UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

____________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

____________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER GOLDEN 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 871-6200

Date of fiscal year end: July 31

Date of reporting period: July 31, 2016

Item 1: Report to Shareholders.

| Letter to shareholders | 1 |

| Commentaries and Performance summaries | |

| All Asset Fund | 4 |

| Dividend & Income Builder Fund | 6 |

| Emerging Markets Fund | 8 |

| European Focus Fund | 10 |

| Global Equity Income Fund | 12 |

| Global Technology Fund | 14 |

| High Yield Opportunities Fund | 16 |

| International Long/Short Equity Fund | 18 |

| International Opportunities Fund | 20 |

| International Select Equity Fund | 22 |

| Strategic Income Fund | 24 |

| Unconstrained Bond Fund | 26 |

| US Growth Opportunities Fund | 28 |

| Portfolios of investments | 30 |

| Statements of assets and liabilities | 120 |

| Statements of operations | 128 |

| Statements of changes in net assets | 136 |

| Statements of changes – capital stock activity | 149 |

| Statement of cash flows | 174 |

| Financial highlights | 176 |

| Notes to financial statements | 202 |

| Report of independent registered public accounting firm | 218 |

| Other information | 219 |

| Trustees and officers | 226 |

International and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies which typically involve greater risk than investing in larger companies. Certain of the Funds are non-diversified and therefore the change in value of a single holding may have a more pronounced effect on a Fund's performance. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition, the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses. The Funds may be subject to frequent trading which may result in a turnover rate of 100% or more. Additional fund-specific risk is described in more detail in the Prospectus and Statement of Additional Information.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains these items and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

Dear shareholder,

We are pleased to provide the annual report for the Henderson Global Funds, which covers the year ended July 31, 2016.

It would be very difficult to cover the events of this time period without mentioning "Brexit" (British exit): the UK's referendum vote to leave the European Union (EU). The (now former) Prime Minister, David Cameron, called for a referendum on continued EU membership as part of his re-election campaign in 2015 due to concerns over the UK's sovereignty, the free movement of people, and the EU's call for an "ever closer union." In the vote on June 23, 2016, the UK voted to leave the EU. The impact of the UK's vote is likely to be felt across Europe's political and investment landscape for years to come.

The next part of the process of exiting the EU will take a minimum of two years and the details have yet to be established. In the meantime, some have wondered whether Brexit will cause a recession in the UK, especially as recent UK industrial data has shown a marked slowing. We do believe business investment will fall, but a recession would be surprising against a backdrop of stable financial conditions and a growing global economy. Additionally, on August 4, 2016, the Bank of England implemented dual stimulus measures, cutting the base interest rate to 0.25% and announcing a quantitative easing program of £70 billion, further reducing the likelihood of a recession.

In Europe, aside from various reactions to the Brexit vote, there have been some positive signs of growth. The unemployment rate fell to 10.1% in May, the lowest rate since 2011 and down from a 2013 peak of 12.1%. Recent German economic news has been upbeat, and European consumer prices rose by an annual 0.1% in June, the first positive reading since January. However, looking forward, there are several political risks on the horizon. Italy will hold a referendum on constitutional reform in October, and elections in Germany and France may discourage necessary decision-making on Brexit and other issues.

Moving outside of Europe, the Chinese government has been working to stabilize growth through infrastructure projects, reducing red tape and maintaining a loose monetary policy. Economic news so far this year has suggested these policies are helping: industrial output rose by an annual 6.0% in May, little changed from 5.9% in Q1. However, exports and imports both fell in July on weak demand, highlighting the headwinds that China is facing.

In Japan, economic pessimism has increased as the yen continued to surge. Prime Minister Abe scrapped a planned 2017 sales tax hike and promised a fiscal stimulus package after July upper house elections. So far, the Bank of Japan has held steady on any big monetary stimulus this year. However, "core" consumer price inflation fell back to 0.8% in May from 1.3% in December, boosting expectations of future monetary easing.

US profits are stabilizing, as the national accounts measure of economic profits recovered by 2% in Q1 after a 16% slide over the previous five quarters. Brexit should have minimal impact on the US economy, and a recovery in profits may encourage investment and hiring. All eyes are on the Federal Reserve as domestic strength could prompt higher interest rates despite global risks.

Looking forward, we believe that the direct impact of Brexit on the world economy is likely to be modest, but it is still expected to weigh on investor confidence at a time when the global recovery remains fragile. Regardless of how the situation plays out, Brexit-related uncertainties will take some time to dispel and in these conditions it will be more important than ever to remain flexible from an investment perspective. We continue to believe that volatility and uncertainty can create attractive investment opportunities, and we are focused on seeking out these opportunities across the globe. We appreciate your trust in, and support of, our Funds, and we look forward to serving your financial needs in the years to come.

James G. O'Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

1

| Multi-Asset Team: Market review and forecast |

It has unquestionably been a turbulent year for markets. Significant financial and geopolitical events have been commonplace and long standing themes such as the omnipotence of central banks have been challenged. Here we review some of the recent market drivers and offer our view on the important developments that are likely to shape the next six months.

While a quick glance at the 2016 scoreboard might suggest broad-based investor confidence, the underlying picture is more nuanced. We believe that four main themes explain much of this year's price action, two bearish and two bullish:

1. Policy fatigue in Japan

With economists forecasting real gross domestic product (GDP) growth of 0.5% this year and consumer price index inflation of zero, it is not surprising that some investors are losing faith in "Abenomics"*.

Japan real effective exchange rate

Source: Bloomberg, August 2016. †Quantitative easing is a monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective.

Given the historically strong negative correlation between Japanese stock prices and the currency, the move has led Japanese markets to materially underperform global peers over the first half of 2016.

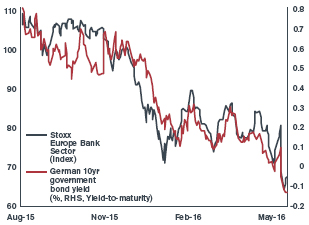

2. Frail financials

The combined impact of low or negative interest rates, flat yield curves, and mounting regulation has weighed heavily on the financial sector. Indeed, the performance of bank stocks has become increasingly correlated to bond yields over the last 12 months.

European banks and German bund yields

Source: Bloomberg, August 2016. The STOXX Sector indices are available for global markets as well as for Europe, the Eurozone and Eastern Europe. Using the market standard ICB Industry Classification Benchmark, companies are categorized according to their primary source of revenue. This categorization guarantees a professional and accurate classification of companies in their respective business environments. There are four levels of classification ranging from broad to very detailed: 10 industries are broken down into 19 supersectors, 41 sectors and 114 subsectors.

Such concerns were encapsulated by the financials panic at the start of the year, in which investors began to worry about banks' abilities to service coupon payments on low quality debt.

3. The prevailing global hunt for yield

Further expansionary monetary policy measures in Europe, Japan and the UK have driven global bond yields to new historic lows. This has been a significant tailwind for fixed income assets and has forced investors to find income elsewhere.

2

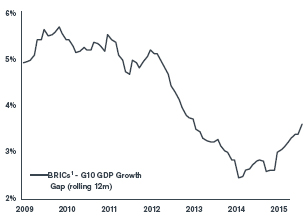

4. The rehabilitation of emerging markets

Emerging markets (EM) have been out of favor for some time, as falling commodity prices and weak developed market demand adversely affected growth. However, of late, the relative momentum has shifted. Market forces have also been supportive as the benefits from weak currencies and recovering commodity markets have eased financial tensions. As a result, EM debt and equities have outperformed their developed peers thus far in 2016.

Where next for global markets?

The macroeconomic picture remains challenging. Analysts continue to downgrade GDP, inflation and earnings forecasts and nominal growth remains subdued. Although the global economy is moving forwards, the recovery remains fragile, policy-dependent and vulnerable to adverse shocks.

Consensus forecasts for GDP growth

| | 2015 | 2016F | 2017F | Rvs 2016 |

| G10 | 1.9 | 1.6 | 1.7 | -0.6 |

| US | 2.4 | 1.9 | 2.2 | -0.9 |

| Eurozone | 1.5 | 1.5 | 1.2 | -0.2 |

| UK | 2.2 | 1.5 | 0.5 | -0.9 |

| Japan | 0.5 | 0.5 | 0.8 | -0.9 |

Source: Bloomberg consensus forecasts, 8/5/16

Note: Revisions (Rvs) refers to the change between the 2016 forecasts taken as of June 2015 and present.

Policy remains critical. Growth and inflation continue to trundle along below trend and many structural dynamics remain apparent. In Europe, corporate profitability is ebbing away and the financial sector is the key vulnerability opening a potential path to further political instability. In Japan, investors are keenly awaiting the Bank of Japan's review of monetary policy in September, to see whether they have exhausted their policy options. For the UK, the outlook is clouded by the uncertainty of its future relationship with the European Union and the path to get there. A short-term recession looks likely, however, monetary and fiscal assistance should limit the extent of a slowdown to a prolonged period of weak growth.

The era of EM underperformance looks to be coming to an end, with both top-down and bottom-up data suggesting a relative improvement in momentum versus developed markets. While it is not hard to identify frailties in the region, we see just as many threats facing the developed economies and correlations between EM equities and other assets that have fallen.

Emerging vs Developed markets GDP growth

Source: Bloomberg, August 2016. 1BRICs: Brazil, Russia, India and China

From monetary to fiscal easing

As the returns to monetary policy dwindle, we expect to see a greater role for fiscal policy. This theme does not appear to have affected financial markets thus far, however, large fiscal programs will undoubtedly face institutional constraints in some countries. Notwithstanding this, we believe that the shifting policy mix is beginning to gather some global momentum. While we believe that 'helicopter money' in its literal form (cash handouts) remains unlikely, further coordination between fiscal and monetary policy appears to be gaining traction with macroeconomists.

Outlook

It is not hard to imagine that the remainder of 2016 will be as eventful and surprising for investors as the year has been so far. In fact, we expect further surprises. Against this backdrop, it is important to remain vigilant, flexible and diversified and avoid taking significant bets on binary events.

| * Abenomics refers to the economic policies advocated by Shinzo Abe and is based upon the "three arrows" of fiscal stimulus, monetary easing and structural reforms. |

3

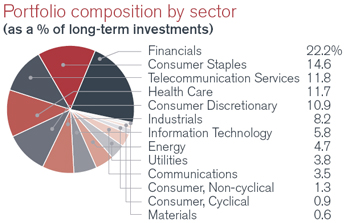

All Asset Fund

It has unquestionably been a turbulent year for markets. Significant financial and geopolitical events have been commonplace and long standing themes, such as the omnipotence of central banks, have been challenged. Over the period, market volatility increased substantially – with periods of relative calm punctuated by short episodic sell-offs such as those seen in August 2015 and January 2016. Furthermore, the easy gains from expansionary monetary policy have been made, leaving policy-makers increasingly bereft of ideas for new stimulus.

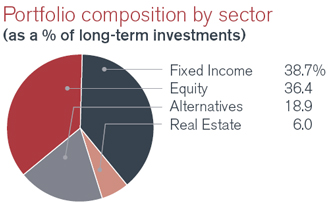

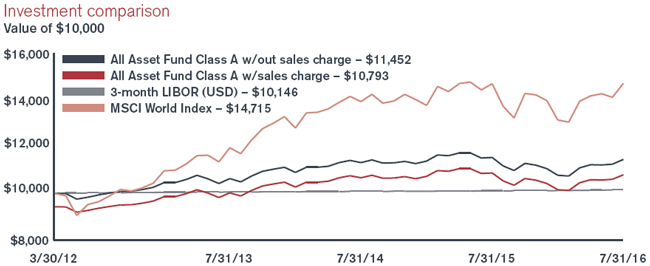

For the year ended July 31, 2016, the Fund returned (0.71)% (Class A at NAV) versus the benchmark, 3-month LIBOR (USD), which posted a return of 0.43%. The Fund's equity allocations were the largest detractor from performance accentuated by a strong dollar, which eroded returns from a domestic currency perspective. Performance was predominantly driven by the Fund's hedging assets with allocations to gold and investment-grade credit providing effective downside protection during setbacks.

Over the period, we dynamically adjusted the Fund's composition to reflect the fluid market environment. From a broad thematic perspective, we reduced the Fund's aggregate level of risk-exposure at the start of the period – primarily through sales of equity positions into cash and gold. Our above average cash balance has proven an effective buffer against market volatility in an environment where traditional

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| iShares TIPS Bond ETF | | | 4.6 | % |

| Henderson Unconstrained Bond Fund | | | 4.5 | |

| iShares Edge MSCI Minimum Volatility EAFE ETF | | | 4.0 | |

| TIAA-CREF Asset Management Core Property Fund LP | | | 3.8 | |

| iShares Core MSCI Emerging Markets ETF | | | 3.4 | |

| ASG Global Alternatives Fund | | | 3.4 | |

| PowerShares Senior Loan Portfolio | | | 3.2 | |

| Henderson High Yield Opportunities Fund | | | 3.2 | |

| AQR Managed Futures Strategy Fund | | | 3.1 | |

| iShares iBoxx Investment Grade Corporate Bond Fund | | | 3.1 | |

hedges, such as government bonds, appear expensive; we therefore retain a defensive stance in the Fund looking ahead.

As the period progressed, we slowly began to increase our emerging market (EM) equity and debt exposure at the expense of developed market assets. The change was spurred by improving absolute and relative macroeconomic fundamentals in the region – which we have largely disdained since the collapse in the oil price 18 months ago. The Fund also made an effective tactical investment in high yield (Henderson High Yield Opportunities Fund) at the start of 2016, when spreads were pricing a global recessionary scenario. We have since taken some profits on the trade, rotating into dollar-denominated EM debt, which is heavily supported by investor inflows.

We also diversified our US equity exposure by replacing a position in the S&P 500 with two equity-style ETFs. The two strategies increase our control over the equity-style bias of our US holdings and ensure the Fund's US exposure remains diversified. Finally, we added two new alternative strategies from Applied Quantitative Research, which bolster the diversifying sub-portfolio of the Fund by providing an attractive source of uncorrelated returns.

Looking forward, nominal growth remains subdued providing sustained support for global bond yields. That said, the increasing propensity to implement fiscal over monetary policy could begin to reverse this relationship to some degree. We remain overweight to equities relative to duration assets and see credit as more attractive than government bonds in our fixed income allocations. Our cash levels remain above average and we continue to underweight sterling relative to other international currencies.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

All Asset Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | inception |

| At NAV | | | symbol | | year | | years* | | (3/30/2012)* |

| Class A | | | HGAAX | | -0.71 | % | | 2.51 | % | | 3.17 | % |

| Class C | | | HGACX | | -1.46 | | | 1.72 | | | 2.40 | |

| Class I | | | HGAIX | | -0.45 | | | 2.78 | | | 3.43 | |

| Class R6** | | | HGARX | | -0.44 | | | 2.78 | | | 3.44 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -6.39 | % | | 0.51 | % | | 1.78 | % |

| Class C | | | | | | -1.46 | | | 1.72 | | | 2.40 | |

| Index | | | | | | | | | | | | | |

| 3-month LIBOR (USD) | | | | | | 0.43 | % | | 0.31 | % | | 0.34 | % |

| MSCI World Index | | | | | | 0.13 | | | 7.19 | | | 9.44 | |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

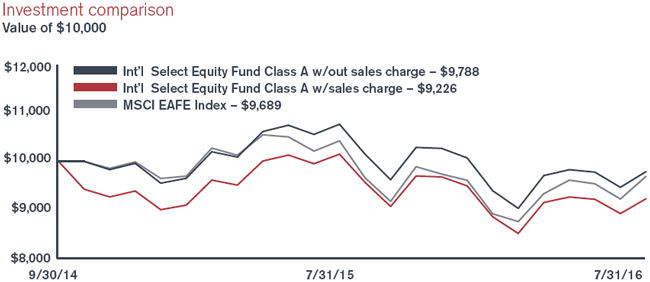

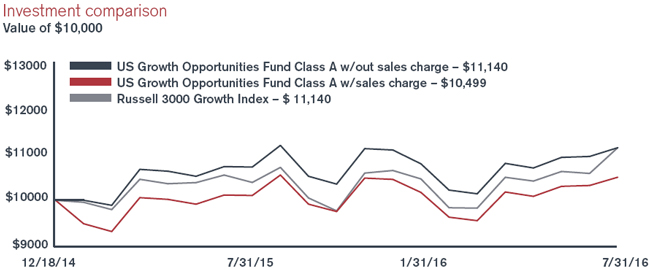

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.41%, 2.18%, 1.13% and 1.10% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.60% of the Fund's average daily net assets, which is in effect until July 31, 2020. With respect to investments in affiliated underlying funds, the Fund's adviser has contractually agreed to reduce or waive the Fund's management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund's management fee. Indirect net expenses associated with the Fund's investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) (USD) is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

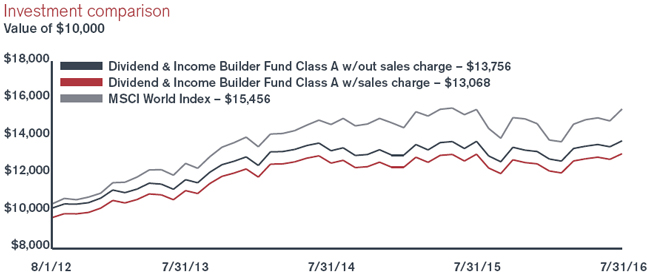

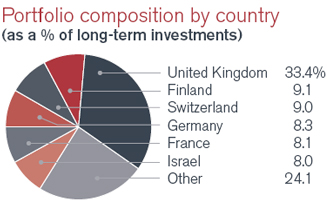

Dividend & Income Builder Fund

The global equity market (as measured by the MSCI World Index) was almost unchanged over the period to the end of July, though geographic and sector performance was widely dispersed. At the country level the US outperformed as the economy continued to modestly recover, giving the Federal Reserve the confidence to raise interest rates in December. In contrast, the UK market underperformed. This was partly a function of currency movements, as sterling fell sharply following the UK's vote to leave the European Union in June ("Brexit"). At the sector level, in an uncertain environment for global economic growth and continually low interest rates, financials were among the weakest performing sectors globally.

For the year ended July 31, 2016, the Fund returned 0.19% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 0.13%. Within this, the fixed income allocation was a positive contributor to returns. The Fund continued to meet its objectives for earning and distributing income over the period.

During the period, the Fund benefitted from its relatively defensive positioning, including an overweight position in the tobacco and telecommunications sectors. This was also reflected at the stock level where it tended to be the more defensive holdings such as Reynolds American, Lockheed Martin and Imperial Brands that performed well, while more cyclical positions such as BHP Billiton and Royal Dutch Shell detracted from performance. The outlier to this trend was the Fund's holding in pharmaceutical company Novartis. For a number of quarters Novartis has had problems with a slowdown in growth and lower margins from its eye care division, Alcon. While the results were disappointing, they have taken measures to improve performance, such as a reinvestment in research & development and putting in place a new head of the division.

Over the period, the Fund used currency hedges to protect against volatility in British pound sterling and

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security/Issuer | | | of net assets |

| Nestle S.A. | | | 2.6 | % |

| Microsoft Corp. | | | 2.6 | |

| Pfizer, Inc. | | | 2.4 | |

| Novartis AG | | | 2.2 | |

| Verizon Communications, Inc. | | | 2.1 | |

| Imperial Brands plc | | | 2.1 | |

| Roche Holding AG | | | 2.1 | |

| RELX N.V. | | | 2.1 | |

| Reynolds American, Inc. | | | 2.0 | |

| Chevron Corp. | | | 1.8 | |

the euro. The sterling hedge significantly reduced the impact of Brexit on the portfolio. We continue to see volatility in currencies as investors question the outlook for economic growth and interest rates across the world. We will seek to protect against currency volatility when the Fund has a significant overweight position versus the benchmark in higher dividend yielding markets.

In its equity allocation, the Fund continues to seek companies with both above-average yield and dividend growth. The equity allocation remained over 80% of the Fund, reflecting our current bias towards equities over bonds. While corporate earnings growth has remained mixed in recent years, dividend growth has proven more consistent. In comparison to other asset classes such as government or corporate bonds, it is our view that equities continue to offer good value, especially given the prospects for ongoing dividend growth. In the fixed income allocation, we prefer credit over interest rate risk and continue to invest in high quality names with attractive coupons.

The outlook for global dividend growth remains modestly positive. Within the portfolio we have seen this across many of our holdings. Taiwan Semiconductor, for example, recently increased its dividend by 33% as a result of the strength of its free cash flow generation. This is particularly positive as Taiwan historically has been a low pay-out ratio market. Within Europe we have also seen double-digit dividend increases from holdings such as AXA, and French homebuilder Nexity. There are some sectors where we are more cautious on the ability for dividend growth – integrated oil companies, for example, are on the whole struggling to generate sufficient free cash flow to cover their dividends despite steep capital expenditure cuts and disposals. Looking at the market as a whole, in our view, dividend growth rates remain positive but the rate of growth has declined to reflect the more cautious economic outlook.

In the context of lower global economic growth, we are comfortable with the defensive positioning of the equity allocation among good quality, global companies. The Fund continues to have an underweight position among cyclical sectors such as industrials, technology and basic materials. Within fixed income, the post-Brexit rally in bond prices across the credit spectrum has left us with a general sense that the returns we expected for the remainder of 2016 have been pulled forward to the month of July. That being said, the backdrop of low growth, low inflation and low default rates in Europe remains supportive of the asset class.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

Dividend & Income Builder Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | inception |

| At NAV | | | symbol | | year | | years* | | (8/1/2012)* |

| Class A | | | HDAVX | | | 0.19 | % | | 5.61 | % | | 8.30 | % |

| Class C | | | HDCVX | | | -0.58 | | | 4.81 | | | 7.49 | |

| Class I | | | HDIVX | | | 0.48 | | | 5.86 | | | 8.54 | |

| Class R6** | | | HDRVX | | | 0.66 | | | 5.92 | | | 8.59 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -4.84 | % | | 3.82 | % | | 6.91 | % |

| Class C | | | | | | -0.58 | | | 4.81 | | | 7.49 | |

| Index | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 0.13 | % | | 7.19 | % | | 11.21 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.47%, 2.24%, 1.25% and 1.19% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.05% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float- adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Emerging Markets Fund

It was a year of two halves for emerging markets (EM) equities after a weak first half of the period was followed by a strong rebound in the second half. The initial weakness was driven by sustained investor bearishness on the asset class which was aided by concerns relating to the slowing Chinese economy, low commodity prices and continuing geopolitical issues. This was compounded by US dollar strength and the speculation surrounding the path for interest rates in the US. As the year progressed, many of these fears receded and appetite for EM equities resurfaced. Thus far in 2016, EM equities have outperformed their developed markets peers, in which the growing risks have featured heavily in news flow.

For the year ended July 31, 2016, the Fund returned 6.07% (Class A at NAV) versus the benchmark, MSCI Emerging Markets Index, which posted a return of (0.38)%. The Fund has benefitted from this year's rebound in Brazilian equities from what were quite distressed valuations. While on a short-term view valuations are no longer so attractive, on our five-year outlook we believe businesses such as Duratex, Mahle-Metal Leve and Banco Bradesco, which all contributed to performance over the period, are well positioned to enjoy a cyclical recovery when it comes. The Fund's exposure to South African equities was also a positive with consumer staples firms Shoprite and Tiger Brands performing well. We are excited by how many high-quality companies are currently trading at reasonable valuations. Many of these also have growing operations across sub-Saharan Africa

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Standard Bank Group, Ltd. | | | 3.5 | % |

| Shoprite Holdings, Ltd. | | | 3.4 | |

| Mahle-Metal Leve S.A. | | | 3.2 | |

| Inversiones Aguas Metropolitanas S.A. | | | 3.1 | |

| Fuyao Glass Industry Group Co., Ltd. | | | 3.1 | |

| Uni-President Enterprises Corp. | | | 3.1 | |

| Housing Development Finance Corp., Ltd. | | | 3.1 | |

| Duratex S.A. | | | 2.9 | |

| Grupo Herdez SAB de CV | | | 2.8 | |

| Cia Cervecerias Unidas S.A., ADR | | | 2.7 | |

meaning they should be able to deliver long-term growth. The Fund's relative underexposure to information technology businesses detracted from performance while on a stock level the Fund's principal detractors were Idea Cellular, the Indian mobile networks company, and Grupo Herdez, a Mexican foods firm.

Over the period the Fund added Chinese auto-glass manufacturer Fuyao Glass. Fuyao continues to be managed by its founder and has expanded into the US and Europe. The Fund also added brand-building Taiwanese businesses Stella International, a footwear company, and Merida, a leading bike manufacturer. Many Taiwanese companies are expanding into China where the consumer base is growing more and more discerning. A position in UltraTech, an Indian cement company, was also taken. Cement consumption in some less developed markets shares the same fundamental driver as basic fast moving consumer goods: namely improving living standards. Indian cement sales are conducted mostly in cash and demand is largely driven by the need for improved housing. A unique feature of Ultratech is its network of over 50,000 dealers throughout India selling "Ultratech" branded cement. This network is far larger than any of its competitors and has enabled the company to reach an almost 40% market share in rural India. SABMiller was sold after the 'MegaBrew' merger was announced. Other sales over the period included Pick n Pay, Baidu and Astra International.

Weak rule of law combined with many undesirable political and business leaders mean there are parts of the EM universe that are cheap for a reason. We are not deep value investors and aim to avoid being seduced by low-quality companies trading cheaply. Neither are we outright growth investors and we continue to avoid what we believe are overvalued but growing Indian and South East Asian consumer businesses. Instead, as "bottom-up" stock pickers, our focus is on combing unpopular markets for good-quality companies trading at reasonable valuations.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

Emerging Markets Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | year | | years* | | years* | | (12/31/2010)* |

| Class A | | | HEMAX | | | 6.07 | % | | 2.42 | % | | -0.83 | % | | -1.21 | % |

| Class C | | | HEMCX | | | 5.27 | | | 1.65 | | | -1.58 | | | -1.95 | |

| Class I | | | HEMIX | | | 6.41 | | | 2.70 | | | -0.58 | | | -0.97 | |

| Class R6** | | | HEMRX | | | 7.59 | | | 3.08 | | | -0.36 | | | -0.77 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | 0.03 | % | | 0.41 | % | | -1.99 | % | | -2.25 | % |

| Class C | | | | | | 5.27 | | | 1.65 | | | -1.58 | | | -1.95 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -0.38 | % | | 0.07 | % | | -2.41 | % | | -1.96 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 2.14%, 2.91%, 1.86% and 1.78% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.54% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

European Focus Fund

Market volatility which began in August dominated the third quarter of 2015, with European equities suffering in tandem with equities worldwide. Concerns over global implications of a slowing Chinese economy precipitated a global sell-off which extended to Europe. German equities, in particular, were hit quite hard due to their export relationship with China. The third quarter also saw a new bailout agreement between Greece and the European Union (EU); a snap election was called shortly afterwards with the incumbent Syriza party remaining as the largest party in the Greek parliament. European equities did produce a strong final quarter of the year - European Central Bank President Mario Draghi announced the extension of their quantitative easing program in December while also cutting the deposit rate to a historic low. After a turbulent start to 2016, including one of the worst Januarys in recent memory, March saw a significant rebound for the vast majority of risk assets with the positive momentum which started midway through February continuing through much of March. Market movements in the second quarter were dominated by the lead up to, and the fallout from, the UK's decision to leave the EU. This outcome caused much volatility in equity markets and currencies.

For the year ended July 31, 2016, the Fund returned (12.20)% (Class A at NAV) versus the benchmark, MSCI Europe Index, which posted a return of (9.75)%. The overweight exposure to consumer discretionary was the main detractor to performance.

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Nokia Oyj | | | 8.6 | % |

| Teva Pharmaceutical Industries, Ltd., ADR | | | 8.1 | |

| Royal Dutch Shell plc, B Shares | | | 5.6 | |

| Dufry AG | | | 3.9 | |

| Roche Holding AG | | | 3.8 | |

| ARM Holdings plc | | | 3.2 | |

| Sanofi | | | 3.1 | |

| Renault S.A. | | | 3.1 | |

| ASML Holding N.V. | | | 3.0 | |

| Continental AG | | | 2.7 | |

Health care exposure led positive returns, while energy and IT exposure was also beneficial.

During the second half of 2015, the Fund took advantage of the adverse price movements in emerging markets-exposed companies such as asset managers Aberdeen and Ashmore. Shire, the pharmaceuticals company, was also added as the Fund increased its health care exposure, while German pharmaceutical company Bayer was also added at the start of 2016. Exposure to financials was increased towards the end of 2015 before being reduced during 2016. The second quarter of 2016 saw the Fund undertake significant trimming within the portfolio in order to focus in on high conviction holdings. This concentration of the portfolio has led to the Fund adding to positions such as Teva Pharmaceutical and Dufry.

In terms of currency hedging, the Fund initiated a hedge on the euro in the third quarter of 2015 in case of any adverse movements versus the US dollar. The Fund closed the hedge on the euro in the early part of 2016. The Fund introduced a British pound sterling hedge in July. There are material risks of a lower sterling; with markets potentially showing a lot of sensitivity to central bank commentary, data releases, political crises and news flow regarding the timeline on when negotiations for the UK's exit from the EU may begin, we believed that some protection was warranted.

The UK's vote to leave the EU adds a layer of uncertainty for global equities over the short to medium term as we wait to find out how the UK's future relationship with the EU manifests itself. As with any major market event, sentiment often goes too far and this presents opportunities for the stock picker. We remain vigilant for new opportunities and continue to believe Europe and international markets, more broadly, offer value for investors.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

European Focus Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFEAX | | | -12.20 | % | | 4.10 | % | | 4.02 | % | | 6.48 | % | | 13.80 | % |

| Class C | | | HFECX | | | -12.91 | | | 3.29 | | | 3.21 | | | 5.67 | | | 12.94 | |

| Class I** | | | HFEIX | | | -12.01 | | | 4.35 | | | 4.30 | | | 6.69 | | | 13.95 | |

| Class R6*** | | | HFERX | | | -11.99 | | | 4.36 | | | 4.31 | | | 6.69 | | | 13.95 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -17.25 | % | | 2.07 | % | | 2.80 | % | | 5.85 | % | | 13.35 | % |

| Class C | | | | | | -12.91 | | | 3.29 | | | 3.21 | | | 5.67 | | | 12.94 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | -9.75 | % | | 1.50 | % | | 3.17 | % | | 2.39 | % | | 5.47 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.31%, 2.10%, 1.08% and 1.01% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

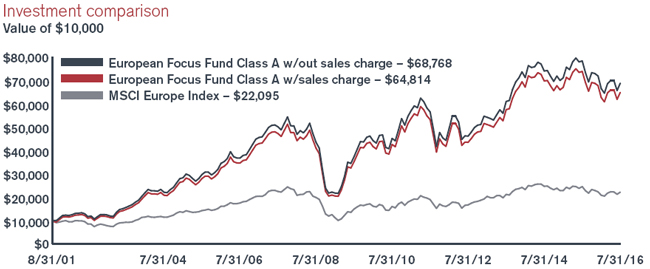

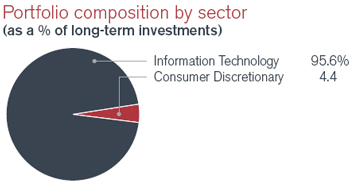

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

Global Equity Income Fund

The global equity market (as measured by the MSCI World Index) was almost unchanged over the period to the end of July, though geographic performance was widely dispersed. The US market outperformed as the economy continued to modestly recover, giving the Federal Reserve the confidence in December to raise interest rates. In contrast, the UK was among the weaker performing markets globally. This was partly as a result of currency moves, as sterling fell sharply against the US dollar following the UK vote to leave the European Union (EU) in June. The other notable move during the year was the oil price, which fell sharply to under $30/barrel as a result of supply increases before increasing to just above $40/barrel at year end.

For the year ended July 31, 2016, the Fund returned (1.05)% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 0.13%. The Fund continued to meet its objectives for earning and distributing income over the period. The Fund underperformed the benchmark largely as a result of geographic allocation, in particular the overweight position in the higher-yielding UK and European markets and underweight position in the structurally lower-yielding US market.

Investments for the Fund continued to be focused on those companies we believe to be capable of delivering earnings and free cash flow growth, subsequently leading to dividend growth. A good example of this would be the telecommunications sector. For several years telecom companies have

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Royal Dutch Shell plc, A Shares | | | 3.2 | % |

| British American Tobacco plc | | | 3.1 | |

| BP plc | | | 2.9 | |

| BT Group plc | | | 2.6 | |

| Legal & General Group plc | | | 2.4 | |

| ING Groep N.V. | | | 2.4 | |

| Singapore Telecommunications, Ltd. | | | 2.4 | |

| SSE plc | | | 2.2 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 2.1 | |

| Pfizer, Inc. | | | 2.0 | |

been investing heavily in expanding fourth generation ('4G') coverage for customers, and this capital expenditure is beginning to subside (boosting cash generation) at the same time as data usage among customers is increasing.

Over the period, the Fund used currency hedges to protect against volatility in the following currencies: British pound sterling, the euro and the Australian dollar. The sterling hedge significantly reduced the impact of the UK referendum to leave the EU on the portfolio.

We continue to see volatility in currencies as investors question the outlook for economic growth and interest rates across the world. We use currency hedges to protect against currency volatility when we have a significant overweight position versus the benchmark in higher dividend-yielding markets, such as the UK and Australia.

The outlook for global dividend growth remains modestly positive. Within the portfolio we have seen this across our holdings – Cisco, for example, raised its quarterly dividend 24% earlier this year as a result of its strong free cash flow generation. There are some sectors where we are more cautious on the ability for dividend growth – integrated oil companies, for example, are on the whole struggling to generate sufficient free cash flow to cover their dividends despite steep capital expenditure cuts and disposals. Looking at the market as a whole, in our view, dividend growth rates have declined to reflect the more cautious economic outlook, but remain positive.

The Fund's focus on high quality, income-generating investments has provided support during the volatile markets seen during the period. We will seek to benefit from periods of volatility by opportunistically adding to any attractively valued companies that offer healthy long-term income and capital appreciation prospects. We believe the portfolio is attractively valued versus the benchmark and we see potential for capital and income returns for investors. Low prevailing interest rates around the world mean that investors will continue to look for income generating assets, such as those held by the Fund.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

12

Global Equity Income Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | year | | years* | | years* | | (11/30/2006)* |

| Class A | | | HFQAX | | | -1.05 | % | | 3.70 | % | | 6.08 | % | | 3.59 | % |

| Class C | | | HFQCX | | | -1.76 | | | 2.92 | | | 5.27 | | | 2.81 | |

| Class I** | | | HFQIX | | | -0.83 | | | 3.94 | | | 6.34 | | | 3.79 | |

| Class R6*** | | | HFQRX | | | -0.54 | | | 4.04 | | | 6.40 | | | 3.82 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -6.74 | % | | 1.67 | % | | 4.84 | % | | 2.96 | % |

| Class C | | | | | | -1.76 | | | 2.92 | | | 5.27 | | | 2.81 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 0.13 | % | | 7.19 | % | | 8.52 | % | | 4.54 | % |

| MSCI World High Dividend Yield Index | | | | | | 5.81 | | | 6.56 | | | 8.52 | | | 4.18 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.19%, 1.96%, 0.96% and 0.89% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.15% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within the MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

Global Technology Fund

It was a volatile period for the technology market which initially underperformed during the third quarter of 2015 as international equity market sell-offs, which began in China, spread globally. The final quarter of the year saw international equity markets bounce back; central banks dominated the news flow as the European Central Bank extended their quantitative easing program and the Federal Reserve hiked interest rates for the first time this cycle. Technology outperformed the broader market against this backdrop. The start of 2016 saw heightened volatility and fears of a macro slowdown which led the technology market lower. The second quarter of 2016 saw international equity markets finishing down after the UK's vote to leave the European Union ("Brexit") in late June prompted a sell off. Technology underperformed the wider market against this backdrop.

For the year ended July 31, 2016, the Fund returned 2.03% (Class A at NAV) versus the benchmark, the MSCI AC World IT Index, which posted a return of 8.66%. This was a weaker period for technology funds with the Morningstar Technology category average also underperforming the index. The technology hardware storage & peripherals sector contributed positively to performance, while semiconductors and IT services were the main detractors. At the stock level, among the main detractors were Microsoft, Vipshop Holdings and Web.com. Apple (on a relative basis), Amazon and Activision Blizzard were among the positives.

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Facebook, Inc., Class A | | | 7.3 | % |

| Apple, Inc. | | | 6.3 | |

| Alphabet, Inc. Class A | | | 5.6 | |

| Alphabet, Inc. Class C | | | 5.4 | |

| Visa, Inc., A Shares | | | 4.4 | |

| Samsung Electronics Co., Ltd. | | | 4.3 | |

| Tencent Holdings, Ltd. | | | 3.7 | |

| Cisco Systems, Inc. | | | 3.7 | |

| Broadcom, Ltd. | | | 3.2 | |

| MasterCard, Inc., Class A | | | 3.0 | |

Notable activity over the latter part of 2015 included the sale of Oracle and switch into Adobe. We increased our holding in Facebook given its dominant position in internet advertising and sold Netflix as we believed the valuation had gotten excessive following a strong run. We also reduced more macro-sensitive names such as Cisco, HP Enterprise and Ciena. We actively reduced our higher beta positions, increased our cash position and tried to position the portfolio more defensively. The start of 2016 began with significant market volatility and we used this to opportunistically buy strong franchises at relatively attractive prices. For example, we initiated a new position in PayPal given the company's exposure to paperless payments, its strong platform and reasonably attractive valuation. We also added to other names such as Electronic Arts, Qualcomm and Alphabet over the period. The second quarter of 2016 included the purchase of a stake in Alibaba given its dominant franchise in Chinese e-commerce and relatively attractive valuation. We reduced Microsoft following the acquisition of LinkedIn, a deal where we questioned the rationale.

The long term drivers of technology remain intact, as it continues to take share versus the old economy, driven by demographics and innovation. The relative valuation of the sector is attractive, especially given the balance sheet strength. The headwinds from a strengthening dollar in 2015 are now abating, which should benefit the sector, although some currency volatility is expected post-Brexit. However, the sector faces significant secular changes in enterprise demand, due to a move toward cloud infrastructure, coupled with the maturation of the personal computer and smartphone markets. This may result in moderating outperformance by the sector. We continue to focus "bottom up" on powerful secular themes and growth at a reasonable price.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

14

Global Technology Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFGAX | | | 2.03 | % | | 9.69 | % | | 8.32 | % | | 9.83 | % | | 8.48 | % |

| Class C | | | HFGCX | | | 1.23 | | | 8.85 | | | 7.49 | | | 8.99 | | | 7.68 | |

| Class I** | | | HFGIX | | | 2.27 | | | 9.95 | | | 8.60 | | | 10.03 | | | 8.62 | |

| Class R6*** | | | HFGRX | | | 2.53 | | | 10.04 | | | 8.65 | | | 10.06 | | | 8.64 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -3.82 | % | | 7.54 | % | | 7.05 | % | | 9.18 | % | | 8.05 | % |

| Class C | | | | | | 1.23 | | | 8.85 | | | 7.49 | | | 8.99 | | | 7.68 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 8.66 | % | | 14.63 | % | | 12.65 | % | | 9.23 | % | | 6.47 | % |

| S&P 500 | | | | | | 5.61 | | | 11.16 | | | 13.38 | | | 7.75 | | | 6.60 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.35%, 2.13%, 1.12% and 1.04% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

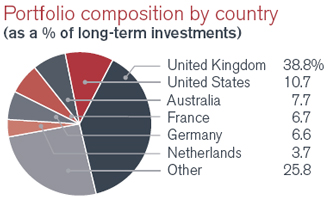

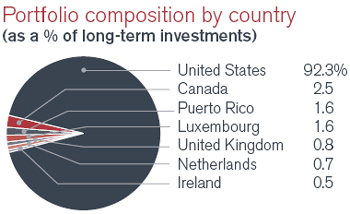

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

High Yield Opportunities Fund

Declining global government bond yields continue to force investors further out on the credit risk spectrum in the search for income. The US high yield market suffered steep declines over the reporting period driven by unclear Federal Reserve expectations, languishing commodity prices, persistent retail outflows and emerging markets growth concerns. For most of the period higher quality rated bonds (double-B) outperformed lower quality rated bonds (triple-C) and both energy and metals/mining were the worst performing sectors. The energy sector now represents over 26% of the emerging market high yield segment as compared to 14% for US high yield and only 5% for European high yield. By region, European high yield outperformed US high yield and emerging market high yield over the reporting period.

Throughout 2016, retail fund flows were negative and new bond issuance fell below last year's amount. Over the same period, approximately 73% of all defaults and distressed debt exchanges occurred in the energy and metals/mining (mostly coal) sectors; excluding the energy and metals and mining (mostly coal) sectors, the trailing 12-month default rate was only 0.56%.

For the year ended July 31, 2016, the Fund returned 4.63% (Class A at NAV) versus the benchmark, Bank of America Merrill Lynch US High Yield Master II Constrained Index, which posted a return of 4.95%.

| Top 10 long-term holdings* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security/Issuer | | | of net assets |

| Prime Security Services Borrower LLC | | | 2.4 | % |

| Herc Rentals, Inc. | | | 1.8 | |

| Frontier Communications Corp. | | | 1.7 | |

| BWAY Holding Co. | | | 1.5 | |

| Popular, Inc. | | | 1.5 | |

| Intelsat Jackson Holdings S.A. | | | 1.5 | |

| Sunoco LP/Sunoco Finance Corp. | | | 1.5 | |

| Signode Industrial Group Lux S.A. | | | 1.4 | |

| Hot Topic, Inc. | | | 1.4 | |

| Argos Merger Sub, Inc. | | | 1.4 | |

Over the period, the Fund benefitted from maintaining a higher quality bias within the lower rating tiers. While an underweight allocation to double-B rated bonds was maintained, the Fund outperformed on strong credit selection, an allocation to loans and an underweight stance in the energy sector. While the Fund incurred some losses in the energy sector, it benefitted from a higher quality bias in this space. The Fund's best sector and company contributors were in defensive industries like healthcare and media, while the worst detractors were almost exclusively in the energy and metals/mining segments.

The Fund is now positioned closer to the benchmark as far as credit risk (as measured by yield) and in line as far as weighted average credit rating. Within the energy sector, we decreased our underweight position during the second quarter of 2016 and have focused on higher quality exploration & production companies as well as midstream companies. We continue to be selective in the new issue market. We have made a conscious effort to add risk to the portfolio over the last three months but have found it difficult given the challenging secondary market liquidity and the higher quality bias of the new issue calendar.

Our energy outlook has improved given the fact that oil has moved from $25 to $50 per barrel (and recently back to $40); furthermore, most of the defaults and distressed exchanges that we expected to occur in the energy sector have taken place. We will look to move the portfolio more in line with the benchmark as far as yield and spread and rely on credit selection as the main driver of alpha over the next few months and quarters. Low global government bond yields continue to drive strong demand for high yield bonds and leveraged loans on both the retail and institutional side.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

16

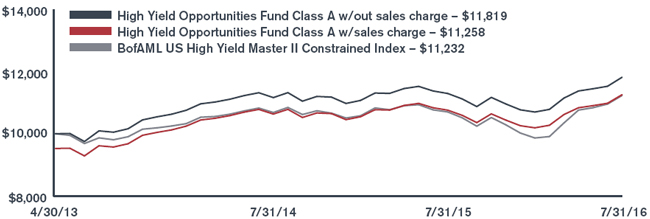

High Yield Opportunities Fund

| Total returns as of July 31, 2016 | | | | | | | | | | | Since |

| | | | NASDAQ | | One | | Three | | inception |

| At NAV | | | symbol | | year | | year* | | (4/30/2013)* |

| Class A | | | HYOAX | | | 4.63 | % | | 5.41 | % | | 5.27 | % |

| Class C | | | HYOCX | | | 3.88 | | | 4.58 | | | 4.47 | |

| Class I | | | HYOIX | | | 4.76 | | | 5.60 | | | 5.49 | |

| Class R6** | | | HYORX | | | 4.70 | | | 5.58 | | | 5.47 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -0.31 | % | | 3.70 | % | | 3.70 | % |

| Class C | | | | | | 3.88 | | | 4.58 | | | 4.47 | |

| Index | | | | | | | | | | | | | |

| BofAML US High Yield Master II Constrained Index | | | | | | 4.95 | % | | 4.41 | % | | 3.64 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.24%, 1.86%, 1.01% and 1.01% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.68% of the Fund's average daily net assets, which is in effect until July 31, 2020. Prior to March 31, 2016, this contractual expense limitation was set at 0.85%. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

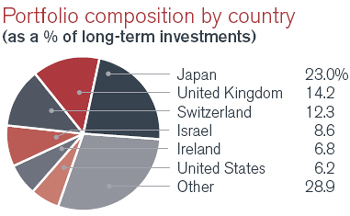

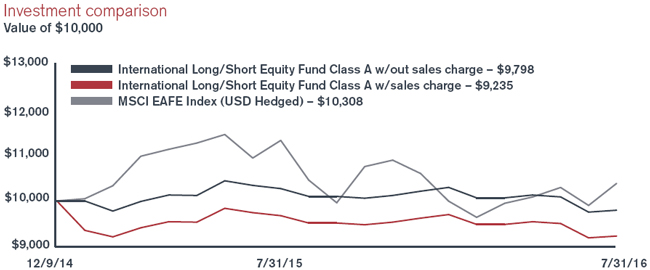

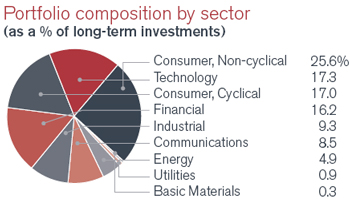

International Long/Short Equity Fund

During the third quarter of 2015, the heightened volatility which began in China, spread globally. After the surprise devaluation of the yuan by the Chinese central bank and fears over slowing economic growth in China, Asia Pacific markets and emerging markets tumbled. European markets followed suit, where price falls were particularly evident in Germany. International equity markets rebounded during the fourth quarter; central banks dominated the news flow as the European Central Bank extended their quantitative easing program while the Federal Reserve increased interest rates for the first time this cycle. The start of 2016 saw a sharp and indiscriminate sell-off with China once again the main area of concern, where authorities intervened with trading halts and liquidity injections, which further weakened the Chinese currency. A further slump in oil and other commodity prices raised fears of deflation. Both developed and emerging equity markets were caught up in the sell-off as investors grew increasingly concerned about the path of global economic growth. A strengthening US dollar compounded this decline for local investors. The second quarter was dominated by the UK's vote to leave the European Union (EU) in late June, ushering in a period of prolonged uncertainty as the

| Top 5 "Long" Holdings (including equity swaps)* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Teva Pharmaceutical Industries, Ltd., ADR | | | 3.5 | % |

| Dufry AG | | | 3.1 | |

| Auto Trader Group plc | | | 2.5 | |

| Inmarsat plc | | | 2.5 | |

| DJI Holdings plc | | | 2.5 | |

| | | | |

| Top 5 "Short" Holdings (including equity swaps)* |

| (at July 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| SSE plc | | | (2.1 | )% |

| Airbus Group NV | | | (1.4 | ) |

| Mitie Group plc | | | (1.2 | ) |

| Carillion plc | | | (1.2 | ) |

| Fenner plc | | | (1.1 | ) |

market waits to see how the UK manages the fallout from the referendum and also how the relationship between the UK and the EU will manifest itself.