We have audited the accompanying consolidated statements of financial position of Aviva plc and subsidiaries as of December 31, 2009, 2008 and 2007, and the related consolidated income statements, statements of comprehensive income, statements of changes in equity, and statements of cash flows for each of the three years in the period ended December 31, 2009. Our audits also include the financial statement schedule listed in the Index at Item 18. These financial statements and the schedule are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements and the schedule based on our audits.

We did not audit at December 31, 2007 and for the year then ended the financial statements of Delta Lloyd NV, a subsidiary of Aviva plc, (Delta Lloyd NV 2007 Annual Report) which statements reflect total assets of £45,770 million as of December 31, 2007, and total income of £6,165 million for the year then ended. Those statements were audited by other auditors whose report has been furnished to us, and our opinion, insofar as it relates to the amounts included for Delta Lloyd NV, is based solely on the report of the other auditors. We have audited the adjustments described in Note 2(b) that were applied on the Delta Lloyd NV 2007 Annual Report to restate the consolidated financial position as of December 31, 2007 and the related consolidated statement of changes in equity for the year ended December 31, 2007 for the correction of an error. In our opinion, such adjustments are appropriate and have been properly applied.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits and the report of other auditors provide a reasonable basis for our opinion.

In our opinion, based on our audits and the report of other auditors, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Aviva plc and subsidiaries as of December 31, 2009, 2008 and 2007, and the consolidated results of their operations and their cash flows for each of the three years in the period ended December 31, 2009, in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board. Also in our opinion, the related financial statement schedule, when considered in relation to the basic financial statements taken as a whole, presents fairly in all material respects the information set forth therein.

As discussed above and in Note 2(b) to the consolidated financial statements, the consolidated financial position as of December 31, 2007 and the related consolidated statement of changes in equity for the year ended December 31, 2007 have been restated for the correction of an error.

99 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies |

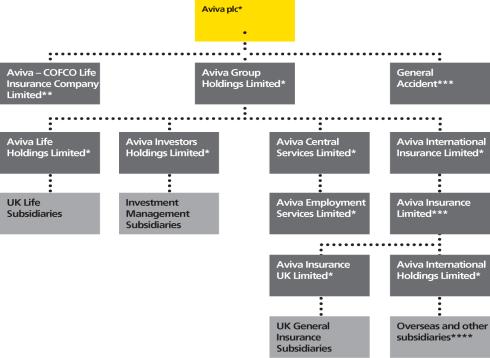

Aviva plc (the “Company”), a public limited company incorporated and domiciled in the United Kingdom (UK), together with its subsidiaries (collectively, the “Group” or “Aviva”) transacts life assurance and long-term savings business, fund management, and most classes of general insurance and health business through its subsidiaries, associates and branches in the UK, Ireland, continental Europe, United States (US), Canada, Asia, Australia and other countries throughout the world.

The Group is managed on a regional basis, reflecting the management structure whereby a member of the Executive Management team is accountable to the Group Chief Executive for the operating segment for which he is responsible. Further details of the reportable segments are given in note 4.

The principal accounting policies adopted in the preparation of these financial statements are set out below.

(A) Basis of presentation

Since 2005, all European Union listed companies have been required to prepare consolidated financial statements using International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and endorsed by the European Union (EU). The date of transition to IFRS was 1 January 2004. In addition to fulfilling their legal obligation to comply with IFRS as adopted by the European Union, the Group and Company have also complied with IFRS as issued by the International Accounting Standards Board and applicable at 31 December 2009.

In 2008, the IASB issued a revised version of IFRS 3, Business Combinations, which introduces a number of changes in accounting for such transactions that will impact the amount of goodwill recognised, the reported results in the period an acquisition occurs, and future reported results. A consequential amendment to IAS 27, Consolidated and Separate Financial Statements, requires a change in the ownership interest of a subsidiary (without loss of control) to be accounted for as an equity transaction, rather than giving rise to goodwill or a gain or loss. Other consequential amendments were made to IAS 7, Statement of Cash Flows, IAS 12, Income Taxes, IAS 21, The Effects of Changes in Foreign Exchange Rates, IAS 28, Investments in Associates, and IAS 31, Interests in Joint Ventures. These are applicable prospectively for accounting periods commencing 1 July 2009 or later, and are therefore not applicable for the current accounting period. On adoption, they will impact the areas noted above in the Group’s financial reporting.

In 2009, the IASB issued IFRS 9, Financial Instruments – Classification and Measurement, the first part of a replacement standard for IAS 39, Financial Instruments: Recognition and Measurement. This is applicable prospectively for accounting periods commencing 1 January 2013 or later, and is therefore not applicable for the current accounting period. It has not yet been endorsed by the EU but, on adoption, will require us to review the classification of certain investments while allowing us to retain the fair value measurement option as we deem necessary.

During 2008 and 2009, the IASB also issued amendments to IFRS 1, First Time Adoption of IFRS, IAS 32, Financial Instruments: Presentation, IAS 39 and the results of its annual improvements project. Further amendments to IFRS 1, IFRS 2, Share-Based Payment, IAS 24, Related Party Disclosures, and the results of its second annual improvements project have been issued but have not yet been endorsed by the EU. These are applicable prospectively for accounting periods commencing 1 July 2009 or later, and are therefore not applicable for the current accounting period. On adoption, they will not have any material impact on the Group’s financial reporting.

IFRIC interpretation 17, Distributions of Non-cash Assets to Owners, and interpretation 19, Extinguishing Financial Liabilities with Equity Instruments, as well as an amendment to interpretation 14, IAS 19 – The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction, were issued during 2008 and 2009 but the latter two have not yet been endorsed by the EU. These are applicable prospectively for accounting periods commencing 1 July 2009 or later, and are therefore not applicable for the current accounting period. On adoption, they will not have any impact on our financial reporting.

In accordance with IFRS 4, Insurance Contracts, the Group has applied existing accounting practices for insurance and participating investment contracts, modified as appropriate to comply with the IFRS framework and applicable standards. Further details are given in policy F below.

Items included in the financial statements of each of the Group’s entities are measured in the currency of the primary economic environment in which that entity operates (the functional currency). The consolidated financial statements are stated in sterling, which is the Company’s functional and presentation currency. Unless otherwise noted, the amounts shown in these financial statements are in millions of pounds sterling (£m). As supplementary information, consolidated financial information is also presented in euros.

The separate financial statements of the Company are on pages 226 to 234.

(B) Critical accounting policies and the use of estimates

The preparation of financial statements requires the Group to select accounting policies and make estimates and assumptions that affect items reported in the consolidated income statement, statement of financial position, other primary statements and notes to the financial statements.

100 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Critical accounting policies

The major areas of judgement on policy application are considered to be over whether Group entities should be consolidated (set out in policy C), on product classification (set out in policy E) and in the classification of financial investments (set out in policy R).

Use of estimates

All estimates are based on management’s knowledge of current facts and circumstances, assumptions based on that knowledge and their predictions of future events and actions. Actual results may differ from those estimates, possibly significantly.

The table below sets out those items we consider particularly susceptible to changes in estimates and assumptions, and the relevant accounting policy.

Item | Accounting

policy |

Insurance and participating investment contract liabilities | E & J |

Goodwill, AVIF and other intangible assets | M |

Fair values of financial investments | R |

Impairment of financial investments | R |

Fair value of derivative financial instruments | S |

Deferred acquisition costs and other assets | V |

Provisions and contingent liabilities | Y |

Pension obligations | Z |

Deferred income taxes | AA |

(C) Consolidation principles

Subsidiaries

Subsidiaries are those entities (including special purpose entities) in which the Group, directly or indirectly, has power to exercise control over financial and operating policies in order to gain economic benefits. Subsidiaries are consolidated from the date on which effective control is transferred to the Group and are excluded from consolidation from the date the Group no longer has effective control. All inter-company transactions, balances and unrealised surpluses and deficits on transactions between Group companies have been eliminated.

From 1 January 2004, the date of first time adoption of IFRS, the Group is required to use the purchase method of accounting to account for the acquisition of subsidiaries. Under this method, the cost of an acquisition is measured as the fair value of assets given up, shares issued or liabilities undertaken at the date of acquisition, plus costs directly attributable to the acquisition. The excess of the cost of acquisition over the fair value of the net assets of the subsidiary acquired is recorded as goodwill (see policy M below). Any surplus of the acquirer’s interest in the subsidiary’s net assets over the cost of acquisition is credited to the income statement.

Merger accounting and the merger reserve

Prior to 1 January 2004, certain significant business combinations were accounted for using the “pooling of interests method” (or merger accounting), which treats the merged groups as if they had been combined throughout the current and comparative accounting periods. Merger accounting principles for these combinations gave rise to a merger reserve in the consolidated statement of financial position, being the difference between the nominal value of new shares issued by the Parent Company for the acquisition of the shares of the subsidiary and the subsidiary’s own share capital and share premium account. These transactions have not been restated, as permitted by the IFRS 1 transitional arrangements.

The merger reserve is also used where more than 90% of the shares in a subsidiary are acquired and the consideration includes the issue of new shares by the Company, thereby attracting merger relief under the UK Companies Act 1985 and, from 1 October 2009, the UK Companies Act 2006.

Investment vehicles

In several countries, the Group has invested in a number of specialised investment vehicles such as Open-ended Investment Companies (OEICs) and unit trusts. These invest mainly in equities, bonds, cash and cash equivalents, and properties, and distribute most of their income. The Group’s percentage ownership in these vehicles can fluctuate from day-to-day according to the Group’s and third-party participation in them. Where Group companies are deemed to control such vehicles, with control determined based on an analysis of the guidance in IAS 27 and SIC 12, they are consolidated, with the interests of parties other than Aviva being classified as liabilities. These appear as “Net asset value attributable to unitholders” in the consolidated statement of financial position. Where the Group does not control such vehicles, and these investments are held by its insurance or investment funds, they do not meet the definition of associates (see below) and are, instead, carried at fair value through profit and loss within financial investments in the consolidated statement of financial position, in accordance with IAS 39, Financial Instruments: Recognition and Measurement.

As part of their investment strategy, the UK and certain European long-term business policyholder funds have invested in a number of property limited partnerships (PLPs), either directly or via property unit trusts (PUTs), through a mix of capital and loans. The PLPs are managed by general partners (GPs), in which the long-term business shareholder companies hold equity stakes and which themselves hold nominal stakes in the PLPs. The PUTs are managed by a Group subsidiary.

Accounting for the PUTs and PLPs as subsidiaries, joint ventures or other financial investments depends on the shareholdings in the GPs and the terms of each partnership agreement. Where the Group exerts control over a PLP, it has been treated as a subsidiary and its results, assets and liabilities have been consolidated. Where the partnership is managed by a contractual agreement such that no party exerts control, notwithstanding that the Group’s partnership share in the PLP (including its indirect stake via the relevant PUT and GP) may be greater than 50%, such PUTs and PLPs have been classified as joint ventures. Where the

| | 101 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Group holds minority stakes in PLPs, with no disproportionate influence, the relevant investments are carried at fair value through profit and loss within financial investments.

Associates and joint ventures

Associates are entities over which the Group has significant influence, but which it does not control. Generally, it is presumed that the Group has significant influence if it has between 20% and 50% of voting rights. Joint ventures are entities whereby the Group and other parties undertake an economic activity which is subject to joint control arising from a contractual agreement. In a number of these, the Group’s share of the underlying assets and liabilities may be greater than 50% but the terms of the relevant agreements make it clear that control is not exercised. Such jointly-controlled entities are referred to as joint ventures in these financial statements.

Gains on transactions between the Group and its associates and joint ventures are eliminated to the extent of the Group’s interest in the associates and joint ventures. Losses are also eliminated, unless the transaction provides evidence of an impairment of the asset transferred between entities.

Investments in associates and joint ventures are accounted for using the equity method of accounting. Under this method, the cost of the investment in a given associate or joint venture, together with the Group’s share of that entity’s post-acquisition changes to shareholders’ funds, is included as an asset in the consolidated statement of financial position. As explained in policy N, the cost includes goodwill identified on acquisition. The Group’s share of their post-acquisition profits or losses is recognised in the income statement and its share of post-acquisition movements in reserves is recognised in reserves. Equity accounting is discontinued when the Group no longer has significant influence over the investment.

If the Group’s share of losses in an associate or joint venture equals or exceeds its interest in the undertaking, the Group does not recognise further losses unless it has incurred obligations or made payments on behalf of the entity.

The Company’s investments

In the Company statement of financial position, subsidiaries and joint ventures are stated at their fair values, estimated using applicable valuation models underpinned by the Company’s market capitalisation. These investments are classified as available for sale (AFS) financial assets, with changes in their fair value being recognised in other comprehensive income and recorded in a separate investment valuation reserve within equity.

(D) Foreign currency translation

Income statements and cash flows of foreign entities are translated into the Group’s presentation currency at average exchange rates for the year while their statements of financial position are translated at the year end exchange rates. Exchange differences arising from the translation of the net investment in foreign subsidiaries, associates and joint ventures, and of borrowings and other currency instruments designated as hedges of such investments, are recognised in other comprehensive income and taken to the currency translation reserve within equity. On disposal of a foreign entity, such exchange differences are transferred out of this reserve and are recognised in the income statement as part of the gain or loss on sale. The cumulative translation differences were deemed to be zero at the transition date to IFRS.

Foreign currency transactions are accounted for at the exchange rates prevailing at the date of the transactions. Gains and losses resulting from the settlement of such transactions, and from the translation of monetary assets and liabilities denominated in foreign currencies, are recognised in the income statement.

Translation differences on debt securities and other monetary financial assets measured at fair value and designated as held at fair value through profit or loss (FV) (see policy R) are included in foreign exchange gains and losses in the income statement. For monetary financial assets designated as AFS, translation differences are calculated as if they were carried at amortised cost and so are recognised in the income statement, whilst foreign exchange differences arising from fair value gains and losses are recognised in other comprehensive income and included in the investment valuation reserve within equity. Translation differences on non-monetary items, such as equities which are designated as FV, are reported as part of the fair value gain or loss, whereas such differences on AFS equities are included in the investment valuation reserve.

(E) Product classification

Insurance contracts are defined as those containing significant insurance risk if, and only if, an insured event could cause an insurer to make significant additional payments in any scenario, excluding scenarios that lack commercial substance, at the inception of the contract. Such contracts remain insurance contracts until all rights and obligations are extinguished or expire. Contracts can be reclassified as insurance contracts after inception if insurance risk becomes significant. Any contracts not considered to be insurance contracts under IFRS are classified as investment contracts.

Some insurance and investment contracts contain a discretionary participating feature, which is a contractual right to receive additional benefits as a supplement to guaranteed benefits. These are referred to as participating contracts.

As noted in policy A above, insurance contracts and participating investment contracts in general continue to be measured and accounted for under existing accounting practices at the later of the date of transition to IFRS or the date of the acquisition of the entity, in accordance with IFRS 4. Accounting for insurance contracts in UK companies is determined in accordance with the Statement of Recommended Practice issued by the Association of British Insurers, the most recent version of which was issued in December 2005 and amended in December 2006. In certain businesses, the accounting policies or accounting estimates have been changed, as permitted by IFRS 4 and IAS 8 respectively, to remeasure designated insurance liabilities to reflect current market interest rates and changes to regulatory capital requirements. When accounting policies or accounting estimates have been changed, and adjustments to the measurement basis have occurred, the financial statements of that year will have disclosed the impacts accordingly.

One such example is our adoption of Financial Reporting Standard 27, Life Assurance, (FRS 27) which was issued by the UK’s Accounting Standards Board (ASB) in December 2004. Aviva, along with other major insurance companies and the ABI, signed a

102 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Memorandum of Understanding with the ASB, under which we voluntarily agreed to adopt in full the standard from 2005 in the Group’s IFRS financial statements. FRS 27 adds to the requirements of IFRS but does not vary them in any way. The additional requirements of FRS 27 are detailed in policy J below and in note 52.

(F) Premiums earned

Premiums on long-term insurance contracts and participating investment contracts are recognised as income when receivable, except for investment-linked premiums which are accounted for when the corresponding liabilities are recognised. For single premium business, this is the date from which the policy is effective. For regular premium contracts, receivables are taken at the date when payments are due. Premiums are shown before deduction of commission and before any sales-based taxes or duties. Where policies lapse due to non-receipt of premiums, then all the related premium income accrued but not received from the date they are deemed to have lapsed is offset against premiums.

General insurance and health premiums written reflect business incepted during the year, and exclude any sales-based taxes or duties. Unearned premiums are those proportions of the premiums written in a year that relate to periods of risk after the statement of financial position date. Unearned premiums are calculated on either a daily or monthly pro rata basis. Premiums collected by intermediaries, but not yet received, are assessed based on estimates from underwriting or past experience, and are included in premiums written.

Deposits collected under investment contracts without a discretionary participating feature (non-participating contracts) are not accounted for through the income statement, except for the fee income (covered in policy G) and the investment income attributable to those contracts, but are accounted for directly through the statement of financial position as an adjustment to the investment contract liability.

(G) Other investment contract fee revenue

Investment contract policyholders are charged fees for policy administration, investment management, surrenders or other contract services. The fees may be for fixed amounts or vary with the amounts being managed, and will generally be charged as an adjustment to the policyholder’s balance. The fees are recognised as revenue in the period in which they are collected unless they relate to services to be provided in future periods, in which case they are deferred and recognised as the service is provided.

Initiation and other “front-end” fees (fees that are assessed against the policyholder balance as consideration for origination of the contract) are charged on some non-participating investment and investment fund management contracts. Where the investment contract is recorded at amortised cost, these fees are deferred and recognised over the expected term of the policy by an adjustment to the effective yield. Where the investment contract is measured at fair value, the front-end fees that relate to the provision of investment management services are deferred and recognised as the services are provided.

(H) Other fee and commission income

Other fee and commission income consists primarily of fund management fees, income from the RAC’s non-insurance activities, distribution fees from mutual funds, commissions on reinsurance ceded, commission revenue from the sale of mutual fund shares, and transfer agent fees for shareholder record keeping. Reinsurance commissions receivable are deferred in the same way as acquisition costs, as described in policy V. All other fee and commission income is recognised as the services are provided.

(I) Net investment income

Investment income consists of dividends, interest and rents receivable for the year, movements in amortised cost on debt securities, realised gains and losses, and unrealised gains and losses on FV investments (as defined in policy R). Dividends on equity securities are recorded as revenue on the ex-dividend date. Interest income is recognised as it accrues, taking into account the effective yield on the investment. It includes the interest rate differential on forward foreign exchange contracts. Rental income is recognised on an accruals basis.

A gain or loss on a financial investment is only realised on disposal or transfer, and is the difference between the proceeds received, net of transaction costs, and its original cost or amortised cost as appropriate.

Unrealised gains and losses, arising on investments which have not been derecognised as a result of disposal or transfer, represent the difference between the carrying value at the year end and the carrying value at the previous year end or purchase value during the year, less the reversal of previously recognised unrealised gains and losses in respect of disposals made during the year. Realised gains or losses on investment property represent the difference between the net disposal proceeds and the carrying amount of the property.

(J) Insurance and participating investment contract liabilities

Claims

Long-term business claims reflect the cost of all claims arising during the year, including claims handling costs, as well as policyholder bonuses accrued in anticipation of bonus declarations.

General insurance and health claims incurred include all losses occurring during the year, whether reported or not, related handling costs, a reduction for the value of salvage and other recoveries, and any adjustments to claims outstanding from previous years.

Claims handling costs include internal and external costs incurred in connection with the negotiation and settlement of claims. Internal costs include all direct expenses of the claims department and any part of the general administrative costs directly attributable to the claims function.

| | 103 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Long-term business provisions

Under current IFRS requirements, insurance and participating investment contract liabilities are measured using accounting policies consistent with those adopted previously under existing accounting practices, with the exception of liabilities remeasured to reflect current market interest rates and those relating to UK with-profit and non-profit contracts, to be consistent with the value of the backing assets. For liabilities relating to UK with-profit contracts, the Group has adopted FRS 27, Life Assurance, as described in policy E above, in addition to the requirements of IFRS.

In the United States, shadow adjustments are made to the liabilities or related deferred acquisition costs and are recognised directly in other comprehensive income. This means that the measurement of these items is adjusted for unrealised gains or losses on the backing assets such as AFS financial investments (see policy R), that are recognised directly in other comprehensive income, in the same way as if those gains or losses had been realised.

The long-term business provisions are calculated separately for each life operation, based either on local regulatory requirements or existing local GAAP at the later of the date of transition to IFRS or the date of the acquisition of the entity, and actuarial principles consistent with those applied in the UK. Each calculation represents a determination within a range of possible outcomes, where the assumptions used in the calculations depend on the circumstances prevailing in each life operation. The principal assumptions are disclosed in note 35(b). For liabilities of the UK with-profit funds, FRS 27 requires liabilities to be calculated as the realistic basis liabilities as set out by the UK’s Financial Services Authority, adjusted to remove the shareholders’ share of future bonuses. For UK non-profit insurance contracts, the Group applies the realistic regulatory basis as set out in the FSA Policy Statement 06/14, Prudential Changes for Insurers, where applicable.

Present value of future profits (PVFP) on non-participating business written in a with-profit fund

For UK with-profit life funds falling within the scope of the FSA realistic capital regime, and hence FRS 27, an amount may be recognised for the present value of future profits on non-participating business written in a with-profit fund where the determination of the realistic value of liabilities in that with-profit fund takes account, directly or indirectly, of this value. This amount is recognised as a reduction in the liability rather than as an asset in the statement of financial position, and is then apportioned between the amounts that have been taken into account in the measurement of liabilities and other amounts which are shown as an adjustment to the unallocated divisible surplus.

Unallocated divisible surplus

In certain participating long-term insurance and investment business, the nature of the policy benefits is such that the division between shareholder reserves and policyholder liabilities is uncertain. Amounts whose allocation to either policyholders or shareholders has not been determined by the end of the financial year are held within liabilities as an unallocated divisible surplus.

If the aggregate carrying value of liabilities for a particular participating business fund is in excess of the aggregate carrying value of its assets, then the difference is held as a negative unallocated divisible surplus balance, subject to recoverability from margins in that fund’s participating business. Any excess of this difference over the recoverable amount is charged to net income in the reporting period.

Embedded derivatives

Embedded derivatives that meet the definition of an insurance contract or correspond to options to surrender insurance contracts for a set amount (or based on a fixed amount and an interest rate) are not separately measured. All other embedded derivatives are separated and measured at fair value, if they are not considered as closely related to the host insurance contract or do not meet the definition of an insurance contract. Fair value reflects own credit risk to the extent the embedded derivative is not fully collateralised.

Liability adequacy

At each reporting date, an assessment is made of whether the recognised long-term business provisions are adequate, using current estimates of future cash flows. If that assessment shows that the carrying amount of the liabilities (less related assets) is insufficient in light of the estimated future cash flows, the deficiency is recognised in the income statement by setting up an additional provision in the statement of financial position.

General insurance and health provisions

(i) Outstanding claims provisions

General insurance and health outstanding claims provisions are based on the estimated ultimate cost of all claims incurred but not settled at the statement of financial position date, whether reported or not, together with related claims handling costs. Significant delays are experienced in the notification and settlement of certain types of general insurance claims, particularly in respect of liability business, including environmental and pollution exposures, the ultimate cost of which cannot be known with certainty at the statement of financial position date. Any estimate represents a determination within a range of possible outcomes. Further details of estimation techniques are given in note 35(c).

Provisions for latent claims are discounted, using rates based on the relevant swap curve, in the relevant currency at the reporting date, having regard to the expected settlement dates of the claims. The discount rate is set at the start of the accounting period. The range of discount rates used is described in note 35(c). Outstanding claims provisions are valued net of an allowance for expected future recoveries. Recoveries include non-insurance assets that have been acquired by exercising rights to salvage and subrogation under the terms of insurance contracts.

104 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

(ii) Provision for unearned premiums

The proportion of written premiums, gross of commission payable to intermediaries, attributable to subsequent periods is deferred as a provision for unearned premiums. The change in this provision is taken to the income statement as recognition of revenue over the period of risk.

(iii) Liability adequacy

At each reporting date, the Group reviews its unexpired risks and carries out a liability adequacy test for any overall excess of expected claims and deferred acquisition costs over unearned premiums, using the current estimates of future cash flows under its contracts after taking account of the investment return expected to arise on assets relating to the relevant general business provisions. If these estimates show that the carrying amount of its insurance liabilities (less related deferred acquisition costs) is insufficient in light of the estimated future cash flows, the deficiency is recognised in the income statement by setting up a provision in the statement of financial position.

Other assessments and levies

The Group is subject to various periodic insurance-related assessments or guarantee fund levies. Related provisions are established where there is a present obligation (legal or constructive) as a result of a past event. Such amounts are not included in insurance liabilities but are included under “Provisions” in the statement of financial position.

(K) Non-participating investment contract liabilities

Claims

For non-participating investment contracts with an account balance, claims reflect the excess of amounts paid over the account balance released.

Contract liabilities

Deposits collected under non-participating investment contracts are not accounted for through the income statement, except for the investment income attributable to those contracts, but are accounted for directly through the statement of financial position as an adjustment to the investment contract liability.

The majority of the Group’s contracts classified as non-participating investment contracts are unit-linked contracts and are measured at fair value. Certain liabilities for non-linked non-participating contracts are measured at amortised cost.

The fair value liability is determined in accordance with IAS 39, using a valuation technique to provide a reliable estimate of the amount for which the liability could be settled between knowledgeable willing parties in an arm’s length transaction. For unit-linked contracts, the fair value liability is equal to the current unit fund value, plus additional non-unit reserves if required based on a discounted cash flow analysis. For non-linked contracts, the fair value liability is based on a discounted cash flow analysis, with allowance for risk calibrated to match the market price for risk.

Amortised cost is calculated as the fair value of consideration received at the date of initial recognition, less the net effect of payments such as transaction costs and front-end fees, plus or minus the cumulative amortisation (using the effective interest rate method) of any difference between that initial amount and the maturity value, and less any write-down for surrender payments. The effective interest rate is the one that equates the discounted cash payments to the initial amount. At each reporting date, the amortised cost liability is determined as the value of future best estimate cash flows discounted at the effective interest rate.

(L) Reinsurance

The Group assumes and cedes reinsurance in the normal course of business, with retention limits varying by line of business. Premiums on reinsurance assumed are recognised as revenue in the same manner as they would be if the reinsurance were considered direct business, taking into account the product classification of the reinsured business. The cost of reinsurance related to long-duration contracts is accounted for over the life of the underlying reinsured policies, using assumptions consistent with those used to account for these policies.

Where general insurance liabilities are discounted, any corresponding reinsurance assets are also discounted using consistent assumptions.

Gains or losses on buying retroactive reinsurance are recognised in the income statement immediately at the date of purchase and are not amortised. Premiums ceded and claims reimbursed are presented on a gross basis in the consolidated income statement and statement of financial position as appropriate.

Reinsurance assets primarily include balances due from both insurance and reinsurance companies for ceded insurance liabilities. Amounts recoverable from reinsurers are estimated in a manner consistent with the outstanding claims provisions or settled claims associated with the reinsured policies and in accordance with the relevant reinsurance contract.

Reinsurance contracts that principally transfer financial risk are accounted for directly through the statement of financial position and are not included in reinsurance assets or liabilities. A deposit asset or liability is recognised, based on the consideration paid or received less any explicitly identified premiums or fees to be retained by the reinsured.

If a reinsurance asset is impaired, the Group reduces the carrying amount accordingly and recognises that impairment loss in the income statement. A reinsurance asset is impaired if there is objective evidence, as a result of an event that occurred after initial recognition of the reinsurance asset, that the Group may not receive all amounts due to it under the terms of the contract, and the event has a reliably measurable impact on the amounts that the Group will receive from the reinsurer.

| | 105 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

(M) Goodwill, AVIF and intangible assets

Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the Group’s share of the net assets of the acquired subsidiary, associate or joint venture at the date of acquisition. Goodwill on acquisitions prior to 1 January 2004 (the date of transition to IFRS) is carried at its book value (original cost less cumulative amortisation) on that date, less any impairment subsequently incurred. Goodwill arising before 1 January 1998 was eliminated against reserves and has not been reinstated. Goodwill arising on the Group’s investments in subsidiaries since that date is shown as a separate asset, whilst that on associates and joint ventures is included within the carrying value of those investments.

Acquired value of in-force business (AVIF)

The present value of future profits on a portfolio of long-term insurance and investment contracts, acquired either directly or through the purchase of a subsidiary, is recognised as an asset. If the AVIF results from the acquisition of an investment in a joint venture or an associate, it is held within the carrying amount of that investment. In all cases, the AVIF is amortised over the useful lifetime of the related contracts in the portfolio on a systematic basis. The rate of amortisation is chosen by considering the profile of the additional value of in-force business acquired and the expected depletion in its value. The value of the acquired in-force long-term business is reviewed annually for any impairment in value and any reductions are charged as expenses in the income statement.

Intangible assets

Intangibles consist primarily of brands, certain of which have been assessed as having indefinite useful lives, and contractual relationships such as access to distribution networks and customer lists. The economic lives of the latter are determined by considering relevant factors such as usage of the asset, typical product life cycles, potential obsolescence, maintenance costs, the stability of the industry, competitive position, and the period of control over the assets. These intangibles are amortised over their useful lives, which range from five to 30 years, using the straight-line method.

The amortisation charge for the year is included in the income statement under “Other operating expenses”. For intangibles with finite lives, a provision for impairment will be charged where evidence of such impairment is observed. Intangibles with indefinite lives are subject to regular impairment testing, as described below.

Impairment testing

For impairment testing, goodwill and intangibles with indefinite useful lives have been allocated to cash-generating units. The carrying amount of goodwill and intangible assets with indefinite useful lives is reviewed at least annually or when circumstances or events indicate there may be uncertainty over this value. Goodwill and indefinite life intangibles are written down for impairment where the recoverable amount is insufficient to support its carrying value. Further details on goodwill allocation and impairment testing are given in note 13(b).

(N) Property and equipment

Owner-occupied properties are carried at their revalued amounts, which are supported by market evidence, and movements are recognised in other comprehensive income and taken to a separate reserve within equity. When such properties are sold, the accumulated revaluation surpluses are transferred from this reserve to retained earnings. These properties are depreciated down to their estimated residual values over their useful lives. All other items classed as property and equipment within the statement of financial position are carried at historical cost less accumulated depreciation.

Investment properties under construction are included within property and equipment until completion, and are stated at cost less any provision for impairment in their values.

Depreciation is calculated on the straight-line method to write-down the cost of other assets to their residual values over their estimated useful lives as follows:

— Land | No depreciation |

— Properties under construction | No depreciation |

— Owner-occupied properties, and related mechanical and electrical equipment | 25 years |

— Motor vehicles | Three-years, or lease term if longer |

— Computer equipment | Three to five years |

— Other assets | Three to five years |

The assets’ residual values, useful lives and method of depreciation are reviewed regularly, and at least at each financial year end, and adjusted if appropriate. Where the carrying amount of an asset is greater than its estimated recoverable amount, it is written down immediately to its recoverable amount. Gains and losses on disposal of property and equipment are determined by reference to their carrying amount.

Until 1 January 2009, borrowing costs directly attributable to the acquisition and construction of property and equipment were expensed as incurred. With effect from 1 January 2009, such costs are capitalised. All repairs and maintenance costs are charged to the income statement during the financial period in which they are incurred. The cost of major renovations is included in the carrying amount of the asset when it is probable that future economic benefits in excess of the most recently assessed standard of performance of the existing asset will flow to the Group and the renovation replaces an identifiable part of the asset. Major renovations are depreciated over the remaining useful life of the related asset.

106 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

(O) Investment property

Investment property is held for long-term rental yields and is not occupied by the Group. Completed investment property is stated at its fair value, which is supported by market evidence, as assessed by qualified external valuers or by local qualified staff of the Group in overseas operations. Changes in fair values are recorded in the income statement in net investment income.

(P) Impairment of non-financial assets

Property and equipment and other non-financial assets are reviewed for impairment losses whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. An impairment loss is recognised for the amount by which the carrying amount of the asset exceeds its recoverable amount, which is the higher of an asset’s net selling price and value in use. For the purposes of assessing impairment, assets are grouped at the lowest level for which there are separately identifiable cash flows.

(Q) Derecognition and offset of financial assets and financial liabilities

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is derecognised where:

— | The rights to receive cash flows from the asset have expired. |

— | The Group retains the right to receive cash flows from the asset, but has assumed an obligation to pay them in full without material delay to a third-party under a “pass-through” arrangement;. |

— | The Group has transferred its rights to receive cash flows from the asset and has either transferred substantially all the risks and rewards of the asset, or has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. |

A financial liability is derecognised when the obligation under the liability is discharged or cancelled or expires.

Financial assets and liabilities are offset and the net amount reported in the statement of financial position when there is a legally enforceable right to set off the recognised amounts and there is an intention to settle on a net basis, or realise the asset and settle the liability simultaneously.

(R) Financial investments

The Group classifies its investments as either financial assets at fair value through profit or loss (FV) or financial assets available for sale (AFS). The classification depends on the purpose for which the investments were acquired, and is determined by local management at initial recognition. The FV category has two subcategories – those that meet the definition as being held for trading and those the Group chooses to designate as FV (referred to in this accounting policy as “other than trading”).

In general, the FV category is used as, in most cases, the Group’s investment or risk management strategy is to manage its financial investments on a fair value basis. Debt securities and equity securities, which the Group buys with the intention to resell in the short term, are classified as trading, as are non-hedge derivatives (see policy S below). All other securities in the FV category are classified as other than trading. The AFS category is used where the relevant long-term business liability (including shareholders’ funds) is passively managed, as well as in certain fund management and non-insurance operations.

Purchases and sales of investments are recognised on the trade date, which is the date that the Group commits to purchase or sell the assets, at their fair values. Debt securities are initially recorded at their fair value, which is taken to be amortised cost, with amortisation credited or charged to the income statement. Investments classified as trading, other than trading and AFS are subsequently carried at fair value. Changes in the fair value of trading and other than trading investments are included in the income statement in the period in which they arise. Changes in the fair value of securities classified as AFS are recognised in other comprehensive income and recorded in a separate investment valuation reserve within equity.

Investments carried at fair value are measured using a fair value hierarchy, described in note 21(b), with values based on quoted bid prices or amounts derived from cash flow models. Fair values for unlisted equity securities are estimated using applicable price/earnings or price/cash flow ratios refined to reflect the specific circumstances of the issuer.

When securities classified as AFS are sold or impaired, the accumulated fair value adjustments are transferred out of the investment valuation reserve to the income statement with a corresponding movement through other comprehensive income.

Financial guarantees are recognised initially at their fair value and are subsequently amortised over the duration of the contract. A liability is recognised for amounts payable under the guarantee if it is more likely than not that the guarantee will be called upon.

Impairment

The Group reviews the carrying value of its investments on a regular basis. If the carrying value of an investment is greater than the recoverable amount, the carrying value is reduced through a charge to the income statement in the period of impairment. The following policies are used to determine the level of any impairment, some of which involve considerable judgement:

AFS debt securities: An AFS debt security is impaired if there is objective evidence that a loss event has occurred which has impaired the expected cash flows, i.e. where all amounts due according to the contractual terms of the security are not considered collectible. An impairment charge, measured as the difference between the security’s fair value and amortised cost, is recognised when the issuer is known to be either in default or in financial difficulty. Determining when an issuer is in financial difficulty requires the use of judgement, and we consider a number of factors including industry risk factors, financial condition, liquidity position and near-term prospects of the issuer, credit rating declines and a breach of contract. A decline in fair value below amortised cost due to changes in risk-free interest rates does not necessarily represent objective evidence of a loss event.

| | 107 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

AFS equity securities: An AFS equity security is considered impaired if there is objective evidence that the cost may not be recovered. In addition to qualitative impairment criteria, such evidence includes a significant or prolonged decline in fair value below cost. Unless there is evidence to the contrary, an equity security is considered impaired if the decline in fair value relative to cost has been either at least 20% for a continuous six month period or more than 40% at the end of the reporting period. Evidence to the contrary may include a significant rise in value of the equity security, for example as a result of a merger announced after the period end. We also review our largest equity holdings for evidence of impairment, as well as individual equity holdings in industry sectors known to be in difficulty. Where there is objective evidence that impairment exists, the security is written down regardless of the size of the unrealised loss.

For both debt and equity AFS securities identified as being impaired, the cumulative unrealised net loss previously recognised within the investment valuation reserve is transferred to realised losses for the year with a corresponding movement through other comprehensive income. Any subsequent increase in fair value of these impaired securities is recognised in other comprehensive income and recorded in the investment valuation reserve, unless this increase can be objectively related to an event occurring after the impairment loss was recognised in the income statement. In such an event, the reversal of the impairment loss is recognised as a gain in the income statement.

Mortgages and securitised loans: Impairment is measured based on the present value of expected future cash flows discounted at the effective rate of interest of the loan, subject to the fair value of the underlying collateral. When a loan is considered to be impaired, the income statement is charged with the difference between the carrying value and the estimated recoverable amount. Interest income on impaired loans is recognised based on the estimated recoverable amount.

Reversals of impairments are only recognised where the decrease in the impairment can be objectively related to an event occurring after the write-down (such as an improvement in the debtor’s credit rating), and are not recognised in respect of equity instruments.

(S) Derivative financial instruments and hedging

Derivative financial instruments include foreign exchange contracts, interest rate futures, currency and interest rate swaps, currency and interest rate options (both written and purchased) and other financial instruments that derive their value mainly from underlying interest rates, foreign exchange rates, commodity values or equity instruments. All derivatives are initially recognised in the statement of financial position at their fair value, which usually represents their cost. They are subsequently remeasured at their fair value, with the method of recognising movements in this value depending on whether they are designated as hedging instruments and, if so, the nature of the item being hedged. Fair values are obtained from quoted market prices or, if these are not available, by using valuation techniques such as discounted cash flow models or option pricing models. All derivatives are carried as assets when the fair values are positive and as liabilities when the fair values are negative. Premiums paid for derivatives are recorded as an asset on the statement of financial position at the date of purchase, representing their fair value at that date.

Derivative contracts may be traded on an exchange or over-the-counter (OTC). Exchange-traded derivatives are standardised and include certain futures and option contracts. OTC derivative contracts are individually negotiated between contracting parties and include forwards, swaps, caps and floors. Derivatives are subject to various risks including market, liquidity and credit risk, similar to those related to the underlying financial instruments.

The notional or contractual amounts associated with derivative financial instruments are not recorded as assets or liabilities on the statement of financial position as they do not represent the fair value of these transactions. These amounts are disclosed in note 54.

Interest rate and currency swaps

Interest rate swaps are contractual agreements between two parties to exchange periodic payments in the same currency, each of which is computed on a different interest rate basis, on a specified notional amount. Most interest rate swaps involve the net exchange of payments calculated as the difference between the fixed and floating rate interest payments. Currency swaps, in their simplest form, are contractual agreements that involve the exchange of both periodic and final amounts in two different currencies. Both types of swap contracts may include the net exchange of principal. Exposure to gain or loss on these contracts will increase or decrease over their respective lives as a function of maturity dates, interest and foreign exchange rates, and the timing of payments.

Interest rate futures, forwards and options contracts

Interest rate futures are exchange-traded instruments and represent commitments to purchase or sell a designated security or money market instrument at a specified future date and price. Interest rate forward agreements are OTC contracts in which two parties agree on an interest rate and other terms that will become a reference point in determining, in concert with an agreed notional principal amount, a net payment to be made by one party to the other, depending what rate in fact prevails at a future point in time. Interest rate options, which consist primarily of caps and floors, are interest rate protection instruments that involve the potential obligation of the seller to pay the buyer an interest rate differential in exchange for a premium paid by the buyer. This differential represents the difference between current rate and an agreed rate applied to a notional amount. Exposure to gain or loss on all interest rate contracts will increase or decrease over their respective lives as interest rates fluctuate.

Foreign exchange contracts

Foreign exchange contracts, which include spot, forward and futures contracts, represent agreements to exchange the currency of one country for the currency of another country at an agreed price and settlement date. Foreign exchange option contracts are similar to interest rate option contracts, except that they are based on currencies, rather than interest rates.

Exposure to gain or loss on these contracts will increase or decrease over their respective lives as currency exchange and interest rates fluctuate.

108 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Derivative instruments for hedging

On the date a derivative contract is entered into, the Group designates certain derivatives as either:

(i) | a hedge of the fair value of a recognised asset or liability (fair value hedge); |

(ii) | a hedge of a future cash flow attributable to a recognised asset or liability, a highly probable forecast transaction or a firm commitment (cash flow hedge); or |

(iii) | a hedge of a net investment in a foreign operation (net investment hedge) |

Hedge accounting is used for derivatives designated in this way, provided certain criteria are met. At the inception of the transaction, the Group documents the relationship between the hedging instrument and the hedged item, as well as the risk management objective and the strategy for undertaking the hedge transaction. The Group also documents its assessment of whether the hedge is expected to be, and has been, highly effective in offsetting the risk in the hedged item, both at inception and on an ongoing basis.

Changes in the fair value of derivatives that are designated and qualify as net investment or cash flow hedges, and that prove to be highly effective in relation to the hedged risk, are recognised in other comprehensive income and a separate reserve within equity. Gains and losses accumulated in this reserve are included in the income statement on disposal of the relevant investment or occurrence of the cash flow as appropriate.

The Group discontinues hedge accounting if the hedging instrument expires, is sold, terminated or exercised, the hedge no longer meets the criteria for hedge accounting or the Group revokes the designation.

For a variety of reasons, certain derivative transactions, while providing effective economic hedges under the Group’s risk management positions, do not qualify for hedge accounting under the specific IFRS rules and are therefore treated as derivatives held for trading. Their fair value gains and losses are recognised immediately in other trading income.

(T) Loans

Loans with fixed maturities, including policyholder loans, mortgage loans on investment property, securitised mortgages and collateral loans, are recognised when cash is advanced to borrowers. The majority of these loans are carried at their unpaid principal balances and adjusted for amortisation of premium or discount, non-refundable loan fees and related direct costs. These amounts are deferred and amortised over the life of the loan as an adjustment to loan yield using the effective interest rate method. Loans with indefinite future lives are carried at unpaid principal balances or cost.

For certain mortgage loans, the Group has taken advantage of the revised fair value option under IAS 39 to present the mortgages, associated borrowings and derivative financial instruments at fair value, since they are managed as a portfolio on a fair value basis. This presentation provides more relevant information and eliminates any accounting mismatch that would otherwise arise from using different measurement bases for these three items. The fair values of mortgages classified as FV are estimated using discounted cash flow forecasts, based on a risk-adjusted discount rate which reflects the risks associated with these products, calibrated using the margins available on new lending or with reference to the rates offered by competitors. They are revalued at each period end, with movements in their fair values being taken to the income statement.

At each reporting date, we review loans carried at amortised cost for objective evidence that they are impaired and uncollectable, either at the level of an individual security or collectively within a group of loans with similar credit risk characteristics. To the extent that a loan is uncollectable, it is written down as impaired to its recoverable amount, measured as the present value of expected future cash flows discounted at the original effective interest rate of the loan, including any collateral receivable. Subsequent recoveries in excess of the loan’s written down carrying value are credited to the income statement.

(U) Collateral

The Group receives and pledges collateral in the form of cash or non-cash assets in respect of stock lending transactions, as well as certain derivative contracts and loans, in order to reduce the credit risk of these transactions. Collateral is also pledged as security for bank letters of credit. The amount and type of collateral required depends on an assessment of the credit risk of the counterparty.

Collateral received in the form of cash, which is not legally segregated from the Group, is recognised as an asset in the statement of financial position with a corresponding liability for the repayment in financial liabilities (note 46). Non-cash collateral received is not recognised in the statement of financial position unless the Group either sells or repledges these assets in the absence of default, at which point the obligation to return this collateral is recognised as a liability.

Collateral pledged in the form of cash, which is legally segregated from the Group, is derecognised from the statement of financial position with a corresponding receivable for its return. Non-cash collateral pledged is not derecognised from the statement of financial position unless the Group defaults on its obligations under the relevant agreement, and therefore continues to be recognised in the statement of financial position within the appropriate asset classification.

(V) Deferred acquisition costs and other assets

The costs directly attributable to the acquisition of new business for insurance and participating investment contracts (excluding those written in the UK) are deferred to the extent that they are expected to be recoverable out of future margins in revenues on these contracts. For participating contracts written in the UK, acquisition costs are generally not deferred as the liability for these contracts is calculated in accordance with the FSA’s realistic capital regime and FRS 27. For non-participating investment and investment fund management contracts, incremental acquisition costs and sales enhancements that are directly attributable to securing an investment management service are also deferred.

Where such business is reinsured, an appropriate proportion of the deferred acquisition costs is attributed to the reinsurer, and is treated as a separate liability.

| | 109 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

Long-term business deferred acquisition costs are amortised systematically over a period no longer than that in which they are expected to be recoverable out of these future margins. Deferrable acquisition costs for non-participating investment and investment fund management contracts are amortised over the period in which the service is provided. General insurance and health deferred acquisition costs are amortised over the period in which the related revenues are earned. The reinsurers’ share of deferred acquisition costs is amortised in the same manner as the underlying asset.

Deferred acquisition costs are reviewed by category of business at the end of each reporting period and are written-off where they are no longer considered to be recoverable.

Other assets include vehicles which are subject to repurchase agreements and inventories of vehicle parts. The former are carried at the lower of their agreed repurchase price or net realisable value, whilst the latter are carried at the lower of cost and net realisable value, where cost is arrived at on the weighted average cost formula or “first in first out” (FIFO) basis. Provision is made against inventories which are obsolete or surplus to requirements.

(W) Statement of cash flows

Cash and cash equivalents

Cash and cash equivalents consist of cash at banks and in hand, deposits held at call with banks, treasury bills and other short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of change in value. Such investments are those with less than three months’ maturity from the date of acquisition, or which are redeemable on demand with only an insignificant change in their fair values.

For the purposes of the statement, of cash flows, cash and cash equivalents also include bank overdrafts, which are included in payables and other financial liabilities on the statement of financial position.

Operating cash flows

Purchases and sales of investment property, loans and financial investments are included within operating cash flows as the purchases are funded from cash flows associated with the origination of insurance and investment contracts, net of payments of related benefits and claims.

(X) Leases

Leases, where a significant portion of the risks and rewards of ownership is retained by the lessor, are classified as operating leases. Assets held for use in such leases are included in property and equipment, and are depreciated to their residual values over their estimated useful lives. Rentals from such leases are credited to the income statement on a straight-line basis over the period of the relevant leases. Payments made as lessee under operating leases (net of any incentives received from the lessor) are charged to the income statement on a straight-line basis over the period of the relevant leases.

(Y) Provisions and contingent liabilities

Provisions are recognised when the Group has a present legal or constructive obligation as a result of past events, it is more probable than not that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate of the amount of the obligation can be made. Where the Group expects a provision to be reimbursed, for example under an insurance contract, the reimbursement is recognised as a separate asset but only when the reimbursement is virtually certain.

The Group recognises a provision for onerous contracts when the expected benefits to be derived from a contract are less than the unavoidable costs of meeting the obligations under the contract. Contingent liabilities are disclosed if there is a possible future obligation as a result of a past event, or if there is a present obligation as a result of a past event but either a payment is not probable or the amount cannot be reasonably estimated.

(Z) Employee benefits

Annual leave and long service leave

Employee entitlements to annual leave and long service leave are recognised when they accrue to employees. A provision is made for the estimated liability for annual leave and long service leave as a result of services rendered by employees up to the statement of financial position date.

Pension obligations

The Group operates a large number of pension schemes around the world, whose members receive benefits on either a defined benefit basis (generally related to a member’s final salary and length of service) or a defined contribution basis (generally related to the amount invested, investment return and annuity rates), the assets of which are generally held in separate trustee-administered funds. The pension plans are generally funded by payments from employees and the relevant Group companies.

For defined benefit plans, the pension costs are assessed using the projected unit credit method. Under this method, the cost of providing pensions is charged to the income statement so as to spread the regular cost over the service lives of employees. The pension obligation is measured as the present value of the estimated future cash outflows, using a discount rate based on market yields for high quality corporate bonds that are denominated in the currency in which the benefits will be paid and that have terms to maturity approximating to the terms of the related pension liability. The resulting pension scheme surplus or deficit appears as an asset or liability in the consolidated statement of financial position.

Costs charged to the income statement comprise the current service cost (the increase in pension obligation resulting from employees’ service in the current period, together with the schemes’ administration expenses), past service cost (resulting from changes to benefits with respect to previous years’ service), and gains or losses on curtailment (when the employer materially reduces the number of employees covered by the scheme) or on settlements (when a scheme’s obligations are transferred outside

110 | | |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

the Group). In addition, the difference between the expected return on scheme assets, less investment expenses, and the interest cost of unwinding the discount on the scheme liabilities (to reflect the benefits being one period closer to being paid out) is credited to investment income. All actuarial gains and losses, being the difference between the actual and expected returns on scheme assets, changes in assumptions underlying the liability calculations and experience gains or losses on the assumptions made at the beginning of the period, are recognised immediately in other comprehensive income.

For defined contribution plans, the Group pays contributions to publicly or privately administered pension plans. Once the contributions have been paid, the Group, as employer, has no further payment obligations. The Group’s contributions are charged to the income statement in the year to which they relate and are included in staff costs.

Other post-employment obligations

Some Group companies provide post-employment healthcare or other benefits to their retirees. The entitlement to these benefits is usually based on the employee remaining in service up to retirement age and the completion of a minimum service period. Unlike the pension schemes, no assets are set aside in separate funds to provide for the future liability but none of these schemes is material to the Group. The costs of the Canadian scheme are included within those for the defined benefit pension schemes in that country. For such schemes in other countries, provisions are calculated in line with local regulations, with movements being charged to the income statement within staff costs.

Equity compensation plans

The Group offers share award and option plans over the Company’s ordinary shares for certain employees, including a Save As You Earn plan (SAYE plan), details of which are given in the Directors’ remuneration report and in note 26.

The Group accounts for options and awards under equity compensation plans, which were granted after 7 November 2002, until such time as they are fully vested, using the fair value based method of accounting (the “fair value method”). Under this method, the cost of providing equity compensation plans is based on the fair value of the share awards or option plans at date of grant, which is recognised in the income statement over the expected vesting period of the related employees and credited to the equity compensation reserve, part of shareholders’ funds.

Shares purchased by employee share trusts to fund these awards are shown as a deduction from shareholders’ funds at their original cost.

When the options are exercised and new shares are issued, the proceeds received, net of any transaction costs, are credited to share capital (par value) and the balance to share premium. Where the shares are already held by employee trusts, the net proceeds are credited against the cost of these shares, with the difference between cost and proceeds being taken to retained earnings. In both cases, the relevant amount in the equity compensation reserve is then credited to retained earnings.

(AA) Income taxes

The current tax expense is based on the taxable profits for the year, after any adjustments in respect of prior years. Tax, including tax relief for losses if applicable, is allocated over profits before taxation and amounts charged or credited to reserves as appropriate.

Provision is made for deferred tax liabilities, or credit taken for deferred tax assets, using the liability method, on all material temporary differences between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements.

The principal temporary differences arise from depreciation of property and equipment, revaluation of certain financial assets and liabilities including derivative contracts, provisions for pensions and other post-retirement benefits and tax losses carried forward; and, in relation to acquisitions, on the difference between the fair values of the net assets acquired and their tax base. The rates enacted or substantively enacted at the statement of financial position date are used to determine the deferred tax.

Deferred tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised. In countries where there is a history of tax losses, deferred tax assets are only recognised in excess of deferred tax liabilities if there is convincing evidence that future profits will be available.

Deferred tax is provided on temporary differences arising from investments in subsidiaries, associates and joint ventures, except where the timing of the reversal of the temporary difference can be controlled and it is probable that the difference will not reverse in the foreseeable future.

Deferred taxes are not provided in respect of temporary differences arising from the initial recognition of goodwill, or from goodwill for which amortisation is not deductible for tax purposes, or from the initial recognition of an asset or liability in a transaction which is not a business combination and affects neither accounting profit nor taxable profit or loss at the time of the transaction.

Current and deferred tax relating to items recognised in other comprehensive income and directly in equity are similarly recognised in other comprehensive income and directly in equity respectively. Deferred tax related to fair value re-measurement of available for sale investments, owner-occupied properties and other amounts charged or credited directly to other comprehensive income is recognised in the statement of financial position as a deferred tax asset or liability. Current tax on interest paid on Direct Capital instruments is credited directly in equity.

In addition to paying tax on shareholders’ profits, the Group’s life businesses in the UK, Ireland, Singapore and Australia (prior to its disposal) pay tax on policyholders’ investment returns (“policyholder tax”) on certain products at policyholder tax rates. Policyholder tax is accounted for as an income tax and is included in the total tax expense. The Group has decided to show separately the amounts of policyholder tax to provide a more meaningful measure of the tax the Group pays on its profits.

| | 111 |

Aviva plc Annual Report on Form 20-F 2009 | | Accounting policies continued |

(AB) Borrowings

Borrowings are recognised initially at their issue proceeds less transaction costs incurred. Subsequently, most borrowings are stated at amortised cost, and any difference between net proceeds and the redemption value is recognised in the income statement over the period of the borrowings using the effective interest rate method. All borrowing costs are expensed as they are incurred except where they are directly attributable to the acquisition or construction of property and equipment as described in policy N above.

Where loan notes have been issued in connection with certain securitised mortgage loans, the Group has taken advantage of the revised fair value option under IAS 39 to present the mortgages, associated liabilities and derivative financial instruments at fair value, since they are managed as a portfolio on a fair value basis. This presentation provides more relevant information and eliminates any accounting mismatch which would otherwise arise from using different measurement bases for these three items.

(AC) Share capital and treasury shares