UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 MADISON AVENUE, NEW YORK, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2011

Item 1. Report to Shareholders

SEMI-ANNUAL REPORT

J U N E 3 0, 2 0 1 1

(unaudited)

MARKET VECTORS

HARD ASSETS ETFs

MOO

KOL

GEX

Agribusiness

ETF

Coal

ETF

Global

Alternative

Energy ETF

GDX

GDXJ

NLR

Gold

Miners

ETF

Junior Gold

Miners ETF

Uranium+

Nuclear

Energy ETF

Rare Earth/

Strategic Metals

ETF

REMX

HAP

KWT

SLX

RVE

Hard Assets

Producers

ETF

Solar

Energy

ETF

Steel

ETF

|

|

|

|

|

|

|

| |

|

|

|

| 1 | |

|

| |

| 3 | |

| 6 | |

| 9 | |

| 12 | |

| 15 | |

| 19 | |

| 23 | |

| 27 | |

| 31 | |

| 34 | |

|

| |

| 5 | |

| 8 | |

| 11 | |

| 14 | |

| 18 | |

| 22 | |

| 26 | |

| 30 | |

| 33 | |

| 37 | |

| 38 | |

|

| |

| 40 | |

| 42 | |

| 44 | |

| 46 | |

| 48 | |

| 50 | |

| 52 | |

| 58 | |

| 60 | |

| 62 | |

| 64 | |

| 66 | |

| 68 | |

|

| |

| 72 | |

| 72 | |

| 73 | |

| 73 | |

| 74 | |

| 74 | |

| 75 | |

| 75 | |

| 76 | |

| 76 | |

| 77 | |

| 83 | |

|

|

|

| ||

The information contained in these shareholder letters represent the opinions of Van Eck Global and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of Van Eck Global are as of June 30, 2011, and are subject to change. | ||

|

Dear Shareholder:

This semi-annual report for the hard assets equity funds of the Market Vectors ETF Trust (the “Trust”) covers a period of high volatility for hard asset commodities overall and their corresponding equity sectors. Commodities prices, especially in the energy sector, benefited from strong global demand and supply disruptions in the Middle East and North Africa during the first quarter of 2011, but the gains were partially offset by reduced demand and heightened risk aversion in the second quarter of 2011 after economic data proved weaker than expected. For the semi-annual period overall, commodities were led by the energy and precious metals sectors, each supported in part by underlying weakness in the U.S. dollar. Crude oil prices topped $110 per barrel for the first time since 2008 in April 2011, ending the semi-annual period still above $95 per barrel. Gold bullion prices trended to an all-time high of $1,577 per ounce in early May 2011 before consolidating to end the semi-annual period at just over $1,500 per ounce. That said, shares of many commodity-related companies lagged the underlying commodities, as investors seemed to focus less on fundamentals and favorable supply/demand conditions and more on the uncertain impact of geopolitical unrest, man-made and natural disasters, rising input costs and what many considered to be a soft patch in the global economic rebound.

As conditions shifted markedly within the financial markets during the six months ended June 30, 2011, Van Eck Global continued to enhance the array of exchange-traded funds we offer our shareholders. During the semi-annual period, three new equity investment opportunities in the Market Vectors ETF family commenced operations—Colombia ETF, Germany Small-Cap ETF and Russia Small-Cap ETF. Investors also added significantly to the Market Vectors Emerging Markets Local Currency Bond ETF (EMLC) as a diversification to fixed income portfolios.

While absolute returns of several of the hard assets equity funds of the Trust were disappointing during the semi-annual period, each of the Market Vectors ETF Trust equity funds met its objective of tracking, as closely as possible, before fees and expenses, the price and yield performance of its benchmark index.

Since the first ETF within the Market Vectors ETF Trust was introduced in May 2006, total assets under management in the 26 equity funds of the Trust grew to more than $21.7 billion as of June 30, 2011. Even during a challenging period such as the six months ended June 30, 2011, total assets under management in the 26 equity funds of the Trust grew by more than 14%. Clearly, our shareholders recognize that the market continues to be filled with new investment opportunity, even as economic indicators remain mixed. We believe such demand also serves as testament to our shareholders’ confidence in the potential diversification benefits ETFs can provide to an investment portfolio over the long term.

The continued enthusiasm for ETFs in general, and for Market Vectors ETFs in particular, further demonstrates the persistent interest in these types of investment vehicles on the part of individual investors and financial professionals alike. These products have enabled investors of all types to find new and exciting sector allocation solutions as well as innovative ways to trade, hedge or invest in specialized segments of the market that have remained largely untapped to date.

On the following pages, you will find a brief review of each of the Trust’s hard assets equity funds as well as their performance for the six-month period ended June 30, 2011. You will, of course, also find the financial statements and portfolio information for each.

1

|

MARKET VECTORS HARD ASSETS ETFs |

We value your ongoing confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

July 20, 2011

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

2

|

Market Vectors Agribusiness ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the DAXglobal® Agribusiness Index1 (DXAG). As of June 30, 2011, DXAG represented 45 publicly traded companies.

For the six months ended June 30, 2011 (the “period”), the Fund gained 0.28%, while DXAG advanced 0.86%.2

While many commodity indices are significantly underweighted to agriculture-related commodities, the Fund offers investors a pure play means to gain access to a diversified group of agribusiness industries and companies worldwide. Broadly speaking, increasing global demand for agricultural-related products and declining arable land for agricultural production make agribusiness an attractive investment opportunity.

During the period, agriculture-related stocks overall experienced great volatility but managed to eke out modestly positive returns due primarily to the fundamentals of supply and demand. Demand for food, grains and biofuel inputs, especially from developing nations such as China, was greater than relatively stable supply. With the exception of wheat, prices for several agricultural commodities increased. An index measuring wholesale prices of agricultural products, reported Bloomberg, was up 9% in the week ended May 28, 2011 from a year earlier. The jump in global food prices put 44 million more people into poverty since June 2010, according to a World Bank estimate. However, at the same time, profits for many agribusinesses rose. The Food and Agriculture Organization of the United Nations stated that food prices were at an all-time high during the period. With an increasing population and growing middle class in the emerging markets, demand for basic foods increases and, as such, producing more food has become an increasingly big business. On the other hand, weighing on the sector’s stocks, especially toward the end of the period, were investor worries over a slowing global economy. Reports from the U.S. Department of Agriculture, providing evidence that farmers planted far more corn than expected while U.S. inventories as of June fell from a year ago but were sharply higher than analysts anticipated, were also of some concern. That said, crop prices remained elevated relative to historical averages.

The Fund is subject to various risks including those associated with making investments in companies engaged in the agriculture business such as economic forces, energy and financial markets, government policies and regulations, and environmental laws and regulations. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The DAXglobal® Agribusiness Index (DXAG), a trademark of Deutsche Börse AG, is licensed for use by Van Eck Associates Corporation. Deutsche Börse AG neither sponsors nor endorses the Fund and makes no warranty or representation as to the accuracy and/or completeness of DXAG or results to be obtained by any person using DXAG in connection with trading the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | DAXglobal® Agribusiness Index (DXAG), calculated by Deutsche Börse AG, is a modified market capitalization-weighted index comprised of publicly traded companies engaged in the agriculture business that are traded on leading global exchanges. |

|

|

2 | The Fund is passively managed and may not hold each DXAG component in the same weighting as the DXAG and is subject to certain expenses that DXAG is not. The Fund thus may not exactly replicate the performance of DXAG. |

3

|

MARKET VECTORS AGRIBUSINESS ETF |

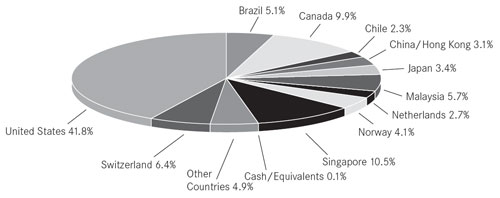

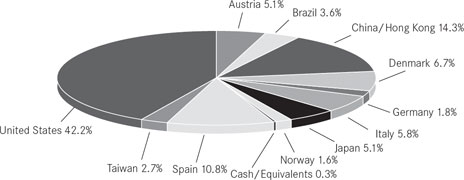

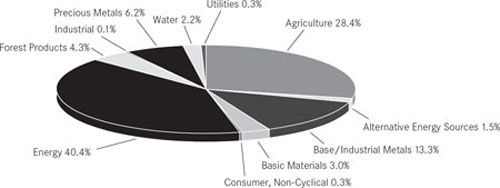

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

Potash Corp. of Saskatchewan Inc. |

| 8.1 | % |

Monsanto Co. |

| 7.7 | % |

Deere & Co. |

| 7.0 | % |

Syngenta AG |

| 6.4 | % |

Wilmar International Ltd. |

| 6.1 | % |

Archer-Daniels-Midland Co. |

| 5.0 | % |

Brasil Foods S.A. |

| 4.5 | % |

Mosaic Co. |

| 4.4 | % |

Agrium Inc. |

| 4.1 | % |

Yara International |

| 4.1 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

4

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| DXAG | |||

Year to Date |

| 0.47 | % |

| 0.28 | % |

| 0.86 | % |

One Year |

| 49.38 | % |

| 47.67 | % |

| 47.79 | % |

Life* (annualized) |

| 8.13 | % |

| 8.00 | % |

| 8.62 | % |

Life* (cumulative) |

| 34.95 | % |

| 34.33 | % |

| 37.29 | % |

|

|

|

|

|

|

|

|

|

|

*since 8/31/07 |

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.53% / Net Expense Ratio 0.53%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.56% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/31/07) to the first day of secondary market trading in shares of the Fund (9/5/07), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

DAXglobal® Agribusiness Index (DXAG) is a modified market capitalization-weighted index designed to track the movements of securities of companies engaged in the agriculture business that are traded on leading global exchanges.

5

|

Market Vectors Coal ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Stowe Coal IndexSM (TCOAL)1. As of June 30, 2011, TCOAL represented 37 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund increased 0.64%, while TCOAL rose 0.72%.2

During the period, coal company equities overall produced modest but positive returns. On the downside, the industry was impacted during the period by Environmental Protection Agency regulations, compliance of which drove some companies to close down coal plants. Fiscal tightening in China and concerns regarding both U.S. and global economic growth also served as headwinds to the sector during the period.

On the upside, however, the industry benefited from heightened merger and acquisition activity, supply constraints caused by floods in Australia, more favorable sentiment following Japan’s nuclear crisis, emerging market demand and analyst upgrades on the sector. In June 2011, Arch Coal completed its acquisition of International Coal Group, and Alpha Natural Resources completed its acquisition of Massey Energy. A massive flood in Australia wreaked havoc on the country’s coal production, causing billions of dollars in damages. Given that Australia is the world’s largest coal exporter and producer of coking coal used in steelmaking, concerns regarding supply disruptions drove coal prices—and select company shares—higher. Japan’s nuclear crisis impacted the coal industry in three primary ways. First, coal prices rallied as Japan is anticipated to experience power shortages for some time and fewer companies within Japan are being asked to make up for the lost electricity from those utilities most impacted by the earthquake and tsunami. Second, coal garnered much renewed interest from countries outside of Japan as an alternative to power generation away from nuclear following Japan’s crisis. Third, the re-building of Japan will rely on coal, pushing thermal coal prices higher in Indonesia, South Africa and South America. Elsewhere, as emerging economies build up and long-term prospects for clean coal technology compete with other “green” energy sources, many expect global demand for coal to rise.

The Fund is subject to various risks including those associated with making investments in the coal business such as changes in exchange rates, interest rates, government regulations, world events, depletion of resources and economic conditions, as well as market, economic and political risks of the countries where energy companies are located or do business. Additional risks include worldwide energy price fluctuations, natural disasters, environmental damage claims and risks related to foreign investments. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The Stowe Coal IndexSM (TCOAL), a trademark of Stowe Global Indexes LLC, is licensed for use by Van Eck Associates Corporation. Stowe Global Indexes LLC neither sponsors nor endorses the Fund and makes no warranty or representation as to the accuracy and/or completeness of TCOAL or results to be obtained by any person using TCOAL in connection with trading the Fund. TCOAL is calculated and maintained by Standard & Poor’s Custom Indices, which neither sponsors nor endorses the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Stowe Coal Index (TCOAL) is a rules-based, modified-capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the coal industry. |

|

|

2 | The Fund is passively managed and may not hold each TCOAL component in the same weighting as TCOAL and is subject to certain expenses that TCOAL is not. The Fund thus may not exactly replicate the performance of TCOAL. |

6

|

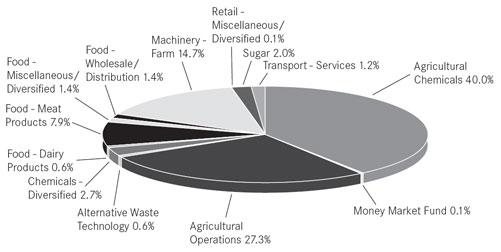

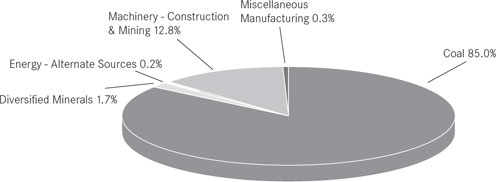

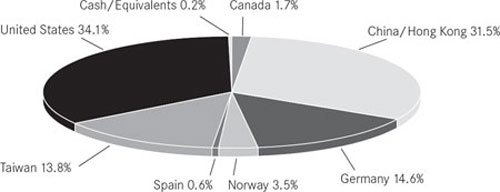

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

Joy Global, Inc. |

|

| 8.4 | % |

Peabody Energy Corp. |

|

| 8.4 | % |

China Shenhua Energy Co. Ltd. |

|

| 8.3 | % |

Consol Energy, Inc. |

|

| 7.8 | % |

Alpha Natural Resources Inc. |

|

| 7.7 | % |

Arch Coal, Inc. |

|

| 4.5 | % |

Bucyrus International, Inc. |

|

| 4.4 | % |

Exxaro Resources Ltd. |

|

| 4.4 | % |

Walter Energy, Inc. |

|

| 4.4 | % |

Yanzhou Coal Mining Co. Ltd. |

|

| 4.3 | % |

|

|

* | Percentage of net assets. |

** | Percentage of investments. |

7

|

PERFORMANCE COMPARISON |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| TCOAL |

| |||

Year to Date |

| 0.44 | % |

| 0.64 | % |

| 0.72 | % |

|

One Year |

| 59.83 | % |

| 58.66 | % |

| 58.21 | % |

|

Life* (annualized) |

| 5.32 | % |

| 5.27 | % |

| 6.01 | % |

|

Life* (cumulative) |

| 19.70 | % |

| 19.51 | % |

| 22.44 | % |

|

|

|

|

|

|

|

|

|

|

|

|

*since 1/10/08 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.55% / Net Expense Ratio 0.55%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.59% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (1/10/08) to the first day of secondary market trading in shares of the Fund (1/14/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Stowe Coal IndexSM (TCOAL) is a rules-based, modified capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the coal industry.

8

|

Market Vectors Global Alternative Energy ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Global IndexSM (Extra Liquid)1 (AGIXLT). As of June 30, 2011, AGIXLT represented 30 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund decreased 6.87%, while AGIXLT fell 7.31%.2

The Fund offers investors pure play access to the global alternative energy sector, a dynamic industry driven by the growing need for alternative fuel sources, including solar power, bio energy, wind power, hydro power and geothermal energy.

Two factors dominated the global alternative energy industry during the period — rising oil prices and the disastrous events at Japan’s Fukushima Dai-ichi nuclear power plant. Oil prices rose 4.42% during the period, in part due to supply disruptions in the Middle East and North Africa. As has often been the case in the past, oil prices and interest in alternative energy tend to move in tandem. Also, several nations’ response to the nuclear disaster in Japan and renewed fear and scrutiny over the nuclear power sector by investors broadly proved to be a catalyst for strong performance by alternative energy companies in March 2011, with solar and wind companies particular beneficiaries. For example, both Germany and Italy announced measures to curb nuclear electricity production. Even China, which maintains its ambitious plans to build a new fleet of nuclear power plants, showed interest in renewables following the tragedies in Japan. Some analysts believe that in the long term, the disaster in Japan puts the importance of alternative energy in the forefront for many investors and may force other countries, including the United States, to create policies that favor renewable energy. Another factor boosting investor interest in the global alternative energy industry during the period was a Pike Research report indicating that military complexes, such as the Pentagon, around the world have made “increased access to clean and reliable energy a leading priority”. This is important because the various branches of the Pentagon combine to form the single largest consumer of energy in the world — more than any other public or private entity and greater than more than 100 other nations, said the report. Thus, military initiatives focused on fostering alternative energy technologies are anticipated to have a substantial impact on the development of the industry as a whole. The report projects expenditure to grow from $1.8 billion in 2010 to $26.8 billion by 2030. Also of note, after years of delay, the first U.S. offshore wind farm, to be located off Massachusetts’ Nantucket Sound, was approved during the period with construction set for this fall.

Even with these supporting drivers, government incentives and profitability in alternative energy continued to be relatively low. The alternative energy sector overall fell in the second quarter along with a broad equity market pullback and as a result of deterioration in the perceived outlook for solar and wind stocks. However, many analysts agreed that valuations in the alternative energy sector at the end of the period were discounting significantly the ability of stocks to deliver expected earnings. Further, the long-term case for investment in the alternative energy sector remained intact. Growth within the sector is expected to continue to be driven by the economics of alternative energy sources as fossil fuel prices increase, energy security concerns remain a high political priority, and environmental and climate change concerns provide a favorable political and popular backdrop.

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

“Ardour Global IndexesSM, LLC”, “ARDOUR GLOBAL INDEXSM (Extra Liquid)”, and “ARDOUR – XLSM” are service marks of Ardour Global IndexesSM, LLC and have been licensed for use by Van Eck Associates Corporation. The Fund is not sponsored, endorsed, sold or promoted by Ardour Global IndexesSM, LLC and Ardour Global IndexesSM, LLC makes no representation regarding the advisability of investing in the Fund. AGIXLT is calculated by Dow Jones Indexes. The Fund, based on the AGIXLT, is not sponsored, endorsed, sold or promoted by Dow Jones Indexes, and Dow Jones Indexes makes no representation regarding the advisability of investing in the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Ardour Global IndexSM (Extra Liquid) (AGIXLT) is a rules-based, global capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the alternative energy industry. |

|

|

2 | The Fund is passively managed and may not hold each AGIXLT component in the same weighting as the AGIXLT and is subject to certain expenses that AGIXLT is not. The Fund thus may not exactly replicate the performance of AGIXLT. |

9

|

MARKET VECTORS GLOBAL ALTERNATIVE ENERGY ETF |

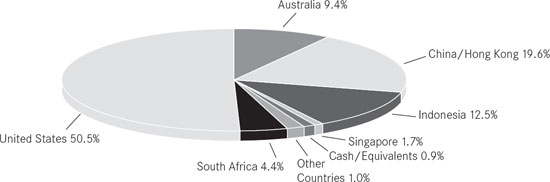

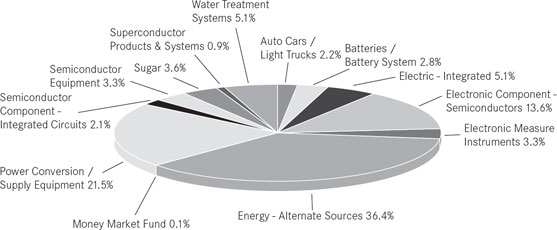

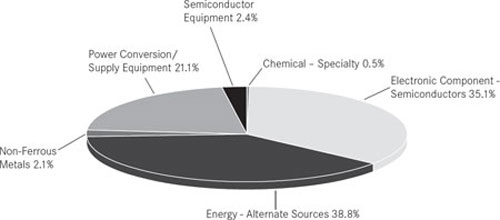

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

First Solar Inc. |

|

| 10.3 | % |

Vestas Wind Systems A/S |

|

| 6.7 | % |

Enel Green Power SpA |

|

| 5.8 | % |

Iberdrola Renovables S.A. |

|

| 5.6 | % |

Cree, Inc. |

|

| 5.5 | % |

Kurita Water Industries Ltd. |

|

| 5.1 | % |

Verbund OE A.G. |

|

| 5.1 | % |

Cosan Ltd. |

|

| 3.6 | % |

Covanta Holding Corp. |

|

| 3.4 | % |

International Rectifier Corp. |

|

| 3.3 | % |

|

|

* | Percentage of net assets. |

** | Percentage of investments. |

10

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| AGIXLT |

| |||

Year to Date |

| (6.65 | )% |

| (6.87 | )% |

| (7.31 | )% |

|

One Year |

| 2.99 | % |

| 2.10 | % |

| 1.09 | % |

|

Life* (annualized) |

| (16.25 | )% |

| (16.23 | )% |

| (16.43 | )% |

|

Life* (cumulative) |

| (52.17 | )% |

| (52.11 | )% |

| (52.62 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 5/3/07 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.60% / Net Expense Ratio 0.60%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.60% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/3/07) to the first day of secondary market trading in shares of the Fund (5/9/07), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Ardour Global IndexSM (Extra Liquid) (AGIXLT) is a rules-based, global capitalization-weighted, float adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the alternative energy industry.

11

|

Market Vectors Gold Miners ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index1 (GDM). As of June 30, 2011, GDM represented 30 publicly traded companies.

Gold Share and Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 11.08%, while GDM fell 10.84%.2

Gold has long been an important part of investors’ portfolios, serving as a potential hedge against inflation, a weakening U.S. dollar, and financial, economic and geopolitical uncertainty. Investing in gold miners has historically provided a means to leverage price changes in gold bullion—and in a tax-advantaged way.

During the period, gold bullion prices gained $79.57 per ounce, or approximately 5.60%, to close on June 30, 2011 at $1,500.35 per ounce. Following strong 2010 performance, the precious metal began the year with weakness, hitting its first-half 2011 low of $1,308 per ounce on January 28. Strength then returned to the market, as gold bullion prices trended to an all-time high of $1,577 per ounce on May 2. Gold bullion prices then consolidated since May when increased margin requirements for silver sparked a selloff in commodities.

While gold mining companies benefited financially from higher gold bullion prices, few stocks were able to outshine the underlying precious metal during the period. The key reason for the underperformance of gold shares may well have been rising production and capital costs in the mining industry. Energy can make up much as 40% of operating costs at a gold mine. Therefore, it is not uncommon to see share prices lag when oil prices rise dramatically. In addition, other commodities vital to mining, such as copper and steel, rose. High commodity prices have brought a global mining boom with competition for equipment and labor that drove costs further.

The year 2011 started with a revolution that began in North Africa and spread through the Middle East. Gold bullion prices failed to react to the overthrow of the Tunisian president and the Egyptian government, as these events carried profound geopolitical consequences but had little impact on global economies, trade or financial security beyond those countries. It was not until February, when civil war broke out in Libya, a producer of light crude oil, that the gold market reacted. Gold ended its January correction and bullion prices moved to new highs in March. Also underpinning gold were sovereign debt issues that continued to worsen around the globe. From Portugal to Japan to Greece and even the U.S., sovereign debt crises were supportive of gold as a sound currency alternative and financial safe haven.

Demand for physical gold was strong during the period, particularly from Asia. Inflationary pressures and negative real interest rates drove investment demand for gold in India, China and other emerging markets. Despite the high prices, the World Gold Council reported an 11.4% increase in global gold demand in the first quarter of 2011, with China reportedly purchasing 200 tonnes. The International Monetary Fund reported that Mexico added about 100 tonnes of gold to its foreign exchange reserves, the first country in the western hemisphere to make a major gold purchase in some time.

The Fund is subject to various risks including those associated with making investments in gold-mining companies such as competitive pressures and fluctuations in the price of gold bullion. In times of stable economic growth, the value of gold and other precious metals may be adversely affected. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

NYSE Arca Gold Miners Index (GDM), a trademark of NYSE Euronext or its affiliates (NYSE Euronext), is licensed for use by Van Eck Associates Corporation. NYSE Euronext neither sponsors nor endorses the Fund and makes no warranty or representation as to the accuracy and/or completeness of GDM or results to be obtained by any person from using GDM in connection with trading the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | NYSE Arca Gold Miners Index (GDM) is a market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold. |

|

|

2 | The Fund is passively managed and may not hold each GDM component in the same weighting as GDM and is subject to certain expenses that GDM is not. The Fund thus may not exactly replicate the performance of GDM. |

12

|

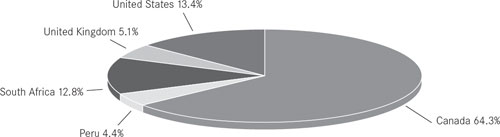

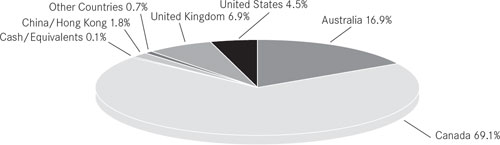

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

Barrick Gold Corp. |

| 15.5 | % |

|

Goldcorp, Inc. |

| 13.3 | % |

|

Newmont Mining Corp. |

| 9.1 | % |

|

Kinross Gold Corp. |

| 6.1 | % |

|

AngloGold Ashanti Ltd. |

| 5.5 | % |

|

Silver Wheaton Corp. |

| 4.6 | % |

|

Agnico-Eagle Mines Ltd. |

| 4.4 | % |

|

Compania de Minas Buenaventura S.A. |

| 4.4 | % |

|

Yamana Gold Inc. |

| 4.4 | % |

|

Gold Fields Ltd. |

| 4.4 | % |

|

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

13

|

PERFORMANCE COMPARISON |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| GDM |

| |||

Year to Date |

| (11.19 | )% |

| (11.08 | )% |

| (10.84 | )% |

|

One Year |

| 5.75 | % |

| 5.75 | % |

| 6.33 | % |

|

Five Year |

| 7.72 | % |

| 7.74 | % |

| 8.30 | % |

|

Life* (annualized) |

| 6.99 | % |

| 7.00 | % |

| 7.53 | % |

|

Life* (cumulative) |

| 41.34 | % |

| 41.44 | % |

| 45.05 | % |

|

| ||||||||||

*since 5/16/06 | ||||||||||

Gross Expense Ratio 0.52% / Net Expense Ratio 0.52%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.53% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/16/06) to the first day of secondary market trading in shares of the Fund (5/22/06), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

NYSE Arca Gold Miners Index (GDM) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold.

14

|

Market Vectors Junior Gold Miners ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Junior Gold Miners Index1 (MVGDXJTR). As of June 30, 2011, MVGDXJTR represented 72 publicly traded companies.

Gold Share and Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 14.17%, while MVGDXJTR fell 13.47%.2

The Fund offers convenient and cost-effective access to small-cap gold miners, which are often companies in the early stages of exploration or development. Small-cap gold miners may incur higher risks than their large-cap counterparts but also offer the potential for higher growth and for being the beneficiary of merger and acquisition activity. The Fund is global and broadly diversified by country.

During the period, gold bullion prices gained $79.57 per ounce, or approximately 5.60%, to close on June 30, 2011 at $1,500.35 per ounce. Following strong 2010 performance, the precious metal began the year with weakness, hitting its first-half 2011 low of $1,308 per ounce on January 28. Strength then returned to the market, as gold bullion prices trended to an all-time high of $1,577 per ounce on May 2. Gold bullion prices then consolidated since May when increased margin requirements for silver sparked a selloff in commodities.

The year 2011 started with a revolution that began in North Africa and spread through the Middle East. Gold bullion prices failed to react to the overthrow of the Tunisian president and the Egyptian government, as these events carried profound geopolitical consequences but had little impact on global economies, trade or financial security beyond those countries. It was not until February, when civil war broke out in Libya, a producer of light crude oil, that the gold market reacted. Gold ended its January correction and bullion prices moved to new highs in March. Also underpinning gold were sovereign debt issues that continued to worsen around the globe. From Portugal to Japan to Greece and even the U.S., sovereign debt crises were supportive of gold as a sound currency alternative and financial safe haven.

Demand for physical gold was strong during the period, particularly from Asia. Inflationary pressures and negative real interest rates drove investment demand for gold in India, China and other emerging markets. Despite the high prices, the World Gold Council reported an 11.4% increase in global gold demand in the first quarter of 2011, with China reportedly purchasing 200 tonnes. The International Monetary Fund reported that Mexico added about 100 tonnes of gold to its foreign exchange reserves, the first country in the western hemisphere to make a major gold purchase in some time.

While gold mining companies benefited financially from higher gold bullion prices, few stocks were able to outshine the underlying precious metal during the period. Indeed, small-cap gold stocks significantly underperformed gold bullion during the period driving a rare disconnect between gold and shares of gold miners. The market seemed to focus on negative factors, such as operating and capital cost escalation and geopolitical risk, while ignoring the value created by higher gold bullion prices. It is well worth noting that with high gold bullion prices, most junior gold miners were able to successfully raise sufficient cash to fund exploration and project development.

The Fund is subject to various risks including those associated with making investments in gold and silver mining companies such as bullion price volatility, changes in world political developments, competitive pressures and risks associated with foreign investments. In times of stable economic growth, the value of gold, silver and other precious metals may be adversely affected. Mining companies are subject to elevated risks, which include, among others, competitive pressures, commodity and currency price fluctuations, and adverse governmental or environmental regulations. In particular, small and mid-cap mining companies may be subject to additional risks including inability to commence production and generate material revenues, significant expenditures and inability to secure financing, which may cause such companies to operate at a loss, greater volatility, lower trading volume and less liquidity than larger companies. Investors should be willing to accept a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

15

|

MARKET VECTORS JUNIOR GOLD MINERS ETF |

Market Vectors Junior Gold Miners Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Market Vectors Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver. |

|

|

2 | The Fund is passively managed and may not hold each MVGDXJTR component in the same weighting as MVGDXJTR and is subject to certain expenses that MVGDXJTR is not. The Fund thus may not exactly replicate the performance of MVGDXJTR. |

16

|

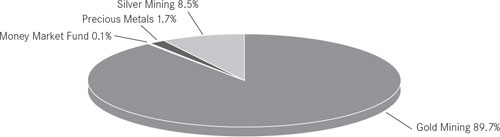

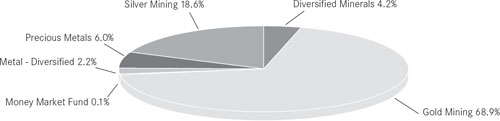

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

Silver Standard Resources, Inc. |

| 4.4 | % |

|

Alamos Gold, Inc. |

| 4.1 | % |

|

First Majestic Silver Corp. |

| 4.0 | % |

|

AuRico Gold, Inc. |

| 4.0 | % |

|

Silvercorp Metals, Inc. |

| 3.5 | % |

|

Nevsun Resources Ltd. |

| 2.6 | % |

|

Medusa Mining Ltd. |

| 2.5 | % |

|

Perseus Mining Ltd. |

| 2.5 | % |

|

Extorre Gold Mines Ltd. |

| 2.3 | % |

|

Kingsgate Consolidated Ltd. |

| 2.3 | % |

|

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

17

|

PERFORMANCE COMPARISON |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVGDXJTR |

| |||

Year to Date |

| (13.56 | )% |

| (14.17 | )% |

| (13.47 | )% |

|

One Year |

| 35.91 | % |

| 33.86 | % |

| 34.80 | % |

|

Life* (annualized) |

| 28.07 | % |

| 27.36 | % |

| 27.39 | % |

|

Life* (cumulative) |

| 49.88 | % |

| 48.53 | % |

| 48.59 | % |

|

| ||||||||||

*since 11/10/09 | ||||||||||

Gross Expense Ratio 0.53% / Net Expense Ratio 0.53%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.56% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (11/10/09) to the first day of secondary market trading in shares of the Fund (11/11/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Market Vectors Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.

18

|

Market Vectors Rare Earth/Strategic Metals ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the performance of the Market Vectors Rare Earth/Strategic Metals Index1 (MVREMXTR). As of June 30, 2011, MVREMXTR represented 26 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund gained 8.40%, while MVREMXTR rose 9.93%.2 The Fund is currently the only ETF that gives investors exposure to rare earth metals.

Rare earth/strategic metals are industrial metals that are typically mined as by-products in operations focused on precious metals and base metals. Compared to base metals, they have more specialized uses and are often more difficult to extract. Currently, approximately 49 elements in the periodic table are considered rare earth/strategic metals, including cerium, manganese, titanium and tungsten. Strategic metals are used in a variety of technologies including jet engines, hybrid cars, steel alloys, wind turbines, flat screen televisions and cellular phones. Rare earth metals, a subset of strategic metals, are a collection of 17 chemical elements that are essential in many of today’s most advanced technologies, with particular applications in electronics and defense.

During the period, as prices of rare earth metals rose, shares of mining companies producing the rare earth metals overall outpaced the broad U.S. and international equity markets. One of the risks of the sector is that China currently produces 97% of the world’s rare earth supply, but, notably, China comprises less than 15% of the Fund. This proved to be important when China announced in December 2010 that it would cut exports of its rare earth metals by about 35% in the first half of 2011. Early in the period, rare earth metals rallied sharply, at least in part, due to China’s limited exports of rare earth metals. But when the World Trade Organization (WTO) decided in February that China has no right to put such export restrictions in place, the decision led to some profit-taking, and prices declined. Meanwhile, fundamentals of supply and demand continued to support strong performance of the metals during the period. First, though China dominates current production of rare earth metals, the country has only a third of the world’s proven rare earth reserves. During the period, as many as 2,500 construction workers in Malaysia began racing to finish the world’s largest refinery for rare earth metals — the first rare earth ore processing plant to be built outside China in nearly three decades, according to The New York Times. Other countries that may fill the supply gap include Brazil, India, Chile, Bolivia, the U.S. and Canada, each of which sits on notable reserve bases of these metals as well. Meanwhile, global demand for rare earth metals continued to soar, especially for those in the appliance, electronics, automobile, telecommunications, alternative energy, medical, aerospace and defense industries. As these metals are included in more technologies, there could be increased pressure on the available supply. During the period, the constrained supply and high demand scenario, anticipated to push prices further, led some Wall Street analysts to offer bullish views on select companies mining rare earth metals.

Investments in companies involved in the various activities related to the mining, refining and manufacturing of rare earth/strategic metals are subject to elevated risks including international political and economic developments, adverse governmental or environmental regulations, and commodity prices. Moreover, some companies may be subject to the risks generally associated with extraction of natural resources, such as the risks and hazards associated with metals and mining, such as fire, drought, and increased regulatory and environmental costs. In addition, companies involved in the various activities that are related to the mining, refining and manufacturing of minor metals may be at risk for environmental damage claims. In particular, small and mid-cap mining companies may be subject to additional risks including inability to commence production and generate material revenues, significant expenditures and inability to secure financing, which may cause such companies to operate at a loss, greater volatility, lower trading volume and less liquidity than larger companies. Investors should be willing to accept a high degree of volatility and the potential of significant loss. China is currently the primary source of rare earth/strategic metals; a ban on the export of rare earth metals, or alternatively a reversal of China’s policies on export limits, could have a significant impact on industries around the globe. Radioactive materials are sometimes associated with rare earth mining projects and may cause difficulties in obtaining necessary permits.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

19

|

MARKET VECTORS RARE EARTH/STRATEGIC METALS ETF |

Market Vectors Rare Earth/Strategic Metals Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Rare Earth/Strategic Metals ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Market Vectors Rare Earth/Strategic Metals Index (MVREMXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies engaged in a variety of activities that are related to the mining, refining and manufacturing of rare earth/strategic metals. |

|

|

2 | The Fund is passively managed and may not hold each MVREMXTR component in the same weighting as MVREMXTR and is subject to certain expenses that MVREMXTR is not. The Fund thus may not exactly replicate the performance of MVREMXTR. |

20

|

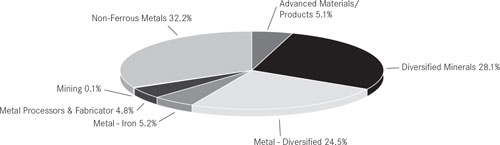

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

Kenmare Resources PLC |

| 8.6 | % |

|

Iluka Resources Ltd. |

| 8.3 | % |

|

Lynas Corp. Ltd. |

| 6.6 | % |

|

Molycorp Inc. |

| 7.3 | % |

|

Thompson Creek Metals Co. Inc. |

| 5.9 | % |

|

Titanium Metals Corp. |

| 5.8 | % |

|

Neo Material Technologies Inc. |

| 5.1 | % |

|

RTI International Metals Inc. |

| 4.8 | % |

|

Osaka Titanium Technologies Co. Ltd. |

| 4.8 | % |

|

China Molybdenum Co. Ltd. |

| 4.3 | % |

|

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

21

|

PERFORMANCE COMPARISON |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVREMXTR |

| |||

Year to Date |

| 7.50 | % |

| 8.40 | % |

| 9.93 | % |

|

Life* (cumulative) |

| 30.57 | % |

| 29.91 | % |

| 30.25 | % |

|

| ||||||||||

*since 10/27/10 | ||||||||||

Gross Expense Ratio 0.55% / Net Expense Ratio 0.55%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.57% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/27/10) to the first day of secondary market trading in shares of the Fund (10/28/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

Market Vectors Rare Earth/Strategic Metals Index (MVREMXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies engaged in a variety of activities that are related to the mining, refining and manufacturing of rare earth/strategic metals.

22

|

Market Vectors RVE Hard Assets Producers ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the RogersTM—Van Eck Hard Assets Producers Index1 (RVEIT). As of June 30, 2011, RVEIT represented 340 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund advanced 3.58%, while RVEIT increased 3.79%.2

The Fund offers investors convenient and cost-effective access to hard assets producers and distributors worldwide. The Fund is comprehensive in its composition, comprising well over 300 companies from more than 40 countries and six hard assets sectors. Unlike many commodities indices, the RVEIT is consumption weighted and thus offers more balanced exposure rather than being dominated by energy companies. Notably, the Fund offers exposure to water and alternative energy, two hard assets sectors not represented in most natural resources indices.

During the period, hard asset commodities overall and their corresponding equity sectors performed well, though volatility was high as a boom in the first quarter of 2011 was followed by a swoon in the second quarter. During the first quarter, commodities rose strongly on the back of strength in energy, due to increasing global demand and supply disruptions in the Middle East and North Africa. However, reduced demand and heightened risk aversion during the second quarter—partially due to spiking energy prices—tempered overall period returns. Prospects of greater supply in agriculture hurt wheat and corn prices during the second quarter. Precious metals was the only major commodities sector to post gains during the second quarter. For the period overall, commodities were led by the energy and precious metals sectors. Crude oil was up approximately 4.42% during the period. Gold prices were up 5.60% and silver prices rose 12.20%, supported by global political unrest, low interest rates and a weak U.S. dollar, as measured by the 5.98% decline in the U.S. Dollar Index.3 For the period, wheat was by far the weakest commodity, experiencing double-digit price declines. Copper prices also fell, though more modestly. Coffee and cotton each experienced price increases, of 9.15% and 17.13%, respectively.

The Fund is subject to various risks including those associated with making investments in companies engaged in producing and distributing hard assets and related products and services, such as commodity price volatility, changes in government policies/regulations and world political and economic developments. Additional risks include competitive pressures, technological advances and/or obsolescence, the depletion of resources, labor relations issues and risks associated with foreign investments, a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market. |

The RogersTM-Van Eck Hard Assets Producers Index has been licensed by Van Eck Associates Corporation from S-Network Global Indexes, LLC for use in connection with Market Vectors RVE Hard Assets Producers ETF (HAP). HAP is not sponsored, endorsed, sold or promoted by S-Network Global Indexes, LLC, which makes no representation regarding the advisability of investing in HAP.

“Jim Rogers,” “James Beeland Rogers, Jr.,” and “Rogers,” are trademarks, service marks and/or registered trademarks of Beeland Interests, Inc. (“Beeland Interests”), which is owned and controlled by James Beeland Rogers, Jr., and are used subject to license. The personal names and likeness of Jim Rogers/James Beeland Rogers, Jr. are owned and licensed by James Beeland Rogers, Jr.

HAP is not sponsored, endorsed, sold or promoted by Beeland Interests or James Beeland Rogers, Jr. Neither Beeland Interests nor James Beeland Rogers, Jr. makes any representation or warranty, express or implied, nor accepts any responsibility, regarding the accuracy or completeness of this material, or the advisability of investing in securities or commodities generally, or in HAP or in futures particularly.

23

|

MARKET VECTORS RVE HARD ASSETS PRODUCERS ETF |

BEELAND INTERESTS AND ITS AFFILIATES AND VAN ECK AND ITS AFFILIATES SHALL NOT HAVE ANY LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS, AND MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY OWNERS OF HAP, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF RVEI. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL BEELAND INTERESTS OR VAN ECK OR ANY THEIR RESPECTIVE AFFILIATES HAVE ANY LIABILITY FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES OR LOSSES, EVEN IF NOTIFIED OF THE POSSIBILITY THEREOF.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | The RogersTM—Van Eck Hard Assets Producers Index (RVEIT) is a rules-based, modified capitalization-weighted, float-adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services. The companies are involved in six hard assets sectors: agriculture, energy, base metals, precious metals, forest products and water/renewable energy sources (solar, wind). |

|

|

2 | The Fund is passively managed and may not hold each RVEIT component in the same weighting as RVEIT and is subject to certain expenses that RVEIT is not. The Fund thus may not exactly replicate the performance of RVEIT. |

|

|

3 | The U.S. Dollar Index (DXY) indicates the general international value of the U.S. dollar. The DXY does this by averaging the exchange rates between the U.S. dollar and six major world currencies. |

24

|

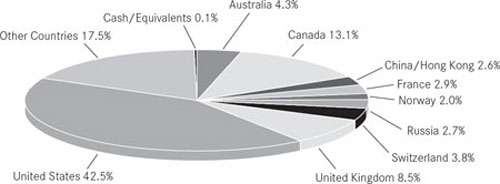

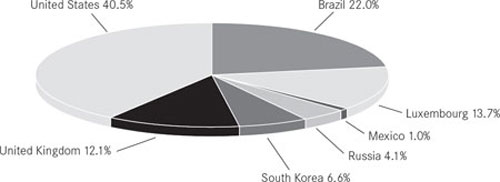

Geographical Weightings*

(unaudited)

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

|

Exxon Mobil Corp. |

| 5.2 | % |

|

Potash Corp. of Saskatchewan, Inc. |

| 4.8 | % |

|

Monsanto Co. |

| 3.9 | % |

|

Deere & Co. |

| 3.4 | % |

|

Syngenta A.G. |

| 3.2 | % |

|

Chevron Corp. |

| 2.7 | % |

|

BHP Billiton Ltd. |

| 2.1 | % |

|

Archer-Daniels-Midland Co. |

| 2.0 | % |

|

Mosaic Co. |

| 1.9 | % |

|

BP PLC |

| 1.8 | % |

|

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

25

|

PERFORMANCE COMPARISON |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| RVEIT |

| |||

Year to Date |

| 3.62 | % |

| 3.58 | % |

| 3.79 | % |

|

One Year |

| 44.74 | % |

| 43.88 | % |

| 43.89 | % |

|

Life* (annualized) |

| 1.32 | % |

| 1.20 | % |

| 1.52 | % |

|

Life* (cumulative) |

| 3.78 | % |

| 3.43 | % |

| 4.38 | % |

|

|

|

|

|

|

|

|

|

|

|

|

*since 8/29/08 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.59% / Net Expense Ratio 0.59%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.59% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/29/08) to the first day of secondary market trading in shares of the Fund (9/3/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

The RogersTM-Van Eck Hard Assets Producers Index is a rules-based, modified capitalization-weighted, float adjusted index intended to give investors a means of tracking the overall performance of a global universe of listed companies engaged in the production and distribution of commodities and commodity-related products and services.

26

|

Market Vectors Solar Energy ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Solar Energy IndexSM (SOLRXT)1. As of June 30, 2011, SOLRXT represented 30 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund was down 3.17%, while SOLRXT fell 3.80%.2

Despite recent challenges, solar energy remains the fastest growing renewable energy source in the world. The Fund offers access to the emerging global solar energy industry via a pure play portfolio that includes photovoltaic, concentrated solar power and solar thermal power; solar integrators; and related technologies. The Fund is also well diversified by country.

Early in 2011, solar stocks faced seasonal headwinds as poor weather in the Northern Hemisphere, where most solar module installations take place, resulted in weak earnings. Then, toward the end of the period, solar stocks declined in line with a broad equity market pullback and a negative shift in the perception for these companies’ prospects. However, solar companies were strong at the end of the first quarter, the beneficiaries of several factors. Most prominent was the aftermath of Japan’s Fukushima nuclear disaster, refocusing attention on and driving political support for the solar industry in several nations. For example, Germany and Italy both announced measures to curb nuclear electricity production. Germany, already the solar industry’s largest market, may experience dramatically higher than expected demand as 2011 progresses. Also, there was less uncertainty about subsidies in Italy after recent announcements there removed a cloud over the sector. More positive news for the solar sector was Google’s announcement that it has made its largest investment into the renewable energy industry to date. Through a partnership with California-based SolarCity (not held by Fund), Google intends to offer homeowners the opportunity to install rooftop solar energy panels in a more affordable way. Another factor buoying the industry was an analyst’s comments that solar pricing is becoming competitive with that of traditional energy sources due to improved technology and more streamlined manufacturing processes. Merger and acquisition activity within the industry provided further validation for the solar sector during the period. For example, French oil giant Total (not held by Fund) announced in April 2011 that it will purchase a controlling stake in SunPower (3.8% of Fund net assets†), an American solar energy firm, for about $1.4 billion. Other solar companies rallied during the period on company-specific news, such as U.S. Energy Department offers of conditional commitments for loan guarantees, significant orders for its products or nods of approval from major investment banks.

The Fund is subject to various risks including those associated with making investments in companies engaged in the solar energy business such as technological developments and obsolescence, short product cycles, commodity and energy price volatility, depletion of resources and risks associated with companies with a limited operating history. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

|

† All Fund assets referenced are Total Net Assets as of June 30, 2011. |

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

27

|

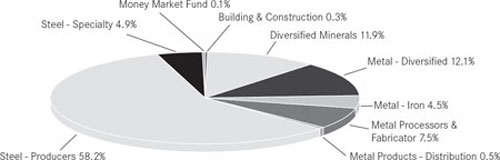

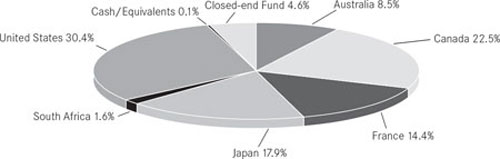

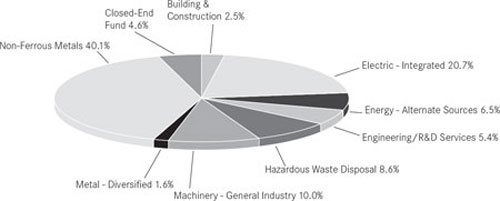

MARKET VECTORS SOLAR ENERGY ETF |