UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

____________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

____________________________________________________________________________

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: July 31, 2015

Item 1: Report to Shareholders.

| Letter to shareholders | 1 |

| Commentaries and Performance summaries | |

| All Asset Fund | 4 |

| Dividend & Income Builder Fund | 6 |

| Emerging Markets Fund | 8 |

| European Focus Fund | 10 |

| Global Equity Income Fund | 12 |

| Global Technology Fund | 14 |

| High Yield Opportunities Fund | 16 |

| International Long/Short Equity Fund | 18 |

| International Opportunities Fund | 20 |

| International Select Equity Fund | 22 |

| Strategic Income Fund | 24 |

| Unconstrained Bond Fund | 26 |

| US Growth Opportunities Fund | 28 |

| Portfolios of investments | 30 |

| Statements of assets and liabilities | 118 |

| Statements of operations | 126 |

| Statements of changes in net assets | 134 |

| Statements of changes – capital stock activity | 147 |

| Statement of cash flows | 161 |

| Financial highlights | 162 |

| Notes to financial statements | 182 |

| Report of independent registered public accounting firm | 197 |

| Other information | 198 |

| Trustees and officers | 204 |

International and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies which typically involve greater risk than investing in larger companies. Certain of the Funds are non-diversified and therefore the change in value of a single holding may have a more pronounced effect on a Fund’s performance. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition, the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses. The Funds may be subject to frequent trading which may result in a turnover rate of 100% or more. Additional fund-specific risk is described in more detail in the Prospectus and Statement of Additional Information.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains these items and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

Dear shareholder,

We are pleased to provide the annual report for the Henderson Global Funds, which covers the year ended July 31, 2015.

In our last shareholder letter, we wrote that there were positive global economic signs already emerging in 2015. Now, over halfway through the year, we have seen many of those positive signs continue, but we note that some negative data has begun to emerge as well.

On the positive side, European economies have been improving despite the headlines of an ongoing crisis in Greece. The tailwinds provided by a lower euro currency, cheaper oil and the European Central Bank’s quantitative easing program have provided a solid platform for recovery. European markets have also recently been buoyed by the news that the Greek government secured interim financing and agreed to a new bailout program with its creditors. Finally, positive signs such as improvements in Purchasing Managers’ Indices, auto and retail sales and bank lending are filtering down to the corporate level and have translated into higher earnings growth forecasts across Europe. After 210 weeks of consecutive earnings downgrades, Europe recently returned to seeing consensus earnings upgrades for the first time since March 2011.

Japanese markets have also moved forward in 2015 despite disappointing macro numbers, including a downturn in second quarter household spending and weaker manufacturing output. With the Bank of Japan continuing its comprehensive asset purchase program, Japanese equity markets remain the best performing dollar-adjusted market in 2015.

In the US, a healthy 223,000 jobs were added in June and the unemployment rate fell from 6.2% in July 2014 to 5.3% in July 2015. Improvements in the economy and the Federal Reserve’s official communications increased expectations for an interest rate hike in the near term.

On a more negative note, ongoing concern over the health of China’s economy has led to further declines in commodity prices, and the Chinese market overall has been weak. In fact, extreme volatility in the Chinese market recently prompted the Chinese government to intervene in an attempt to quell frenetic selling by retail investors. The government’s measures included suspending trading on over 50% of listed A-shares, banning short-sales and initial public offerings, and prohibiting major shareholders from selling their stakes.

The effect of China’s macroeconomic slowdown has significantly affected other emerging markets, both directly and through its impact on the price of major commodities. Many emerging market economies rely on revenues from commodity exports and there have been knock-on effects on currency and stock markets across Latin America, Africa and parts of Asia. Latin American markets generally have struggled in 2015, with Brazil particularly beset by low commodity prices and political scandal.

Looking forward, as the Greek debt crisis moves towards a full resolution, we believe diverging monetary policy and economic momentum will return as a dominant theme. Investors will be particularly interested in when, and how quickly, the Federal Reserve and Bank of England raise interest rates and the impact this will have on the global economy. The slowing of the emerging market business cycle will also be important, notably in local equity markets, commodities, and emerging market currencies.

At Henderson, we marked the three-year anniversaries of the All Asset Fund on March 30, 2015 and the Dividend & Income Builder Fund on August 1, 2015. We are also pleased to report that Henderson won the “Global Group of the Year” award1 at Investment Week’s 2015 Fund Manager of the Year Awards in the UK, in recognition of Henderson’s strong fund performance, its new brand and strategic acquisitions that widen the investment skillset. We appreciate your trust in, and support of, our Funds, and we look forward to serving your financial needs in the years to come.

James G. O’Brien

President, Henderson Global Funds

| 1 | The Investment Week Global Group of the Year award took into consideration the new Henderson global brand, fund flows including those into US products and strategic acquisitions including that of Geneva Capital Management in the US. |

1

| The need for income – looking beyond fixed income |

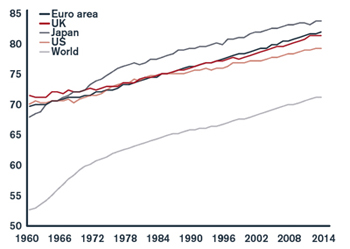

With baby boomers entering retirement age and people living longer, the need for income has never been greater

| • | The World Bank projects the world’s population will continue to shift upward in age and, by 2050, 15% of the world’s population will be over the age of 65 |

| | |

| • | Life expectancy around the world is also projected to grow continually due to advances in healthcare and technology |

| | |

| • | This global shift in population age and life expectancy will create greater demand in the future for diversified sources of inco ome me to meet basic living needs |

Life expectancy

Source: World Bank Economic Data as of 7/31/15

Population statistics

| World | 2005 | 2015 | 2035 | 2050 |

| Population Growth | 1.3% | | 1.1% | | 0.7% | | 0.5% | |

| Population: Age 0-14 | 28.0% | | 26.1% | | 22.8% | | 21.6% | |

| Population: Age 15-64 | 64.7% | | 65.7% | | 64.5% | | 63.2% | |

| Population: Age 65 & above | 7.3% | | 8.2% | | 12.7% | | 15.5% | |

Source: World Bank Economic Data as of 7/31/15

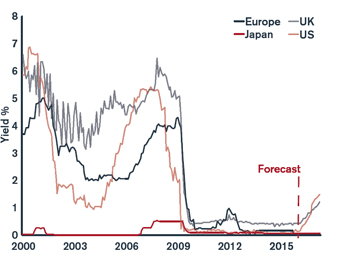

Falling rates have driven a search for other sources of income

| • | Government interest rates and fixed income yields have been on the decline worldwide since the financial crisis of 2008 due to slowing global growth and unprecedented global monetary policy, leaving investors with few options for high income sources |

| | |

| • | On the other hand, dividends for global equities have been steadily rising and offer investors a diversified source for income with the potential for a much more attractive yield |

Expected path for interest rates remains low

Source: Bloomberg as of 7/31/15

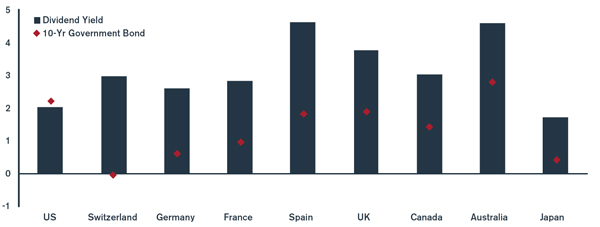

Dividend yields

Source: Thompson Datastream as of 7/31/15. The MSCI Indices are free float-adjusted market capitalization indices that are designated to measure market equity performance within their specific geographic region.

2

There’s more than one path to income

International dividends currently offer larger yields when compared to fixed income

Source: Thompson Datastream as of 7/31/15

Further, in many markets we’re seeing dividend yields higher than corporate bond yields. For example, more than 50% of European companies have a dividend yield greater than their corporate bond yield.

Percent of European companies with dividend yield > corporate bond yield

Source: Goldman Sachs, as of 6/30/15 Note: Indices used are DJ Stoxx 600 and iBoxx EUR/GBP corporate bond yields. CY= corporate bond yield, DY= dividend yield

Dividend growth outlook

2015 has been a strong year for dividend growth with the MSCI World Index as a whole forecasted to grow 6%. Regionally, Japan and the US are forecast to be the fastest countries for dividend growth with some companies growing dividends at double-digit rates. We have also seen an ongoing theme of companies returning cash via special dividends and share buybacks. Looking long-term, we remain encouraged by the prospects for dividend growth. Many sectors and countries, previously often outside the realm of dividend investors, have become more focused on consistently returning cash to shareholders.

Relative to other asset classes, dividend paying equities look attractively valued, particularly in a world where income is scarce; dividend yields are, in the majority of cases, above corporate bond yields with the added benefit that we believe those dividends are capable of growing.

It remains our view that the outlook for dividend paying equities is favorable - in particular those capable of generating sustained dividend growth backed by earnings and cash flow.

3

All Asset Fund

There are a number of macroeconomic forces that suggest 2016 will see the return of market volatility. We retain a positive view on equity markets relative to bonds in this environment; however, we expect the divergence in global monetary policy and growing pains in the major emerging market economies to provide plenty of potential pitfalls for increasingly macro-driven global markets.

While the declining oil price has been beneficial for many emerging economies, the fall in the price of broader commodity markets may begin to have a detrimental effect on growth in 2016. For those countries that rely heavily on raw material exports, the slowdown of the Chinese economy, coupled with an advancing US dollar, will likely dampen the demand for industrial inputs. The “China effect” is unlikely to be confined to emerging markets, as exports of luxury goods and automobiles from developed markets also come under pressure.

Monetary policy and geopolitics could potentially be the most important influence on markets over the next 12 months. Investors will be particularly interested in when, and how quickly, the Federal Reserve and Bank of England raise interest rates and the impact this will have on the global economy. In a rising interest rate environment, we retain a positive but watchful outlook on risk assets as

| Top 10 long-term holdings* |

| (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Henderson Unconstrained Bond Fund | 4.8 | % |

iShares MSCI EAFE Minimum Volatility Index Fund | 4.5 | |

TIAA-CREF Asset Management Core Property Fund LP | 4.4 | |

| iShares TIPS Bond ETF | 4.1 | |

| ASG Global Alternatives Fund | 3.5 | |

| MSIF Multi-Asset Portfolio | 3.2 | |

| iShares Russell 1000 Value ETF | 2.8 | |

| iShares Russell 2000 Value ETF | 2.8 | |

| Gateway Fund | 2.8 | |

| Calamos Market Neutral Income Fund | 2.7 | |

markets adapt to falling liquidity and increasing volatility. The pace of tightening and the subsequent effect on bond yields will be particularly significant.

For the year ended July 31, 2015, the Fund returned 1.94% (Class A at NAV) versus the benchmark, 3-month LIBOR (USD), which posted a return of 0.24%. Performance was largely driven by the allocation to equities, particularly in the US and Japan. The fixed income allocation was broadly flat while the allocation to property and private equity modestly added to performance.

Towards the end of the period, we took the opportunity to increase the Fund’s European equity exposure as uncertainty surrounding the Greek debt crisis began to abate. Our medium term view on Europe remains positive given the European Central Bank’s quantitative easing program; however, the increased threat of a Greek exit from the euro had severely damaged short-term investor sentiment and allowed us to increase the allocation at an attractive price.

The allocation to US Treasuries was also increased. The rationale behind the decision was two-fold: in the short-term, we believe that there is still sufficient uncertainty in the global macroeconomic environment to potentially delay the first Federal Reserve interest rate hike, while from a longer-term perspective, the position adds a degree of insurance should any of the current macroeconomic uncertainties develop into a more serious concern for global economic growth.

As the Greek debt crisis moves towards a full resolution, diverging monetary policy and economic momentum will return to the fore as a dominant theme. Investors will be particularly interested in the Federal Reserve Bank’s and Bank of England’s approach to interest rates and the impact this will have on the global economy. The slowing of the emerging market business cycle will also be important, notably in local equity markets, commodities, and emerging market currencies.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

All Asset Fund

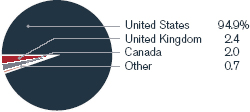

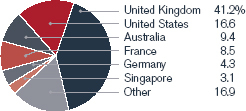

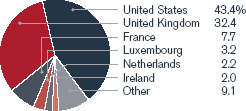

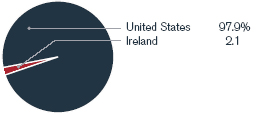

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

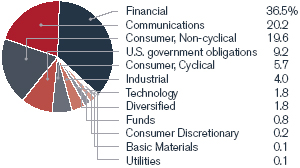

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | inception |

| At NAV | | | symbol | | | year | | years* | | (3/30/2012)* |

| Class A | | | HGAAX | | | 1.94 | % | | 5.12 | % | | 4.37 | % |

| Class C | | | HGACX | | | 1.23 | | | 4.32 | | | 3.59 | |

| Class I | | | HGAIX | | | 2.20 | | | 5.37 | | | 4.63 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -3.95 | % | | 3.05 | % | | 2.53 | % |

| Class C | | | | | | 1.23 | | | 4.32 | | | 3.59 | |

| Index | | | | | | | | | | | | | |

| 3-month LIBOR (USD) | | | | | | 0.24 | % | | 0.28 | % | | 0.31 | % |

| MSCI World Index | | | | | | 5.49 | | | 15.09 | | | 12.24 | |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.33%, 2.07% and 1.02%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.60% of the Fund’s average daily net assets, which is in effect until July 31, 2020. With respect to investments in affiliated underlying funds, the Fund’s adviser has contractually agreed to reduce or waive the Fund’s management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund’s management fee. Indirect net expenses associated with the Fund’s investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) (USD) is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

Dividend & Income Builder Fund

2015 has been a strong year (so far) for dividend growth. Many of the companies held in the portfolio have increased dividends, some substantially, in local currency terms. Globally, as measured by the MSCI World Index, dividends are forecast to grow 6% in 2015. Regionally, the US and Japan are forecast to have the most potential for dividend growth and we have seen this reflected in the portfolio, with companies such as NTT and Las Vegas Sands growing dividends at double digit rates. We have also seen an ongoing theme of companies returning cash via special dividends and share buybacks. Certain sectors, such as technology, and countries, such as Japan, typically outside the realm of dividend investors, have become more focused on consistently returning cash to shareholders.

For the year ended July 31, 2015, the Fund returned 3.81% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 5.49%. The Fund continued to meet its objectives for earning and distributing income over the period. Overall, the fixed income sub-portfolio was a negative contributor to returns. Performance relative to the equity benchmark was held back by a structural underweight to the US (where dividends are typically lower) as well as disappointing stock selection in Hong Kong. The Fund made gains in UK and Swiss holdings, particularly in the financials sector as well as in European telecommunications holdings.

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security/Issuer | of net assets |

| Novartis AG | 2.9 | % |

| Pfizer, Inc. | 2.7 | |

| Roche Holding AG | 2.0 | |

| Verizon Communications, Inc. | 1.8 | |

| Vodafone Group plc | 1.7 | |

| Orange S.A. | 1.7 | |

| Imperial Tobacco Group plc | 1.7 | |

| Royal Dutch Shell plc, A Shares | 1.7 | |

| WPP plc | 1.7 | |

| Reynolds American, Inc. | 1.6 | |

Among the best performers at the stock level were tobacco firms Reynolds American and British American Tobacco, both of which reported better than expected results in which volumes were higher than expected. The largest individual detractor from performance was Tokyo Electron, a semiconductor equipment manufacturer, where the company lowered earnings guidance for the second half of the year as lower than expected personal computer sales have resulted in less demand for semiconductors.

In the equity allocation, the Fund continued to seek companies with both above-average yield and dividend growth. The equity allocation remained over 85% of the Fund, reflecting our current bias towards equities over bonds. In terms of the Fund’s positioning, the portfolio at the end of the period was underweight in some of the larger-yielding areas of the markets such as energy and mining stocks. Due to oversupply in many commodities and falling prices, we believe the pressure on free cash flow will reduce the dividends these companies may pay in the future. Another underweight sector is utilities, where again we see market pressures that may lead to dividend cuts.

In contrast, we continue to see opportunities and attractive investments in pharmaceutical companies. We have seen positive growth reported in both developed and emerging markets as well as some promising new drugs in the pipeline. We are also quite favorable towards European financial companies. Many have been rebuilding their capital levels from the credit crisis and we see the potential for higher dividends in the future.

In our view, the outlook for dividend paying companies remains favorable. Investors around the world are seeking income and the dividend yield of many companies has remained above their corporate bond yield. Equally, we see companies in a low growth environment increasingly paying free cash flow back to shareholders through special dividends, share buybacks and ordinary dividends.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

Dividend & Income Builder Fund

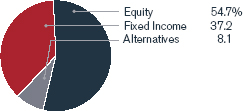

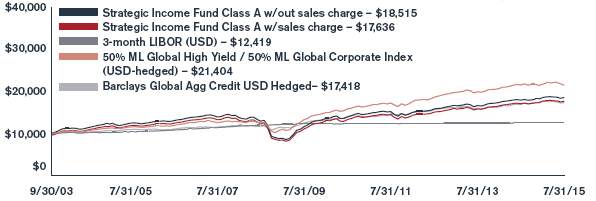

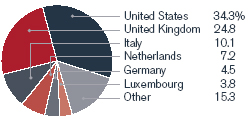

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

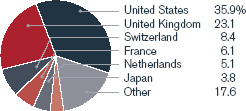

Investment comparison

Value of $10,000

| | | | | | | | | | | |

| Total returns as of July 31, 2015 | | | | | | | | | Since |

| | | | NASDAQ | | | One | | inception |

| At NAV | | | symbol | | | year | | (8/1/2012)* |

| Class A | | | HDAVX | | | 3.81 | % | | 11.15 | % |

| Class C | | | HDCVX | | | 3.00 | | | 10.32 | |

| Class I | | | HDIVX | | | 3.97 | | | 11.37 | |

| With sales charge | | | | | | | | | | |

| Class A | | | | | | -1.37 | % | | 9.25 | % |

| Class C | | | | | | 3.00 | | | 10.32 | |

| Index | | | | | | | | | | |

| MSCI World Index | | | | | | 5.49 | % | | 15.09 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.95%, 2.69% and 1.67%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.05% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Emerging Markets Fund

On March 31, 2015, the Fund’s management team was changed and many of the Fund’s holdings were turned over to match the new team’s global emerging markets process.

Over the period, emerging markets equities underperformed developed market equities. A sharp drop in the price of oil and a steep rise in the US dollar led to a general lack of investor confidence in commodity demand and the performance of the asset class fell into negative territory. The strength of the US dollar and expectations of rising US interest rates had a significant impact on emerging markets currencies. Latin American equities had a particularly difficult time over the period, underperforming their emerging market counterparts as declining commodity prices and a stronger US Dollar raised questions over the region’s economic growth outlook. Elsewhere, continued geopolitical concerns in the Middle East and Ukraine dominated news flow in the emerging Europe, Middle East and Africa (EMEA) region. The Asia-Pacific region has been dominated by volatility in China. A strong Chinese equity market rally was seen as the Chinese government stimulated the economy through interest rate and reserve requirement cuts to offset slowing economic growth. The Chinese government then attempted to restrict leveraged trading accounts to curb the stock market rally and there followed a sharp sell-off in Chinese equities.

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Grupo Herdez SAB de CV | 3.5 | % |

| Inversiones Aguas Metropolitanas S.A. | 3.5 | |

| SABMiller plc | 3.4 | |

| Unilever plc | 3.4 | |

| Tiger Brands, Ltd. | 3.0 | |

| Cia Cervecerias Unidas S.A., ADR | 3.0 | |

| Standard Bank Group, Ltd. | 2.7 | |

| Bank Pekao S.A. | 2.7 | |

| Standard Foods Corp. | 2.7 | |

| Uni-President Enterprises Corp. | 2.6 | |

For the year ended July 31, 2015, the Fund returned -12.42% (Class A at NAV) versus the benchmark, MSCI Emerging Markets Index, which posted a return of -13.07%. Over the period, the Fund’s overweight exposure to consumer staples led the positive returns. Our bias against the cyclical energy and materials sectors helped in a period that included a broad sell-off of emerging market assets. At the stock level, our developed world-listed holdings Unilever, SABMiller, PZ Cussons and Jeronimo Martins performed well, as did Mexican food producer Grupo Herdez. Brazilian stocks, Petrobras and Companhia Brasileira de Distribuicao, were among the main underperformers.

As a result of the change of fund manager towards the end of the period, and a consolidation of the multi-managed, geographic portfolio approach, there were significant adjustments made to the Fund’s positioning. Going forward, the team will take a bottom-up, long-term approach to investing, focusing on quality companies with proven track records, strong franchises and management teams with a history of integrity. From a portfolio perspective, this resulted in a reduction of the Fund’s exposure to Chinese financials, popular internet companies and Korea. These sales were offset by increases in exposure to privately owned Chilean companies and a number of developed world-listed businesses which have greater than 50% economic exposure to developing markets; these include Unilever PLC and Jeronimo Martins, a family controlled Portuguese company with two-thirds of its revenue generated in Poland.

Some quality emerging market companies have become considerably less popular than they once were. This follows a sustained period of poor stock and currency market performance relative to much of the developed world. As bottom-up stock pickers, we relish this opportunity to comb less popular markets for quality companies trading at reasonable valuations.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

Emerging Markets Fund

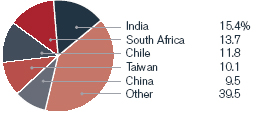

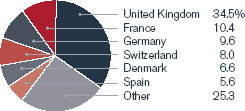

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | inception |

| At NAV | | | symbol | | | year | | years* | | (12/31/2010)* |

| Class A | | | HEMAX | | | -12.42 | % | | 2.77 | % | | -2.73 | % |

| Class C | | | HEMCX | | | -13.11 | | | 1.99 | | | -3.46 | |

| Class I | | | HEMIX | | | -12.34 | | | 2.97 | | | -2.51 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -17.47 | % | | 0.75 | % | | -3.98 | % |

| Class C | | | | | | -13.11 | | | 1.99 | | | -3.46 | |

| Index | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -13.07 | % | | 0.96 | % | | -2.30 | % |

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.97%, 2.74% and 1.66%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.54% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

European Focus Fund

It was a volatile period for European equity markets where the general trend of European recovery was persistently tested by issues such as deflationary fears, slowing German growth and the re-emergence of a possible Greek exit from the euro. The prolonged negotiations between Greece and its creditors dominated headlines and eventually culminated in a deal. Reassuringly, there was little contagion and peripheral bond yields saw only a muted response. The precipitous fall in the price of oil weighed heavily on the energy sector; however, companies took heart from the prospect of lower prices, helping consumers and reducing costs for many industries (although being clearly bad for producers). Currency - in particular the volatility of the euro - played a significant role in market returns declining from a level around 1.33 versus the US Dollar at the start of the reporting period, to 1.04 by mid-March. The second quarter proved more stable in terms of currency moves and the euro / USD rate levelled out in the 1.10 - 1.15 range, proving resilient despite the ongoing Greek debt crisis.

Other notable events included the Swiss National Bank jettisoning its currency peg to the euro in January. The market correctly assumed that this was in readiness for the European Central Bank (ECB) finally delivering on the promise of formal quantitative easing (QE). Although the ECB announcement of QE in January was not a surprise, the scale of the program, in addition to the tailwinds of lower currency and oil prices, resulted in a larger than expected market impact.

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| BG Group plc | 4.0 | % |

| Alcatel-Lucent | 3.7 | |

| Barclays plc | 3.7 | |

| Nokia Oyj | 3.7 | |

| Roche Holding AG | 3.3 | |

| Intesa Sanpaolo SpA | 3.2 | |

| Lloyds Banking Group plc | 3.0 | |

| Teva Pharmaceutical Industries, Ltd., ADR | 2.6 | |

| NH Hotel Group S.A. | 2.3 | |

| Novo Nordisk A/S | 2.3 | |

Positive signs, such as improvements in Purchasing Managers’ Indices, auto and retail sales and bank lending, are filtering down to the corporate level and have translated into higher earnings growth forecasts. Europe recently returned to seeing consensus earnings upgrades for the first time since March 2011. Gross domestic product projections have been encouraging with France and Italy returning to growth while Spain looks to be the real growth story this year. An inflation improvement (from 0% to 1.3% next year) is a particularly positive sign as this allays fears of deflation and the concerns that Europe would follow the Japanese experience.

For the year ended July 31, 2015, the Fund returned 5.83% (Class A at NAV) versus the benchmark, MSCI Europe Index, which posted a return of -0.51%. The overweight exposure to the consumer discretionary sector drove returns with key stocks being Taylor Wimpey, Carnival Corp and Renault. Health care and industrial exposure was also beneficial as a result of investment in Teva Pharmaceutical, Indivior and AA.

While maintaining a bias towards ‘recovery’ positions, the overweight to the consumer discretionary sector has been reduced and we have been looking at selected stocks which have been ignored or discarded in favor of more recovery-like stocks. There have been opportunities presented by mergers and acquisition activity; for instance Nokia and the deal with Alcatel Lucent, and BG Group, which has been bid for by Royal Dutch Shell.

In terms of currency hedging, the euro hedge was reduced during the latter part of 2014 and subsequently closed in March. The sterling hedge that was introduced due to uncertainty over the outcome of May’s UK general election was closed following its comprehensive conclusion. The Fund was unhedged in its currency exposure at the period end.

A slowdown in asset flows to Europe would not be unexpected, but, given that profits are only just starting to recover, we do expect flows to continue to remain positive. Our view is that Europe’s economy will sustain a recovery with investors ultimately focusing once again on the weaker euro, lower oil price, as well as earnings recovery. We believe increased currency stability and the ECB’s QE program are helping to provide a positive environment for European equity progression.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

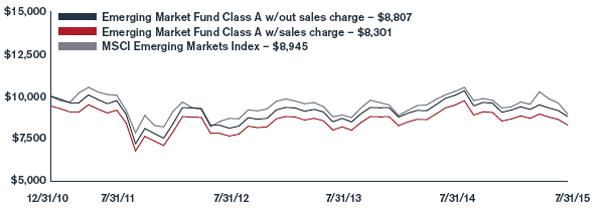

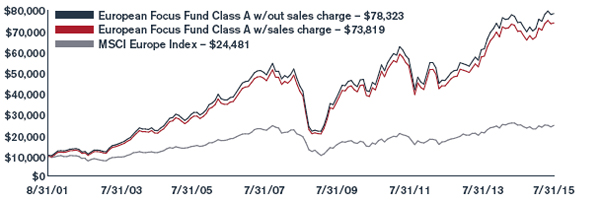

European Focus Fund

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFEAX | | | 5.83 | % | | 19.32 | % | | 11.66 | % | | 10.20 | % | | 15.94 | % |

| Class B | | | HFEBX | | | 4.92 | | | 18.32 | | | 10.75 | | | 9.53 | | | 15.45 | |

| Class C | | | HFECX | | | 4.99 | | | 18.40 | | | 10.79 | | | 9.37 | | | 15.07 | |

| Class I** | | | HFEIX | | | 6.10 | | | 19.64 | | | 11.96 | | | 10.39 | | | 16.08 | |

| With sales charge |

| Class A | | | | | | -0.26 | % | | 16.98 | % | | 10.34 | % | | 9.55 | % | | 15.45 | % |

| Class B | | | | | | 0.92 | | | 17.60 | | | 10.61 | | | 9.53 | | | 15.45 | |

| Class C | | | | | | 4.99 | | | 18.40 | | | 10.79 | | | 9.37 | | | 15.07 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | -0.51 | % | | 13.73 | % | | 8.92 | % | | 5.59 | % | | 6.65 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.37%, 2.19%, 2.14% and 1.11%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

Global Equity Income Fund

Global dividend growth has continued to be strong, with global dividends forecast to rise 6% in 2015. Companies are increasingly recognizing the value in returning cash to shareholders, particularly in countries such as the US where dividends grew 11% in 2014. We have also seen evidence of this at the portfolio level. For example, Cisco, which prior to 2011 chose not to pay a dividend, increased its dividend a further 12% in 2014.

Inflation has reached record lows in many developed economies, with government bond yields remaining low as investors “price-in” monetary stimulus in Europe and delays to interest rate increases elsewhere. Therefore, we believe equities remain an attractive source of income for investors in many markets. In addition, over the long term, dividends and dividend growth have provided a significant portion of an investor’s total equity return.

For the year ended July 31, 2015, the Fund returned -0.21% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of 5.49%. The Fund continued to meet its objectives for earning and distributing income over the period. The Fund’s structural underweight to low yielding markets such as the US and Japan were the main drivers of underperformance. The overweight to Hong Kong also detracted from performance. Over the period, the Fund had a headwind in terms of the

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| British American Tobacco plc | 3.3 | % |

| AstraZeneca plc | 2.8 | |

| Diageo plc | 2.4 | |

| SSE plc | 2.1 | |

| Pfizer, Inc. | 2.1 | |

| Royal Dutch Shell plc, A Shares | 2.1 | |

| Reynolds American, Inc. | 2.0 | |

| BT Group plc | 2.0 | |

| HSBC Holdings plc | 2.0 | |

| BP plc | 2.0 | |

strengthening of the US dollar relative to most other currencies. The Fund is global with a foreign bias and, therefore, has the majority of its assets outside the US. Underlying that, however, the Fund had strong performance (in local terms) from UK holdings, which significantly outperformed the domestic indices there.

There has been broad sector exposure across the portfolio. A favored area currently is in telecommunications where we are finding not only a strong secular theme but also relatively attractive valuations and dividend yields. In telecommunications, the trends are fairly global where more users are adopting smart phones and therefore using the internet more heavily. Data usage has been increasing and this creates the opportunity to increase revenue per customer. The Fund decreased exposure to energy and mining towards the end of 2014 as a result of the falling commodity price environment. Regionally we increased the allocation to Europe, nearly doubling the weighting from the end of 2014 to the end of the period. We are seeing improvement in the macro data from the region and corporations are benefitting from a low oil price, a cheap euro and the implementation of quantitative easing.

We continue to find dividend paying equities attractive; many companies have dividend yields above their corporate bond yields, forecasted dividend growth remains strong and companies are increasingly focused on returning cash back to shareholders via dividends and share buybacks. We believe the key in managing the Fund remains stock selection, and we continue to use a bottom-up selection process with a focus on balance sheet strength and cash generation. This allows us to avoid ‘value traps’ while striving to maintain a high yield in order to avoid dividends that are unsustainable or stocks that are overvalued.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

12

Global Equity Income Fund

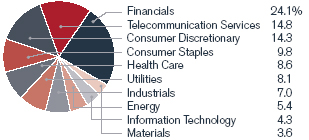

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

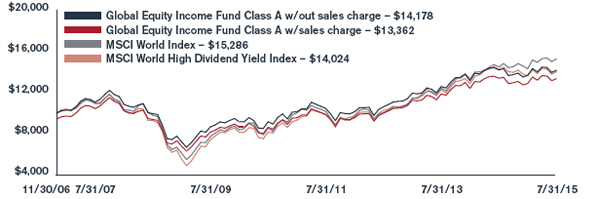

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | (11/30/2006)* |

| Class A | | | HFQAX | | | -0.21 | % | | 10.15 | % | | 9.15 | % | | 4.14 | % |

| Class C | | | HFQCX | | | -1.09 | | | 9.29 | | | 8.33 | | | 3.35 | |

| Class I** | | | HFQIX | | | -0.10 | | | 10.41 | | | 9.45 | | | 4.34 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -5.95 | % | | 8.00 | % | | 7.86 | % | | 3.43 | % |

| Class C | | | | | | -1.09 | | | 9.29 | | | 8.33 | | | 3.35 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 5.49 | % | | 15.09 | % | | 12.36 | % | | 5.04 | % |

| MSCI World High Dividend Yield Index | | | | | | -1.58 | | | 11.02 | | | 11.44 | | | 3.99 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.18%, 1.93% and 0.92%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.15% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within the MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

Global Technology Fund

Global equity markets experienced high levels of volatility over the period. In the second half of 2014 there were fears over deflationary pressures in Europe, sluggish global growth and the possibility of Greece exiting the euro. The decline in commodity prices, particularly oil, played an important role in share price action and currency volatility played a significant role in market returns, although there was stabilization during the second quarter of 2015. Equity markets have made progress during 2015; however, there has been a significant disparity between developed and emerging market performance with market leadership shifting to Europe and Japan. US equities have been dull but the region has seen a strengthening in economic data. Volatility in Chinese equity markets has marred Asian and emerging market equities as a whole. Against this backdrop, the technology sector outperformed the wider market.

For the year ended July 31, 2015, the Fund returned 10.61% (Class A at NAV) versus the benchmark, the MSCI AC World Information Technology Index, which posted a return of 8.43%. The internet and information technology services sectors contributed positively to performance, while hardware was the main detractor. At the stock level, Netflix was an outperformer; the company reported a very encouraging quarter of growth in key metrics, with new subscriber additions above expectations both

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Apple, Inc. | 8.1 | % |

| Google, Inc., Class C | 5.0 | |

| Facebook, Inc., Class A | 4.2 | |

| Google, Inc., Class A | 4.2 | |

| Cisco Systems, Inc. | 3.7 | |

| Visa, Inc., A Shares | 3.4 | |

| MasterCard, Inc., Class A | 2.9 | |

| Avago Technologies, Ltd. | 2.8 | |

| NXP Semiconductor N.V. | 2.4 | |

| Tencent Holdings, Ltd. | 2.4 | |

domestically and internationally. Netease, a Chinese online game developer and publisher, outperformed following strong results and the company’s new mobile game, Fantasy Westward Journey, is now the number one mobile game in China. Amazon contributed positively to performance as the company reported strong growth in its North American business, and levels of profitability within its Web Services division continued to surprise the market. Personal computer-related stocks were generally weak. We continue to be positive on Apple but given that the Fund’s position is structurally underweight the benchmark, continued outperformance hurt the Fund’s performance and was the largest relative detractor versus the benchmark over the period.

Notable activity during the period included the purchase of a stake in Activision Blizzard, the video game developer, in light of its strong release slate. Positions were also added in security software providers Palo Alto Networks and Check Point Software Technologies in light of a strong security spend environment. A purchase was also made in EPAM Systems, the specialist high-tech IT services vendor, given its strong growth outlook, and we sold out of our position in Accenture as it hit our price target.

While further rounds of global quantitative easing are occurring, the uncertain economic environment continues to curtail capital spending, including technology expenditure. In addition, the strengthening Dollar is proving an increasing headwind for US technology companies. While we think technology stocks remain attractive relative to the overall market, these headwinds may mean that in the short-term they could struggle to outperform. Longer term, however, we believe the technology sector is attractive given its structurally higher earnings growth rate and strong balance sheets.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

14

Global Technology Fund

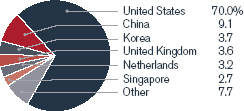

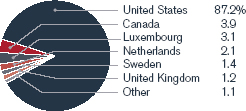

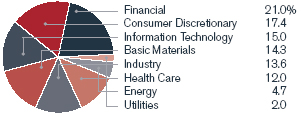

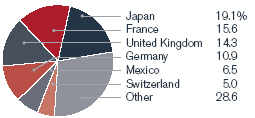

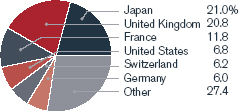

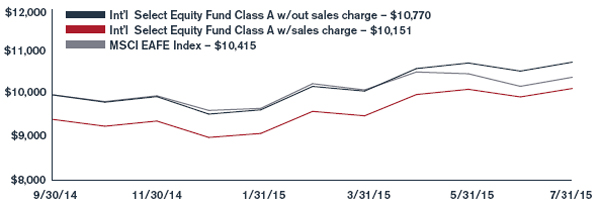

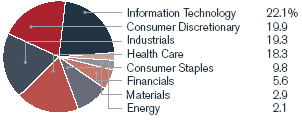

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

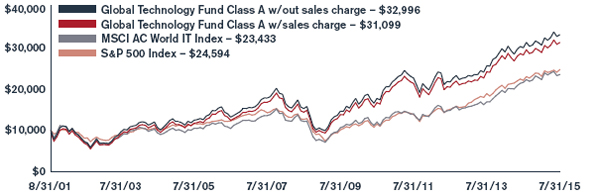

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | | | | | | | Since |

| | | | NASDAQ | | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFGAX | | | 10.61 | % | | 15.12 | % | | 13.28 | % | | 10.23 | % | | 8.96 | % |

| Class B | | | HFGBX | | | 9.74 | | | 14.19 | | | 12.38 | | | 9.55 | | | 8.52 | |

| Class C | | | HFGCX | | | 9.75 | | | 14.22 | | | 12.42 | | | 9.40 | | | 8.15 | |

| Class I** | | | HFGIX | | | 10.88 | | | 15.39 | | | 13.58 | | | 10.41 | | | 9.09 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 4.24 | % | | 12.87 | % | | 11.95 | % | | 9.58 | % | | 8.49 | % |

| Class B | | | | | | 5.74 | | | 13.42 | | | 12.26 | | | 9.55 | | | 8.52 | |

| Class C | | | | | | 9.75 | | | 14.22 | | | 12.42 | | | 9.40 | | | 8.15 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 8.43 | % | | 16.37 | % | | 14.20 | % | | 8.30 | % | | 6.31 | % |

| S&P 500 | | | | | | 11.21 | | | 17.58 | | | 16.24 | | | 7.72 | | | 6.68 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.35%, 2.16%, 2.12% and 1.10%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

High Yield Opportunities Fund

The US high yield (HY) bond market was broadly flat over the period and underperformed most other fixed income asset classes such as loans, 10-year Treasuries and investment grade corporates. While Treasury yields dropped slightly over the period amid plenty of volatility, US HY spreads widened steadily. BB-rated bonds significantly outperformed CCC-rated bonds. Defensive industries such as healthcare and food and beverage significantly outperformed the cyclical commodity sectors, in particular energy, mining and metals. While overall default rates remain low at around 2% of the market, the energy, metals and mining sectors account for over 70% of the default volume. The majority of the volatility in the HY market over this time period can also be attributed to the energy, metals and mining sectors. Excluding these sectors, strategists estimate that HY bonds would have performed in line with leveraged loans over the 12-month period.

New issuance over the last twelve months has approximated a very healthy $350 billion. Just over $50 billion of this issuance was concentrated among 7 of the top 20 largest HY issues ever. We have noticed a changing trend in new issuance whereby proceeds are being diverted away from refinancing toward more aggressive uses such as leveraged buyouts and dividends. Roughly $78 billion of the new issuance total was non-US dollar issuance. We are experiencing a trend of increasing new issuance by non-US companies into the HY market.

Top 10 long-term holdings* (at July 31, 2015) |

| | As a percentage |

| Security/Issuer | of net assets |

| ILFC E-Capital Trust II | 3.4 | % |

| Argos Merger Sub, Inc. | 2.2 | |

Infor Software Parent LLC/Infor Software Parent, Inc. | 2.2 | |

| Post Holdings, Inc. | 2.1 | |

| RCN Telecom Services LLC | 2.1 | |

| CCO Holdings LLC | 2.0 | |

| Digicel Group, Ltd. | 2.0 | |

| Koppers, Inc. Term Loan A | 1.9 | |

| KLX, Inc. | 1.8 | |

| Tenet Healthcare Corp. | 1.7 | |

For the year ended July 31, 2015, the Fund returned 1.19% (Class A at NAV) versus the benchmark, Bank of America Merrill Lynch US High Yield Master II Constrained Index, which posted a return of 0.17%. Over the period, the Fund benefitted from maintaining a higher quality bias within the lower rating tiers. While an underweight allocation to BB-rated bonds was maintained, the Fund outperformed on strong credit selection, an allocation to loans and an underweight stance in the energy sector. While the Fund incurred some losses in the energy sector, it benefitted from a higher quality bias in this space. The Fund’s best sector and company contributors were in defensive industries like healthcare and media, while the worst detractors were almost exclusively in the energy and mining segments.

After upgrading the credit quality of the portfolio during the fourth quarter of 2014, the Fund is positioned slightly below the benchmark with respect to credit risk as measured by yield, spread and weighted average credit rating. Within the energy sector, the underweight positioning has been gradually reduced by selectively adding higher quality exploration and production companies. We continue to remain underweight in the energy service and pipeline sectors.

We are also cautious on the metals and mining industry, including the steel sector, on a credit quality basis. We continue to view default risk in excess of consensus expectations (2-3%) as highly dependent on what happens in the energy space.

We continue to be selective in the new issue calendar as we are witnessing declining credit quality in the new issue market as measured by higher leverage, less robust covenants and smaller equity contributions in leveraged buyout deals. We are not seeing much value in the US leveraged loan market at the moment and have pared back our exposure.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

16

High Yield Opportunities Fund

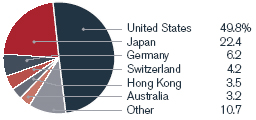

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

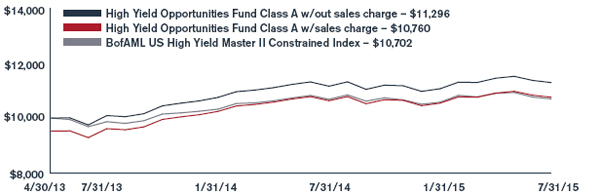

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | | | | Since |

| | | | NASDAQ | | | One | | inception |

| At NAV | | | symbol | | | year | | (4/30/2013)* |

| Class A | | | HYOAX | | | 1.19 | % | | 5.55 | % |

| Class C | | | HYOCX | | | 0.39 | | | 4.73 | |

| Class I | | | HYOIX | | | 1.48 | | | 5.82 | |

| With sales charge | | | | | | | | | | |

| Class A | | | | | | -3.64 | % | | 3.29 | % |

| Class C | | | | | | 0.39 | | | 4.73 | |

| Index | | | | | | | | | | |

| BofAML US High Yield Master II Constrained Index | | | | | | 0.17 | % | | 3.14 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.68%, 2.45% and 1.38%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.85% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

International Long/Short Equity Fund

The Fund commenced operations on December 9, 2014 against a volatile market backdrop, with December seeing heightened unease in international equity markets and investor concerns about the resilience of global growth, European deflation and the end of quantitative easing (QE) in the US. Economic data in Japan was negative and disappointed again in January with weaker than expected gross domestic product numbers. In emerging markets, weak economic data in China led to the first interest rate cut in two years as well as capital injections into the banking system.

Global equity markets have made progress during 2015; however, there has been significant disparity between developed and emerging market performance with market leadership shifting to Europe and Japan. European stock markets were underpinned by a larger than expected European Central Bank QE program, in addition to the tailwinds of a lower currency and oil price. Europe proved generally resilient in the face of the ongoing negotiations between Greece and its creditors and the region responded well after a deal was eventually reached. There has been a strengthening in economic data and emergence of investor confidence in Japan, which was the leading developed market over the period, helped by further yen weakness. Top-down and bottom-up structural

Top 5 “Long” Holdings (including equity swaps)* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Alcatel Lucent | 5.0 | % |

| Roche Holding AG | 4.6 | |

| BG Group Plc | 4.1 | |

| Kingfisher Plc | 3.6 | |

| Deutsche Annington Inmobilien SE | 3.6 | |

Top 5 “Short” Holdings (including equity swaps)* (at July 31, 2015) |

| | As a percentage |

| Security | of net assets |

| ICA Gruppen AB | (4.9) | % |

| CNH Industrial N.V. | (3.0) | |

| Hargreaves Lansdown Plc | (3.0) | |

| Woodford Patient Capital Trust | (2.9) | |

| Kuehne & Nagel International AG | (2.6) | |

reforms are continuing and at the corporate level there is a focus on optimizing balance sheets and an increasing focus on corporate governance. Earnings upgrades for Japanese companies have been the strongest globally and we have finally started to see wages rise which has provided support to equities. The Asia Pacific region has been dominated by extreme volatility in China. A strong Chinese equity market rally was seen as the Chinese government stimulated the economy through interest rate and reserve requirement cuts to offset slowing economic growth. The Chinese government attempted to restrict leveraged trading accounts to curb the stock market rally and there followed a sharp sell-off in Chinese equities.

For the reporting period (since inception) ended July 31, 2015, the Fund returned 2.70% (class A at NAV) versus the benchmark, MSCI EAFE Index (US Hedged), which posted a return of 11.99%. The biggest overall drag on performance was the Asia Pacific strategy which was impacted most heavily by Tata Motors, Samsung Electronics and Baidu; all positions held on the long-book. The long-books of the remaining strategies - UK, Europe and Japan - all produced positive returns, and among the highlights were NMC Health, Nippon Telegraph and Telephone Corporation, Virgin Money and CK Hutchison. There were also positives from the short-books, in particular from the UK sub-portfolio’s short position in Afren, a company which has now gone into administration. However, all sub-portfolio short-books weighed on performance, with the UK and Japan strategies particularly impacted through positions such as Yamato Holdings, Taisei Corporation, and Quindell, which was the single largest stock specific drag to overall Fund performance.

We remain broadly positive on the outlook for equities. In this low inflation, low growth, low interest rate environment, equities have been offering attractive return opportunities. Various European tailwinds and the sustained political momentum behind the Japanese recovery are further positive signs. Heightened volatility means that stock selection remains key; however, we believe there remain many long and short investment opportunities from a bottom-up perspective.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

18

International Long/Short Equity Fund

Portfolio composition by country (as a % of long-term investments) | Portfolio composition by sector (as a % of long-term investments) |

| |

Investment comparison

Value of $10,000

| Total returns as of July 31, 2015 | | | | | | Since |

| | | | NASDAQ | | | inception |

| At NAV | | | symbol | | | (12/9/2014) |

| Class A | | | HLNAX | | | 2.70 | % |

| Class C | | | HLNCX | | | 2.20 | |

| Class I | | | HLNIX | | | 2.80 | |

| With sales charge | | | | | | | |

| Class A | | | | | | -3.20 | % |

| Class C | | | | | | 1.20 | |

| Index | | | | | | | |

| MSCI EAFE Index (USD Hedged) | | | | | | 11.99 | % |

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles (“GAAP”)-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares, inclusive of distribution and service fees and dividends and interest expense on securities sold short, are estimated to be 5.25%, 6.00% and 5.00%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive its management fee and, if necessary, reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies and dividends and interest expense on securities sold short) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.50% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index (USD Hedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada, excluding the effect of currency translations. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

19

International Opportunities Fund