Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Certegy Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Lee A. Kennedy | Certegy Inc. | |

Chairman and | 100 Second Avenue South | |

Chief Executive Officer | Suite 1100S | |

| St. Petersburg, Florida 33701 | ||

April 11, 2005 | ||

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Certegy Inc. The meeting will be held on May, 24, 2005, at 11:00 a.m., local time, at the Renaissance Vinoy Resort, Sunset Ballroom, 600 Snell Isle Boulevard, St. Petersburg, Florida 33704.

At the annual meeting, shareholders will be asked to consider and vote upon the election of three Certegy directors and to ratify the appointment of Ernst & Young LLP as our independent auditors for fiscal 2005. The attached proxy statement, with formal notice of the meeting on the first page, sets forth information about the nominees for directors and certain other matters. We urge you to review these materials carefully and to take this opportunity to participate in Certegy’s affairs by voting. We have also enclosed our 2004 annual report to shareholders, which, among other things, contains certain financial information for our company’s 2004 fiscal year.

Your vote is important. Regardless of whether you plan to attend the meeting in person, please complete the enclosed proxy card and return it promptly, or vote by using any other method described on your proxy card. If you attend the meeting, you may continue to have your shares voted as instructed in the proxy, or you may withdraw your proxy at the meeting and vote your shares in person.

We look forward to seeing you at the meeting.

| Sincerely, | ||

| ||

LEE A. KENNEDY Chairman and Chief Executive Officer | ||

Table of Contents

CERTEGY INC.

100 Second Avenue South, Suite 1100 S

St. Petersburg, Florida 33701

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 24, 2005

The 2005 annual meeting of shareholders of Certegy Inc. will be held on May, 24, 2005, at 11:00 a.m. local time, at the Renaissance Vinoy Resort, Sunset Ballroom, 600 Snell Isle Boulevard, St. Petersburg, Florida 33704. At the meeting, shareholders will vote upon the following proposals:

| 1. | Election of three Class I directors to serve until the 2008 annual meeting of shareholders. |

| 2. | Ratification of the appointment of Ernst & Young LLP as Certegy’s auditors for its fiscal year ending December 31, 2005. |

| 3. | Any other matters as may properly come before the meeting and any adjournment or postponement of the meeting. |

You may vote if you are a shareholder of record as of the close of business on March 28, 2005. Please mark, sign, date, and promptly return the enclosed proxy card in the postage-paid envelope, or vote using any other method that may be described on your proxy card. If you attend the meeting you may, if you wish, withdraw your proxy and vote in person. Any proxy may be revoked at any time prior to its exercise at the annual meeting.

| By Order of the Board of Directors | ||

| ||

WALTER M. KORCHUN Secretary | ||

April 11, 2005

Table of Contents

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 6 | ||

| 7 | ||

| 8 | ||

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 9 | |

| 9 | ||

| 9 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 26 | ||

Table of Contents

April 11, 2005

CERTEGY INC.

100 Second Avenue South, Suite 1100 S

St. Petersburg, Florida 33701

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Certegy Inc. for use at the 2005 annual meeting of shareholders to be held on Tuesday, May 24, 2005, at 11:00 a.m. local time, at the Renaissance Vinoy Resort, Sunset Ballroom, 600 Snell Isle Boulevard, St. Petersburg, Florida 33704, and at any adjournments or postponements of the annual meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

What is the purpose of the annual meeting?

At the annual meeting, shareholders will vote upon:

| • | the election of three Class I directors to serve until the 2008 annual meeting of shareholders; |

| • | the ratification of the appointment of Ernst & Young LLP as Certegy’s independent auditors for fiscal year 2005; and |

| • | any other matters that may properly come before the meeting. |

All shareholders of record of Certegy’s common stock (including shareholders through Certegy’s 401(k) plan) at the close of business on March 28, 2005, which we refer to as the record date, are entitled to receive notice of the annual meeting and to vote the shares of common stock held by them on the record date. Each outstanding share of common stock entitles its holder to cast one vote for each matter to be voted upon.

If your shares of common stock are held by a broker, bank, or other nominee (i.e., in “street name”), you will receive instructions from your nominee, which you must follow in order to have your shares voted. The instructions may appear on the special proxy card provided to you by your nominee (also called a “voting instruction form”). Your nominee may offer you different methods of voting, such as by telephone or Internet.

If you hold your shares of common stock in your own name as a holder of record, you may vote in person at the annual meeting or instruct the proxy holders named in the enclosed proxy card how to vote your shares by marking, signing, dating, and returning the proxy card in the postage-paid envelope that we have provided to you.

Proxies that are executed, but do not contain any specific instructions, will be voted “FOR” the election of the nominees for directors specified in this proxy statement and “FOR” ratification of the appointment of auditors. The persons named in the proxy will have authority to vote in accordance with their own discretion on any other matters that properly come before the meeting.

1

Table of Contents

All shareholders of record of Certegy’s common stock at the close of business on the record date, or their designated proxies, and management’s guests, are authorized to attend the annual meeting.

If you plan to attend the annual meeting, please check the appropriate box on the enclosed proxy. If you hold your Certegy shares in “street name” — for instance, through a broker or through Certegy’s 401(k) plan trustee—you must request a proxy from your broker or other nominee holding your shares in record name on your behalf in order to attend the meeting and vote at that time (your broker may refer to it as a “legal” proxy).

What are the quorum and voting requirements to elect the nominees for director and to ratify the appointment of our independent auditors?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares of common stock entitled to vote is necessary to constitute a quorum for the transaction of business at the annual meeting. As of the record date, there were 62,537,409 shares of common stock outstanding.

For proposal 1, the election of directors, the nominees receiving the greatest number of votes at the annual meeting will be elected, even though such nominees may not receive a majority of the votes cast.

For proposal 2, ratification of the appointment of our independent auditors, the appointment of the auditors will be ratified if the votes cast “for” ratification exceed the votes cast “against.”

For any other business that may properly come before the annual meeting, the vote of a majority of the shares voted on the matter will constitute the act of the shareholders on that matter, unless the law, or our articles of incorporation or bylaws, require the vote of a greater number.

Each share of common stock is entitled to one vote on each matter submitted to the shareholders. Abstentions and “broker non-votes” will be counted only for purposes of establishing a quorum, but will not otherwise affect the outcome of the voting. Broker non-votes are proxies received from brokers or other nominees holding shares on behalf of their clients who have not received specific voting instructions from their clients with respect to non-routine matters. In counting the votes cast, only those cast “for” and “against” a matter are included, although you cannot vote “against” a nominee for director.

If you hold your shares of common stock in your own name as a holder of record, and you fail to vote your shares, either in person or by proxy, the votes represented by your shares will not affect the vote. If, however, your shares are held in “street name” and you fail to give instructions as to how you want your shares voted, the broker, bank or other nominee may vote the shares in their own discretion on certain routine matters, including the election of directors.

Will other matters be voted on at the annual meeting?

We are not aware of any other matters to be presented at the annual meeting other than those described in this proxy statement. If any other matters not described in the proxy statement are properly presented at the meeting, proxies will be voted in accordance with the discretion of the proxy holders.

You may revoke your proxy at any time before it has been exercised by:

| • | Filing a written revocation with the Secretary of Certegy Inc. at the following address: 100 Second Avenue South, Suite 1100 S, St. Petersburg, Florida 33701; |

2

Table of Contents

| • | Filing a duly executed proxy bearing a later date; or |

| • | Appearing in person and voting by ballot at the annual meeting. |

Any shareholder of record as of the record date attending the annual meeting may vote in person whether or not they previously have given a proxy, but the presence (without further action) of a shareholder at the annual meeting will not constitute revocation of a previously given proxy.

What other information should I review before voting?

Our 2004 annual report to shareholders, including financial statements for the fiscal year ended December 31, 2004, is being mailed to shareholders concurrently with this proxy statement. The annual report, however, is not part of the proxy solicitation material. A copy of our annual report on Form 10-K filed with the Securities and Exchange Commission (the SEC), including the financial statements, may be obtained without charge by:

| • | Writing to Certegy Inc., Investor Relations, 11720 Amber Park Drive, Suite 600, Alpharetta, Georgia 30004; or |

| • | Accessing Certegy’s website at www.certegy.com or the EDGAR database at the SEC’s website at www.sec.gov. |

You also may obtain copies of our Form 10-K from the SEC at prescribed rates by writing to the Public Reference Section of the SEC, 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at (800) SEC-0330 for further information on the SEC’s public reference rooms.

3

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors is responsible for directing the management of the company. Certegy’s Bylaws provide that the Board of Directors shall consist of not less than five nor more than fifteen directors, with the exact number being set from time to time by the Board. Currently, the Board’s size is set at eight, and the members are divided into three classes. The Board has determined that all of its members, with the exception of Mr. Kennedy, our Chairman and Chief Executive Officer, are independent directors under the listing standards of the New York Stock Exchange.

Upon the recommendation of the Governance Committee, the Board has nominated Charles T. Doyle, Kenneth A. Guenther and Keith W. Hughes for election as Class I directors, to serve for the three-year term expiring in 2008 and until their successors are duly elected and qualified. Messrs. Doyle, Guenther and Hughes currently are Class I directors, and their present terms expire at this year’s annual meeting. At the time of the 2004 annual meeting of shareholders in May 2004, one vacancy existed in the Board’s membership. On July 1, 2004, upon the recommendation of the Governance Committee, the Board elected Mr. Guenther to serve as a Class I Director, thereby filling that vacancy. Mr. Kennedy, our Chairman and Chief Executive Officer, recommended that the Governance Committee consider Mr. Guenther as a possible candidate to fill the then-existing vacancy in the Board’s membership.

All nominees have consented to serve as directors if elected, but, if any of these persons are unable to accept election, proxies will be voted for the election of another candidate recommended by the Board. Proxies cannot be voted for more than three nominees however.

The Board of Directors recommends a vote FOR

the election of all 3 nominees.

Information Regarding Nominees and Other Directors

The following are brief biographies as of February 28, 2005, furnished by the respective individuals, for the nominees proposed for election as directors at the annual meeting, and the incumbent directors who are not up for election at this annual meeting. Expiration terms of nominees for election at the annual meeting are given assuming the nominees are elected.

Nominees for Class I Directors – Term Expiring 2008

Charles T. Doyle has served as a director since June 29, 2001. Mr. Doyle has served as Chairman of the Board of Texas First Bank, an independent community bank in Galveston County, Texas, since October 1972, and as Chairman and Chief Executive Officer of Texas Independent Bancshares, Inc., of Texas City, a provider of correspondent banking services to community banks, since July 1979. He has also served as Chairman of the Board of Rust, Ewing, Watt & Haney, Inc., an independent general insurance agency and subsidiary of Texas Independent Bancshares, since September 2000. Mr. Doyle currently serves as a director of bank card associations VISA USA, Inc., VISA International, Inc. and Inovant, a transaction processor for merchants and issuers of credit cards. He is 70 years old.

Kenneth A. Guenther has served as a director since July 2004. He currently serves as a financial services industry consultant. Mr. Guenther retired in 2004 as the President and Chief Executive Officer of the Independent Community Bankers of America, a national trade organization representing community banks (ICBA), after having spent 24 years at the ICBA. He is 69 years old.

4

Table of Contents

Keith W. Hughes has served as a director since August 2002. Mr. Hughes is currently a self-employed consultant to domestic and international financial services institutions. From November 2000 to April 2001, he served as Vice Chairman of Citigroup Inc., a diversified global financial services holding company. Mr. Hughes was named to that position in 2000 when Citigroup acquired Associates First Capital Corporation, a leading finance company, where he had served as Chairman and Chief Executive Officer since February 1995. Mr. Hughes joined Associates in 1981 and held several other executive positions during his tenure there, including President from August 1991 to February 1995. Mr. Hughes serves as a director of (1) Carreker Inc., a consulting and technology firm to financial institutions, (2) Texas Industries Inc., a major producer of cement, concrete and structural steel, and (3) Pilgrim’s Pride, the second largest poultry company in the United States. He also serves as an advisory director to Majesco Software, Inc., an applications management software company and subsidiary of Mastek Ltd. He is 58 years old.

Incumbent Class II Directors – Term Expiring 2006

Richard N. Child has served as a director since June 29, 2001. Mr. Child is the founder of Mattrix Group, LLC, a consultancy practice created to assist and support companies, principally in the financial services and payments industries, with business strategy and development advice. From November 1999 to May 2000, he served as Executive Vice President of ZonaFinanciera.com., a financial services portal. Mr. Child served as Executive Vice President for MasterCard International, a global bank card association, and as President of its Latin American division, from January 1996 to April 1999. He also serves on the Board of Directors of Netspend Corporation, a privately-held processor and marketer of prepaid debit cards. He is 48 years old.

Lee A. Kennedy has served as a director and Certegy Inc.’s Chief Executive Officer since March 5, 2001, and has served as Certegy Inc.’s Chairman since his appointment to this position in February 2002. Mr. Kennedy previously served as President from March 2001 until May 2004, and served as President, Chief Operating Officer and director of Equifax Inc., a leading provider of consumer credit and other business information, from June 1999 until Certegy’s spin-off from Equifax on June 29, 2001. From June 1997 to June 1999, Mr. Kennedy served as Executive Vice President and Group Executive of Equifax. From July 1995 to July 1997 he served as President of Equifax Payment Services, a division of Equifax. Mr. Kennedy returned to the Board of Directors of Equifax in May 2004. He is 54 years old.

Incumbent Class III Directors – Term Expiring 2007

David K. Hunt has served as a director since June 29, 2001. Mr. Hunt has served as the non-executive Chairman of the Board of OnVantage, Inc. since October 2004. He previously served as the Chief Executive Officer of PlanSoft Corporation, an internet-based business-to-business solutions provider in the meeting and convention industry, a position he held from May 1999 to October 2004. From January 1997 to April 1999, he served as President, Chief Executive Officer, and a director of Global Payment Systems, a transaction processing service provider. He is 59 years old.

Phillip B. Lassiter has served as a director since September 2002. Mr. Lassiter has served as Chairman of the Board of Ambac Financial Group, Inc., a financial guarantee insurance holding company, since 1991, when Citicorp, one of Citigroup’s predecessors, divested itself of its control of Ambac in Ambac’s initial public offering. He retired as Ambac’s Chief Executive Officer on January 26, 2004. Mr. Lassiter currently serves as a director of Diebold, Incorporated, a self-service systems and security systems company. He is 61 years old.

Kathy Brittain White has served as a director since June 2001. In 2003, Ms. White founded Rural Sourcing, Inc., an organization providing information technology services while developing employment opportunities in rural regions of the United States, and she currently serves as its President. In 2002, Ms. White established the Horizon Institute of Technology and serves as its President. The Institute is a non-profit organization that provides technology education and economic expansion in the Arkansas Delta. From 1999 until March 2003, Ms. White served as Executive Vice President—E-Business and Chief Information Officer of Cardinal Health, Inc., a

5

Table of Contents

health care products and services company. She served as Senior Vice President and Chief Information Officer of Allegiance Corporation, a provider of healthcare products and cost management services, from 1996 until that company’s merger with Cardinal Health in 1999. Prior to her executive positions, Ms. White was a professor at the University of North Carolina at Greensboro. Ms. White currently serves as a director of toy manufacturer Mattel, Inc. and information solutions provider Novell, Inc. She is 55 years old.

Committees of the Board of Directors

The membership of the various committees of the Board of Directors is as follows:

Director | Audit | Compensation | Governance | Business Strategies Analysis | ||||

Child | X | |||||||

Doyle | X | |||||||

Guenther | X | |||||||

Hughes | Chair | Chair | ||||||

Hunt | Chair | X | X | |||||

Kennedy | X | |||||||

Lassiter | X | X | ||||||

White | Chair |

The Board of Directors met six times in 2004. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director) and (2) the total number of meetings of all committees of the Board of Directors on which the director served (during the periods that he or she served). The Board also believes that it should be sufficiently represented at Certegy’s annual meetings of shareholders. Last year, four of the Board’s members attended the annual meeting.

In addition to Board and committee meetings, Certegy’s non-management directors meet in executive sessions without management present. These meetings are chaired by Certegy’s Presiding Director, a position that rotates annually among the non-employee chairs of the Board’s committees. The Presiding Director is currently David K. Hunt.

Audit Committee. The Audit Committee’s primary function, as set forth in its written charter, is to assist the Board in overseeing (1) the integrity of Certegy’s financial reports and other financial information provided to the public, (2) Certegy’s systems of controls, (3) the company’s legal, regulatory, and ethical compliance, and (4) the auditing process. The Committee appoints and oversees the company’s independent accountants. The Audit Committee met ten times in 2004. The report of the Audit Committee is included in this proxy statement but is not part of the proxy solicitation material.

The Board has determined that Mr. Hunt, Chair of the Audit Committee, is an “audit committee financial expert” within the meaning of the federal securities laws.

Compensation Committee. The Compensation Committee conducts its duties pursuant to its written charter, which sets forth its responsibility for approving and monitoring executive compensation plans, policies, and programs, and advising management on succession planning and other significant human resources matters. As part of its responsibilities, the Committee reviews and sets salaries and establishes incentive compensation awards for our executive officers. In addition, the Committee is responsible for all significant employee benefit plan actions, including funding matters. The Compensation Committee met three times in 2004. The Compensation Committee Report on Executive Compensation appears in this proxy statement, but is not part of the proxy solicitation material.

6

Table of Contents

Governance Committee. The Governance Committee’s written charter sets forth its responsibility for shaping Certegy’s corporate governance and assisting the Board with respect to (1) Board and committee organization, membership and function, and (2) oversight of evaluations of the Board and management. The Governance Committee met three times in 2004. The Committee also met in February 2005 to consider and recommend to the Board the slate of director nominees up for election at this year’s annual meeting of shareholders.

Business Strategies Analysis Committee. In November 2004, the Board formed the Business Strategies Analysis Committee. The principal responsibilities of the Business Strategies Analysis Committee are to conduct a review of Certegy’s strategic plans and alternatives and report its findings to the Board. The Business Strategies Analysis Committee met once in 2004.

Nominations Process. The Governance Committee is responsible for recommending to the Board a slate of director nominees for the Board to consider recommending to the shareholders, and for recommending to the Board nominees for appointment to fill any Board vacancy. To fulfill these responsibilities, the Committee periodically assesses the collective requirements of the Board and makes recommendations to the Board regarding its size, composition and structure. In determining whether to nominate an incumbent director for reelection, the Governance Committee evaluates each incumbent director’s continued service in light of the current assessment of the Board’s collective requirements, taking into account factors such as evaluations of the incumbent’s performance.

When a need for a new director to fill a new Board seat or vacancy arises, the Committee proceeds by whatever means it deems appropriate to identify a qualified candidate or candidates, including engaging director search firms. The Committee reviews the qualifications of each candidate. Final candidates are generally interviewed by one or more Committee members. The Committee makes a recommendation to the Board based on its review, the results of interviews with the candidate and all other available information. The Board makes the final decision on whether to invite the candidate to join the Board, which is extended through the Chair of the Governance Committee and the Chairman of the Board and Chief Executive Officer.

Director Qualifications. The Governance Committee reviews and develops criteria for the selection of qualified directors. At a minimum, directors should have high moral character and personal integrity, demonstrated accomplishment in his or her field, the ability to devote sufficient time to carry out the duties of a director, and be at least 21 years of age. In addition to these minimum qualifications in evaluating candidates, the Governance Committee may consider all information relevant in their business judgment to the decision of whether to nominate a particular candidate for a particular Board seat, taking into account the then-current composition of the Board. These factors may include whether the candidate is independent and able to represent the interests of Certegy and its shareholders as a whole; a candidate’s professional and educational background, reputation, industry knowledge and business experience, and the relevance of those characteristics to Certegy and the Board; the candidate’s ability to fulfill the responsibilities of a director and member of one or more of Certegy’s standing Board committees; whether the candidate will complement or contribute to the mix of talents, skills and other characteristics needed to maintain the Board’s effectiveness; the candidate’s other board and committee commitments; whether the candidate is financially literate or a financial expert; board diversity; and public disclosure and antitrust matters.

Shareholder Nominations.Nominations of individuals for election to the Board at any meeting of shareholders at which directors are to be elected may be made by any Certegy shareholder entitled to vote for the election of directors at that meeting by complying with the procedures set forth in Section 1.12 of Certegy’s Bylaws. Section 1.12 generally requires that shareholders submit nominations by written notice to the Corporate Secretary setting forth certain prescribed information about the nominee and the nominating shareholder. Section 1.12 also requires that the nomination notice be submitted a prescribed time in advance of the meeting. The deadline for submission of a nomination notice in connection with Certegy’s 2006 annual meeting of shareholders is December 12, 2005.

7

Table of Contents

The Governance Committee will consider recommending to the Board that it include in the Board’s slate of director nominees for a shareholders’ meeting a nominee submitted to Certegy by a shareholder. In addition to complying with the procedures set forth in the Section 1.12 of the Bylaws, the nominating shareholder should expressly indicate in the nomination notice that such shareholder desires that the Governance Committee consider recommending inclusion of such shareholder’s nominee in the Board’s slate of nominees for the meeting. The nominating shareholder and shareholder’s nominee must comply with all requests for information and consent to Certegy obtaining other information in order for the Governance Committee and Board to evaluate such candidate.

The shareholder’s nominee should satisfy the minimum qualifications for director described above in the judgment of the Governance Committee. In evaluating shareholder nominees for possible inclusion in the Board’s slate of nominees, the Committee may consider all relevant information, including the factors described above, and additionally may consider the size of the nominating shareholder’s holdings in Certegy and the length of time such shareholder has owned such holdings; whether the nominee is independent of the nominating shareholder and able to represent the interests of Certegy and its shareholders as a whole; the interests and/or intentions of the nominating shareholder; and the availability and qualifications of other candidates.

Corporate Governance and Ethics Information

The Board’s Corporate Governance Policy, as well as the charters of the Audit, Compensation, and Governance Committees, can be viewed at http://www.certegy.com/AC_corpgovernance.html. Certegy has adopted a Code of Business Conduct and Ethics applicable to its directors, officers, and employees, which is also available at this website. Any amendment to or waiver of a provision of these codes of ethics that applies to any Certegy director or executive officer also will be disclosed there.

8

Table of Contents

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Our Audit Committee, pursuant to its charter, has appointed Ernst & Young LLP as Certegy’s independent auditors to examine Certegy’s consolidated financial statements for our 2005 fiscal year. While the Audit Committee is responsible for the appointment, compensation, retention, termination and oversight of the independent auditors, the Audit Committee and our Board of Directors are requesting, as a matter of policy, that the shareholders ratify the appointment of Ernst & Young LLP. The Audit Committee is not required to take any action as a result of the outcome of the vote on this proposal. However, if the shareholders do not ratify the appointment, the Audit Committee may investigate the reasons for shareholder rejection and may consider whether to retain Ernst & Young LLP or to appoint other auditors. Furthermore, even if the appointment is ratified, the members of the Audit Committee in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of Certegy and its shareholders. Information about Ernst & Young LLP, including the fees it has billed Certegy in the past two fiscal years, appears below. We expect a representative of Ernst & Young to be present at the annual meeting, to be able to make a statement if they desire to do so, and to be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR

the ratification of Ernst & Young LLP

as Certegy’s independent auditors for fiscal 2005.

Auditor Fees Billed in Last Two Fiscal Years

The following table sets forth the fees billed by Ernst & Young for services to Certegy in the last two fiscal years.

| Year Ended December 31, | ||||||

| 2003 | 2004 | |||||

Audit (1) | $ | 556,321 | $ | 2,003,200 | ||

Audit-Related (2) | 242,019 | 173,000 | ||||

Tax (3) | 110,668 | 62,500 | ||||

All Other | — | — | ||||

| $ | 909,008 | $ | 2,238,700 | |||

| (1) | Audit fees represent fees for professional services provided in connection with the audits of our financial statements and internal control over financial reporting and review of our quarterly financial statements and audit services provided in connection with statutory and regulatory filings. |

| (2) | Audit-related fees consisted primarily of fees for service auditor reviews, employee benefit plan audits, debt offering and other accounting consultations. |

| (3) | Tax fees represent fees for expatriate tax services, tax planning services, and tax advice. |

The Audit Committee is responsible for pre-approving all audit and permitted non-audit services provided to Certegy by its independent public accountants. To help fulfill this responsibility, the Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy. Under the policy, all auditors’ services must be pre-approved by the Audit Committee either (1) before the commencement of each service on a case-by-case basis—called “specific pre-approval”—or (2) by the description in sufficient detail in exhibits to the policy of particular

9

Table of Contents

services, which the Audit Committee has generally approved, without the need for case-by-case consideration– called “general pre-approval.” Unless a particular service has received general pre-approval, it must receive the specific pre-approval of the Committee, or one of its members to whom the Committee has delegated specific pre-approval authority. The policy describes the audit and audit-related services which have received general pre-approval–these general pre-approvals allow the company to engage the independent accountants for the enumerated services for individual engagements of no greater than $25,000 in fees. No service other than audit or audit-related services have received general pre-approval. Any engagement of the independent accountants pursuant to a general pre-approval must be reported to the Audit Committee at its next regular meeting. The Audit Committee periodically reviews the services that have received general pre-approval and the associated fee ranges. The policy does not delegate the Audit Committee’s responsibility to pre-approve services performed by the independent public accountants to management.

10

Table of Contents

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Directors who are our salaried employees receive no additional compensation for services as a director or as a member of a committee of our Board. All non-employee directors receive an annual retainer of $30,000, plus $1,500 for each Board or committee meeting he or she attends. The chairperson of each standing committee of our Board receives an additional annual fee of $5,000, payable in quarterly installments. We also reimburse each non-employee director for all reasonable out-of-pocket expenses incurred in connection with attendance at Board and committee meetings.

We have adopted a deferred compensation plan for the benefit of our non-employee directors. Under this plan, a non-employee director may defer and be deemed to invest up to 100% of their director’s fees in either a stock fund representing our common stock or in an interest bearing account. Interest on deferred amounts deemed to be invested in the interest bearing account are credited monthly to our directors’ accounts at the prime rate on the first day of each month as reported in theWall Street Journal. All deferred fees are held in our general funds and are paid in cash. In general, deferred amounts are not paid until after the director terminates service from our Board, at which time they will be paid either in a lump sum or in annual payments of not more than ten years, as determined by the director.

In June 2004, the Certegy Inc. Stock Incentive Plan was amended to allow for the issuance of restricted stock units in addition to stock options and restricted shares. Following the adoption of this amendment, in June 2004 each of our non-employee directors received a grant of 1,925 restricted stock units. These restricted stock units, which vest in June 2005, represent the right to receive shares of common stock subject to the fulfillment of the vesting period.

Due to recent changes in the treatment of stock options under U.S. federal tax laws, we believe it is in the best interests of Certegy and our shareholders to provide equity compensation to our non-employee directors for their services in the form of restricted shares or restricted stock units, as opposed to stock options. Accordingly, no stock options were granted to non-employee directors for their services under the Stock Incentive Plan or the Non-Employee Director Stock Option Plan in 2004.

11

Table of Contents

Summary Compensation Table. The following table sets forth in summary form the compensation paid during fiscal years 2004, 2003 and 2002 to our chief executive officer and the four other most highly compensated executive officers—referred to as the named executive officers.

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | ||||||||||||||||||

| Awards | Payouts | ||||||||||||||||||

Name | Fiscal Year | Salary | Bonus | Other Annual Compensation | Restricted Stock Awards(1) | Securities Underlying Options | LTIP Payouts | All Other Compensation | |||||||||||

Lee A. Kennedy Chairman and Chief Executive Officer | 2004 2003 2002 | $731,923 667,500 617,308 | $760,000 279,015 — | $162,549 19,759 16,677 | (2) | $1,408,015 — 2,796,800 | | 175,366 — 190,000 | — $1,200,000 — | $381,093 8,901 424,484 | (3) | ||||||||

Larry J. Towe President and Chief Operating Officer | 2004 2003 2002 | 454,731 417,000 395,385 | 340,707 130,730 — | 67,016 15,127 12,451 | (2) | 688,465 1,170,000 1,258,560 | (4) | 57,166 — 90,000 | — 800,000 — | 91,572 63,383 71,461 | (3) | ||||||||

Michael T. Vollkommer Executive Vice President and Chief Financial Officer | 2004 2003 2002 | 350,792 321,900 306,154 | 227,787 87,460 — | 15,332 9,957 7,710 | (2) | 462,275 650,000 699,200 | | 38,383 — 50,000 | — 440,000 — | 9,410 5,682 100,542 | (3) | ||||||||

Jeffrey S. Carbiener Executive Vice President and Group Executive— Check Services | 2004 2003 2002 | 294,439 259,605 246,278 | 194,977 14,388 — | 23,829 34,323 9,092 | (2) | 245,883 780,000 559,360 | | 20,416 — 38,000 | — 300,000 — | 7,640 5,629 5,218 | (3) | ||||||||

Walter M. Korchun Executive Vice President, General Counsel and Secretary | 2004 2003 2002 | 294,439 259,606 226,047 | 177,811 59,683 — | 63,394 18,393 4,882 | (2) | 167,209 410,087 496,500 | (4) | 13,883 — 32,000 | — 105,986 — | 89,514 9,313 7,077 | (3) | ||||||||

| (1) | Dividend income is paid on restricted stock at the same rate as paid to all shareholders. Value of restricted stock shown in the table is as of the date of award. As of December 31, 2004, total restricted stock awards outstanding and the related fair market values were as follows: Mr. Kennedy — 123,257 shares ($4,379,321); Mr. Towe — 102,151 shares ($3,629,425); Mr. Vollkommer — 59,202 shares ($2,103,447); Mr. Carbiener — 53,554 shares ($1,902,774); and Mr. Korchun — 30,137 shares ($1,070,768). |

| (2) | Other annual compensation includes tax equalization payments, financial counseling fees and club membership dues. Tax equalization payments for 2004 include payments to Messrs. Kennedy, Towe and Korchun in the amount of $131,085, $41,440 and $35,590, respectively, in connection with their relocation expenses. |

| (3) | Includes a 401(k) matching contribution in the maximum amount of $4,100 for each officer. With respect to Messrs. Kennedy, Towe and Korchun, includes $363,331, $72,250 and $62,050, respectively, in relocation expenses in connection with the transfer of Certegy’s corporate headquarters from the Atlanta area to St. Petersburg, Florida. Relocation expenses include, among other items, moving expenses, short-term financing by Certegy of home sales and purchases and the temporary maintenance by the company of an apartment in Atlanta for the Chairman and Chief Executive Officer. “All Other Compensation” also includes the portion of premiums paid by Certegy pursuant to the Executive Life and Supplemental Retirement Benefit Plan attributable to term life insurance for the named executive officers in the following amounts: Mr. Kennedy — $13,662; Mr. Towe — $15,222; Mr. Vollkommer — $5,310; Mr. Carbiener — $3,540; and Mr. Korchun — $23,364. |

| (4) | Includes the following restricted shares awarded for retention purposes: 45,000 shares to Mr. Towe on May 7, 2003 vesting on May 7, 2005; 10,000 shares to Mr. Korchun on May 7, 2003 vesting on May 7, 2005; and an additional 6,116 shares to Mr. Korchun on February 2, 2003 that vested on January 7, 2004. |

12

Table of Contents

Option Awards. A stock option allows an individual to purchase shares of common stock at a fixed price (the exercise price) during a specific period of time. In general, whether exercising stock options is profitable to an option holder depends on the relationship between the common stock market price and the option exercise price. At any given time, vested options can be “in the money” (the exercise price is less than the market price) or “out of the money” (the exercise price is greater than the market price), depending on the current market price of the stock.

The following table contains information with respect to stock options awarded to the named executive officers during the fiscal year ended December 31, 2004.

Option Awards in Last Fiscal Year

Shares Options(1) | Percent of Total Fiscal Year | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation | |||||||||

Name | 5% | 10% | |||||||||

Lee A. Kennedy | 175,366 | 22.9 | % | $ | 2,323,796 | $ | 5,415,432 | ||||

Larry J. Towe | 57,166 | 7.5 | 757,513 | 1,765,328 | |||||||

Michael T. Vollkommer | 38,383 | 5.0 | 508,618 | 1,185,296 | |||||||

Jeffrey S. Carbiener | 20,416 | 2.7 | 270,535 | 630,461 | |||||||

Walter M. Korchun | 13,883 | 1.8 | 183,965 | 428,717 | |||||||

| (1) | All options in the table have an exercise price of $32.55 per share, vested 25% on the date of award with the remainder vesting in three equal annual installments (becoming fully vested on December 31, 2006) and expire on February 4, 2011. |

Option Exercises and Year-End Option Values. The following table sets forth certain information with respect to stock option exercises by the named executive officers during fiscal 2004, and the number and value of stock options held by the named executive officers as of December 31, 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

Shares Exercise | Value Realized(1) | Number of Securities Underlying Unexercised Options at December 31, 2004 | Value of Unexercised In-the-Money Options at | ||||||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||||

Lee A. Kennedy | 29,272 | $ | 661,946 | 570,079 | 135,182 | $ | 4,419,469 | $ | 288,367 | ||||||

Larry J. Towe | 8,888 | 240,386 | 364,926 | 51,082 | 3,426,424 | 97,999 | |||||||||

Michael T. Vollkommer | 3,973 | 72,611 | 178,373 | 31,691 | 1,087,809 | 64,314 | |||||||||

Jeffrey S. Carbiener | 27,472 | 466,150 | 111,435 | 19,708 | 863,466 | 35,869 | |||||||||

Walter M. Korchun | — | — | 42,396 | 14,941 | 207,202 | 36,869 | |||||||||

| (1) | Represents aggregate excess of market value of the shares underlying the options exercised, as of the date of exercise, over the exercise price of the options. |

| (2) | Represents aggregate excess of market value of shares under options as of December 31, 2004 over the exercise price of the options. |

13

Table of Contents

| Retirement | Benefits |

Pension Plan. The Certegy Inc. Pension Plan is a tax-qualified retirement plan available to all full-time U.S. employees. The pension plan provides benefits based on a participant’s length of service with Certegy and average earnings (comprised of a participant’s annual salary and bonus) up to a maximum of either 125% of salary or salary plus 75% of other earnings, whichever is greater. Pension plan benefits are computed by averaging the employee’s earnings for the highest paid thirty-six consecutive months of employment to arrive at final average earnings. However, federal laws place limitations on earnings amounts that may be included in calculating benefits under the pension plan. In 2005, only the first $210,000 in eligible earnings can be included in the calculation. Based on this 2005 limitation, the maximum benefit payable under the pension plan is $170,000 per year.

Supplemental Executive Retirement Plan. The Certegy Inc. Supplemental Executive Retirement Plan, or SERP, provides certain designated executives an annual benefit at normal retirement (age 60) equal to 50% of average earnings (comprised of a participant’s annual salary and bonus) multiplied by a fraction (not greater than 1) equal to the executive’s years of credited service divided by 30 years. SERP benefits are computed by averaging the executive’s earnings for the highest three calendar years in the ten calendar years preceding retirement to arrive at final average earnings. The benefit under the SERP is reduced by the benefit payable under the pension plan and by the benefit, if any, payable on the date of retirement under the Special Supplemental Executive Retirement Plan. Benefits under the SERP are payable as a life annuity, although the executive can elect an optional form of payment (including a lump sum). The following named executive officers participate in the SERP: Mr. Kennedy; Mr. Towe; and Mr. Vollkommer.

Executive Life and Supplemental Retirement Benefit Plan and Special Supplemental Executive Retirement Plan. We maintain for our executive officers and certain other management employees the Executive Life and Supplemental Retirement Benefit Plan, which is intended to maintain competitiveness of the company’s benefits. This plan is a company owned life insurance program, under which the participants receive life insurance coverage. The plan was amended in 2003 to eliminate the opportunity for deferred cash accumulation benefits under the life insurance policies for executive officers. In lieu of this, the Certegy Inc. Special Supplemental Executive Retirement Plan, or Special Plan, was established in 2003 to provide executive officers with a benefit opportunity comparable to the deferred cash accumulation benefit opportunity that would have been available had the split-dollar life insurance program not been amended. If any Special Plan benefits are ultimately payable, they will reduce an executive officer’s SERP benefits. For the named executive officers, the following benefit assets have accrued as of December 31, 2004 under the Special Plan: Mr. Kennedy — $280,623; Mr. Towe — $155,120; Mr. Vollkommer — $75,372; Mr. Carbiener — $38,792 and Mr. Korchun — $0. The policy premiums paid by the company attributable to term life insurance are included in the “Summary Compensation Table” under the heading “All Other Compensation.”

We have also established a rabbi trust in connection with the Executive Life and Supplemental Retirement Benefit Plan. If there is a change in control, we are required to fully fund the trust, and the trustee will make premium payments on the participants’ policies and pay any benefits accrued under the Special Plan if for any reason the company fails to fund the trust.

14

Table of Contents

The following tables show the annual retirement benefits that would be payable at age 65 or later under the pension plan and at age 60 or later under the SERP (for those individuals eligible for the SERP) and various rates of final average earnings and years of service. The SERP benefits reflected in the table would be reduced for pension plan benefits and by the benefit, if any, payable on the date of retirement under the Special Supplemental Executive Retirement Plan and are paid without regard to the limitations under Internal Revenue Code Sections 401(a) and 415. Neither pension plan nor SERP benefits are reduced for Social Security benefits.

Pension Plan Benefits

| Years of Service | |||||||||||||||

Final Average Earnings | 15 | 20 | 25 | 30 | 35 | ||||||||||

$ 205,000 | $ | 39,083 | $ | 52,110 | $ | 65,138 | $ | 78,165 | $ | 91,193 | |||||

400,000 | 39,083 | 52,110 | 65,138 | 78,165 | 91,193 | ||||||||||

600,000 | 39,083 | 52,110 | 65,138 | 78,165 | 91,193 | ||||||||||

800,000 | 39,083 | 52,110 | 65,138 | 78,165 | 91,193 | ||||||||||

1,000,000 | 39,083 | 52,110 | 65,138 | 78,165 | 91,193 | ||||||||||

The credited years of service for each of the named executive officers as of December 31, 2004 for the pension plan were as follows: Mr. Kennedy — 23 years; Mr. Towe — 11 years; Mr. Vollkommer — 5 years; Mr. Carbiener — 13 years; and Mr. Korchun — 5 years.

SERP Benefits

| Years of Service | |||||||||||||||

Final Average Earnings | 15 | 20 | 25 | 30 | 35 | ||||||||||

$ 205,000 | $ | 51,250 | $ | 68,333 | $ | 85,417 | $ | 102,500 | $ | 102,500 | |||||

400,000 | 100,000 | 133,333 | 166,667 | 200,000 | 200,000 | ||||||||||

600,000 | 150,000 | 200,000 | 250,000 | 300,000 | 300,000 | ||||||||||

800,000 | 200,000 | 266,667 | 333,333 | 400,000 | 400,000 | ||||||||||

1,000,000 | 250,000 | 333,333 | 416,667 | 500,000 | 500,000 | ||||||||||

1,200,000 | 300,000 | 400,000 | 500,000 | 600,000 | 600,000 | ||||||||||

1,400,000 | 350,000 | 466,667 | 583,333 | 700,000 | 700,000 | ||||||||||

1,600,000 | 400,000 | 533,333 | 666,667 | 800,000 | 800,000 | ||||||||||

The credited years of service for each of the named executive officers as of December 31, 2004 for the SERP were as follows: Mr. Kennedy — 32 years; Mr. Towe — 14 years; and Mr. Vollkommer — 5 years.

We have entered into change in control agreements with all of our named executive officers. These agreements have five-year terms with automatic renewal provisions and become operative only upon a change in control of our company. A change in control is generally defined by the agreements to mean:

| • | An accumulation by any person, entity, or group of 20% or more of the combined voting power of our voting stock; |

| • | A business combination resulting in our shareholders immediately prior to the combination owning less than two-thirds of the common stock and combined voting power of the new company; |

| • | A sale or disposition of all or substantially all of our assets; or |

| • | Approval by the shareholders of our complete liquidation or dissolution. |

15

Table of Contents

If any of these events happen and the executive’s employment terminates within six months prior to, or three years after, the date of the change in control, other than from death, disability, termination for cause, or voluntary termination other than for good reason, he will be entitled to a severance payment and other benefits described in the agreements. The severance payment will equal up to, in the case of our agreements with (1) Messrs. Kennedy, Towe and Vollkommer, three times, and (2) Messrs. Carbiener and Korchun, two times, the sum of (a) that executive’s highest annual salary for the twelve months prior to the termination, and (b) the executive’s highest annual bonus (or target bonus) in the three years prior to termination or the partial year ending on the date of termination.

Benefits payable under these agreements and other compensation or benefit plans of ours are not reduced because of Section 280G of the Internal Revenue Code. Any payments the executive receives will be increased, if necessary, so that after taking into account any excise taxes under Section 4999 of the Code, they would incur as a result of those payments, the executive would receive the same after-tax amount they would have received had no such excise taxes been imposed.

Certegy’s Executive Life and Supplemental Retirement Benefit Plan also has change-in-control features described above under “Retirement Benefits.”

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee has served as an officer or an employee of our businesses during the previous fiscal year. No interlocking relationship exists between our Board of Directors, Compensation Committee or executive officers and the board of directors, compensation committee or executive officers of another company, nor has such relationship existed in the past.

16

Table of Contents

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Overall Philosophy and Administration

The goals of Certegy’s executive compensation program, as developed and administered by the Compensation Committee of the Board of Directors, include:

| • | Offering market competitive total compensation opportunities to attract and retain talented executives; |

| • | Providing strong links between Certegy’s performance and total compensation earned — i.e., “paying for performance”; |

| • | Emphasizing Certegy’s long-term performance, thus enhancing shareholder value; and |

| • | Promoting and facilitating executive officer stock ownership. |

The Committee intends that the company’s pay programs provide compensation commensurate with the level of financial performance achieved relative to industry performance and internal goals. A significant portion of compensation is directly linked to the returns generated for shareholders.

Certegy sets its financial performance and shareholder return objectives above the middle of the market when compared with comparably sized financial, technology and information services companies. The pay programs are designed to provide above median compensation levels when those goals are achieved.

The Committee, which is composed entirely of independent directors, establishes base salaries for the executive officers, including the named executive officers. The Committee also administers incentive compensation programs under both annual and long-term incentive plans. In fulfilling its responsibilities, the Committee regularly seeks input from independent compensation consultants chosen by the Committee, and periodically seeks input from appropriate Certegy executives.

Base Salaries

The Committee generally sets base salaries for its senior executives and other officers between the market median (50th percentile) and the market 60th percentile for comparably sized financial, technology and information services companies, based on a survey conducted by independent compensation consultants previously retained by the Committee. The group surveyed is a more targeted group than the groups of companies comprising the different stock indices in the stock performance graph appearing in this proxy statement.

In addition, the Committee may consider other factors when setting individual salary levels, which may result in salaries above or below the targeted range. These factors may include availability of talent, recruiting requirements of the particular situation, specific technical backgrounds, experience and demonstrated performance.

Base salary adjustments for executive officers generally are made annually and are dependent on such factors as the executive’s current responsibilities, experience and performance, competitive compensation practices at comparable companies, and the Committee’s assessment of the executive’s overall contribution to Certegy’s financial success. The salaries earned by the named executive officers in 2004, which appear in the “Summary Compensation Table” of this proxy statement, were increased from those earned in the prior year in accordance with the foregoing practices.

Incentive Compensation

Certegy’s incentive compensation programs currently comprise cash incentives under its annual incentive plans, and long-term equity incentives under its stock incentive plan. In determining appropriate annual and long-term incentive compensation levels for the executive officers, the Committee seeks to award incentives that,

17

Table of Contents

when combined with annual salary, put the total overall compensation for Certegy’s executives midway between the market 50th percentile and the market 75th percentile for comparably sized financial, technology and information services companies in our survey, commensurate with the company’s above market performance objectives. Generally, officers with greater responsibilities have a greater percentage of their total compensation “at risk”—that is, contingent on the achievement of company or business unit objectives—than executives with lesser responsibilities.

Annual Incentive Compensation. Annual incentives provide opportunities for Certegy executives to earn compensation based on the achievement of a combination of important corporate and divisional financial goals, such as earnings per share, operating income growth and revenue growth. The performance factors selected for any particular officer vary depending on the officer’s specific responsibilities within the company.

Under Certegy’s annual incentive plans, each executive has a bonus target expressed as a percentage of base salary. Bonus targets for the named executive officers range from 40% to 100% of base salary. Actual awards can range from 0% to 200% of target, depending on performance against the established objectives. For 2004, the objectives for the named executive officers consisted of Certegy’s attainment of specified levels of diluted earnings per share (comprising 50% of incentive opportunity) and revenues (comprising 20%), as well as the results of individual performance assessments of each of the officers (30%). For 2004, all of the named executive officers received a bonus, which appear in the “Summary Compensation Table” of this proxy statement, as performance objectives were determined to have been met for the year.

Long-Term Incentive Compensation.The Committee administers the shareholder-approved Certegy Inc. Stock Incentive Plan, which allows for the award of both non-qualified and incentive stock options, and restricted stock. In June 2004, this plan was amended to allow for the issuance of restricted stock units in addition to actual restricted shares. Restricted stock units represent the right to receive actual shares of common stock, subject to any applicable vesting criteria or period, and are general unsecured obligations of Certegy. Consistent with prevailing practices in the marketplace, the Committee currently intends to make a long-term incentive award for each fiscal year.

The long-term incentive awards from the Stock Incentive Plan made during 2004 to Certegy executives included the following:

| • | Restricted stock grants with performance-based vesting acceleration features to all of the named executive officers. If Certegy’s compound earnings per share growth meets or exceed 10% per year at the third anniversary of the grant date, the restricted stock will vest; otherwise, it does not vest until the fifth anniversary. |

| • | Stock option grants to all of the named executive officers, vesting in four installments beginning on the grant date. |

The stock option and restricted stock grants made to Certegy’s key executives were designed to create a direct link between shareholder and executive interests by focusing executive attention on increasing shareholder value. In each case, the size of the awards made to individual officers was based on an evaluation of several factors, including the officer’s level of responsibility and the company’s overall compensation objectives. The amount and nature of prior equity incentive awards are generally considered in determining new Stock Incentive Plan awards for executive officers.

Please see the “Summary Compensation Table” and “Option Awards in Last Fiscal Year” table of this proxy statement for the Stock Incentive Plan awards made to the named executive officers in 2004.

Certegy also maintains a shareholder-approved Key Management Long-Term Incentive Plan (LTIP), which provides for performance-based cash incentives for periods ranging from a portion of a year to multi-year periods. No incentive awards or payouts were made pursuant to the LTIP in 2004.

18

Table of Contents

Chief Executive Officer Compensation

Compensation decisions for Mr. Kennedy, as chief executive officer, are made under the same methodology as for other executives. Mr. Kennedy has a greater proportion of his compensation dependent on performance objectives than the other executives. Mr. Kennedy was paid a base salary of $731,923 in fiscal 2004. As with all other named executive officers, Mr. Kennedy was paid a bonus for 2004, as his performance objectives (described under “—Annual Incentive Compensation” above) were met for the year. Mr. Kennedy’s performance-based incentive compensation targets were set between the market 60th percentile and the market 75th percentile for the surveyed peer group previously described.

As with all the named executive officers, Mr. Kennedy received restricted stock and stock option incentives in fiscal 2004, with the same vesting provisions described above under “Long-Term Incentive Compensation.” We believe that the equity incentives awarded to Mr. Kennedy in 2004 were sufficient to maintain a strong financial link between Mr. Kennedy and Certegy’s other shareholders.

Other Benefits

Certegy’s executive officers participate in the Certegy Inc. Pension Plan, which is a non-contributory, qualified defined benefit pension plan, and the Executive Life and Supplemental Retirement Benefit Plan, both of which are described in “Executive Compensation — Retirement Benefits.” As described in that section the Executive Life and Supplemental Retirement Benefit Plan was amended in 2003 to eliminate deferred cash accumulation benefits for executive officers, and the Special Supplemental Executive Retirement Plan was adopted to provide a comparable replacement cash accumulation opportunity for executive officers. Certegy also maintains a separate defined benefit Supplemental Executive Retirement Plan that provides additional retirement benefits to Messrs. Kennedy, Towe and Vollkommer, also described in the “Retirement Benefits” section of this proxy statement. Benefits under this plan are reduced by benefits payable under the pension plan and the Special Supplemental Executive Retirement Plan. In addition, the named executives and certain other officers have entered into agreements with Certegy that provide for severance payments in certain circumstances following a change in control of the company, as described in the “Change of Control Agreements” section of this proxy statement. Executives also participate, on a voluntary basis, in customary benefit programs generally available to employees, including Certegy’s 401(k) plan.

Certegy maintains a nonqualified deferred compensation plan for senior executives that allows cash deferrals from base pay, annual incentive awards and long-term incentive awards into various ‘phantom’ investment options. Until the end of 2004, this plan also allowed for the deferral of stock option gains and vested restricted stock into a company phantom stock account. The deferrals are not actual investments, but rather unsecured general obligations of Certegy to issue cash upon payout in an amount that reflects deferred cash contributions and any gains on the notional investments, or in the case of deferrals of option gains and restricted stock, to issue shares of actual stock upon payout. The company does not match any deferred contributions made by executives.

Compensation Deductibility Policy

An income tax deduction under federal law will generally be available for annual compensation in excess of $1 million paid to the chief executive officer and the named executive officers of a public corporation only if that compensation is “performance-based” and complies with certain other tax law requirements. Although the Committee considers deductibility issues when approving executive compensation elements, Certegy and the Committee believe that other compensation objectives, such as attracting, retaining and providing incentives to qualified managers, are important and may supersede the goal of maintaining deductibility. Consequently, Certegy and the Committee may make compensation decisions without regard to deductibility when it is in the best interests of Certegy and its shareholders to do so.

By: The Compensation Committee

Kathy Brittain White, Chairperson

Phillip B. Lassiter

19

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth aggregate information as of December 31, 2004 about all Certegy compensation plans, including individual compensation arrangements, under which our equity securities are authorized for issuance.

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans | |||

Equity Compensation Plans Approved by Shareholders (1) | 4,587,394 | $28.32 | 1,156,677 | |||

Equity Compensation Plans Not Approved by Shareholders (2)(3) | 39,178 | 31.83 | 164,000 |

| (1) | Includes only our Stock Incentive Plan, which was approved by Certegy’s shareholders in 2002. |

| (2) | Includes our Non-Employee Director Stock Option Plan, which is not required to be approved by Certegy’s public shareholders. Each director who is not employed by us or any of our affiliates is eligible to participate in this plan. We have reserved 200,000 shares under this plan, of which 164,000 shares remain available for issuance. The plan is a “formula plan” under which grants are automatic. Due to recent changes in the treatment of stock options under U.S. federal tax laws, however, Certegy believes it is currently in the best interests of the company and its shareholders to provide equity compensation to the non-employee directors in the form of restricted shares or restricted stock units, as opposed to stock options—consequently, option grants to non-employee directors under this plan were suspended in 2004. |

| (3) | As of December 31, 2004, there were 5,178 shares of “phantom” stock existing under our nonqualified deferred compensation plan described above under “Compensation Committee Report on Executive Compensation—Other Benefits.” This plan allows for the deferral of stock option gains and vested restricted stock into a company phantom stock account, payable in shares of actual stock. |

20

Table of Contents

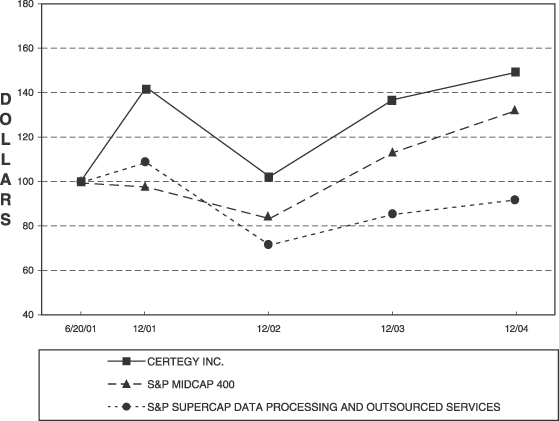

The graph and table below compare the cumulative total return among investments in Certegy Inc., the S&P MidCap 400 Index©, and the S&P SuperCap Data Processing and Outsourced Services Index© (previously the S&P Supercap Data Processing Services Index). The graph and table assume that $100 was invested in Certegy stock on June 20, 2001, and each index on May 31, 2001, and that any dividends were reinvested. The total cumulative dollar returns shown on the graph and table represent the value that the investments would have had at the end of each calendar year through December 31, 2004.

| 06/20/01 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | |||||||||||

CERTEGY INC. | $ | 100.00 | $ | 143.18 | $ | 102.72 | $ | 137.66 | $ | 149.95 | |||||

S&P MIDCAP 400 | 100.00 | 98.04 | 83.82 | 113.67 | 132.41 | ||||||||||

S&P SUPERCAP DATA | 100.00 | 109.14 | 71.85 | 85.70 | 92.13 | ||||||||||

21

Table of Contents

PRINCIPAL AND MANAGEMENT SHAREHOLDERS

The following table sets forth information regarding beneficial ownership of our common stock by:

| • | Each shareholder who is known by us to beneficially own 5% or more of the common stock; |

| • | Each of our directors; |

| • | Each of our executive officers named in the Summary Compensation Table; and |

| • | All of our executive officers and directors as a group. |

Unless otherwise indicated, each of the shareholders has sole voting and investment power with respect to the shares of common stock beneficially owned by that shareholder. The number of shares beneficially owned by each shareholder is determined under rules issued by the SEC. The information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and any shares as to which the individual or entity has the right to acquire beneficial ownership within 60 days, through the exercise of any stock option or other right.

Beneficial Ownership Table(1)

Name | Common Stock Beneficially Owned | Percent of Shares Beneficially Owned | |||||

T. Rowe Price Associates, Inc. (2) | 8,717,751 | 13.9 | % | ||||

General Electric Pension Trust (3) GE Asset Management Incorporated General Electric Company GE Frankona Ruckversicherungs AG | } | 5,157,774 | 8.3 | ||||

Kayne Anderson Rudnick Investment Management, LLC (4) | 4,023,146 | 6.4 | |||||

Ariel Capital Management, LLC (5) | 5,953,957 | 9.5 | |||||

Lee A. Kennedy (6) | 926,508 | 1.5 | |||||

Larry J. Towe (7) | 555,651 | * | |||||

Michael T. Vollkommer (8) | 296,015 | * | |||||

Jeffrey S. Carbiener (9) | 195,403 | * | |||||

Walter M. Korchun (10) | 88,147 | * | |||||

Richard N. Child (11) | 13,925 | * | |||||

Charles T. Doyle (11) | 14,471 | * | |||||

Kenneth A. Guenther | 2,425 | * | |||||

Keith W. Hughes (12) | 12,925 | * | |||||

David K. Hunt (13) | 15,425 | * | |||||

Phillip B. Lassiter (12) | 13,925 | * | |||||

Kathy Brittain White (11) | 13,925 | * | |||||

All directors and executive officers as a group, including those named | 2,966,983 | 4.6 | |||||

| * | Represents less than 1% of the outstanding shares of common stock. |

| (1) | Based on 62,537,418 shares of common stock outstanding as of February 28, 2005. The number of shares owned by any director or executive officer is given as of December 31, 2004 and, pursuant to SEC rules, includes shares subject to vested options or options vesting within 60 days. |

22

Table of Contents

| (2) | As reported in a joint Schedule 13G filed with the SEC on February 15, 2005 by T. Rowe Price Associates, Inc., a registered investment adviser, and T. Rowe Price Mid-Cap Growth Fund, Inc., these securities are owned by various individual and institutional investors, including T. Rowe Price Mid-Cap Growth Fund, Inc. (which owns 3,700,000 shares of Certegy common stock, representing 5.9% of the shares outstanding), which T. Rowe Price Associates, Inc. (“Price Associates”) serves as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. Their address is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (3) | As reported in a joint Schedule 13G filed with the SEC on February 14, 2005, GE Asset Management Incorporated (GEAM), a registered investment adviser, has sole voting and dispositive power over 4,139,858 Certegy shares owned by entities and accounts for which GEAM serves as investment adviser, and shared voting and dispositive power over 1,017,916 shares owned by GEPT and GEFR (as defined below). GEAM acts as investment manager for GEPT and GEFR. General Electric Pension Trust (GEPT) has shared voting and dispositive power with GEAM over 1,003,916 Certegy shares. GE Frankona Ruckversicherungs AG (GEFR) has shared voting and dispositive power with GEAM over 14,000 Certegy shares. General Electric Company (GE), the direct or indirect parent of GEAM and GEFR, disclaims beneficial ownership of all shares reported. All of the filers disclaim that they are members of a “group.” The address of GEPT and GEAM is 3001 Summer Street, Stamford, Connecticut 06904. GEFR’s address is Maria-Theresia-Strasse 35, D-81675 Munchen, Germany. GE’s address is 3135 Easton Turnpike, Fairfield, Connecticut 06431. |

| (4) | As reported in a Schedule 13G filed with the SEC on February 7, 2005, Kayne Anderson Rudnick Investment Management, LLC, a registered investment adviser, has sole voting and dispositive power over 4,023,146 Certegy shares. Their address is 1800 Avenue of the Stars, 2nd Floor, Los Angeles, California 90067. |

| (5) | As reported in a Schedule 13G filed with the SEC on February 14, 2005, Ariel Capital Management, LLC, a registered investment adviser, has sole voting power over 5,082,620 Certegy shares and sole dispositive power over 5,912,906 shares. Their address is 200 E. Randolph Drive, Suite 2900, Chicago, Illinois 60601. |

| (6) | Includes 36,292 shares of common stock owned through our 401(k) plan, 614,719 shares of common stock that may be acquired pursuant to currently exercisable options and 258 shares of common stock owned by his children. |

| (7) | Includes 6,943 shares of common stock owned through our 401(k) plan and 384,566 shares of common stock that may be acquired pursuant to currently exercisable options. |

| (8) | Includes 3,001 shares of common stock owned through our 401(k) plan, 210,064 shares of common stock that may be acquired pursuant to currently exercisable options and 9,490 shares of common stock owned jointly with his wife. |

| (9) | Includes 1,299 shares of common stock owned through our 401(k) plan and 120,935 shares of common stock that may be acquired pursuant to currently exercisable options. |

| (10) | Includes 374 shares of common stock owned through our 401(k) plan and 44,146 shares of common stock that may be acquired pursuant to currently exercisable options. |

| (11) | Includes 12,000 shares of common stock that may be acquired pursuant to currently exercisable options. |

| (12) | Includes 10,000 shares of common stock that may be acquired pursuant to currently exercisable options. |

| (13) | Includes 12,000 shares of common stock that may be acquired pursuant to currently exercisable options and 1,500 shares of common stock held by Mr. Hunt’s wife as to which he disclaims all beneficial ownership. |

| (14) | Includes 1,982,537 shares of common stock that may be acquired by such directors and executive officers as a group pursuant to currently exercisable options. |

23

Table of Contents

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Certegy’s directors and executive officers, and persons who own more than 10% of Certegy’s common stock, to file with the Securities and Exchange Commission certain reports of beneficial ownership of the common stock. Based solely on company records and other information, Certegy believes that all applicable Section 16(a) reports were timely filed by its directors, officers, and more than 10% shareholders during the fiscal year ended December 31, 2004, except that Mr. Guenther made one inadvertent late Form 4 filing relating to an open market purchase of common stock.

24

Table of Contents

The Audit Committee assists the Board of Directors in overseeing Certegy’s financial reporting process and internal controls. The Committee is composed of independent directors and operates under a written charter approved by the Board.

Management has primary responsibility for the financial statements and the reporting process, including the systems of internal controls, and has represented to us that the 2004 consolidated financial statements were prepared in accordance with generally accepted accounting principles. Certegy’s independent accountants for 2004, Ernst & Young LLP, are responsible for performing an audit of Certegy’s consolidated financial statements in accordance with auditing standards generally accepted in the United States and for expressing an opinion as to their conformity with generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and oversee these processes.

The Committee reviewed and discussed the audited financial statements with management and with Ernst & Young. We reviewed further with Ernst & Young the matters required to be discussed under Statement on Auditing Standards No. 61 (Communication with Audit Committees), including among other matters their judgments about the quality, not just the acceptability, of Certegy’s accounting principles; the reasonableness of management’s significant accounting estimates; and the clarity and completeness of the financial statements. The Committee also received from and discussed with Ernst & Young the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).