Filed Pursuant to Rule 424(B)(3)

File No. 333-53984

SUPPLEMENT NO. 1 DATED AUGUST 21, 2002

TO PROSPECTUS DATED MAY 22, 2002

APPLE HOSPITALITY TWO, INC.

The following information supplements the prospectus of Apple Hospitality Two, Inc. dated May 22, 2002 and is part of the prospectus.Prospective investors should carefully review the prospectus and this Supplement.

TABLE OF CONTENTS FOR SUPPLEMENT NO. 1

The prospectus, and each supplement, contains forward-looking statements within the meaning of the federal securities laws, and such statements are intended to be covered by the safe harbors created by those laws. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations, which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of units, future economic, competitive and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

S-1

We are continuing our offering of units (consisting of one Common Share and one Series A Preferred Share) in accordance with the prospectus dated May 22, 2002. From that date through July 23, 2002, we have closed on the following sales of units:

Price Per Unit

| | Number of Units Sold

| | Gross Proceeds

| | Proceeds Net

of Selling Commissions

and Marketing

Expense Allowance

|

| $10.00 | | 3,288,010.3 | | $32,880,103 | | $29,592,093 |

Potential Acquisition of Hotels

We entered into an agreement on April 30, 2002 regarding the potential acquisition of 23 extended-stay hotels that operate as part of the Residence Inn® by Marriott® franchise. The acquisitions are considered potential due to the number of conditions to closing. Either party to the agreement may terminate if closing does not occur on or before September 27, 2002, although the closing may occur earlier. As required by the agreement, we made an escrow deposit equal to $3 million. This amount, plus any accrued interest, would be applied as a credit toward the purchase price if the transaction were to occur. The agreement provides that, in the event there are certain defaults by us and the agreement is terminated as a result, $1 million of the deposit would become the property of the seller and the $2 million balance of the deposit would be returned to us. While we expect the acquisition to close in August 2002, there can be no assurance that we will complete the transaction in August, or at all, due to a number of closing conditions.

The agreement provides for our acquisition, through our subsidiaries, of Marriott Residence Inn II Limited Partnership, which has direct or indirect ownership of 23 extended-stay hotels. Although the acquisition would be conducted through a merger in which our subsidiaries would acquire this partnership, the purpose and result would be our acquisition of the hotels.

If the acquisition occurs, the total base purchase price for the acquisition is expected to be approximately $161 million. The purchase price, as subject to certain adjustments at closing, would be paid through a combination of transactions. They would include credit for our deposit, as described above, the assumption of existing debt held by the partnership in the approximate amount of $132 million (representing principal and interest as of July 31, 2002), and a cash payment for the balance of the purchase price. Our source for the cash payment would be our ongoing and registered public offering of units, plus funds raised in our prior offering, which ended as of May 29, 2002. We also would use the proceeds of our ongoing offering to pay 2% of the total base purchase price for these 23 hotels, in the amount of approximately $3.2 million, as a commission to Apple Suites Realty Group, Inc. This entity is owned by Glade M. Knight, who is one of our directors and our Chief Executive Officer.

S-2

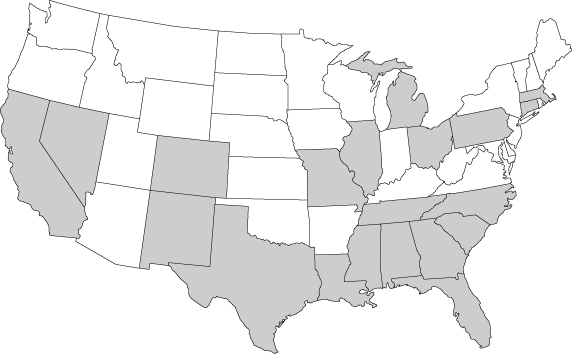

There can be no assurance that this potential acquisition will occur. If it does occur, however, we would own a total of 48 hotels containing 5,767 suites. The following map shows the 20 states where we would own hotels if the potential acquisition occurs:

Business Combination Being Evaluated

We are evaluating a possible business combination with Apple Suites, Inc., which would involve our acquisition of Apple Suites in a merger transaction. Our board of directors, and the board of Apple Suites, has each appointed a separate subcommittee to evaluate the potential business combination and each subcommittee is expected to engage separate financial advisors to assist in the evaluation. The transaction being evaluated would involve a stock merger with a partial cash election feature that would be treated for federal income tax purposes as a tax free reorganization, except to the extent of cash, if any, received by Apple Suites shareholders. There can be no assurance that this evaluation will result in any agreement or that a business combination will occur.

Apple Suites is a real estate investment trust that owns upper-end extended-stay hotels. Apple Suites owns 17 hotels, all of which are operated under the Homewood Suites® by Hilton brand. Our directors also serve as directors for Apple Suites. Glade M. Knight, our Chairman and President, also serves as Chairman and President of Apple Suites. See “Conflicts of Interest” beginning on page 30 of our prospectus dated May 22, 2002.

S-3

We currently own a total of 25 extended-stay hotels, which contain 3,280 suites and are part of the Residence Inn® by Marriott® franchise system. The hotels first began their operations during the period from 1984 through 1990. Each hotel was in business when acquired by us. Each hotel offers one and two room suites with the amenities generally offered by upscale extended-stay hotels. The hotels are located in developed areas in competitive markets. We believe the hotels are well-positioned to compete in these markets based on their location, amenities, rate structure and franchise affiliation. In the opinion of management, all of the hotels are adequately covered by insurance.

If the potential acquisition of 23 additional Residence Inn® by Marriott® hotels (described in the preceding section) were to occur, we would own 48 hotels containing 5,767 suites, as summarized below:

SUMMARY

(An asterisk * shows currently owned hotels. Hotels for potential acquisition are shown in italics.)

State

| | Hotel

| | Suites

| | State

| | Hotel

| | Suites

|

Alabama | | Birmingham | | 128 | | Michigan | | Kalamazoo | | 83 |

| | | Montgomery * | | 94 | | | | Southfield * | | 144 |

|

California | | Arcadia | | 120 | | Mississippi | | Jackson | | 120 |

| | | Bakersfield * | | 114 | | | | | | |

| | | Concord-Pleasant Hill * | | 126 | | Missouri | | St. Louis-Chesterfield * | | 104 |

| | | Costa Mesa * | | 144 | | | | St. Louis-Galleria * | | 152 |

| | | Irvine | | 112 | | | | | | |

| | | La Jolla * | | 288 | | Nevada | | Las Vegas | | 192 |

| | | Long Beach * | | 216 | | | | | | |

| | | Placentia | | 112 | | New Mexico | | Santa Fe | | 120 |

| | | San Ramon * | | 106 | | | | | | |

| | | | | | | North Carolina | | Charlotte | | 91 |

Colorado | | Boulder * | | 128 | | | | Greensboro | | 128 |

| | | | | | | | | | | |

Connecticut | | Meriden * | | 106 | | Ohio | | Akron | | 112 |

| | | | | | | | | Cincinnati-Blue Ash * | | 118 |

Florida | | Boca Raton | | 120 | | | | Cincinnati-Sharonville * | | 144 |

| | | Clearwater-St. Petersburg | | 88 | | | | Columbus * | | 96 |

| | | Jacksonville | | 112 | | | | Dayton North * | | 64 |

| | | Pensacola | | 64 | | | | Dayton South * | | 96 |

|

Georgia | | Atlanta Airport-Hapeville* | | 126 | | Pennsylvania | | Philadelphia-Berwyn | | 88 |

| | | Atlanta-Buckhead * | | 136 | | | | | | |

| | | Atlanta-Cumberland * | | 130 | | South Carolina | | Columbia | | 128 |

| | | Atlanta-Dunwoody * | | 144 | | | | Spartanburg | | 88 |

|

Illinois | | Chicago-Deerfield | | 128 | | Tennessee | | Memphis | | 105 |

| | | Chicago-Lombard * | | 144 | | | | | | |

| | | | | | | Texas | | Dallas-Irving * | | 120 |

Louisiana | | Shreveport-Bossier City | | 72 | | | | Houston-Clear Lake * | | 110 |

| | | | | | | | | Lubbock | | 80 |

Massachusetts | | Boston-Danvers | | 96 | | | | | | |

| | | Boston-Tewksbury * | | 130 | | | | | | |

S-4

APPLE HOSPITALITY TWO, INC.

(As of June 30, 2002 or, as applicable, for the period from January 1, 2002—June 30, 2002)

Revenues: | | | | |

| Suite Revenue | | $ | 33,381,932 | |

| Interest income and other revenue | | | 1,524,608 | |

| | |

|

|

|

| Total Revenue | | $ | 34,906,540 | |

|

Expenses: | | | | |

| Hotel expenses | | $ | 18,902,697 | |

| Taxes, insurance and other | | | 2,212,034 | |

| General and administrative | | | 683,325 | |

| Depreciation | | | 2,639,286 | |

| Interest | | | 4,952,602 | |

| | |

|

|

|

| Total expenses | | $ | 29,389,944 | |

| | |

|

|

|

| Net income | | $ | 5,516,596 | |

| | |

|

|

|

Per Share | | | | |

| Earnings per share—basic and diluted | | $ | .33 | |

| Distributions to common shareholders | | $ | .50 | |

| Weighted-average common shares outstanding—basic | | | 16,810,654 | |

|

Balance Sheet Data at June 30, 2002: | | | | |

| Cash and cash equivalents | | $ | 68,794,802 | |

| Investment in hotels, net | | $ | 249,532,341 | |

| Total assets | | $ | 336,680,450 | |

| Notes payable—secured | | $ | 142,912,276 | |

| Shareholders’ equity | | $ | 189,828,076 | |

|

Other Data: | | | | |

| Cash flow from: | | | | |

| Operating activities | | $ | 7,775,877 | |

| Investing activities | | $ | (11,733,934 | ) |

| Financing activities | | $ | 57,284,018 | |

| Number of hotels owned at end of period | | | 25 | |

|

Funds From Operations Calculation | | | | |

| Net income | | $ | 5,516,596 | |

| Depreciation | | $ | 2,639,286 | |

| Interest expense (imputed) | | $ | 450,000 | |

| Funds from Operation (a) | | $ | 8,605,882 | |

| FFO per share | | $ | .51 | |

| (a) | | Funds from operations (FFO) is defined as net income (computed in accordance with generally accepted accounting principles-GAAP) excluding gains and losses from sales of depreciable property, plus depreciation and amortization. We consider FFO in evaluating property acquisitions and operating performance. We believe that FFO should be considered along with, but not as an alternative to, net income and cash flows as a measure of our activities in accordance with GAAP and that it is not necessarily indicative of cash available to fund cash needs. |

S-5

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

The Company is a real estate investment trust (REIT) with activities related to the acquisition and ownership of upper-end extended-stay and upper-end limited services hotels.The Company was formed on January 17, 2001, with the first investor closing commencing on May 1, 2001.

The Company owns twenty-five hotels, with a total of 3,280 suites. Ten of the hotels were acquired in 2001 by the Company from Crestline Capital Corporation and certain of its subsidiaries. The following table summarizes the locations of and the number of suites located at these ten hotels (collectively, the “Crestline Portfolio”):

General location of hotels

| | # of Suites

| | General location of hotels

| | # of Suites

|

| Montgomery, Alabama | | 94 | | Atlanta/Hapeville, Georgia | | 126 |

| Bakersfield, California | | 114 | | Boston, Massachusetts | | 130 |

| Concord, California | | 126 | | Cincinnati, Ohio | | 118 |

| San Ramon, California | | 106 | | Dallas, Texas | | 120 |

| Meriden, Connecticut | | 106 | | Houston, Texas | | 110 |

The remaining fifteen hotels owned by the Company were acquired on March 29, 2002, in a transaction described below under “Recent Acquisition.” The following table summarizes the location of and the number of suites located at these fifteen hotels (the “Res I Portfolio”):

General location of hotel

| | # of Suites

| | General location of hotels

| | # of Suites

|

| Costa Mesa, California | | 144 | | Southfield, Michigan | | 144 |

| La Jolla, California | | 288 | | St. Louis/Chesterfield, Missouri | | 104 |

| Long Beach, California | | 216 | | St. Louis-Galleria, Missouri | | 152 |

| Boulder, Colorado | | 128 | | Cincinnati, Ohio | | 144 |

| Atlanta-Buckhead, Georgia | | 136 | | Columbus, Ohio | | 96 |

| Atlanta-Cumberland, Georgia | | 130 | | Dayton-North, Ohio | | 64 |

| Atlanta-Dunwoody, Georgia | | 144 | | Dayton-South, Ohio | | 96 |

| Chicago, Illinois | | 144 | | | | |

The Company is externally advised and has contracted with Apple Suites Advisors, Inc. (“ASA”) to manage its day-to-day operations and make investment decisions. The Company has contracted with Apple Suites Realty Group, Inc. (“ASRG”) to provide brokerage and acquisition services in connection with its hotel acquisitions. ASA and ASRG are both owned by Mr. Glade Knight, the Company’s Chairman.

Recent Acquisition—Res I Portfolio

On March 29, 2002, the Company acquired, through subsidiaries, Marriott Residence Inn Limited Partnership (the “Partnership”), which owns fifteen (15) extended-stay hotels. Although the acquisition was conducted through a merger in which the Company’s subsidiaries acquired the Partnership, the purpose and result was acquisition of the hotels.

The purchase price, as adjusted at closing, was paid through a combination of transactions. The total base purchase price for the acquisition was approximately $133.4 million. In November 2001, the Company made a

S-6

deposit of $35 million, which was applied toward the purchase price at closing. In addition, the Company made a cash payment of approximately $7 million at closing. To satisfy the remainder of the purchase price, the Company received a credit at closing equal to the unpaid balance of existing loans, which are secured by the hotels. The secured loans will continue to be an obligation of the Partnership, which continues to own the hotels.

Results of Operations

On May 1, 2001, the first investor closing occurred and the Company began operations. Since the Company did not purchase any hotels until September 2001, a comparison of revenues and expenses to the corresponding fiscal quarter and year-to-date period of 2001 is not possible.

For the six months ended June 30, 2001, the Company reported interest income which consisted of interest income from a 12%, $47,000,000 promissory note and interest on cash and cash reserves. Expenses consisted of day to day home office general and administrative expenses.

Revenues

The Company’s principal source of revenue is hotel suite revenue. For the six months ended June 30, 2002, the Company had suite revenue and other revenue of $33,381,932 and $1,188,221 respectively. For the six month period ended June 30, 2002, revenue per occupied room was $74.22, average daily rate was $95.96, and occupancy was 77%.

For the six months ended June 30, 2002, the Company had interest income of $336,387, which represents excess cash invested in short term money market instruments.

Expenses

Interest expense was $4,502,602 for the six months ended June 30, 2002. Interest expense represented interest expense on the 8.08%, $53 million promissory note assumed in conjunction with the Crestline acquisition. Imputed interest expense on the 8.6% $71 million promissory note and 15.25% $21 million promissory note assumed in conjunction with the Company’s recent acquisition, effective February 22, 2002, was $450,000.

Depreciation expense for the six months ended June 30, 2002 was $2,639,286. Depreciation expense for 2002 represents expense of the Company’s 25 hotels and related personal property.

Taxes, insurance and other expense for the six months ended June 30, 2002 was $2,212,034 or 6% of the Company’s suite revenue in 2002.

General and administrative expenses for the six months ended June 30, 2002 was $683,325 or 2% of the Company’s suite revenue in 2002. This percentage is expected to decrease as the Company’s asset base grows. These expenses represent the administrative expenses of the Company as distinguished from the hotel operations.

Hotel operating expenses totaled $7,598,969 or 22% of the Company’s suite revenue for the six months ended June 30, 2002.

Residence Inn By Marriott, Inc. (the “Manager”) manages the day-to-day operations of the hotels under management agreements with the Lessee. All of the Company’s hotels are managed as part of the Residence Inn® by Marriott® franchise. The Manager receives management fees for its services. The management fees consist of (a) a base management fee of two percent (2%) of gross revenues, (b) a Residence Inn® system fee of four percent (4%) of suite revenues and (c) an incentive management fee based on the operating profit of the hotels. For the six months ended June 30, 2002 the Company had incurred $691,405 in base management fees, $1,335,276 in system fees and $824,475 in incentive management fees.

S-7

In addition to management fees, the Company also pays each hotel’s pro rata share of the Manager’s actual costs and expenses incurred in providing certain services (“Chain Services”) on a central or regional basis to all the hotels operated by the Manager or other Marriott affiliate. Chain Services include central training and development; computerized payroll and accounting services; and such additional central or regional services performed on a centralized basis. For six months ended June 30, 2002 the Company had incurred $538,334 in Chain Services.

The management agreements also provide for payments of costs associated with certain system-wide advertising, promotional and public relations materials and programs and the operational costs of reservation systems. Each hotel pays two and one-half percent (2.5%) of suite revenues to this marketing fund. For the six month period ended June 30, 2002 the Company had incurred $834,548 in marketing fees.

Liquidity and Capital Resources

From the initial closing, through the period ended June 30, 2002, the Company sold 21,344,510 shares (3,157,895 shares at $9.50 per share and 18,186,615 shares at $10 per share) of its common stock to its investors, including shares sold through the reinvestment of distributions. The total gross proceeds from the shares sold were $211,866,157, which netted $190,484,388 to the Company after the payment of selling commissions and other offering costs.

Res I Portfolio

The Company is committed, under the management agreement, to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. For the six month period ended June 30, 2002, $4,537,548 was held by the Manager for furniture, fixtures and equipment reserve.

Crestline Portfolio

The Company is committed, under the management agreement, to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. For the six month period ended June 30, 2002, $2,595,196 was held by the Manager for furniture, fixtures and equipment reserve.

Additional Offering

On May 22, 2002, the Company filed with the United States Securities and Exchange Commission a registration statement covering the offer and sale to the public of an additional 10 million Units (each Unit consists of one common share and one Series A preferred share) at $10 per Unit for an aggregate public offering price of $100 million. Proceeds from the sale of these Units, will be available for the acquisition of additional properties and general corporate purposes. As of June 30, 2002, the Company had sold 1,186,615 units to its investors under this offering. However, the Company cannot predict how many additional Units will be sold pursuant to this additional offering.

Notes payable

Res I Portfolio

The Partnership, which was acquired by the Company, through subsidiaries, in connection with the Res I Portfolio, is the borrower under secured loans from two lenders (with one being the senior lender and the other being the subordinate lender). The senior lender is LaSalle Bank National Association as Trustee for Mortgage Pass-Through Certificates Series 1996-2. The senior lender holds separate loans for each hotel in the aggregate

S-8

original principal amount of $100 million. Each loan held by the senior lender is secured by a first mortgage on the hotel involved and by a related first priority security interest in the rents, revenues and other personal property of such hotel.

On June 30, 2002, the aggregate unpaid principal balance of these senior loans was $69,761,691. Each senior loan bears interest at an annual rate of 8.60% and has a maturity date of September 30, 2002. The aggregate monthly payment under the senior loans is $874,163. An aggregate balloon payment in the amount of approximately $70 million is scheduled to be due at maturity. The subordinate lender is LaSalle Bank National Association, as Indenture Trustee for Benefit of the Holders of iStar Asset Receivables Trust Collateralized Mortgage Bonds Series 2000-1. The subordinate lender holds a loan in the original principal amount of $30 million. The subordinate loan is secured by a subordinate mortgage on the hotels and by related second priority security interests in the rents, revenues and other personal property of the hotels. On June 30, 2002, the unpaid principal balance of the subordinate loan was $21,064,097. The subordinate loan bears interest at an annual rate of 15.25% and requires monthly payments of $400,590. The maturity date is September 30, 2002. A balloon payment in the amount of approximately $20 million is scheduled to be due at maturity.

The Company has entered into a debt refinancing commitment. The rate is based on a 10 year treasury rate, and rate lock deposit of $2,000,000 was issued. The deposit, less the change in 10 year treasury rate from the time of deposit to the time of termination, is refundable if the commitment is terminated.

Crestline Portfolio

In conjunction with our previously acquired portfolio of properties, the Company assumed a $53 million promissory note. The note bears a fixed interest rate of 8.08% per annum and is secured by the 10 hotels. The maturity date is January 2010, with a balloon payment of $35.4 million. The loan is payable in monthly installments, including principal and interest. On June 30, 2002, the unpaid principal balance was $52,086,488.

Cash and cash equivalents

Cash and cash equivalents totaled $68,794,802 at June 30, 2002. The company plans to use this cash for future acquisition costs, to pay dividends, to pay down debt service and to fund general corporate expenses.

Capital requirements

The Company’s divided distribution policy is at the discretion of the board of directors and depends on several factors. The distribution for the six months ended June 30, 2002 is $0.25 per share.

Capital resources are expected to grow with the future sale of its shares. In general, the Company expects capital resources to be adequate to meet its cash requirements in 2002.

The Company has ongoing capital commitments to fund its capital improvements. The Company, through the Lessee, is required, under management agreements with the Managers, to make available to the Lessee, for the repair, replacement, refurbishing of furniture, fixtures, and equipment, an amount of 5%, for both the Crestline portfolio and Res I portfolio, of gross revenues provided that such amount may be used for capital expenditures made by the Company with respect to the hotels.

The Company expects that this amount will be adequate to fund the required repair, replacement, and refurbishments and to maintain its hotels in a competitive condition.

It is anticipated that revenues generated from hotels and equity funds will be used to meet normal hotel operating expenses, make principal payments on the notes assumed with the 2001 and 2002 acquisitions and payment of distributions.

S-9

Impact of inflation

Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. Competitive pressures may, however, limit the operator’s ability to raise room rates.

Seasonality

The hotel industry historically has been seasonal in nature, reflecting higher occupancy rates primarily during the first three quarters of the year. Seasonal variations in occupancy at the Company’s hotels may cause quarterly fluctuations in the Company’s revenues, particularly during the fourth quarter. To the extent that cash flow from operations is insufficient during any quarter, due to temporary or seasonal fluctuations in revenue, the Company expects to utilize cash on hand to make distributions.

The Company believes its liquidity and capital resources are adequate to meet its cash requirements for the foreseeable future subject to finding suitable refinancing of the debt assumed in the Res I portfolio transaction (see discussion above).

Potential Acquisition

The Company entered into an agreement on April 30, 2002, regarding the potential acquisition of twenty-three (23) extended-stay hotels that operate as part of the Residence Inn® by Marriott® franchise. The acquisitions are considered potential, due to the number of conditions to closing. Either party to the agreement may terminate if closing does not occur on or before September 27, 2002. As required by the agreement, we made an escrow deposit equal to $3,000,000. This amount, plus any accrued interest, would be applied as a credit toward the purchase price if the transaction were to occur. Should the agreement be terminated on account of certain breaches by us, $1,000,000 of the deposit would become the property of the seller and the $2,000,000 balance of the deposit would be returned to us. While the acquisition is expected to close in August 2002, there can be no assurance that the transaction will be consummated due to the number of closing conditions.

Recent Accounting Pronouncements

In June 2001, the FASB issued Statement for Financial Accounting Standards (SFAS) No. 141, “Business Combinations,” and SFAS No. 142, “Goodwill and Other Intangibles,” effective for fiscal years beginning after December 15, 2001.

Under new rules, goodwill and intangible assets deemed to have indefinite lives will no longer be amortized but will be subject to annual impairment tests in accordance with the Statements. Other intangible assets will continue to be amortized over their useful lives. The company adopted these new accounting standards beginning the first quarter of fiscal 2002. The adoption of these standards will not have a material impact on its financial statements.

In August 2001, the FASB issued Statement 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”. The Statement supercedes Statement 121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed of”, and APB Opinion No.30, “Reporting the Results of Operations—Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions”, for segments of a business to be disposed of. SFAS No. 144 retains the requirements of Statement 121 relating to recognition and measurement of an impairment loss and resolves certain implementation issues resulting from Statement 121. This statement became effective January 1, 2002. The adoption of this statement did not have a material impact on the consolidated financial position or results of operations of the company.

S-10

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

All of the Company’s market risk is exposure to changes in mortgage interest rates related to the assumption of the promissory notes and interest rates on short-term investments. The interest rate of the assumed debt for the Crestline acquisition was 8.08% and the interest rates of the assumed debt for the Res I acquisition were 8.60% and 15.25%. The Company invests proceeds from its best efforts offering in short-term money market investments pending acquisitions. The Company intends to invest this money in real estate assets as suitable opportunities arise.

There have been no other material changes since December 31, 2001. See the information provided in the Company’s annual report under item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations.

S-11

INDEX TO FINANCIAL STATEMENTS (Unaudited)

APPLE HOSPITALITY TWO, INC.

| Consolidated Balance Sheets—June 30, 2002 and December 31, 2001 | | F-2 |

| Consolidated Income Statements—Six months ended June 30, 2002 and for the period January 17, 2001 (initial capitalization) through June 30, 2001 | | F-3 |

| Consolidated Statement of Shareholders’ Equity—Six months ended June 30, 2002 | | F-4 |

| Consolidated Statements of Cash Flows—Six months ended June 30, 2002 and for the period January 17, 2001 (initial capitalization) through June 30, 2001 | | F-5 |

| Notes to Consolidated Financial Statements | | F-6 |

F-1

APPLE HOSPITALITY TWO, INC.

CONSOLIDATED BALANCE SHEETS (unaudited)

| | | June 30, 2002

| | | December 31, 2001

| |

ASSETS | | | | | | | | |

| Investment in hotels, net of accumulated depreciation of $2,639,286 and $1,084,933 respectively | | $ | 249,532,341 | | | $ | 121,078,235 | |

| Cash and cash equivalents | | | 68,794,802 | | | | 15,468,841 | |

| Deposit for potential acquisition | | | 3,000,000 | | | | 35,000,000 | |

| Due from third party manager, net | | | 2,535,282 | | | | 860,229 | |

| Furniture, fixtures & equipment escrow | | | 7,132,744 | | | | 2,254,674 | |

| Deposit for refinancing | | | 2,000,105 | | | | — | |

| Other assets | | | 3,685,176 | | | | 3,719,308 | |

| | |

|

|

| |

|

|

|

| Total Assets | | $ | 336,680,450 | | | $ | 178,381,287 | |

| | |

|

|

| |

|

|

|

LIABILITIES | | | | | | | | |

| Notes payable-secured | | $ | 142,912,276 | | | $ | 52,874,346 | |

| Accounts payable & accrued expenses | | | 2,476,954 | | | | 934,198 | |

| Capital lease obligations | | | 153,066 | | | | 276,135 | |

| Interest payable | | | 367,888 | | | | 367,888 | |

| Account payable-affiliate | | | 123,610 | | | | 261,330 | |

| Distributions payable | | | — | | | | 3,001,721 | |

| Deferred incentive management fees payable | | | 818,580 | | | | 204,698 | |

| | |

|

|

| |

|

|

|

| Total Liabilities | | | 146,852,374 | | | | 57,920,316 | |

| | |

|

|

| |

|

|

|

SHAREHOLDERS’ EQUITY | | | | | | | | |

| Preferred stock, no par value, authorized 15,000,000 shares; none issued or outstanding | | | — | | | | — | |

| Series B preferred convertible stock, no par value, authorized 240,000 shares; issued and outstanding 240,000 shares | | | 24,000 | | | | 24,000 | |

| Common stock, no par value, authorized 200,000,000 shares; issued and outstanding 21,344,510 shares at June 30, 2002 and 13,907,733 shares at December 31, 2001 | | | 190,484,388 | | | | 122,889,057 | |

| Distributions greater than net income | | | (680,312 | ) | | | (2,452,086 | ) |

| | |

|

|

| |

|

|

|

| Total Shareholders’ equity | | | 189,828,076 | | | | 120,460,971 | |

| | |

|

|

| |

|

|

|

| Total Liabilities and Shareholders’ equity | | $ | 336,680,450 | | | $ | 178,381,287 | |

| | |

|

|

| |

|

|

|

See accompanying notes to consolidated financial statements.

F-2

APPLE HOSPITALITY TWO, INC.

CONSOLIDATED INCOME STATEMENTS (unaudited)

| | | Three months ended

June 30, 2002

| | | Six months ended

June 30, 2002

| | | Three months ended

June 30, 2001

| | | January 17, 2001 (initial capitalization) through

June 30, 2001

| |

REVENUES: | | | | | | | | | | | | | | | | |

| Suite revenue | | $ | 21,508,446 | | | $ | 33,381,932 | | | $ | — | | | $ | — | |

| Other revenue | | | 711,191 | | | | 1,188,221 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total Revenues | | | 22,219,637 | | | | 34,570,153 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

EXPENSES: | | | | | | | | | | | | | | | | |

| Operating expenses | | | 4,988,913 | | | | 7,598,969 | | | | — | | | | — | |

| Hotel administrative expense | | | 2,418,433 | | | | 3,778,594 | | | | — | | | | — | |

| Sales and marketing | | | 1,185,833 | | | | 1,816,796 | | | | — | | | | — | |

| Utilities | | | 823,588 | | | | 1,394,588 | | | | — | | | | — | |

| Repair & maintenance | | | 591,440 | | | | 924,260 | | | | — | | | | — | |

| Franchise fees | | | 860,339 | | | | 1,335,276 | | | | — | | | | — | |

| Management fees | | | 1,107,002 | | | | 1,515,880 | | | | — | | | | — | |

| Chain services | | | 338,915 | | | | 538,334 | | | | — | | | | — | |

| Taxes, insurance and other | | | 1,424,144 | | | | 2,212,034 | | | | — | | | | — | |

| General and administrative | | | 409,883 | | | | 683,325 | | | | 53,298 | | | | 53,298 | |

| Depreciation of real estate owned | | | 1,568,528 | | | | 2,639,286 | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total Expenses | | | 15,717,018 | | | | 24,437,342 | | | | 53,298 | | | | 53,298 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Operating Income | | | 6,502,619 | | | | 10,132,811 | | | | (53,298 | ) | | | (53,298 | ) |

| Interest income | | | 133,449 | | | | 336,387 | | | | 635,526 | | | | 635,526 | |

| Imputed interest expense Res I | | | — | | | | (450,000 | ) | | | — | | | | — | |

| Interest expense | | | (3,408,015 | ) | | | (4,502,602 | ) | | | — | | | | — | |

Net Income | | | 3,228,053 | | | | 5,516,596 | | | | 582,228 | | | | 582,228 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Basic and diluted earnings per common share | | $ | 0.17 | | | $ | 0.33 | | | $ | 0.20 | | | $ | 0.36 | |

| Weighted average shares | | | 18,640,216 | | | | 16,810,654 | | | | 2,966,053 | | | | 1,627,712 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Distributions per share | | $ | 0.25 | | | $ | 0.50 | | | $ | 0.25 | | | $ | 0.25 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

See accompanying notes to consolidated financial statements.

F-3

APPLE HOSPITALITY TWO, INC.

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (unaudited)

| | | Common Stock

| | Series B Preferred Convertible Stock

| | Distributions Greater

Than

Net Income

| | | Total Shareholders Equity’

| |

| | | Number of Shares

| | Amount

| | Number of Shares

| | Amount

| | |

| Balance at December 31, 2001 | | 13,907,733 | | $ | 122,889,057 | | 240,000 | | $ | 24,000 | | $ | (2,452,086 | ) | | $ | 120,460,971 | |

| Net proceeds from the sale of common shares | | 7,154,757 | | | 64,775,135 | | — | | | — | | | — | | | | 64,775,135 | |

| Common shares issued through reinvestment of distributions | | 282,020 | | | 2,820,196 | | — | | | — | | | — | | | | 2,820,196 | |

| Net income | | — | | | — | | — | | | — | | $ | 5,516,596 | | | | 5,516,596 | |

| Cash distributions declared to shareholders ($.25 per share) | | — | | | — | | — | | | — | | | (3,744,822 | ) | | | (3,744,822 | ) |

| | |

| |

|

| |

| |

|

| |

|

|

| |

|

|

|

| Balance at June 30, 2002 | | 21,344,510 | | $ | 190,484,388 | | 240,000 | | $ | 24,000 | | $ | (680,312 | ) | | $ | 189,828,076 | |

| | |

| |

|

| |

| |

|

| |

|

|

| |

|

|

|

See accompanying notes to consolidated financial statements.

F-4

APPLE HOSPITALITY TWO, INC.

CONSOLIDATED STATEMENT OF CASH FLOWS (unaudited)

| | | For the six

months ended

June 30, 2002

| | | For the period

January 17, 2001

(initial capitalization)

through

June 30, 2001

| |

| Cash flow from operating activities: | | | | | | | | |

| Net income | | $ | 5,516,596 | | | $ | 582,228 | |

| Depreciation of Real estate owned | | | 1,554,353 | | | | — | |

| Imputed interest | | | 450,000 | | | | — | |

| Changes in operating assets and liabilities | | | | | | | | |

| Due from third party manager | | | (1,675,053 | ) | | | — | |

| Deferred incentive management fee | | | 613,882 | | | | — | |

| Other assets | | | 34,132 | | | | (739,072 | ) |

| Capital lease obligations-principal payments | | | (123,069 | ) | | | — | |

| Accounts payable-affiliates | | | (137,720 | ) | | | 25,429 | |

| Accrued expenses | | | 1,542,756 | | | | 120,374 | |

| | |

|

|

| |

|

|

|

| Net cash provided by operating activities | | | 7,775,877 | | | | (11,041 | ) |

| Cash flow from investing activities: | | | | | | | | |

| (Increase) decrease in cash restricted for cap improvement, net | | | (4,878,070 | ) | | | — | |

| Capital improvements | | | (347,525 | ) | | | — | |

| Issuance of promissory note | | | — | | | | (47,000,000 | ) |

| Deposit for potential acquisition | | | (3,000,000 | ) | | | (1,001,000 | ) |

| Cash paid for acquisition of LLC | | | (3,508,339 | ) | | | — | |

| | |

|

|

| |

|

|

|

| Net cash used in investing activities | | | (11,733,934 | ) | | | (48,001,000 | ) |

| Cash flow from financing activities: | | | | | | | | |

| Payment of mortgage note | | | (1,564,665 | ) | | | — | |

| Deposit for mortgage note refinancing | | | (2,000,105 | ) | | | — | |

| Payment from officer-shareholder for Series B convertible preferred stock | | | — | | | | 24,000 | |

| Net proceeds from issuance of common stock | | | 67,595,331 | | | | 59,035,771 | |

| Cash distributions paid to shareholders | | | (6,746,543 | ) | | | — | |

| | |

|

|

| |

|

|

|

| Net cash provided by financing activities | | | 57,284,018 | | | | 59,059,771 | |

| Increase in cash and cash equivalents | | | 53,325,961 | | | | 11,047,730 | |

| Cash and cash equivalents, beginning of period | | | 15,468,841 | | | | 100 | |

| | |

|

|

| |

|

|

|

| Cash and cash equivalents, end of period | | $ | 68,794,802 | | | $ | 11,047,830 | |

| | |

|

|

| |

|

|

|

| Supplemental Information: | | | | | | | | |

| Assumption of mortgage notes payable | | $ | 91,602,595 | | | | | |

| Deposit for acquisitions used for acquisition of hotels | | $ | 35,000,000 | | | | | |

See accompanying notes to consolidated financial statements.

F-5

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

June 30, 2002

(1) General Information and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying interim unaudited consolidated financial statements have been prepared in accordance with the instructions for Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information required by generally accepted accounting principles. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation of financial position have been included. These unaudited financial statements should be read in conjunction with Apple Hospitality Two, Inc’s. (the “Company’s”) audited consolidated financial statements contained in the Company’s December 31, 2001 Annual Report on Form 10-K.

Residence Inn by Marriott, Inc. (the “Manager”), a wholly owned subsidiary of Marriott International, Inc. (“Marriott”), manages the Company’s hotels under the terms of management agreements between the Manager and the Lessee. The Manager records operations of the hotels on a 13 period fiscal year, which includes 28 days per period. The Company will continue to report on a calendar year basis, but will incorporate hotel operations based on three 12 week periods for quarters one, two, and three, and one 16 week period for quarter four.

Organization

The Company, was formed on January 17, 2001, with the first investor closing on May 1, 2001.The Company did not have any activity for the first quarter 2001. The unaudited consolidated financial statements include the accounts of the Company and its subsidiaries. All significant intercompany transactions and balances have been eliminated upon consolidation.

The REIT Modernization Act, effective January 1, 2001, permits REIT’s to establish taxable businesses to conduct certain previously disallowed business activities. The Company has formed a wholly-owned taxable REIT subsidiary, Apple Hospitality Management, Inc., and has leased all of its hotels to Apple Hospitality Management or its subsidiaries (collectively, the “Lessee”).

Income Taxes

The Company is operated as, and will annually elect to be taxed as a REIT under Section 856 to 860 of the Internal Revenue Code. Earnings and profits, which will determine the taxability of distributions to shareholders, will differ from income reported for financial reporting purposes primarily due to the differences for federal income tax purposes in the estimated useful lives used to compute depreciation.

The Lessee, as a taxable REIT subsidiary of the company, is subject to federal and state income taxes. The taxable REIT subsidiary incurred a loss for the six months ended June 30, 2002 and therefore did not have any tax expense. No operating loss benefit has been recorded in the consolidated balance sheet since realization is uncertain.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make certain estimates and assumptions that affect amounts reported in the financial statements and accompanying notes. Actual results may differ from those estimates.

F-6

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)—(Continued)

June 30, 2002

Recent Transaction – Res I Portfolio

On March 29, 2002, the Company acquired, through subsidiaries, Marriott Residence Inn Limited Partnership, which owns 15 extended-stay hotels. For simplicity, this entity will be referred to as the “Res I Partnership.” Although the acquisition was conducted through a merger in which our subsidiaries acquired the Res I Partnership, the purpose and result was our acquisition of the hotels. Each hotel operates as part of the Residence Inn® by Marriott® franchise system.

The total base purchase price for the acquisition was approximately $133.4 million. The purchase price, as subject to certain adjustments at closing, was paid through a combination of transactions, described below. In November 2001, the Company made a deposit of $35 million, which was applied toward the purchase price at closing. In addition, a cash payment of approximately $7 million was made at closing. Our source for these funds was our ongoing and registered public offering of units. To satisfy the remainder of the purchase price, the Company received a credit at closing equal to the unpaid balance of existing loans, which are secured by the hotels.

The secured loans continue to be an obligation of the Res I Partnership, which continues to own the hotels. Further details about the secured loans are provided in Note 3 below. The Company also used the proceeds of our ongoing offering to pay 2% of the total base purchase price, which equals $2,667,052, as a commission to Apple Suites Realty Group, Inc.

The entire purchase price paid for the hotels was allocated to tangible assets. No goodwill was recorded.

Recent Accounting Pronouncements

In June 2001, the FASB issued Statement for Financial Accounting Standards (SFAS) No. 141, “Business Combinations,” and SFAS No. 142, “Goodwill and Other Intangibles,” effective for fiscal years beginning after December 15, 2001. Under new rules, goodwill and intangible assets deemed to have indefinite lives will no longer be amortized but will be subject to annual impairment tests in accordance with the Statements. Other intangible assets will continue to be amortized over their useful lives. The company adopted these new accounting standards beginning the first quarter of fiscal 2002. The adoption of these standards did not have a material impact on its financial statements.

In August 2001, the FASB issued Statement 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”. The Statement supercedes Statement 121, “Accounting for the Impairment of Long-lived Assets and for Long-lived Assets to be Disposed of”, and APB Opinion No.30, “Reporting the Results of Operations—Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions”, for segments of a business to be disposed of. SFAS No. 144 retains the requirements of Statement 121 relating to recognition and measurement of an impairment loss and resolves certain implementation issues resulting from Statement 121. This statement became effective January 1, 2002. The adoption of this statement did not have a material impact on the consolidated financial position or results of operations of the company.

(2) Investment in Hotels

At June 30, 2002, the Company owned twenty-five hotels. Ten of the hotels (the “Crestline Portfolio”) were acquired by the Company in September 2001 from Crestline Capital Corporation and certain of its subsidiaries. The remaining fifteen of the Company’s hotels (the “Res I Portfolio”) were acquired effective February 22, 2002.

F-7

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)—(Continued)

June 30, 2002

Investment in hotels consisted of the following:

| Land | | $ | 67,752,013 | |

| Building | | | 173,532,784 | |

| Furniture and equipment | | | 11,971,763 | |

| | |

|

|

|

| Less: accumulated depreciation | | | 253,256,560 | |

| Investment in hotels, net | | | (3,724,219 | ) |

| | |

|

|

|

| | | $ | 249,532,341 | |

| | |

|

|

|

(3) Notes Payable

Res I Portfolio

The Res I Partnership, the direct owner of the hotels, is also the borrower under secured loans from two lenders (with one being the senior lender and the other being the subordinate lender). The senior lender is LaSalle Bank National Association as Trustee for Mortgage Pass-Through Certificates Series 1996-2. The senior lender holds separate loans for each hotel in the aggregate original principal amount of $100 million. Each loan held by the senior lender is secured by a first mortgage on the hotel involved and by a related first priority security interest in the rents, revenues and other personal property of such hotel. At closing, the aggregate unpaid principal balance of these senior loans was $70,868,403. Each senior loan bears interest at an annual rate of 8.60% and has a maturity date of September 30, 2002. The aggregate monthly payment under the senior loans is $874,163. An aggregate balloon payment in the amount of approximately $69 million is scheduled to be due at maturity.

The subordinate lender is LaSalle Bank National Association, as Indenture Trustee for Benefit of the Holders of iStar Asset Receivables Trust Collateralized Mortgage Bonds Series 2000-1. The subordinate lender holds a loan in the original principal amount of $30 million. The subordinate loan is secured by a subordinate mortgage on the hotels and by related second priority security interests in the rents, revenues and other personal property of the hotels. At closing, the unpaid principal balance of the subordinate loan was $20,734,191. The subordinate loan bears interest at an annual rate of 15.25% and requires monthly payments of $400,590. The maturity date is September 30, 2002. A balloon payment in the amount of approximately $20 million is scheduled to be due at maturity.

Crestline Portfolio

In conjunction with the Company’s 2001 acquisition of the Crestline Portfolio, the Company assumed a $53 million promissory note. The note bears a fixed interest rate of 8.08% per annum and is secured by the 10 hotels. The maturity date is January 2010, with a balloon payment of $35.4 million. The loan is payable in monthly installments, including principal and interest.

The aggregate maturities of principal, for the promissory note, for the five years subsequent to June 30, 2002 are as follows:

| 2002 | | $ | 675,032 |

| 2003 | | | 1,744,451 |

| 2004 | | | 1,881,011 |

| 2005 | | | 2,052,865 |

| 2006 | | | 2,227,502 |

| Thereafter | | | 43,505,627 |

| | |

|

|

| | | $ | 52,086,488 |

| | |

|

|

F-8

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)—(Continued)

June 30, 2002

(4) Shareholders’ Equity

The Company is raising equity capital through a “best-efforts” offering of shares by David Lerner Associates, Inc. (the “Managing Dealer”), which will receive selling commissions of 7.5% and a marketing expense allowance of 2.5% based on proceeds of the shares sold. The Company received gross proceeds of $211,866,157 from the sale of 3,157,895 shares at $9.50 per share and 18,186,616 shares at $10 per share, including shares sold through the reinvestment of distributions through June 30, 2002. The net proceeds of the offering, after deducting selling commissions and other offering costs were $190,484,388.

(5) Management Agreement

Res I Portfolio

The Manager has agreed to manage the hotels under an amendment and restatement of management agreement with the Lessee dated as of March 29, 2002. The management agreement is similar to the prior management agreement for the hotels, which had been executed in 1988. Management services under the management agreement include supervising the operation of the hotels and collecting revenues from their operation for the benefit of the Lessee.

The initial term of the management agreement will continue until December 28, 2007. The Manager may renew the term of the management agreement for five periods of 10 years each, provided that an event of default by the Manager has not occurred and provided that the Manager exercises its renewal option with respect to at least 80% of the hotels that either meet the then-current brand standards for Residence Inn® by Marriott® or are subject to property improvement programs reasonably required by the Manager.

The Manager may elect to renew for an additional term by giving notice to the Lessee at least 18 months before the expiration of the then current term.

The Manager receives a management fee for its services. The total management fee consists of (a) a base management fee calculated on the basis of gross revenues, (b) a Residence Inn® system fee calculated on the basis of suite revenues and (c) an incentive management fee calculated on the basis of operating profit. The formulas for these fees are complex and were the result of prior negotiations between the Res I Partnership and the Manager, but were not materially modified in connection with our acquisition of the Partnership. As of June 30, 2002, $367,079 of base management fees and $376,000 of deferred incentive management fees were incurred by the Company.

Incentive management fees that do not meet certain criteria based on the earnings of the properties are deferred (deferred incentive management fees) and are available to be paid out of cash flow upon the occurrence of certain events. In connection with the acquisition of the Res I portfolio, the Company assumed the management agreement of the prior owner which included an accumulated deferred incentive management fee of approximately $7.3 million, payment of which is contingent upon the occurrence of certain events, including the sale of the properties. However, the Company would have to realize substantial gains on the sale of the properties before this deferred incentive management fee would become payable. The Company has not recorded any of the $7.3 million deferred incentive management fee at June 30, 2002 as the payment of these amounts is not considered probable.

F-9

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)—(Continued)

June 30, 2002

The management agreement also includes a provision to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. At June 30, 2002, $4,537,548 was held by the Manager for furniture, fixtures and equipment reserve.

Crestline Portfolio

The Lessee has entered into a management agreement with the Manager to operate the hotels. The initial term expires on December 2011 and has renewal terms of up to five 10-year terms. The management agreement provides for payment of base management fees equal to 2% of gross revenues and incentive management fees calculated on the basis of operating profit. As of June 30, 2002, $330,215 of base management fees and $442,586 of incentive management fees were incurred by the Company.

The Company is committed, under the management agreement, to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. At June 30, 2002, $2,595,196 was held by the Manager for furniture, fixtures and equipment reserve.

(6) Potential Transaction

The Company entered into an agreement on April 30, 2002, regarding the potential acquisition of twenty-three (23) extended-stay hotels that operate as part of the Residence Inn® by Marriott® franchise. The acquisitions are considered potential, due to the number of conditions at closing. Either party to the agreement may terminate if closing does not occur on or before September 27, 2002, although the closing may occur earlier. As required by the agreement, we made an escrow deposit equal to $3,000,000. This amount, plus any accrued interest, would be applied as a credit toward the purchase price if the transaction were to occur. Should the agreement be terminated on account of certain breaches by us, $1,000,000 of the deposit would become the property of the seller and the $2,000,000 balance of the deposit would be returned to us.

(7) Commitments

The Company has entered into a debt refinancing commitment. The rate is based on a 10 year treasury rate, and a rate lock deposit of $2,000,000 was issued. The deposit, less the change in 10 year treasury rate from time of deposit to the time of termination, is refundable if the commitment is terminated.

(8) Related Parties

The Company has contracted with Apple Suites Realty Group, Inc. (“ASRG”) to acquire and dispose of real estate assets for the Company. In accordance with the contract, ASRG is to be paid a fee of 2% of the purchase price of any acquisitions or sale price of any dispositions of real estate investments, subject to certain conditions, in addition to certain reimbursable expenses. As of June 30, 2002, ASRG had earned $5,047,052.

The Company has contracted with Apple Suites Advisors, Inc. (“ASA”) to advise and provide day to day management services to the Company. In accordance with the contract, the Company will pay ASA a fee equal to .1% to .25% of total equity contributions received by the Company in addition to certain reimbursable expenses. As of June 30, 2002 ASA had earned $223,338 under this agreement.

ASRG and ASA are 100% owned by Glade M. Knight, Chairman and President of the Company

F-10

APPLE HOSPITALITY TWO, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)—(Continued)

June 30, 2002

(9) Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share in accordance with FAS 128:

| | | Three months

ended

June 30, 2002

| | Six months

ended

June 30, 2002

| | For the period

January 17, 2001

(initial capitalization)

through June 30, 2001

| | Three months

ended

June 30, 2001

|

| Numerator: | | | | | | | | | | | | |

| Net income and numerator for basic and diluted earnings | | $ | 3,228,053 | | $ | 5,516,596 | | $ | 582,228 | | $ | 582,228 |

| Denominator: | | | | | | | | | | | | |

| Denominator for basic earnings per share-weighted—average shares | | | 18,640,216 | | | 16,810,654 | | | 1,627,712 | | | 2,966,053 |

| Effect of dilutive securities: | | | | | | | | | | | | |

| Stock options: | | | 2,316 | | | 2,316 | | | — | | | — |

| | |

|

| |

|

| |

|

| |

|

|

| Denominator for basic and diluted earnings per share-adjusted weighted—average shares and assumed conversions | | | 18,642,532 | | | 16,812,970 | | | 1,627,712 | | | 2,966,053 |

| | |

|

| |

|

| |

|

| |

|

|

| Basic and diluted earnings per common share | | $ | .17 | | $ | .33 | | $ | .36 | | $ | .20 |

| | |

|

| |

|

| |

|

| |

|

|

(10) Acquisition

The following unaudited pro forma information for the six months ended June 30, 2002 is presented as if the acquisition of the Res I portfolio of 15 hotels occurred on January 1, 2002. The pro forma information does not purport to represent what the Company’s results of operations would actually have been if such transactions, in fact, had occurred on January 1, 2002, nor does it purport to represent the results of operations for future periods

| | | Six Months

Ended

June 30, 2002

|

| Hotel revenues | | $ | 42,382,443 |

| Net income | | $ | 6,251,162 |

| Net income per share-basic and diluted | | $ | 0.37 |

The pro forma information reflects adjustments for actual revenues and expenses of the 15 hotels acquired in 2002 for the respective period in 2002 prior to acquisition by the Company. Net income has been adjusted as follows: (1) depreciation has been adjusted based on the Company’s basis in the hotels; (2) advisory expenses have been adjusted based on the Company’s contractual arrangements; (3) interest expense has been adjusted to reflect the acquisition as of January 1, 2002; (4) common stock raised during 2002 to purchase these hotels has been adjusted to reflect issuances as of January 1, 2002.

(11) Subsequent Events

In July 2002, the Company distributed to its shareholders approximately $2,652,452 ($.25 per share) of which approximately $2,017,548 was reinvested in the purchase of additional shares. On July 23, 2002, the Company closed the sale to investors of 1,899,677 shares at $10 per share representing net proceeds to the Company of $17,097,091.

F-11