As filed with the Securities and Exchange Commission on March 25, 2013

| | UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549 |

| | FORM 20-F |

| (Mark one) |

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR (G) |

| | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) |

| | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2012 |

| | OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

| | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | OR |

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) |

| | OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | Commission file number: 001-34486 |

| | AVIVA PLC

(Exact Name of Registrant as Specified in its Charter) |

| | |

| | ENGLAND AND WALES

(Jurisdiction of Incorporation) |

| | |

| | St. Helen’s, 1 Undershaft

London EC3P 3DQ, England

(Address of Principal Executive Offices) |

| | |

| | David Rogers

Chief Accounting Officer

Aviva plc

St. Helen’s, 1 Undershaft

London EC3P 3DQ, England

+44 20 7662 8934 david.f.rogers@aviva.com

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Name of Each Exchange on Which Registered |

American Depositary Shares, each representing 2 Ordinary Shares,

25 pence par value each

Ordinary Shares 8.25% Capital Securities | New York Stock Exchange

New York Stock Exchange (for listing purposes only) New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2012 was:

Ordinary Shares, 25 pence par value each 2,945,972,261

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data file required to be submitted and posted pursuant to of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).**

**This requirement does not apply to the registrant.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filerx | Accelerated filero | Non-accelerated filero |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAPo | International Financial Reporting Standards as issued by the International Accounting Standards Boardx | Othero |

If ‘‘Other’’ has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

* Not for trading, but only in connection with the registration of American Depositary Shares.

Cross reference to Form 20-F

| | | | Page |

| Item 1. | Identity of Directors, Senior Management and Advisors | n/a |

| Item 2. | Offer Statistics and Expected Timetable | n/a |

| Item 3. | Key Information | |

| | A. | Selected financial data | 17,84-85,239 |

| | B. | Capitalisation and indebtedness | n/a |

| | C. | Reason for the offer and use of proceeds | n/a |

| | D. | Risk factors | 95-104 |

| Item 4. | Information on the Company | |

| | A. | History and development of the company | 3,5,18, 82 |

| | B. | Business overview | 2-16, 18-24, 25, 27-31, 89-94 |

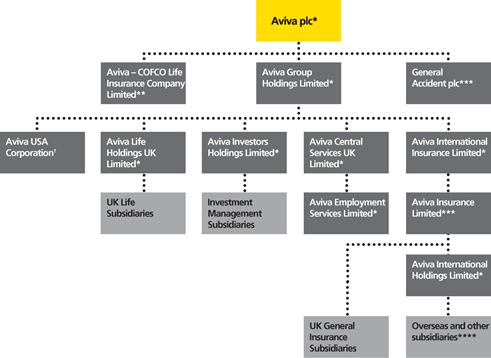

| | C. | Organisational structure | 25-26 |

| | D. | Property, plants and equipment | 31 |

| Item 4A. | Unresolved Staff Comments | n/a |

| Item 5. | Operating and Financial Review and Prospects | |

| | A. | Operating results | 2-16 |

| | B. | Liquidity and capital resources | 33-35,85-88, 219-220 |

| | C. | Research and development, patents and licences, etc. | n/a |

| | D. | Trend information | 2-17,85, 239 |

| | E. | Off-balance sheet arrangements | 85 |

| | F. | Tabular disclosure of contractual arrangements | 32 |

| | G. | Safe harbour | ii |

| Item 6. | Directors, Senior Management and Employees | |

| | A. | Directors and senior management | 40-44 |

| | B. | Compensation | 64-80, 84, 197-202 |

| | C. | Board practices | 45-54, 57-59, 64-80 |

| | D. | Employees | 145, 256 |

| | E. | Share ownership | 72, 77-80,171-174 |

| Item 7. | Major Shareholders and Related Party Transactions | |

| | A. | Major Shareholders | 239 |

| | B. | Related Party Transactions | 84, 229, 237 |

| | C. | Interests of Experts and Counsel | n/a |

| Item 8. | A. | Financial information | 2-17, 84-85, 105--237 |

| | B. | Significant changes | 239 |

| Item 9. | The Offer and Listing | 239 |

| Item 10. | Additional Information | |

| | A. | Share capital | 82-83, 171, 175 |

| | B. | Articles of association | 248-252 |

| | C. | Material contracts | 5 |

| | D. | Exchange controls | 252 |

| | E. | Taxation | 253-254 |

| | F. | Dividends and paying agents | 255 |

| | G. | Statements by experts | n/a |

| | H. | Documents on display | 255 |

| | I. | Subsidiary information | n/a |

| Item 11. | Quantitative and Qualitative Disclosures about Market Risk | 33,95-98, 217-219 |

| Item 12. | Description of Securities Other Than Equity Securities | 255 |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | n/a |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | n/a |

| Item 15. | Controls and Procedures | 256 |

| Item 16A. | Audit Committee Financial Expert | 57 |

| Item 16B. | Code of Ethics | 94 |

| Item 16C. | Principal Accountant Fees and Services | 59, 146-147 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | n/a |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchaser | 256 |

| Item 16F. | Change in Registrant’s Certifying Accountant | n/a |

| Item 16G. | Corporate Governance | 54 |

| Item 16H. | Mine Safety Disclosure | n/a |

| Item 17. | Financial Statements | n/a |

| Item 18. | Financial Statements | 105 – 237 |

| Item 19. | Exhibits | 262 |

| | | | |

| Glossary | | 259-260 |

| Signatures | | 261 |

Main contents

| In this Form 20-F | |

| Performance review | 1 |

| Governance | 37 |

| Shareholder information | 81 |

| Financial statements IFRS | 105 |

| Additional disclosures for SEC | 238 |

| Other information | 258 |

Forward looking statements

This Annual Report on Form 20-F may contain certain “forward-looking statements” with respect to certain of our plans, current goals and expectations relating to our future financial condition, performance, results, strategic initiatives and objectives. Statements containing the words “believes”, “intends”, “expects”, “plans”, “will”, “seeks”, “aims”, “may”, “could”, “outlook”, “target”, “goal”, “projects”, “estimates” and “anticipates”, and words of similar meaning, are forward-looking. By their nature, all forward-looking statements involve risk and uncertainty because they relate to future events and circumstances which are beyond our control. These forward-looking statements reflect our current views with respect to future events and because our business is subject to numerous risks, uncertainties and other factors, our actual future financial condition, performance and results may differ materially from those anticipated in our forward-looking statements and the differences could be significant.

All forward-looking statements address matters that involve risks and uncertainties. We believe that these factors include, but are not limited to, those set forth under “Financial and operating performance” and “Risks relating to our business” included in our most recent Annual Report on Form 20-F as filed with the SEC, with regard to trends, risk management, and exchange rates and with regard to the effects of changes or prospective changes in regulation, and the following:

| n | the impact of ongoing difficult conditions in the global financial markets and the economy generally; |

| n | the impact of simplifying our operating structure and activities; |

| n | the impact of various local political, regulatory and economic conditions; |

| n | market developments and government actions regarding the sovereign debt crisis in Europe; |

| n | the effect of credit spread volatility on the net unrealised value of the investment portfolio; |

| n | the effect of losses due to defaults by counterparties, including potential sovereign debt defaults or restructurings, on the value of our investments; |

| n | changes in interest rates that may cause policyholders to surrender their contracts, reduce the value of our portfolio and impact our asset and liability matching; |

| n | the impact of changes in equity or property prices on our investment portfolio; |

| n | fluctuations in currency exchange rates; |

| n | the effect of market fluctuations on the value of options and guarantees embedded in some of our life insurance products and the value of the assets backing their reserves; |

| n | the amount of allowances and impairments taken on our investments; |

| n | the effect of adverse capital and credit market conditions on our ability to meet liquidity needs and our access to capital; |

| n | a cyclical downturn of the insurance industry; |

| n | changes in or inaccuracy of assumptions in pricing and reserving for insurance business (particularly with regard to mortality and morbidity trends, lapse rates and policy renewal rates), longevity and endowments; |

| n | the impact of catastrophic events on our business activities and results of operations; |

| n | the inability of reinsurers to meet obligations or unavailability of reinsurance coverage; |

| n | increased competition in the UK and in other countries where we have significant operations; |

| n | the effect of the European Union’s “Solvency II” rules on our regulatory capital requirements; |

| n | the impact of actual experience differing from estimates used in valuing and amortising deferred acquisition costs (“DAC”) and acquired value of in-force business (“AVIF”); |

| n | the impact of recognising an impairment of our goodwill or intangibles with indefinite lives; |

| n | changes in valuation methodologies, estimates and assumptions used in the valuation of investment securities; |

| n | the effect of legal proceedings and regulatory investigations; |

| n | the impact of operational risks, including inadequate or failed internal and external processes, systems and human error or from external events; |

| n | risks associated with arrangements with third parties, including joint ventures; |

| n | funding risks associated with our participation in defined benefit staff pension schemes; |

| n | the failure to attract or retain the necessary key personnel; |

| n | the effect of systems errors or regulatory changes on the calculation of unit prices or deduction of charges for our unit-linked products that may require retrospective compensation to our customers; |

| n | the effect of a decline in any of our ratings by rating agencies on our standing among customers, broker-dealers, agents, wholesalers and other distributors of our products and services; |

| n | changes to our brand and reputation; |

| n | changes in government regulations or tax laws in jurisdictions where we conduct business; |

| n | the inability to protect our intellectual property; |

| n | the effect of undisclosed liabilities, integration issues and other risks associated with our acquisitions; and |

| n | the timing, regulatory approval and impact and other uncertainties relating to announced acquisitions and pending disposals and relating to future acquisitions, combinations or disposals within relevant industries. |

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Annual Report.

You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date hereof. Except as required by the Financial Services Authority, the London Stock Exchange plc or applicable law, we do not intend to, and undertake no obligation to (and expressly disclaim any such obligations to), update publicly or revise any forward-looking statement as a result of new information, future events or otherwise. In light of these risks, our results could differ materially from the forward-looking statements contained in this Annual Report. We may also make or disclose written and/or oral forward-looking statements in reports filed or furnished to the US Securities and Exchange Commission (“SEC”), our annual report and accounts to shareholders, proxy statements, offering circulars, registration statements and prospectuses, press releases and other written materials and in oral statements made by our directors, officers or employees to third parties, including financial analysts.

Performance review

| In this section | |

| Financial and operating performance | 2 |

| Selected consolidated financial data | 17 |

| Information on the company | 18 |

| Organisational structure | 25 |

| Analysis of investments | 27 |

| Contractual obligations | 32 |

| Risk and capital management | 33 |

| Basis of preparation | 36 |

Financial and operating performance

Financial performance overview

Overview

We have made good progress improving our capital strength and narrowing the Group’s focus so that we now operate in materially fewer countries.

The agreed sale of the US business has been a main contributor to a loss before tax of £2.7 billion. Operating performance is broadly in line with the previous year, but with higher restructuring costs as we transform the company.

We have seen improvements in profitability of new business, cash flows to Group and good levels of operating capital generation. The economic capital position has significantly improved but, as a result of the disposals we have made, leverage has increased. We have also taken action to simplify the group’s corporate structure, formalising the inter-divisional balance into a loan of which we will pay down £600 million over the next three years.

Financial strength

The number one priority in 2012 was to improve Aviva’s IGD and economic capital solvency surplus position. During the year we have taken a number of management actions and this, combined with market movements, means that our IGD and economic capital solvency surpluses1, 2, have improved significantly.

We have simplified our portfolio of businesses and as a result Aviva will operate in 18 countries, from 30 three years ago. These changes, including the announced sales of Aviva USA and Delta Lloyd and the settlement of our agreement to transfer Aseval to Bankia in Spain, will result in a positive movement in our economic capital. Including the effect of these transactions, the estimated economic capital surplus would improve to £7.1 billion with a coverage ratio of 172% as at 31 December 2012(2011: £3.6 billion; 130% coverage). In addition, we have now made the calculation more prudent to now include the pension deficit funding on a 10 year basis (previously five year basis). The IGD solvency surplus has improved to £3.8 billion as at 31 December 2012(2011: £2.2 billion).

At the end of February 2013, including the effect of the transactions noted above, our estimated economic capital coverage ratio was 175%.

We also took a number of steps to reduce the volatility of our capital position. In July we reduced our holding in Delta Lloyd from 41% to just under 20% and in January 2013 we sold our remaining stake.

Over the course of the year we also reduced our exposure to Italian sovereign debt with a gross sell down of €6.5 billion3this year from our shareholder and participating funds. After taking into account market movements and new business, the value of our net direct shareholder and participating fund holdings (net of NCI) in Italian sovereign debt is now £4.9 billion(2011: £6.4 billion) of which net direct shareholder exposure is £0.4 billion. Of the £4.9 billion Italian sovereign debt 74% is held in Italy.

Loss before tax

The overall result for the year was a loss before tax of £2.7 billion(2011: profit before tax £87 million).

The largest driver of the overall loss is the agreed sale of our US business. At HY12 we recognised an impairment of goodwill and intangibles of £0.9 billion related to that business, and at the full year we recognised a further impairment of £2.4 billion.This was partially offset by positive investment variances of £0.3 billion.

For continuing operations, the profit before tax was £25 million. Drivers of this profit before tax are adjusted operating profits offset by integration and restructuring costs of £461 million, primarily reflecting the execution of the transformation plan; adverse investment variances of £634 million; net adverse pre-tax non-operating items in Delta Lloyd of £411 million (principally relating to movements in the Delta Lloyd Group curve), and loss on disposals of £164 million and other goodwill and intangible impairments of £188 million.

Total earnings per share was negative 113.1p(2011: 5.8p) reflecting the loss on the sale of the US business.

Cash flows

Aviva increased the amount of cash remittances from the businesses to Group to £0.9 billion in 2012(2011: £0.8 billion).France resumed dividend payments to Group and management actions in UK Life led to a significant increase in cash remitted to Group.

The following table shows dividends paid to Group by business units.

| | Received in

2012

(£m) | |

| Total by country | | Dividend | |

| UK Life | | | 150 | |

| UK GI | | | 150 | |

| France | | | 202 | |

| Canada | | | 136 | |

| Poland | | | 70 | |

| Spain | | | 68 | |

| Singapore | | | 17 | |

| Italy | | | 0 | |

| Ireland | | | 0 | |

| Other* | | | 151 | |

| Total | | | 944 | |

*includes Aviva Re, US and Delta Lloyd

We continue to take a number of actions on capital efficiency and our corporate structures to increase cash remittances going forward.

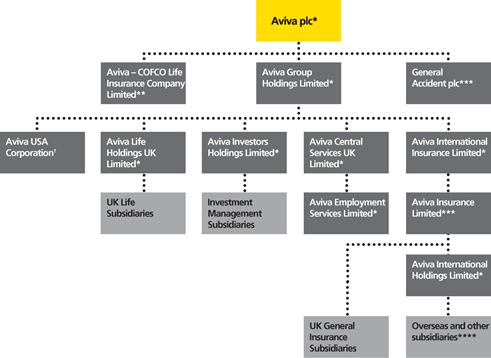

Changes to Aviva’s capital structure

We are taking action to reduce the complexity of the balance sheet and reduce internal leverage. Prior to 2013 in the Group’s corporate structure, AIL (Aviva Insurance Limited) was both the underwriting company for the UK General Insurance business and the holding company for the majority of the Group’s overseas subsidiaries. Prior to 2013 an inter-divisional loan balance of around £5 billion was in place between the UK General Insurance business and the Group and this was used over a number of years to purchase overseas subsidiaries and for other general corporate purposes.

This structure was complex from a corporate governance point of view; created the potential for dividend traps and made demonstrating that Aviva has appropriate resolution arrangements in place (a key requirement of the PRA/FSA) more difficult. A more straightforward structure has now been put in place with two separate legal entities — Aviva Group Holdings Ltd (as holding company) and Aviva Insurance Limited (as the general insurance underwriting company). As a result of this change the inter-divisional balance between the Group and UK General Insurance will be formalised into an interest bearing loan of around £5.8 billion between AGH and AIL. We have decided to reduce the size of this loan balance and will pay down £600 million in total over the next three years.

As a result of this change, which the FSA are supportive of, our corporate structure will be more transparent, the Group will have direct ownership of overseas subsidiaries and the exposure of our UK general insurance business to these will be reduced over time.

| 1 | The economic capital surplus represents an estimated unaudited position. The capital requirement is based on Aviva’s own internal assessment and capital management policies. The term ‘economic capital’ does not imply capital as required by regulators or other third parties. Pension scheme risk is allowed for through ten years of stressed contributions. |

| 2 | Economic capital surplus shows the estimated risk adjusted capital position of the Group. This metric does not relate and cannot be reconciled to IFRS GAAP |

| 3 | Gross of non-controlling interests (NCI), purchases and redemptions. |

Financial and operating performance

Our main activities are the provision of products and services in relation to long-term insurance and savings, fund management and general insurance.

Factors affecting results of operations

Our financial results are affected, to some degree, by a number of external factors, including demographic trends, general economic and market conditions, government policy and legislation and exchange rate fluctuations. See ‘Performance review – Risk and capital management’ and ‘Shareholder Information – Risks relating to our business’ for more information on these and other risk factors. In addition, our financial results are affected by corporate actions taken by the Group, including acquisitions, disposals and other actions aimed at achieving our stated strategy. We believe that all of these factors will continue to affect our results in the future.

Group restructuring

During the year, the Group undertook the following actions which impacted the overall results and performance:

| n | The Group changed its organisational reporting structure, and the Group’s operating segments were changed to align them with this revised structure. Further details of the reportable segments are given in ‘Financial statements – note 4 – Segmental information’. |

| n | The Group undertook restructuring and transformation activity to align our business operations with our strategy, including the Group’s Simplify programme. Integration and restructuring costs of £468 million (2011: £268 million) include Simplify costs of £165 million, Ireland transformation costs (including the merger of the UK and Ireland businesses) of £130 million, £24 million in relation to the transformation of Aviva Investors, £30 million in respect of other restructuring activities and £119 million relating to the cost of preparing the businesses for the implementation of Solvency II. |

| n | The Group also announced a number of disposals during the year, including the Group’s US life and related internal asset management businesses (‘US Life’) which have been classified as discontinued operations for reporting of financial performance, and held for sale in the statement of financial position. |

As a result of the held for sale classification, US Life has been written down to fair value less costs to sell which is the main driver for the loss from discontinued operations of £2,848 million and the Group’s loss for the year of £3,050 million. Further details are given in ‘Financial statements – note 3 – Subsidiaries’.

Demographic trends

Our results are affected by the demographic make-up of the countries in which we operate. The types of products that we sell reflect the needs of our customers. For example, in countries with a high proportion of older people, a larger proportion of our sales will reflect their needs for pre- and post-retirement planning. Our sales levels will also be impacted by our ability to help provide useful information to such policyholders on retirement planning and to offer products that are competitive and respond to such policyholders’ needs.

In our long-term insurance and savings business we make assumptions about key non-economic factors, such as the mortality rate that we expect to be experienced by our policyholders. In countries where the life expectancy is growing, this will need to be reflected in our pricing models as lower mortality rates will increase profitability of life insurance products but will reduce the returns on annuity products. We review our assumptions against our own experience and industry expectations.

Economic conditions

Our results are affected by the economic conditions in our geographic markets and, consequently, by economic cycles in those markets. High levels of general economic activity typically result in high levels of demand for, and sales of, our products and services. Economic activity in turn is affected by government monetary and fiscal policy as well as by global trading conditions and external shocks such as terrorist activity, war and oil price movements.

During 2012, conditions remained challenging with continued concerns over levels of sovereign debt within the eurozone. Towards the year end, market sentiment started to improve which saw improvements in credit spreads. However, the challenging conditions in the economies of major European markets (including the UK) has led to lower demand for savings products. During 2011, concerns over slowing economic growth, higher levels of sovereign debt within, and to a lesser degree outside the eurozone, the stability and solvency of financial institutions, longer-term low interest rates in developed markets, inflationary threats as well as geopolitical issues contributed to increased volatility in the financial markets. The continued market volatility across global financial markets saw customers reassert their preference for less complex products and reduce their exposure to investment markets.

The European economies where the Group has operations were impacted in 2012 by forecast low or negative growth including: UK (-0.1%)4; France (0.2%)1; Spain (-1.3%)1; and Italy (-2.2%)1.

Capital and credit market conditions

An important part of our business involves investing client, policyholder and shareholder funds across a wide range of financial investments, including equities, fixed income securities and properties. Our results are sensitive to volatility in the market value of these investments, either directly because we bear some or all of the investment risk, or indirectly because we earn management fees for investments managed on behalf of policyholders. Investment market conditions also affect the demand for a substantial portion of our life insurance products. In general, rising equity price levels have a positive effect on the demand for equity-linked products, such as unit trusts and unit-linked life insurance products, and conversely have a negative effect on the demand for products offering fixed or guaranteed minimum rates of return. Declining equity price levels tend to have the opposite effects.

During 2012, the challenging conditions continued to impact the Group’s performance. The total long-term business investment return variance was negative £278 million(2011: £1,616million negative).

For continuing operations, negative long-term business investment variances of £620 million (2011: £897 million negative) mainly relates to the UK. This is mainly due to increasing the allowance for credit defaults on UK commercial mortgages to reflect uncertainty in the macro-economic environment, and the cost of de-risking activity. Elsewhere, positive variances in Spain and France were offset by a negative variance in Italy.

For 2011, the adverse life investment variances of £897 million related largely to the impact of lower risk-free interest rates, wider credit spreads and increased market volatility in the UK and Europe.

4 http://www.oecd-ilibrary.org/economics/real-gross-domestic-product-forecasts_gdp-kusd-gr-table-en

The positive variance of £342 million for discontinued operations relates to the US, driven by reductions in interest rates and credit spreads and the impact of favourable equity market performance on embedded derivatives. The prior period negative variance(2011: £719 million negative) includes the result for Delta Lloyd up to the partial disposal on 6 May 2011 of £820 million negative.

With-profits business

We write products through our with-profits funds mainly in our UK & Ireland operating segment, with a small fund in Singapore. These funds enable policyholders to participate in a large pool of diverse investments, therefore reducing their exposure to individual securities or asset classes. The investment pool is managed by us with returns to with-profits policyholders paid through bonuses which are added to the value of their policy. In order to provide an element of stability in the returns to policyholders, bonuses are designed to reduce policyholders’ exposure to the volatility of investment returns over time and to provide an equitable share of surplus earned, depending on the investment and operating performance of the fund. Shareholders also have a participating interest in the with-profits funds and any declared bonuses. Generally, policyholder and shareholder participation in with-profits funds in the UK is split 90:10.

Shareholders’ profits arising on with-profits business under IFRS depend on the total bonuses declared to policyholders on an annual basis.

The level of bonuses declared to policyholders is influenced by the actual returns on investments and our expectation of future rates of return. Whilst bonuses can never be negative, a predicted sustained fall in equity markets could lead to a reduction in regular and final bonus rates, thereby reducing both policyholder returns and shareholders’ profit under IFRS. In 2011, low investment returns and the difficult economic outlook led to reductions in regular and final bonus rates. Better investment performance in 2012 meant that we have been able to increase the majority of final bonus rates.

General insurance and health underwriting cycle

Our general insurance and health business is comprised of our property and casualty insurance and health insurance operations. In 2012, general insurance and health sales accounted for 42% of Group net written premiums (“NWP”) from continuing operations. Demand for general insurance is usually price-sensitive because of the limited degree of product differentiation inherent in the industry. As a result, the price of insuring property and casualty risks is subject to a cycle (called an underwriting cycle). In periods when the price of risk is high, the high profitability of selling insurance attracts new entrants and hence new capital into the market. Increased competition, however, drives prices down. Eventually the business becomes uneconomic and some industry players, suffering from losses, exit the market whilst others fail, resulting in lower capital invested within the market. Decreased competition leads to increasing prices, thereby repeating the cycle. Our various general insurance markets are not always at the same stage of the underwriting cycle.

In the UK, the personal motor market has seen rate reductions in 2012 reflecting intense competition and regulatory change. This follows a period of rate increases in previous periods in response to rising claims costs and frequencies. Challenging rating conditions also apply to other UK classes of business.

We expect the underwriting cycle to continue in the future but to be less pronounced than in the past because of structural changes to the industry over the past decade. Capital markets are imposing financial discipline by being increasingly more demanding about performance from insurance companies before extending new capital. Such discipline, together with the increased concentration of competitors within the market, recent natural disasters and the adoption of more advanced pricing methods, is expected to make the underwriting cycle less pronounced in the future.

Natural and man-made disasters

Our general insurance and health business results are affected by the amount of claims we need to pay out which, in turn, can be subject to significant volatility depending on many factors, including natural and man-made disasters. Natural disasters arise from adverse weather, earthquakes and other such natural phenomena. Man-made disasters include accidents and intentional events, such as acts of terrorism. These events are difficult to predict with a high degree of accuracy, although they generally occur infrequently at a material level. Our exposure to large disasters is somewhat reduced through our focus on personal lines business and small to medium sized commercial risks in the general insurance business. The Group cedes much of its worldwide catastrophe risk to third-party reinsurers but retains a pooled element for its own account gaining diversification benefit. See ‘Financial statements IFRS – Note 53 – Risk management’.

In 2012, the UK and Ireland were impacted by flood losses and France by a severe freeze. In 2011, France and Ireland were impacted by storm and flood losses and Canada incurred losses from a wildfire in Slave Lake.

Government policy and legislation

Changes in government policy and legislation applicable to our business in many of the markets in which we operate, particularly in the UK, may affect the results of our operations. These include changes to the tax treatment of financial products and services, government pension arrangements and policies, the regulation of selling practices and the regulation of solvency standards. Such changes may affect our existing and future business by, for example, causing customers to cancel existing policies, requiring us to change our range of products and services, forcing us to redesign our technology, requiring us to retrain our staff or increase our tax liability. As a global business, we are exposed to various local political, regulatory and economic conditions, and business risks and challenges which may affect the demand for our products and services, the value of our investments portfolio and the credit quality of local counterparties. Our regulated business is subject to extensive regulatory supervision both in the UK and internationally. For details please refer to the section ‘Shareholder information – Regulation’.

Exchange rate fluctuations

We publish our consolidated financial statements in pounds sterling. Due to our substantial non-UK operations, a significantportion of our operating earnings and net assets are denominated in currencies other than sterling, most notably the euro and the US dollar. As a consequence, our results are exposed to translation risk arising from fluctuations in the values of these currencies against sterling. Total foreign currency translation recognised in the income statement was a gain of £128 million (2011: £35 million loss).

We generally do not hedge foreign currency revenues, as we prefer to retain revenue locally in each business to support business growth, to meet local and regulatory market requirements and to maintain sufficient assets in local currency to match local currency liabilities.

Movements in exchange rates may affect the value of consolidated shareholders’ equity, which is expressed in sterling. Exchange differences taken to other comprehensive income arise on the translation of the net investment in foreign subsidiaries, associates and joint ventures. This aspect of foreign exchange risk is monitored centrally against limits that we have set to control the extent to which capital deployment and capital requirements are not aligned. We use currency borrowings and derivatives when necessary to keep currency exposures within these predetermined limits, and to hedge specific foreign exchange risks when appropriate; for example, in any acquisition or disposal activity.

During 2012, sterling strengthened in value against the euro and marginally strengthened against the dollar, resulting in a foreign currency loss in other comprehensive income from continuing operations of £200 million(2011:£284 million loss).

The impact of these fluctuations is limited to a significant degree, however, by the fact that revenues, expenses, assets and liabilities within our non-UK operations are generally denominated in local currencies.

Acquisitions and disposals

Over the last two years we have completed and announced a number of transactions, some of which have had a material impact on our results. These transactions reflect our strategic objectives of narrowing our focus to businesses where we can produce attractive returns and exit businesses which we do not consider central to our future growth.

Activity in 2012

In March Aviva’s distribution arrangement with Allied Irish Bank (“AIB”) for long term business ceased and the bancassurance partnership with AIB is being unwound. A strategic review is underway to determine the most effective distribution channels going forward.

In July the Group sold 37.2 million shares in Delta Lloyd for £313 million (net of transaction costs), reducing our holding to 19.8% of Delta Lloyd’s ordinary share capital, representing 18.6% of shareholder voting rights. As the Group no longer had significant influence over Delta Lloyd, we ceased to account for that company as an associate from 5 July 2012. Subsequent to the 2012 year end we disposed of our entire remaining holding.

In July, the Group sold its life businesses in the Czech Republic, Hungary and Romania to MetLife Inc., for £37 million. The sale of our Romania pensions business is still subject to regulatory approval and is expected to complete later in 2013.

In December we sold our controlling 58.4% interest in AVIVA NDB Holdings Lanka to a subsidiary of AIA group for a consideration of £31 million.

On 18 December we reached an agreement with Bankia S.A. to transfer our holding in our Spanish joint venture Aseval to Bankia for £494 million. The transfer is subject to regulatory approval and is expected to be completed no later than 30 April 2013. Due to the announced sale, Aseval has been treated as held for sale at the balance sheet date.

During the year the Group entered into negotiations to dispose of Aviva ZAo, its Russian long-term business subsidiary, and the requirements for that business to be classified as held for sale were met. The disposal of the business was announced in February 2013 for consideration of €35 million and is expected to complete in the first half of 2013.

In December 2012 the Group announced the disposal of its US life and related internal fund management business to Athene Holding Ltd for £1.0 billion, including the shareholder loan.

There is uncertainty in the ultimate consideration received, which depends on changes in statutory surplus which would be taken into account in a purchase price adjustment mechanism. The transaction agreement includes customary representations, warranties and indemnities from Aviva plc as the seller. The transaction is currently anticipated to complete in 2013, subject to closing conditions including approvals by insurance regulators in Iowa and New York and by other insurance and non-insurance regulatory authorities. As a result of this announcement the results of the business for 2012 and comparative periods have been classified as a discontinued operation and it is held for sale at the balance sheet date.

Further details can be found in the section ‘Financial statements IFRS – Note 3 –Subsidiaries’.

Subsequent events

In January 2013, we announced the sale of our 49% stake in CIMB Aviva Assurance Berhad and CIMB Aviva Takaful Berhad (together “CIMB-Aviva”) to Sun Life Assurance Company of Canada for a consideration of £152 million. Further details can be found in ‘Financial statements IFRS – Note 3c –Subsidiaries’ and ‘Financial statements – Note 15 – Interests in, and loans to, joint ventures’.

On 8 January 2013, we sold the remainder of our stake in Delta Lloyd at €12.65 per share resulting in total cash proceeds for Aviva of £353 million.

As noted above, on 27 February we announced the sale of our Russian Life business.

On 8 March 2013 we completed the transaction with AIB. Further details can be found in, ‘Financial statements IFRS – note 3 – Subsidiaries’.

Activity in 2011

On 6 May 2011, the Group sold 25 million shares in Delta Lloyd reducing our holding to 42.7% (41.9% as at 31 December 2011) of Delta Lloyd's ordinary share capital, representing 40% (39.3% as at 31 December 2011) of shareholder voting rights. Accordingly, the Group ceased to consolidate the results of Delta Lloyd in its financial statements. Cash consideration of £380 million was received for the sale of shares, and £8 million of costs were attributable to the disposal transaction. The transaction resulted in the loss of control of a major geographical area of operations, previously presented as 'Delta Lloyd' in the segmental reporting note. The results of Delta Lloyd as a subsidiary for 2011 as well as those for the comparative periods were therefore classified as discontinued operations. The Group’s share of the profits of its retained interest in Delta Lloyd as an associate are shown separately within continuing operations.

On 30 September 2011, the Group sold RAC Limited (“RAC”) to The Carlyle Group for £977 million, realising a profit of £532 million. Aviva is continuing its commercial relationship with RAC, both as a key underwriter of motor insurance on RAC’s panel and as a partner selling RAC breakdown cover to our customers. The Group has retained the RAC (2003) Pension Scheme which, at 31 December 2011, had an IAS 19 deficit of £51 million.

On 1 October 2011, the Group sold its Australian fund management business, Aviva Investors Australia Ltd, to nabInvest, National Australia Bank’s direct asset management business, for £35 million, which included contingent consideration with a fair value of £3 million. This resulted in a profit on disposal of £20 million, increased to £23 million after recycling £3 million from currency translation reserve to the income statement.

Activity in 2010

On 17 February 2010, we sold our 35% holding in Sogessur SA to that company’s main shareholder for a consideration of £35 million, realising a profit on disposal of £24 million. On 24 February 2010, we acquired 100% of River Road Asset Management, a US equity manager, to support the expansion of Aviva Investors’ third-party institutional asset management business. The total consideration was estimated as £83 million (US$128 million).

On 31 December 2010, the Group entered into transactions with RBS Group plc (RBSG) and agreed that, with effect from 31 December 2010, the Group would take ownership of the back book of RBS Life in exchange for RBSG taking 100% ownership of RBS Collective. Separately, a new distribution agreement was signed between our UK Life business and RBSG, with the new structure providing more flexibility in our long-term business operations.

Basis of earnings by line of business

Our earnings originate from three main lines of business: our long-term insurance and savings business, which includes a range of life insurance and savings products; general insurance and health, which focuses on personal and commercial lines; and fund management, which manages funds on behalf of our long-term insurance and general insurance businesses, external institutions, pension funds and retail clients. These lines of business are present in our various operating segments to a greater or lesser extent.

In the UK, we have major long-term insurance and savings businesses and general insurance businesses; in Europe we have long-term insurance and savings businesses in all countries in which we operate, large general insurance businesses in France, Ireland and Italy, and smaller general insurance operations in several other countries; in Canada we have a leading general insurance operation; in Asia we predominantly have long-term insurance and savings businesses. Our fund management businesses operate across Europe, Asia, North America and the UK.

Long-term insurance and savings business

For most of our life insurance businesses, such as those in the UK and France, operating earnings are generated principally from our in-force books of business. Our in-force books consist of business written in prior years and on which we continue to generate profits for shareholders. Nevertheless new business written in these markets, with the exception of our UK with-profits business which is discussed below, has a significant direct effect on our operating earnings. Under IFRS, certain costs incurred in acquiring new business must be expensed thereby typically giving rise to a loss in the period of acquisition, though the degree of this effect will depend on the pricing structure of product offerings. In certain higher growth markets, current year sales have a more significant effect on current year operating earnings.

UK with-profits business

With-profits products are designed to pay policyholders smoother investment returns through a combination of regular bonuses and final bonuses. Shareholders’ profit emerges from this business in direct proportion to policyholder bonuses, as shareholders receive up to one-ninth of the value of each year’s bonus declaration to policyholders. Accordingly, the smoothing inherent in the bonus declarations provides for relatively stable annual shareholders’ profit from this business. The most significant factors that influence the determination of bonus rates are the return on the investments of the with-profits funds and expectations about future investment returns. Actual and expected investment returns are affected by, among other factors, the mix of investments supporting the with-profits fund, which in turn is influenced by the extent of the inherited estate within the with-profits fund.

The annual excess of premiums and investment return over operating expenses, benefit provisions and claims payments within our with-profits funds that are not distributed as bonuses and related shareholders’ profit is transferred from the income statement to the unallocated divisible surplus. Conversely, if a shortfall arises one year, for example because of insufficient investment return, a transfer out of the unallocated divisible surplus finances bonus declarations and related shareholders’ profit.

The unallocated divisible surplus consists of future (as yet undetermined) policyholder benefits, associated shareholders’ profit and the orphan estate. The orphan estate serves as working capital for our with-profits funds. It affords the with-profits fund a degree of freedom to invest a substantial portion of the funds’ assets in investments yielding higher returns than might otherwise be obtainable without being constrained by the need to absorb the cash-flow strain of writing large volumes of new business and the need to demonstrate solvency.

Other participating business

Outside of the UK, most of our long-term operations write participating business. This is predominantly savings or pensions business, where the policyholders receive guaranteed minimum investment returns, and additional earnings are shared between policyholders and shareholders in accordance with local regulatory and policy conditions. This may also be referred to as ‘with-profits’ business.

Other long-term insurance and savings business

Non-profit business falls into two categories: investment type business and risk cover and annuity business. Investment type business, which accounts for most of our non-profit business, includes predominantly unit-linked life and pensions business where the risk of investing policy assets is borne entirely by the policyholder. In addition, investment type business includes life and pensions business where the risk of investing policy assets is typically shared between policyholders and shareholders, subject to a minimum rate of investment return guaranteed to policyholders. Operating earnings arise from unit-linked business when fees charged to policyholders based on the value of the policy assets exceed costs of acquiring new business and administration costs. In respect of remaining investment type business, investment return generated from policy assets has an effect on operating earnings though this is often non-proportional. Finally, in respect of all investment type business, shareholders bear the risk of investing shareholder capital in support of these operations.

Risk cover business includes term assurance, or term life insurance business. Annuity business includes immediate annuities purchased for individuals or on a bulk purchase basis for groups of people. The risk of investing policy assets in this business is borne entirely by the shareholders. Operating earnings arise when premiums, and investment return earned on assets supporting insurance liabilities and shareholder capital, exceed claims and benefit costs, costs of acquiring new business and administration costs.

General insurance and health business

Operating earnings within our general insurance and health business arise when premiums and investment return earned on assets supporting insurance liabilities and shareholder capital exceed claims costs, costs of acquiring new business and administration costs.

Fund management

Fund management operating earnings consist of fees earned for managing policyholder funds and external retail and institutional funds on behalf of clients, net of operating expenses.

Arrangements for the management of proprietary funds are conducted on an arm’s length basis between our fund management and insurance businesses. Such arrangements exist mainly in the UK, France, Ireland, and Canada. Proprietary insurance funds in other countries are externally managed.

Other business

Other business includes our operations other than insurance and fund management, including Group Centre expenses. In 2011 this also included the RAC roadside recovery operation in the UK up to its sale on 30 September 2011.

Financial highlights

The following analysis is based on our consolidated financial statements and should be read in conjunction with those statements. In order to fully explain the performance of our business, we discuss and analyse the results of our business in terms of certain financial measures which are based on ‘non-GAAP measures’ and which we use for internal monitoring and for executive remuneration purposes. We review these in addition to GAAP measures, such as profit before and after tax.

The remainder of the financial performance section focuses on the activity of the Group’s continuing operations. Details of the performance of the United States which has been classified as discontinued can be found in the market performance section.

Non-GAAP measures

Sales

The total sales of the Group consist of long-term insurance and savings new business sales and general insurance and health net written premiums.

Long-term insurance and savings new business sales

Sales of the long-term insurance and savings business consist of:

| n | Insurance and participating investment business |

| – | This includes traditional life insurance, annuity business and with-profits business. |

| – | There is an element of insurance risk borne by the Group therefore, under IFRS, these are reported within net written premiums. |

| n | Non-participating investment business |

| – | This includes unit-linked business and pensions business. |

| – | The amounts received for this business are treated as deposits under IFRS and an investment management fee is earned on the funds deposited. |

| – | For new business reporting in the UK, companies continue to report non-participating investment business within their ‘covered business’ sales, in line with the historic treatment under UK GAAP. |

| n | Non-covered business or investment sales: |

| – | These include retail sales of mutual fund type products. |

| – | There is no insurance risk borne by the Group therefore, under IFRS, these are treated as deposits and investment management fee income is earned on the funds deposited. These have never been treated as ‘covered business’ for long-term insurance and savings reporting so we show these separately as investment sales. |

Sales is a non-GAAP financial measure and key performance indicator that we report to our key decision makers in the businesses in order to assess the value of new business from our customers and compare performance across the markets in which we operate. We consider sales to be a critical indicator of new business, and is the basis on which we provide analysis of our results to our shareholders and analysts. The non-GAAP measure of sales is also currently used internally in the determination of bonus awards as an executive performance measure.

For long-term insurance and savings new business, we define sales as the sum of the present value of new business premiums (PVNBP) of life, pension and savings products and investment sales.

PVNBP is equal to total single premium sales received in the year plus the discounted value of annual premiums expected to be received over the terms of newly incepted contracts and is calculated as at the date of sale. We adjust annual premiums to reflect the expected stream of business coming from this new business over future years. In the view of management, this performance measure better recognises the relative economic value of regular premium contracts compared with single premium contracts. PVNBP is a European insurance industry standard measure of new business.

For our long-term insurance and savings business, we believe that sales is an important measure of underlying performance and a better measure for new business than IFRS net written premiums. We consider that the use of sales over IFRS net written premiums provides a:

| n | Consistent treatment of long-term insurance and investment contracts: IFRS net written premiums do not include deposits received on non-participating investment contracts. Long-term insurance contracts and participating investment contracts both contain a deposit component, which are included in IFRS net written premiums, in addition to an insurance risk component. Therefore, to assess the revenue generated on a consistent basis between types of contracts, we evaluate the present value of new business sales of long-term insurance and investment products on the basis of total premiums and deposits collected, including sales of mutual fund type products such as unit trusts and Open ended investment companies (OEICs). |

| n | Better reflection of the relative economic value of regular premium contracts compared to single premium contracts: Sales recognise the economic value of all expected contractual cash flows for regular premium contracts in the year of inception, whereas IFRS net written premiums only recognise premiums received in the year. |

| n | Better reflection of current management actions in the year: IFRS net written premiums include premiums on regular premium contracts which incepted in prior years, and therefore reflect the actions of management in prior years. |

In comparison with IFRS net written premiums, sales do not include premiums received from contracts in-force at the beginning of the year, even though these are a source of IFRS revenue, as these have already been recognised as sales in the year of inception of the contract. In addition, unlike IFRS net written premiums, sales do not reflect the effect on premiums of any increase or decrease in persistency of regular premium contracts compared with what was assumed at the inception of the contract.

PVNBP is not a substitute for net written premiums as determined in accordance with IFRS. Our definition of sales may differ from similar measures used by other companies, and may change over time.

General insurance and health sales

General insurance and health sales are defined as IFRS net written premiums, which are premiums written during the year net of amounts reinsured with third parties. For sales reporting, we use the GAAP measure for general insurance and health business.

The table below presents our consolidated sales for the three years ended 31 December 2012, 2011 and 2010 for our continuing operations, as well as the reconciliation of sales to net written premiums in IFRS.

| Continuing operations | | 2012

£m | | | 2011

£m | | | 2010

£m | |

| Long-term insurance and savings new business sales | | | 25,232 | | | | 27,461 | | | | 28,839 | |

| General insurance and health sales | | | 8,894 | | | | 9,162 | | | | 8,522 | |

| Total sales | | | 34,126 | | | | 36,623 | | | | 37,361 | |

| Less: Effect of capitalisation factor on regular premium long-term business | | | (5,935 | ) | | | (6,079 | ) | | | (5,482 | ) |

| Share of long-term new business sales from JVs and associates | | | (592 | ) | | | (604 | ) | | | (1,446 | ) |

| Annualisation impact of regular premium long-term business | | | (239 | ) | | | (533 | ) | | | (357 | ) |

| Deposits taken on non-participating investment contracts and equity release contracts | | | (4,607 | ) | | | (4,573 | ) | | | (3,795 | ) |

| Retail sales of mutual fund type products (investment sales) | | | (4,586 | ) | | | (3,473 | ) | | | (3,387 | ) |

| Add: IFRS gross written premiums from existing long-term business | | | 3,936 | | | | 4,305 | | | | 3,547 | |

| Less: long-term insurance and savings business premiums ceded to reinsurers | | | (930 | ) | | | (959 | ) | | | (855 | ) |

| Total IFRS net written premiums | | | 21,173 | | | | 24,707 | | | | 25,586 | |

| Analysed as: | | | | | | | | | | | | |

| Long-term insurance and savings net written premiums | | | 12,279 | | | | 15,545 | | | | 17,064 | |

| General insurance and health net written premiums | | | 8,894 | | | | 9,162 | | | | 8,522 | |

| | | | 21,173 | | | | 24,707 | | | | 25,586 | |

| n | Effect of capitalisation factor on regular premium long-term business |

PVNBP is derived from the single and regular premiums of the products sold during the financial period and is expressed at the point of sale. The PVNBP calculation is equal to total single premium sales received in the year plus the discounted value of regular premiums expected to be received over the term of the new contracts. The discounted value of regular premiums is calculated using the market consistent embedded value methodology proposed by the CFO Forum Principles.

The discounted value reflects the expected income streams over the life of the contract, adjusted for expected levels of persistency, discounted back to present value. The discounted value can also be expressed as annualised regular premiums multiplied by a weighted average capitalisation factor (WACF). The WACF varies over time depending on the mix of new products sold, the average outstanding term of the new contracts and the projection assumptions.

| n | Share of long-term new business sales from joint ventures and associates |

Total long-term new business sales include our share of sales from joint ventures and associates. Under IFRS reporting, premiums from these sales are excluded from our consolidated accounts, with only our share of profits or losses from such businesses being brought into the income statement separately.

| n | Annualisation impact of regular premium long-term business |

As noted above, the calculation of PVNBP includes annualised regular premiums. The impact of this annualisation is removed in order to reconcile the non-GAAP new business sales to IFRS premiums and will vary depending on the volume of regular premium sales during the year.

| n | Deposits taken on non-participating investment contracts and equity release contracts |

Under IFRS, non-participating investment contracts are recognised in the Statement of Financial position by recording the cash received as a deposit and an associated liability and are not recorded as premiums received in the Income Statement. Only the margin earned is recognised in the Income Statement.

| n | Retail sales of mutual fund type products (investment sales) |

Investment sales included in the total sales number represent the cash inflows received from customers to invest in mutual fund type products such as unit trusts and OEICs. We earn fees on the investment and management of these funds which are recorded separately in the IFRS income statement as ’fees and commissions received’ and are not included in statutory premiums.

| n | IFRS gross written premiums from existing long-term business |

The non-GAAP measure of long-term and savings sales focuses on new business written in the year under review whilst the IFRS income statement includes premiums received from all business, both new and existing.

Adjusted operating profit

We report to our chief operating decision makers in the businesses the results of our operating segments using a financial performance measure we refer to as ‘adjusted operating profit’. We define our segment adjusted operating profit as profit before income taxes and non-controlling interests in earnings, excluding the following items: investment return variances and economic assumption changes on long-term and non-long-term business, impairment of goodwill, joint ventures and associates, amortisation and impairment ofother intangibles (excluding the acquired value of in-force business), profit or loss on the disposal and remeasurement of subsidiaries and associates, integration and restructuring costs and exceptional items.

Whilst these excluded items are significant components in understanding and assessing our consolidated financial performance, we believe that the presentation of adjusted operating profit enhances the understanding and comparability of the underlying performance of our segments by highlighting net income attributable to on-going segment operations.

Adjusted operating profit for long-term insurance and savings business is based on expected investment returns on financial investments backing shareholder and policyholder funds over the period, with consistent allowance for the corresponding expected movements in liabilities. The expected rate of return is determined using consistent assumptions between operations, having regard to local economic and market forecasts of investment return and asset classification. Where assets are classified as fair value through profit and loss, expected return is based on the same assumptions used under embedded value principles for fixed income securities, equities and properties. Where fixed interest securities are classified as available for sale, such as in the US, the expected return comprises interest or dividend payments and amortisation of the premium or discount at purchase. Adjusted operating profit includes the effect of variances in experience for non-economic items, such as mortality, persistency and expenses, and the effect of changes in non-economic assumptions. Changes due to economic items, such as market value movement and interest rate changes, which give rise to variances between actual and expected investment returns, and the impact of changes in economic assumptions on liabilities, are disclosed as non-operating items.

Adjusted operating profit for non-long-term insurance business is based on expected investment returns on financial investments backing shareholder funds over the period. Expected investment returns are calculated for equities and properties by multiplying the opening market value of the investments, adjusted for sales and purchases during the year, by the longer-term rate of return. This rate of return is the same as that applied for the long-term business expected returns. The longer-term return for other investments is the actual income receivable for the period. Changes due to market value movement and interest rate changes, which give rise to variances between actual and expected investment returns, are disclosed as non-operating items. The impact of changes in the discount rate applied to claims provisions is also treated outside adjusted operating profit.

Adjusted operating profit is not a substitute for profit before income taxes and non-controlling interests in earnings or net income as determined in accordance with IFRS. Our definition of adjusted operating profit may differ from similar measures used by other companies, and may change over time.

The table below presents our consolidated adjusted operating profit for the three years ended 31 December 2012, 2011 and 2010, as well as the reconciliation of adjusted operating profit to loss/profit before tax attributable to shareholders’ profits under IFRS.

| Continuing operations | | 2012

£m | | | 2011

£m | | | 2010

£m | |

| United Kingdom & Ireland | | | 1,340 | | | | 1,509 | | | | 1,478 | |

| France | | | 422 | | | | 471 | | | | 362 | |

| Canada | | | 276 | | | | 254 | | | | 229 | |

| Italy, Spain and Other | | | 414 | | | | 334 | | | | 400 | |

| Higher growth markets | | | 202 | | | | 229 | | | | 170 | |

| Aviva Investors | | | 42 | | | | 53 | | | | 63 | |

| Other Group Activities | | | (920 | ) | | | (918 | ) | | | (878 | ) |

| Adjusted operating profit before tax (excl Delta Lloyd as an associate) | | | 1,776 | | | | 1,932 | | | | 1,824 | |

| Share of Delta Lloyd’s adjusted operating profit (before tax) as an associate | | | 112 | | | | 157 | | | | – | |

| Adjusted operating profit before tax | | | 1,888 | | | | 2,089 | | | | 1,824 | |

| Integration and restructuring costs | | | (461 | ) | | | (261 | ) | | | (216 | ) |

| Adjusted operating profit before tax after integration and restructuring costs | | | 1,427 | | | | 1,828 | | | | 1,608 | |

| Adjusting items: | | | | | | | | | | | | |

| Investment return variances and economic assumption changes on long-term business | | | (620 | ) | | | (897 | ) | | | (229 | ) |

| Short-term fluctuation in return on investments on non-long-term business | | | 7 | | | | (266 | ) | | | (199 | ) |

| Economic assumption changes on general insurance and health business | | | (21 | ) | | | (90 | ) | | | (61 | ) |

| Impairment of goodwill, associates and joint ventures and other amounts expensed | | | (60 | ) | | | (392 | ) | | | (23 | ) |

| Amortisation and impairment of intangibles | | | (128 | ) | | | (116 | ) | | | (139 | ) |

| (Loss)/profit on the disposal and remeasurement of subsidiaries and associates | | | (164 | ) | | | 565 | | | | 163 | |

| Exceptional items | | | – | | | | (57 | ) | | | 276 | |

| Share of Delta Lloyd’s non-operating items (before tax) as an associate | | | (523 | ) | | | 10 | | | | – | |

| Share of Delta Lloyd’s tax expense, as an associate | | | 107 | | | | (34 | ) | | | – | |

| Profit before tax attributable to shareholders’ profits – continuing operations | | | 25 | | | | 551 | | | | 1,396 | |

| (Loss)/profit before tax attributable to shareholders’ profits – discontinued operations | | | (2,696 | ) | | | (464 | ) | | | 1,044 | |

| (Loss)/Profit before tax attributable to shareholders’ profits | | | (2,671 | ) | | | 87 | | | | 2,440 | |

Adjusting items (from continuing operations)

Year ended 31 December 2012

The negative investment return variances and economic assumption changes of £620 million (2011: £897 million negative) mainly relates to the UK, where the allowance for credit defaults on UK commercial mortgages has increased to reflect uncertainty in the macroeconomic environment and the cost of de-risking activity. Elsewhere, positive variances in Spain and France were offset by a negative variance in Italy.

Short term fluctuations and economic assumption changes on non-long term business of £7 million positive (2011: £266 million negative) reflected favourable market movements.

The impairment of goodwill, associates and joint ventures was £60 million in 2012(2011: £392 million). This includes an impairment of £147 million in respect of the Group’s Indian associate, an impairment of £76 million in relation to goodwill on the Spanish business, an impairment of £33 million in relation to the Italian business and a small write down of £9 million in respect of the Group’s Korean joint venture. These impairments were partly offset by a reversal of the impairment recognised in 2011 in respect of our associate investment in Delta Lloyd of £205 million.

Loss on disposal of subsidiaries and associates was £164 million (2011: £565 million profit). This includes a loss of £129 million relating to the disposal of our associate stake in Delta Lloyd.

Integration and restructuring costs are £461 million(2011: £261 million). This includes costs relating to restructuring and transformation activity that has been taken to align our business operations with our strategy, including the Group’s Simplify programme (£165 million), £130 million in Ireland which includes expenses associated with the merging of the UK and Irish business, £24 million for restructuring in Aviva Investors, £25 million in respect of restructuring activities and £117 million relating to preparing the businesses for the implementation of Solvency II.

Exceptional items in 2012 were £nil (2011: £57 million unfavourable).

Year ended 31 December 2011

The investment return variances and economic assumption changes on long-term insurance business in 2011 produced a £897 million charge (2010: £229 million charge). The short-term fluctuations and economic assumption changes on the non-life business produced a £266 million charge (2010: £199 million charge). This was due to unfavourable market movements in a number of our markets.

The impairment of goodwill, associates and joint ventures was £392 million in 2011(2010: £23 million). An impairment of £217 million was recognised in respect of the associate, Delta Lloyd. The fair value was calculated based on the market price of the ordinary shares of Delta Lloyd NV quoted on the NYSE Euronext Amsterdam as at 31 December 2011. Following the announcement of the termination of Aviva Ireland’s bancassurance distribution contract, management reviewed the recoverability of the goodwill associated with this business and an impairment loss of £120 million was recognised, reducing the carrying value of goodwill relating to this business to nil. The UK long-term business had an impairment of £29 million. In Italy, an impairment of £11 million was recognised in respect of Aviva Assicurazioni Vita Spa, as a result of a reduction in management’s estimates for the future profitability of the business due to current economic circumstances. There was an impairment charge of £15 million recognised in respect of goodwill within interests in joint ventures relating to South Korea.

Amortisation of intangibles decreased by £23 million, or 17%, to £116 million (2010: £139 million).

Profit on disposal of subsidiaries and associates was £565 million (2010: £163 million). The profit comprised principally of a £532 million profit in relation to the sale of RAC, as described in note 3 to the IFRS financial statements.

Integration and restructuring costs for 2011 were £261 million (2010: £216 million). This includes costs associated with preparing the businesses for Solvency II implementation of £96 million, a £30 million charge in the UK relating to the reattribution of the inherited estate and expenditure relating to the Quantum Leap project (the Group’s previous European restructuring program) in Europe of £51 million. Expenditure relating to other restructuring exercises across the Group amounted to £84 million.

Exceptional items in 2011 were £57 million unfavourable (2010: £276 million favourable) relating to a £22 million provision for compensation scheme costs for the leveraged property fund in Ireland, and a £35 million expense for the discounted cost of strengthening latent claims provisions in the UK written a significant number of years ago. In 2010, exceptional items mainly related to a £286 million benefit from the closure of the final salary section of the UK staff pension scheme.

Consolidated results of operations

The table below presents our consolidated sales from continuing operations for the three years ended 31 December 2012, 2011 and 2010.

| Continuing operations | | 2012

£m | | | 2011

£m | | | 2010

£m | |

| United Kingdom & Ireland | | | 17,790 | | | | 19,175 | | | | 17,458 | |

| France | | | 4,640 | | | | 5,063 | | | | 5,886 | |

| Canada | | | 2,176 | | | | 2,083 | | | | 1,958 | |

| Italy, Spain and Other | | | 3,849 | | | | 5,665 | | | | 7,484 | |

| Higher growth markets | | | 2,944 | | | | 3,039 | | | | 2,959 | |

| Aviva Investors | | | 2,727 | | | | 1,598 | | | | 1,616 | |

| Total sales | | | 34,126 | | | | 36,623 | | | | 37,361 | |

Sales (from continuing operations)

Year ended 31 December 2012

Total sales from continuing operations decreased £2,497 million or 7% to £34,126 million(2011: £36,623 million). This decrease was mainly driven by lower life and pension sales in the UK, Italy, and Spain, partly offset by higher investment sales.

Sales in the UK and Ireland decreased for long-term insurance and savings, by £1,088 million, or 8%, to £12,772 million(2011:£13,860 million).The decline in UK sales reflects lower sales of bulk purchase annuities following our decision to withdraw from this market, as well as falls in bonds and savings products. These were partly offset by increased sales of individual annuities and protection products. In Ireland, life sales are down due to the closure to new business of our joint venture with AIB from April 2012. General insurance and health sales decreased by £297 million, or 6%, to £5,018 million(2011: £5,315million)mainly as a result of the disposal of RAC in 2011.Results across Europe have also been adversely impacted by the weakness of the euro and zloty. In our European operations, long term sales in France decreased £409 million, or 10% (4% decrease on a local currency basis), to £3,638 million(2011: £4,047 million) due to lower sales in the AFER (Association Francaise d’Epargne et de Retraite) product. Sales in Italy, Spain and Other decreased by £1,756 million, or 34% (29% decrease on a local currency basis) to £3,425 million(2011: £5,181 million) reflecting lower sales of protection and savings products due to the challenging economic environment. General insurance and health sales in France decreased by £14 million, or 1%, to £1,002 million(2011: £1,016 million) whilst sales in Italy and Other were down £60 million, or 12%, to £424 million(2011: £484 million) primarily due to declining credit protection and motor sales. Sales in Canada increased by £93 million, or 4%, to £2,176 million(2011:£2,083 million)due to a combination of improved retention levels and rate increases across both personal and commercial lines. Total sales in Higher growth markets decreased by £95 million, or 3%, to £2,944 million(2011: £3,039million) with higher long-term sales in Singapore more than offset by lower sales in other markets. Aviva Investors sales increased by £1,129 million or 71%. The opening of distribution offices in Europe contributed to most of this growth.

Year ended 31 December 2011

Sales in 2011 were £36,623 million, a decrease of £738 million, or 2%, from £37,361 million in 2010. Sales in the UK and Ireland for long-term insurance and savings were £13,860 million, an increase of £1,337 million, or 11%, from £12,523 million in 2010 and general insurance and health was £5,315 million, an increase of £380 million, or 8%, from £4,935 million in 2010. Long term sales in France decreased by £871 million, or 18% to £4,047 million(2010: £4,918 million) and Italy, Spain and other decreased by £1,865 million, or 26%, to £5,181 million(2010: £7,046 million).The decrease in sales in France and Italy was primarily driven by management actions to reduce sales of participating business. Sales in France for general insurance and health increased by £48 million, or 5%, to £1,016 million(2010: £968 million) while sales in Italy and other increased £46 million or 11% to £484 million(2011: £438 million). General insurance sales in Canada increased by £125 million, or 6%, to £2,083 million(2010: £1,958 million). Total sales in Higher Growth markets increased £80 million, or 3%, to £3,039 million(2010: £2,961 million) due to higher life and pension sales from bancassurance channels in Asia.

The table below presents our consolidated income statement from continuing operations under IFRS for the three years ended 31 December 2012, 2011 and 2010, before the effects of taxation to shareholder profit.

| Continuing operations | | 2012

£m | | | Restated1 2011

£m | | | Restated1 2010

£m | |

| Income | | | | | | | | | | | | |

| Gross written premiums | | | 22,744 | | | | 26,255 | | | | 27,192 | |

| Premiums ceded to reinsurers | | | (1,571 | ) | | | (1,548 | ) | | | (1,606 | ) |