UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Item 1: Report to Shareholders.

| | |

Table of contents | |

LETTER TO SHAREHOLDERS | 1 |

WORLDWIDE INCOME FUND | |

Commentary | 2 |

Performance summary | 3 |

PORTFOLIOS OF INVESTMENTS | 4 |

STATEMENTS OF ASSETS AND LIABILITIES | 9 |

STATEMENTS OF OPERATIONS | 10 |

STATEMENTS OF CHANGES IN NET ASSETS | 11 |

STATEMENTS OF CHANGES - CAPITAL STOCK ACTIVITY | 13 |

FINANCIAL HIGHLIGHTS | 16 |

NOTES TO FINANCIAL STATEMENTS | 18 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 27 |

OTHER INFORMATION | 28 |

TRUSTEES AND OFFICERS | 30 |

MASTER PORTFOLIO FINANCIAL STATEMENTS AND NOTES | 33 |

The Henderson Money Market Fund is a feeder fund that invests substantially all of its assets in the State Street Money Market Portfolio. The financial statements of the State Street Money Market Portfolio, including its investment portfolio, are included elsewhere within this report and should be read in conjunction with the Henderson Money Market Fund’s financial statements.

The Henderson Worldwide Income Fund may invest in high yield, lower rated (junk) bonds which involve a greater degree of risk than investment grade bonds. As such, securities rated below investment grade generally entail greater credit, market, issuer and liquidity risk than investment grade securities. Moreover, the Fund is subject to interest rate risk which is the risk that debt securities in the Fund’s portfolio will decline in value because of increases in market interest rates. The Fund may borrow money which may adversely affect the return to shareholders of the Fund, also known as leverage risk.

The views in this report were those of the Fund managers as of December 31, 2010 and may not reflect the views of the managers on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice.

| | |

Henderson Global Funds | Letter to shareholders |

Dear shareholder,

We are pleased to provide the annual report for the Henderson Worldwide Income Fund and the Henderson Money Market Fund, which covers the year ended December 31, 2010.

Global equities continued to make gains in 2010 on further evidence that the global economic recovery continues. There is a growing expectation that the more robust economic growth will be reflected in corporate earnings and analysts' forecasts are being revised upwards. Equity valuations as a result remain either around fair value or even cheaper than average in most developed markets, which should offer the potential for good returns in line with earnings growth as we move through 2011.

Emerging markets performed very strongly last year (with the notable exceptions of China and Brazil) and, consequently, we have more concerns about valuation support in some developing regions - particularly in light of increasing inflationary pressures and the likelihood of central bank actions to combat this. However, when it becomes clear that we are close to or at the end of the tightening cycle in emerging markets, this is an area that we believe will generate excellent returns over the long term.

The policy measures undertaken by global governments over the past three years will continue to have an impact on bond markets in 2011. European sovereign debt in particular is likely to remain hostage to investor confidence and political constraints. We therefore expect the avoidance of peripheral European exposure and the risk of contagion to be a continued theme for bond investors to navigate in 2011.

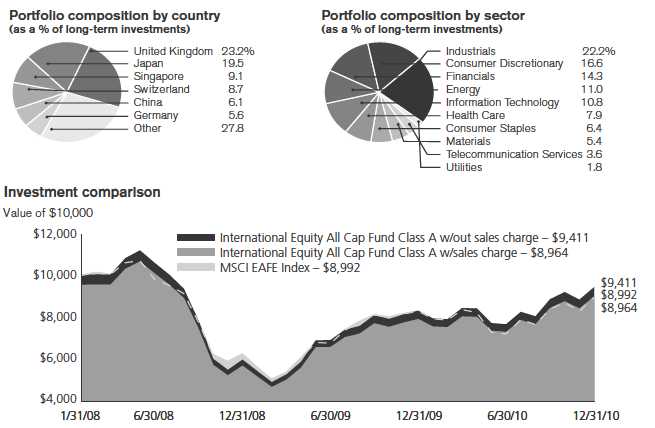

In other news, we are pleased to announce that on December 31, 2010 the Henderson Global Funds launched two new portfolios for our retail investors: Emerging Markets Opportunities Fund (HEMAX) and the International All Cap Equity Fund (HFNAX). The Emerging Markets Opportunities Fund seeks to participate in the long term growth of the developing economies and their capital markets. In addition, we expect the Fund to be a truly differentiated offering through its utilization of a specialized regional sub-portfolio structure with a strategic asset allocation overlay. The International All Cap Equity Fund has added retail share classes. The Class I Shares (HIEIX) were launched on January 31, 2008, and was the first Henderson mutual fund offered to US institutional investors. The Fund follows a bottom-up all cap growth strategy and focuses primarily on the developed markets of Europe, Australasia and the Far East (EAFE).

We believe that these Funds are key additions to the Henderson Global Funds family as we seek to provide you with further options to diversify clients’ portfolios with Funds that are truly differentiated from the competition. It’s our goal to continue to serve your financial needs successfully in the years to come, and we appreciate your trust and support in our Funds.

/s/ James O’Brien

James O’Brien

President, Henderson Global Funds

1

| | |

Henderson Global Funds | Commentary |

| | |

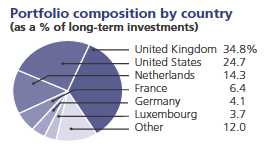

Worldwide Income Fund | |

Bond markets were volatile during the year but ultimately posted total returns above income yields as some capital appreciation was experienced. Rapidly falling default rates supported the lower end of the corporate bond market as investors sought out the higher yields offered in this space. However, government bonds also performed well as a slowdown in economic data in the summer of 2010 and a second round of quantitative easing from the Federal Reserve in November increased the attraction of this asset class.

| | | |

Worldwide Income Fund | |

Top 10 long term holdings | |

| | as a percentage |

Security | of net assets |

United States | | |

Treasury Note | | 6.6% |

FS Funding AS | | 2.9 |

Arran Corporate Loans | |

B.V., Class E3 | | 2.9 |

Service Corp International | 2.9 |

Impress Holdings B.V. | 2.9 |

AXA S.A. | | 2.8 |

Daily Mail & General Trust | 2.6 |

UPC Holding B.V. | | 2.4 |

ITV plc | | 2.4 |

Iron Mountain, Inc. | | 2.4 |

For the reporting period ended December 31, 2010, the Fund returned 10.17% (Class A shares at NAV) versus the benchmark, 50% ML Global High Yield Index (USD hedged) /50% ML Global Broad Market Corp Index (USD hedged), which posted a return of 11.39%.

The Fund maintained a position of long credit risk and short sovereign risk throughout the year. The long credit risk position was expressed through holdings in high yield bonds and subordinated financial bonds (issued by banks and insurance companies). There were changes in the overall composition of these holdings, aimed at diversifying the names within the Fund. In contrast, the Fund continued to steer away from investment grade bonds that have a very high sensitivity to government bond yields.

Mid year, the Fund invested in high yielding equities where the dividend yield was substantially higher than the yield on the corresponding corporate bond. This was an opportunistic asset allocation following weakness in the equity market during the spring and summer of 2010.

The Fund had substantial repayments during December as a number of its larger high yield holdings were repaid earlier than the final maturity date at the issuer’s option. We recycled some of the proceeds into other high yield names. This also reflected a move to increase the US domiciled holdings in order to diversify somewhat away from Europe. In addition, the Fund reduced some of its holdings in UK banks in a move to reduce its subordinated financial weighting.

Cash and short dated higher yielding bonds have continued to be preferred to longer dated investment grade or government bond holdings where we see further risk to capital in 2011 from rising yields. During the year interest rate derivatives were used to hedge out exposure to rising government bond yields. Expectation for 2011 is for risk assets to follow on from 2010 and continue to outperform government bonds and cash. The backdrop of exceptionally low default rates, markets open to refinancing, improving economic data and company balance sheets continuing to strengthen gives us confidence in the sustainability of the recovery.

2

| | |

Henderson Global Funds | Performance Summary |

| | |

Worldwide Income Fund | |

Investment comparison

Value of $10,000

Total returns as of December 31, 2010†

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | Since | |

| | NASDAQ | | One | | | Three | | | Five | | | inception | |

At NAV | symbol | | year | | | years* | | | years* | | | (9/30/03)* | |

Class A | HFAAX | | | 10.17 | % | | | 0.60 | % | | | 3.04 | % | | | 5.28 | % |

Class B | HFABX | | | 9.21 | | | | -0.04 | | | | 2.32 | | | | 4.52 | |

Class C | HFACX | | | 9.39 | | | | -0.27 | | | | 2.20 | | | | 4.46 | |

With sales charge | | | | | | | | | | | | | | | | | |

Class A | | | | 4.95 | % | | | -1.01 | % | | | 2.04 | % | | | 4.58 | % |

Class B | | | | 5.21 | | | | -1.05 | | | | 2.14 | | | | 4.52 | |

Class C | | | | 9.39 | | | | -0.27 | | | | 2.20 | | | | 4.46 | |

Index | | | | | | | | | | | | | | | | | |

50% ML Global High Yield / 50% ML Global Corporate | | | | | | | | | | | | | | | | | |

Index (USD-hedged) | | | | 11.39 | % | | | 8.79 | % | | | 7.33 | % | | | 7.12 | % |

Barclays Capital Global Aggregate Bond (Ex US MBS) Index | | | 5.52 | % | | | 5.57 | % | | | 6.68 | % | | | 5.77 | % |

| * | Average annual return. |

| † | Effective August 1, 2009, the Worldwide Income Fund changed its fiscal year end from July 31 to December 31. |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B and C shares are 1.64%, 2.39% and 2.39%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses (other than Acquired Fund Fees and Expenses allocated from unaffiliated investment companies) do not exceed 1.30%, 2.05% and 2.05%, for Class A, B and C shares, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during the periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. Effective May 19, 2006, the Henderson Income Advantage Fund changed its name, investment objective and policies and became the Henderson Worldwide Income Fund. The Fund’s historical performance may not represent current investment policies. Effective as of March 31, 2010, the Funds’s benchmark was changed from the Barclays Capital Global Aggregate Bond Index (ex US MBS) to 50% Merrill Lynch Global High Yield Index (USD Hedged) and 50% Merrill Lynch Global Broad market Corporate Index (USD Hedged). The adviser has determined that the blended index is a more appropriate broad based index. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

| | |

Henderson Global Funds | Portfolio of Investments |

Money Market Fund | |

December 31, 2010 | |

Mutual Funds – 99.74% | |

| | |

| | Value |

Investments in State Street Money Market Portfolio - 99.74% | $81,578,281 |

Total Investments: 99.74% | |

(cost $81,578,281) | 81,578,281 |

Other assets and liabilities, net: 0.26% | 215,866 |

Total net assets: 100.00% | $81,794,147 |

Henderson Money Market Fund invests substantially all of its investable assets into State Street Money Market Portfolio. At December 31, 2010, Henderson Money Market Fund owned 0.31% of the State Street Money Market Portfolio.

| | |

Maturities ladder as of December 31, 2010* | |

1 Day | 32.9% |

2-30 Days | 22.1 |

31-60 Days | 13.1 |

61-90 Days | 17.9 |

Over 90 Days | 14.0 |

Average Maturity | 29 Days |

| * | Portfolio construction and maturities ladder represents the composition of the underlying holdings in the State Street Money Market Portfolio, whose financial statements are included elsewhere in this report. An investment in the Henderson Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. |

See Notes to Financial Statements.

4

| | | | | | | |

Henderson Global Funds | | Portfolio of Investments |

| | | |

Worldwide Income Fund | | | |

December 31, 2010 | | | |

| | | | |

| | Face | | | | | Value |

| | amount | | | Coupon | Maturity | (note 2) |

Corporate Bonds – 80.01% | | | |

| | | | Canada – 2.22% | | | |

EUR | 1,000,000 | | Bombardier, Inc | 7.250% | 11/15/16 | $ 1,416,478 |

| | | | Denmark – 2.95% | | | |

EUR | 1,350,000 | | FS Funding AS | 8.875 | 5/15/16 | 1,876,165 |

| | | | France – 5.89% | | | |

USD | 2,000,000 | | AXA S.A. (a) (b) | 6.463 | 12/14/18 | 1,805,000 |

EUR | 550,000 | | Crown European Holdings S.A | 7.125 | 8/15/18 | 769,876 |

EUR | 550,000 | | Rexel S.A | 8.250 | 12/15/16 | 808,609 |

EUR | 275,228 | | Rhodia S.A. (c) | 3.735 | 10/15/13 | 367,787 |

| | | | | | | 3,751,272 |

| | | | Germany – 3.76% | | | |

EUR | 650,000 | | Fresenius Medical Care Capital Trust V | 7.375 | 6/15/11 | 890,310 |

EUR | 240,000 | | HeidelbergCement AG | 8.500 | 10/31/19 | 353,174 |

USD | 1,100,000 | | UPC Germany GmbH (a) | 8.125 | 12/1/17 | 1,155,000 |

| | | | | | | 2,398,484 |

| | | | Ireland – 1.57% | | | |

EUR | 750,000 | | Ardagh Glass Finance plc | 8.750 | 2/1/20 | 997,214 |

| | | | Italy – 1.85% | | | |

EUR | 900,000 | | Lottomatica SpA | 8.250 | 3/31/16 | 1,175,610 |

| | | | Luxembourg – 3.41% | | | |

GBP | 400,000 | | Glencore Finance Europe S.A | 6.500 | 2/27/19 | 639,149 |

EUR | 1,100,000 | | UPC Holding BV | 8.000 | 11/1/16 | 1,536,077 |

| | | | | | | 2,175,226 |

| | | | Netherlands – 13.10% | | | |

EUR | 500,000 | | Ahold Finance USA LLC | 5.875 | 3/14/12 | 705,299 |

USD | 625,000 | | Allianz Finance II B.V. (b) | 7.250 | 6/10/11 | 631,875 |

USD | 2,000,000 | | Arran Corporate Loans B.V., Class E3 (c) (d) (e) | 3.554 | 6/20/25 | 1,850,000 |

GBP | 500,000 | | Heineken N.V | 7.250 | 3/10/15 | 882,124 |

USD | 500,000 | | Impress Holdings B.V. (a) (c) | 3.414 | 9/15/13 | 500,000 |

EUR | 1,000,000 | | Impress Holdings B.V. (c) | 4.110 | 9/15/13 | 1,332,959 |

EUR | 690,000 | | ING Verzekeringen N.V. | 6.250 | 6/21/21 | 834,452 |

EUR | 500,000 | | OI European Group B.V | 6.750 | 9/15/20 | 674,831 |

EUR | 675,000 | | Ziggo Bond Co. B.V. (a) | 8.000 | 5/15/18 | 933,573 |

| | | | | | | 8,345,113 |

| | | | Switzerland – 2.26% | | | |

USD | 1,500,000 | | Swiss Re Capital I LP (a) (b) (f) | 6.854 | 5/25/16 | 1,440,409 |

See Notes to Financial Statements.

5

| | | | | | | |

Henderson Global Funds | | Portfolio of Investments |

| | | |

Worldwide Income Fund | | | |

December 31, 2010 (continued) | | | |

| | | | |

| | Face | | | | | Value |

| | amount | | | Coupon | Maturity | (note 2) |

| | | | United Kingdom – 27.74% | | | |

GBP | 1,100,000 | | Aviva plc (b) | 6.125% | 9/29/22 | $ 1,389,157 |

EUR | 700,000 | | BAA Funding, Ltd | 4.600 | 2/15/18 | 932,019 |

USD | 1,150,000 | | Barclays Bank plc (a) (b) | 5.926 | 9/29/49 | 1,035,000 |

USD | 1,000,000 | | Catlin Insurance Co., Ltd. (a) (b) | 7.249 | 1/19/17 | 885,000 |

EUR | 250,000 | | Co-Operative Bank plc (c) | 1.326 | 5/18/16 | 298,169 |

GBP | 1,000,000 | | Daily Mail & General Trust | 5.750 | 12/7/18 | 1,497,562 |

GBP | 100,000 | | Daily Mail & General Trust | 6.375 | 6/21/27 | 135,174 |

GBP | 125,000 | | EGG Banking plc | 6.875 | 12/29/21 | 186,240 |

GBP | 400,000 | | F&C Finance plc | 9.000 | 12/20/16 | 644,976 |

EUR | 800,000 | | Investec Tier I UK LP plc (b) | 7.075 | 6/24/15 | 924,720 |

GBP | 1,002,000 | | ITV plc | 5.375 | 10/19/15 | 1,523,162 |

GBP | 1,100,000 | | Legal & General Group plc (b) | 6.385 | 5/2/17 | 1,490,343 |

USD | 1,100,000 | | Lloyds TSB Group plc (a) (b) (g) | 6.267 | 11/14/16 | 772,750 |

EUR | 1,000,000 | | Rexam plc (b) | 6.750 | 6/29/17 | 1,302,879 |

USD | 1,000,000 | | Royal Bank of Scotland Group plc (b) (f) (g) | 7.640 | 9/29/17 | 670,000 |

USD | 1,100,000 | | Standard Chartered plc (b) (f) | 6.409 | 1/30/17 | 1,026,912 |

GBP | 1,000,000 | | Standard Life plc (b) | 6.750 | 7/12/27 | 1,383,701 |

GBP | 650,000 | | Virgin Media Finance plc | 8.875 | 10/15/19 | 1,155,293 |

GBP | 250,000 | | WPP plc | 6.000 | 4/4/17 | 418,142 |

| | | | | | | 17,671,199 |

| | | | United States – 15.26% | | | |

USD | 1,250,000 | | Constellation Brands, Inc | 7.250 | 5/15/17 | 1,329,687 |

USD | 560,000 | | Digicel Group, Ltd. (a) | 10.500 | 4/15/18 | 618,800 |

USD | 1,000,000 | | DISH DBS Corp | 7.125 | 2/1/16 | 1,037,500 |

USD | 600,000 | | HCA Holdings , Inc. (a) | 7.750 | 5/15/21 | 601,500 |

USD | 1,500,000 | | Iron Mountain, Inc | 6.625 | 1/1/16 | 1,513,125 |

EUR | 2,500,000 | | Lehman Brothers UK Capital Funding IV LP (b) (d) (e) (g) | 5.750 | 4/25/12 | — |

EUR | 525,000 | | Levi Strauss & Co | 7.750 | 5/15/18 | 717,343 |

USD | 400,000 | | Nalco Co. (a) | 6.625 | 1/15/19 | 411,000 |

USD | 1,740,000 | | Service Corp International (f) | 7.625 | 10/1/18 | 1,835,700 |

USD | 500,000 | | Sungard Data Systems, Inc | 10.250 | 8/15/15 | 526,875 |

USD | 1,000,000 | | Yum! Brands, Inc | 6.250 | 3/15/18 | 1,130,752 |

| | | | | | | 9,722,282 |

| | | | Total Corporate Bonds | | | |

| | | | (Cost $52,690,929) | | | 50,969,452 |

See Notes to Financial Statements.

6

| | | | | | |

Henderson Global Funds | | Portfolio of Investments |

Worldwide Income Fund | | | |

| | | | |

December 31, 2010 (continued) | | | |

Face | | | | | Value |

amount | | | Coupon | Maturity | (note 2) |

U.S. Government Obligation – 6.59% | | | |

| | | United States - 6.59% | | | |

USD 4,200,000 | | United States Treasury Note | 0.500% | 11/30/12 | $ 4,195,241 |

| | | Total U.S. Government Obligation | | | |

| | | (Cost $4,196,031) | | | 4,195,241 |

| | | Total Corporate Bond and | | | |

| | | U.S. Government Obligations | | | |

| | | (Cost $56,886,960) | | | 55,164,693 |

Common Stocks – 4.14% | | | |

Shares | | | | | |

| | | United Kingdom – 4.14% | | | |

12,800 | | British American Tobacco plc | | | 491,628 |

20,000 | | GlaxoSmithKline plc | | | 386,656 |

56,000 | | National Grid plc | | | 482,822 |

23,000 | | Scottish & Southern Energy plc | | | 439,276 |

325,000 | | Vodafone Group plc | | | 840,120 |

| | | | | | 2,640,502 |

| | | Total Common Stock | | | |

| | | (Cost $2,281,758) | | | 2,640,502 |

Preferred Stock – 0.75% | | | |

| | | United States - 0.75% | | | |

500 | | Bank of America Corp | | | 478,485 |

| | | Total Preferred Stock | | | |

| | | (Cost $500,000) | | | 478,485 |

| | | Total Long Term Investments | | | |

| | | (Cost $59,668,718) | | | 58,283,680 |

Short Term Investment - 7.63% | | | |

4,862,580 | | Fidelity Institutional Treasury Portfolio | | | 4,862,580 |

| | | Total Short Term Investment | | | |

| | | (Cost $4,862,580) | | | 4,862,580 |

See Notes to Financial Statements.

7

| | | | |

| | Henderson Global Funds | | Portfolio of Investments |

| | | | |

| | Worldwide Income Fund | | |

| | December 31, 2010 (continued) | | |

| | | | Value |

| | | | (note 2) |

| | Total Investments - 99.12% | | |

| | (Cost $64,531,298) | | $63,146,260 |

| | Net Other Assets and Liabilities – 0.88% | | 560,089 |

| | Total Net Assets – 100.00% | | $63,706,349 |

| (a) | Restricted security, purchased under Rule 144A, section 4(2)g which is exempt registration under the securities Act of 1933 as amended. At December 31, 2010 the securities had an aggregate value of $10,158,032, which represents 16.0% of net assets. |

| (b) | Maturity date is perpetual. Maturity date presented represents the next call date. |

| (c) | Security is a floating rate bond. |

| (d) | The security has been deemed illiquid according to the policies and procedures adopted by the Board of Trustees. |

| (e) | Fair valued at December 31, 2010 as determined in good faith using procedures approved by the Trustees of the Trust. |

| (f) | Security is segregated as collateral to cover margin requirements on open futures contracts. |

| (g) | Security is in default. |

| | | | |

Other Information: | | | |

Industry concentration as | % of Net | Industry concentration as | % of Net |

a percentage of net assets: | Assets | a percentage of net assets: | Assets |

Life & Health Insurance | 6.69% | Brewers | 1.38% |

Government | 6.59 | Wireless Telecommunication Services | 1.32 |

Telecommunication Services | 6.07 | Electronics | 1.27 |

Commercial Banks Non- U.S | 6.05 | Diversified Banking Institution | 1.22 |

Multi-line Insurance | 5.21 | Apparel/Textiles | 1.13 |

Containers - Metal/Glass | 4.93 | Food & Staples Retailing | 1.11 |

Packaging | 3.84 | Banking | 1.05 |

Building Maintenance & Services | 2.95 | Diversified Financial Services | 1.01 |

Other - ABS | 2.90 | Natural Resources | 1.00 |

Funeral Services & Related Items | 2.88 | Health Services | 0.94 |

Publishing | 2.56 | Computer Services | 0.83 |

Cable TV | 2.41 | Tobacco | 0.77 |

Television | 2.39 | Electric Utilities | 0.76 |

Commercial Services & Supply | 2.38 | Electric - Integrated | 0.69 |

Special Purpose Entity | 2.26 | Multimedia | 0.66 |

Diversified Manufacturing Operations | 2.22 | Chemicals | 0.64 |

Beverages - Wine & Spirits | 2.09 | Pharmaceuticals | 0.60 |

Lottery Services | 1.85 | Chemicals Specialty | 0.58 |

Restaurants | 1.77 | Building Products | 0.55 |

Cable and Satellite | 1.63 | Long Term Investments | 91.49 |

Airport Development & Maintenance | 1.46 | Short Term Investment | 7.63 |

Finance - Commercial | 1.45 | Total Investments | 99.12 |

Medical Products | 1.40 | Net Other Assets and Liabilities | 0.88 |

| | | | 100.00% |

See Notes to Financial Statements.

8

| | | | | | | |

Henderson Global Funds | | Financial Statements | |

| | | | |

Statement of Assets and Liabilities | | | | | | |

December 31 , 2010 | | | | | | |

| | | Money | | | Worldwide | |

| | | Market | | | Income | |

| | | Fund | | | Fund | |

ASSETS: | | | | | | |

Investments in State Street Money Market Portfolio, at value | | $ | 81,578,281 | | | $ | — | |

Investment in securities, at value | | | — | | | | 58,283,680 | |

Short term investments | | | — | | | | 4,862,580 | |

Total investments, at value | | | 81,578,281 | | | | 63,146,260 | |

Foreign cash, at value | | | — | | | | 1,471,383 | |

Dividends and interest receivable | | | — | | | | 988,169 | |

Receivable for fund shares sold | | | 254,119 | | | | 43,816 | |

Unrealized appreciation on open futures contracts | | | — | | | | 64,313 | |

Prepaid expenses and other assets | | | 19,372 | | | | 90,802 | |

Total Assets | | | 81,851,772 | | | | 65,804,743 | |

LIABILITIES: | | | | | | | | |

Payable for investment securities purchased | | | — | | | | 1,597,648 | |

Payable for fund shares redeemed | | | 34,852 | | | | 268,119 | |

Payable for dividends | | | 206 | | | | — | |

Payable for open forward foreign currency contracts | | | — | | | | 58,832 | |

Payable to investment adviser | | | — | | | | 47,736 | |

Payable for 12b-1 distribution and service fees | | | — | | | | 36,635 | |

Due to broker for open futures contracts | | | — | | | | 31,545 | |

Accrued expenses and other payables | | | 22,567 | | | | 57,879 | |

Total Liabilities | | | 57,625 | | | | 2,098,394 | |

NET ASSETS | | $ | 81,794,147 | | | $ | 63,706,349 | |

NET ASSETS consist of: | | | | | | | | |

Paid-in capital | | $ | 81,792,849 | | | $ | 102,411,409 | |

Accumulated undistributed net investment income (loss) | | | 1,298 | | | | (600,093 | ) |

Accumulated net realized gain (loss) on investments, futures, options and foreign currency transactions | | | — | | | | (36,731,974 | ) |

Net unrealized appreciation (depreciation) of investments, futures and foreign currencies | | | — | | | | (1,372,993 | ) |

| | | $ | 81,794,147 | | | $ | 63,706,349 | |

NET ASSETS: | | | | | | | | |

Class A Shares | | $ | 3,069,201 | | | $ | 28,171,439 | |

Class B Shares | | $ | 702,544 | | | $ | 8,537,422 | |

Class C Shares | | $ | 3,019,217 | | | $ | 26,997,488 | |

Class Z Shares | | $ | 75,003,185 | | | | N/A | |

SHARES OUTSTANDING: | | | | | | | | |

Class A Shares (unlimited number of shares authorized) | | | 3,069,201 | | | | 3,193,910 | |

Class B Shares (unlimited number of shares authorized) | | | 702,544 | | | | 966,406 | |

Class C Shares (unlimited number of shares authorized) | | | 3,019,217 | | | | 3,072,948 | |

Class Z Shares (unlimited number of shares authorized) | | | 75,003,185 | | | | N/A | |

CLASS A SHARES: | | | | | | | | |

Net asset value and redemption price per share | | $ | 1.00 | | | $ | 8.82 | |

Maximum sales charge* | | | N/A | | | | 4.75 | % |

Maximum offering price per share | | | N/A | | | $ | 9.26 | |

CLASS B SHARES: | | | | | | | | |

Net asset value and offering price per share | | $ | 1.00 | | | $ | 8.83 | |

CLASS C SHARES: | | | | | | | | |

Net asset value and offering price per share | | $ | 1.00 | | | $ | 8.79 | |

CLASS Z SHARES: | | | | | | | | |

Net asset value and offering price per share | | $ | 1.00 | | | | N/A | |

Investments, at cost | | $ | 81,578,281 | | | | 64,531,298 | |

Foreign cash, at cost | | $ | — | | | $ | 1,467,137 | |

*On sales of $50,000 or more, the sales charge will be reduced. | | | | | | | | |

See Notes to Financial Statements. |

9

| | | | | | | |

Henderson Global Funds | | Financial Statements | |

| | | | |

Statement of Operations | | | | | | |

For the Year Ended December 31, 2010 | | | | | | |

| | | Money | | | Worldwide | |

| | | Market | | | Income | |

| | | Fund | | | Fund | |

INVESTMENT INCOME: | | | | | | |

Dividends | | $ | — | | | $ | 78,651 | |

Interest allocated from State Street Money Market Portfolio | | | 218,209 | | | | — | |

Interest | | | — | | | | 4,570,507 | |

Foreign taxes withheld | | | — | | | | (6,792 | ) |

Expenses allocated from State Street Money Market Portfolio | | | (81,457 | ) | | | — | |

Total Investment Income | | | 136,752 | | | | 4,642,366 | |

EXPENSES: | | | | | | | | |

Investment Advisory fees | | | — | | | | 527,355 | |

12b-1 distribution and service fees: | | | | | | | | |

Class A Shares | | | 9,928 | | | | 80,374 | |

Class B Shares | | | 7,826 | | | | 84,578 | |

Class C Shares | | | 39,574 | | | | 297,068 | |

Registration and filing fees | | | 35,310 | | | | 36,886 | |

Audit fees | | | 30,200 | | | | 38,428 | |

Legal fees | | | 26,894 | | | | 10,526 | |

Printing and postage fees | | | 25,834 | | | | 46,577 | |

Administrative fees | | | 23,976 | | | | 18,410 | |

Transfer agent fees | | | 16,344 | | | | 90,813 | |

Accounting fees | | | 11,802 | | | | 47,391 | |

Trustees’ fees and expenses | | | 2,249 | | | | 3,039 | |

Compliance Officer fees | | | 1,991 | | | | 2,298 | |

Custodian fees | | | — | | | | 17,426 | |

Miscellaneous fees | | | 8,096 | | | | 70,434 | |

Total Expenses | | | 240,024 | | | | 1,371,603 | |

Fees waived and expenses reimbursed by investment adviser | | | (92,537 | ) | | | (171,286 | ) |

Fees waived by distributor | | | (57,328 | ) | | | — | |

Net Expenses | | | 90,159 | | | | 1,200,317 | |

NET INVESTMENT INCOME | | | 46,593 | | | | 3,442,049 | |

NET REALIZED AND UNREALIZED GAIN/(LOSS): | | | | | | | | |

Net realized gain/(loss) from : | | | | | | | | |

Investment transactions | | | — | | | | (2,948,698 | ) |

Futures contracts | | | — | | | | (676,350 | ) |

Options | | | — | | | | (96,753 | ) |

Foreign currency transactions | | | — | | | | 2,757,470 | |

Net change in unrealized appreciation/(depreciation) of: | | | | | | | | |

Investments | | | — | | | | 4,653,368 | |

Futures contracts | | | — | | | | 37,352 | |

Translation of other assets and liabilities | | | — | | | | (622,349 | ) |

Net Realized and Unrealized Gain/(Loss) | | | — | | | | 3,104,040 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 46,593 | | | $ | 6,546,089 | |

See Notes to Financial Statements.

10

| | | | | | | |

Henderson Global Funds | | Financial Statements | |

| | | | |

Statement of Changes in Net Assets | | | | | | |

Money Market Fund | | | | | | |

| | | Year Ended | | | Period Ended | |

| | | December 31, | | | December 31, | |

| | | 2010 | | | | 2009 | * |

Net investment income | | $ | 46,593 | | | $ | 49,628 | |

Net increase in net assets resulting from operations | | | 46,593 | | | | 49,628 | |

Distributions to shareholders from net investment income: | | | | | | | | |

Class A Shares | | | (2,578 | ) | | | (3,496 | ) |

Class B Shares | | | (493 | ) | | | (772 | ) |

Class C Shares | | | (2,573 | ) | | | (4,188 | ) |

Class Z Shares | | | (40,949 | ) | | | (41,172 | ) |

| | | | (46,593 | ) | | | (49,628 | ) |

Net increase (decrease) in Fund share transactions: | | | | | | | | |

Class A Shares | | | (654,423 | ) | | | 3,723,624 | |

Class B Shares | | | (98,526 | ) | | | 801,070 | |

Class C Shares | | | (1,003,062 | ) | | | 4,022,278 | |

Class Z Shares | | | 30,001,329 | | | | 45,001,857 | |

| | | | 28,245,318 | | | | 53,548,829 | |

Net increase in net assets | | | 28,245,318 | | | | 53,548,829 | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 53,548,829 | | | | — | |

End of year | | $ | 81,794,147 | | | $ | 53,548,829 | |

Accumulated undistributed net investment income | | $ | 1,298 | | | | — | |

* Inception date for the Henderson Money Market Fund was April 20, 2009. | | | | | | | | |

See Notes to Financial Statements.

11

| | | | | | | | | | |

Henderson Global Funds | | | | | Financial Statements | |

| | | | | | | |

| Statement of Changes in Net Assets | | | | | | | |

Worldwide Income Fund | | | | | | | | | |

| | | Year Ended | | | Period Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | July 31, | |

| | | 2010 | | | | 2009 | * | | | 2009 | |

Net investment income | | $ | 3,442,049 | | | $ | 1,691,151 | | | $ | 6,009,580 | |

Net realized loss on investments, options, futures contacts and | | | | | | | | | | | | |

foreign currency transactions | | | (964,331 | ) | | | (4,229,777 | ) | | | (26,890,647 | ) |

Net change in unrealized appreciation (depreciation) of investments, | | | | | | | | | | | | |

futures contracts and foreign currency translations | | | 4,068,371 | | | | 11,194,007 | | | | (2,469,006 | ) |

Net increase (decrease) in net assets resulting from operations | | | 6,546,089 | | | | 8,655,381 | | | | (23,350,073 | ) |

Distributions to shareholders from net investment income: | | | | | | | | | | | | |

Class A Shares | | | (1,212,447 | ) | | | — | | | | (3,333,354 | ) |

Class B Shares | | | (276,642 | ) | | | — | | | | (402,379 | ) |

Class C Shares | | | (971,551 | ) | | | — | | | | (3,075,858 | ) |

| | | | (2,460,640 | ) | | | — | | | | (6,811,591 | ) |

Return of Capital: | | | | | | | | | | | | |

Class A Shares | | | (466,804 | ) | | | (801,752 | ) | | | — | |

Class B Shares | | | (106,510 | ) | | | (154,980 | ) | | | — | |

Class C Shares | | | (374,056 | ) | | | (653,057 | ) | | | — | |

| | | | (947,370 | ) | | | (1,609,789 | ) | | | — | |

Net increase (decrease) in Fund share transactions: | | | | | | | | | | | | |

Class A Shares | | | (8,886,617 | ) | | | 3,476,090 | | | | (21,459,603 | ) |

Class B Shares | | | 356,139 | | | | 780,723 | | | | 1,352,785 | |

Class C Shares | | | (4,533,368 | ) | | | (1,413,126 | ) | | | (19,370,764 | ) |

| | | | (13,063,846 | ) | | | 2,843,687 | | | | (39,477,582 | ) |

Net increase (decrease) in net assets | | | (9,925,767 | ) | | | 9,889,279 | | | | (69,639,246 | ) |

NET ASSETS: | | | | | | | | | | | | |

Beginning of year | | | 73,632,116 | | | | 63,742,837 | | | | 133,382,083 | |

End of year | | $ | 63,706,349 | | | $ | 73,632,116 | | | $ | 63,742,837 | |

Accumulated undistributed net investment loss | | $ | (600,093 | ) | | $ | (180,351 | ) | | $ | (3,456,697 | ) |

| * The Henderson Worldwide Income Fund changed its fiscal year end from July 31 to December 31. | | | | | | | | | |

See Notes to Financial Statements.

12

| | | | | | | |

Henderson Global Funds | | Financial Statements | |

| | | | |

| Statement of Changes - Capital Stock Activity | | | | |

Money Market Fund | | | | | | |

| | | Year Ended | | | Period Ended | |

| | | December 31, | | | December 31, | |

| | | 2010 | | | | 2009 | * |

Amount | | | | | | | |

Class A Shares: | | | | | | | |

Sold | | $ | 5,981,792 | | | $ | 8,080,751 | |

Issued as reinvestment of dividends | | | 1,954 | | | | 2,402 | |

Redeemed | | | (6,638,169 | ) | | | (4,359,529 | ) |

Net increase (decrease) | | $ | (654,423 | ) | | $ | 3,723,624 | |

Class B Shares: | | | | | | | | |

Sold | | $ | 618,535 | | | $ | 1,540,372 | |

Issued as reinvestment of dividends | | | 452 | | | | 650 | |

Redeemed | | | (717,513 | ) | | | (739,952 | ) |

Net increase (decrease) | | $ | (98,526 | ) | | $ | 801,070 | |

Class C Shares: | | | | | | | | |

Sold | | $ | 3,861,888 | | | $ | 7,276,083 | |

Issued as reinvestment of dividends | | | 2,359 | | | | 3,905 | |

Redeemed | | | (4,867,309 | ) | | | (3,257,710 | ) |

Net increase (decrease) | | $ | (1,003,062 | ) | | $ | 4,022,278 | |

Class Z Shares | | | | | | | | |

Sold | | $ | 426,552,955 | | | $ | 281,851,911 | |

Issued as reinvestment of dividends | | | 40,949 | | | | 40,973 | |

Redeemed | | | (396,592,575 | ) | | | (236,891,027 | ) |

Net increase | | $ | 30,001,329 | | | $ | 45,001,857 | |

* Inception date for the Henderson Money Market Fund was April 20, 2009. | | | | | | | | |

| The number of shares sold, issued as reinvestment of dividends and redeemed approximates the dollar amount of transactions. | | | | | |

See Notes to Financial Statements.

13

| | | | | | | | | | |

Henderson Global Funds | | | | | Financial Statements | |

| | | | | | | |

| Statement of Changes - Capital Stock Activity | | | | |

Worldwide Income Fund | | | | | | | | | |

| | | Year Ended | | | Period Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | July 31, | |

| | | 2010 | | | | 2009 | * | | | 2009 | |

Amount | | | | | | | | | | | |

Class A Shares: | | | | | | | | | | | |

Sold | | $ | 7,504,819 | | | $ | 7,706,649 | | | $ | 6,436,688 | |

Issued as reinvestment of dividends | | | 1,143,214 | | | | 520,375 | | | | 1,831,377 | |

Redeemed ** | | | (17,534,650 | ) | | | (4,750,934 | ) | | | (29,727,668 | ) |

Net increase (decrease) | | $ | (8,886,617 | ) | | $ | 3,476,090 | | | $ | (21,459,603 | ) |

Class B Shares: | | | | | | | | | | | | |

Sold | | $ | 2,190,741 | | | $ | 1,366,280 | | | $ | 2,618,316 | |

Issued as reinvestment of dividends | | | 149,698 | | | | 59,580 | | | | 131,962 | |

Redeemed ** | | | (1,984,300 | ) | | | (645,137 | ) | | | (1,397,493 | ) |

Net increase | | $ | 356,139 | | | $ | 780,723 | | | $ | 1,352,785 | |

Class C Shares: | | | | | | | | | | | | |

Sold | | $ | 5,339,610 | | | $ | 2,595,652 | | | $ | 8,507,174 | |

Issued as reinvestment of dividends | | | 772,516 | | | | 372,443 | | | | 1,467,617 | |

Redeemed ** | | | (10,645,494 | ) | | | (4,381,221 | ) | | | (29,345,555 | ) |

Net decrease | | $ | (4,533,368 | ) | | $ | (1,413,126 | ) | | $ | (19,370,764 | ) |

Shares | | | | | | | | | | | | |

Class A Shares: | | | | | | | | | | | | |

Sold | | | 860,440 | | | | 937,535 | | | | 859,802 | |

Issued as reinvestment of dividends | | | 131,056 | | | | 63,260 | | | | 272,218 | |

Redeemed | | | (2,020,264 | ) | | | (579,442 | ) | | | (4,173,888 | ) |

Net increase (decrease) | | | (1,028,768 | ) | | | 421,353 | | | | (3,041,868 | ) |

Class B Shares: | | | | | | | | | | | | |

Sold | | | 250,158 | | | | 165,584 | | | | 388,884 | |

Issued as reinvestment of dividends | | | 17,136 | | | | 7,229 | | | | 19,879 | |

Redeemed | | | (226,079 | ) | | | (78,220 | ) | | | (191,616 | ) |

Net increase | | | 41,215 | | | | 94,593 | | | | 217,147 | |

Class C Shares: | | | | | | | | | | | | |

Sold | | | 616,491 | | | | 315,836 | | | | 1,183,055 | |

Issued as reinvestment of dividends | | | 88,911 | | | | 45,479 | | | | 219,085 | |

Redeemed | | | (1,216,752 | ) | | | (533,051 | ) | | | (4,302,763 | ) |

Net decrease | | | (511,350 | ) | | | (171,736 | ) | | | (2,900,623 | ) |

| * | The Henderson Worldwide Income Fund changed its fiscal year end from July 31 to December 31. |

| ** | Amounts shown are inclusive of redemption fees. |

See Notes to Financial Statements.

14

This page deliberately left blank.

15

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Henderson Global Funds | | | | | | | | | | | | Financial Highlights | |

| | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Periods Indicated | | | | | | | | | | | | | |

| | | | | | Income (loss) from investment operations: | | | Less distributions: |

| | | | | | | | | Net | | | | | | Dividends Distributions | | | | |

| | | | | | | | | realized and | | | | | | | | | | | | | | | | |

| | | Net asset | | | Net | | | unrealized | | | Total | | | from | | | from net | | | | | | | |

| | | value, | | | investment | | | gain | | | from | | | net | | | realized | | | Return | | | | |

| | | beginning | | | income | | | | | | investment | | | investment | | | capital | | | of | | | Total | |

| | | of period | | | (loss) (c) | | | investments | | | operations | | | income | | | gains | | | capital | | | distributions | |

| Henderson Money Market Fund (b) | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Period Ended 12/31/2009 (a) | | | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Class B | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Period Ended 12/31/2009 (a) | | | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Period Ended 12/31/2009 (a) | | | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Class Z | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Period Ended 12/31/2009 (a) | | | 1.00 | | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | | | | 0.00 | | | | 0.00 | (d) |

Worldwide Income Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 8.44 | | | | 0.46 | | | | 0.38 | | | | 0.84 | | | | (0.33 | ) | | | 0.00 | | | | (0.13 | ) | | | (0.46 | ) |

Period Ended 12/31/2009(a) | | | 7.60 | | | | 0.21 | | | | 0.83 | | | | 1.04 | | | | 0.00 | | | | 0.00 | | | | (0.20 | ) | | | (0.20 | ) |

Year Ended 7/31/2009 | | | 9.45 | | | | 0.63 | | | | (1.78 | ) | | | (1.15 | ) | | | (0.70 | ) | | | 0.00 | | | | 0.00 | | | | (0.70 | ) |

Year Ended 7/31/2008 | | | 10.87 | | | | 0.71 | | | | (1.37 | ) | | | (0.66 | ) | | | (0.76 | ) | | | 0.00 | | | | 0.00 | | | | (0.76 | ) |

Year Ended 7/31/2007 | | | 10.78 | | | | 0.66 | | | | 0.08 | | | | 0.74 | | | | (0.65 | ) | | | 0.00 | | | | 0.00 | | | | (0.65 | ) |

Year Ended 7/31/2006 | | | 11.03 | | | | 0.71 | | | | (0.22 | ) | | | 0.49 | | | | (0.74 | ) | | | 0.00 | | | | 0.00 | | | | (0.74 | ) |

Class B | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 8.46 | | | | 0.40 | | | | 0.37 | | | | 0.77 | | | | (0.29 | ) | | | 0.00 | | | | (0.11 | ) | | | (0.40 | ) |

Period Ended 12/31/2009(a) | | | 7.61 | | | | 0.19 | | | | 0.84 | | | | 1.03 | | | | 0.00 | | | | 0.00 | | | | (0.18 | ) | | | (0.18 | ) |

Year Ended 7/31/2009 | | | 9.44 | | | | 0.56 | | | | (1.75 | ) | | | (1.19 | ) | | | (0.64 | ) | | | 0.00 | | | | 0.00 | | | | (0.64 | ) |

Year Ended 7/31/2008 | | | 10.84 | | | | 0.64 | | | | (1.36 | ) | | | (0.72 | ) | | | (0.68 | ) | | | 0.00 | | | | 0.00 | | | | (0.68 | ) |

Year Ended 7/31/2007 | | | 10.76 | | | | 0.57 | | | | 0.07 | | | | 0.64 | | | | (0.56 | ) | | | 0.00 | | | | 0.00 | | | | (0.56 | ) |

Year Ended 7/31/2006 | | | 11.00 | | | | 0.62 | | | | (0.20 | ) | | | 0.42 | | | | (0.66 | ) | | | 0.00 | | | | 0.00 | | | | (0.66 | ) |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 12/31/2010 | | $ | 8.41 | | | | 0.40 | | | | 0.38 | | | | 0.78 | | | | (0.29 | ) | | | 0.00 | | | | (0.11 | ) | | | (0.40 | ) |

Period Ended 12/31/2009(a) | | | 7.59 | | | | 0.19 | | | | 0.81 | | | | 1.00 | | | | 0.00 | | | | 0.00 | | | | (0.18 | ) | | | (0.18 | ) |

Year Ended 7/31/2009 | | | 9.45 | | | | 0.57 | | | | (1.79 | ) | | | (1.22 | ) | | | (0.64 | ) | | | 0.00 | | | | 0.00 | | | | (0.64 | ) |

Year Ended 7/31/2008 | | | 10.86 | | | | 0.64 | | | | (1.37 | ) | | | (0.73 | ) | | | (0.68 | ) | | | 0.00 | | | | 0.00 | | | | (0.68 | ) |

Year Ended 7/31/2007 | | | 10.78 | | | | 0.57 | | | | 0.07 | | | | 0.64 | | | | (0.56 | ) | | | 0.00 | | | | 0.00 | | | | (0.56 | ) |

Year Ended 7/31/2006 | | | 11.02 | | | | 0.63 | | | | (0.21 | ) | | | 0.42 | | | | (0.66 | ) | | | 0.00 | | | | 0.00 | | | | (0.66 | ) |

| (a) | The Henderson Money Market Fund commenced operations on April 20, 2009. The Henderson Worldwide Income Fund changed its fiscal year end from July 31 to December 31. |

| (b) | The per share amounts and percentages include the Fund's proportionate share of income, expenses and net realized and unrealized gains or losses of the State Street Money Market Portfolio. |

| (c) | Per share data was calculated using average shares outstanding during the period. |

| (d) | Amount represents less than $0.01. |

| (e) | Total returns are historical and assume changes in share price, reinvestment of all dividends and distributions and no sales charge. Had certain expenses not been reduced during the periods shown, total returns would have been lower. Total returns for periods of less than one year are not annualized. |

See Notes to Financial Statements.

16

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | Henderson Global Funds | | | | | | | | | Financial Highlights | |

| | | | | | | | | | | | | Ratios to average net assets: | | | |

| | | | | | | | | | | | | | | | | | | Annualized ratio of | | | | |

| | | | | | | | | | | | | Annualized | | | Annualized | | | operating expenses | | | | |

| | | | | | | | | | | | | ratio of | | | ratio of | | | to average net | | | | |

| | | | Net asset | | | | | | Net assets, | | | operating | | | net investment | | | assets without | | | | |

| | | | value, | | | | | | end of | | | expenses to | | | income/(loss) | | | waivers and/or | | | Portfolio | |

| Redemption | | | end of | | | Total | | | period | | | average | | | to average | | | expenses | | | turnover | |

| fees | | | period | | | return (e) | | | | (000 | ) | | net assets | | | net assets | | | reimbursed | | | rate | |

| | 0.00 | | | $ | 1.00 | | | | 0.06 | % | | $ | 3,069 | | | | 0.25 | % | | | 0.06 | % | | | 0.63 | % | | | N/A | |

| | 0.00 | | | | 1.00 | | | | 0.09 | | | | 3,724 | | | | 0.35 | | | | 0.13 | | | | 0.78 | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | | | $ | 1.00 | | | | 0.06 | % | | $ | 703 | | | | 0.25 | % | | | 0.06 | % | | | 1.38 | % | | | N/A | |

| | 0.00 | | | | 1.00 | | | | 0.09 | | | | 801 | | | | 0.35 | | | | 0.13 | | | | 1.53 | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | | | $ | 1.00 | | | | 0.06 | % | | $ | 3,019 | | | | 0.25 | % | | | 0.06 | % | | | 1.38 | % | | | N/A | |

| | 0.00 | | | | 1.00 | | | | 0.09 | | | | 4,022 | | | | 0.35 | | | | 0.13 | | | | 1.53 | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | | | $ | 1.00 | | | | 0.06 | % | | $ | 75,003 | | | | 0.25 | % | | | 0.06 | % | | | 0.38 | % | | | N/A | |

| | 0.00 | | | | 1.00 | | | | 0.09 | | | | 45,002 | | | | 0.35 | | | | 0.13 | | | | 0.53 | | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | (d) | | $ | 8.82 | | | | 10.17 | % | | $ | 28,171 | | | | 1.30 | % | | | 5.30 | % | | | 1.54 | % | | | 38 | % |

| | 0.00 | (d) | | | 8.44 | | | | 13.82 | | | | 35,656 | | | | 1.30 | | | | 6.19 | | | | 1.63 | | | | 11 | |

| | 0.00 | (d) | | | 7.60 | | | | (10.71 | ) | | | 28,905 | | | | 1.30 | | | | 8.69 | | | | 1.62 | | | | 53 | |

| | 0.00 | (d) | | | 9.45 | | | | (6.47 | ) | | | 64,687 | | | | 1.30 | | | | 6.87 | | | | 1.45 | | | | 41 | |

| | 0.00 | | | | 10.87 | | | | 6.71 | | | | 39,470 | | | | 1.30 | | | | 5.89 | | | | 1.77 | | | | 73 | |

| | 0.00 | | | | 10.78 | | | | 4.70 | | | | 17,927 | | | | 1.30 | | | | 6.61 | | | | 1.93 | | | | 161 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | (d) | | $ | 8.83 | | | | 9.21 | % | | $ | 8,537 | | | | 2.05 | % | | | 4.55 | % | | | 2.29 | % | | | 38 | % |

| | 0.00 | (d) | | | 8.46 | | | | 13.59 | | | | 7,824 | | | | 2.05 | | | | 5.44 | | | | 2.38 | | | | 11 | |

| | 0.00 | (d) | | | 7.61 | | | | (11.23 | ) | | | 6,325 | | | | 2.05 | | | | 8.02 | | | | 2.37 | | | | 53 | |

| | 0.00 | (d) | | | 9.44 | | | | (7.00 | ) | | | 5,789 | | | | 2.05 | | | | 6.13 | | | | 2.20 | | | | 41 | |

| | 0.00 | | | | 10.84 | | | | 5.93 | | | | 5,003 | | | | 2.05 | | | | 5.17 | | | | 2.52 | | | | 73 | |

| | 0.00 | | | | 10.76 | | | | 3.93 | | | | 5,210 | | | | 2.05 | | | | 5.77 | | | | 2.68 | | | | 161 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 0.00 | (d) | | $ | 8.79 | | | | 9.39 | % | | $ | 26,997 | | | | 2.05 | % | | | 4.55 | % | | | 2.29 | % | | | 38 | % |

| | 0.00 | (d) | | | 8.41 | | | | 13.22 | | | | 30,152 | | | | 2.05 | | | | 5.45 | | | | 2.38 | | | | 11 | |

| | 0.00 | (d) | | | 7.59 | | | | (11.55 | ) | | | 28,513 | | | | 2.05 | | | | 7.96 | | | | 2.37 | | | | 53 | |

| | 0.00 | (d) | | | 9.45 | | | | (7.09 | ) | | | 62,906 | | | | 2.05 | | | | 6.17 | | | | 2.20 | | | | 41 | |

| | 0.00 | | | | 10.86 | | | | 5.92 | | | | 29,752 | | | | 2.05 | | | | 5.11 | | | | 2.52 | | | | 73 | |

| | 0.00 | | | | 10.78 | | | | 3.92 | | | | 13,150 | | | | 2.05 | | | | 5.78 | | | | 2.68 | | | | 161 | |

See Notes to Financial Statements.

17

Henderson Global Funds

Notes to Financial Statements

Note 1. Organization

Henderson Global Funds (the “Trust”) was organized on May 11, 2001, as a Delaware business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust has an unlimited number of authorized shares that are divided among ten series: seven series of the Trust, Henderson Emerging Market Opportunities, Henderson European Focus Fund, Henderson Global Equity Income Fund, Henderson Global Opportunities Fund, Henderson Global Technology Fund, Henderson International Opportunities Fund and Henderson Japan-Asia Focus Fund are not included in this report because their fiscal year end is July 31. Henderson International All Cap Equity Fund (formerly known as “International Equity”) has a fiscal year ending December 31, and is not included in this report. The Henderson Money Market Fund (“Money Market”) and Henderson Worldwide Income Fund (“Worldwide Income”) (collectively, the “Funds”), have fiscal years ending December 31, are both diversified and included in this report.

Money Market began operations, including recording income and expenses (“commencement of operations”) on April 20, 2009. Money Market is a feeder fund that invests substantially all of its assets in the State Street Money Market Portfolio, (the “Master Portfolio”), a series of State Street Master Funds. The investment objective and policies of Master Portfolio are substantially similar to those of Money Market. The value of Money Market’s investment in Master Portfolio reflects its proportionate interest of the net assets of Master Portfolio (0.31% at December 31, 2010). The performance of Money Market is directly affected by the performance of the Master Portfolio. The financial statements of Master Portfolio are included elsewhere in this report and should be read in conjunction with Money Market’s financial statements. The investment objective of Money Market is to seek to maximize current income while providing liquidity, preservation of capital, and a stable $1.00 per share price.

The Funds offer Class A shares, Class B shares and Class C shares. Money Market also offers Class Z shares. Class A shares provide for a front-end sales charge for Worldwide Income only, and Class B shares and Class C shares provide for a contingent deferred sales charge. Each class of shares has exclusive voting rights with respect to matters that affect just that class. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains and losses on investments are allocated to each class of shares based on its relative net assets. Class B shares automatically convert to Class A shares at the end of the month following the eighth anniversary of issuance. Class Z shares are only available for purchase by other series of the Trust. Effective November 30, 2010, the Funds will not accept new or additional investments in Class B shares of the Funds with the limited exception that current Class B shareholders may continue to have their dividends automatically reinvested in Class B shares of their Fund. As described in the prospectus, Class B shares of the Fund may continue to be exchanged with Class B shares of other Henderson Global Funds.

Note 2. Significant Accounting Policies

Security Valuation

Money Market records its investments in Master Portfolio at NAV which approximates fair market value. The valuation policies of Master Portfolio are discussed in Note 2 of Master Portfolio’s Notes to Financial Statements, which are included elsewhere within this report.

Securities and derivatives traded on a recognized exchange or market are generally valued at the last reported sale price or at the official closing price. Listed securities for which no sale was reported on that date and other securities traded in the over-the-counter market are valued at the mean between the last bid and asked price.

Debt securities are valued at the last sales price or market value by independent pricing services approved by the Trustees of the Trust. If the pricing services are unable to provide valuations, the securities are valued at the mean between the last bid and asked price or if no ask is available, then the last bid price obtained from one or more broker dealers. Such pricing services may use various pricing techniques, which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes.

Short-term investments purchased with an original or remaining maturity of 60 days or less are valued at amortized cost, which approximates market value.

Investments in Registered Investment Companies are valued at NAV which approximates fair market value.

Forward foreign currency contracts are valued daily at the applicable forward rate.

If market quotations are not readily available, or if the investment adviser determines that a quotation of a security does not represent a fair value, then the security is valued at a fair value as determined in good faith using procedures approved by the Trustees of the Trust. The Trustees of the Trust, or its designee, may also establish fair value using a wide variety of market data including yields or prices of investments of comparable quality, type of issue, coupon, maturity and rating, market quotes or indications of value from security dealers, evaluations of anticipated cash flows or collateral, general market conditions and other information and

18

| | |

Henderson Global Funds | Notes to Financial Statements |

analysis, including the obligor’s credit characteristics considered relevant.

The Trust has retained an independent statistical fair value pricing service to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for possible changes in value that may occur between the close of the foreign exchange and the time at which Fund shares are priced. If a security is valued at a “fair value”, that value may be different from the last quoted market price for the security. As a result, it is possible that fair value prices will be used by the Funds.

Various inputs are used in determining the value of the Funds’ investments. The Funds established a three-tier hierarchy of inputs to establish classification of fair value measurements for disclosure purposes. These inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available under the circumstances. The inputs used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| · | Level 1 – quoted prices in active markets for identical investments |

| · | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

On January 21, 2010, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update (“ASU”), Fair Value Measurements and Disclosures – Accounting Standards Codification 820 (“ASC 820”): Improving Disclosures about Fair Value Measurements which provides guidance on how investment assets and liabilities are to be valued and disclosed. Specifically, the amendment requires reporting entities to disclose: i) the input and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements, for Level 2 or Level 3 positions: ii) transfers between all levels (including Level 1 and Level 2) will be required to be disclosed on a gross basis (i.e. transfers out must be disclosed separately from transfers in) as well as the reason(s) for the transfer and iii) purchases, sales, issuances and settlements must be shown on a gross basis in the Level 3 rollforward rather than as one net number. The effective date of the amendment is for interim and annual periods beginning after December 15, 2009, however, the requirement to provide the Level 3 activity for purchases, sales, issuances and settlements on a gross basis will be effective for interim and annual periods beginning after December 15, 2010. Fund management has implemented part (i) and (ii) and is evaluating the implications of part (iii) of ASC 820 and the impact to the financial statements.

The following is a summary of the inputs used as of December 31, 2010 in valuing the Funds’ investments carried at value:

| | | | | | | | | | | | | |

Money Market | | | | | | | | | | | | |

| | | Quoted Prices | | | Significant | | | | | | | |

| | | in Active | | | Other | | | Significant | | | | |

| | | Markets for | | | Observable | | | Unobservable | | | | |

| | | Identical Assets | | | Inputs | | | Inputs | | | | |

Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

Mutual Funds | | $ | — | | | $ | 81,578,281 | | | $ | — | | | $ | 81,578,281 | |

Total | | $ | — | | | $ | 81,578,281 | | | $ | — | | | $ | 81,578,281 | |

19

| | | | | | | | | | | | | |

Henderson Global Funds | | | | | | | | Notes to Financial Statements | |

| | | | | | | | | | |

Worldwide Income | | | | | | | | | | | | |

| | | Quoted Prices | | | Significant | | | | | | | |

| | | in Active | | | Other | | | Significant | | | | |

| | | Markets for | | | Observable | | | Unobservable | | | | |

| Identical Assets | | | Inputs | | | Inputs | | | | |

Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

Assets | | | | | | | | | | | | |

Corporate Bonds | | | | | | | | | | | | |

Canada | | $ | — | | | $ | 1,416,478 | | | $ | — | | | $ | 1,416,478 | |

Denmark | | | — | | | | 1,876,165 | | | | — | | | | 1,876,165 | |

France | | | — | | | | 3,751,272 | | | | — | | | | 3,751,272 | |

Germany | | | — | | | | 2,398,484 | | | | — | | | | 2,398,484 | |

Ireland | | | — | | | | 997,214 | | | | — | | | | 997,214 | |

Italy | | | — | | | | 1,175,610 | | | | — | | | | 1,175,610 | |

Luxembourg | | | — | | | | 2,175,226 | | | | — | | | | 2,175,226 | |

Netherlands | | | — | | | | 6,495,113 | | | | 1,850,000 | | | | 8,345,113 | |

Switzerland | | | — | | | | 1,440,409 | | | | — | | | | 1,440,409 | |

United Kingdom | | | — | | | | 17,671,199 | | | | — | | | | 17,671,199 | |

United States | | | — | | | | 9,722,282 | | | | — | | | | 9,722,282 | |

Total Corporate Bonds | | | — | | | | 49,119,452 | | | | 1,850,000 | | | | 50,969,452 | |

U.S. Government Agency Obligation | | | | | | | | | | | | | | | | |

United States | | | — | | | | 4,195,241 | | | | — | | | | 4,195,241 | |

Total U.S. Government Agency Obligation | | | — | | | | 4,195,241 | | | | — | | | | 4,195,241 | |

Common Stocks | | | | | | | | | | | | | | | | |

United Kingdom | | | 2,640,502 | | | | — | | | | — | | | | 2,640,502 | |

Total Common Stock | | | 2,640,502 | | | | — | | | | — | | | | 2,640,502 | |

Preferred Stock | | | | | | | | | | | | | | | | |

United States | | | 478,485 | | | | — | | | | — | | | | 478,485 | |

Total Preferred Stock | | | 478,485 | | | | — | | | | — | | | | 478,485 | |

Short Term Investment | | | 4,862,580 | | | | — | | | | — | | | | 4,862,580 | |

Total Investments | | | 7,981,567 | | | | 53,314,693 | | | | 1,850,000 | | | | 63,146,260 | |

Financial Derivative Instruments | | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | | — | | | | 159,676 | | | | — | | | | 159,676 | |

Interest Rate Futures Contracts | | | 64,313 | | | | — | | | | — | | | | 64,313 | |

Liabilities | | | | | | | | | | | | | | | | |

Financial Derivative Instruments | | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | | — | | | | (218,508 | ) | | | — | | | | (218,508 | ) |

Total Financial Derivative Instruments | | $ | 64,313 | | | $ | (58,832 | ) | | $ | — | | | $ | 5,481 | |

During the year ended December 31, 2010, there were no transfers in or out of security levels as a result of the fair value pricing procedures utilized by the Fund.

20

| | |

Henderson Global Funds | Notes to Financial Statements |

Following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | Balance | |

| | | | | | | | | | | | Change in | | | | | | | | | Gross | | | Gross | | | | |

| | | Balance as of | | | Accrued | | | | | | Unrealized | | | | | | | | | transfers | | | transfers | | | December | |

Investments in | | January 1, | | | Discounts/ | | | Realized | | | Appreciation | | | Gross | | | Gross | | | in to | | | out of | | | 31, | |

Securities | | 2010 | | | Premiums | | | Gain/(Loss) | | | (Depreciation) | | | Purchases | | | Sales | | | Level 3 | | | Level 3 | | | 2010 | |

Corporate Bonds | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Netherlands Arran | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Corporate Loans B.V., Class E3 | | $ | 1,330,000 | | | $ | 2,960 | | | $ | 0 | | | $ | 517,040 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 1,850,000 | |

United States | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lehman Brothers UK Capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Funding IV LP | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

Total | | $ | 1,330,000 | | | $ | 2,960 | | | $ | 0 | | | $ | 517,040 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 1,850,000 | |

The total change in unrealized appreciation depreciation included in the Statement of Operations attributable to level 3 investments still held at December 31, 2010 was $517,040.

Security Transactions and Investment Income

Investment transactions are accounted for on trade date basis. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date. Bond premium is amortized and discount is accreted over the expected life of each applicable security. Corporate actions involving foreign securities, including dividends, are recorded as soon as the information becomes available. Withholding taxes on foreign dividends are accrued in accordance with the applicable country’s tax rules and rates. Securities gains and losses are determined on the specific identified cost basis, which is the same basis used for federal income tax purposes.

In addition to the types of income noted above, Money Market also has a pro-rata share in the net investment income and gains or losses of the Master Portfolio. Net investment income for Money Market consists of the Money Market’s pro-rata share of the investment income of the Master Portfolio less all expenses of the Money Market. Realized gains and losses from security transactions consist of the Money Market’s pro-rata share of the realized gains and losses of the Master Portfolio.

Futures Contracts

Worldwide Income is subject to interest rate risk and foreign currency risk in the normal course of pursuing investment objectives. The Fund may invest in futures contracts to gain exposure to, or hedge against changes in the value of interest rates or foreign currencies. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price and date. Upon entering into such contracts, the Fund is required to deposit with the broker either in cash or securities an initial margin in an amount equal to a certain percentage of the contract amount. Subsequent payments, known as "variation margin," are made or received by the Fund, depending on the fluctuations in the fair value of the position. The Fund recognizes a gain or loss equal to the variation margin. Should market conditions move unexpectedly, the Fund may not achieve the anticipated benefits of the futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates, and the underlying hedged assets. With futures, there is minimal counterparty credit risk to the Fund since futures are exchange traded and the exchange’s clearing house, as counterparty to all exchange traded futures, guarantees the futures against default.

The Worldwide Income held the following open interest rate futures contracts at December 31, 2010:

| | | | | |

| | Number | | Aggregate | |

| | of | Expiration | Notional | Unrealized |

| | contracts | Date | Value | appreciation |

5 Year | | | | |

U.S. | | | | |

Treasury | | | | |

Note | | | | |

(Short) | 28 | 3/31/11 | $3,296,125 | $64,313 |

During the year ended December 31, 2010 the Fund’s average notional value related to Interest Rate Futures Contracts was $4 million or 6.6% of net assets.

Options

Worldwide Income may purchase options on futures indexes to create investment exposure consistent with its investment objective or to hedge or limit exposure of its positions. Options are valued daily and unrealized appreciation or depreciation is recorded. The Fund will realize a gain or loss upon the expiration or closing of the option transaction. Options are subject to substantial risks. The primary risks include the risk

21

| | |

Henderson Global Funds | Notes to Financial Statements |

of imperfect correlation between the option price and the value of the underlying futures indexes, the possibility of an illiquid market for the option or the inability of counterparties to perform.

Forward Foreign Currency Contracts

Worldwide Income may enter into forward foreign currency contracts primarily to hedge against foreign currency exchange rate risks on their non-U.S. dollar denominated investment securities. When entering into forward foreign currency contracts, the Fund agrees to receive or deliver a fixed quantity of foreign currency for an agreed-upon price on an agreed future date. Realized gains or losses on forward foreign currency contracts include net gains or losses on contracts that have matured or which the Fund has terminated by entering into offsetting closing transactions. Forward foreign currency contracts are valued daily and the unrealized appreciation or depreciation is included in the Statements of Assets and Liabilities. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statements of Operations. These risks arise from the possible inability of counterparties to meet the terms of their contracts and from unfavorable currency fluctuations.

Worldwide Income held the following open forward foreign currency contracts at December 31, 2010:

| | | | |

| | | | Unrealized |

| | Value | Local | Current | appreciation/ |

| | date | amount | value | (depreciation) |

British | | | |

Pound | | | |

| Short | 1/21/11 | 10,585,078 | $16,501,237 | $ 159,676 |

Euro | | | |

| Short | 1/21/11 | 18,116,116 | 24,207,869 | (218,508) |

During the year ended December 31, 2010 the Fund’s average notional value related to forward foreign currency contracts was 19 million or 29.3% of net assets.

Derivative Instruments

The following table summarizes the Worldwide Income fair value of derivative instruments held at December 31, 2010 and the related location on the accompanying Statement of Assets and Liabilities, presented by primary underlying risk exposure:

| | | |

| | Location on Statement of | |

| | Assets and Liabilities | Fair Value |

Assets | | |

Foreign currency | Payable for open | |

contracts | forward foreign | |

| | currency contracts | $159,676 |

| | | |

Interest rate | Unrealized appreciation | |

futures | on open | |

| | futures contracts | $64,313 |

Liabilities | | |

Foreign currency | Payable for open | |

contracts | forward foreign | |

| | currency contracts | $218,508 |

Additionally, the amount of gains and losses on derivative instruments recognized in Worldwide Income’s earnings during the year and the related location on the accompanying Statement of Operations is summarized in the following table by primary risk exposure:

| | | |

| | Location on Statement | |

| | of Operations | |

| | | Realized |

| | | Gain (Loss) |

Interest rate | Realized gain (loss) | |

futures | from futures | |

| | contracts | $ (676,350) |

| | | |

Foreign currency | Realized gain (loss) | |

contracts | from foreign currency | |

| | transactions | 2,862,859 |

| | | |

Options on | Realized gain (loss) | |

interest rate | from options | |

futures | | (96,753) |

| | | |

| | Change in unrealized |

| | | Gain (Loss) |

Interest rate | Unrealized gain (loss) | |

futures | from futures | |

| | contracts | $ 37,352 |

| | | |

Foreign currency | Unrealized gain (loss) | |

contracts | from foreign currency | |

| | transactions | (645,886) |

Foreign Currency Translation

Worldwide Income’s investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

Worldwide Income does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from

22

| | |

Henderson Global Funds | Notes to Financial Statements |

changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments on the Statement of Operations.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

Indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnifications to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet been asserted.

Use of Estimates

The preparation of financial statements, in conformity with United States generally accepted accounting principles (“GAAP”), requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results may differ from those estimates.

Expenses

Expenses are recorded on an accrual basis. Expenses of the Trust that are directly attributable to a specific Fund are charged to that Fund. Other expenses are allocated proportionately among each Fund within the Trust based on average daily net assets or on another reasonable basis. Money Market indirectly bears a pro-rata share of the fees and expenses of the underlying portfolio in which the Fund invests.

Federal Income Taxes

The Trust’s policy is that each Fund continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, that are applicable to regulated investment companies and to distribute substantially all its taxable income to shareholders. Therefore, no federal income tax provision is required. Management has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Management of the Funds is also not aware of any tax positions for which it is reasonably possible that the total amount of unrecognized tax benefits will significantly change in the next twelve months. The Funds intend to file tax returns with the U.S. Internal Revenue Service and various states. Generally, the tax authorities can examine all tax returns filed for the last three years.

Worldwide Income intends to utilize provisions of the federal income tax laws which allows it to carry a realized capital loss forward for eight years following the year of loss and offset such losses against any future realized capital gains. At December 31, 2010 Worldwide Income had the following capital loss carryforwards:

| | | | |

Expiring | Expiring | Expiring | Expiring |

on | on | on | on |

July 31, | July 31, | July 31, | July 31, |

2014 | 2015 | 2016 | 2017 |

Worldwide | | | |

| Income | $341,836 | $207,447 | $477,632 | $1,001,344 |

| | | Expiring | Expiring |

| | | on | on |

| | | December 31, | December 31, |

| | | 2017 | 2018 |

Worldwide Income | $34,174,962 | $336,160 |

At December 31, 2010, Worldwide Income deferred post-October losses which will be recognized on the first day of the following year:

| | |

| | Currency |

| | loss |

| | deferred |

Worldwide income | $497,346 |

Distributions to Shareholders