UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

____________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

____________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: July 31, 2013

Item 1: Report to Shareholders.

Annual Report

July 31, 2013

All Asset Fund

Dividend & Income Builder Fund

Emerging Markets Opportunities Fund

European Focus Fund

Global Equity Income Fund

Global Technology Fund

High Yield Opportunities Fund

International Opportunities Fund

Strategic Income Fund

World Select Fund (formerly Global Leaders Fund)

Table of contents

| Letter to shareholders | 1 |

| All Asset Fund | |

| Commentary | 2 |

| Performance summary | 3 |

| Dividend & Income Builder Fund | |

| Commentary | 4 |

| Performance summary | 5 |

| Emerging Markets Opportunities Fund | |

| Commentary | 6 |

| Performance summary | 7 |

| European Focus Fund | |

| Commentary | 8 |

| Performance summary | 9 |

| Global Equity Income Fund | |

| Commentary | 10 |

| Performance summary | 11 |

| Global Technology Fund | |

| Commentary | 12 |

| Performance summary | 13 |

| High Yield Opportunities Fund | |

| Commentary | 14 |

| Performance summary | 15 |

| International Opportunities Fund | |

| Commentary | 16 |

| Performance summary | 17 |

| Strategic Income Fund | |

| Commentary | 18 |

| Performance summary | 19 |

| World Select Fund (formerly Global Leaders Fund)* | |

| Commentary | 20 |

| Performance summary | 21 |

| Portfolios of investments | 22 |

| Statements of assets and liabilities | 66 |

| Statements of operations | 70 |

| Statements of changes in net assets | 73 |

| Statements of changes - capital stock activity | 83 |

| Financial highlights | 94 |

| Notes to financial statements | 108 |

| Report of independent registered public accounting firm | 126 |

| Other information | 127 |

| Trustees and officers | 136 |

International investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies, which typically involves greater risk than investing in larger companies. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. This risk is heightened in investments in emerging markets. In addition some of the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses.

The All Asset Fund invests in a smaller number of securities than the average mutual fund and the change in value of a single holding may have a more pronounced effect on the Fund’s net asset value and performance. The Fund may invest in derivatives and commodities. Investing in commodities entails additional risks including instability regarding control and jurisdiction of governments, international companies and other entities. Asset allocation strategies do not assure profit nor protect against loss. The Fund may be subject to frequent trading which may result in a turnover rate of 100% or more. The Fund is subject to investment company and pooled vehicles risk, allocation risk, leverage risk, interest rate risk and high yield securities risk. An investment in pooled vehicles, including closed-end funds, trusts, and exchange-traded funds (“ETFs”), may involve paying a premium at the time of purchase or receiving a discounted price at the time of sale. The Fund (and indirectly its shareholders) is responsible for a proportional share of the underlying investment company’s expenses, in addition to its own. Investments in high yield securities may offer more attractive returns than higher-rated securities, but the potentially higher yield is a function of the greater risk that a particular security may default.

The Dividend & Income Builder Fund invests in a smaller number of securities than the average mutual fund and the change in value of a single holding may have a more pronounced effect on the Fund’s net asset value and performance. The Fund may invest in illiquid securities and is subject to investment company and pooled vehicles risk, interest rate risk, credit/default risk and high yield securities risk. An investment in pooled vehicles, including closed-end funds, trusts, and ETFs, may involve paying a premium at the time of purchase or receiving a discounted price at the time of sale. The Fund (and indirectly its shareholders) is responsible for a proportional share of the underlying investment company’s expenses, in addition to its own. The Fund’s share price and yield will be affected by interest rate movements, with bond prices generally moving in the opposite direction from interest rates. During periods of rising interest rates, the value of a bond investment is at greater risk than during periods of stable or falling rates. The Fund may be subject to frequent trading which may result in a turnover rate of 100% or more. Credit risk refers to the bond issuer’s ability to make timely payments of principal and interest. Investments in high yield securities may offer more attractive returns than higher-rated securities, but the potentially higher yield is a function of the greater risk that a particular security may default.

Technology companies may react similarly to certain market pressure and events. This may be significantly affected by short product cycles, aggressive pricing of products and services, competition from new market entrants, and obsolescence of existing technology. As a result, the Global Technology Fund’s returns may be considerably more volatile than a fund that does not invest in technology companies.

The views in this report were those of the Funds’ Portfolio Managers as of July 31, 2013, and may not reflect the views of the portfolio managers on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Funds in understanding their investment in the Funds and do not constitute investment advice.

* As of December 20, 2012, the Global Leaders Fund changed its name to the World Select Fund.

| Henderson Global Funds | Letter to shareholders |

Dear shareholder,

We are pleased to provide the annual report for the Henderson Global Funds, which covers the year ended July 31, 2013.

Over the past year, we have begun to see many signs of economic recovery and improvement in key markets around the globe. In the US, consumer confidence reached a six-year high in June, while a stable oil price lifted auto sales. The housing recovery continued its upward momentum and labor markets also continued to improve. More recently, however, markets have experienced volatility following Fed chairman Ben Bernanke’s testimony to Congress in May, where he commented on the possibility of slowing down its bond purchase program.

Europe finally seems to be showing signs of improvement as well. Confidence is returning, deals are picking up, supply-side reforms are beginning to take effect, and Gross Domestic Product (GDP), while still shrinking, is shrinking more slowly. The Flash Eurozone Composite Purchasing Managers’ Index (PMI) moved back above 50 in July (a figure above 50 indicates expansion in activity) while German and French PMI releases were also upbeat. In the UK there is firm evidence of an improvement in the economy, with the second quarter GDP up 0.6% and construction and manufacturing boosting Britain’s recovery prospects.

In Japan, the latest quarterly Tankan report revealed that business confidence moved into positive territory for the first time since September 2011. The government upgraded its economic outlook for the third straight month while consumer prices rose in June for the first time in over a year. Additionally, first quarter economic growth was revised from 3.5% to a much stronger 4.1% (annualized), beating expectations and raising hopes that the economy may see a recovery.

In the face of all this positive news, emerging markets have suffered from significant capital outflows. Growth expectations for the region have been falling, possibly due to weak demand from developed economies, lower commodity prices, and Chinese policymakers favoring stability over near-term growth as they try to rebalance their economy. China’s manufacturing sector weakened in June in the latest indication that the slowdown in growth has deepened.

Looking forward, we believe the current global environment offers significant potential rewards for long-term investors. We are encouraged by the signs of economic recovery in Europe, Japan and the US. The risk/reward ratio offered by European companies appears particularly attractive, especially as signs of recovery increase and Europe remains cheap on a relative basis compared to other major developed markets. In Asia and emerging markets we believe that volatility and nervousness will continue, but we also believe that the sheer breadth of these markets will continue to generate investment opportunities for us.

We are pleased to report that we launched two new Funds in the past year: the Henderson Dividend & Income Builder Fund (HDAVX, HDCVX, HDIVX) on August 1, 2012, and the Henderson High Yield Opportunities Fund (HYOAX, HYOCX, HYOIX) on April 30, 2013. The Dividend & Income Builder Fund is a global diversified portfolio of income-producing securities with a focus on growth, seeking high and rising dividends as well as capital appreciation. The High Yield Opportunities Fund offers exposure to US and international high yielding securities representing Portfolio Manager Kevin Loome’s “best ideas.”

These Funds are key additions to the Henderson Global Funds family as we seek to provide you with further options to diversify your portfolios with Funds that we believe are truly differentiated from the competition. We appreciate your trust in, and support of, our Funds, and we look forward to serving your financial needs in the years to come.

James G. O’Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.hendersonglobalinvestors.com. The Prospectus should be read carefully before investing.

1

| Henderson Global Funds | Commentary |

Henderson All Asset Fund

All Asset Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage |

| Security | | | of net assets |

| PIMCO Enhanced | | | | |

| Short Maturity ETF | | | 5.1 | % |

| PIMCO Total Return ETF | | | 4.5 | |

| Vanguard Dividend | | | | |

| Appreciation ETF | | | 3.5 | |

| Legg Mason BW Global | | | | |

| Opportunities Bond Fund | | | 3.4 | |

| SPDR S&P 500 ETF Trust | | | 3.4 | |

| iShares MSCI EAFE | | | | |

| Minimum Volatility | | | | |

| Index Fund | | | 2.8 | |

| iShares iBoxx Investment | | | | |

| Grade Corporate | | | | |

| Bond Fund | | | 2.7 | |

| iShares MSCI Pacific | | | | |

| ex-Japan Index Fund | | | 2.6 | |

| iShares High Dividend | | | | |

| Equity Fund | | | 2.5 | |

| iShares MSCI USA Minimum | | | | |

| Volatility Index Fund | | | 2.4 | |

The tremendous rally in markets since summer 2012 – undeniably led by the European Central Bank’s pledge to preserve the Euro and the move towards potentially unlimited quantitative easing as in the US – appears to be grinding to a halt. Economists had been widely predicting a raft of soft data globally into the second quarter of this year, but instead macroeconomic releases have generally been brighter than anticipated, particularly in the US. But the prospect of the return to a more normal environment, one in which policy begins to take a back-seat to growth, has not been well-received by markets addicted to stimulus. The US Federal Reserve has been talking in more definitive terms about an exit strategy from unconventional monetary policy. At its meeting in June it said that it could begin tapering its asset purchases later this year and potentially end them by mid-2014. Volatility returned to markets globally during what became a broad sell-off that has encompassed both equities and bonds. The withdrawal of US ‘easy money’ is something that the world fears – not simply because of the risk of a policy error, but because a return to fundamental-based investing will have to occur if it does work – something that could greatly affect areas of the capital market that have seen substantial inflows, such as emerging market debt. The pace of economic recovery will be inconsistent across economies globally, so greater care will have to be taken with asset allocation decisions.

For the year ended July 31, 2013 the Fund returned 7.05% (Class A at NAV) versus the benchmark, 3-month LIBOR USD, which posted a return of 0.36%. While European equities continued to struggle on poor economic news from the region, both the US and Japan pulled ahead. Within this environment, the Fund’s allocation to bonds as well as to US and Japanese equities was beneficial to performance. It was a changeable environment and as bond yields began to rise, bonds (government in particular) began to detract from performance.

The Fund’s allocation shifted from favoring fixed income, heavy cash, and a defensively positioned portfolio to one that reflects our views of a slightly more optimistic macro environment. The asset allocation of the Fund at the end of the period is equities neutral (preferring Japan and US, neutral UK and cautious on Europe, Asia and emerging markets), fixed income underweight (high levels of cash, underweight duration and long short-maturity ETFs), and a small allocation to gold.

Risk appetite at the end of the reporting period returned after central banks reassured investors that they would continue to keep monetary policy loose until the economy is firmly on an upward trajectory. Economic data in developed markets (US, Japan and recently in Europe) has been improving and this may lead to central banks beginning to withdraw support towards the end of the year. Major policy changes by the Chinese authorities seem unlikely unless we see a significant slowdown in economic growth. We remain constructive on equities and believe there may be a pick-up in growth led by developed economies during the second half of the year.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

2

| Henderson Global Funds | Performance summary |

Henderson All Asset Fund

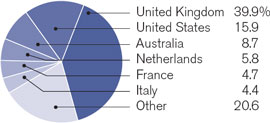

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | NASDAQ | | One | Since inception |

| At NAV | | symbol | | year | (3/30/2012)* |

| Class A | | HGAAX | | 7.05 | % | 4.67 | % |

| Class C | | HGACX | | 6.28 | | 3.95 | |

| Class I | | HGAIX | | 7.28 | | 4.91 | |

| With sales charge | | | | | | | |

| Class A | | | | 0.86 | % | 0.14 | % |

| Class C | | | | 6.28 | | 3.95 | |

| Index | | | | | | | |

| 3-month LIBOR USD | | | | 0.36 | % | 0.39 | % |

| MSCI World Index | | | | 23.96 | | 14.24 | |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 2.54%, 4.90% and 1.82%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 0.85%, 1.60% and 0.60% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. With respect to investments in affiliated underlying funds, the Fund’s adviser has contractually agreed to reduce or waive the Fund’s management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund’s management fee. Indirect net expenses associated with the Fund’s investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) USD is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

| Henderson Global Funds | Commentary |

Dividend & Income Builder Fund

Dividend & Income Builder Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage |

| Security | | | of net assets |

| HSBC Holdings plc | | | 2.1 | % |

| Lloyds Banking Group plc | | | 2.1 | |

| Prudential plc | | | 1.9 | |

| Novartis AG | | | 1.8 | |

| Nestle S.A. | | | 1.7 | |

| BT Group plc | | | 1.7 | |

| Deutsche Post AG | | | 1.7 | |

| Walgreen Co. | | | 1.6 | |

| Roche Holding AG | | | 1.6 | |

| JPMorgan Chase & Co. | | | 1.6 | |

Global equity markets rose strongly over the reporting period, as supportive monetary policy measures from both the European Central Bank and the US Federal Reserve buoyed investor confidence in the sustainability of a global economic recovery.

While developed market equities, particularly the US and Japan, made strong gains, emerging market equities and fixed income performance was mixed. As economic data from the US showed further signs of improvement, US long bond yields began to steepen from a trough of 1.4% in July 2012 to over 2.5% by the end of the reporting period, a move which was accelerated by statements from the Federal Reserve that they will being scaling back on quantitative easing by the end of 2013. In this environment of sharply rising yields, fixed income, particularly in emerging markets, underperformed as investors feared that the yield compression that had taken place due to excess global liquidity would be unwound. In this environment, the Fund’s performance benefitted from its overweight position in developed markets, and its low weight in fixed income.

Since the Fund’s inception on August 1, 2012, for the period ended July 31, 2013, the Fund returned 16.79% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 24.19%. The Fund successfully met its income objectives over the period. Relative underperformance was largely driven by the Fund’s underweight position in the US and Japan, both of which are lower yielding markets.

At the stock level, amongst the best performers during the year was Swiss pharmaceutical company Roche, which generated strong sales from its existing portfolio of primarily oncological products, as well as successful late stage pipeline results. Another strong performer during the year was Kansas City Southern, a railroad operator between the US and Mexico, which benefitted from growing cross-border trade.

In the equity allocation the Fund continues to seek companies with above-average yield and dividend growth potential. Sectors we have added to over the year include Technology, where we believe sustainable cash generation and already strong balance sheets will lead to increased shareholder returns via dividends in future. Microsoft is held in the Fund and is an example of a large technology company that has the ability to generate very healthy returns on capital and cash. We continue to have a low weighting in the Energy sector, where high capital expenditure requirements in order to maintain an adequate reserve base will put pressure on dividend increases in the future.

Toward the end of the period the Fund increased its allocation to fixed income from 15% to 20%. Within fixed income, the newly allocated funds went into holdings focused on large reliable and predominately non-cyclical businesses. The fixed income sub-portfolio’s duration remains on the shorter end at three to four years.

Second quarter 2013 company earnings reports have been very encouraging and we are seeing signs that sales and earnings growth are filtering through into strong dividend increases for shareholders. Nielsen Holdings for example, a global information services provider, recently announced a 25% increase to their quarterly dividend as they have become more comfortable with their leverage position and continue to generate sustainable cash flow.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

| Henderson Global Funds | Performance summary |

Dividend & Income Builder Fund

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | Since |

| | | NASDAQ | | inception |

| At NAV | | symbol | | (8/1/2012) |

| Class A | | HDAVX | | 16.79 | % |

| Class C | | HDCVX | | 15.94 | |

| Class I | | HDIVX | | 17.01 | |

| With sales charge | | | | | |

| Class A | | | | 10.91 | % |

| Class C | | | | 15.94 | |

| Index | | | | | |

| MSCI World Index | | | | 24.19 | % |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 1.73%, 2.48% and 1.48%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.30%, 2.05% and 1.05% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

| Henderson Global Funds | Commentary |

Emerging Markets Opportunities Fund

Emerging Markets Opportunities Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage |

| Security | | | of net assets |

| Samsung Electronics | | | | |

| Co., Ltd. | | | 3.7 | % |

| Chinatrust Financial | | | | |

| Holding Co., Ltd. | | | 3.0 | |

| Samsonite | | | | |

| International S.A. | | | 2.9 | |

| SK Telecom Co., Ltd. | | | 2.9 | |

| Baidu, Inc., ADR | | | 2.9 | |

| AIA Group, Ltd. | | | 2.8 | |

| Hyundai Motor Co. | | | 2.8 | |

| Kasikornbank pcl | | | 2.8 | |

| SJM Holdings, Ltd. | | | 2.7 | |

| Yum! Brands, Inc. | | | 2.7 | |

Since 2010, emerging markets equities have underperformed developed markets equities. Where the emerging markets in general had been reporting very strong economic data, they now have been running into a host of issues that has taken some of the shine off the asset class. China has shown clear signs of slowing down and we believe that is likely to continue as they make the change from an export-driven economy supported by government projects with explosive growth to a domestic consumer-based economy with a more realistic level of growth. The reverberations of this slowing growth will run through the whole emerging markets supply chain by affecting rates of growth in places like Brazil as a result of less commodity demand from China. Other current issues hitting the emerging markets include inflation rates higher than central banks would like and a reoccurrence of current account deficits for certain countries.

For the year ended July 31, 2013, the Fund returned 7.16% (Class A at NAV) versus the benchmark, MSCI Emerging Markets Index, which posted a return of 2.29%. Strong stock selection in Asia and Latin America contributed to the Fund’s outperformance. In Asia, consumer led shares in Sands China (Macanese casino), Prada (Hong Kong traded luxury retailer), and GT Capital (Philippine bank) made gains. By avoiding large commodity related names, such as Petrobras (Brazil), as well as overweighting Mexico and extending into small companies such as Copa Airlines (Panama) and Alsea (Mexico) the Latin America sub-portfolio strongly outperformed its regional benchmark. The EMEA (Emerging Europe, Middle East and Africa) sub-portfolio provided mixed returns with its commodity related names such as African Petroleum, Sable Mining, Cape Lambert Resources and RusPetro all declined on a reduction of risk appetite in the region, but the best contributors, NMC Health Care and EuroCash, helped to balance the resource allocation performance.

In Asia the Fund continues to have a strong bias to shares focused on the growth and strength of the Asian domestic consumer. In Latin America the Fund found new opportunities in the high growth markets of Peru and Panama. In the EMEA sub-portfolio, the Fund changed it bias from a strong overweight to resources to a mix of consumer-focused shares, including Health Care, Transportation and Consumer Staples. At the end of the period the Fund is even-weighted to Asia, overweight to EMEA and underweight to Latin America.

The economic outlook for the emerging markets continues to look challenging as commodities and government spending have fueled their growth over the last decade and is now under pressure. The emerging markets are making the slow shift to a more consumer-driven economic model and this is where we believe global growth will come in the long term, however in the short term prices will largely be dictated by policymakers’ intervention on inflation in Brazil, rising bond yields in the US causing volatility in Asia and a slowing China leading to less hard asset market demand across the emerging markets bloc. We believe active stock selection will be crucial in such an environment. While valuations are now looking relatively attractive in the emerging markets, we remain cautious and continue to focus on the areas that offer true medium term potential. We suspect that there will be better buying opportunities in broad emerging markets equities in the future.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

| Henderson Global Funds | Performance summary |

Emerging Markets Opportunities Fund

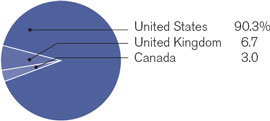

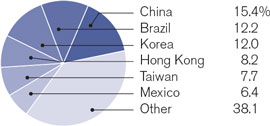

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | | | Since |

| | | NASDAQ | | One | inception |

| At NAV | | symbol | | year | (12/31/2010)* |

| Class A | | HEMAX | | 7.16 | % | -5.27 | % |

| Class C | | HEMCX | | 6.33 | | -5.97 | |

| Class I | | HEMIX | | 7.25 | | -5.06 | |

| With sales charge | | | | | | | |

| Class A | | | | 0.95 | % | -7.42 | % |

| Class C | | | | 6.33 | | -5.97 | |

| Index | | | | | | | |

| MSCI Emerging Markets Index | | | | 2.29 | % | -4.45 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are estimated to be 2.52%, 3.24% and 2.17%, respectively. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.79%, 2.54% and 1.54% for Class A, C and I shares, respectively, which is in effect until July 31, 2015. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

| Henderson Global Funds | | Commentary |

European Focus Fund

European Focus Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage of net assets |

| Security | | |

| European Aeronautic | | | | |

| Defence and | | | | |

| Space Co. N.V. | | | 4.6 | % |

| Investment AB | | | | |

| Kinnevik, B Shares | | | 4.3 | |

| Accor S.A. | | | 3.1 | |

| Continental AG | | | 3.0 | |

| Lloyds Banking Group plc | | | 2.9 | |

| Kingfisher plc | | | 2.8 | |

| Zhaikmunai LP, GDR | | | 2.8 | |

| KION Group AG | | | 2.8 | |

| International | | | | |

| Consolidated Airlines | | | | |

| Group S.A. | | | 2.7 | |

| Vodafone Group plc | | | 2.6 | |

European markets were very challenging early in the reporting period as investor attention was focused on the need for political action to resolve sovereign debt problems, combined with softening macroeconomic data from China and the US. Markets rose strongly during the latter part of 2012 following a significant reduction in European tail-risk, mainly on the back of European Central Bank action and easing global monetary policy. After a positive start to 2013, European markets finished the first quarter nervously; companies announced full year 2012 results broadly in line with market expectations, however most expressed caution about the outlook for the first half of 2013. The following period saw markets rally strongly, however they were interrupted in June as the US Federal Reserve confirmed its intentions to begin tapering its quantitative easing program later this year and over the significant shift in sentiment toward emerging markets.

For the year ended July 31, 2013 the Fund returned 32.19% (Class A at NAV) versus the benchmark, MSCI Europe Index, which posted a return of 26.94%. Although the overweight exposure to the Energy sector and stock selection in Materials weighed on performance, this was successfully overcome by the overweight to the Consumer Discretionary sector as stocks such as Sky Deutschland, Renault and Continental performed strongly. In addition, strong performance from a number of the Financials, Consumer Staples and IT positions bolstered returns, such as Lloyds Banking, Investment AB Kinnevik, Svenska Cellulosa and Amadeus Information Technology Holding. African Petroleum was the biggest detractor to performance. The stock initially sold off on little volume and limited news flow but was then severely impacted due to lower than expected reservoir permeability at its Bee Eater-1 Well in offshore Liberia. RusPetro also had a poor run after suffering operational delays surrounding oil extraction as well as a tight funding situation.

New additions to the portfolio have generally been in laggard stocks which have their own ‘special situation’ dynamics. Those additions include hotel chain operator, Accor, shipping conglomerate, AP Moller-Maersk and Spanish utility company, Red Electrica. Shareholder angst created an attractive entry point to Accor which is under new management and is moving from asset-light by way of an expansionary three year strategy. In our view, the market was overly negative to AP Moller-Maersk; management is intent on improving returns to shareholders and the underlying value of the business. Red Electrica was bought in expectation that they would benefit from an on-going regulatory review by the government.

Europe remains cheap on a relative basis compared to other major developed markets. Over the mid to longer term, as member states work out their differences and as the world economy moves forward, the depressed ratings afforded to companies domiciled in the Eurozone should abate. In the meantime, for the forward-looking investor, the risk/reward ratio offered by these stocks appears attractive. Although an emerging markets slowdown rightfully caused nervousness, we remain encouraged about European equity returns going forward. Bond investors have started to feel the pain of rising yields, which will likely prompt capital allocators to look at equities once again. Any such move would be disproportionately helpful to ‘cheap’ assets such as select European stocks.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

| Henderson Global Funds | Performance summary |

European Focus Fund

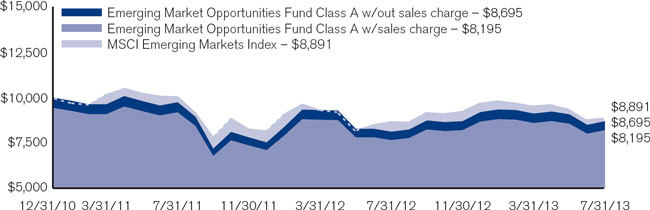

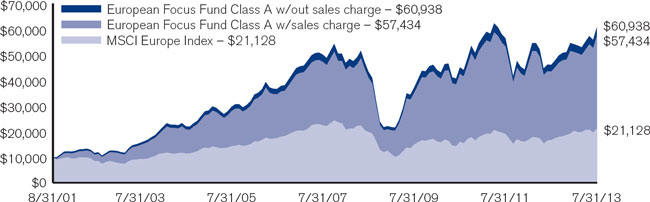

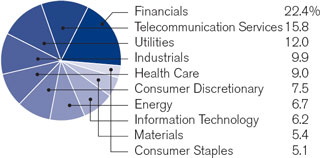

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | | | | | | | | | Since |

| | | NASDAQ | | One | Three | Five | Ten | inception |

| At NAV | | symbol | | year | years* | years* | years* | (8/31/2001)* |

| Class A | | HFEAX | | 32.19 | % | 10.53 | % | 7.01 | % | 14.64 | % | 16.38 | % |

| Class B | | HFEBX | | 31.11 | | 9.66 | | 6.18 | | 13.97 | | 15.81 | |

| Class C | | HFECX | | 31.16 | | 9.68 | | 6.19 | | 13.79 | | 15.51 | |

| Class I** | | HFEIX | | 32.60 | | 10.85 | | 7.27 | | 14.78 | | 16.50 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | 24.58 | % | 8.37 | % | 5.75 | % | 13.96 | % | 15.80 | % |

| Class B | | | | 27.11 | | 8.82 | | 6.03 | | 13.97 | | 15.81 | |

| Class C | | | | 31.16 | | 9.68 | | 6.19 | | 13.79 | | 15.51 | |

| Index | | | | | | | | | | | | | |

| MSCI Europe Index | | | | 26.94 | % | 9.78 | % | 1.30 | % | 8.65 | % | 6.47 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.53%, 2.36%, 2.32% and 1.21% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

| Henderson Global Funds | Commentary |

Global Equity Income Fund

Global Equity Income Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage of net assets |

| Security | | |

| BT Group plc | | | 3.0 | % |

| Vodafone Group plc | | | 2.9 | |

| GlaxoSmithKline plc | | | 2.5 | |

| Delta Lloyd N.V. | | | 2.4 | |

| Pfizer, Inc. | | | 2.3 | |

| Westfield Retail Trust | | | 2.3 | |

| Merck & Co., Inc. | | | 2.1 | |

| SSE plc | | | 2.1 | |

| Deutsche Post AG | | | 2.1 | |

| Standard Chartered plc | | | 2.0 | |

Global equity markets made solid gains over the reporting period led by the US and Japan. The US market performed strongly on the back of positive economic releases though experienced volatility towards the end of the reporting period after the US Federal Reserve confirmed that it was likely to begin tapering its asset buying program later in the year. Japan experienced a similar strong rise followed by a volatile period. Investors were encouraged by structural reforms (“Abe-nomics”) to generate growth; as a result Japanese equities rallied strongly but then pulled back sharply to a less exuberant, more sustainable level.

Elsewhere, the data coming from Europe has been improving and despite a rally over the last year, European shares remain relatively inexpensive. Company earnings reports from the region have largely been positive, adding to a return of risk appetite amongst investors. Emerging markets equities have struggled, underperforming the developed world markedly on the back of a strong US dollar and the possibility of rising interest rates. China was a particular source of concern as fears grew that a reduction in infrastructure spending would lead to a sharper than anticipated slowdown in economic growth.

For the year ended July 31, 2013, the Fund returned 18.58% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 23.96%. The Fund also continued to meet its high income objectives over the period. The Fund’s structural underweight to the US and Japan, both of which are lower yielding markets, as well as the low beta bias, led to relative underperformance versus the broader market’s rally. Amongst the best performing sectors during the year was Insurance. Life insurers such as Delta Lloyd, AXA and Standard Life were amongst the top contributors to performance, as improved capital positions and a bottoming of bond yields (reducing their long duration liabilities) led to improved confidence in the sustainability of earnings.

At the stock level, amongst the top performers was global pharmaceutical company Pfizer, which benefitted from further rationalization to its portfolio (such as beginning the spin-off of animal health company Zoetis), as well as successful new drug launches. Another top performer was aerospace company BAE, which outperformed strongly towards the end of the period as confidence increased that US “sequestration” would have less of an effect on sales and earnings growth than originally feared.

Following an improved economic forecast, inexpensive valuations and healthy dividend increases allowed the Fund to extend its allocation to Europe. The Fund subsequently reduced its allocation to the US as valuations in some sectors have been getting stretched. On a sector basis the Fund has been reducing its Consumer Staples exposure and adding to Technology companies, including Microsoft and Cisco Systems. Also for the first time in a number of years the Fund has increased its Financials weighting (such as HSBC) as we are seeing better valuations and the possibility of re-ratings.

While there will likely be some uncertainties surrounding the timing of quantitative easing being withdrawn in the US, we see the steepening of bond yields as an encouraging sign that the US economy is returning to sustained economic growth. In this environment we remain confident in the ability of companies held within the portfolio to generate sales and earnings growth in the year ahead.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

| Henderson Global Funds | Performance summary |

Global Equity Income Fund

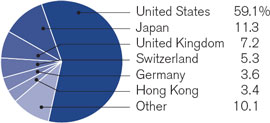

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | | | | | | | Since |

| | | NASDAQ | | One | Three | Five | inception |

| At NAV | | symbol | | year | years* | years* | (11/30/06)* |

| Class A | | HFQAX | | 18.58 | % | 11.19 | % | 4.83 | % | 3.54 | % |

| Class C | | HFQCX | | 17.65 | | 10.37 | | 4.04 | | 2.76 | |

| Class I** | | HFQIX | | 18.87 | | 11.53 | | 5.08 | | 3.73 | |

| With sales charge | | | | | | | | | | | |

| Class A | | | | 11.77 | % | 9.00 | % | 3.60 | % | 2.63 | % |

| Class C | | | | 17.65 | | 10.37 | | 4.04 | | 2.76 | |

| Index | | | | | | | | | | | |

| MSCI World Index | | | | 23.96 | % | 13.34 | % | 4.88 | % | 3.31 | % |

| MSCI World High Dividend Yield Index | | | | 19.67 | | 14.53 | | 5.73 | | 3.11 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.29%, 2.05% and 1.01%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.40%, 2.15% and 1.15% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within select MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

| Henderson Global Funds | | Commentary |

Global Technology Fund

Global Technology Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage of net assets |

| Security | | |

| Cisco Systems, Inc. | | | 3.8 | % |

| ASML Holding N.V. | | | 3.5 | |

| QUALCOMM, Inc. | | | 3.4 | |

| Cognizant Technology | | | | |

| Solutions Corp. | | | 3.4 | |

| MasterCard, Inc., Class A | | | 3.2 | |

| Apple, Inc. | | | 3.2 | |

| Samsung Electronics | | | | |

| Co., Ltd. | | | 3.2 | |

| Priceline.com, Inc. | | | 2.9 | |

| Western Digital Corp. | | | 2.3 | |

| TripAdvisor, Inc. | | | 2.0 | |

After an initial period of nervousness, global equities performed strongly in the second half of 2012, aided by accommodative monetary policies enforced by the world’s central banks. Markets began 2013 brightly, with the S&P 500 posting its best January in a decade. The Technology sector underperformed the wider market as the declining performance of Apple, in particular, significantly affected indices and overall sentiment. Likewise, the relative underperformance in growth-orientated sectors, such as Technology, was partly attributable to what we believe was yield seeking investors purchasing high dividend parts of the equity market as a substitute for bonds.

For the year ended July 31, 2013 the Fund returned 17.93% (Class A at NAV) versus the benchmark, MSCI AC IT World Index, which posted a return of 13.69%. The underweight to the Computers and Peripherals sector was the largest positive contributor to relative outperformance. Stock selection within the Internet and Catalog Retail sector was also a significant contributor. Stock selection within the Software and Electronic Equipment Instruments & Components sectors were the largest detractors from performance. At the stock level, positive contributions came from the underweight in Apple relative to the index, which, at writing stands at approximately 5% versus 10%. The positions in social media companies Facebook and LinkedIn (purchased at low valuations) performed well and were sold after hitting our valuation targets. Online travel research company, TripAdvisor, surged to a record high driven by increasing confidence in their growth trends. OpenTable, the online restaurant reservation site, also performed strongly. Elsewhere, ASML, the Netherlands-based semiconductor equipment manufacturer, performed well as it benefitted from its leadership in the lithography equipment market. Google, which the Fund is underweight, was the largest detractor from relative performance. There were a few disappointments as some earnings fell short of market expectations, including: Verifone, which missed its second quarter profit estimates after suffering execution issues; F5 Networks, due to telecommunications spending being reined in and issues in their product transition; and VMWare, as slowing server virtualization affected their business.

Notable trading activity over the period included sales of Verifone, following its profit warning, and the Chinese internet company, Tencent Holdings, following concerns over margin trends. Fusion-IO was exited as the company’s outlook for first quarter revenues dropped significantly from last year’s fourth quarter. Symantec was purchased in the belief that the company can improve its operating margins through refocusing its product mix, reducing headcount and streamlining its sales teams. The position in ASML was further built out as we became increasingly confident in its competitive position.

While near-term direction will be sensitive to macroeconomic conditions, we believe the fundamental backdrop for Technology equities looks very attractive. Valuation levels look extremely compelling from both an absolute and relative basis: balance sheets are very healthy, cash generation is solid and demand has the potential to recover from below-trend levels. The overall bias of the Fund toward companies with strong barriers to entry should cushion the portfolio from macroeconomic volatility and the valuation-aware process focuses on underappreciated areas of secular growth that offer the potential for strong returns over the long-term. The Fund remains biased to our preferred themes of E-Commerce, Online Advertising, Data Growth, Connectivity and Paperless Payment.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

12

| Henderson Global Funds | Performance summary |

Global Technology Fund

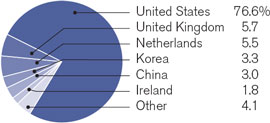

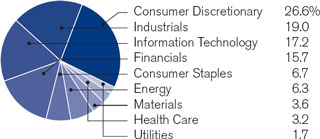

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

| | | | | | | | | | | | | Since |

| | | NASDAQ | | One | Three | Five | Ten | inception |

| At NAV | | symbol | | year | years* | years* | years* | (8/31/01)* |

| Class A | | HFGAX | | 17.93 | % | 12.98 | % | 10.84 | % | 10.19 | % | 8.17 | % |

| Class B | | HFGBX | | 16.94 | | 12.08 | | 9.97 | | 9.52 | | 7.67 | |

| Class C | | HFGCX | | 16.97 | | 12.13 | | 9.99 | | 9.36 | | 7.38 | |

| Class I** | | HFGIX | | 18.21 | | 13.29 | | 11.11 | | 10.32 | | 8.28 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | 11.15 | % | 10.78 | % | 9.53 | % | 9.54 | % | 7.64 | % |

| Class B | | | | 12.94 | | 11.28 | | 9.83 | | 9.52 | | 7.67 | |

| Class C | | | | 16.97 | | 12.13 | | 9.99 | | 9.36 | | 7.38 | |

| Index | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | 13.69 | % | 11.90 | % | 6.71 | % | 6.91 | % | 4.46 | % |

| S&P 500 | | | | 25.00 | | 17.72 | | 8.26 | | 7.64 | | 5.45 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of hte 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.50%, 2.36%, 2.29% and 1.23%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75% and 1.75% for Class A, B, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

| Henderson Global Funds | | Commentary |

High Yield Opportunities Fund

High Yield Opportunities Fund

Top 10 long-term issuers*

(at July 31, 2013)

| | | As a percentage of net assets |

| Security | |

| Landry’s, Inc. | | | 3.2 | % |

| Wok Acquisition Corp. | | | 2.2 | |

| Univision | | | | |

| Communications, Inc. | | | 2.1 | |

| Digicel Group, Ltd. | | | 2.1 | |

| Radnet Management, Inc. | | | 2.1 | |

| Serta Simmons | | | | |

| Holdings LLC | | | 2.1 | |

| Intelsat Luxembourg S.A. | | | 2.1 | |

| SandRidge Energy, Inc. | | | 2.0 | |

| TPC Group, Inc. | | | 2.0 | |

| Consolidated Container | | | | |

| Co. LLC | | | 2.0 | |

New issuance during May 2013 was an all-time record month in the US high yield market at $56 billion and brought year-to-date new issuance to $188 billion. Despite the frothy demand for high yield bonds, the composition of the new issuance continued to be somewhat conservative with 61% directed at refinancing and only 8% used for leveraged buyout financing. This is compared to only 25% used for refinancing and 33% used for leveraged buyout financing during 2007, which is deemed to be the last peak in the high yield credit cycle when spreads tightened to 250 basis points (2.50%) over Treasuries. Following this, June witnessed the worst sell-off in the US high yield market since September 2011 on the heels of a 50 basis point (0.50%) increase in 5-year Treasury yields. As was the case in May, there was no discernible pattern in the sell-off among the credit tiers, in fact, double-B bonds underperformed both single-B and triple-C rated issuers, suggesting an increasing correlation of the high yield asset class to 5-year Treasuries in a low rate and spread environment. The US high yield market experienced a rebound in July as rate fears stabilized and fund flows returned to positive territory for the asset class.

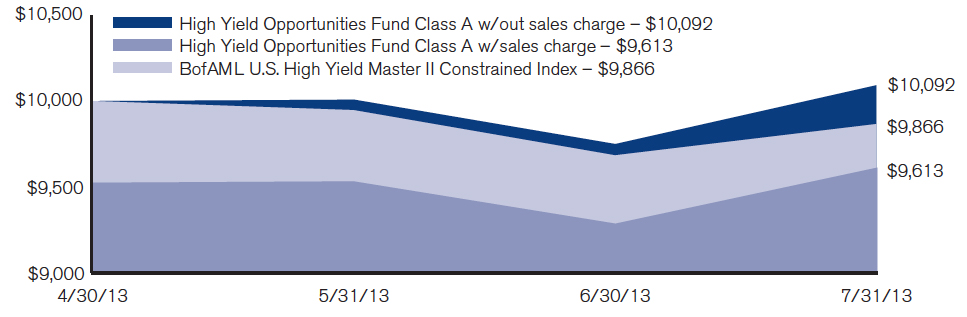

Since the Fund’s inception on April 30, 2013, to the end of the reporting period July 31, 2013, the Fund returned 0.92% (Class A at NAV) versus the benchmark, BofAML US High Yield Master II Constrained Index, which posted a return of -1.33%.

Performance against the peer group in June was hindered by low levels of cash and absence of bank loans in the portfolio, but benefitted by not having to meet large fund redemptions. July saw the Fund post above average performance versus the benchmark and peer group, aided (conversely to June) by low levels of cash, no bank loans and additionally no exposure to utilities. Some ground was given up however by not owning the lower quality triple C issuers which rallied the most during the rebound.

There have not been any major changes to the Fund as far as industry weightings or credit-tier weightings after the sell-off in June or rebound in July. We continue to employ a slight carry1 advantage to the benchmark and peer group by overweighting the lower quality single-B space as well as the higher quality triple-C sector. Credit fundamentals remain positive and most of the companies that we follow have taken advantage of the easy new issuance market to address any lingering liquidity concerns. As a result, we estimate that default rates will remain low, yet secondary market liquidity will remain challenging.

Bank loans offer an attractive investment opportunity to dampen the risk of further increases in interest rates; however, we view the leveraged loan market as slightly overvalued due to the extraordinary inflows to the asset class amid a rising rate environment. Further outperformance of the asset class would depend on further upward shocks in interest rates from this point onward. We expect volatility to remain high for the balance of the year, but will maintain the discipline of managing the portfolio on a credit by credit basis.

1 Carry trade is defined as a strategy in which an investor sells a certain currency with a relatively low interest rate and uses the funds to purchase a different currency yielding a higher interest rate.

* For further details about these issuers, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

14

| Henderson Global Funds | Performance summary |

High Yield Opportunities Fund

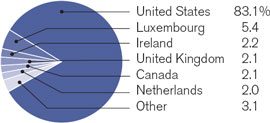

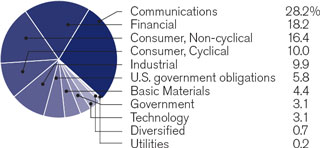

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | Since |

| | | NASDAQ | | inception |

| At NAV | | symbol | | (4/30/2013) |

| Class A | | HYOAX | | 0.92 | % |

| Class C | | HYOCX | | 0.81 | |

| Class I | | HYOIX | | 1.06 | |

| With sales charge | | | | | |

| Class A | | | | -3.89 | % |

| Class C | | | | -0.19 | |

| Index | | | | | |

| BofAML U.S. High Yield Master II Constrained Index | | | | -1.33 | % |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios gross) for Class A, C and I shares are estimated to be 1.83%, 2.58% and 1.58%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 1.10%, 1.85% and 0.85% for Class A, C and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

| Henderson Global Funds | | Commentary |

International Opportunities Fund

International Opportunities Fund

Top 10 long-term holdings*

(at July 31, 2013)

| | | | As a percentage of net assets |

| Security | | |

| European Aeronautic | | | | |

| Defence and Space | | | | |

| Co. N.V. | | | 3.6 | % |

| Deutsche Post AG | | | 3.0 | |

| Continental AG | | | 3.0 | |

| UBS AG | | | 3.0 | |

| Lloyds Banking Group plc | | | 2.9 | |

| Amadeus IT Holding | | | | |

| S.A., A Shares | | | 2.8 | |

| ASML Holding N.V. | | | 2.7 | |

| Capita Group plc | | | 2.6 | |

| Fresenius SE & Co., KGaA | | | 2.6 | |

| Roche Holding AG | | | 2.6 | |

Global equity markets initially struggled for direction amid poor earnings and economic data, with sentiment dominated by central bank action, political rhetoric and stimulus measures enacted by the US Federal Reserve and the European Central Bank. Markets rallied strongly into the year-end due to improving economic data in the US and China, an approved bailout for Greece and Spanish banks and a regime change in Japan. 2013 began with a considerable relief rally, sparked by a last minute compromise by the US Congress to avert the spending cuts and tax increases (the “fiscal cliff”) which threatened continued growth in the US economy. As the year progressed, we started to see improving cash flows into equities as investors began to allocate away from cash and bonds in search of return in the low interest rate environment. Accommodative monetary policy and improving economic data, particularly in the US and Japan, has helped drive markets higher, however, sentiment has been tested along the way by implications of a reduction in the $85 billion monthly stimulus injected by the Federal Reserve through quantitative easing.

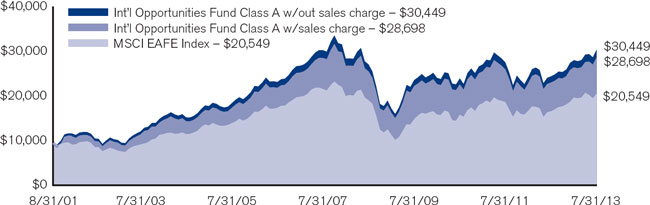

For the year ended July 31, 2013 the Fund returned 24.64% (Class A at NAV) versus the benchmark, MSCI EAFE Index, which posted a return of 24.02%.

The Fund’s European Growth sub-portfolio was consistently strong throughout the period as quality growth positions such as Deutsche Post and Capita performed very well. The Japan and Asia portfolios weighed on relative performance and, although initially struggling due to stock specific issues, the Pan-European sub-portfolio – along with European Growth – has driven recent performance. Strong gains have been seen in cyclical positions, such as European Aeronautic Defense and Space Company (EADS) and Renault. RusPetro was the worst performer over the period due to operational delays surrounding oil extraction as well as a tight funding situation. African Petroleum also suffered over lower than expected reservoir permeability at its Bee Eater-1 well in offshore Liberia.

December saw the introduction of a Latin American sub-portfolio. As Brazil and Mexico forecasted to be in the top five global economies, the region represents 9% of the world’s population and 7% of the world’s GDP, this addition was a natural evolution of the portfolio.

Notable trading activity has included the Pan-European sub-portfolio buying a number of laggard stocks that we viewed as compelling recovery stocks with “special situation” dynamics. Those stocks include hotel operator, Accor and shipping conglomerate, AP Moller-Maersk. Apple was sold from the Technology sub-portfolio due to concerns over competitive pressure and the maturity of Apple’s end markets; however, the stock has been a significant positive performer for the Fund over the period of its inclusion. Among the purchases in the Japanese sub-portfolio were H2O Retailing Corp, the operator of railway department stores, and Taiheiyo Cement, which has exposure both domestically and in the US.

Europe remains cheap on a relative basis compared to other major developed markets and Japan is at an interesting point leading us to believe there will be significant rewards for good stock-picking. Asia and emerging markets are currently going through a difficult stage. While we believe that volatility and nervousness will continue, the sheer breadth of these markets should generate opportunities for us. Overall, we retain our faith in equities as an asset class. Bond investors have started to feel the pain of rising yields, which will likely prompt capital allocators to look at equities once again.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

16

| Henderson Global Funds | Performance summary |

International Opportunities Fund

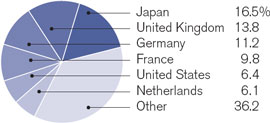

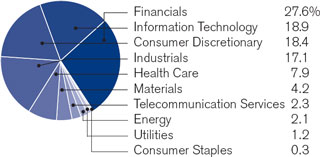

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments) |

| | | |

| | |

Investment comparison

Value of $10,000

Total returns as of July 31, 2013

| | | | | | | | | | | | | Since |

| | | NASDAQ | | One | Three | Five | Ten | inception |

| At NAV | | symbol | | year | years* | years* | years* | (8/31/01)* |

| Class A | | HFOAX | | 24.64 | % | 8.29 | % | 2.37 | % | 9.70 | % | 9.79 | % |

| Class B | | HFOBX | | 23.55 | | 7.40 | | 1.57 | | 9.05 | | 9.26 | |

| Class C | | HFOCX | | 23.62 | | 7.44 | | 1.57 | | 8.86 | | 8.97 | |

| Class R** | | HFORX | | 24.23 | | 7.90 | | 2.06 | | 9.40 | | 9.50 | |

| Class I*** | | HFOIX | | 25.00 | | 8.57 | | 2.62 | | 9.83 | | 9.90 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | 17.48 | % | 6.17 | % | 1.16 | % | 9.05 | % | 9.25 | % |

| Class B | | | | 19.55 | | 6.53 | | 1.38 | | 9.05 | | 9.26 | |

| Class C | | | | 23.62 | | 7.44 | | 1.57 | | 8.86 | | 8.97 | |

| Index | | | | | | | | | | | | | |

| MSCI EAFE Index | | | | 24.02 | % | 9.11 | % | 1.54 | % | 8.45 | % | 6.23 | % |

* Average annual return.

** Class R shares commenced operations on September 30, 2005. The performance for Class R shares for the period prior to September 30, 2005 is based on the performance of Class A shares, adjusted for the higher expenses applicable to R shares. Class R shares are not subject to a front-end sales charge but are subject to a distribution fee of 0.50%.

*** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Class R shares have no front-end sales charge or CDSC. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C, R and I shares are 1.47%, 2.32%, 2.29%, 1.94% and 1.20% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has agreed to contractually waive a portion of its fees and/or reimburse expenses such that total ordinary operating expenses do not exceed 2.00%, 2.75%, 2.75%, 2.25% and 1.75% for Class A, B, C, R and I shares, respectively, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.hendersonglobalinvestors.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

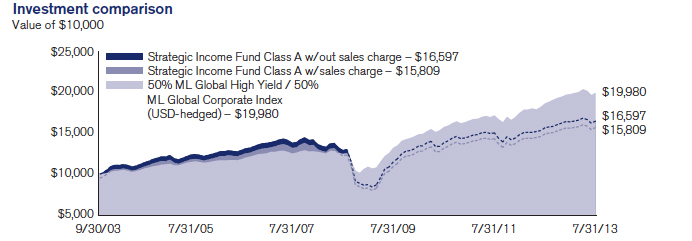

| Henderson Global Funds | | Commentary |

Strategic Income Fund