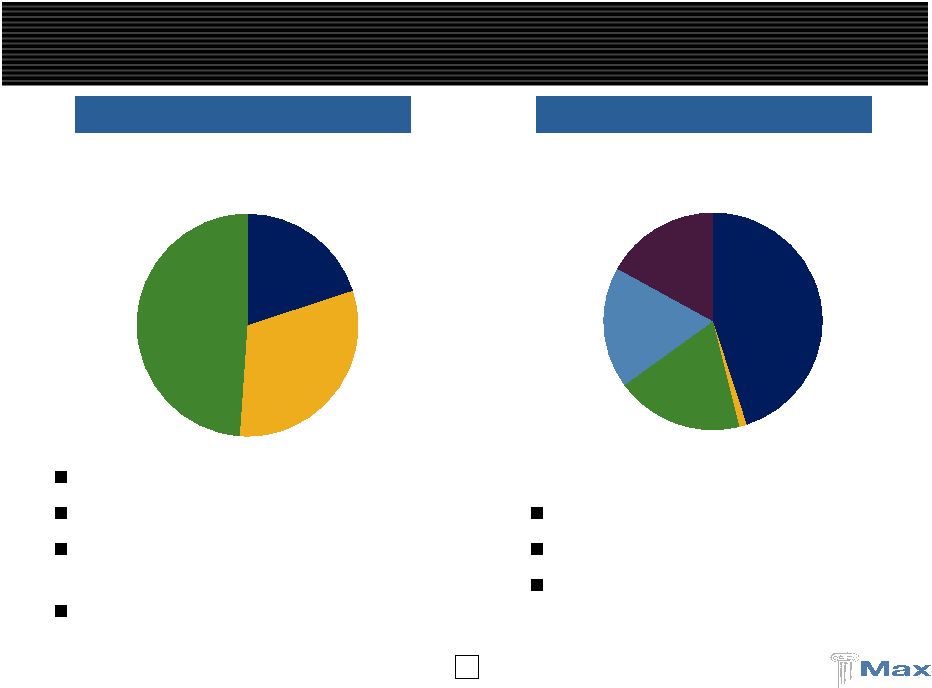

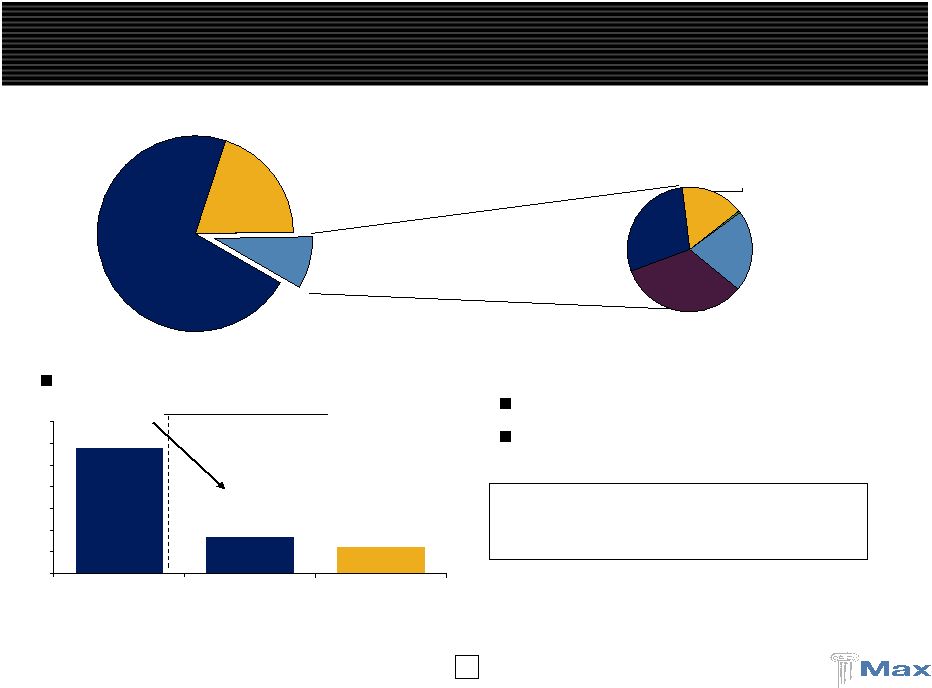

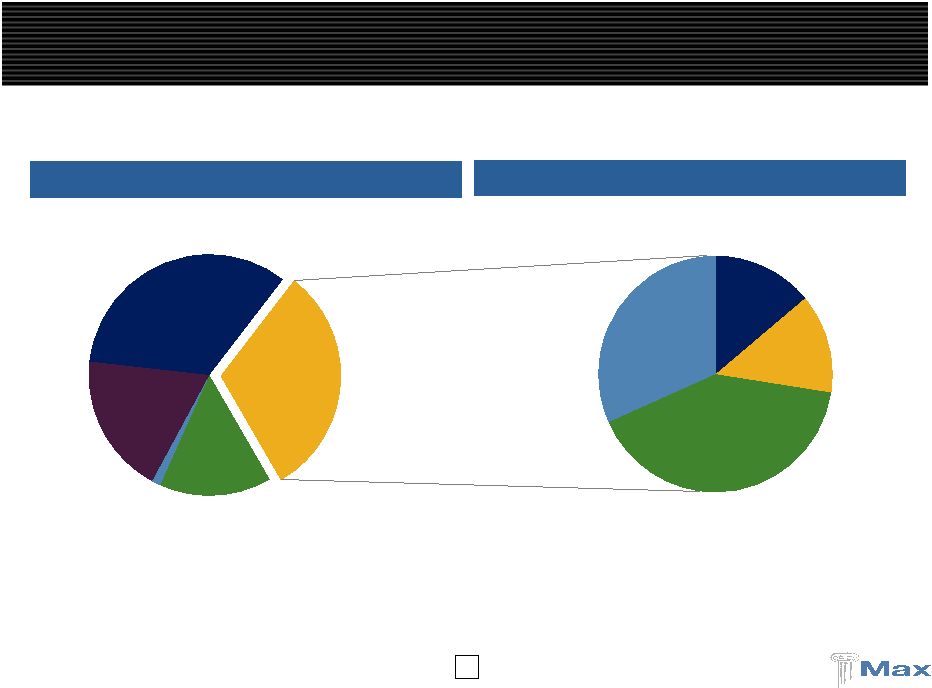

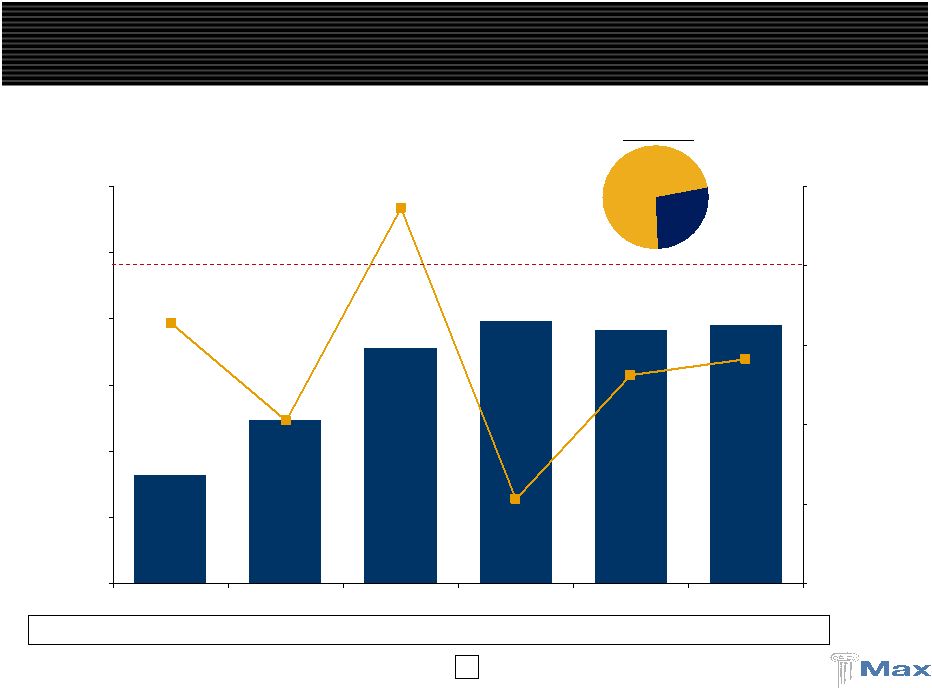

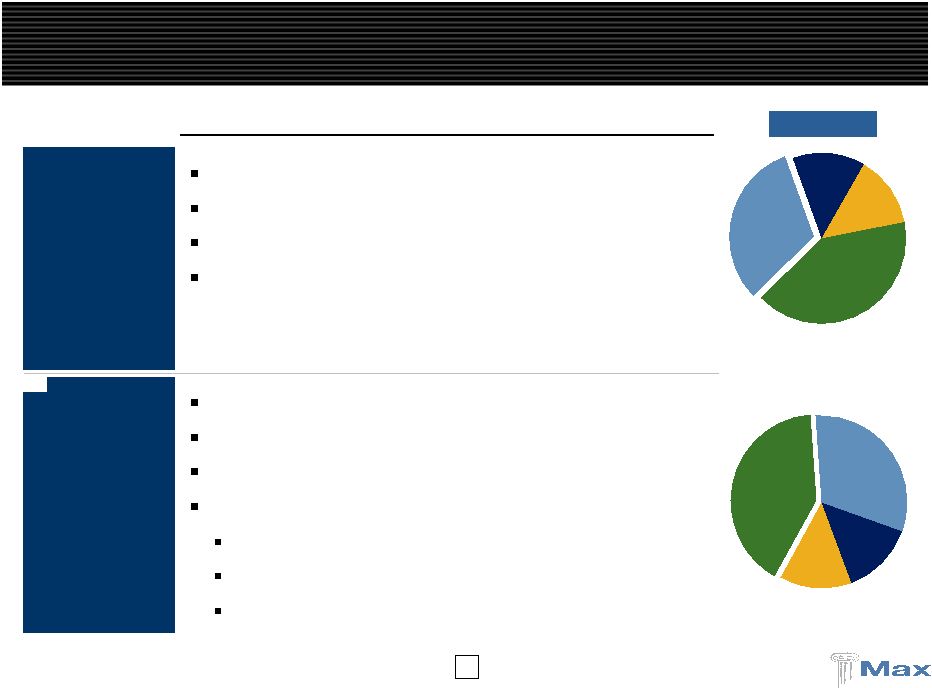

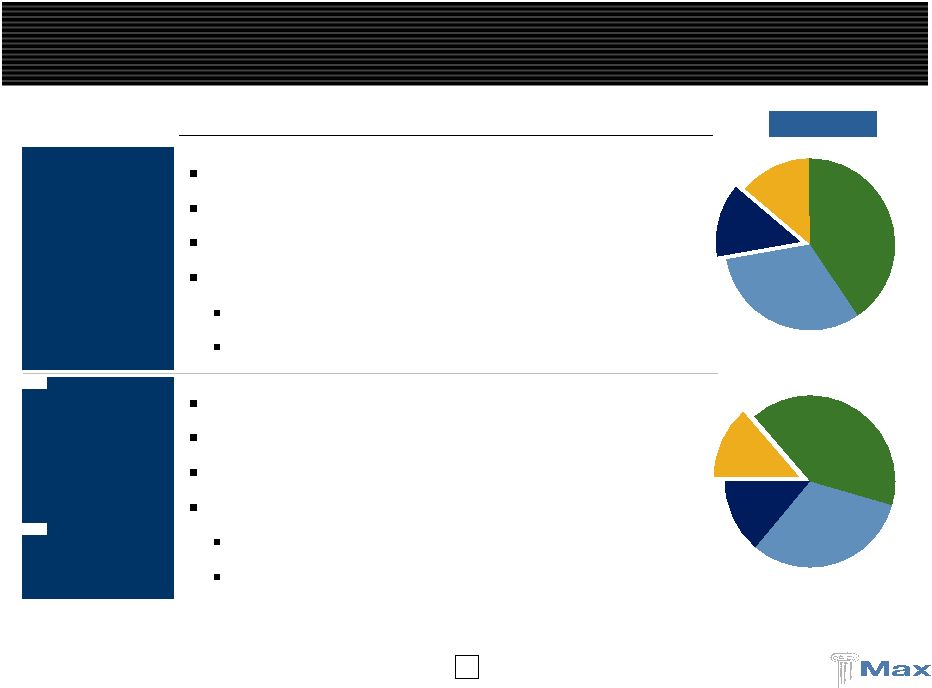

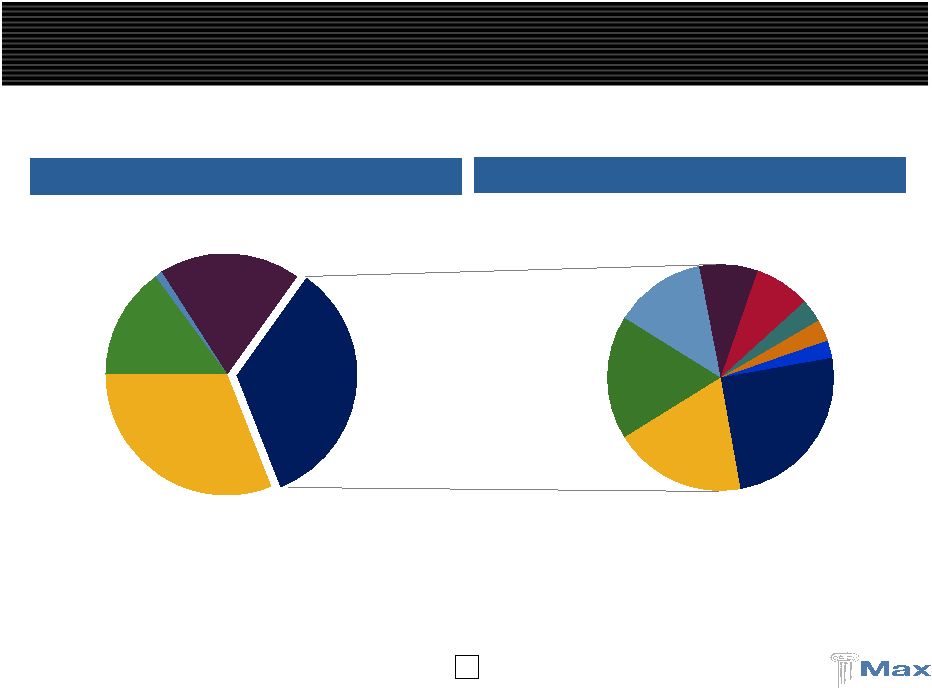

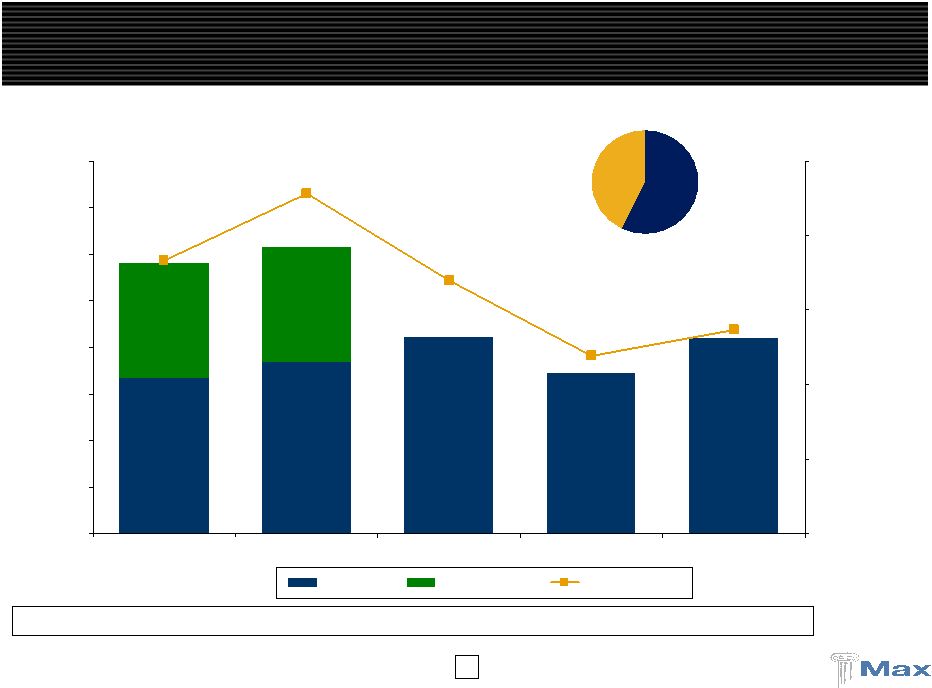

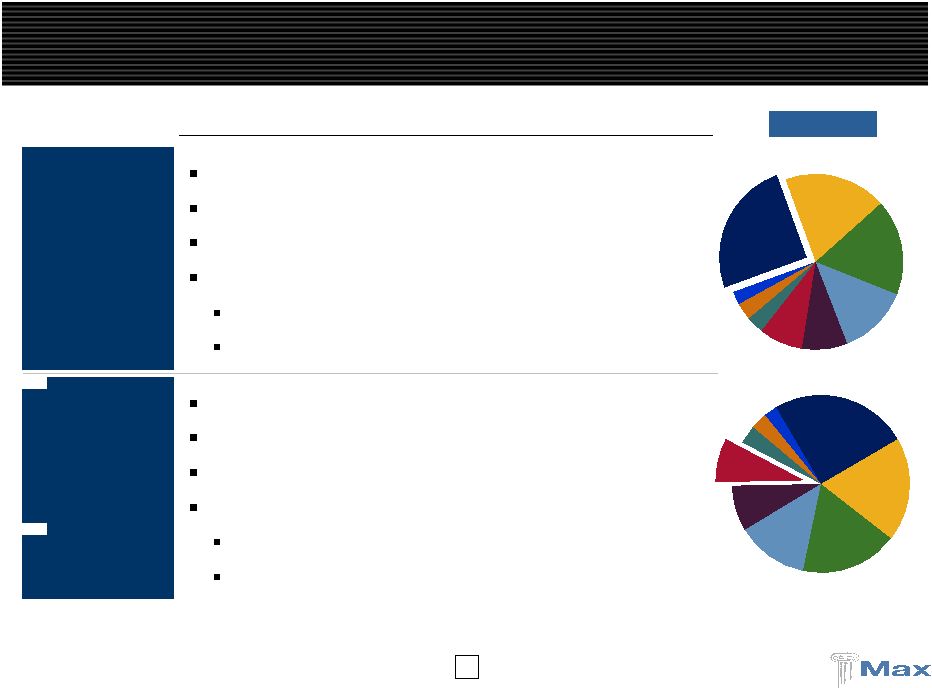

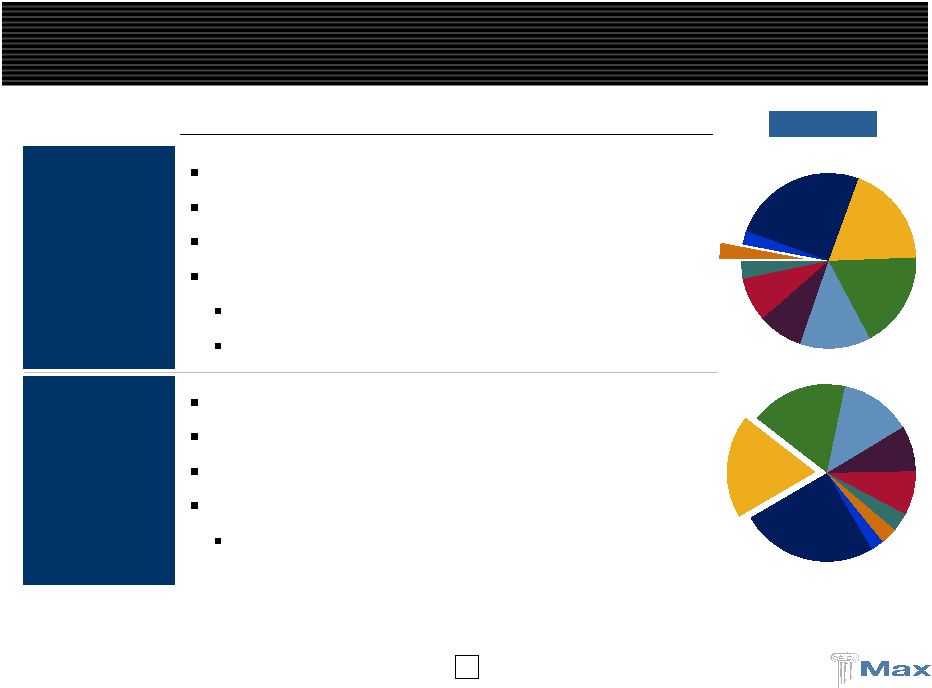

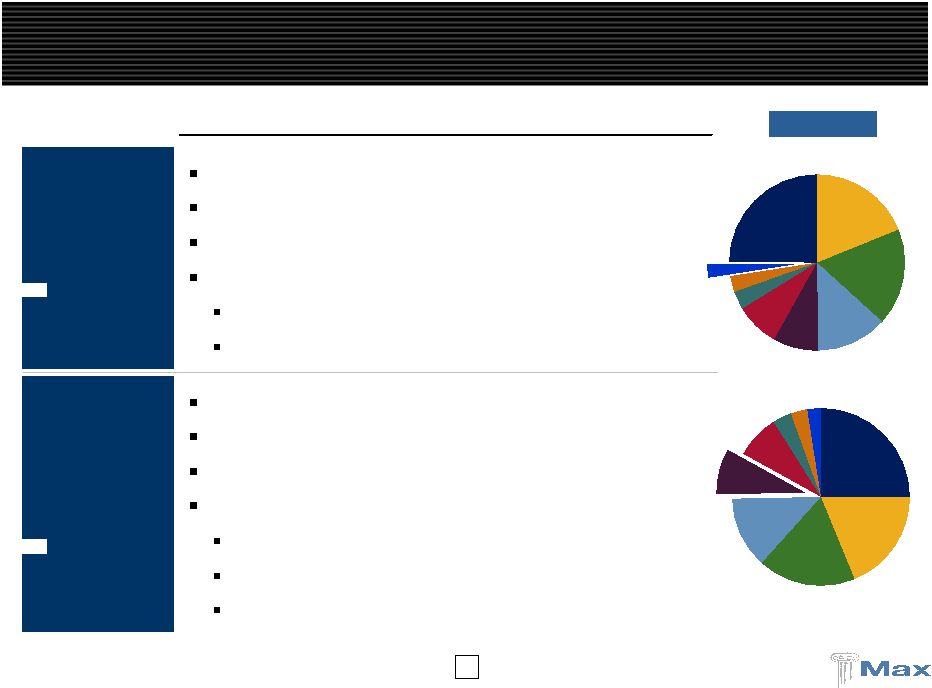

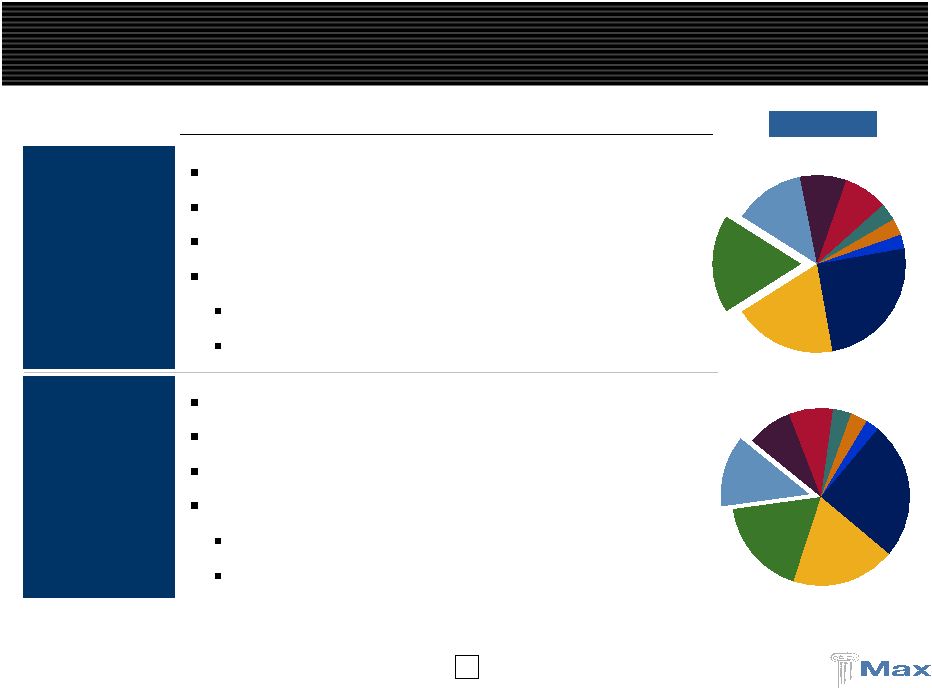

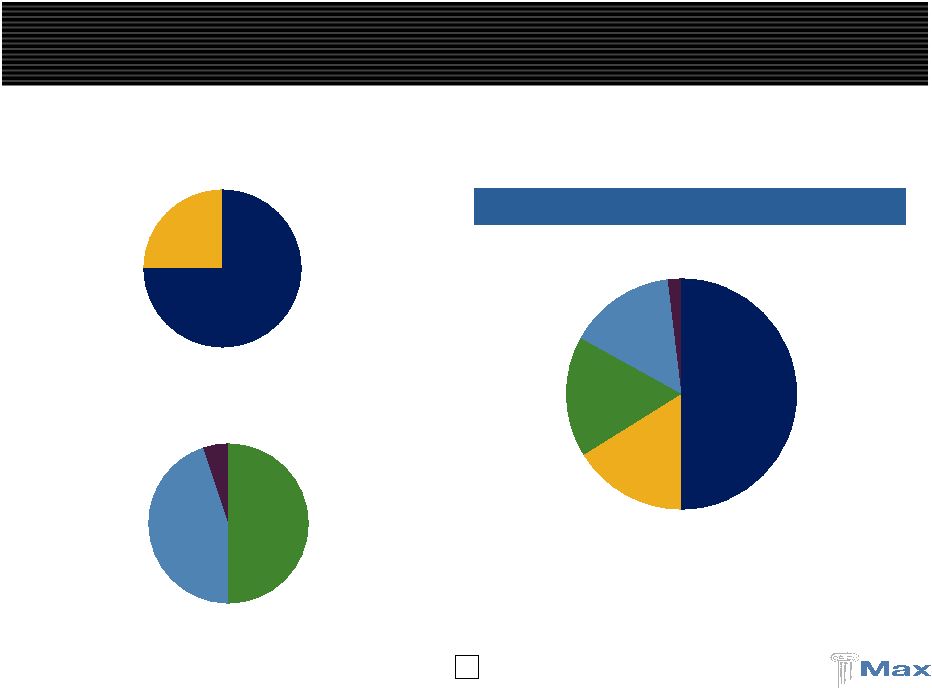

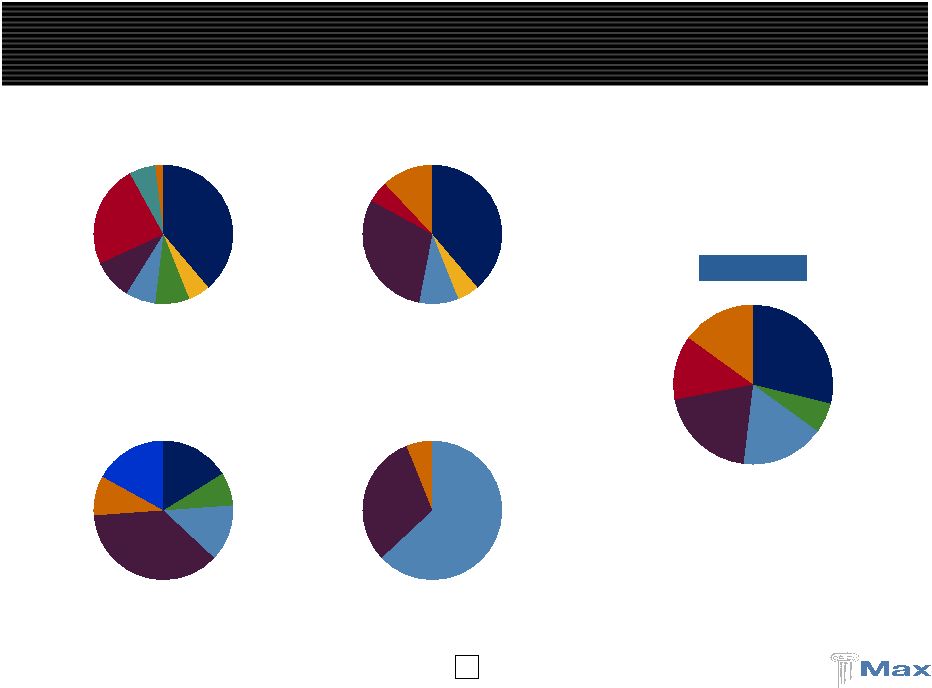

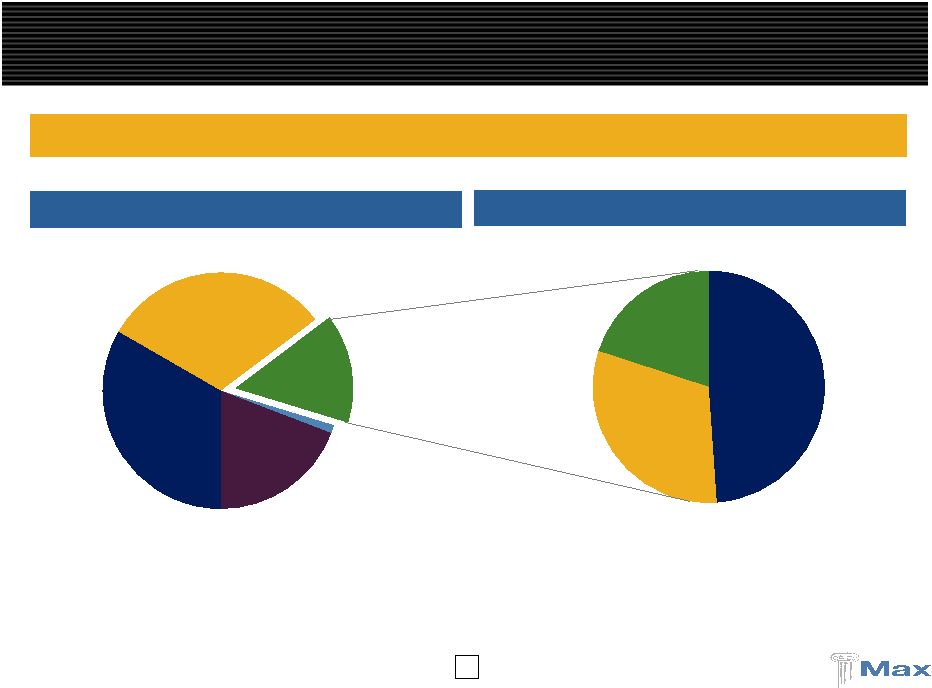

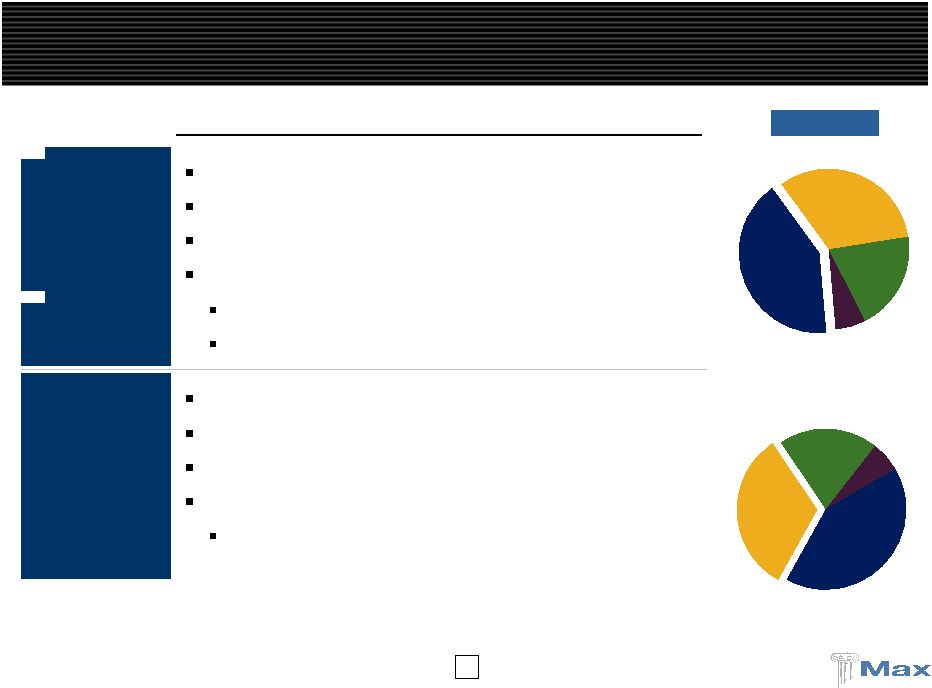

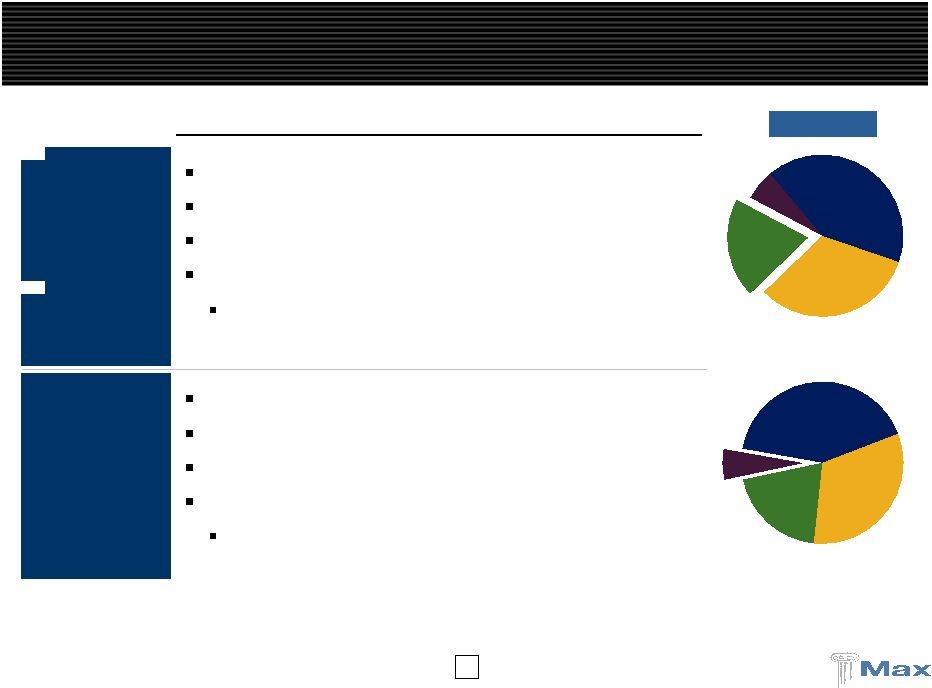

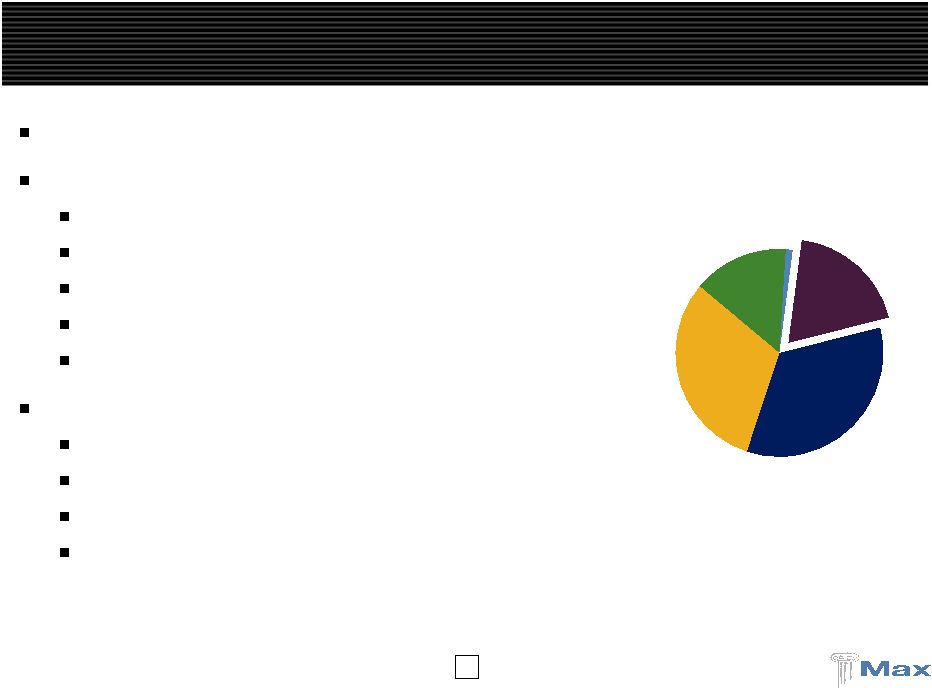

42 Average quality of AA 70%+ of fixed income securities rated Aa or better Less than 7% rated Baa or below Approximately 42% of portfolio is Cash, Governments, Agencies, and Agency MBS Cash balance is approximately $1,008 million or 22% of the portfolio U.S. and G7 governments approximately $805 million or 17% of the portfolio U.S. Agencies approximately $238 million or 5% of the portfolio U.S. Agency MBS approximately $571 million or 12% of the portfolio Corporate Holdings are well diversified Approximately 32% of the portfolio Approximately 200 different corporate issuers Largest “Aa” issuer is less than 1.1% of the portfolio Largest “A” issuer is less than 1.0% of the portfolio No CDO’s, CLO’s, SIV’s or other highly structured securities Remaining portfolio is high quality ABS, RMBS and CMBS Holdings Almost all RMBS holdings are rated AAA, with substantial portion being agency CMO’s All CMBS holdings are rated AAA Principal losses, if any, are expected to be minimal based upon cash flow and stress testing ABS holdings are largely comprised of plain vanilla auto and credit cards Home equity ABS holdings amount to approximately $38 million (all Subprime and Alt – A) Subprime and Alt – A exposures are approximately $68 million book value 2.8 year weighted average life Significant and growing over-collateralization No principal losses are expected based upon cash flow and stress testing Unrealized loss of approximately $20 million High Quality Cash and Fixed Income Portfolio |