QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.4

Independent Market Consultant's Report

Electricity Market Analysis of the

Midwest and Forecast of Electricity

Revenues for AmerenEnergy Generating

May 24, 2002

Prepared For:

Lehman Brothers

745 7th Avenue 25th Floor

New York, NY 10019

Prepared By:

Platts/RDI Consulting, A McGraw-Hill Company.

3333 Walnut Street

Boulder, CO 80301-2515

Tel: (720) 548-5000

Table of Contents

| Executive summary | | B-3 |

| | Summary of Results and Conclusions | | B-3 |

| Introduction | | B-10 |

| Midwest Market Overview | | B-11 |

| | Midwest Supply | | B-11 |

| | Future Supply | | B-13 |

| | Demand Forecast | | B-13 |

| | Transmission Capacity and Pricing | | B-15 |

| | Industry Restructuring in MAIN and ECAR | | B-16 |

| | Historic Pricing In Midwest U.S. Markets | | B-18 |

| Base Case Assumptions | | B-19 |

| | Existing Supply | | B-19 |

| | New Generation | | B-21 |

| | Cost of New Generation Technologies | | B-25 |

| | Nuclear Generation | | B-26 |

| | Demand Forecast | | B-26 |

| | Reserve Requirements | | B-27 |

| | Coal Price Forecast | | B-28 |

| | Environmental Regulation | | B-29 |

| | NOx Regulations | | B-30 |

| | Gas Price Forecast | | B-32 |

| | AEG Contractual Obligations | | B-34 |

| Methodology Overview | | B-35 |

| | Reserve Requirement Model | | B-35 |

| | Explicit Capacity Adder Model | | B-35 |

| | Energy Only Model | | B-36 |

| | RDI's Energy Market Methodology | | B-36 |

| | Capacity Market Methodology | | B-37 |

| Base Case Results | | B-39 |

| | Energy Price Forecast | | B-40 |

| | ECAR/MAIN Supply and Demand Balance | | B-41 |

| | Projected Operations and Market Sales Revenue for AEG's Units | | B-43 |

| Sensitivity Case Results | | B-48 |

| | Sensitivity Case Results | | B-48 |

B-2

Executive Summary

AmerenEnergy Generating (AEG), the non-regulated generating subsidiary of Ameren Corporation, retained Platts/RDI Consulting (RDI) to prepare this independent electricity market study of the Midwest United States, including the Mid-American Interconnected Network (MAIN) and the East Central Area Reliability council (ECAR). The purpose of this study is to assess the dispatch and potential market sales revenue of AEG's power plant portfolio in support of its existing generating capacity. AEG was created in May 2000 when Ameren Corp spun off its Illinois generating assets into a new power generation subsidiary. This report provides a forecast of market clearing prices for Southern Illinois, where most of AEG's assets are located, and also describes the key assumptions and the methodologies used in developing this forecast.

The base analytical tools utilized for this study were the Inter-Regional Electric Market Model (IREMM) and an integrated capacity price model. IREMM is a sophisticated production simulation model that simulates the Eastern Interconnection on an hourly basis for each year within the time horizon of the forecast. The capacity price model is integrated with IREMM and calculates the additional revenue required for maintenance of adequate capacity reserves. Using these models, RDI forecasts the market clearing price of energy and capacity to assess the economics of selling power in the Midwest U.S.

Summary of Results and Conclusions

The following represents the conclusions and key findings of RDI's market assessment and electricity price forecast.

- i.

- While MAIN and ECAR represent distinct reliability councils, because of strong interconnections between them, as well as implementation of the Midwest Independent System Operator, they are viewed as a combined region for capacity and reserve purposes. Key characteristics of these regions include the following:

- a.

- Strong interconnections between ECAR and MAIN. The North American Electric Reliability Council's (NERC)2001 Summer Assessmentindicates peak season transfer capability from MAIN to ECAR of 4,000 MW. On a net basis, MAIN tends to import power from ECAR during intermediate load hours and export power to ECAR during peak hours.

- b.

- A Memorandum of Cooperation was signed on May 9, 2002 to expand MISO to include PJM, SPP, and TRANSLink Transmission Company's participants to create a single wholesale energy market. The union should be finalized later in 2002 and will serve customers in ECAR, MAIN, MAPP, SPP, PJM, the Canadian province of Manitoba, and service territory held by Public Service Company of Colorado. By eliminating pancaking of wheeling tariffs across multiple control areas, MISO should provide AEG with greater access to higher priced on-peak markets to the east.

- c.

- Annual energy and peak demand growth of 2.5% and 2.0% (weather normalized) from 1995-1999 for MAIN and ECAR, respectively. RDI projects that slowing population growth will restrain future energy and peak demand growth to 1.5% and 1.3%, respectively, in the two regions, below the U.S. forecast average of 1.7%.

- d.

- An abundance of baseload generation. The Midwest markets of MAIN and ECAR have the largest proportions of coal and nuclear generation of any region in the country. This makes the region very competitive with regard to off-peak generation.

- e.

- Significant wholesale and retail deregulation in Ohio, Illinois and Michigan. In the Midwest, deregulation appears to be partly responsible for large amounts of new capacity development.

- ii.

- MAIN and ECAR have experienced high levels of new capacity development in the last two years.

B-3

- a.

- RDI estimates that in ECAR and MAIN, over 29,000 MW of new capacity will come on-line between 2000 and 2005. This amount of new capacity represents 19% of ECAR/MAIN's 2001 peak demand.

- b.

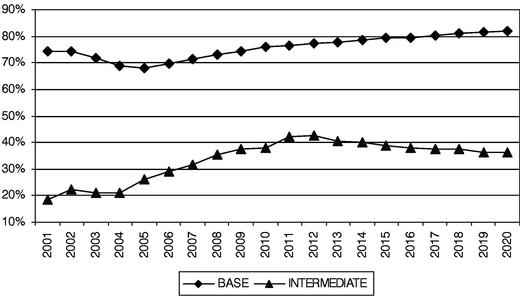

- RDI projects that ECAR/MAIN reserve margins will approach 19% by 2003 before declining to 16% in 2005.

- iii.

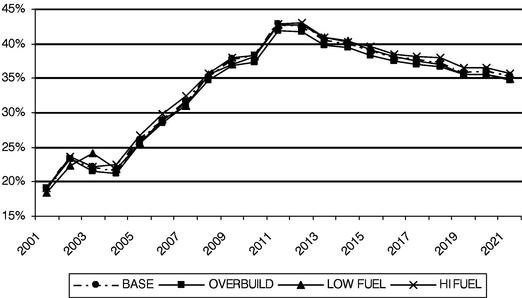

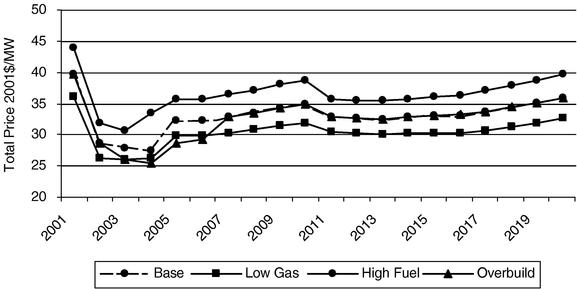

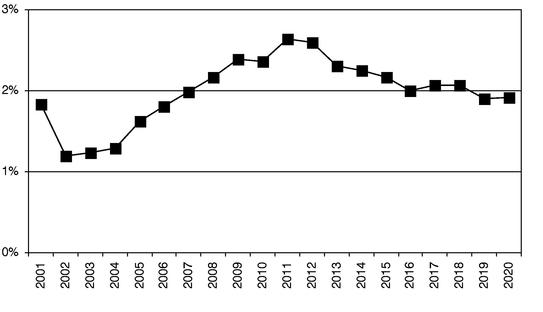

- RDI's base case electricity price forecast (including both energy and capacity prices) for Southern Illinois, drop to a low of $27.37 in 2004 (in 2001 dollars) before returning to equilibrium pricing. The results of the forecast are summarized in Table 1. Key findings of the forecast include:

- a.

- RDI's base case forecast reflects a long market in 2002-2004. ECAR/MAIN is forecast to be in supply/demand balance by 2005.

- b.

- The primary drivers of the price forecast in Southern Illinois are high levels of baseload nuclear and coal generation setting off-peak prices, and natural gas units setting on-peak prices. As loads grow and a greater number of gas-fired power plants enter the capacity mix, natural gas prices exert greater influence over the region's price trends.

- c.

- Table 3 and Table 4 summarize RDI's key assumptions used in developing the forecast. The assumptions shown in Table 3 primarily influence the capacity market forecast with secondary influences on the energy market forecast.

- d.

- Table 4 summarizes the factors that primarily influence the energy market forecast, with secondary influences on the capacity market forecasts.

- iv.

- RDI's findings regarding AEG's assets are as follows:

- a.

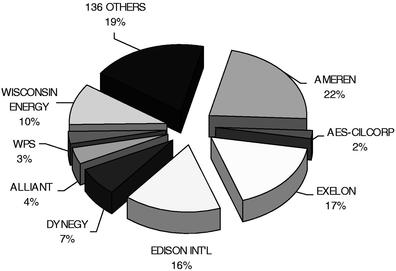

- Ameren Corporation, which controls regulated generation in Missouri and AEG's unregulated assets, is the second largest generator in ECAR/MAIN, after AEP. FirstEnergy in Ohio and Edison Mission Energy in Illinois each operate comparable amounts of generation to Ameren.

- b.

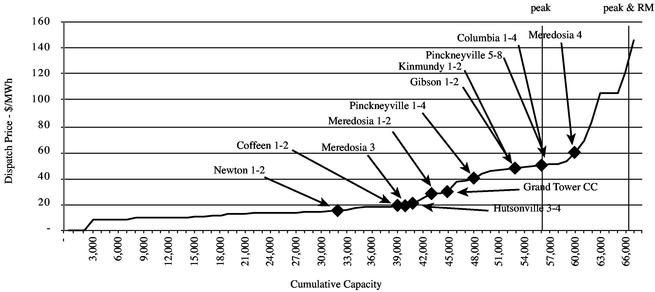

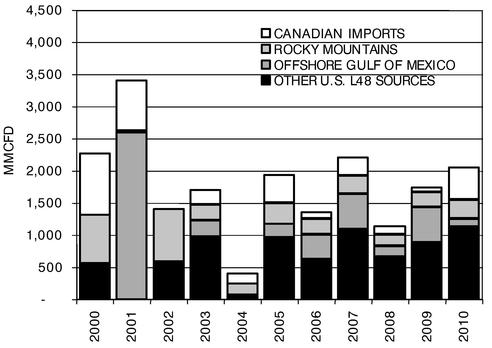

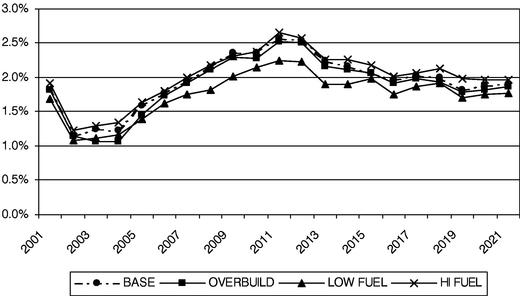

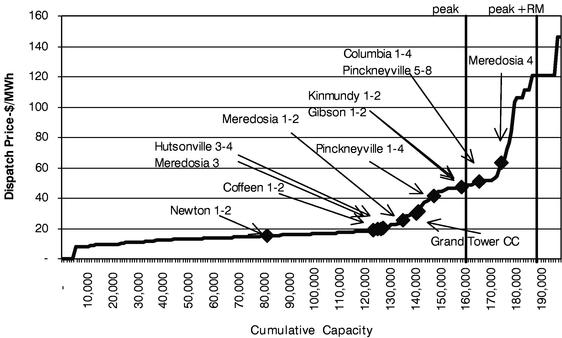

- Figure 1 shows the regional peak season dispatch curve for power plants in the MAIN region. The region features high levels of nuclear and coal-fired capacity with a dispatch price below $20/MWh. AEG's generation portfolio, as indicated, includes coal- and gas-fired power plants in all portions of the dispatch curve.

- c.

- Through 2004, AEG's principal revenue source will be derived from its term wholesale contracts. After the contracts currently in place expire, RDI's analysis assumes that AEG will receive, on average, the wholesale market rate for subsequent contracts. Table 2 shows RDI's base projection of revenues from AEG's market sales. Average revenues fall from 2001-2004 as natural gas prices decline and reserve margins increase. After 2004, AEG's average market revenues show nominal growth of 3.4% per year.

- v.

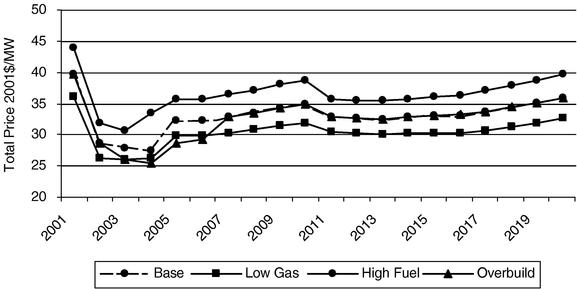

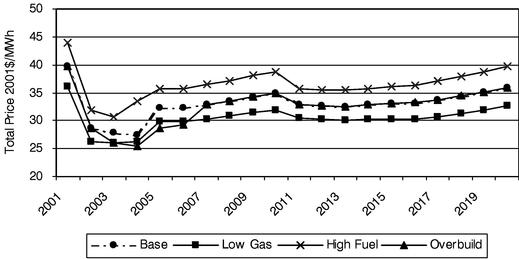

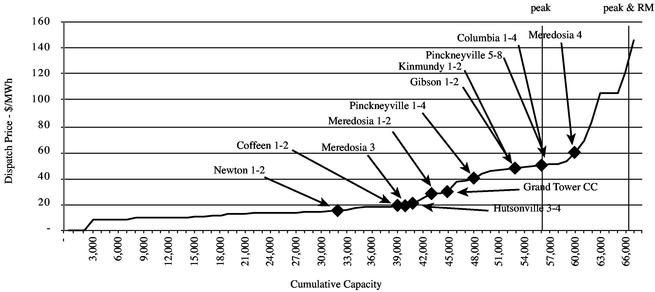

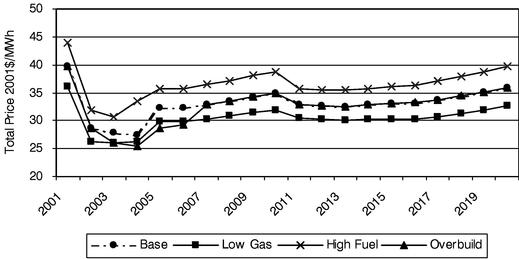

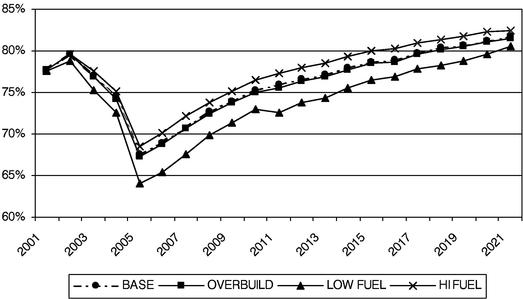

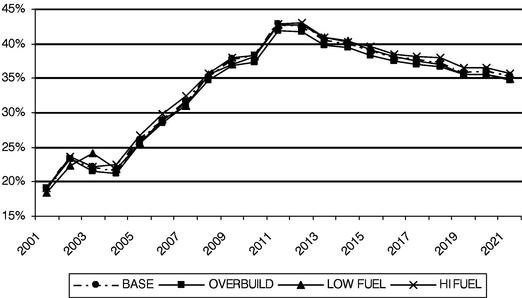

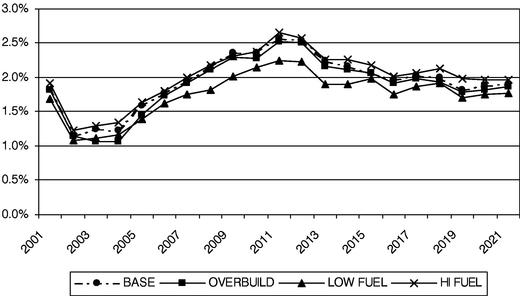

- RDI conducted sensitivity analysis on key market variables; including natural gas prices and the possibility of regional overbuild. RDI's findings include the following:

- a.

- Because of the large number of new plants proposed for the Midwest, the risk of overbuild may be considered to be higher than in the past. RDI evaluated an overbuild scenario in which a higher proportion of projects were built, pushing reserve margins for ECAR and MAIN to 23% by 2003. This level of capacity addition results in the region being oversupplied through 2006.

- b.

- To capture the effect of volatile fuel prices on market sales revenues, RDI modeled low and high fuel scenarios in which natural gas and oil prices trended 15% below the base case and 15% above the base case.

B-4

- c.

- Figure 2 shows the market price outcome of each of these sensitivity cases for Southern Illinois. The overbuild case results in an 11% reduction in annual prices from 2003-2006, while the low natural gas price case results in an 8% reduction in annual prices over the study period. The high fuel scenario results in an 11% increase in annual prices over the study period. In terms of revenue effects, the overbuild case results in a 19% reduction in annual market sales revenues during the years of surplus capacity. The low natural gas case reduces annual revenues by 8% and the high natural gas increases annual revenues 9%.

- d.

- It is important to note that while two of the sensitivity cases RDI investigated represent downside risks to AEG's market sales revenues, RDI believes the potential for strong markets due to higher fuel prices and tight generation conditions are likely to occur during the forecast period. While today's natural gas prices are low and reserve margins are at historic highs, gas prices can certainly rise to high levels, as they did during the latter half of 2000, and tight generation conditions can occur, as they did during the summers of 1998-1999.

TABLE 1

FORECAST PRICE RESULTS: 2001-2020 (NOMINAL$)

| | ENERGY PRICE ($/MWh)

| |

| |

| |

| |

| |

|---|

YEAR

| | ON-PEAK

| | MID-PEAK

| | OFF-PEAK

| | YEAR

ROUND

| | ANNUAL

GROWTH

%

| | CAPACITY

PRICE

$/kW-yr

| | TOTAL

PRICE

$/MWh

| | TOTAL

PRICE

2001$/MWh

| | REAL

ANNUAL

GROWTH %

| |

|---|

| 2001 | | 45.67 | | 26.14 | | 17.98 | | 32.71 | | — | | 60.77 | | 39.65 | | 39.65 | | — | |

| 2002 | | 32.80 | | 22.44 | | 17.46 | | 25.71 | | -21 | % | 33.53 | | 29.54 | | 28.68 | | -28 | % |

| 2003 | | 31.73 | | 23.03 | | 18.89 | | 25.79 | | 0 | % | 33.02 | | 29.56 | | 27.86 | | -3 | % |

| 2004 | | 31.77 | | 22.81 | | 18.39 | | 25.60 | | -1 | % | 37.70 | | 29.91 | | 27.37 | | -2 | % |

| 2005 | | 35.92 | | 25.67 | | 20.26 | | 28.75 | | 12 | % | 66.58 | | 36.35 | | 32.29 | | 18 | % |

| 2006 | | 37.15 | | 26.79 | | 20.99 | | 29.79 | | 4 | % | 67.83 | | 37.53 | | 32.37 | | 0 | % |

| 2007 | | 38.99 | | 28.22 | | 21.97 | | 31.26 | | 5 | % | 69.09 | | 39.15 | | 32.79 | | 1 | % |

| 2008 | | 41.09 | | 30.14 | | 23.35 | | 33.09 | | 6 | % | 70.69 | | 41.16 | | 33.47 | | 2 | % |

| 2009 | | 43.93 | | 32.31 | | 24.74 | | 35.32 | | 7 | % | 72.11 | | 43.55 | | 34.38 | | 3 | % |

| 2010 | | 46.19 | | 34.14 | | 26.11 | | 37.20 | | 5 | % | 73.67 | | 45.61 | | 34.96 | | 2 | % |

| 2011 | | 45.08 | | 33.43 | | 26.30 | | 36.60 | | -2 | % | 66.58 | | 44.20 | | 32.89 | | -6 | % |

| 2012 | | 46.22 | | 34.37 | | 27.11 | | 37.59 | | 3 | % | 67.05 | | 45.25 | | 32.69 | | -1 | % |

| 2013 | | 46.63 | | 34.88 | | 27.92 | | 38.15 | | 1 | % | 70.56 | | 46.21 | | 32.41 | | -1 | % |

| 2014 | | 48.81 | | 36.58 | | 29.53 | | 40.05 | | 5 | % | 71.13 | | 48.17 | | 32.80 | | 1 | % |

| 2015 | | 50.48 | | 38.07 | | 30.87 | | 41.57 | | 4 | % | 73.74 | | 49.99 | | 33.05 | | 1 | % |

| 2016 | | 51.59 | | 39.14 | | 31.94 | | 42.66 | | 3 | % | 78.41 | | 51.61 | | 33.13 | | 0 | % |

| 2017 | | 54.42 | | 41.45 | | 34.17 | | 45.19 | | 6 | % | 78.13 | | 54.11 | | 33.72 | | 2 | % |

| 2018 | | 57.60 | | 44.03 | | 36.34 | | 47.92 | | 6 | % | 77.91 | | 56.81 | | 34.37 | | 2 | % |

| 2019 | | 60.33 | | 46.46 | | 38.42 | | 50.37 | | 5 | % | 81.74 | | 59.70 | | 35.07 | | 2 | % |

| 2020 | | 64.27 | | 49.51 | | 41.29 | | 53.78 | | 7 | % | 80.62 | | 62.98 | | 35.92 | | 2 | % |

B-5

FIGURE 1

MAIN SUPPLY CURVE 2002

TABLE 2

WHOLESALE MARKET REVENUES FOR AEG, 2001-2020 ($NOMINAL)

YEAR

| | AVAILABLE

CAPACITY

(MW)

| | ENERGY

SALES

(GWH)

| | TOTAL

REVENUES

($000)

| | AVERAGE

REVENUES

$/MWh

|

|---|

| 2001 | | 138 | | 601 | | 31,525 | | 52.48 |

| 2002 | | 546 | | 1,060 | | 50,203 | | 47.38 |

| 2003 | | 551 | | 1,041 | | 48,418 | | 46.52 |

| 2004 | | 989 | | 2,306 | | 105,379 | | 45.69 |

| 2005 | | 2,844 | | 10,457 | | 528,628 | | 50.55 |

| 2006 | | 3,183 | | 12,728 | | 639,219 | | 50.22 |

| 2007 | | 3,673 | | 15,099 | | 777,127 | | 51.47 |

| 2008 | | 3,757 | | 16,148 | | 849,160 | | 52.59 |

| 2009 | | 4,040 | | 17,719 | | 971,889 | | 54.85 |

| 2010 | | 4,040 | | 18,044 | | 1,024,337 | | 56.77 |

| 2011 | | 4,040 | | 18,418 | | 971,844 | | 52.77 |

| 2012 | | 4,105 | | 19,122 | | 1,025,124 | | 53.61 |

| 2013 | | 4,105 | | 19,125 | | 1,051,452 | | 54.98 |

| 2014 | | 4,105 | | 19,264 | | 1,093,374 | | 56.76 |

| 2015 | | 4,141 | | 19,364 | | 1,140,576 | | 58.90 |

| 2016 | | 4,141 | | 19,361 | | 1,182,507 | | 61.08 |

| 2017 | | 4,141 | | 19,543 | | 1,238,042 | | 63.35 |

| 2018 | | 4,141 | | 19,667 | | 1,301,268 | | 66.16 |

| 2019 | | 4,141 | | 19,659 | | 1,363,271 | | 69.35 |

| 2020 | | 4,141 | | 19,789 | | 1,435,839 | | 72.56 |

B-6

FIGURE 2

COMPARISON OF BASE AND SENSITIVITY CASE RESULTS, TOTAL PRICE ($2001/MWH)

B-7

TABLE 3

KEY INPUT VALUES AND ASSUMPTIONS FOR THE CAPACITY MARKET FORECAST—ECAR/MAIN

Parameter

| | Input Values

| |

|

|---|

| Demand | | Base Case | | |

| 2001 Net Peak Projection (MW) | | 157,382 | | |

| Annual Peak Growth 2001-2010 | | 1.7% | | |

| Annual Peak Growth 2011-2020 | | 1.1% | | |

| | |

| | |

| Planning Reserve Margin (%) | | | | | | | | | | |

| | | 2001-2010 | | 16.0% | | |

| | | 2011-2015 | | 15.0% | | |

| | | 2016-2020 | | 15.0% | | |

| | |

| | |

| New Power Plant Builds | | | | | | | | | | |

| | Capital Costs ($2001/kW) | | CT | | CC | | |

| | and Heat Rate (Btu/kWh) | | Cost | | Heat Rate | | Cost | | Heat Rate | | |

| | | 2001 | | 450.0 | | 10,900 | | 600.0 | | 7,000 | | |

| | | 2005 | | 350.0 | | 10,900 | | 500.0 | | 7,000 | | |

| | | 2011 | | 350.0 | | 10,200 | | 500.0 | | 6,500 | | |

| | | 2015 | | 350.0 | | 10,200 | | 500.0 | | 6,500 | | |

| | | 2020 | | 350.0 | | 10,200 | | 500.0 | | 6,500 | | |

| | Fixed O&M ($2001/kW/yr) | | 5.0 | | 15.0 | | |

| | Variable O&M ($2001/MWh) | | 5.0 | | 2.2 | | |

| | Equivalent Availability Factor (%) | | 95.0 | | 92.0 | | |

| | Equivalent Forced Outage Rate (%) | | 3.0 | | 5.0 | | |

| | |

| | | |

| | | | |

| Financial Costs for New Builds | | | | | | | | | | |

| | Debt/Equity Ratio (%) | | 50/50 | | |

| | Nominal Cost of Debt (%) | | 8.5% | | |

| | Nominal After Tax ROE (%) | | 15.0% | | |

| | Marginal Income Tax Rate (%) | | 40.7% | | |

| | Depreciation Schedule | | MACRS | | |

| | General Inflation Rate | | 2.5% | | |

| New Capacity Additions | | Projected Firm Capacity Additions Plus Additional Capacity Required to Achieve Reserve Margin | | |

| Firmly Planned Capacity Additions (MW) | | ECAR

| | MAIN

| | |

| | | 2000 | | 3,944 | | 2,830 | | |

| | | 2001 | | 4,943 | | 4,974 | | |

| | | 2002 | | 3,425 | | 2,566 | | |

| | | 2003 | | 1,657 | | 1,744 | | |

| | | 2004 | | 0 | | 76 | | |

| | |

| | | |

| | | | |

| | Total Firmly Planned Additions | | 13,969 | | 12,190 | | |

B-8

TABLE 4

KEY INPUT VALUES AND ASSSUMPTIONS FOR THE ENERGY MARKET FORECAST

| | Input Values *

|

|---|

| | 2001

| | 2005

| | 2010

| | 2015

| | 2020

|

|---|

| So. IL Delivered Natural Gas Prices ($/MMbtu) | | $ | 5.89 | | $ | 3.26 | | $ | 3.34 | | $ | 3.09 | | $ | 3.57 |

ECAR Delivered Natural Gas Prices ($/MMbtu) |

|

$ |

6.01 |

|

$ |

3.38 |

|

$ |

3.48 |

|

$ |

3.25 |

|

$ |

3.82 |

Henry Hub Delivered Natural Gas Prices ($/MMbtu) |

|

$ |

5.65 |

|

$ |

3.17 |

|

$ |

3.18 |

|

$ |

2.96 |

|

$ |

3.45 |

Delivered Oil Prices ($/MMbtu) |

|

$ |

4.25 |

|

$ |

3.22 |

|

$ |

2.55 |

|

$ |

2.87 |

|

$ |

3.38 |

Typical FOB Coal Prices ($/MMbtu) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Central Appalachia |

|

$ |

1.57 |

|

$ |

1.06 |

|

$ |

1.06 |

|

$ |

1.03 |

|

$ |

1.01 |

| |

Illinois Basin |

|

$ |

1.16 |

|

$ |

0.83 |

|

$ |

0.80 |

|

$ |

0.78 |

|

$ |

0.77 |

| |

Southern Powder River Basin |

|

$ |

0.50 |

|

$ |

0.32 |

|

$ |

0.31 |

|

$ |

0.30 |

|

$ |

0.30 |

Nuclear Retirements |

|

|

Projected 772MW in 2010; 3,709 between 2010 - 2020 due to retirement or license expiration |

Fossil Retirements |

|

|

As indicated by Form 411 submissions |

- *

- All prices expressed in constant 2001 dollars

B-9

Introduction

AmerenEnergy Generating (AEG), the non-regulated generating subsidiary of Ameren Corporation, retained Platts/RDI Consulting (RDI) to prepare this independent electricity market study of the Midwest United States, including the Mid-American Interconnected Network (MAIN) and the East Central Area Reliability council (ECAR). The purpose of this study is to assess the dispatch and potential market sales revenue of AEG's power plant portfolio in support of its generating capacity. AEG was created in May 2000 when Ameren Corp spun off its Illinois generating assets into a new power generation subsidiary. This report provides a forecast of market clearing prices for Southern Illinois, where AEG's assets are located, and also describes the key assumptions and the methodologies used in developing this forecast.

The first section of this report provides an overview of the ECAR/MAIN electricity market. The next section details the base case assumptions employed for the forecast. The third section discusses RDI's forecasting methodology. The final section summarizes the results of the study including regional price results and forecasts of unit generation and market purchases and sales.

B-10

Midwest Market Overview

This section provides an overview of the midwestern markets of MAIN and ECAR. AEG's generation is located in the MAIN region, with plants in central and southern Illinois and Missouri, close to the juncture of ECAR and the Southeast Electric Reliability Council. Because of historically heavy interconnections, power exchange, and high pricing correlation, RDI considers ECAR and MAIN to be a common market for reserve sharing purposes. The common membership of ECAR and MAIN generators and transmission owners in the Midwest Independent System Operator (MISO) further underscores the common basis of the two regions.

Midwest Supply

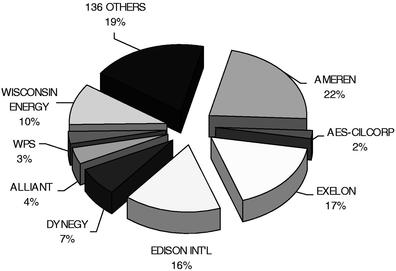

Within the MAIN region, Ameren Corp. is the largest generation provider (Figure 3). The generation assets of the former Commonwealth Edison are now split between Exelon (principally nuclear generation) and Edison Mission (most of the fossil generation). Overall, the market concentration of assets in MAIN is not high enough to permit the exercise of market power.

FIGURE 3

MAIN MARKET SHARE, 2001 (% OF TOTAL CAPACITY)

When considered together, ECAR and MAIN have several generation providers, including integrated investor-owned utilities, exempt wholesale generation companies, and nuclear generating companies (Figure 4). American Electric Power (AEP), with generation and retail operations in Ohio, West Virginia, Kentucky, Indiana, and Michigan, is the largest holder of generating assets. After AEP, 39% of the generation ownership is spread evenly among the next six owners, reflecting a low concentration of ownership for the region. The remainder is spread amongst numerous market participants.

B-11

FIGURE 4

ECAR/MAIN MARKET SHARE, 2001 (% OF TOTAL CAPACITY)

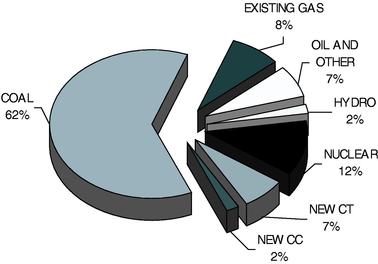

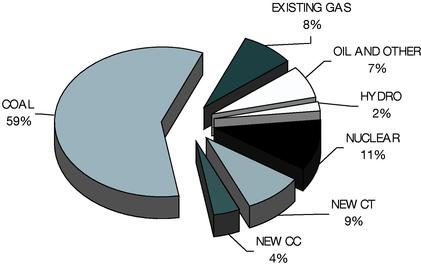

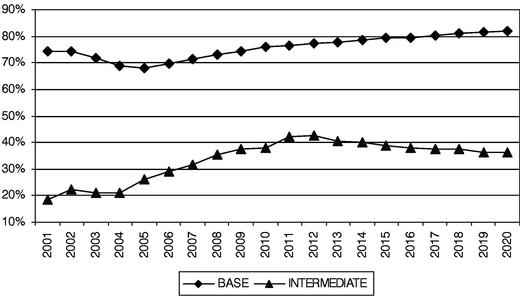

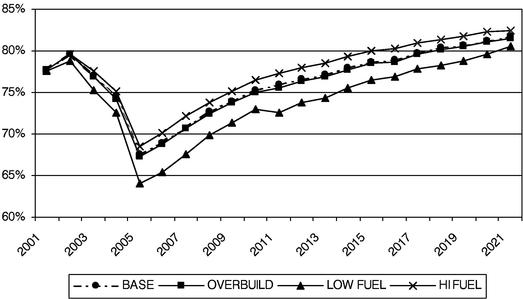

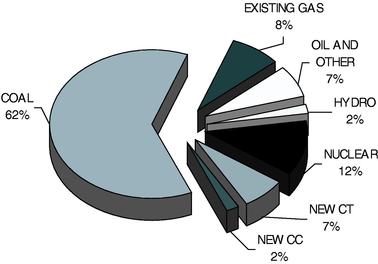

Figure 5 shows the break down of capacity by fuel type as of the summer of 2001. The "New CC" and "New CT" categories include units that came on-line in 1999 and 2000, while the "Existing Gas" category includes gas-fired generation on-line before January 1999. As illustrated in Figure 5, the total share of capacity in gas-fired generation has doubled since 1999, with much of the new capacity in peaking combustion turbines.

An important characteristic of this region is the low proportion of peaking resources, compared to other regions. Baseload and intermediate generating resources (coal, nuclear, combined cycle, and hydro) make up 78% of the region's generating mix, with peakers representing the remaining 22%.

FIGURE 5

ECAR/MAIN CAPACITY SHARE BY PLANT TYPE—2001

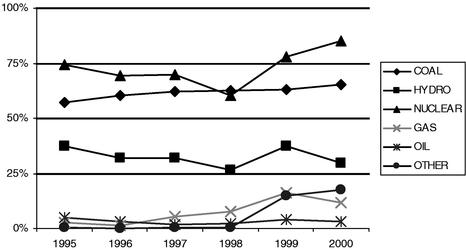

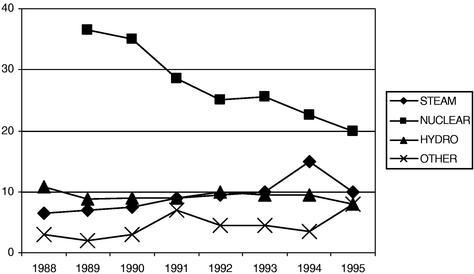

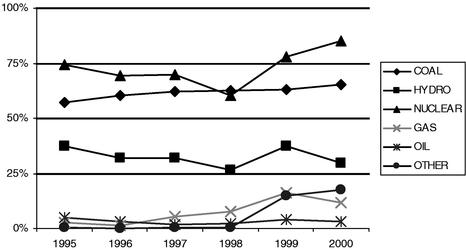

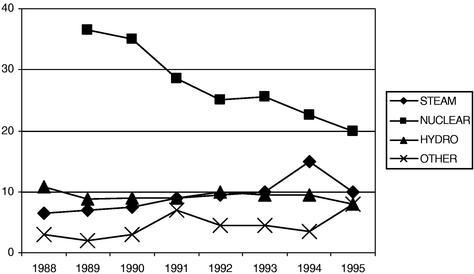

Capacity factors for plants in the Midwest have shown gradual growth over the last several years. A larger than usual amount of nuclear capacity was out of service in 1998, but nuclear utilization has increased steadily since then. Load growth has increased capacity factors of the region's coal and gas-fired generation as well. Figure 6 shows historic capacity factors for generation by fuel type.

B-12

FIGURE 6

MIDWEST CAPACITY FACTORS (1995-2000)

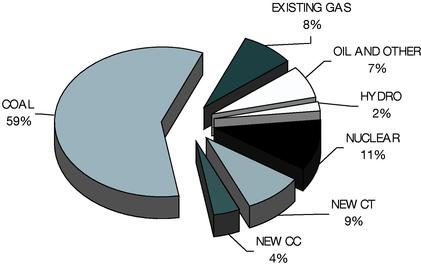

Future Supply

Between 2002 and 2004, RDI projects that more than 9,000 MW of capacity will be placed in service in ECAR and MAIN, including a mix of gas-fired combined cycle plants and combustion turbines. This infusion of capacity is expected to change the dispatch profile in the region for intermediate and peaking resources. Figure 7 shows the breakdown of capacity by fuel type in 2003. From 2001-2003, new capacity is projected to expand at a slower pace than in 1999-2001, and the new capacity is split more evenly between new combined cycle plants and combustion turbines. Overall, new gas-fired capacity is expected to expand its share from 9% of the generation mix to 13% between 2001 and 2003. The majority of the new peaking capacity is located in ECAR, while the majority of the new combined-cycle capacity is located in MAIN.

FIGURE 7

ECAR/MAIN CAPACITY SHARE BY PLANT TYPE—2003

Demand Forecast

Load growth forecasts for this study were developed from RDI's own demand forecast and the 1999 FERC Form 714. The FERC 714 report contains hourly load information. This information is utilized to simulate hourly chronological demand in IREMM.

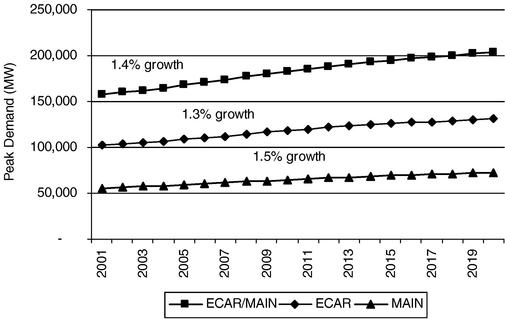

B-13

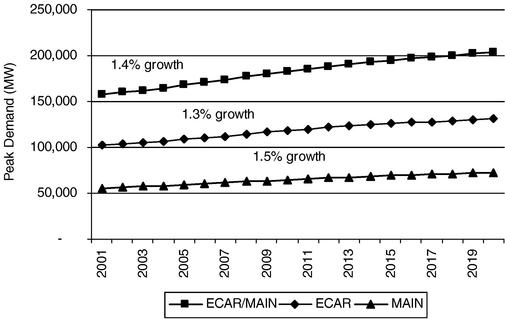

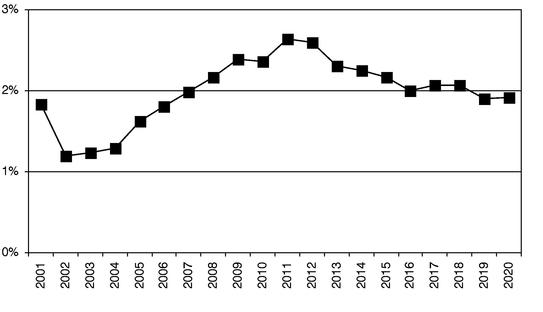

Historic and forecast regional demand growth is driven by economic and demographic factors. Figure 8 shows RDI's peak demand forecast for ECAR and MAIN combined. Factors affecting historic and forecast demand are discussed below.

States in the ECAR region made a strong recovery from the 1989-1991 recession, reflecting the recovery of the industrial base in the region, which resulted in strong growth in electricity sales. Sales grew rapidly through 1995 and slowed down somewhat through 1998. Between 1992 and 1998, Gross State Product (GSP) growth averaged 3.8% per year, equal to the national average. Population growth in ECAR has averaged 0.5% per year, roughly half the national average. Electric load growth averaged 2.4% per year (2.1% on a weather-normalized basis) during this period.

RDI forecasts electricity sales and peak demand to grow at 1.6% annually from 2001 through 2005, slightly below RDI's national average forecast of 1.8%. After 2005, sales growth is projected to moderate to 1.3% annually.

The states in the MAIN region experienced sustained economic growth in the 90s, driven primarily by continued expansion of manufacturing in Illinois and Wisconsin. Economic production, measured in terms of real dollar GSP, expanded by 3.8% annually from 1992 to 1998—slightly faster than the national average. During the same period, population growth averaged 0.7% per year, below the national average.

Between 1992 and 1998, electricity sales increased at a 3.2% annualized rate, although much of this was attributable to higher than average summer temperatures. On a weather-normalized basis, electricity sales in MAIN are estimated to have grown 2.6% on an annualized basis, close to the national average.

A projected slowdown in economic growth for the MAIN region drives electricity sales projections to slightly below U.S. averages over the forecast period. Electricity sales are projected to grow at 1.5% through the forecast period.

A small amount of the demand in each region is interruptible. RDI includes this demand in its forecast of peak demand. RDI models interruptible demand as an expensive peaking resource. That is, we represent it as actual capacity with a very high marginal cost so that this resource would be dispatched only during the highest peak demand conditions to reflect the manner in which interruptible resources are used and how they contribute to regional reserves.

B-14

FIGURE 8

ECAR/MAIN FORECAST PEAK DEMAND GROWTH (2000-2015)

Transmission Capacity and Pricing

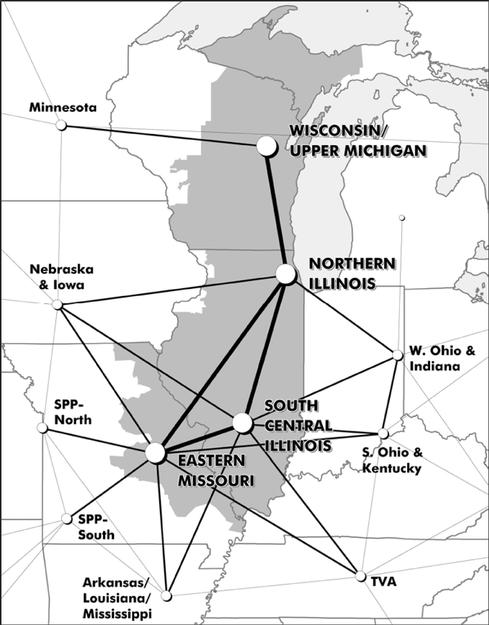

The transmission system of MAIN and ECAR is centrally located amongst many interconnection points with other reliability councils, owing to AEP's efforts to interconnect its five-state system of generation and loads. ECAR is the only region in the U.S. with significant transmission mileage at 765 kV.

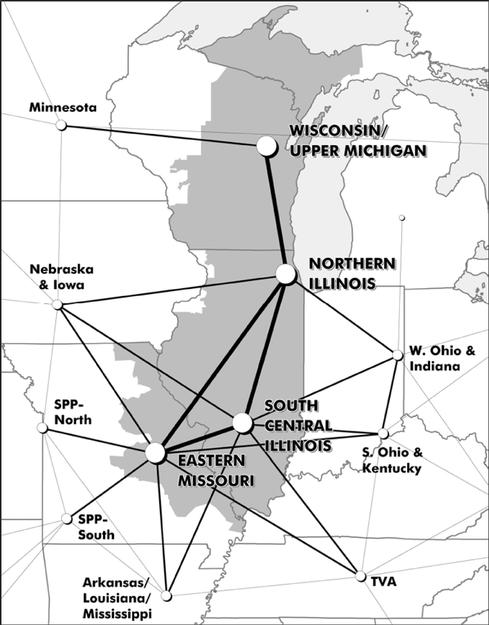

Figure 9 shows a general schematic of transmission paths between MAIN and surrounding areas. As shown in Figure 9, MAIN has strong interconnections with ECAR to the east and SERC (Entergy and TVA to the south, with lesser interconnections going west.(1) Transmission transfer capabilities directly affecting the MAIN region include the following:

- •

- MAIN to ECAR: 4,000 MW (Reverse 3,800 MW)

- •

- MAIN to Entergy: 3,000 MW (Reverse 650 MW)

- •

- MAIN to SPP: 900 MW (Reverse 2,300 MW)

- •

- MAIN to TVA: 2,300 MW (Reverse 1,800 MW)

- (1)

- Figure 9 does not reflect the recent switch in membership of Alliant-West from the MAPP reliability council to the MAIN reliability council. Load and capacity balances presented in this study account for the change in membership.

B-15

FIGURE 9

MAIN TRANSMISSION INTERCONNECTIONS

Based on analysis of Open Access Same-time Information System (OASIS) data, RDI assumes that transmission tariffs for spot transactions will be set at $2.50 per MWh. This amount is assigned to each utility market area to reflect the cost of transferring power over multiple systems during those times when power cost differentials make such transfers attractive.

The presence of transmission system coordination via a Regional Transmission Organization (RTO) or an Independent System Operator (ISO) could change the dynamics of transmission wheeling charges by eliminating system-by-system wheeling.

Industry Restructuring in MAIN and ECAR

Industry restructuring is proceeding on several fronts in both the federal and state arenas. This section first discusses restructuring initiatives at the state level, and then discusses key federal initiatives.

B-16

State Restructuring Initiatives

Several states in the Midwest U.S. have actively restructured their electricity markets. Major restructuring initiatives include the following:

- •

- Michigan enacted restructuring legislation in June 2000 after several years of controversy. The Michigan Public Service Commission (PSC) had previously attempted to order restructuring, but was determined by the state Supreme Court in June 1999 to lack authority in this area. Detroit Edison and Consumers Power then began to phase in retail competition on a voluntary basis. Legislation called for IOUs and cooperatives with peak loads of 1 MW or more to offer retail choice starting January 2002. Nine regulatory orders took effect January 1, 2002 to protect customers, adopt reliability and accounting standards, protects and determine net stranded costs unilaterally, in addition to other related regulatory issues.

- •

- Ohio has moved ahead with plans to begin retail competition for all IOU customers in January 2001, pursuant to legislation enacted in 1999. In October 2000 the Public Utility Commission of Ohio (PUCO) completed its process of reviewing utilities' transition plans and approving settlements in their transition cases. Utilities are supposed to ensure that at least 20 percent of their distribution-service customers are served by competitive suppliers (including utility affiliates) by the end of the transition period ending in 2005.

- •

- West Virginia is reconsidering its prior support of electric restructuring. In March 2000 the legislature adopted a resolution accepting a restructuring plan proposed by the West Virginia Public Service Commission (PSC). The plan incorporates a four-year rate freeze. Details are being worked out in PSC rulemakings. Higher prices in other restructured states, particularly California and Montana, have given lawmakers misgivings about moving ahead with restructuring. The legislature must pass a resolution giving final approval to any restructuring plan adopted by the PSC. The details of the plan have not been finalized, and the legislature has not yet voted on it, meaning the advent of restructured deregulation in West Virginia will be delayed or possibly negated.

- •

- Illinois enacted restructuring legislation in late 1997. The phase-in of retail competition among IOUs started with large commercial and industrial customers in October 1999, and runs until May 2002, when competition extends to residential customers. Municipals and cooperatives can opt-in to competition. Early data indicate that statewide, a little over 3% of industrial customers have switched away from their traditional retail suppliers.

- •

- Wisconsin has taken some steps to restructure the electric industry, but so far has not elected to pursue retail competition. In 1997 the state's Public Service Commission determined that action on retail competition should be deferred in favor of concentrating on transmission and reliability issues. The state's budget bill, passed in October 1999, included several electric industry provisions, including a requirement that utility transmission assets be transferred to an independent transmission company, and funding for a study of market power issues.

Federal Restructuring Initiatives

Several transmission-owning utilities within ECAR and MAIN are members of the Midwest Independent System Operator (ISO), formed in 1996. The Midwest ISO is expected to be the nation's largest ISO. Market trials of its systems began in August 2001.

Also pertinent to ECAR is the proposed Alliance Regional Transmission Organization (RTO), a for-profit group being formed by Consumers Energy, Detroit Edison, FirstEnergy, Illinois Power (which has been a member of the Midwest ISO), and Virginia Power. RDI expects that a unified Midwest market will broaden the reach of low-cost generators such as AEG's coal-fired plants. Reduced costs of

B-17

electricity transfers may also favor gas-fired generation in Illinois, which has historically enjoyed lower delivered gas costs than similar plants in Indiana, Michigan, and Ohio.

Historic Pricing In Midwest U.S. Markets

Table 5 shows monthly average on-peak prices for two regional electricity hubs nearest AEG. Table 5 illustrates the convergence in pricing between the two hubs that has occurred. The summer time price spikes experienced at Cinergy in 1998-1999 reflected abnormal weather, generation outages, and fragmented transmission system operation. Prices into Ameren, while affected by the spike, were significantly lower than Cinergy. Summertime prices in 2000 in Cinergy moderated significantly because of new capacity construction cited previously. An uptick in natural gas prices toward the end of the year drove up on-peak power prices to the point where annual average prices finished higher than the previous year. From 1999 through 2001, prices into Ameren were very similar to prices at Cinergy.

TABLE 5

MONTHLY WHOLESALE ON-PEAK ELECTRICITY PRICES IN ECAR AND MAIN ($/MWH):

1998-PRESENT

| | AMEREN

| | CINERGY

|

|---|

MONTH

|

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 1998

| | 1999

| | 2000

| | 2001

|

|---|

| JAN | | N/A | | 22.63 | | 25.65 | | 46.44 | | 17.02 | | 21.02 | | 26.33 | | 46.49 |

| FEB | | 17.00 | | 18.69 | | 24.85 | | 36.65 | | 16.20 | | 17.62 | | 22.78 | | 36.19 |

| MAR | | 25.68 | | 20.44 | | 25.67 | | 39.15 | | 23.21 | | 20.14 | | 23.62 | | 40.03 |

| APR | | 23.75 | | 29.00 | | 30.09 | | 46.61 | | 20.98 | | 24.67 | | 27.06 | | 47.98 |

| MAY | | N/A | | 24.60 | | 45.87 | | 35.69 | | 43.67 | | 22.70 | | 40.38 | | 35.17 |

| JUN | | 127.11 | | 42.22 | | 37.84 | | 33.42 | | 243.73 | | 51.12 | | 37.65 | | 36.56 |

| JUL | | 53.67 | | 245.51 | | 44.55 | | 41.37 | | 114.66 | | 245.37 | | 37.45 | | 40.85 |

| AUG | | 33.00 | | 73.25 | | 57.76 | | 48.04 | | 36.24 | | 63.73 | | 43.35 | | 46.83 |

| SEP | | 35.73 | | 21.36 | | 31.20 | | 22.59 | | 31.10 | | 19.58 | | 23.10 | | 22.92 |

| OCT | | 20.00 | | 21.26 | | 34.84 | | 23.14 | | 19.54 | | 20.98 | | 30.67 | | 22.57 |

| NOV | | 21.73 | | 21.71 | | 40.44 | | 21.43 | | 19.39 | | 19.42 | | 47.15 | | 22.72 |

| DEC | | 21.17 | | 21.84 | | 69.29 | | 19.08 | | 18.91 | | 19.28 | | 68.78 | | 19.00 |

| | |

| |

| |

| |

| |

| |

| |

| |

|

| DAILY AVERAGE | | 32.08 | | 46.85 | | 59.26 | | 34.49 | | 51.88 | | 45.58 | | 58.89 | | 33.86 |

B-18

Base Case Assumptions

This section provides a detailed accounting of the factors driving the base case forecast. While RDI models the entire Eastern Interconnect, this section will focus on assumptions relating to the ECAR/MAIN regions.

Existing Supply

The supply curves constructed by RDI for this analysis were built on a unit-by-unit basis. The unit data used are based on the annual EIA-411 reports supplied to the Department of Energy via the regional councils of the North American Electric Reliability Council (NERC), and from RDI's proprietary databases. RDI also verified the EIA-411 report by utilizing integrated resource plans and RDI's internal databases. Key assumptions relating to generating units were as follows:

Unit Ratings The EIA-411 report was used to determine the summer and winter capacity ratings of each unit on the grid.

Primary and Alternate Fuel Types For non-coal burning plants, RDI determined each type of fuel that can be used at a generating unit from EIA-411 reports. Each month the relative price of alternate fuels is compared to the primary fuel and the least expensive fuel is selected. Coal fired plants are treated separately and are discussed later in the report.

Availability The availability statistics for all non-nuclear units were obtained from aggregate NERC/GADS statistics by prime mover type. The equivalent availability factor (EAF)(2) and the equivalent forced outage rate (EFOR)(3) were used to calculate the scheduled outage factor (SOF) to determine the maintenance period for each unit. Regional average availability factors and forced outage rates are shown in Table 6 for 1995-1999. Availability statistics for nuclear units are based on an engineering and statistical analysis performed by RDI.

- (2)

- EAF is the percentage of hours in the year that a unit is available to operate whether or not it is actually dispatched.

- (3)

- EFOR is the percentage of hours in the year in which a plant will incur an unplanned outage.

TABLE 6

FIVE YEAR AVERAGE AVAILABILITY STATISTICS (1995-1999)

TECHNOLOGY

| | EAF

| | EFOR

| |

|---|

| STEAM TURBINES | | 82 | % | 8 | % |

| GAS TURBINES | | 85 | % | 10 | % |

Heat Rates Heat rate information was obtained from RDI's POWERdat information system, based on a combination of EIA-411 and EIA-860 information.

Non-Fuel Variable O&M Variable O&M costs affect the dispatch price of individual units. Variable O&M calculations vary across utilities. It is RDI's opinion that this variation occurs primarily because utilities have never had profit incentives that motivate them to fully understand their cost structure. A few utilities do not include a variable O&M adder in dispatch decisions. One RDI client assumes that 20% of its total non-fuel O&M is variable. Another client uses a variable O&M of $1/MWh at one coal-fired power plant and $2/MWh at another coal fired power plant because the second plant must pay the local water utility for its water supplies. This same client dispatches its gas turbine assuming a variable O&M of $3/MWh.

RDI assumed that a $1.80/MWh variable O&M dispatch cost for coal-fired capacity. For other existing plants, RDI assumed that 20% of each unit's historical operating costs—less land leasing costs

B-19

and allowances—were variable. A two-year average for 1998 to 1999 was employed to determine historical operating costs. For existing peaking units, RDI assumed an additional $5.00/MWh charge to capture start-up costs upon dispatch.

For new units, RDI assumed a variable O&M of $1.80/MWh for new coal-fired plants, $2.20/MWh for all new combined cycle units, and $5.00/MWh for all new simple-cycle peaking turbines. The higher O&M cost for peaking turbines is intended to reflect the additional start-up costs such units typically incur. Units with scrubbers are assigned an additional $1/MWh charge based on information reported in the EIA-767 form by utilities.

Fixed O&M Fixed O&M calculations for individual plants were based on data filed with the Energy Information Administration. For each plant and prime mover type, the fixed O&M was calculated as follows:

Fixed O&M = Total Non-Fuel O&M less (Assumed Variable O&M ($/MWh) × Generation (MWh))

If power plant land leasing costs were greater than 20% of total non-fuel O&M, then power plant rents were subtracted from total non-fuel O&M for purposes of calculating fixed O&M. In many instances, sale-leaseback expenses are reported as an operating cost associated with the plant. Because these expenses would have to be paid whether or not the plant is shutdown, it is not appropriate to consider these expenses when analyzing a plant's cash costs. Also, since there can be significant year to year swings in O&M expenses due to major overhauls or other major non-recurring costs, RDI averaged fixed O&M expenses from 1998 and 1999.

The above approach was used to estimate fixed O&M expenses for all utility owned generation. However, actual power plant O&M cost information is not publicly available for non-utility owned plants. For non-utility coal units, it is assumed that fixed O&M expenses equal $20/kW-year. For non-utility gas plants, it is assumed that fixed O&M expenses equal $5/kW-year for peaking plants and $15/kW-yr for combined-cycle plants. These assumptions are based on RDI's prior engagements with power plant developers. For non-utility units that have contracts guaranteeing a fixed price for their output, it was not necessary to make any assumptions regarding fixed O&M.

Replacement Capital Costs Since generating assets are assumed to maintain operations over the forecast horizon (unless it is uneconomic to do so), it is also assumed that replacement capital would have to be invested to keep the plant in service. It is also necessary to include replacement capital costs in the model because many utilities account for operating expenses as capital expenses to increase their rate base. The cost of replacement capital in this analysis is based on the historic information and trends shown in Figure 10. It is largely consistent with replacement cost information presented in numerous utility Integrated Resource Plans as well.

B-20

FIGURE 10

UTILITY ANNUAL CAPITAL ADDITIONS ($/KW-YR)

New Generation

In the past two years, MAIN and ECAR have seen a significant number of new capacity projects announced. Except for those announced new power projects that RDI considers very likely to be seen to completion, IREMM adds new capacity only as it is economically justified.(4) For this analysis RDI explicitly modeled projects which were under construction as of the start of the study, or if there were other strong indications that a project was likely to come on line by June of 2004. Such indicators may include the existence of fuel supply, or a power off-take contract; an announcement that the project has been financed; or an assessment of the developer's track record for seeing projects to fruition.

- (4)

- Given the regional capacity balances, the first year of automatic additions in ECAR/MAIN is 2005.

Table 7 through Table 10 shows the list of projects explicitly modeled by RDI in the base case analysis in ECAR and MAIN. Negative capacity amounts shown in these tables reflect conversions from simple cycle to combined cycle facilities. Essentially, the CT is "retired" and the "new" combined cycle is simultaneously brought on-line. The capacity listed for the combined cycle phase of the project represents the total capacity at the plant after the conversion. Altogether, RDI projects that over 26,000 MW of new capacity will be placed in service in ECAR/MAIN between 2000-2004.

As discussed above, the projects listed in Table 7 through Table 10 represent the projects that as of July 2001 were deemed likely to be brought on-line. An additional 82,000 MW of capacity has been proposed for construction in ECAR and MAIN. However, it is implicit in this analysis that developers will recognize the potential for over-supply in the region and will curtail project development unless the regional supply/demand mix indicates new capacity will be required and developers can earn an adequate return on investment. Over the course of the forecast (2001-2020), RDI projects that over 66,000 MW will be required in ECAR and MAIN.

B-21

TABLE 7

ASSUMED NEW CAPACITY ADDITIONS IN ECAR (RECENTLY OPERATING)—1999-2001

NAME

| | ST

| | PRIME MOVER

| | CAPACITY

MW

| | RDI ONLINE

DATE

| | NEWGen

PROJECT

STATUS

|

|---|

| AES Warrior Run | | MD | | Coal Boiler/Cogen | | 180 | | Feb-00 | | Operating |

| Allegheny Energy Supply/Springdale | | PA | | Combust Turb | | 88 | | Dec-99 | | Operating |

| American Municipal Power/Belleville | | WV | | Hydro | | 42 | | Jul-99 | | Operating |

| American Municipal Power/Bowling Green | | OH | | Combust Turb | | 32 | | Jul-00 | | Operating |

| American Municipal Power/Hamilton | | OH | | Combust Turb | | 32 | | Jul-00 | | Operating |

| American Municipal Power/Ohio | | OH | | Combust Turb | | 38 | | Jul-00 | | Operating |

| Appalachian Power/Smith Mountain | | VA | | Hydro | | 36 | | Jan-00 | | Operating |

| APS/Fayette | | PA | | Combust Turb | | 88 | | Aug-00 | | Operating |

| Catamount Energy/Gauley River | | WV | | Hydro | | 80 | | Apr-01 | | Operating |

| Cinergy/Madison | | OH | | Combust Turb | | 640 | | Jun-00 | | Operating |

| Cinergy/Vermillion | | IN | | Combust Turb | | 640 | | Jun-00 | | Operating |

| CMS Generation Co. | | MI | | Combust Turb | | 136 | | Jun-99 | | Operating |

| CMS Generation/Kalamazoo River | | MI | | Combust Turb | | 63 | | Jun-99 | | Operating |

| CMS/Dearborn | | MI | | Combust Turb | | 38 | | Jun-02 | | Operating |

| CMS/Zilwaukee | | MI | | Combust Turb | | 41 | | May-00 | | Operating |

| Constellation Power/Wayne County | | WV | | Combust Turb | | 300 | | May-01 | | Operating |

| Constellation Power/Wolf Hills | | VA | | Combust Turb | | 250 | | Jun-01 | | Operating |

| Dearborn Industrial Generation | | MI | | CT/Cogen | | 160 | | Jul-99 | | Operating |

| Detroit Edison/Belle River | | MI | | Combust Turb | | 216 | | Jul-99 | | Operating |

| Detroit Edison/Greenwood | | MI | | Combust Turb | | 226 | | Jun-99 | | Operating |

| Detroit Edison/River Rouge | | MI | | CT/Cogen | | 260 | | Jun-00 | | Operating |

| DPL Energy/Chester Township | | IN | | Combust Turb | | 200 | | Jun-01 | | Operating |

| DPL Energy/Darby | | OH | | Combust Turb | | 320 | | Jun-01 | | Operating |

| DPL Energy/Greenville | | OH | | Combust Turb | | 200 | | Jul-00 | | Operating |

| Energy Developments/Model Landfill | | OH | | Combust Turb | | 4 | | Jun-01 | | Operating |

| Energy Developments/Ottawa Landfill | | OH | | Combust Turb | | 3 | | Jun-01 | | Operating |

| Enron/West Fork | | IN | | Combust Turb | | 540 | | Jul-00 | | Operating |

| FirstEnergy/Perry | | OH | | Nuclear | | 35 | | Jul-00 | | Operating |

| FirstEnergy/Perry | | OH | | Nuclear | | 25 | | Mar-01 | | Operating |

| Holland/491 E. 48th Steet | | MI | | Combust Turb | | 80 | | Jun-00 | | Operating |

| Indianapolis Power & Light/Georgetown | | IN | | Combust Turb | | 264 | | Jun-00 | | Operating |

| Indianapolis Power & Light/Georgetown | | IN | | Combust Turb | | 80 | | Jun-01 | | Operating |

| Kentucky Utilities Co. | | KY | | Combust Turb | | 75 | | Jun-00 | | Operating |

| Kentucky Utilities Co./Brown | | KY | | Combust Turb | | 133 | | Jul-01 | | Operating |

| Kentucky Utilities/Brown | | KY | | Combust Turb | | 328 | | Aug-99 | | Operating |

| Mirant/Zeeland | | MI | | Combust Turb | | 300 | | Jun-01 | | Operating |

| Ohio Edison/Burger | | OH | | Coal Boiler | | 94 | | May-99 | | Operating |

| Ohio Edison/West Lorain | | OH | | Combust Turb | | 120 | | May-99 | | Operating |

| Ohio Edison/West Lorain | | OH | | Combust Turb | | 425 | | Jun-01 | | Operating |

| Orion Power/Ceredo | | WV | | Combust Turb | | 510 | | Jun-01 | | Operating |

| PG&E Generating/Bowling Green | | OH | | Combust Turb | | 50 | | Nov-00 | | Operating |

| PG&E Generating/Galion | | OH | | Combust Turb | | 50 | | Nov-00 | | Operating |

| PG&E Generating/Napoleon | | OH | | Combust Turb | | 50 | | Aug-00 | | Operating |

| PG&E Generating/Napoleon | | OH | | Combust Turb | | 45 | | Nov-00 | | Operating |

| Riverside Generating/Riverside | | KY | | Combust Turb | | 560 | | Aug-01 | | Operating |

| Toledo Edison/Richland Peaking | | OH | | Combust Turb | | 390 | | Nov-00 | | Operating |

| Trigen-Cinergy/Ashtabula | | OH | | CT/Cogen | | 28 | | Feb-01 | | Operating |

| Trigen-Cinergy/Lafarge Gypsum | | KY | | CT/Cogen | | 5 | | Apr-01 | | Operating |

| Williams Energy/Worthington | | IN | | Combust Turb | | 180 | | Jun-00 | | Operating |

|

| RECENTLY OPERATING CAPACITY (MW): | | 8,678 | | | | |

|

B-22

TABLE 8

ASSUMED NEW CAPACITY ADDITIONS IN ECAR (UNDER CONSTRUCTION AND ADV. DEVELOPMENT)—2001-2004

NAME

| | ST

| | PRIME MOVER

| | CAPACITY

MW

| | RDI ONLINE

DATE

| | NEWGen

PROJECT

STATUS

|

|---|

| Atlantic Renewable Energy/Tucker County Wind | | WV | | Wind Turb | | 21 | | Jan-02 | | Advan Develop |

| Dayton Power & Light/Tait | | OH | | Combust Turb | | 320 | | Dec-01 | | Advan Develop |

| Decker Energy/Carson City | | MI | | Combust Turb | | 510 | | Jun-02 | | Advan Develop |

| Decker Energy/St. Clair County | | MI | | Comb Cycle | | 510 | | Jan-03 | | Advan Develop |

| AEP/Van Wert County | | OH | | Combust Turb | | 510 | | Jun-02 | | Under Constr |

| Allegheny Energy Supply/Springdale | | PA | | Comb Cycle | | 540 | | Jan-03 | | Under Constr |

| Dearborn Industrial Generation | | MI | | CC/Cogen | | 550 | | Jun-01 | | Under Constr |

| Dominion Energy/Pleasants County | | WV | | Combust Turb | | 340 | | Jun-02 | | Under Constr |

| DPL Energy/Darby | | OH | | Combust Turb | | 160 | | Jun-01 | | Under Constr |

| Dresden Energy/Muskingum County | | OH | | Comb Cycle | | 607 | | Jun-03 | | Under Constr |

| Duke Energy Washington, L.L.C. | | OH | | Comb Cycle | | 620 | | Jun-02 | | Under Constr |

| Dynegy/Bluegrass | | KY | | Combust Turb | | 372 | | Jun-02 | | Under Constr |

| East Kentucky Power/J.K. Smith | | KY | | Combust Turb | | 80 | | Jun-01 | | Under Constr |

| Kinder Morgan Power/Jackson | | MI | | CC/Duct | | 414 | | Jun-02 | | Under Constr |

| Mill Run Windpower | | PA | | Wind Turb | | 15 | | Sep-01 | | Under Constr |

| Primary Energy/Indiana Harbor | | IN | | CT/Cogen | | 50 | | Sep-01 | | Under Constr |

| Primary Energy/Whiting Refinery | | IN | | CC/Cogen | | 545 | | Jun-01 | | Under Constr |

| Troy Energy/Wood County | | OH | | Combust Turb | | 600 | | Jun-02 | | Under Constr |

|

| ADVANCED DEVELOPMENT AND UNDER CONSTRUCTION: | | 6,764 | | | | |

|

B-23

TABLE 9

ASSUMED NEW CAPACITY ADDITIONS IN MAIN (RECENTLY OPERATING)—1999-2001

NAME

| | ST

| | PRIME MOVER

| | CAPACITY

MW

| | RDI ONLINE

DATE

| | NEWGen

PROJECT

STATUS

|

|---|

| Ameren/Gibson | | IL | | Combust Turb | | 113 | | Jun-00 | | Operating |

| Ameren/Gibson | | IL | | Combust Turb | | 113 | | Jul-00 | | Operating |

| Ameren/Grand Tower | | IL | | CC/Duct | | 519 | | Jul-01 | | Operating |

| Ameren/Grand Tower | | IL | | Coal Boiler | | -190 | | Jan-01 | | Operating |

| Ameren/Kinmundy | | IL | | Combust Turb | | 117 | | May-01 | | Operating |

| Ameren/Kinmundy | | IL | | Combust Turb | | 117 | | Jun-01 | | Operating |

| Ameren/Pinckneyville | | IL | | Combust Turb | | 89 | | Jun-00 | | Operating |

| Ameren/Pinckneyville | | IL | | Combust Turb | | 89 | | Jun-00 | | Operating |

| Ameren/Pinckneyville | | IL | | Combust Turb | | 108 | | Jul-01 | | Operating |

| Ameren/Pinckneyville | | IL | | Combust Turb | | 36 | | Jul-01 | | Operating |

| AmerenUE/Meramec | | MO | | Combust Turb | | 48 | | Jun-00 | | Operating |

| Calpine/De Pere Energy | | WI | | Combust Turb | | 179 | | Jun-99 | | Operating |

| CILCO/AES Medina Valley | | IL | | CC/Duct/Cogen | | 45 | | Jun-01 | | Operating |

| CogenAmerica/Morris | | IL | | CC/Cogen | | 155 | | Mar-00 | | Operating |

| Commonwealth Edison/La Salle | | IL | | Nuclear | | 50 | | Jun-00 | | Operating |

| Duke Energy/Audrain | | MO | | Combust Turb | | 640 | | Jun-01 | | Operating |

| Duke Energy/Lee | | IL | | Combust Turb | | 640 | | Jun-01 | | Operating |

| Dynegy/Rocky Road Power | | IL | | Combust Turb | | 250 | | Jun-99 | | Operating |

| Dynegy/Rocky Road Power | | IL | | Combust Turb | | 100 | | Jul-00 | | Operating |

| Electric Energy/Joppa | | IL | | Combust Turb | | 155 | | Aug-00 | | Operating |

| Elwood Energy | | IL | | Combust Turb | | 750 | | Jun-01 | | Operating |

| Elwood Energy | | IL | | Combust Turb | | 600 | | Jul-99 | | Operating |

| Enron/Lincoln Energy Center | | IL | | Combust Turb | | 664 | | Jun-00 | | Operating |

| Illinova/Havana | | IL | | Other Boiler | | 238 | | Jun-99 | | Operating |

| Illinova/Tilton | | IL | | Combust Turb | | 176 | | Jun-99 | | Operating |

| Indeck/Rockford | | IL | | Combust Turb | | 300 | | Jun-00 | | Operating |

| Madison Gas & Electric/Rosiere Wind | | WI | | Wind Turb | | 3 | | Jun-99 | | Operating |

| Madison Gas & Electric/West Marinette | | WI | | Combust Turb | | 83 | | Jun-00 | | Operating |

| MidAmerican Energy/Cordova | | IL | | Comb Cycle | | 537 | | Jun-01 | | Operating |

| Mirant/SEI Wisconsin | | WI | | Combust Turb | | 300 | | May-00 | | Operating |

| Reliant/Shelby County | | IL | | Combust Turb | | 340 | | Jul-00 | | Operating |

| SkyGen/Rockgen Energy | | WI | | Combust Turb | | 510 | | Jun-01 | | Operating |

| Southwestern Electric/St. Elmo | | IL | | Combust Turb | | 45 | | Jun-00 | | Operating |

| Soyland/Alsey | | IL | | Combust Turb | | 92 | | Aug-99 | | Operating |

| Soyland/Alsey | | IL | | Combust Turb | | 21 | | Jun-00 | | Operating |

| Trigen-Cinergy/Tuscola | | IL | | Coal Boiler/Cogen | | 6 | | Dec-99 | | Operating |

| Trigen-St. Louis Energy/St. Louis Cogen | | MO | | CT/Cogen | | 15 | | Jun-99 | | Operating |

| Unicom/McDonalds | | IL | | Combust Turb | | 0 | | Jun-99 | | Operating |

| University Park/Chicago (Conpow) | | IL | | Combust Turb | | 300 | | Jun-01 | | Operating |

| Wisconsin Electric/Fond Du Lac Wind | | WI | | Wind Turb | | 0.3 | | Jun-99 | | Operating |

| Wisconsin Electric/Germantown | | WI | | Combust Turb | | 85 | | May-00 | | Operating |

| Wisconsin Electric/Germantown | | WI | | Other | | 50 | | Aug-00 | | Operating |

| WPS/Kewaunee | | WI | | Nuclear | | 30 | | Jan-00 | | Operating |

| WPS/Lincoln Turbines | | WI | | Wind Turb | | 3 | | Jun-99 | | Operating |

|

| RECENTLY OPERATING CAPACITY (MW): | | 8,521 | | | | |

|

B-24

TABLE 10

ASSUMED NEW CAPACITY ADDITIONS IN MAIN (UNDER CONSTRUCTION AND ADV. DEVELOPMENT)—2001-2004

NAME

| | ST

| | PRIME MOVER

| | CAPACITY

MW

| | RDI ONLINE

DATE

| | NEWGen

PROJECT

STATUS

|

|---|

| Alliant/Amerhest Digester | | WI | | Combust Turb | | 0.2 | | Jun-01 | | Under Constr |

| Ameren/Grand Tower | | IL | | CC/Duct | | 290 | | Jun-01 | | Under Constr |

| Ameren/Grand Tower | | IL | | Coal Boiler | | -100 | | Jun-01 | | Under Constr |

| Calumet/Cook County | | IL | | Combust Turb | | 300 | | Jun-01 | | Under Constr |

| FPL Energy/Iowa Co. Wind Farm | | WI | | Wind Turb | | 9 | | Apr-01 | | Under Constr |

| Holland Energy | | IL | | CC/Duct | | 665 | | Jun-02 | | Under Constr |

| NRG Energy/Kendall County | | IL | | Comb Cycle | | 1,100 | | May-02 | | Under Constr |

| Reliant/Aurora | | IL | | Combust Turb | | 270 | | Jun-01 | | Under Constr |

| University of Missouri | | MO | | Combust Turb | | 26 | | Dec-01 | | Under Constr |

| Badger Generating | | WI | | Comb Cycle | | 1,080 | | Jan-03 | | Advan Develop |

| Calpine/De Pere Energy | | WI | | Combust Turb | | -179 | | Jan-04 | | Advan Develop |

| Calpine/De Pere Energy | | WI | | CC/Cogen | | 255 | | Jan-04 | | Advan Develop |

| Commonwealth Edison/La Salle | | IL | | Nuclear | | 50 | | Jun-01 | | Advan Develop |

| Enron/Great Plains | | IL | | Combust Turb | | 664 | | Apr-03 | | Advan Develop |

| Microgy Cogeneration/Shawano | | WI | | Waste | | 1 | | Mar-02 | | Advan Develop |

| Zion Energy | | IL | | Combust Turb | | 800 | | Jun-02 | | Advan Develop |

|

| ADVANCED DEVELOPMENT AND UNDER CONSTRUCTION: | | 5,231 | | | | |

|

Cost of New Generation Technologies

Assumptions for the cost and operating parameters of new generation technologies have been developed throughout RDI's work with other developers and through the review of publicly available documents related to new power plant construction. These assumptions are shown in Table 11.

Table 11 shows declining costs for gas turbines from 2001-2005. This reflects a shortage of turbines and peak delivery of new turbines during 2001-2002. Developers currently looking to build should see prices similar to 1999-2000 levels. This is substantiated by the unwillingness of General Electric or Siemens Westinghouse to expand their turbine manufacturing capacity despite current shortages. Both expect an easing of orders and perceive excess capacity as a greater risk than lost sales opportunities.

Turbine technology has made substantial technological progress in the last five years—increasing efficiencies for both simple cycle combustion turbines (CT) and combined cycle (CC) facilities. However, because turbine technology is already highly sophisticated, RDI does not expect major improvements in heat rates or efficiencies in the future. Still, RDI's base case assumes that by 2011 new vintage turbines will be available. These turbines are assumed to have a 6.5% efficiency improvement over current vintage CT's, and 7.2% improvement over current vintage CC's.

RDI also assumes the cost of building new capacity remains constant in real terms during each year of the forecast.

B-25

TABLE 11

COST OF NEW TECHNOLOGIES ($2001)

ASSUMPTION

| | COMBINED

CYCLE

| | COMBUSTION

TURBINE

| | ADVANCED

CC

| | ADVANCED

CT

|

|---|

| Initial Capital Cost $/kW | | 600 - 500 (2005 | ) | 450 - 350 (2005 | ) | 500 | | 350 |

| Construction Period | | 2 Years | | 1.5 Years | | 2 Years | | 1.5 Years |

| Availability Factor | | 92% | | 95% | | 92% | | 95% |

| Heat Rate | | 7,000 | | 10,900 | | 6,500 | | 10,200 |

| Variable O&M | | 2.20 | | 5.00 | | 1.20 | | 5.00 |

| Fixed O&M $/kW-yr | | 15.00 | | 5.00 | | 20.00 | | 5.00 |

- *

- Variable O&M for combustion turbines consists primarily of start-up costs.

Other financial assumptions are as follows:

- •

- Debt Financing: 50%

- •

- Pre-Tax Cost of Debt: 8.5%

- •

- Cost of Equity: 15%

- •

- General Inflation: 2.5%

- •

- Marginal Income Tax Rate: 40.7%

- •

- Depreciation Schedule (20 years): MACRS

Nuclear Generation

Operating licenses for nuclear plants in the U.S. will begin to expire in 2010. The Nuclear Regulatory Commission (NRC) will have to consider whether or not to extend the 40-year operating licenses of its reactors. Constellation Energy—formerly Baltimore Gas and Electric—was the first nuclear operator to be granted a license extension, for its Calvert Cliffs nuclear station.7 Other nuclear operators are carefully watching the re-licensing process. It is estimated that for as little as $10-50/kW a nuclear plant can be upgraded to operate 20 years beyond its current 40-year licensing period. In fact, Constellation estimated the final cost of the Calvert Cliffs re-licensing at $11/kW. The construction of new baseload capacity could not even be conceived at this price. RDI therefore expects that there will be substantial pressure on the NRC to re-license nuclear plants in the coming years. In ECAR, two nuclear plants have announced their intention to seek license extensions: Beaver Valley and Donald C. Cook. RDI believes 20-year extensions will be granted in each case, pushing their potential retirement dates beyond 2030.

Ontario Power Generation (OPG) has embarked on a program to restart its operationally troubled CANDU nuclear reactors at the Bruce and Pickering stations. The restart process for Pickering is underway, with the first 514 MW unit scheduled for December 2001. OPG intends to bring up the remaining 3 units in six-month stages thereafter, beginning August 2002. RDI's forecast assumes the Bruce restart will be delayed until 2004-2005.

Demand Forecast

The previous section of the report summarizes the primary drivers of demand growth for the region. Table 12 shows historic and forecast peak demand for ECAR/MAIN.

- (5)

- Energy Insight, "20,000 MW of Nuke Capacity Likely to Seek License Extensions", December 1, 1999.

B-26

TABLE 12

ECAR/MAIN SUMMER AND WINTER PEAK DEMAND FORECAST

YEAR

| | Summer Peak

MW

| | Annual %

Growth

| | Winter Peak

MW

| | Annual %

Growth

| |

|---|

| 1996 | | 137,200 | | | | 121,696 | | | |

| 1997 | | 139,379 | | 1.6 | % | 110,643 | | -9.1 | % |

| 1998 | | 141,293 | | 1.4 | % | 121,811 | | 10.1 | % |

| 1999 | | 150,774 | | 6.7 | % | 125,320 | | 2.9 | % |

| 2000 | | 144,585 | | -4.1 | % | 126,489 | | 0.9 | % |

| 4-YR AVG | | | | 1.3 | % | | | 1.0 | % |

| | |

| |

| |

| |

| |

| 2001 | | 157,382 | | | | 128,289 | | | |

| 2002 | | 159,990 | | 1.7 | % | 130,405 | | 1.6 | % |

| 2003 | | 162,323 | | 1.5 | % | 132,303 | | 1.5 | % |

| 2004 | | 164,919 | | 1.6 | % | 134,418 | | 1.6 | % |

| 2005 | | 168,103 | | 1.9 | % | 136,991 | | 1.9 | % |

| 2006 | | 170,737 | | 1.6 | % | 139,134 | | 1.6 | % |

| 2007 | | 173,850 | | 1.8 | % | 141,657 | | 1.8 | % |

| 2008 | | 177,031 | | 1.8 | % | 144,235 | | 1.8 | % |

| 2009 | | 180,270 | | 1.8 | % | 146,853 | | 1.8 | % |

| 2010 | | 183,110 | | 1.6 | % | 149,157 | | 1.6 | % |

| 2011 | | 185,833 | | 1.5 | % | 151,365 | | 1.5 | % |

| 2012 | | 188,533 | | 1.5 | % | 153,552 | | 1.4 | % |

| 2013 | | 190,923 | | 1.3 | % | 155,492 | | 1.3 | % |

| 2014 | | 193,034 | | 1.1 | % | 157,205 | | 1.1 | % |

| 2015 | | 195,006 | | 1.0 | % | 158,809 | | 1.0 | % |

Note that historic values represent actual peak demand, while the forecast assumes normal weather. Year-to-year swings in historic peak demand often reflect transitions from hotter to milder summers.

Reserve Requirements

RDI developed assumed reserve equilibrium levels for ECAR/MAIN based on historical requirements and an analysis of loss-of-load expectation (LOLE). The loss-of-load expectation represents the probability of curtailing demand owing to generation shortfall. This probability is multiplied by the value of lost load (VOLL), expressed in $/MWh, which represents the economic cost to buyers of interruptions in supply. For its analysis, RDI assumed that VOLL is $10,000/MWh; the reliability required reserve margin is relatively insensitive to this value. The VOLL multiplied by hourly LOLE is an hourly capacity value; that is, it represents the value of having an additional megawatt of generating capacity in the region. The sum of this hourly capacity value over all hours of the year is the annual capacity value, in $/MW-yr.

For the purpose of determining equilibrium reserves, RDI used iterative IREMM runs to estimate the annual capacity value for each region varying reserve margins from 9% to 21%. The reserve margin yielding a capacity value equal to the annual cost of new combustion turbine capacity was used as the target reserve margin for these regions.

The result of this process was used to determine the minimum reserve margin required for reliability purposes through 2010. The reserve equilibrium after 2010 was set 1% below this target, assuming a moderate improvement in availability factors for existing generation. In ECAR/MAIN, the resulting target reserve margins were 16% through 2009 and 15% thereafter.

B-27

Coal Price Forecast

For this analysis, RDI developed plant specific coal price forecasts for coal burning plants in the East Central U.S. These forecasts reflect RDI's analysis of such factors as existing coal supply contracts, Clean Air Act Compliance strategies, trends in transportation costs and regional coal supply and demand balances.

Existing Coal Supply Contracts RDI maintains a detailed database on fuel supply agreements at U.S. coal-fired facilities—including delivered costs and the minemouth and transportation components of that cost, as well as contract expirations. Existing coal supply contracts are forecast to continue at historic volumes through the contract expiration date. Future delivered costs of contracted coal are projected using historical price trends. Upon the expiration of the contract, contract volumes are replaced by the least expensive delivered spot-market coal available.

Clean Air Act Compliance Costs Each coal type has a sulfur emission cost calculated based on the sulfur content, scrubber efficiency at each plant (if any), and the forecast cost of SO2 emission allowances. This approach increases the effective cost of higher sulfur coal relative to coals with lower sulfur content. Allowance prices and the sulfur content of a coal play a role in determining the dispatch of individual plants.

Transportation Transportation costs for various coal source regions are developed for each coal plant. Actual transportation rates are used where known for existing movements, and others are modeled where no prior transactions have been reported. The transportation cost model takes into account such factors as the coal source region, distance to the plant, delivery options at the plant, and transportation productivity improvement. Transportation rates in real terms decline annually at various rates that range between 1.6% and 0.4%. Western rail shipments decline at an average rate of 1.25% per year while eastern rail rates average a 1.05% decline per year.

Mine Prices FOB mine prices for each major supply region were obtained from RDI'sCoal Market Research Service. Spot coal prices have increased dramatically in the past year, reversing a steady long-term trend of declining prices and margins to coal producers. Several factors contributed to the surge in prices, including the following:

- •

- Powder River Basin (PRB) curtailed production when prices reached historic lows dipping below $5/ton in 1999;

- •

- Over the past two years, coal plants around the country had reduced stockpiles as a competitive effort to cut costs. Higher loads due to warmer weather pushed plant owners back into spot markets at the same time to rebuild plant inventories;

- •

- Problems developed at several eastern mines as they moved to comply with new regulations regarding mining practices and waste disposal, further constraining supply.

In some cases, PRB prices jumped to $15/ton on the spot market. RDI believes the coal industry will respond to increased prices with additional investment. However, a lagging cycle for investment and historically low returns to production may create a period of 3 - 4 years in which spot prices may exceed marginal costs of production. RDI believes several additional factors will push average coal prices lower in real terms:

- •

- Average coal mine productivity in the West will increase as longwall mining technology is improved in Colorado and Utah, and as surface mining operations in Wyoming install larger scale haulage, more efficient overburden coal stripping equipment, and improve mine planning and maintenance efficiency.

- •

- The current application of the synfuels tax credit allows synfuel producers to sell premium quality coals for less than they bought it for in some cases. This tax credit will tend to distort

B-28

eastern markets to end users, keeping end user prices low and delaying further penetration of PRB coals to eastern markets. The tax credit will expire in 2007, and some possibility exists that the IRS will nullify its use earlier.

- •

- Numerous coal contracts will expire or "rollover" during the next ten years. As these contracts are replaced or renegotiated, coal consumers will likely receive price reductions resulting from productivity improvements and general oversupply conditions. New contracts are of substantially shorter duration, almost always less than five years. The elimination of long-term contracts will result in a more volatile, commodity-like pricing environment where the primary factor determining sales success is price.

- •

- Premium quality, eastern low-sulfur coal will see supply constraints in the forecast period due to reserve depletion and additional mining regulations. However, declining demand for this product due to eroding export coal markets, and the continued encroachment of lower cost western coals will prevent run-ups in the price of eastern coal.

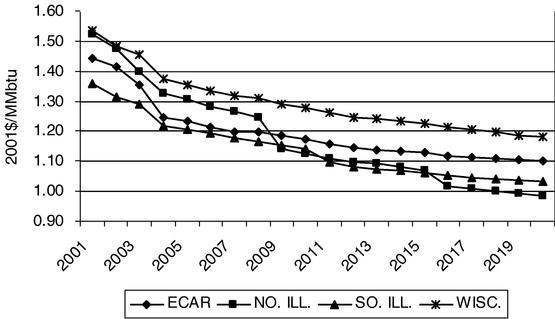

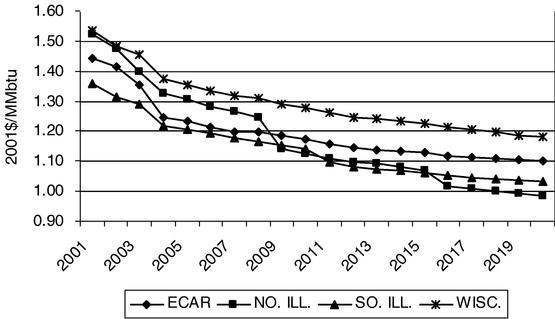

Overall, RDI expects that regional coal-fired power plants will experience declining real prices as shown in Figure 11. RDI projects these prices to fall in the near term, as new suppliers enter the spot market. In the longer term, prices are projected to fall at 0.7% annually in real terms. Figure 11 shows RDI's average delivered spot coal price for plants in ECAR and in neighboring regions.

FIGURE 11

DELIVERED COAL PRICES FOR ECAR AND NEIGHBORING REGIONS ($2001/MMBTU)

Environmental Regulation

Future SO2 Compliance Requirements Phase II of EPA's Acid Rain Program began on January 1, 2000. Provisions for SO2 control are divided into two phases. Phase I ran from January 1, 1995 through December 31, 1999 and affected 263 coal units and oil units in the U.S. Phase II of the Acid Rain program applies to all coal and oil plants greater than 25 MW. Once affected, units must comply with emission tonnage caps on an annual basis for January through December. These caps are determined by calculating a unit's imputed emissions based on a rate of 2.5 pounds SO2/mmBtu (lbs. SO2/mmBtu) for Phase I and 1.2 lbs. SO2/mmBtu for Phase II multiplied by the unit's actual heat input during the base period 1985-1987 (the "Baseline"). EPA makes adjustments that reduce the final target by about 3% in Phase I and 10% in Phase II.

B-29

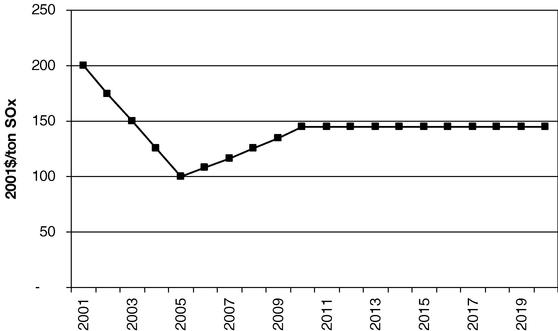

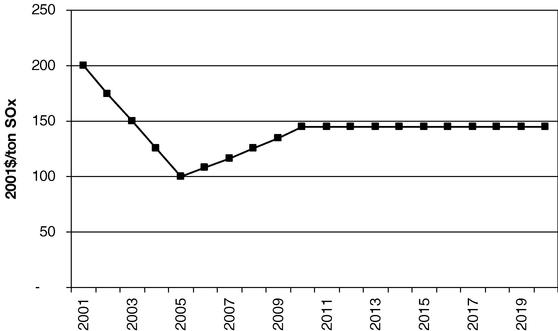

RDI's modeling establishes a baseline for SO2 emissions. RDI then constructs a marginal cost curve for additional SO2 removal, including a plant-by-plant analysis of scrubbing and fuel switching options. An SO2 allowance forecast is established by calculating the additional SO2 emissions to be removed beyond the baseline and applying that amount against the marginal cost of removing emissions. This also provides a forecast of capital expenditures for SO2 compliance at specific power plants. RDI assumes FGD capital costs of $125/kW for units greater than 450 MW. FGD O&M costs are estimated at $0.50/MWh for new installations. Based on this analysis and the current size of the bank for SO2 allowances, RDI forecasts allowance prices starting at $200 in the 2001 and declining to $100 per ton in 2005. At this point, RDI projects the bank will be drawn down and the market will move upward in response to the final ratchet in 2010, gradually increasing to just under $150 in 2013 in $2001 dollars. RDI's SO2 allowance price forecast is shown in Figure 12.

FIGURE 12

SULFUR DIOXIDE ALLOWANCE FORECAST ($2001/TON)

NOx Regulations

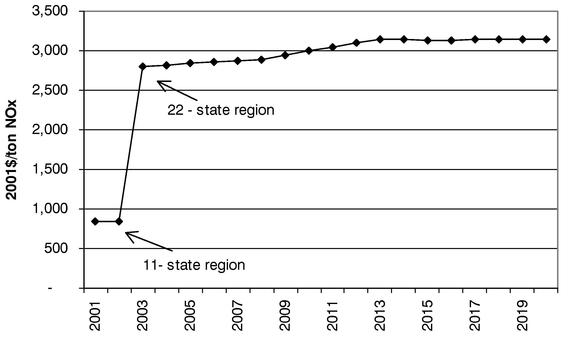

RDI independently forecasts nitrogen oxide (NOX) controls to electric generating units affected by future NOX requirements. The key inputs to RDI's model include forecast generation levels developed by the IREMM model, historic NOX emission rates collected by the U.S. Environmental Protection Agency, and estimated NOX control costs. The model evaluates multiple control options per unit including selective catalytic reduction (SCR), selective non-catalytic reduction (SNCR) and gas reburn.

RDI assumes a two-phase allowance trading program for controlling summertime NOX emissions for the 11 states (and the District of Columbia) included in the northeast OTC NOX Budget Program. The first phase of the trading program is currently in effect and runs through the summer of 2002. Starting in May 2003, RDI assumes EPA's NOX SIP Call regional trading program will go into effect—impacting 11 additional states.(6) This phase establishes an emission cap set at 0.15 lbs./mmBtu. Additional emission controls that are necessary to comply with the second phase of the program are forecast based on RDI's estimate of the most economic NOX control options available at affected units

B-30

under the regional trading program. Table 13 shows the jurisdictions included in both the OTC Budget and the NOX SIP Call programs.

- (6)

- EPA has since announced its intention to delay implementation of a state budget limitation for NOx until 2004, effectively delaying the implementation of a cap and trade program by a year.

TABLE 13

OTC NOX BUDGET AND EPA NOX SIP CALL JURISDICTIONS

OTC

| | EPA NOX SIP CALL

|

|---|

| Connecticutt | | Alabama |

| Delaware | | Indiana |

| Maine | | Illinois |

| Maryland | | Kentucky |

| Massachusetts | | Michigan |

| New Hampshire | | North Carolina |

| New Jersey | | Ohio |

| New York | | South Carolina |

| Pennsylvania | | Tennessee |

| Rhode Island | | Virginia |

| Vermont | | West Virginia |

| District of Columbia | | |

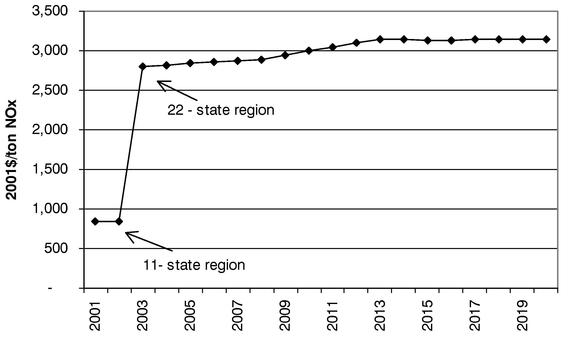

To ascertain the cost associated with NOx emission allowances, IREMM first determines whether a unit is in a market participating in a regional allowance trading market. If the unit is in an allowance trading market, the corresponding dispatch cost is determined by evaluating the NOx emission rate of the unit—taking into account any emission control technologies—and the cost of purchasing an allowance for those emissions. Forecast NOx allowance prices are shown in Figure 13.

B-31

FIGURE 13

FORECAST NOX ALLOWANCE PRICES FOR NOX SIP CALL TRADING PROGRAM

($2001/TON)

Gas Price Forecast

Key national level assumptions and results driving RDI's forecast of natural gas prices include the following:

- •

- U.S. gas supply including imports reaches about 79 Bcfd or 28.9 Tcf by 2010. Gulf offshore gas production grows at 3.4% per year.

- •

- Gas consumption by electric generators grows to 7.5 Tcf (20.5 Bcfd) by 2010, up from the 1999 level of 4.1 Tcf (11.4 Bcfd).

- •

- 200,000 MW of cumulative gas-fired additions by 2010 drive demand growth. 61% of these additions are combined cycle. The regional generation additions are the same as those reported in RDI's power market analysis.

- •

- Average annual U.S. GDP growth from 1999 to 2010 is assumed to be 3.0% per year. U.S. population is expected to grow at 0.8% per year.

- •

- West Texas Intermediate (WTI) oil prices decline in real terms from current levels to about $23/bbl by 2005 and then decrease to $20/bbl by 2010.

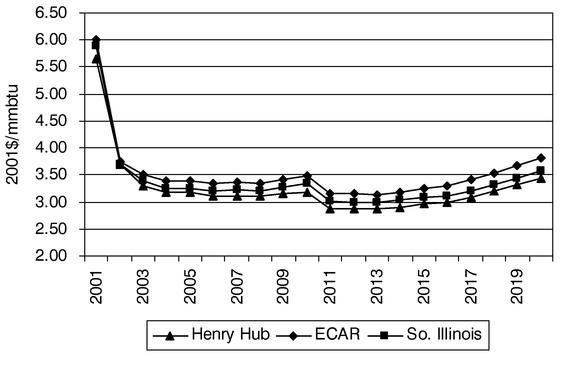

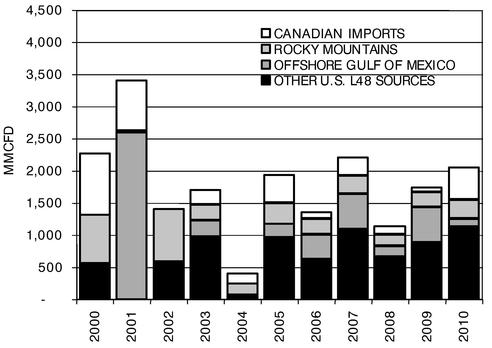

In the Base Case projection, the Rocky Mountain, Gulf Offshore and Canadian imports account for almost 60% of the incremental gas supplies in any given year. However, in the near-term the price effect associated with the current market should also stimulate incremental production from other U.S. onshore basins primarily in Texas. Increasing demand growth from electric generation is expected to keep the pressure on incremental supplies. Near term pressure will come from the need to refill depleted storage fields and meet new generation demands. Table 14 shows North American supply projections, and Figure 14 summarizes sources of incremental supply growth.

B-32

TABLE 14

NATURAL GAS SUPPLY PROJECTIONS—BILLIONS OF CUBIC FEET PER DAY (BCFD)

YEAR

| | US ONSHORE

| | ROCKY

MOUNTAIN

| | GULF

OFFSHORE

| | CANADIAN

IMPORT

| | LNG

| | TOTAL U.S.

GAS SUPPLY

| |

|---|

| 1996 | | 33.69 | | 3.09 | | 14.75 | | 7.76 | | 0.15 | | 59.43 | |

| 1997 | | 33.91 | | 3.36 | | 14.95 | | 7.91 | | 0.18 | | 60.32 | |

| 1998 | | 32.66 | | 3.72 | | 15.36 | | 8.46 | | 0.24 | | 60.44 | |

| 1999 | | 30.54 | | 5.11 | | 15.49 | | 9.24 | | 0.23 | | 60.61 | |

| | |

| |

| |

| |

| |

| |

| |

| 2000 | | 31.29 | | 5.09 | | 13.27 | | 11.03 | | 0.51 | | 61.19 | |

| 2001 | | 31.83 | | 5.15 | | 14.53 | | 11.54 | | 0.63 | | 63.68 | |

| 2002 | | 32.62 | | 5.33 | | 15.33 | | 10.84 | | 0.62 | | 64.73 | |

| 2003 | | 34.28 | | 5.60 | | 15.49 | | 11.45 | | 0.66 | | 67.48 | |

| 2004 | | 34.61 | | 5.87 | | 15.59 | | 11.95 | | 0.66 | | 68.69 | |

| 2005 | | 35.48 | | 6.19 | | 15.62 | | 12.67 | | 0.70 | | 70.65 | |

| 2006 | | 36.08 | | 6.43 | | 16.74 | | 12.78 | | 0.72 | | 72.76 | |

| 2007 | | 36.78 | | 6.77 | | 18.14 | | 12.87 | | 0.76 | | 75.32 | |

| 2008 | | 37.73 | | 7.02 | | 18.60 | | 13.05 | | 0.83 | | 77.23 | |

| 2009 | | 38.70 | | 7.26 | | 18.94 | | 13.26 | | 0.93 | | 79.09 | |

| 2010 | | 39.27 | | 7.54 | | 19.85 | | 13.65 | | 1.02 | | 81.34 | |

| | |

| |

| |

| |

| |

| |

| |

| % CHG 2000 to 2010 | | 2.5 | % | 4.8 | % | 5.0 | % | 2.4 | % | 10.0 | % | 3.3 | % |

FIGURE 14

SOURCES OF INCREMENTAL GAS SUPPLY MMCFD

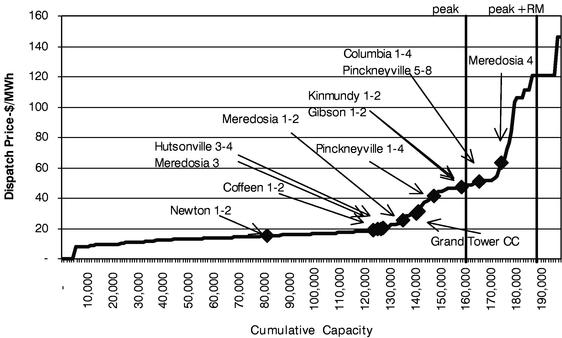

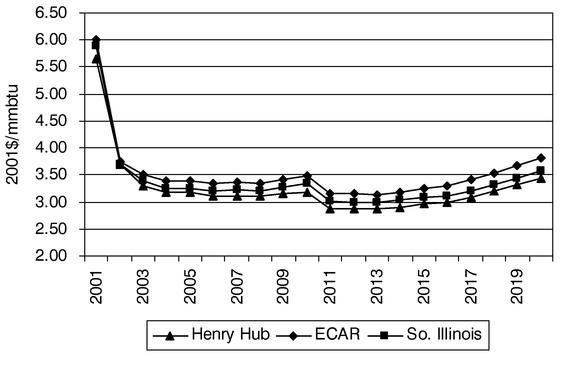

As shown in Figure 15, natural gas delivers into PJM at a premium to ECAR (approximately $0.19/mmBtu).

B-33

FIGURE 15

REGIONAL DELIVERED NATURAL GAS PRICE FORECAST ($2001/MMBTU)

AEG Contractual Obligations