UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

335 Madison Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

335 MADISON AVENUE, NEW YORK, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: DECEMBER 31, 2014

Item 1. Report to Shareholders

| ANNUAL REPORT D e c e m b e r 3 1 , 2 0 1 4 |

MARKET VECTORS

INTERNATIONAL ETFs

The information contained in this report represents the opinions of Van Eck Global and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of Van Eck Global are as of December 31, 2014, and are subject to change.

MARKET VECTORS INTERNATIONAL ETFs

(unaudited)

China continues to be an important area of focus for us, as it has become an important part of the world economy and as it currently offers interesting investment opportunities as well.

Together with continued liberalization within the country, the government has also moved to provide access to local markets to those outside the country. In November, the Shanghai-Hong Kong Stock Connect program was launched, which began providing access to over 550 A-share stocks not previously available to investors outside the mainland.

The Chinese government appears also to recognize that small, non-government-backed firms, so important when it comes to fostering innovation, often struggle to access capital because large banks generally do not offer them financing.1 As such, the Small and Medium Enterprise (SME) and ChiNext Boards were established (the former under the Shenzhen Stock Exchange (SZSE) and the latter as a wholly owned but independent arm of the SZSE), to help promote private innovation in the public markets.2 As of December 31, 2014, a total of 732 companies were listed on the SME Board with a combined market value of $823.52 billion, while 406 companies traded on the ChiNext Board with a combined market value of $352.43 billion.3

According to the World Trade Organization, at the start of 2014, SMEs in China were contributing 60% of the country’s GDP and 75% of its urban employment opportunities.4 In addition, we are seeing the information technology, consumer discretionary and staples, and health care sectors becoming the drivers of what has been called China’s “New Economy”.

Contributions of SMEs in China:

Source: World Trade Organization, January 2014.

On July 23 this year, we were excited to announce the launch of the Market Vectors ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT), a new fund which seeks to provide not only exposure primarily to China’s market for innovative, non-government owned companies, but also to the very sectors that are increasingly recognized as underpinning the growth of China’s New Economy. CNXT gives investors a liquid, transparent way to gain access to some of these growing companies.

Market Vectors continues to be an industry leader in offering single-country and region-specific equity ETFs. When performance varies so widely between countries and regions, it is all the more important to be able to select your focus. The suite of Market Vectors country and regional ETFs give you the flexibility to do just that, and we at Van Eck Global also continue to look for ways to enhance your access to the markets you choose and to seek out and evaluate the most attractive opportunities for you as a shareholder in the international space.

Please stay in touch with us through our website (http://www.marketvectorsetfs.com) on which we offer videos, email subscriptions and educational literature, all of which are designed to keep you up to date with your investments in Market Vectors ETFs.

| 1 |

MARKET VECTORS INTERNATIONAL ETFs

(unaudited)

On the following pages, you will find the performance record of each of the funds for the 12 month period ending December 31, 2014. You will also find their financial statements. As always, we value your continuing confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

January 20, 2015

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

| 1 | The Wall Street Journal: “China’s Central Bank to Expand Loans to Small Businesses”, http://online.wsj.com/news/articles/SB10001424127887324110404578628904026769958 |

| 2 | “About ChiNext.” Shenzhen Stock Exchange, 2013, http://www.szse.cn/main/en/ChiNext/aboutchinext/ |

| 3 | Shenzhen Stock Exchange, http://www.szse.cn/main/en/MarketStatistics/MarketOverview/ |

| 4 | World Trade Organization: Integrating small and medium-sized enterprises into global trade flows: the case of China, http://www.wto.org/english/res_e/booksp_e/cmark_full_e.pdf |

| 2 |

Management Discussion (unaudited)

The performance of funds in the suite of Market Vectors International ETFs was predominantly positive during the 12 month period. Eight funds, from a total of 13 that traded for the entire period under review, posted positive total returns. The top two performing funds, each returning more than 40% over the 12 month period, were Market Vectors ChinaAMC A-Share ETF (NYSE Arca: PEK) (+49.11%) and Market Vectors India Small-Cap Index ETF (NYSE Arca: SCIF) (+43.65%). Five funds reported negative performance over the period: Market Vectors Africa Index ETF (NYSE Arca: AFK) (-12.86%), Market Vectors Brazil Small-Cap ETF (NYSE Arca: BRF) (-25.19%), Market Vectors Poland ETF (NYSE Arca: PLND) (-16.90%), Market Vectors Russia ETF (NYSE Arca: RSX) (-44.95%), and Market Vectors Russia Small-Cap ETF (NYSE Arca: RSXJ) (-52.67%).

January 1 through December 31, 2014

Market Vectors International ETFs Total Return

Note: Market Vectors ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT) is not included above as it was launched on July 23, 2014.

Source: Van Eck Global. Returns based on each Fund’s net asset value (NAV). The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Funds reflects temporary waivers of expenses and/or fees. Had the Funds incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the Funds will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

Country/Regional Overviews

Africa

The energy sector was the greatest detractor from performance for the 12 month period. The consumer discretionary, health care, financial, and telecommunication services sectors all provided small positive contributions to overall performance. Large- and mid-cap companies were the greatest detractors from performance, with mid-caps detracting significantly more than the large-cap grouping of companies. Geographically, South Africa and Egypt were the two most significant contributors to return, and Nigeria detracted the most from performance.

Brazil

Though the first half of 2014 was a challenging one for Brazil, the Fund recorded modest positive performance for the six month period. The second half of the year, however, proved to be even more challenging, with the Fund recording a significant negative return for the entire 12 month period. Uncertainties surrounding the outcome of the elections were finally dispelled when President Dilma Rousseff, following a second round run-off, was reelected1 on

| 3 |

MARKET VECTORS INTERNATIONAL ETFs

(unaudited)

October 26 with a narrow victory over Aécio Neves. Prospects of any much-needed economic reforms and budget cuts before the end of the year never materialized. No sector except healthcare, and then only minimally, contributed positively to return over the 12 month period. The consumer discretionary, financial, and industrial sectors were the three greatest detractors from performance.

China

2014 saw the government pass numerous reforms to provide necessary adjustments to the economy and attempt to spur growth through various measures, including a surprising interest rate reduction in November which represented the first such cut in over two years. More broadly, the government continued to undertake measures to move the economy away from one driven primarily by investment to one powered by domestic consumption. Quarterly GDP growth consistently fell below the government’s 7.5% target, and by the end of the year, it was generally accepted that 7.0% growth in 2015 will have to serve as the “new normal”. The A-share equity market, while extremely sluggish during the first half of 2014, finally began to pick up during the second half of year, driven by anticipation of the Shanghai-Hong Kong Stock Connect program, which began providing access to over 550 A-share stocks not previously available to investors outside the mainland in November, as well as by the aforementioned interest rate cut.

Performance of the Market Vectors ChinaAMC A-Share ETF during the first week in January 2014 was primarily derived from swap contracts on the CSI 300 Index† (CSI 300). The Fund began direct investment in the A-share constituents of the CSI 300 on January 8, 2014 and eliminated the majority of its exposure previously achieved through swap contracts. Contracts outstanding as of December 31, 2014 are presented in the Fund’s Schedule of Investments. All sectors contributed positively to performance during the period under review. The vast majority of returns came from companies in the financial sector, followed by industrial companies. However, while still positive, the telecommunications services and health care sectors only contributed minimally.

The Market Vectors ChinaAMC SME-ChiNext ETF traded for a little more than five months. During this period, the industrial, financial, and information technology were the largest contributors to performance. The energy sector, however, posted a small negative return for this period.

Egypt

With his landslide victory at the end of May, newly elected President Abdel Fattah al-Sisi, the country’s former army chief, won a firm enough mandate to tackle the country’s economic woes. As early as June 24, in a speech in Cairo, he was seeking to forewarn Egyptians of austerity measures2 to come. At the end of November, an IMF official was reported as saying that the country’s economy had started to recover after four years of slow activity.3 Each sector in the domestic market, except the consumer staples and energy sectors, contributed to a positive return for the year. The financial sector was by far the greatest contributor to performance. In addition to having the highest average weighting, small-cap companies also made the most significant contribution to return. Regardless of the significant average weighting of mid-cap companies, their contribution to return lagged far behind those of both their larger and smaller peers.

Gulf States

Anchored on solid growth of 3.7% in 2013 and budget surpluses,4 the GCC economies enjoyed a healthy first half to 2014. The second half of the year, however, was somewhat more challenging for the Gulf States, caught as they were between the Scylla of falling oil prices and the Charybdis of regional conflict.5 However, the Fund still ended the year posting a positive return for the 12 month period. With tensions high in the Middle East and in an attempt to shore up unity among GCC members, in mid-November Saudi’s 90-year old King Abdullah engineered reconciliation between council members and Qatar, which it had accused, among other things, of supporting Islamist militants both in Syria and elsewhere.6 Geographically, the United Arab Emirates, with the greatest average country weighting, contributed most significantly to performance, followed by Qatar and Oman—in that order. In terms of sector, financial stocks were the greatest contributors, with industrial and telecommunication services stocks providing the only other significant contributions. Large-cap stocks contributed to performance, while mid- and small-cap stocks detracted from performance.

| 4 |

India

Following a somewhat lackluster first quarter and Narendra Modi’s election as India’s new prime minister, the performance of smaller companies strengthened firmly toward the end of the first half of the year. At 5.5% for the half of the year, economic growth was higher than the 4.9% figure for the same period last year.7 The third quarter of the year, though, brought with it a slowdown in growth, with the Indian economy only expanding 5.3%, in contrast with 5.7% during the previous quarter.8 However, since his election in May, Mr. Modi has demonstrated his pro-business stance in a number of different ways, not least by permitting more foreign investment in various of the country’s industrial sectors, including defense.9 After the Market Vectors ChinaAMC A-Share ETF, the Fund posted the highest total return of any in the Market Vectors suite of international funds. All sectors, except three, contributed positively to return. The consumer discretionary, industrial, and financial sectors were the greatest contributors to performance. While posting negative returns, the detraction from performance of each of the consumer staples, energy, and telecommunication services sectors was minimal.

Indonesia

Indonesia was another country with an election cycle in 2014. The presidential race was won by the governor of Jakarta, Joko Widodo, who beat Prabowo Subianto, a former army general. Faced with a moribund economy and a potentially widening current account deficit,10 action sooner rather than later was required of the president. As a first step, fuel prices (heavily subsidized) were raised 30% on November 18, while, on the same day, Bank Indonesia increased its benchmark interest rate by 25 bps to 7.75%. At the same time, the bank reconfirmed its intention, in the near term, to focus on economic stability over growth.11 For medium- and large-cap names, there were positive contributions to return across all sectors except for energy, with financial stocks providing by far the most significant contribution to performance. Among small-cap stocks, three sectors contributed positively to return. The telecommunication services and financial sectors were the two greatest contributors to performance. Consumer discretionary stocks provided a lesser, but still positive, contribution to performance. Negative returns from small-cap energy companies in particular detracted most from performance.

Israel

After a promising first half year—two quarters of economic growth—and an annual growth rate of 3%,12 third quarter figures reflected the high toll Israel’s 50-day war in Gaza13 took on its economic health: the economy contracted, for the first time in five years, by approximately 0.4%.14 Current Prime Minister Benjamin Netanyahu’s decision to hold early elections in March 2015 is being seen by many as more of a hindrance than a help in efforts to revive the country’s slowing economy.15 Over the 12 month period, health care and information technology stocks, constituting the two sectors with the highest individual average weightings, were the Fund’s most significant contributors to performance. The energy and financial sectors were the greatest detractors from performance. While large-cap stocks contributed positively to performance, small-cap stocks detracted significantly.

Poland

Poland continues to be the EU’s largest emerging economy.16 In the context of economic stagnation in the Eurozone, the country’s performance in the latter half of 2014 was robust. In the third quarter, its economy grew, in annual terms, by 3.3%—better than expected—and continued to benefit from relatively low private and public debt.17 Despite this strength, however, with the fluid situation in Ukraine and slow economic growth in other EU countries, the outlook for Poland remains uncertain. Polish stocks slid over the last quarter of the year, in particular, in December. No sector performed positively over the 12 month period, with the financial, materials, and consumer staples sectors detracting most from performance. However, the negative returns from information technology and consumer discretionary sectors detracted only minimally from performance.

Russia

The consequences of Russia’s involvement in Ukraine, in the form of European and U.S. sanctions, together with the drop in oil prices during the year, took a heavy toll on the country’s economy in 2014. From earlier expectations of 1.2% growth in 2015 (0.5% in 2014), by early December 2014, the Russian Economy Ministry saw the country’s GDP contracting by 0.8% in 2015.18 After a rough period in March and April, both the small- and large-cap funds saw a considerable improvement in performance through May and June. From early July,

| 5 |

MARKET VECTORS INTERNATIONAL ETFs

(unaudited)

however, it was downhill through to the end of the year. No sector contributed a positive return to the large-cap fund, with energy and telecommunication services serving as the two worst performing sectors. In the small-cap fund, companies in the utilities sector, closely followed by those in the financial sector, detracted most from performance. As with the large-cap fund, no sector performed positively.

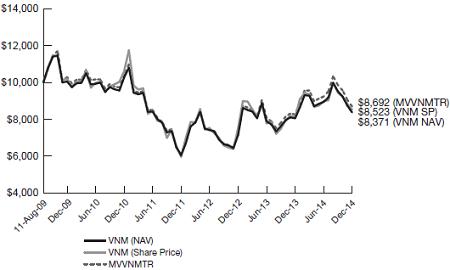

Vietnam

With stability restored once again on May 18, 2014, following a number of deaths during violent riots against both foreign- and, particularly, Chinese-owned factories in the provinces, Vietnamese companies posted gains through the beginning of September. Thereafter, however, their stocks declined, albeit haltingly, until late December. This was despite moves by the government at the end of November to open up the property market to foreigners.19 A forecast of economic growth in 2014 from the World Bank in early December revised growth upward from 5.4% to 5.6%.20 This did not, however, prevent the Fund posting a positive return for the 12 month period. With an average weighting of approximately 49%, small-cap companies made by far the greatest contribution to return. The energy, consumer discretionary, and financial sectors were the three most significant contributors to return. However, the consumer staples and materials sectors both detracted from performance.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the fund. An index’s performance is not illustrative of the fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results.

| † | CSI 300 Index (CSIR0300) is a modified free-float market capitalization-weighted index compiled and managed by China Securities Index Co., Ltd. Considered to be the leading index for the Chinese equity market, the CSI 300 is a diversified index consisting of 300 constituent stocks listed on the Shenzhen Stock Exchange and/or the Shanghai Stock Exchange. |

| 1 | BBC: Brazil elections: Dilma Rousseff promises reform after poll win, http://www.bbc.com/news/world-latin-america-29782073 |

| 2 | Financial Times: Egypt’s president to donate personal income as austerity looms, http://www.ft.com/intl/cms/s/0/50bfef5a-fbb0-11e3-aa19-00144feab7de.html?siteedition=intl#axzz35fihbd9M |

| 3 | ABC News: IMF Says Egypt’s Economy Starting to Recover, http://abcnews.go.com/International/wireStory/imf-egypts-economy-starting-recover-27189651 |

| 4 | Al Bawaba: Budget surpluses seen to spur GCC growth in 2014; outlook still positive, http://www.albawaba.com/business/budget-gcc-growth-557324 |

| 5 | Business Insider: Gulf stocks dive over global growth fears, oil prices, http://www.businessinsider.com/afp-gulf-stocks-dive-over-global-growth-fears-oil-prices-2014-10 |

| 6 | Business Insider: Saudi Arabia Leans On Gulf States To Close Ranks As Region Boils, http://www.businessinsider.com/r-saudi-arabia-leans-on-gulf-states-to-close-ranks-as-region-boils-2014-11 |

| 7 | Moneycontrol.com: India’s economic growth likely to be 5.6% in FY15: Citi, http://www.moneycontrol.com/news/economy/indias-economic-growth-likely-to-be-56fy15-citi_1241213.html |

| 8 | Bloomberg: Rajan Holds India’s Rates While Signaling Cut to Come: Economy, http://www.bloomberg.com/news/print/2014-12-02/rajan-holds-rates-for-fifth-meeting-while-signaling-cut-to-come.html |

| 9 | Ibid. |

| 10 | Reuters: UPDATE 3-Indonesia c.bank trims economic outlook, rates stay on hold, http://www.reuters.com/article/2014/06/12/indonesia-economy-idUSL4N0OS2A220140612 |

| 11 | UK FCO Country Update(s) for Business: Indonesia: prospects for growth in the economy, https://www.gov.uk/government/publications/indonesia-prospects-for-growth-in-the-economy/indonesia-prospects-for-growth-in-the-economy |

| 12 | Financial Times: Violence takes toll on Israel’s economy, http://www.ft.com/intl/cms/s/0/af80d236-74c6-11e4-a418-00144feabdc0.html |

| 13 | Chicago Tribune/Bloomberg News: Early Israeli election to hurt economy already slowed by war, http://www.chicagotribune.com/sns-wp-blm-news-bc-israel-econ02-20141202-story.html |

| 14 | Financial Times: Violence takes toll on Israel’s economy, http://www.ft.com/intl/cms/s/0/af80d236-74c6-11e4-a418-00144feabdc0.html |

| 15 | Chicago Tribune/Bloomberg News: Early Israeli election to hurt economy already slowed by war, http://www.chicagotribune.com/sns-wp-blm-news-bc-israel-econ02-20141202-story.html |

| 16 | The Wall Street Journal: Polish Rate Setter Sees Room for Cuts Totaling One Percentage Point, http://online.wsj.com/articles/polish-rate-setter-sees-room-for-cuts-totaling-one-percentage-point-1415807868 |

| 17 | The Wall Street Journal: Poland Still Has Room to Cut Interest Rates, http://online.wsj.com/articles/poland-still-has-room-to-cut-interest-rates-1416495671 |

| 18 | The Wall Street Journal: Russia Sees Economy in Recession Next Year, http://www.wsj.com/articles/russia-sees-economy-in-recession-next-year-1417513889 |

| 19 | Bloomberg: Vietnam Expands Foreign Property Ownership to Boost Economy, http://www.bloomberg.com/news/2014-11-25/vietnam-expands-foreign-property-ownership-to-boost-economy.html |

| 20 | Tuoi Tre News: Vietnam economy to grow 5.6% in 2014 over ‘ongoing macroeconomic stability’: WB, http://tuoitrenews.vn/business/24452/wb-raises-vietnam-growth-forecast-to-56-over-ongoing-macroeconomic-stability |

| 6 |

MARKET VECTORS AFRICA INDEX ETF

December 31, 2014 (unaudited)

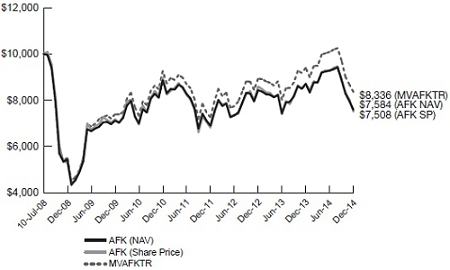

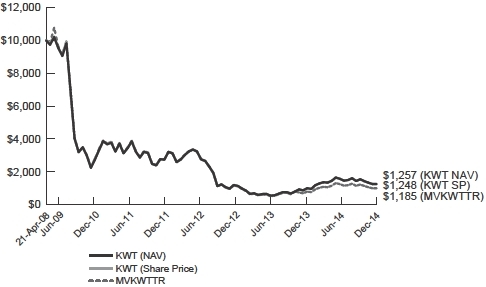

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVAFKTR2 | |||||||||

| One Year | (13.68 | )% | (12.86 | )% | (11.10 | )% | ||||||

| Five Years | 0.92 | % | 1.31 | % | 2.44 | % | ||||||

| Life* (annualized) | (4.33 | )% | (4.18 | )% | (2.77 | )% | ||||||

| Life* (cumulative) | (24.92 | )% | (24.16 | )% | (16.64 | )% | ||||||

| * since 7/10/08 | ||||||||||||

| Index data prior to June 21, 2013 reflects that of the Dow Jones Africa Titans 50 IndexSM. From June 21, 2013, forward, the index data reflects that of the Market Vectors® GDP Africa Index (MVAFKTR). All Index history reflects a blend of the performance of the aforementioned Indexes. | ||||||||||||

Commencement date for the Market Vectors Africa Index ETF was 7/10/08.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/10/08) to the first day of secondary market trading in shares of the Fund (7/14/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888. MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.80% / Net Expense Ratio 0.80%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.78% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units

| 7 |

MARKET VECTORS AFRICA INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® GDP Africa Index (MVAFKTR) tracks the performance of the largest and most liquid companies in Africa. The weighting of a country in the index is determined by the size of its gross domestic product. |

Market Vectors GDP Africa Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Africa Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

Africa Index ETF (AFK)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for AFK is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| July 14, 2008* through December 31, 2014 | ||||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||||||

| Greater than or Equal to 5.0% | 8 | 0.5 | % | |||||

| Greater than or Equal to 4.5% And Less Than 5.0% | 5 | 0.3 | % | |||||

| Greater than or Equal to 4.0% And Less Than 4.5% | 10 | 0.6 | % | |||||

| Greater than or Equal to 3.5% And Less Than 4.0% | 7 | 0.4 | % | |||||

| Greater than or Equal to 3.0% And Less Than 3.5% | 24 | 1.5 | % | |||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 34 | 2.1 | % | |||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 74 | 4.5 | % | |||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 125 | 7.7 | % | |||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 220 | 13.5 | % | |||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 313 | 19.3 | % | |||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 269 | 16.5 | % | |||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 214 | 13.1 | % | |||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 183 | 11.2 | % | |||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 85 | 5.2 | % | |||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 38 | 2.3 | % | |||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 15 | 0.9 | % | |||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 3 | 0.2 | % | |||||

| Greater than or Equal to -3.5% And Less Than -3.0% | 2 | 0.1 | % | |||||

| Greater than or Equal to -4.0% And Less Than -3.5% | 1 | 0.1 | % | |||||

| Greater than or Equal to -4.5% And Less Than -4.0% | 0 | 0.0 | % | |||||

| Greater than or Equal to -5.0% And Less Than -4.5% | 0 | 0.0 | % | |||||

| Less Than -5.0% | 0 | 0.0 | % | |||||

| 1630 | 100.0 | % | ||||||

* First day of secondary market trading.

| 8 |

MARKET VECTORS BRAZIL SMALL-CAP ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVBRFTR2 | |||||||||

| One Year | (25.75 | )% | (25.19 | )% | (24.73 | )% | ||||||

| Five Years | (11.03 | )% | (10.52 | )% | (9.79 | )% | ||||||

| Life* (annualized) | 2.09 | % | 2.23 | % | 2.90 | % | ||||||

| Life* (cumulative) | 12.38 | % | 13.24 | % | 17.49 | % | ||||||

| * since 5/12/09 | ||||||||||||

Commencement date for the Market Vectors Brazil Small-Cap ETF was 5/12/09.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/12/09) to the first day of secondary market trading in shares of the Fund (5/14/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.66% / Net Expense Ratio 0.60%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.59% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 9 |

MARKET VECTORS BRAZIL SMALL-CAP ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Brazil Small-Cap Index (MVBRFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Brazil, or that generate at least 50% of their revenues in Brazil. |

Market Vectors Brazil Small-Cap Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Brazil Small-Cap ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

Brazil Small-Cap ETF (BRF)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for BRF is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| May 14, 2009* through December 31, 2014 | ||||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||||||

| Greater than or Equal to 3.0% | 7 | 0.5 | % | |||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 18 | 1.3 | % | |||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 64 | 4.5 | % | |||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 62 | 4.4 | % | |||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 69 | 4.9 | % | |||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 137 | 9.7 | % | |||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 321 | 22.6 | % | |||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 460 | 32.3 | % | |||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 234 | 16.5 | % | |||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 33 | 2.3 | % | |||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 9 | 0.6 | % | |||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 5 | 0.4 | % | |||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 0 | 0.0 | % | |||||

| Less Than -3.0% | 0 | 0.0 | % | |||||

| 1419 | 100.0 | % | ||||||

* First day of secondary market trading.

| 10 |

MARKET VECTORS CHINAAMC A-SHARE ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | CSIR03002 | |||||||||

| One Year | 44.63 | % | 49.11 | % | 51.96 | % | ||||||

| Life* (annualized) | 4.07 | % | 4.21 | % | 4.34 | % | ||||||

| Life* (cumulative) | 18.31 | % | 18.98 | % | 19.62 | % | ||||||

| * since 10/13/10 | ||||||||||||

| As of January 7, 2014, Market Vectors China ETF’s name changed to Market Vectors ChinaAMC A-Share ETF. | ||||||||||||

Commencement date for the Market Vectors ChinaAMC A-Share ETF was 10/13/10

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/13/10) to the first day of secondary market trading in shares of the Fund (10/14/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 1.69% / Net Expense Ratio 0.72%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.72% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 11 |

MARKET VECTORS CHINAAMC A-SHARE ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | CSI 300 Index (CSIR0300) is a modified free-float market capitalization weighted index comprised of the largest and most liquid stocks in the Chinese A-share market. Constituent stocks for the Index must have been listed for more than three months (unless the stock’s average daily A-share market capitalization since its initial listing ranks among the top 30 of all A-shares) and must not be experiencing what the Index Provider believes to be obvious abnormal fluctuations or market manipulation. |

CSI 300 Index and its logo are service marks of China Securities Index Co., Ltd. (“CSI”) and have been licensed for use by Van Eck Associates Corporation. Market Vectors ChinaAMC A-Share ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by CSI and CSI makes no representation regarding the advisability of investing in the Fund. CSI 300 is a registered trademark of China Securities Index Co., Ltd.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

ChinaAMC A-Share ETF (PEK)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for PEK is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| October 14, 2010* through December 31, 2014 | ||||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||||||

| Greater than or Equal to 16.0% | 32 | 3.0 | % | |||||

| Greater than or Equal to 15.0% And Less Than 16.0% | 11 | 1.0 | % | |||||

| Greater than or Equal to 14.0% And Less Than 15.0% | 22 | 2.1 | % | |||||

| Greater than or Equal to 13.0% And Less Than 14.0% | 28 | 2.6 | % | |||||

| Greater than or Equal to 12.0% And Less Than 13.0% | 34 | 3.2 | % | |||||

| Greater than or Equal to 11.0% And Less Than 12.0% | 55 | 5.2 | % | |||||

| Greater than or Equal to 10.0% And Less Than 11.0% | 40 | 3.8 | % | |||||

| Greater than or Equal to 9.0% And Less Than 10.0% | 41 | 3.9 | % | |||||

| Greater than or Equal to 8.0% And Less Than 9.0% | 23 | 2.2 | % | |||||

| Greater than or Equal to 7.0% And Less Than 8.0% | 45 | 4.2 | % | |||||

| Greater than or Equal to 6.0% And Less Than 7.0% | 42 | 4.0 | % | |||||

| Greater than or Equal to 5.0% And Less Than 6.0% | 59 | 5.6 | % | |||||

| Greater than or Equal to 4.0% And Less Than 5.0% | 75 | 7.1 | % | |||||

| Greater than or Equal to 3.0% And Less Than 4.0% | 80 | 7.5 | % | |||||

| Greater than or Equal to 2.0% And Less Than 3.0% | 82 | 7.7 | % | |||||

| Greater than or Equal to 1.0% And Less Than 2.0% | 73 | 6.9 | % | |||||

| Greater than or Equal to 0.0% And Less Than 1.0% | 137 | 12.9 | % | |||||

| Less Than 0.0% | 182 | 17.1 | % | |||||

| 1061 | 100.0 | % | ||||||

* First day of secondary market trading.

| 12 |

MARKET VECTORS CHINAAMC SME-CHINEXT ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | SZ3996112 |

| Life* (cumulative) | 16.73% | 15.88% | 17.89% |

| * since 7/23/14 |

Commencement date for the Market Vectors ChinaAMC SME-ChiNext ETF was 7/23/14.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/23/14) to the first day of secondary market trading in shares of the Fund (7/24/14), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 1.48% / Net Expense Ratio 0.78%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.78% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 13 |

MARKET VECTORS CHINAAMC SME-CHINEXT ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| 2 | The SME-ChiNext 100 Index (SZ399611) is a modified, free-float adjusted index intended to track the performance of the 100 largest and most liquid stocks listed and trading on the Small and Medium Enterprise (“SME”) Board and the ChiNext Board of the Shenzhen Stock Exchange. The Index is comprised of A-shares. |

The SME-ChiNext 100 Index (the “Index”) is the exclusive property of the Shenzhen Securities Information Co., Ltd (the “Index Provider”), which is a subsidiary of the Shenzhen Stock Exchange. The Index Provider does not sponsor, endorse, or promote Market Vectors ChinaAMC SME-ChiNext ETF (the “Fund”) and bears no liability with respect to the Fund or any security.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

ChinaAMC SME-ChiNext ETF (CNXT)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for CNXT is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| July 24, 2014* through December 31, 2014 | |||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | |||||

| Greater than or Equal to 5.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to 4.5% And Less Than 5.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to 4.0% And Less Than 4.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to 3.5% And Less Than 4.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to 3.0% And Less Than 3.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 2 | 1.8 | % | ||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 3 | 2.7 | % | ||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 10 | 8.9 | % | ||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 24 | 21.4 | % | ||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 43 | 38.4 | % | ||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 19 | 17.0 | % | ||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 9 | 8.0 | % | ||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 2 | 1.8 | % | ||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to -3.5% And Less Than -3.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to -4.0% And Less Than -3.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to -4.5% And Less Than -4.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to -5.0% And Less Than -4.5% | 0 | 0.0 | % | ||||

| Less Than -5.0% | 0 | 0.0 | % | ||||

| 112 | 100.0 | % | |||||

* First day of secondary market trading.

| 14 |

MARKET VECTORS EGYPT INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVEGPTTR2 |

| One Year | 13.60% | 12.92% | 16.38% |

| Life* (annualized) | (3.45)% | (2.93)% | (2.89)% |

| Life* (cumulative) | (15.74)% | (13.50)% | (13.33)% |

| * since 2/16/10 |

Commencement date for the Market Vectors Egypt Index ETF was 2/16/10.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/16/10) to the first day of secondary market trading in shares of the Fund (2/18/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.97% / Net Expense Ratio 0.97%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.94% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 15 |

MARKET VECTORS EGYPT INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Egypt Index (MVEGPTTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Egypt, or that generate at least 50% of their revenues in Egypt. |

Market Vectors Egypt Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Egypt Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

Egypt Index ETF (EGPT)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for EGPT is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| February 18, 2010* through December 31, 2014 | |||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | |||||

| Greater than or Equal to 3.0% | 53 | 4.3 | % | ||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 12 | 1.0 | % | ||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 49 | 4.0 | % | ||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 91 | 7.4 | % | ||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 102 | 8.3 | % | ||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 133 | 10.8 | % | ||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 153 | 12.3 | % | ||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 138 | 11.5 | % | ||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 149 | 12.1 | % | ||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 146 | 12.0 | % | ||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 101 | 8.2 | % | ||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 38 | 3.1 | % | ||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 36 | 2.9 | % | ||||

| Less Than -3.0% | 26 | 2.1 | % | ||||

| 1227 | 100.0 | % | |||||

* First day of secondary market trading.

| 16 |

MARKET VECTORS GULF STATES INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

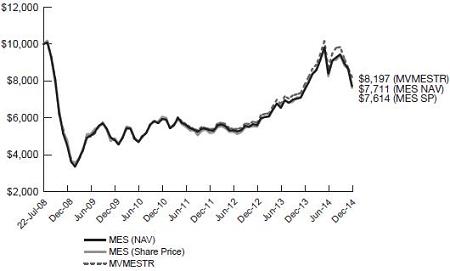

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVMESTR2 |

| One Year | 1.50% | 2.41% | 4.81% |

| Five Years | 9.25% | 9.96% | 11.36% |

| Life* (annualized) | (4.14)% | (3.95)% | (3.04)% |

| Life* (cumulative) | (23.86)% | (22.89)% | (18.03)% |

| * since 7/22/08 | |||

| Index data prior to June 21, 2013 reflects that of the Dow Jones GCC Titans 40 IndexSM. From June 21, 2013, forward, the index data reflects that of the Market Vectors® GDP GCC Index (MVMESTR). All Index history reflects a blend of the performance of the aforementioned Indexes. | |||

Commencement date for the Market Vectors Gulf States Index ETF was 7/22/08.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/22/08) to the first day of secondary market trading in shares of the Fund (7/24/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 2.07% / Net Expense Ratio 0.99%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.98% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the

| 17 |

MARKET VECTORS GULF STATES INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® GDP GCC Index (MVMESTR) provides exposure to publicly traded companies either headquartered in countries belonging to the Gulf Cooperation Council (GCC) or companies that generate the majority of their revenues in these countries |

Market Vectors GDP GCC Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Gulf States Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

Gulf States Index ETF (MES)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for MES is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| July 24, 2008* through December 31, 2014 | |||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | |||||

| Greater than or Equal to 5.0% | 1 | 0.1 | % | ||||

| Greater than or Equal to 4.5% And Less Than 5.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to 4.0% And Less Than 4.5% | 0 | 0.0 | % | ||||

| Greater than or Equal to 3.5% And Less Than 4.0% | 0 | 0.0 | % | ||||

| Greater than or Equal to 3.0% And Less Than 3.5% | 2 | 0.1 | % | ||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 6 | 0.4 | % | ||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 16 | 1.0 | % | ||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 55 | 3.4 | % | ||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 94 | 5.8 | % | ||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 120 | 7.4 | % | ||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 478 | 29.5 | % | ||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 166 | 10.2 | % | ||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 161 | 9.9 | % | ||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 178 | 11.0 | % | ||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 159 | 9.8 | % | ||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 98 | 6.0 | % | ||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 49 | 3.0 | % | ||||

| Greater than or Equal to -3.5% And Less Than -3.0% | 27 | 1.7 | % | ||||

| Greater than or Equal to -4.0% And Less Than -3.5% | 4 | 0.2 | % | ||||

| Greater than or Equal to -4.5% And Less Than -4.0% | 3 | 0.2 | % | ||||

| Greater than or Equal to -5.0% And Less Than -4.5% | 4 | 0.2 | % | ||||

| Less Than -5.0% | 1 | 0.1 | % | ||||

| 1622 | 100.0 | % | |||||

* First day of secondary market trading.

| 18 |

MARKET VECTORS INDIA SMALL-CAP INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVSCIFTR2 |

| One Year | 42.37% | 43.65% | 44.92% |

| Life* (annualized) | (11.52)% | (11.60)% | (11.19)% |

| Life* (cumulative) | (41.32)% | (41.53)% | (40.37)% |

| * since 8/24/10 |

Commencement date for the Market Vectors India Small-Cap Index ETF was 8/24/10.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/24/10) to the first day of secondary market trading in shares of the Fund (8/25/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.92% / Net Expense Ratio 0.89%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.85% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 19 |

MARKET VECTORS INDIA SMALL-CAP INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| 2 | Market Vectors® India Small-Cap Index (MVSCIFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are headquartered in India or that generate the majority of their revenues in India. |

Market Vectors India Small-Cap Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors India Small-Cap Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

India Small-Cap Index ETF (SCIF)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for SCIF is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| August 25, 2010* through December 31, 2014 | |||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | |||||

| Greater than or Equal to 3.0% | 4 | 0.4 | % | ||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 6 | 0.5 | % | ||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 17 | 1.6 | % | ||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 81 | 7.4 | % | ||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 169 | 15.4 | % | ||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 170 | 15.5 | % | ||||

| Greater than or Equal to 0.0% And Less Than 0.5% | 200 | 18.1 | % | ||||

| Greater than or Equal to -0.5% And Less Than 0.0% | 197 | 18.0 | % | ||||

| Greater than or Equal to -1.0% And Less Than -0.5% | 127 | 11.6 | % | ||||

| Greater than or Equal to -1.5% And Less Than -1.0% | 72 | 6.6 | % | ||||

| Greater than or Equal to -2.0% And Less Than -1.5% | 35 | 3.2 | % | ||||

| Greater than or Equal to -2.5% And Less Than -2.0% | 10 | 0.9 | % | ||||

| Greater than or Equal to -3.0% And Less Than -2.5% | 4 | 0.4 | % | ||||

| Less Than -3.0% | 4 | 0.4 | % | ||||

| 1096 | 100.0 | % | |||||

* First day of secondary market trading.

| 20 |

MARKET VECTORS INDONESIA INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |||

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVIDXTR2 | |||||||||

| One Year | 16.63 | % | 18.34 | % | 19.52 | % | ||||||

| Five Years | 5.26 | % | 5.33 | % | 5.96 | % | ||||||

| Life* (annualized) | 21.77 | % | 21.80 | % | 22.79 | % | ||||||

| Life* (cumulative) | 223.44 | % | 223.90 | % | 240.03 | % | ||||||

| * since 1/15/09 | ||||||||||||

Commencement date for the Market Vectors Indonesia Index ETF was 1/15/09.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (1/15/09) to the first day of secondary market trading in shares of the Fund (1/20/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 1.888.MKT.VCTR or by visiting marketvectorsetfs.com.

Gross Expense Ratio 0.66% / Net Expense Ratio 0.58%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.57% of the Fund’s average daily net assets per year until at least May 1, 2015. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 21 |

MARKET VECTORS INDONESIA INDEX ETF

PERFORMANCE COMPARISON

December 31, 2014 (unaudited)

| 2 | Market Vectors® Indonesia Index (MVIDXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Indonesia, or that generate at least 50% of their revenues in Indonesia. |

Market Vectors Indonesia Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Indonesia Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS

(unaudited)

Indonesia Index ETF (IDX)

Closing Price vs. NAV

The following Frequency Distribution of Premiums and Discounts chart is provided to show the frequency at which the closing price for IDX is at a premium or discount to its daily net asset value (NAV). The chart is for comparative purposes only and represents the period noted.

| January 20, 2009* through December 31, 2014 | ||||||||

| Premium/Discount Range | Number of Days | Percentage of Total Days | ||||||

| Greater than or Equal to 3.0% | 12 | 0.8 | % | |||||

| Greater than or Equal to 2.5% And Less Than 3.0% | 1 | 0.1 | % | |||||

| Greater than or Equal to 2.0% And Less Than 2.5% | 7 | 0.5 | % | |||||

| Greater than or Equal to 1.5% And Less Than 2.0% | 19 | 1.3 | % | |||||

| Greater than or Equal to 1.0% And Less Than 1.5% | 103 | 6.9 | % | |||||

| Greater than or Equal to 0.5% And Less Than 1.0% | 274 | 18.3 | % | |||||