UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-10325

MARKET VECTORS ETF TRUST

(Exact name of registrant as specified in charter)

666 Third Avenue, New York, NY 10017

(Address of principal executive offices) (Zip code)

Van Eck Associates Corporation

666 THIRD AVENUE, NEW YORK, NY 10017

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 293-2000

Date of fiscal year end: DECEMBER 31

Date of reporting period: DECEMBER 31, 2015

Item 1. Report to Shareholders

ANNUAL REPORT

December 31, 2015

MARKET VECTORS

COUNTRY/REGIONAL ETFs

| Africa Index ETF | AFK® |

| Brazil Small-Cap ETF | BRF® |

| ChinaAMC A-Share ETF | PEK® |

| ChinaAMC SME-ChiNext ETF | CNXT® |

| Egypt Index ETF | EGPT® |

| Gulf States Index ETF | MES® |

| India Small-Cap Index ETF | SCIF® |

| Indonesia Index ETF | IDX® |

| Indonesia Small-Cap ETF | IDXJ® |

| Israel ETF | ISRA® |

| Poland ETF | PLND® |

| Russia ETF | RSX® |

| Russia Small-Cap ETF | RSXJ® |

| Vietnam ETF | VNM® |

| 1.800.826.2333 | vaneck.com |

The information contained in this shareholder letter represents the opinions of VanEck and may differ from other persons. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. The information contained herein regarding each index has been provided by the relevant index provider. Also, unless otherwise specifically noted, any discussion of the Funds’ holdings and the Funds’ performance, and the views of VanEck are as of December 31, 2015.

MARKET VECTORS COUNTRY/REGIONAL ETFs

(unaudited)

When I wrote last year, Market Vectors ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT) had traded for just over five months. After trading 12 full months, and despite significant volatility in the market and its precipitous downturns in the middle of the year and August, the Fund returned a healthy 45.94% during this period. Our other China-focused ETF, the Market Vectors ChinaAMC A-Share ETF (NYSE Arca: PEK), provided a modest positive return of 0.22% for the same period.

While China’s economy may currently be slowing down, the country remains both an important part of the world economy and, we believe, continues to offer interesting investment opportunities.

At the center of China’s economy, small and medium enterprises (SMEs) now account for 60% of the country’s gross domestic product and provide 80% of urban employment. However, despite rate cuts, small, non-government backed firms are still struggling to access capital because large banks generally do not offer them financing.1 Established as a way to help promote private innovation in the public markets, the SME and ChiNext Boards (the former under the Shenzhen Stock Exchange (SZSE) and the latter as a wholly owned but independent arm of the SZSE) continue to prove effective in addressing the issue.

As of December 31, 2014, a total of 732 companies were listed on the SME Board with a combined market value of $823.52 billion, while 406 companies traded on the ChiNext Board with a combined market value of $352.43 billion. At the end of 2015, these figures had risen to 776 companies (up 6%) listed on the SME Board with a combined market value of $1.6 trillion, and 492 companies (up 21%) traded on the ChiNext Board with a combined market value of $860.91 billion.

We still believe CNXT provides not only exposure primarily to China’s market for innovative, non-government owned companies, but also to the very sectors that are increasingly recognized as underpinning the growth of China’s New Economy. CNXT gives investors a liquid, transparent way to gain access to some of these growing companies.

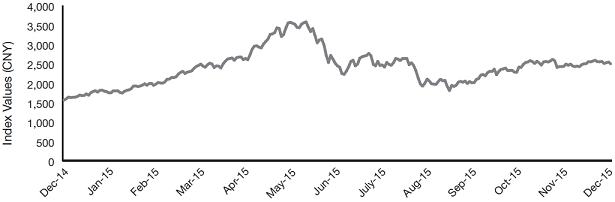

| SME-ChiNext 100 Index‡ |

|

Source: Bloomberg. Data as of December 31, 2015. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted. Index performance is not illustrative of fund performance. Investors cannot invest directly in an Index.

Market Vectors continues to be an industry leader in offering single-country and region-specific equity ETFs. When performance varies so widely between countries and regions, it is all the more important to be able to select your focus. The suite of Market Vectors country and regional ETFs give you the flexibility to do just that, and we at Van Eck also continue to look for ways to enhance your access to the markets you choose and to seek out and evaluate the most attractive opportunities for you as a shareholder in the international space.

| 1 |

MARKET VECTORS COUNTRY/REGIONAL ETFs

(unaudited) (continued)

Please stay in touch with us through our website (http://www.vaneck.com) on which we offer videos, email subscriptions, and educational literature, all of which are designed to keep you up to date with your investments in Market Vectors ETFs.

On the following pages, you will find the performance record of each of the funds for the 12 month period ending December 31, 2015. You will also find their financial statements. As always, we value your continued confidence in us and look forward to helping you meet your investment goals in the future.

Jan F. van Eck

Trustee and President

Market Vectors ETF Trust

January 22, 2016

Represents the opinions of the investment adviser. Past performance is no guarantee of future results. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the fund. An index’s performance is not illustrative of the fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results.

| ‡ | SME-ChiNext 100 Index (SZ399611) comprises of 100 of the largest and most liquid stocks listed and trading on the Small and Medium Enterprise (SME) Board and the ChiNext Board of the Shenzhen Stock Exchange. |

| 1 | Business Standard: China rate cuts bypass SMEs, raise questions about economy, http://www.business-standard.com/article/international/china-rate-cuts-bypass-smes-raise-questions-about-economy-115092200052_1.html |

| 2 |

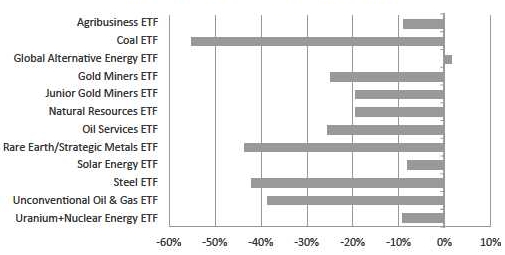

Management Discussion (unaudited)

The performance of funds in the suite of Market Vectors Country/Regional ETFs was predominantly negative during the 12 month period. Five funds, from a total of 14, posted positive total returns. The top performing fund was the Market Vectors ChinaAMC SME-ChiNext ETF (NYSE Arca: CNXT) (+45.94%).

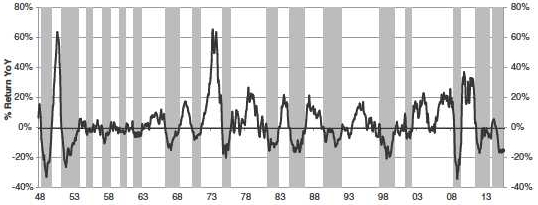

January 1 through December 31, 2015

Market Vectors Country/Regional ETFs Total Return

Source: Van Eck Global. Returns based on each fund’s net asset value (NAV). The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the funds reflects temporary waivers of expenses and/or fees. Had the funds incurred all expenses, investment returns would have been reduced. Investment return and value of the shares of the funds will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted.

Country/Regional Overviews

Africa

The financial sector was the greatest detractor from performance for the 12 month period. In addition to energy, the materials, telecommunications services, and consumer staples sectors were also significant detractors. No one sector provided positive contributions to overall performance. Mid- and large-cap companies detracted most from performance. Geographically, Kenya contributed positive performance, albeit minimally. Egypt, South Africa, and Nigeria were the most significant negative contributors to total return.

Brazil

If the first half of 2015 was a challenging period for Brazil, so, too, was the second. Dropping to 9% in April, their lowest ever for a Brazilian president, Dilma Rousseff’s approval ratings had risen only a single percentage point by the end of September,1 but, as the year drew to a close, they were still languishing in single figures.2 Having deteriorated steadily in the first half of the year, economic activity in the third quarter (down 1.41% from the previous three months), contracted for the fourth straight quarter, pushing the country deeper into recession—its worst for 25 years.3 Independent economists were forecasting that the economy would contract 3.10% in 2015.4 In November, the country’s public sector deficit rose to one of the highest levels on record.5 Only one sector, consumer staples, contributed positively, and, then only minimally, to return over the 12 month period. The consumer discretionary and industrial sectors were the two greatest detractors from performance.

| 3 |

MARKET VECTORS COUNTRY/REGIONAL ETFs

(unaudited) (continued)

China

During the first half of 2015, the Chinese government continued its efforts to support the economy through accommodative monetary policy, including four separate interest rate cuts. The A-share equity market grew significantly during the period, spurred by mainland retail investors who began to take highly leveraged positions as they were confident in the government’s ability to sustain market growth. However, having peaked in mid-June, the equity rally began to sputter thereafter, largely driven by investors’ concern that regulators would soon tighten requirements for margin investing. The second half of the year was notable for further precipitous declines in the market both at the start of July and toward the end of August. While it recovered somewhat thereafter, the remainder of the year was marked by uncertainty both as to the growth prospects for the country going forward, and as to the extent and nature of government policy for dealing with the country’s economic predicament and, in particular, the value of the yuan.

While the Market Vectors ChinaAMC A-Share ETF (PEK) began direct investment in the A-share constituents of the CSI 300 Index* on January 8, 2014, thereby eliminating the majority of its exposure previously achieved through swap contracts, some contracts remained outstanding as of December 31, 2015. These are presented in the Fund’s Schedule of Investments. While most sectors contributed positively to performance during the period under review, of those that detracted from performance, the financial sector was the most notable.

Both relative to PEK (which ended the year up slightly) and in absolute terms, the performance of the Market Vectors ChinaAMC SME-ChiNext ETF (CNXT) was exceptional. This was to be expected from a fund that seeks to provide not only exposure primarily to China’s market for innovative, non-government owned companies, but also to the very sectors that are increasingly underpinning the growth of China’s “New Economy”. The vast majority of the Fund’s notable returns came from companies in the information technology sector, followed by both the healthcare and consumer discretionary sectors. The energy sector did, however, detract from performance.

Egypt

Having reached highs in early February, Egyptian stocks fell thereafter, albeit fitfully, throughout the rest of the year. This decline was recorded despite GDP growth of 4.1% during 2014/2015, compared to 2.2% for 2013/2014.6 (The country’s fiscal year runs from July to June.) After a slight recovery in the first half of the year, due primarily to improved political stability,7 the destruction of a Russian plane over Sinai by a terrorist bomb (with the loss of all 224 passengers on board) at the end of October8 dealt a severe blow to Egyptian tourism. (Tourism remains exceptionally important to the country, making up 11.3% of the country’s GDP, and providing up to 14% of its foreign currency revenue.9) During the year, the dearth of foreign currency in the country, particularly U.S. dollars, and particularly to pay for imports, continued to hurt businesses and was seen by some as contributing to a “sharp slowdown in growth in the first half of the year.”10 In December, Fitch forecast that inflation would continue to run near 10% through the end of the year.11 On December 24, citing inflationary pressures, the country’s Monetary Policy Committee raised benchmark rates by 50bps, the first such rate hike since July 2014.12 While every sector detracted from performance, the financial and telecommunications services sectors were the greatest detractors. Mid- and small-cap companies, both with significant average weightings, together detracted the most from performance. Large-cap companies with a much smaller average weighting detracted commensurately less.

Gulf States

During the first six months of the year, the Fund posted a positive total return. However, the second half of the year was challenging, and it ended the 12 month period posting a negative total return of -13.42%. Although the Gulf States were, of course, hit by the drop in the price of oil during 2015, not only had most member countries bolstered reserves when the oil price was high, but also, for a number, growth is not tied to the hydrocarbon sector.13 As noted in a report on the Middle East published in November: “A combination of diversification and drawing on financial reserves will allow oil-exporting GCC countries to continue their economic growth plans in the short term.”14 However, “strong performance down the line will require reconsideration of both public spending priorities and sources of government revenue”.15 Something that, with its budget proposals announced at the end of the year, Saudi Arabia appeared prepared to do.16 But this did not prevent countries in the Gulf Cooperation Council, as a regional grouping, falling victim economically to the depressed price of oil.

| 4 |

No one country contributed positively to total returns. Geographically, the United Arab Emirates, with the greatest average country weighting, detracted most from performance. Qatar and Kuwait, with the second and the third greatest average country weighting respectively, were, likewise, the second and third greatest detractors. Financial stocks were the greatest detractors, with industrial stocks the other significant detractors from performance. Large-cap stocks detracted the most from performance, while small-cap stocks detracted the least.

India

Despite an economy that grew by 7.5%17 in the first quarter, and 7.1%18 in the second quarter of 2015, and despite the IMF’s prediction that it would increase further the following year (making the country the world’s fastest growing large economy19), total capital expenditure in the private sector declined severely during the year. In mid-October, according to the rating agency Fitch, it was “set to hit its lowest level since 2010.”20 The third quarter of the year, however, brought with it further economic expansion, with gross domestic product growing 7.4%21 from a year earlier. In particular, during the three months ended September 30, manufacturing output rose 9.3%22 from a figure of 7.2% in the previous quarter. For the 12 months under review, the Fund recorded a small gain of just more than 1%. A number of sectors, in particular healthcare, industrials and information technology, provided creditable positive returns. These were, however, offset by negative performance in the consumer discretionary, materials, and utilities sectors, and, in particular, in the financial sector, the greatest detractor from performance.

Indonesia

In early May 2015, President Joko Widodo promised to boost investment, increase infrastructure spending and, by 2017, expand the economy by 7%. However, GDP during the first quarter of 2015 contracted 0.18% over the previous quarter, a year-on-year growth figure of 4.71%. It was the slowest since the third quarter of 2009.23 As the year progressed, there was little improvement: 4.67% year-on-year during the second quarter and 4.73% during the third.24 At the beginning of November, the country’s finance minister, Bambang Brodjonegoro, said that growth in 2015 would, at most, be 4.8% (the slowest since 2009). President Widodo’s initial target for growth in 2015 had been 5.7%.25 Challenging conditions faced by Indonesia’s economy included forest fires and haze which, according to the World Bank, cost the country’s economy an estimated 1.9% of GDP and subdued private sector investment.26

For mid- and large-cap names, the focus of the Indonesia ETF, all sectors detracted from performance, with financial stocks detracting by far the most, and industrial stocks the least. Similarly, among small-cap stocks, the focus of the Indonesia Small-Cap ETF, not one sector contributed positively to performance. The financial, energy, and consumer discretionary sectors were by far the worst performing sectors, with the healthcare sector detracting the least from performance.

Israel

After a weak first half in 2015, Israel’s economy bounced back in the third quarter. Both investment and exports rebounded, resulting in annualized growth for the quarter of 2.5%.27 In particular, private spending—recently the country’s main growth driver—ticked up to 2.4% for the quarter from 1.5% the previous quarter.28 The public sector aside, in the third quarter Israel’s economy grew at an annualized rate of 2.7%.29 By the end of the year, however, the Bank of Israel’s Research Department had revised down its growth forecast for 2016 to 2.8%, from the 3.3% it had previously forecast in September.30 Over the period under review, the list of positive contributing sectors was topped by the telecommunications services and energy sectors. Of those sectors detracting from performance, the materials and information technology sectors were notable.

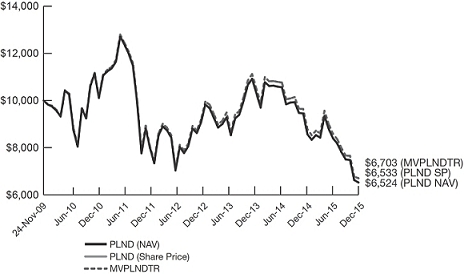

Poland

In May, in an unexpected turn of events, conservative candidate, Andrzej Duda won the presidential election against the incumbent president Bronisław Komorowski.31 And while President Duda may have become leader as the country’s economy started to pick up—GDP grew 1% in the first quarter and inflation rose to -1.1% in April from the March rate of -1.5%32—Polish stocks fell inexorably, if erratically, from the middle of May through to the end of the year. Between the election and late-December, the index of Poland’s main stock exchange had fallen 17.5%33 and, in response to concerns about the country’s significant shift to the right, its administration (in the form of deputy prime minister Mateusz Morawiecki) felt it necessary to reassure investors of the

| 5 |

MARKET VECTORS COUNTRY/REGIONAL ETFs

(unaudited) (continued)

government’s pro-market credentials. In an interview he was quoted as saying: “I am extremely open to international investors, especially those that bring lots of added value . . . we want to open the gates as broadly as possible.”34 Over the 12 month period under review, Polish stocks fell 9.62% in local currency terms (zloty) and 18.38% in terms of the U.S. dollar.

Three sectors, consumer staples, energy, and information technology each contributed positively to performance. However, together with the financial sector, the greatest detractor from performance, the materials and utilities sectors, both provided negative returns. Small-cap companies detracted the least from performance. Mid-cap companies, followed by large-cap companies, detracted the most from performance.

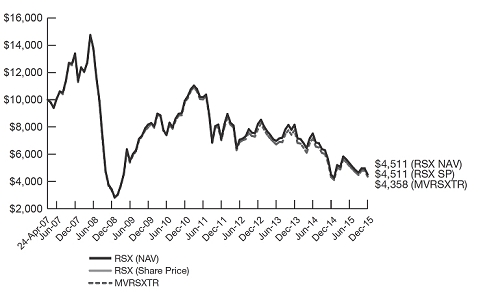

Russia

Over the first six months of 2015, Russia’s economy continued to suffer both from the imposition of sanctions stemming from its involvement in Ukraine and falling energy prices. Year-on-year, the economy contracted by 1.9% in the first quarter35 and inflation rose to 17%.36 However by the end of May, the ruble had bounced back to its mid-November 2014 level.37 By the end of the first half, the Russian stock market index had risen over 19.7%.38 While sanctions dampened investor exposure in 2015, the economy proved more resilient than expected—in part due to the fact that the authorities opted for a more orthodox policy response allowing the currency (rather than the international reserves) to act as a shock-absorber. By December 31, 2015, the stock market had risen 32.33% in local currency (ruble) terms for the full 12 month period, but only 0.41% in U.S. dollar terms.

Financial and utilities companies contributed positive returns to the large-cap fund, the Russia ETF. The materials sector detracted the most from performance. In the Russia Small-Cap ETF, companies in the materials sector performed well. Similarly sized companies in the consumer discretionary and consumer staples sectors were, however, the bottom performers.

Vietnam

In October, Vietnam’s Prime Minister, Nguyen Tan Tung, raised the target for GDP growth, set in November 2014, from 6.2% to at least 6.5%.39 If this growth was actually achieved, it would be the fastest in eight years.40 The government remained intent upon diversifying export markets by signing trade agreements, increasing domestic production, and developing substitute industries for imported products.41 Should it be ratified by participating countries, the recently signed Trans-Pacific Partnership will improve the Vietnam’s medium-term growth outlook significantly.42 In the present, however, the Fund ended the 12 month period down 18.87%.

Mid-cap companies actually performed positively over the 12 month period, but only minimally. With an average weighting of approximately 55%, small-cap companies were by far the greatest detractors from performance. While no sector contributed positively to total return, the materials sector detracted the least and the energy sector performed the worst.

| All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the fund. An index’s performance is not illustrative of the fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results. | |

| * | CSI 300 Index (CSIR0300) is a modified free-float market capitalization-weighted index compiled and managed by China Securities Index Co., Ltd. Considered to be the leading index for the Chinese equity market, the CSI 300 is a diversified index consisting of 300 constituent stocks listed on the Shenzhen Stock Exchange and/or the Shanghai Stock Exchange. |

| 1 | The Wall Street Journal: Brazilian President Dilma Rousseff’s Approval Ratings Languish, http://www.wsj.com/articles/brazilian-president-dilma-rousseffs-approval-ratings-remain-depressed-1443629542 |

| 2 | Associated Press: South American left in retreat as economic crisis deepens, http://bigstory.ap.org/article/7997d9bae7df4e7fa2259cdbfbeea668/south-american-left-retreat-economic-crisis-deepens |

| 3 | Reuters: UPDATE 2-Brazil economic activity falls for fourth straight quarter—cenbank, http://www.reuters.com/article/2015/11/18/brazil-economic-activity-idUSL1N13D0KV20151118#HebKEYUdIgvxg0km.97 |

| 4 | Ibid. |

| 5 | BBC: Brazil’s deficit jumps sharply as recession bites, http://www.bbc.co.uk/news/business-35195908 |

| 6 | Emirates 24/7: Egypt GDP growth seen at 4.4% in 2015-2016, http://www.emirates247.com/business/economy-finance/egypt-gdp-growth-seen-at-4-4-in-2015-2016-2015-11-16-1.610710 (Accessed November 23, 2015) |

| 6 |

| 7 | Ibid. |

| 8 | CNN: Russian plane crashes in Sinai, killing all 224 people on board, http://www.cnn.com/2015/10/31/middleeast/egypt-plane-crash/ |

| 9 | International Business Times: Egypt tourism industry to shrink 70% if British and Russian visitors stay away, http://www.ibtimes.co.uk/egypt-tourism-industry-shrink-70-if-british-russian-visitors-stay-away-1527681 |

| 10 | The Economist: Egypt’s foreign reserves: Dwindling dollars, http://www.economist.com/news/finance-and-economics/21676836-facing-shortage-foreign-exchange-egypt-allows-its-currency-fall-dwindling |

| 11 | Middle East Monitor: Egypt economy likely to slow as inflation bites, https://www.middleeastmonitor.com/blogs/politics/22962-egypt-economy-likely-to-slow-as-inflation-bites |

| 12 | Bank Audi: MENA Weekly Monitor (52) 28-12-15, http://www.bankaudi.com.lb/GroupWebsite/openAudiFile.aspx?id=2874 |

| 13 | ConstructionWeekOnline.com: Non-hydrocarbon sector still buffers GCC economy, http://www.constructionweekonline.com/article-33614-non-hydrocarbon-sector-still-buffers-gcc-economy/ |

| 14 | BQ Magazine: GCC in a position to weather global economic slowdown, http://www.bq-magazine.com/economy/macro-economy/2015/11/gcc-in-a-position-to-weather-global-economic-slowdown |

| 15 | Ibid. |

| 16 | Financial Times: Saudi budget lifts prospect of prolonged oil market glut, http://www.ftchinese.com/story/001065519/en |

| 17 | BBC: India’s economy surges by 7.5% in first quarter, http://www.bbc.com/news/business-32928138 |

| 18 | Trading Economics: India GDP Annual Growth Rate, http://www.tradingeconomics.com/india/gdp-growth-annual |

| 19 | Financial Times: Modi struggles to unleash investment, http://www.ft.com/intl/cms/s/0/db03eb3e-6d9d-11e5-8608-a0853fb4e1fe.html#axzz3sReidRoV |

| 20 | Ibid. |

| 21 | The Wall Street Journal: India’s Economic Growth Accelerates, http://www.wsj.com/articles/indias-economic-growth-accelerates-1448886206 |

| 22 | Ibid. |

| 23 | Bloomberg Business: Indonesian Economy Shrinks a Second Quarter; Rupiah Declines, http://www.bloomberg.com/news/articles/2015-05-05/indonesian-economy-shrinks-raising-risk-for-widodo-growth-goal |

| 24 | Bloomberg Business: Indonesia’s Economy Expanded Less Than Estimated Last Quarter, http://www.bloomberg.com/news/articles/2015-11-05/indonesia-s-economy-expanded-less-than-estimated-last-quarter |

| 25 | Ibid. |

| 26 | The World Bank: Indonesia Economic Quarterly – December 2015, http://www.worldbank.org/en/news/feature/2015/12/15/indonesia-economic-quarterly-december-2015 |

| 27 | Reuters: Israel economy bounces back in third-quarter, grows 2.5 percent, http://mobile.reuters.com/article/BigStory10/idUSKCN0T51B520151116 |

| 28 | Ibid. |

| 29 | Ibid. |

| 30 | Globes: Bank of Israel Research Dept cuts 2016 growth forecast, http://www.globes.co.il/en/article-bank-of-israel-research-dept-cuts-2016-growth-forecast-1001091576 |

| 31 | The Financial Times: Andrzej Duda, accidental president, http://www.ft.com/intl/cms/s/0/06130322-047c-11e5-95ad-00144feabdc0.html#axzz3dpMr2CmH |

| 32 | Central Bank News: Poland says improving growth to limit risk of low inflation, http://www.centralbanknews.info/2015/06/poland-says-improving-growth-to-limit.html |

| 33 | Financial Times: Poland’s new government aims to reassure investors over policies, http://www.ft.com/intl/cms/s/0/5305390e-a80d-11e5-955c-1e1d6de94879.html#axzz3vqLpqMQC |

| 34 | Ibid. |

| 35 | The New York Times: Russian Economy Shrinks 1.9% in First Quarter, http://www.nytimes.com/2015/05/16/business/international/russian-economy-shrinks-1-9-in-first-quarter.html?_r=0 |

| 36 | Forbes: A Russian Crisis With No End in Sight, Thanks to Low Oil Prices and Sanctions, http://www.forbes.com/sites/paulroderickgregory/2015/05/14/a-russian-crisis-with-no-end-in-sight-thanks-to-low-oil-prices-and-sanctions/3/ |

| 37 | Brookings: The ruble currency storm is over, but is the Russian economy ready for the next one?, http://www.brookings.edu/blogs/up-front/posts/2015/05/18-russian-economy-aleksashenko |

| 38 | Bloomberg: INDEXCF Index, Total Return in Russian Rubles |

| 7 |

MARKET VECTORS COUNTRY/REGIONAL ETFs

(unaudited) (continued)

| 39 | Bloomberg Business: Vietnam Growth Masks Weak Local Firms in 2-Speed Economy, http://www.bloomberg.com/news/articles/2015-11-08/vietnam-growth-surge-masks-weak-local-firms-in-2-speed-economy |

| 40 | Ibid. |

| 41 | Viet Nam News: Trade deficit reaches $3 billion, http://vietnamnews.vn/economy/271103/trade-deficit-reaches-3-billion.html |

| 42 | Bloomberg Business: Vietnam Growth Masks Weak Local Firms in 2-Speed Economy, http://www.bloomberg.com/news/articles/2015-11-08/vietnam-growth-surge-masks-weak-local-firms-in-2-speed-economy |

| 8 |

December 31, 2015 (unaudited)

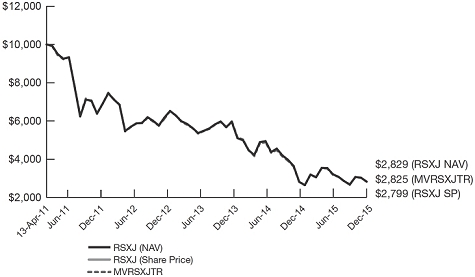

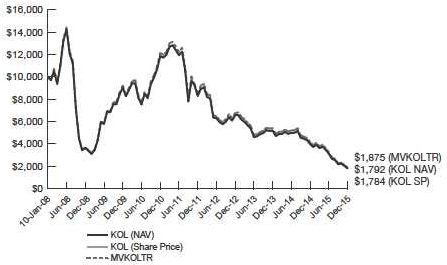

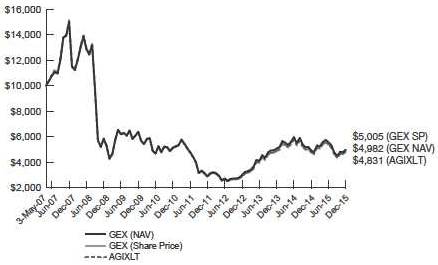

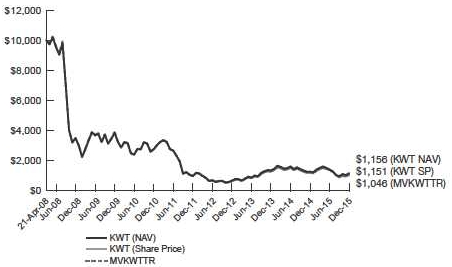

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVAFKTR2 | |||||||||

| One Year | (29.95 | )% | (29.41 | )% | (29.07 | )% | ||||||

| Five Years | (10.15 | )% | (9.57 | )% | (8.59 | )% | ||||||

| Life* (annualized) | (8.24 | )% | (8.02 | )% | (6.78 | )% | ||||||

| Life* (cumulative) | (47.41 | )% | (46.46 | )% | (40.86 | )% | ||||||

| * since 7/10/2008 | ||||||||||||

Index data prior to June 21, 2013 reflects that of the Dow Jones Africa Titans 50 IndexSM. From June 21, 2013, forward, the index data reflects that of the Market Vectors® GDP Africa Index (MVAFKTR). All Index history reflects a blend of the performance of the aforementioned Indexes. | ||||||||||||

Commencement date for the Market Vectors Africa Index ETF was 7/10/08.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/10/08) to the first day of secondary market trading in shares of the Fund (7/14/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 0.82% / Net Expense Ratio 0.79%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.78% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 9 |

AFRICA INDEX ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® GDP Africa Index (MVAFKTR) tracks the performance of the largest and most liquid companies in Africa. The weighting of a country in the index is determined by the size of its gross domestic product. |

Market Vectors GDP Africa Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Africa Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 10 |

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVBRFTR2 | |||||||||

| One Year | (48.90 | )% | (48.97 | )% | (48.50 | )% | ||||||

| Five Years | (25.49 | )% | (25.27 | )% | (24.57 | )% | ||||||

| Life* (annualized) | (8.02 | )% | (7.93 | )% | (7.29 | )% | ||||||

| Life* (cumulative) | (42.57 | )% | (42.22 | )% | (39.49 | )% | ||||||

| * since 5/12/2009 | ||||||||||||

Commencement date for the Market Vectors Brazil Small-Cap ETF was 5/12/09.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (5/12/09) to the first day of secondary market trading in shares of the Fund (5/14/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 0.72% / Net Expense Ratio 0.60%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.59% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 11 |

BRAZIL SMALL-CAP ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Brazil Small-Cap Index (MVBRFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are domiciled and primarily listed on an exchange in Brazil, or that generate at least 50% of their revenues in Brazil. |

Market Vectors Brazil Small-Cap Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Brazil Small-Cap ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 12 |

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

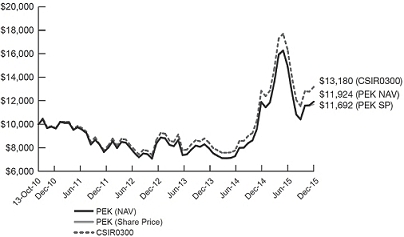

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | CSIRO3002 | |||||||||

| One Year | (1.17 | )% | 0.22 | % | 2.59 | % | ||||||

| Five Year | 0.64 | % | 4.00 | % | 6.03 | % | ||||||

| Life* (annualized) | 3.04 | % | 3.43 | % | 5.44 | % | ||||||

| Life* (cumulative) | 16.92 | % | 19.24 | % | 31.80 | % | ||||||

| * since 10/13/2010 | ||||||||||||

Commencement date for the Market Vectors ChinaAMC A-Share ETF was 10/13/10

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (10/13/10) to the first day of secondary market trading in shares of the Fund (10/14/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 1.20% / Net Expense Ratio 0.75%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.72% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 13 |

CHINAAMC A-SHARE ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | CSI 300 Index (CSIR0300) is a modified free-float market capitalization weighted index comprised of the largest and most liquid stocks in the Chinese A-share market. Constituent stocks for the Index must have been listed for more than three months (unless the stock’s average daily A-share market capitalization since its initial listing ranks among the top 30 of all A-shares) and must not be experiencing what the Index Provider believes to be obvious abnormal fluctuations or market manipulation. |

CSI 300 Index (the “Index”) and its logo are service marks of China Securities Index Co., Ltd. (“CSI”) and have been licensed for use by Van Eck Associates Corporation. Market Vectors ChinaAMC A-Share ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by CSI and CSI makes no representation regarding the advisability of investing in the Fund. CSI 300 is a registered trademark of China Securities Index Co., Ltd.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 14 |

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

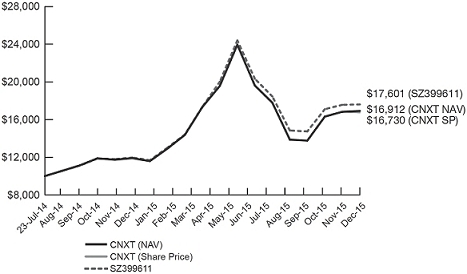

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | SZ3996112 | |||||||||

| One Year | 43.32 | % | 45.94 | % | 50.65 | % | ||||||

| Life* (annualized) | 42.92 | % | 44.00 | % | 48.04 | % | ||||||

| Life* (cumulative) | 67.30 | % | 69.12 | % | 76.01 | % | ||||||

| * since 7/23/2014 | ||||||||||||

Commencement date for the Market Vectors ChinaAMC SME-ChiNext ETF was 7/23/14.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/23/14) to the first day of secondary market trading in shares of the Fund (7/24/14), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 1.11% / Net Expense Ratio 0.79%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.78% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 15 |

CHINAAMC SME-CHINEXT ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | The SME-ChiNext 100 Index (SZ399611) is a modified, free-float adjusted index intended to track the performance of the 100 largest and most liquid stocks listed and trading on the Small and Medium Enterprise (“SME”) Board and the ChiNext Board of the Shenzhen Stock Exchange. The Index is comprised of A-shares. |

The SME-ChiNext 100 Index (the “Index”) is the exclusive property of the Shenzhen Securities Information Co., Ltd (the “Index Provider”), which is a subsidiary of the Shenzhen Stock Exchange. The Index Provider does not sponsor, endorse, or promote Market Vectors ChinaAMC SME-ChiNext ETF (the “Fund”) and bears no liability with respect to the Fund or any security.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 16 |

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVEGPTTR2 | |||||||||

| One Year | (33.44 | )% | (33.89 | )% | (33.92 | )% | ||||||

| Five Year | (10.73 | )% | (10.03 | )% | (10.09 | )% | ||||||

| Life* (annualized) | (9.38 | )% | (9.08 | )% | (9.06 | )% | ||||||

| Life* (cumulative) | (43.92 | )% | (42.82 | )% | (42.72 | )% | ||||||

| * since 2/16/2010 | ||||||||||||

Commencement date for the Market Vectors Egypt Index ETF was 2/16/10.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (2/16/10) to the first day of secondary market trading in shares of the Fund (2/18/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 1.07% / Net Expense Ratio 0.98%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.94% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 17 |

EGYPT INDEX ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Egypt Index (MVEGPTTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Egypt, or that generate at least 50% of their revenues in Egypt. |

Market Vectors Egypt Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Egypt Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 18 |

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

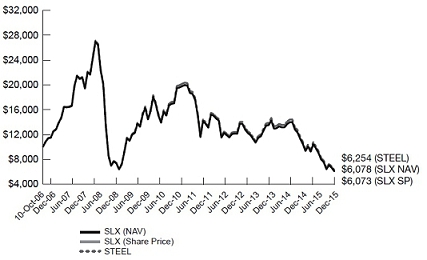

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVMESTR2 | |||||||||

| One Year | (12.45 | )% | (13.42 | )% | (13.15 | )% | ||||||

| Five Years | 1.94 | % | 2.40 | % | 3.56 | % | ||||||

| Life* (annualized) | (5.30 | )% | (5.28 | )% | (4.46 | )% | ||||||

| Life* (cumulative) | (33.34 | )% | (33.24 | )% | (28.81 | )% | ||||||

| * since 7/22/2008 | ||||||||||||

Index data prior to June 21, 2013 reflects that of the Dow Jones GCC Titans 40 IndexSM. From June 21, 2013, forward, the index data reflects that of the Market Vectors® GDP GCC Index (MVMESTR). All Index history reflects a blend of the performance of the aforementioned Indexes. | ||||||||||||

Commencement date for the Market Vectors Gulf States Index ETF was 7/22/08.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (7/22/08) to the first day of secondary market trading in shares of the Fund (7/24/08), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 2.77% / Net Expense Ratio 1.00%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.98% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 19 |

GULF STATES INDEX ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® GDP GCC Index (MVMESTR) provides exposure to publicly traded companies either headquartered in countries belonging to the Gulf Cooperation Council (GCC) or companies that generate the majority of their revenues in these countries |

Market Vectors GDP GCC Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Gulf States Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 20 |

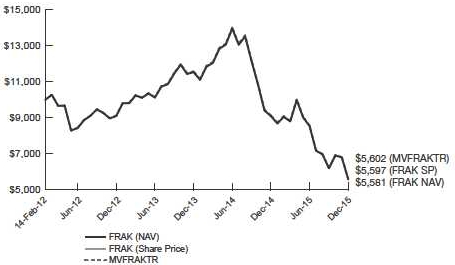

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

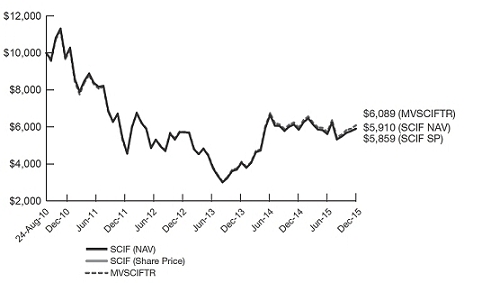

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVSCIFTR2 | |||||||||

| One Year | (0.16 | )% | 1.07 | % | 2.12 | % | ||||||

| Five Year | (10.50 | )% | (10.48 | )% | (9.74 | )% | ||||||

| Life* (annualized) | (9.50 | )% | (9.36 | )% | (8.85 | )% | ||||||

| Life* (cumulative) | (41.41 | )% | (40.90 | )% | (39.11 | )% | ||||||

| * since 8/24/2010 | ||||||||||||

Commencement date for the Market Vectors India Small-Cap Index ETF was 8/24/10.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (8/24/10) to the first day of secondary market trading in shares of the Fund (8/25/10), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 0.78% / Net Expense Ratio 0.78%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.85% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in cash. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 21 |

INDIA SMALL-CAP INDEX ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® India Small-Cap Index (MVSCIFTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded small-capitalization companies that are headquartered in India or that generate the majority of their revenues in India. |

Market Vectors India Small-Cap Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors India Small-Cap Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 22 |

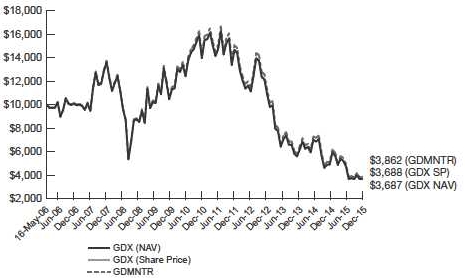

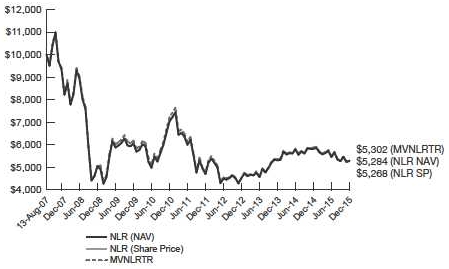

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

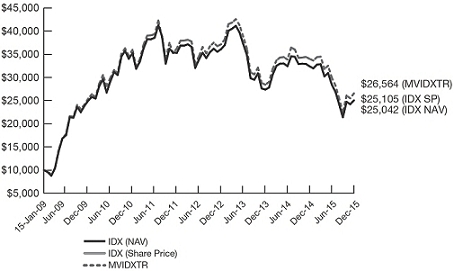

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVIDXTR2 | |||||||||

| One Year | (22.38 | )% | (22.69 | )% | (21.85 | )% | ||||||

| Five Year | (6.69 | )% | (6.59 | )% | (5.87 | )% | ||||||

| Life* (annualized) | 14.14 | % | 14.10 | % | 15.07 | % | ||||||

| Life* (cumulative) | 151.05 | % | 150.42 | % | 165.64 | % | ||||||

| * since 1/15/2009 | ||||||||||||

Commencement date for the Market Vectors Indonesia Index ETF was 1/15/09.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (1/15/09) to the first day of secondary market trading in shares of the Fund (1/20/09), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 0.72% / Net Expense Ratio 0.58%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.57% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 23 |

INDONESIA INDEX ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Indonesia Index (MVIDXTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Indonesia, or that generate at least 50% of their revenues in Indonesia. |

Market Vectors Indonesia Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Indonesia Index ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 24 |

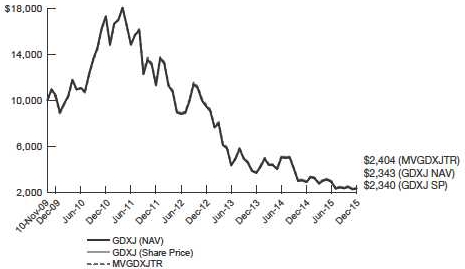

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | MVIDXJTR2 | |||||||||

| One Year | (42.24 | )% | (42.14 | )% | (42.74 | )% | ||||||

| Life* (annualized) | (20.21 | )% | (20.13 | )% | (19.47 | )% | ||||||

| Life* (cumulative) | (57.43 | )% | (57.28 | )% | (55.92 | )% | ||||||

| * since 3/20/2012 | ||||||||||||

Commencement date for the Market Vectors Indonesia Small-Cap ETF was 3/20/12.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (3/20/12) to the first day of secondary market trading in shares of the Fund (3/21/12), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.

Investment return and value of the shares of the Fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Performance current to the most recent month-end is available by calling 800.826.2333 or by visiting vaneck.com.

Gross Expense Ratio 2.68% / Net Expense Ratio 0.63%

Van Eck Associates Corporation (the “Adviser”) has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, offering costs, trading expenses, taxes and extraordinary expenses) from exceeding 0.61% of the Fund’s average daily net assets per year until at least May 1, 2016. During such time, the expense limitation is expected to continue until the Fund’s Board of Trustees acts to discontinue all or a portion of such expense limitation.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Creation units are issued and redeemed principally in kind. Shares may trade at a premium or discount to their NAV in the secondary market.

The “Net Asset Value” (NAV) of a Market Vectors exchange-traded fund (ETF) is determined at the close of each business day, and represents the dollar value of one share of the fund; it is calculated by taking the total assets of the fund, subtracting total liabilities, and dividing by the total number of shares outstanding. The NAV is not necessarily the same as the ETF’s intraday trading value. Market Vectors ETF investors should not expect to buy or sell shares at NAV.

| 25 |

INDONESIA SMALL-CAP ETF

PERFORMANCE COMPARISON

(unaudited) (continued)

Index returns assume the reinvestment of all income and do not reflect any management fees or brokerage expenses associated with Fund returns. Investors cannot invest directly in the Index. Returns for actual Fund investors may differ from what is shown because of differences in timing, the amount invested and fees and expenses.

| 2 | Market Vectors® Indonesia Small-Cap Index (MVIDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of publicly traded companies that are domiciled and primarily listed on an exchange in Indonesia, or that generate at least 50% of their revenues in Indonesia. |

Market Vectors Indonesia Small-Cap Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH (a wholly owned subsidiary of the Adviser), which has contracted with Solactive AG to maintain and calculate the Index. Solactive AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards Market Vectors Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Index to third parties. Market Vectors Indonesia Small-Cap ETF (the “Fund”) is not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of investing in the Fund.

PREMIUM/DISCOUNT INFORMATION

(unaudited)

Information regarding how often the Shares of each Fund traded on NYSE Arca, Inc. or The NASDAQ Stock Market LLC as applicable, at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund during the past four calendar quarters, as applicable, can be found at www.vaneck.com.

| 26 |

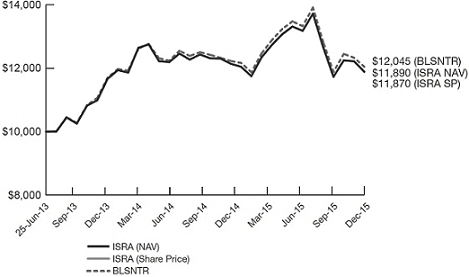

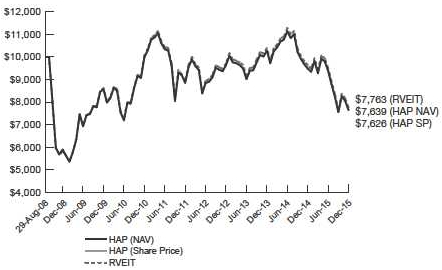

PERFORMANCE COMPARISON

December 31, 2015 (unaudited)

| Hypothetical Growth of $10,000 (Since Inception) | |

| This chart shows the value of a hypothetical $10,000 investment in the Fund at NAV and at Share Price over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with the Fund’s benchmark. |  |

| Total Return | Share Price1 | NAV | BLSNTR2 | |||||||||

| One Year | (1.47 | )% | (1.27 | )% | (1.00 | )% | ||||||

| Life* (annualized) | 7.05 | % | 7.12 | % | 7.67 | % | ||||||

| Life* (cumulative) | 18.70 | % | 18.90 | % | 20.45 | % | ||||||

| * since 6/25/2013 | ||||||||||||

Commencement date for the Market Vectors Israel ETF was 6/25/13.

| 1 | The price used to calculate market return (Share Price) is determined by using the closing price listed on NYSE Arca. Since the shares of the Fund did not trade in the secondary market until several days after the Fund’s commencement, for the period from commencement (6/25/13) to the first day of secondary market trading in shares of the Fund (6/26/13), the NAV of the Fund is used as a proxy for the secondary market trading price to calculate market returns. |

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Performance information for the Fund reflects temporary waivers of expenses and/or fees. Had the Fund incurred all expenses, investment returns would have been reduced. These returns do not reflect the deduction of taxes that a shareholder would pay on Fund dividends and distributions or the sale of Fund shares.