Annual Report

September 30, 2023

CrossingBridge Low Duration High Yield Fund

Institutional Class

(CBLDX)

CrossingBridge Responsible Credit Fund

Institutional Class

(CBRDX)

CrossingBridge Ultra-Short Duration Fund

Institutional Class

(CBUDX)

CrossingBridge Pre-Merger SPAC ETF

(SPC)

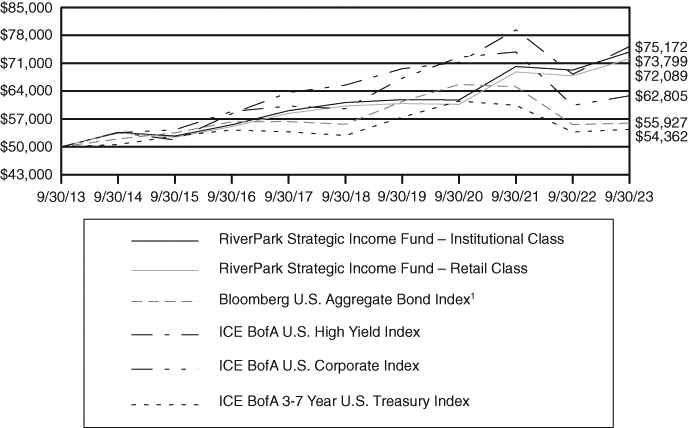

RiverPark Strategic Income Fund

Institutional Class

(RSIIX)

Retail Class

(RSIVX)

Investment Adviser

CrossingBridge Advisors, LLC

427 Bedford Road

Suite 220

Pleasantville, New York 10570

Phone: 1-888-898-2780

Table of Contents

| COMMENTARY | 3 |

| MANAGEMENT’S DISCUSSION OF | |

| FUND PERFORMANCE AND ANALYSIS | 17 |

| EXPENSE EXAMPLE | 32 |

| INVESTMENT HIGHLIGHTS | 34 |

| SCHEDULES OF INVESTMENTS | 44 |

| STATEMENTS OF ASSETS AND LIABILITIES | 85 |

| STATEMENTS OF OPERATIONS | 88 |

| STATEMENTS OF CHANGES IN NET ASSETS | 91 |

| FINANCIAL HIGHLIGHTS | 96 |

| NOTES TO FINANCIAL STATEMENTS | 102 |

| REPORT OF INDEPENDENT REGISTERED | |

| PUBLIC ACCOUNTING FIRM | 129 |

| BASIS FOR TRUSTEES’ APPROVAL OF | |

| INVESTMENT ADVISORY AGREEMENTS | 131 |

| REVIEW OF LIQUIDITY RISK MANAGEMENT PROGRAM | 140 |

| ADDITIONAL INFORMATION | 141 |

Commentary

Rooting for my hometown Philadelphia Phillies in the playoffs, I am reminded that “fat pitches” are rarely presented to batters. To avoid striking out, they are often forced to swing at “skinny pitches” just inside the strike zone. Unlike baseball players, investors looking for the fat pitch are not forced to swing and can safely hold cash until the right opportunity comes along. Unfortunately, investors are often overeager to spot and embrace a “fat pitch” when, in truth, there is often less than meets the eye. In our view, the key to investment success is avoiding strike outs and successfully hitting “singles” and “doubles”. Of course, who doesn’t like a fat pitch?

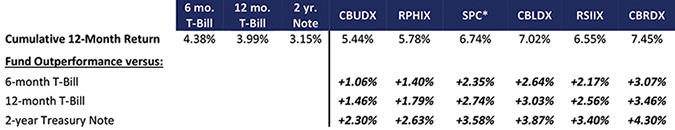

CrossingBridge & Affiliate Managed Funds vs Short-Term Treasury SecuritiesA,1

*The return for SPC (ETF) is reflected by the Market Price.

A year ago, many investors took the view that short-dated U.S. Treasuries were a “fat pitch”. On September 30, 2022, the 2-year Treasury bond was yielding 4.28% – “pretty good,” they thought, in comparison to the miniscule yields over the prior 15 years and “risk free”, backed by the U.S. Government. Although this perspective had some merit, it was not the fat pitch investors believed it to be. Rather, because rates had risen, it was simply a higher yielding place to hold cash while waiting for the fat pitch. It also had risks that investors did not consider. For example, as rates continued to rise, these securities experienced mark-to-market losses and investors were cut off from the ability to reinvest at higher yields during the holding period. Further, it ignored the risk posed by the disfunction of the U.S. Congress, crystalized when Fitch downgraded the U.S. sovereign credit rating2 and exemplified by the recent, unprecedented ouster of the Speaker of the House. In addition, an investor in Treasuries missed the opportunity to capture the risk premium in corporate securities. As shown above, our Funds outperformed short-term Treasuries over the last twelve months, benefitting from active management and spread premium in the underlying investments.

________________

1 | CBUDX is the symbol for the CrossingBridge Ultra Short Duration Fund. RPHIX is the symbol for the RiverPark Short Term High Yield Fund. SPC is the symbol for the CrossingBridge Pre-Merger SPAC ETF. CBLDX is the symbol for the CrossingBridge Low Duration High Yield Fund. RSIIX is the symbol for the RiverPark Strategic Income Fund. CBRDX is the symbol for the CrossingBridge Responsible Credit Fund. For further reference on the specific funds, please see www.crossingbridgefunds.com and www.riverparkfunds.com/funds. |

2 | On August 1, 2023, Fitch downgraded the U.S. sovereign credit rating from AAA to AA+, warning that “risks have risen that the debt limit will not be raised or suspended before the x-date and consequently that the government could begin to miss payments on some of its obligations.” Standard & Poors effected a downgrade to the same level on August 5, 2011 following a previous debt ceiling crisis that took the country to the brink of default. |

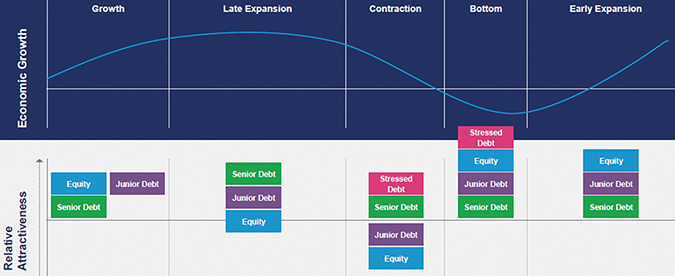

Attractiveness of Asset Classes Across the Economic CycleB

The diagram above, prepared by Mercer,3 reflects their view that different asset classes are more or less attractive depending on the stage of the economic cycle. An investor looking for “fat pitches” should keep this in mind.

Currently, a fat pitch being discussed is the upcoming opportunity for distressed investing. We have our doubts.4 Years ago, good companies with bad balance sheets presented fruitful opportunities. Today, most distressed candidates are more likely to be either venture-like businesses, running out of capital, or mature zombies, both of which have been described in previous letters. Although it may be tempting to allocate to the distressed market when the economy is bottoming out, the dramatic growth in funds raised that are dedicated to this asset class, combined with limited availability of high-quality opportunities has led distressed funds to practice “creditor-on-creditor warfare,” to compensate for sub-optimal returns.5 That said, we have the skill set to participate in a distressed fat pitch should we come across one.

In the spirit of hitting singles and doubles, senior debt appears to be the only asset class that consistently remains attractive throughout the economic cycle. This is where we live.

________________

3 | Mercer is an employee benefits and investment consultant. |

4 | Note that most vehicles through which one may invest in distressed securities are private funds that charge high management and incentive fees, reducing returns to the investor. In addition, these funds will often have “lockup” periods, limiting liquidity. |

5 | For a primer on “creditor-on-creditor warfare”, read The Caesars Palace Coup by Sujeet Indap and Max Frumes. |

Energy Sector: Exploration & Production Companies and Midstream Service Providers

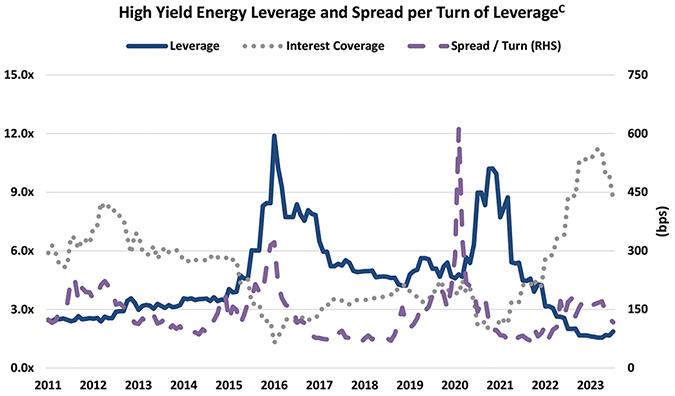

In June, I participated in a panel at a high yield conference sponsored by the CFA Society of New York. One of the speakers made the case that high yield exploration & production (“E&P”) credit was a “fat pitch” that should be overweighted. She argued that many of the companies had de-levered and that yields were attractive relative to other sectors in the high yield indices. Indeed, as shown above, leverage among high yield energy credits has declined from the peak in 2020-22 and interest coverage has dramatically improved due to lower interest expense and higher cash flow. However, as of August 31, 2023, the average option adjusted spread per turn of leverage, a measure of return relative to risk, was 117 basis points, below the long-term average of 140 basis points.D

Moreover, we have several concerns related to exploration and production credits as the energy sector may repeat a well-established cycle:

| | 1. | Merger and acquisition activity is robust with capital chasing production and consolidation opportunities in response to rising energy prices. Risk is already rising. For example, in the Permian basin this year,6 nearly 44%E of acquired reserves have consisted of more speculative proven, undeveloped (“PUD”) reserves, to which we, in our analysis, attribute little value. Furthermore, several recent transactions are being priced at modest premiums to proven developed reserves (“PDP”), leaving little or no safety margin. |

| | | |

| | 2. | As valuations rise, companies pursue the cheapest form of capital. Recently, debt financing has become more prevalent as a primary source of capital. In fact, the energy sector is the highest dollar value issuer of junk bonds in 2023. With the futures curve for oil prices in “backwardation”7 the present value of reserves is likely inflated, suggesting that collateral support for debt may be lower than perceived. |

________________

6 | Located in western Texas and southeastern New Mexico, the Permian Basin is the highest producing oil field in the U.S. |

7 | Commodity price curves are “normal” or in “contango” when prices are lowest in the near term and are expected to rise as time passes. Curves in “backwardation” are the opposite with prices high at present (“spot”) and expected to decline over time. |

| | 3. | Eventually, commodity prices drop and/or operating execution disappoints, potentially leading to over-levered companies with depleting assets. |

| | | |

| | 4. | Companies are forced to rationalize their balance sheets and focus on cash flow to survive – some don’t make it. |

| | | |

| | 5. | Wash – rinse – repeat. |

Although we have been a net seller of exploration & production (E&P) credits in 2023 and presently have low exposure to the sector,F there have been instances in which we find attractive investments in E&P. Often, the opportunities we find interesting are companies that are emerging from distress with low leverage and cleansed of value-impairing liabilities. These investments must meet high hurdles in terms of asset coverage, expected return and covenant protection. Today, most of our new debt investments in the E&P sector are event-driven, premised on a corporate event such as an asset sale or refinancing.

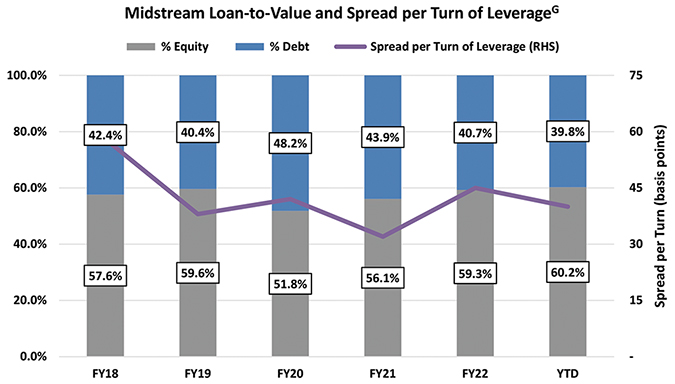

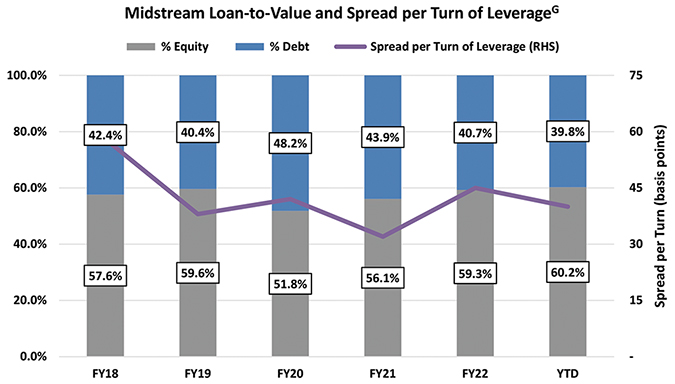

Another part of the energy sector, midstream service providers (“MSPs”) is also garnering attention from the wealth advisory community because, having learned the lessons of the past, these companies have been reducing leverage, increasing dividends, and repurchasing shares. MSPs, typically oil & gas pipelines, are often lumped together with energy producers yet have their own specific characteristics when it comes to credit. MSP assets may provide the only energy transport infrastructure available to an energy producer in a region, allowing good visibility of cash flow via long term contracts and minimum volume commitments. However, as these companies are often structured as master limited partnerships, they are required to distribute a large portion of net income to their equity holders, limiting their ability to pay down debt or reinvest for growth. Loan-to-value, a measure of credit risk, has improved modestly over the last five years but does not make the sector that much more attractive. Meanwhile, compensation for credit risk, as reflected in the credit spread per turn of leverage, is currently about average – thus, no great bargain. Moreover, these companies are increasing dividends and share buybacks enhancing shareholder value to the detriment of lenders.

We have invested in debt of MSPs selectively. For example, NGL Energy, which we will discuss below, has been prohibited from paying dividends since April 2019 when it issued its 7.50% secured bonds, due 2026. As a result, the company has been paying down debt

since leverage peaked in 2021 and has vocally stated its intention to refinance all of its bonds in the near term, potentially creating an attractive event-driven opportunity.

Securitizations

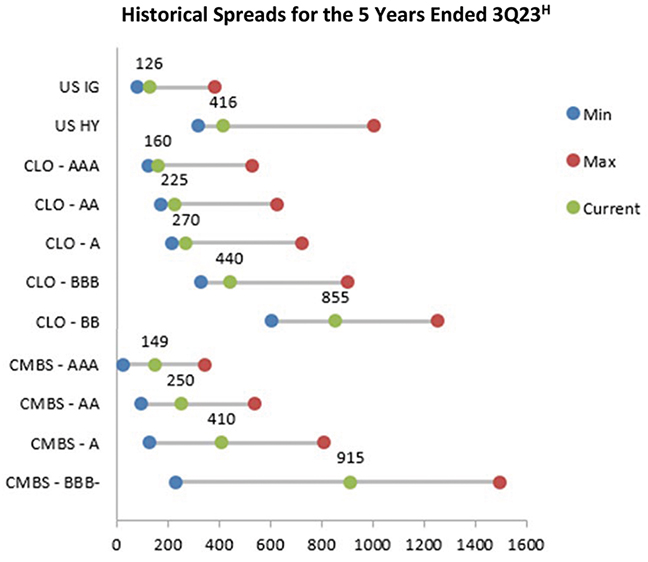

Following the scare brought on by the failure of Silicon Valley Bank and the near-death experience of First Republic Bank, spreads of asset-backed securities widened to attractive levels. As time has passed, spreads have narrowed. Still, BBB and below collateralized loan obligation (CLO) securities and AA and below commercial mortgage-backed securities (CMBS) appear cheap on a relative basis.

We continue to focus primarily on single-A CMBS securities that are not exposed to central business district properties. As we discussed in prior letters, we expect the commercial real estate market to take several years to heal and we hope, ultimately, to find a fat pitch or two in the future – but buyer beware.

Investors are also pointing to the lower tranches of CLOs that are providing high yields. This may be the case, but we do not invest in that market unless we see a fat pitch such as in 2009, when the economy was emerging from the Great Financial Crisis (“GFC”). Moreover, we typically do not invest in CLOs for the same reason that we shy away from financial institutions: they take underwriting risk, they take spread risk, they take counterparty risk, and they are dependent on the capital markets remaining fluid. These risks are similar to the risks we face every day. Therefore, we choose not to increase our exposure unnecessarily, particularly as these financial issuers also employ leverage. Investors attracted to the wide spreads for BBB tranches of CLOs should be aware that, typically, this tranche begins to experience principal losses when aggregate portfolio losses reach 16%. This is comparable to a real estate loan or a leveraged buyout (LBO) that has been financed at an 84% loan-to-value – risky propositions in our estimation. “Live by the sword, die by the sword.”

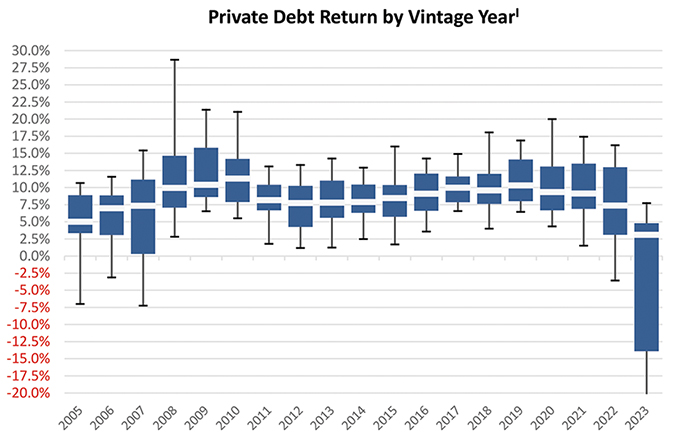

Private Credit

The graph above shows the performance of private debt issued by cohort year. It appears that private debt is not the “fat pitch” being widely touted. The median return for originations in each year since 2005 has been 8.8% with a wide range of performance. Clearly, manager selection is paramount.

The growth in “private credit” over the last few years has come about as private lenders have replaced banks, providing floating rate debt that affords borrowers the flexibility to repay early with little or no prepayment penalty and providing investors with interest rate protection. Thus, “private credit” is supposedly the hot new thing providing higher returns with lower volatility, yet our head of research began his career in the 1980s in the private placement group of a large life insurer and sees nothing new. As was the case 30 years ago, private credit is typically:

| | • | Provided by institutions other than banks. |

| | • | Issued by privately-owned borrowers who prefer a private transaction or, more likely, have no access to the public bond or bank loan markets due to their smaller size or complex credit story. |

| | • | Tailored to the borrower’s specific needs in terms of size, repayment schedule, covenants, etc. |

| | • | Backed by senior claims on issuers’ cash flow and/or assets. |

These factors contribute to the belief that private credit provides higher returns. However, as with most investments, higher return comes with higher risks (selectively, but not all-inclusive):

A lower default rate does not mean there is less distress. Defaults are lower because, when faced with a potential default, it is easier to get a small group of lenders to agree to waive a covenant than to get 20-100 bondholders or a large syndicate of lenders to agree to a waiver. While there may be fewer “defaults”, the aggregate level of distress may be comparable to the leveraged loan market.

Volatility is low because there is no credible mark-to-market. Proponents of private credit often point to lower volatility relative to high yield and syndicated leveraged loans. However, this does not reflect greater safety in the private credit market; it is a direct result of the fact that these loans do not trade so there is no price discovery, potentially imparting a false sense of stability.

Minimal market liquidity means lenders must live with their mistakes. Given that each private debt issue may be held by one lender or a small group of lenders, it is much more difficult to sell a distressed private loan than a troubled bond or syndicated loan for which there are many holders and a well-established market for distressed debt. Thus, private lenders have limited ability to sell a loan to avoid anticipated losses. Moreover, in the absence of an ability to sell troubled credits, a private lender will need to develop an in-house workout capability to manage the distressed situations that are inevitable in any credit portfolio.

The private credit market has not experienced a default cycle. The private credit market has seen its greatest growth in the aftermath of the GFC when it began to fill the void left by banks that dramatically reduced their loan exposure in the face of new capital rules. The rise in defaults in 2014-16 was primarily concentrated in the energy industry and weakness in credit in 2020-21 resulting from the COVID-19 crisis was largely offset by government-funded stimulus. Thus, there has not yet been a broad default cycle since the GFC to test the safety and security attributed to the private credit market.

We continue to emphasize idiosyncratic investments with the discipline to re-evaluate and potentially sell (even if it means taking a loss) when, in our view, risk versus return goes askew – see FXI below. As mentioned earlier in this letter, we discuss a MSP investment – see NGL Energy below. Lastly, we provide a recent portfolio holding which was intended, in baseball parlance, to be a “single”, but turned out to be a “double” – see Georg Jensen.

FXI Holdings (FXIHLD) 12.25% Secured Notes due 11/15/26J – The company, formerly known as Foamex, is a leading North American producer of foam solutions selling bedding, furniture and automotive foam via retail and wholesale channels. The company was acquired by private equity firm One Rock Partners, LLC in 2017. We have owned several of the company’s bonds at various times since 2018 and initially purchased the 12.25% Secured Notes, due 2026, in October 2019 when the bond was issued. We were attracted to the solid management, the benefits of rapid growth in the bedding industry, reasonable leverage below 5.0x EBITDA and free cash flow enabled by low capital expenditures. With the ability to pass through supply chain-related cost increases and benefitting from a rise in household formation during COVID which led to increased mattress sales, the company performed very well in 2021. However, they experienced a contraction in 2022 as demand for new bedding waned and new car production was constrained due to supply chain issues. In March 2023, ahead of its 2024 unsecured bond going current in November 2023, the company exchanged the majority of its 7.875% unsecured bonds for new 12.25% secured bonds due 2026. This exchange increased annual cash interest expense by approximately $20 million, pressuring cash flow, and increasing the amount of debt that is pari passu with the bond we held prior to the exchange, weakening its position. Thus, given the declining trajectory of the business, rising leverage, weaker structural protection and the challenging $1.24 billion maturity wall that looms in late 2026, we concluded that the 16% yield to maturity was not enough compensation for the growing risk and sold the remainder of our position in 3Q23.

NGL Energy Partners LP (NGL) 6.125% Unsecured Notes due 3/1/25, 7.50% Senior Secured Notes due 2/1/26, Series B Preferred StockK –– NGL Energy is a diversified midstream master limited partnership (MLP) that provides transportation, storage, marketing and other logistics services for crude oil, liquid hydrocarbons, and water

generated as part of energy production. Experiencing a sharp decline in EBITDA during 2020, NGL repaid its asset-backed loan facility and bridge loan in January 2021 by issuing a 7.50% senior secured note due 2/1/26. Given elevated pro forma net leverage, bond purchasers required a covenant preventing the company from paying dividends until total leverage was reduced below 4.75x EBITDA. Thus, since that bond was issued in January 2021, the company has keenly focused on de-leveraging. “Walking the talk,” the company partially repurchased its 7.50% unsecured notes, due 11/1/23, during 1Q23, ultimately calling the remaining bonds, of which we were holders, at par on 3/31/23. Concurrent with our initial purchases of the unsecured bonds in January 2023, we began to purchase the 7.50% senior secured notes due 2/1/26. With conservative secured leverage and expectations for continued de-leveraging, we were comfortable purchasing these bonds at a weighted average price of 95.8, providing a yield to maturity averaging of 9.14% and the opportunity for a higher rate of return if the company followed through on its stated intention to repay this bond before it became a current liability on 2/1/25.8 To that end, management expressed its intention to repay the 6.125% unsecured bonds, due 3/1/25, no later than the end of March 2024. Still able to purchase the bonds at a discount, we added to the position in the 6.125% bonds in late August, and, in addition, have been actively trading the NGL Series B Preferred Stock. The preferred shares have been accruing their dividend at a rate that resets each quarter, currently 12.783%, and, as of quarter-end, are trading at nearly a 20% discount to their liquidation value which continues to increase with each dividend deferral. As the company is prohibited from making distributions to MLP unit holders until it has paid the preferred dividends that are in arrears and resumed the cash dividend to the preferred shareholders, we anticipate significant catch-up payments as early as late 2024 if the company succeeds in refinancing its capital structure. NGL is a good example of a series of attractive, well-grounded investments, that “advance the runner” without ��swinging for the fences.”

Georg Jensen A/S (GEORGJ) Secured Floating Rate Note due 5/14/25L – Georg Jensen is a globally recognized Danish design house, with a history spanning over 119 years. The company designs, manufactures, and distributes an extensive range of gold, silver, and diamond jewelry, watches, home décor, tableware, and hollowware. In February 2023, we participated in the issuance of the company’s secured floating rate notes due 5/14/25, purchasing the notes at par to yield 9.55% with proceeds used to repay the company’s secured floating rate note due 5/15/23, which we previously held. We sold a portion of the bonds in the 100.50-101.50 range to book small gains in the months following issuance. However, the bonds jumped to the 104.00-104.50 range following the 9/14/23 announcement that the company was being sold to Fiskars Group, the owner of several global home goods brands including Fiskars, Gerber, Iittala, Royal Copenhagen, Moomin Arabia, Waterford, and Wedgwood. With some uncertainty as to the timing to complete the sale and the specific disposition of the bonds as a result of this transaction, we took advantage of the sharply higher price to sell most of our remaining bonds within days of the sale announcement. The bonds will be redeemed at a price closer to 106 on October 26, but given the opportunity to realize a quick gain rather than risk the bonds falling back if the deal fell through, we were quite content to sell and look for another opportunity.

________________

8 | We made multiple purchases over several days at varying prices. Assuming a weighted average purchase date of 2/6/23 and a weighted average purchase price of 95.8, the rate of return to a 2/1/25 repayment would be approximately 9.88%. |

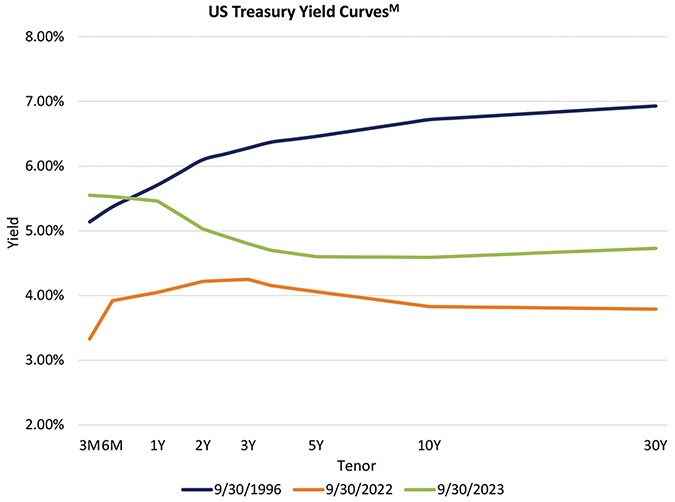

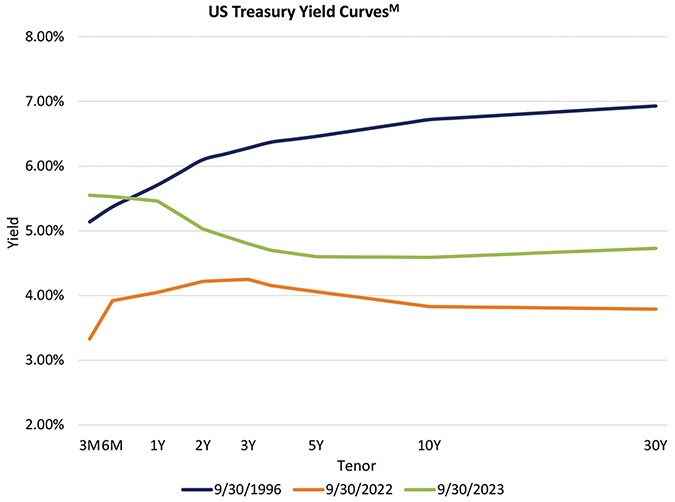

When I left Leucadia National in 1996 to “put out my own shingle” as an investment manager, short term interest rates were not that different from today’s levels. However, as shown above, the yield curve was “normal”, sloping upward, as opposed to the inverted curve we have today. Rates have risen dramatically over the last year, especially in the short end of the curve. Today’s inverted yield curve reflects an expectation by some that the economy will slow down and force the Federal Reserve’s hand to lower rates. Others are challenging this conventional wisdom with the belief that, structurally, the curve will normalize with medium and long-term rates going up; so far, they are right. Both sides, advocating getting long or shorting long duration bonds, believe that the setup is a fat pitch. Rather, we believe this is nothing more than interest rate speculation and, instead, will take a more agnostic approach. We prefer to accept risk in the form of corporate credit, taking advantage of high short-term rates and acceptable spreads to capture our returns.

The subject of the book and the movie, Moneyball,N Billy Beane is former professional baseball player who was named general manager of the Oakland A’s in 1997. He is best known for crafting the team into a winner despite one of the lowest payrolls in the league by analyzing key statistical elements of overlooked, undervalued players rather than paying high salaries for stars. This approach is exemplified by a few lines from the movie9 in which Billy Beane is discussing a player prospect with John Poloni, an “old school” scout focused on players who can hit the fat pitch, and Peter Brand, the analyst who developed the mathematical tools employed by Beane:

________________

9 | This iconic scene can be revisited at the following: https://www.youtube.com/watch?v=3MjxoaynCmk&ab_channel=SceneCity |

(the scouts look at the report)

The Scouts: He gets on base.

Billy Beane: He gets on base!

John Poloni: So he walks a lot.

Billy Beane: He gets on base a lot. Do I care if it’s a walk or a hit?

(looks over at Peter)

Peter Brand: You do not.

Billy Beane: I do not.

Beane recognized that, in his system, the objective is to get on base regardless of whether it is by getting a hit or being walked. We think we are similar. We don’t think anything in our markets is easy or obvious. We expect to be successful by analyzing individual credit opportunities in a methodical, disciplined manner to determine whether they provide a respectable level of return that is commensurate with a responsible level of risk. Grinding out returns, this is the approach that permitted our portfolios to outperform Treasuries (and a lot of other portfolios) over the last year and, we believe, will serve our long-term investors well going forward.

Playing “small ball,”10

David K. Sherman and the CrossingBridge team

________________

10 | “Small ball” is an offensive strategy in baseball that emphasizes getting runners on base and advancing them to scoring position, 2nd or 3rd base, via singles, bases on balls, stolen bases, bunts, sacrifice flies, etc. The strategy de-emphasizes extra base hits, swinging for home runs, etc. |

Endnotes

________________

A | The return for the 6-month T-Bill is the compounded return of a generic on-the-run 6-month T-Bill purchased on 9/30/22 with proceeds from the 3/31/23 maturity reinvested in another 6-month T-Bill that matures on 9/30/23. The return on the 12-month T-Bill is the yield of a generic one-year T-Bill as if purchased on 9/30/22. The return on the 2-year Treasury Note reflects the compounded monthly return of a 2-year Treasury Note as if purchased on 9/30/22 and sold on 9/30/23. The returns on the funds managed by CrossingBridge and affiliates reflect the compound monthly returns of each fund for the twelve months ended 9/30/23. Standardized performance for the Funds can be found here: CrossingBridge Ultra-Short Duration Fund: http://www.crossingbridgefunds.com/ultra-short-duration-fund. RiverPark Short Term High Yield Fund: http://www.riverparkfunds.com/short-term-high-yield-fund. CrossingBridge Pre-Merger SPAC ETF: https://www.crossingbridgefunds.com/spac-etf. CrossingBridge Low Duration High Yield Fund: http://www.crossingbridgefunds.com/low-duration-high-yield-fund. RiverPark Strategic Income Fund: http://www.crossingbridgefunds.com/riverpark-strategic-income-fund. CrossingBridge Responsible Credit Fund: https://www.crossingbridgefunds.com/responsible-credit-fund. Standardized performance for the Treasuries can be found here: https://info.crossingbridgefunds.com/hubfs/Standardized%20Performance%20for%20Treasuries%20as%20of%209-30-23.pdf. Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. |

B | Private versus Liquid Credit, Mercer LLC, September 2023 (with permission) |

C | Bank of America; data from February 28, 2011 through August 31, 2023 |

D | Bank of America; data from February 28, 2011 through August 31, 2023 |

E | Company filings and internal research |

F | As of 9/30/23, exposure to the Exploration and Production sector was 1.68% in the CrossingBridge Low Duration High Yield Fund, 0.00% in the CrossingBridge Responsible Credit Fund, 3.61% in the CrossingBridge Ultra-Short Duration Fund, 4.37% in RiverPark Short Term High Yield Fund and 1.34% in the RiverPark Strategic Income Fund. |

G | E&P and Midstream Relative Value Update, Barclays, September 19, 2023, and Midstream Monthly Outlook: October 2023, Wells Fargo, October 5, 2023 |

H | Bank of America – Reflects the range of credit spreads for each asset class over the five-year period ended September 29, 2023. Investment grade spreads reflect the credit spread for the ICE BofA US Corporate Index. High yield spreads reflect the credit spread for the ICE BofA US High Yield Corporate Index. CLO spreads reflect the market spread over the US Secured Overnight Financing Rate (SOFR) for 5-year floating rate tranches. CMBS spreads reflect the market spread over the Treasury rate for on-the-run fixed rate conduit structures (multi-asset, multi-sector) with a 3-year maturity for AAA tranches and a 10-year maturity for all other tranches |

I | Pitchbook vintage year data |

J | As of 6/30/23, our position in FXI Holdings 12.25% Secured Notes due 11/15/26 represented 0.71% of the CrossingBridge Low Duration High Yield Fund and 0.69% of the RiverPark Strategic Income Fund. As of 9/30/23, our position in these bonds represented 0.00% of the CrossingBridge Low Duration High Yield Fund and the RiverPark Strategic Income Fund. |

K | As of 6/30/23, our position in the NGL Energy 6.125% Senior Notes represented 0.00% of the CrossingBridge Ultra-Short Duration Fund and 0.00% of the RiverPark Short Term High Yield Fund. As of 9/30/23, our position in the NGL Energy 6.125% Senior Notes represented 2.44% of the CrossingBridge Ultra-Short Duration Fund and 2.57% of the RiverPark Short Term High Yield Fund. As of 6/30/23, our position in the NGL Energy 7.50% Senior Secured Notes represented 1.48% of the CrossingBridge Low Duration High Yield Fund and 1.58% of the RiverPark Strategic Income Fund. As of 9/30/23, our position in the NGL Energy 7.50% Senior Secured Notes represented 1.39% of the CrossingBridge Low Duration High Yield Fund and 1.14% of the RiverPark Strategic Income Fund. As of 6/30/23, our position in the NGL Energy Series B Preferred Stock represented 0.47% of the CrossingBridge Responsible Credit Fund and 0.46% of the RiverPark Strategic Income Fund. As of 9/30/23, our position in the NGL Energy Series B Preferred represented 0.44% of the CrossingBridge Responsible Credit Fund and 0.33% of the RiverPark Strategic Income Fund. |

L | As of 6/30/23, our position in the Georg Jensen Secured Floating Rate Notes represented 1.13% of the CrossingBridge Low Duration High Yield Fund, 2.62% of the CrossingBridge Responsible Credit Fund and 1.10% of the CrossingBridge Ultra-Short Duration Fund. As of 9/30/23, our position in the Georg Jensen Secured Floating Rate Notes represented 0.11% of the CrossingBridge Low Duration High Yield Fund and 0.00% of the CrossingBridge Responsible Credit Fund and the CrossingBridge Ultra-Short Duration Fund. |

M | Bloomberg |

N | Moneyball: The Art of Winning an Unfair Game, Michael Lewis, 2003 |

Disclosures

Must be preceded or accompanied by a prospectus. The prospectus for the CrossingBridge Ultra-Short Duration Fund, CrossingBridge Low Duration High Yield Fund, and the CrossingBridge Responsible Credit Fund can be found here: www.crossingbridgefunds.com/assets/fund/CrossingBridge_Prospectus.pdf. The prospectus for the RiverPark Strategic Income Fund can be found here: info.crossingbridgefunds.com/hubfs/Regulatory/RSIIX_Prospectus.pdf. To obtain a hardcopy of the prospectus, call 855-552-5863. Please read and consider the prospectus carefully before investing. Per rule 30e-3, the fiscal Q1 holdings can be found here: info.crossingbridgefunds.com/hubfs/FY%20Q1%20Holdings.pdf. The fiscal Q3 holdings can be found here: info.crossingbridgefunds.com/hubfs/FY%20Q3%20Holdings.pdf.

The prospectus for the CrossingBridge Pre-Merger SPAC ETF can be found here: https://www.crossingbridgefunds.com/assets/spac-etf/crossingbridge-spac-etf-prospectus.pdf. The

Statement of Additional Information (SAI) can be found here: https://www.crossingbridgefunds.com/assets/spac-etf/crossingbridge-spac-etf-sai.pdf. To obtain a hardcopy of the prospectus, call 855-552-5863. Please read and consider the prospectus carefully before investing.

The Funds are offered only to United States residents, and information on this site is intended only for such persons. Nothing on this website should be considered a solicitation to buy or an offer to sell shares of the fund in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction.

CrossingBridge mutual funds’ disclosure: mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Because the fund may invest in exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), they are subject to additional risks that do not apply to conventional mutual fund, including the risks that the market price of an ETF’s and ETN’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. The value of ETN’s may be influenced by the level of supply and demand for the ETN, volatility and lack of liquidity. A Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in asset backed, mortgage backed, and collateralized mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investing in commodities may subject the fund to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. Shares of closed-end fund frequently trade at a price per share that is less than the nav per share. There can be no assurance that the market discount on shares of any closed-end fund purchased by the Fund will ever decrease or that when the Fund seeks to sell shares of a closed-end fund it can receive the nav of those shares. There are greater risks involved in investing in securities with limited market liquidity.

CrossingBridge Pre-Merger SPAC ETF disclosure: investing involves risk; principal loss is possible. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business other than seeking combinations, and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable combination. There is no guarantee that the SPACs in which the fund invests will complete a combination or that any combination that is completed will be profitable. Unless and until a combination is completed, a SPAC generally invests its assets in U.S. Government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a combination even though a majority of its public stockholders do not support such a combination. Some SPACs may pursue combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. May involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. And foreign regulatory requirements and market practices. Further,

tax treatment may differ from U.S. SPACs and securities may be subject to foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination. Because the Fund is non-diversified it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio.

Definitions: The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the united states. The ICE BOFA Investment Grade Index tracks the performance of us dollar denominated investment grade rated corporate debt publicly issued in the us domestic market. The ICE BOFA High Yield Index tracks the performance of us dollar denominated below investment grade rated corporate debt publicly issued in the us domestic market. EBITDA is a company’s earnings before interest, taxes, depreciation, and amortization is an accounting measure calculated using a company’s earnings, before interest expenses, taxes, depreciation, and amortization are subtracted, as a proxy for a company’s current operating profitability. A Basis Point (BP) is 1/100 of one percent. Pari-Passu is a Latin term that means ‘on equal footing’ or ‘ranking equally’. It is an important clause for creditors of a company in financial difficulty which might become insolvent. If the company’s debts are Pari-Passu, they are all ranked equally, so the company pays each creditor the same amount in insolvency. LIBOR is the average interbank interest rate at which a selection of banks on the London money market are prepared to lend to one another. Yield to Maturity (YTM) is the total return anticipated on a bond (on an annualized basis) if the bond is held until it matures. Free Cash Flow (FCF) is the cash a company produces through its operations, less the cost of expenditures on assets. In other words, Free Cash Flow is the cash left over after a company pays for its operating expenses and capital expenditures. Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Debtor-in-Possession (DIP) financing is a special kind of financing meant for companies that are in bankruptcy. Only companies that have filed for bankruptcy protection under chapter 11 are allowed to access dip financing, which usually happens at the start of a filing. Dip financing is used to facilitate the reorganization of a Debtor-in-Possession (the status of a company that has filed for bankruptcy) by allowing it to raise capital to fund its operations as its bankruptcy case runs its course. Yield to Call (YTC) refers to the return a bondholder receives if the bond is held until the call date, which occurs sometime before it reaches maturity. The SEC Yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.” Yield to Worst is the yield on the portfolio if all bonds are held to the worst date; Yield to Worst date is the date of lowest possible yield outcome for each security without a default.

ETF definitions: the ICE BOFA 0-3 Year U.S. Treasury Index tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than three years. Gross Spread is the amount by which a SPAC is trading at a discount or premium to its pro rata share of the collateral trust value. For example, if a SPAC is trading at $9.70 and shareholders’ pro rata share of the trust account is $10.00/share, the SPAC has a gross spread of 3% (trading at a 3% discount). Yield to Liquidation: similar to a bond’s yield to maturity, SPACs have a yield to liquidation/redemption, which can be calculated using the gross spread and time to liquidation. Maturity: similar to a bond’s maturity date, SPAC also have a maturity, which is the defined time period in which they have to complete a business combination. This is referred to as the Liquidation or Redemption Date. Price refers to the price at which the ETF is currently trading. The sec yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the

dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.” Weighted Average Life refers to the weighted average time until a portfolio of SPACs’ Liquidation or Redemption Dates.

All performance data greater than 1 year is annualized.

Diversification does not assure a profit nor protect against loss in a declining market.

A stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation’s assets and earnings. A bond is a debt investment in which an investor loans money to an entity that borrows the fund for a defined period of time at a fixed interest rate. A stock may trade with more or less liquidity than a bond depending on the number of shares and bonds outstanding, the size of the company, and the demand for the securities. The Securities and Exchange Commission (SEC) does not approve, endorse, nor indemnify any security. Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Tax features may vary based on personal circumstances. Consult a tax professional for additional information.

The CrossingBridge Ultra-Short Duration Fund, CrossingBridge Low Duration High Yield Fund, CrossingBridge Responsible Credit Fund, and the RiverPark Strategic Income Fund are distributed by Quasar Distributors, LLC.

The CrossingBridge Pre-Merger SPAC ETF is distributed by Foreside Fund Services, LLC.

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Low Duration High Yield Fund

(Unaudited)

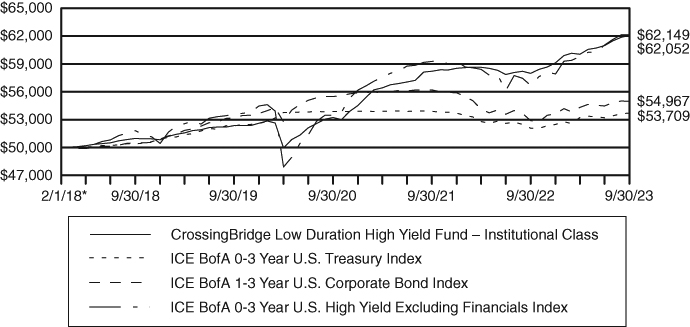

The 2023 fiscal year for the CrossingBridge Low Duration High Yield Fund (CBLDX; the “Fund”) covers the twelve-month period of October 1, 2022 through September 30, 2023. During the fiscal year, the Fund gained 7.02% on its Institutional Class shares while the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index gained 9.63%, the ICE BofA 1-3 Year U.S. Corporate Bond Index gained 3.93% and the ICE BofA 0-3 Year U.S. Treasury Index gained 3.14%.

Monthly investment results for the fiscal year ranged from -0.17% in March 2023 to 1.31% in January 2023. The Fund generated positive returns for eleven out of the twelve months during the fiscal year. The median monthly return for the fiscal year was 0.53% with an annualized standard deviation of 1.31%.

The Fund had positive contributions from interest income and had realized losses and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 8.74%. The Fund’s subsidized 30-day SEC yield was 8.10% and unsubsidized 30-day SEC yield was 8.11%. The total return for the fiscal year was positive. Although the Fund’s NAV decreased from $9.84 on September 30, 2022 to $9.66 on September 30, 2023, this was offset by the Fund distributing $0.84 in income during the fiscal year.

Over the past year and a half, the Federal Reserve (the “Fed”) has been fully committed to quell out inflation and wring out excess liquidity. While the general market consensus was that the Fed was going to ‘pivot’ and begin cutting rates in mid-2023, we believed that not only would the Fed not pivot, but rather that inflation would be sticky and that we would be in a ‘higher for longer’ environment.

In our 2022 year-end quarterly commentary “Qué Será, Será – The Future’s Not Ours to See”, we discussed that we remained opportunistic and outlined our key themes and opportunities for 2023:

| | • | Although the market is not necessarily cheap, it is also not expensive. Opportunities will arise from uncertainty, volatility, flow of funds and a “day of reckoning” among borrowers. |

| | | |

| | • | Inflation is expected to decline but will remain. The Fed will continue rate increases. Although it may ultimately pause, the Fed won’t pivot unless systematic risk emerges. |

| | | |

| | • | Corporations are in pretty good shape, but the differences between the “haves” and the “have nots” are likely to widen. Regardless, profit margins will narrow. Inflation in the cost of raw materials and labor, as well as the Fed’s efforts to reduce demand, will pressure profit margins. |

| | | |

| | • | Higher interest rates have increased the cost of debt and reduced asset valuations. |

| | | |

| | • | The leveraged loan market will present opportunistic investments. Overall credit quality in the loan market has improved significantly since mid-2020, which should provide us with the opportunity to invest in leveraged loans that provide both better credit quality and higher yields, given the rise in rates. |

| | | |

| | • | Bond spreads are “middle of the road” – not cheap, not expensive – but provide improved return versus risk. |

With this as the backdrop as we entered 2023, we remained defensively positioned, maintaining attractive yields while keeping duration relatively low and holding significant

“dry powder”1 to take advantage of opportunities as they arise. As fixed core fixed income allocations continued to struggle throughout the year as rates continued to rise, our focus on selective bottom up credit selection and maintaining a low duration helped maintain steady and consistent returns for our investors. Our core philosophy as a firm is that “Return of Capital is more important that Return on Capital.” We are not absent of making mistakes, but in an environment where yields in short term credits are yielding in excess of 8-9%, we believe that by avoiding the potholes and being conservative and selective in credit selection, we can rely on fundamentals instead of making ‘bets’ on rates to try and deliver attractive risk-adjusted returns for our shareholders.

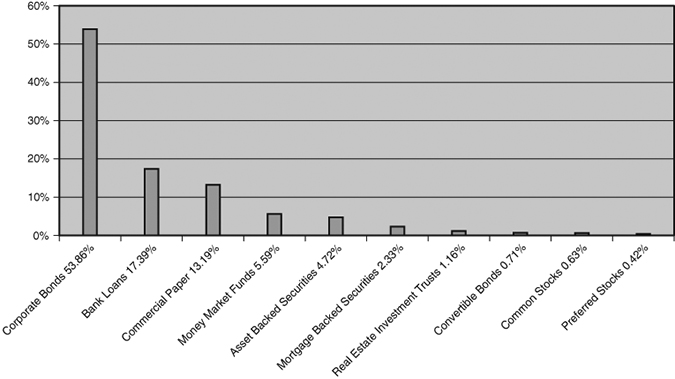

As of September 30, 2023, the Fund’s net assets were weighted by category as follows: 28.1% in Short Term Securities, 8.0% in Event Driven, 25.7% in Interest Rate Sensitive, 29.0% in Core Value, 6.7% in Credit Opportunities, with the remaining 2.6% in cash and cash equivalents.

1 | “Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose acquisition companies (SPACs). |

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index (HSNF) tracks the performance of short maturity U.S. dollar-denominated below investment grade rating (based on an average of Moody’s, S&P, and Fitch), at least 18 months to final maturity at the time of issuance, at least one month but less than three years remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and minimum amount outstanding of $250 million. The ICE BofA 1-3 Year U.S. Corporate Bond Index (C1A0) is a subset of the ICE BofA U.S. Corporate Bond Index including all securities with a remaining term to final maturity less than three years. The ICE BofA 0-3 Year U.S. Treasury Index (G1QA) tracks the performance of U.S. dollar-denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than three years. The S&P 500, or simply the S&P, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. The ICE BofA U.S. Corporate Bond Index tracks the performance of U.S. dollar-denominated investment grade rated corporate debt publicly issues in the U.S. domestic market. Standard Deviation is a statistical measure that is used to quantify the amount of variation or dispersion of a set of data values. Duration is the weighted average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Dividend Yield expresses a percentage of a current share price. SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.” Basis Point is one hundredth of one percent.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may invest in exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”), which are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s and ETN’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Fund’s ability to sell the shares. The value of ETNs may be influenced by the level of supply and demand for the ETN, volatility and lack of liquidity. The Fund may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in asset-backed, mortgage-backed, and collateralized mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund invests in equity securities and warrants of special purpose acquisition companies (“SPACs”) . Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Responsible Credit Fund

(Unaudited)

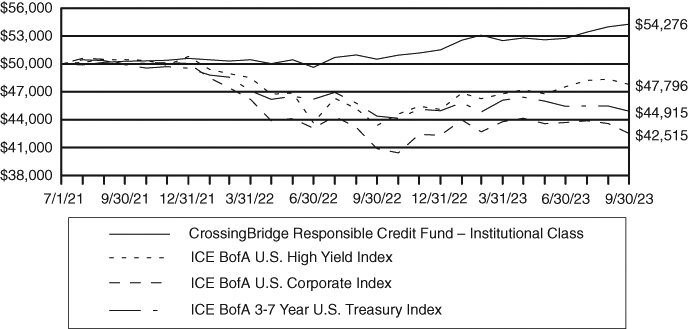

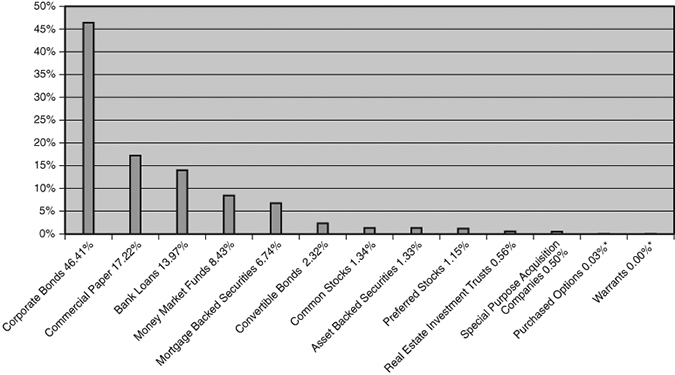

The 2023 fiscal year for the CrossingBridge Responsible Credit Fund (CBRDX; the “Fund”) covers the twelve-month period of October 1, 2022 through September 30, 2023. During the fiscal year, the Fund gained 7.45% on its Institutional Class shares while the ICE BofA U.S. High Yield Index gained 10.19%, the ICE BofA U.S. Corporate Index gained 3.99% and the ICE BofA 3-7 Year U.S. Treasury Index gained 1.19%.

Monthly investment results for the fiscal year ranged from -1.11% in March 2023 to 2.02% in January 2023. The Fund generated positive returns for ten out of the twelve months during the fiscal year. The median monthly return for the fiscal year was 0.61% with an annualized standard deviation of 2.75%.

The Fund had positive contributions from interest income and had realized capital losses and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 10.31%. The Fund’s subsidized 30-day SEC yield was 7.82% and unsubsidized 30-day SEC yield was 7.07%. The total return for the fiscal year was positive. Although the Fund’s NAV decreased from $9.65 on September 30, 2022 to $9.36 on September 30, 2023, that decrease was more than offset as the Fund distributed $0.97 in income during the fiscal year.

Over the past year and a half, the Federal Reserve (the “Fed”) has been fully committed to quell out inflation and wring out excess liquidity. While the general market consensus was that the Fed was going to ‘pivot’ and begin cutting rates in mid-2023, we believed that not only would the Fed not pivot, but rather that inflation would be sticky and that we would be in a ‘higher for longer’ environment.

In our 2022 year-end quarterly commentary “Qué Será, Será – The Future’s Not Ours to See”, we discussed that we remained opportunistic and outlined our key themes and opportunities for 2023:

| | • | Although the market is not necessarily cheap, it is also not expensive. Opportunities will arise from uncertainty, volatility, flow of funds and a “day of reckoning” among borrowers. |

| | | |

| | • | Inflation is expected to decline but will remain. The Fed will continue rate increases. Although it may ultimately pause, the Fed won’t pivot unless systematic risk emerges. |

| | | |

| | • | Corporations are in pretty good shape, but the differences between the “haves” and the “have nots” are likely to widen. Regardless, profit margins will narrow. Inflation in the cost of raw materials and labor, as well as the Fed’s efforts to reduce demand, will pressure profit margins. |

| | | |

| | • | Higher interest rates have increased the cost of debt and reduced asset valuations. |

| | | |

| | • | The leveraged loan market will present opportunistic investments. Overall credit quality in the loan market has improved significantly since mid-2020, which should provide us with the opportunity to invest in leveraged loans that provide both better credit quality and higher yields, given the rise in rates. |

| | | |

| | • | Bond spreads are “middle of the road” – not cheap, not expensive – but provide improved return versus risk. |

With this as the backdrop as we entered 2023, we remained defensively positioned, maintaining attractive yields while keeping duration relatively low and holding significant

“dry powder”1 to take advantage of opportunities as they arise. As fixed core fixed income allocations continued to struggle throughout the year as rates continued to rise, our focus on selective bottom-up credit selection and maintaining a low duration helped maintain steady and consistent returns for our investors. Our core philosophy as a firm is that “Return of Capital is more important that Return on Capital.” We are not absent of making mistakes, but in an environment where yields in short term credits are yielding in excess of 8-9%, we believe that by avoiding the potholes and being conservative and selective in credit selection, we can rely on fundamentals instead of making ‘bets’ on rates to try and deliver attractive risk-adjusted returns for our shareholders.

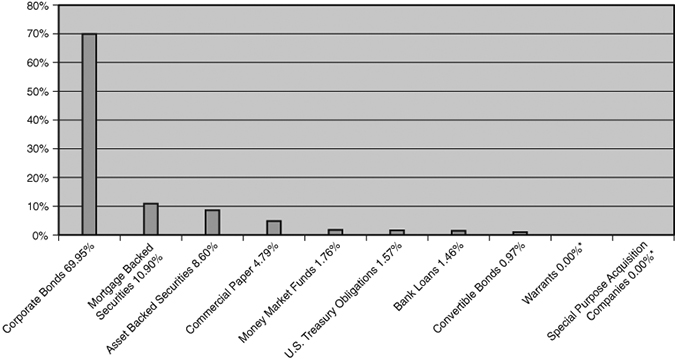

As of September 30, 2023, the Fund’s net assets were weighted by category as follows: 20.6% in Short Term Securities, 6.5% in Event Driven, 35.9% in Interest Rate Sensitive, 27.6% in Core Value, 7.9% in Credit Opportunities, with the remaining 1.5% in cash and cash equivalents.

1 | “Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose acquisition companies (SPACs). |

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

The Fund is non-diversified under the Investment Company Act of 1940 Act, therefore allowing the Fund to be more concentrated than a diversified fund. Because the Fund is non-diversified it may invest a greater percentage of its assets in the securities of a single issuer or a smaller number of issuers than if it were a diversified fund. As a result, a decline in the value of an investment in a single issuer could cause the Fund’s overall value to decline to a greater degree than if the Fund held a more diversified portfolio. Current fund statistics may not be indicative of future positioning.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

Definitions: The ICE BofA U.S. High Yield Index (H0A0) tracks the performance of U.S. dollar-denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The ICE BofA U.S. Corporate Index (C0A0) tracks the performance of U.S. dollar-denominated investment grade corporate debt publicly issued in the U.S. domestic market. The ICE BofA 3-7 Year U.S. Treasury Index (G30C) is a subset of ICE BofA U.S. Treasury Index including all securities with a remaining term to final maturity greater than or equal to 3 years and less than 7 years. Basis Point is one hundredth of one percent. Standard Deviation is a statistical measure of portfolio risk used to measure variability of total return around an average, over a specified period of time. The greater the standard deviation over the period, the wider the variability or range of returns and hence, the greater the fund’s volatility. The standard deviation has been calculated since inception and is annualized. Duration is the weighted average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Dividend Yield expresses a percentage of a current share price. SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund’s focus on sustainability considerations (ESG criteria) may limit the number of investment opportunities available to the Fund, and as a result, at times, the Fund may underperform funds that are not subject to similar investment considerations. The Fund invests in equity securities of special purpose acquisition companies (“SPACs”), which raise assets to seek potential business combination opportunities. Unless and until a business combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Because SPACs have no operating history or ongoing business other than seeking a business combination, the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable business combination. There is no guarantee that the SPACs in which the Fund invests will complete a business combination or that any business combination that is completed will be profitable. The Fund is non-diversified meaning it may concentrate its assets in fewer individual holdings than a diversified fund. The Fund invests in equity securities and warrants of SPACs. Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Ultra-Short Duration Fund

(Unaudited)

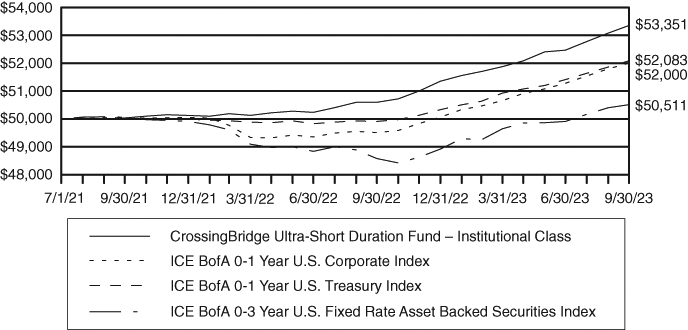

The 2023 fiscal year for the CrossingBridge Ultra-Short Duration Fund (CBUDX; the “Fund”) covers the twelve-month period of October 1, 2022 through September 30, 2023. During the fiscal year, the Fund gained 5.44% on its Institutional Class shares while the ICE BofA 0-1 Year U.S. Corporate Index gained 5.03%, the ICE BofA 0-1 Year U.S. Treasury Index gained 4.35% and the ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index gained 3.98%.

Monthly investment results for the fiscal year ranged from 0.12% in June 2023 to 0.70% in December 2022. The Fund generated positive returns for all twelve months during the fiscal year. The median monthly return for the fiscal year was 0.46% with an annualized standard deviation of 0.61%

The Fund had positive contributions from interest income and had realized losses and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 5.95%. The Fund’s subsidized 30-day SEC yield was 6.57% and unsubsidized 30-day SEC yield was 6.41%. The total return for the fiscal year was positive. Although the Fund’s NAV decreased from $9.97 on September 30, 2022 to $9.91 on September 30, 2023, this was more than offset by the distribution of $0.59 of income during the fiscal year.

Over the past year and a half, the Federal Reserve (the “Fed”) has been fully committed to quell out inflation and wring out excess liquidity. While the general market consensus was that the Fed was going to ‘pivot’ and begin cutting rates in mid-2023, we believed that not only would the Fed not pivot, but rather that inflation would be sticky and that we would be in a ‘higher for longer’ environment.

In our 2022 year-end quarterly commentary “Qué Será, Será – The Future’s Not Ours to See”, we discussed that we remained opportunistic and outlined our key themes and opportunities for 2023:

| | • | Although the market is not necessarily cheap, it is also not expensive. Opportunities will arise from uncertainty, volatility, flow of funds and a “day of reckoning” among borrowers. |

| | | |

| | • | Inflation is expected to decline but will remain. The Fed will continue rate increases. Although it may ultimately pause, the Fed won’t pivot unless systematic risk emerges. |

| | | |

| | • | Corporations are in pretty good shape, but the differences between the “haves” and the “have nots” are likely to widen. Regardless, profit margins will narrow. Inflation in the cost of raw materials and labor, as well as the Fed’s efforts to reduce demand, will pressure profit margins. |

| | | |

| | • | Higher interest rates have increased the cost of debt and reduced asset valuations. |

| | | |

| | • | The leveraged loan market will present opportunistic investments. Overall credit quality in the loan market has improved significantly since mid-2020, which should provide us with the opportunity to invest in leveraged loans that provide both better credit quality and higher yields, given the rise in rates. |

| | | |

| | • | Bond spreads are “middle of the road” – not cheap, not expensive – but provide improved return versus risk. |

With this as the backdrop as we entered 2023, we remained defensively positioned, maintaining attractive yields while keeping duration relatively low and holding significant

“dry powder”1 to take advantage of opportunities as they arise. As fixed core fixed income allocations continued to struggle throughout the year as rates continued to rise, our focus on selective bottom up credit selection and maintaining a low duration helped maintain steady and consistent returns for our investors. Our core philosophy as a firm is that “Return of Capital is more important that Return on Capital.” We are not absent of making mistakes, but in an environment where yields in short term credits are yielding in excess of 8-9%, we believe that by avoiding the potholes and being conservative and selective in credit selection, we can rely on fundamentals instead of making ‘bets’ on rates to try and deliver attractive risk-adjusted returns for our shareholders.

Especially within an ultra-short duration portfolio, CrossingBridge stresses preservation of capital rather than chasing yield. Per the Fund’s prospectus, CrossingBridge manages interest rate risk by maintaining an average portfolio duration of 1 or less by investing in short-term, medium-term, and floating rate securities. As a result, the Fund was well insulated from the steep rise in rates. In addition, although the Fund has no restrictions as to credit quality, the intention is that the Fund will maintain a minimum of at least 65% of the portfolio in investment grade securities, further insulating the Fund in the difficult fixed income environment. As of September 30, 2023, the Fund had 70.85% of the portfolio in investment grade securities. As rates have continued to rise and the market has become more bifurcated, we believe the opportunity set for the Fund remains.

As of September 30, 2023, the Fund’s net assets were weighted by category as follows: 33.2% in Short Term Securities, 5.3% in Event Driven, 18.1% in Interest Rate Sensitive, 42.9% in Core Value, 0.0% in Credit Opportunities, with the remaining 0.5% in cash and cash equivalents.

1 | “Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose acquisition companies (SPACs). |

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against risk in a declining market.

Fund holdings and sector allocation are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for complete Fund holdings.

*Definitions: The ICE BofA 0-1 Year U.S. Corporate Index (H540) tracks the performance of short-maturity U.S. dollar- denominated investment grade corporate debt publicly issued in the U.S. domestic market. The ICE BofA 0-1 Year U.S. Treasury Index (G0QA) tracks the performance of U.S. dollar-denominated sovereign debt publicly issued by the U.S. government in its domestic market with maturities less than a year. The ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index (R1A0) is a subset of ICE BofA U.S. Fixed Rate Asset Backed Securities Index including all securities with an average life less than 3 years. Duration is the weighted average of the present value of the cash flows and is used as a measure of a bond price’s response to changes in yield. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. Standard Deviation is a statistical measure of portfolio risk used to measure variability of total return around an average, over a specified period of time. The greater the standard deviation over the period, the wider the variability or range of returns and hence, the greater the fund’s volatility. The standard deviation has been calculated since inception and is annualized. Dividend Yield expresses

a percentage of a current share price. SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses.

It is not possible to invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. The fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund invests in equity securities and warrants of special purpose acquisition companies (“SPACs”). Pre-combination SPACs have no operating history or ongoing business other than seeking a merger, share exchange, asset acquisition, share purchase negotiation or similar business combination (a “Combination”), and the value of their securities is particularly dependent on the ability of the entity’s management to identify and complete a profitable Combination. There is no guarantee that the SPACs in which the Fund invests will complete a Combination or that any Combination that is completed will be profitable. Unless and until a Combination is completed, a SPAC generally invests its assets in U.S. government securities, money market securities, and cash. Public stockholders of SPACs may not be afforded a meaningful opportunity to vote on a proposed initial Combination because certain stockholders, including stockholders affiliated with the management of the SPAC, may have sufficient voting power, and a financial incentive, to approve such a transaction without support from public stockholders. As a result, a SPAC may complete a Combination even though a majority of its public stockholders do not support such a Combination. Some SPACs may pursue Combinations only within certain industries or regions, which may increase the volatility of their prices. The Fund may invest in SPACs domiciled or listed outside of the U.S., including, but not limited to, Canada, the Cayman Islands, Bermuda and the Virgin Islands. Investments in SPACs domiciled or listed outside of the U.S. may involve risks not generally associated with investments in the securities of U.S. SPACs, such as risks relating to political, social, and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Further, tax treatment may differ from U.S. SPACs and securities may be subject of foreign withholding taxes. Smaller capitalization SPACs will have a more limited pool of companies with which they can pursue a business combination relative to larger capitalization companies. That may make it more difficult for a small capitalization SPAC to consummate a business combination.

Must be preceded or accompanied by a prospectus.

Distributor: Quasar Distributors, LLC.

Management’s Discussion of Fund Performance and Analysis

CrossingBridge Pre-Merger SPAC ETF

(Unaudited)

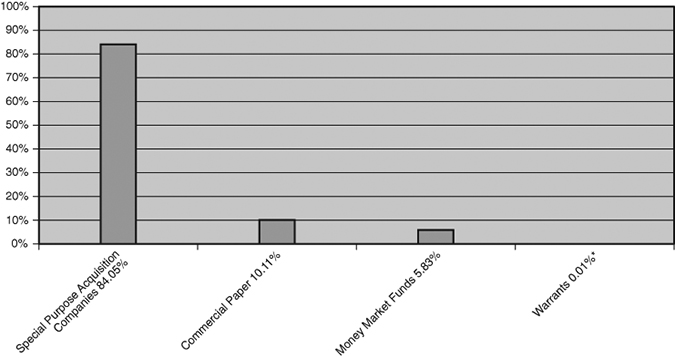

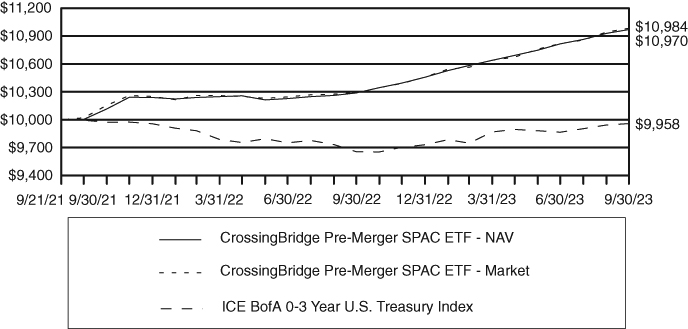

The 2023 fiscal year for the CrossingBridge Pre-Merger SPAC ETF (SPC; the “Fund”) covers the twelve-month period of October 1, 2022 through September 30, 2023. During the fiscal year, the Fund had a NAV return of 6.63% and a market return of 6.74%. The Fund’s market return of 6.74% compared favorably to the ICE BofA 0-3 Year U.S. Treasury Index’s gain of 3.14%. The Fund had realized and unrealized gains during the fiscal year. The total return for the period was higher as the market price increased from $20.56 on September 30, 2022 to $21.72 on September 30, 2023, while the NAV increased from $20.56 to $21.69 for the fiscal year.