UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | (811-10373) |

| |

| Exact name of registrant as specified in charter: TH Lee, Putnam Investment Trust |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Francis J. McNamara III, Vice President |

| | Clerk and Chief Legal Officer |

|

| | One Post Office Square |

|

| | Boston, Massachusetts 02109 |

|

| |

| Copy to: | John E. Baumgardner, Esq. |

| | Sullivan & Cromwell LLP |

| | 125 Broad Street |

| | New York, New York 10004-2498 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

Date of fiscal year end: October 31, 2006

Date of reporting period: November 1, 2006— April 30, 2007

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

About the fund and TH Lee, Putnam Capital LLC

TH Lee, Putnam Emerging Opportunities Portfolio (“the fund”) is a closed-end interval fund. This innovative fund pursues aggressive growth by combining investments in publicly traded stocks and privately held companies in a closed-end format. With this special structure, the fund can tap into companies with the best growth potential while maintaining diversification across public and private markets.

The fund is sponsored by an affiliate of TH Lee, Putnam Capital LLC, which is a joint venture of Putnam Investments (“Putnam”) and Thomas H. Lee Partners LP (“TH Lee”). This venture was founded in 1999 to offer alternative investment products to individual investors who have historically lacked access to the private-equity marketplace. Thomas H. Lee Partners LP, founded in 1974, is one of the oldest and most successful private-equity investment firms in the United States. The firm’s investment strategy targets growth companies with competitive advantages in expanding or consolidating industries. Putnam Investments, founded in 1937, is one of the world’s largest mutual fund companies and a leader in investment research and portfolio management through disciplined teamwork.

The fund’s public-equity portfolio is managed by members of Putnam’s Small and Emerging Growth Team — Richard Weed, Managing Director, and Raymond Haddad, Senior Vice President. This team analyzes small- and mid-capitalization growth stocks. Frederick Wynn, Managing Director, is responsible for managing the fund’s private-equity investments.

The fund’s management structure also includes an Investment Committee consisting of senior Putnam and TH Lee investment professionals. The Investment Committee consults with the management team and gives final approval to the structure of all private-equity deals.

Report from Fund Management

Performance commentary

We are pleased to report an impressive return from the fund during its semiannual period, which ended April 30, 2007. The fund outperformed its benchmark, the Russell 2500 Growth Index, by a substantial margin. Holdings from throughout the portfolio — both the private-equity holdings and public-equity holdings from all sectors — contributed to this outperformance.

| RETURN FOR PERIODS ENDED APRIL 30, 2007 | | | |

|

| | | | | Russell 2500 | |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | | Growth Index | |

|

| 6 months | 19.67% | | 14.60% | | 10.62% | |

|

| 1 year | 14.40 | | 9.54 | | 7.32 | |

|

| 3 years | 49.17 | | 42.82 | | 47.70 | |

|

| Annual average | 14.26 | | 12.62 | | 13.88 | |

|

| 5 years | 63.08 | | 56.17 | | 64.99 | |

|

| Annual average | 10.28 | | 9.33 | | 10.53 | |

|

| Life of fund (since inception 7/30/01) | 60.52 | | 53.70 | | 52.63 | |

|

| Annual average | 8.57 | | 7.75 | | 7.62 | |

|

| |

| RETURN FOR PERIODS ENDED MARCH 31, 2007 (most recent quarter) | | |

|

| | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | Growth Index |

|

| 6 months | 9.37% | | 4.73% | | 12.61% | |

|

| 1 year | 16.94 | | 11.97 | | 4.44 | |

|

| 3 years | 37.08 | | 31.24 | | 37.22 | |

|

| Annual average | 11.09 | | 9.49 | | 11.12 | |

|

| 5 years | 51.03 | | 44.60 | | 54.76 | |

|

| Annual average | 8.60 | | 7.65 | | 9.13 | |

|

| Life of fund (since inception 7/30/01) | 52.46 | | 45.98 | | 48.09 | |

|

| Annual average | 7.71 | | 6.89 | | 7.16 | |

|

Past performance does not indicate future results. Performance assumes reinvestment of distributions and does not account for taxes. More recent returns may be less or more than those shown. Investment returns will fluctuate, and you may have a gain or a loss when you sell your shares. Returns at public offering price (POP) reflect the highest applicable sales charge of 4.25% . Sales charges differ with the original purchase amount. The fund is currently closed to new investments. The Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation. Indexes are not available for direct investment. For a portion of the period this fund limited expenses, without which returns would have been lower.

Market overview

The stock market staged a significant rally during the fund’s semiannual period, which spanned the six months from November 1, 2006, through April 30, 2007. Although gross domestic product in the United States grew at a sub-par rate, corporate earnings remained at elevated levels, supporting stock valuations. Energy prices and inflationary pressures, two of the major risks to the current economic expansion, remained in check. While prices are increasing fast enough to be a source of concern for the Federal Reserve (the Fed), the core inflation rate did not worsen during the period, and the Fed continued to hold short-term interest rates steady at 5.25% .

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 1 |

The period was also marked by an increase in market volatility, especially during February and March. At the end of February, a sell-off was triggered by the spillover effects of a sharp drop in China’s stock market, and by concerns about mounting defaults of subprime mortgages. Fortunately, during the following month, expectations that steady levels of job creation and consumer spending would help avert a recession enabled stock markets inside and outside the United States to recover. Investors were also encouraged by the realization that the weakness in the housing market was not spreading to other areas of the economy.

Among sectors, financial stocks struggled as investors wrestled with the ramifications of rising mortgage delinquencies and drastic reductions in credit availability across the subprime lending industry. The utilities and consumer staples sectors strengthened substantially. Mid- and small-cap stocks led the market, and stocks with relatively low price-earnings multiples generally outperformed stocks with higher multiples.

Strategy overview

In selecting publicly traded stocks for your fund’s portfolio, we rely on a combination of fundamental and quantitative analytical tools to research U.S. mid- and small-cap companies. Our goal is to identify those companies likely to achieve consistently high rates of sales and earnings growth. We rigorously evaluate the companies we target to determine which stocks appear to have the most attractive capital appreciation potential relative to their risk, and we rely on our proprietary research to understand each company’s competitive advantages. We try to generate superior performance through stock selection because we believe that our research process can uncover securities with significant appreciation potential. Typically, the portfolio team does not take major sector risks, and the public-equity portfolio’s sector weightings are generally in line with those of its benchmark.

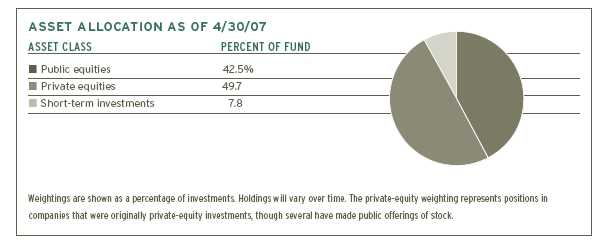

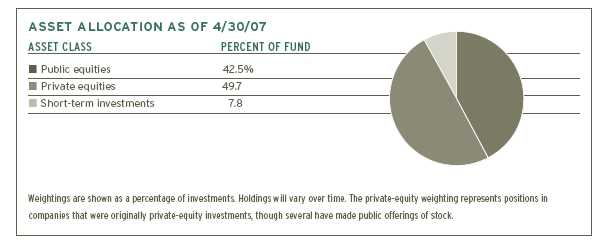

With regard to private equities, as we have noted in previous reports, we currently do not plan to add new private-equity investments to the portfolio. Both your fund’s management team and its Trustees want to maintain the fund’s diversification among public and private equities. Given the fund’s current weighting in private equities represents approximately half of the portfolio, we do not consider it prudent to

| 2 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

increase this amount. Asset diversification also contributes to maintaining liquidity sufficient to meet quarterly repurchase requests. However, we may decide to make additional investments in a company that is already among the fund’s private-equity holdings if we believe this action would be in the best interest of shareholders.

How fund holdings affected performance

In November, Capella Education successfully completed its initial public offering. Capella is an online university that offers undergraduate and graduate degree programs, and has more than 13,000 enrolled students. The offering triggered a special dividend from Capella, resulting in a cash distribution to the fund that by itself constituted a gain of more than 50% of our original investment in the company. The offering was priced at $20 per share and the stock subsequently appreciated in market trading, reaching a price of $35 at the end of the period. In May, 2007, after the end of the period, we sold the fund’s position in Capella Education in a secondary offering of the company's stock, and thereby realized a gain of approximately $12.7 million on the investment.

During the period, we also decided to sell the fund’s position in Spirit Finance, another private equity investment that had made an IPO before this fiscal year. We sold the position in February 2007, once the stock’s price had risen to what we considered its appropriate valuation. The fund realized a gain of more than $900,000 on this investment.

CommVault Systems and Restore Medical, two formerly private securities, each completed public offerings in the fund’s previous fiscal year. CommVault Systems reported solid revenues and earnings during its first two quarters as a public company. While the stock price remains above its public offering price, and significantly above the fund’s purchase price, the stock traded down somewhat during the current period. Late last calendar year, Restore Medical revised its revenue and earnings outlook to below analysts’ estimates. The stock price declined in reaction to this negative news. The company has reported publicly that it is taking steps to reorganize its sales force and sales strategy to address the causes of the revisions to forecasted revenues.

The portfolio currently has one pure private-equity holding, Refractec, which has developed a non-surgical, non-laser procedure that corrects presbyopia — a widespread condition that makes it difficult to see close details. This treatment, NearVisionSM CK(r), is the first FDA-approved technology for

| TOP SECTOR WEIGHTINGS AS OF 4/30/07 (includes both public and private equity) |

|

| Technology | 38.0% |

|

| Consumer staples | 24.6 |

|

| Healthcare | 12.0 |

|

| Consumer cyclicals | 9.8 |

|

| Capital goods | 4.5 |

|

| Weightings are shown as a percentage of net assets. Holdings will vary over time. |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 3 |

| TOP 10 HOLDINGS (includes public and private companies) | INDUSTRY |

|

| Commvault Systems, Inc. | Software |

|

| Capella Education Co. | Schools |

|

| Restore Medical, Inc. | Medical technology |

|

| Cephalon, Inc. | Pharmaceuticals |

|

| Laboratory Corp. of America Holdings | Health-care services |

|

| Whirlpool Corp. | Household furniture |

| | and appliances |

|

| Hospira, Inc. | Medical technology |

|

| Domino's Pizza, Inc. | Restaurants |

|

| Amphenol Corp. Class A | Electronics |

|

| C.R. Bard, Inc. | Medical technology |

|

| These holdings represent 57.8% of the fund's net assets as of 4/30/07. Portfolio holdings will vary over time. |

presbyopia, and frees patients with this condition from the need to use reading glasses. Physicians have performed over 150,000 of these treatments to help their patients. However, it is our opinion that Refractec’s ability to generate sufficient cash flow to remain a standalone entity has significantly deteriorated over the period. The fund’s present valuation for the company reflects a significantly reduced value relative to the fund’s original cost.

With regard to the performance of public equities during the period, our stock selection decisions led to solid results across almost every sector. The best results came from health-care, energy, and financial stocks. Among the top contributors was MedImmune, a biotechnology company that has developed treatments for cancer as well as infectious diseases. MedImmune’s strong pipeline of drugs has led to rising profits, and the stock price jumped in April when the company agreed to be acquired by AstraZeneca, a British pharmaceutical company.

In the financials sector, one of the best-performing stocks was Intercontinental Exchange. This company operates as an electronic marketplace for trading an array of energy products internationally. The stock benefited from both the strong performance of financial exchanges and from high energy prices. The fund held an overweight position in this stock relative to the benchmark, which enhanced its positive contribution to results.

In the technology sector, two of the top performers were Avnet and On Semiconductor Corp. The fund had overweight positions in both stocks relative to the benchmark. Avnet distributes electronic components for enterprise networks, and provides related services such as engineering design, materials management, and system configuration. On Semiconductor manufactures standard semiconductors as well as semiconductors designed to manage electrical power.

| 4 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Just as an overweight position in a strong performer can boost the fund’s gains from that holding, an overweight position in a stock that weakens can increase the negative impact of poor performance. We saw this scenario when the stock of Agnico-Eagle Mines, a Canadian mining company we had overweighted relative to the benchmark, declined in response to concerns about the possibility of a correction in prices for gold and zinc. In our view, these concerns about metals prices do not diminish the company’s growth potential and we are maintaining the position.

Please note that all holdings discussed in this report may not have been held by the fund for the entire period discussed, are subject to review in accordance with the fund’s investment strategy, and may vary in the future.

Of special interest

On February 1, 2007, Marsh & McLennan Companies, Inc. announced that it had signed a definitive agreement to sell its ownership interest in Putnam Investments Trust, the parent company of Putnam Management and its affiliates, to Great-West Lifeco Inc. Great-West Lifeco is a financial services holding company with operations in Canada, the United States, and Europe and is a member of the Power Financial Corporation group of companies. We are pleased to announce that in mid-May, shareholders voted overwhelmingly in favor of the proposed transaction. While it is still subject to regulatory approvals and other conditions, we currently expect the transaction to be completed in the middle of the year.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 5 |

The outlook for your fund

The following commentary reflects anticipated developments that could affect your fund over the next

six months, as well as your management team’s plans for responding to them.

Though equity markets were near record price levels at the close of the period, we do not consider stocks significantly overvalued. Corporate earnings continue to provide reasonable support to current valuations. In fact, the current level of corporate prosperity is fueling further market gains as shares are retired through repurchase programs as well as through mergers and acquisitions. In short, there is reason to believe equity markets could continue to advance. At present, we do not expect the Fed to implement further interest-rate increases; economic data appear to be softening just enough to weaken the outlook for inflation. Outside of the United States, meanwhile, the synchronized economic boom continues at full force, and appetite for risk-taking remains high among investors and business leaders.

Of course, we are also closely monitoring risks. The failures of subprime lenders and the ongoing weakness in the housing market point to one of the chief risks to growth in the U.S. economy. Also, after several years of strong growth of corporate profits, it would not be unusual to see some leveling off of profits. Fortunately, our mandate to invest in aggressive growth companies positions the fund in many companies that should be able to sustain growth even in weaker economic conditions. We will monitor these risks as we continue to execute the fund’s strategy of pursuing growth with a portfolio of public and private equities.

| 6 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Trustee approval of management contract

General conclusions

The Board of Trustees of your fund oversees the management of the fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with TH Lee, Putnam Capital Management, LLC. In this regard, the Board of Trustees requests and evaluates all information it deems reasonably necessary under the circumstances. On June 12, 2006, the Board of Trustees met to consider the information provided by the Manager and other information developed with the assistance of the Board’s independent counsel. Upon completion of this review, the Board of Trustees, following a vote by the Independent Trustees (those Trustees who are not “interested persons,” as defined in the Investment Company Act, of your fund or the Manager), approved the continuance of your fund’s management contract, effective July 27, 2006.

This approval was based on the following conclusions:

• That the fee schedule is, and since the inception of the fund has been, unusual and seeks appropriately to reflect fees charged by Putnam and competitive advisers in respect of the public and private securities portions of the fund’s portfolio, and in particular to reward successful investment decisions through the incentive fee applicable only to the private securities, and

• That the fee schedule currently in effect for your fund, including the base fee and incentive fee components, represents reasonable compensation in light of the nature and quality of the services being provided to the fund and the costs incurred by the Manager in providing such services.

These conclusions were based on a careful consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund are the result of several years of review and discussion between the Trustees and the Manager, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Services provided; investment performance

The quality of the investment process provided by the Manager represented a major factor in the Trustees’ evaluation of the quality of services provided by the Manager under your fund’s management contract. The Trustees concluded that the Manager generally provides a high-quality investment process but also recognize that this does not guarantee favorable investment results for the fund in every time period. The Trustees evaluated the experience and skills of the individuals assigned to the management of your fund’s public equity and private equity investments and the resources made available to such personnel. Recognizing that expertise of portfolio management personnel, particularly for private equity investments, is highly prized among competitive investment advisers, the Trustees have noted favorably the Manager’s commitment to retaining highly qualified personnel notwithstanding the relatively small size of the fund and the determination in early 2005 to suspend sales of fund shares.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 7 |

The Trustees considered the investment performance of your fund over the 1-year and since-inception periods ended March 31, 2006, and considered information comparing the fund’s performance with its benchmark index and with the performance of competitive funds. They also reviewed analysis provided by the Manager regarding the performance of your fund’s current and former private equity investments. Recognizing that the incentive fee component of the fund’s management fee is tied to the performance of these investments, the Trustees noted the amounts your fund has accrued as incentive fees payable to the Manager under your fund’s management contract as a result of appreciation in the value of these investments. They also noted that the Manager had not actually received any incentive fees from the fund to date. The Trustees also reviewed an analysis from the Manager of the costs of the services provided and profits realized by the Manager from the relationship with the fund in 2005.

Competitiveness

The Trustees reviewed comparative fee and expense information for other closed-end funds investing both in public and private equities, and noted that your fund’s management fees were generally lower than those of these funds. The Trustees noted in addition that the Manager has agreed to reimburse the fund to the extent that total fund expenses (exclusive of incentive fees payable under the management contract) exceed 1.85% of average annual assets through October 31, 2007.

The Trustees noted that your fund is the only client of the Manager, and that your fund is unique among all registered investment companies managed by affiliates of the Manager with respect to its investment objective and fee structure. The Trustees also noted generally that in providing services to the fund under the management contract, the Manager is able to a large degree to utilize the resources of Putnam Investments, and that the fund would probably not be able to obtain these services for the same or lower costs if the Manager were not able to leverage its association with a large mutual fund manager.

The Trustees have been satisfied that the fund’s fee structure appropriately mediates the fees charged by Putnam Investments and competitors on portfolios of publicly traded securities and those (including both asset-based fees and incentive fees) charged by managers of private securities. Accordingly, the Trustees did not attribute great weight to a comparative review of fees paid by other funds and institutional accounts whose assets are managed by the Manager’s affiliates.

Economies of scale

The Trustees noted that the fund’s fee structure does not have breakpoints (which lower the net effective fee rate as assets grow), that the Manager is compensated under the incentive fee only if the performance of the fund’s private assets is successful and that, since inception, the fund’s expenses have been limited by the Manager. The Trustees also noted that the fund’s assets as of May 31, 2006, were approximately $65 million and that, because your fund is presently not open to new investments, regular quarterly repurchases of five percent of the fund’s shares have diminished the fund’s assets (to the extent they have not been offset by appreciation of the fund’s portfolio holdings). The Trustees expressed their intent to consider whether the current fee arrangements remain appropriate if and when the fund is reopened to new investments and fund assets increase.

| 8 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that the Manager may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment adviser. This area has been marked by significant change in recent years. The Trustees noted that Putnam has revised its soft-dollar policies to significantly reduce the allocation of client brokerage commissions to purchase third-party research services, and that such allocation continues at a modest level only to acquire research that is not customarily available for cash.

The Trustees’ annual review of your fund’s management contract also included the review of its administrative services contract with the Manager and its distributor’s contract with Putnam Retail Management Limited Partnership (“PRM”) and a report from the Manager on the custodian agreement and investor servicing agreements between the fund and Putnam Fiduciary Trust Company (“PFTC”). PRM and PFTC are affiliates of the Manager. PFTC benefits from the fund’s custodian and investor servicing agreements, and PRM benefits from the fund’s distributor’s contract at times when the fund is open to new investments.

Approval of new management contract in connection with pending change in control

On February 1, 2007, Marsh & McLennan Companies, Inc. announced that it had signed a definitive agreement to sell its ownership interest in Putnam Investments Trust, the parent company of TH Lee, Putnam Capital Management, LLC and its affiliates, to Great-West Lifeco Inc., a member of the Power Financial Corporation group of companies. In mid-May, shareholders voted overwhelmingly in favor of the proposed transaction. While the transaction is still subject to regulatory approvals and other conditions, it is currently expected to be completed in the summer of 2007.

At an in-person meeting on March 12, 2007, the Trustees considered the approval of a new management contract between your fund and the Manager, proposed to become effective upon the closing of the transaction, and the filing of a preliminary proxy statement. They reviewed the terms of the proposed new management contract and the differences between the proposed new management contract and the current management contract. They noted that the terms of the proposed new management contract were substantially identical to the current management contracts, except for one change meant to clarify that the end of the initial period for measuring the eligibility of the Manager to receive an incentive fee from the fund will be October 31, 2007 (to coincide with the end of the fund’s current fiscal year); the Trustees noted that this change from the current management contract will neither increase nor decrease the incentive fee, if any, payable by the fund. In considering the approval of the proposed new management contracts, the Trustees also considered, as discussed further in the proxy statement, various matters relating to the transaction. Finally, in considering the proposed new management contract, the Trustees also took into account their deliberations and conclusions (discussed above in the preceding paragraphs of the “Trustee Approval of Management Contract” section) in connection with the most recent annual approval of the

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 9 |

continuance of the fund’s management contract effective July 27, 2006, and the extensive materials that they had reviewed in connection with that approval process. Based upon the foregoing considerations, on March 9, 2007, the Trustees unanimously approved the proposed new management contract and determined to recommend their approval to the shareholders of the fund.

| 10 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

The fund’s portfolio

| April 30, 2007 (Unaudited) | | | | |

|

| |

| Common stocks (97.9%)* | | | | |

| | SHARES | | | VALUE |

|

| |

| |

| Basic Materials (2.7%) | | | | |

|

| |

| Agnico-Eagle Mines, Ltd. (Canada) | 9,900 | | $ | 349,272 |

| Ceradyne, Inc. † | 4,600 | | | 270,710 |

| Cleveland-Cliffs, Inc. | 2,400 | | | 166,296 |

| Freeport-McMoRan Copper & Gold, Inc. Class B | 4,200 | | | 282,072 |

| Goldcorp, Inc. (Canada) | 6,350 | | | 154,559 |

| Hecla Mining Co. † | 18,072 | | | 159,214 |

| PAN American Silver Corp. (Canada) † | 5,600 | | | 158,200 |

| Quanex Corp. | 1,684 | | | 72,463 |

| Steel Dynamics, Inc. | 4,454 | | | 197,357 |

| |

|

| | | | | 1,810,143 |

| |

| Capital Goods (4.5%) | | | | |

|

| |

| Actuant Corp. Class A | 4,200 | | | 222,600 |

| Alliant Techsystems, Inc. † | 1,700 | | | 158,321 |

| Cummins, Inc. | 3,000 | | | 276,480 |

| Curtiss-Wright Corp. | 5,200 | | | 224,068 |

| Dover Corp. | 2,200 | | | 105,864 |

| Foster Wheeler, Ltd. † | 3,800 | | | 261,554 |

| Gardner Denver, Inc. † | 8,129 | | | 307,276 |

| Lincoln Electric Holdings, Inc. | 3,700 | | | 235,801 |

| Parker-Hannifin Corp. | 2,900 | | | 267,206 |

| Superior Essex, Inc. † | 4,100 | | | 146,370 |

| Timken Co. | 6,100 | | | 201,178 |

| Wabtec Corp. | 9,100 | | | 338,065 |

| WESCO International, Inc. † | 4,500 | | | 284,265 |

| |

|

| | | | | 3,029,048 |

| |

| Consumer Cyclicals (9.8%) | | | | |

|

| |

| A.C. Moore Arts & Crafts, Inc. † | 8,800 | | | 180,664 |

| Abercrombie & Fitch Co. Class A | 3,900 | | | 318,474 |

| Advance Auto Parts, Inc. | 5,400 | | | 222,480 |

| AnnTaylor Stores Corp. † | 5,900 | | | 227,032 |

| Chemed Corp. | 6,400 | | | 321,920 |

| Dollar Tree Stores, Inc. † | 3,700 | | | 145,484 |

| Dress Barn, Inc. † | 14,900 | | | 296,659 |

| Equifax, Inc. | 5,700 | | | 226,860 |

| Expedia, Inc. † | 11,400 | | | 269,268 |

| FTD Group, Inc. | 18,700 | | | 333,795 |

| Genlyte Group, Inc. (The) † | 2,800 | | | 218,428 |

| infoUSA, Inc. | 16,000 | | | 150,240 |

| Jakks Pacific, Inc. † | 10,000 | | | 240,300 |

| Maidenform Brands, Inc. † | 9,600 | | | 195,744 |

| Manpower, Inc. | 3,400 | | | 272,850 |

| Morningstar, Inc. † | 4,000 | | | 208,280 |

| Navigant Consulting, Inc. † | 13,300 | | | 255,094 |

| OfficeMax, Inc. | 5,500 | | | 270,710 |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 11 |

The fund’s portfolio

| Common stocks | | | | |

| | SHARES | | | VALUE |

|

| |

| |

| Consumer Cyclicals (continued) | | | | |

|

| |

| Pre-Paid Legal Services, Inc. † | 5,600 | | $ | 319,480 |

| RC2 Corp. † | 7,500 | | | 298,950 |

| Ross Stores, Inc. | 5,600 | | | 185,640 |

| Select Comfort Corp. † | 13,900 | | | 257,706 |

| Sherwin-Williams Co. (The) | 3,000 | | | 191,310 |

| Tenneco Automotive, Inc. † | 7,900 | | | 236,605 |

| Timberland Co. (The) Class A † | 6,900 | | | 178,089 |

| Town Sports International Holdings, Inc. † | 2,100 | | | 47,859 |

| Whirlpool Corp. | 4,600 | | | 487,738 |

| |

|

| | | | | 6,557,659 |

| |

| Consumer Staples (24.6%) | | | | |

|

| |

| Administaff, Inc. | 6,900 | | | 229,011 |

| Beacon Roofing Supply, Inc. † | 17,100 | | | 268,983 |

| Capella Education Co. (acquired 2/14/02, | | | | |

| cost $2,754,469) (F) ‡ † | 449,640 | | | 14,143,419 |

| Career Education Corp. † | 8,200 | | | 242,228 |

| Central European Distribution Corp. † | 7,000 | | | 208,250 |

| Domino’s Pizza, Inc. | 13,300 | | | 428,925 |

| Jack in the Box, Inc. † | 2,200 | | | 146,564 |

| Nutri/System, Inc. † | 4,400 | | | 272,800 |

| Papa John’s International, Inc. † | 6,500 | | | 199,615 |

| Sonic Corp. † | 6,900 | | | 154,836 |

| USANA Health Sciences, Inc. † | 5,200 | | | 207,168 |

| |

|

| | | | | 16,501,799 |

| |

| Energy (2.8%) | | | | |

|

| |

| ATP Oil & Gas Corp. † | 4,100 | | | 178,186 |

| Cameron International Corp. † | 5,000 | | | 322,850 |

| FMC Technologies, Inc. † | 2,500 | | | 177,200 |

| Grant Prideco, Inc. † | 4,200 | | | 216,468 |

| Helix Energy Solutions Group, Inc. † | 3,700 | | | 141,562 |

| Helmerich & Payne, Inc. | 6,100 | | | 196,969 |

| National-Oilwell Varco, Inc. † | 4,500 | | | 381,825 |

| Smith International, Inc. | 4,400 | | | 230,736 |

| |

|

| | | | | 1,845,796 |

| |

| Financial (3.0%) | | | | |

|

| |

| Advanta Corp. Class B | 5,500 | | | 252,010 |

| Affiliated Managers Group † | 2,500 | | | 294,075 |

| CB Richard Ellis Group, Inc. Class A † | 8,400 | | | 284,340 |

| FCStone Group, Inc. † | 1,766 | | | 79,576 |

| HFF, Inc. Class A † | 4,500 | | | 71,910 |

| Hilb, Rogal & Hamilton Co. | 3,900 | | | 169,455 |

| IntercontinentalExchange, Inc. † | 2,340 | | | 297,180 |

| Nasdaq Stock Market, Inc. (The) † | 6,900 | | | 224,664 |

| Penson Worldwide, Inc. † | 7,600 | | | 203,832 |

| Safety Insurance Group, Inc. | 3,800 | | | 152,228 |

| |

|

| | | | | 2,029,270 |

12 TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007

The fund’s portfolio

| Common stocks | | | | |

| |

| | SHARES | | | VALUE |

|

| |

| |

| Health Care (12.0%) | | | | |

|

| |

| Alnylam Pharmaceuticals, Inc. † | 5,500 | | $ | 103,235 |

| AMERIGROUP Corp. † | 8,800 | | | 247,544 |

| AmSurg Corp. † | 4,800 | | | 110,160 |

| Barr Pharmaceuticals, Inc. † | 5,300 | | | 256,308 |

| BioMarin Pharmaceuticals, Inc. † | 6,300 | | | 101,808 |

| C.R. Bard, Inc. | 4,600 | | | 382,398 |

| Cephalon, Inc. † | 8,100 | | | 644,841 |

| Charles River Laboratories International, Inc. † | 5,000 | | | 236,800 |

| Dade Behring Holdings, Inc. | 6,200 | | | 304,482 |

| DENTSPLY International, Inc. | 10,100 | | | 337,441 |

| Edwards Lifesciences Corp. † | 7,300 | | | 357,700 |

| Hospira, Inc. † | 10,775 | | | 436,926 |

| Kinetic Concepts, Inc. † | 5,450 | | | 272,500 |

| Laboratory Corp. of America Holdings † | 7,000 | | | 552,580 |

| LifePoint Hospitals, Inc. † | 6,300 | | | 230,013 |

| Medicines Co. † | 9,700 | | | 220,966 |

| Mylan Laboratories, Inc. | 14,964 | | | 328,161 |

| PDL BioPharma, Inc. † | 14,000 | | | 353,640 |

| Restore Medical, Inc. † § | 862,069 | | | 2,146,552 |

| Salix Pharmaceuticals, Ltd. † | 13,100 | | | 170,562 |

| WellCare Health Plans, Inc. † | 3,400 | | | 274,006 |

| |

|

| | | | | 8,068,623 |

| |

| Technology (38.0%) | | | | |

|

| |

| Advanced Energy Industries, Inc. † | 5,800 | | | 142,100 |

| Amphenol Corp. Class A | 11,600 | | | 407,276 |

| Avaya, Inc. † | 18,300 | | | 236,436 |

| Avnet, Inc. † | 7,400 | | | 302,660 |

| Avocent Corp. † | 4,900 | | | 137,249 |

| Brooks Automation, Inc. † | 9,100 | | | 158,977 |

| Cadence Design Systems, Inc. † | 15,800 | | | 350,760 |

| Checkfree Corp. † | 3,400 | | | 114,444 |

| Commvault Systems, Inc. † | 1,127,926 | | | 19,129,755 |

| Cymer, Inc. † | 5,700 | | | 230,907 |

| Electronics for Imaging, Inc. † | 6,300 | | | 168,021 |

| Epicor Software Corp. † | 21,300 | | | 308,850 |

| Fiserv, Inc. † | 3,900 | | | 207,363 |

| Formfactor, Inc. † | 5,981 | | | 246,955 |

| General Cable Corp. † | 3,500 | | | 201,040 |

| Glu Mobile, Inc. † | 10,150 | | | 114,035 |

| Harris Corp. | 5,356 | | | 275,031 |

| Jack Henry & Associates, Inc. | 9,900 | | | 235,125 |

| Lam Research Corp. † | 4,200 | | | 225,876 |

| LSI Logic Corp. † | 18,672 | | | 158,712 |

| Manhattan Associates, Inc. † | 6,100 | | | 176,412 |

| Mentor Graphics Corp. † | 11,600 | | | 187,688 |

| Micrel, Inc. | 15,500 | | | 194,525 |

| ON Semiconductor Corp. † | 23,200 | | | 248,472 |

| Parametric Technology Corp. † | 12,000 | | | 213,240 |

| RF Micro Devices, Inc. † | 44,600 | | | 278,750 |

| Sybase, Inc. † | 13,200 | | | 319,308 |

| Tekelec † | 16,800 | | | 240,912 |

| Trimble Navigation, Ltd. † | 5,800 | | | 166,344 |

| TTM Technologies, Inc. † | 18,000 | | | 165,240 |

| |

|

| | | | 25,542,463 |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 13 |

The fund’s portfolio

| Common stocks | | | | |

| | SHARES | | | VALUE |

|

| |

| Transportation (0.5%) | | | | |

|

| Omega Navigation Enterprises, Inc. | 9,600 | | $ | 189,792 |

| Ultrapetrol, Ltd. (Bahamas) † | 7,140 | | | 149,940 |

| |

|

| | | | | 339,732 |

| |

|

| Total common stocks (cost $38,626,292) | | | $65,724,533 |

| |

| Convertible preferred stocks (—%)* | | | | |

| | SHARES | | | VALUE |

|

| Refractec, 8% cv. bridge notes (acquired 1/31/07, | | | | |

| cost $450,000) (Private) (F) ‡ † § | 1 | | $ | 45 |

| Refractec Ser. D, zero % cv. pfd. (acquired various | | | | |

| dates from 8/16/02 through 6/30/03, | | | | |

| cost $4,999,998) (Private) (F) ‡ † § | 833,333 | | | 833 |

| |

|

| Total convertible preferred stocks (cost $5,449,998) | | | $ | 878 |

| |

| Short-term Investments (8.3%)* (cost $5,573,000) | | | |

| | PRINCIPAL AMOUNT | | | VALUE |

|

| Repurchase agreement dated April 30, 2007 with Bank | | | | |

| of America due May 1, 2007 with respect to various | | | | |

| U.S. Government obligations — maturity value | | | | |

| of $5,573,805 for an effective yield of 5.2% | | | | |

| (collateralized by Federal Home Loan Bank 5.625% | | | | |

| due 10/2/08 valued at $5,621,337) | $5,573,000 | | $ 5,573,000 |

|

| Total investments (cost $49,649,290) | | | $ | 71,298,411 |

|

* Percentages indicated are based on net assets of $67,106,323.

† Non-income-producing security.

‡ Restricted, excluding 144A securities, as to public resale. The total market value of restricted securities held at April 30, 2007 was $14,144,297 or 21.1% of net assets.

§ Affiliated Companies (Note 4).

(F) Security is valued at fair value following procedures approved by the Trustees (Note 1).

At April 30, 2007, liquid assets totaling $57,622 have been designated as collateral for open options contracts.

The accompanying notes are an integral part of these financial statements.

Written options outstanding at April 30, 2007

(premiums received $1,287)(Unaudited)

| | | CONTRACT | | EXPIRATION DATE/ | | |

| | | AMOUNT | | STRIKE PRICE | | VALUE |

|

| |

| Grant Prideco, Inc. | | $420 | | May 07/$54.71 | | $ 475 |

| Nutri/System, Inc. | | 560 | | May 07/$61.86 | | 1,428 |

| |

|

| | | | | | | $1,903 |

| 14 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Statement of assets and liabilities

| April 30, 2007 (Unaudited) | |

|

| |

| Assets | |

|

| Investment in securities, at value (Note 1): | |

|

| Unaffiliated issuers (identified cost $41,189,623) | $69,150,981 |

|

| Affiliated issuers (identified cost $8,459,667) (Note 4) | 2,147,430 |

|

| Cash | 22,407 |

|

| Dividends and other receivables | 10,437 |

|

| Receivable for securities sold | 899,541 |

|

| Total assets | 72,230,796 |

|

| |

| Liabilities | |

|

| Payable for securities purchased | 1,142,185 |

|

| Payable for shareholder servicing fee (Note 2) | 45,260 |

|

| Payable for compensation of Manager (Note 2) | 133,148 |

|

| Accrual for incentive fee (Note 2) | 3,709,161 |

|

| Payable for investor servicing and custodian fees (Note 2) | 10,484 |

|

| Payable for administrative services (Note 2) | 10,795 |

|

| Written options outstanding, at value (premiums received $1,287) (Notes 1 and 3) | 1,903 |

|

| Other accrued expenses | 71,537 |

|

| Total liabilities | 5,124,473 |

|

| Net assets | $67,106,323 |

|

| |

| Represented by | |

|

| Paid-in capital (10,000,000 unlimited shares authorized) (Note 1) | $43,328,393 |

|

| Accumulated net investment loss (Note 1) | (1,706,970) |

|

| Accumulated net realized gain on investments (Note 1) | 3,836,395 |

|

| Net unrealized appreciation of investments | 21,648,505 |

|

| Total — Representing net assets applicable to capital shares outstanding | $67,106,323 |

|

| |

| Computation of net asset value | |

|

| Net asset value and redemption price per common share | |

| ($67,106,323 divided by 2,146,864 shares) | $31.26 |

|

| Offering price class common share (100/$95.75 of $31.26)* | $32.65 |

|

* On single retail shares of less than $500,000. On sales of $500,000 or more, the offering price is reduced.

The accompanying notes are an integral part of these financial statements.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 15 |

Statement of operations

| Six months ended 4/30/07 (Unaudited) | |

|

| |

| Investment income: | |

|

| Dividends (net of foreign tax of $345) | $ 782,282 |

|

| Interest | 125,030 |

|

| Total investment income | 907,312 |

|

| |

| Expenses: | |

|

| Compensation of Manager (Note 2) | 383,237 |

|

| Incentive fee (Note 2) | 2,028,205 |

|

| Investor servicing fees (Note 2) | 15,413 |

|

| Custodian fees (Note 2) | 19,851 |

|

| Trustee compensation and expenses (Note 2) | 38,228 |

|

| Administrative services (Note 2) | 32,277 |

|

| Shareholder servicing fees (Note 2) | 68,065 |

|

| Other | 109,312 |

|

| Fees waived and reimbursed by Manager (Note 2) | (75,797) |

|

| Total expenses | 2,618,791 |

|

| Expense reduction (Note 2) | (4,509) |

|

| Net expenses | 2,614,282 |

|

| Net investment loss | (1,706,970) |

|

| Net realized gain on investments (Notes 1 and 3) | 4,005,603 |

|

| Net realized loss on written options (Notes 1 and 3) | (6,740) |

|

| Net unrealized appreciation of investments and written | |

| options during the period | 9,220,265 |

|

| Net gain on investments | 13,219,128 |

|

| Net increase in net assets resulting from operations | $11,512,158 |

|

| The accompanying notes are an integral part of these financial statements. | |

| 16 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Statement of changes in net assets

| | Six months ended | | Year ended |

| | April 30 | | October 31 |

| | 2007* | | 2006 |

|

| |

| Increase (decrease) in net assets | | | |

|

| Operations: | | | |

|

| Net investment loss | $ (1,706,970) | | $ (1,517,160) |

|

| Net realized gain on investments | 3,998,863 | | 5,472,533 |

|

| Net unrealized appreciation of investments | 9,220,265 | | 4,099,745 |

|

| Net increase in net assets resulting from operations | 11,512,158 | | 8,055,118 |

|

| Distributions to shareholders (Note 1): | | | |

|

| From ordinary income | | | |

|

| Net realized short-term gain on investments | (653,931) | | (2,882,477) |

|

| From net realized long-term gain on investments | (3,216,230) | | (4,811,953) |

|

| |

| Capital share transactions: | | | |

|

| Reinvestments in connection with distributions | 3,449,045 | | 6,992,072 |

|

| Cost of shares repurchased (Note 5) | (6,533,609) | | (12,663,978) |

|

| Decrease from capital share transactions | (3,084,564) | | (5,671,906) |

|

| Total increase (decrease) in net assets | 4,557,433 | | (5,311,218) |

|

| |

| Net assets | | | |

|

| Beginning of period | 62,548,890 | | 67,860,108 |

|

| End of period | $67,106,323 | | $62,548,890 |

|

| |

| Number of fund shares | | | |

|

| Shares outstanding at beginning of period | 2,248,878 | | 2,438,393 |

|

| Shares reinvested | 123,048 | | 276,125 |

|

| Shares repurchased (Note 5) | (225,062) | | (465,640) |

|

| Shares outstanding at end of period | 2,146,864 | | 2,248,878 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 17 |

Statement of cash flows

| For the six months ended 4/30/07 (Unaudited) | |

|

| |

| Increase in cash | |

|

| Cash flows from operating activities: | |

|

| Net increase in net assets from operations | $11,512,158 |

|

| Adjustments to reconcile net increase in net assets | |

| from operations to net cash used in operating activities: | |

|

| Purchase of investment securities | (17,802,187) |

|

| Proceeds from disposition of investment securities | 26,999,053 |

|

| Purchase of short-term investment securities, net | (2,574,000) |

|

| Increase in dividends receivable | (6,056) |

|

| Increase in payable for shareholder servicing fees | 33,764 |

|

| Increase in payable for compensation of Manager | 32,434 |

|

| Increase in incentive fee accrual | 2,028,205 |

|

| Decrease in payable for investor servicing and custodian fees | (8,563) |

|

| Net decrease in premiums received on written options | (22,488) |

|

| Increase in payable for administration services | 5,696 |

|

| Decrease in other accrued expenses | (3,275) |

|

| Net realized gain on investments | (4,001,571) |

|

| Net unrealized appreciation on investments during the period | (9,220,265) |

|

| Net cash provided by operating and investing activities | 6,972,905 |

|

| Cash flows from financing activities: | |

|

| Payment of shares redeemed | (6,533,609) |

|

| Cash distribution to shareholders paid | (421,116) |

|

| Net cash used in financing activities | (6,954,725) |

|

| Net increase in cash | 18,180 |

|

| Cash balance, beginning of period | 4,227 |

|

| Cash balance, end of period | $22,407 |

|

| The accompanying notes are an integral part of these financial statements. | |

| 18 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Financial highlights

(For a common share outstanding throughout the period)

| Per-share | Six months ended** | | Year ended | | |

| operating performance | 4/30/07 | 10/31/06 | 10/31/05 | 10/31/04 | 10/31/03 | 10/31/02 |

|

| Net asset value, | | | | | | | |

| beginning of period | | $27.81 | $27.83 | $26.54 | $25.32 | $18.91 | $22.44 |

|

| Investment operations: | | | | | | | |

|

| Net investment income (loss)(a,b) | (.78) | (.63) | (.34)(f) | (.59) | (.45) | (.38) |

|

| Net realized and unrealized | | | | | | | |

| gain (loss) on investments | | 6.04 | 3.89 | 2.13 | 1.81 | 6.86 | (3.11) |

|

| Total from | | | | | | | |

| investment operations | | 5.26 | 3.26 | 1.79 | 1.22 | 6.41 | (3.49) |

|

| Less distributions: | | | | | | | |

|

| From net investment income | — | — | — | — | — | (.04) |

|

| From net realized gain | | | | | | | |

| on investments | | (1.81) | (3.28) | (.50) | — | — | — |

|

| From return of capital | | — | — | — | — | — | —(e) |

|

| Total distributions | | (1.81) | (3.28) | (.50) | — | — | (.04) |

|

| Net asset value, | | | | | | | |

| end of period | | $31.26 | $27.81 | $27.83 | $26.54 | $25.32 | $18.91 |

|

| Total return at net asset value | | | | | | |

| after incentive fee (%)(c) | | 19.67* | 12.86 | 6.78 | 4.82 | 33.90 | (15.61) |

|

| Total return at net asset value | | | | | | |

| before incentive fee (%)(c) | | 22.65* | 14.13 | 7.07 | 5.53 | 34.43 | (15.61) |

|

| |

| Ratios And Supplemental Data | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in thousands) | | $67,106 | $62,549 | $67,860 | $77,542 | $90,020 | $73,682 |

|

| Ratio of expenses to average net | | | | | | |

| assets after incentive fee (%)(b,d) | 4.07* | 2.93 | 2.00 | 2.49 | 2.30 | 2.21 |

|

| Ratio of expenses to average net | | | | | | |

| assets before incentive fee (%)(b,d) | .92* | 1.85 | 1.85 | 1.85 | 1.85 | 2.21 |

|

| Ratio of net investment loss to average | | | | | |

| net assets after incentive fee (%)(b) | (2.65)* | (2.31) | (1.23)(f) | (2.30) | (2.17) | (1.76) |

|

| Portfolio turnover rate (%) | | 25.96* | 57.01 | 103.14 | 100.29 | 93.90 | 102.88 |

|

* Not annualized.

** Unaudited.

(a) Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

(b) Reflects an expense limitation in effect during the period (Note 2). As a result of such limitation, expenses of the fund for the periods ended April 30, 2007, October 31, 2006, October 31, 2005, October 31, 2004, October 31, 2003 and October 31, 2002 reflect a reduction of 0.12%, 0.23%, 0.19%, 0.15%, 0.10% and 0.07%, respectively, based on average net assets.

(c) Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

(d) Includes amounts paid through expense offset arrangements (Note 2).

(e) Amount represents less than $0.01 per share.

(f) Reflects a non-recurring accrual related to Putnam Management’s settlement with the SEC regarding brokerage allocation practices, which amounted to less than $0.01 per share and 0.02% of average net assets.

The accompanying notes are an integral part of these financial statements.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 19 |

Notes to financial statements

April 30, 2007 (Unaudited)

Note 1 Significant accounting policies

TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”), is a series of TH Lee, Putnam Investment Trust (the “trust”), which is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. The objective of the fund is to seek long-term capital appreciation by investing at least 80% of its total assets in publicly traded growth stocks and privately issued venture capital investments. The fund may invest up to 50% of its portfolio in private equity investments as well as up to 5% of its assets in private equity funds.

The fund offers its shares at net asset value plus a maximum front-end sales charge of 4.25% . The fund provides a limited degree of liquidity to its shareholders by conducting quarterly repurchase offers. In each repurchase offer, the fund intends to repurchase 5% of its outstanding shares at their net asset value. The fund may also, at any time, conduct additional sales of its shares to qualified clients, as defined in the Investment Advisers Act of 1940, as amended. Effective January 26, 2005, the Trustees closed the fund to any new sales (except through dividend reinvestments) of shares. The Trustees may consider reopening the fund to new sales of shares again if current conditions change.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets. If no sales are reported — as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price. Market quotations are not considered to be readily available for private equity securities: such investments are initially valued at cost and then stated at fair value following procedures approved by the Trustees. As part of those procedures, TH Lee, Putnam Capital Management, LLC (the “Manager“), a subsidiary of TH Lee, Putnam Capital, L.P. (a joint venture of Putnam Investment Holdings, LLC, which in turn is an indirect subsidiary of Putnam LLC (“Putnam”) and Thomas H. Lee Partners, LP) will monitor each fair valued security on a daily basis and will adjust its value, as

| 20 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

necessary, based on such factors as the financial and/or operating results, the general developments in the issuer’s business including products and services offered, management changes, changes in contracts with customers, issues relating to financing, the likelihood of a public offering, the liquidity of the security, any legal or contractual restrictions, the value of an unrestricted related public security and other analytical data. Restricted securities of the same class as publicly traded securities will be valued at a discount from the public market price reflecting the nature and extent of the restriction. The discount applied to securities subject to resale restrictions with known expirations will be reduced according to a specified timetable as the applicable expiration approaches.

Securities fair valued at April 30, 2007 represented 21.1% of the fund’s net assets. Fair value prices may differ materially from the value that would be realized if the fair-valued securities were sold. Securities quoted in foreign currencies are translated into U.S. dollars at the current exchange rate. For foreign investments, if trading or events occurring in other markets after the close of the principal exchange in which the securities are traded are expected to materially affect the value of the investments, then those investments are valued, taking into consideration these events, at their fair value. Short-term investments having remaining maturities of 60 days or less are stated at amortized cost, which approximates fair value.

B) Security transactions and related investment income

Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis. Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain.

C) Repurchase agreements

The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. The Manager is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest.

D) Futures and options contracts

The fund may use futures and options contracts to hedge against changes in the values of securities the fund owns or expects to purchase, or for other investment purposes. The fund may also write options on swaps or securities it owns or in which it may invest to increase its current returns.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 21 |

The potential risk to the fund is that the change in value of futures and options contracts may not correspond to the change in value of the hedged instruments. In addition, losses may arise from changes in the value of the underlying instruments, if there is an illiquid secondary market for the contracts, or if the counterparty to the contract is unable to perform. Risks may exceed amounts recognized on the Statement of assets and liabilities. When the contract is closed, the fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. Realized gains and losses on purchased options are included in realized gains and losses on investment securities. If a written call option is exercised, the premium originally received is recorded as an addition to sales proceeds. If a written put option is exercised, the premium originally received is recorded as a reduction to the cost of investments.

Futures contracts are valued at the quoted daily settlement prices established by the exchange on which they trade. The fund and the broker agree to exchange an amount of cash equal to the daily fluctuation in the value of the futures contract. Such receipts or payments are known as “variation margin.” Exchange traded options are valued at the last sale price or, if no sales are reported, the last bid price for purchased options and the last ask price for written options. Options traded over-the-counter are valued using prices supplied by dealers. Futures and written option contracts outstanding at period end, if any, are listed after the fund’s portfolio.

E) Federal taxes

It is the policy of the fund to distribute all of its taxable income within the prescribed time and otherwise comply with the provisions of the Internal Revenue Code of 1986 (the “Code”) applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code, as amended. Therefore, no provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains.

The aggregate identified cost on a tax basis is $49,703,182, resulting in gross unrealized appreciation and depreciation of $28,461,948 and $6,866,719, respectively, or net unrealized appreciation of $21,595,229.

F) Distributions to shareholders

Distributions to shareholders from net investment income are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

| 22 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

G) Deal related costs

Deal related costs are comprised primarily of legal and consulting costs incurred in connection with private equity investment transactions of the fund, whether or not consummated. Deal related costs that are attributable to existing private equity securities are added to the cost basis of the investments. All other deal related costs are expensed as incurred.

H) Statement of cash flows

The cash amount shown in the Statement of cash flows is the amount reported as cash in the fund’s Statement of assets and liabilities and represents cash on hand at its custodian and does not include any short-term investments at April 30, 2007.

Note 2 Management fee, administrative services and other transactions

The fund has entered into a Management Contract with the Manager. As compensation for the services rendered and expenses borne by the Manager, the fund pays the Manager a fee at an annual rate of 1.20% of the average daily net assets of the fund, computed daily and payable monthly.

In addition, the fund will accrue daily a liability for incentive fees payable equal to 20% of the realized and unrealized gains less realized and unrealized losses on investments that were originally purchased by the fund in private equity transactions. The fund will not accrue an incentive fee unless all realized and unrealized losses from prior periods have been offset by realized (and, where applicable unrealized) gains. The fund will pay annually, on December 31, to the Manager a fee equal to 20% of the aggregate incentive fee base, calculated from the commencement of the fund’s operations, less the cumulative amount of the incentive fee paid to the Manager in previous periods. The incentive fee base for a private equity security equals realized gains less realized and unrealized losses until the issuer of the security has completed an initial public offering and any applicable lockup period has expired and, thereafter, equals realized and unrealized gains less realized and unrealized losses. In the case of private equity funds, the incentive fee base equals the sum of all amounts that are actually distributed to the fund less realized and unrealized losses. The fund does not pay any incentive fee on a private equity holding until the fund sells the holding or the holding becomes freely sellable, although the fund will continue to accrue a liability with respect to additional unrealized gains for such security. At April 30, 2007, incentive fees totaling $3,709,161 have been accrued based on the aggregate incentive fee base, of which $2,028,205 was accrued for the six months ended April 30, 2007.

The Manager has agreed to limit its compensation (and, to the extent necessary, bear other expenses) through October 31, 2007, to the extent that expenses of the fund (exclusive of the incentive fee, interest expense on any borrowings, offering costs and any extraordinary expenses) exceed an annual rate of 1.85% of its average daily net assets.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 23 |

The fund has entered into an Administrative Services Contract with Putnam Fiduciary Trust Company (“PFTC”), an affiliate of the Manager, to provide administrative services, including fund accounting and the pricing of the fund shares. As compensation for the services, the fund pays PFTC a fee at an annual rate of 0.10% of the average daily net assets of the fund, computed daily and payable monthly.

Custodial functions for the fund’s assets were provided by PFTC and by State Street Bank and Trust Company. Custody fees are based on the fund’s asset level, the number of its security holdings and transaction volumes. Putnam Investor Services, a division of PFTC, provided investor servicing agent functions to the fund. Putnam Investor Services received fees for investor servicing based on the number of shareholder accounts. During the six months ended April 30, 2007, the fund incurred $28,802 for custody and investor servicing agent functions provided by PFTC.

The fund has entered into arrangements with PFTC and State Street Bank and Trust Company whereby PFTC’s and State Street Bank and Trust Company’s fees are reduced by credits allowed on cash balances. For the six months ended, the fund’s expenses were reduced by $4,509 under these arrangements.

Each independent Trustee of the trust receives an annual Trustee fee of $25,000. Trustees receive additional fees for attendance at certain committee meetings.

The fund intends to pay compensation to selected brokers and dealers that are not affiliated with the fund, the Manager or Putnam that hold shares for their customers in accordance with the shareholder servicing agreements between the fund and the brokers and dealers. The shareholder servicing fee is accrued daily and payable quarterly at an annual rate of 0.25% of the average daily net assets attributable to outstanding shares beneficially owned by customers of the brokers and dealers.

For the six months ended April 30, 2007, Putnam Retail Management, acting as underwriter received no net commissions from the sale of common shares.

Note 3 Purchases and sales of securities

During the six months ended April 30, 2007, cost of purchases and proceeds from sales of investment securities other than short-term investments aggregated $18,721,184 and $27,834,272, respectively. There were no purchases or sales of U.S. government securities.

| 24 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

| Written option transactions during the period are summarized as follows: | |

|

| | | | Contract | | Premiums | |

| | | | Amounts | | Received | |

|

| Written options outstanding at | | | |

| beginning of period | | | 12,800 | | $ 23,775 | |

|

| Options opened | | | 41,212 | | 33,074 | |

| Options exercised | | | (5,243) | | (3,902) | |

| Options expired | | | (44,589) | | (47,420) | |

| Options closed | | | (3,200) | | (4,240) | |

|

| Written options outstanding | | | |

| at end of period | | | 980 | | $ 1,287 | |

|

| |

| Note 4 Transactions with affiliated issuers | | |

| |

| Transactions during the six months with companies in which the fund owned at least 5% of the voting |

| securities were as follows: | | | |

| |

| Name of Affiliates | Purchase cost | Sales cost | Dividend Income | Fair Value |

|

| Refractec | $— | $— | $— | $ 833 | |

| Refractec 8% cv. | | | | |

| bridge note | 450,000 | — | — | 45 | |

| Restore Medical | — | — | — | 2,146,552 | |

|

| Totals | $450,000 | $— | $— | $2,147,430 | |

|

Fair value amounts are shown for issues that are affiliated at period end.

Note 5 Share repurchase

To provide liquidity to the shareholders, the fund has a policy of making offers to repurchase a portion of its shares on a quarterly basis. Repurchases are made in February, May, August and November of each year. Repurchase offers are made for at least 5% (but not more than 25%) of its shares in any quarter with the approval of the Trustees. If the number of shares tendered for repurchase exceeds the offering limit, or if the Manager in its discretion elects to limit repurchases to 5% of the fund shares, the fund will repurchase shares on a pro-rata basis, and tendering shareholders will not have all of their tendered shares repurchased by the fund. During the six months ended April 30, 2007, the fund repurchased 225,062 shares valued at $6,533,609.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 25 |

On November 10, 2006, the fund received actual redemption requests totaling $6,231,980 or 9.5% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 52.31% of the shares the shareholder requested be repurchased.

On February 9, 2007, the fund received actual redemption requests totaling $7,866,458 or 11.97% of total fund assets. To protect the liquidity of the fund and as a protective measure for shareholders choosing to remain in the fund, the Manager elected to pro-rate the repurchases, and each shareholder requesting a redemption of his/her shares received a pro-rated portion equal to 41.76% of the shares the shareholder requested be repurchased.

| | Shares | |

| Date | Repurchased | Amount |

|

| November 2006 | 111,848 | $3,242,478 |

| February 2007 | 113,214 | 3,291,131 |

|

At April 30, 2007, the Manager owned 256,746 shares of the fund (12.0% of shares outstanding) valued at $8,025,880.

Note 6 Regulatory matters and litigation

In late 2003 and 2004, Putnam Management settled charges brought by the Securities and Exchange Commission (the “SEC”) and the Massachusetts Securities Division (“MSD”) in connection with excessive short-term trading by certain former Putnam employees and, in the case of charges brought by the MSD, excessive short-term trading by participants in some Putnam-administered 401(k) plans. Putnam Management agreed to pay $193.5 million in penalties and restitution, of which $153.5 million will be distributed to certain open-end Putnam funds and their shareholders after the SEC and MSD approve a distribution plan being developed by an independent consultant. The allegations of the SEC and MSD and related matters have served as the general basis for certain lawsuits, including purported class action lawsuits filed against Putnam Management and, in a limited number of cases, against some Putnam funds. Putnam Management believes that these lawsuits will ha ve no material adverse effect on the funds or on Putnam Management’s ability to provide investment management services. In addition, Putnam Management has agreed to bear any costs incurred by the Putnam funds as a result of these matters.

| 26 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Note 7 New accounting pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”). The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken by a filer in the filer’s tax return. The Interpretation will become effective for fiscal years beginning after December 15, 2006 but will also apply to tax positions reflected in the fund’s financial statements as of that date. No determination has been made whether the adoption of the Interpretation will require the fund to make any adjustments to its net assets or have any other effect on the fund’s financial statements. The effects of implementing this pronouncement, if any, will be noted in the fund’s next semiannual financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, Fair Value Measurements (the “Standard”). The Standard defines fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. The Standard applies to fair value measurements already required or permitted by existing standards. The Standard is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. Putnam Management is currently evaluating what impact the adoption of the Standard will have on the fund’s financial statements.

Note 8 Subsequent Event

Shortly after the end of the fiscal period, during May, the fund sold its entire position in Capella Education. As a result of the sale, the fund received $15,458,589 in proceeds from a sale price of $34.38 and realized gains totaling $12,704,120.

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 | 27 |

IMPORTANT NOTICE REGARDING DELIVERY OF SHAREHOLDER DOCUMENTS

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

PROXY VOTING

TH Lee, Putnam Capital is committed to managing its mutual funds in the best interests of shareholders. The fund’s proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2006, are available on the Putnam Individual Investor Web site, www.putnaminvestments.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the fund’s proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

FUND PORTFOLIO HOLDINGS

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

| 28 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2007 |

Not FDIC Insured

May Lose Value

No Bank Guarantee

Fund information

INVESTMENT MANAGER

TH Lee, Putnam Capital Management, LLC

One Post Office Square

Boston, MA 02109

MARKETING SERVICES

Putnam Retail Management, L.P.

One Post Office Square

Boston, MA 02109

CUSTODIAN

Putnam Fiduciary Trust Company,

State Street Bank and Trust Company

LEGAL COUNSEL

Sullivan & Cromwell LLP

TRUSTEES

John A. Hill

Chairman

Joseph L. Bower

Stephen B. Kay

OFFICERS

Linwood E. Bradford

President and Principal Executive Officer

Steven D. Krichmar

Vice President and Principal Financial Officer

Janet Smith

Vice President, Assistant Treasurer, and

Principal Accounting Officer

Susan Malloy

Vice President and Assistant Treasurer

James F. Clark

Vice President and Assistant Clerk

Amrit Kanwal

Vice President and Treasurer

Karen R. Kay

Vice President and Assistant Clerk

Francis J. McNamara, III

Vice President, Chief Legal Officer

and Clerk

Robert R. Leveille

Vice President, Chief Compliance

Officer, and Assistant Clerk

James P. Pappas

Vice President

TH Lee Putnam Capital

One Post Office Square

Boston, Massachusetts 02109

TH601 244360 6/07

Item 2. Code of Ethics:

Not Applicable

Item 3. Audit Committee Financial Expert:

Not Applicable

Item 4. Principal Accountant Fees and Services:

Not Applicable

Item 5. Audit Committee

Not Applicable

Item 6. Schedule of Investments:

The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above.

Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies:

Not Applicable

Item 8. Portfolio Managers of Closed-End Management Investment Companies

(a) Not Applicable

(b) Not Applicable

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Registrant Purchase of Equity Securities

| | | | Total Number of Shares | |

| | | | Purchased as Part | Maximum Number (or Approximate Dollar |

| | Total Number of | Average Price Paid | of Publicly Announced | Value ) of Shares that May Yet Be Purchased |

| Period | Shares Purchased | per Share | Plans or Programs | under the Plans or Programs |

| |