I N FRASTRUCTURE | A G I L I T Y | E X P E R T I S E Globally Diversified Investment Institution Specializing In Alternative Investment Strategies This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities . Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable . However, we have not verified such information and we do not make any representations as to its accuracy or completeness . Any statements non - factual in nature constitute only current opinions, which are subject to change . No part of this report may be reproduced in any manner without the prior permission of Clinton Group, Inc . All return figures are net of fees . Total return and value will fluctuate and past performance is no guarantee of future results . The information set forth here should not be construed as an investment recommendation . This presentation should be read in conjunction with important disclosures included with this booklet . CCO Approved 4 / 2013 © Clinton Group, Inc . All rights reserved 2013 Enhancing Stockholder Value at Stillwater Mining Company April 2013 www.TapStillwater.com

Page 1 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Important Information About This Solicitation CLINTON RELATIONAL OPPORTUNITY MASTER FUND, L.P., CLINTON MAGNOLIA MASTER FUND, LTD., CLINTON SPOTLIGHT MASTER FUND, L.P., CLINTON RETAIL OPPORTUNITY PARTNERSHIP, L.P., CLINTON RELATIONAL OPPORTUNITY, LLC, CLINTON GROUP, INC. AND GEORGE E. HALL (COLLECTIVELY, "CLINTON") AND CHARLES R. ENGLES, SETH E. GARDNER, MICHAEL MCMULLEN, MICHAEL MCNAMARA, PATRICE E. MERRIN, BRIAN SCHWEITZER AND GREGORY P. TAXIN (TOGETHER WITH CLINTON, THE "PARTICIPANTS") HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE PARTICIPANTS' SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF STILLWATER MINING COMPANY (THE "COMPANY") FOR USE AT THE COMPANY'S 2013 ANNUAL MEETING OF STOCKHOLDERS (THE "PROXY SOLICITATION"). ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE PROXY SOLICITATION BY THE PARTICIPANTS BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS. THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD HAVE BEEN FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, OKAPI PARTNERS LLC, CLINTON'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT CHARGE UPON REQUEST BY CALLING (212) 297 - 0720 OR TOLL - FREE AT (855) 305 - 0857.

Page 2 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies I Executive Summary II Stillwater’s Record of Underperformance III Introduction to the Independent Nominees IV How the Nominees Can Help Create Stockholder Value V Questions for Incumbent Directors

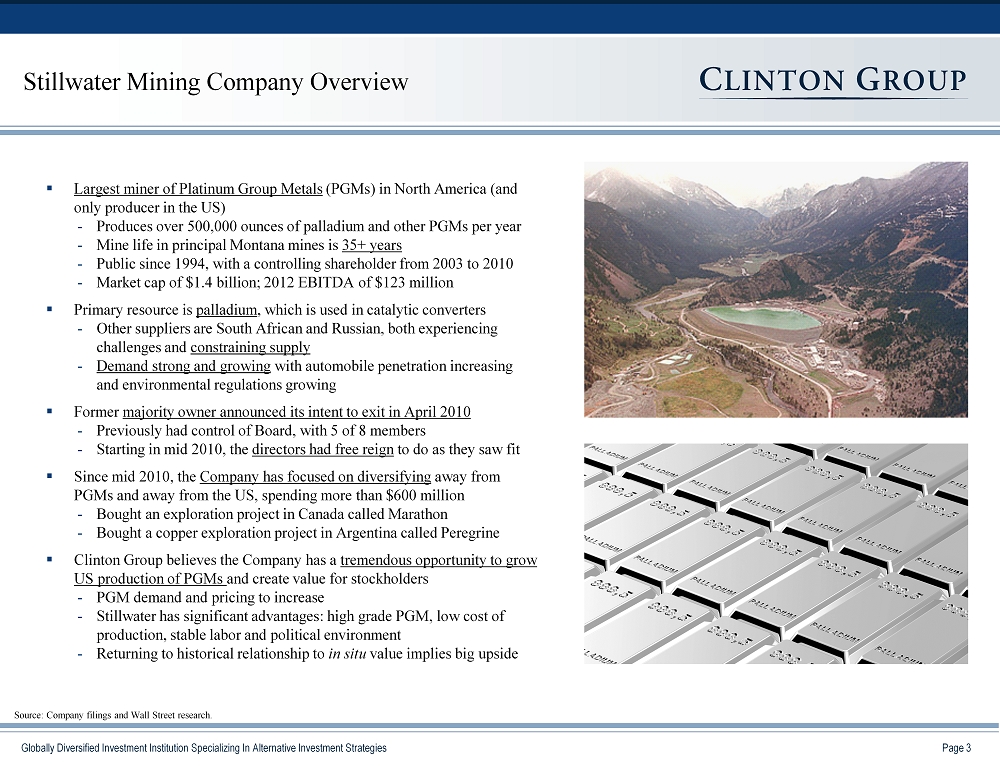

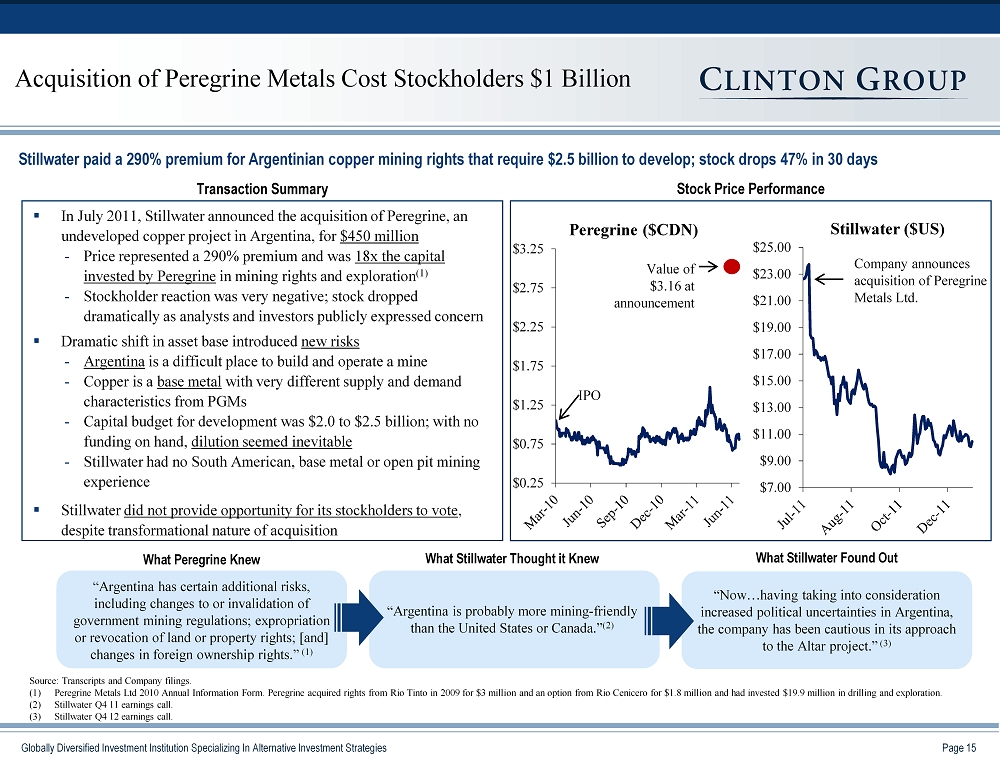

Page 3 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Stillwater Mining Company Overview ▪ Largest miner of Platinum Group Metals (PGMs) in North America (and only producer in the US) - Produces over 500,000 ounces of palladium and other PGMs per year - Mine life in principal Montana mines is 35+ years - Public since 1994, with a controlling shareholder from 2003 to 2010 - Market cap of $1.4 billion; 2012 EBITDA of $123 million ▪ Primary resource is palladium , which is used in catalytic converters - Other suppliers are South African and Russian, both experiencing challenges and constraining supply - Demand strong and growing with automobile penetration increasing and environmental regulations growing ▪ Former majority owner announced its intent to exit in April 2010 - Previously had control of Board, with 5 of 8 members - Starting in mid 2010, the directors had free reign to do as they saw fit ▪ Since mid 2010, the Company has focused on diversifying away from PGMs and away from the US, spending more than $600 million - Bought an exploration project in Canada called Marathon - Bought a copper exploration project in Argentina called Peregrine ▪ Clinton Group believes the Company has a tremendous opportunity to grow US production of PGMs and create value for stockholders - PGM demand and pricing to increase - Stillwater has significant advantages: high grade PGM, low cost of production, stable labor and political environment - Returning to historical relationship to in situ value implies big upside Source: Company filings and Wall Street research.

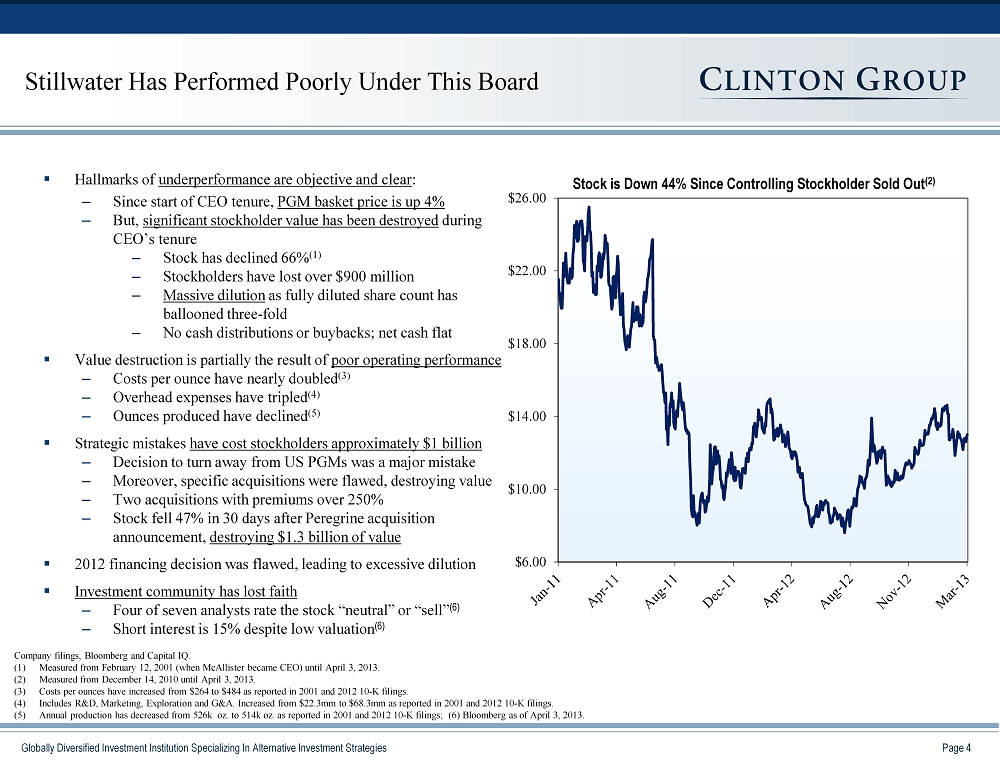

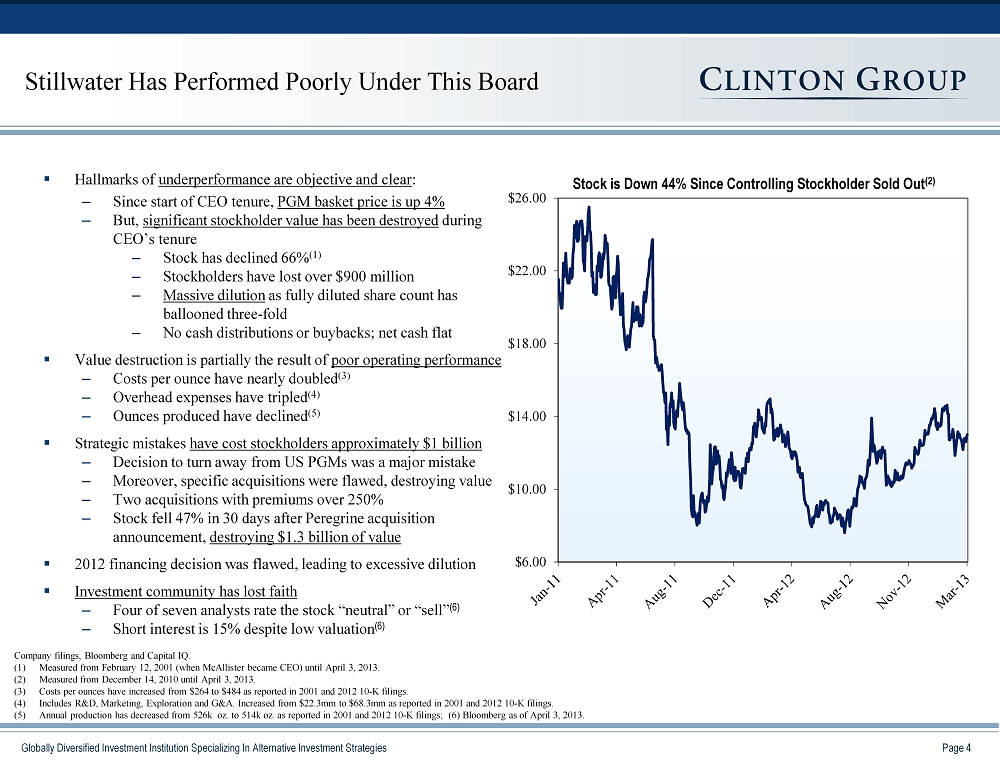

Page 4 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies $6.00 $10.00 $14.00 $18.00 $22.00 $26.00 Stillwater Has Performed Poorly Under This Board ▪ Hallmarks of underperformance are objective and clear : – Since start of CEO tenure, PGM basket price is up 4% – But, significant stockholder value has been destroyed during CEO’s tenure – Stock has declined 66% (1) – Stockholders have lost over $900 million – Massive dilution as fully diluted share count has ballooned three - fold – No cash distributions or buybacks; net cash flat ▪ Value destruction is partially the result of poor operating performance – Costs per ounce have nearly doubled (3) – Overhead expenses have tripled (4) – Ounces produced have declined (5) ▪ Strategic mistakes have cost stockholders approximately $1 billion – Decision to turn away from US PGMs was a major mistake – Moreover, specific acquisitions were flawed, destroying value – Two acquisitions with premiums over 250% – Stock fell 47% in 30 days after Peregrine acquisition announcement, destroying $1.3 billion of value ▪ 2012 financing decision was flawed, leading to excessive dilution ▪ Investment community has lost faith – Four of seven analysts rate the stock “neutral” or “sell ” (6) – Short interest is 15% despite low valuation (6) Stock is Down 44% Since Controlling Stockholder Sold Out (2) Company filings, Bloomberg and Capital IQ. (1) Measured from February 12, 2001 (when McAllister became CEO) until April 3, 2013. (2) Measured from December 14, 2010 until April 3, 2013. (3) Costs per ounces have increased from $264 to $484 as reported in 2001 and 2012 10 - K filings. (4) Includes R&D, Marketing, Exploration and G&A. Increased from $22.3mm to $68.3mm as reported in 2001 and 2012 10 - K filings. (5) Annual production has decreased from 526k oz. to 514k oz. as reported in 2001 and 2012 10 - K filings; (6) Bloomberg as of April 3, 2013.

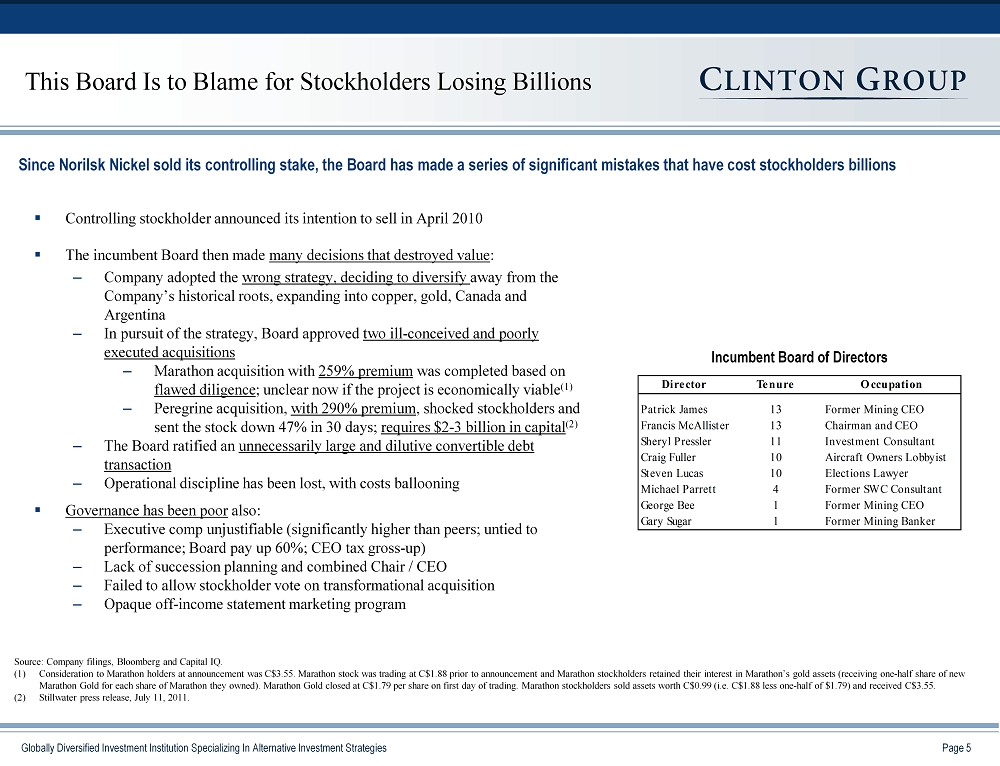

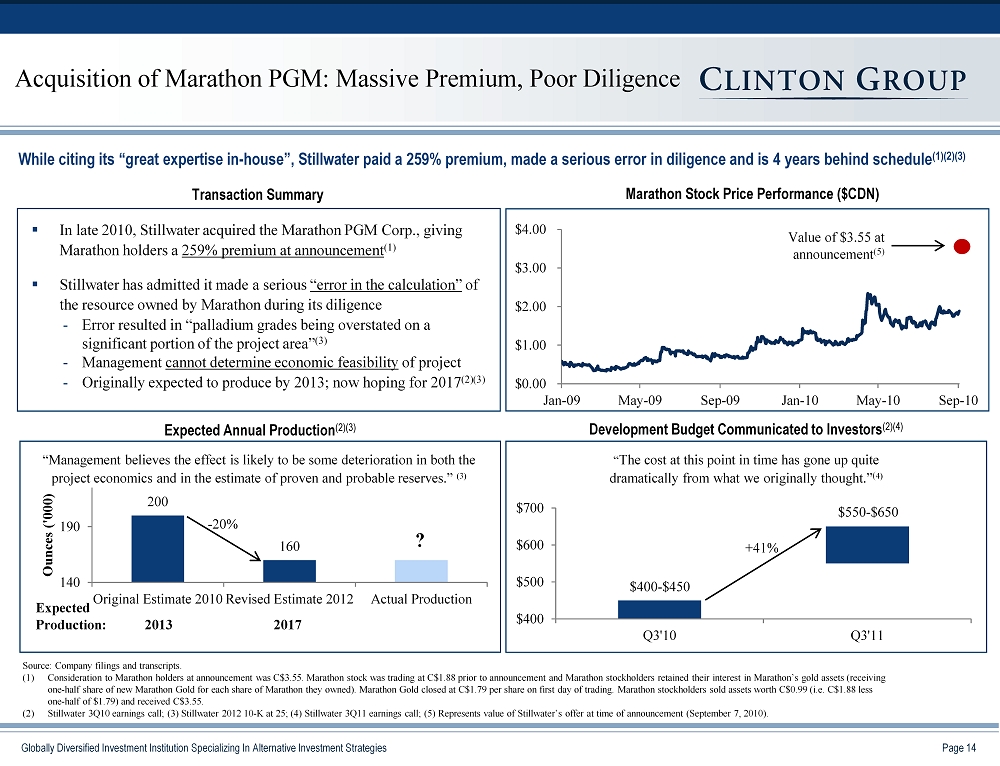

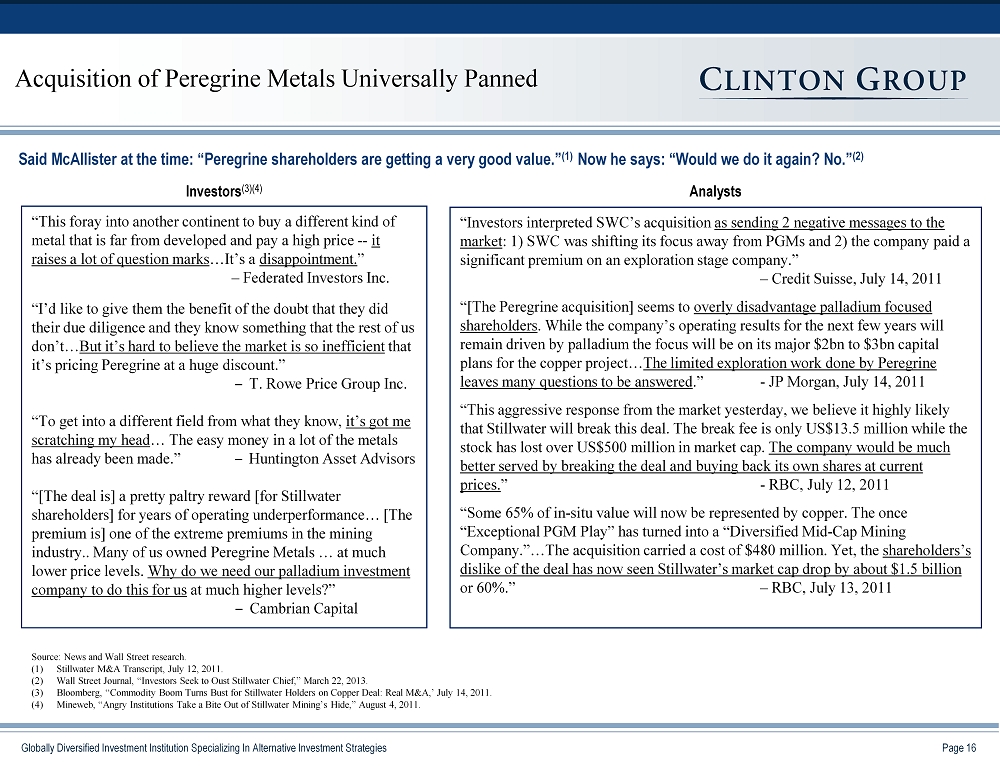

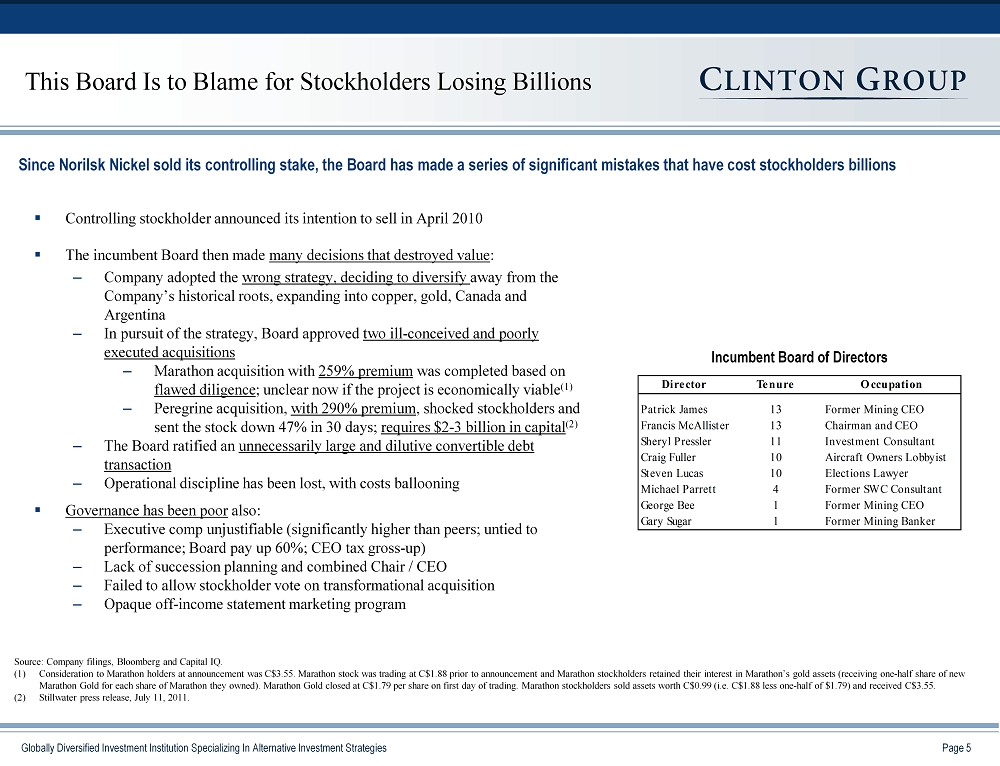

Page 5 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies This Board Is to Blame for Stockholders Losing Billions ▪ Controlling stockholder announced its intention to sell in April 2010 ▪ The incumbent Board then made many decisions that destroyed value : – Company adopted the wrong strategy, deciding to diversify away from the Company’s historical roots, expanding into copper, gold, Canada and Argentina – In pursuit of the strategy, Board approved two ill - conceived and poorly executed acquisitions – Marathon acquisition with 259% premium was completed based on flawed diligence ; unclear now if the project is economically viable (1) – Peregrine acquisition, with 290% premium , shocked stockholders and sent the stock down 47% in 30 days; requires $2 - 3 billion in capital (2) – The Board ratified an unnecessarily large and dilutive convertible debt transaction – Operational discipline has been lost, with costs ballooning ▪ Governance has been poor also: – Executive comp unjustifiable (significantly higher than peers; untied to performance; Board pay up 60%; CEO tax gross - up) – Lack of succession planning and combined Chair / CEO – Failed to allow stockholder vote on transformational acquisition – Opaque off - income statement marketing program Incumbent Board of Directors Since Norilsk Nickel sold its controlling stake, the Board has made a series of significant mistakes that have cost stockhold ers billions Source: Company filings, Bloomberg and Capital IQ. (1) Consideration to Marathon holders at announcement was C$3.55. Marathon stock was trading at C$1.88 prior to announcement and Mar athon stockholders retained their interest in Marathon’s gold assets (receiving one - half share of new Marathon Gold for each share of Marathon they owned). Marathon Gold closed at C$1.79 per share on first day of trading. Marat hon stockholders sold assets worth C$0.99 (i.e. C$1.88 less one - half of $1.79) and received C$3.55. (2) Stillwater press release, July 11, 2011. Director Tenure Occupation Patrick James 13 Former Mining CEO Francis McAllister 13 Chairman and CEO Sheryl Pressler 11 Investment Consultant Craig Fuller 10 Aircraft Owners Lobbyist Steven Lucas 10 Elections Lawyer Michael Parrett 4 Former SWC Consultant George Bee 1 Former Mining CEO Gary Sugar 1 Former Mining Banker

Page 6 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Stockholders Should Empanel a New Board ▪ A new, independent and qualified Board can help solve the Company’s issues – We do not believe the directors who created the issues can be relied upon to solve the Company’s problems – We believe a fresh and objective look at the Company’s assets and capital allocation is required – No one on Board has even acknowledged the mistakes or is willing to be held accountable ▪ Key agenda items for the new Board include: – Ending and reversing diversification strategy in responsible manner – Evaluate opportunities to sell Peregrine and to determine economic viability of Marathon – Re - evaluate ways to expand production in Montana with sharp focus on returns on capital, which has been missing – Eliminate wasteful spending and off income - statement spending – Restore discipline on overhead expenses and executive compensation – Suspend wasteful marketing efforts, and evaluate returns on capital and opportunities to join International Palladium Board – Review merchant activities , with focus on collaring some price exposure or lowering cost of capital through favorable project financing with customers – Succession planning (CEO is 70 and has been under - performing and over - compensated) – Review all capital allocation and capital structure decisions and alternatives – Every existing and proposed project should be thoroughly reviewed – Capital structure alternatives should be considered, given the expensive convertible debt ▪ A w hole new Board is warranted – Most of the existing Board has been in place for more than 10 years , and have had their chance to impact the Company – Horrible decisions, such as the acquisition of Peregrine, were unanimous Board decisions; accountability should match – We believe the Board we have recruited is a better collection of directors, person - for - person – Why should stockholders hope that new directors would be able to convince the legacy directors to course correct? – The Company is owned by the stockholders and they should decide on the direction of the Company by empowering a cohesive Board

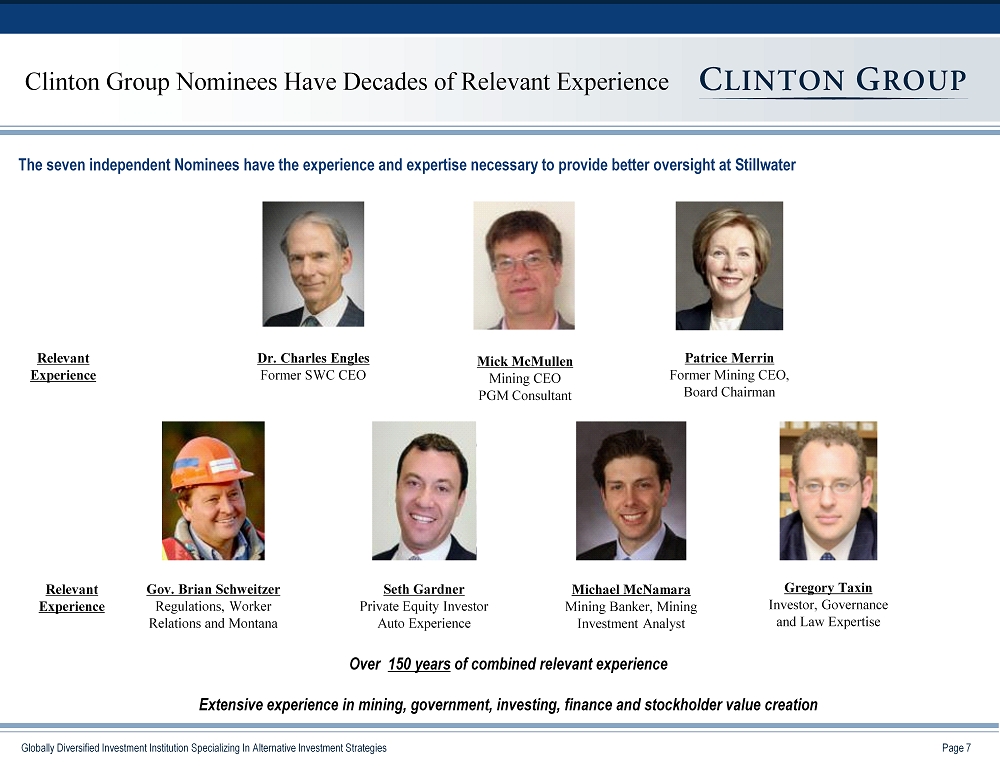

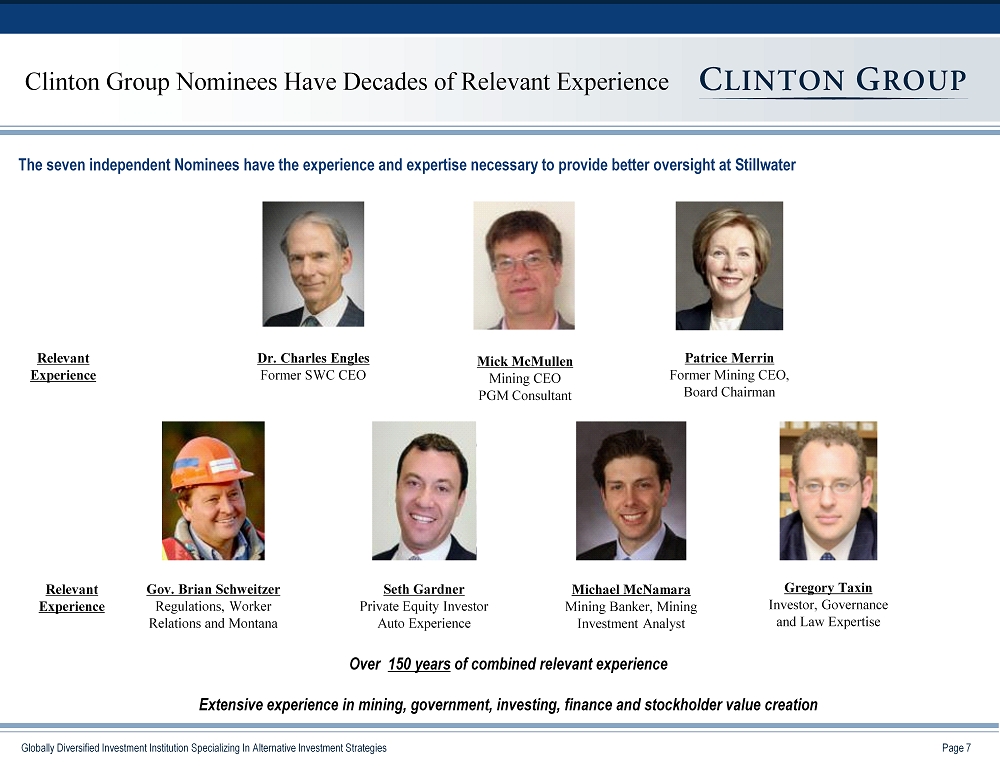

Page 7 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Patrice Merrin Former Mining CEO, Board Chairman Gov. Brian Schweitzer Regulations, Worker Relations and Montana Seth Gardner Private Equity Investor Auto Experience Dr. Charles Engles Former SWC CEO Gregory Taxin Investor, Governance and Law Expertise Michael McNamara Mining Banker, Mining Investment Analyst Mick McMullen Mining CEO PGM Consultant The seven i ndependent N ominees have the experience and expertise necessary to provide better oversight at Stillwater Clinton Group Nominees Have Decades of Relevant Experience Relevant Experience Relevant Experience Over 150 years of combined relevant experience Extensive experience in mining, government, investing, finance and stockholder value creation

Page 8 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies I Executive Summary II Stillwater’s Record of Underperformance III Introduction to the Independent Nominees IV How the Nominees Can Help Create Stockholder Value V Questions for Incumbent Directors

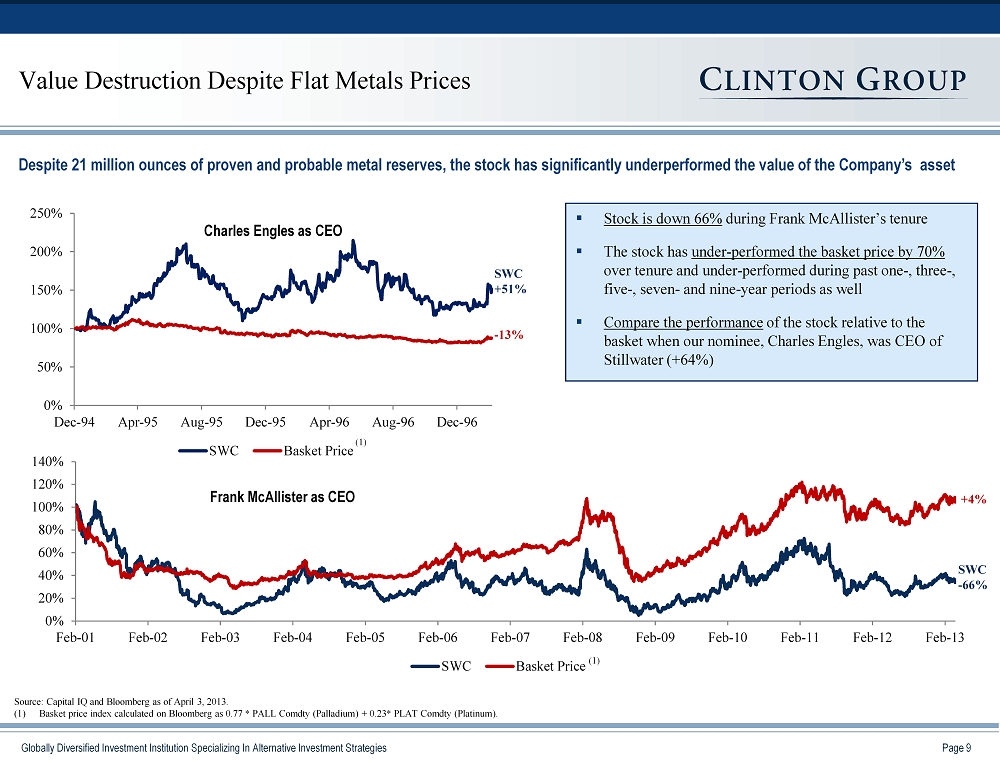

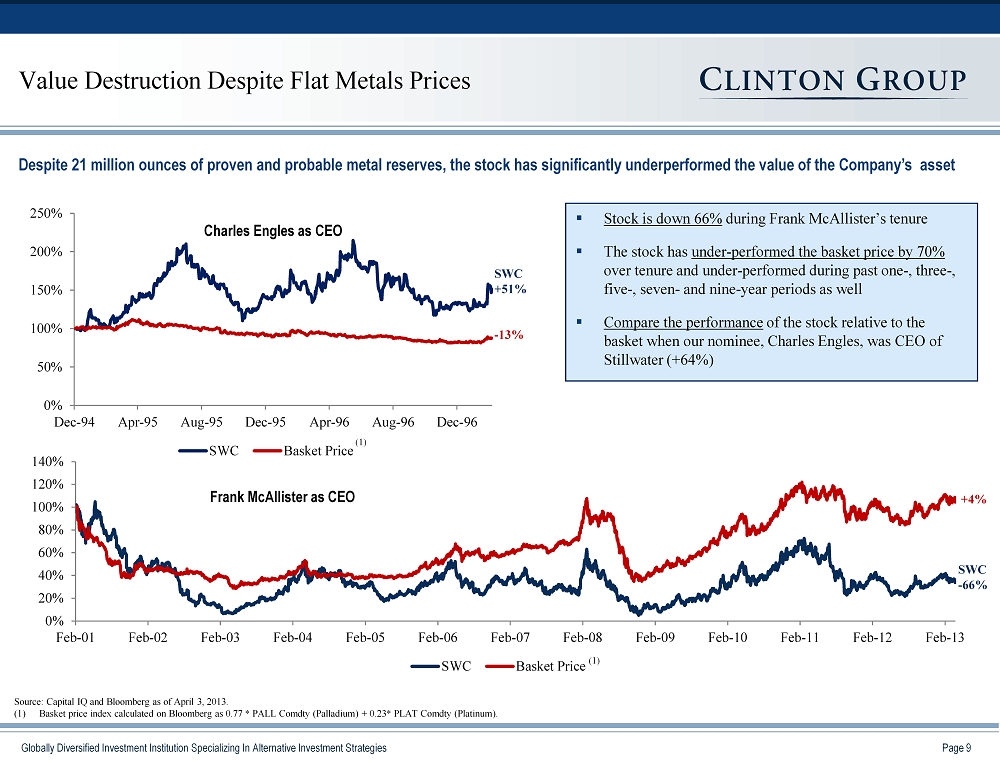

Page 9 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies 0% 20% 40% 60% 80% 100% 120% 140% Feb-01 Feb-02 Feb-03 Feb-04 Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13 SWC Basket Price Value Destruction Despite Flat Metals Prices Despite 21 million ounces of proven and probable metal reserves, the stock has significantly underperformed the value of the Com pany’s asset Frank McAllister as CEO Charles Engles as CEO ▪ Stock is down 66% during Frank McAllister’s tenure ▪ The stock has under - performed the basket price by 70% over tenure and under - performed during past one - , three - , five - , seven - and nine - year periods as well ▪ Compare the performance of the stock relative to the basket when our nominee, Charles Engles , was CEO of Stillwater (+64%) +4% SWC - 66% SWC +51% - 13% Source: Capital IQ and Bloomberg as of April 3, 2013. (1) Basket price index calculated on Bloomberg as 0.77 * PALL Comdty (Palladium) + 0.23* PLAT Comdty (Platinum). 0% 50% 100% 150% 200% 250% Dec-94 Apr-95 Aug-95 Dec-95 Apr-96 Aug-96 Dec-96 SWC Basket Price (1) (1)

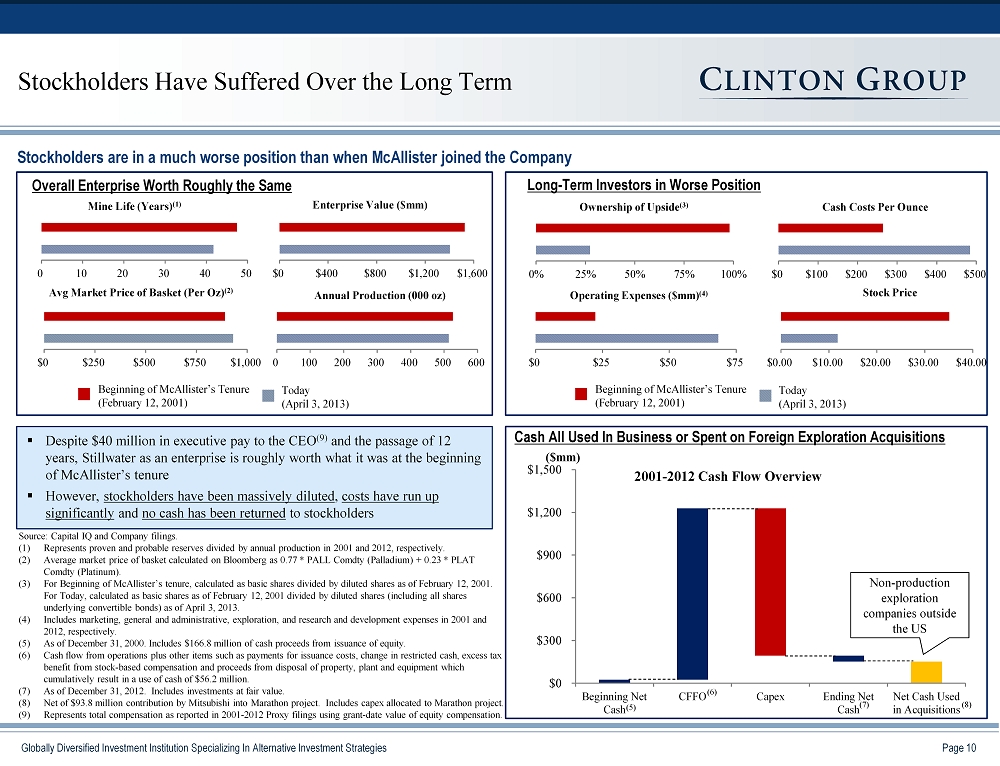

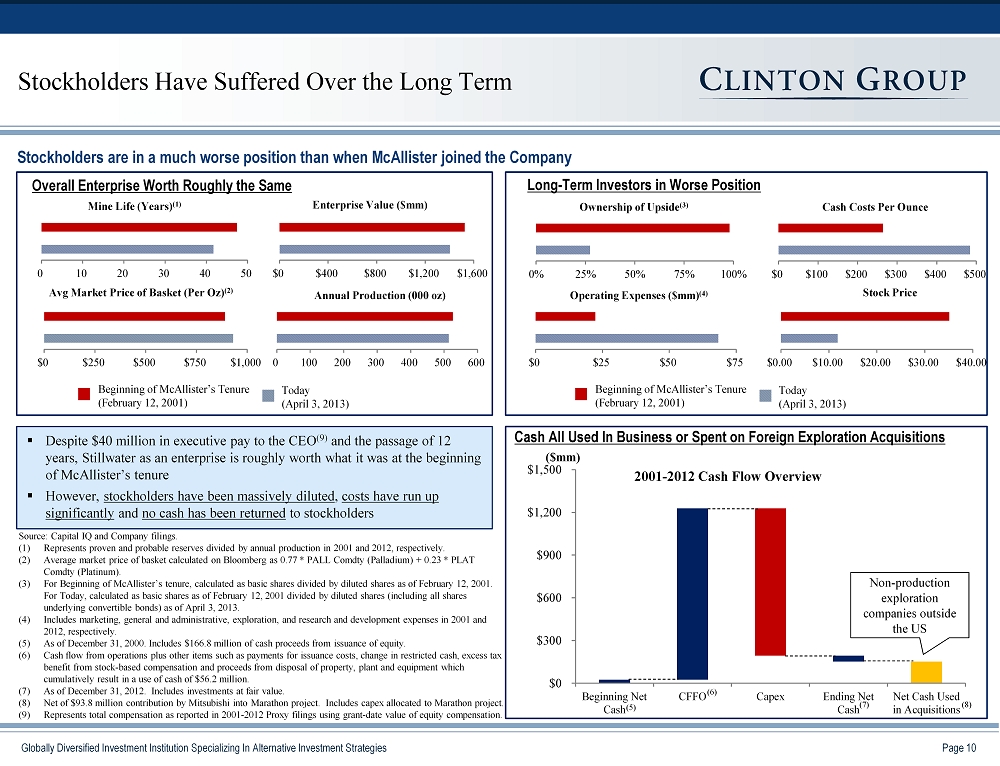

Page 10 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies $0 $100 $200 $300 $400 $500 Cash Costs Per Ounce Stockholders Have Suffered Over the Long Term Source: Capital IQ and Company filings. (1) Represents proven and probable reserves divided by annual production in 2001 and 2012, respectively. (2) Average market price of basket calculated on Bloomberg as 0.77 * PALL Comdty (Palladium) + 0.23 * PLAT Comdty (Platinum). (3) For Beginning of McAllister’s tenure, calculated as basic shares divided by diluted shares as of February 12, 2001. For Today, calculated as basic shares as of February 12, 2001 divided by diluted shares (including all shares underlying convertible bonds) as of April 3, 2013. (4) Includes marketing, general and administrative, exploration, and research and development expenses in 2001 and 2012, respectively. (5) As of December 31, 2000. Includes $166.8 million of cash proceeds from issuance of equity. (6) Cash flow from operations plus other items such as payments for issuance costs, change in restricted cash, excess tax benefit from stock - based compensation and proceeds from disposal of property, plant and equipment which cumulatively result in a use of cash of $56.2 million. (7) As of December 31, 2012. Includes investments at fair value. (8) Net of $93.8 million contribution by Mitsubishi into Marathon project. Includes capex allocated to Marathon project. (9) Represents total compensation as reported in 2001 - 2012 Proxy filings using grant - date value of equity compensation . Stockholders are in a much worse position than when McAllister joined the Company ($mm) ▪ Despite $40 million in executive pay to the CEO (9) and the passage of 12 years, Stillwater as an enterprise is roughly worth what it was at the beginning of McAllister’s tenure ▪ However, stockholders have been massively diluted , costs have run up significantly and no cash has been returned to stockholders Beginning of McAllister’s Tenure (February 12, 2001) Today (April 3, 2013) Overall Enterprise Worth Roughly the Same Long - Term Investors in Worse Position Cash All Used In Business or Spent on Foreign Exploration Acquisitions (8) 0 100 200 300 400 500 600 Annual Production (000 oz) 0 10 20 30 40 50 Mine Life (Years ) (1) Beginning of McAllister’s Tenure (February 12, 2001) Today (April 3, 2013) $0 $25 $50 $75 Operating Expenses ($mm) (4) $0 $300 $600 $900 $1,200 $1,500 Beginning Net Cash CFFO Capex Ending Net Cash Net Cash Used in Acquisitions 2001 - 2012 Cash Flow Overview (5) (6) (7) Non - production exploration companies outside the US $0 $400 $800 $1,200 $1,600 Enterprise Value ($mm) $0 $250 $500 $750 $1,000 Avg Market Price of Basket (Per Oz) (2) 0% 25% 50% 75% 100% Ownership of Upside (3) $0.00 $10.00 $20.00 $30.00 $40.00 Stock Price

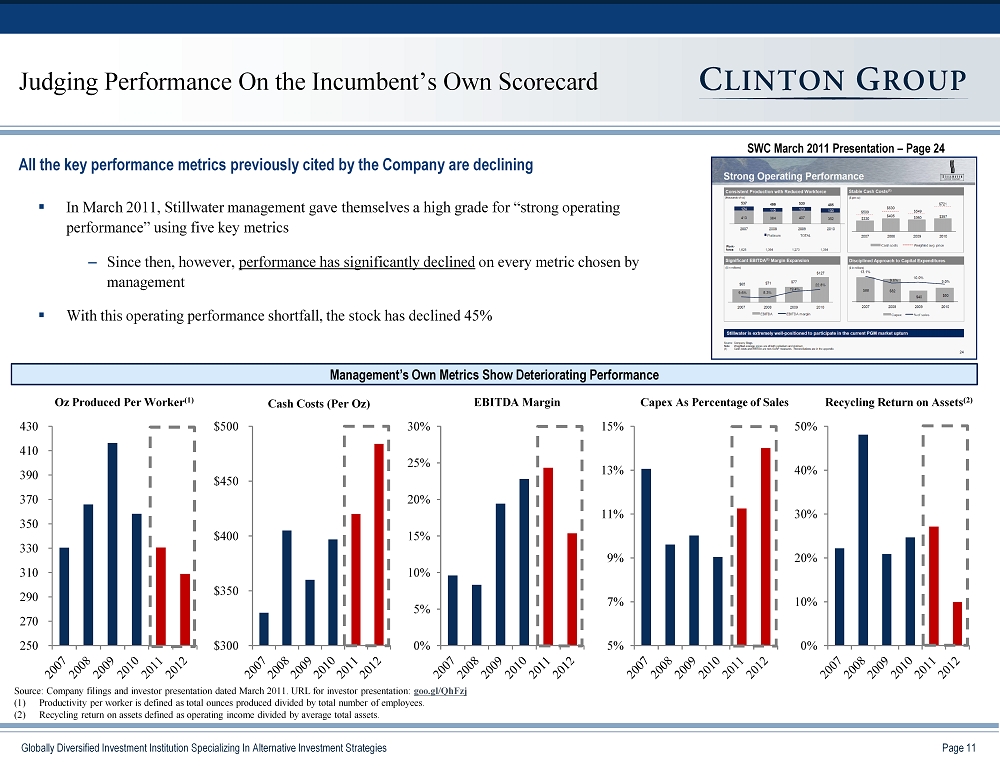

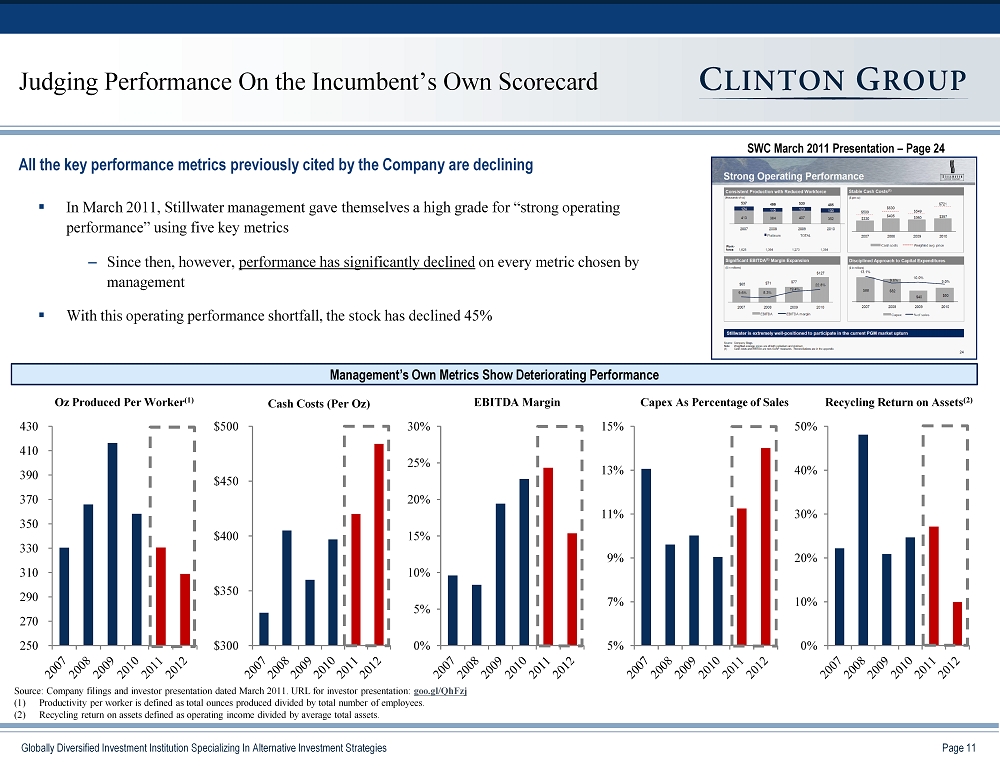

Page 11 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Judging Performance On the Incumbent’s Own Scorecard All the key performance metrics previously cited by the Company are declining Source: Company filings and investor presentation dated March 2011. URL for investor presentation: goo.gl/ QhFzj (1) Productivity per worker is defined as total ounces produced divided by total number of employees. (2) Recycling return on assets defined as operating income divided by average total assets. 250 270 290 310 330 350 370 390 410 430 Oz Produced Per Worker (1) 0% 5% 10% 15% 20% 25% 30% EBITDA Margin 5% 7% 9% 11% 13% 15% Capex As Percentage of Sales $300 $350 $400 $450 $500 Cash Costs (Per Oz) Management’s Own Metrics Show Deteriorating Performance SWC March 2011 Presentation – Page 24 0% 10% 20% 30% 40% 50% Recycling Return on Assets (2) ▪ In March 2011, Stillwater management gave themselves a high grade for “strong operating performance ” using five key metrics – Since then, however, performance has significantly declined on every metric chosen by management ▪ With this operating performance shortfall, the stock has declined 45%

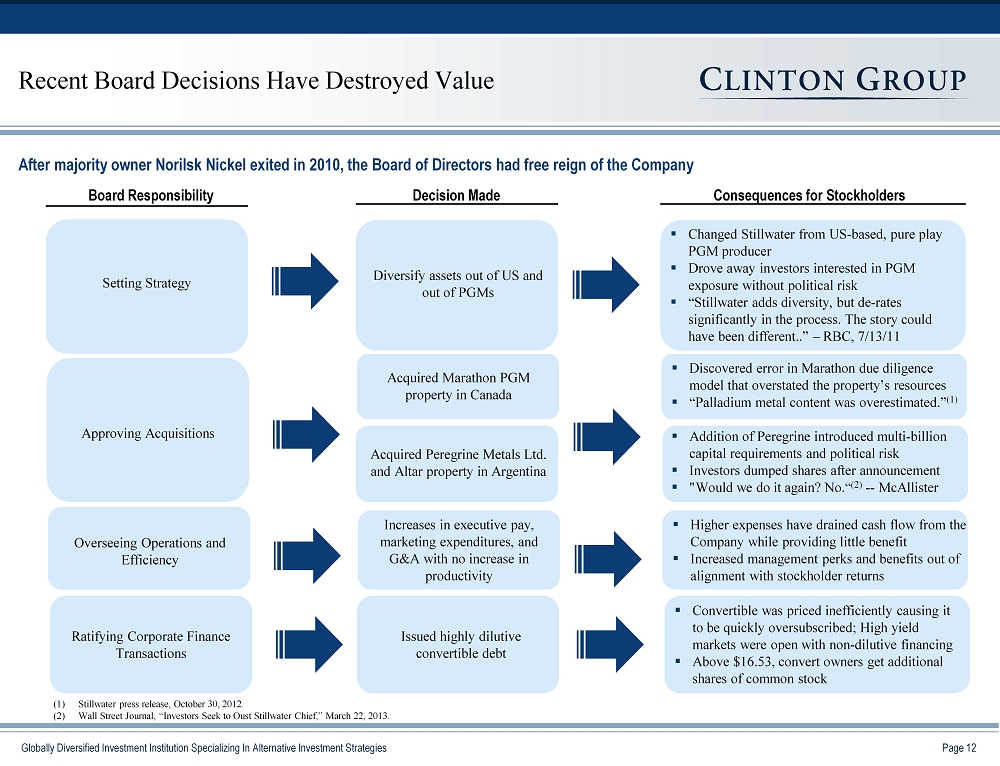

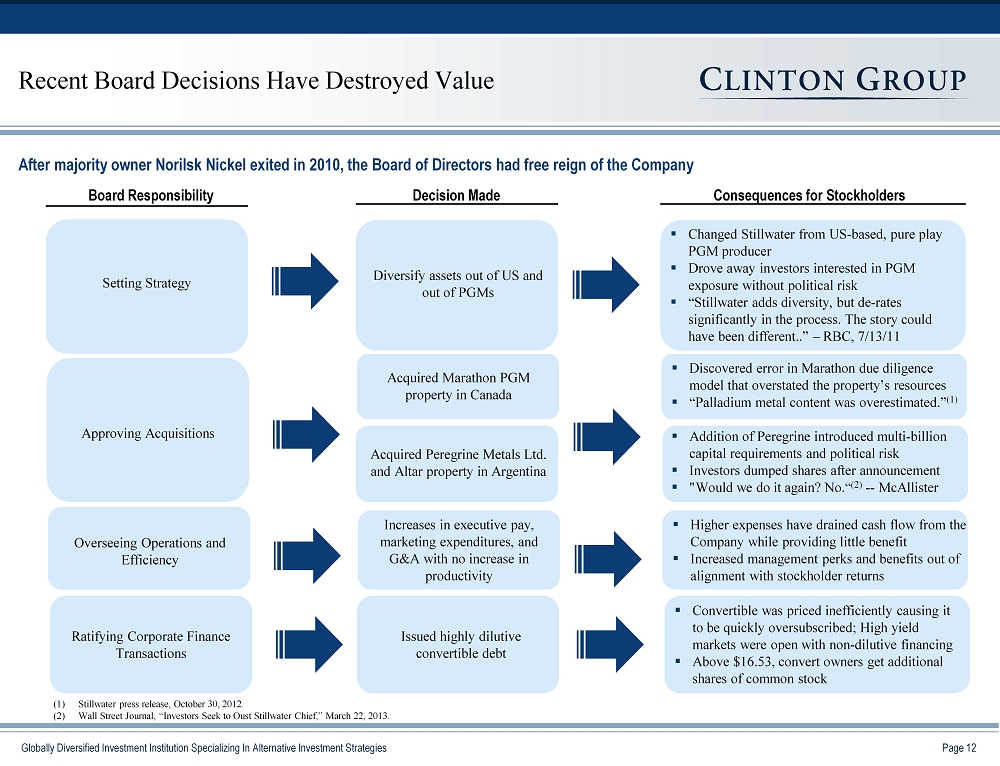

Page 12 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies ▪ Discovered error in Marathon due diligence model that overstated the property’s resources ▪ “Palladium metal content was overestimated.” ( 1) ▪ Addition of Peregrine introduced multi - billion capital requirements and political risk ▪ Investors dumped shares after announcement ▪ "Would we do it again? No .“ (2) -- McAllister Acquired Marathon PGM property in Canada Acquired Peregrine Metals Ltd. and Altar property in Argentina Diversify assets out of US and out of PGMs Increases in executive pay, marketing expenditures, and G&A with no increase in productivity Recent Board Decisions Have Destroyed Value Board Responsibility Decision Made Consequences for Stockholders Setting Strategy ▪ Changed Stillwater from US - based, pure play PGM producer ▪ Drove away investors interested in PGM exposure without political risk ▪ “Stillwater adds diversity, but de - rates significantly in the process. The story could have been different..” – RBC, 7/13/11 Approving Acquisitions Overseeing Operations and Efficiency ▪ Higher expenses have drained cash flow from the Company while providing little benefit ▪ Increased management perks and benefits out of alignment with stockholder returns Ratifying Corporate Finance Transactions ▪ Convertible was priced inefficiently causing it to be quickly oversubscribed; High yield markets were open with non - dilutive financing ▪ Above $16.53, convert owners get additional shares of common stock Issued highly dilutive convertible debt After majority owner Norilsk Nickel exited in 2010, the Board of Directors had free reign of the Company (1) Stillwater press release, October 30, 2012. (2) Wall Street Journal, “Investors Seek to Oust Stillwater Chief,” March 22, 2013.

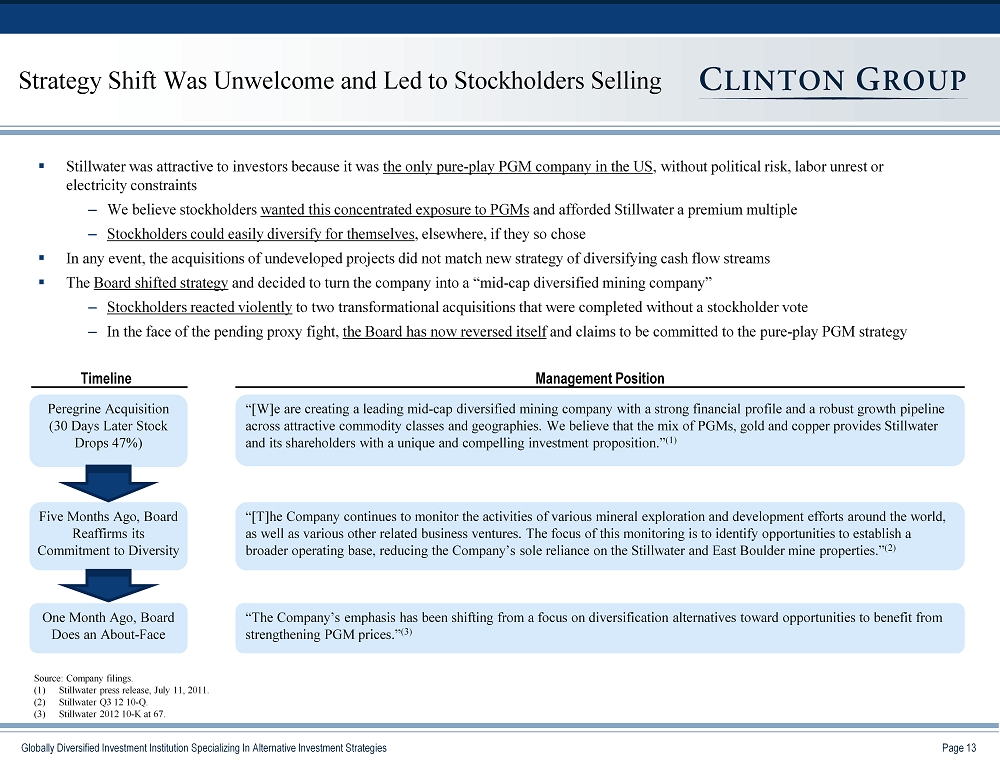

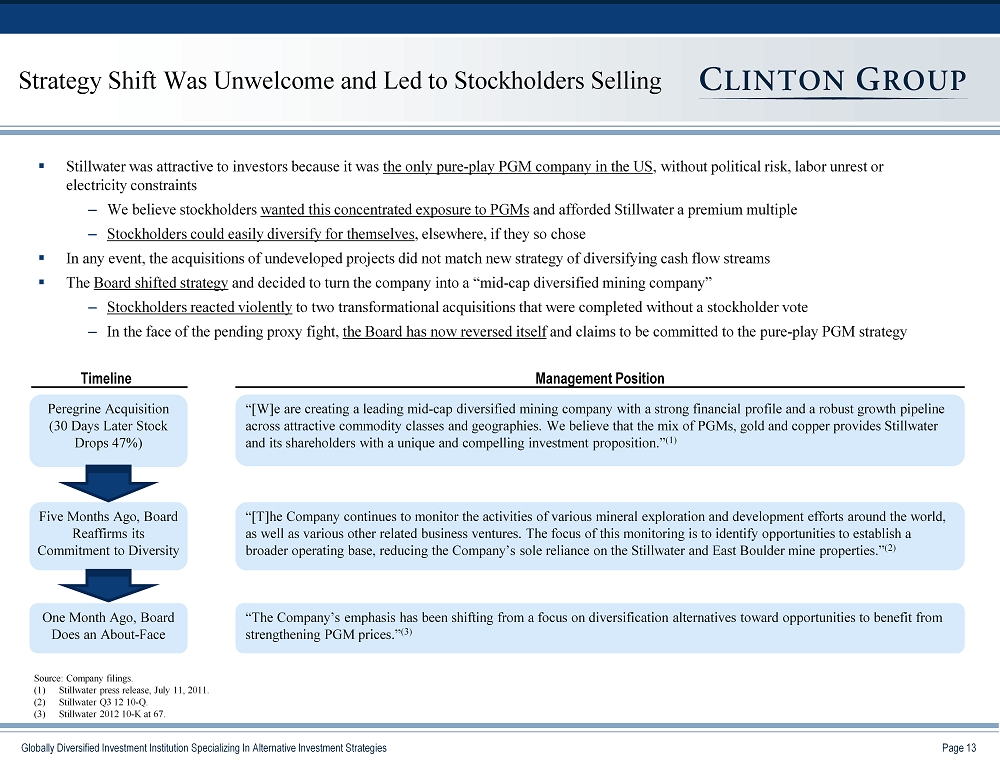

Page 13 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Strategy Shift Was Unwelcome and Led to Stockholders Selling “[W]e are creating a leading mid - cap diversified mining company with a strong financial profile and a robust growth pipeline across attractive commodity classes and geographies. We believe that the mix of PGMs, gold and copper provides Stillwater and its shareholders with a unique and compelling investment proposition.” (1) “The Company’s emphasis has been shifting from a focus on diversification alternatives toward opportunities to benefit from strengthening PGM prices.” (3) “[T]he Company continues to monitor the activities of various mineral exploration and development efforts around the world, as well as various other related business ventures. The focus of this monitoring is to identify opportunities to establish a broader operating base, reducing the Company’s sole reliance on the Stillwater and East Boulder mine properties.” ( 2 ) ▪ Stillwater was attractive to investors because it was the only pure - play PGM company in the US , without political risk, labor unrest or electricity constraints – We believe stockholders wanted this concentrated exposure to PGMs and afforded Stillwater a premium multiple – Stockholders could easily diversify for themselves , elsewhere, if they so chose ▪ In any event, the acquisitions of undeveloped projects did not match new strategy of diversifying cash flow streams ▪ The Board shifted strategy and decided to turn the company into a “mid - cap diversified mining company” – Stockholders reacted violently to two transformational acquisitions that were completed without a stockholder vote – In the face of the pending proxy fight, the Board has now reversed itself and claims to be committed to the pure - play PGM strategy Source: Company filings. (1) Stillwater press release, July 11, 2011. (2) Stillwater Q3 12 10 - Q. (3) Stillwater 2012 10 - K at 67. Peregrine Acquisition (30 Days Later Stock Drops 47 %) Five Months Ago, Board Reaffirms its Commitment to Diversity One Month Ago , Board Does an About - Face Timeline Management Position

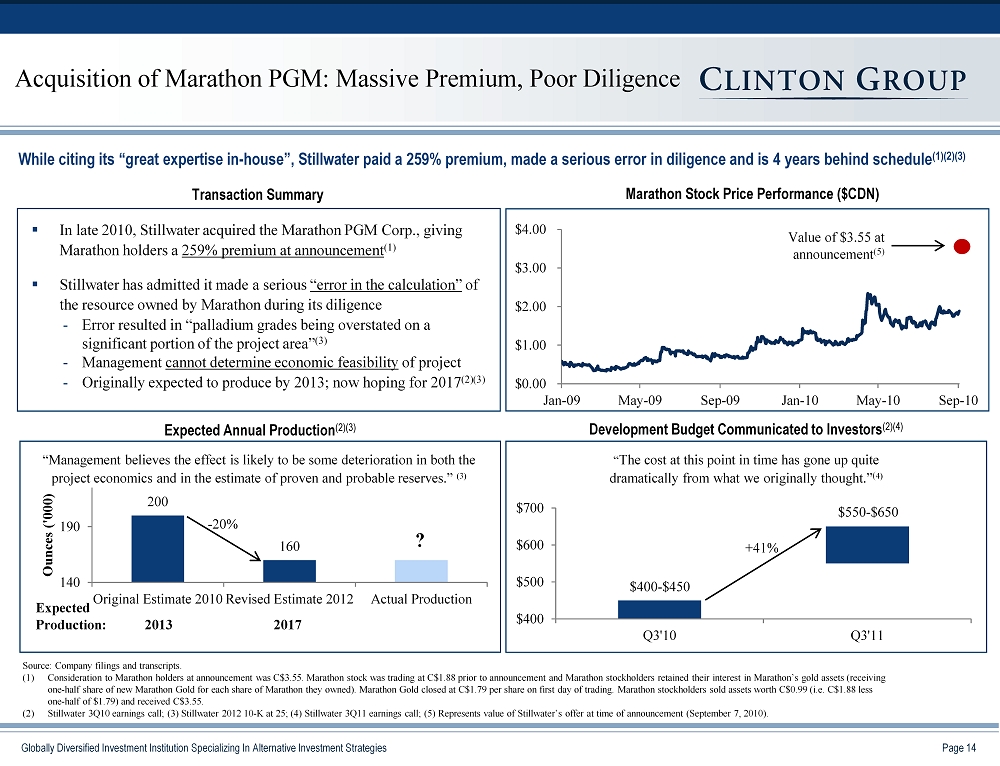

Page 14 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies $0.00 $1.00 $2.00 $3.00 $4.00 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 “Management believes the effect is likely to be some deterioration in both the project economics and in the estimate of proven and probable reserves.” (3) 200 160 160 140 190 Original Estimate 2010 Revised Estimate 2012 Actual Production Ounces ('000) $400 $500 $600 $700 Q3'10 Q3'11 ▪ In late 2010, Stillwater acquired the Marathon PGM Corp., giving Marathon holders a 259% premium at announcement (1) ▪ Stillwater has admitted it made a serious “error in the calculation” of the resource owned by Marathon during its diligence - Error resulted in “palladium grades being overstated on a significant portion of the project area” (3) - Management cannot determine economic feasibility of project - Originally expected to produce by 2013; now hoping for 2017 (2)(3) Expected Annual Production (2)( 3 ) Development Budget Communicated to Investors (2)(4) Transaction Summary Acquisition of Marathon PGM: Massive Premium, Poor Diligence $400 - $450 $550 - $ 6 50 While citing its “great expertise in - house”, Stillwater paid a 259% premium, made a serious error in diligence and is 4 years be hind schedule (1)(2)(3) +41% Source: Company filings and transcripts. (1) Consideration to Marathon holders at announcement was C$3.55. Marathon stock was trading at C$1.88 prior to announcement and Mar athon stockholders retained their interest in Marathon’s gold assets (receiving one - half share of new Marathon Gold for each share of Marathon they owned). Marathon Gold closed at C$1.79 per share on first da y of trading. Marathon stockholders sold assets worth C$0.99 (i.e. C$1.88 less one - half of $1.79) and received C$3.55. (2) Stillwater 3Q10 earnings call; (3) Stillwater 2012 10 - K at 25; (4) Stillwater 3Q11 earnings call; (5) Represents value of Stillwater’s offer at time of announcement (September 7, 2010). - 20% Expected Production: 2013 2017 “ The cost at this point in time has gone up quite dramatically from what we originally thought .” ( 4) ? Marathon Stock Price Performance ($CDN) Value of $3.55 at announcement (5)

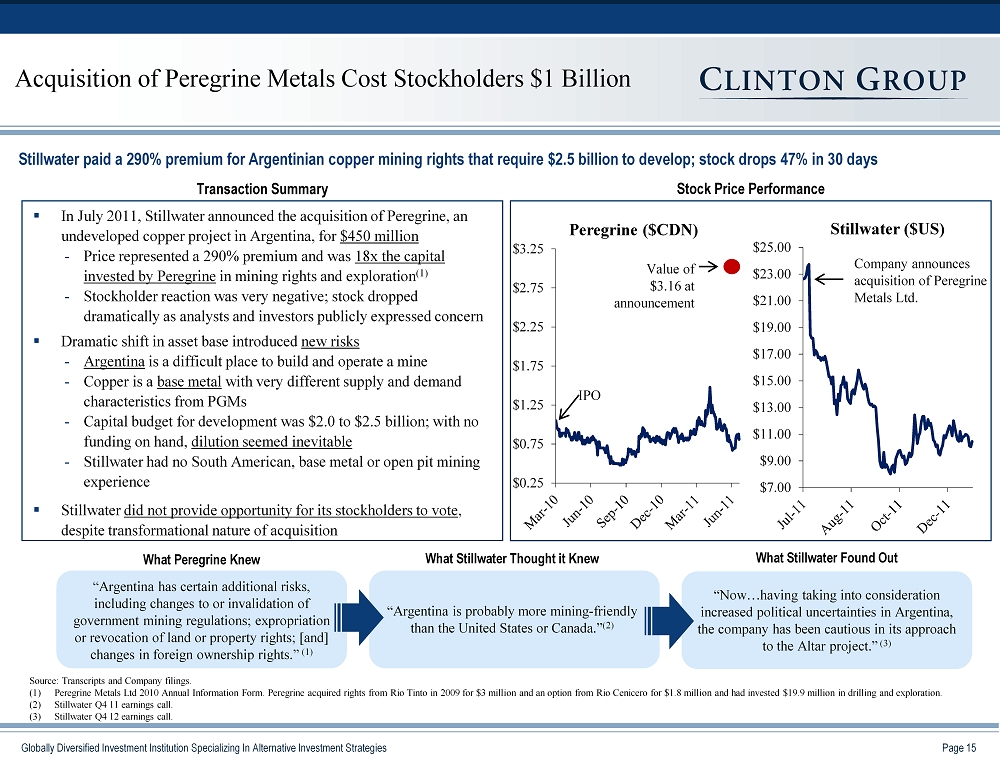

Page 15 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies $0.25 $0.75 $1.25 $1.75 $2.25 $2.75 $3.25 $7.00 $9.00 $11.00 $13.00 $15.00 $17.00 $19.00 $21.00 $23.00 $25.00 ▪ In July 2011, Stillwater announced the acquisition of Peregrine, an undeveloped copper project in Argentina, for $450 million - Price represented a 290% premium and was 18x the capital invested by Peregrine in mining rights and exploration (1) - Stockholder reaction was very negative; stock dropped dramatically as analysts and investors publicly expressed concern ▪ Dramatic shift in asset base introduced new risks - Argentina is a difficult place to build and operate a mine - Copper is a base metal with very different supply and demand characteristics from PGMs - Capital budget for development was $2.0 to $2.5 billion; with no funding on hand, dilution seemed inevitable - Stillwater had no South American, base metal or open pit mining experience ▪ Stillwater did not provide opportunity for its stockholders to vote , despite transformational nature of acquisition Stock Price Performance Transaction Summary Acquisition of Peregrine Metals Cost Stockholders $1 Billion Company announces acquisition of Peregrine Metals Ltd. Peregrine ($CDN) Stillwater ($US) Value of $3.16 at announcement IPO Source: Transcripts and Company filings. (1) Peregrine Metals Ltd 2010 Annual Information Form. Peregrine acquired rights from Rio Tinto in 2009 for $3 million and an option from Rio Cenicero for $1.8 million and had invested $19.9 million in drilling and exploration. (2) Stillwater Q4 11 earnings call. (3) Stillwater Q4 12 earnings call. Stillwater paid a 290% premium for Argentinian copper mining rights that require $2.5 billion to develop; stock drops 47% in 30 days What Stillwater Found Out “ Now…having taking into consideration increased political uncertainties in Argentina, the company has been cautious in its approach to the Altar project.” (3) What Peregrine Knew “Argentina has certain additional risks, including changes to or invalidation of government mining regulations; expropriation or revocation of land or property rights; [and] changes in foreign ownership rights.” (1) What Stillwater Thought it Knew “ Argentina is probably more mining - friendly than the United States or Canada .” ( 2)

Page 16 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies “ This foray into another continent to buy a different kind of metal that is far from developed and pay a high price -- it raises a lot of question marks …It’s a disappointment . ” – Federated Investors Inc. “I’d like to give them the benefit of the doubt that they did their due diligence and they know something that the rest of us don’t… But it’s hard to believe the market is so inefficient that it’s pricing Peregrine at a huge discount .” – T . Rowe Price Group Inc. “ To get into a different field from what they know, it’s got me scratching my head … The easy money in a lot of the metals has already been made.” – Huntington Asset Advisors “[The deal is] a pretty paltry reward [for Stillwater shareholders] for years of operating underperformance… [The premium is] one of the extreme premiums in the mining industry.. Many of us owned Peregrine Metals … at much lower price levels. Why do we need our palladium investment company to do this for us at much higher levels?” – Cambrian Capital Investors (3)(4) Analysts “Investors interpreted SWC’s acquisition as sending 2 negative messages to the market : 1) SWC was shifting its focus away from PGMs and 2) the company paid a significant premium on an exploration stage company.” – Credit Suisse, July 14, 2011 “[The Peregrine acquisition] seems to overly disadvantage palladium focused shareholders . While the company’s operating results for the next few years will remain driven by palladium the focus will be on its major $2bn to $3bn capital plans for the copper project… The limited exploration work done by Peregrine leaves many questions to be answered .” - JP Morgan, July 14, 2011 “This aggressive response from the market yesterday, we believe it highly likely that Stillwater will break this deal. The break fee is only US$13.5 million while the stock has lost over US$500 million in market cap. The company would be much better served by breaking the deal and buying back its own shares at current prices. ” - RBC, July 12, 2011 “Some 65% of in - situ value will now be represented by copper. The once “Exceptional PGM Play” has turned into a “Diversified Mid - Cap Mining Company.”…The acquisition carried a cost of $480 million. Yet, the shareholders’s dislike of the deal has now seen Stillwater’s market cap drop by about $1.5 billion or 60%.” – RBC, July 13, 2011 Acquisition of Peregrine Metals Universally Panned Said McAllister at the time: “Peregrine shareholders are getting a very good value .” (1) Now he says: “Would we do it again? No .” ( 2 ) Source: News and Wall Street research. (1) Stillwater M&A Transcript, July 12, 2011. (2) Wall Street Journal, “Investors Seek to Oust Stillwater Chief,” March 22, 2013. (3) Bloomberg, “Commodity Boom Turns Bust for Stillwater Holders on Copper Deal: Real M&A,’ July 14, 2011 . (4) Mineweb , “Angry Institutions Take a Bite Out of Stillwater Mining’s Hide,” August 4, 2011.

Page 17 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies $100 $140 $180 $220 2006 2007 2008 2009 2010 2011 2012 $ ('000s) Costs Are Bloated And Untied To Productivity Director Compensation Source: Company filings. G&A Marketing Spending CEO Compensation Norilsk Sells Stake Avg 0 3.0 6.0 9.0 12.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $ mms $ 11.5 $2.1 $0.0 $2.0 $4.0 $6.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $ mms $5.3 $2.7 $204 $128 $41.5 $22.1 Marketing expenses are up 5x since 2010 After Norilsk sold its stake, operating costs have ballooned CEO pay has nearly doubled from 2009, the last year for which Norilsk had data before selling Director pay is up 60% from 2010 Overall G&A expenses are running nearly 2x the average from the first decade of this century, and yet production of ounces is down 4.0 14.0 24.0 34.0 44.0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 $ mms

Page 18 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Celebrity Endorsements Paid For By Stillwater (4) Rose McGowan Kelly Osbourne Pamela Anderson Ounces of Palladium Jewelry Sold Vs. Marketing Spend (3) ▪ Stillwater set up the Palladium Alliance International to serve as a “trade group” to market palladium jewelry - Stillwater funds the entire budget despite a 4% market share of palladium - Stillwater refuses to work with the International Palladium Board , which has the same mission - Spending by the Alliance seems high - We found 27 news releases and mentions sponsored by the Alliance in 2012; each cost $400,000 - Who profits from this spending? ▪ Since Norilsk sold it stock, spending has increased from $2.4 million per year to $11.2 million annually , - No discernible impact on palladium demand or prices - Palladium needs to be $30/ounce higher to earn return on marketing spend (1) - Palladium ounces in jewelry have declined steadily, despite spending ▪ Facing criticism in the proxy fight, Stillwater has changed its tune : “the Company will reassess whether such expenditures should be reduced.” (2) Stillwater’s Marketing Program is Expensive and Unnecessary The Company shoulders the entire burden of marketing palladium through an off - income statement entity that it claims is a “trade group” Source: Company filings. (1) Calculated as $11.2mm in marketing spend divided by 386 Troy oz. of palladium produced. (2) Stillwater 2012 10 - K at 66 . (3) Johnson Matthey ( http://www.platinum.matthey.com/media/816540/pd__03_to_12.pdf ) (4) Luxurypalladium.com. $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 0 200 400 600 800 1,000 1,200 1,400 1,600 2005 2006 2007 2008 2009 2010 2011 2012 Marketing ($ mms) Jewelry Sold ('000 oz.) SWC Marketing Spending Palladium Jewelry Sold

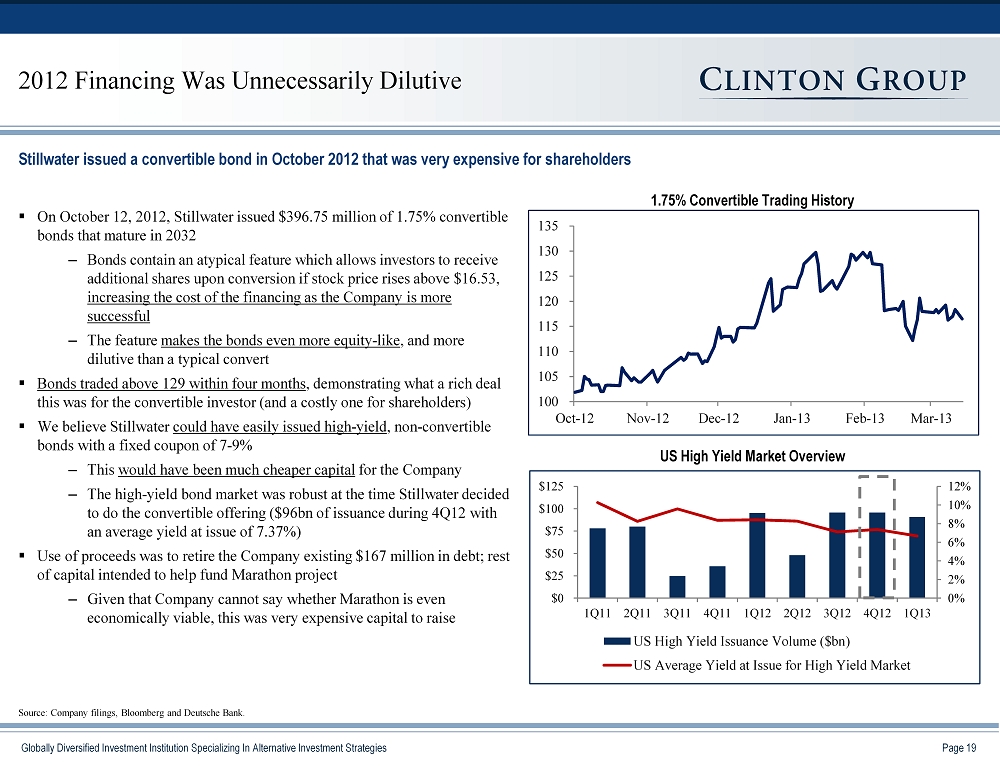

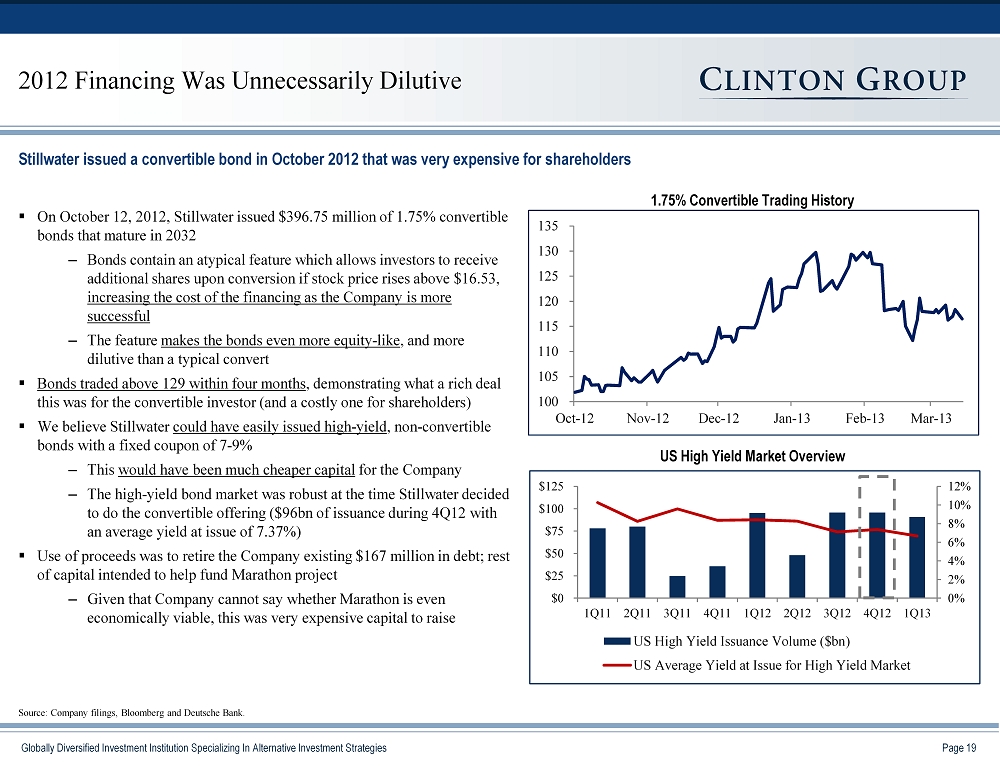

Page 19 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies ▪ On October 12, 2012, Stillwater issued $396.75 million of 1.75% convertible bonds that mature in 2032 – Bonds contain an atypical feature which allows investors to receive additional shares upon conversion if stock price rises above $16.53, increasing the cost of the financing as the Company is more successful – The feature makes the bonds even more equity - like , and more dilutive than a typical convert ▪ Bonds traded above 129 within four months , demonstrating what a rich deal this was for the convertible investor (and a costly one for shareholders ) ▪ We believe Stillwater could have easily issued high - yield , non - convertible bonds with a fixed coupon of 7 - 9% – This would have been much cheaper capital for the Company – The high - yield bond market was robust at the time Stillwater decided to do the convertible offering ($96bn of issuance during 4Q12 with an average yield at issue of 7.37%) ▪ Use of proceeds was to retire the Company existing $167 million in debt; rest of capital intended to help fund Marathon project – Given that Company cannot say whether Marathon is even economically viable, this was very expensive capital to raise Stillwater issued a convertible bond in October 2012 that was very expensive for shareholders 100 105 110 115 120 125 130 135 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 2012 Financing Was Unnecessarily Dilutive Source: Company filings, Bloomberg and Deutsche Bank. 0% 2% 4% 6% 8% 10% 12% $0 $25 $50 $75 $100 $125 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 US High Yield Issuance Volume ($bn) US Average Yield at Issue for High Yield Market US High Yield Market Overview 1.75% Convertible Trading History

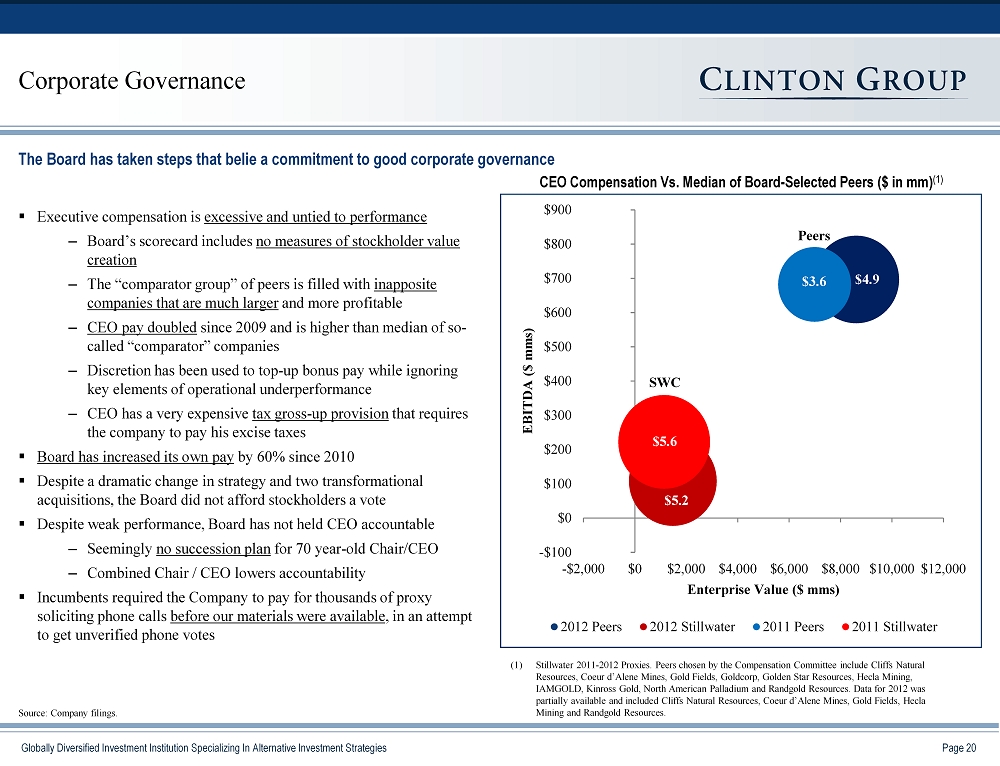

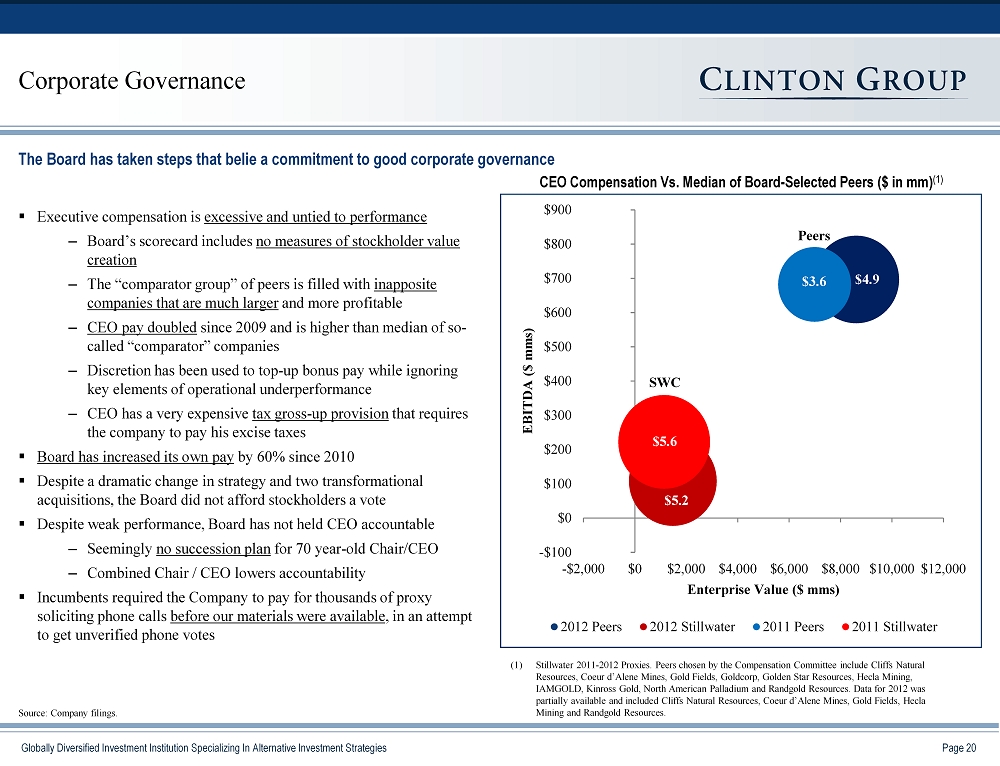

Page 20 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies -$100 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 -$2,000 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 EBITDA ($ mms) Enterprise Value ($ mms) 2012 Peers 2012 Stillwater 2011 Peers 2011 Stillwater ▪ Executive compensation is excessive and untied to performance – Board’s scorecard includes no measures of stockholder value creation – The “comparator group” of peers is filled with inapposite companies that are much larger and more profitable – CEO pay doubled since 2009 and is higher than median of so - called “comparator” companies – Discretion has been used to top - up bonus pay while ignoring key elements of operational underperformance – CEO has a very expensive tax gross - up provision that requires the company to pay his excise taxes ▪ Board has increased its own pay by 60% since 2010 ▪ Despite a dramatic change in strategy and two transformational acquisitions, the Board did not afford stockholders a vote ▪ Despite weak performance, Board has not held CEO accountable – Seemingly no succession plan for 70 year - old Chair/CEO – Combined Chair / CEO lowers accountability ▪ Incumbents required the Company to pay for thousands of proxy soliciting phone calls before our materials were available , in an attempt to get unverified phone votes The Board has taken steps that belie a commitment to good corporate governance Corporate Governance Source: Company filings. CEO Compensation Vs . Median of Board - Selected Peers ($ in mm) (1) (1) Stillwater 2011 - 2012 Proxies. Peers chosen by the Compensation Committee include Cliffs Natural Resources, Coeur d’Alene Mines, Gold Fields, Goldcorp, Golden Star Resources, Hecla Mining, IAMGOLD, Kinross Gold, North American Palladium and Randgold Resources. Data for 2012 was partially available and included Cliffs Natural Resources, Coeur d’Alene Mines, Gold Fields, Hecla Mining and Randgold Resources. $5.2 $5.6 $3.6 $4.9 SWC Peers

Page 21 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies I Executive Summary II Stillwater’s Record of Underperformance III Introduction to the Independent Nominees IV How the Nominees Can Help Create Stockholder Value V Questions for Incumbent Directors

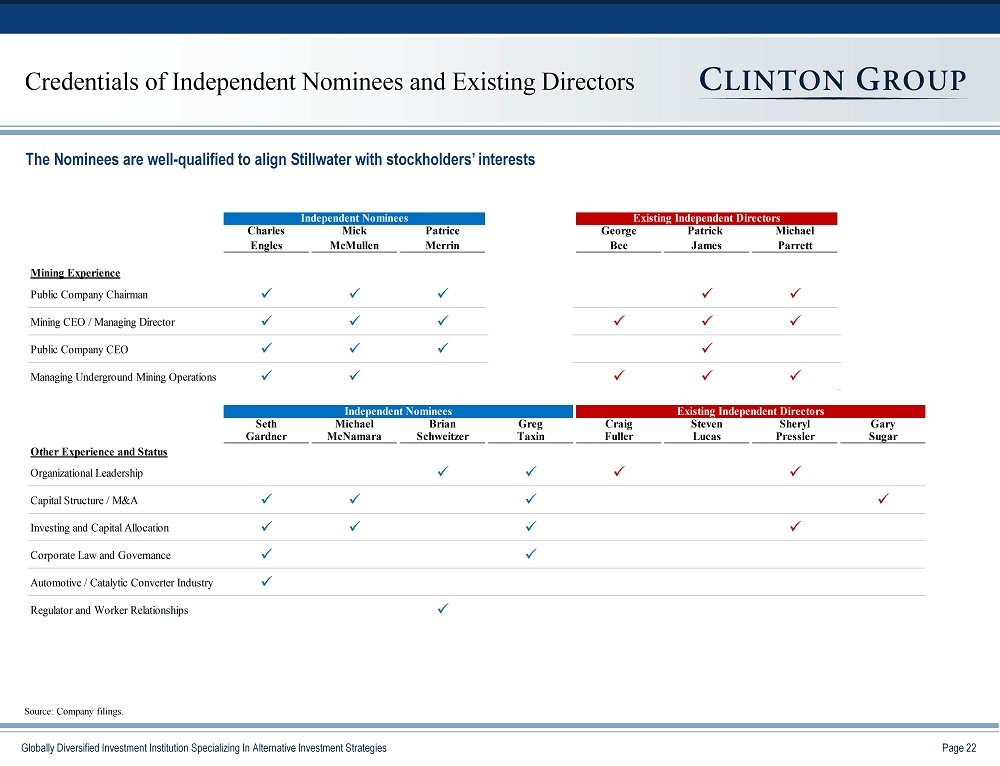

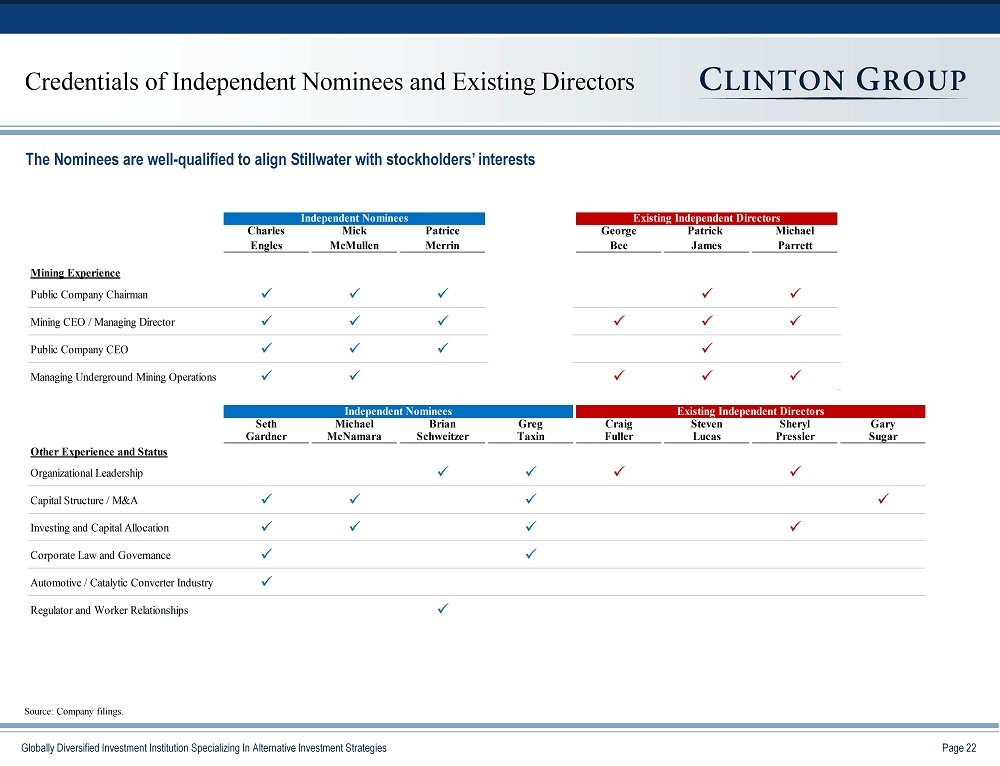

Page 22 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Credentials of Independent Nominees and Existing Directors The Nominees are well - qualified to align Stillwater with stockholders’ interests Source: Company filings. Independent Nominees Existing Independent DirectorsCharles Mick Patrice George Patrick Michael Engles McMullen Merrin Bee James Parrett Mining Experience Public Company Chairman x x x x x Mining CEO / Managing Director x x x x x x Public Company CEO x x x x Managing Underground Mining Operations x x x x x Independent Nominees Existing Independent Directors Seth Michael Brian Greg Craig Steven Sheryl Gary Gardner McNamara Schweitzer Taxin Fuller Lucas Pressler Sugar Other Experience and Status Organizational Leadership x x x x Capital Structure / M&A x x x x Investing and Capital Allocation x x x x Corporate Law and Governance x x Automotive / Catalytic Converter Industry x Regulator and Worker Relationships x

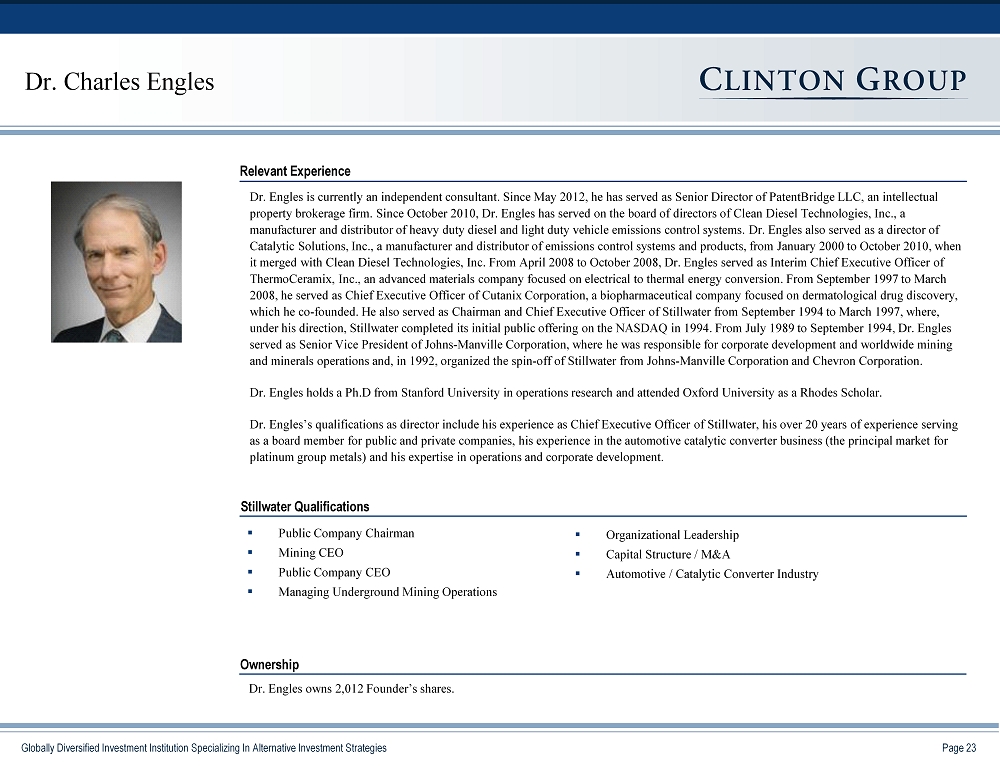

Page 23 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Dr. Charles Engles Dr . Engles is currently an independent consultant. Since May 2012, he has served as Senior Director of PatentBridge LLC, an intellectual property brokerage firm. Since October 2010, Dr. Engles has served on the board of directors of Clean Diesel Technologies, Inc., a manufacturer and distributor of heavy duty diesel and light duty vehicle emissions control systems. Dr. Engles also served as a director of Catalytic Solutions, Inc., a manufacturer and distributor of emissions control systems and products, from January 2000 to Oct obe r 2010, when it merged with Clean Diesel Technologies, Inc. From April 2008 to October 2008, Dr. Engles served as Interim Chief Executive Officer of ThermoCeramix , Inc., an advanced materials company focused on electrical to thermal energy conversion. From September 1997 to March 2008, he served as Chief Executive Officer of Cutanix Corporation, a biopharmaceutical company focused on dermatological drug discovery, which he co - founded. He also served as Chairman and Chief Executive Officer of Stillwater from September 1994 to March 1997, whe re, under his direction, Stillwater completed its initial public offering on the NASDAQ in 1994. From July 1989 to September 1994 , D r. Engles served as Senior Vice President of Johns - Manville Corporation, where he was responsible for corporate development and worldwide mining and minerals operations and, in 1992, organized the spin - off of Stillwater from Johns - Manville Corporation and Chevron Corporati on. Dr. Engles holds a Ph.D from Stanford University in operations research and attended Oxford University as a Rhodes Scholar. Dr. Engles’s qualifications as director include his experience as Chief Executive Officer of Stillwater, his over 20 years of experience s er ving as a board member for public and private companies, his experience in the automotive catalytic converter business (the princi pal market for platinum group metals) and his expertise in operations and corporate development. Relevant Experience Stillwater Qualifications ▪ Public Company Chairman ▪ Mining CEO ▪ Public Company CEO ▪ Managing Underground Mining Operations Ownership Dr. Engles owns 2,012 Founder’s shares. ▪ Organizational Leadership ▪ Capital Structure / M&A ▪ Automotive / Catalytic Converter Industry

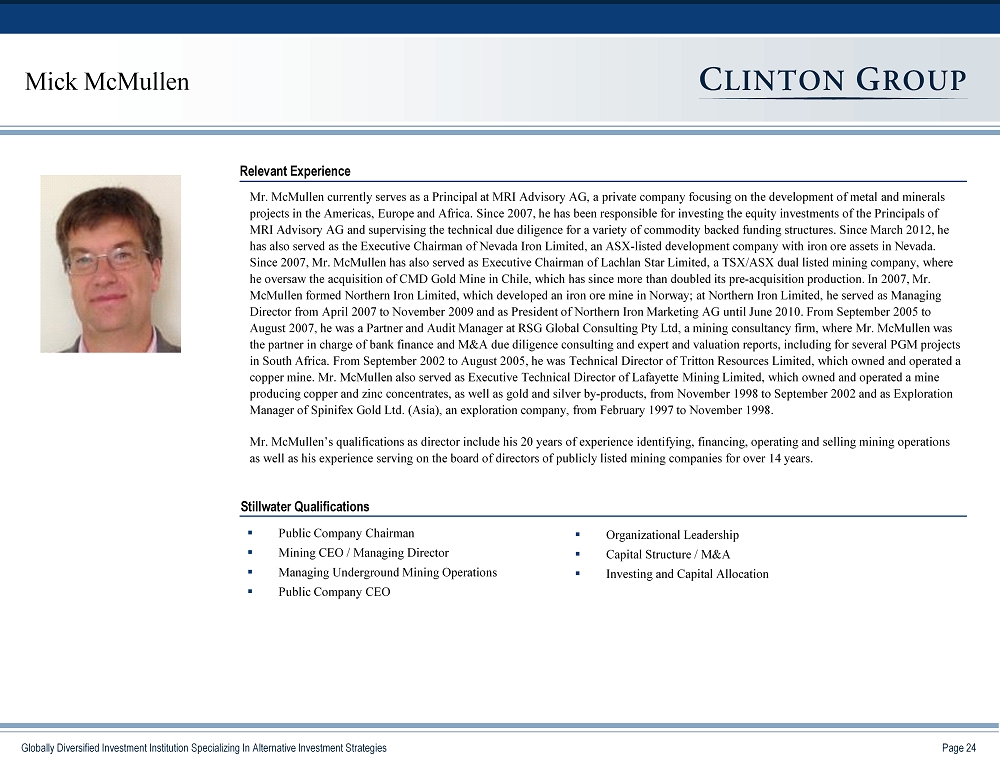

Page 24 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Mick McMullen Mr . McMullen currently serves as a Principal at MRI Advisory AG, a private company focusing on the development of metal and min era ls projects in the Americas, Europe and Africa. Since 2007, he has been responsible for investing the equity investments of the Pri ncipals of MRI Advisory AG and supervising the technical due diligence for a variety of commodity backed funding structures. Since March 20 12, he has also served as the Executive Chairman of Nevada Iron Limited, an ASX - listed development company with iron ore assets in Neva da. Since 2007, Mr. McMullen has also served as Executive Chairman of Lachlan Star Limited, a TSX/ASX dual listed mining company, wh ere he oversaw the acquisition of CMD Gold Mine in Chile, which has since more than doubled its pre - acquisition production. In 2007, Mr. McMullen formed Northern Iron Limited, which developed an iron ore mine in Norway; at Northern Iron Limited, he served as Man agi ng Director from April 2007 to November 2009 and as President of Northern Iron Marketing AG until June 2010. From September 2005 to August 2007, he was a Partner and Audit Manager at RSG Global Consulting Pty Ltd, a mining consultancy firm, where Mr. McMull en was the partner in charge of bank finance and M&A due diligence consulting and expert and valuation reports, including for severa l P GM projects in South Africa. From September 2002 to August 2005, he was Technical Director of Tritton Resources Limited, which owned and operated a copper mine. Mr. McMullen also served as Executive Technical Director of Lafayette Mining Limited, which owned and operated a mi ne producing copper and zinc concentrates, as well as gold and silver by - products, from November 1998 to September 2002 and as Expl oration Manager of Spinifex Gold Ltd. (Asia), an exploration company, from February 1997 to November 1998. Mr. McMullen’s qualifications as director include his 20 years of experience identifying, financing, operating and selling mi nin g operations as well as his experience serving on the board of directors of publicly listed mining companies for over 14 years. Relevant Experience Stillwater Qualifications ▪ Public Company Chairman ▪ Mining CEO / Managing Director ▪ Managing Underground Mining Operations ▪ Public Company CEO ▪ Organizational Leadership ▪ Capital Structure / M&A ▪ Investing and Capital Allocation

Page 25 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Patrice Merrin Ms . Merrin is currently Chairman of the Board of Directors of CML HealthCare, Inc., a leading provider of private laboratory te sti ng services, as well as a member of the Nominating and Governance, Audit and Human Resources Committees. Ms. Merrin joined the B oar d of CML HealthCare, Inc. in March 2008 and became Chairman in March 2011. She also served as Interim President and Chief Executiv e O fficer of CML HealthCare from May 2011 to February 2012. Since January 2012, she has served as director of Ornge , Ontario’s air ambulance service, and has chaired its Chief Executive Officer Search Committee. From October 2009 to June 2011, Ms. Merrin served as a di rector of EnsSolutions Group, Inc., which provides engineered environmental applications for mine tailings control, process dust and stockpile seali ng . She also served as a director of The NB Power Group, a company that generates and distributes electricity from nuclear, hydro , w ind and oil, from 2007 to 2009 and as Chairman of the Environment, Health and Safety Committee from 2008 to 2009. From 2005 to 2006, Ms. M err in served as President, Chief Executive Officer and a director of Luscar Ltd., Canada’s largest producer of thermal coal, and as Executive Vice President from 2004 to 2005. Before joining Luscar , from 1999 to 2004, Ms. Merrin was Executive Vice President and Chief Operating Officer of Sherritt International Corporation, a diversified international natural resources company with assets in base metals mining and refining, thermal coal, oil, gas and power generation. She is also currently a director of the Climate Change and Emissions M ana gement Corporation, which was created in 2009 to support Alberta’s initiatives on climate change and the reduction of emissions. In add ition, Ms. Merrin was a member of the National Advisory Panel on Sustainable Energy Science & Technology from 2005 to 2006, and from 200 3 t o 2006 was a member of Canada’s National Round Table on the Environment and the Economy. Ms. Merrin holds a Bachelor of Arts degree from Queen’s University and completed the Advanced Management Programme at INSEAD. Ms. Merrin’s qualifications as director include her operating experience as an executive in the mining sector and her experience serving o n several boards of directors or trustees, as applicable. Relevant Experience Stillwater Qualifications ▪ Public Company Chairman ▪ Mining CEO ▪ Public Company CEO ▪ Managing Mining Operations ▪ Organizational Leadership ▪ Corporate Governance ▪ Communications and Public Policy ▪ Environmental Stewardship

Page 26 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Seth Gardner Seth Gardner formerly served as the founding Executive Director of the Center for Financial Excellence at Duke University’s Fuqua Sch ool of Business in Durham, North Carolina from 2009 to 2012. From 2003 to 2009, Mr. Gardner worked at Cerberus Capital Management , L .P. in New York City, where he was a Managing Director in the private equity group. Mr. Gardner was responsible for sourcing, evalua tin g, structuring and negotiating private equity investments. He also spearheaded, planned and implemented (with company management ) operational and financial restructurings of portfolio companies across a wide range of industries, including financial servic es, retail, transportation and automotive. During 2008 and 2009, he played critical and lead roles in connection with the U.S. Government ’s financial rescues of Chrysler and Chrysler Financial, which were controlled by Cerberus. From 1995 to 2003, Mr. Gardner was an associat e a t Wachtell , Lipton, Rosen & Katz, a New York City law firm. Mr. Gardner served as a director on the boards of several Cerberus portfolio companies including Chrysler Financial from 2007 - 20 09, Tower Automotive from 2008 - 2009 and Scottish Re Group from 2008 - 2009. Mr. Gardner received his BA degree from Duke University in 1989. He also received a MBA degree from The Fuqua School of Busin ess and a JD degree from Duke Law School in 1994. Mr. Gardner’s qualifications as director include his previous experience as a professional investor, making acquisition and c api tal allocation decisions, as a director of a large automotive supplier, and as a director and investor helping to implement restructuring an d o perational strategies for various companies. Relevant Experience Stillwater Qualifications ▪ Capital Structure / M&A ▪ Investing and Capital Allocation ▪ Corporate Law and Governance ▪ Automotive / Catalytic Converter Industry

Page 27 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Michael McNamara In January 2013, Mr. McNamara joined Dominick & Dominick LLC, a wealth management and investment services firm, where he is a Managing Director of natural resources investment banking. Prior to joining Dominick & Dominick LLC, from January 2010 to Jan uar y 2012, Mr. McNamara worked at Talpion LLC, a boutique private investment firm. At Talpion LLC, Mr. McNamara was responsible for investments in the global metals and mining industry. Prior to such time, from June 2006 until January 2009, Mr. McNamara wor ked at the asset management firm One East Partners, LP, where he was responsible for industrials and commodity investing. From November 200 3 to June 2006, Mr. McNamara was employed by Twin Capital Management, a hedge fund, and from September 2002 to November 2003, by PricewaterhouseCoopers, a global audit and consulting firm. Mr. McNamara received a B.S. degree in Business Administration with a concentration in finance and accounting from Georgetown University. Mr. McNamara’s qualifications as director include his investment banking experience in the industrials, natural resources, an d m ining industries. Relevant Experience Stillwater Qualifications ▪ Capital Structure / M&A ▪ Investing and Capital Allocation

Page 28 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Governor Brian Schweitzer Mr . Schweitzer most recently served as Governor of Montana, from January 5, 2005 to January 7, 2013. Gov. Schweitzer maintained on e of the highest approval ratings among American politicians, delivered the eight largest budget surpluses in Montana history, cut th e most taxes in history and froze tuition increases at state universities, before retiring due to term limits. Gov. Schweitzer is the only Go vernor in Montana history elected directly from the business world, not having been elected to any other office. As Governor, he served as chai r o f the Western Governors Association, during 2009, and the Democratic Governors Association, during 2008. Mr. Schweitzer also served as the 201 1 President of the Council of State Governments. In 1993, he was appointed by former President Bill Clinton to the United State s D epartment of Agriculture as a member of the Montana USDA Farm Service Agency Committee, where he served until 2000, when he ran for the U. S. Senate. While at the Department of Agriculture, Mr. Schweitzer served on the Montana Rural Development Board and the National Dr ought Task Force. Prior to entering politics, Mr. Schweitzer assisted on irrigation development projects in Africa, Asia, Europe an d S outh America prior to his founding and operating a ranching and irrigation business in Montana. Mr. Schweitzer earned his Bachelor of Science degree in international agronomy from Colorado State University and a Master of Sc ience in soil science from Montana State University, Bozeman. Mr. Schweitzer’s qualifications as a director include his extensive leadership experience as Governor of Montana and through var ious other political endeavors, as well as his familiarity with the regulatory, labor and business leaders in the Corporation’s main ope rat ing geography, Montana. Relevant Experience Stillwater Qualifications ▪ Organizational Leadership ▪ Regulator and Worker Relationships ▪ Montana Resident and Industry Knowledge ▪ Communications and Public Policy Ownership Ms. Schweitzer purchased 29,000 shares with cash.

Page 29 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Gregory Taxin Greg Taxin is a Managing Director of the Clinton Group, where he has served since June 2012. Prior to joining Clinton, Mr. Taxin w as the Managing Member of Spotlight Advisors (and its predecessors), an investment advisor focused on activist equity investments si nce 2007. Prior to Spotlight, from February 2003 through May 2007, Mr. Taxin was the co - founder and Chief Executive Officer of Glass, Lewi s & Co., an independent research firm that assists institutional investors in making more informed investment and proxy voting decisio ns by uncovering business, legal, governance and financial statement risk at public companies. Prior to co - founding Glass Lewis, Mr. T axin was an investment banker. He provided advice to public and private companies, assisting in raising billions of dollars in capital an d i n mergers and acquisitions worth billions of dollars, principally in the technology and telecommunications industry. Mr. Taxin was a Managi ng Director at Banc of America Securities where he served from October 2001 through November 2002, Director of Epoch Partners where he serve d f rom January 2000 through July 2001, and a Vice President at Goldman, Sachs & Co., where he served from July 1997 through January 200 0. Mr. Taxin serves on the Board of Directors of Ionetix Corporation and the ProCure Cancer Foundation, each of which he has served on since 2010. Mr. Taxin is a magna cum laude graduate of the Harvard Law School, where he was a John M. Olin Fellow in Law and Economics an d received his JD in 1994, and a graduate of the University of California, Berkeley in 1990. Mr. Taxin’s qualifications as director include his experience as an executive of multiple companies, his experience as a director and his expertise in finance, business and corporate governance. Relevant Experience Stillwater Qualifications ▪ Organizational Leadership ▪ Capital Structure / M&A ▪ Investing and Capital Allocation ▪ Corporate Law and Governance

Page 30 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies I Executive Summary II Stillwater’s Record of Underperformance III Introduction to the Independent Nominees IV How the Nominees Can Help Create Stockholder Value V Questions for Incumbent Directors

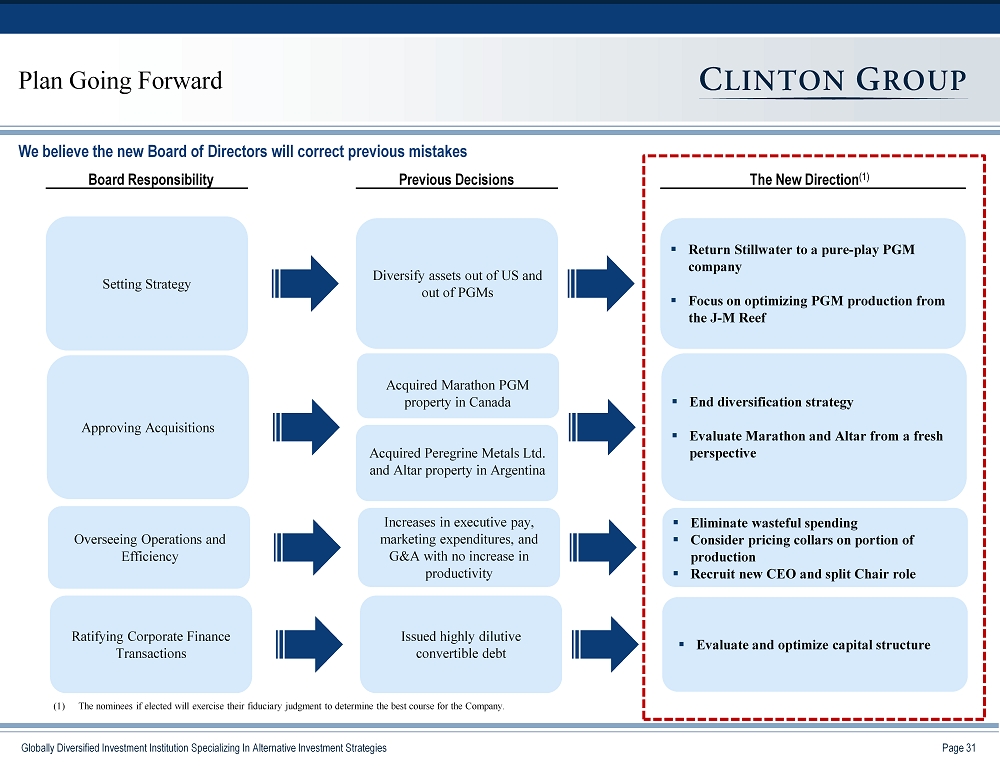

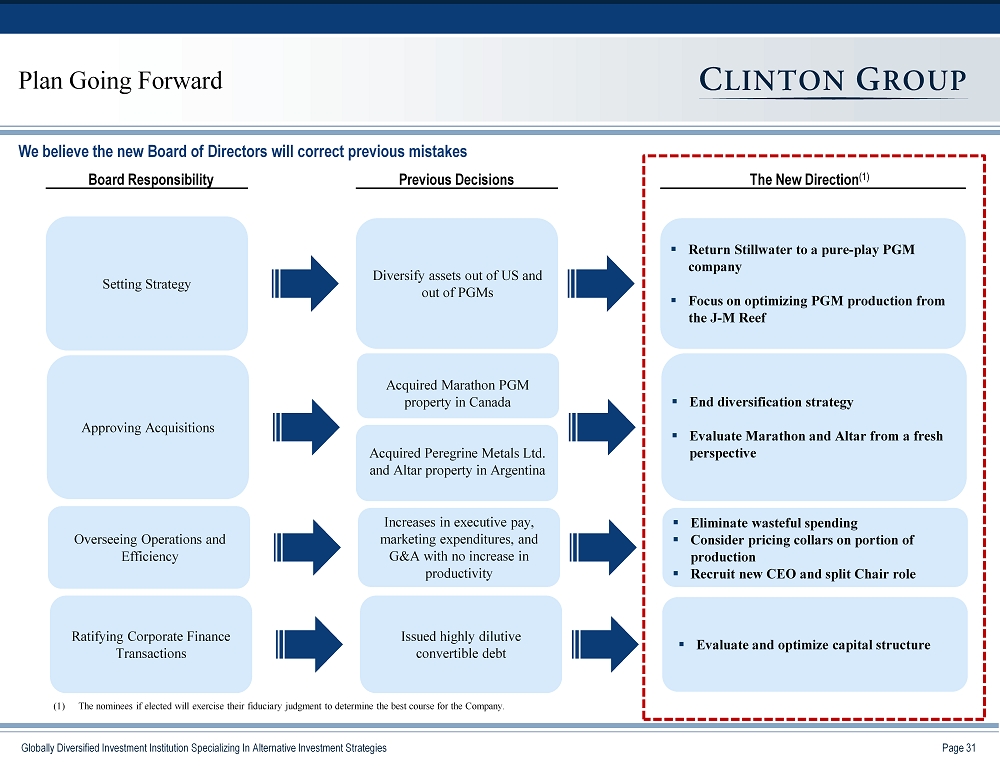

Page 31 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Plan Going Forward ▪ End d iversification s trategy ▪ Evaluate Marathon and Altar from a fresh p erspective Board Responsibility Previous Decisions The New Direction (1) ▪ Return Stillwater to a pure - play PGM c ompany ▪ Focus on optimizing PGM production from the J - M Reef ▪ Eliminate wasteful s pending ▪ Consider pricing collars on portion of production ▪ Recruit new CEO and split Chair role ▪ Evaluate and o ptimize c apital s tructure We believe the new Board of Directors will correct previous mistakes Acquired Marathon PGM property in Canada Acquired Peregrine Metals Ltd. and Altar property in Argentina Diversify assets out of US and out of PGMs Increases in executive pay, marketing expenditures, and G&A with no increase in productivity Setting Strategy Approving Acquisitions Overseeing Operations and Efficiency Ratifying Corporate Finance Transactions Issued highly dilutive convertible debt (1) The nominees if elected will exercise their fiduciary judgment to determine the best course for the Company.

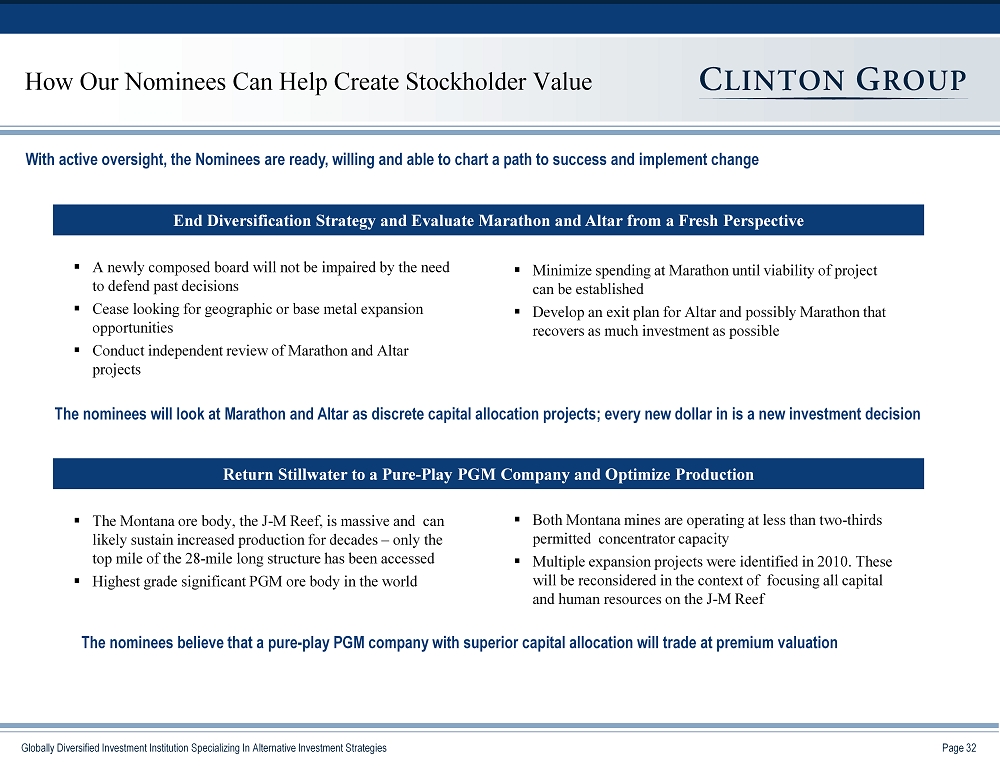

Page 32 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies How Our Nominees Can Help Create Stockholder Value With active o versight, the Nominees are ready, willing and able to chart a path to success and implement change End Diversification Strategy and Evaluate Marathon and Altar from a Fresh Perspective ▪ A newly composed board will not be impaired by the need to defend past decisions ▪ Cease looking for geographic or base metal expansion opportunities ▪ Conduct independent review of Marathon and Altar projects ▪ Minimize spending at Marathon until viability of project can be established ▪ Develop an exit plan for Altar and possibly Marathon that recovers as much investment as possible The nominees will look at Marathon and Altar as discrete capital allocation projects; every new dollar in is a new investment de cision Return Stillwater to a Pure - Play PGM Company and Optimize Production ▪ The Montana ore body, the J - M Reef, is massive and can likely sustain increased production for decades – only the top mile of the 28 - mile long structure has been accessed ▪ Highest grade significant PGM ore body in the world ▪ Both Montana mines are operating at less than two - thirds permitted concentrator capacity ▪ Multiple expansion projects were identified in 2010. These will be reconsidered in the context of focusing all capital and human resources on the J - M Reef The nominees believe that a pure - play PGM company with superior capital allocation will trade at premium valuation

Page 33 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies How Our Nominees Can Help Create Stockholder Value With active o versight, the Nominees are ready, willing and able to chart a path to success and implement change Consider Pricing Collars and Off - take Agreements with Financing for Price Protection and Inexpensive Capital ▪ Collared price contracts were vital to Company during price downturns; consider re - establishing now that price is attractive ▪ Work with management to evaluate medium - term and longer - term contracts for a portion of supply to “lock in” cash flow ▪ Leverage new board member relationships with automobile manufacturers ▪ Consider “project financing” arrangements (for J - M Reef expansion capital) The nominees will have a “hands on” approach to evaluating the PGM and capital pricing environment Eliminate Wasteful Spending ▪ Eliminate marketing expenses and the Palladium Alliance unless others are willing to join ▪ Cease spending on celebrity endorsements and magazine articles ▪ Focus on costs per ounce of production to ensure profitability at lower PGM prices ▪ Evaluate all overhead costs in the Company, including the >25 non - mining heads added in last two years outside of Argentina and Canada ▪ Bring corporate G&A back to appropriate levels for a focused Montana company The nominees know that eliminating $20 million in wasteful spending can increase EPS for stockholders by $0.15 per share

Page 34 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies How Our Nominees Can Help Create Stockholder Value With active o versight, the Nominees are ready, willing and able to chart a path to success and implement change Evaluate and Optimize Capital Structure ▪ History has shown that stockholders would be better served receiving dividends or share buyback ▪ Evaluate a partial tender or full tender for outstanding convertible debt with existing cash and a new high yield bond offering ▪ Evaluate cash needs of recycling business, its return on invested capital, and the viability of employing asset base debt to improve equity returns ▪ Consider other capital structure alternatives, such as project financing from OEM or MLP structures for portion of J - M Reef off - take The nominees understand balance sheet optimization and creation of shareholder value through capital allocation Recruit and Employ a New CEO and Appoint Non - Executive Chairman ▪ Retain executive search firm specializing in mining to find a new CEO; l eading firms are known to the nominees ▪ Split roles of Chairman and CEO to enhance accountability ▪ Review basis for executive compensation levels ▪ Implement management incentive plans tied to financial performance and shareholder value creation ▪ If necessary, former CEO and nominee, Charles Engles, can fulfill the role of Interim CEO while a permanent CEO is found The nominees have the leadership and operating experience in mining to hire the best CEO available for long - term success

Page 35 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies I Executive Summary II Stillwater’s Record of Underperformance III Introduction to the Independent Nominees IV How the Nominees Can Help Create Stockholder Value V Questions for Incumbent Directors

Page 36 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Questions for Incumbent Directors ▪ As recently as November 2012 you indicated your desire to do more acquisitions and “establish a broader operating base” somew her e “around the world.” (1) You did a complete reverse just three months later, when the Company said it “has been shifting from a focus on diversificati on alternatives toward opportunities to benefit from strengthening PGM prices.” (2) You attribute the change in heart to “growing PGM demand” and “prices for both palladium and platinum … at historically strong levels.” (2) However, realized PGM prices were higher in 2011 (3) when you did the Peregrine acquisition than they are now and demand for Palladium had its best year on record in 2010. (4) – Why the epiphany on “focusing” on PGMs the Company’s Montana assets suddenly after spending more than $600 million on “diversification”? – Given that prices have been high and demand has been growing all along, was the strategy of diversification a mistake? ▪ In 2010, you did a special review to prioritize additional PGM development opportunities along the J - M Reef. You decided to move forward on Blitz and in March 2011 listed its development budget as $68 million. (5) Two years later, the new budget is $210 million. (6) – Why have development costs more than tripled? – Why was the project initially expected to be completed in 2016 (5) but is now expected to be completed in 2019? (6) – When was the last time the Board did a full review of this project and determined its ROI was still attractive? ▪ Did you understand the risks inherent in paying a 290% premium for Peregrine and getting into business in Argentina, a country th at has a record of seizing natural resource assets and not allowing currency to be converted out into US dollars? (1) Stillwater 3Q 12 10 - Q at 31. (2) Stillwater 2012 10 - K at 67. (3) Stillwater 2012 10 - K at 59. (4) Stillwater 2012 10 - K at 38. (5) Stillwater 2010 10 - K at 62. (6) Stillwater 2012 10 - K at 12 . (7) Stillwater press release, October 3, 2012. Strategy Peregrine Acquisition ▪ In late November 2010, Stillwater acquired the Marathon PGM/Copper project in Canada. Almost two years later in October 2012 , S tillwater disclosed in a press release that the “palladium metal content was overestimated” and further “cautioned that the effect is likely to be a deterioration in both project economics and ore reserves.” (7) – Who is responsible for the failures in due diligence? – Will the economic assessment of the Marathon project be the subject of an independent audit by an expert outside agency, reviewing the validity of all important input parameters before additional capital is spent? – Marathon Acquisition

Page 37 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Questions for Incumbent Directors ▪ You have described the “Palladium Alliance International” as a “industry trade group” to which the Company makes “contributions .” ( 1) The Company has said the Alliance was “established in early 2006.” (2) In 2011, however, a new legal entity called Palladium Alliance International was incorporated as a for - profit business in Delaware by one of the Company’s officers. The directors have told us that the Alli ance is not owned by the Company. That same year, “contributions” to the Alliance grew from $2.4 million to $11.8 million. The Company is the only financial “contributor” to the Alliance . – Who owns the Palladium Alliance International corporation? – The industry has another trade group called the International Palladium Board which is sponsored by other industry participants a nd engages in marketing the metal. Why shoulder the entire burden of the Alliance instead of working with the International Palladium Board? – Please detail the spending of the Alliance. We know of 32 press releases and 3 ads using 3 celebrities over the past two years. Did this cost $24 million? – Palladium jewelry is declining in sales. Can you provide evidence that the expenditure of $12 million per year on efforts to promote palladium jewelry makes a sufficient return, given the Company’s 4% market share in palladium? To do so, palladium would have to increase in price by $30 per ounce. What is the evidence that your marketing efforts have done that? ▪ Since 2009, general and administrative expenses have grown from $25.1 (4) million to $40.9 million (4) in 2012, an increase of 63%. In addition, over the same period, total employees have grown from 1,273 (5) to 1,664 (6) , with administrative support employees increasing from 53 (5) to 80, (6) an increase of 51%. Yet, PGM production has declined from 530,000 ounces in 2009 (7) to 514,000 ounces in 2012. (7) – The MD&A discusses several one - time items over the last several years in accounting for the rise in general and administrative c osts, yet the costs continue growing year - over - year. Why? – Why has total headcount increased at the same time PGM production has decreased? – What has necessitated an increase in administrative headcount of 51% in addition to the 32 employees currently working in Can ada and Argentina? (1) Stillwater 2011 10 - K at 59. (2) Stillwater 2007 10 - K at 56. (3) Stillwater 2012 10 - K at 98. (4) Stillwater 2012 10 - K at 57. (5) Stillwater 2009 10 - K at 16. (6) Stillwater 2012 10 - K at 23. (7) Stillwater 2012 10 - K at 58. Palladium Alliance Increase in G&A Expenditure

Page 38 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Questions for Incumbent Directors ▪ In calculating your executive pay, you use a “scorecard” approach to evaluating management. Because stock price has not been a f act or, in 2012 you paid the CEO more than $5 million in respect of his performance in 2011. During 2011, however, the stock fell 51%. For 20 12 performance, you again did not take account of the stock price, net income, cash flow or other items tied to stockholder returns. – Why shouldn’t the CEO’s pay be more tightly tied to stock price performance? – In a year in which the CEO recommended a disastrous acquisition (which he now admits he would not do again), is it proper tha t h e be paid $5 million? – The board has agreed to a tax gross - up to pay for all excise taxes that the CEO may incur upon his departure from the Company. H ow is it fair that stockholders pay Mr. McAllister’s taxes, and the taxes on that same benefit, for him? – The peers used by the Company in calculating the executives’ target compensation are significantly bigger and more profitable (s ome are ten times larger). Nevertheless, Mr. McAllister has consistently been paid more than the CEOs of these companies. Is this a f air way to benchmark Mr. McAllister’s pay ? ▪ Could you describe an instance when the board of directors disagreed? What was the issue and how was it resolved? – Is there a healthy tension between Mr. James and Mr. McAllister? – Who has the performance assessment conversation with Mr. McAllister? – Did that person review the qualitative areas where Mr. McAllister could improve? Executive Compensation Board Dynamics

Page 39 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Contact Information Clinton Group Corporate Office: 601 Lexington Avenue 51tst Floor New York, New York 10022 Contacts: Gregory P. Taxin, Managing Director Tel: +1 (212) 825 0400

Page 40 Globally Diversified Investment Institution Specializing In Alternative Investment Strategies Disclaimers CLINTON DOES NOT ASSUME RESPONSIBILITY FOR INVESTMENT DECISIONS . THIS PRESENTATION DOES NOT RECOMMEND THE PURCHASE OR SALE OF ANY SECURITY . UNDER NO CIRCUMSTANCES IS THIS PRESENTATION TO BE USED OR CONSIDERED AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER BUY ANY SECURITY . THE PARTICIPANTS INCLUDE FUNDS AND ACCOUNTS THAT ARE IN THE BUSINESS OF TRADING - BUYING AND SELLING - PUBLIC SECURITIES . IT IS POSSIBLE THAT THERE WILL BE DEVELOPMENTS IN THE FUTURE THAT CAUSE ONE OR MORE OF THE PARTICIPANTS FROM TIME TO TIME TO SELL ALL OR A PORTION OF THEIR SHARES IN OPEN MARKET TRANSACTIONS OR OTHERWISE (INCLUDING VIA SHORT SALES) . BUY ADDITIONAL SHARES (IN OPEN MARKET OR PRIVATELY NEGOTIATED TRANSACTIONS OR OTHERWISE) OR TRADE IN OPTIONS, PUTS CALLS OR OTHER DERIVATIVE INSTRUMENTS RELATING TO SUCH SHARES . THE DATA AND INFORMATION USED IN THE ACCOMPANYING ANALYSIS CONTAINED HEREIN HAVE BEEN OBTAINED FROM SOURCES THAT CLINTON GROUP, INC . AND/OR ITS AFFILIATES (COLLECTIVELY, “CLINTON”) BELIEVE TO BE RELIABLE, IS SUBJECT TO CHANGE WITHOUT NOTICE, ITS ACCURACY IS NOT GUARANTEED, AND IT MAY NOT CONTAIN ALL MATERIAL INFORMATION CONCERNING THE SECURITIES WHICH MAY BE THE SUBJECT OF THE ANALYSIS . NEITHER CLINTON NOR ITS AFFILIATES MAKE ANY REPRESENTATION REGARDING, OR ASSUME RESPONSIBILITY OR LIABILITY FOR, THE ACCURACY OR COMPLETENESS OF, OR ANY ERRORS OR OMISSIONS IN, ANY INFORMATION THAT IS PART OF THE ANALYSIS . CLINTON MAY HAVE RELIED UPON CERTAIN QUANTITATIVE AND QUALITATIVE ASSUMPTIONS WHEN PREPARING THE ANALYSIS WHICH MAY NOT BE ARTICULATED AS PART OF THE ANALYSIS . THE REALIZATION OF THE ASSUMPTIONS ON WHICH THE ANALYSIS WAS BASED ARE SUBJECT TO SIGNIFICANT UNCERTAINTIES, VARIABILITIES AND CONTINGENCIES AND MAY CHANGE MATERIALLY IN RESPONSE TO SMALL CHANGES IN THE ELEMENTS THAT COMPRISE THE ASSUMPTIONS, INCLUDING THE INTERACTION OF SUCH ELEMENTS . FURTHERMORE, THE ASSUMPTIONS ON WHICH THE ANALYSIS WAS BASED MAY BE NECESSARILY ARBITRARY, MAY MADE AS OF THE DATE OF THE ANALYSIS, DO NOT NECESSARILY REFLECT HISTORICAL EXPERIENCE WITH RESPECT TO SECURITIES SIMILAR TO THOSE THAT MAY BE THE CONTAINED IN THE ANALYSIS, AND DOES NOT CONSTITUTE A PRECISE PREDICTION AS TO FUTURE EVENTS . BECAUSE OF THE UNCERTAINTIES AND SUBJECTIVE JUDGMENTS INHERENT IN SELECTING THE ASSUMPTIONS AND ON WHICH THE ANALYSIS WAS BASED AND BECAUSE FUTURE EVENTS AND CIRCUMSTANCES CANNOT BE PREDICTED, THE ACTUAL RESULTS REALIZED MAY DIFFER MATERIALLY FROM THOSE PROJECTED IN THE ANALYSIS . NOTHING INCLUDED IN THE ANALYSIS CONSTITUTES ANY REPRESENTATIONS OR WARRANTY BY CLINTON AS TO FUTURE PERFORMANCE . NO REPRESENTATION OR WARRANTY IS MADE BY CLINTON AS TO THE REASONABLENESS, ACCURACY OR SUFFICIENCY OF THE ASSUMPTIONS UPON WHICH THE ANALYSIS WAS BASED OR AS TO ANY OTHER FINANCIAL INFORMATION THAT IS CONTAINED IN THE ANALYSIS, INCLUDING THE ASSUMPTIONS ON WHICH THEY WERE BASED . MEMBERS OF THE CLINTON TEAM SHALL NOT BE LIABLE FOR EITHER (I) ANY ERRORS OR OMISSIONS MADE IN DISSEMINATING THE DATA OR ANALYSIS CONTAINED HEREIN OR (II) DAMAGES (INCIDENTAL, CONSEQUENTIAL OR OTHERWISE) WHICH MAY ARISE FROM YOUR OR ANY OTHER PARTY’S USE OF THE DATA OR ANALYSIS CONTAINED HEREIN . THE INFORMATION THAT CONTAINED IN THE ANALYSIS SHOULD NOT BE CONSTRUED AS FINANCIAL, LEGAL, INVESTMENT, TAX, OR OTHER ADVICE . YOU ULTIMATELY MUST RELY UPON ITS OWN EXAMINATION AND PROFESSIONAL ADVISORS, INCLUDING LEGAL COUNSEL AND ACCOUNTANTS AS TO THE LEGAL, ECONOMIC, TAX, REGULATORY, OR ACCOUNTING TREATMENT, SUITABILITY, AND OTHER ASPECTS OF THE ANALYSIS .