Filed Pursuant to Rule 424(B)(3)

File No. 333-84098

APPLE HOSPITALITY TWO, INC.

SUPPLEMENT NO. 2 DATED SEPTEMBER 18, 2002

TO PROSPECTUS DATED MAY 22, 2002

The following information supplements the prospectus of Apple Hospitality Two, Inc. dated May 22, 2002 and is part of the prospectus. This Supplement supersedes and replaces Supplement No. 1.Prospective investors should carefully review the prospectus and this Supplement No. 2.

TABLE OF CONTENTS FOR SUPPLEMENT NO. 2

| | S–2 |

| | S–2 |

| | S–4 |

| | S–5 |

| | S–8 |

| | S–10 |

| | S–11 |

| | S–16 |

| | S–16 |

| | F–1 |

The prospectus, and each supplement, contains forward-looking statements within the meaning of the federal securities laws, and such statements are intended to be covered by the safe harbors created by those laws. These forward-looking statements may involve our plans and objectives for future operations, including future growth and availability of funds. These forward-looking statements are based on current expectations, which are subject to numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, the continuation of our offering of units, future economic, competitive and market conditions and future business decisions, together with local, national and international events (including, without limitation, acts of terrorism or war, and their direct and indirect effects on travel and the economy). All of these matters are difficult or impossible to predict accurately and many of them are beyond our control. Although we believe the assumptions relating to the forward-looking statements, and the statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. In light of the significant uncertainties inherent in these forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved.

We are continuing our offering of units (consisting of one Common Share and one Series A Preferred Share) in accordance with the prospectus dated May 22, 2002. From that date through August 26, 2002, we have closed on the following sales of units:

Price Per Unit

| | Number of Units Sold

| | Gross Proceeds

| | Proceeds Net of Selling Commissions and Marketing Expense Allowance

|

| $10.00 | | 5,830,526 | | $58,305,260 | | $52,474,734 |

Acquisition of Hotels

On August 28, 2002, we acquired, through our subsidiaries, Marriott Residence Inn II Limited Partnership, which has direct or indirect ownership of 23 extended-stay hotels. For simplicity, this entity will be referred to as the “Partnership.” Although the acquisition was conducted through a merger in which our subsidiaries acquired the Partnership, the purpose and result was our acquisition of the hotels. Each hotel operates as part of the Residence Inn® by Marriott® franchise system (such trademarks are the property of Marriott International, Inc. or one of its affiliates).

The gross purchase price for the acquisition was approximately $160 million. The purchase price, as subject to certain adjustments at closing, was satisfied by a combination of actions. They included the assumption of existing debt in the approximate amount of $132 million (representing outstanding principal and interest as of August 31, 2002), which is secured by the hotels owned directly by the Partnership, together with a cash payment for the net balance of the purchase price (after credit for our deposit of $3 million, with interest, and certain other cash balances). Our source for the cash payment was our ongoing and registered public offering of units, plus funds raised in our prior offering, which ended as of May 29, 2002.

We also used the proceeds of our ongoing offering to pay 2% of the gross purchase price for these 23 hotels, in the amount of $3,200,000, as a commission to Apple Suites Realty Group, Inc. This entity is owned by Glade M. Knight, who is one of our directors and our Chief Executive Officer.

On page 48 and elsewhere in our Prospectus dated May 22, 2002, we describe our Property Acquisition/Disposition Agreement under which Apple Suites Realty acts as a real estate broker in connection with our purchases and sales of properties. Under the Agreement, Apple Suites Realty is entitled to a real estate commission equal to 2% of the gross purchase price of our properties payable by us in connection with each purchase or sale. If the Company were to purchase properties on an all-cash basis using the proceeds of the offering, the maximum commission Apple Suites Realty would receive from the offering is $2,000,000. However, because the Company pays the gross purchase price of properties using cash from the offering and leveraged debt, the maximum commission Apple Suites Realty will receive during and from the offering will be higher than it would be if properties were purchased on an all-cash basis.

S-2

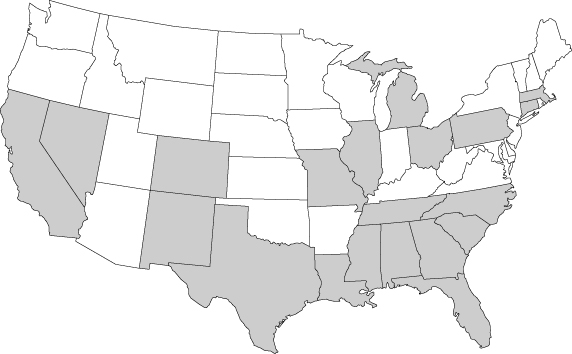

As a result of the acquisition described above, we now own a total of 48 hotels, which contain 5,767 suites. The following map shows the 20 states where our hotels are located:

Business Combination Being Evaluated

We are evaluating a possible business combination with Apple Suites, Inc., which would involve our acquisition of Apple Suites in a merger transaction. Our board of directors, and the board of Apple Suites, has each appointed a separate subcommittee to evaluate the potential business combination and each subcommittee is expected to engage separate financial advisors to assist in the evaluation. The transaction being evaluated would involve a stock merger with a partial cash election feature that would be treated for federal income tax purposes as a tax free reorganization, except to the extent of cash, if any, received by Apple Suites shareholders. There can be no assurance that this evaluation will result in any agreement or that a business combination will occur.

Apple Suites is a real estate investment trust that owns upper-end extended-stay hotels. Apple Suites owns 17 hotels, all of which are operated under the Homewood Suites® by Hilton brand. Our directors also serve as directors for Apple Suites. Glade M. Knight, our Chairman and President, also serves as Chairman and President of Apple Suites. See “Conflicts of Interest” beginning on page 30 of our prospectus dated May 22, 2002.

New REIT by Mr. Knight

Currently Mr. Knight is in the preliminary stage of creating another real estate investment trust to be called Apple Hospitality Five, Inc. Apple Hospitality Five will focus on purchasing and owning upper-end, extended-stay hotel properties and other upper-end, limited-service hotel properties located in selected metropolitan areas. Some of the hotels owned by Apple Hospitality Five may be in the same markets and may compete with hotels owned by Apple Hospitality Two and Apple Suites. Apple Hospitality Five’s hotels may be operated as part of the Homewood Suites® by Hilton or the Residence Inn® by Marriott® franchise systems. We anticipate that Apple Hospitality Five will have the same board of directors and executive officers as Apple Hospitality Two and Apple Suites.

S-3

ACQUISITIONS AND RELATED MATTERS

New Subsidiaries

We formed new subsidiaries to acquire the Partnership and its 23 hotels. Specifically, we formed two direct wholly-owned subsidiaries. One of these subsidiaries, AHT Res II GP, Inc., acquired the entire general partnership interest in the Partnership and now holds a 1% interest as its sole general partner. The other newly-formed and directly-owned subsidiary, AHT Res II LP, Inc., acquired the entire limited partnership interest in the Partnership and now holds a 99% interest as its sole limited partner. The Partnership directly owns all of the hotels, except for the hotel in Bossier City, Louisiana. For simplicity, this hotel will be referred to as the “Bossier Hotel.” The Bossier Hotel has been and continues to be owned by a wholly-owned subsidiary of the Partnership, Bossier RIBM Two LLC.

We also formed new subsidiaries in connection with the leasing of the hotels under master hotel lease agreements, which are among the material contracts summarized in another section below. Specifically, we formed AHM Res II GP, Inc. and AHM Res II LP, Inc., to serve as the sole general partner and sole limited partner, respectively, of AHM Res II Limited Partnership. This limited partnership was formed as one of our indirect, wholly-owned subsidiaries to lease the 22 hotels owned directly by the Partnership. In a similar fashion, we formed another limited partnership, Bossier Res II Limited Partnership, and its general and limited partners, Bossier Res II GP, Inc. and Bossier Res II LP, Inc., to lease the Bossier Hotel from its direct owner, Bossier RIBM Two LLC. For simplicity, these two newly-formed limited partnerships will be referred to as the “Lessees” or individually as a “Lessee.”

Loans Secured By Hotels

The Partnership received a loan in the original principal amount of $140 million prior to our recent acquisition of the Partnership. The current lender, by assignment of the original loans, is LaSalle Bank National Association, as Trustee for Nomura Asset Securities Corporation Commercial Mortgage Pass-Through Certificates Series 1996-MD V. Our recent acquisition of the Partnership occurred with the consent of the lender and did not result in any material change to the terms or conditions of the loans.

The loan is secured by a first mortgage on the 22 hotels owned directly by the Partnership and by a related first priority security interest in the rents, revenues and other personal property of such hotels. For simplicity, these 22 hotels will be referred to as the “Secured Hotels.” On August 31, 2002, the aggregate unpaid balance of the loan was approximately $132 million (representing principal and interest). Interest accrues at an annual rate of 8.85%. The monthly payment under the loans is approximately $1.16 million. An aggregate balloon payment in the amount of approximately $123 million is scheduled to be due on the maturity date, which is March 10, 2006.

We expect that revenues from the Secured Hotels will be sufficient to make monthly payments under the loan. If such revenues are not sufficient and other sources of funds are not available, we could lose the Secured Hotels through foreclosure. While the secured loan remains outstanding, certain covenants apply to the Partnership, as the borrower, and its general partner, as well as to AHM Res II Limited Partnership, as the lessee for the Secured Hotels, and its general partner. Among other things, these covenants (a) prohibit such entities from engaging in any business that is not related to the Secured Hotels or the secured loans, (b) require such entities to each maintain a separate legal identity and an arms-length relationship with affiliates, (c) restrict the transfer of ownership interests in such entities, and (d) limit the extent to which modifications may be made to the organizational documents of such entities, or to the master hotel lease agreement or the amended and restated management agreement for the Secured Hotels.

Other Actions

All 23 hotels have been and will continue to be managed by Residence Inn By Marriott, Inc., which will be referred to, for simplicity, as the “Manager.” Such management is occurring in accordance with amended and

S-4

restated management agreements, which are among the material contracts described in the next section.Neither Manager, Marriott International, Inc., nor any of their affiliates will be deemed an issuer, obligor or guarantor in respect of any securities described in our prospectus, nor will they have any responsibility or liability for any statement or omission contained in our prospectus or for such securities.

SUMMARY OF MATERIAL CONTRACTS

Agreement and Plan of Merger

Our acquisition of the Partnership and its direct and indirect hotels occurred in accordance with an agreement and plan of merger dated as of April 30, 2002. The closing occurred on August 28, 2002, after a number of required conditions to closing were satisfied.

Master Hotel Lease Agreements

The Secured Hotels are leased by the Partnership to AHM Res II Limited Partnership under a master hotel lease agreement dated as of August 28, 2002. For simplicity, this master hotel lease agreement will be referred to as the “Secured Hotel Lease.” The Secured Hotel Lease provides for an initial term of 15 years. The applicable Lessee has the option to extend the term for two additional five-year periods, provided it is not in default at the end of the prior term or at the time the option is exercised.

The Secured Hotel Lease provides that the applicable Lessee will pay an annual base rent, a quarterly percentage rent and a quarterly sundry rent. Annual base rent is payable in advance in equal monthly installments. The amount of annual base rent for the Secured Hotels ranges from $100,509 to $817,099 (as prorated for 2002). The base rent will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). The lease commencement date for each of the Secured Hotels for rent pro-ration and other purposes is August 10, 2002. Percentage rent is payable quarterly. Percentage rent depends on a formula that compares fixed “suite revenue breakpoints” with a portion of “suite revenue,” which is equal to gross revenue from suite rentals less sales and room taxes, credit card fees and sundry rent (as described below). The suite revenue breakpoints will be adjusted each year in proportion to the Consumer Price Index (based on the U.S. City Average). Specifically, the percentage rent is equal to the sum of (a) 17% of all year-to-date suite revenue, up to the applicable suite revenue breakpoint, plus (b) 55% of the year-to-date suite revenue in excess of the applicable suite revenue breakpoint, as reduced by base rent and the percentage rent paid year to date. The sundry rent is payable quarterly and equals 55% of all sundry revenue, which consists of revenue other than suite revenue, less the amount of sundry rent paid year-to-date.

In addition, the Partnership and the applicable Lessee entered into a tenant security agreement dated as of August 28, 2002 in which the Lessee granted the Partnership a security interest in certain collateral to secure, among other things, its obligations under the Secured Hotel Lease. The Bossier Hotel is leased under a master hotel lease agreement also dated as of August 28, 2002, which is substantially similar to the Secured Hotel Lease.

S-5

Amended and Restated Management Agreements

The Manager will continue to manage the Secured Hotels under an amended and restated management agreement dated as of August 28, 2002, with the consent of the secured lender and the applicable Lessee. For simplicity, this agreement will be referred to as the “Management Agreement.” Management services under the Management Agreement include supervising the operation of the Secured Hotels and collecting revenues from their operation for the benefit of the Lessee.

The initial term of the Management Agreement will continue until December 28, 2012. The Manager may renew the term of the Management Agreement for one period of 5 years, followed by four periods of 10 years each, provided that an event of default by the Manager has not occurred and provided that the Manager exercises its renewal option with respect to at least 80% of the Secured Hotels that either meet the then-current brand standards for Residence Inn® by Marriott® or are subject to property improvement programs reasonably required by the Manager. The Manager may elect to renew for an additional term by giving notice to the Lessee at least 18 months before the expiration of the then current term. Such renewal may apply to all or only some of the Secured Hotels. The Lessee may terminate the Management Agreement with respect to the Secured Hotels if the total operating profit for certain specified periods does not reach a specified minimum amount. The Manager has the option to avoid such termination by advancing the amount of the deficiency in operating profit to the Lessee.

The Manager will receive a management fee for its services. The total management fee consists of a base management fee based on gross revenues, a Residence Inn® system fee based on suite revenues and an incentive management fee and a contingent management fee, both based on operating profit. The formulas for these fees are complex and were the result of prior negotiations between the Partnership and the Manager, but were not materially changed in connection with our acquisition of the Partnership.

The Manager also may exercise a right of first refusal if the Lessee receives a bona fide written offer from a third party that, if accepted and consummated, would cause the Secured Hotels to have more than five separate owners. In such an event, the applicable Lessee must cause the Partnership to give prior notice to the Manager, which will then have 30 days in which to exercise its right of first refusal. Any such purchase, lease or other acquisition of the Secured Hotels by the Manager is required to comply with the terms and conditions set forth in the bona fide offer. The Management Agreement would remain in effect as to any Secured Hotels not involved in such sale, lease or other disposition.

A substantially similar amended and restated management agreement was executed with the Manager with respect to the Bossier Hotel.

Owner Agreement

In owner agreements dated as of August 28, 2002, the Manager granted its consent to our acquisition of the Partnership and to the execution of the Secured Hotel Lease and the lease for the Bossier Hotel. In return, the Partnership, as the direct or indirect owner of the hotels, agreed to guarantee the performance of the obligations, including monetary obligations, of each Lessee under the management agreements described above.

Agreements with Secured Lender

The secured lender granted its consent to our acquisition of the Partnership and to the leasing of the Secured Hotels to the applicable Lessee by an acknowledgement, waiver, consent and amendment dated as of August 28, 2002.

The secured lender has security interests in the personal property at the Secured Hotels, and in the rents and revenues from their operation, pursuant to separate deeds of trust, assignments of leases and security agreements that were executed by the Partnership prior to our acquisition.

S-6

The Partnership executed a facility mortgagee agreement, a supplemental assignment of leases and rents and a supplemental security agreement, each dated as of August 28, 2002. These agreements contain a number of provisions designed to preserve and protect the secured lender’s interest in the Secured Hotels. These protections include subordinating the Secured Hotel Lease to the secured lender’s interest in its collateral, granting the secured lender a security interest in the Partnership’s interests under the Secured Hotel Lease and granting the secured lender a security interest in any new furniture, fixtures and equipment acquired by the Partnership or the applicable Lessee for the Secured Hotels.

(Remainder of Page is Intentionally Blank)

S-7

We currently own a total of 48 extended-stay hotels, which contain 5,767 suites and are part of the Residence Inn® by Marriott® franchise system. The hotels first began their operations during the period from 1984 through 1990. Each hotel was in business when acquired by us. Each hotel offers one and two room suites with the amenities generally offered by upscale extended-stay hotels. The hotels are located in developed areas in competitive markets. We believe the hotels are well-positioned to compete in these markets based on their location, amenities, rate structure and franchise affiliation. In the opinion of management, all of the hotels are adequately covered by insurance. All of our hotels are listed in the table below (with the recently acquired 23 hotels indicated by an asterisk):

HOTEL SUMMARY

State

| | Hotel

| | Suites

| | State

| | Hotel

| | Suites

|

|

| Alabama | | Birmingham* | | 128 | | Michigan | | Kalamazoo* | | 83 |

| | | Montgomery | | 94 | | | | Southfield | | 144 |

|

| California | | Arcadia* | | 120 | | Mississippi | | Jackson* | | 120 |

| | | Bakersfield | | 114 | | | | | | |

| | | Concord-Pleasant Hill | | 126 | | Missouri | | St. Louis-Chesterfield | | 104 |

| | | Costa Mesa | | 144 | | | | St. Louis-Galleria | | 152 |

| | | Irvine* | | 112 | | | | | | |

| | | La Jolla | | 288 | | Nevada | | Las Vegas* | | 192 |

| | | Long Beach | | 216 | | | | | | |

| | | Placentia* | | 112 | | New Mexico | | Santa Fe* | | 120 |

| | | San Ramon | | 106 | | | | | | |

| | | | | | | North Carolina | | Charlotte* | | 91 |

| Colorado | | Boulder | | 128 | | | | Greensboro* | | 128 |

|

| Connecticut | | Meriden | | 106 | | Ohio | | Akron* | | 112 |

| | | | | | | | | Cincinnati-Blue Ash | | 118 |

| Florida | | Boca Raton* | | 120 | | | | Cincinnati-Sharonville | | 144 |

| | | Clearwater-St. | | | | | | Columbus | | 96 |

| | | Petersburg* | | 88 | | | | Dayton North | | 64 |

| | | Jacksonville* | | 112 | | | | Dayton South | | 96 |

| | | Pensacola* | | 64 | | | | | | |

| Georgia | | Atlanta

Airport-Hapeville | | 126 | | Pennsylvania | | Philadelphia-Berwyn* | | 88 |

| | | Atlanta-Buckhead | | 136 | | South Carolina | | Columbia* | | 128 |

| | | Atlanta-Cumberland | | 130 | | | | Spartanburg* | | 88 |

| | | Atlanta-Dunwoody | | 144 | | | | | | |

|

| Illinois | | Chicago-Deerfield* | | 128 | | Tennessee | | Memphis* | | 105 |

| | | Chicago-Lombard | | 144 | | | | | | |

| | | | | | | Texas | | Dallas-Irving | | 120 |

| Louisiana | | Shreveport-Bossier | | | | | | Houston-Clear Lake | | 110 |

| | | City* | | 72 | | | | Lubbock* | | 80 |

| | | | | | | | | | | |

| Massachusetts | | Boston-Danvers* | | 96 | | | | | | |

| | | Boston-Tewksbury | | 130 | | | | | | |

| * | | Acquired on August 28, 2002. |

S-8

Because of the number of hotels we own, the effect of an individual hotel on our overall operations is minimal, and specific operating data and real estate information is not presented for each hotel. Such data and information (including average daily occupancy rate and revenue per available suite) varies among the hotels and depends on a variety of factors, including location, condition, and overall demand for hotel suites in the area. These factors, in turn, are affected by general and local economic conditions and the proximity of employers, business travelers and other sources of occupancy. We believe the combined operating data for our hotels is within the normal range for comparable hotels in the same or similar markets. We are not presently aware of any circumstances or factors that have caused, or are expected to cause, the operating data for a particular hotel to be materially below such normal range. Our hotels are subject to real estate taxes levied by various governmental authorities. We believe these taxes are also within the normal range for comparable hotels in the same or similar markets.

Eight of our hotels are located in the same markets as extended-stay hotels owned by Apple Suites, Inc. (These hotels are the ones located in Atlanta-Buckhead, Atlanta-Cumberland, Boulder, Clearwater, Dallas-Irving, Jackson, Philadelphia and St. Louis-Chesterfield). As discussed above, the day-to-day operations of our hotels has been contracted to Residence Inn by Marriott, Inc. and our hotels operate under the Residence Inn® by Marriott® brand. The hotels owned by Apple Suites are operated on a day-to-day basis by a separate management company and operate under the Homewood Suites® by Hilton brand. We may in the future acquire additional hotels located in the same markets as hotels owned by Apple Suites. Our Chairman and President, Glade M. Knight, is also Chairman and President of Apple Suites.

The site of the Bossier Hotel is a portion of a larger property that was previously used as an oil refinery. This refinery property has been a focus of federal and state environmental agencies for a number of years and has undergone some environmental clean-up procedures. To deal with remaining contamination on the refinery property, the U.S. Environmental Protection Agency has developed a clean-up plan, which may result in the installation of monitoring wells or extraction wells on the Bossier Hotel site. We have received a letter from the U.S. Environmental Protection Agency informing us that the EPA is in negotiations with certain other companies with regard to the performance of the EPA-approved remedial design and remedial action plan and also telling us that EPA has no intention of pursuing any party other than those other companies for cleanup costs associated with the refinery property.

As part of the previous refinancing of the loan secured by the Secured Hotels, the owner of the Bossier Hotel, a wholly-owned subsidiary of the Partnership, was required to establish and fund a reserve account to be held by the lender and to provide for any claim, investigation or litigation that may arise from the environmental condition of the Bossier Hotel. The owner of the Bossier Hotel is required to add $250,000 to the fund each year until 2006. The current balance of this reserve account is $1,542,000. If funds are not disbursed from the reserve account, the lender will hold the reserve until the loan is repaid, or the relevant governmental authority determines that the statute of limitations on filing any claims has expired and no further remedial activities are required at the refinery site.

S-9

APPLE HOSPITALITY TWO, INC.

(As of June 30, 2002 or, as applicable, for the period from January 1, 2002—June 30, 2002)

Revenues: | | | | |

| Suite Revenue | | $ | 33,381,932 | |

| Interest income and other revenue | | | 1,524,608 | |

| | |

|

|

|

| Total Revenue | | $ | 34,906,540 | |

|

Expenses: | | | | |

| Hotel expenses | | $ | 18,902,697 | |

| Taxes, insurance and other | | | 2,212,034 | |

| General and administrative | | | 683,325 | |

| Depreciation | | | 2,639,286 | |

| Interest | | | 4,952,602 | |

| | |

|

|

|

| Total expenses | | $ | 29,389,944 | |

| Net income | | $ | 5,516,596 | |

| | |

|

|

|

Per Share | | | | |

| Earnings per share—basic and diluted | | $ | .33 | |

| Distributions to common shareholders | | $ | .50 | |

| Weighted-average common shares outstanding—basic | | | 16,810,654 | |

|

Balance Sheet Data at June 30, 2002: | | | | |

| Cash and cash equivalents | | $ | 68,794,802 | |

| Investment in hotels, net | | $ | 249,532,341 | |

| Total assets | | $ | 336,680,450 | |

| Notes payable—secured | | $ | 142,912,276 | |

| Shareholders’ equity | | $ | 189,828,076 | |

|

Other Data: | | | | |

| Cash flow from: | | | | |

| Operating activities | | $ | 7,775,877 | |

| Investing activities | | $ | (11,733,934 | ) |

| Financing activities | | $ | 57,284,018 | |

| Number of hotels owned at end of period | | | 25 | |

|

Funds From Operations Calculation | | | | |

| Net income | | $ | 5,516,596 | |

| Depreciation | | $ | 2,639,286 | |

| Interest expense (imputed) | | $ | 450,000 | |

| Funds from Operation (a) | | $ | 8,605,882 | |

| FFO per share | | $ | .51 | |

| (a) | | Funds from operations (FFO) is defined as net income (computed in accordance with generally accepted accounting principles-GAAP) excluding gains and losses from sales of depreciable property, plus depreciation and amortization. We consider FFO in evaluating property acquisitions and operating performance. We believe that FFO should be considered along with, but not as an alternative to, net income and cash flows as a measure of our activities in accordance with GAAP and that it is not necessarily indicative of cash available to fund cash needs. |

S-10

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(As of June 30, 2002 or, as applicable, for the period from January 1, 2002 - June 30, 2002)

General

The Company is a real estate investment trust (REIT) with activities related to the acquisition and ownership of upper-end extended-stay and upper-end limited services hotels.The Company was formed on January 17, 2001, with the first investor closing commencing on May 1, 2001.

The Company owns twenty-five hotels, with a total of 3,280 suites. Ten of the hotels were acquired in 2001 by the Company from Crestline Capital Corporation and certain of its subsidiaries. The following table summarizes the locations of and the number of suites located at these ten hotels (collectively, the “Crestline Portfolio”):

General location of hotels

| | # of Suites

| | General location of hotels

| | # of Suites

|

| Montgomery, Alabama | | 94 | | Atlanta/Hapeville, Georgia | | 126 |

| Bakersfield, California | | 114 | | Boston, Massachusetts | | 130 |

| Concord, California | | 126 | | Cincinnati, Ohio | | 118 |

| San Ramon, California | | 106 | | Dallas, Texas | | 120 |

| Meriden, Connecticut | | 106 | | Houston, Texas | | 110 |

The remaining fifteen hotels owned by the Company were acquired on March 29, 2002, in a transaction described below under “Recent Acquisition.” The following table summarizes the location of and the number of suites located at these fifteen hotels (the “Res I Portfolio”):

General location of hotel

| | # of Suites

| | General location of hotels

| | # of Suites

|

| Costa Mesa, California | | 144 | | Southfield, Michigan | | 144 |

| La Jolla, California | | 288 | | St. Louis/Chesterfield, Missouri | | 104 |

| Long Beach, California | | 216 | | St. Louis-Galleria, Missouri | | 152 |

| Boulder, Colorado | | 128 | | Cincinnati, Ohio | | 144 |

| Atlanta-Buckhead, Georgia | | 136 | | Columbus, Ohio | | 96 |

| Atlanta-Cumberland, Georgia | | 130 | | Dayton-North, Ohio | | 64 |

| Atlanta-Dunwoody, Georgia | | 144 | | Dayton-South, Ohio | | 96 |

| Chicago, Illinois | | 144 | | | | |

The Company is externally advised and has contracted with Apple Suites Advisors, Inc. (“ASA”) to manage its day-to-day operations and make investment decisions. The Company has contracted with Apple Suites Realty Group, Inc. (“ASRG”) to provide brokerage and acquisition services in connection with its hotel acquisitions. ASA and ASRG are both owned by Mr. Glade Knight, the Company’s Chairman.

Recent Acquisition—Res I Portfolio

On March 29, 2002, the Company acquired, through subsidiaries, Marriott Residence Inn Limited Partnership (the “Partnership”), which owns fifteen (15) extended-stay hotels. Although the acquisition was conducted through a merger in which the Company’s subsidiaries acquired the Partnership, the purpose and result was acquisition of the hotels.

The purchase price, as adjusted at closing, was paid through a combination of transactions. The total base purchase price for the acquisition was approximately $133.4 million. In November 2001, the Company made a

S-11

deposit of $35 million, which was applied toward the purchase price at closing. In addition, the Company made a cash payment of approximately $7 million at closing. To satisfy the remainder of the purchase price, the Company received a credit at closing equal to the unpaid balance of existing loans, which are secured by the hotels. The secured loans will continue to be an obligation of the Partnership, which continues to own the hotels.

Results of Operations

On May 1, 2001, the first investor closing occurred and the Company began operations. Since the Company did not purchase any hotels until September 2001, a comparison of revenues and expenses to the corresponding fiscal quarter and year-to-date period of 2001 is not possible.

For the six months ended June 30, 2001, the Company reported interest income which consisted of interest income from a 12%, $47,000,000 promissory note and interest on cash and cash reserves. Expenses consisted of day to day home office general and administrative expenses.

Revenues

The Company’s principal source of revenue is hotel suite revenue. For the six months ended June 30, 2002, the Company had suite revenue and other revenue of $33,381,932 and $1,188,221 respectively. For the six month period ended June 30, 2002, revenue per occupied room was $74.22, average daily rate was $95.96, and occupancy was 77%.

For the six months ended June 30, 2002, the Company had interest income of $336,387, which represents excess cash invested in short term money market instruments.

Expenses

Interest expense was $4,502,602 for the six months ended June 30, 2002. Interest expense represented interest expense on the 8.08%, $53 million promissory note assumed in conjunction with the Crestline acquisition. Imputed interest expense on the 8.6% $71 million promissory note and 15.25% $21 million promissory note assumed in conjunction with the Company’s recent acquisition, effective February 22, 2002, was $450,000.

Depreciation expense for the six months ended June 30, 2002 was $2,639,286. Depreciation expense for 2002 represents expense of the Company’s 25 hotels and related personal property.

Taxes, insurance and other expense for the six months ended June 30, 2002 was $2,212,034 or 6% of the Company’s suite revenue in 2002.

General and administrative expenses for the six months ended June 30, 2002 was $683,325 or 2% of the Company’s suite revenue in 2002. This percentage is expected to decrease as the Company’s asset base grows. These expenses represent the administrative expenses of the Company as distinguished from the hotel operations.

Hotel operating expenses totaled $7,598,969 or 22% of the Company’s suite revenue for the six months ended June 30, 2002.

Residence Inn By Marriott, Inc. (the “Manager”) manages the day-to-day operations of the hotels under management agreements with the Lessee. All of the Company’s hotels are managed as part of the Residence Inn® by Marriott® franchise. The Manager receives management fees for its services. The management fees consist of (a) a base management fee of two percent (2%) of gross revenues, (b) a Residence Inn® system fee of four percent (4%) of suite revenues and (c) an incentive management fee based on the operating profit of the hotels. For the six months ended June 30, 2002 the Company had incurred $691,405 in base management fees, $1,335,276 in system fees and $824,475 in incentive management fees.

S-12

In addition to management fees, the Company also pays each hotel’s pro rata share of the Manager’s actual costs and expenses incurred in providing certain services (“Chain Services”) on a central or regional basis to all the hotels operated by the Manager or other Marriott affiliate. Chain Services include central training and development; computerized payroll and accounting services; and such additional central or regional services performed on a centralized basis. For six months ended June 30, 2002 the Company had incurred $538,334 in Chain Services.

The management agreements also provide for payments of costs associated with certain system-wide advertising, promotional and public relations materials and programs and the operational costs of reservation systems. Each hotel pays two and one-half percent (2.5%) of suite revenues to this marketing fund. For the six month period ended June 30, 2002 the Company had incurred $834,548 in marketing fees.

Liquidity and Capital Resources

From the initial closing, through the period ended June 30, 2002, the Company sold 21,344,510 shares (3,157,895 shares at $9.50 per share and 18,186,615 shares at $10 per share) of its common stock to its investors, including shares sold through the reinvestment of distributions. The total gross proceeds from the shares sold were $211,866,157, which netted $190,484,388 to the Company after the payment of selling commissions and other offering costs.

Res I Portfolio

The Company is committed, under the management agreement, to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. For the six month period ended June 30, 2002, $4,537,548 was held by the Manager for furniture, fixtures and equipment reserve.

Crestline Portfolio

The Company is committed, under the management agreement, to fund 5% of gross revenues for capital expenditures to include periodic replacement or refurbishment of furniture, fixtures, and equipment. For the six month period ended June 30, 2002, $2,595,196 was held by the Manager for furniture, fixtures and equipment reserve.

Additional Offering

On May 22, 2002, the Company filed with the United States Securities and Exchange Commission a registration statement covering the offer and sale to the public of an additional 10 million Units (each Unit consists of one common share and one Series A preferred share) at $10 per Unit for an aggregate public offering price of $100 million. Proceeds from the sale of these Units, will be available for the acquisition of additional properties and general corporate purposes. As of June 30, 2002, the Company had sold 1,186,615 units to its investors under this offering. However, the Company cannot predict how many additional Units will be sold pursuant to this additional offering.

Notes payable

Res I Portfolio

The Partnership, which was acquired by the Company, through subsidiaries, in connection with the Res I Portfolio, is the borrower under secured loans from two lenders (with one being the senior lender and the other being the subordinate lender). The senior lender is LaSalle Bank National Association as Trustee for Mortgage Pass-Through Certificates Series 1996-2. The senior lender holds separate loans for each hotel in the aggregate

S-13

original principal amount of $100 million. Each loan held by the senior lender is secured by a first mortgage on the hotel involved and by a related first priority security interest in the rents, revenues and other personal property of such hotel.

On June 30, 2002, the aggregate unpaid principal balance of these senior loans was $69,761,691. Each senior loan bears interest at an annual rate of 8.60% and has a maturity date of September 30, 2002. The aggregate monthly payment under the senior loans is $874,163. An aggregate balloon payment in the amount of approximately $70 million is scheduled to be due at maturity. The subordinate lender is LaSalle Bank National Association, as Indenture Trustee for Benefit of the Holders of iStar Asset Receivables Trust Collateralized Mortgage Bonds Series 2000-1. The subordinate lender holds a loan in the original principal amount of $30 million. The subordinate loan is secured by a subordinate mortgage on the hotels and by related second priority security interests in the rents, revenues and other personal property of the hotels. On June 30, 2002, the unpaid principal balance of the subordinate loan was $21,064,097. The subordinate loan bears interest at an annual rate of 15.25% and requires monthly payments of $400,590. The maturity date is September 30, 2002. A balloon payment in the amount of approximately $20 million is scheduled to be due at maturity.

The Company has entered into a debt refinancing commitment. The rate is based on a 10 year treasury rate, and rate lock deposit of $2,000,000 was issued. The deposit, less the change in 10 year treasury rate from the time of deposit to the time of termination, is refundable if the commitment is terminated.

Crestline Portfolio

In conjunction with our previously acquired portfolio of properties, the Company assumed a $53 million promissory note. The note bears a fixed interest rate of 8.08% per annum and is secured by the 10 hotels. The maturity date is January 2010, with a balloon payment of $35.4 million. The loan is payable in monthly installments, including principal and interest. On June 30, 2002, the unpaid principal balance was $52,086,488.

Cash and cash equivalents

Cash and cash equivalents totaled $68,794,802 at June 30, 2002. The company plans to use this cash for future acquisition costs, to pay dividends, to pay down debt service and to fund general corporate expenses.

Capital requirements

The Company’s divided distribution policy is at the discretion of the board of directors and depends on several factors. The distribution for the six months ended June 30, 2002 is $0.25 per share.

Capital resources are expected to grow with the future sale of its shares. In general, the Company expects capital resources to be adequate to meet its cash requirements in 2002.

The Company has ongoing capital commitments to fund its capital improvements. The Company, through the Lessee, is required, under management agreements with the Managers, to make available to the Lessee, for the repair, replacement, refurbishing of furniture, fixtures, and equipment, an amount of 5%, for both the Crestline portfolio and Res I portfolio, of gross revenues provided that such amount may be used for capital expenditures made by the Company with respect to the hotels.

The Company expects that this amount will be adequate to fund the required repair, replacement, and refurbishments and to maintain its hotels in a competitive condition.

It is anticipated that revenues generated from hotels and equity funds will be used to meet normal hotel operating expenses, make principal payments on the notes assumed with the 2001 and 2002 acquisitions and payment of distributions.

S-14

Impact of inflation

Operators of hotels, in general, possess the ability to adjust room rates daily to reflect the effects of inflation. Competitive pressures may, however, limit the operator’s ability to raise room rates.

Seasonality

The hotel industry historically has been seasonal in nature, reflecting higher occupancy rates primarily during the first three quarters of the year. Seasonal variations in occupancy at the Company’s hotels may cause quarterly fluctuations in the Company’s revenues, particularly during the fourth quarter. To the extent that cash flow from operations is insufficient during any quarter, due to temporary or seasonal fluctuations in revenue, the Company expects to utilize cash on hand to make distributions.

The Company believes its liquidity and capital resources are adequate to meet its cash requirements for the foreseeable future subject to finding suitable refinancing of the debt assumed in the Res I portfolio transaction (see discussion above).

Potential Acquisition

The Company entered into an agreement on April 30, 2002, regarding the potential acquisition of twenty-three (23) extended-stay hotels that operate as part of the Residence Inn® by Marriott® franchise. The acquisitions are considered potential, due to the number of conditions to closing. Either party to the agreement may terminate if closing does not occur on or before September 27, 2002. As required by the agreement, we made an escrow deposit equal to $3,000,000. This amount, plus any accrued interest, would be applied as a credit toward the purchase price if the transaction were to occur. Should the agreement be terminated on account of certain breaches by us, $1,000,000 of the deposit would become the property of the seller and the $2,000,000 balance of the deposit would be returned to us. While the acquisition is expected to close in August 2002, there can be no assurance that the transaction will be consummated due to the number of closing conditions.

Recent Accounting Pronouncements

In June 2001, the FASB issued Statement for Financial Accounting Standards (SFAS) No. 141, “Business Combinations,” and SFAS No. 142, “Goodwill and Other Intangibles,” effective for fiscal years beginning after December 15, 2001.

Under new rules, goodwill and intangible assets deemed to have indefinite lives will no longer be amortized but will be subject to annual impairment tests in accordance with the Statements. Other intangible assets will continue to be amortized over their useful lives. The company adopted these new accounting standards beginning the first quarter of fiscal 2002. The adoption of these standards will not have a material impact on its financial statements.

In August 2001, the FASB issued Statement 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”. The Statement supercedes Statement 121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed of”, and APB Opinion No.30, “Reporting the Results of Operations—Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions”, for segments of a business to be disposed of. SFAS No. 144 retains the requirements of Statement 121 relating to recognition and measurement of an impairment loss and resolves certain implementation issues resulting from Statement 121. This statement became effective January 1, 2002. The adoption of this statement did not have a material impact on the consolidated financial position or results of operations of the company.

S-15

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

All of the Company’s market risk is exposure to changes in mortgage interest rates related to the assumption of the promissory notes and interest rates on short-term investments. The interest rate of the assumed debt for the Crestline acquisition was 8.08% and the interest rates of the assumed debt for the Res I acquisition were 8.60% and 15.25%. The Company invests proceeds from its best efforts offering in short-term money market investments pending acquisitions. The Company intends to invest this money in real estate assets as suitable opportunities arise.

There have been no other material changes since December 31, 2001. See the information provided in the Company’s annual report under item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The financial statements for the Partnership included herein have been audited by Arthur Andersen LLP (“Andersen”), independent public accountants as indicated in their reports with respect thereto. After reasonable efforts, we have been unable to obtain the written consent of Andersen to the inclusion of their audit report on such financial statements into the registration statement of which this supplement is a part. Because Andersen has not consented to the inclusion of its report in the registration statement of which this supplement is a part, you will not be able to recover against Andersen under Section 11 of the Securities Act of 1933 for any untrue statement of a material fact contained in the financial statements audited by Andersen that are included in this supplement or any omission to state a material fact required to be stated therein.

S-16

INDEX TO FINANCIAL STATEMENTS

Financial Statements of Businesses Acquired

Marriott Residence Inn II Limited Partnership

(Audited)

| | F-2 |

| | F-3 |

| | F-4 |

| | F-5 |

| | F-6 |

| | F-7 |

(Unaudited) | | |

| | F-14 |

| | F-15 |

| | F-16 |

| | F-17 |

Pro Forma Financial Information

Apple Hospitality Two, Inc.

(Unaudited)

F-1

Report of Independent Public Accountants

TO THE PARTNERS OF MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP:

We have audited the accompanying consolidated balance sheets of Marriott Residence Inn II Limited Partnership (a Delaware limited partnership) and subsidiary, as of December 31, 2001 and 2000, and the related consolidated statements of operations, changes in partners’ capital and cash flows for each of the three fiscal years in the period ended December 31, 2001. These financial statements and the schedule referred to below are the responsibility of the general partner’s management. Our responsibility is to express an opinion on these financial statements and schedule based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Marriott Residence Inn II Limited Partnership and subsidiary as of December 31, 2001 and 2000, and the results of their operations and their cash flows for each of the three fiscal years in the period ended December 31, 2001, in conformity with accounting principles generally accepted in the United States.

Our audits were made for the purpose of forming an opinion on the basic financial statements taken as a whole. The schedule listed in the index at Item 14(a)(2) is presented for purposes of complying with the Securities and Exchange Commission’s rules and is not part of the basic financial statements. This schedule has been subjected to the auditing procedures applied in our audit of the basic financial statements and, in our opinion, fairly states in all material respects the financial data required to be set forth therein in relation to the basic financial statements taken as a whole.

/S/ ARTHUR ANDERSENLLP

Vienna, Virginia

March 18, 2002

***This is a copy of the audit report previously issued by Arthur Andersen in connection with the Partnership's filing on Form 10-K for the year ended December 31, 2001. This audit report has not been reissued by Arthur Andersen in connection with this supplement.

F-2

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS December 31, 2001 and 2000

(In Thousands)

| | | 2001

| | | 2000

| |

ASSETS | | | | | | | | |

|

| Property and equipment, net | | $ | 132,137 | | | $ | 133,126 | |

| Due from Residence Inn by Marriott, Inc. | | | 3,005 | | | | 2,814 | |

| Deferred financing costs, net of accumulated amortization | | | 1,738 | | | | 2,150 | |

| Property improvement fund | | | 3,923 | | | | 3,998 | |

| Restricted cash reserves | | | 7,762 | | | | 7,693 | |

| Cash and cash equivalents | | | 25,149 | | | | 22,291 | |

| | |

|

|

| |

|

|

|

| | | $ | 173,714 | | | $ | 172,072 | |

| | |

|

|

| |

|

|

|

|

LIABILITIES AND PARTNERS’ CAPITAL | | | | | | | | |

|

| LIABILITIES | | | | | | | | |

| Mortgage debt | | $ | 132,198 | | | $ | 134,166 | |

| Incentive management fee due to Residence Inn by Marriott, Inc. | | | 5,440 | | | | 2,895 | |

| Accounts payable and accrued expenses | | | 2,037 | | | | 1,998 | |

| | |

|

|

| |

|

|

|

| Total Liabilities | | | 139,675 | | | | 139,059 | |

| | |

|

|

| |

|

|

|

|

| PARTNERS’ CAPITAL | | | | | | | | |

| General Partner | | | | | | | | |

| Capital contribution | | | 707 | | | | 707 | |

| Capital distributions | | | (461 | ) | | | (461 | ) |

| Cumulative net income | | | 172 | | | | 162 | |

| | |

|

|

| |

|

|

|

| | | | 418 | | | | 408 | |

| | |

|

|

| |

|

|

|

| Limited Partners | | | | | | | | |

| Capital contributions | | | 62,155 | | | | 62,155 | |

| Capital distributions | | | (45,640 | ) | | | (45,640 | ) |

| Cumulative net income | | | 17,106 | | | | 16,090 | |

| | |

|

|

| |

|

|

|

| | | | 33,621 | | | | 32,605 | |

| | |

|

|

| |

|

|

|

| Total Partners’ Capital | | | 34,039 | | | | 33,013 | |

| | |

|

|

| |

|

|

|

| | | $ | 173,714 | | | $ | 172,072 | |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

F-3

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended December 31, 2001, 2000 and 1999

(in thousands, except per Unit amounts)

| | | 2001

| | | 2000

| | | 1999

| |

| REVENUES | | | | | | | | | | | | |

| Suites | | $ | 63,727 | | | $ | 69,721 | | | $ | 68,360 | |

| Other | | | 2,804 | | | | 3,367 | | | | 3,597 | |

| | |

|

|

| |

|

|

| |

|

|

|

| Total revenues | | | 66,531 | | | | 73,088 | | | | 71,957 | |

| | |

|

|

| |

|

|

| |

|

|

|

| OPERATING COSTS AND EXPENSES | | | | | | | | | | | | |

| Suites | | | 16,107 | | | | 17,752 | | | | 17,213 | |

| Other department costs and expenses | | | 1,475 | | | | 1,806 | | | | 1,910 | |

| Selling, administrative and other | | | 19,877 | | | | 21,254 | | | | 20,380 | |

| Depreciation | | | 7,295 | | | | 7,163 | | | | 8,120 | |

| Incentive management fee | | | 2,545 | | | | 2,895 | | | | 3,090 | |

| Residence Inn system fee | | | 2,549 | | | | 2,789 | | | | 2,734 | |

| Property taxes | | | 2,262 | | | | 2,307 | | | | 2,270 | |

| Base management fee | | | 1,331 | | | | 1,462 | | | | 1,439 | |

| Equipment rent and other | | | 1,165 | | | | 1,202 | | | | 1,325 | |

| Loss on impairment of long-lived assets | | | — | | | | 5,170 | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | | 54,606 | | | | 63,800 | | | | 58,481 | |

| | |

|

|

| |

|

|

| |

|

|

|

| OPERATING PROFIT | | | 11,925 | | | | 9,288 | | | | 13,476 | |

| Interest expense | | | (12,362 | ) | | | (12,562 | ) | | | (12,681 | ) |

| Interest income | | | 1,463 | | | | 1,798 | | | | 1,151 | |

| | |

|

|

| |

|

|

| |

|

|

|

| INCOME (LOSS) BEFORE EXTRAORDINARY ITEMS | | | 1,026 | | | | (1,476 | ) | | | 1,946 | |

| Extraordinary gain on the forgiveness of deferred incentive management fees | | | — | | | | 22,693 | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

|

| NET INCOME | | $ | 1,026 | | | $ | 21,217 | | | $ | 1,946 | |

| | |

|

|

| |

|

|

| |

|

|

|

| ALLOCATION OF NET INCOME | | | | | | | | | | | | |

| General Partner | | $ | 10 | | | $ | 212 | | | $ | 19 | |

| Limited Partners | | | 1,016 | | | | 21,005 | | | | 1,927 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | $ | 1,026 | | | $ | 21,217 | | | $ | 1,946 | |

| | |

|

|

| |

|

|

| |

|

|

|

| NET INCOME PER LIMITED PARTNER UNIT (70,000 Units) | | $ | 15 | | | $ | 300 | | | $ | 28 | |

| | |

|

|

| |

|

|

| |

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

F-4

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CHANGES IN PARTNERS’ CAPITAL For the Years Ended December 31, 2001, 2000 and 1999

(in thousands)

| | | General Partner

| | Limited Partners

| | Total

|

| Balance, December 31, 1998 | | $ | 177 | | $ | 9,673 | | $ | 9,850 |

| Net income | | | 19 | | | 1,927 | | | 1,946 |

| | |

|

| |

|

| |

|

|

| Balance, December 31, 1999 | | | 196 | | | 11,600 | | | 11,796 |

| Net income | | | 212 | | | 21,005 | | | 21,217 |

| | |

|

| |

|

| |

|

|

| Balance, December 31, 2000 | | | 408 | | | 32,605 | | | 33,013 |

| Net income | | | 10 | | | 1,016 | | | 1,026 |

| | |

|

| |

|

| |

|

|

| Balance, December 31, 2001 | | $ | 418 | | $ | 33,621 | | $ | 34,039 |

| | |

|

| |

|

| |

|

|

The accompanying notes are an integral part of these consolidated financial statements.

F-5

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

CONSOLIDATED STATEMENTS OF CASH FLOWS For the Years Ended December 31, 2001, 2000 and 1999

(in thousands)

| | | 2001

| | | 2000

| | | 1999

| |

| OPERATING ACTIVITIES | | | | | | | | | | | | |

| Net income | | $ | 1,026 | | | $ | 21,217 | | | $ | 1,946 | |

| Extraordinary gain on the forgiveness of deferred incentive management fees | | | — | | | | (22,693 | ) | | | — | |

| Depreciation | | | 7,295 | | | | 7,163 | | | | 8,120 | |

| Deferred incentive management fee | | | 2,545 | | | | 2,895 | | | | 3,076 | |

| Amortization of deferred financing costs as interest | | | 412 | | | | 412 | | | | 411 | |

| Loss on dispositions of property and equipment | | | 2 | | | | 73 | | | | 125 | |

| Loss on impairment of long-lived assets | | | — | | | | 5,170 | | | | — | |

| Change in operating accounts: | | | | | | | | | | | | |

| (Increase)/Decrease in due from Residence Inn by Marriott, Inc. | | | (191 | ) | | | 610 | | | | 522 | |

| Increase/(Decrease) in accounts payable and accrued expenses | | | 39 | | | | (249 | ) | | | 430 | |

| Decrease/(Increase) in restricted cash reserves | | | (91 | ) | | | 155 | | | | (251 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

| Cash provided by operating activities | | | 11,037 | | | | 14,753 | | | | 14,379 | |

| | |

|

|

| |

|

|

| |

|

|

|

| INVESTING ACTIVITIES | | | | | | | | | | | | |

| Additions to property and equipment, net | | | (6,308 | ) | | | (5,008 | ) | | | (7,387 | ) |

| Change in property improvement fund | | | 75 | | | | (3,532 | ) | | | (607 | ) |

| Change in restricted cash reserves | | | 768 | | | | (250 | ) | | | (250 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

| Cash used in investing activities | | | (5,465 | ) | | | (8,790 | ) | | | (8,244 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

| FINANCING ACTIVITIES | | | | | | | | | | | | |

| Repayment of mortgage debt | | | (1,968 | ) | | | (1,767 | ) | | | (1,649 | ) |

| Change in restricted cash reserves | | | (746 | ) | | | 216 | | | | 452 | |

| | |

|

|

| |

|

|

| |

|

|

|

| Cash used in financing activities | | | (2,714 | ) | | | (1,551 | ) | | | (1,197 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

| INCREASE IN CASH AND CASH EQUIVALENTS | | | 2,858 | | | | 4,412 | | | | 4,938 | |

| CASH AND CASH EQUIVALENTS at beginning of year | | | 22,291 | | | | 17,879 | | | | 12,941 | |

| | |

|

|

| |

|

|

| |

|

|

|

| CASH AND CASH EQUIVALENTS at end of year | | $ | 25,149 | | | $ | 22,291 | | | $ | 17,879 | |

| | |

|

|

| |

|

|

| |

|

|

|

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | | | | | | | | |

| Cash paid for mortgage interest | | $ | 11,960 | | | $ | 12,159 | | | $ | 12,278 | |

| | |

|

|

| |

|

|

| |

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

F-6

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS NOTE 1. THE PARTNERSHIP

Description of the Partnership

Marriott Residence Inn II Limited Partnership, a Delaware limited partnership, was formed on September 20, 1988, to acquire, own and operate 23 Residence Inn by Marriott hotels (the “Inns”) and the land on which the Inns are located. The Inns are located in 16 states in the United States: four in Florida, three in California, two in both North Carolina and South Carolina and one in each of Alabama, Illinois, Louisiana, Massachusetts, Michigan, Mississippi, Nevada, New Mexico, Ohio, Pennsylvania, Tennessee and Texas. As of December 31, 2001, the Inns have a total of 2,487 suites. The Inns are managed by Residence Inn by Marriott, Inc. (the “Manager”), a wholly-owned subsidiary of Marriott International, Inc. (“MII”), as part of the Residence Inn by Marriott hotel system.

The partnership was formed through a public offering of 70,000 limited partnership interests (the “Units”) in 1998. The sole general partner, with a 1% interest, is RIBM Two LLC, a Delaware single member limited liability company, which is owned directly and indirectly by Host Marriott, L.P. (`Host LP”), as of December 31, 2001.

To facilitate the refinancing of the partnership’s mortgage debt, on March 22, 1996, as permitted by the partnership agreement, the partnership transferred ownership of the Bossier City Residence Inn to a newly formed subsidiary, Bossier RIBM Two LLC (“Bossier LLC”), a Delaware limited liability company.

Partnership Allocations and Distributions

Net profits for Federal income tax purposes are generally allocated to the partners in proportion to the distributions of cash available for distribution. The partnership generally distributes cash available for distribution as follows: (i) first, 99% to the limited partners and 1% to the general partner, until the partners have received, with respect to such year, an amount equal to 10% of their Net Capital Investment, defined as the excess of original capital contributions over cumulative distributions of net refinancing and sales proceeds (“Capital Receipts”); and (ii) second, remaining cash available for distribution will be distributed as follows, depending on the amount of Capital Receipts previously distributed:

(a) 99% to the limited partners and 1% to the general partner, if the partners have received aggregate cumulative distributions of Capital Receipts of less than 50% of their original capital contributions; or

(b) 90% to the limited partners and 10% to the general partner, if the partners have received aggregate cumulative distributions of Capital Receipts equal to or greater than 50% but less than 100% of their original capital contributions; or

(c) 75% to the limited partners and 25% to the general partner, if the partners have received aggregate cumulative distributions of Capital Receipts equal to 100% or more of their original capital contributions.

For Federal income tax purposes, losses and net losses are allocated 99% to the limited partners and 1% to the general partner.

F-7

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Capital Receipts not retained by the partnership will generally be distributed (i) first, 99% to the limited partners and 1% to the general partner until the partners have received cumulative distributions from all sources equal to a cumulative simple return of 12% per annum on their Net Capital Investment and an amount equal to their contributed capital, payable only from Capital Receipts; (ii) next, if the Capital Receipts are from a sale, 100% to the general partner until it has received 2% of the gross proceeds from the sale; and (iii) thereafter, 75% to the limited partners and 25% to the general partner.

Gains will generally be allocated (i) first, to those partners whose capital accounts have negative balances until such negative balances are brought to zero; (ii) second, to all partners in amounts necessary to bring their respective capital account balances equal to their invested capital, as defined, plus a 12% return on such invested capital; (iii) next, to the general partner in an amount necessary to bring the general partner’s capital account balance to an amount which is equal to 2% of the gross proceeds from the sale, and (iv) thereafter, 75% to the limited partners and 25% to the general partner.

Proceeds from a sale of substantially all of the assets of the partnership will be distributed to the partners in accordance with their capital account balances as adjusted to take into account gain or loss resulting from such sale.

For financial reporting purposes, profits and losses are allocated among the partners based upon their stated interests in cash available for distribution.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The partnership’s records are maintained on the accrual basis of accounting and its fiscal year coincides with the calendar year.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Property and Equipment

Property and equipment is recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the assets, as follows:

| | | |

| Land improvements | | 40 years |

| Building and improvements | | 40 years |

| Furniture and equipment | | 3 to 10 years |

All property and equipment at 22 of the partnership’s 23 Inns (Bossier City excluded) is pledged as security for the mortgage debt described in Note 6.

F-8

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The partnership assesses impairment of its real estate properties based on whether estimated undiscounted future cash flows from such properties on an individual hotel basis will be less than their net book value. If a property is impaired, its basis is adjusted to fair market value. During 2000, the Inn located in Memphis, Tennessee experienced declining cash flows, primarily due to additional competition in its local market. As a result, the partnership concluded that the Inn was impaired, adjusted its basis to the estimated fair market value, and recorded an impairment charge of $5,170,000 during the fourth quarter of 2000. There was no such adjustment required at December 31, 2001.

Income Taxes

Provision for Federal and state income taxes has not been made in the consolidated financial statements since the partnership does not pay income taxes but rather allocates profits and losses to the individual partners. Significant differences exist between the net income for financial reporting purposes and the net income (loss) as reported in the partnership’s tax return. These differences are due primarily to the use, for income tax purposes, of accelerated depreciation methods and shorter depreciable lives of the assets and the timing of the recognition of base and incentive management fee expense. As a result of these differences, the partnership’s net assets reported in the accompanying consolidated financial statements exceed the tax basis of such net assets by $6,819,000 and $8,721,000 as of December 31, 2001 and 2000, respectively.

Deferred Financing Costs

Deferred financing costs represent the costs incurred in connection with obtaining the debt financing and are amortized over the term of the debt. As of December 31, 2001 and 2000, deferred financing costs, net of accumulated amortization, totaled $1,738,000 and $2,150,000, respectively. Amortization of deferred financing costs totaled $412,000, $412,000 and $411,000 in 2001, 2000, and 1999, respectively.

Restricted Cash Reserves

On March 22, 1996, the partnership was required to establish certain reserves in conjunction with the refinancing of the Mortgage Debt as described in Note 6. The balances in those reserves, along with other reserves, as of December 31 are as follows (in thousands):

| | | 2001

| | 2000

|

| Capital Expenditure Reserve | | $ | 1,523 | | $ | 2,291 |

| Debt Service Reserve | | | 5,172 | | | 4,426 |

| Real Estate Tax and Insurance Reserve | | | 1,067 | | | 976 |

| | |

|

| |

|

|

| | | $ | 7,762 | | $ | 7,693 |

| | |

|

| |

|

|

Cash and Cash Equivalents

The partnership considers all highly liquid investments with a maturity of three months or less at date of purchase to be cash equivalents.

Reclassifications

Certain reclassifications were made to the prior year financial statements to conform to the 2001 presentation.

F-9

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Application of New Accounting Standards

In October 2001, the Financial Accounting Standards Board issued SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” which replaces SFAS No. 121, “Accounting for the Impairment of Long-Lived Assets SFAS No. 121” to determine when a long-lived asset should be classified as held for sale, among other things. Those criteria specify that the asset must be available for immediate sale in its present condition, subject only to terms that are usual and customary for sales of such assets, and the sale of the asset must be probable, and its transfer expected to qualify for recognition as a completed sale, within one year. This Statement is effective for fiscal years beginning after December 15, 2001. The Partnership does not believe implementation of the standard will have a material effect on the Partnership.

NOTE 3. LITIGATION SETTLEMENT

In September 2000, the general partner, Marriott International, Inc., and related defendants closed on the settlement of a lawsuit filed by limited partners from seven limited partnerships, including the partnership’s limited partners (“Litigation Settlement”). In accordance with the terms of the settlement, the defendants made cash payments of approximately $152 per Unit to the limited partners, in exchange for dismissal of the litigation and a complete release of all claims. In addition to these cash payments, the Manager agreed to forgive $22.7 million of deferred incentive management fees payable by the partnership, which is reflected as an extraordinary gain in the statements of operations for the year ended December 31, 2000.

The partnership and the Inns are involved in routine litigation and administrative proceedings arising in the ordinary course of business, some of which are expected to be covered by liability insurance and which collectively are not expected to have a material adverse effect on the business, financial condition or results of operations of the partnership.

NOTE 4. PROPERTY AND EQUIPMENT

Property and equipment consists of the following as of December 31 (in thousands):

| | | 2001

| | | 2000

| |

| Land | | $ | 36,613 | | | $ | 36,613 | |

| Building and improvements | | | 132,841 | | | | 128,145 | |

| Furniture and equipment | | | 34,093 | | | | 32,497 | |

| | |

|

|

| |

|

|

|

| | | | 203,547 | | | | 197,255 | |

| Accumulated depreciation | | | (71,410 | ) | | | (64,129 | ) |

| | |

|

|

| |

|

|

|

| | | $ | 132,137 | | | $ | 133,126 | |

| | |

|

|

| |

|

|

|

NOTE 5. ESTIMATED FAIR VALUE OF FINANCIAL INSTRUMENTS

The estimated fair value of financial instruments are shown below (in thousands). The fair values of financial instruments not included in this table are estimated to be equal to their carrying amounts.

F-10

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP AND SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

| | | As of December 31, 2001

| | As of December 31, 2000

|

| | | Carrying Amount

| | Estimated Fair Value

| | Carrying Amount

| | Estimated Fair Value

|

| Mortgage debt | | $ | 132,198 | | $ | 132,628 | | $ | 134,166 | | $ | 137,427 |

The estimated fair value of the mortgage debt obligation is based on expected future debt service payments discounted at estimated risk adjusted rates.

NOTE 6. MORTGAGE DEBT

The partnership’s mortgage debt (the “Mortgage Debt”) is comprised of a $140 million note. The Mortgage Debt is nonrecourse to the partnership, bears interest at a fixed rate of 8.85% based upon actual number of days over a 360 day year for a 10-year term expiring March 10, 2006 and required payments of interest only during the first loan year and principal amortization based upon a 25-year amortization schedule beginning with the second loan year.

Principal amortization of the Mortgage Debt at December 31, 2001 is as follows (in thousands):

| | | | |

| 2002 | | $ | 2,152 |

| 2003 | | | 2,353 |

| 2004 | | | 2,540 |

| 2005 | | | 2,811 |

| 2006 | | | 122,342 |

| Thereafter | | | — |

| | |

|

|

| | | $ | 132,198 |

| | |

|

|

The Mortgage Debt is secured by first mortgages on 22 of the partnership’s 23 Inns, the land on which they are located, a security interest in all personal property associated with those Inns including furniture and equipment, inventory, contracts, and other intangibles and the partnership’s rights under the management agreements. The Bossier City Residence Inn did not pass certain required thresholds to enable the property to collateralize the Mortgage Debt. The partnership was required to deposit $500,000 into a reserve account and fund $250,000 annually into the account to provide for any claim, investigation, or litigation that may arise from any environmental condition at the Bossier City Residence Inn. The initial $500,000 deposit was funded by the lender. The partnership is required to repay the initial reserve as promptly as possible if the partnership draws on the deposit or by the end of the 10-year term in March 2006. Any draws upon the account will accrue interest at the 30-day London Interbank Offered Rate (“LIBOR”) plus 4.5 percentage points. If the partnership does not need to draw on the reserve account, the lender will hold the reserve until such time as the Mortgage Debt is either repaid, or a governmental authority determines that the statute of limitations on filing any claims has expired or that no further remedial activities are required at the property. The balance of this reserve, as of December 31, 2001, is $1,292,000 and is included in capital expenditure reserves, a component of restricted cash on the accompanying consolidated balance sheets.

Pursuant to the terms of the Mortgage Debt, the partnership was required to establish with the lender a separate escrow account for payments of insurance premiums and real estate taxes (the “Real Estate Tax and Insurance Escrow Reserves”) for each mortgaged property due to a downgrade of the credit rating of MII by Standard and Poor Rating Services in 1997. The partnership funded the Real Estate Tax and Insurance Escrow Reserve for $834,000 in 1997. As a result of this downgrade, the Mortgage Debt also required the partnership to fund an additional month’s debt service into the debt service reserve account over a six month period and the

F-11

MARRIOTT RESIDENCE INN II LIMITED PARTNERSHIP

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Manager required the partnership to fund an additional working capital reserve. Additionally, the terms of the Mortgage Debt require the partnership to maintain a debt service reserve equal to three months of debt service and a reserve for environmental remediation projects identified during the course of the environmental studies undertaken in conjunction with the refinancing.

NOTE 7. MANAGEMENT AGREEMENTS

The Manager operates the Inns pursuant to two long-term management agreements (“Management Agreements”) with initial terms expiring December 31, 2012. The Management Agreements expire in 2012 with renewal at the option of the Manager for one or more of the Inns for up to 45 years thereafter. The Manager earns a base management fee equal to 2% of the Inns’ gross revenues. Base management fees are paid currently.