint Venture Agreement have been accepted by both CRL and OMC, however such revised agreement remains subject to the approval from the State of Orissa. As of the date of the Report, the Orissa State Government has not authorized OMC to execute the final Proposed Revised Joint Venture Agreement. There can be no assurance the Orissa State Government will authorize OMC to sign the Proposed Revised Joint Venture Agreement on the terms currently prescribed. In the event that OMC does not sign the Proposed R evised Joint Venture Agreement, the Company's interest in the Project would be significantly adversely affected.

Substantial expenditures are required to establish resources and reserves through drilling, to develop processes for extraction and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. No assurance can be given that Mineral Resources will be converted to Mineral Reserves, that funds required for the development can be obtained on a timely basis, that funds will be adequate to complete a feasibility study and/or that bauxite can be economically extracted from the Gandhamardan Project.

Even with a combination of experience, knowledge and careful examination, operating hazards and risks may not be mitigated. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of resources, any of which could result in work stoppages, damage to persons or property and possible environmental damage. Although the Company has or will obtain liability insurance in an amount which it considers adequate, the nature of these risks is such that the liabilities might exceed policy limits, the liabilities and hazards might not be insurable against, or the Company might not elect to insure itself against such liabilities due to high premium costs or other reasons, in which event the Company could incur significant costs that could have a material adverse effect upon its financial condition.

Commodity prices fluctuate and are affected by factors beyond the Company's control. The Company's revenues, if any, are expected to be in large part derived from future resource efforts including those of CRL's projects. Commodity prices fluctuate and are affected by numerous factors beyond the Company's control including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to extractive developments and improved extractive production methods. The effect of these factors on the price of bauxite, and therefore the economic viability of the Company's exploration projects, cannot be accurately predicted.

The Company operates in a highly competitive industry. The resource industry is intensely competitive in all of its phases with numerous companies seeking to explore and develop resource properties. The Company competes with many companies larger than it and possessing greater financial resources and technical facilities. Competition could adversely affect CRL's ability to develop the Gandhamardan Project.

9

The Company may enter into option and joint venture agreements, which would reduce its interests in these projects. In order to conserve financial resources, the Company's efforts are focused on CRL, which intends to enter into option, joint venture, or development agreements to form a consortium to finance the exploration and possible development of the Gandhamardan Project following obtaining approval from the State Government of Orissa for the Proposed Revised Joint Venture Agreement between OMC and CRL. In addition, on May 8, 2007 the Company announced that CRL entered into an agreement in principal with Essar to develop the Gandhamardan Project and set up an Alumina/Aluminum complex subject to feasibility study and applicable approvals. The Essar Agreement is subject to the negotiation and execution of a definitive shareholder's agreement among Essar and CRL and, additionally, subject to the approval of the OMC and the approval of the revised agreeme nt between CRL and OMC to develop the Gandhamardan Deposit by the State of Orissa, India. There is no assurance that OMC or the Government of Orissa will approve CRL's agreement with Essar or the Proposed Revised Joint Venture Agreement between CRL and OMC. As of July 14, 2008, a definitive agreement between CRL and Essar had not been reached. If such agreements are entered into, CRL's current interest in the Gandhamardan Project would be reduced and CRL would share with others in the development of the project. There is no assurance that a consortium will be formed, or if formed, that it will be formed on terms favourable to CRL, or that the development of the Gandhamardan Project will proceed.

The Company cannot guarantee title to its assets. While the Company has or will receive title opinions for any properties in which it has or will acquire a material interest, such opinions cannot be viewed as a guarantee of title. Title may be affected by unregistered interests and claims to title, which could adversely affect the Company's ability to develop its properties.

The Company has inadequate working capital. It will be necessary for CRL to raise additional funds this year to move forward on the Gandhamardan Project. The Company's other projects, such as the Pisces Process, will require raising funds in addition to the funds required for CRL's project in India. The Company and/or CRL may be required to raise funds through private placements or public offerings of treasury shares, through debt financing, if available, or sale of a portion of its interest in its projects. If the Company is not successful in raising further funds, it may not be able to complete its development plans.

The Company lacks experience in fish protection projects.The Company has not constructed, installed or sold the Pisces Process (other than its tested prototypes) to anyone. There is no assurance that the Company will ever construct, install or sell the Pisces Process and the Company has not received any significant expression of interest for the Pisces Process.

The Company is subject to Indian government regulations.CRL is subject to all governmental regulations in India on the development of the Gandhamardan Project. The level of regulation by the government in India relating to the project could affect the Company's ability to obtain partners or consortium members for the construction of the aluminium complex.

The Company relies on Indian government agencies for the development of the Gandhamardan Project. The Company relies heavily on the cooperation of the State Government of Orissa, OMC and other governmental agencies in the finalization of joint venture relationships and the issuance of permits and licenses for the development of the Gandhamardan Project. The Company is dependent upon the Government of Orissa to approve the Proposed Revised Joint Venture Agreement and the Essar Agreement and there is no assurance that the Government of Orissa will give such approval.

The Companymay face inflationary and other economic pressures. The Company is not currently generating any revenue. However, future revenues, if any, may be generated from CRL's Gandhamardan Project. Any such revenues could be affected by world commodity prices. No immediate effect in respect to inflation and changes on prices is realized. However, inflationary pressures affect the Company's operation and development expenditures, which is primarily incurred in U.S. dollars. The directors' estimation of inflation is considered with respect to the general state of the world economy and the economy of the United States in particular.

The Companyissubject to government policies in India.Activities conducted by residents and non-residents in India and the flow of investment into the country and the return of capital out of the country are subject to regulation. All such controls and regulations are subject to change from time to time. Any change in government regulation or the economic and political stability of the host country India, could have a material adverse effect on the business of the Company and could impact investments by U.S. residents in the Company's common shares.

10

Currency exchange rate fluctuations and higher inflation may adversely impactthe Company'sfuture operating results and financial condition.The exchange rate between the Indian Rupee and the U.S. dollar has changed substantially in the last two decades and could fluctuatesubstantially in the future. On an annual average basis, the Indian Rupee declined against the U.S. dollar from 1980 to 2002. In May 2002, however, the Indian Rupee began appreciating relative to the U.S. dollar. Because some the Company's assets may be held in Indian Rupees, devaluation or depreciation of the value of the Indian Rupee will adversely affect the value of these assets in foreign currency terms. In addition, the Company's market valuation could be materially adversely affected by the devaluation of the Indian Rupee if U.S. investors analyze the Company's value and performance based on the U.S. dollar equivalent of the Company's financial condition and operating results. The Company expects that a substantial portion of its expenses, including personnel costs, may be denominated in Indian Rupees. As such, any appreciation of the Indian Rupee against the U.S. dollar would reduce the cost advantage derived from the Company's Indian Rupee-denominated expenses and would likely adversely affect the Company's financial condition and results of operations. In addition, an increase in inflation would adversely affect world economies generally, which would adversely affect the Company's business.

The Company is subject to risks of operating in India.A large part of the Company's assets and business operations are expected to be located in India. Consequently, the Company's financial performance and the market price of its shares may be affected by social and economic developments in India and the policies of the Government of India, including taxation and foreign investment policies, as well as changes in exchange rates, interest rates and controls.

Political instability related to the current multi-party coalition government could halt or delay the liberalization of the Indian economy and adversely affect economic conditions in India generally. The Government has traditionally exercised and continues to exercise significant influence over many aspects of the economy. The Company's business, and the market price and liquidity of its shares, may be affected by interest rates, changes in Government policy, taxation, social and civil unrest and other political, economic or other developments in or affecting India. Since 1991, successive Indian governments have pursued policies of economic liberalization, including significantly relaxing restrictions on the private sector. The Company cannot assure you that these liberalization policies will continue in the future. The rate of economic liberalization could change, and specific laws and policies affecting the Company's business, foreign investment, currency exchange rates and other matter s affecting investment in the Company's securities could change as well. A significant change in India's economic liberalization and deregulation policies could adversely affect business and economic conditions in India generally, including the Company's business.

The Company may be required to protect its patents which could be costly. In March 1999, BSA filed for a patent on its Pisces Process and was in a patent pending status until November 4, 2003 when the patent was issued. The Company has a license to manufacture and sell the Pisces Process detailed in Item 4 of this document. There is no assurance, however, that third parties will not infringe or try to infringe on the patents. Litigation may be necessary to enforce patents issued or licensed to the Company or to determine the scope and validity of a third party's proprietary rights. The Company could incur substantial costs if litigation is required to defend itself in patent suits brought by third parties or if the Company initiates such suits. There can be no assurance that funds or resources would be available to the Company in the event of any such litigation. Additionally, there can be no assurance that the Company would prevail in any such action. An adverse outcome i n litigation or an interference to determine priority or other proceeding in a court or patent office could subject the Company to significant liabilities, or require the Company to cease using certain technology or products, any of which may have a material adverse effect on the Company's business, financial condition and results of operations.

11

Litigation and disputes may adversely affect the Company's profitability and financial condition.The Company is, and may be in the future, subject to legal actions and disputes in the ordinary course of its business operations. Legal actions and disputes may arise under contracts, regulations or from a course of conduct taken by the Company. Differences in the legal and judicial system according to region make it difficult to predict the result of litigation or other legal proceedings currently involving the Company or of these which may arise in the future. Although the Company believes that it has adequately reserved in all material aspects for the costs of litigation and regulatory matters, no assurance can be provided that such reserves are sufficient. Given the large or indeterminate amounts of damages sometimes sought, and the inherent unpredictability of litigation and disputes, it is possible that an adverse outcome could have an adverse effect on the Company's results of operation or cash flows. No assurance can be made that this matter will be resolved in a manner and on terms acceptable to CRL or that the rulings when made will be in favour of CRL. As the outcome is not determinable, the Company has not accrued any amount for this claim.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development

The Company's legal and commercial name is Balaton Power Inc. The Company was incorporated under theCompany Act (British Columbia) (now the British ColumbiaBusiness Corporations Act) under the laws of the Province of British Columbia on June 25, 1986. The Company's principal place of business is 16678 77th Avenue, Surrey, BC V3S 8G1, telephone number (604) 574-9551.

The Company is in the start-up stage and has initiated limited operations. Prior to the acquisition/merger with CRL in October 2002 (the "Acquisition"), the Company was in the business of constructing, installing and selling "low impact" run-of-the-river hydroelectric power production systems (the "System") which incorporated a patent pending fish protective water inlet device (the "Pisces Process"). Following the Acquisition, the Company changed its focus to pursuing the exploration and development of the Company's mineral project, a significant bauxite deposit, in the Gandhamardan Hill, Duragali, State of Orissa, India (the "Gandhamardan Project"). During 2007, the hydroelectric site held by the Company's then wholly owned subsidiary, Snoqualmie River Hydro Inc., expired and the Company no longer owns or has any rights to any sites for hydroelectric power development. The Acquisition, the Gandhamardan Project and other important events in the development of t he Company's business are described below.

The Company commenced business with certain hydroelectric power assets known as the Pisces System and the Balaton Remote Integrated Monitoring and Control System ("BRIMAC"). The Company's intent was to use these systems in connection with the development of hydroelectric power projects in the Pacific Northwest region of the United States. Between 2000 and 2002, the Company entered into various agreements to acquire unlicensed hydropower sites. Although these acquisitions were completed, subsequent to 2002, all of the hydropower sites have expired or terminated and the Company no longer owns or has any rights to any sites for hydroelectric power development.

12

On September 30, 2002, the Company entered into a Stock Exchange Agreement with Perial Ltd. ("Perial") for the purchase of CRL. The Company issued a total of 33,000,000 common shares in its own capital to acquire CRL, of which 25,000,000 shares were allocated to Perial and 8,000,000 shares were issued as finder's fees to non-related parties of the Company. At that time CRL was a joint venture partner with OMC, which held an interest in the Gandhamardan Project. The Acquisition was treated as a capital transaction by the Company and not a business combination. Prior to the Acquisition, CRL sold all of its oil and gas assets to its then parent company, Perial, for a promissory note in the amount of $481,724 and the assumption of CRL's outstanding debts. The note is non-interest bearing and is repayable through the payment of a 25% interest in production from the oil and gas assets. Subsequently the 25% interest was converted to a 6.25% override and the value was lowered to $126,176. No revenues were received during 2007 and this interest was written down to zero on December 31, 2007.

CRL's sole asset at the time of the Acquisition was a 50% interest and effective control of Continental Orissa Mining Private Limited ("COMPL"), which CRL acquired during 2002 in consideration for agreeing to direct the exploration and development of the Gandhamardan Project.

Over the past three years, the Company has focussed on establishing a strong working relationship with OMC, the other 50% owner of COMPL. The Company and OMC have discussed the principal terms of the exploration and possible development of the Gandhamardan Project, although no written agreement has yet been signed. Management has held discussions with potential partners to provide financial and technical resources to assist in the exploration and potential development of the Gandhamardan Project. These efforts have taken substantially all of the time of the Company's management over the past three years.

During 2004, COMPL was voluntarily dissolved to make way for a new entity that will facilitate future joint venture agreements with OMC. CRL and OMC plan to incorporate a new entity that will direct the development of the Gandhamardan Project according to the terms and conditions of the Proposed Revised Joint Venture Agreement submitted to the Orissa Government for approval, upon the effectiveness of such revised agreement.

In March 2007, CRL entered into an agreement in principle (the "Essar Agreement"), with Essar Aluminum Orissa Limited ("Essar"), an Indian resource development corporation, to develop the Gandhamardan Project and set up an Alumina/Aluminum complex subject to a feasibility study and applicable approvals. The Essar Agreement is subject to the negotiation and execution of a definitive agreement among Essar and CRL and, additionally, subject to the approval of the OMC and the approval of the revised agreement between CRL and OMC to develop the Gandhamardan Deposit by the State of Orissa, India. As of July 14, 2008, a definitive agreement between CRL and Essar had not been reached.

The Company is currently seeking a manager, joint venture partner or purchaser for its Pisces Process. The Company does not intend to install the Pisces System at any sites. As of the date hereof, the Company has not constructed, installed or sold any Systems or the Pisces Process (other than its tested prototypes). There is no assurance that the Company will ever construct, install or sell the Pisces Process and the Company has not received any significant expression of interest in the Pisces Process.

B. Business Overview

The Company's principle business is focussed on the exploration of the Gandhamardan Project located in the State of Orissa in India through CRL. The Company is currently seeking approval from the Government in the State of Orissa to a Proposed Revised Joint Venture Agreement with OMC as described below relating to the Gandhamardan Project.

13

Gandhamardan Project

On April 18, 1997, Continental entered into an agreement with OMC to form a 50-50 joint venture company in the State of Orissa, India with its primary purpose to explore and develop the Gandhamardan Project (the "Joint Venture Agreement"). Continental managed the daily operations of COMPL, the joint venture company. Under the Joint Venture Agreement, OMC had an option to participate in Continental's proposed aluminium complex (including refinery, power plant and smelter). OMC had to exercise this option within one year from the date of transfer of leases concerning the Gandhamardan Project, of which such option could be extended by mutual consent. Pursuant to the Joint Venture Agreement, Continental bore all costs associated with the preparation of a feasibility report and exploration of the deposit. In 2002, Continental transferred its interest in the deposit to CRL, an unrelated company, with the result that CRL and OMC became joint venture partners. On September 30, 2002, the Company entered into a Stock Exchange Agreement with Perial for the purchase of CRL in consideration for 33,000,000 common shares. See "History and Development" above for terms of the acquisition of CRL. During 2004, COMPL was voluntarily dissolved at the request of OMC. CRL and OMC plan to incorporate a new entity that will direct the development of the Gandhamardan Project according to the terms and conditions of a new agreement submitted to the Orissa Government for approval.

During 2004, CRL met with OMC to discuss the terms and conditions for a new joint venture agreement to explore and develop the Gandhamardan Project. Based upon these discussions, CRL's interests in the mining phase would increase and place 100% of the downstream facilities (alumina plant and aluminium shelter) in favour of CRL. The Proposed Revised Joint Venture Agreement has been approved by CRL and OMC but is awaiting final approval from the Government of Orissa. No assurance can be made that the Government of Orissa will give its approval to the new propose joint venture agreement.

During 2005, CRL set up and staffed an office in Bhubaneswar, Orissa and proceeded with the initial start up of the Gandhamardan Project. Included in the staff in the Bhubaneswar is a geological team that has obtained more than 1400 maps and reports covering the Gandhamardan area and has catalogued them with reference numbers for evaluating the top sites for alumina refinery, power plants, railroad spurs, water pipeline and aluminium smelter.

The Company believes that the most efficient way to potentially develop the Gandhamardan Project is through the establishment of a consortium, as it will allow the members to spread the financial burden for building the aluminium complex. The Company has not yet confirmed specific consortium partners although several parties have expressed interest.There is no assurance that the Company will be able to form a consortium, or what the terms of any consortium formed will be. If the Company is unable to locate suitable partners, the Company will have to seek additional financing to carry out the Gandhamardan Project.

In May 2007, CRL entered into an agreement (the "Essar Agreement") with Essar Aluminum Orissa Limited ("Essar"), an Indian resource development corporation, to develop the Gandhamardan Project and set up an Alumina/Aluminum complex subject to feasibility study and applicable approvals. The Essar Agreement is subject to the negotiation and execution of a definitive agreement among Essar and CRL and, additionally, subject to the approval of the OMC and the approval of the revised agreement between CRL and OMC to develop the Gandhamardan Project by the State of Orissa, India. As of July 14, 2008, a definitive agreement between CRL and Essar has not been reached.

Summary Report on Gandhamardan Project

CRL's Gandhamardan Project is summarized in the following information from a report prepared by E.A. Gallo, P. Geo. titled "Summary Report Gandhamardan Bauxite Deposit Sambalpur and Bolangir Districts, State of Orissa, India", dated April 8, 2003 as amended January 19, 2007, and February 9, 2007 (the "Report"). The Report summarizes exploration on the property by past operations, and was prepared and is disclosed by the Company under Canadian securities regulations. The Report has been filed on SEDAR and can be reviewed in its entirety at www.SEDAR.com. E.A. Gallo, a geologist, had worked extensively on the project and had visited the Gandhamardan area and made several trips to India to become knowledgeable on the Gandhamardan area.

14

Historical Resource Estimates

The Report sets out resource estimates calculated prior to the Canadian Institute of Mining and Metallurgy ("CIM") Best Practices Guidelines for Estimation of Mineral Resources and Mineral Reserves and National Instrument 43-101 ("NI 43-101") and were not performed to CIM standards. The Company has obtained the original data but a qualified person has not done the work necessary to verify the classification of the resource and the Company is not treating it as a NI 43-101 defined resource. It is a historic estimate that should not be relied upon. Moreover, there is no guarantee that further work will result in the delineation of the current mineral resources.

Significant risks are associated with the development of the Gandhamardan Project and the Company's effort to date can only be considered preliminary in nature. Many factors affect the development of the project including the proximity of the project to rail, roads, water, cost of energy and environmental concerns associated with the development of the project. Based on the preliminary nature of the Company's efforts, there can be no assurance that the project will be feasible or economically viable.

Introduction And Terms Of Reference

The Report was written at the request of Continental Resources (USA) Ltd., a subsidiary of Balaton Power Inc. It was written on April 8, 2003, and revised on January 15, 2007 and further revised on February 9, 2007.

The Gandhamardan bauxite deposit was the focus of an extensive exploration-evaluation programme conducted in stages over a number of years by ODM and MECL. A need was recognized to examine and assimilate the technical results of all this work, to draw whatever conclusions might emerge, and to make recommendations regarding any further work that might be warranted. The Report addresses that need.

The prime sources of data utilized in preparing the Report are technical reports written by geologists and engineers employed on the project by ODM and MECL. Information was also obtained from other technical reports, and from discussions held with officials of OMC, MECL, GSI, National Aluminium Company of India, and SNC-Lavalin Inc. As well, the author drew upon observations made during five visits to the area, including three to the property. These three visits lasted a total of 59 days.

The author has relied heavily on technical reports written by ODM and MECL personnel. These persons are competent, qualified professionals. Nevertheless, occasional minor discrepancies were found in their reports, such as conflicting numbers, typographical errors, and illegible words. Most of the discrepancies involve drill hole sites and pit sites, and they could not be resolved. One of the more bothersome was in the ODM resource calculations. One calculation appears to include Block 10, the other does not, although it is not clear that this is the case. At any rate, Block 10 is one of the smallest blocks, and accounts for only about 3% of the total calculated tonnage. Its inclusion or omission does not change the weighted average grade calculations. The other discrepancies appear to have similar minimal effects on the size, shape, and grade of the bauxite zone, due to the thorough extent of work performed, and to the straight-forward nature of the deposit.

15

Property Description And Location

The Gandhamardan bauxite deposit occurs at the top of Gandhamardan hill. This hill, which has a plateau top, is linear, aligned in a NE-SW direction. The hill straddles the boundary between Balangir District to the SE, and Sambalpur District to the NW, in the west central part of the State of Orissa, in eastern India.

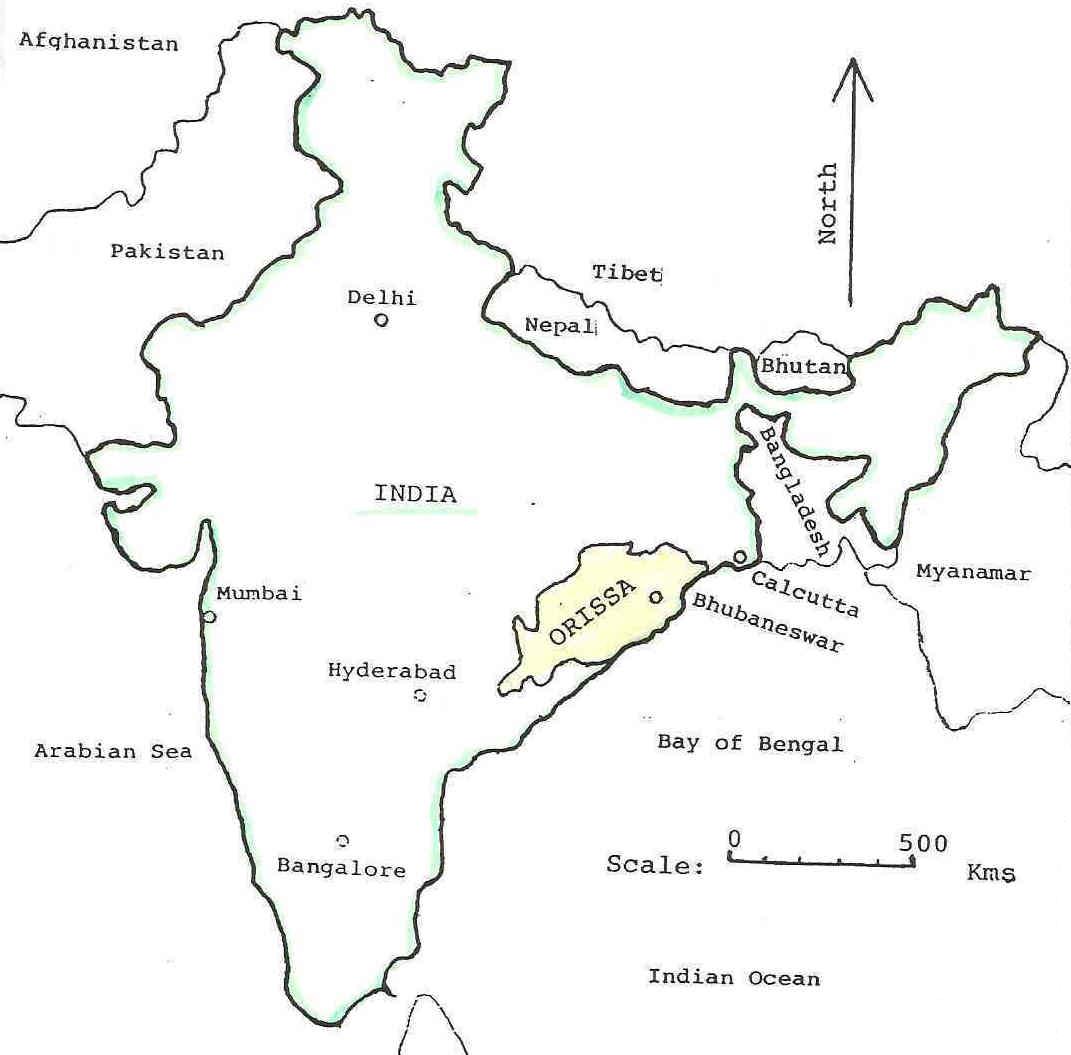

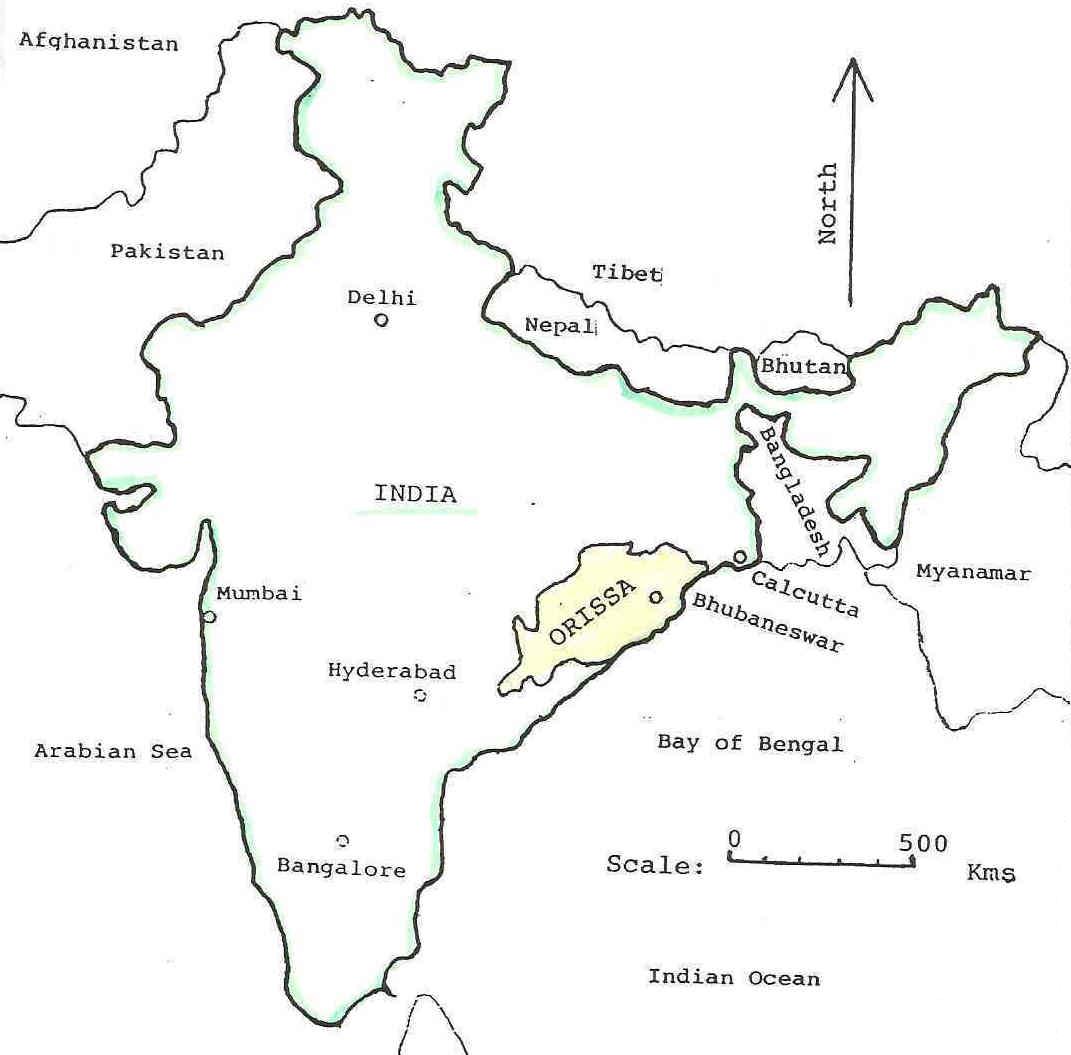

Figure I shows the general location of the State of Orissa in India.

Figure I - General Location Sketch

16

Figure II shows the location of Gandhamardan in the State of Orissa.

Figure II - Location of Gandhamardan in Orissa

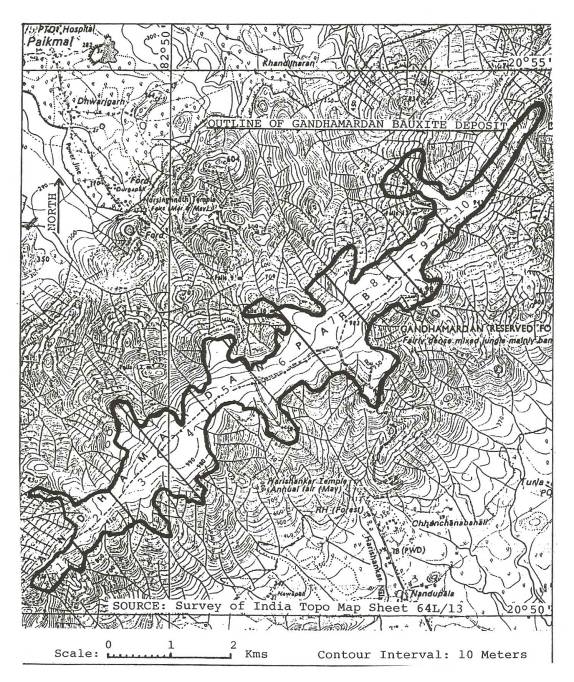

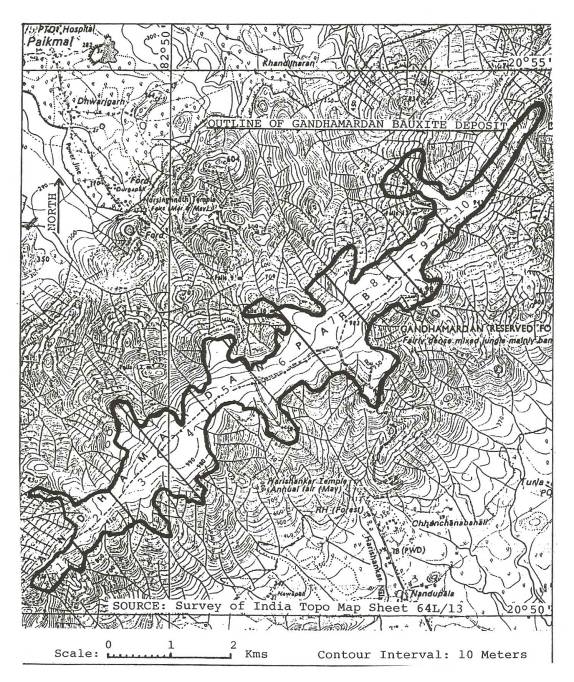

Gandhamardan is bounded by Latitudes 20 50' and 20 55' North, and Longitudes 82 45' and 82 54' East. It plots on Survey of India topographic sheet NTS 65L/13.

Gandhamardan hill extends in the NE-SW direction for a length of 9.8 kms. Its width ranges from 0.4 to 2.6 kms., and averages 0.75 km. The top of the hill is a plateau, with an areal extent of 7.4 kms2. The bauxite zone covers an area of 735 hectares. Because of its large size and lineal alignment, the deposit has been divided into 10 1-km wide blocks, numbered 1 to 10.

17

Figure III shows the extent of the deposit and the 10 blocks.

Figure III - Gandhamardan Bauxite Deposit Showing Block Divisions

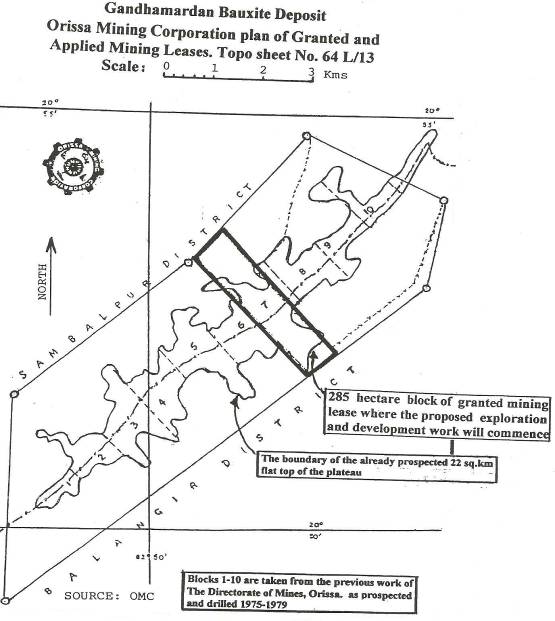

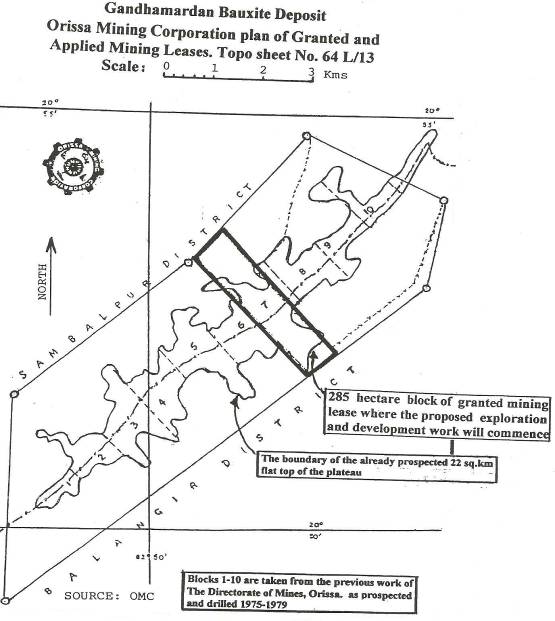

OMC currently holds a Mining Lease on Block 7, which contains about 20% of the deposit, or approximately 40 million tonnes. The Lease covers an area of 285 hectares, as shown in Figure IV.

18

Figure IV - Granted and Applied Mining Leases

OMC has applied for a Mining Lease covering the rest of the deposit. A perimeter land survey must be performed before this second Lease is granted.

Gandhamardan hill stands approximately 1,200 meters above sea level, and 700 meters above a plain at the base of the hill, The plateau top has a gentle relief of about 50 meters.

Vegetation on the plateau consists primarily of tiger-grass, dwarf palm, chachar, chhena, bantulsi, etc., with small, isolated clumps of stunted hardwood trees such as char and kendu. The stunted trees rarely exceed 4 meters in height.

19

Vegetation on the hill flanks contrast greatly with that on the plateau. The flanks are densely forested by mature hardwood trees such as char, kendu, tenk, and sal. Underbrush consists mainly of bamboo clumps, leafy vines, shrubs, and medicinal herbs.

Gandhamardan hill is a designated Forest Reserve. Indian government regulations permit mining in a designated Forest Reserve provided that another area of equal or greater areal extent is secured and substituted in its stead, and the designation transferred to it. A permit must be granted by the Dept. of Forests to effect such a transfer. The Directorate of Mines has identified 3 potential substitute sites, and has made application to the Dept. of Forests for the necessary permit. Granting of the permit is pending.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The property is easily accessed by 4-wheel drive vehicle along a poorly-maintained road up the NW flank of the hill. This road departs from the village of Duragali, at the base of the hill, and winds 4 kms. to the top. Duragali is connected by the paved road to Paikmal, a town with all modern facilities, including power, water, transportation, communication, food, shelter, supplies, services, and labour. Paikmal is connected by a paved road to the State Capital, Bhubaneswar, about 300 kms. to the E, and to port cities along the Bay of Bengal, equidistant to the SE.

At the time that the exploration work was performed, the hill top could also be accessed up the SE side. This road currently has three wash-outs. After repairs, this road would be navigable by 4-wheel drive vehicles. The SE road is preferable, as it provides a slightly shorter route to the hill top, and access by paved roads southerly to the towns of Lakhna and Nawaspara, 32 and 39 kms. distant, respectively. Both these towns lie along the South Eastern Railway line. This rail line was recently constructed by the Indian Government to facilitate the development of Orissa bauxite deposits by linking them to the port of Vishakhapnam on the Bay of Bengal.

The climate in the Gandhamardan area is sub-tropical, with summer temperatures averaging 33°C, and winter temperatures averaging 18°C. Annual rainfall averages 150 cms., most of it during the monsoon season, between July and August. The months of January and February experience little or no rain. Previously, the monsoon rains came in 3-year cycles, however, they have failed to come for the past several years, resulting in impoverished drought conditions.

Should a mining operation be established, no tailings or wastes would be created, since the bauxite is direct-shipping. The cover of soil and laterite would be moved and stockpiled, then replaced after removal of the bauxite.

History

The potential for bauxite at Gandhamardan was first recognized by the GSI in the 1940's, and they recommended that the area be thoroughly prospected.

In 1948, ODM sank several pits, which intersected only laterite.

In 1959, ODM identified bauxite at Gandhamardan, and they immediately undertook a programme of exploration and evaluation. GSI and MECL participated, as did Aluminium Corp. of India, an aluminium producer.

ODM drilled 75 holes in 1959, and reported a resource of 6 million tonnes grading +50% Al2O3 to a depth of 17 meters.This figure does not conform to current NI 43-101 standards, and is classified as a historical estimate.

20

Subsequent phases of drilling were conducted between 1961 and 1965. In the late 1960's, Aluminium Corp. of India undertook detailed exploration with MECL, after which MECL reported a resource of 26 million tones of metallurgical grade bauxite, using a cut-off of +46% Al2O3.This figure does not conform to current NI 43-101 standards, and is classified as a historical estimate.

The deposit attracted no further attention until 1975, when the economic potential of the large, low-silica bauxite deposits in the State Orissa became recognized. Balco expressed interest in Gandhamardan as a source of feed for their aluminium plant at Korba, situated 350 kms. by rail to the N, in the adjoining State of Madhya Pradesh. At Balco's request, an integrated exploration programme was undertaken jointly by MECL, GSI, and ODM. The programme included linecutting, topographic surveying, geological mapping, pitting, drilling, sampling, mineralogical studies, and metallurgical tests.

Balco commissioned a feasibility study on a portion of the deposit in 1980, and upon its conclusion, prepared to bring the deposit into production. Local villagers opposed the project, and Balco finally gave it up.

The property remained idle until 1997, when Continental Resources Ltd. and OMC agreed to jointly develop it. Continental commissioned SNC-Lavalin to undertake a feasibility study on the deposit, however numerous delays ensued, and the study was never completed. The author visited the property at this time, and during one of the visits, collected six samples, two from Pit GP-2, and two from each of two scarp sites. The samples were collected in the author's presence, and he personally transported them to a Canadian commercial laboratory. Analyses were performed for 12 radicals, including Al2O3, SiO2, Fe2O3, TiO2, and LOI, by x-ray fluorescence, fused-disc method. Appendix I of the Report is the Certificate of Analyses for these samples. In 2002, OMC transferred the Agreement from Continental to CRL. There is no connection between the two companies.

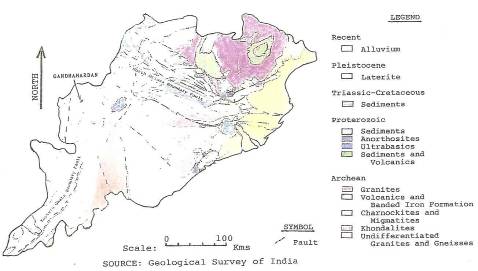

Geological Setting

The general geology of the Orissa region consists primarily of Precambrian rocks of the Indian Shield. These rocks have been divided into four distinct sectors, based on their lithologies and structure. The sectors are named after the geographic region in which they occur - West, South, Coastal, and North Sectors.

The West Sector is where Gandhamardan is located. This sector is underlain primarily by Archean granitic gneisses, khondalites, charnockites, and migmatites. These rocks trend in a general NE-SW direction, gently curving eastward at their northern end. Khondalites are rocks formed by high-grade metamorphism of argillaceous, arenaceous, and calcareous sediments. They are unique to this part of the world, and they host major deposits of bauxite. The West Sector is separated from the South and North Sectors by the Eastern Ghat Boundary Fault and the North Orissa Boundary Fault, respectively.

The South Sector is also underlain predominantly by Archean rocks. They are comprised of marbles, calc-granulites, carbonatites, gneisses, khondalites, and charnockites. This sector is composed of four fault blocks, each with distinct trends. The rocks in two of the blocks trend E-W. Trends in the other two blocks are NE-SW, and NW-SE, respectively. The North Orissa Boundary Fault separates the South Sector from the North Sector.

The Coastal Sector is underlain primarily by Quaternary laterite and alluvium. They appear to overlie the eastward extension of the South Sector rocks.

The North Sector is composed mainly of Archean granites and greenstones. The granites occur as large batholiths, and the greenstones as broad, intervening belts. The greenstones are comprised of mafic volcanics and banded iron formation. This assemblage of granites and greenstones is very similar to that which occurs in the Superior Province in NW Ontario. Ultramafic bodies intrude the granites and the volcanics. The western third of the North Sector is underlain by Grenville-type metasediments consisting of marble, quartzite, phyllite, and slate.

21

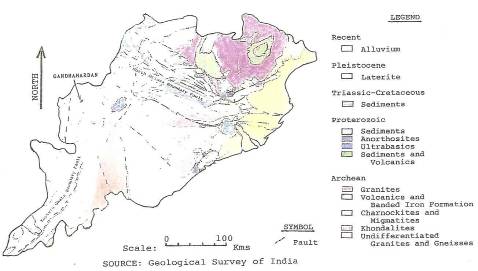

Figure V shows the general geology of the State of Orissa.

The local geology at Gandhamardan and the geology of the property are the same. Both consist exclusively of khondalites, represented by garnetiferous quartz-feldspar-sillimanite gneisses and schists with or without ilmenite and graphite. Subordinate garnetiferous quartzites are also present. The rocks have a pronounced NE-SW strike, conformable to the regional trend, and curve slightly to the east at their northern extremity. The rocks have been tightly folded, and now dip steeply to the SE at 45 to 70°.

Figure V - General Geology of Orissa

Prolonged exposure to the elements has altered the khondalite at the top of Gandhamardan hill, resulting in the formation of bauxite as an extensive layer blanketing the parent rock throughout the plateau.

Deposit Type

The bauxite occurs as a large residual deposit, formed by in situ, subaerial weathering of aluminium-rich rocks (khondalites) under tropical conditions. The deposit blankets the plateau top of a high ridge known as Gandhamardan hill. The bauxite mineralization is continuous and homogeneous, and is analogous to a horizontally-bedded stratigraphic unit.

Figure VI is a schematic longitudinal section through Gandhamardan hill depicting the bauxite layer.

22

Figure VI - Schematic Longitudinal Section Through Gandhamardan

The bauxite is overlain by laterite, and the laterite by a thin, discontinuous layer of lateritic soil. This soil is rusty-red in colour, granular, and high in silca and iron content. It reaches a thickness of up to several centimeters.

The laterite is also rusty-red in colour, and high in silica and iron. The weathered surface is irregular, porous, and craggy. The upper portion of the laterited is hard, reflecting a relatively higher silica content than the lower portion. Iron content also decreases with depth, while aluminous content increases. The laterite varies in thickness from 0.3 to 12.0 meters, and averages 5.0 meters. The laterite grades downwards into bauxite.

The bauxite layer ranges from 4.3 to 35.0 meters in thickness, and averages 16.6 meters. It varies in colour from pinkish-red to yellowish-brown, buff, or brown. It is medium to fine grained, massive and compact. Vesicular and pisolitic textures may be displayed. Hardness varies from 2.5 to 3.5. Banding and foliation are sometimes evident.

Mineralization

The bauxite is composed mainly of the minerals gibbsite and hematite, which together comprise about 95%. The remaining 5% is a mixture of several oxide minerals in minor and trace amounts.

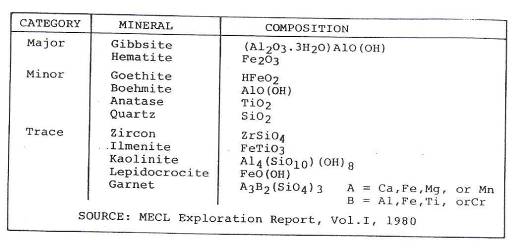

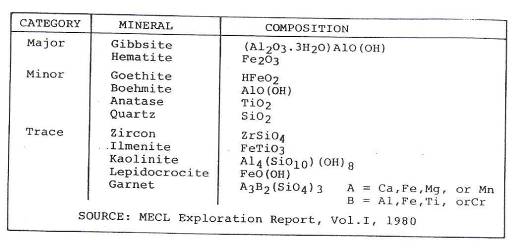

Table I shows the mineralogical composition of bauxite.

23

Table I - Mineralogical Composition of the Bauxite

The basement khondalite rock is composed of a heterogeneous mix of minerals, including quartz, orthoclase, sillimanite, garnet, ilmenite, and graphite. Quartz predominates, forming up to 60% of the rock locally. The khondalite is gneissic, and the quartz is closely associated with orthoclase and sillimanite in gneissic bands of leucocratic minerals. Orthoclase locally forms up to 35% of the rock, sillimanite up to 20%, garnet up to 20 %, and ilmenite and graphite together up to 3%. The contact between the khondalite and the bauxite is fairly sharp, although the khondalite immediately beneath the bauxite is partly altered. Orthoclase in altered khondalite displays varying stages of bauxitization, while sillimanite displays varying stages of gibbsitization.

Exploration / Previous Work

Linecutting - Using theodolite and steel tape, ODM established a grid with base line oriented at Azimuth 50°, parallel to the longitudinal axis of Gandhamardan hill. Cross lines were run at right angles to the base line, spaced at 100-meter intervals. Stations were established on all lines at 25-meter intervals, and marked by stone monuments. A total of 85 kms. of lines were established. Accuracy of the grid was maintained by triangulation.

Topographic Survey - Survey of India performed a topographic survey using a standard bubble level. All stations were read. An area of 5.8 kms2. was covered.

Geological Mapping - ODM geologists mapped Gandhamardan plateau using the grid for their traverses. Scarp faces were also examined, at the ends of cross lines, wherever accessible.

Pitting - According to ODM reports, 26 pits were sunk into the bauxite zone, however data exists for only 24. It appears that 26 may have been planned, but only 24 actually dug. The pits are spaced at 400-meter intervals, and their sites were selected to coincide with previously-drilled holes. They were dug by hand in such a way that half the drill hole was retained in one wall of the pit. Each pit is 2.5 m2 in cross section. Depth ranged from 17.9 to 41.2 meters, and averaged 31 meters. A total of 744 meters of pits were excavated, producing 4,650 m3 of material, equal to more than 2,300 tonnes. Pit data indicates that the soil-laterite overburden ranges between 0.8 to 4.5 meters in thickness and averages 2.7 meters.

24

Drilling

Drilling - Both ODM and MECL undertook extensive drill programmes. ODM concentrated on the SW portion of the deposit, on Blocks 1 to 8, and MECL on Blocks 7 to 10 at the NE end. Drilling was performed dry. NX size casing bits of tungsten carbide were used at the start of a hole, to penetrate the hard laterite capping. Bit size was reduced to BX in the softer bauxite zone. Short sections of thin-walled casing shoes were used, and drill runs were restricted to less than 1 meter in length. This technique allowed the drill cuttings to be collected in the casing, thus eliminating the need for a core barrel. The entire deposit was drilled at a hole spacing of 200 meters. Spacing was reduced to 100 meters in Blocks 5 to 8, where the plateau is widest, and therefore the bulk concentration the greatest. Selected portions of Blocks 6, 7 and 8 were detail-drilled at 50-, 25-, and 15-meter spacing. Two small areas, termed Clusters I and II, were detailed-drilled at a 5-meter spacing. Cluster I sits in Block 7, at Station N2 on Line E19, and covers an area of 0.24 hectare. Cluster II is in Block 8, at Station SO.5 on Line E24 and covers 0.16 hectare. Together ODM and MECL drilled a total of 462 holes, for a cumulative length of 15.1 kms. Except for 36 holes drilled at 450, all the holes were drilled vertically into the flat-lying bauxite zone. The cuttings from each hole were collected, geologically mapped, sampled and analysed. Figure VIII shows the locations of the dill holes, the pits, and the scarp sampling sites.

Sampling Procedures And Analyses

Samples of the bauxite zone were taken from selected scarp sites, from each pit, and from each drill hole. All samples were collected under direct supervision of ODM or MECL geologists.

Scarp samples of bauxite were taken by ODM wherever accessible at the ends of cross lines. Channel samples were cut vertically along 1-meter intervals, forming channels 15 cms. wide, 5 cms deep, and 1 meter long. A total of 130 samples were cut from 17 scarp sites, across a cumulative length of 121 meters. The bauxite zone in the scarp faces is not fully exposed, the lower half being buried by talus. Recognizing this limitation, ODM nevertheless calculated average grades from the assay results. They are given in MECL's Exploration Report, Volume I, 1980, as 47.03% Al2O3, 2.97% SiO2, 22.00% Fe2O3, 2.09% TiO2, and 22.27% LOI, across an average thickness of +7.6 meters.

ODM also sampled the pits. Channel samples were cut in the same manner employed in scarp sampling. All four walls of each pit were sampled. As a check, and for comparison, the walls of one pit were sampled at 25-cm. intervals. Surplus materials from the channel samples was combined to form composite samples, which were also analysed. A total of 1,772 pit samples were collected and analysed. The bauxite zone exposed in the pits ranged from 2.0 to 30.0 meters in thickness, and averaged 18.7 meters. ODM calculated average grades from the pit sample results. MECL's same report shows them as 46.31% Al2O3, 4.37% SiO2, 20.34% Fe2O3, 1.78% TiO2, and 23.71% LOI.

Both ODM and MECL sampled the drill holes in their respective programmes, employing the same technique. Casing shoes were used in place of core barrels. The drill cuttings were carefully removed from the shoe, put into paper sleeves in the order drilled, identified by hole number and footage, and boxed. Cuttings were collected continuously across 1-meter intervals. If the upper or lower contact of the bauxite zone did not coincide exactly with a whole-integer meter mark then that particular sample was taken as a fraction of a meter. Within the bauxite zone, if "non-ore" material was recognized or suspected, then two sub-samples were taken from that 1-meter interval, separated by their geological contact.

All collected samples were geologically classified before being prepared for analyses. Samples of the drill cuttings were crushed to -60 mesh, and quartered using a Jones Sample Splitter. Three-quarters of the sample was shipped to Balco for storage, and the remaining quarter was further crushed to -120 mesh. This -120-mesh fraction was further reduced by coning and quartering, and a 50-gram portion was weighed out, bagged, and shipped to the laboratory for analyses. Pit and scarp samples were prepared in a similar manner, except for their primary crushing, which was to -10 mesh rather than -60.

25

Samples were shipped for analyses to ODM's own laboratory in Bhubaneswar, or to MECL's own lab in Nagpur. Minor and trace element analyses were conducted at a commercial laboratory in Bangalore operated by Esson and Co. All samples were analysed for Al2O3, SiO2, Fe2O3, TiO2, and LOI. Composite samples were analysed as well for V, Zn, S, P2O5, K2O, Na2O, CaO, adherent moisture, and organic carbon.

Analyses for all these radicals were determined by chemical method, employing the EDTA technique (ethylene-diamene-tetra-acetic acid), the industry standard at that time. LOI was determined thermally, by calculating the percentage loss on ignition of the resultant ash compared to the weight of the pre-heated sample.

Sample Preparation, Analyses And Security

Samples collected personally by the author were transported to a Canadian commercial laboratory for analyses. Determinations were performed of the major oxides by the x-ray fluorescence - fused disc method, currently recognized as a standard analytical technique. The results obtained for these samples are in general agreement with the results reported by ODM and MECL, and are shown in Appendix I.

Data Verification

In examining the technical reports authored by ODM and MECL, it became apparent to the author that the exploration-evaluation programmes were conducted in a thorough, competent manner by knowledgeable, capable persons. The programmes followed a logical sequence of steps, justified by positive results, to determine the nature and extent of the bauxite deposit, and its suitability for the production of alumina by the Bayer Process.

Discussion with OMC technical staff verified the integrity of the data.

Three site visits verified the presence of bauxite, the extent of the deposit, the grid that was established, the holes that were drilled, and the pits that were sunk. Six bauxite samples were personally collected by the author, and transported to a Canadian commercial laboratory for analyses.

Mineralogical Studies and Metallurgical Tests

Mineralogical Studies - MECL conducted a number of studies of the bauxite to determine its mineral constituents, and to identify any deleterious chemical constituents that might be present. A total of 182 studies were undertaken, including petrological studies, heavy mineral determinations, acid-alkali treatments, derivatography, and x-ray diffraction. The studies indicate that gibbsite and hematite are the main minerals present. According to Indian Bauxite Standards, metallurgical grade bauxite must contain at least 44.0% A1203. As well, the maximum and/or minimum contents of certain deleterious constituents are listed. A comparison of these standards with the chemical composition of Gandhamardan bauxite is shown in Table II.

26

Table II - Indian Standards Compared to Gandhamardan Bauxite

Metallurgical Tests - Five autoclave tests were performed by MECL. Separate tests were undertaken on bauxite from the upper part of the zone, where the Si02 content is higher, and on bauxite from the lower part of the zone, where the A1203 content is higher. Results indicate that the Bayer Process would extract 93.5% of the A1203 from the upper part of the zone, and 97 to 99% from the lower part.

Balco, in cooperation with MECL, collected 12 composite drill hole samples, and submitted them to Aluterv-FKI, an integrated aluminium producer in Budapest, Hungary. MECL's Exploration Report, Volume I, 1980, states "....industrial tests..." were undertaken, however it does not describe the nature of these tests. The MECL report does provide the results of additional autoclave tests and chemical analyses performed by Aluterv, and it states "...The Hungarian tests indicate that for the Korba plant the Gandhamardan bauxite can be processed advantageously...", and also that "...the deposit has a potential for low temperature technology..." The conclusions in the report state "...The immediate objective of establishing reserves of suitable categories for developing a mine to feed the Korba plant has been achieved..." MECL also states in the Report that the Gandhamardan bauxite is suitable "...for use in Bayer's process is general..."

Feasibility Study - In 1980, Balco commissioned Metallurgical and Engineering Consultants (India) Ltd. to conduct a feasibility study. Their report is titled "Feasibility Report for Development of Gandhamardan Bauxite Deposit" and is dated February, 1981. In the Report, they state "...a mining operation could be established...with annual production of 500,000 tpy on dry basis.." Capital costs were estimated to be "...about 50 crore Rupees..." (approx. US$10.5 million), including equipment, service buildings, townsite, class I access road, ore tram line to base of hill, loading complex, and a 25-km spur rail line. The Report also states "...Operating cost for mine, crushing plant, ropeway and wagon loading complex...(estimated)...as 35.28 Rupees per tonne..." (approx. US$0.75/tonne).

The Balco feasibility study is not current. It was based upon historical estimates that are too speculative to have economic considerations applied to them, and therefore it does not conform to current NI 43-101 standards. It cannot be relied upon. The economic viability of this project has not yet been determined. Any future development of this project will be contingent to the completion of a positive feasibility or other study demonstrating its technical and economic viability.

27

Historical Resource Calculations

There are no current mineral resources or mineral reserves on the property. The author has not done sufficient work to reclassify the historical estimates as current mineral resources or mineral reserves, and the public should not rely on the historical estimates.

The resource estimates referred to in the Report were performed by competent geologists employed by Indian federal and/or state government agencies. As such they are considered by the author to be accurate and reliable. However, these resource estimates were not performed in accordance with NI 43-101 standards, and therefore are classified as historical estimates.

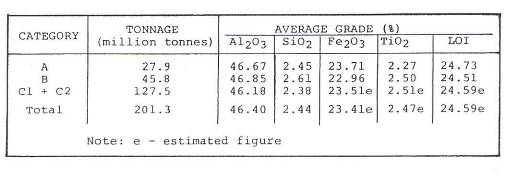

ODM and MECL independently calculated resource estimates, based exclusively on data obtained from the holes drilled at 200-meter intervals. Data obtained from the closer-spaced drill holes were also utilized, but only as a check on the validity of the calculations. Data from the inclined drill holes, and from the pits were similarly utilized for checking purposes.