UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 Madison Avenue, New York, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: JUNE 30, 2011

ITEM 1. Report to Shareholders

SEMI-ANNUAL REPORT

J u n e 3 0 , 2 0 1 1

( u n a u d i t e d )

MARKET VECTORS

INTERNATIONAL ETFs

AFK

GERJ

PLND

EVX

MARKET VECTORS

SPECIALTY ETFs

BRF

MES

RSX

BJK

PEK

SCIF

RSXJ

COLX

IDX

VNM

EGPT

LATM

Africa Index

ETF

Brazil

Small-Cap ETF

China ETF

Colombia ETF

Egypt Index ETF

Germany

Small-Cap ETF

Gulf States

Index ETF

India

Small-Cap Index ETF

Indonesia

Index ETF

Latin America

Small-Cap Index ETF

Poland

ETF

Russia

ETF

Russia

Small-Cap ETF

Vietnam

ETF

Environmental

Services ETF

Gaming

ETF

|

|

|

| ||

|

|

|

|

|

| 1 | |

|

| |

| 3 | |

| 6 | |

| 9 | |

| 12 | |

| 15 | |

| 18 | |

| 21 | |

| 24 | |

| 27 | |

| 31 | |

| 34 | |

| 37 | |

| 41 | |

| 44 | |

| 47 | |

| 50 | |

|

| |

| 5 | |

| 8 | |

| 11 | |

| 14 | |

| 17 | |

| 20 | |

| 23 | |

| 26 | |

| 30 | |

| 33 | |

| 36 | |

| 40 | |

| 43 | |

| 46 | |

| 49 | |

| 52 | |

| 53 |

|

|

|

|

|

| |

| 56 | |

| 58 | |

| 60 | |

| 61 | |

| 62 | |

| 63 | |

| 65 | |

| 67 | |

| 69 | |

| 71 | |

| 74 | |

| 75 | |

| 77 | |

| 79 | |

| 81 | |

| 83 | |

| 86 | |

| 90 | |

| 94 | |

|

| |

| 101 | |

| 101 | |

| 102 | |

| 102 | |

| 103 | |

| 103 | |

| 104 | |

| 104 | |

| 105 | |

| 105 | |

| 106 | |

| 106 | |

| 107 | |

| 107 | |

| 108 | |

| 108 | |

| 109 | |

| 117 |

|

The information contained in these shareholder letters represent the opinions of Van Eck Global and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of Van Eck Global are as of June 30, 2011, and are subject to change. |

|

This semi-annual report for the international and specialty equity funds of the Market Vectors ETF Trust (the “Trust”) covers a period of high volatility in the equity markets.

Global equities broadly were resilient during the semi-annual period despite a deluge of unfavorable news, including the development of a soft patch in the U.S. economy, ongoing sovereign debt crises in Europe and the looming expiration of the Federal Reserve Board’s quantitative easing program, known as QE2, at the end of June 2011. Additional challenges came from exogenous shocks, such as political turmoil in the Middle East and North Africa, which heightened volatility in the energy sector. Also, the impact of the devastating earthquake and tsunami in Japan reverberated across the international equity markets, leading to supply chain disruptions in global industrial and technology sectors. Despite a backdrop of negative sentiment driven by these conditions, corporate earnings momentum generally remained positive, supporting moderate gains for developed market equities.

In contrast, emerging market equities generally were weaker, beset by heightened inflationary pressures with concomitant tighter monetary policy.

As conditions shifted markedly within the financial markets during the six months ended June 30, 2011, Van Eck Global continued to enhance the array of exchange-traded funds we offer our shareholders. During the semi-annual period, three new equity investment opportunities in the Market Vectors ETF family commenced operations — Colombia ETF, Germany Small-Cap ETF and Russia Small-Cap ETF. Investors also added significantly to the Market Vectors Emerging Markets Local Currency Bond ETF (EMLC) as a diversification to fixed income portfolios.

While absolute returns of several of the equity funds of the Trust were disappointing during the semi-annual period, each of the Market Vectors ETF Trust international and specialty equity funds met its objective of tracking, as closely as possible, before fees and expenses, the performance of its benchmark index.

Since the first ETF within the Market Vectors ETF Trust was introduced in May 2006, total assets under management in the 26 equity funds of the Trust grew to more than $21.7 billion as of June 30, 2011. Even during a challenging period such as the six months ended June 30, 2011, total assets under management in the 26 equity funds of the Trust grew by more than 14%. Clearly, our shareholders recognize that the market continues to be filled with new investment opportunity, even as economic indicators remain mixed. We believe such demand also serves as testament to our shareholders’ confidence in the potential diversification benefits ETFs can provide to an investment portfolio over the long term.

The continued enthusiasm for ETFs in general, and for Market Vectors ETFs in particular, further demonstrates the persistent interest in these types of investment vehicles on the part of individual investors and financial professionals alike. These products have enabled investors of all types to find new and exciting sector allocation solutions as well as innovative ways to trade, hedge or invest in specialized segments of the market that have remained largely untapped to date.

On the following pages, you will find a brief review of each of the Trust’s international and specialty equity funds as well as their performance for the six-month period ended June 30, 2011. You will, of course, also find the financial statements and portfolio information for each.

1

|

MARKET VECTORS INTERNATIONAL/SPECIALTY ETFs |

We value your ongoing confidence in us and look forward to helping you meet your investment goals in the future.

|

|

|

Jan F. van Eck |

Trustee and President |

Market Vectors ETF Trust |

|

July 20, 2011 |

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

2

|

MARKET VECTORS AFRICA INDEX ETF |

Market Vectors Africa Index ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Dow Jones Africa Titans 50 IndexSM 1 (DJAFKT). As of June 30, 2011, DJAFKT represented 51 publicly traded companies.

For the six months ended June 30, 2011 (the “period”), the Fund declined 6.60%, while DJAFKT fell 6.20%.2

The Fund offers investors convenient pure play access to Africa, a continent with abundant natural resources, strengthening capital markets and an improving economic and political environment. Importantly, Africa has also become a growing exporter to China.

During the period, Africa’s equity markets lagged both the emerging equity markets and the developed international equity markets overall. The largest economy on the continent — and the nation where the Fund has its greatest weighting — is South Africa. South Africa’s equity market struggled during the period, as the nation’s economy failed to generate the necessary growth to diminish a 25% unemployment rate. While South Africa increased its non-farm labor force by 47,000 in the first quarter of 2011, its National Treasury calculates that the country will need a 7% annual growth rate over the next decade to meet the government’s goal of creating five million jobs and bringing down unemployment to 15% by 2020. The economy expanded 4.8% in the first quarter of 2011 year-over-year. On the positive side, South Africa got a vote of confidence early in the period from independent ratings firm Fitch in the form of a ratings upgrade due to the strength the country showed coming out of the economic downturn. The Fund was also impacted, of course, by Egypt, the third heaviest African weighting in the Fund at June 30, 2011. Headline-making political unrest in Egypt led its equity market to close for several weeks during the period and to generate double-digit declines for the period overall.

While the International Monetary Fund (IMF) acknowledges that economic growth has been recovering more gradually in the region’s middle-income countries, including South Africa, it continued to state even in late June 2011 that sub-Saharan Africa’s recovery from the crisis-induced slowdown is well under way. The IMF stated that growth in most countries of sub-Saharan Africa was, toward the end of the period, fairly close to the high levels of the mid-2000s and projected that economic growth will average 5.5% in 2011 and 6% in 2012.

|

The Fund is subject to a high degree of risk, including those associated with less reliable financial information, higher costs, taxation, decreased liquidity, less stringent reporting, and foreign currency risks. Special risks particular to African investments include expropriation, political instability, economic impacts of armed conflict, civil war and severe social instability, less developed capital markets, lower market capitalization, lower trading volume, illiquidity, inflation, greater price fluctuations, uncertainty regarding the existence of trading markets, politically controlled access to trading markets, unsettled securities laws, and trade barriers. Investors should be willing to accept a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk. |

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The Dow Jones Africa Titans 50 IndexSM, licensed for use by Van Eck Associates Corporation, is calculated by Dow Jones Indexes. Dow Jones®, Titans and Dow Jones Africa Titans 50 Index are service marks of Dow Jones & Company, Inc. The Fund is not sponsored, endorsed, sold or promoted by Dow Jones Indexes, and Dow Jones Indexes makes no representation regarding the advisability of investing in the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Dow Jones Africa Titans 50 IndexSM (DJAFKT) is a rules-based, modified capitalization weighted, float-adjusted index comprised of publicly traded companies that are headquartered in Africa or that generate the majority of their revenues in Africa. |

|

|

2 | The Fund is passively managed and may not hold each DJAFKT component in the same weighting as DJAFKT and is subject to certain expenses that DJAFKT is not. The Fund thus may not exactly replicate the performance of DJAFKT. |

3

|

|

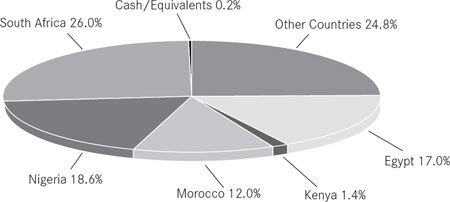

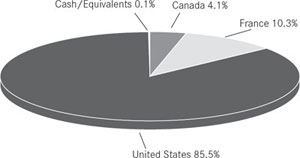

Geographical Weightings* |

(unaudited) |

|

|

|

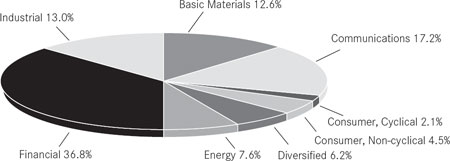

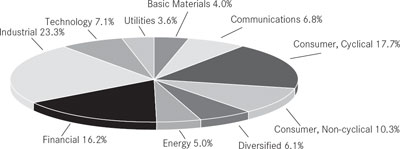

Sector Weightings** |

(unaudited) |

|

|

|

Top Ten Fund Holdings* |

(unaudited) |

|

|

|

|

|

Tullow Oil PLC |

|

| 6.0 | % |

Nigerian Breweries PLC |

|

| 5.7 | % |

Orascom Construction Industries |

|

| 5.0 | % |

Attijariwafa Bank |

|

| 4.6 | % |

First Quantum Minerals Ltd. |

|

| 4.3 | % |

Old Mutual PLC |

|

| 4.2 | % |

Maroc Telecom |

|

| 4.1 | % |

Zenith Bank PLC |

|

| 4.0 | % |

Guaranty Trust Bank PLC |

|

| 3.9 | % |

Sasol Ltd. |

|

| 3.6 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

4

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| DJAFKT |

| |||

Year to Date |

| (8.30 | )% |

| (6.60 | )% |

| (6.20 | )% |

|

One Year |

| 18.51 | % |

| 18.19 | % |

| 18.59 | % |

|

Life* (annualized) |

| (6.32 | )% |

| (6.19 | )% |

| (4.61 | )% |

|

Life* (cumulative) |

| (17.65 | )% |

| (17.30 | )% |

| (13.10 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 7/22/08 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.94% / Net Expense Ratio 0.82% | |

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.78% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation. | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/10/08) to the first day of secondary market trading in shares of the Fund (7/14/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Dow Jones Africa Titans 50 IndexSM (DJAFKT) is a rules-based, modified capitalization-weighted, float-adjusted index comprised of publicly traded companies that are headquartered in Africa or that generate the majority of their revenues in Africa.

5

|

Market Vectors Brazil Small-Cap ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Brazil Small-Cap Index1 (MVBRFTR). As of June 30, 2011, MVBRFTR represented 70 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 2.38%, while MVBRFTR fell 1.69%.2

The Fund offers investors pure play access to a basket of Brazil’s small-cap companies. Importantly, MVBRFTR is not dominated by global heavyweights in commodities and materials, but rather is focused on companies whose performance may be driven by growth in the domestic economy, including household durables, real estate management and development companies, health care providers, multi-line retail companies and other local industries benefiting from increasing wealth and a growing middle class.

During the period, Brazilian small-cap equities struggled as the nation’s economy faced headwinds in inflationary pressures and budget cuts. Still, Brazil’s Central Bank President Alexandre Tombini stated that Brazil’s economy continued to experience sustainable growth. In fact, the Brazilian government announced that first quarter 2011 Gross Domestic Product expanded 1.3% over the prior quarter and 4.2% year-over-year. Especially important for investors in Brazilian small-cap equities to note is Tombini’s statement that “domestic demand continues to be the main support of the economy, with family consumption registering 5.9% growth compared to the first quarter of 2010, a performance which has been spurred by the moderate expansion of credit to families, by the generation of employment and wages.” Brazilian equities overall are also anticipated to continue to benefit from a strong central bank, good demographics, a diverse economy, high demand dynamics and reasonable valuations. Further, in early April, independent ratings firm Fitch upgraded Brazil due to its sustainable potential growth rate.

The Fund is subject to elevated risks, including those associated with investments in derivatives and foreign securities. In particular, Brazilian investments are subject to elevated risks, which include, among others, actions taken by the Brazilian government, inflation, high interest rates, currency risk, less reliable financial information, higher transactional costs, taxation, political instability and other risks associated with foreign investments. In addition, companies with small capitalizations are subject to elevated risks, which include, among others, greater volatility, lower trading volume and less liquidity than larger companies. Investors should be willing to accept a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market. |

The Market Vectors Brazil Small-Cap Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Brazil Small-Cap Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

|

|

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index. | |

|

|

1 | Market Vectors Brazil Small-Cap Index (MVBRFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Brazil, or that generate at least 50% of their revenues in Brazil. |

|

|

2 | The Fund is passively managed and may not hold each MVBRFTR component in the same weighting as the MVBRFTR and is subject to certain expenses that MVBRFTR is not. The Fund thus may not exactly replicate the performance of MVBRFTR. |

6

|

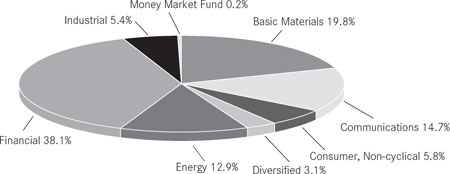

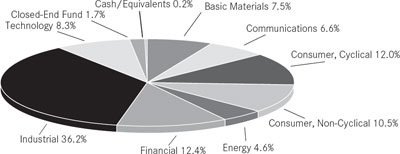

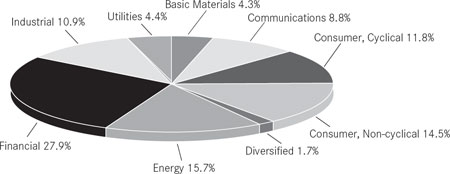

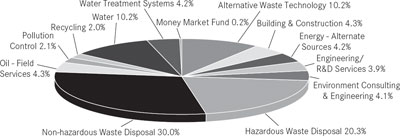

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

CETIP S.A. |

| 6.0 | % |

Cia Hering S.A. |

| 5.1 | % |

Anhanguera Educacional Participacoes S.A. |

| 4.1 | % |

Totvs S.A. |

| 3.4 | % |

Localiza Rent A Car S.A. |

| 3.3 | % |

Gafisa S.A. |

| 3.2 | % |

Sul America S.A. |

| 3.1 | % |

TAM S.A. |

| 2.7 | % |

Klabin S.A. |

| 2.6 | % |

LLX Logistica S.A. |

| 2.5 | % |

|

|

* | Percentage of net assets. |

** | Percentage of investments. |

7

|

MARKET VECTORS BRAZIL SMALL-CAP ETF |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVBRFTR |

| |||

Year to Date |

| (1.63 | )% |

| (2.38 | )% |

| (1.69 | )% |

|

One Year |

| 38.22 | % |

| 35.15 | % |

| 36.36 | % |

|

Life* (annualized) |

| 52.45 | % |

| 51.30 | % |

| 51.76 | % |

|

Life* (cumulative) |

| 145.95 | % |

| 142.01 | % |

| 143.56 | % |

|

|

|

|

|

|

|

|

|

|

|

|

*since 5/12/09 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 0.62% / Net Expense Ratio 0.62% | |

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.62% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation. | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/12/09) to the first day of secondary market trading in shares of the Fund (5/14/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Market Vectors Brazil Small-Cap Index (MVBRFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Brazil, or that generate at least 50% of their revenues in Brazil.

8

|

*The Fund does not invest directly in A-Shares, but gains exposure to the China A-share market by investing in swaps that are linked to the performing A-shares which comprise the CSIR0300.

Market Vectors China ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the CSI 300 Index1 (CSIR0300). As of June 30, 2011, CSIR0300 represented 300 A-share stocks.

Fund Review

For the six months ended June 30, 2011, (the “period”), the Fund declined 0.49%, while CSIR0300 fell 1.75%.2

The Fund is the first U.S. ETF to offer investors access to China’s A-Share market, a market driven by consumption amongst China’s local population, the largest in the world. China’s A-Shares are issued by companies that have been incorporated in the mainland of China, which trade on the Chinese stock markets (Shanghai and Shenzhen). These A-Shares, which have historically been restricted to the country’s domestic investors and Qualified Foreign Institutional Investors, have experienced high growth as a result of a steadily expanding Chinese economy and heightened domestic demand.

Accessing China’s equity market for U.S. investors has historically been challenging as the Chinese government has only allowed foreign access to certain Chinese stocks packaged as B-shares (a relatively limited number of stocks that also trade on the Shanghai and Shenzhen exchanges), as well as H-shares, Red chips, N-shares, S-shares and L-shares (which trade on foreign stock exchanges).

Without A-Share exposure, investors may be underweighting China. After all, as measured by market capitalization, China’s total equity market comprises approximately 33% of the emerging market universe. The CSIR0300, the Fund’s underlying index, consists of 300 A-Share stocks, representing approximately 64% of the total market capitalization of China’s Shanghai and Shenzhen exchanges, and is broadly diversified by both sector and market capitalization.

During the period, China’s equity market generated rather flat returns. On the one hand, competition from India heightened; strikes, riots and protests were on the rise; and investors were concerned about slowed manufacturing growth and surging inflation in China. For example, consumer prices jumped 5.4% in March and 5.3% in April. However, by the end of the period, the nation’s government seemed less worried about inflation than it had been in the months prior, boding well perhaps for its overall economic prospects ahead. On the positive side, while corporate profits of Chinese companies broadly cooled, Chinese banks overall reported better-than-expected earnings during the period, despite increased lending and a jump in property prices. Further supporting investment activity in China were several demographic trends made evident from the nation’s sixth census in November 2010. Among these were an accelerating pace of urbanization and a sharply rising ratio of Chinese with a junior college or higher level degree, thereby providing a much more educated workforce.

Chinese investments are subject to elevated risks, which include, among others, political and economic instability, inflation, confiscatory taxation, nationalization and expropriation, Chinese securities market volatility, less reliable financial information, differences in accounting, auditing and financial standards and requirements from those applicable to U.S. issuers, uncertainty of implementation of existing Chinese law. In addition, the Fund is also subject to liquidity and valuation risks, foreign securities risk and other risks associated with foreign investments. The Fund invests in swaps on the CSI 300 Index or on securities comprising the CSI 300 Index. The Fund may also invest in other swaps and derivatives on other funds that track the CSI 300 Index or invest directly in the shares of such funds. The use of swap and derivatives entails certain risks, which may be different from, and possibly greater than, the risks associated with investing directly in the underlying asset for the swap agreement. These risks include limited availability of swaps, counterparty risk, liquidity risk, risks of A-shares and the QFII system, tax risk (including short-term capital gains and/or ordinary income), premium risk, currency risk, market risk, and index tracking risk. Investors should be willing to accept a high degree of volatility and the potential of significant loss.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market. |

9

|

MARKET VECTORS CHINA ETF |

CSI 300 Index and its logo are service marks of China Securities Index Co., Ltd. (“CSI”) and have been licensed for use by Van Eck Associates Corporation. The Market Vectors China ETF is not sponsored, endorsed, sold or promoted by CSI and CSI makes no representation regarding the advisability of investing in the Market Vectors China ETF. CSI 300 is a registered trademark of China Securities Index Co., Ltd.

|

|

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index. | |

|

|

1 | CSI 300 Index (CSIR0300) is a modified free-float market capitalization-weighted index compiled and managed by China Securities Index Co., Ltd. Considered to be the leading index for the Chinese equity market, the CSI 300 is a diversified index consisting of 300 constituent stocks listed on the Shenzhen Stock Exchange and/or the Shanghai Stock Exchange. |

|

|

2 | The Fund is passively managed and may not hold each CSIR0300 component in the same weighting as the CSIR0300 and is subject to certain expenses that CSIR0300 is not. The Fund thus may not exactly replicate the performance of CSIR0300. |

10

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| CSIR0300 |

| |||

Year to Date |

| (3.40 | )% |

| (0.49 | )% |

| (1.75 | )% |

|

Life* (cumulative) |

| 9.42 | % |

| (2.48 | )% |

| (4.47 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 10/13/10 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 1.08% / Net Expense Ratio 0.71%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.72% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/13/10) to the first day of secondary market trading in shares of the Fund (10/14/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

CSI 300 Index (CSIR0300) is a modified free-float market capitalization-weighted index compiled and managed by China Securities Index Co., Ltd. Considered to be the leading index for the Chinese equity market, the CSI 300 is a diversified index consisting of 300 constituent stocks listed on the Shenzhen Stock Exchange and/or the Shanghai Stock Exchange.

11

|

Market Vectors Colombia ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Colombia Index1 (MVCOLXTR). As of June 30, 2011, MVCOLXTR represented 27 publicly traded companies.

Fund Review

For the period from the Fund’s commencement date on March 14, 2011 through June 30, 2011, (the “period”), the Fund gained 1.35%, while MVCOLXTR rose 1.59%.2

The Fund offers investors pure play and diversified access to Colombia, a commodity-based economy, uniquely positioned to benefit from increasing trade and development of Andean capital markets.

During the period, the Colombian equity market generated positive returns as it did for the six months ended June 30, 2011 as well. Such performance was supported in large part by Colombia’s economic growth, which not only exceeded expectations by its central bank and by many analysts but also outstripped that of Mexico and Brazil within the Latin America region. In the first quarter of 2011, the Gross Domestic Product (GDP) in Colombia expanded 5.1% year-over-year. Mining, agriculture, cattle, forestry and fisheries were the fastest growing sectors. Domestic consumption, investment and exports rose 5.4%, 13.2% and 11.5%, respectively, in the first quarter compared with a year earlier. Colombia’s accelerating economic growth raised expectations that the country’s central bank will increase interest rates again in an attempt to ward off inflationary pressures, which are considered by many to be the greatest threat to the nation’s ongoing health. According to Reuters, Colombia’s central bank already hiked rates five times during the first half of 2011 to 4.25% to temper consumer demand, driven by what the central bank claims are historically low private bank interest rates. Having made a strong recovery from the global economic crisis, Colombia, Latin America’s fourth-largest oil producer, earned three investment-grade credit ratings during the first half of 2011 and continued to see strong inflows in its mining and oil sectors.

The Fund is subject to risks associated with investments in derivatives and foreign securities. In particular, Colombian investments are subject to elevated risks, which include, among others, high interest rates, economic volatility, inflation, currency devaluations, high unemployment rates, commodity price volatility, and adverse economic events in other South American countries. In general, foreign investments are subject to greater market volatility, less reliable financial information, high transactional costs, taxation, decreased liquidity, political risks, and currency risk. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The Market Vectors Colombia Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Colombia ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Market Vectors Colombia Index (MVCOLXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Colombia, or that generate at least 50% of their revenues in Colombia. |

|

|

2 | The Fund is passively managed and may not hold each MVCOLXTR component in the same weighting as the MVCOLXTR and is subject to certain expenses that MVCOLXTR is not. The Fund thus may not exactly replicate the performance of MVCOLXTR. |

12

|

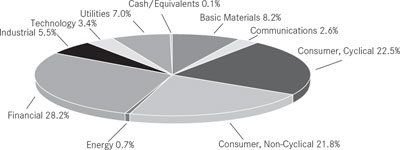

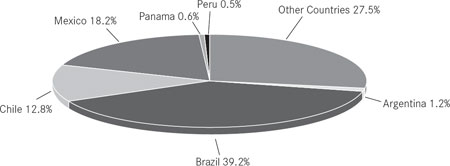

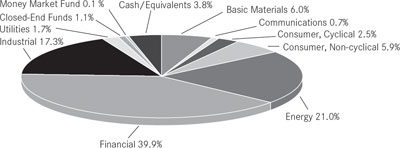

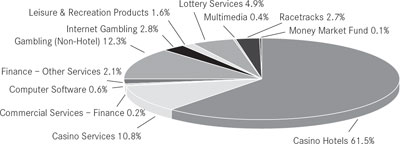

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

BanColombia S.A. |

| 11.4 | % |

Inversiones Argos S.A. |

| 8.0 | % |

Ecopetrol S.A. |

| 8.0 | % |

Grupo Nutresa S.A. |

| 6.4 | % |

Grupo de Inversiones Suramericana S.A. |

| 6.3 | % |

Corporacion Financiera Colombiana S.A. |

| 5.7 | % |

Gran Tierra Energy Inc. |

| 4.8 | % |

Interconexion Electrica S.A. |

| 4.7 | % |

Petrominerales Ltd. |

| 4.7 | % |

Pacific Rubiales Energy Corp. |

| 4.6 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

13

|

MARKET VECTORS COLOMBIA ETF |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVCOLXTR |

| |||

Life* (cumulative) |

| 2.00 | % |

| 1.35 | % |

| 1.59 | % |

|

|

|

|

|

|

|

|

|

|

|

|

*since 3/14/11 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 7.15% / Net Expense Ratio 0.75%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.75% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (3/14/11) to the first day of secondary market trading in shares of the Fund (3/15/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Market Vectors Colombia Index (MVCOLXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Colombia, or that generate at least 50% of their revenues in Colombia.

14

|

Market Vectors Egypt Index ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Egypt Index1 (MVEGPTTR). As of June 30, 2011, MVEGPTTR represented 28 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 22.12%, while MVEGPTTR fell 25.50%.2

The Fund offers investors pure play and diversified access to Egypt, the third largest economy in Africa. The Fund also offers investors a convenient way to complement their traditional international exposure with investments beyond mainstream emerging markets.

It should come as no surprise that Egypt was one of the poorest performing equity markets during the period, as the political uprising, ouster of President Hosni Mubarak and subsequent uncertainties about post-Mubarak Egyptian government, economics and more dominated headlines. In fact, Egypt’s equity market was closed for seven weeks during the period, starting in late January. The Fund continued trading on the NYSEArca exchange while Egypt’s market was shuttered, and we used what is called fair-value pricing to determine net asset value (NAV), based on several factors, including the movement of the Egyptian pound, other markets and correlations as well as news and material events. Also, some of the Fund’s holdings are listed in London and Canada. Still, on January 31, the Fund temporarily halted the creation of new shares to prevent the costs of creation activity from being passed on to existing Fund shareholders. The Fund resumed share creation as Egypt’s equity market reopened on March 23. It is well worth noting that during the second quarter of 2011, the Egyptian equity market actually generated positive, albeit, modest gains.

The Fund is subject to a high degree of risk, including those associated with less reliable financial information, higher costs, taxation, decreased liquidity, less stringent reporting, and foreign currency risks. Special risks particular to Egypt investments include expropriation, political instability, economic impacts of armed conflict, civil war and severe social instability, less developed capital markets, lower market capitalization, lower trading volume, illiquidity, inflation, greater price fluctuations, uncertainty regarding the existence of trading markets, politically controlled access to trading markets, unsettled securities laws, and trade barriers. Investors should be willing to accept a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The Market Vectors Egypt Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Egypt Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Market Vectors Egypt Index (MVEGPTTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Egypt, or that generate at least 50% of their revenues in Egypt. |

|

|

2 | The Fund is passively managed and may not hold each MVEGPTTR component in the same weighting as the MVEGPTTR and is subject to certain expenses that MVEGPTTR is not. The Fund thus may not exactly replicate the performance of MVEGPTTR. |

15

|

MARKET VECTORS EGYPT INDEX ETF |

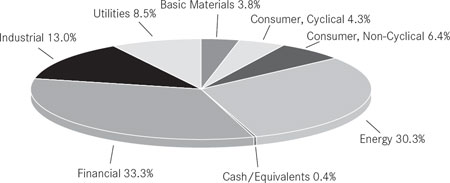

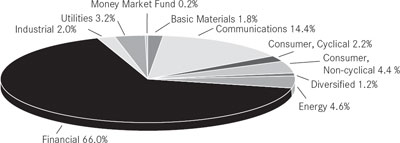

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

Commercial International Bank (Egypt) S.A.E. |

| 8.0 | % |

Orascom Construction Industries |

| 7.9 | % |

Orascom Telecom Holding S.A.E. |

| 7.2 | % |

Egyptian Kuwait Holding Co. |

| 6.2 | % |

Talaat Moustafa Group |

| 6.1 | % |

Telecom Egypt |

| 5.8 | % |

Egyptian Financial Group-Hermes Holding S.A.E. |

| 4.9 | % |

Centamin Egypt Ltd. |

| 4.6 | % |

Juhayna Food Industries Co. |

| 4.5 | % |

National Societe Generale Bank S.A.E. |

| 4.4 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

16

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVEGPTTR |

| |||

Year to Date |

| (23.77 | )% |

| (22.12 | )% |

| (25.50 | )% |

|

One year |

| (11.58 | )% |

| (8.52 | )% |

| (13.02 | )% |

|

Life* (annualized) |

| (18.66 | )% |

| (18.54 | )% |

| (20.87 | )% |

|

Life* (cumulative) |

| (24.60 | )% |

| (24.44 | )% |

| (27.39 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 2/16/10 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 1.04% / Net Expense Ratio 0.93% | |

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.94% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation. | |

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/16/10) to the first day of secondary market trading in shares of the Fund (2/18/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

Market Vectors Egypt Index (MVEGPTTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Egypt, or that generate at least 50% of their revenues in Egypt.

17

|

Market Vectors Germany Small-Cap ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Germany Small-Cap Index1 (MVGERJTR). As of June 30, 2011, MVGERJTR represented 94 publicly traded companies.

Fund Review

For the period from the Fund’s commencement date on April 4, 2011 through June 30, 2011, (the “period”), the Fund gained 2.25%, while MVGERJTR advanced 2.27%.2

The Fund offers investors pure play and diversified access to Germany, Europe’s largest economy and one that has been rather resilient through the recent economic downturn, generating the fastest growth among the G-7 in 2010. (The G-7 is comprised of the seven largest industrialized countries — the U.S., Japan, the U.K., France, Germany, Italy and Canada. Each has a finance minister who attends G-7 meetings to discuss economic policy issues.) With a small-cap focus, the Fund captures the vast majority of German companies. Indeed, small and medium enterprises employ more than 70% of German workers currently.

With a history of innovation and niche market strength, Germany’s small-cap equities performed well during the period, benefiting from strong export-driven demand, especially in areas such as autos, electrical equipment and machine tools, as well as from domestic consumption. Germany is the fourth largest economy in the world. Exceeding analysts’ expectations, Germany’s economy grew at a rate of 5.2% in the first quarter of 2011 year-over-year. Its unemployment levels decreased. Rising commodity prices and renewed concerns over the sovereign debt in the Eurozone remained, at the end of the period, remained the primary risks to ongoing strength in Germany’s economy.

The Fund is subject to risks associated with investments in derivatives and foreign securities. In particular, German investments are subject to elevated risks, which include, among others, dependence upon trade partners, volatility and/or negative changes in surrounding European countries, changes to EU regulations or interest rates, political, social and regulatory risks. In addition, companies with small capitalizations are subject to elevated risks, which include, among others, greater volatility, lower trading volume and less liquidity than larger companies. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market. |

The Market Vectors Germany Small-Cap Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors Germany Small-Cap Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

|

|

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index. | |

|

|

1 | Market Vectors Germany Small-Cap Index (MVGERJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Germany, or that generate at least 50% of their revenues in Germany. |

|

|

2 | The Fund is passively managed and may not hold each MVGERJTR component in the same weighting as the MVGERJTR and is subject to certain expenses that MVGERJTR is not. The Fund thus may not exactly replicate the performance of MVGERJTR. |

18

|

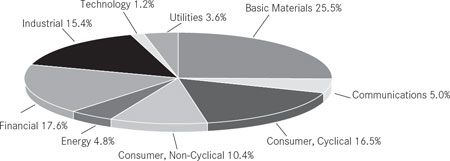

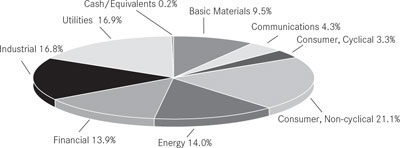

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

MTU Aero Engines Holding AG |

| 4.8 | % |

Symrise A.G. |

| 4.3 | % |

Rheinmetall A.G. |

| 4.0 | % |

Kloeckner & Co. S.E. |

| 3.6 | % |

Aurubis A.G. |

| 2.8 | % |

SGL Carbon S.E. |

| 2.7 | % |

Wincor Nixdorf A.G. |

| 2.7 | % |

Stada Arzneimittel A.G. |

| 2.6 | % |

Fuchs Petrolub A.G. |

| 2.4 | % |

Sky Deutschland A.G. |

| 2.3 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

19

|

MARKET VECTORS GERMANY SMALL-CAP ETF |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVGERJTR |

| |||

Life* (cumulative) |

| 2.88 | % |

| 2.25 | % |

| 2.27 | % |

|

|

|

|

|

|

|

|

|

|

|

|

*since 4/4/11 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 9.81% / Net Expense Ratio 0.55% | |

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.55% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation. | |

| |

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (4/4/11) to the first day of secondary market trading in shares of the Fund (4/5/11), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Market Vectors Germany Small-Cap Index (MVGERJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Germany, or that generate at least 50% of their revenues in Germany.

20

|

Market Vectors Gulf States Index ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Dow Jones GCC Titans 40 IndexSM 1 (DJMEST). As of June 30, 2011, DJMEST represented 42 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 5.32%, while DJMEST also fell 5.32%.2

The Fund offers investors pure play and diversified access to the countries of the Gulf Cooperation Council (GCC), including Kuwait, the United Arab Emirates, Qatar, Oman and Bahrain.

Clearly, the Gulf States and their equity markets were impacted, albeit by regional proximity rather than by tensions or uprisings within these countries themselves, by the “Arab Spring” that arose during the period and by the accompanying uncertain economic, political and social outlook for the region. Still, with all of the unsettling news and political strife of protests, uprising and cut-offs of oil supply, Gulf-based companies continued to attract investors, especially toward the end of the period, as many believed that protests in the region could bring both political and economic reform. Indeed, while volatility, instability and geopolitical risk remained high, some analysts and investors alike appeared to feel that a call for more democracy potentially could lead to more open markets, income diversified outside of oil and building of new infrastructure. Also, the fundamentals of growth opportunities remained solid, as oil exports make up a major stake in the region and the corporate sectors of the nations’ economies are in the early stages of development.

The Fund is subject to a high degree of risk, including those associated with less reliable financial information, higher costs, taxation, decreased liquidity, less stringent reporting, and foreign currency risks. Special risks particular to Gulf investments include expropriation, political instability, economic impacts of armed conflict, civil war and severe social instability, less developed capital markets, lower market capitalization, lower trading volume, illiquidity, inflation, greater price fluctuations, uncertainty regarding the existence of trading markets, politically controlled access to trading markets, unsettled securities laws, and trade barriers. Investors should be willing to accept a high degree of volatility and the potential of significant loss. The Fund may loan its securities, which may subject it to additional credit and counterparty risk.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market. |

The Dow Jones GCC Titans 40 IndexSM, licensed for use by Van Eck Associates Corporation, is calculated by Dow Jones Indexes. Dow Jones®, Titans and Dow Jones GCC Titans 40 Index are service marks of Dow Jones & Company, Inc. The Fund is not sponsored, endorsed, sold or promoted by Dow Jones Indexes, and Dow Jones Indexes makes no representation regarding the advisability of investing in the Fund.

|

|

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index. | |

|

|

1 | Dow Jones GCC Titans 40 IndexSM (DJMEST) is a rules-based, modified capitalization weighted, float-adjusted index comprised of publicly traded companies that are headquartered in tradable GCC nations or that generate the majority of their revenues in these countries. |

|

|

2 | The Fund is passively managed and may not hold each DJMEST component in the same weighting as DJMEST and is subject to certain expenses that DJMES is not. The Fund thus may not exactly replicate the performance of DJMEST. |

21

|

MARKET VECTORS GULF STATES INDEX ETF |

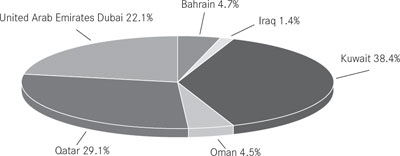

Geographical Weightings*

(unaudited)

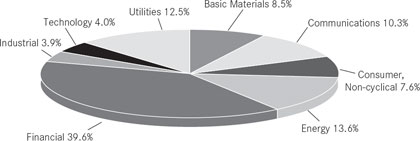

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

Qatar National Bank S.A.Q. |

| 8.3 | % |

Mobile Telecommunications Co. K.S.C. |

| 8.1 | % |

National Bank of Kuwait S.A.K. |

| 8.0 | % |

Kuwait Finance House K.S.C. |

| 8.0 | % |

Emaar Properties PJSC |

| 4.6 | % |

Masraf Al Rayan Q.S.C. |

| 4.4 | % |

DP World Ltd. |

| 4.4 | % |

National Bank of Abu Dhabi PJSC |

| 4.0 | % |

Gulf Bank of Kuwait K.S.C. |

| 3.7 | % |

Qatar Telecom (QTel) Q.S.C. |

| 3.7 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

22

|

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| DJMEST |

| |||

Year to Date |

| (9.03 | )% |

| (5.32 | )% |

| (5.32 | )% |

|

One Year |

| 17.57 | % |

| 19.83 | % |

| 19.73 | % |

|

Life* (annualized) |

| (18.35 | )% |

| (17.84 | )% |

| (17.62 | )% |

|

Life* (cumulative) |

| (44.90 | )% |

| (43.87 | )% |

| (43.43 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 7/22/08 |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 1.65% / Net Expense Ratio 0.98% | |

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.98% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation. | |

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/22/08) to the first day of secondary market trading in shares of the Fund (7/24/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

Dow Jones Gulf States Titans 40 IndexSM (DJMEST) is a rules-based, modified capitalization-weighted, float-adjusted index comprised of publicly traded companies that are headquartered in countries belonging to the Gulf Cooperation Council (GCC) or that generate the majority of their revenues in these countries.

23

|

Market Vectors India Small-Cap Index ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors India Small-Cap Index1 (MVSCIFTR). As of June 30, 2011, MVSCIFTR represented 129 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund declined 20.54%, while MVSCIFTR fell 20.53%.2

The Fund offers investors convenient and diversified access to India’s small-cap equities. Prospects ahead for India’s small-cap companies are expected to be driven by strong growth of the country’s middle class, estimated to increase by 350% to 600 million people over the next 15 years. This figure is approximately double that of the entire U.S. population. This middle class boom is expected to fuel demand for discretionary goods and services, homebuilding and infrastructure building. Importantly, MVSCIFTR includes offshore companies generating 50% or more of their revenue in India, helping the Fund to more accurately capture local consumption trends.

India’s small-cap equities struggled during the period, as economic problems weighed on the country. The biggest threat to India’s economy was widely seen as inflation, especially evident when taking a look at the rise in India’s food costs, since a large proportion of income for low-income workers is spent on food. While India’s central bank has taken steps to increase interest rates to bring down inflation, India’s annualized inflation rate surged to 9.13% in June 2011, and its food price index was up 8.60%. Increased crude prices, a series of corruption scams and negative political sentiment also pressured India’s equity markets. From a longer term perspective, a lack of infrastructure and a large population in dire poverty hamper growth in India’s Gross Domestic Product (GDP) as well. Indeed, the International Monetary Fund (IMF) lowered India’s economic growth rate forecast to 8.2% for 2011 and 7.8% for 2012. That said, while such growth rates may be slow for India, they remain attractive to U.S. and other investors, and many consider recent weakness in India’s economy as temporary. India still has a far better GDP than developed nations, lower levels of debt and a growing middle class that is spending increasing portions of its income. As small-cap equities are generally considered to be strongly correlated to domestic consumers, these factors are particularly important.

The Fund is subject to various risks which include, among others, political and economic instability, inflation, confiscatory taxation, nationalization and expropriation, Indian securities market volatility, less reliable financial information, differences in accounting, auditing, and financial standards and requirements from those applicable to U.S. issuers, and uncertainty of implementation of existing Indian law. In addition, companies with small capitalizations are subject to elevated risks, which include, among others, greater volatility, lower trading volume and less liquidity than larger companies. Investors should be willing to accept a high degree of volatility and the potential for significant loss.

|

|

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market. |

The Market Vectors India Small-Cap Index (the “Index”) is the exclusive property of 4asset-management GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards 4asset-management GmbH, Structured Solutions AG has no obligation to point out errors in the Index to third parties. Market Vectors India Small-Cap Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by 4asset-management GmbH and 4asset-management GmbH makes no representation regarding the advisability of investing in the Fund.

|

|

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index. | |

|

|

1 | Market Vectors India Small-Cap Index (MVSCIFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are headquartered in India or that generate the majority of their revenues in India. |

|

|

2 | The Fund is passively managed and may not hold each MVSCIFTR component in the same weighting as the MVSCIFTR and is subject to certain expenses that MVSCIFTR is not. The Fund thus may not exactly replicate the performance of MVSCIFTR. |

24

|

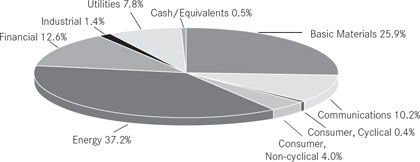

Sector Weightings**

(unaudited)

Top Ten Fund Holdings*

(unaudited)

|

|

|

|

Sintex Industries Ltd. |

| 3.6 | % |

IFCI Ltd. |

| 3.2 | % |

Punj Lloyd Ltd. |

| 2.9 | % |

Core Projects & Technologies Ltd. |

| 2.6 | % |

India Infoline Ltd. |

| 2.5 | % |

Era Infra Engineering Ltd. |

| 2.2 | % |

South Indian Bank Ltd. |

| 2.2 | % |

Gujarat NRE Coke Ltd. |

| 2.1 | % |

Hexaware Technologies Ltd. |

| 2.1 | % |

Sujana Towers Ltd. |

| 2.0 | % |

|

|

As of June 30, 2011. Portfolio is subject to change. | |

* | Percentage of net assets. |

** | Percentage of investments. |

25

|

MARKET VECTORS INDIA SMALL-CAP INDEX ETF |

June 30, 2011 (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Total Return |

| Share Price1 |

| NAV |

| MVSCIFTR |

| |||

Year to Date |

| (19.30 | )% |

| (20.54 | )% |

| (20.53 | )% |

|

Life* (cumulative) |

| (17.67 | )% |

| (18.32 | )% |

| (19.25 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

*since 8/24/10 |

|

|

|

|

|

|

|

|

|

|

Gross Expense Ratio 1.36% / Net Expense Ratio 0.85%

The Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.85% of average daily net assets per year until at least May 1, 2012. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

|

|

1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/24/10) to the first day of secondary market trading in shares of the Fund (8/25/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting vaneck.com/etf. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses. You cannot invest directly in an Index.

|

|

1 | Market Vectors India Small-Cap Index (MVSCIFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are headquartered in India or that generate the majority of their revenues in India. |

26

|

Market Vectors Indonesia Index ETF (the “Fund”) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Market Vectors Indonesia Index1 (MVIDXTR). As of June 30, 2011, MVIDXTR represented 39 publicly traded companies.

Fund Review

For the six months ended June 30, 2011 (the “period”), the Fund advanced 9.49%, while MVIDXTR rose 9.35%.2