UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-10385

Pacific Funds Series Trust

(Exact name of registrant as specified in charter)

700 Newport Center Drive, P.O. Box 7500

Newport Beach, CA 92660

(Address of principal executive offices) (Zip code)

Mark Karpe, Esq.

Pacific Life Insurance Company

700 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

Registrant’s telephone number, including area code: 949-219-3224

Date of fiscal year end: March 31

Date of reporting period: April 1, 2022 - March 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

PACIFIC FUNDS

ANNUAL REPORT

AS OF MARCH 31, 2023

Pacific Funds Series Trust, which is a Delaware statutory trust, may be referred to as “Pacific Funds” or the “Trust”.

PACIFIC FUNDS

Dear Shareholders:

We are pleased to share with you the Pacific Funds Series Trust (“Pacific Funds” or the “Trust”) Annual Report for the fiscal year ended March 31, 2023, including performance data, management’s discussion of fund performance, and a complete list of investments as of the close of this reporting period. Pacific Funds is comprised of twenty-nine funds (each individually, a “Fund�� and collectively, the “Funds”), fifteen of which are available for direct investment. Pacific Life Fund Advisors LLC (PLFA) is the Adviser to the Trust and supervises the management of all of the Trust’s Funds. PLFA directly manages Pacific FundsSM Portfolio Optimization Conservative, Pacific FundsSM Portfolio Optimization Moderate-Conservative, Pacific FundsSM Portfolio Optimization Moderate, Pacific FundsSM Portfolio Optimization Growth and Pacific FundsSM Portfolio Optimization Aggressive-Growth (together, the “Portfolio Optimization Funds”) as well as the PF Multi-Asset Fund.

Each of the Portfolio Optimization Funds is an asset allocation “Fund of Funds” that invests in Class P shares of certain other Funds of the Trust (the “PF Underlying Funds”). PLFA supervises the management of those PF Underlying Funds which are only available for investment by the Portfolio Optimization Funds. The Portfolio Optimization Funds also invest in Class P shares of Pacific FundsSM Core Income, Pacific FundsSM High Income and Pacific FundsSM Floating Rate Income.

The Adviser has retained other firms to serve as sub-advisers under its supervision. The sub-advisers, the Adviser and the Funds of the Trust that they manage as of March 31, 2023 are listed below:

| | | | |

| | | |

| Sub-Adviser or Adviser | | Funds Available for Direct Investment | | Page Number |

| | | |

| Pacific Life Fund Advisors LLC (PLFA) | | Pacific FundsSM Portfolio Optimization Conservative | | A-5 |

| | Pacific FundsSM Portfolio Optimization Moderate-Conservative | | A-6 |

| | Pacific FundsSM Portfolio Optimization Moderate | | A-7 |

| | Pacific FundsSM Portfolio Optimization Growth | | A-9 |

| | Pacific FundsSM Portfolio Optimization Aggressive-Growth | | A-10 |

| | | |

| Pacific Asset Management LLC (Pacific Asset Management) | | Pacific FundsSM Ultra Short Income | | A-11 |

| | Pacific FundsSM Short Duration Income | | A-12 |

| | Pacific FundsSM Core Income | | A-13 |

| | Pacific FundsSM ESG Core Bond | | A-14 |

| | Pacific FundsSM Strategic Income | | A-15 |

| | Pacific FundsSM Floating Rate Income | | A-16 |

| | Pacific FundsSM High Income | | A-17 |

| | | |

| Rothschild & Co Asset Management US Inc. (Rothschild & Co) | | Pacific FundsSM Small/Mid-Cap | | A-18 |

| | Pacific FundsSM Small-Cap | | A-19 |

| | Pacific FundsSM Small-Cap Value | | A-20 |

| | | | |

| | | |

| Sub-Adviser or Adviser | | PF Underlying Funds | | Page

Number |

| | | |

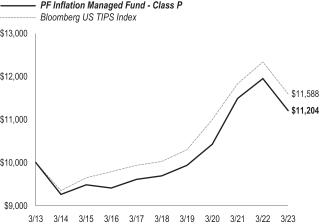

| Pacific Investment Management Company LLC (PIMCO) | | PF Inflation Managed Fund | | A-21 |

| | | |

| J.P. Morgan Investment Management Inc. (JPMorgan) / Pacific Investment Management Company LLC (PIMCO) / Western Asset Management Company, LLC (Western Asset) | | PF Managed Bond Fund | | A-22 |

| | | |

| T. Rowe Price Associates, Inc. (T. Rowe Price) | | PF Short Duration Bond Fund | | A-24 |

| | | |

| Principal Global Investors, LLC (PGI) | | PF Emerging Markets Debt Fund | | A-25 |

| | | |

| MFS Investment Management (MFS) | | PF Growth Fund | | A-26 |

| | | |

| ClearBridge Investments, LLC (ClearBridge) | | PF Large-Cap Value Fund | | A-27 |

| | | |

| MFS Investment Management (MFS) | | PF Small-Cap Growth Fund | | A-28 |

| | | |

| Alliance Bernstein L.P. (AB) | | PF Small-Cap Value Fund | | A-29 |

| | | |

| Invesco Advisers, Inc. (Invesco) | | PF Emerging Markets Fund | | A-30 |

| | | |

| ClearBridge Investments, LLC (ClearBridge) | | PF International Growth Fund | | A-32 |

| | | |

| FIAM LLC (FIAM) | | PF International Small-Cap Fund | | A-33 |

| | | |

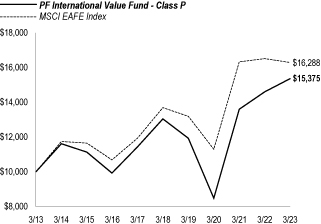

| Wellington Management Company LLP (Wellington) | | PF International Value Fund | | A-34 |

| | | |

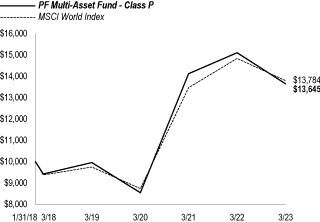

| Pacific Life Fund Advisors LLC (PLFA) / portion sub-advised by Pacific Asset Management LLC | | PF Multi-Asset Fund | | A-35 |

| | | |

| Principal Real Estate Investors, LLC (Principal REI) | | PF Real Estate Fund | | A-36 |

A-1

PACIFIC FUNDS

Each of the sub-advisers and the Adviser has prepared a discussion regarding the performance of the Funds of the Trust that they manage, including commentary discussing positive and negative factors affecting performance for the past twelve months.

This will be our last shareholder report to you. Pursuant to proxy materials you previously received, as a result of a proxy vote that was held on April 10, 2023, the funds of Pacific Funds that are available for direct investment were each reorganized into the corresponding fund of the Aristotle Funds Series Trust (“Aristotle Funds”) effective April 17, 2023. As a result, Aristotle Funds will service your funds going forward. Thank you for your prior confidence in Pacific Funds and the opportunity to service your investment needs, and we wish you all the best in the future.

Sincerely,

| | |

| | |

| |

Adrian S. Griggs President and Chief Executive Officer | | |

| |

| Pacific Funds Series Trust | | |

A-2

PACIFIC FUNDS PERFORMANCE DISCUSSION

This Annual Report is provided for the general information of investors with beneficial interests in the Trust. This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current Trust prospectus, as supplemented, which contains information about the Trust and each of its Funds, including their investment objectives, risks, charges and expenses. You should read the prospectus carefully before investing. There is no assurance that a Fund will achieve its investment objective. Each Fund is subject to market risk. The value of a Fund changes as its asset values go up or down. The value of a Fund’s shares will fluctuate, and when redeemed, may be worth more or less than their original cost. The total return for each share class of each Fund is net of fees and includes reinvestment of all dividends and capital gain distributions, if any, and does not include deductions of any applicable share class sales charges. Past performance is not predictive of future performance. This report shows you the performance of each Fund compared to its benchmark index. Index performance is provided for illustrative and comparative purposes only and does not predict or depict the performance of the Funds. Indices are unmanaged, do not incur transaction costs, do not include fees and expenses, and cannot be purchased directly by investors. Index returns include reinvested dividends.

The composite benchmarks for the Portfolio Optimization Funds are composed of up to four broad-based indices. The percentage amounts of each broad-based index within each composite benchmark are based on each Fund’s target asset class allocations in effect during the reporting period. The percentages attributed to a broad-based index within a composite benchmark will change if a Fund’s target asset class allocations change.

PLFA supervises the management of the Funds contained in this report, subject to the oversight of the Trust’s Board of Trustees (Board). PLFA directly manages the Portfolio Optimization Funds as well as the PF Multi-Asset Fund. PLFA has written the general market conditions commentary which expresses PLFA’s opinions and views on how the market generally performed for the fiscal year ended March 31, 2023 (the reporting period) as well as separate commentary specific to those Funds that it directly manages that is based on its opinion of how these Funds performed during this reporting period.

For the other Funds, PLFA has retained other firms to serve as sub-advisers under its supervision. Each of these sub-advisers has written a separate commentary specific to the Fund(s) that they manage that is based on their opinions of how their Fund(s) performed during the reporting period. The views expressed in those commentaries reflect those of the respective sub-advisers for the fiscal year ended March 31, 2023.

All views and opinions expressed in the management discussion of fund performance are subject to change at any time based upon market, economic or other conditions, and the Trust, its Adviser and the sub-advisers disclaim any responsibility to update such views. These views and options may not be relied upon as investment advice or recommendations, or as an offer for any particular security. Any references to “we”, “I”, or “ours” are references to the sub-adviser or Adviser, as applicable. Any sectors referenced are provided by the applicable sub-adviser and could be different from the sectors listed in the Schedules of Investments if obtained from another source. The Adviser and sub-advisers may include statements that constitute “forward-looking statements” under the United States (U.S.) securities laws. Forward-looking statements include information concerning possible or assumed future results of the Trust’s investment operations, asset levels, earnings, expenses, industry or market conditions, regulatory developments and other aspects of the Trust’s operations or general economic conditions. In addition, when used in this report, words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “projects” and future or conditional verbs such as “will”, “may”, “could”, “should”, and “would”, or any other statement that necessarily depends on future events, are intended to identify forward- looking statements. Forward-looking statements are not guarantees of performance or economic results. They involve risks, uncertainties and assumptions. Although such statements are based on expectations that the Adviser or a sub-adviser believes to be reasonable, actual results may differ materially from expectations. Investors must not rely on any forward-looking statements. Statements of facts and performance data are from sources considered reliable, but no representation or warranty is made as to their completeness or accuracy.

In connection with any forward-looking statements and any investment in the Trust, investors should carefully consider the investment objectives, policies and risks described in the Trust’s current prospectuses, as supplemented, and Statement of Additional Information, as supplemented, as filed with the United States (U.S.) Securities and Exchange Commission (SEC), which may be obtained from the SEC or by contacting the Trust as noted in the Where to Go for More Information section of this Annual Report.

Market Conditions (for the fiscal year ended March 31, 2023)

Executive Summary

While equity markets managed to recover over the latter half of the reporting period, they faced losses over the reporting period as the S&P 500 Index fell 7.73%. Value stocks fared better than growth stocks, while large-capitalization stocks outperformed small-capitalization stocks over the reporting period. International equities outperformed domestic stocks as European stocks recovered and European economies turned out to be less fragile than feared. Luxury brand names performed well as China’s economy emerged from strict Covid-related lockdowns. Furthermore, global equity investors turned to international stocks over U.S. equities due to attractive valuations abroad.

Within fixed income, longer-duration bonds suffered as interest rates spiked over the reporting period. On the other hand, shorter-duration bonds held up as investors sought safer and more liquid assets. While high yield bonds faced losses over the reporting period, they managed to outperform the Bloomberg U.S. Aggregate Bond Index.

Outlook

While domestic inflation may have peaked, the United States Federal Reserve’s (Fed’s) fighting endeavors against it is yet to be completed. We’ve seen headline inflation ease as supply-chain congestions have cleared up and crude prices have fallen from its peak levels seen during 2022. However, services inflation has yet to show any meaningful signs of slowing down. In particular, wage growth continues to remain elevated due to labor shortages caused by Baby Boomer retirement and stricter immigration policies. Nonetheless, higher interest rates have more recently eased the strong job growth experienced over the past couple of years.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-3

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

The slowdown in employment growth should eventually ease services inflation, although it’s expected to remain sticky due to the relatively healthy labor market. The negative impact from higher interest rates extends beyond just employment growth. Amid this environment, Silicon Valley Bank became the second largest bank to fail in U.S. history. With the failure of a few banks, we are beginning to see some of the collateral damage caused by the Fed’s aggressive rate hikes. As the era of easy money comes to an end, companies with weak fundamentals are beginning to be revealed.

This economic deterioration has convinced the market that the Fed will cut rates later this year. However, this conflicts with the Fed’s projections as it is not expected to start cutting until 2024. As long as inflation remains sticky and the labor market remains healthy, we believe the Fed is unlikely to budge from maintaining interest rates at a high level. Nevertheless, the aggressive rate hikes will likely dampen economic growth as gross domestic product (GDP) forecasts remain relatively dismal for 2023.

In the meantime, the overall equity market appears to be settling down after a turbulent year in 2022. Coincidently, price-to-earnings multiples for the S&P 500 have come down to fair levels as we may be approaching the end of the recent bear market. However, we do not expect all equities will perform in sync with each other. In fact, investors are likely to gravitate toward safer and more defensive areas like large capitalization stocks and avoid vulnerable ones like small capitalization value stocks that have a high concentration in the financial sector.

Growth stocks started to look interesting in 2023 as their multiples went from overly expensive to very attractive over 2022. Investors have turned to growth stocks once again in 2023, as they may be experiencing a bull market in 2023. Furthermore, while sales growth projections have turned negative for value indices, those of larger growth indices remain positive and healthy.

While the picture may look mixed in the U.S., conditions abroad appear to be improving. In particular, economic activity in several emerging market countries has been recovering. India shows much promise with its strong fundamentals and China’s GDP growth is expected to be solid this year as many pro-growth policies were implemented recently. Although Taiwan and South Korea have struggled recently with the downturn in semiconductor demand, the semiconductor industry is expected to recover in the second half of 2023.

Within the fixed income market, much focus has been placed on the shape of the yield curve. The negative spread between the 10- and 2-year Treasuries may have peaked, as the inverted yield curve is signaling a recession ahead. Core bonds should generally outperform equities if we face a recession. On the other hand, credit sectors like high yield bonds and bank loans would struggle if default rates spike. However, we do not anticipate significant credit events to occur in the near-term. Meanwhile, high yields currently offer attractive yield and default rates remain below historical averages.

Although the overall economy remains relatively healthy, the effects from the Fed’s aggressive rate hikes are beginning to take hold. Nonetheless, services inflation remains stubbornly high, which means the Fed will maintain its diligent efforts to quell inflation. While we anticipate the economy to slow down, we do not foresee a major crisis to unfold. In the meantime, markets will likely remain modestly volatile until the Fed has a firm grip on inflation. Given the tradeoff between avoiding a severe recession and maintaining inflation with interest rates, the Fed must carefully walk a fine line to bring the economy back into balance. In this environment, it remains prudent to maintain a relatively defensive allocation, particularly as the equity market may be disappointed if the Fed foregoes rates cuts later in 2023.

Portfolio Optimization Funds

Performance

Since the performance of each Portfolio Optimization Fund is a composite of the performance of each of the PF Underlying Funds in which it invests (which may include bonds and domestic and/or international equities), there is no one broad-based industry index to use as a meaningful comparison to a Portfolio Optimization Fund’s performance. Therefore, we at PLFA have provided information for four broad-based indices to use as a comparison to each Portfolio Optimization Fund’s performance. In addition, to assist in performance comparisons, composite benchmarks were constructed for each Portfolio Optimization Fund each of which is comprised of up to four broad-based indices shown below.

The composition of the composite benchmark reflects the Portfolio Optimization Funds’ broad debt and equity asset class allocations for domestic equity, international equity and fixed income. However, the actual allocation of a Portfolio Optimization Fund could vary because of factors such as market performance and adjustments to allocations within each Funds’ allocation ranges. The one-year performance for these broad-based indices for the year ended March 31, 2023 is shown in the following table:

| | | | |

Broad-Based Indices | | | |

S&P 500 Index (representing U.S. Stocks) | | | -7.73% | |

MSCI EAFE Index (International Stocks) | | | -1.38% | |

Bloomberg US Aggregate Bond Index (Fixed Income) | | | -4.78% | |

ICE BofA U.S. 3-Month Treasury Bill (T-Bill) Index (Cash) | | | 2.50% | |

The benchmark indices for the PF Underlying Funds may differ from the Portfolio Optimization Funds’ broad-based indices. Each Portfolio Optimization Fund may not be invested in all eligible PF Underlying Funds.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-4

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

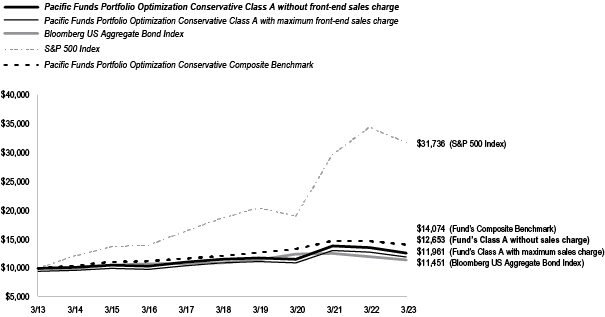

Pacific Funds Portfolio Optimization Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

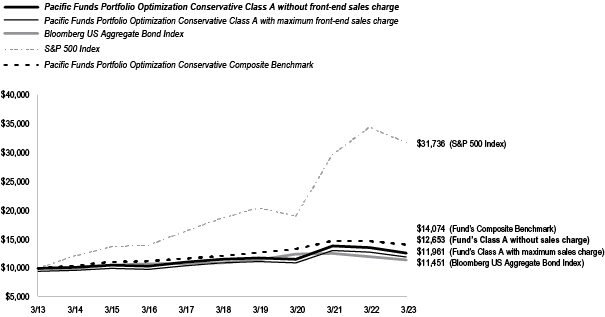

A. For the year ended March 31, 2023, Pacific Funds Portfolio Optimization Conservative’s Class A (without sales charge) returned -6.71%, compared to a return of -4.78% for the Bloomberg US Aggregate Bond Index, a return of -7.73% for the S&P 500 Index, and a return of -4.37% for the Pacific Funds Portfolio Optimization Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | (6.71% | ) | | | 1.81% | | | | 2.38% | |

Fund’s Class A with maximum sales charge | | | (11.87% | ) | | | 0.68% | | | | 1.81% | |

Fund’s Class C without sales charge | | | (7.34% | ) | | | 1.05% | | | | 1.63% | |

Fund’s Class C with maximum sales charge | | | (8.20% | ) | | | 1.05% | | | | 1.63% | |

Fund’s Class I-2 | | | (6.50% | ) | | | 2.09% | | | | 2.62% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

S&P 500 Index | | | (7.73% | ) | | | 11.19% | | | | 12.24% | |

Pacific Funds Portfolio Optimization Conservative Composite Benchmark | | | (4.37% | ) | | | 3.03% | | | | 3.48% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Conservative Composite Benchmark. To seek current income and preservation of capital, under normal market conditions, the Fund is expected to be within the following ranges of the two broad asset classes of debt (fixed income) and equity, respectively: 70% - 85% and 15% - 30%.

The Fund was primarily invested in various fixed income strategies, with a smaller allocation to equity, during the reporting period. Fixed income investments included allocations to intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond and floating rate strategies. The equity segment consisted mainly of allocations to domestic and foreign large-capitalization strategies.

Among the fixed income lineup, emerging market bonds and Treasury-inflation protected securities detracted from performance over the reporting period, while short-term bonds contributed positively. Additionally, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg US Aggregate Bond Index and detracted from performance over the reporting period. On the other hand, the exposure to bank loans contributed to performance. Additionally, Pacific Funds Floating Rate Income outperformed its benchmark, contributing to performance.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-5

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Among domestic equities, exposure to large-capitalization value stocks contributed to performance over the reporting period. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, the PF Multi-Asset Fund underperformed its benchmark, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. While the exposure to emerging markets and international small-capitalization stocks dragged on performance, the PF Emerging Markets and PF International Small-Cap Funds outperformed their respective benchmarks and contributed to performance.

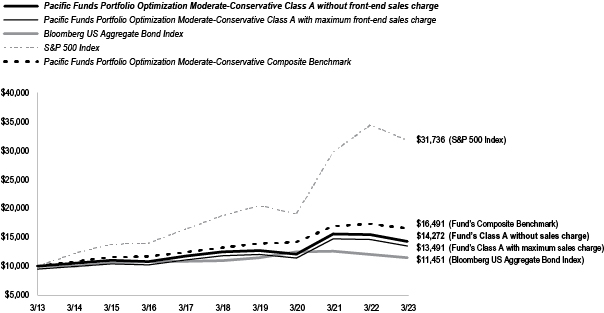

Pacific Funds Portfolio Optimization Moderate-Conservative (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

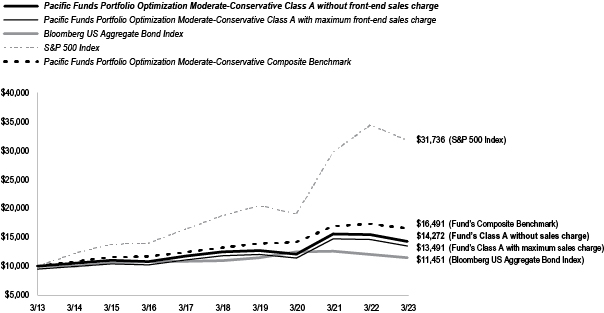

A. For the year ended March 31, 2023, Pacific Funds Portfolio Optimization Moderate-Conservative’s Class A (without sales charge) returned -7.59%, compared to a return of -4.78% for the Bloomberg US Aggregate Bond Index, a return of -7.73% for the S&P 500 Index, and a return of -4.64% for the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | (7.59% | ) | | | 2.76% | | | | 3.62% | |

Fund’s Class A with maximum sales charge | | | (12.70% | ) | | | 1.61% | | | | 3.04% | |

Fund’s Class C without sales charge | | | (8.37% | ) | | | 1.97% | | | | 2.86% | |

Fund’s Class C with maximum sales charge | | | (9.18% | ) | | | 1.97% | | | | 2.86% | |

Fund’s Class I-2 | | | (7.36% | ) | | | 3.01% | | | | 3.87% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

S&P 500 Index | | | (7.73% | ) | | | 11.19% | | | | 12.24% | |

Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark | | | (4.64% | ) | | | 4.56% | | | | 5.13% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate-Conservative Composite Benchmark. To seek current income and moderate growth of capital, under normal market conditions, the Fund is expected to be within the following ranges of the two broad asset classes of debt (fixed income) and equity, respectively: 50% - 70% and 30% - 50%.

The Fund had a diversified allocation mix that was modestly tilted to fixed income during the reporting period. Fixed income investments included intermediate-term bond strategies as well as short duration bond, inflation-indexed bond, high yield bond, emerging markets bond and

| | |

| | See benchmark definitions on A-37 – A-38 |

A-6

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

floating rate strategies. The Fund’s equity exposure was diversified across style (growth and value), market capitalization and region (including an allocation to foreign small-capitalization and emerging markets strategies).

Among the fixed income lineup, Treasury-inflation protected securities detracted from performance over the reporting period, while short-term bonds and bank loans contributed positively. Additionally, the PF Managed Bond Fund, which represented the largest weight in the Fund, underperformed the Bloomberg US Aggregate Bond Index and detracted from performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income outperformed its benchmark, contributing to performance.

Among domestic equities, exposure to large-capitalization value stocks contributed to performance over the reporting period, while the exposure to small-capitalization stocks detracted from performance. Furthermore, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. Additionally, the PF Multi-Asset Fund underperformed its benchmark, which detracted from performance. International equities as a group outperformed the MSCI EAFE Index over the reporting period. While the exposure to emerging markets and international small-capitalization stocks dragged on performance, the PF Emerging Markets and PF International Small-Cap Funds outperformed their respective benchmarks and contributed to performance.

Pacific Funds Portfolio Optimization Moderate (managed by Pacific Life Fund Advisors LLC)

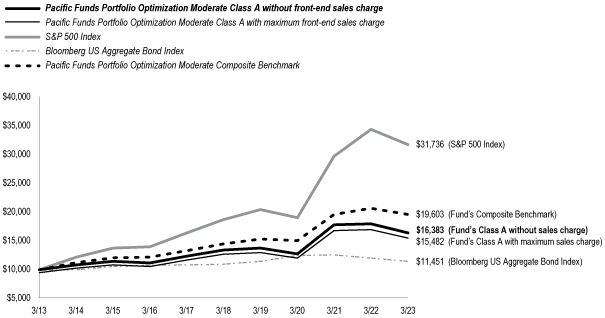

Q. How did the Fund perform for the year ended March 31, 2023?

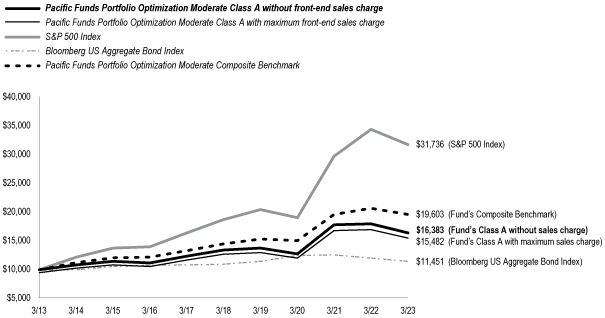

A. For the year ended March 31, 2023, Pacific Funds Portfolio Optimization Moderate’s Class A (without sales charge) returned -8.67%, compared to a return of -7.73% for the S&P 500 Index, a return of -4.78% for the Bloomberg US Aggregate Bond Index, and a return of -5.14% for the Pacific Funds Portfolio Optimization Moderate Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | (8.67% | ) | | | 4.11% | | | | 5.06% | |

Fund’s Class A with maximum sales charge | | | (13.72% | ) | | | 2.94% | | | | 4.47% | |

Fund’s Class C without sales charge | | | (9.24% | ) | | | 3.36% | | | | 4.31% | |

Fund’s Class C with maximum sales charge | | | (9.97% | ) | | | 3.36% | | | | 4.31% | |

Fund’s Class I-2 | | | (8.39% | ) | | | 4.38% | | | | 5.32% | |

S&P 500 Index | | | (7.73% | ) | | | 11.19% | | | | 12.24% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

Pacific Funds Portfolio Optimization Moderate Composite Benchmark | | | (5.14% | ) | | | 6.23% | | | | 6.96% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| | |

| | See benchmark definitions on A-37 – A-38 |

A-7

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Moderate Composite Benchmark. To seek long-term growth of capital and low to moderate income, under normal market conditions, the Fund is expected to be within the following ranges of the two broad asset classes of debt (fixed income) and equity, respectively: 30% - 50% and 50% - 70%.

The Fund allocated to a mix of equity and fixed income strategies during the reporting period, with a larger allocation toward equity investments. The equity exposure was diversified across style (growth and value), market capitalization and region (including allocations to foreign small-capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded real estate investment trusts (REITs). Fixed income investments included intermediate-term bond, short duration bond, inflation-indexed bond, emerging markets bond and floating rate loan strategies.

Among domestic equities, exposure to large-capitalization value stocks contributed to performance over the reporting period. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. The exposure to growth stocks also detracted from performance as the technology sector struggled over the reporting period. Additionally, the PF Multi-Asset Fund underperformed its benchmark, which detracted from performance.

International equities as a group outperformed the MSCI EAFE Index over the reporting period. While the exposure to emerging markets and international small-capitalization stocks dragged on performance, the PF Emerging Markets and PF International Small-Cap Funds outperformed their respective benchmarks and contributed to performance.

Among the fixed income lineup, Treasury-inflation protected securities detracted from performance over the reporting period, while short-term bonds and bank loans contributed positively. Additionally, the PF Managed Bond Fund underperformed the Bloomberg US Aggregate Bond Index and detracted from performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income outperformed its benchmark, contributing to performance.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-8

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

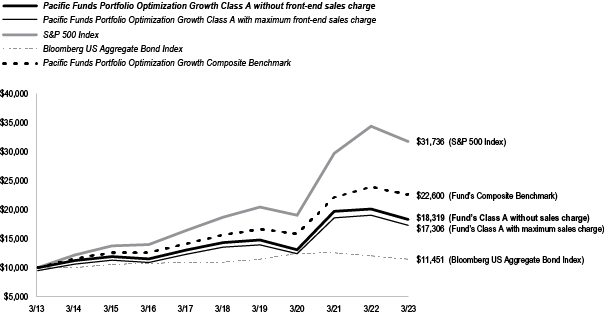

Pacific Funds Portfolio Optimization Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

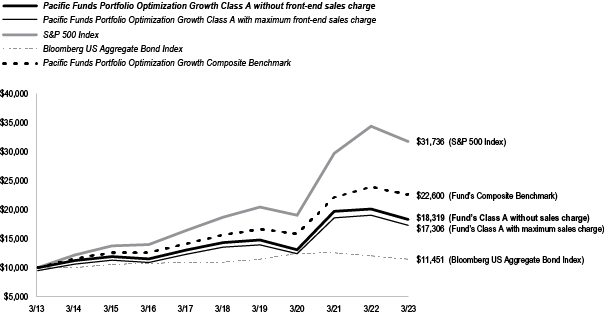

A. For the year ended March 31, 2023, Pacific Funds Portfolio Optimization Growth’s Class A (without sales charge) returned -8.93%, compared to a return of -7.73% for the S&P 500 Index, a return of -4.78% for the Bloomberg US Aggregate Bond Index, and a return of -5.61% for the Pacific Funds Portfolio Optimization Growth Composite Benchmark.

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | (8.93% | ) | | | 5.03% | | | | 6.24% | |

Fund’s Class A with maximum sales charge | | | (13.92% | ) | | | 3.84% | | | | 5.64% | |

Fund’s Class C without sales charge | | | (9.63% | ) | | | 4.24% | | | | 5.47% | |

Fund’s Class C with maximum sales charge | | | (10.34% | ) | | | 4.24% | | | | 5.47% | |

Fund’s Class I-2 | | | (8.72% | ) | | | 5.28% | | | | 6.49% | |

S&P 500 Index | | | (7.73% | ) | | | 11.19% | | | | 12.24% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

Pacific Funds Portfolio Optimization Growth Composite Benchmark | | | (5.61% | ) | | | 7.59% | | | | 8.50% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Growth Composite Benchmark. To seek moderately high, long-term capital appreciation with low, current income, under normal market conditions, the Fund is expected to be within the following ranges of the two broad asset classes of debt (fixed income) and equity, respectively: 15% - 30% and 70% - 85%.

The Fund had a diversified allocation mix during the reporting period with the majority allocated to equity. The equity exposure was diversified across style (growth and value), market capitalization and region (including allocations to foreign small capitalization and emerging markets stocks). The Fund also maintained exposure to select market sectors such as publicly-traded REITs. Fixed income investments included intermediate-term bond strategies as well as specific strategies such as short duration bond, inflation-indexed bond and emerging markets bond strategies.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-9

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Among domestic equities, exposure to large-capitalization value stocks contributed to performance over the reporting period. On the other hand, the exposure to real estate detracted from performance as work-from-home arrangements amid the pandemic lowered demand for office space. The exposure to growth stocks also detracted from performance as the technology sector struggled over the reporting period. Additionally, the PF Multi-Asset Fund underperformed its benchmark, which detracted from performance.

International equities as a group outperformed the MSCI EAFE Index over the reporting period. While the exposure to emerging markets and international small-capitalization stocks dragged on performance, the PF Emerging Markets and PF International Small-Cap Funds outperformed their respective benchmarks and contributed to performance.

Among the fixed income lineup, Treasury-inflation protected securities detracted from performance over the reporting period, while short-term bonds and bank loans contributed positively. Additionally, the PF Managed Bond Fund underperformed the Bloomberg US Aggregate Bond Index and detracted from performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income outperformed its benchmark, contributing to performance.

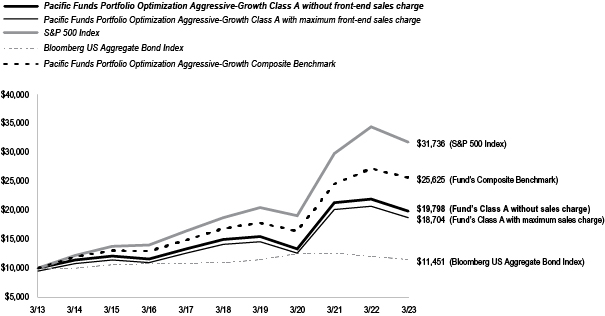

Pacific Funds Portfolio Optimization Aggressive-Growth (managed by Pacific Life Fund Advisors LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

A. For the year ended March 31, 2023, Pacific Funds Portfolio Optimization Aggressive-Growth’s Class A (without sales charge) returned -9.53%, compared to a return of -7.73% for the S&P 500 Index, a return of -4.78% for the Bloomberg US Aggregate Bond Index, and a return of -5.83% for the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark.

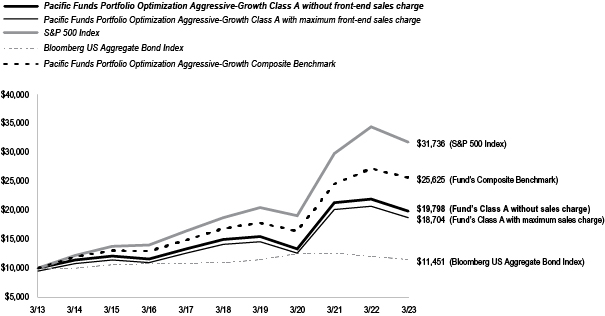

The following graph compares the performance of a hypothetical $10,000 investment in Class A shares of the Fund to its benchmarks for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class A without sales charge | | | (9.53% | ) | | | 5.85% | | | | 7.07% | |

Fund’s Class A with maximum sales charge | | | (14.49% | ) | | | 4.66% | | | | 6.46% | |

Fund’s Class C without sales charge | | | (10.16% | ) | | | 5.07% | | | | 6.31% | |

Fund’s Class C with maximum sales charge | | | (10.81% | ) | | | 5.07% | | | | 6.31% | |

Fund’s Class I-2 | | | (9.25% | ) | | | 6.12% | | | | 7.33% | |

S&P 500 Index | | | (7.73% | ) | | | 11.19% | | | | 12.24% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark | | | (5.83% | ) | | | 8.76% | | | | 9.87% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| | |

| | See benchmark definitions on A-37 – A-38 |

A-10

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class A underperformed the Pacific Funds Portfolio Optimization Aggressive-Growth Composite Benchmark. To seek high, long-term capital appreciation, under normal market conditions, the Fund is expected to be within the following ranges of the two broad asset classes of debt (fixed income) and equity, respectively: 0%—15% and 85%—100%.

The Fund primarily allocated to domestic and international equity funds that are diversified across style (growth and value), market capitalization and region (which included allocations to foreign small-capitalization and emerging markets stocks) during the reporting period. The Fund also maintained exposure to select sectors, such as publicly-traded REITs, as well as a small allocation to intermediate-term fixed income securities.

Among domestic equities, exposure to large-capitalization value stocks contributed to performance over the reporting period, while the exposure to small-capitalization stocks detracted from performance. Nonetheless, the PF Large-Cap Value and PF Small-Cap Value Funds outperformed their respective benchmarks and contributed to performance. On the other hand, the exposure to small-capitalization stocks and real estate detracted from performance. The exposure to growth stocks also detracted from performance as the technology sector struggled over the reporting period. Additionally, the PF Multi-Asset Fund underperformed its benchmark, which detracted from performance.

International equities as a group outperformed the MSCI EAFE Index over the reporting period. While the exposure to emerging markets and international small-capitalization stocks dragged on performance, the PF Emerging Markets and PF International Small-Cap Funds outperformed their respective benchmarks and contributed to performance.

Among the fixed income lineup, emerging markets debt detracted from performance over the reporting period, while short-term bonds and bank loans contributed positively. Additionally, the PF Managed Bond Fund underperformed the Bloomberg US Aggregate Bond Index and detracted from performance over the reporting period. On the other hand, Pacific Funds Floating Rate Income outperformed its benchmark, contributing to performance.

Pacific Funds Ultra Short Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

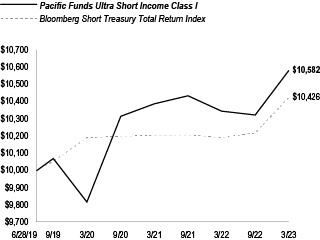

A. For the year ended March 31, 2023, Pacific Funds Ultra-Short Income’s Class I returned 2.30%, compared to a return of 2.27% for its benchmark, the Bloomberg Short Treasury Total Return Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2023. For comparison purposes, the performance of all classes for the period ended March 31, 2023 are also shown in the table below. Performance data for Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | |

| | | 1 Year | | | Since

Inception

(6/28/19) | |

Fund’s Class I | | | 2.30% | | | | 1.52% | |

Fund’s Class I-2 | | | 2.30% | | | | 1.52% | |

Bloomberg Short Treasury Total Return Index | | | 2.27% | | | | 1.12% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| | |

| | See benchmark definitions on A-37 – A-38 |

A-11

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period the Fund’s Class I outperformed the benchmark. The Fund seeks current income consistent with capital preservation. The Fund primarily invests in investment grade short-term fixed and floating rate debt securities. Using a fundamental approach with a top-down overlay, we, the Pacific Asset Management’s team of portfolio managers and research analysts, look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

Our focus on corporate debt versus government securities was the primary contributor to performance. The Fund’s overweight relative to the benchmark to corporate bonds, notably BBB-rated corporate bonds, benefited performance. The Fund’s exposure to the non-investment grade bank loans and collateralized loan obligations benefited performance. The Fund’s exposure to securities that have longer maturities than the benchmark detracted from performance. At the sector level, exposures to consumer cyclical, energy, electric utilities, and communications benefited performance while exposures to asset backed securities, insurance, and transportation detracted.

Pacific Funds Short Duration Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

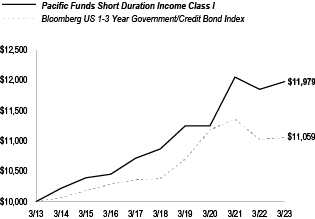

A. For the year ended March 31, 2023, Pacific Funds Short Duration Income’s Class I returned 1.06%, compared to a return of 0.26% for its benchmark, the Bloomberg US 1-3 Year Government/Credit Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class I | | | 1.06% | | | | 1.96% | | | | 1.82% | |

Fund’s Class A without sales charge | | | 0.75% | | | | 1.69% | | | | 1.56% | |

Fund’s Class A with maximum sales charge | | | (2.23% | ) | | | 1.07% | | | | 1.26% | |

Fund’s Class C without sales charge | | | 0.00% | | | | 0.93% | | | | 0.81% | |

Fund’s Class C with maximum sales charge | | | (0.99% | ) | | | 0.93% | | | | 0.81% | |

Fund’s Class I-2 | | | 1.01% | | | | 1.94% | | | | 1.82% | |

Bloomberg 1-3 Year US Government/Credit Bond Index | | | 0.26% | | | | 1.26% | | | | 1.01% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund seeks current income. We at Pacific Asset Management use a short maturity corporate debt focused strategy for the Fund. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund’s asset allocation and focus on corporate debt were the primary contributors to relative performance. The Fund’s overweight relative to the benchmark to corporate bonds, notably BBB-rated corporate bonds, contributed to performance. The Fund’s overweight to the non-investment grade bank loan sector and the high yield bond sector also contributed to performance. While the Fund’s overall duration was below benchmark, which contributed to performance, the overweight to the intermediate portion of the yield curve was a detractor. The Fund’s overweight to insurance, technology, and electric utilities benefited performance while the Fund’s overweight to REITs and asset backed securities detracted. At the issuer level, Banco Santander (banking), Assured Partners (insurance) and Hub International (insurance) were the top contributors while Thrive Pet Healthcare (healthcare), CoreLogic (technology) and Spin (capital goods) were the top detractors.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-12

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Core Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

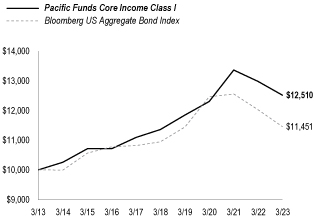

A. For the year ended March 31, 2023, Pacific Funds Core Income’s Class I returned -3.60%, compared to a return of -4.78% for its benchmark, the Bloomberg US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C, Class P and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class I | | | (3.60% | ) | | | 1.96% | | | | 2.26% | |

Fund’s Class A without sales charge | | | (3.90% | ) | | | 1.65% | | | | 1.96% | |

Fund’s Class A with maximum sales charge | | | (7.96% | ) | | | 0.78% | | | | 1.53% | |

Fund’s Class C without sales charge | | | (4.63% | ) | | | 0.87% | | | | 1.19% | |

Fund’s Class C with maximum sales charge | | | (5.56% | ) | | | 0.87% | | | | 1.19% | |

Fund’s Class I-2 | | | (3.60% | ) | | | 1.94% | | | | 2.25% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(4/27/15) | |

Fund’s Class P | | | (3.59% | ) | | | 1.95% | | | | 1.86% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.00% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund uses an intermediate term corporate debt focused strategy. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund benefited from asset allocation and the focus on corporate debt versus government securities as the primary contributors to relative performance. The Fund’s exposure to the non-investment grade bank loan sector and the high yield bond sector benefited performance. The Fund’s overweight to BBB-rated corporate bonds (relative to the benchmark) detracted from performance. While the Fund’s overall duration was below benchmark, which contributed to performance, the Fund’s overweight to the long-end of the yield curve was a detractor. The Fund’s sector overweight to consumer cyclicals, electric utilities, transportation, capital goods, and collateralized loan obligations benefited performance while the Fund’s sector overweight to banking, REITs and consumer non-cyclicals detracted. At the Issuer level, Hub International (insurance), Nevada Power (Electric Utility), and Filtration Group (Capital Goods) were the top contributors, while Universal Health Services (healthcare), Charter Communications (communications), and AT&T (communications) were the top detractors.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-13

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds ESG Core Bond (managed by Pacific Asset Management LLC)

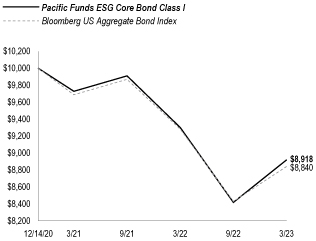

Q. How did the Fund perform for the year ended March 31, 2023?

A. For the year ended March 31, 2023, Pacific Funds ESG Core Bond’s Class I returned -4.12% compared to a return of -4.78% for its benchmark, the Bloomberg US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the period from inception through March 31, 2023. For comparison purposes, the performance of all classes for the period ended March 31, 2023 are also shown in the table below. Performance data for Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | |

| | | 1 Year | | | Since

Inception

(12/14/20) | |

Fund’s Class I | | | (4.12% | ) | | | (4.87% | ) |

Fund’s Class I-2 | | | (4.12% | ) | | | (4.87% | ) |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | (5.24% | ) |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund uses an intermediate term corporate debt focused strategy. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection. The Fund also incorporates sustainable investment goals into the investment process by use of ESG Exclusions and ESG metrics. The sub-adviser created the following ESG Exclusions to seek to screen out investment in issuers with direct involvement in: (i) the production, distribution, sale or use of thermal coal exceeding the sub-adviser’s revenue threshold; (ii) the production of tobacco; (iii) the production or sale of controversial military weapons; and (iv) serious human rights violations, severe environmental damage or gross corruption. Individual investment selection was also based on the sub-adviser’s analysis of ESG metrics provided by independent third-party ESG service providers. That is, the sub-adviser relies on ESG ratings and other information provided by various independent third-party ESG service providers to help construct a portfolio that rates highly on ESG factors.

The Fund benefited from asset allocation, security selection, and the underweight to duration during the reporting period. While the Fund’s overall duration was below benchmark, which contributed to performance, the overweight to the long-end of the yield curve was a detractor. The Fund’s overweight to, and selection within electrical utilities, natural gas, technology, and collateralized loan obligations benefited performance, while the Fund’s selection within banking, consumer cyclicals, and energy detracted. At the issuer level, Comcast Corporation (communication), Alcon Finance (consumer non-cyclical), and Intel Corporation (technology) contributed to performance, while Jab Holdings (insurance) Bank of America (banking) and Lowe’s Companies (retail) detracted.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-14

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

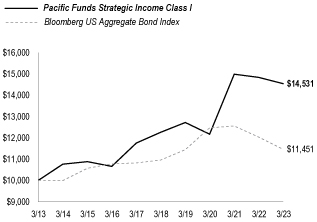

Pacific Funds Strategic Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

A. For the year ended March 31, 2023, Pacific Funds Strategic Income’s Class I returned -2.03%, compared to a return of -4.78% for its benchmark, the Bloomberg US Aggregate Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C and Class I-2 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class I | | | (2.03% | ) | | | 3.48% | | | | 3.81% | |

Fund’s Class A without sales charge | | | (2.41% | ) | | | 3.15% | | | | 3.50% | |

Fund’s Class A with maximum sales charge | | | (6.59% | ) | | | 2.25% | | | | 3.05% | |

Fund’s Class C without sales charge | | | (3.04% | ) | | | 2.43% | | | | 2.76% | |

Fund’s Class C with maximum sales charge | | | (3.97% | ) | | | 2.43% | | | | 2.76% | |

Fund’s Class I-2 | | | (2.16% | ) | | | 3.42% | | | | 3.76% | |

Bloomberg US Aggregate Bond Index | | | (4.78% | ) | | | 0.91% | | | | 1.36% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund seeks a high level of current income, and may also seek capital appreciation. We, the Pacific Asset Management portfolio management team, focus the Fund on U.S. dollar credit focused fixed income asset classes, notably non-investment grade securities. Based on our view of the market conditions during the reporting period, we positioned the Fund towards non-investment grade securities. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts in the process of individual investment selection.

The Fund outperformed its benchmark for the reporting period due to asset allocation and an underweight to duration relative to the benchmark. The Fund’s reporting period saw both interest rates and corporate credit spreads increase, leading investment grade credit to moderately underperform Treasuries and Agency Mortgage Back Securities. The Fund’s exposure to the non-investment grade bank loans, high yield securities, and collateralized loan obligations contributed to performance. The Fund’s overall duration was below that of the benchmark, which contributed to performance. At the sector level, overweights to, and selection within, energy, capital goods, and finance companies benefited performance. Positioning in REITS and banking detracted. At the issuer level, Ahern Rentals (capital goods), Applied Systems (technology) and Bway (capital goods) were the top contributors while Athene (insurance), CSC Holding (communications) and Community Health Systems (healthcare) were the top detractors.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-15

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

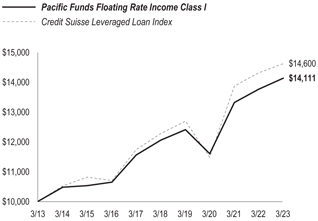

Pacific Funds Floating Rate Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

A. For the year ended March 31, 2023, Pacific Funds Floating Rate Income’s Class I returned 2.69%, compared to a return of 2.12% for its benchmark, the Credit Suisse Leveraged Loan Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C , Class I-2 and Class P shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class I | | | 2.69% | | | | 3.23% | | | | 3.50% | |

Fund’s Class A without sales charge | | | 2.50% | | | | 2.94% | | | | 3.20% | |

Fund’s Class A with maximum sales charge | | | (0.59% | ) | | | 2.32% | | | | 2.89% | |

Fund’s Class C without sales charge | | | 1.75% | | | | 2.22% | | | | 2.46% | |

Fund’s Class C with maximum sales charge | | | 0.79% | | | | 2.22% | | | | 2.46% | |

Fund’s Class I-2 | | | 2.66% | | | | 3.18% | | | | 3.46% | |

Fund’s Class P | | | 2.71% | | | | 3.23% | | | | 3.48% | |

Credit Suisse Leveraged Loan Index | | | 2.12% | | | | 3.55% | | | | 3.86% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund seeks a high level of current income. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look for investment opportunities in floating rate loans and floating rate debt securities.

For the reporting period, the Fund outperformed the benchmark primarily due to its focus on the performing segment of the loan market and selection within second-lien loans. During the reporting period, the Fund’s underweight (relative to its benchmark) to higher quality loans rated BB and above detracted from performance as these loans outperformed lower quality loans. The Fund’s underweight to distressed loans contributed to performance. The Fund’s overweights to issuers in the financials, healthcare and information technology sectors benefited performance while underweights to energy, services and utility sectors detracted from performance. The Fund’s security selection within performing second lien CCC-rated loans contributed to performance during the reporting period. The Fund’s focus on larger and more liquid issuers (which we generally defined as those issuers with facility sizes greater than $1 billion) contributed to performance as larger issuers outperformed.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-16

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

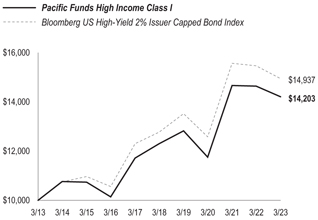

Pacific Funds High Income (managed by Pacific Asset Management LLC)

Q. How did the Fund perform for the year ended March 31, 2023?

A. For the year ended March 31, 2023, Pacific Funds High Income’s Class I returned -2.91%, compared to a return of -3.35% for its benchmark, the Bloomberg US High-Yield 2% Issuer Capped Bond Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I shares of the Fund to its benchmark for the ten-year period ended March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C , Class I-2 and Class P shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023(1)

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Fund’s Class I | | | (2.91% | ) | | | 2.93% | | | | 3.57% | |

Fund’s Class A without sales charge | | | (3.09% | ) | | | 2.69% | | | | 3.33% | |

Fund’s Class A with maximum sales charge | | | (7.23% | ) | | | 1.81% | | | | 2.87% | |

Fund’s Class C without sales charge | | | (3.81% | ) | | | 1.96% | | | | 2.57% | |

Fund’s Class C with maximum sales charge | | | (4.73% | ) | | | 1.96% | | | | 2.57% | |

Fund’s Class I-2 | | | (2.84% | ) | | | 2.96% | | | | 3.58% | |

Bloomberg US High-Yield 2% Issuer Capped Bond Index | | | (3.35% | ) | | | 3.19% | | | | 4.09% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(1/14/15) | |

Fund’s Class P | | | (2.83% | ) | | | 2.94% | | | | 3.83% | |

Bloomberg US High-Yield 2% Issuer Capped Bond Index | | | (3.35% | ) | | | 3.19% | | | | 4.16% | |

| | (1) | Pacific Asset Management LLC began managing the Fund effective December 31, 2019. Prior to that date, Pacific Life Fund Advisors LLC doing business under the name Pacific Asset Management managed the Fund. |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I outperformed the benchmark. The Fund seeks a high level of current income by investing in non-investment grade debt instruments or in instruments with characteristics of non-investment grade instruments. Using a fundamental approach with a top-down overlay, Pacific Asset Management’s team of portfolio managers and research analysts look at the relative value of each security and assess the macro environment and marketplace for tailwinds and catalysts.

For the reporting period, the Fund outperformed the benchmark primarily due to security selection within corporate credit and an underweight (relative to the benchmark) to duration. The Fund’s underweight to BB-rated securities and overweight to B-rated securities benefited performance. The Fund’s exposure to bank loans contributed to performance given the rise in interest rates during the reporting period. At the sector level, underweights to communications and banking, as well as an overweight to capital goods benefited performance. The Fund’s security selection within energy, technology, and consumer non-cyclical detracted from performance. At the issuer level, BCPE Ulysses (capital goods), Ford Motor (consumer cyclical), and Allied Universal (consumer cyclical) were the top contributors while Level 3 Financing (communications), Lumen Technologies (communications), and CSC Holdings (communications) were the top detractors.

| | |

| | See benchmark definitions on A-37 – A-38 |

A-17

PACIFIC FUNDS PERFORMANCE DISCUSSION (Continued)

Pacific Funds Small/Mid-Cap (managed by Rothschild & Co Asset Management US Inc.)

Q. How did the Fund perform for the year ended March 31, 2023?

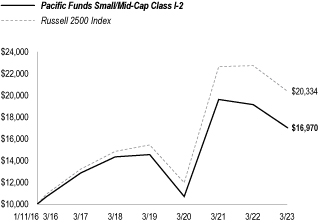

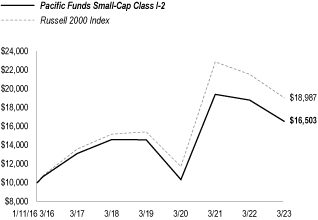

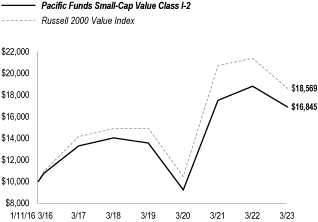

A. For the year ended March 31, 2023, Pacific Funds Small/Mid-Cap’s Class I-2 returned -11.15%, compared to a return of -10.39% for its benchmark, the Russell 2500 Index.

The following graph compares the performance of a hypothetical $10,000 investment in Class I-2 shares of the Fund to its benchmark for the period from inception through March 31, 2023. For comparison purposes, the performance of all classes for the periods ended March 31, 2023 are also shown in the table below. Performance data for Class A, Class C, and Class R6 shares will vary due to differences in fees and sales charges. The Fund’s performance reflects reinvestments of all dividends and capital gains distributions, if any.

Performance Comparison

Average Annual Total Returns for the Periods Ended March 31, 2023

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(1/11/16) | |

Fund’s Class I-2 | | | (11.15% | ) | | | 3.49% | | | | 7.59% | |

Fund’s Class A without sales charge | | | (11.41% | ) | | | 3.22% | | | | 7.33% | |

Fund’s Class A with maximum sales charge | | | (15.17% | ) | | | 2.32% | | | | 6.69% | |

Fund’s Class C without sales charge | | | (12.01% | ) | | | 2.47% | | | | 6.54% | |

Fund’s Class C with maximum sales charge | | | (12.57% | ) | | | 2.47% | | | | 6.54% | |

Russell 2500 Index | | | (10.39% | ) | | | 6.65% | | | | 10.33% | |

| | | |

| | | 1 Year | | | 5 Years | | | Since

Inception

(12/31/14) | |

Fund’s Class R6 | | | (11.11% | ) | | | 3.57% | | | | 5.90% | |

Russell 2500 Index | | | (10.39% | ) | | | 6.65% | | | | 7.64% | |

|

| |

Performance data shown represents past performance. Investment return and principal value will fluctuate so that shares of the Fund when redeemed may be worth more or less than their original cost. Past performance is not predictive of future performance. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Q. Discuss both positive and negative factors that materially affected the Fund’s performance during the year, including relevant market conditions, investment strategies and techniques, and particular sectors or securities.

A. For the reporting period, the Fund’s Class I-2 underperformed the benchmark. We at Rothschild & Co Asset Management US implement the Fund’s strategy by investing in common stocks and other equity securities of small and medium capitalization U.S. companies. We analyze a variety of quantitative and fundamental inputs in making stock decisions and seek to build a portfolio that is well diversified at the issuer level and by economic sector. Our focus remains on identifying stocks with attractive relative valuations and the ability to exceed investors’ expectations.

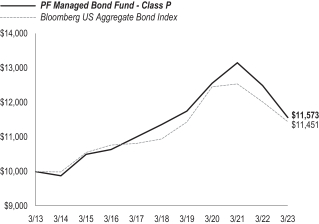

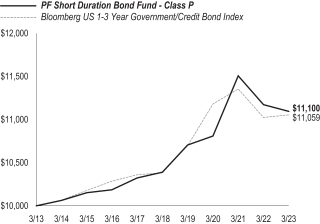

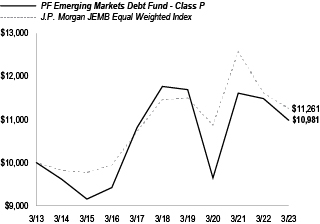

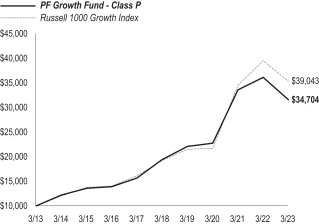

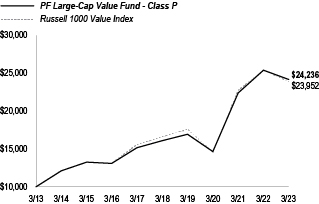

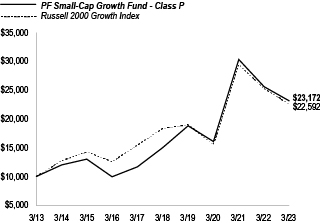

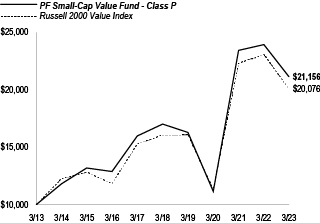

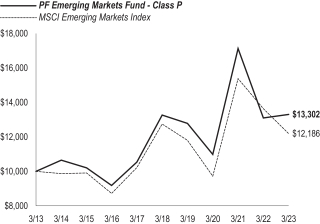

Leading sectors contributing to the Fund’s underperformance included healthcare, consumer discretionary, and industrials. Conversely, the energy, real estate, and technology sectors provided the largest contributors to the Fund’s performance. Sector allocation was negative, with the main detractors coming from industrials, health care, and real estate partially offset by positive attribution from financial services, technology and communication services. Stock selection was a positive contributor to the Fund’s performance with the effects of contributors in the real estate, energy, and materials falling short of those of the detractors in the financials, consumer discretionary, and communications sectors.