UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-10371 |

|

LORD ABBETT BLEND TRUST |

(Exact name of registrant as specified in charter) |

|

90 Hudson Street, Jersey City, NJ | | 07302 |

(Address of principal executive offices) | | (Zip code) |

|

Christina T. Simmons, Vice President & Assistant Secretary 90 Hudson Street, Jersey City, NJ 07302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 201-6984 | |

|

Date of fiscal year end: | 7/31 | |

|

Date of reporting period: | 7/31/2007 | |

| | | | | | | | |

Item 1: Reports to Stockholders.

2007

LORD ABBETT ANNUAL REPORT

Lord Abbett Small Cap Blend Fund

For the fiscal year ended July 31, 2007

Lord Abbett Small Cap Blend Fund

Annual Report

For the fiscal year ended July 31, 2007

Dear Shareholders: We are pleased to provide you with this overview of the Lord Abbett Small Cap Blend Fund's performance for the fiscal year ended July 31, 2007. On this and the following pages, we discuss the major factors that influenced performance. For detailed and more timely information about the Fund, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries of the Fund's portfolio managers.

General information about Lord Abbett mutual funds, as well as in-depth discussion of market trends and investment strategies, is also provided in Lord Abbett Insights, a newsletter accompanying your quarterly account statements. We also encourage you to call Lord Abbett at 888-522-2388 and speak to one of our professionals if you would like more information.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Robert S. Dow

Chairman

From left to right: Robert S. Dow, Director and Chairman of the Lord Abbett Funds; E. Thayer Bigelow, Independent Lead Director of the Lord Abbett Funds; and Daria L. Foster, Director and President of the Lord Abbett Funds.

Q: What were the overall market conditions during the fiscal year ended July 31, 2007?

A: Despite an economic backdrop besieged by a confluence of mixed fundamentals, which included solid earnings growth, relatively stable bond yields, moderating inflation, dollar weakness, and a housing market in decline, equities, as measured by the S&P Composite 1500® Index,1 returned a robust 16.1% in the fiscal year ended July 31, 2007. The market rallied in the final five calendar months of 2006. That momentum was carried into 2007, before a brief, but sharp, correction in late February eroded about three month's worth of gains. The market quickly found its f ooting in mid March and both the Dow

1

Jones Industrial Average2 and S&P 500® Index3 established new highs by early summer, with the latter finally cresting (albeit for only a brief period) its prior high established seven years ago. With several large hedge funds forced to close when their leverage bets on subprime loans went sour, the equity markets sold off and erased about 3.3% worth of gains in July, as measured by the S&P Composite 1500 Index.

Though the equity market became notably more volatile as the fiscal year progressed, investors who stayed the course were rewarded with double-digit returns for the fiscal year as a whole. As the risk of owning equities increased, as evidenced by the spike in volatility, investors gravitated toward shares of large cap companies. As a result, large cap companies, as represented by the S&P 100® Index,4 gained a total return of 17.3% in the year, outperforming the 14.1% total return produced by small cap companies, as represented by the S&P SmallCap 600® Index.5 Most of the large cap outperformance came during the month of July, when shares of small cap companies fell twice as much as did large caps.

Broadly speaking, the growth style of investing outperformed the value style of investing. The top-performing investment style, among the six popular styles of investing, was mid cap growth, with a total return in excess of 18%, as measured by the S&P MidCap 400/Citigroup Growth Index6 for the one-year period ended July 31, 2007.

Q: How did the Fund perform during the fiscal year ended July 31, 2007?

A: The Fund returned 22.1%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared with its benchmark, the Russell 2000® Index,7 which returned 12.1% over the same period.

Q: What were the most significant factors affecting performance?

A: The greatest contributor to the Fund's performance relative to its benchmark for the 12-month period was the financial services sector, followed by the healthcare sector and the producer durables sector (owing to an overweight position).

Among individual holdings that contributed to performance were financial services holding Ohio Casualty Corp. (the Fund's number-one contributor), a provider of property and casualty insurance (the company announced that it would be acquired by Liberty Mutual Insurance); healthcare holdings Kyphon Inc., a developer of medical devices for orthopedic applications utilizing balloon technology, and Option Care, Inc., a provider of home healthcare products and services (both holdings positively affected performance, as they are being acquired by Medtronic and Walgreens, respectively); consumer discretionary holding Universal Electronics Inc., a manufacturer of preprogrammed universal wireless remote controls, wireless

2

keyboards, and gaming controls; and technology holding Stratasys, Inc., a developer of rapid prototyping systems.

The largest detractor from the Fund's performance relative to its benchmark for the 12-month period was the materials and processing sector, followed by the consumer staples sector and the auto and transportation sector.

Among individual holdings that detracted from performance were consumer discretionary holding Select Comfort Corp. (the Fund's number-one detractor), a designer of a line of air bed mattresses, foundations, and accessories; materials and processing holdings Beacon Roofing Supply, Inc., a distributor of roofing materials, and Brush Engineered Materials Inc., a producer of high-performance engineered materials; technology holding RadiSys Corp., a designer of embedded computer solutions; and financial services holding PrivateBancorp, Inc., a bank holding company.

The Fund's portfolio is actively managed and, therefore, its holdings and weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

A prospectus contains important information about a fund, including its investment objectives, risks, charges, and ongoing expenses, which an investor should carefully consider before investing. To obtain a prospectus on any Lord Abbett mutual fund, please contact your investment professional or Lord Abbett Distributor LLC at 888-522-2388 or visit our Website at www.lordabbett.com. Read the prospectus carefully before investing.

1 The S&P Composite 1500® Index combines the S&P 500®, S&P MidCap 400®, and S&P SmallCap 600® to create a broad market portfolio representing approximately 85% of U.S. equities.

2 The Dow Jones Industrial Average (DJIA) is an unmanaged index of common stocks comprised of major industrial companies and assumes the reinvestment of dividends and capital gains.

3 The S&P 500® Index is widely regarded as the standard for measuring large-cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

4 The S&P 100® Index measures large company U.S. stock market performance. This market capitalization-weighted index is made up of 100 major, blue-chip stocks across diverse industry groups.

5 The S&P SmallCap 600® Index is a widely accepted benchmark due to its low turnover and greater liquidity.

6 The S&P MidCap 400/Citigroup Growth Index measures the performance of growth-oriented, mid-size capitalization U.S. companies. The S&P MidCap 400/Citigroup Growth Index contains those securities in the S&P MidCap 400 Index with higher price-to-book ratios.

7 The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

3

Important Performance and Other Information

Performance data quoted reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to our Website at www.lordabbett.com.

Except where noted, comparative fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Fund offers additional classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Fund's prospectus.

The views of the Fund's management and the portfolio holdings described in this report are as of July 31, 2007; these views and portfolio holdings may have changed subsequent to this date, and they do not guarantee the future performance of the markets or the Fund. Information provided in this report should not be considered a recommendation to purchase or sell securities.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund's prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks, including possible loss of principal amount invested.

4

Investment Comparison

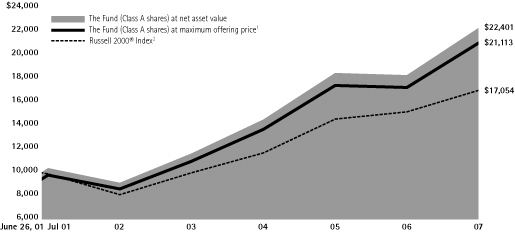

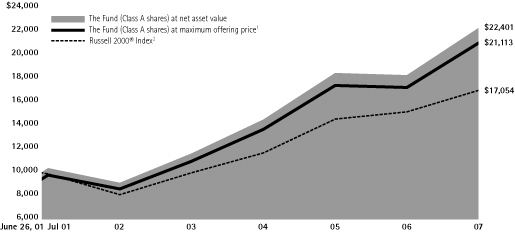

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2000® Index (the "Index") assuming reinvestment of all distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, certain expenses of the Fund have been reimbursed by Lord Abbett; without such reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Return at Maximum Applicable Sales Charge for the Periods Ended July 31, 2007

| | | 1 Year | | 5 Years | | Life of Class | |

| Class A3 | | | 15.04 | % | | | 18.25 | % | | | 13.05 | % | |

| Class B4 | | | 17.29 | % | | | 18.82 | % | | | 13.44 | % | |

| Class C5 | | | 21.24 | % | | | 18.91 | % | | | 13.43 | % | |

| Class P6 | | | 21.93 | % | | | 19.62 | % | | | 14.13 | % | |

| Class Y7 | | | 22.43 | % | | | 20.05 | % | | | 14.49 | % | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance of the unmanaged index does not reflect transaction costs, management fees or sales charges. The performance of the index is not necessarily representative of the Fund's performance.

3 Performance is calculated from June 26, 2001, SEC effective date. Class A shares were first offered to the public on July 2, 2001. Total return, which is the percent change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A Shares, with all distributions reinvested for the periods shown ended July 31, 2007, is calculated using the SEC-required uniform method to compute such return.

4 Performance is calculated from June 26, 2001, SEC effective date. Class B shares were first offered to the public on July 2, 2001. Performance reflects the deduction of a CDSC of 4% for 1 year, 1% for 5 years and 0% for life of the class.

5 Performance is calculated from June 26, 2001, SEC effective date. Class C shares were first offered to the public on July 2, 2001. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Performance is calculated from June 26, 2001, SEC effective date. Class P shares were first offered to the public on July 2, 2001. Performance is at net asset value.

7 Performance is calculated from June 26, 2001, SEC effective date. Class Y shares were first offered to the public on July 2, 2001. Performance is at net asset value.

5

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2007 through July 31, 2007).

Actual Expenses

For each class of the Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period 2/1/07 – 7/31/07" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of the Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

6

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 2/1/07 | | 7/31/07 | | 2/1/07 –

7/31/07 | |

| Class A | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.80 | | | $ | 7.00 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.05 | | | $ | 6.80 | | |

| Class B | |

| Actual | | $ | 1,000.00 | | | $ | 1,071.50 | | | $ | 10.32 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.83 | | | $ | 10.04 | | |

| Class C | |

| Actual | | $ | 1,000.00 | | | $ | 1,070.90 | | | $ | 10.32 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,014.83 | | | $ | 10.04 | | |

| Class P | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.00 | | | $ | 7.51 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.55 | | | $ | 7.30 | | |

| Class Y | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.40 | | | $ | 5.20 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.79 | | | $ | 5.06 | | |

† For each class of the Fund, expenses are equal to the annualized expense ratio for such class (1.36% for Class A, 2.01% for Classes B and C, 1.46% for Class P and 1.01% for Class Y) multiplied by the average account value over the period, multiplied by 181/365 (to reflect one-half year period).

Portfolio Holdings Presented by Sector

July 31, 2007

| Sector* | | %** | |

| Auto & Transportation | | | 2.28 | % | |

| Consumer Discretionary | | | 13.18 | % | |

| Consumer Staples | | | 1.71 | % | |

| Financial Services | | | 12.27 | % | |

| Healthcare | | | 15.52 | % | |

| Materials & Processing | | | 12.95 | % | |

| Other | | | 0.82 | % | |

| Other Energy | | | 5.87 | % | |

| Producer Durables | | | 15.54 | % | |

| Technology | | | 15.25 | % | |

| Short-Term Investment | | | 4.61 | % | |

| Total | | | 100.00 | % | |

* A sector may comprise several industries.

** Represents percent of total investments.

7

Schedule of Investments

July 31, 2007

| Investments | |

Shares | | Value

(000) | |

| COMMON STOCKS 95.52% | |

| Aerospace 2.29% | |

| Curtiss-Wright Corp. | | | 529,678 | | | $ | 23,078 | | |

| HEICO Corp. | | | 280,252 | | | | 11,255 | | |

| HEICO Corp. Class A | | | 134,096 | | | | 4,459 | | |

| Total | | | | | | | 38,792 | | |

| Air Transportation 0.61% | |

| AirTran Holdings, Inc.* | | | 1,053,700 | | | | 10,368 | | |

| Aluminum 0.73% | |

| Century Aluminum Co.* | | | 238,500 | | | | 12,292 | | |

| Banks 1.58% | |

| CVB Financial Corp. | | | 360,000 | | | | 3,524 | | |

| PrivateBancorp, Inc. | | | 749,906 | | | | 20,247 | | |

| Smithtown Bancorp, Inc. | | | 81,477 | | | | 1,894 | | |

| State Street Corp. | | | 14,807 | | | | 993 | | |

| Total | | | | | | | 26,658 | | |

Biotechnology Research &

Production 0.72% | |

Martek Biosciences

Corp.* | | | 477,142 | | | | 12,224 | | |

| Building: Materials 1.71% | |

| Watsco, Inc. | | | 580,100 | | | | 28,953 | | |

| Building: Roofing & Wallboard 1.82% | |

Beacon Roofing

Supply, Inc.* | | | 2,059,850 | | | | 30,815 | | |

| Casinos & Gambling 0.31% | |

Progressive Gaming

International Corp.* | | | 1,014,976 | | | | 5,176 | | |

| Chemicals 0.51% | |

| Albemarle Corp. | | | 215,100 | | | | 8,653 | | |

| Communications & Media 1.51% | |

Entravision

Communications Corp.* | | | 2,728,900 | | | | 25,543 | | |

| Investments | |

Shares | | Value

(000) | |

| Communications Technology 1.49% | |

Comtech

Telecommunication Corp.* | | | 239,440 | | | $ | 10,408 | | |

| Foundry Network, Inc.* | | | 844,166 | | | | 14,849 | | |

| Total | | | | | | | 25,257 | | |

Computer Services, Software &

Systems 6.35% | |

American

Reprographics Co.* | | | 858,047 | | | | 21,383 | | |

CACI International,

Inc. Class A* | | | 90,300 | | | | 4,013 | | |

| Epicor Software Corp.* | | | 1,413,458 | | | | 18,460 | | |

Lionbridge

Technologies, Inc.* | | | 1,806,920 | | | | 8,474 | | |

| Solera Holdings, Inc.* | | | 947,700 | | | | 17,722 | | |

| SRA International, Inc.* | | | 493,742 | | | | 11,761 | | |

| Sykes Enterprises, Inc.* | | | 43,969 | | | | 736 | | |

| Websense, Inc.* | | | 1,249,400 | | | | 24,938 | | |

| Total | | | | | | | 107,487 | | |

| Computer Technology 2.12% | |

| Komag, Inc.* | | | 134,318 | | | | 4,300 | | |

| RadiSys Corp.*(b) | | | 1,162,225 | | | | 13,645 | | |

| Stratasys, Inc.* | | | 407,761 | | | | 17,946 | | |

| Total | | | | | | | 35,891 | | |

| Consumer Electronics 1.22% | |

Universal

Electronics, Inc.* | | | 587,346 | | | | 20,698 | | |

| Consumer Products 1.60% | |

| Citi Trends, Inc.* | | | 246,200 | | | | 8,100 | | |

USANA Health

Sciences, Inc.* | | | 468,025 | | | | 18,889 | | |

| Total | | | | | | | 26,989 | | |

Containers & Packaging: Metal &

Glass 0.44% | |

| Mobile Mini, Inc.* | | | 260,007 | | | | 7,428 | | |

See Notes to Financial Statements.

8

Schedule of Investments (continued)

July 31, 2007

| Investments | |

Shares | | Value

(000) | |

| Diversified Manufacturing 2.02% | |

| CLARCOR, Inc. | | | 668,143 | | | $ | 23,245 | | |

| Hexcel Corp.* | | | 503,721 | | | | 10,951 | | |

| Total | | | | | | | 34,196 | | |

| Education Services 1.37% | |

| Strayer Education, Inc. | | | 152,496 | | | | 23,108 | | |

| Electrical & Electronics 1.63% | |

Power

Intergrations, Inc.* | | | 1,037,215 | | | | 27,486 | | |

Electrical Equipment &

Components 1.27% | |

Genlyte Group,

Inc. (The)* | | | 308,715 | | | | 21,477 | | |

Electronics: Instruments, Gauges &

Meters 2.79% | |

| FARO Technologies, Inc.* | | | 539,949 | | | | 20,102 | | |

Measurement

Specialties, Inc.*(b) | | | 1,231,145 | | | | 27,098 | | |

| Total | | | | | | | 47,200 | | |

| Electronics: Technology 3.67% | |

American Science &

Engineering, Inc.* | | | 66,945 | | | | 3,710 | | |

| PerkinElmer, Inc. | | | 996,900 | | | | 27,744 | | |

| ScanSource, Inc.* | | | 1,143,852 | | | | 30,690 | | |

| Total | | | | | | | 62,144 | | |

Financial Data Processing Services &

Systems 1.83% | |

| Global Payments, Inc. | | | 828,000 | | | | 30,967 | | |

| Financial Information Services 0.51% | |

| Equifax, Inc. | | | 213,742 | | | | 8,648 | | |

| Foods 1.71% | |

| J & J Snack Foods Corp. | | | 838,738 | | | | 28,895 | | |

| Health & Personal Care 2.84% | |

| Amedisys, Inc.* | | | 1,269,973 | | | | 48,068 | | |

| Investments | |

Shares | | Value

(000) | |

| Healthcare Facilities 4.48% | |

| ICON plc ADR* | | | 494,105 | | | $ | 23,109 | | |

| LCA-Vision, Inc. | | | 955,757 | | | | 33,939 | | |

Psychiatric

Solutions, Inc.* | | | 546,827 | | | | 18,642 | | |

| Total | | | | | | | 75,690 | | |

| Healthcare Management Services 1.51% | |

| HealthExtras, Inc.* | | | 724,149 | | | | 19,429 | | |

| Phase Forward, Inc.* | | | 359,524 | | | | 6,180 | | |

| Total | | | | | | | 25,609 | | |

| Household Furnishings 2.45% | |

Select Comfort

Corp.*(b) | | | 2,604,908 | | | | 41,522 | | |

Identification Control & Filter

Devices 0.93% | |

| X-Rite, Inc. | | | 1,166,060 | | | | 15,742 | | |

| Insurance: Multi-Line 2.28% | |

| Hilb, Rogal & Hobbs Co. | | | 891,300 | | | | 38,593 | | |

| Insurance: Property-Casualty 3.17% | |

| First Acceptance Corp.* | | | 408,700 | | | | 3,638 | | |

HCC Insurance

Holdings, Inc. | | | 905,750 | | | | 26,520 | | |

| Ohio Casualty Corp. | | | 372,942 | | | | 16,189 | | |

| Tower Group, Inc. | | | 277,300 | | | | 7,348 | | |

| Total | | | | | | | 53,695 | | |

| Machinery: Industrial/Specialty 4.09% | |

| Actuant Corp. Class A | | | 608,176 | | | | 37,087 | | |

| EnPro Industries, Inc.* | | | 493,951 | | | | 19,452 | | |

| Gardner Denver, Inc.* | | | 303,200 | | | | 12,610 | | |

| Total | | | | | | | 69,149 | | |

Machinery: Oil Well Equipment &

Services 1.12% | |

| Carbo Ceramics, Inc. | | | 419,888 | | | | 18,929 | | |

See Notes to Financial Statements.

9

Schedule of Investments (continued)

July 31, 2007

| Investments | |

Shares | | Value

(000) | |

| Machinery: Specialty 4.18% | |

Bucyrus International,

Inc. | | | 487,500 | | | $ | 30,986 | | |

Flow International

Corp.* | | | 1,016,149 | | | | 9,379 | | |

| Graco, Inc. | | | 740,100 | | | | 30,374 | | |

| Total | | | | | | | 70,739 | | |

Medical & Dental Instruments &

Supplies 5.30% | |

| Kyphon, Inc.* | | | 580,232 | | | | 38,075 | | |

| Mentor Corp. | | | 510,700 | | | | 20,096 | | |

| Symmetry Medical, Inc.* | | | 1,031,300 | | | | 15,397 | | |

| Techne Corp.* | | | 287,260 | | | | 16,161 | | |

| Total | | | | | | | 89,729 | | |

| Medical Services 0.71% | |

| Option Care, Inc. | | | 615,411 | | | | 11,933 | | |

| Metal Fabricating 3.08% | |

| Commercial Metals Co. | | | 621,900 | | | | 19,180 | | |

Haynes International

Inc.* | | | 94,300 | | | | 8,469 | | |

Reliance Steel &

Aluminum Co. | | | 465,000 | | | | 24,431 | | |

| Total | | | | | | | 52,080 | | |

| Metals & Minerals Miscellaneous 0.98% | |

Brush Engineered

Materials, Inc.* | | | 438,031 | | | | 16,588 | | |

| Multi-Sector Companies 0.82% | |

| Foster Wheeler Ltd.* | | | 123,304 | | | | 13,858 | | |

| Oil: Crude Producers 4.75% | |

| Arena Resources, Inc.* | | | 81,499 | | | | 4,426 | | |

Berry Petroleum

Co. Class A | | | 556,600 | | | | 20,711 | | |

Comstock Resources,

Inc.* | | | 684,846 | | | | 18,395 | | |

| EXCO Resources, Inc.* | | | 1,938,900 | | | | 33,853 | | |

| Investments | |

Shares | | Value

(000) | |

| Parallel Petroleum Corp.* | | | 147,260 | | | $ | 3,000 | | |

| Total | | | | | | | 80,385 | | |

Rental & Leasing Services:

Commercial 0.95% | |

Williams Scotsman

International, Inc.* | | | 590,337 | | | | 16,028 | | |

| Retail 1.52% | |

| PetMed Express, Inc.* | | | 548,134 | | | | 7,992 | | |

Rush Enterprises, Inc.

Class A* | | | 633,871 | | | | 17,717 | | |

| Total | | | | | | | 25,709 | | |

| Savings & Loan 0.46% | |

| Brookline Bancorp, Inc. | | | 757,234 | | | | 7,777 | | |

| Securities Brokerage & Services 1.51% | |

optionsXpress

Holdings, Inc. | | | 1,017,992 | | | | 25,460 | | |

| Services: Commercial 3.22% | |

Advisory Board

Co. (The)* | | | 218,200 | | | | 11,235 | | |

AMN Healthcare

Services, Inc.* | | | 919,112 | | | | 19,733 | | |

| ICT Group, Inc.* | | | 549,911 | | | | 8,683 | | |

| Kforce, Inc.* | | | 1,022,790 | | | | 14,820 | | |

| Total | | | | | | | 54,471 | | |

| Steel 1.68% | |

Carpenter Technology

Corp. | | | 183,979 | | | | 21,837 | | |

Claymont Steel

Holdings, Inc.* | | | 325,709 | | | | 6,491 | | |

| Total | | | | | | | 28,328 | | |

| Transportation: Miscellaneous 0.96% | |

| Celadon Group, Inc.* | | | 753,993 | | | | 11,355 | | |

Vitran Corp.,

Inc. (Canada)*(a) | | | 239,164 | | | | 4,807 | | |

| Total | | | | | | | 16,162 | | |

See Notes to Financial Statements.

10

Schedule of Investments (concluded)

July 31, 2007

| Investments | |

Shares | | Value

(000) | |

| Truckers 0.72% | |

J.B. Hunt Transport

Services, Inc. | | | 434,378 | | | $ | 12,132 | | |

Total Common Stocks

(cost $1,479,239,202) | | | | | 1,615,721 | | |

| | | Principal

Amount

(000) | | | |

| SHORT-TERM INVESTMENT 4.61% | |

| Repurchase Agreement | |

Repurchase Agreement

dated 7/31/2007,

4.67% due 8/1/2007

with State Street

Bank & Trust Co.

collateralized by

$78,985,000 of Federal

Home Loan Bank

at 5.50% due 6/11/2009;

value: $79,577,388;

proceeds: $78,025,920

(cost $78,015,799) | | $ | 78,016 | | | | 78,016 | | |

Total Investments in

Securities 100.13%

(cost $1,557,255,001) | | | | | 1,693,737 | | |

Liabilities in Excess of

Cash and

Other Assets (0.13%) | | | | | (2,155 | ) | |

| Net Assets 100.00% | | | | $ | 1,691,582 | | |

ADR American Depositary Receipt.

* Non-income producing security.

(a) Foreign security traded in U.S. dollars.

(b) Affiliated issuer (holding represents 5% or more of the underlying issuer's outstanding voting shares). (See Note 9).

Industry classifications have not been audited by Deloitte & Touche LLP.

See Notes to Financial Statements.

11

Statement of Assets and Liabilities

July 31, 2007

| ASSETS: | |

| Investments in unaffiliated issuers, at value (cost $1,467,743,605) | | $ | 1,611,472,564 | | |

| Investments in affiliated issuers, at value (cost $89,511,396) | | | 82,264,257 | | |

| Cash | | | 2,335,795 | | |

| Receivables: | |

| Investment securities sold | | | 26,380,775 | | |

| Capital shares sold | | | 1,222,449 | | |

| Interest and dividends | | | 364,263 | | |

| Prepaid expenses and other assets | | | 149,346 | | |

| Total assets | | | 1,724,189,449 | | |

| LIABILITIES: | |

| Payables: | |

| Investment securities purchased | | | 25,909,747 | | |

| Capital shares reacquired | | | 3,901,200 | | |

| Management fee | | | 1,063,427 | | |

| 12b-1 distribution fees | | | 882,280 | | |

| Trustees' fees | | | 84,708 | | |

| Fund administration | | | 69,394 | | |

| To affiliate (See Note 3) | | | 4,256 | | |

| Accrued expenses and other liabilities | | | 692,268 | | |

| Total liabilities | | | 32,607,280 | | |

| NET ASSETS | | $ | 1,691,582,169 | | |

| COMPOSITION OF NET ASSETS: | |

| Paid-in capital | | $ | 1,410,859,191 | | |

| Accumulated net investment loss | | | (84,708 | ) | |

| Accumulated net realized gain on investments | | | 144,325,866 | | |

| Net unrealized appreciation on investments | | | 136,481,820 | | |

| Net Assets | | $ | 1,691,582,169 | | |

| Net assets by class: | |

| Class A Shares | | $ | 828,468,955 | | |

| Class B Shares | | $ | 89,990,233 | | |

| Class C Shares | | $ | 292,438,022 | | |

| Class P Shares | | $ | 111,014,505 | | |

| Class Y Shares | | $ | 369,670,454 | | |

Outstanding shares by class (unlimited number of authorized shares

of beneficial interest, no par value): | | | | | |

| Class A Shares | | | 44,323,436 | | |

| Class B Shares | | | 5,002,193 | | |

| Class C Shares | | | 16,271,839 | | |

| Class P Shares | | | 5,929,385 | | |

| Class Y Shares | | | 19,421,288 | | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | | |

| Class A Shares-Net asset value | | $ | 18.69 | | |

Class A Shares-Maximum offering price

(Net asset value plus sales charge of 5.75%) | | $ | 19.83 | | |

| Class B Shares-Net asset value | | $ | 17.99 | | |

| Class C Shares-Net asset value | | $ | 17.97 | | |

| Class P Shares-Net asset value | | $ | 18.72 | | |

| Class Y Shares-Net asset value | | $ | 19.03 | | |

See Notes to Financial Statements.

12

Statement of Operations

For the Year Ended July 31, 2007

| Investment income: | |

| Dividends from unaffiliated issuers | | $ | 6,714,736 | | |

| Dividends from affiliated issuers | | | 269,631 | | |

| Interest | | | 2,986,661 | | |

| Total investment income | | | 9,971,028 | | |

| Expenses: | |

| Management fee | | | 11,861,522 | | |

| 12b-1 distribution plan-Class A | | | 2,826,075 | | |

| 12b-1 distribution plan-Class B | | | 920,935 | | |

| 12b-1 distribution plan-Class C | | | 3,111,918 | | |

| 12b-1 distribution plan-Class P | | | 441,067 | | |

| Shareholder servicing | | | 3,178,541 | | |

| Fund administration | | | 649,230 | | |

| Reports to shareholders | | | 342,000 | | |

| Registration | | | 150,781 | | |

| Custody | | | 77,179 | | |

| Professional | | | 56,419 | | |

| Trustees' fees | | | 45,099 | | |

| Subsidy (See Note 3) | | | 4,256 | | |

| Other | | | 38,612 | | |

| Gross expenses | | | 23,703,634 | | |

| Expense reductions (See Note 7) | | | (57,780 | ) | |

| Net expenses | | | 23,645,854 | | |

| Net investment loss | | | (13,674,826 | ) | |

| Net realized and unrealized gain: | |

| Net realized gain on investments in unaffiliated issuers | | | 161,246,329 | | |

| Net realized gain on investments in affiliated issuers | | | 16,801,958 | | |

| Net change in unrealized appreciation on investments | | | 148,686,999 | | |

| Net realized and unrealized gain | | | 326,735,286 | | |

| Net Increase in Net Assets Resulting From Operations | | $ | 313,060,460 | | |

See Notes to Financial Statements.

13

Statements of Changes in Net Assets

| INCREASE IN NET ASSETS | | For the Year Ended

July 31, 2007 | | For the Year Ended

July 31, 2006 | |

| Operations: | |

| Net investment loss | | $ | (13,674,826 | ) | | $ | (11,640,886 | ) | |

| Net realized gain on investments | | | 178,048,287 | | | | 73,620,717 | | |

| Net change in unrealized appreciation (depreciation) on investments | | | 148,686,999 | | | | (110,815,202 | ) | |

| Net increase (decrease) in net assets resulting from operations | | | 313,060,460 | | | | (48,835,371 | ) | |

| Distributions to shareholders from: | |

| Net realized gain | |

| Class A | | | (38,604,026 | ) | | | (16,715,878 | ) | |

| Class B | | | (4,623,256 | ) | | | (2,674,386 | ) | |

| Class C | | | (16,140,593 | ) | | | (8,323,036 | ) | |

| Class P | | | (4,644,406 | ) | | | (788,460 | ) | |

| Class Y | | | (14,578,813 | ) | | | (3,630,563 | ) | |

| Total distributions to shareholders | | | (78,591,094 | ) | | | (32,132,323 | ) | |

| Capital share transactions (Net of share conversions) (See Note 12): | |

| Net proceeds from sales of shares | | | 363,605,919 | | | | 959,072,595 | | |

| Reinvestment of distributions | | | 68,433,567 | | | | 27,056,823 | | |

| Cost of shares reacquired | | | (487,941,006 | ) | | | (269,685,377 | ) | |

Net increase (decrease) in net assets resulting

from capital share transactions | | | (55,901,520 | ) | | | 716,444,041 | | |

| Net increase in net assets | | | 178,567,846 | | | | 635,476,347 | | |

| NET ASSETS: | |

| Beginning of year | | $ | 1,513,014,323 | | | $ | 877,537,976 | | |

| End of year | | $ | 1,691,582,169 | | | $ | 1,513,014,323 | | |

| Accumulated net investment loss | | $ | (84,708 | ) | | $ | (73,240 | ) | |

See Notes to Financial Statements.

14

Financial Highlights

| | | Class A Shares | |

| | | Year Ended 7/31 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance | |

| Net asset value, beginning of year | | $ | 16.08 | | | $ | 16.71 | | | $ | 14.37 | | | $ | 11.71 | | | $ | 9.18 | | |

| Investment operations: | |

| Net investment loss(a) | | | (.13 | ) | | | (.12 | ) | | | (.15 | ) | | | (.16 | ) | | | (.12 | ) | |

| Net realized and unrealized gain (loss) | | | 3.60 | | | | (.03 | ) | | | 3.88 | | | | 3.07 | | | | 2.65 | | |

| Total from investment operations | | | 3.47 | | | | (.15 | ) | | | 3.73 | | | | 2.91 | | | | 2.53 | | |

| Distributions to shareholders from: | |

| Net realized gain | | | (.86 | ) | | | (.48 | ) | | | (1.39 | ) | | | (.25 | ) | | | – | | |

| Net asset value, end of year | | $ | 18.69 | | | $ | 16.08 | | | $ | 16.71 | | | $ | 14.37 | | | $ | 11.71 | | |

| Total Return(b) | | | 22.05 | % | | | (.99 | )% | | | 27.38 | % | | | 24.96 | % | | | 27.56 | % | |

| Ratios to Average Net Assets: | |

Expenses, including expense

reductions | | | 1.36 | % | | | 1.38 | % | | | 1.47 | % | | | 1.55 | % | | | 1.71 | % | |

Expenses, excluding expense

reductions | | | 1.36 | % | | | 1.38 | % | | | 1.47 | % | | | 1.55 | % | | | 1.89 | % | |

| Net investment loss | | | (.74 | )% | | | (.71 | )% | | | (.96 | )% | | | (1.12 | )% | | | (1.30 | )% | |

| Supplemental Data: | |

| Net assets, end of year (000) | | $ | 828,469 | | | $ | 767,283 | | | $ | 465,124 | | | $ | 162,651 | | | $ | 59,717 | | |

| Portfolio turnover rate | | | 59.23 | % | | | 55.39 | % | | | 58.65 | % | | | 84.91 | % | | | 68.48 | % | |

(a) Calculated using average shares outstanding during the period.

(b) Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions.

See Notes to Financial Statements.

15

Financial Highlights (continued)

| | | Class B Shares | |

| | | Year Ended 7/31 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance | |

| Net asset value, beginning of year | | $ | 15.60 | | | $ | 16.34 | | | $ | 14.15 | | | $ | 11.56 | | | $ | 9.12 | | |

| Investment operations: | |

| Net investment loss(a) | | | (.24 | ) | | | (.23 | ) | | | (.24 | ) | | | (.24 | ) | | | (.18 | ) | |

| Net realized and unrealized gain (loss) | | | 3.49 | | | | (.03 | ) | | | 3.82 | | | | 3.02 | | | | 2.62 | | |

| Total from investment operations | | | 3.25 | | | | (.26 | ) | | | 3.58 | | | | 2.78 | | | | 2.44 | | |

| Distributions to shareholders from: | |

| Net realized gain | | | (.86 | ) | | | (.48 | ) | | | (1.39 | ) | | | (.19 | ) | | | – | | |

| Net asset value, end of year | | $ | 17.99 | | | $ | 15.60 | | | $ | 16.34 | | | $ | 14.15 | | | $ | 11.56 | | |

| Total Return(b) | | | 21.29 | % | | | (1.70 | )% | | | 26.71 | % | | | 24.19 | % | | | 26.75 | % | |

| Ratios to Average Net Assets: | |

Expenses, including expense

reductions | | | 2.01 | % | | | 2.02 | % | | | 2.10 | % | | | 2.18 | % | | | 2.33 | % | |

Expenses, excluding expense

reductions | | | 2.01 | % | | | 2.02 | % | | | 2.10 | % | | | 2.18 | % | | | 2.51 | % | |

| Net investment loss | | | (1.39 | )% | | | (1.36 | )% | | | (1.61 | )% | | | (1.75 | )% | | | (1.92 | )% | |

| Supplemental Data: | |

| Net assets, end of year (000) | | $ | 89,990 | | | $ | 89,943 | | | $ | 81,117 | | | $ | 45,384 | | | $ | 21,518 | | |

| Portfolio turnover rate | | | 59.23 | % | | | 55.39 | % | | | 58.65 | % | | | 84.91 | % | | | 68.48 | % | |

(a) Calculated using average shares outstanding during the period.

(b) Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions.

See Notes to Financial Statements.

16

Financial Highlights (continued)

| | | Class C Shares | |

| | | Year Ended 7/31 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance | |

| Net asset value, beginning of year | | $ | 15.59 | | | $ | 16.32 | | | $ | 14.14 | | | $ | 11.56 | | | $ | 9.12 | | |

| Investment operations: | |

| Net investment loss(a) | | | (.24 | ) | | | (.23 | ) | | | (.24 | ) | | | (.24 | ) | | | (.18 | ) | |

| Net realized and unrealized gain (loss) | | | 3.48 | | | | (.02 | ) | | | 3.81 | | | | 3.02 | | | | 2.62 | | |

| Total from investment operations | | | 3.24 | | | | (.25 | ) | | | 3.57 | | | | 2.78 | | | | 2.44 | | |

| Distributions to shareholders from: | |

| Net realized gain | | | (.86 | ) | | | (.48 | ) | | | (1.39 | ) | | | (.20 | ) | | | – | | |

| Net asset value, end of year | | $ | 17.97 | | | $ | 15.59 | | | $ | 16.32 | | | $ | 14.14 | | | $ | 11.56 | | |

| Total Return(b) | | | 21.24 | % | | | (1.64 | )% | | | 26.65 | % | | | 24.18 | % | | | 26.75 | % | |

| Ratios to Average Net Assets: | |

Expenses, including expense

reductions | | | 2.01 | % | | | 2.02 | % | | | 2.10 | % | | | 2.18 | % | | | 2.33 | % | |

Expenses, excluding expense

reductions | | | 2.01 | % | | | 2.02 | % | | | 2.10 | % | | | 2.18 | % | | | 2.51 | % | |

| Net investment loss | | | (1.39 | )% | | | (1.36 | )% | | | (1.60 | )% | | | (1.75 | )% | | | (1.92 | )% | |

| Supplemental Data: | |

| Net assets, end of year (000) | | $ | 292,438 | | | $ | 317,028 | | | $ | 221,554 | | | $ | 64,447 | | | $ | 23,039 | | |

| Portfolio turnover rate | | | 59.23 | % | | | 55.39 | % | | | 58.65 | % | | | 84.91 | % | | | 68.48 | % | |

(a) Calculated using average shares outstanding during the period.

(b) Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions.

See Notes to Financial Statements.

17

Financial Highlights (continued)

| | | Class P Shares | |

| | | Year Ended 7/31 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance | |

| Net asset value, beginning of year | | $ | 16.12 | | | $ | 16.77 | | | $ | 14.42 | | | $ | 11.73 | | | $ | 9.19 | | |

| Investment operations: | |

| Net investment loss(a) | | | (.15 | ) | | | (.14 | ) | | | (.17 | ) | | | (.37 | ) | | | (.10 | ) | |

| Net realized and unrealized gain (loss) | | | 3.61 | | | | (.03 | ) | | | 3.91 | | | | 3.28 | | | | 2.64 | | |

| Total from investment operations | | | 3.46 | | | | (.17 | ) | | | 3.74 | | | | 2.91 | | | | 2.54 | | |

| Distributions to shareholders from: | |

| Net realized gain | | | (.86 | ) | | | (.48 | ) | | | (1.39 | ) | | | (.22 | ) | | | – | | |

| Net asset value, end of year | | $ | 18.72 | | | $ | 16.12 | | | $ | 16.77 | | | $ | 14.42 | | | $ | 11.73 | | |

| Total Return(b) | | | 21.93 | % | | | (1.11 | )% | | | 27.35 | % | | | 24.97 | % | | | 27.64 | % | |

| Ratios to Average Net Assets: | |

Expenses, including expense

reductions | | | 1.46 | % | | | 1.48 | % | | | 1.69 | % | | | 1.63 | %† | | | 1.78 | %† | |

Expenses, excluding expense

reductions | | | 1.46 | % | | | 1.48 | % | | | 1.70 | % | | | 1.63 | %† | | | 1.96 | %† | |

| Net investment loss | | | (.84 | )% | | | (.80 | )% | | | (1.06 | )% | | | (1.20 | )%† | | | (1.37 | )%† | |

| Supplemental Data: | |

| Net assets, end of year (000) | | $ | 111,015 | | | $ | 80,298 | | | $ | 13,954 | | | $ | 218 | | | $ | 1 | | |

| Portfolio turnover rate | | | 59.23 | % | | | 55.39 | % | | | 58.65 | % | | | 84.91 | % | | | 68.48 | % | |

† The ratios have been determined on a Fund basis.

(a) Calculated using average shares outstanding during the period.

(b) Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions.

See Notes to Financial Statements.

18

Financial Highlights (concluded)

| | | Class Y Shares | |

| | | Year Ended 7/31 | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per Share Operating Performance | |

| Net asset value, beginning of year | | $ | 16.31 | | | $ | 16.88 | | | $ | 14.45 | | | $ | 11.75 | | | $ | 9.20 | | |

| Investment operations: | |

| Net investment loss(a) | | | (.07 | ) | | | (.06 | ) | | | (.09 | ) | | | (.10 | ) | | | (.11 | ) | |

| Net realized and unrealized gain (loss) | | | 3.65 | | | | (.03 | ) | | | 3.91 | | | | 3.07 | | | | 2.66 | | |

| Total from investment operations | | | 3.58 | | | | (.09 | ) | | | 3.82 | | | | 2.97 | | | | 2.55 | | |

| Distributions to shareholders from: | |

| Net realized gain | | | (.86 | ) | | | (.48 | ) | | | (1.39 | ) | | | (.27 | ) | | | – | | |

| Net asset value, end of year | | $ | 19.03 | | | $ | 16.31 | | | $ | 16.88 | | | $ | 14.45 | | | $ | 11.75 | | |

| Total Return(b) | | | 22.43 | % | | | (.61 | )% | | | 27.88 | % | | | 24.45 | % | | | 27.72 | % | |

| Ratios to Average Net Assets: | |

Expenses, including expense

reductions | | | 1.01 | % | | | 1.03 | % | | | 1.17 | % | | | 1.18 | %† | | | 1.33 | %† | |

Expenses, excluding expense

reductions | | | 1.01 | % | | | 1.03 | % | | | 1.17 | % | | | 1.18 | %† | | | 1.51 | %† | |

| Net investment loss | | | (.39 | )% | | | (.36 | )% | | | (.57 | )% | | | (.75 | )%† | | | (.92 | )%† | |

| Supplemental Data: | |

| Net assets, end of year (000) | | $ | 369,670 | | | $ | 258,461 | | | $ | 95,788 | | | $ | 5,295 | | | $ | 1 | | |

| Portfolio turnover rate | | | 59.23 | % | | | 55.39 | % | | | 58.65 | % | | | 84.91 | % | | | 68.48 | % | |

† The ratios have been determined on a Fund basis.

(a) Calculated using average shares outstanding during the period.

(b) Total return does not consider the effects of sales loads and assumes the reinvestment of all distributions.

See Notes to Financial Statements.

19

Notes to Financial Statements

1. ORGANIZATION

Lord Abbett Blend Trust (the "Trust") is registered under the Investment Company Act of 1940 (the "Act") as a diversified open-end management investment company organized as a Delaware Statutory Trust on May 1, 2001. The Trust has one series, Lord Abbett Small-Cap Blend Fund (the "Fund"). The Securities and Exchange Commission declared the registration of the Fund and its shares effective on June 26, 2001 and each class of shares became available to the public on July 2, 2001. As of the close of business on January 31, 2006, Class A, B, C, P, and Y shares of the Fund were not available for purchase by new investors other than through certain retirement and benefit plans, and financial intermediaries that provide recordkeeping or advisory services and have entered into special arrangements with the Fund or the Distributor. In addition, Directors/Trustees of the Lord Abbett Funds, partners and employees of Lord Abbett, and the family members o f such persons may purchase shares of the Fund. Investors should note, however, that the Fund reserves the right to refuse any order that might disrupt the efficient management of the Fund.

The Fund's investment objective is to seek long-term growth of capital by investing primarily in stocks of small companies. The Fund offers five classes of shares: Classes A, B, C, P and Y, each with different expenses and dividends. A front-end sales charge is normally added to the Net Asset Value ("NAV") for Class A shares. There is no front-end sales charge in the case of the Class B, C, P and Y shares, although there may be a contingent deferred sales charge ("CDSC") as follows: certain redemptions of Class A shares made within 12 months following certain purchases made without a sales charge; Class B shares redeemed before the sixth anniversary of purchase; and Class C shares redeemed before the first anniversary of purchase. Class B shares will convert to Class A shares on the eighth anniversary of the original purchase of Class B shares.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. SIGNIFICANT ACCOUNTING POLICIES

(a) Investment Valuation–Securities traded on any recognized U.S. or non-U.S. exchange or on NASDAQ, Inc. are valued at the last sale price or official closing price on the exchange or system on which they are principally traded. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. The Fund may rely on an independent fair valuation service in adjusting the valuations of foreign securities. Unlisted equity securities are valued at the last quoted sale price or, if no sale price is available, at the mean between the most recently quoted bid and asked prices. Securities for which market quotatio ns are not readily available are valued at fair value as determined by management and approved in good faith by the Board of Trustees. Short-term securities with 60 days or less remaining to maturity are valued using the amortized cost method, which approximates current market value.

20

Notes to Financial Statements (continued)

(b) Security Transactions–Security transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses on sales of portfolio securities are calculated using the identified-cost method. Realized and unrealized gains (losses) are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day.

(c) Investment Income–Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized using the effective interest method. Investment income is allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day.

(d) Federal Taxes–It is the policy of the Fund to meet the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all taxable income and capital gains to its shareholders. Therefore, no Federal income tax provision is required.

(e) Expenses–Expenses, excluding class specific expenses, are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. Class A, B, C, and P shares bear their class specific share of all expenses and fees relating to the Fund's 12b-1 Distribution Plan.

(f) Repurchase Agreements–The Fund may enter into repurchase agreements with respect to securities. A repurchase agreement is a transaction in which the Fund acquires a security and simultaneously commits to resell that security to the seller (a bank or securities dealer) at an agreed-upon price on an agreed-upon date. The Fund requires at all times that the repurchase agreement be collateralized by cash, or by securities of the U.S. Government, its agencies, its instrumentalities, or U.S. Government sponsored enterprises having a value equal to, or in excess of, the value of the repurchase agreement (including accrued interest). If the seller of the agreement defaults on its obligation to repurchase the underlying securities at a time when the value of these securities has declined, the Fund may incur a loss upon disposition of the securities.

3. MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Management Fee

The Trust has a management agreement with Lord, Abbett & Co. LLC ("Lord Abbett") pursuant to which Lord Abbett supplies the Fund with investment management services and executive and other personnel, pays the remuneration of officers, provides office space and pays for ordinary and necessary office and clerical expenses relating to research and statistical work and supervision of the Fund's investment portfolio.

The management fee is based on average daily net assets at the following annual rates:

| First $1 billion | | | .75 | % | |

| Over $1 billion | | | .70 | % | |

For the year ended July 31, 2007, the effective management fee paid to Lord Abbett was at a rate of .73% of the Fund's average daily net assets.

Lord Abbett provides certain administrative services to the Fund pursuant to an Administrative Services Agreement at an annual rate of .04% of the Fund's average daily net assets.

21

Notes to Financial Statements (continued)

The Fund, along with certain other funds managed by Lord Abbett (the "Underlying Funds"), has entered into a Servicing Arrangement with Lord Abbett Alpha Strategy Fund of Lord Abbett Securities Trust (the "Alpha Strategy Fund"), pursuant to which each Underlying Fund pays a portion of the expenses (excluding management fees and distribution and service fees) of the Alpha Strategy Fund in proportion to the average daily value of Underlying Fund shares owned by the Alpha Strategy Fund. Amounts paid pursuant to the Servicing Arrangement are included in Subsidy expense on the Fund's Statement of Operations and Payable to affiliate on the Fund's Statement of Assets and Liabilities.

12b-1 Distribution Plan

The Fund has adopted a distribution plan with respect to Class A, B, C and P shares pursuant to Rule 12b-1 of the Act, which provides for the payment of ongoing distribution and service fees to Lord Abbett Distributor LLC ("Distributor"), an affiliate of Lord Abbett. The fees are accrued daily at annual rates based upon average daily net assets as follows:

| Fee* | | Class A | | Class B | | Class C | | Class P | |

| Service | | | .25 | % | | | .25 | % | | | .25 | % | | | .20 | % | |

| Distribution | | | .10 | % | | | .75 | % | | | .75 | % | | | .25 | % | |

* The Fund may designate a portion of the aggregate fee as attributable to service activities for purpose of calculating NASD sales charge limitations.

Class Y does not have a distribution plan.

Commissions

Distributor received the following commissions on sales of shares of the Fund, after concessions were paid to authorized dealers, for the year ended July 31, 2007:

Distributor

Commissions | | Dealers'

Concessions | |

| $ | 109,280 | | | $ | 612,308 | | |

Distributor received CDSCs of $28,062 and $24,170 for Class A and Class C shares, respectively, for the year ended July 31, 2007.

Two Trustees and certain of the Trust's officers have an interest in Lord Abbett.

4. DISTRIBUTIONS AND CAPITAL LOSS CARRYFORWARDS

Dividends from net investment income, if any, are declared and paid at least annually. Taxable net realized gains from investment transactions, reduced by capital loss carryforwards, if any, are declared and distributed to shareholders at least annually. The capital loss carryforward amount, if any, is available to offset future net capital gains. Dividends and distributions to shareholders are recorded on the ex-dividend date. The amount of dividends and distributions from net investment income and net realized capital gains are determined in accordance with Federal income tax regulations which may differ from accounting principles generally accepted in the United States of America. These book/tax differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their federal tax basis treatment; temporary di fferences do not require reclassification. Dividends and distributions, which exceed earnings and profits for tax purposes, are reported as a tax return of capital.

22

Notes to Financial Statements (continued)

The tax character of distributions paid during the years ended July 31, 2007 and 2006 are as follows:

| | | Year Ended

7/31/2007 | | Year Ended

7/31/2006 | |

| Distributions paid from: | |

| Ordinary income | | $ | 25,645,657 | | | $ | 16,605,582 | | |

| Net long-term capital gains | | | 52,945,437 | | | | 15,526,741 | | |

| Total distributions paid | | $ | 78,591,094 | | | $ | 32,132,323 | | |

As of July 31, 2007, the components of accumulated earnings (losses) on a tax-basis are as follows:

| Undistributed ordinary income – net | | $ | 50,577,618 | | |

| Undistributed long-term capital gains | | | 95,085,856 | | |

| Total undistributed earnings | | $ | 145,663,474 | | |

| Temporary differences | | | (84,708 | ) | |

| Unrealized gains - net | | | 135,144,212 | | |

| Total accumulated gains - net | | $ | 280,722,978 | | |

As of July 31, 2007, the aggregate unrealized security gains and losses based on cost for U.S. Federal income tax purposes are as follows:

| Tax cost | | $ | 1,558,592,609 | | |

| Gross unrealized gain | | | 220,930,662 | | |

| Gross unrealized loss | | | (85,786,450 | ) | |

| Net unrealized security gain | | $ | 135,144,212 | | |

The difference between book-basis and tax-basis unrealized gains (losses) is attributable to wash sales.

Permanent items identified during the year ended July 31, 2007, have been reclassified among the components of net assets based on their tax basis treatment as follows:

Accumulated

Net Investment

Loss | | Accumulated

Net Realized

Gain | |

| $ | 13,663,358 | | | $ | (13,663,358 | ) | |

The permanent difference is due to tax net investment losses.

5. PORTFOLIO SECURITIES TRANSACTIONS

Purchases and sales of investment securities (excluding short-term investments) for the year ended July 31, 2007 are as follows:

| Purchases | | Sales | |

| $ | 919,912,173 | | | $ | 1,069,794,106 | | |

There were no purchases or sales of U.S. Government securities for the year ended July 31, 2007.

23

Notes to Financial Statements (continued)

6. TRUSTEES' REMUNERATION

The Trust's officers and the two Trustees who are associated with Lord Abbett do not receive any compensation from the Trust for serving in such capacities. Outside Trustees' fees are allocated among all Lord Abbett-sponsored funds based on the net assets of each fund. There is an equity based plan available to all outside Trustees under which outside Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, Trustees' fees. The deferred amounts are treated as though equivalent dollar amounts have been invested proportionately in the funds. Such amounts and earnings accrued thereon are included in Trustees' fees on the Statement of Operations and in Trustees' fees payable on the Statement of Assets and Liabilities and are not deductible for U.S. Federal income tax purposes until such amounts are paid.

7. EXPENSE REDUCTIONS

The Fund has entered into arrangements with its transfer agent and custodian, whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund's expenses.

8. LINE OF CREDIT

The Fund, along with certain other funds managed by Lord Abbett, has available a $250,000,000 unsecured revolving credit facility ("Facility") from a consortium of banks, to be used for temporary or emergency purposes as an additional source of liquidity to fund redemptions of investor shares. Any borrowings under this Facility will bear interest at current market rates as defined in the agreement. The fee for this Facility is at an annual rate of .08%. As of July 31, 2007, there were no loans outstanding pursuant to this Facility nor was the Facility utilized at any time during the year ended July 31, 2007.

9. TRANSACTIONS WITH AFFILIATED ISSUERS

An affiliated issuer is one in which the Fund has ownership of at least 5% of the outstanding voting securities of the underlying issuer at any point during the fiscal year. The Fund had the following transactions with affiliated issuers during the year ended July 31, 2007:

| Affiliated Issuer | | Balance of

Shares Held

at 7/31/2006 | | Gross

Additions | | Gross

Sales | | Balance of

Shares Held

at 7/31/2007 | | Value

at

7/31/2007 | | Net Realized

Gain (Loss)

8/1/2006

to 7/31/2007(c) | | Dividend

Income

8/1/2006

to 7/31/2007(c) | |

| Amedisys, Inc.(a)(b) | | | 1,108,184 | | | | 358,395 | | | | (196,606 | ) | | | 1,269,973 | | | $ | - | | | $ | 2,082,479 | | | $ | - | | |

Beacon Roofing

Supply, Inc.(a) | | | 1,967,797 | (d) | | | 334,553 | | | | (242,500 | ) | | | 2,059,850 | | | | - | | | | 937,222 | | | | - | | |

Entravision

Communications(a) | | | 3,159,300 | | | | 41,100 | | | | (471,500 | ) | | | 2,728,900 | | | | - | | | | (93,313 | ) | | | - | | |

| LCA-Vision, Inc.(a) | | | 1,071,356 | | | | 87,401 | | | | (203,000 | ) | | | 955,757 | | | | - | | | | (187,917 | ) | | | 128,563 | | |

Measurement

Specialties, Inc. | | | 1,378,145 | | | | - | | | | (147,000 | ) | | | 1,231,145 | | | | 27,097,501 | | | | 90,636 | | | | - | | |

| Option Care, Inc.(a) | | | 1,811,866 | | | | 126,245 | | | | (1,322,700 | ) | | | 615,411 | | | | - | | | | 950,085 | | | | 141,068 | | |

| RadiSys Corp. | | | 959,804 | (d) | | | 296,421 | | | | (94,000 | ) | | | 1,162,225 | | | | 13,644,522 | | | | (13,945 | ) | | | - | | |

| Select Comfort Corp. | | | 2,807,938 | | | | 128,170 | | | | (331,200 | ) | | | 2,604,908 | | | | 41,522,234 | | | | 2,927,393 | | | | - | | |

| SpectraLink Corp.(a) | | | 1,253,937 | | | | 15,900 | | | | (1,269,837 | ) | | | - | | | | - | | | | 102,341 | | | | - | | |

| Stratasys, Inc.(a) | | | 902,624 | | | | 13,500 | | | | (508,363 | ) | | | 407,761 | | | | - | | | | 6,664,258 | | | | - | | |

| Universal Electronics, Inc.(a) | | | 1,004,369 | | | | - | | | | (417,023 | ) | | | 587,346 | | | | - | | | | 3,342,719 | | | | - | | |

| Total | | | | | | | | | | | | | | | | | | $ | 82,264,257 | | | $ | 16,801,958 | | | $ | 269,631 | | |

(a) No longer an affiliated issuer as of July 31, 2007.

(b) 358,395 shares acquired in a 4-for-3 stock split; ex-date December 5, 2006.

(c) Represents realized gains (losses) and dividend income earned only when the issuer was an affiliate of the Fund.

(d) Not an affiliated issuer as of July 31, 2006.

24

Notes to Financial Statements (continued)

10. CUSTODIAN AND ACCOUNTING AGENT

State Street Bank & Trust Company ("SSB") is the Fund's custodian and accounting agent. SSB performs custodial, accounting and recordkeeping functions relating to portfolio transactions and calculating the Fund's NAV.

11. INVESTMENT RISKS

The Fund is subject to the general risks and considerations associated with equity investing as well as the particular risks associated with growth and value stocks. The value of an investment will fluctuate in response to movements in the stock market in general and to the changing prospects of individual companies in which the Fund invests. Different types of stocks shift in and out of favor depending on market and economic conditions. Growth stocks tend to be more volatile than other stocks. The market may fail to recognize the intrinsic value of particular value stocks for a long time. In addition, if the Fund's assessment of a company's potential for growth or market conditions is wrong, it could suffer losses or produce poor performance relative to other funds, even in a rising market. The Fund invests primarily in small company stocks, which tend to be more volatile and can be less liquid than large company stocks. Small companies may also have more limited product lines, markets or financial resources, and typically experience a higher risk of failure than large companies.

These factors can affect the Fund's performance.

12. SUMMARY OF CAPITAL TRANSACTIONS

Transactions in shares of beneficial interest are as follows:

| | | Year Ended

July 31, 2007 | | Year Ended

July 31, 2006 | |

| Class A Shares* | | Shares | | Amount | | Shares | | Amount | |

| Shares sold | | | 9,701,505 | | | $ | 171,313,864 | | | | 28,220,231 | | | $ | 485,505,990 | | |

| Converted from Class B** | | | 99,159 | | | | 1,757,392 | | | | 113,646 | | | | 1,945,546 | | |

| Reinvestment of distributions | | | 2,015,847 | | | | 34,571,542 | | | | 888,249 | | | | 14,860,535 | | |

| Shares reacquired | | | (15,207,442 | ) | | | (266,075,856 | ) | | | (9,336,966 | ) | | | (158,820,032 | ) | |

| Increase (decrease) | | | (3,390,931 | ) | | $ | (58,433,058 | ) | | | 19,885,160 | | | $ | 343,492,039 | | |

| Class B Shares* | |

| Shares sold | | | 394,984 | | | $ | 6,743,472 | | | | 1,604,893 | | | $ | 26,461,264 | | |

| Reinvestment of distributions | | | 238,076 | | | | 3,948,227 | | | | 137,504 | | | | 2,242,684 | | |

| Shares reacquired | | | (1,292,534 | ) | | | (21,959,682 | ) | | | (826,955 | ) | | | (13,806,818 | ) | |

| Converted to Class A** | | | (102,688 | ) | | | (1,757,392 | ) | | | (116,861 | ) | | | (1,945,546 | ) | |

| Increase (decrease) | | | (762,162 | ) | | $ | (13,025,375 | ) | | | 798,581 | | | $ | 12,951,584 | | |

| Class C Shares | |

| Shares sold | | | 1,352,384 | | | $ | 22,944,241 | | | | 9,006,248 | | | $ | 148,198,140 | | |

| Reinvestment of distributions | | | 691,273 | | | | 11,454,761 | | | | 346,405 | | | | 5,643,031 | | |

| Shares reacquired | | | (6,108,678 | ) | | | (103,226,230 | ) | | | (2,591,892 | ) | | | (43,028,434 | ) | |

| Increase (decrease) | | | (4,065,021 | ) | | $ | (68,827,228 | ) | | | 6,760,761 | | | $ | 110,812,737 | | |

| Class P Shares | |

| Shares sold | | | 2,802,929 | | | $ | 49,588,710 | | | | 5,038,099 | | | $ | 87,319,105 | | |

| Reinvestment of distributions | | | 232,088 | | | | 3,989,598 | | | | 44,887 | | | | 753,644 | | |

| Shares reacquired | | | (2,086,186 | ) | | | (36,590,299 | ) | | | (934,488 | ) | | | (16,031,475 | ) | |

| Increase | | | 948,831 | | | $ | 16,988,009 | | | | 4,148,498 | | | $ | 72,041,274 | | |

25

Notes to Financial Statements (concluded)

| | | Year Ended

July 31, 2007 | | Year Ended

July 31, 2006 | |

| Class Y Shares | | Shares | | Amount | | Shares | | Amount | |

| Shares sold | | | 6,130,564 | | | $ | 113,015,632 | | | | 12,168,212 | | | $ | 211,588,096 | | |

| Reinvestment of distributions | | | 830,145 | | | | 14,469,439 | | | | 210,220 | | | | 3,556,929 | | |

| Shares reacquired | | | (3,389,837 | ) | | | (60,088,939 | ) | | | (2,201,768 | ) | | | (37,998,618 | ) | |

| Increase | | | 3,570,872 | | | $ | 67,396,132 | | | | 10,176,664 | | | $ | 177,146,407 | | |

*Amounts for the year ended July 31, 2006 have been reclassified to conform with current presentation.

**Automatic conversion of Class B shares occurs approximately eight years after the initial purchase date.

13. RECENT ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation 48, Accounting for Uncertainty in Income Taxes – an interpretation of FASB Statement 109 (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. FIN 48 is effective for fiscal years beginning after December 15, 2006. The Fund will adopt FIN 48 no later than January 31, 2008 and the impact to the Fund's financial statements, if any, is currently being assessed.

In September 2006, Statement of Financial Accounting Standards No.157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

14. SUBSEQUENT EVENTS

Effective August 10, 2007, the Fund created three new share classes: Class F, Class R2 and Class R3.

As of October 1, 2007, the Fund's Class P shares will be closed to substantially all new retirement and benefit plans and fee-based programs, with certain exceptions as set forth in the Fund's Prospectus.

26

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders,

Lord Abbett Blend Trust – Lord Abbett Small-Cap Blend Fund:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Lord Abbett Blend Trust – Lord Abbett Small-Cap Blend Fund (the "Fund") as of July 31, 2007, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estim ates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2007 by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Lord Abbett Blend Trust – Lord Abbett Small-Cap Blend Fund as of July 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

New York, New York

September 24, 2007

27

Basic Information About Management

The Board of Trustees (the "Board") is responsible for the management of the business and affairs of the Trust in accordance with the laws of the State of Delaware. The Board appoints officers who are responsible for the day-to-day operations of the Fund and who execute policies authorized by the Board. The Board also approves an investment adviser to the Trust continues to monitor the cost and quality of the services provided by the investment adviser, and annually considers whether to renew the contract with the adviser. Generally, each Trustee holds office until his/her successor is elected and qualified or until his/her earlier resignation or removal, as provided in the Trust's organizational documents.

Lord, Abbett & Co. LLC ("Lord Abbett"), a Delaware limited liability company, is the Trust's investment adviser.

Interested Trustees

The following Trustees are Partners of Lord Abbett and are "interested persons" of the Fund as defined in the Act. Mr. Dow and Ms. Foster are officers, directors, or trustees, of the fourteen Lord Abbett-sponsored funds, which consist of 55 portfolios or series.

Name, Address and

Year of Birth | | Current Position

Length of Service

with Trust | | Principal Occupation

During Past Five Years | | Other

Directorships | |

Robert S. Dow

Lord, Abbett & Co. LLC

90 Hudson Street

Jersey City, NJ 07302 (1945) | | Trustee and

Chairman

since 2001 | | Managing Partner and Chief

Executive Officer of

Lord Abbett since 1996. | | N/A | |

|

Daria L. Foster

Lord, Abbett & Co. LLC 90 Hudson Street

Jersey City, NJ 07302 (1954) | | Trustee

since 2006 | | Partner and Director of Marketing and

Client Service of

Lord Abbett since 1990. | | N/A | |

|

Independent Trustees

The following independent or outside Trustees ("Independent Trustees") are also directors or trustees of each of the fourteen Lord Abbett-sponsored funds, which consist of 55 portfolios or series.

Name, Address and

Year of Birth | | Current Position

Length of Service

with Trust | | Principal Occupation

During Past Five Years | | Other

Directorships | |

E. Thayer Bigelow

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1941) | | Trustee since 2001 | | Managing General Partner, Bigelow Media, LLC

(since 2000); Senior Adviser, Time Warner Inc. (1998 - 2000); Acting Chief Executive Officer of Courtroom Television Network (1997 – 1998); President and Chief Executive Officer of Time Warner Cable Programming, Inc. (1991 – 1997). | | Currently serves as director of Crane Co. and Huttig Building Products Inc. | |

|

28

Basic Information About Management (continued)

Name, Address and

Year of Birth | | Current Position

Length of Service

with Trust | | Principal Occupation

During Past Five Years | | Other

Directorships | |

William H.T. Bush

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street Jersey City, NJ 07302

(1938) | | Trustee since 2001 | | Co-founder and Chairman of the Board of the financial

advisory firm of Bush-

O'Donnell & Company

(since 1986). | | Currently serves as director of WellPoint, Inc. (since 2002). | |

|

Robert B. Calhoun, Jr. Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1942) | | Trustee since 2001 | | Managing Director of Monitor Clipper Partners (since 1997) and President of Clipper Asset Management Corp. (since 1991), both private equity investment funds. | | Currently serves as director of Avondale, Inc. and Interstate Bakeries Corp. | |

|

Julie A. Hill

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1946) | | Trustee since 2004 | | Owner and CEO of The Hill Company, a business consulting firm (since 1998); Founder, President and Owner of the Hiram-Hill and Hillsdale Development Company, a residential real estate development firm (1998 - 2000). | | Currently serves as director of WellPoint, Inc. and Lend Lease Corporation Limited. | |

|

Franklin W. Hobbs

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1947) | | Trustee since 2001 | | Advisor of One Equity Partners, a private equity firm (since 2004); Chief Executive Officer of Houlihan Lokey Howard & Zukin, an investment bank (2002 - 2003); Chairman of Warburg Dillon Read, an investment bank (1999 - 2001); Global Head of Corporate Finance of SBC Warburg Dillon Read (1997 - 1999); Chief Executive Officer of Dillon, Read & Co. (1994 - 1997). | | Currently serves as director of Molson Coors Brewing Company. | |

|

Thomas J. Neff

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1937) | | Trustee since 2001 | | Chairman of Spencer Stuart (U.S.), an executive search consulting firm (since 1996); President of Spencer Stuart (1979 – 1996). | | Currently serves as director of Ace, Ltd. (since 1997) and Hewitt Associates, Inc. | |

|

James L.L. Tullis

Lord, Abbett & Co. LLC c/o Legal Dept.

90 Hudson Street

Jersey City, NJ 07302 (1947) | | Trustee since 2006 | | CEO of Tullis-Dickerson and Co. Inc, a venture capital management firm

(since 1990). | | Currently serves as director of Crane Co. (since 1998) and Viacell Inc. (since 2002). | |

|

29

Basic Information About Management (concluded)

Officers

None of the officers listed below have received compensation from the Trust. All the officers of the Trust may also be officers of the other Lord Abbett-sponsored funds and maintain offices at 90 Hudson Street, Jersey City, NJ 07302.

Name and

Year of Birth | | Current Position

with Fund | | Length of Service

of Current Position | | Principal Occupation

During Past Five Years | |

Robert S. Dow

(1945) | | Chief Executive Officer and Chairman | | Elected in 2001 | | Managing Partner and Chief Executive Officer of Lord Abbett (since 1996). | |

|

Daria L. Foster

(1954) | | President | | Elected in 2006 | | Partner and Director of Marketing and Client Service of Lord Abbett (since 1990). | |

|

Michael T. Smith

(1963) | | Executive Vice President | | Elected in 2001 | | Partner and Investment Manager, joined Lord Abbett in 1997. | |

|

James Bernaiche

(1956) | | Chief Compliance Officer | | Elected in 2004 | | Chief Compliance Officer, joined Lord Abbett in 2001. | |

|

Joan A. Binstock

(1954) | | Chief Financial Officer and Vice President | | Elected in 2001 | | Partner and Chief Operations Officer, joined Lord Abbett in 1999. | |

|

John K. Forst

(1960) | | Vice President and Assistant Secretary | | Elected in 2005 | | Deputy General Counsel, joined Lord Abbett in 2004; Managing Director and Associate General Counsel at New York Life Investment Management LLC (2002 – 2003); attorney at Dechert LLP (2000 – 2002). | |

|

| Lawrence H. Kaplan (1957) | | Vice President and Secretary | | Elected in 2001 | | Partner and General Counsel, joined Lord Abbett in 1997. | |

|

| A. Edward Oberhaus, III (1959) | | Vice President | | Elected in 2001 | | Partner and Manager of Equity Trading, joined Lord Abbett in 1983. | |

|