UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513)-520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: August 31, 2023

Date of reporting period: August 31, 2023

Item 1. Reports to Stockholders.

(a)

PMC Funds

PMC Core Fixed Income Fund

Advisor Class Shares: (PMFIX)

Institutional Class Shares: (PMFQX)

PMC Diversified Equity Fund

Advisor Class Shares: (PMDEX)

Institutional Class Shares: (PMDQX)

ActivePassive ETFs

ActivePassive Core Bond ETF (APCB)

ActivePassive Intermediate Municipal Bond ETF (APMU)

ActivePassive International Equity ETF (APIE)

ActivePassive U.S. Equity ETF (APUE)

Annual Report

August 31, 2023

Table of Contents

PMC Funds

Letter to Shareholders

(Unaudited)

To our Shareholders:

We are pleased to present you with the Annual Report for the PMC Funds mutual fund family. This report covers both the fiscal quarter and one-year period ended August 31, 2023.

The table below presents the standardized performance of the PMC Funds relative to their respective benchmarks. The past twelve month period ended August 31, 2023 has been one in which the global economy has continued to struggle due to the ongoing effects of high inflation. The U.S. consumer has held up the domestic economy in 2023, but warning signs have begun to appear. Consumer confidence declined in August, and job openings were lower in July. In addition, real gross domestic product (GDP)1 for the second quarter 2023 was revised lower to an annual rate of 2.1%, and corporate profits declined. Consumer confidence is notoriously fragile, and if consumers believe their jobs are in jeopardy they will rein in spending. Historically, if consumer confidence declines for several months, this has often presaged an economic downturn. Consumers may be feeling pressure on several fronts, including the potential for a government shutdown at the beginning of the fiscal year in October, the end to the moratorium on student loan repayments, rising mortgage rates that now exceed 7%, the United Auto Workers strike, and the jump in oil prices. Oil prices have risen sharply in recent weeks, and are up 25% from levels earlier in the year. Saudi Arabia has been able to inject additional supply when oil prices get so high that demand is crimped, but it is more difficult for them to manage the price of oil given the sanctions on Russia and the increasing demand coming from China. Economists warn that if oil prices exceed $100 for more than a few weeks consumers will further scale back spending and the economy will have difficulty avoiding recession. Economies in Europe and China also bear close watching. Europe has experienced choppy economic data in 2023, and leading indicators such as the Purchasing Managers Index have recently flashed warning signs. China is also in the throes of an economic slowdown led by another property crisis. Property prices are declining, economic growth is slowing, and the country’s policymakers have stopped reporting weak economic data. Economists question whether China has the levers to pull to reinvigorate growth.

The Federal Open Market Committee (FOMC) has been actively striving to corral inflation and bring the U.S. economy to a soft landing in the hopes of averting a recession. The FOMC has aggressively raised the federal funds target rate since its low 18 months ago. Over the past year the committee has hiked the rate seven times, from a range of 2.25%-2.50% on August 31, 2022 to its current range of 5.25%-5.50%. Over the past 18 months, the FOMC has raised the fed funds rate a total of 11 times. The consensus among economists is that the recent reduction in inflation means that this cycle of interest rate increases has likely ended unless inflation accelerates once again.

Despite the concerns about the economy stock prices have remained resilient throughout this period. After suffering an 18.1% decline in 2022–its steepest drop since 2008–the S&P 500 Index has posted an 18.7% gain so far in 2023. The gains have been decidedly top-heavy, with some of the largest technology companies driving the performance of the index, while the broader market has not generated returns nearly as impressive.

The Bureau of Economic Analysis released the second estimate of the second quarter 2023 real GDP, a seasonally adjusted annualized rise of 2.1%, lower than the prior estimate, and in line with the increase in the prior quarter. The employment situation has been lukewarm over the past year. The August employment report showed that employers added 187,000 jobs in the month, and that the unemployment rate was slightly higher at 3.8%. As mentioned above, the FOMC, in its continuing effort to tame inflation, raised its federal funds rate target range by 0.25% in the quarter, to 5.00% to 5.25%, from a range of 4.75% to 5.00%. The yield on the 10-year U.S. Treasury climbed from 3.2% to 4.1% over the twelve months ended August 31, 2023.

| 1 | | Gross Domestic Product (“GDP”) is the total monetary value of all the finished goods and services produced within a country’s borders in a specific period. |

3

Total Returns as of August 31, 2023*

*Periods of Less than 1-Year Are Unannualized

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fund

| | Three

Months

| | | Six

Months

| | | One

Year

| | | Five

Year

| | | Ten

Year

| | | Since

Inception

| | | Inception

Date

| | | Gross

Expense

Ratio

| |

PMC Diversified Equity Fund – Adv. Class | | | 7.16 | % | | | 7.04 | % | | | 13.94 | % | | | 5.44 | % | | | 7.32 | % | | | 8.66 | % | | | 8-26-09 | | | | 0.93 | %** |

PMC Diversified Equity Fund – Inst. Class | | | 7.19 | % | | | 7.15 | % | | | 14.19 | % | | | NA | | | | NA | | | | 7.33 | % | | | 7-1-19 | | | | 0.68 | %** |

MSCI World Index Net Return | | | 6.99 | % | | | 11.11 | % | | | 15.60 | % | | | 8.33 | % | | | 9.28 | % | | | 9.54 | % | | | | | | | | |

| | | | | | | | |

PMC Core Fixed Income Fund – Adv. Class | | | -0.68 | % | | | 1.10 | % | | | -0.89 | % | | | 0.74 | % | | | 1.41 | % | | | 3.21 | % | | | 9-28-07 | | | | 1.13 | %** |

PMC Core Fixed Income Fund – Inst. Class | | | -0.61 | % | | | 1.25 | % | | | -0.67 | % | | | NA | | | | NA | | | | -0.43 | % | | | 7-1-19 | | | | 0.88 | %** |

Bloomberg U.S. Aggregate Bond Index | | | -1.06 | % | | | 0.95 | % | | | -1.19 | % | | | 0.49 | % | | | 1.48 | % | | | 2.78 | % | | | | | | | | |

| * | | Periods of Less than 1-Year Are Unannualized |

| ** | | Gross expense ratio as disclosed in the prospectus dated December 29, 2022. Please see the Financial Highlights in this report for the most recent expense ratio. |

The S&P 500 Index represents a broad cross-section of the U.S. equity market, including common stocks traded on U.S. exchanges. The MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries. The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investor cannot invest directly in an index.

Past performance is no guarantee of future returns. Current performance may be higher or lower than the performance data shown. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the Funds’ website at www.investpmc.com or by calling 888-762-7338.

PMC Diversified Equity Fund

The PMC Diversified Equity Fund was launched on August 26, 2009, and provides broad equity asset class exposure, diversified globally. The Fund’s investment objective is long-term capital appreciation.

One of the primary drivers of the Fund’s performance is its exposure to the well-known value, momentum and quality asset pricing factors. Over the past year ended August 31, 2023, asset pricing factors have generally performed poorly. The one exception is the quality factor, which is the tendency for stocks of more highly profitable and financially strong companies within an index to outperform those exhibiting less financial strength. The poor factor performance translated into Fund performance that, while strong in absolute terms, lagged that of the benchmark over the twelve-month period ended August 31, 2023. For the most recent three-month period, the Advisor Class of the Fund generated a return of 7.16%, outperforming the 6.99% return of the Fund’s benchmark index, MSCI World Index Net Return. For the twelve months ended August 31, 2023, the Fund generated a total return of 13.94%, underperforming the 15.60% return of the benchmark. The primary driver of the Fund’s performance during the year was the aggregate performance of the asset pricing factors toward which the portfolio is tilted. The Fund has maintained positive tilts to the size, value, momentum and quality factors. The Fund’s orientation toward value stocks was a key detractor from the performance relative to the benchmark, and its exposure to the momentum and quality factors was modestly additive to relative performance. However, performance was negatively impacted by having a lower weighted average market capitalization than the benchmark, as stocks of smaller companies significantly underperformed stocks of larger companies. Relative performance was also disadvantaged during both the most recent three- and six-month periods from a slight underweight to domestic equities relative to European equities. Among the positive contributors to performance during the year were limited underweights to the information technology and communications services sectors. Security selection in the health care, utilities, and real estate sectors also contributed positively to performance during the year. Among the detractors from performance was security selection in the information technology and communications services sectors. As is typically the case, the strategy’s factor orientation resulted in over- or underweights to specific stocks that have a meaningful impact on performance. Over the past twelve months underweights to well-known companies such as NVIDIA Corp. (NVDA), Apple, Inc. (AAPL), and Microsoft Corp. (MSFT) resulted in underperformance. However, overweights to PulteGroup, Inc. (PHM), Broadcom, Inc. (AVGO) and D.R. Horton, Inc. (DHI) benefited performance.

4

In addition to the risk that the investment strategy employed in the Fund will underperform the benchmark index generally, the primary risks continue to primarily involve systematic risk. Because the Fund’s investment adviser controls the risk of the Fund’s portfolio relative to the benchmark, the overall portfolio should track the Fund’s benchmark fairly closely on a relative basis. However, in general market declines the Fund’s fully invested strategy would incur a setback commensurate with the decline in the benchmark.

PMC Core Fixed Income Fund

The PMC Core Fixed Income Fund provides broad exposure to the core segments of the domestic fixed income market. The Fund’s investment objective is to provide current income consistent with low volatility of principal, and in addition to the Fund’s investment adviser, one sub-adviser manages a portion of the Fund’s assets: Neuberger Berman Investment Advisers LLC.

Over the past 12 months ended August 31, 2023, the environment for fixed income securities has once again been marked by significantly rising yields resulting from the FOMC’s decision to aggressively raise short-term interest rates in an effort to combat decades-high inflation. The FOMC recently raised the fed funds rate to a range of 5.25%-5.50%, up a full three percentage points over the level on August 31, 2022. The FOMC’s actions seem to have had a positive impact, as inflation is moderating from the acceleration of a year ago. As a result, many economists believe the FOMC has completed its rate increases for this cycle. Against this backdrop, the Fund generated negative returns for the three-month and one-year periods ended August 31, 2023. For the most recent three-month period, the Advisor Class of the Fund generated a return of -0.68%, slightly outperforming the benchmark Bloomberg U.S. Aggregate Bond Index return of -1.06%. For the twelve months ended August 31, 2023, the Advisor Class of the Fund posted a return of -0.89%, outperforming the benchmark return of -1.19%. The primary factors positively impacting performance over the past 12-month period were an underweight to U.S. Treasury securities and security selection in the corporate bond segment. The primary detractors from performance included the Fund’s aggregate underweight to securitized bonds, and security selection in the U.S. Treasury and government-related securities areas.

The primary risks to the strategies employed by the Fund’s investment adviser and sub-advisers remain in place and exist at both the macro level and in individual security selection. Due to the Fund’s aggregate overweight exposure to credit securities, the Fund remains likely to underperform the benchmark somewhat if the Federal Reserve makes a policy misstep, and U.S. Treasury securities consequently rise relative to credits. In addition, if the general level of interest rates continues to rise rapidly, the Fund will not be immune to further losses. Similarly, if certain of the individual credits currently owned by the Fund are adversely affected by economic events, the Fund itself will also be affected.

Remarks

The U.S. economy is muddling along, with economists having mixed opinions as to whether the FOMC will be able to create conditions that allows the economy to glide to a soft landing or enter a recession. It appears the FOMC has been able to arrest the rise in inflation, with the consensus among economists being that the committee’s rate increase regime has ended. U.S. consumers have been resilient, but confidence is beginning to erode, and is at risk as a result of several factors, including a significant rise in mortgage rates and a surge in oil prices. There are a number of potential downside risks outlined by economists, including a government shutdown at the beginning of the fiscal year in October if Congress cannot come to agreement in the coming weeks; property market weakness in China, which has the potential to impact the global economy; and a continuation in the recent surge in oil prices.

As always, we appreciate your continued trust and confidence in the PMC Funds. We will continue to do all we can to ensure that such trust and confidence are well placed and will manage the PMC Funds with that goal clearly in mind.

Brandon R. Thomas

Co-Founder and Co-Chief Investment Officer

Envestnet Asset Management

5

Envestnet Asset Management

The views in this report were those of the Funds’ investment adviser and the PMC Core Fixed Income Fund’s sub-adviser as of the date of this report and may not reflect their views on the date the report is first published or anytime thereafter. These views are intended to assist the shareholders of the Funds in understanding their investments in the Funds and do not constitute investment advice.

Diversification neither assures a profit nor guarantees against loss in a declining market.

Holdings are subject to change and are not a recommendation to buy or sell any security. Please see the schedule of holdings for a full list of fund holdings.

Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. Income (bond) funds are subject to interest rate risk, which is the risk that debt securities in a fund’s portfolio will decline in value because of increases in market interest rates.

Please see the prospectus

(https://www.investpmc.com/sites/default/files/documents/PMC%20Statutory%20Prospectus%2012.29.2022.pdf) for a complete description of the risks associated with investing in the PMC Funds.

PMC Funds are distributed by Foreside Fund Services, LLC. Foreside Fund Services, LLC is not an affiliate of Envestnet Asset Management, Inc./Envestnet PMC.

6

ActivePassive ETFs

Letter to Shareholders

(Unaudited)

To our Shareholders:

We are pleased to present you with the Annual Report for the ActivePassive ETF fund family. This report covers both the fiscal quarter and since inception period ended August 31, 2023.

The table below presents the standardized performance of the ActivePassive ETFs relative to their respective benchmarks. The ActivePassive ETFs opened on May 2 of this year, launching into a economic period full of complexity. The global economy has continued to struggle due to the ongoing effects of high inflation. The U.S. consumer has held up the domestic economy in 2023, but warning signs have begun to appear. Consumer confidence declined in August, and job openings were lower in July. In addition, real gross domestic product (GDP)1 for the second quarter 2023 was revised lower to an annual rate of 2.1%, and corporate profits declined. Consumer confidence is notoriously fragile, and if consumers believe their jobs are in jeopardy they will rein in spending. Historically, if consumer confidence declines for several months, this has often presaged an economic downturn. Consumers may be feeling pressure on several fronts, including the potential for a government shutdown at the beginning of the fiscal year in October, the end to the moratorium on student loan repayments, rising mortgage rates that now exceed 7%, the United Auto Workers strike, and the jump in oil prices. Oil prices have risen sharply in recent weeks, and are up 25% from levels earlier in the year. Saudi Arabia has been able to inject additional supply when oil prices get so high that demand is crimped, but it is more difficult for them to manage the price of oil given the sanctions on Russia and the increasing demand coming from China. Economists warn that if oil prices exceed $100 for more than a few weeks consumers will further scale back spending and the economy will have difficulty avoiding recession. Economies in Europe and China also bear close watching. Europe has experienced choppy economic data in 2023, and leading indicators such as the Purchasing Managers Index have recently flashed warning signs. China is also in the throes of an economic slowdown led by another property crisis. Property prices are declining, economic growth is slowing, and the country’s policymakers have stopped reporting weak economic data. Economists question whether China has the levers to pull to reinvigorate growth.

The Federal Open Market Committee (FOMC) has been actively striving to corral inflation and bring the U.S. economy to a soft landing in the hopes of averting a recession. The FOMC has aggressively raised the federal funds target rate since its low 18 months ago. Over the past year the committee has hiked the rate seven times, from a range of 2.25%-2.50% on August 31, 2022 to its current range of 5.25%-5.50%. Over the past 18 months, the FOMC has raised the fed funds rate a total of 11 times. The consensus among economists is that the recent reduction in inflation means that this cycle of interest rate increases has likely ended unless inflation accelerates once again.

Despite the concerns about the economy stock prices have remained resilient throughout this period. After suffering an 18.1% decline in 2022–its steepest drop since 2008–the S&P 500 Index has posted an 18.7% gain so far in 2023. The gains have been decidedly top-heavy, with some of the largest technology companies driving the performance of the index, while the broader market has not generated returns nearly as impressive.

| 1 | | Gross Domestic Product (“GDP”) is the total monetary value of all the finished goods and services produced within a country’s borders in a specific period. |

7

The Bureau of Economic Analysis released the second estimate of the second quarter 2023 real GDP, a seasonally adjusted annualized rise of 2.1%, lower than the prior estimate, and in line with the increase in the prior quarter. The employment situation has been lukewarm over the past year. The August 2023 employment report showed that employers added 187,000 jobs in the month, and that the unemployment rate was slightly higher at 3.8%. As mentioned above, the FOMC, in its continuing effort to tame inflation, raised its federal funds rate target range by 0.25% in the quarter, to 5.00% to 5.25%, from a range of 4.75% to 5.00%. The yield on the 10-year U.S. Treasury climbed from 3.2% to 4.1% over the twelve months ended August 31, 2023.

Total Returns as of August 31, 2023*

*Periods of Less than 1-Year Are Unannualized

| | | | | | | | | | | | | | |

Fund

| | | | | Three

Months

| | Six

Months

| | Since

Inception

| | Inception

Date

| | Gross

Expense

Ratio**

|

| ActivePassive US Equity ETF (ticker: APUE) | | | @Market | | | 8.67% | | n/a | | 10.95% | | 5/2/2023 | | 0.33% |

| | | | @NAV | | | 8.55% | | | | 10.78% | | | | |

CRSP U.S. Total Market Index | | | | | | 8.51% | | | | 10.37% | | | | |

| | | | | | |

| ActivePassive International Equity ETF (ticker: APIE) | | | @Market | | | 4.50% | | n/a | | 2.16% | | 5/2/2023 | | 0.45% |

| | | | @NAV | | | 4.70% | | | | 2.12% | | | | |

S&P Classic ADR Composite Index (USD) NTR | | | | | | 3.91% | | | | 1.05% | | | | |

| | | | | | |

| ActivePassive Core Bond ETF (ticker: APCB) | | | @Market | | | -0.80% | | n/a | | -1.80% | | 5/2/2023 | | 0.36% |

| | | | @NAV | | | -0.84% | | | | -1.96% | | | | |

Bloomberg U.S. Aggregate Bond Index | | | | | | -1.06% | | | | -2.12% | | | | |

| | | | | | |

ActivePassive Intermediate Municipal Bond ETF (ticker: APMU) | | | @Market | | | -0.15% | | n/a | | -1.93% | | 5/2/2023 | | 0.35% |

| | | | @NAV | | | -0.01% | | | | -1.94% | | | | |

Bloomberg Municipal 1-10 Year Blend Index | | | | | | 0.24% | | | | -0.64% | | | | |

| * | | Periods of Less than 1-Year Are Unannualized |

| ** | | Gross expense ratio as disclosed in the prospectus dated March 9, 2023, as amended March 31, 2023, includes Acquired Fund Fees and Expenses. Please see the Financial Highlights in this report for the most recent expense ratio. |

The S&P 500 Index represents a broad cross-section of the U.S. equity market, including common stocks traded on U.S. exchanges. The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The CRSP U.S. Total Market Index captures broad U.S. equity market coverage and include securities traded on NYSE, NYSE American, NYSE ARCA, NASDAQ, Bats Global Markets, and the Investors Exchange. Nearly 4,000 constituents across mega, large, small and micro capitalizations, representing nearly 100 percent of the U.S. investable equity market. The S&P Classic ADR Composite Index (USD) NTR seeks to track all American depositary receipts trading on the NYSE, NYSE American, NASDAQ, and over the counter (OTC) in the United States, subject to size and liquidity requirement. The Bloomberg 1-10 Year Municipal Blend Index is a market value-weighted index which covers the short and intermediate components of the Bloomberg Municipal Bond Index–an unmanaged, market value-weighted index which covers the U.S. investment-grade tax-exempt bond market.

An investor cannot invest directly in an index. Past performance is no guarantee of future returns. Current performance may be higher or lower than the performance data shown. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Short term performance, in particular, is not a good indication of a fund’s future performance, and an investment should not be made based solely on returns. For the most recent month-end performance, please visit the Funds’ website at www.activepassive.com or by calling 800-617-0004.

8

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

ActivePassive U.S. Equity ETF

The ActivePassive U.S. Equity ETF was launched on May 2, 2023, and provides broad U.S. equity exposure. The Fund’s investment objective is long-term capital appreciation.

The Fund is an actively managed exchange-traded fund that blends active and passive investment strategies to optimize costs, tracking and potential return over the Fund’s benchmark index, the CRSP U.S. Total Market Index (the “Benchmark Index”). The Fund also employs a factor active strategy for a portion of the investment portfolio. Passive exposure within the large cap sleeve of the portfolio contributed to results and was a driver of the overall performance in the past three months. In the up-trending market environment for U.S. equities over the past three months, passive strategies have been rewarded. The exposure to well-known value, momentum, and quality asset pricing factors was mixed in its relative contribution to performance. Within the small cap sleeve, factor exposure benefited the Fund, whereas factor exposure within large cap detracted from results. The Fund generated results of 8.55% (NAV), slightly outpacing the Benchmark Index return of 8.51% by 4 basis points, for the three-month period ended August 31, 2023.

In the trailing three months, contributors to performance include exposure to the Information Technology, Consumer Cyclical, and Financial Services sectors, all of which outperformed the Benchmark Index. Detracting from performance was exposure to the weaker performing Utilities, Consumer Defensive, and Real Estate sectors, all of which lagged the Benchmark Index in the trailing three months. The small cap sleeve’s positive relative performance outpaced the large cap sleeve results and was a key driver of the narrow outperformance.

In addition to the risk that the investment strategies employed in the Fund may underperform the Benchmark Index, the primary risks continue to involve systematic risk. Because the Fund’s investment adviser controls the risk of the portfolio relative to the Benchmark Index, the overall portfolio should track the Fund’s benchmark fairly closely on a relative basis. However, in general market declines the Fund’s fully invested strategy would incur a setback commensurate with the decline in the benchmark.

ActivePassive International Equity ETF

The ActivePassive International Equity ETF was launched on May 2, 2023, and provides broad international equity asset class exposure. The Fund’s investment objective is long-term capital appreciation and in addition to the Fund’s investment adviser, two sub-advisers manage a portion of the Fund’s assets: AllianceBernstein L.P. and Causeway Capital Management LLC.

The Fund is an actively managed exchange-traded fund that blends active and passive investment strategies to optimize costs, tracking and potential return over the Fund’s benchmark index, the S&P Classic ADR Composite Index (USD) NTR (the “Benchmark Index”). The Fund also employs a factor active strategy for a portion of the investment portfolio. Strong relative outperformance from the foreign large value equity sleeve and the emerging market equity sleeve drove much of the outperformance over the prior three-month period. The foreign large growth sleeve underperformed as growth equities generally lagged value equities within international equity markets. European equities generally posted weaker relative performance while stronger relative performance from Latin America contributed to results. Stock selection within China and United Kingdom contributed to relative outperformance while

9

negative stock selection in France and Germany detracted from results. For the three-month period ended August 31, 2023, the Fund generated performance of 4.70% (NAV), which outpaced the Benchmark Index return of 3.91% by 79 basis points.

In addition to the risk that the investment strategies employed in the Fund may underperform the benchmark indices, the primary risks continue to involve systematic risk. Because the Adviser and Sub-advisers control the risk of the portfolio relative to the benchmark, the overall portfolio should track the Fund’s benchmark fairly closely on a relative basis. However, in general market declines the Fund’s fully invested strategy would incur a setback commensurate with the decline in the benchmark.

ActivePassive Core Bond ETF

The ActivePassive Core Bond ETF was launched on May 2, 2023, and provides broad fixed income asset class exposure. The Fund’s investment objective is current income consistent with low volatility of principal, and in addition to the Fund’s investment adviser, two sub-advisers manage a portion of the Fund assets: Neuberger Berman Investment Advisers LLC and Sage Advisory Services, Ltd. Co.

The Fund is an actively managed exchange-traded fund that blends active and passive investment strategies to optimize costs, tracking and potential return over the Fund’s benchmark index, the Bloomberg U.S. Aggregate Bond Index (the “Benchmark Index”). Strong relative performance from the active manager sleeves as well as the international bond sleeve, with each slightly outperforming the Benchmark Index, contributed to portfolio results. Over the past 3 months the environment for fixed income securities has to been marked by rising yields resulting from the FOMC’s decision to aggressively raise short-term interest rates in an effort to combat decades-high inflation. The FOMC recently raised the fed funds rate to a range of 5.25%-5.50%. The committee’s actions seem to have had a positive impact, as inflation is moderating from the acceleration of a year ago. As a result, many economists believe the FOMC has completed its rate increases for this cycle. Within this environment, the Fund generated results of -0.84% (NAV), outpacing the Benchmark Index return of -1.06% by 22 basis points, for the three-month period ended August 31, 2023. The passively managed sleeve trailed active manager performance as active credit selection and sector positioning proved additive within fixed income. The primary contributors to fund performance include corporate credit exposure and short duration securities, while U.S. Treasury securities and mortgage- and asset-backed securities were the primary detractors from results. Slightly shorter duration positioning within the Fund relative to the Benchmark Index added to performance as longer duration securities lagged amid the rising rate environment.

The primary risks to the strategies employed by the Fund remain in place and exist at both the macro level and in individual security selection. Due to the Fund’s aggregate overweight exposure to credit securities, the Fund remains likely to underperform the Benchmark Index somewhat if the Federal Reserve makes a policy misstep, and U.S. Treasury securities consequently rise relative to credits. In addition, if the general level of interest rates continues to rise rapidly, the Fund will not be immune to further losses. Similarly, if certain of the individual credits currently owned by the Fund pare adversely affected by economic events, the Fund itself will also be affected.

ActivePassive Intermediate Municipal Bond ETF

The ActivePassive Intermediate Municipal Bond ETF was launched on May 2, 2023, and provides broad municipal fixed income asset class exposure. The Fund’s investment objective is current income that is exempt from federal income taxes consistent with low volatility of principal, and in addition to the Fund’s investment adviser, one sub-adviser manages a portion of the Fund assets: GW&K Investment Management, LLC.

10

The Fund is an actively managed exchange-traded fund that blends active and passive investment strategies to optimize costs, tracking and potential return over the Fund’s benchmark index, the Bloomberg Municipal 1-10 Year Blend Index (the “Benchmark Index”). Over the past 3 months the environment for fixed income securities has been marked by rising yields, including within the municipal fixed income markets. While the FOMC’s ongoing path to combat inflation will continue to have a factor on yields, the long-term trend in lower supply also continues to influence the direction of the municipal markets. The passively managed and actively managed sleeves both slightly trailed the benchmark over the trailing three months. Lower quality municipal bonds generally outperformed leading to some relative weakness for the higher quality issues in the portfolio. Shorter duration municipals outpaced longer duration amid a rising rate environment. The Fund generated results of -0.01% (NAV), trailing the Benchmark Index return of 0.24% by 25 basis points, for the three-month period ended August 31, 2023.

The primary risks to the strategies employed by the Fund remain in place and exist at both the macro level and in individual security selection. Due to the Fund’s exposure to municipal securities, the Fund remains likely to underperform the Benchmark Index somewhat if the Federal Reserve makes a policy misstep and rates moves against positioning in the fund. In addition, if the general level of interest rates continues to rise rapidly, the Fund will not be immune to further losses. Similarly, if certain of the individual securities currently owned by the Fund are adversely affected by economic or municipal-specific events, the Fund itself will also be affected.

Remarks

The U.S. economy is muddling along, with economists having mixed opinions as to whether the FOMC will be able to create conditions that allows the economy to glide to a soft landing or enter a recession. It appears the FOMC has been able to arrest the rise in inflation, with the consensus among economists being that the committee’s rate increase regime has ended. U.S. consumers have been resilient, but confidence is beginning to erode, and is at risk as a result of several factors, including a significant rise in mortgage rates and a surge in oil prices. There are a number of potential downside risks outlined by economists, including a government shutdown at the beginning of the fiscal year in October if Congress cannot come to agreement in the coming weeks; property market weakness in China, which has the potential to impact the global economy; and a continuation in the recent surge in oil prices.

As always, we appreciate your continued trust and confidence in the ActivePassive ETFs. We will continue to do all we can to ensure that such trust and confidence are well placed and will manage the ActivePassive ETFs with that goal clearly in mind.

| | |

| |  |

| |

Brandon R. Thomas Co-Founder and Co-Chief Investment Officer Envestnet Asset Management | | Gregory A. Classen Principal Director, Portfolio Management Envestnet Asset Management |

11

Envestnet Asset Management

The views in this report were those of the Funds’ investment adviser and the Funds’ sub-advisers, as applicable, as of the date of this report and may not reflect their views on the date the report is first published or anytime thereafter. These views are intended to assist the shareholders of the Funds in understanding their investments in the Funds and do not constitute investment advice.

Quantitative easing is a monetary policy strategy used by central banks to keep credit flowing to the economy.

Diversification neither assures a profit nor guarantees against loss in a declining market. Holdings are subject to change and are not a recommendation to buy or sell any security. Please see the schedule of holdings for a full list of fund holdings. Investments in smaller companies carry greater risk than is customarily associated with larger companies for various reasons such as volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. Income (bond) funds are subject to interest rate risk, which is the risk that debt securities in a fund’s portfolio will decline in value because of increases in market interest rates.

ActivePassive ETFs are distributed by Foreside Fund Services, LLC. Foreside Fund Services, LLC is not an affiliate of Envestnet Asset Management, Inc.

12

ENVESTNET FUNDS

Expense Examples

(Unaudited)

As a shareholder of the PMC Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution (12b-1) fees (Advisor Class shares only) and other Fund expenses. As a shareholder of the ActivePassive ETFs (together with the PMC Funds, the “Funds”), you incur two types of costs: (1) transaction costs, including brokerage commissions paid on purchases and sales of Fund shares, and (2) ongoing costs, including management fees of the Fund. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2023 - August 31, 2023).

The first lines of the following tables provide information about actual account values and actual expenses. Although the Funds do not charge a sales load, shareholders of the PMC Funds will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the PMC Funds’ transfer agent. Shareholders of the PMC Funds who hold their shares through Individual Retirement Accounts (“IRA”) will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of exchange-traded funds or other investment companies as part of their investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the direct expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. For the PMC Funds, the Example includes, but is not limited to, management fees, distribution (12b-1) fees, fund administration and accounting, custody and transfer agent fees. For the ActivePassive ETFs, the Example includes, but is not limited to, each ActivePassive ETF’s unitary management fee. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | Hypothetical | | Example for Comparison Purposes |

The second lines of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or exchange fees. Therefore, the second lines of the tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

3/1/23-8/31/23*

| |

PMC Core Fixed Income Fund–Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,011.00 | | | $ | 4.31 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.92 | | | | 4.33 | |

| * | | Expenses are equal to the Fund’s annualized net expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

13

| | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

3/1/23-8/31/23*

| |

PMC Core Fixed Income Fund–Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,012.50 | | | $ | 3.04 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.18 | | | | 3.06 | |

| * | | Expenses are equal to the Fund’s annualized net expense ratio of 0.60%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

3/1/23-8/31/23*

| |

PMC Diversified Equity Fund–Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,070.40 | | | $ | 4.91 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.47 | | | | 4.79 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.94%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

3/1/23-8/31/23*

| |

PMC Diversified Equity Fund–Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,071.50 | | | $ | 3.60 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.73 | | | | 3.52 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.69%, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

5/2/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

5/2/23-8/31/23*

| |

ActivePassive Core Bond ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 980.40 | | | $ | 1.16 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.54 | | | | 1.18 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.35%, multiplied by the average account value over the period, multiplied by 122/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

5/2/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

5/2/23-8/31/23*

| |

ActivePassive Intermediate Municipal Bond ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 980.60 | | | $ | 1.16 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.54 | | | | 1.18 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.35%, multiplied by the average account value over the period, multiplied by 122/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

5/2/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

5/2/23-8/31/23*

| |

ActivePassive International Equity ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,021.20 | | | $ | 1.52 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.21 | | | | 1.52 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.45%, multiplied by the average account value over the period, multiplied by 122/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Beginning

Account Value

5/2/23

| | | Ending

Account Value

8/31/23

| | | Expenses Paid

During Period

5/2/23-8/31/23*

| |

ActivePassive U.S. Equity ETF | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,107.80 | | | $ | 1.06 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,015.71 | | | | 1.01 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.30%, multiplied by the average account value over the period, multiplied by 122/365 to reflect the one-half year period. |

14

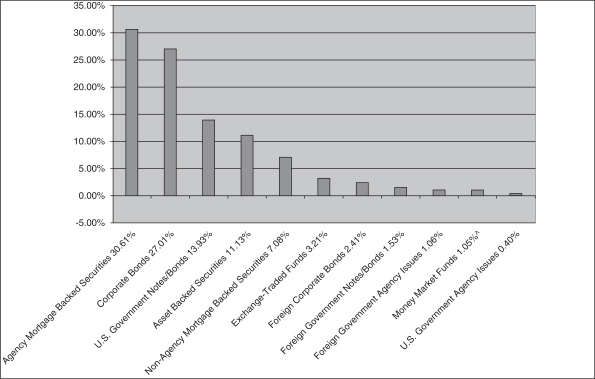

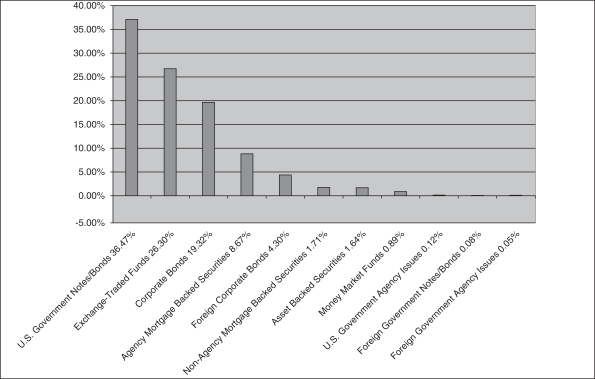

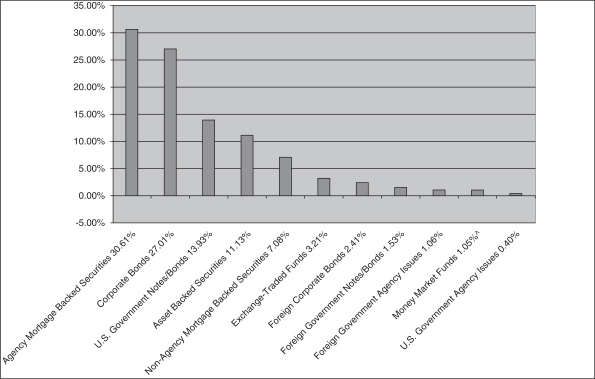

PMC CORE FIXED INCOME FUND (PMFIX, PMFQX)

Investment Highlights (Unaudited)

The investment objective of the Fund is to provide current income consistent with low volatility of principal. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

Allocation of Portfolio Holdings

% of Net assets

| ^ | | Excludes securities lending collateral. |

15

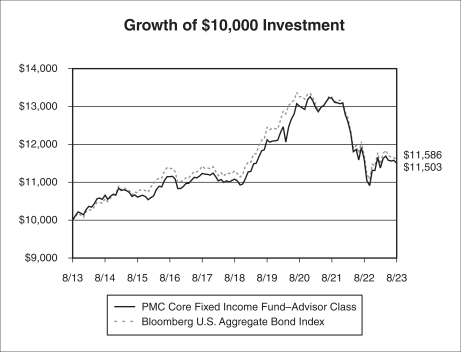

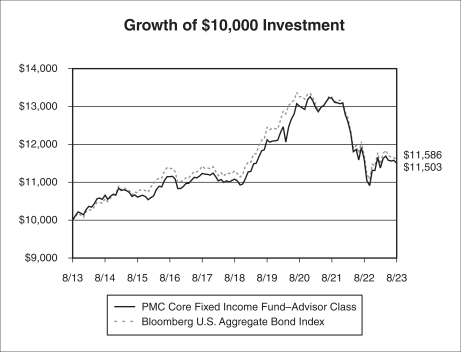

PMC CORE FIXED INCOME FUND–ADVISOR CLASS (PMFIX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | |

| | | PMC Core

Fixed Income

Fund–Advisor

Class

| | | Bloomberg U.S.

Aggregate Bond

Index

| |

One Year | | | -0.89 | % | | | -1.19 | % |

Five Year | | | 0.74 | % | | | 0.49 | % |

Ten Year | | | 1.41 | % | | | 1.48 | % |

Since Inception (9/28/07) | | | 3.21 | % | | | 2.78 | % |

| | |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on August 31, 2013. The graph does not reflect any future performance.

The Bloomberg U.S. Aggregate Bond Index is an index composed of U.S. securities in Treasury, Government-Related, Corporate and Securitized Sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

One cannot invest directly in an index.

16

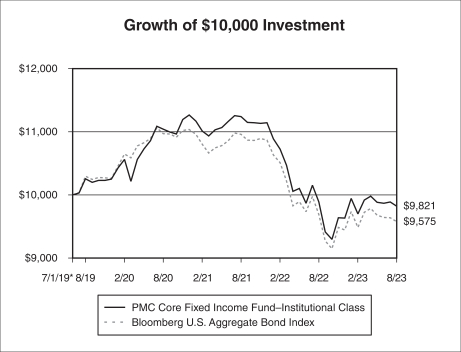

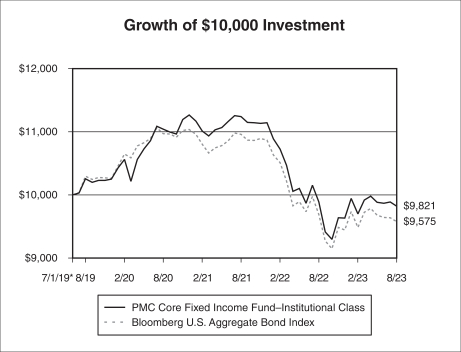

PMC CORE FIXED INCOME FUND–INSTITUTIONAL CLASS (PMFQX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | |

| | | PMC Core

Fixed Income

Fund–Institutional

Class

| | | Bloomberg U.S.

Aggregate Bond

Index

| |

One Year | | | -0.67 | % | | | -1.19 | % |

Since Inception (7/1/19) | | | -0.43 | % | | | -1.04 | % |

| | |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on July 1, 2019, the inception date of the Institutional Class. The graph does not reflect any future performance.

The Bloomberg U.S. Aggregate Bond Index is an index composed of U.S. securities in Treasury, Government-Related, Corporate and Securitized Sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

One cannot invest directly in an index.

17

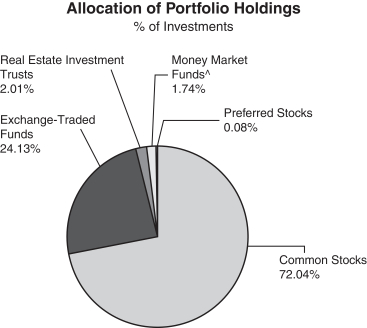

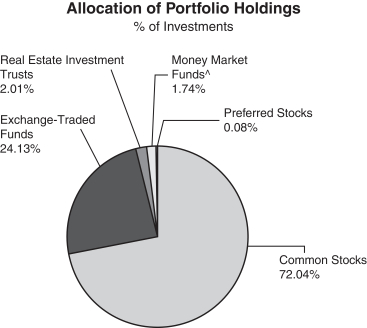

PMC DIVERSIFIED EQUITY FUND (PMDEX, PMDQX)

Investment Highlights (Unaudited)

The investment objective of the Fund is long-term capital appreciation. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

| | ^ | | Excludes securities lending collateral. |

18

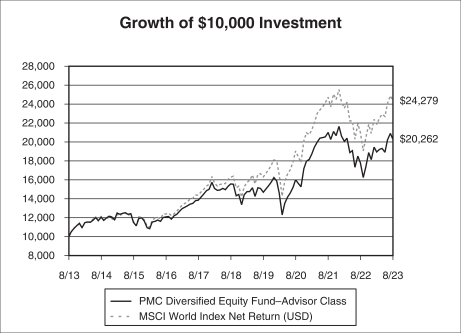

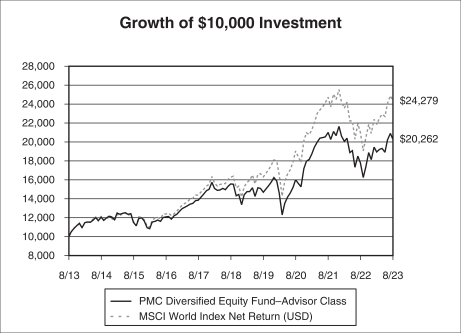

PMC DIVERSIFIED EQUITY FUND–ADVISOR CLASS (PMDEX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | |

| | | PMC Diversified

Equity Fund–

Advisor Class

| | | MSCI

World Index

Net Return

| |

One Year | | | 13.94 | % | | | 15.60 | % |

Five Year | | | 5.44 | % | | | 8.33 | % |

Ten Year | | | 7.32 | % | | | 9.28 | % |

Since Inception (8/26/09) | | | 8.66 | % | | | 9.54 | % |

| | |

|

|

| |

|

|

|

On May 25, 2018, Envestnet Asset Management, Inc. (the “Adviser”), the Fund’s investment adviser, assumed all responsibilities for selecting investments in the Fund’s portfolio in connection with a change to the Fund’s investment strategies. The Fund’s performance prior to this date reflects the Fund’s returns achieved when the Adviser actively managed a portion of the Fund’s portfolio and used a “manager of managers” investment strategy by engaging sub-advisers to manage other portions of the Fund’s portfolio.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on August 31, 2013. The graph does not reflect any future performance.

The MSCI World Index Net Return is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net return indices reinvest dividends after the deduction of taxes, using a tax rate applicable to non-resident investors who do not benefit from table taxation treaties. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

One cannot invest directly in an index.

Continued

19

PMC DIVERSIFIED EQUITY FUND–ADVISOR CLASS (PMDEX)

Investment Highlights (Unaudited) (Continued)

20

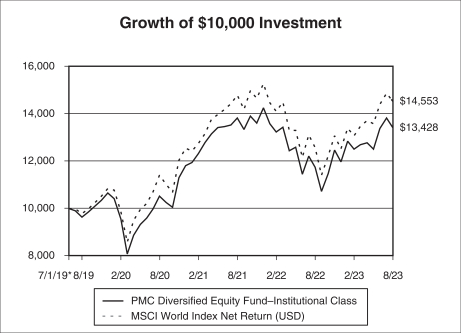

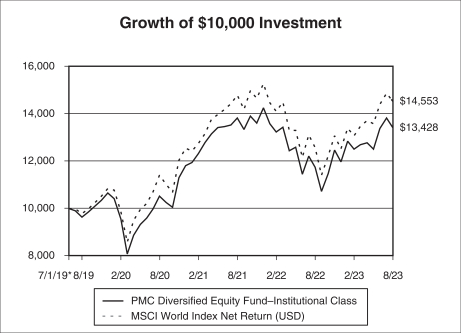

PMC DIVERSIFIED EQUITY FUND–INSTITUTIONAL CLASS (PMDQX)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | |

| | | PMC Diversified

Equity Fund–

Institutional Class

| | | MSCI

World Index

Net Return

| |

One Year | | | 14.19 | % | | | 15.60 | % |

Since Inception (7/1/19) | | | 7.33 | % | | | 9.42 | % |

| | |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at (866) PMC-7338.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on July 1, 2019, the inception date of the Institutional Class. The graph does not reflect any future performance.

The MSCI World Index Net Return is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. Net return indices reinvest dividends after the deduction of taxes, using a tax rate applicable to non-resident investors who do not benefit from table taxation treaties. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

One cannot invest directly in an index.

21

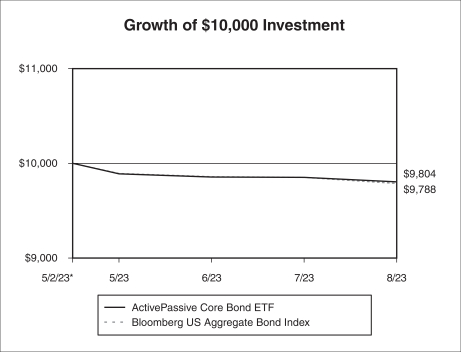

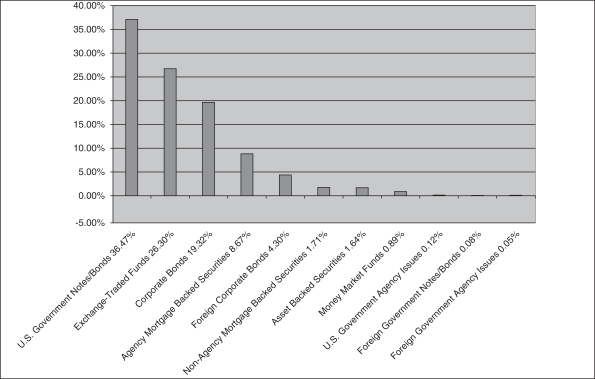

ActivePassive Core Bond ETF (APCB)

Investment Highlights (Unaudited)

The investment objective of the Fund is to provide current income consistent with low volatility of principal. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

Allocation of Portfolio Holdings

% of Net assets

22

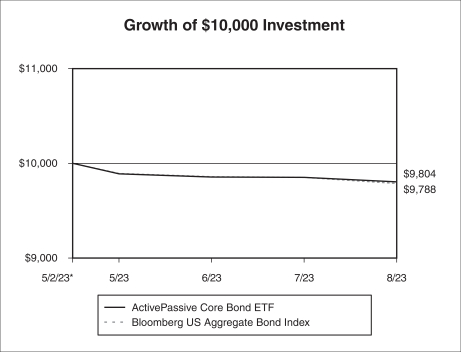

ActivePassive Core Bond ETF (APCB)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | | | | | |

| | | ActivePassive

Core Bond

ETF (NAV)

| | | ActivePassive

Core Bond ETF

(Market Price)

| | | Bloomberg U.S.

Aggregate Bond

Index

| |

Since Inception (5/2/23) | | | -1.96 | % | | | -1.80 | % | | | -2.12 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at 800-617-0004.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on May 2, 2023, the inception date of the Fund. The graph does not reflect any future performance.

The Bloomberg U.S. Aggregate Bond Index is an index composed of U.S. securities in Treasury, Government-Related, Corporate and Securitized Sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity and have an outstanding par value of at least $250 million.

One cannot invest directly in an index.

23

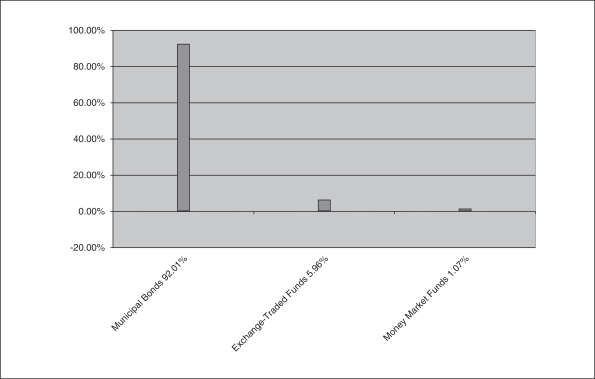

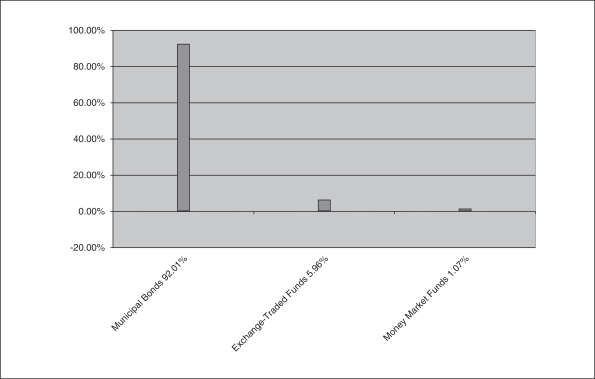

ActivePassive Intermediate Municipal Bond ETF (APMU)

Investment Highlights (Unaudited)

The investment objective of the Fund is to provide current income that is exempt from federal income taxes consistent with low volatility of principal. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

Allocation of Portfolio Holdings

% of Net assets

24

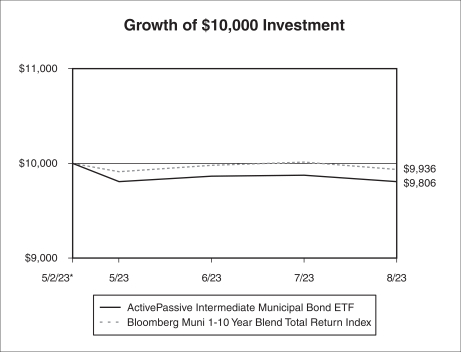

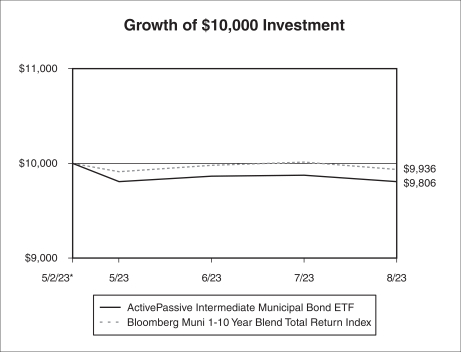

ActivePassive Intermediate Municipal Bond ETF (APMU)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | | | | | |

| | | ActivePassive

Intermediate

Municipal

Bond ETF

(NAV)

| | | ActivePassive

Intermediate

Municipal

Bond ETF

(Market Price)

| | | Bloomberg

Municipal

1-10 Year

Blend Index

| |

Since Inception (5/2/23) | | | -1.94 | % | | | -1.93 | % | | | -0.64 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at 800-617-0004.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on May 2, 2023, the inception date of the Fund. The graph does not reflect any future performance.

The Bloomberg 1-10 Year Municipal Blend Index is a market value-weighted index which covers the short and intermediate components of the Bloomberg Municipal Bond Index–an unmanaged, market value-weighted index which covers the U.S. investment-grade tax-exempt bond market.

One cannot invest directly in an index.

25

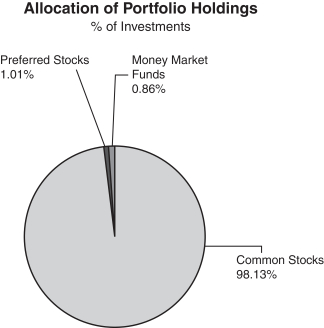

ActivePassive International Equity ETF (APIE)

Investment Highlights (Unaudited)

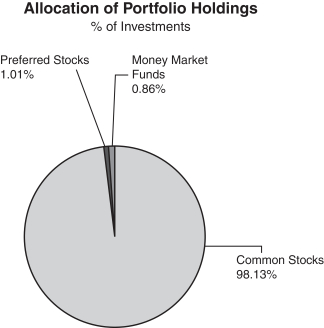

The investment objective of the Fund is long-term capital appreciation. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

26

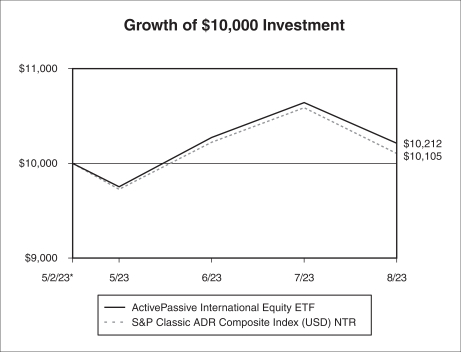

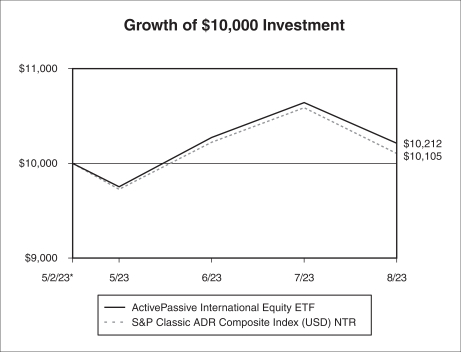

ActivePassive International Equity ETF (APIE)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | | | | | |

| | | ActivePassive

International

Equity ETF

(NAV)

| | | ActivePassive

International

Equity ETF

(Market Price)

| | | S&P Classic

ADR

Composite

Index NTR

| |

Since Inception (5/2/23) | | | 2.12 | % | | | 2.16 | % | | | 1.05 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at 800-617-0004.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on May 2, 2023, the inception date of the Fund. The graph does not reflect any future performance.

The S&P Classic ADR Composite Index seeks to track all American depositary receipts trading on the NYSE, NYSE American, NASDAQ, and over the counter (OTC) in the United States, subject to size and liquidity requirement.

One cannot invest directly in an index.

27

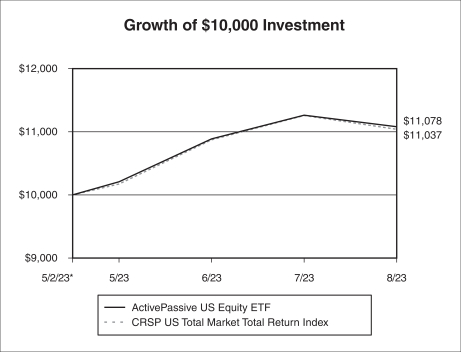

ActivePassive U.S. Equity ETF (APUE)

Investment Highlights (Unaudited)

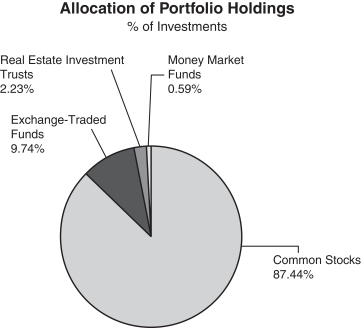

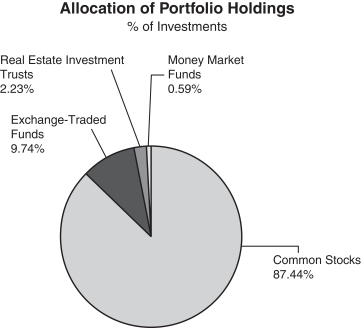

The investment objective of the Fund is long-term capital appreciation. The Fund’s allocation of portfolio holdings as of August 31, 2023 is shown below.

28

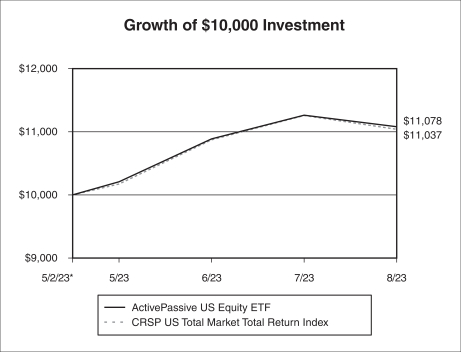

ActivePassive U.S. Equity ETF (APUE)

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2023

| | | | | | | | | | | | |

| | | ActivePassive

U.S. Equity

ETF (NAV)

| | | ActivePassive

U.S. Equity ETF

(Market Price)

| | | CRSP U.S. Total

Market Index

| |

Since Inception (5/2/23) | | | 10.78 | % | | | 10.95 | % | | | 10.37 | % |

| | |

|

|

| |

|

|

| |

|

|

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling the Fund (toll free) at 800-617-0004.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on May 2, 2023, the inception date of the Fund. The graph does not reflect any future performance.

The CRSP U.S. Total Market Index captures broad U.S. equity market coverage and include securities traded on NYSE, NYSE American, NYSE ARCA, NASDAQ, Bats Global Markets, and the Investors Exchange. Nearly 4,000 constituents across mega, large, small and micro capitalizations, representing nearly 100 percent of the U.S. investable equity market.

One cannot invest directly in an index.

29

PMC CORE FIXED INCOME FUND | Schedule of Investments |

August 31, 2023

| | | | | | | | |

| | |

| | | Principal

Amount

| | | Value

| |

| ASSET BACKED SECURITIES—11.13% | | | | | | | | |

37 Capital CLO I | | | | | | | | |

2021-1, 6.770% (TSFR3M + 1.462%), 10/15/2034(b) | | $ | 1,000,000 | | | $ | 988,515 | |

AM Capital Funding LLC | | | | | | | | |

2018-1, 4.980%, 12/15/2023 | | | 760,000 | | | | 760,348 | |

Amur Equipment Finance Receivables XI LLC | | | | | | | | |

2022-2A, 5.300%, 06/21/2028 | | | 218,226 | | | | 216,365 | |

Amur Equipment Finance Receivables XII LLC | | | | | | | | |

A-2, 6.090%, 12/20/2029 | | | 610,000 | | | | 611,867 | |

Angel Oak Mortgage Trust | | | | | | | | |

2021-3, 1.068%, 05/25/2066(c) | | | 584,184 | | | | 486,527 | |

2022-5, 4.500%, 05/25/2067 | | | 488,230 | | | | 468,157 | |

Aqua Finance Trust 2021-A | | | | | | | | |

2021-A, 1.540%, 07/17/2046 | | | 425,415 | | | | 376,627 | |

Avis Budget Rental Car Funding AESOP LLC | | | | | | | | |

2018-2 B, 4.250%, 03/20/2025 | | | 360,000 | | | | 357,483 | |

2019-3 A, 2.360%, 03/20/2026 | | | 376,000 | | | | 358,159 | |

2020-2 B, 2.960%, 02/20/2027 | | | 852,000 | | | | 790,497 | |

Beacon Container Finance II LLC | | | | | | | | |

2021-1A, 2.250%, 10/22/2046 | | | 867,300 | | | | 747,813 | |

BlueMountain CLO Ltd. | | | | | | | | |

2013-2R, 6.787% (TSFR3M + 1.442%), 10/22/2030(b) | | | 296,725 | | | | 295,981 | |

BMW Vehicle Owner Trust | | | | | | | | |

2023-A, 5.470%, 02/25/2028 | | | 549,000 | | | | 551,958 | |

Carmax Auto Owner Trust | | | | | | | | |

2023-3, 5.280%, 05/15/2028 | | | 592,000 | | | | 592,302 | |

CCG Receivables Trust | | | | | | | | |

2023-1, 5.820%, 09/16/2030 | | | 400,000 | | | | 400,480 | |

Cedar Funding VI CLO Ltd. | | | | | | | | |

2016-6A, 6.638% (TSFR3M + 1.312%), 04/20/2034(b) | | | 1,480,000 | | | | 1,459,196 | |

Crown Castle Towers LLC | | | | | | | | |

4.241%, 07/15/2028 | | | 439,000 | | | | 406,487 | |

DLLAA LLC | | | | | | | | |

2023-1, 5.640%, 02/22/2028 | | | 381,000 | | | | 384,248 | |

Dryden 75 CLO Ltd. | | | | | | | | |

2019-75R2, 6.610% (TSFR3M + 1.302%), 04/15/2034(b) | | | 850,000 | | | | 840,547 | |

Fort Washington CLO Ltd. | | | | | | | | |

2021-2A, 6.808% (TSFR3M + 1.482%), 10/20/2034(b) | | | 2,000,000 | | | | 1,989,034 | |

Frontier Issuer LLC | | | | | | | | |

2023-1, 6.600%, 08/20/2053 | | | 691,000 | | | | 671,240 | |

GCAT Trust | | | | | | | | |

2019-NQM3, 2.686%, 11/25/2059(c) | | | 104,111 | | | | 96,525 | |

2021-NQM5, 1.262%, 07/25/2066 | | | 482,097 | | | | 378,698 | |

GM Financial Automobile Leasing Trust | | | | | | | | |

2023-3, 5.380%, 11/20/2026 | | | 552,000 | | | | 552,885 | |

Hyundai Auto Receivables Trust | | | | | | | | |

2023-B, 5.480%, 04/17/2028 | | | 458,000 | | | | 461,133 | |

JPMorgan Chase Bank NA—CACLN | | | | | | | | |

2021-3, 0.760%, 02/26/2029 | | | 661,464 | | | | 631,761 | |

Kubota Credit Owner Trust | | | | | | | | |

2023-2, 5.280%, 01/18/2028 | | | 444,000 | | | | 443,762 | |

Madison Park Funding XXVI Ltd. | | | | | | | | |

2007-26, 6.831% (TSFR3M + 1.462%), 07/29/2030(b) | | | 2,251,567 | | | | 2,248,798 | |

The accompanying notes are an integral part of these financial statements.

30

PMC CORE FIXED INCOME FUND | Schedule of Investments |

August 31, 2023 (Continued)

| | | | | | | | |

| | |

| | | Principal

Amount

| | | Value

| |

Magnetite XXIII Ltd. | | | | | | | | |

2019-23R, 6.743% (TSFR3M + 1.392%), 01/25/2035(b) | | $ | 1,000,000 | | | $ | 995,988 | |

MetroNet Infrastructure Issuer LLC | | | | | | | | |

2022-1A, 6.350%, 10/20/2052 | | | 960,000 | | | | 934,303 | |

MMAF Equipment Finance LLC | | | | | | | | |

2023-A, 5.540%, 12/13/2029 | | | 594,000 | | | | 596,764 | |

MVW LLC | | | | | | | | |

2021-2A A, 1.430%, 05/20/2039 | | | 606,459 | | | | 552,242 | |

2021-2A B, 1.830%, 05/20/2039 | | | 494,802 | | | | 437,670 | |

2022-1, 4.400%, 11/21/2039 | | | 236,637 | | | | 222,643 | |

2023-1, 5.420%, 10/20/2040 | | | 507,896 | | | | 496,405 | |

2021-1W, 1.440%, 01/22/2041 | | | 252,036 | | | | 227,666 | |

Navient Private Education Refi Loan Trust | | | | | | | | |

2021-B, 0.940%, 07/15/2069 | | | 974,756 | | | | 845,577 | |

2021-C, 1.060%, 10/15/2069 | | | 728,899 | | | | 624,302 | |

2021-E, 0.970%, 12/16/2069 | | | 1,277,568 | | | | 1,076,581 | |

2021-F, 1.110%, 02/18/2070 | | | 463,130 | | | | 389,965 | |

OneMain Financial Issuance Trust | | | | | | | | |

2018-2, 3.570%, 03/14/2033 | | | 771,760 | | | | 762,153 | |

2023-2, 5.840%, 09/15/2036 | | | 820,000 | | | | 824,754 | |

PFS Financing Corp. | | | | | | | | |

2022-C, 3.890%, 05/15/2027 | | | 1,635,000 | | | | 1,584,206 | |

RASC Trust | | | | | | | | |

2005-KS12, 6.119% (TSFR1M + 0.574%), 01/25/2036(b) | | | 38,450 | | | | 38,191 | |

SBA Tower Trust | | | | | | | | |

2020-1-2, 2.328%, 01/15/2028 | | | 618,000 | | | | 532,358 | |

2021-3, 2.593%, 10/15/2056 | | | 1,243,000 | | | | 979,570 | |

Sierra Timeshare Receivables Funding LLC | | | | | | | | |

2019-2, 2.590%, 05/20/2036 | | | 245,118 | | | | 237,322 | |

2020-2, 3.510%, 07/20/2037 | | | 284,604 | | | | 270,078 | |

2021-2, 1.350%, 09/20/2038 | | | 204,847 | | | | 192,886 | |

2023-2, 5.800%, 04/20/2040 | | | 678,921 | | | | 681,421 | |

SoFi Consumer Loan Program Trust | | | | | | | | |

2023-1S, 5.810%, 05/15/2031 | | | 268,116 | | | | 268,419 | |

SoFi Professional Loan Program Trust | | | | | | | | |

2021-B, 1.140%, 02/15/2047 | | | 92,690 | | | | 77,409 | |

Starwood Mortgage Residential Trust | | | | | | | | |

2021-3, 1.127%, 06/25/2056(c) | | | 543,298 | | | | 436,221 | |

2021-6, 1.920%, 11/25/2066(c) | | | 842,548 | | | | 684,203 | |

Taco Bell Funding LLC | | | | | | | | |

2021-1, 1.946%, 08/25/2051 | | | 786,983 | | | | 683,990 | |

Thayer Park CLO Ltd. | | | | | | | | |

2017-R, 6.628% (TSFR3M + 1.302%), 04/20/2034(b) | | | 500,000 | | | | 495,951 | |

Towd Point Mortgage Trust | | | | | | | | |

2017-5, 6.029% (TSFR1M + 0.714%), 02/25/2057(b) | | | 124,368 | | | | 124,703 | |

2017-2 A1, 2.750%, 04/25/2057(c) | | | 3,743 | | | | 3,715 | |

2017-2, 3.250%, 04/25/2057(c) | | | 351,000 | | | | 340,849 | |

2017-3, 2.750%, 06/25/2057(c) | | | 77,977 | | | | 76,177 | |

2017-4, 2.750%, 06/25/2057(c) | | | 88,188 | | | | 83,632 | |

2022-4, 3.750%, 09/25/2062 | | | 1,432,071 | | | | 1,331,037 | |

TRESTLES CLO Ltd. | | | | | | | | |

2017-1, 6.603% (TSFR3M + 1.252%), 04/25/2032(b) | | | 500,000 | | | | 495,852 | |

TRESTLES CLO V Ltd. | | | | | | | | |

2021-5, 6.758% (TSFR3M + 1.432%), 10/20/2034(b) | | | 1,000,000 | | | | 988,629 | |

The accompanying notes are an integral part of these financial statements.

31

PMC CORE FIXED INCOME FUND | Schedule of Investments |

August 31, 2023 (Continued)

| | | | | | | | |

| | |

| | | Principal

Amount

| | | Value

| |

Vantage Data Centers Issuer LLC | | | | | | | | |

2019-1, 3.188%, 07/15/2044 | | $ | 1,263,360 | | | $ | 1,225,572 | |

2021-1, 2.165%, 10/15/2046 | | | 817,000 | | | | 721,762 | |

Verus Securitization Trust | | | | | | | | |

2021-3, 1.046%, 06/25/2066(c) | | | 667,549 | | | | 562,353 | |

2021-6, 1.630%, 10/25/2066(c) | | | 578,666 | | | | 471,446 | |

2022-7, 5.152%, 07/25/2067 | | | 872,190 | | | | 853,769 | |

| | | | | | |

|

|

|

TOTAL ASSET BACKED SECURITIES (Cost $44,237,229) | | | | | | | 41,996,127 | |

| | | | | | |

|

|

|

| CORPORATE BONDS—27.01% | | | | | | | | |

Automobiles & Components—0.68% | | | | | | | | |

Ford Motor Co. | | | | | | | | |

4.750%, 01/15/2043 | | | 90,000 | | | | 67,366 | |

Ford Motor Credit Co. LLC | | | | | | | | |

5.113%, 05/03/2029 | | | 310,000 | | | | 285,456 | |

General Motors Co. | | | | | | | | |

6.125%, 10/01/2025 | | | 1,248,000 | | | | 1,253,708 | |

General Motors Financial Co., Inc. | | | | | | | | |

5.100%, 01/17/2024 | | | 320,000 | | | | 319,014 | |

3.600%, 06/21/2030(e) | | | 605,000 | | | | 519,872 | |

Goodyear Tire & Rubber Co. | | | | | | | | |

5.250%, 04/30/2031 | | | 125,000 | | | | 109,761 | |

| | | | | | |

|

|

|

| | | | | | | | 2,555,177 | |

| | | | | | |

|

|

|

Banks—3.17% | | | | | | | | |

Bank of America Corp. | | | | | | | | |

3.875%, 08/01/2025 | | | 480,000 | | | | 467,491 | |

3.559% to 04/23/2026, then TSFR3M + 1.322%, 04/23/2027(a) | | | 1,610,000 | | | | 1,525,939 | |

2.884% to 10/22/2029, then TSFR3M + 1.452%, 10/22/2030(a) | | | 743,000 | | | | 637,870 | |

1.922% to 10/24/2030, then SOFR + 1.370%, 10/24/2031(a) | | | 2,430,000 | | | | 1,904,975 | |

Citigroup, Inc. | | | | | | | | |

3.200%, 10/21/2026 | | | 1,121,000 | | | | 1,045,830 | |

3.887% to 01/10/2027, then TSFR3M + 1.825%, 01/10/2028(a) | | | 835,000 | | | | 789,117 | |

2.976% to 11/05/2029, then SOFR + 1.422%, 11/05/2030(a) | | | 495,000 | | | | 425,972 | |

JPMorgan Chase & Co. | | | | | | | | |

2.950%, 10/01/2026 | | | 1,667,000 | | | | 1,558,141 | |

Wells Fargo & Co. | | | | | | | | |

2.406% to 10/30/2024, then TSFR3M + 1.087%, 10/30/2025(a)(e) | | | 900,000 | | | | 863,470 | |

2.393% to 06/02/2027, then SOFR + 2.100%, 06/02/2028(a) | | | 1,020,000 | | | | 908,163 | |

4.150%, 01/24/2029 | | | 1,581,000 | | | | 1,492,047 | |

5.013% to 04/04/2050, then TSFR3M + 4.502%, 04/04/2051(a) | | | 365,000 | | | | 329,899 | |

| | | | | | |

|

|

|

| | | | | | | | 11,948,914 | |

| | | | | | |

|

|

|

Capital Goods—1.48% | | | | | | | | |

Boeing Co. | | | | | | | | |

4.875%, 05/01/2025 | | | 1,181,000 | | | | 1,165,306 | |

3.900%, 05/01/2049 | | | 160,000 | | | | 119,851 | |

5.805%, 05/01/2050 | | | 1,273,000 | | | | 1,240,265 | |

Deere & Co. | | | | | | | | |

5.375%, 10/16/2029 | | | 999,000 | | | | 1,032,196 | |

Honeywell International, Inc. | | | | | | | | |

5.000%, 02/15/2033 | | | 905,000 | | | | 912,991 | |

Ingersoll Rand, Inc. | | | | | | | | |

5.400%, 08/14/2028 | | | 260,000 | | | | 260,729 | |

5.700%, 08/14/2033 | | | 325,000 | | | | 329,741 | |

The accompanying notes are an integral part of these financial statements.

32

PMC CORE FIXED INCOME FUND | Schedule of Investments |

August 31, 2023 (Continued)

| | | | | | | | |

| | |

| | | Principal

Amount

| | | Value

| |

RTX Corp. | | | | | | | | |

7.500%, 09/15/2029 | | $ | 467,000 | | | $ | 520,856 | |

| | | | | | |

|

|

|

| | | | | | | | 5,581,935 | |

| | | | | | |

|

|

|

Commercial & Professional Services—0.27% | | | | | | | | |

ASGN, Inc. | | | | | | | | |

4.625%, 05/15/2028 | | | 350,000 | | | | 314,859 | |

Enviri Corp. | | | | | | | | |

5.750%, 07/31/2027 | | | 165,000 | | | | 143,270 | |

Korn Ferry | | | | | | | | |

4.625%, 12/15/2027 | | | 100,000 | | | | 93,104 | |

Waste Management, Inc. | | | | | | | | |

4.150%, 04/15/2032 | | | 503,000 | | | | 472,087 | |

| | | | | | |

|

|

|

| | | | | | | | 1,023,320 | |

| | | | | | |

|

|

|

Consumer Discretionary Distribution & Retail—0.46% | | | | | | | | |

Amazon.com, Inc. | | | | | | | | |

3.800%, 12/05/2024 | | | 1,038,000 | | | | 1,019,762 | |

eBay, Inc. | | | | | | | | |

2.600%, 05/10/2031 | | | 790,000 | | | | 653,985 | |

Macy’s Retail Holdings LLC | | | | | | | | |