| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | |

| Investment Company Act file number: (811-10373) | |

| | |

| Exact name of registrant as specified in charter: TH Lee, Putnam Investment Trust |

| |

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Francis J. McNamara III, Vice President |

| | Clerk and Chief Legal Officer |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John E. Baumgardner, Esq. |

| | Sullivan & Cromwell LLP |

| | 125 Broad Street |

| | New York, New York 10004-2498 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | | |

| Date of fiscal year end: October 31, 2008 | | |

| |

| Date of reporting period: November 1, 2007— April 30, 2008 |

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Report from Fund Management

Richard Weed

Raymond Haddad

Frederick Wynn

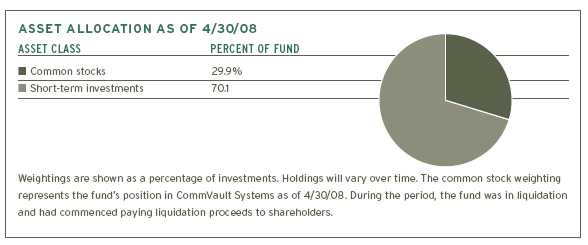

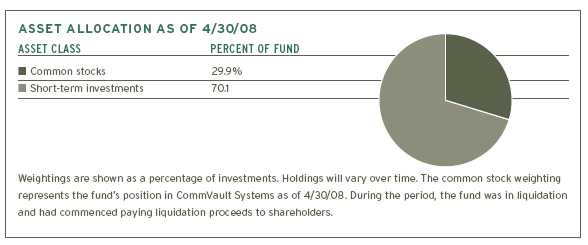

As you may recall, TH Lee Putnam Emerging Opportunities Portfolio (the “fund”) has been in a process of liquidation since the final months of the previous fiscal year, which ended October 31, 2007. The proceeds of the initial liquidation of the fund’s readily tradable securities were distributed to shareholders in early November. At the time, this distribution represented about 63% of the fund’s net asset value.

When the current fiscal year began, the fund’s remaining equity holdings were two former venture capital investments, CommVault Systems and Restore Medical. During the past six months we have found opportunities to sell down these positions. Although pricing conditions were challenging because of financial market instability and the lingering effects of the credit crisis, we took advantage of windows of opportunity when prices and trading volumes were relatively firm. In our view, it was more attractive to sell the positions at these times rather than wait, given that the current risk of recession could cause trading conditions to remain unstable.

By the end of the fiscal period, the fund had completely sold its position in Restore Medical. The fund returned –27.55% at net asset value during the six-month period.

After the end of the fund’s semiannual period, we completed selling the remaining position in CommVault. The fund is now preparing to make a final cash distribution of the fund’s assets to shareholders, which is expected to take place in the coming weeks. Please watch for additional communications about the distributions and consult your financial representative for more information.

Thank you for your investment in TH Lee, Putnam Emerging Opportunities Portfolio.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 1 |

| | | | |

| RETURN FOR PERIODS ENDED APRIL 30, 2008 (unaudited) | | | |

|

| | | | | Russell 2500 |

| TH Lee, Putnam Emerging Opportunities Portfolio | NAV | POP | | Growth Index |

| |

|

| 6 months | –27.55% | –30.62% | | –11.37% |

| |

|

| 1 year | –21.96 | –25.28 | | –3.56 |

| |

|

| 3 years | 10.99 | 6.28 | | 38.76 |

| |

|

| Annual average | 3.54 | 2.05 | | 11.54 |

| |

|

| 5 years | 53.18 | 46.64 | | 100.06 |

| |

|

| Annual average | 8.90 | 7.96 | | 14.88 |

| |

|

| Life of fund (since inception 7/30/01) | 25.27 | 19.95 | | 47.19 |

| |

|

| Annual average | 3.39 | 2.73 | | 5.89 |

| |

|

Past performance does not indicate future results. Performance assumes reinvestment of distributions and does not account for taxes. More recent returns may be less or more than those shown. Investment returns will fluctuate, and you may have a gain or a loss when you sell your shares. Returns at public offering price (POP) reflect the highest applicable sales charge of 4.25% . Sales charges differ with the original purchase amount. The fund is currently closed to new investments. The Russell 2500 Growth Index is an unmanaged index of those companies in the small/mid-cap Russell 2500 Index chosen for their growth orientation. Indexes are not available for direct investment. For a portion of the period this fund limited expenses, without which returns would have been lower.

| |

| 2 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

The fund’s portfolio

| | | |

| April 30, 2008 (Unaudited) | | | |

|

| |

| |

| Common stocks (29.4%)* | | | |

| | SHARES | | VALUE |

|

| |

| Computers (29.4%) | | | |

|

| CommVault Systems, Inc. † | 417,222 | | $ 5,131,830 |

| | |

|

| Total common stocks (cost $2,592,247) | | | $ 5,131,830 |

| | | | |

| | | | |

| Short-term Investments (68.8%)* (cost $12,006,267) | | | |

| | SHARES | | VALUE |

|

| Putnam Prime Money Market Fund (e) | 12,006,267 | | $ 12,006,267 |

|

| Total investments (cost $14,598,514) | | | $ 17,138,097 |

|

* Percentages indicated are based on net assets of $17,451,659.

† Non-income-producing security.

(e) See Note 5 to the financial statements regarding investments in Putnam Prime Money Market Fund.

The accompanying notes are an integral part of these financial statements.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 3 |

Statement of assets and liabilities

(liquidation basis)

| | |

| April 30, 2008 (Unaudited) | | |

|

| | |

| Assets | | |

|

| Investment in securities, at value (Note 1) | | |

|

| Unaffiliated issuers (identified cost $2,592,247) | $ 5,131,830 | |

|

| Affiliated issuers (identified cost $12,006,267) (Note 5) | 12,006,267 | |

|

| Interest receivable | 22,311 | |

|

| Receivable for securities sold | 702,521 | |

|

| Total assets | 17,862,929 | |

|

| | |

| Liabilities | | |

|

| Payable for investor servicing (Note 2) | 38,213 | |

|

| Payable for custodian fees (Note 2) | 14,831 | |

|

| Payable for trustee compensation and expenses (Note 2) | 86,250 | |

|

| Payable for legal fees | 190,875 | |

|

| Other accrued expenses | 81,101 | |

|

| Total liabilities | 411,270 | |

|

| Net assets | $ 17,451,659 | |

|

| | |

| Represented by | | |

|

| Paid-in capital (10,000,000 unlimited shares authorized) (Note 1) | $36,754,905 | |

|

| Distributions in excess of net investment income (Note 1) | (26,243,353) | |

|

| Accumulated net realized gain on investments (Note 1) | 4,400,524 | |

|

| Net unrealized appreciation of investments | 2,539,583 | |

|

| Total — Representing net assets applicable to capital shares outstanding | $ 17,451,659 | |

|

| | |

| Computation of net asset value | | |

|

| Net asset value and redemption price per common share | | |

| ($17,451,659 divided by 1,937,532 shares) | $9.01 | |

|

| Offering price class common share (100/$95.75 of $9.01)* | $9.41 | |

|

* On single retail shares of less than $500,000. On sales of $500,000 or more, the offering price is reduced.

The accompanying notes are an integral part of these financial statements.

| |

| 4 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

Statement of operations

(liquidation basis)

| | |

| Six months ended April 30, 2008 (Unaudited) | | |

|

| | |

| Investment income: | | |

|

| Interest income from investment in affiliated issuer (Note 5) | $ 185,473 | |

|

| Other income | 5,723 | |

|

| Net investment income | 191,196 | |

|

| Net realized gain on investments (including net realized loss | | |

| related to an affiliated issuer of $1,971,366) (Notes 1 and 3) | 4,888,437 | |

|

| Net unrealized depreciation of investments during the period | (11,503,837) | |

|

| Net loss on investments | (6,615,400) | |

|

| Net decrease in net assets resulting from operations | $(6,424,204) | |

|

The accompanying notes are an integral part of these financial statements.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 5 |

Statement of changes in net assets

(liquidation basis)

| | | |

| Six months ended | | Year ended |

| | April 30 | | October 31 |

| | 2008* | | 2007 |

|

| Increase (decrease) in net assets | | | |

|

| Operations: | | | |

|

| Net investment income (loss) | $ 191,196 | | $ (3,365,178) |

|

| Net realized gain on investments | 4,888,437 | | 17,961,797 |

|

| Net unrealized appreciation (depreciation) of investments | (11,503,837) | | 1,615,180 |

|

| Net increase (decrease) in net assets resulting from operations | (6,424,204) | | 16,211,799 |

|

| Distributions to shareholders (Note 1): | | | |

|

| From ordinary income | | | |

|

| Net realized short-term gain on investments | (1,071,452) | | (653,931) |

|

| Net realized long-term gain on investments | (14,279,611) | | (3,216,230) |

|

| Return of capital from cash liquidation | (26,005,549) | | — |

|

| |

| Capital share transactions: | | | |

|

| Reinvestments in connection with distributions | — | | 3,449,045 |

|

| Cost of shares repurchased | — | | (13,107,098) |

|

| Decrease from capital share transactions | — | | (9,658,053) |

|

| Total increase (decrease) in net assets | (47,780,816) | | 2,683,585 |

|

| |

| Net assets | | | |

|

| Beginning of period | 65,232,475 | | 62,548,890 |

|

| End of period | $ 17,451,659 | | $65,232,475 |

|

| |

| Number of fund shares | | | |

|

| Shares outstanding at beginning of period | 1,937,532 | | 2,248,878 |

|

| Shares reinvested | — | | 123,049 |

|

| Shares repurchased | — | | (434,395) |

|

| Shares outstanding at end of period | 1,937,532 | | 1,937,532 |

|

* Unaudited

The accompanying notes are an integral part of these financial statements.

| |

| 6 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

Statement of cash flows

(liquidation basis)

| | |

| For the six months ended April 30, 2008 (unaudited) | | |

|

| | |

| Increase in cash | | |

|

| Cash flows from operating activities: | | |

|

| Net decrease in net assets from operations | $(6,424,204) | |

|

| Adjustments to reconcile net decrease in net assets | | |

| from operations to net cash used in operating activities: | | |

|

| Proceeds from disposition of investment securities | 11,779,875 | |

|

| Sale of short-term investment securities, net | 34,311,005 | |

|

| Decrease in dividends and interest receivable | 40,828 | |

|

| Decrease in payable for shareholder servicing fees | (40,248) | |

|

| Decrease in payable for compensation of Manager | (136,467) | |

|

| Decrease in payable for trustee fees | (37,500) | |

|

| Decrease in incentive fee accrual | (4,562,710) | |

|

| Decrease in payable for investor servicing and custody fees | (27,049) | |

|

| Decrease in payable for administration services | (8,353) | |

|

| Decrease in other accrued expenses | (153,965) | |

|

| Net realized gain on investments | (4,888,437) | |

|

| Net unrealized depreciation on investments during the period | 11,503,837 | |

|

| Net cash provided by operating and investing activities | 41,356,612 | |

|

| Cash flows from financing activities: | | |

|

| Cash distribution to shareholders paid | (41,356,612) | |

|

| Net cash used in financing activities | (41,356,612) | |

|

| Net increase in cash | — | |

|

| Cash balance, beginning of period | — | |

|

| Cash balance, end of period | $— | |

|

The accompanying notes are an integral part of these financial statements.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 7 |

Financial highlights

(For a common share outstanding throughout the period)

| | | | | | | | | |

| | | | | | | |

| Per-share | | Six months ended** | | | Year ended | | |

| operating performance | 4/30/08 | 10/31/07 | 10/31/06 | 10/31/05 | 10/31/04 | 10/31/03 |

|

| | | (liquidation basis) | (liquidation basis) | | | | |

|

| Net asset value, | | | | | | | |

| beginning of period | | $33.67 | $27.81 | $27.83 | $26.54 | $25.32 | $18.91 |

|

| Investment operations: | | | | | | | |

|

| Net investment gain (loss)(a,b) | | .10 | (1.61) | (.63) | (.34)(e) | (.59) | (.45) |

|

| Net realized and unrealized | | | | | | | |

| gain on investments | | (3.42) | 9.28 | 3.89 | 2.13 | 1.81 | 6.86 |

|

| Total from | | | | | | | |

| investment operations | | (3.32) | 7.67 | 3.26 | 1.79 | 1.22 | 6.41 |

|

| Less distributions: | | | | | | | |

|

| From net realized gain | | | | | | | |

| on investments | | (7.92) | (1.81) | (3.28) | (.50) | — | — |

|

| Return of capital from | | | | | | | |

| cash liquidation | | (13.42) | — | — | — | — | — |

|

| Total distributions | | (21.34) | (1.81) | (3.28) | (.50) | — | — |

|

| Net asset value, | | | | | | | |

| end of period | | $9.01 | $33.67 | $27.81 | $27.83 | $26.54 | $25.32 |

|

| Total return at net asset value | | | | | | |

| after incentive fee (%)(c) | | (27.55)* | 28.89 | 12.86 | 6.78 | 4.82 | 33.90 |

|

| Total return at net asset value | | | | | | |

| before incentive fee (%)(c) | | (27.55)* | 33.94 | 14.13 | 7.07 | 5.53 | 34.43 |

|

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period | | | | | | | |

| (in thousands) | | $17,452 | $65,232 | $62,549 | $67,860 | $77,542 | $90,020 |

|

| Ratio of expenses to average net | | | | | | |

| assets after incentive fee (%)(b,d) | —(g) | 7.09(f) | 2.93 | 2.00 | 2.49 | 2.30 |

|

| Ratio of expenses to average net | | | | | | |

| assets before incentive fee (%)(b,d) | —(g) | 2.63(f) | 1.85 | 1.85 | 1.85 | 1.85 |

|

| Ratio of net investment income | | | | | | |

| (loss) to average net assets after | | | | | | |

| incentive fee (%)(b) | | 1.76* | (5.21)(f) | (2.31) | (1.23)(e) | (2.30) | (2.17) |

|

| Portfolio turnover rate (%) | | — | 105.86 | 57.01 | 103.14 | 100.29 | 93.90 |

|

* Not annualized.

** Unaudited.

(a) Per share net investment income (loss) has been determined on the basis of the weighted average number of shares outstanding during the period.

(b) Reflects an expense limitation in effect during the period (Note 2). As a result of such limitation, expenses of the fund for the periods ended October 31, 2007, October 31, 2006, October 31, 2005, October 31, 2004 and October 31, 2003 reflect a reduction of 0.13%, 0.23%, 0.19%, 0.15% and 0.10%, respectively, based on average net assets.

(c) Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

(d) Includes amounts paid through expense offset arrangements (Note 2).

(e) Reflects a non-recurring accrual related to Putnam Management’s settlement with the SEC regarding brokerage allocation practices, which amounted to less than $0.01 per share and 0.02% of average net assets.

(f) Reflects expenses associated with the liquidation of the fund which commenced during the period, which resulted in expenses of the fund for the period ended October 31, 2007 being increased by $547,206 or 0.84% based on average net assets.

(g) The fund did not incur any expenses during the six months ended April 30, 2008, as estimated liquidation costs were accrued in the prior fiscal year. The accompanying notes are an integral part of these financial statements.

| |

| 8 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

Notes to financial statements

April 30, 2008 (Unaudited)

|

| Note 1 Significant accounting policies |

|

TH Lee, Putnam Emerging Opportunities Portfolio (the “fund”), is a series of TH Lee, Putnam Investment Trust (the “trust”), which is registered under the Investment Company Act of 1940, as amended, as a non-diversified closed-end management investment company. On October 18, 2007 the shareholders of the fund approved a plan of complete liquidation and dissolution of the fund. As a result, the fund has begun liquidating portfolio assets and made an initial distribution of liquidation proceeds on November 7, 2007 to fund shareholders (See Note 2). Liquidation of the fund’s remaining venture capital investment was completed near the end of May 2008 and a final distribution will occur in the coming weeks.

In connection with the liquidation, the fund has adopted the liquidation basis of accounting, which, among other things, requires the fund to record assets and liabilities at their net realizable value and to provide estimated costs of liquidating the fund to the extent that they are reasonably determinable.

On October 18, 2007, the fund recorded a liability for $547,206, reflecting estimated liquidation expenses for the period October 18, 2007 through the completion of the fund’s liquidation. Actual expenses incurred by the fund during the liquidation period could exceed this estimate and could exceed income recognized by the fund during the period.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund expects the risk of material loss to be remote.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A) Security valuation

Investments for which market quotations are readily available are valued at the last reported sales price on their principal exchange, or official closing price for certain markets. If no sales are reported —as in the case of some securities traded over-the-counter — a security is valued at its last reported bid price. Market quotations are not considered to be readily available for private equity securities: such investments are initially valued at cost and then stated at fair value following procedures approved by the Trustees. As part of those procedures, TH Lee, Putnam Capital Management, LLC (the “Manager”), which is 80% owned by Putnam Capital, LLC, which in turn is owned by Putnam Investment Holdings, LLC, an indirect subsidiary of Putnam, and 20% owned by TH Lee, Putnam Capital L.P., a subsidiary of Thomas H. Lee Partners L.P. will monitor each fair valued security on a daily basis and will adjust its

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 9 |

value, as necessary, based on such factors as the financial and/or operating results, the general developments in the issuer’s business including products and services offered, management changes, changes in contracts with customers, issues relating to financing, the likelihood of a public offering, the liquidity of the security, any legal or contractual restrictions, the value of an unrestricted related public security and other analytical data. Restricted securities of the same class as publicly traded securities will be valued at a discount from the public market price reflecting the nature and extent of the restriction. The discount applied to securities subject to resale restrictions with known expirations will be reduced according to a specified timetable as the applicable expiration approaches.

Fair value prices may differ materially from the value that would be realized if the fair-valued securities were sold. Securities quoted in foreign currencies are translated into U.S. dollars at the current exchange rate. Short-term investments having remaining maturities of 60 days or less are stated at amortized cost, which approximates fair value.

B) Security transactions and related investment income

Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Gains or losses on securities sold are determined on the identified cost basis. Interest income is recorded on the accrual basis. Dividend income, net of applicable withholding taxes, is recognized on the ex-dividend date except that certain dividends from foreign securities, if any, are recognized as soon as the fund is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Dividends representing a return of capital or capital gains, if any, are reflected as a reduction of cost and/or as a realized gain.

C) Repurchase agreements

The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. The Manager is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest.

D) Federal taxes

It is the policy of the fund to distribute all of its taxable income within the prescribed time and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, (the “Code”) applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code, as amended. Therefore, no provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains.

The aggregate identified cost on a tax basis is $14,598,517, resulting in gross unrealized appreciation of $2,539,580.

| |

| 10 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

E) Distributions to shareholders

Distributions to shareholders from net investment income are recorded by the fund on the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

On November 2, 2007, the Manager announced an initial distribution of the liquidation proceeds from the fund.

| | | |

| Distributions | Ex Date | Record Date | Payment Date |

|

| $0.553 per share short-term capital gain | | | |

| $7.370 per share long-term capital gain | | | |

| $13.422 per share cash liquidating distribution | | | |

|

| $21.345 per share total | 11/2/2007 | 11/2/2007 | 11/7/2007 |

F) Statement of cash flows

The cash amount shown in the Statement of cash flows is the amount reported as cash in the fund’s Statement of assets and liabilities and represents cash on hand at its custodian and does not include any short-term investments at April 30, 2008.

|

| Note 2 Incentive fee and other expenses |

|

The fund has entered into a Management Contract with the Manager. However, effective October 18, 2007, in connection with the commencement of the fund’s liquidation, the fund will no longer accrue the base management fee under the Management Contract.

The fund will accrue daily a liability for incentive fees payable equal to 20% of the realized and unrealized gains less realized and unrealized losses on investments that were originally purchased by the fund in private equity transactions. The fund will not accrue an incentive fee unless all realized and unrealized losses from prior periods have been offset by realized (and, where applicable unrealized) gains. The fund will pay annually, on December 31, a fee to the Manager equal to 20% of the aggregate incentive fee base, calculated from the commencement of the fund’s operations, less the cumulative amount of the incentive fee paid to the Manager in previous periods. The incentive fee base for a

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 11 |

private equity security equals realized gains less realized and unrealized losses until the issuer of the security has completed an initial public offering and any applicable lock-up period has expired and, thereafter, equals realized and unrealized gains less realized and unrealized losses. In the case of private equity funds, the incentive fee base equals the sum of all amounts that are actually distributed to the fund less realized and unrealized losses. The fund does not pay any incentive fee on a private equity holding until the fund sells the holding or the holding becomes freely sellable, although the fund will continue to accrue a liability with respect to additional unrealized gains for such security. At April 30, 2008, no incentive fees were accrued based on the aggregate incentive fee base.

The fund made an incentive fee payment to the Manager in the amount of $4,562,710 on or about December 31, 2007.

Custodial functions for the fund’s assets were provided by Putnam Fiduciary Trust Company (“PFTC”) and by State Street Bank and Trust Company (“State Street”). Custody fees are based on the fund’s asset level, the number of its security holdings and transaction volumes. Putnam Investor Services, a division of PFTC, provided investor servicing agent functions to the fund. The fund has entered into arrangements with PFTC and State Street whereby PFTC’s and State Street’s fees are reduced by credits allowed on cash balances. For the six months ended April 30, 2008, the fund’s expenses were reduced by $11 under these arrangements.

Each independent Trustee of the fund receives an annual Trustee fee of $25,000. Trustees receive additional fees for attendance at certain committee meetings and industry seminars and for certain compliance-related matters. Trustees also are reimbursed for expenses they incur relating to their services as Trustees.

For the six months ended April 30, 2008, Putnam Retail Management, acting as underwriter, received no net commissions from the sale of common shares.

|

| Note 3 Purchases and sales of securities |

|

During the six months ended April 30, 2008, proceeds from sales of investment securities other than short-term investments was $12,237,071. There were no purchases of investment securities other than short-term investments and no sales of U.S. government securities.

| |

| 12 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

|

| Note 4 Transactions with affiliated issuers |

|

Transactions during the year with companies in which the fund owned at least 5% of the voting securities were as follows:

| | | | |

| Name of Affiliate | Purchase cost | Sales cost | Dividend Income | Value |

|

| Restore Medical | $— | $3,009,669 | $— | $— |

|

Market values, if any, are shown for issuers that are affiliated at period end.

At April 30, 2008, the Manager owned 256,746 shares of the fund (13.3% of shares outstanding) valued at $2,313,281.

|

| Note 5 Investment in Putnam Prime Money Market Fund |

|

The fund invests in Putnam Prime Money Market Fund, an open-end management investment company managed by Putnam Management. Investments in Putnam Prime Money Market Fund are valued at its closing net asset value each business day. Management fees paid by the fund are reduced by an amount equal to the management fees paid by Putnam Prime Money Market Fund with respect to assets invested by the fund in Putnam Prime Money Market Fund. For the six months ended April 30, 2008, management fees paid were reduced by $3,954 relating to the fund’s investment in Putnam Prime Money Market Fund. Income distributions earned by the fund are recorded as income in the Statement of operations and totaled $185,473 for the six months ended April 30, 2008. During the six months ended April 30, 2008, cost of purchases and proceeds of sales of investments in Putnam Prime Money Market Fund aggregated $15,950,778 and $50,261,783, respectively.

|

| Note 6 Regulatory matters and litigation |

|

In late 2003 and 2004, Putnam Management settled charges brought by the Securities and Exchange Commission (the “SEC”) and the Massachusetts Securities Division in connection with excessive short-term trading in Putnam funds. Payments from Putnam Management will be distributed to certain open-end Putnam funds and their shareholders. These allegations and related matters have served as the general basis for certain lawsuits, including purported class action lawsuits against Putnam Management and, in a limited number of cases, some Putnam funds. Putnam Management believes that these lawsuits will have no material adverse effect on the funds or on Putnam Management’s ability to provide investment management services. In addition, Putnam Management has agreed to bear any costs incurred by the Putnam funds as a result of these matters.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 13 |

|

| Note 7 New accounting pronouncements |

|

In June 2006, the Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, Accounting for Uncertainty in Income Taxes (the “Interpretation”). The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken by a filer in the filer’s tax return. Upon adoption, the Interpretation did not have a material effect on the fund’s financial statements. However, the conclusions regarding the Interpretation may be subject to review and adjustment at a later date based on factors including, but not limited to, further implementation guidance expected from the FASB, and on-going analysis of tax laws, regulations and interpretations thereof.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, Fair Value Measurements (the “Standard”). The Standard defines fair value, sets out a framework for measuring fair value and expands disclosures about fair value measurements. The Standard applies to fair value measurements already required or permitted by existing standards. The Standard is effective for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The Manager does not believe the adoption of the Standard will impact the amounts reported in the financial statements; however, additional disclosures will be required about the inputs used to develop the measurements of fair value.

In March 2008, Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“SFAS 161”) — an amendment of FASB Statement No. 133 (“SFAS 133”), was issued and is effective for fiscal years beginning after November 15, 2008. SFAS 161 requires enhanced disclosures about how and why an entity uses derivative instruments and how derivative instruments affect an entity’s financial position. The Manager is currently evaluating the impact the adoption of SFAS 161 will have on the fund’s financial statement disclosures.

| |

| 14 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

IMPORTANT NOTICE REGARDING DELIVERY OF SHAREHOLDER DOCUMENTS

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

PROXY VOTING

TH Lee, Putnam Capital is committed to managing its mutual funds in the best interests of shareholders. The fund’s proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available on the Putnam Individual Investor Web site, www.putnaminvestments.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the fund’s proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

FUND PORTFOLIO HOLDINGS

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

| |

| TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 | 15 |

This page left blank intentionally.

| |

| 16 | TH Lee, Putnam Emerging Opportunities Portfolio Semiannual Report April 30, 2008 |

| |

| Not FDIC Insured |

|

|

| May Lose Value |

|

|

| No Bank Guarantee |

Fund information

| |

| INVESTMENT MANAGER | Francis J. McNamara, III |

| | Vice President, Chief Legal Officer, and Clerk |

| TH Lee, Putnam Capital Management, LLC | |

| One Post Office Square | Janet Smith |

| Boston, MA 02109 | Vice President, Assistant Treasurer, and |

| | Principal Accounting Officer |

| MARKETING SERVICES | |

| | James F. Clark |

| Putnam Retail Management, L.P. | Vice President and Assistant Clerk |

| One Post Office Square | |

| Boston, MA 02109 | Karen R. Kay |

| | Vice President and Assistant Clerk |

| CUSTODIAN | |

| | Susan G. Malloy |

| State Street Bank and Trust Company | Vice President and Assistant Treasurer |

| | |

| LEGAL COUNSEL | James P. Pappas |

| | Vice President |

| Sullivan & Cromwell LLP | |

| | |

| TRUSTEES | |

| | |

| John A. Hill | |

| Chairman | |

| | |

| Joseph L. Bower | |

| | |

| Stephen B. Kay | |

| | |

| OFFICERS | |

| Linwood E. Bradford | |

| President and Principal Executive Officer | |

| | |

| Steven D. Krichmar | |

| Vice President, Principal Financial Officer, | |

| and Treasurer | |

| | |

| Robert R. Leveille | |

| Vice President, Chief Compliance Officer, | |

| and Assistant Clerk | |

Item 2. Code of Ethics:

Not Applicabe

Item 3. Audit Committee Financial Expert:

Not Applicabe

Item 4. Principal Accountant Fees and Services:

Not Applicabe

Item 5. Audit Committee

Not Applicabe

Item 6. Schedule of Investments:

The registrant’s schedule of investments in unaffiliated issuers is included in the report to shareholders in Item 1 above.

Item 7. Disclosure of Proxy Voting Policies and Procedures For Closed-End Management Investment Companies:

Not Applicable

Item 8. Portfolio Managers of Closed-End Management Investment Companies

(a) Not Applicable

(b) Not Applicable

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

None

Item 10. Submission of Matters to a Vote of Security Holders:

Not applicable

Item 11. Controls and Procedures:

(a) The registrant's principal executive officer and principal financial officer have concluded, based on their evaluation of the effectiveness of the design and operation of the registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the design and operation of such procedures are generally effective to provide reasonable assurance that information required to be disclosed by the registrant in this report is recorded, processed, summarized and reported (except as described in the third sentence of this paragraph) within the time periods specified in the Commission's rules and forms

(b) Changes in internal control over financial reporting: Not applicable

Item 12. Exhibits:

(a)(1) Not Applicable

(a)(2) Separate certifications for the principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940, as amended, are filed herewith.

(b) The certifications required by Rule 30a-2(b) under the Investment Company Act of 1940, as amended, are filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TH Lee, Putnam Investment Trust

By (Signature and Title):

/s/ Janet C. Smith

Janet C. Smith

Principal Accounting Officer

Date: June 27, 2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title):

/s/ Linwood E. Bradford

Linwood E. Bradford

Principal Executive Officer

Date: June 27, 2008

By (Signature and Title):

/s/ Steven D. Krichmar

Steven D. Krichmar

Principal Financial Officer

Date: June 27, 2008