UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

____________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

____________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: July 31, 2012

Item 1: Report to Shareholders.

Annual Report

July 31, 2012

All Asset Fund

Emerging Markets Opportunities Fund

European Focus Fund

Global Equity Income Fund

Global Leaders Fund

Global Technology Fund

International Opportunities Fund

Japan Focus Fund

Table of contents

| Letter to shareholders | 1 |

| All Asset Fund | |

| Commentary | 2 |

| Performance summary | 3 |

| Emerging Markets Opportunities Fund | |

| Commentary | 4 |

| Performance summary | 5 |

| European Focus Fund | |

| Commentary | 6 |

| Performance summary | 7 |

| Global Equity Income Fund | |

| Commentary | 8 |

| Performance summary | 9 |

| Global Leaders Fund | |

| Commentary | 10 |

| Performance summary | 11 |

| Global Technology Fund | |

| Commentary | 12 |

| Performance summary | 13 |

| International Opportunities Fund | |

| Commentary | 14 |

| Performance summary | 15 |

| Japan Focus Fund | |

| Commentary | 16 |

| Performance summary | 17 |

| Portfolios of investments | 18 |

| Statements of assets and liabilities | 38 |

| Statements of operations | 42 |

| Statements of changes in net assets | 44 |

| Statements of changes - capital stock activity | 52 |

| Financial highlights | 60 |

| Notes to financial statements | 72 |

| Report of independent registered public accounting firm | 91 |

| Other information. | 92 |

| Trustees and officers | 98 |

International investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies, which typically involves greater risk than investing in larger companies. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition some of the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses.

The All Asset Fund invests in a smaller number of securities than the average mutual fund and the change in value of a single holding may have a more pronounced effect on the Fund’s net asset value and performance. The Fund may invest in derivatives and commodities. Investing in commodities entails additional risks including instability regarding control and jurisdiction of governments, international companies and other entities. Asset allocation strategies do not assure profit nor protect against loss. The Fund may be subject to frequent trading which may result in a turnover rate of 100% or more. The Fund is subject to investment company and pooled vehicles risk, allocation risk, leverage risk, interest rate risk and high yield securities risk. An investment in pooled vehicles, including closed-end funds, trusts, and ETFs, may involve paying a premium at the time of purchase or receiving a discounted price at the time of sale. The Fund (and indirectly its shareholders) is responsible for a proportional share of the underlying investment company’s expenses, in addition to its own. Investments in high yield securities may offer more attractive returns than higher-rated securities, but the potentially higher yield is a function of the greater risk that a particular security may default.

Technology companies may react similarly to certain market pressure and events. This may be significantly affected by short product cycles, aggressive pricing of products and services, competition from new market entrants, and obsolescence of existing technology. As a result, the Global Technology Fund’s returns may be considerably more volatile than a fund that does not invest in technology companies.

The views in this report were those of the Funds’ Portfolio Managers as of July 31, 2012, and may not reflect the views of the portfolio managers on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice.

| Henderson Global Funds | Letter to shareholders |

Dear shareholder,

We are pleased to provide the annual report for the Henderson Emerging Markets Opportunities, European Focus, Global Equity Income, Global Leaders, Global Technology, International Opportunities and Japan Focus Funds, which covers the year ended July 31, 2012, and the annual report for the Henderson All Asset Fund, which covers the fiscal period ended July 31, 2012.

Global markets finished the first half of the year in positive territory as measured by the MSCI World Index, but the outlook for the global economy remains uncertain as risks persist.

Within Europe, Spain’s banking sector worries, the elections in Greece and the Eurozone summit kept markets on edge. The €100bn Spanish bank bailout and election victory by pro-austerity parties eased fears of a Greek Eurozone exit and restored some of the confidence eroded in the last couple of months. June ended with an unexpectedly successful European Summit as leaders agreed to stabilize the region’s debt markets and recapitalize its banks, easing the funding strains on Spain and Italy. A key outcome from the summit was a new roadmap for European banking supervision via the European Central Bank, which is the first step towards a full banking union.

As the Eurozone crisis continues and economic data continues to point to a softening outlook, the pressure for further quantitative easing (“QE”) appears to be building. June revealed that Eurozone manufacturing output fell at the fastest pace in the last three years and US job growth slowed along with poor retail sales. The weaker economic data failed to prompt the US Federal Reserve into a third round of QE; instead Federal Reserve chairman Ben Bernanke and the Federal Open Markets Committee agreed to extend Operation Twist (a strategy to reduce long-term interest rates) to boost confidence amid falling consumer demand and a drop in output growth in recent months.

Emerging markets lagged other regions as fears of a hard landing resurfaced. Continuing softness in Chinese economic data drove commodities into bear market territory as Brent crude oil sank below the $90 a barrel level for the first time in 18 months. The Chinese central bank subsequently cut its benchmark interest rate by 0.25% in June in a bid to boost growth in the near term.

Looking forward, the expectation of further stimulus by global central banks is likely to provide short-term support for markets, which are currently pricing in exceptionally low interest rates for an extended period of time across developed regions. However, recent economic data continues to point towards a slowdown in global growth, which may provide a headwind later this year.

At Henderson we remain focused on seeking attractive global investment opportunities which may be created by these uncertain markets. It is our goal to continue to create differentiated portfolios for our shareholders, and we appreciate your trust in and support of our Funds.

James G. O’Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.hendersonglobalinvestors.com. The Prospectus should be read carefully before investing.

| Henderson Global Funds | Commentary |

Henderson All Asset Fund

Global equity markets have been volatile with investors largely focused on Europe’s sovereign debt crisis and slowing growth in China. This story has not changed materially in a year; however, at the end of July most regional equity markets rebounded (Japan excepted) as Mario Draghi, President of the European Central Bank (ECB), promised that he would do “whatever it takes” to preserve the euro. His comments came in a speech that appeared to define some of the rise in Italian and Spanish government bond yields as reflecting the risk of Eurozone breakup. His pledge has been interpreted as a step up in the government bond buying program and was enough to stall the pace of rising peripheral bond yields.

| All Asset Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| iShares iBoxx Investment Grade Corporate Bond Fund | 6.3 | % |

| iShares MSCI Pacific ex-Japan Index Fund | 4.8 | |

| BlueCrest AllBlue Fund, Ltd. | 3.3 | |

| BH Global, Ltd. | 3.2 | |

| Sprott Physical Gold Trust | 3.0 | |

| Calamos Market Neutral Income Fund | 2.9 | |

| Gateway Fund | 2.9 | |

| iShares JP Morgan USD Emerging Markets Bond Fund | 2.8 | |

| Vanguard Dividend Appreciation ETF | 2.8 | |

| Legg Mason BW Global Opportunities Bond Fund | 2.8 | |

The Fund was successfully launched on March 30, 2012. For the four month period to July 31, 2012, the Fund returned -0.70% (Class A at NAV) versus the benchmark, 3-month LIBOR USD, which posted a return of 0.16%. For a majority of the period, negative developments of the European debt crisis and worries over weaker economic data were the key drivers of performance. Within this environment, the Fund’s allocation to fixed income was beneficial to performance. Commodities entered bear market territory as there was a continuing softness in Chinese economic data; Brent crude oil sank below the $90 a barrel level for the first time in 18 months. Consequently, the Fund’s holding in SPDR S&P Oil and Gas Exploration & Production ETF contributed negatively to performance. Additionally, as equity markets performed poorly, the Fund’s equity holdings were detrimental to performance.

The Fund made investments in the SPDR S&P 500 ETF and the Vanguard Dividend Appreciation ETF gaining exposure to US Equities. Within Japanese equities, the Fund initiated a position in the Henderson Japan Focus Fund and in Asia gained exposure through the iShares MSCI Pacific ex-Japan Index Fund.

The Fund invested in government bonds including US treasuries, German bunds and the iShares Barclays TIPS Bond Fund. The Fund also initiated positions in the iShares iBoxx Investment Grade Corporate Bond Fund, Henderson Strategic Income Fund and the iShares iBoxx High Yield Corporate Bond Fund. In the absolute return funds space, the Fund invested in the Franklin Templeton Hard Currency Fund, BlueCrest All Blue, BH Global, ASG Global Alternatives Fund and the Gateway Fund. Within commodities, the Fund initiated positions in oil and physical gold.

In the current environment there are strong headwinds to global economic growth from Europe, China and the US. Weaker than expected economic data seen from China and the US are not helpful in contributing to the growth outlook. The Eurozone crisis remains unresolved and surveys reveal that the region’s economy remains sluggish. If the ECB can deliver a policy that lowers the risk of a Eurozone breakup, this may restore some confidence to investors and the recent rally in stock prices could continue for the near term.

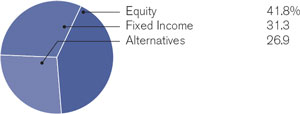

Given the uncertain economic environment ahead, the Fund’s asset allocation remains tilted towards fixed income (27.4%); equities (17.2%); cash (32.4%); absolute return funds (17.1%); private equity (3.0%); and commodities (2.9%).

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Henderson Global Funds | Performance summary |

Henderson All Asset Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | Since |

| | | | NASDAQ | | | inception |

| At NAV | | | symbol | | | (3/30/2012) |

| Class A | | | HGAAX | | | -0.70 | % |

| Class C | | | HGACX | | | -0.90 | |

| Class I | | | HGAIX | | | -0.60 | |

| With sales charge | | | | | | | |

| Class A | | | | | | -6.41 | % |

| Class C | | | | | | -1.90 | |

| Index | | | | | | | |

| 3-month LIBOR USD | | | | | | 0.16 | % |

| MSCI World Index | | | | | | -3.61 | |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 2.23%, 2.98% and 1.98%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.65%, 2.40% and 1.40% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-month LIBOR (London Interbank Offered Rate) USD is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Emerging Markets Opportunities Fund

The reporting year has been dominated by events surrounding the Eurozone sovereign debt crisis leading to high levels of price volatility. Markets began 2012 on a positive note as fears about the European Union subsided somewhat and subsequently experienced an abrupt reversal in risk appetite. This was followed by yet another period of investor aversion to risk assets as investors feared that policymakers in Europe would continue to “speak” of solutions rather than “act.” Also, Asian data disappointed and Chinese growth continued to slow.

| Emerging Markets Opportunities Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| Samsung Electronics Co., Ltd. | 3.3 | % |

| PetroChina Co., Ltd., Class H | 2.9 | |

| GT Capital Holdings, Inc. | 2.7 | |

| SK Innovation Co., Ltd. | 2.7 | |

| Baidu, Inc., ADR | 2.5 | |

| Prada SpA | 2.4 | |

| Robinson Department Store pcl | 2.4 | |

| Hyundai Glovis Co., Ltd. | 2.3 | |

| Fomento Economico Mexicano, S.A.B. de C.V., ADR | 2.3 | |

| Petroleo Brasileiro S.A., ADR | 2.3 | |

Towards the end of the period, emerging markets equities moved higher, supported by positive news of policy support in Asia where policymakers took a more aggressive stance, and in Latin America where the Brazilian central bank cut rates again and talked of additional fiscal stimulus measures. The European Central Bank also made further moves to address the European sovereign debt crisis. This was viewed positively by the market and once again helped risk assets move forward.

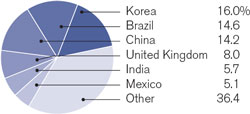

For the year ended July 31, 2012, the Fund returned -16.70% (Class A at NAV) versus the benchmark MSCI Emerging Markets Index, which posted a return of -13.64%. For most of the period, investors avoided anything deemed to be a “risky asset” and a number of the Fund’s higher beta¹ names were punished, in particular, the pro-cyclical names of the Europe, Middle East and Africa (EMEA) sub-portfolio. Conversely, when markets had moments of “risk-on” appetite, EMEA powered performance forward, especially in African Petroleum and Gulf Keystone Petroleum. In the Latin America sub-portfolio, performance was boosted by the positions in the Mexican stocks, FEMSA and Bank Grupo Financiero Banorte. Both companies reported strong results and were beneficiaries of the continued outperformance of the Mexican market versus other regional markets. The main positive contributors in Asia were Prada, the Hong Kong-listed luxury goods retailer, and Robinson Department Store in Thailand which performed well on a recovery in sales following last year’s devastating floods and new store openings outside Bangkok.

Over the period, the Fund maintained its allocation of an overweight to EMEA, underweight to Latin America and even-weight to Asia. At the end of the period, the Fund increased its cash position to 10% to mitigate against further market falls and to provide the Portfolio Managers with the capital to move quickly should opportunities present themselves. In Asia, the Fund has continued to have a strong bias to shares focused on the growth and strength of the Asian domestic consumer. In Latin America the Fund increased its weighting in Mexico to an overweight as both a defensive measure relative to the large index weighting in Brazil and as a reflection of the growing Mexican industrial renaissance. In the EMEA sub-portfolio, we made no changes to the overall theme and remain overweight commodity-related equities.

We expect markets to remain volatile over the next few months. The main positive is valuation; many shares in the emerging markets are trading on historic price-to-book value multiples close to the lows experienced during the global financial crisis in 2008. Going forward we believe the market will see both an improvement in China and some marked progress within Europe. Both would improve investor risk appetite and thus improve the outlook for emerging markets equities.

¹Beta measures a fund’s risk relative to its benchmark, and also indicates an individual stock’s risk and volatility relative to the market as a whole. A beta of 1.00 indicates that the fund is as volatile as its benchmark.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Henderson Global Funds | Performance summary |

Emerging Markets Opportunities Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | Since |

| | | | NASDAQ | | | One | | inception |

| At NAV | | | symbol | | | year | | (12/31/10)* |

| Class A | | | HEMAX | | | -16.70 | % | | -12.36 | % |

| Class C | | | HEMCX | | | -17.31 | | | -12.99 | |

| Class I | | | HEMIX | | | -16.38 | | | -12.09 | |

| With sales charge | | | | | | | | | | |

| Class A | | | | | | -21.45 | % | | -15.57 | % |

| Class C | | | | | | -17.31 | | | -12.99 | |

| Index | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -13.64 | % | | -8.47 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 3.98%, 4.73% and 3.73%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.79%, 2.54% and 1.54% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

European Focus Fund

European equity markets were volatile during the reporting period. In addition to concerns over the sustainability of sovereign debt in the Eurozone, the region was also affected by worries of slowing global economic growth, particularly in China. During the latter part of 2011, contagion worries were rife as issues centered on measures to try and deal with the Eurozone crisis, including haircuts to Greek bonds, recapitalization of the banks and a plan to leverage the European Financial Stability Facility. The new year began with one of the strongest starts since 1998 as risk assets were buoyed by the increased liquidity from the European Central Bank (ECB) and positive earnings and banking stress test results in the US. However, the second quarter of 2012 proved to be challenging for European markets as woes continued to center on the need for political action to resolve sovereign debt problems, softening macroeconomic data from China and the US, as well as falling commodities prices. July saw a slight improvement in investor sentiment and with it a broad-based rally in risk assets after signs of a global easing in monetary policy and growing expectations for further action from the ECB. Commodity and oil prices rose and European markets outperformed other global markets.

| European Focus Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| BP plc | 5.8 | % |

| African Petroleum Corp., Ltd. | 4.7 | |

| African Minerals, Ltd. | 3.6 | |

| Continental AG | 2.9 | |

| Sky Deutschland AG | 2.9 | |

| Providence Resources plc | 2.8 | |

| Svenska Cellulosa AB, B Shares | 2.8 | |

| Zhaikmunai LP, GDR | 2.8 | |

| Renault S.A. | 2.7 | |

| Smith & Nephew plc | 2.5 | |

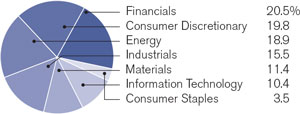

For the year ended July 31, 2012, the Fund returned -18.35% (Class A at NAV) versus the benchmark MSCI Europe Index, which posted a return of -11.97%. Although underweight, exposure to financials was the most detrimental to performance and industrial and materials companies struggled in the “risk-off” environment and outweighed positive returns from consumer staples and healthcare.

However, recent performance has been relatively strong and possibly indicates that the sell-off in cyclically exposed shares had become too extreme and that selected, good quality companies had reached attractive levels compared to more defensive areas of the market. On a stock level, resource related names suffered the most, including African Minerals, Northland Resources, Exillon Energy and Borders & Southern. On a positive note, Providence Resources is currently appraising its Ballyroe oil field in the Celtic Sea and recently upgraded its ‘oil in place’ estimate at the field, and African Petroleum benefited from its successful offshore-Liberia drilling campaign.

The Fund initiated a number of positions in stocks believed to be oversold and offering attractive entry points; for instance, Russian oil producer RusPetro at its London initial public offering, GKN, the automotive components and aerospace equipment producer, and G4S, after the shares fell due to the company struggling to meet their staffing commitments for the London Olympics contract. Key sales included European Goldfields and Kalahari Minerals; both of which had performed well for the Fund and were in the process of being acquired.

Materials and energy-related stocks are two cyclical areas of the market that have remained sluggish even as the broader market has made some ground. We are hopeful that over the coming months we will see both an improvement in sentiment towards China and some progress within Europe; both of which could help the Fund’s performance. We see significant value in the Fund’s current holdings and are optimistic of realizing this value over time.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

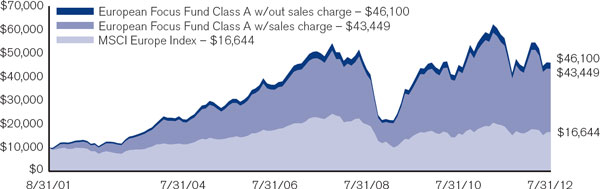

| Henderson Global Funds | Performance summary |

European Focus Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFEAX | | | -18.35 | % | | 7.32 | % | | -1.64 | % | | 14.79 | % | | 15.03 | % |

| Class B | | | HFEBX | | | -19.01 | | | 6.49 | | | -2.39 | | | 14.11 | | | 14.41 | |

| Class C | | | HFECX | | | -18.98 | | | 6.49 | | | -2.39 | | | 13.94 | | | 14.18 | |

| Class I** | | | HFEIX | | | -18.08 | | | 7.61 | | | -1.46 | | | 14.89 | | | 15.12 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -23.04 | % | | 5.22 | % | | -2.80 | % | | 14.11 | % | | 14.40 | % |

| Class B | | | | | | -23.01 | | | 5.60 | | | -2.61 | | | 14.11 | | | 14.41 | |

| Class C | | | | | | -18.98 | | | 6.49 | | | -2.39 | | | 13.94 | | | 14.18 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | -11.97 | % | | 3.84 | % | | -5.75 | % | | 7.04 | % | | 4.77 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.54%, 2.29%, 2.29% and 1.29% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Equity Income Fund

Global equity markets finished down during the period amidst continued macroeconomic uncertainty. While at the company level earnings and dividend growth remained strong, mixed economic data and ongoing fears surrounding the sovereign debt crisis in the Eurozone led to volatility in the equity markets.

For the year ended July 31, 2012, the Fund returned 1.59% (Class A at NAV) versus the benchmark MSCI World Index, which posted a return of -1.40%. The Fund also continued to meet its income objectives over the period. Strong relative performance was largely driven by positive stock selection in shares with a defensive bias and lower beta1, which fared well during periods of high volatility and declining markets. At the stock level, among the top performers during the period was Pfizer, the global pharmaceutical company, which announced an increase to its quarterly dividend and a new share repurchase program that was met with a positive reaction by the market. Verizon Communications was also an outperformer, benefitting from rising margins in the wireless division as customers used more data on their smartphones, driving up average revenue per customer. Among the emerging market positions, CCR, the Brazilian toll road operator, also performed well on strong traffic growth.

| Global Equity Income Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| Vodafone Group plc | 3.5 | % |

| Pfizer, Inc. | 3.3 | |

| Merck & Co., Inc. | 3.2 | |

| Centrica plc | 2.9 | |

| Royal Dutch Shell plc, Class B | 2.7 | |

| ENI SpA | 2.7 | |

| Telstra Corp., Ltd. | 2.5 | |

| British American Tobacco plc | 2.4 | |

| United Utilities Group plc | 2.2 | |

| BAE Systems plc | 2.1 | |

The Fund’s geographic exposure varied throughout the period in accordance with the investment process and regional rotation strategy. For example, the weighting within the Eurozone was reduced, in particular among the peripheral Eurozone countries which are more vulnerable to debt crises. During the period we took advantage of market volatility to reduce positions in holdings that had performed well and/or paid their annual dividend in order to invest in new positions where we see the potential for better opportunities from income and capital growth over the medium-term.

The Fund initiated a new position in SJM Holdings, the Macau casino operator, following strong gaming growth in the region, which could lead to earnings upgrades and strong cash generation. A new position was also added in Cinemark, the US and Latin American cinema operator, which we believe can benefit from structural growth in the Latin American region.

While there are currently a number of uncertainties surrounding the future of the Eurozone and a potential slowdown in global economic growth, we believe that at current valuation levels, there are strong opportunities for capital and dividend growth within the equity markets over the long-term. We see particularly attractive opportunities in equities with an above-average level of yield relative to, for example, government bond yields, which are at or near historic lows.

¹Beta measures a fund’s risk relative to its benchmark, and also indicates an individual stock’s risk and volatility relative to the market as a whole. A beta of 1.00 indicates that the fund is as volatile as its benchmark.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

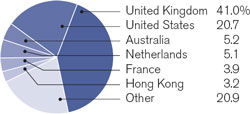

| Henderson Global Funds | Performance summary |

Global Equity Income Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | (11/30/06)* |

| Class A | | | HFQAX | | | 1.59 | % | | 7.03 | % | | -0.79 | % | | 1.09 | % |

| Class C | | | HFQCX | | | 0.82 | | | 6.27 | | | -1.53 | | | 0.34 | |

| Class I** | | | HFQIX | | | 1.87 | | | 7.30 | | | -0.60 | | | 1.27 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -4.20 | % | | 4.96 | % | | -1.96 | % | | 0.04 | % |

| Class C | | | | | | 0.82 | | | 6.27 | | | -1.53 | | | 0.34 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -1.40 | % | | 9.05 | % | | -1.71 | % | | 0.05 | % |

| MSCI World High Dividend Yield Index | | | | | | 3.94 | | | 11.37 | | | -1.38 | | | 0.43 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.32%, 2.07% and 1.07%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within select MSCI World Index. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Leaders Fund

The second half of 2011 was volatile for global equity markets. The declines and rallies were driven not by changes in company fundamentals but rather political indecision and rhetoric from central bankers and ratings agencies. The picture improved somewhat at the start of 2012 as risk assets found favor. Growth sensitive sectors such as consumer discretionary, materials, industrials and information technology delivered some of the strongest returns as demand proved robust and earnings resilient. Rather predictably however, the second quarter in 2012 witnessed a sharp reversal with the Eurozone at the epicenter of concern. Investors were becoming increasingly frustrated with politicians and the lack of a permanent solution to sovereign debt levels and stagnation in economic growth, which was combined with weakened news flow from the US and China. However, June proved a little stronger, extending into July.

| Global Leaders Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| Apple, Inc. | 4.5 | % |

| Occidental Petroleum Corp. | 4.3 | |

| Dollar General Corp. | 4.0 | |

| United Parcel Service, Inc., Class B | 3.9 | |

| Bayer AG | 3.7 | |

| Microsoft Corp. | 3.4 | |

| Unilever plc | 3.4 | |

| VF Corp. | 3.3 | |

| Pfizer, Inc. | 3.3 | |

| National Oilwell Varco, Inc. | 3.3 | |

For the year ended July 31, 2012, the Fund returned -2.37% (Class A at NAV) versus the benchmark MSCI World Index, which posted a return of -1.40%. By sector, stock selection in energy and consumer staples detracted the most from performance and outweighed positive returns from information technology and materials. By region, holdings in North America and Europe were positive but were held back by selections in Asia Pacific. On the downside, Tempur-Pedic was the worst performer after the luxury mattress maker cut its full-year profit and revenue forecasts amid lower-than-expected sales in North America. Makita, the Japanese tool manufacturer, and Bank of China also performed poorly. Positive performers included Apple, which soared through $600 per share for the first time on the back of strong demand for its next generation iPad and its intention to return $45 billion to shareholders. American Tower also performed well. The company generates business through renting antenna infrastructure to mobile phone operators and has benefitted from industry growth in various areas such as data provision.

Sales included the long-held position in Sands China after the company valuation had reached its target. The Fund added a position in Japanese multi-line insurer Tokyo Marine Holdings. The company has been well capitalized, has demonstrated strong risk management and could benefit from potential premium growth. German healthcare company Bayer was also added due to the promising pipeline of drugs in its pharmaceutical division and targeted growth in its crop science division to bring it in line with peers. The Fund also purchased Google, attractive as a pivotal market player and on the success of its ‘Android’ devices.

Investors have reacted positively to the prospect of a banking union in the Eurozone though political negotiations are still at an early stage. That said, we believe valuations are attractive in Europe and forward-looking investors may begin to put cash to work, even though we are likely to see further weakness in economic growth globally in the near-term. The drop in inflation levels, however, is a positive sign; in Asia it allows authorities to loosen monetary policy and in Western economies it allows central banks scope to consider further stimulus should economic growth stagnate or weaken further. We believe that focusing on corporate valuations and fundamentals will allow us to seek investments to deliver on shareholder goals.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

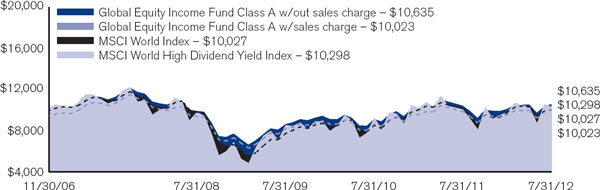

| Henderson Global Funds | Performance summary |

Global Leaders Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | (11/30/06)* |

| Class A | | | HFPAX | | | -2.37 | % | | 7.90 | % | | -2.53 | % | | 0.07 | % |

| Class C | | | HFPCX | | | -3.09 | | | 7.12 | | | -3.25 | | | -0.41 | |

| Class I** | | | HFPIX | | | -2.07 | | | 8.05 | | | -2.45 | | | 0.14 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -7.99 | % | | 5.80 | % | | -3.69 | % | | -0.97 | % |

| Class C | | | | | | -3.09 | | | 7.12 | | | -3.25 | | | -0.41 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -1.40 | % | | 9.05 | % | | -1.71 | % | | 0.05 | % |

* Average annual return

** Class I shares commenced operations on May 31, 2011. The performance for Class I shares for the period prior to May 31, 2011 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 2.09%, 2.84% and 1.84%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that the total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hender-songlobalinvestors. com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. Effective June 1, 2011, the Henderson Global Opportunities Fund changed its name, investment objective and policies and became the Henderson Global Leaders Fund. The Fund’s historical performance may not represent current investment policies. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Global Technology Fund

The reporting year has been characterized by continued market volatility as Eurozone debt issues continued to cause concern. Increasing capital ratios and toxic debt caused the financial sector to reduce lending and, coupled with low confidence, stalled global growth. The US started to show some promise towards the back end of 2011 after political spatting over the debt ceiling was resolved. Data in 2012 spurred the market into a rally that lasted a few months and the technology sector performed particularly well during this period. However, in the second quarter of 2012, retraction seemed inevitable as Europe’s woes failed to receive a permanent solution, dovetailing with soft releases from the US and China. In this environment, the technology sector underperformed the wider market as news flow emerged from many technology companies that growth rates were under pressure.

| Global Technology Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| Apple, Inc. | 8.0 | % |

| Samsung Electronics Co., Ltd. | 3.5 | |

| Google, Inc., Class A | 3.3 | |

| Cadence Design Systems, Inc. | 3.2 | |

| MasterCard, Inc., Class A | 3.2 | |

| Microsoft Corp. | 3.1 | |

| Cisco Systems, Inc. | 3.0 | |

| Cognizant Technology Solutions Corp. | 3.0 | |

| Nuance Communications, Inc. | 2.8 | |

| VeriFone Systems, Inc. | 1.8 | |

For the year ended July 31, 2012, the Fund returned -4.18% (Class A at NAV) versus the benchmark MSCI AC World IT Index, which posted a return of 5.91%. Apple’s substantial size in the index (approximately 15%) and strong stock performance hindered the Fund’s performance versus the index (Apple is the Fund’s largest position but given the Fund’s construction process, the position is structurally underweight relative to the index). At the sector level, the main drag to relative performance was weakness in internet software & services and internet & catalog retail. The biggest stock specific drags included Netflix, OpenTable and NetApp. The biggest positive contributors to relative performance were the communications equipment and office electronics sectors. At the stock level, Telecity, ASML and Priceline all contributed positively to performance. MasterCard also performed very well as it continued to gain market share over traditional payment methods of cash and checks.

The Fund added a number of positions including some in its core themes. Within e-commerce, the Fund bought eBay following a reacceleration in growth trends as a result of smartphone popularity. eBay also owns PayPal, an electronic payment company that falls into the paperless payment theme. This theme was bolstered with purchases of Verifone and Cielo. Within online advertising, LinkedIn was also amongst the new positions added. LinkedIn operates a social networking website used for professional networking. Elsewhere, the Fund bought Tibco Software, a leading provider of middleware and infrastructure software, and social networker Mail.ru Group, a Russian site that has leveraged its consumer base in free e-mail to generate additional revenue in gaming and recruitment.

Economic factors will continue to dominate going forward, although technology companies again showed in the latest reporting season that they remain resistant. The Fund will continue to be biased towards our favored long term secular growth themes of e-commerce, online advertising, data growth, connectivity and paperless payment. There will continue to be an overall bias towards companies with strong barriers to entry. We believe that these characteristics, combined with the gradual increase of technology’s share of spending within the overall economy, offer a strong risk/reward proposition for investors relative to the world equity market.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Henderson Global Funds | Performance summary |

Global Technology Fund

| Portfolio composition by country | | Portfolio composition by industry |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | years* | | (8/31/01)* |

| Class A | | | HFGAX | | | -4.18 | % | | 13.91 | % | | 4.00 | % | | 11.38 | % | | 7.32 | % |

| Class B | | | HFGBX | | | -4.97 | | | 13.03 | | | 3.21 | | | 10.77 | | | 6.78 | |

| Class C | | | HFGCX | | | -4.87 | | | 13.06 | | | 3.23 | | | 10.58 | | | 6.54 | |

| Class I** | | | HFGIX | | | -3.87 | | | 14.22 | | | 4.20 | | | 11.49 | | | 7.42 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -9.68 | % | | 11.70 | % | | 2.78 | % | | 10.72 | % | | 6.74 | % |

| Class B | | | | | | -8.97 | | | 12.24 | | | 3.04 | | | 10.77 | | | 6.78 | |

| Class C | | | | | | -4.87 | | | 13.06 | | | 3.23 | | | 10.58 | | | 6.54 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 5.91 | % | | 11.58 | % | | 1.76 | % | | 7.57 | % | | 3.66 | % |

| S&P 500 | | | | | | 9.13 | | | 14.11 | | | 1.13 | | | 6.33 | | | 3.82 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.55%, 2.30%, 2.30% and 1.30%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

International Opportunities Fund

The period was volatile for risk assets and dominated by worries over slowing global economic growth, particularly in China, and the sustainability of sovereign debt in the Eurozone. Concerns in the latter part of 2011 centered on contagion worries in the Eurozone and, after three months of gains in 2012, the second quarter proved more uncertain as global equities fell amid resumed sovereign debt issues, primarily with Greece. Softening macroeconomic releases from the US and China as well as falling commodities added to the bearish sentiment, although this did spur policymakers to become more accommodative by initiating easing policies where possible. After the Greeks elected a “pro-Euro” government, politics and macroeconomics dominated the overall market direction with investors wavering between whether or not policymakers would increase stimulus measures. Although markets trended upwards at the end of the period, significant volatility remained as weak economic data was released by the US and China. A mixed second quarter earnings reporting season added further uncertainty, although overall, earnings were generally ahead of downbeat expectations.

| International Opportunities Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

Samsung Electronics Co., Ltd. | 3.1 | % |

| Fresenius SE & Co., KGaA | 2.9 | |

| Capita Group plc | 2.8 | |

| ASML Holding N.V. | 2.8 | |

| Telefonaktiebolaget LM Ericsson, B Shares | 2.8 | |

| Deutsche Post AG | 2.7 | |

| Roche Holding AG | 2.7 | |

| Continental AG | 2.6 | |

| SAP AG | 2.6 | |

| Daiwa Securities Group, Inc. | 2.5 | |

For the year ended July 31, 2012, the Fund returned -11.17% (Class A at NAV) versus the benchmark MSCI EAFE Index, which posted a return of -10.99%. Three of the Fund’s sub-portfolios (which focus on certain regions or sectors) underperformed in a year dominated by volatility within global equity markets, but performance was bolstered by returns from the European growth and technology sub-portfolios. There was a wide dispersion in performance, with financials and the more cyclical stocks bearing the brunt of the falls, including AXA and Banco Santander (financials), Indian-focused energy company Essar Energy, the French Telecom equipment maker Alcatel Lucent and Japanese retailer Yamada Denki (cyclical stocks). On the positive side, more stable growth positions drove the performance of the European growth sub-portfolio, such as Essilor and Inditex, with Baidu and Samsung Electronics making gains for both the technology and Asia sub-portfolios.

Trading activity was spread between the sub-portfolios and included buying a stake in African Petroleum, an oil and gas exploration company focused on offshore West Africa. Deutsche Telekom was also purchased as the company is set to benefit from a change in the European Union telecommunications regulatory environment. PTT, the Thai state-owned oil and gas company, and Kuhne & Nagel, the global transportation and logistics company, were sold and positions were initiated in AIA, a Pan Asian life insurer and Kasikornbank, Thailand’s third-largest commercial bank and second largest private bank. The Fund also bought a position in ASML, a world leader in the provision of lithography systems for the semiconductor industry.

Second quarter earnings results were generally ahead of downbeat expectations; however, margins tended to outperform while revenues were weaker. This has added to the view that while demand is generally lackluster, in line with weak economic data, companies are continuing to manage their businesses well during this difficult environment. Company management teams are cautious in their outlooks for the second half of the year and overall equity market performance is likely to be dominated by political rhetoric and government action to stabilize finance and/or stimulate growth. Given this backdrop we continue to believe that focusing on the long-term fundamentals of a company has the potential to deliver positive shareholder returns.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Henderson Global Funds | Performance summary |

International Opportunities Fund

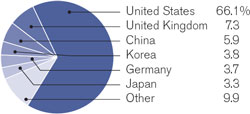

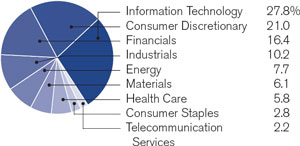

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

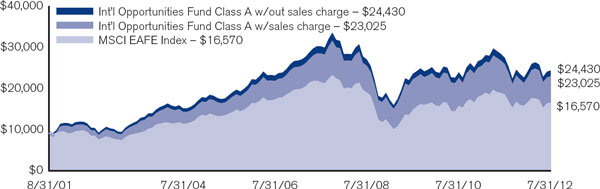

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | years* | | (8/31/01) * |

| Class A | | | HFOAX | | | -11.17 | % | | 1.16 | % | | -4.20 | % | | 8.80 | % | | 8.53 | % |

| Class B | | | HFOBX | | | -11.90 | | | 0.39 | | | -4.93 | | | 8.17 | | | 7.95 | |

| Class C | | | HFOCX | | | -11.87 | | | 0.39 | | | -4.92 | | | 7.99 | | | 7.72 | |

| Class R** | | | HFORX | | | -11.60 | | | 0.84 | | | -4.48 | | | 8.51 | | | 8.24 | |

| Class I*** | | | HFOIX | | | -10.93 | | | 1.43 | | | -4.02 | | | 8.90 | | | 8.62 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -16.29 | % | | -0.82 | % | | -5.33 | % | | 8.16 | % | | 7.94 | % |

| Class B | | | | | | -15.90 | | | -0.61 | | | -5.17 | | | 8.17 | | | 7.95 | |

| Class C | | | | | | -11.87 | | | 0.39 | | | -4.92 | | | 7.99 | | | 7.72 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI EAFE Index | | | | | | -10.99 | % | | 3.78 | % | | -5.13 | % | | 6.84 | % | | 4.73 | % |

* Average annual return.

** Class R shares commenced operations on September 30, 2005. The performance for Class R shares for the period prior to September 30, 2005 is based on the performance of Class A shares, adjusted for the higher expenses applicable to R shares. Class R shares are not subject to a front-end sales charge but are subject to a distribution fee of 0.50%.

*** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Class R shares have no front-end sales charge or CDSC. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C, R and I shares are 1.44%, 2.19%, 2.19%, 1.69% and 1.19% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75%, 2.25% and 1.75% for Class A, B, C, R and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Commentary |

Japan Focus Fund

Japanese equities disappointed over the period reflecting the trend seen in markets elsewhere. While the sovereign issues within Europe dominated global attention, Japan had its own issues to contend with, notably a stronger yen and bond yields hitting fresh lows. Not that newsflow within the Japanese economy was poor. On the contrary, some figures have been encouraging as reflected in the stronger than expected housing starts. Nonetheless, with scant domestic support for equities and foreign investors looking to retrench, the stockmarket retreated.

| Japan Focus Fund |

| Top 10 long-term holdings* |

| (at July 31, 2012) |

| | As a percentage | |

| Security | of net assets | |

| Mitsubishi UFJ Financial Group, Inc. | 6.2 | % |

| Yamada Denki Co., Ltd. | 5.9 | |

| Rakuten, Inc. | 4.9 | |

| Sumitomo Mitsui Financial Group, Inc. | 4.7 | |

| Daiwa Securities Group, Inc. | 4.5 | |

| Mizuho Financial Group, Inc. | 4.3 | |

| Keyence Corp. | 4.1 | |

| Canon, Inc. | 4.0 | |

| Tokio Marine Holdings, Inc. | 3.8 | |

| Credit Saison Co., Ltd. | 3.6 | |

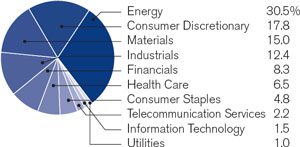

For the year ended July 31, 2012, the Fund returned -6.22% (Class A at NAV) versus the benchmark MSCI Japan Index, which posted a return of -12.39%. Within the Fund it was the emphasis on the financial and consumer discretionary sectors that propelled relative outperformance. Among the strongest contributors was the Japanese financial services company Credit Saison, which witnessed an improvement in the more problematic areas of its business while underlying demand recovered. Hakuhodo, the advertising and public relations company, benefitted from an upturn in corporate spending while contributions from Benesse, a company that focuses on correspondence education and publishing, and information technology company Oracle Japan were a further indication that domestic activity had begun to recover. Less impressive performance came from Yamada Denki, the consumer electronics retailer, Nintendo, the multinational consumer electronics company, and Mitsui OSK, an international shipping company, which suffered from weaker than expected profits.

The Fund retains a domestic bias favoring financials and domestic services versus companies more dependent on demand overseas. Japanese banks are in robust shape and have been increasing business in overseas markets as incumbent banks retreat due to capital constraints. Domestic service companies are benefitting as the country recovers from the natural disasters in 2011. Investment activity within the portfolio centered around taking advantage of opportunities during periods of market volatility.

Markets have grinded higher over the past couple of months despite the backdrop of general uncertainty with regard to the economic outlook and investor sentiment, which remains fragile. There is always the possibility, if not probability, of further quantitative easing (QE) from various central banks. We believe investors want to know what life after QE is going to look like and how economies will progress. Japan is less influenced by the events playing out overseas, and investments within the Fund will concentrate on companies that are either focused on the domestic economy or are of the highest quality, which we believe can weather conditions abroad.

* For further detail about these holdings, please refer to the section entitled “Portfolio of Investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Henderson Global Funds | Performance summary |

Japan Focus Fund

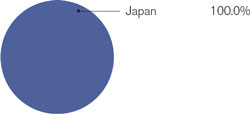

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | |

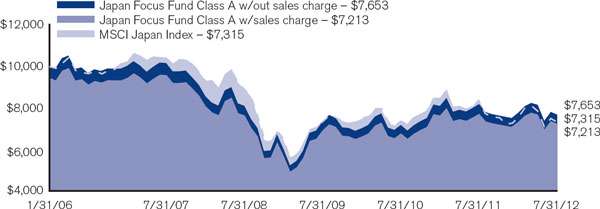

Investment comparison

Value of $10,000

Total returns as of July 31, 2012

| | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | (1/31/06) * |

| Class A | | | HFJAX | | | -6.22 | % | | 1.46 | % | | -5.45 | % | | -4.03 | % |

| Class C | | | HFJCX | | | -6.92 | | | 0.73 | | | -6.18 | | | -4.74 | |

| Class I** | | | HFJIX | | | -5.89 | | | 1.58 | | | -5.39 | | | -3.98 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -11.65 | % | | -0.53 | % | | -6.57 | % | | -4.90 | % |

| Class C | | | | | | -6.92 | | | 0.73 | | | -6.18 | | | -4.74 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI Japan Index | | | | | | -12.39 | % | | -0.23 | % | | -6.79 | % | | -4.70 | % |

* Average annual return.

** Class I shares commenced operations on May 31, 2011. The performance for Class I shares for the period prior to May 31, 2011 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Class A, C and I shares are 1.79%, 2.54% and 1.54%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.35%, 2.10% and 1.10% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ web-site at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. Effective June 1, 2011, the Henderson Japan – Asia Focus Fund changed its name, investment objective and policies and became the Henderson Japan Focus Fund. The Fund’s historical performance may not represent current investment policies. The MSCI Japan Index is a free float-adjusted market capitalization weighted index designed to measure equity market performance in Japan. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Henderson Global Funds | Portfolio of investments |

All Asset Fund

July 31, 2012

| Shares | | | | | Value (note 2) | |

| | | | | | | |

| Investment companies - 55.70% | | | | |

| | | | | | | |

| Alternatives - 14.99% | | | | |

| 96,789 | | ASG Global Alternatives | | | | |

| | | Fund | | $ | 987,250 | |

| 63,497 | | BH Global, Ltd. * | | | 1,144,869 | |

| 451,354 | | BlueCrest AllBlue Fund, Ltd. * | | | 1,164,093 | |

| 105,152 | | Franklin Templeton Hard | | | | |

| | | Currency Fund | | | 987,382 | |

| 75,227 | | Sprott Physical Gold | | | | |

| | | Trust * | | | 1,056,940 | |

| | | | | | 5,340,534 | |

| | | | | | | |

| Equity - 23.25% | | | | |

| 82,685 | | Calamos Market Neutral | | | | |

| | | Income Fund | | | 1,032,733 | |

| 37,613 | | Gateway Fund | | | 1,026,471 | |

| 86,367 | | Graphite Enterprise | | | | |

| | | Trust plc | | | 521,161 | |

| 80,282 | | HarbourVest Global Private | | | | |

| | | Equity (a) * | | | 576,826 | |

| 32,186 | | Henderson Global Technology | | | | |

| | | Fund (b) * | | | 639,861 | |

| 116,377 | | Henderson Japan Focus | | | | |

| | | Fund (b) | | | 850,717 | |

| 39,719 | | iShares MSCI Pacific ex-Japan | | | | |

| | | Index Fund | | | 1,700,768 | |

| 6,694 | | SPDR S&P 500 ETF Trust | | | 921,831 | |

| 17,546 | | Vanguard Dividend | | | | |

| | | Appreciation ETF | | | 1,014,159 | |

| | | | | | 8,284,527 | |

| | | | | | | |

| Fixed income - 17.46% | | | | |

| 73,785 | | Henderson Strategic Income | | | | |

| | | Fund (b) | | | 653,737 | |

| 5,458 | | iShares Barclays TIPS Bond | | | | |

| | | Fund | | | 662,820 | |

| 6,879 | | iShares iBoxx $High Yield | | | | |

| | | Corporate Bond Fund | | | 630,804 | |

| 18,588 | | iShares iBoxx Investment | | | | |

| | | Grade Corporate Bond Fund | | | 2,254,353 | |

| 8,570 | | iShares JP Morgan USD | | | | |

| | | Emerging Markets Bond | | | | |

| | | Fund | | | 1,015,973 | |

| 87,851 | | Legg Mason BW Global | | | | |

| | | Opportunities Bond Fund | | | 1,002,382 | |

| | | | | | 6,220,069 | |

| | | | | | | |

| | | Total investment companies | | | | |

| | | (Cost $19,903,451) | | | 19,845,130 | |

| Short-term investments - 43.69% | | | | |

| 10,046,657 | | Federated Obligations | | | | |

| | | Fund (c) | | $ | 10,046,657 | |

| 5,520,165 | | Fidelity Institutional | | | | |

| | | Treasury Portfolio | | | 5,520,165 | |

| | | | | | | |

| | | Total short-term investments | | | | |

| | | (Cost $15,566,822) | | | 15,566,822 | |

| | | | | | | |

| Total investments - 99.39% | | | | |