UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

| | |

Check the appropriate box: | | |

| |

☐ Preliminary Proxy Statement | | ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ Definitive Proxy Statement |

|

☒ Definitive Additional Materials |

|

☐ Soliciting Material Pursuant to § 240.14a-12 |

BLACKROCK CALIFORNIA MUNICIPAL INCOME TRUST

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

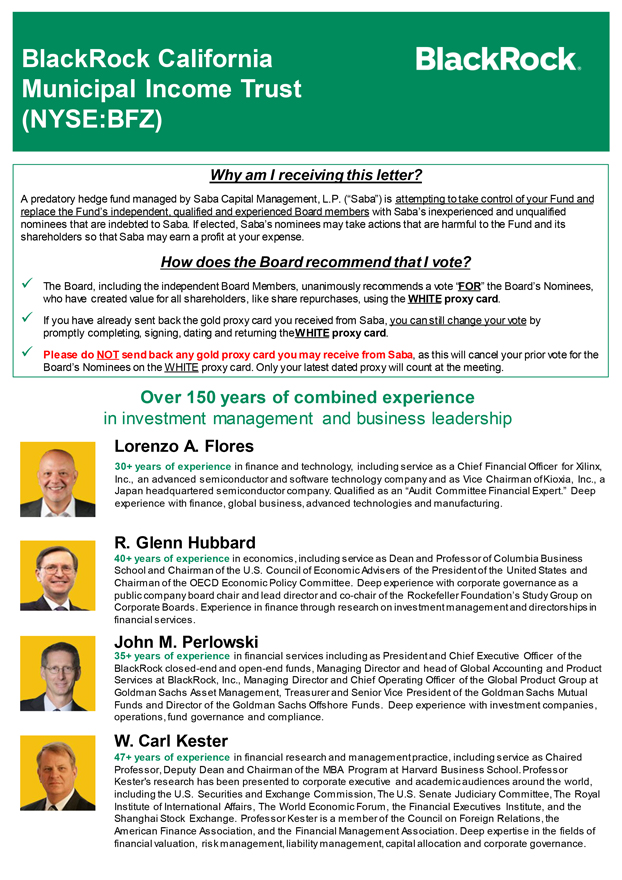

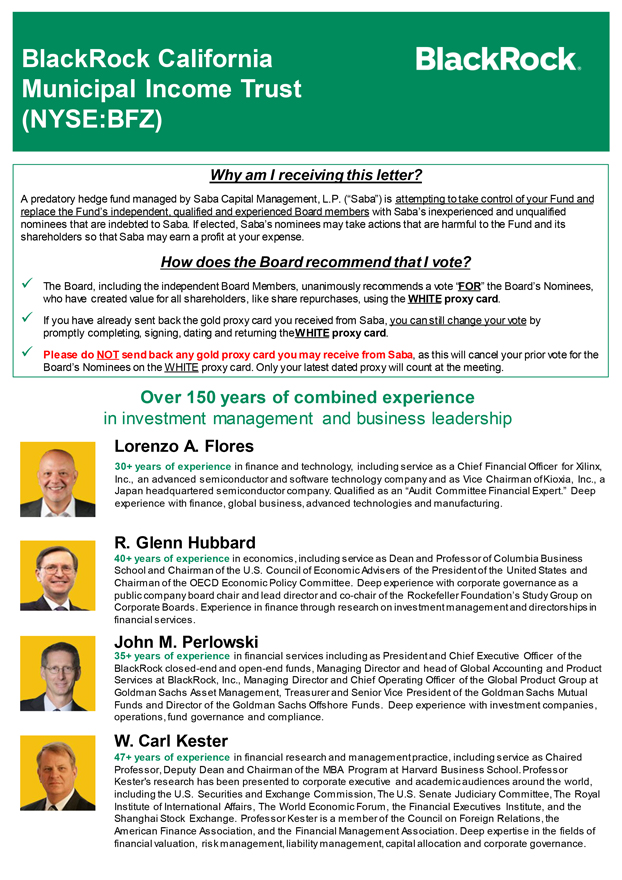

BlackRock California Municipal Income Trust (NYSE:BFZ) Why am I receiving this letter? A predatory hedge fund managed by Saba Capital Management, L.P. (“Saba”) is attempting to take control of your Fund and replace the Fund’s independent, qualified and experienced Board members with Saba’s inexperienced and unqualified nominees that are indebted to Saba. If elected, Saba’s nominees may take actions that are harmful to the Fund and its shareholders so that Saba may earn a profit at your expense. How does the Board recommend that I vote? ✓ The Board, including the independent Board Members, unanimously recommends a vote “FOR” the Board’s Nominees, who have created value for all shareholders, like share repurchases, using the WHITE proxy card. ✓ If you have already sent back the gold proxy card you received from Saba, you can still change your vote by promptly completing, signing, dating and returning the WHITE proxy card. ✓ Please do NOT send back any gold proxy card you may receive from Saba, as this will cancel your prior vote for the Board’s Nominees on the WHITE proxy card. Only your latest dated proxy will count at the meeting. Over 150 years of combined experience in investment management and business leadership Lorenzo A. Flores 30+ years of experience in finance and technology, including service as a Chief Financial Officer for Xilinx, Inc., an advanced semiconductor and software technology company and as Vice Chairman of Kioxia, Inc., a Japan headquartered semiconductor company. Qualified as an “Audit Committee Financial Expert.” Deep experience with finance, global business, advanced technologies and manufacturing. R. Glenn Hubbard 40+ years of experience in economics, including service as Dean and Professor of Columbia Business School and Chairman of the U.S. Council of Economic Advisers of the President of the United States and Chairman of the OECD Economic Policy Committee. Deep experience with corporate governance as a public company board chair and lead director and co-chair of the Rockefeller Foundation’s Study Group on Corporate Boards. Experience in finance through research on investment management and directorships in financial services. John M. Perlowski 35+ years of experience in financial services including as President and Chief Executive Officer of the BlackRock closed-end and open-end funds, Managing Director and head of Global Accounting and Product Services at BlackRock, Inc., Managing Director and Chief Operating Officer of the Global Product Group at Goldman Sachs Asset Management, Treasurer and Senior Vice President of the Goldman Sachs Mutual Funds and Director of the Goldman Sachs Offshore Funds. Deep experience with investment companies, operations, fund governance and compliance. W. Carl Kester 47+ years of experience in financial research and management practice, including service as Chaired Professor, Deputy Dean and Chairman of the MBA Program at Harvard Business School. Professor Kester’s research has been presented to corporate executive and academic audiences around the world, including the U.S. Securities and Exchange Commission, The U.S. Senate Judiciary Committee, The Royal Institute of International Affairs, The World Economic Forum, the Financial Executives Institute, and the Shanghai Stock Exchange. Professor Kester is a member of the Council on Foreign Relations, the American Finance Association, and the Financial Management Association. Deep expertise in the fields of financial valuation, risk management, liability management, capital allocation and corporate governance.

BFZ_LTR3

All inv estments involve risk, including the possible loss of the principalamount invested. Important information about the Fund This material is not an advertisement and is intended for existing shareholder use only. This document and the information contained herein relates solely to BlackRock California Municipal Income Trust (BFZ). The information contained herein does not relate to, and is not relevant to, any other fund or product sponsored or distributed by BlackRock or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation of an offer to buy any securities. Common shares for the closed-end fund identified above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund’s dividend yield, market price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares. © 2023 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and ALADDIN are trademarks of BlackRock, Inc., or its affiliates. All other trademarks are those of their respective owners. June 2023 | BlackRock California Municipal Income Trust (BFZ) Not FDIC Insured • May Lose Value • No BankGuarantee