Exhibit (c)(8)

Project Maple Tree

Presentation to the Special Committee

February 8, 2007

1

Table of Contents

Sections

1. Situation Overview

2. Process Considerations

3. Valuation Framework

4. Scotia Capital’s Team

Situation Overview

3

Our Understanding

We understand that the Board has received a proposal (the “Offer”) from Apax Partners

Worldwide LLP and Apax Partners L.P. (together, .Apax.) to acquire all of the outstanding common shares (the “Shares”) of the Company from the holders of the Shares (the Shareholders.) (the “Transaction”).

We also understand that the Committee has been appointed to consider the Offer and to make a recommendation respecting the Offer to the Board following the completion of its review process.

We further understand that the Offer may be subject to the formal valuation and minority

approval requirements of the Ontario Securities Commission Rule 61-501 and the

corresponding policy of the Quebec Securities Commission (collectively, .Rule 61-501.).

Finally, we understand that the Committee has chosen to engage Scotia Capital to provide

an opinion (the “Opinion”) as to the fairness of the consideration under the Offer, from a

financial point of view, to holders of the Shares other than the Company.s senior

management team (the “Public Shareholders”), to act as financial advisor to the Committee in connection with the Offer, and and if requested, to provide a formal valuation of the Shares under Rule 61-501 (the .Valuation.).

The purpose of this initial presentation to the Committee is to discuss:

The current proposal by Apax; Process considerations; and Valuation framework.

4

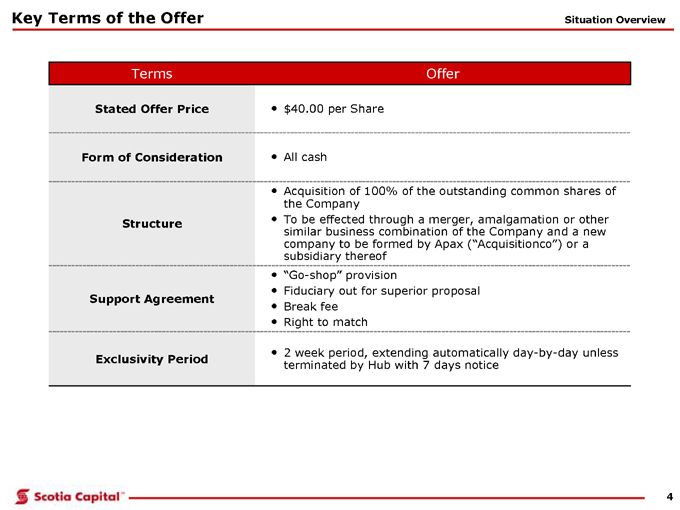

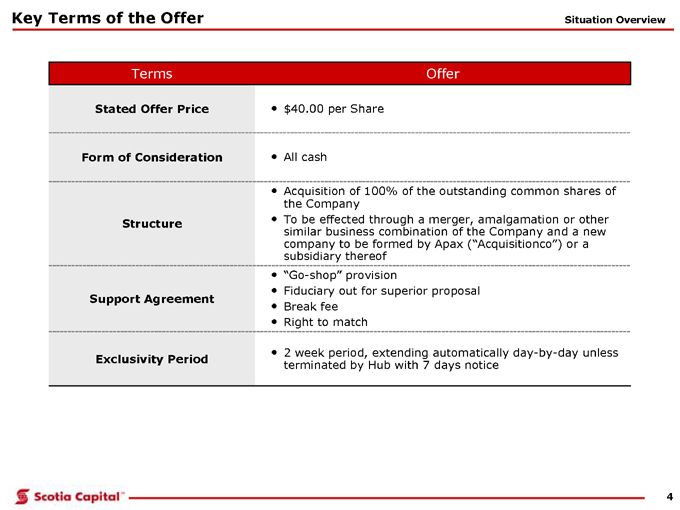

Key Terms of the Offer Situation Overview Go-shop. provision Fiduciary out for superior proposal Break fee Right to match Support Agreement

2 week period, extending automatically day-by-day unless terminated by Hub with 7 days notice Exclusivity Period Acquisition of 100% of the outstanding common shares of the Company

To be effected through a merger, amalgamation or other similar business combination of the Company and a new company to be formed by Apax (“Acquisitionco”) or a subsidiary thereof All cash $40.00 per Share Stated Offer Price Form of Consideration Structure

Process Considerations

6

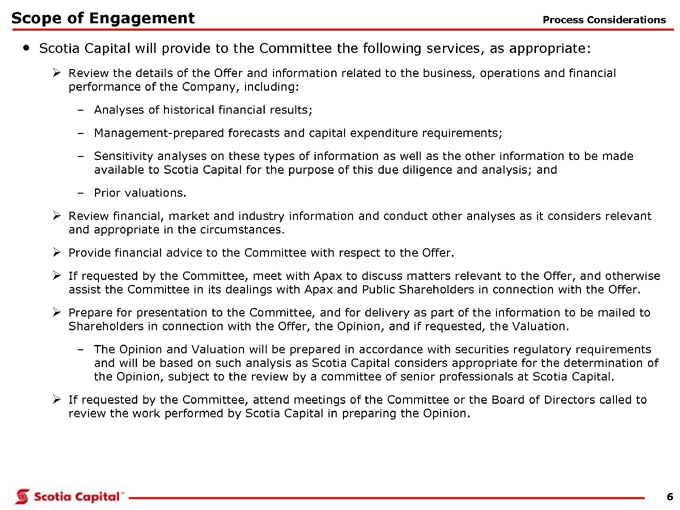

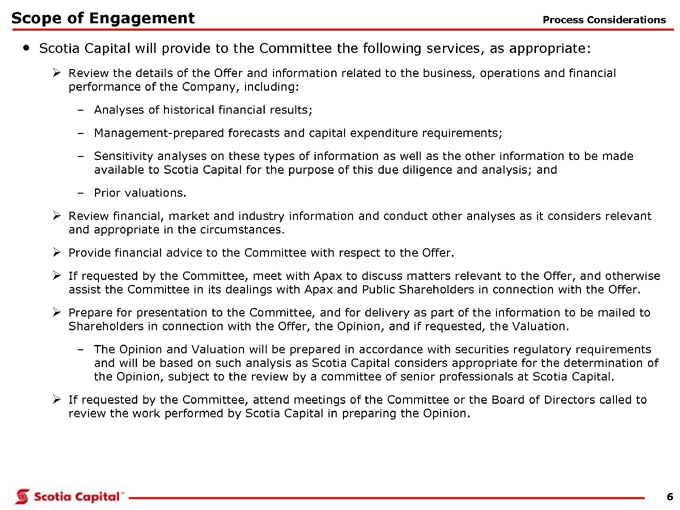

Scope of Engagement Scotia Capital will provide to the Committee the following services, as appropriate:

Review the details of the Offer and information related to the business, operations and financial performance of the Company, including: Analyses of historical financial results;

Management-prepared forecasts and capital expenditure requirements; Sensitivity analyses on these types of information as well as the other information to be made available to Scotia Capital for the purpose of this due diligence and analysis; and

Prior valuations.

Review financial, market and industry information and conduct other analyses as it considers relevant and appropriate in the circumstances.

Provide financial advice to the Committee with respect to the Offer.

If requested by the Committee, meet with Apax to discuss matters relevant to the Offer, and otherwise assist the Committee in its dealings with Apax and Public Shareholders in connection with the Offer.

Prepare for presentation to the Committee, and for delivery as part of the information to be mailed to

Shareholders in connection with the Offer, the Opinion, and if requested, the Valuation.

The Opinion and Valuation will be prepared in accordance with securities regulatory requirements and will be based on such analysis as Scotia Capital considers appropriate for the determination of the Opinion, subject to the review by a committee of senior professionals at Scotia Capital.

If requested by the Committee, attend meetings of the Committee or the Board of Directors called to review the work performed by Scotia Capital in preparing the Opinion. Process Considerations

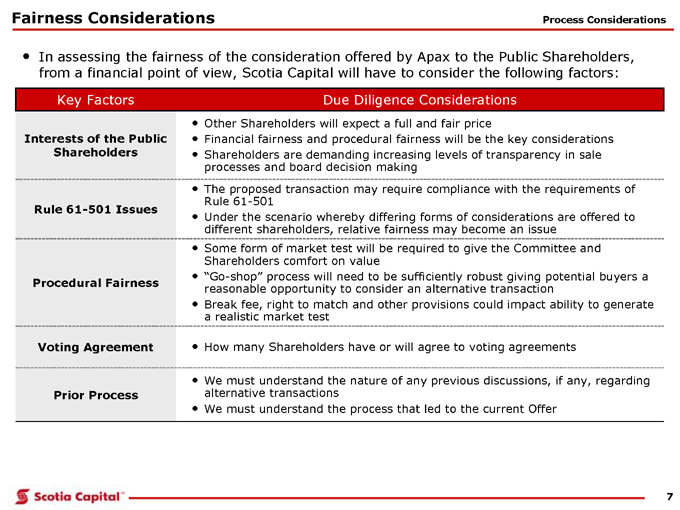

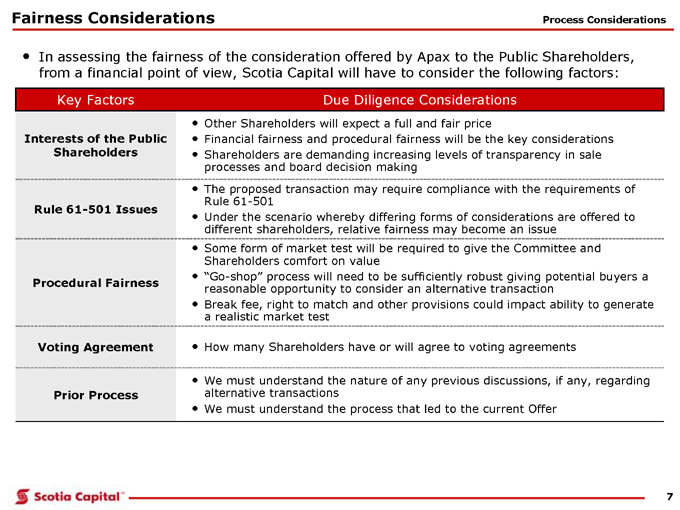

Fairness Considerations Process Considerations

. How many Shareholders have or will agree to voting agreements Voting Agreement

. We must understand the nature of any previous discussions, if any, regarding

alternative transactions

. We must understand the process that led to the current Offer

Prior Process

. The proposed transaction may require compliance with the requirements of

Rule 61-501

. Under the scenario whereby differing forms of considerations are offered to

different shareholders, relative fairness may become an issue

Rule 61-501 Issues

. Some form of market test will be required to give the Committee and

Shareholders comfort on value

. .Go-shop. process will need to be sufficiently robust giving potential buyers a

reasonable opportunity to consider an alternative transaction

. Break fee, right to match and other provisions could impact ability to generate

a realistic market test

Procedural Fairness

. Other Shareholders will expect a full and fair price

. Financial fairness and procedural fairness will be the key considerations

. Shareholders are demanding increasing levels of transparency in sale

processes and board decision making

Interests of the Public

Shareholders

Due Diligence Considerations Key Factors

. In assessing the fairness of the consideration offered by Apax to the Public Shareholders,

from a financial point of view, Scotia Capital will have to consider the following factors:

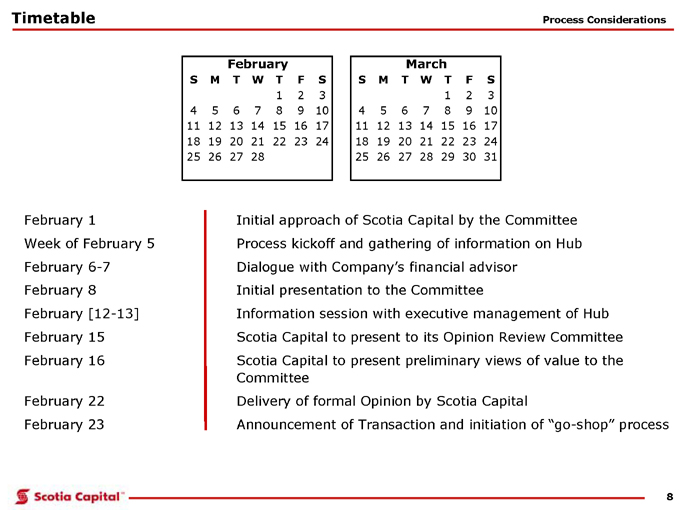

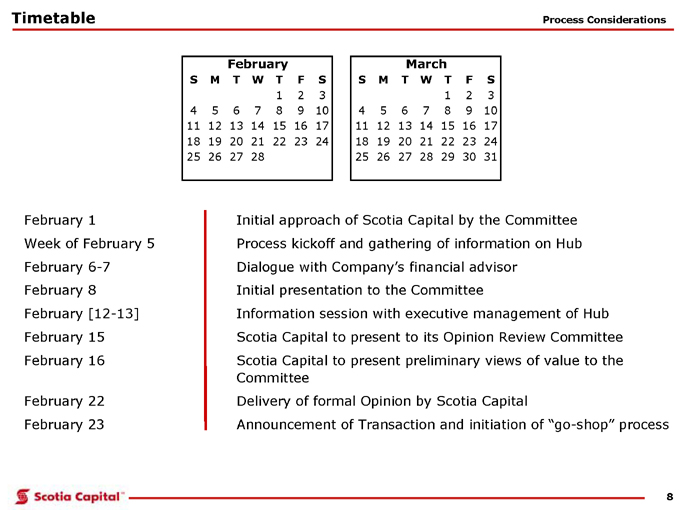

Timetable Process Considerations

February 1 Initial approach of Scotia Capital by the Committee

Week of February 5 Process kickoff and gathering of information on Hub

February 6-7 Dialogue with Company’s financial advisor

February 8 Initial presentation to the Committee

February [12-13] Information session with executive management of Hub

February 15 Scotia Capital to present to its Opinion Review Committee

February 16 Scotia Capital to present preliminary views of value to the

Committee

February 22 Delivery of formal Opinion by Scotia Capital

February 23 Announcement of Transaction and initiation of “go-shop” process

February March

S M T W T F S S M T W T F S

1 2 3 1 2 3

4 5 6 7 8 9 10 4 5 6 7 8 9 10

11 12 13 14 15 16 17 11 12 13 14 15 16 17

18 19 20 21 22 23 24 18 19 20 21 22 23 24

25 26 27 28 25 26 27 28 29 30 31

Valuation Framework

10

Methodology

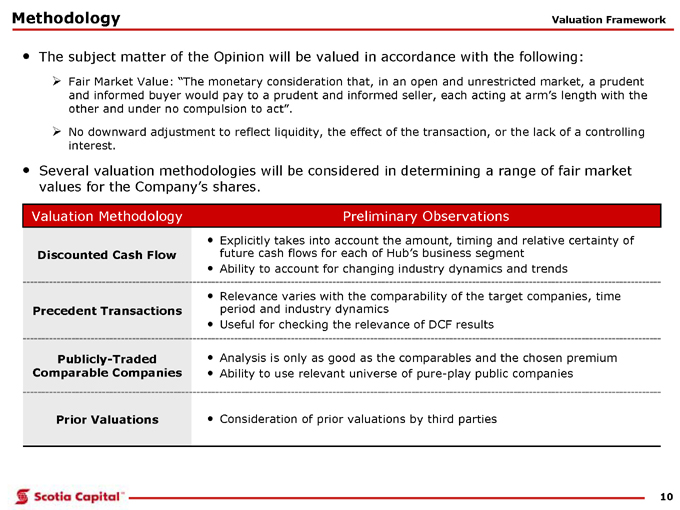

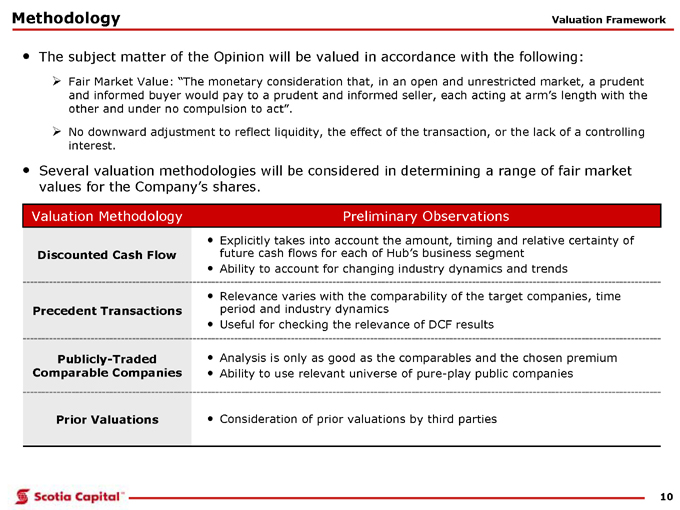

The subject matter of the Opinion will be valued in accordance with the following:

Fair Market Value: .The monetary consideration that, in an open and unrestricted market, a prudent and informed buyer would pay to a prudent and informed seller, each acting at arm.s length with the other and under no compulsion to act.

No downward adjustment to reflect liquidity, the effect of the transaction, or the lack of a controlling interest.

Several valuation methodologies will be considered in determining a range of fair market values for the Company.s shares.

Valuation Framework

Consideration of prior valuations by third parties Prior Valuations

Analysis is only as good as the comparables and the chosen premium

Ability to use relevant universe of pure-play public companies

Relevance varies with the comparability of the target companies, time period and industry dynamics

Useful for checking the relevance of DCF results

Explicitly takes into account the amount, timing and relative certainty of future cash flows for each of Hub.s business segment

. Ability to account for changing industry dynamics and trends

Preliminary Observations

Discounted Cash Flow

Precedent Transactions

Publicly-Traded

Comparable Companies

Valuation Methodology

11

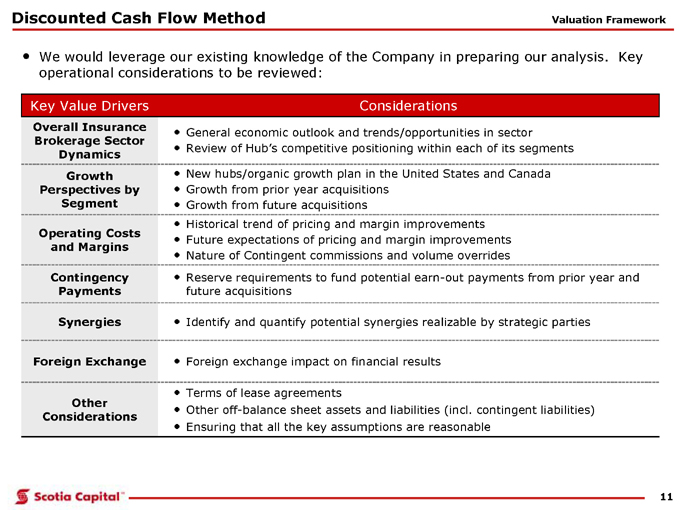

Discounted Cash Flow Method

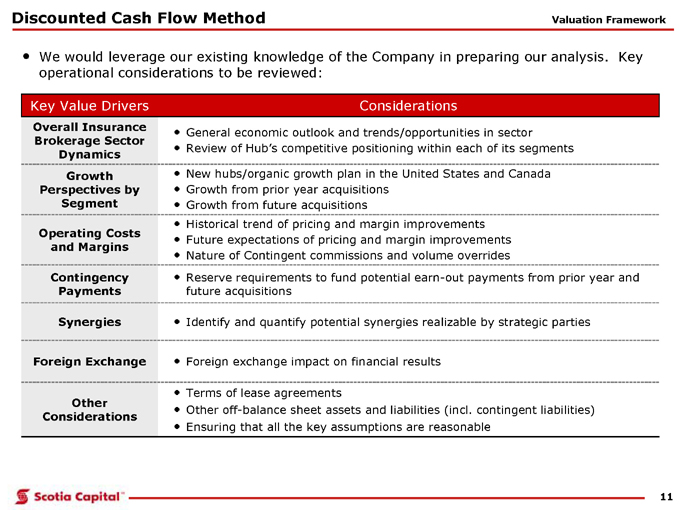

. We would leverage our existing knowledge of the Company in preparing our analysis. Key operational considerations to be reviewed:

. Foreign exchange impact on financial results Foreign Exchange

New hubs/organic growth plan in the United States and Canad Growth from prior year acquisitions Growth from future acquisitions

Growth Perspectives by Segment

Identify and quantify potential synergies realizable by strategic parties Synergies

Reserve requirements to fund potential earn-out payments from prior year and future acquisitions Contingency Payments

. Terms of lease agreements. Other off-balance sheet assets and liabilities (incl. contingent liabilities) . Ensuring that all the key assumptions are reasonable Other Considerations. Historical trend of pricing and margin improvements. Future expectations of pricing and margin improvements. Nature of Contingent commissions and volume overrides

Operating Costs and Margins. General economic outlook and trends/opportunities in sector. Review of Hub.s competitive positioning within each of its segments Overall Insurance Brokerage Sector Dynamics Considerations Key Value Drivers Valuation Framework

Scotia Capital.s Team

13

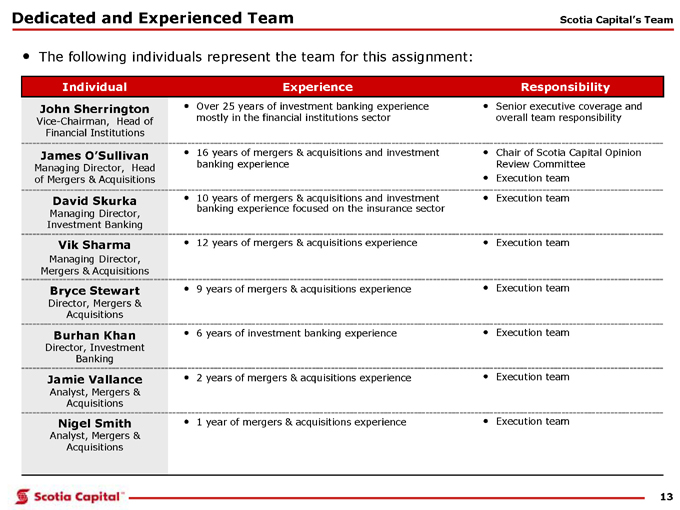

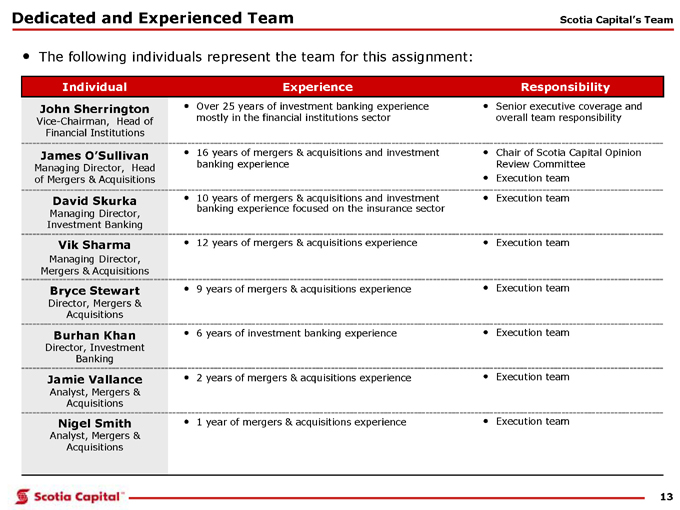

Dedicated and Experienced Team. The following individuals represent the team for this assignment:. Execution team . 6 years of investment banking experience Burhan Khan

Director, Investment Banking. Execution team . 1 year of mergers & acquisitions experience Nigel Smith Analyst, Mergers & Acquisitions. Execution team . 2 years of mergers & acquisitions experience Jamie Vallance Analyst, Mergers & Acquisitions. Senior executive coverage and overall team responsibility. Over 25 years of investment banking experience mostly in the financial institutions sector John Sherrington Vice-Chairman, Head of Financial Institutions. Execution team . 9 years of mergers & acquisitions experience Bryce Stewart Director, Mergers & Acquisitions. Execution team. 10 years of mergers & acquisitions and investment banking experience focused on the insurance sector

David Skurka Managing Director, Investment Banking. Execution team . 12 years of mergers & acquisitions experience Vik Sharma

Managing Director, Mergers & Acquisitions. 16 years of mergers & acquisitions and investment banking experience Experience. Chair of Scotia Capital Opinion Review Committee. Execution team James O.Sullivan Managing Director, Head of Mergers & Acquisitions Responsibility Individual Scotia Capital.s Team