UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant's telephone number, including area code

Date of fiscal year end: August 31, 2024

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

| | |

| Column Small Cap Select Fund | |

| CFSSX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Column Small Cap Select Fund for the period of December 11, 2023 (inception date), to August 31, 2024. You can find additional information about the Fund at https://columnfunds.com/literature. You can also request this information by contacting us at 1-866-950-4644.

WHAT WERE THE FUND COSTS FOR THE PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Column Small Cap Select Fund | $72* | 0.66% |

| * | Amount shown reflects the expenses of the Fund from inception date through August 31, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM DURING THE PERIOD AND WHAT AFFECTED ITS PERFORMANCE?

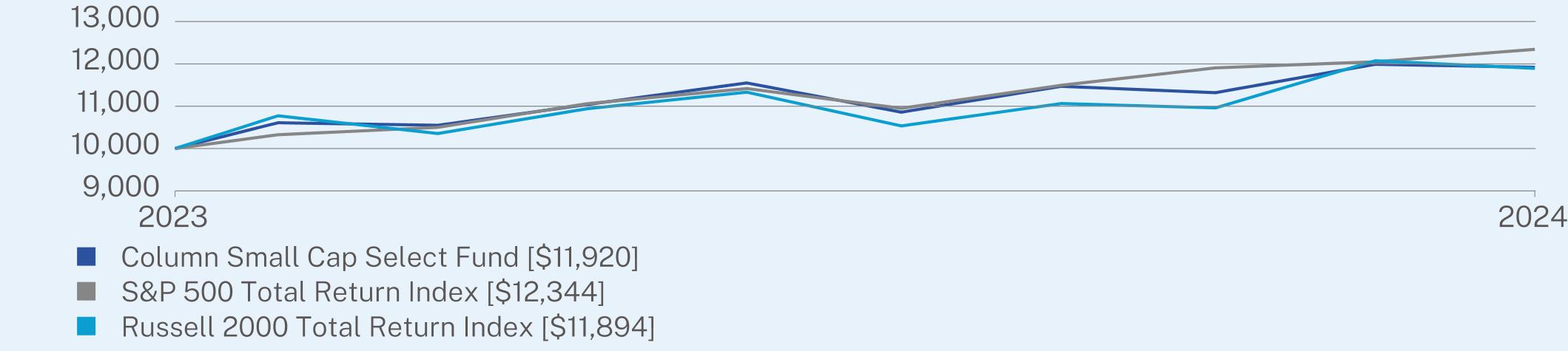

From its December 11, 2023 inception through August 31, 2024, the Column Small Cap Select Fund gained 19.20%, outperforming the 18.94% gain of the Russell 2000 Total Return Index, the benchmark we believe best represents the market in which the Fund invests due to its focus on small U.S. companies. The Fund lagged the 23.44% return of its broad-based benchmark index, the S&P 500 Total Return Index, as large companies outperformed small companies. Due to the Fund’s initial small size early in the period, expenses detracted notably from returns, a temporary headwind that was resolved when the Fund saw significant net inflows starting in mid-January 2024.

Relative to the Russell 2000 Total Return Index, the Fund’s stock selection across most sectors contributed to its outperformance during the period. Among the Fund’s sub-advisers, Driehaus Capital Management LLC was the largest contributor. In addition to benefiting from growth outperforming value, the Driehaus strategy was helped by strong stock selection—especially in industrials, health care, and information technology—and its exposure to the momentum risk factor, which outperformed other risk factors. Neuberger Berman Investment Advisers, LLC’s Small Cap Intrinsic Value strategy was the largest detractor due to both sector allocation—mainly an underweight to real estate and an overweight to information technology—and stock selection, where health care, consumer discretionary, and materials picks struggled.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Column Small Cap Select Fund | PAGE 1 | TSR-AR-89834G620 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(12/11/2023) |

Column Small Cap Select Fund | 19.20 |

S&P 500 Total Return Index | 23.44 |

Russell 2000 Total Return Index | 18.94 |

Visit https://columnfunds.com/performance for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $1,062,775,442 |

Number of Holdings | 373 |

Net Advisory Fee | $2,440,714 |

Portfolio Turnover | 54% |

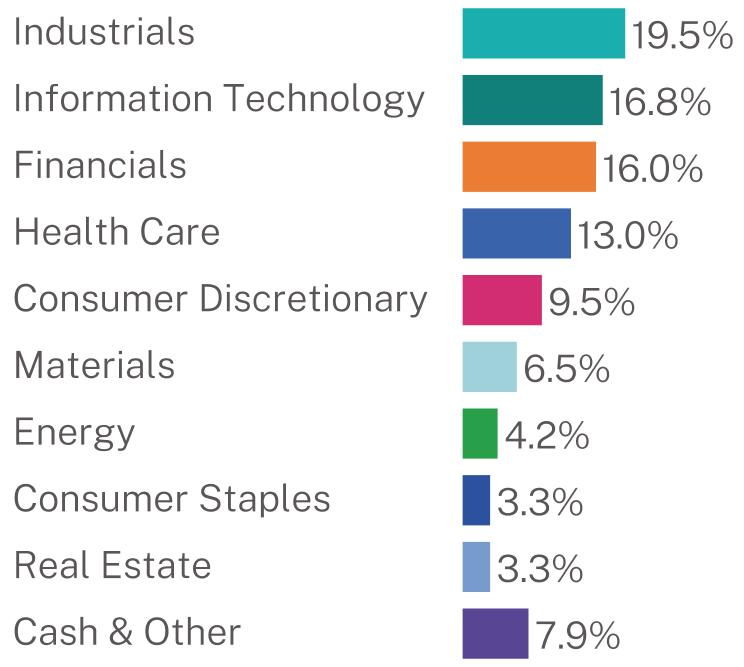

WHAT DID THE FUND INVEST IN? (% of investments as of August 31, 2024)

| |

Top Holdings | (%) |

First American Government Obligations Fund | 3.2% |

Arcosa, Inc. | 1.8% |

Kemper Corp. | 1.6% |

Gildan Activewear, Inc. | 1.5% |

BGC Group, Inc. - Class A | 1.4% |

Enovis Corp. | 1.4% |

Clarivate PLC | 1.3% |

Nomad Foods Ltd. | 1.1% |

Air Lease Corp. | 1.0% |

FirstCash Holdings, Inc. | 1.0% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://columnfunds.com/literature

| Column Small Cap Select Fund | PAGE 2 | TSR-AR-89834G620 |

11920123441189419.516.816.013.09.56.54.23.33.37.9

| | |

| Column Small Cap Fund | |

| CFSLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Column Small Cap Fund for the period of December 11, 2023 (inception date), to August 31, 2024. You can find additional information about the Fund at https://columnfunds.com/literature. You can also request this information by contacting us at 1-866-950-4644.

WHAT WERE THE FUND COSTS FOR THE PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Column Small Cap Fund | $71* | 0.66% |

| * | Amount shown reflects the expenses of the Fund from inception date through August 31, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM DURING THE PERIOD AND WHAT AFFECTED ITS PERFORMANCE?

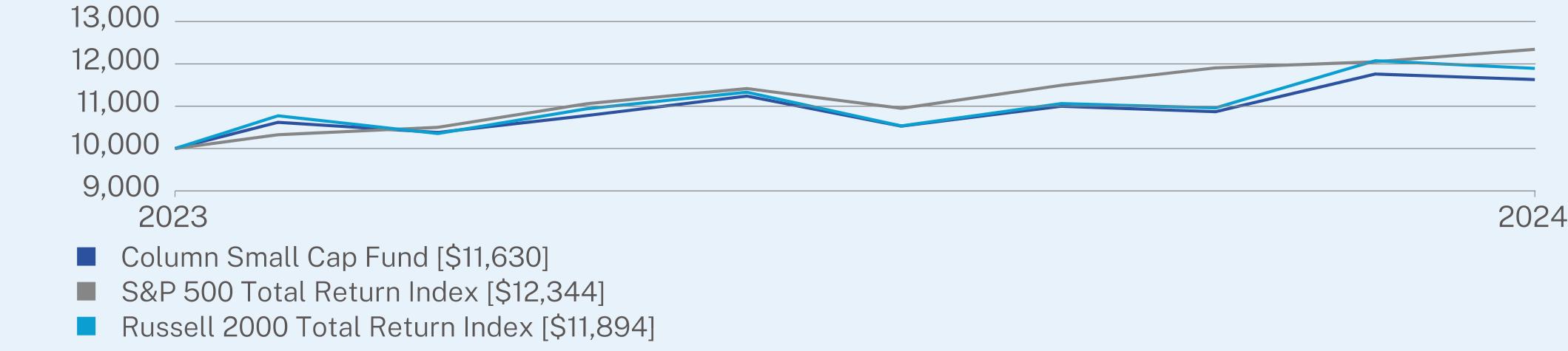

From its December 11, 2023 inception through August 31, 2024, the Column Small Cap Fund gained 16.30%, underperforming the 18.94% return of the Russell 2000 Total Return Index, the benchmark index we believe best represents the market in which the Fund invests due to its focus on small U.S. companies. The Fund also lagged the 23.44% return of its broad-based benchmark index, the S&P 500 Total Return Index, as large companies outperformed small companies. Due to the Fund’s initial small size early in the period, expenses detracted notably from returns, a temporary headwind that was resolved when the Fund saw significant net inflows starting in mid-January 2024.

Relative to the Russell 2000 Total Return Index, both the Fund’s stock selection, mainly in information technology, and sector allocation detracted from performance during the period. Kayne Anderson Rudnick Investment Management, LLC’s Small Cap Growth strategy trailed other Fund sub-advisers’ returns primarily due to stock selection struggles in a relatively concentrated portfolio. Technology services company Endava Plc was the largest individual detractor for the strategy and the Fund, as the company faced headwinds that resulted in a decline in revenues. Despite growth beating value over this stretch, the Small Cap Value strategy run by Boston Partners Global Investors, Inc. (WPG Partners division) was the top sub-adviser contributor, driven by strong stock selection across most sectors.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Column Small Cap Fund | PAGE 1 | TSR-AR-89834G612 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(12/11/2023) |

Column Small Cap Fund | 16.30 |

S&P 500 Total Return Index | 23.44 |

Russell 2000 Total Return Index | 18.94 |

Visit https://columnfunds.com/performance for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $429,222,102 |

Number of Holdings | 971 |

Net Advisory Fee | $977,408 |

Portfolio Turnover | 36% |

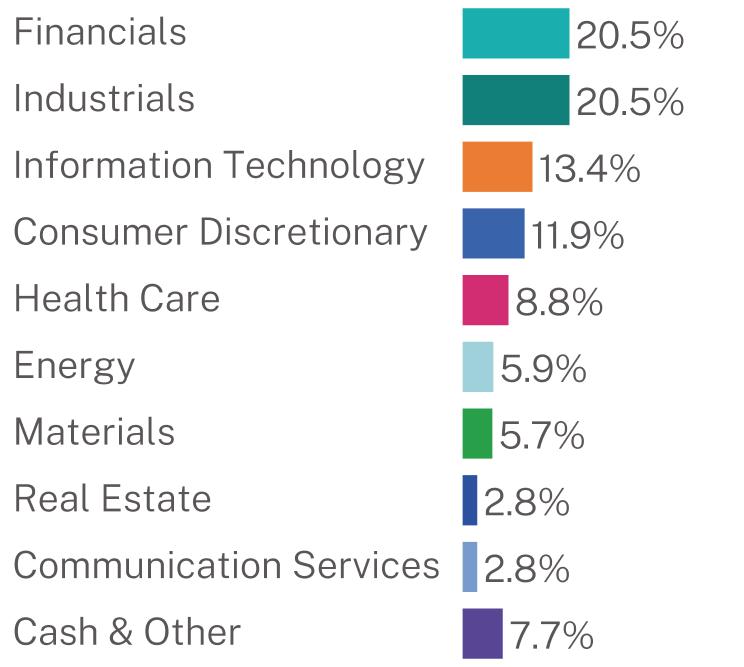

WHAT DID THE FUND INVEST IN? (% of investments as of August 31, 2024)

| |

Top Holdings | (%) |

First American Government Obligations Fund | 2.9% |

AAON, Inc. | 1.4% |

Ryan Specialty Holdings, Inc. | 1.3% |

Morningstar, Inc. | 1.1% |

Auto Trader Group PLC | 1.0% |

ServisFirst Bancshares, Inc. | 0.8% |

Triumph Financial, Inc. | 0.7% |

SPS Commerce, Inc. | 0.7% |

nCino, Inc. | 0.7% |

Enerpac Tool Group Corp. | 0.7% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://columnfunds.com/literature

| Column Small Cap Fund | PAGE 2 | TSR-AR-89834G612 |

11630123441189420.520.513.411.98.85.95.72.82.87.7

| | |

| Column Mid Cap Select Fund | |

| CFMSX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Column Mid Cap Select Fund for the period of December 11, 2023 (inception date), to August 31, 2024. You can find additional information about the Fund at https://columnfunds.com/literature. You can also request this information by contacting us at 1-866-950-4644.

WHAT WERE THE FUND COSTS FOR THE PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Column Mid Cap Select Fund | $58* | 0.54% |

| * | Amount shown reflects the expenses of the Fund from inception date through August 31, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM DURING THE PERIOD AND WHAT AFFECTED ITS PERFORMANCE?

From its December 11, 2023 inception through August 31, 2024, the Column Mid Cap Select Fund returned 14.10%, underperforming the 17.63% return of the Russell Midcap Total Return Index, the benchmark index we believe best represents the market in which the Fund invests due to its focus on medium-sized U.S. companies. The Fund also lagged the 23.44% return of its broad-based benchmark index, the S&P 500 Total Return Index, as large companies outperformed medium-sized companies. Due to the Fund’s initial small size early in the period, expenses detracted notably from returns, a temporary headwind that was resolved when the Fund saw significant net inflows starting in mid-January 2024.

Relative to the Russell Midcap Total Return Index, the Fund’s stock selection was the primary detractor from performance, particularly in the consumer staples, consumer discretionary, and health care sectors. Sector allocation had a neutral impact, as an underweight to utilities, a sector that surged on optimism surrounding the growth of artificial intelligence, offset the benefits of the overweight to the strong-performing financials and industrials sectors. Each of the Fund’s sub-advisers underperformed the Russell Midcap Total Return Index during the period. Kayne Anderson Rudnick Investment Management, LLC’s Mid Cap Core strategy was the largest detractor primarily due to stock selection struggles in a relatively concentrated portfolio. Frozen potato producer Lamb Weston Holdings, Inc. was the largest individual detractor for the strategy and the Fund, as the company faced operational challenges that lowered its near-term financial outlook.

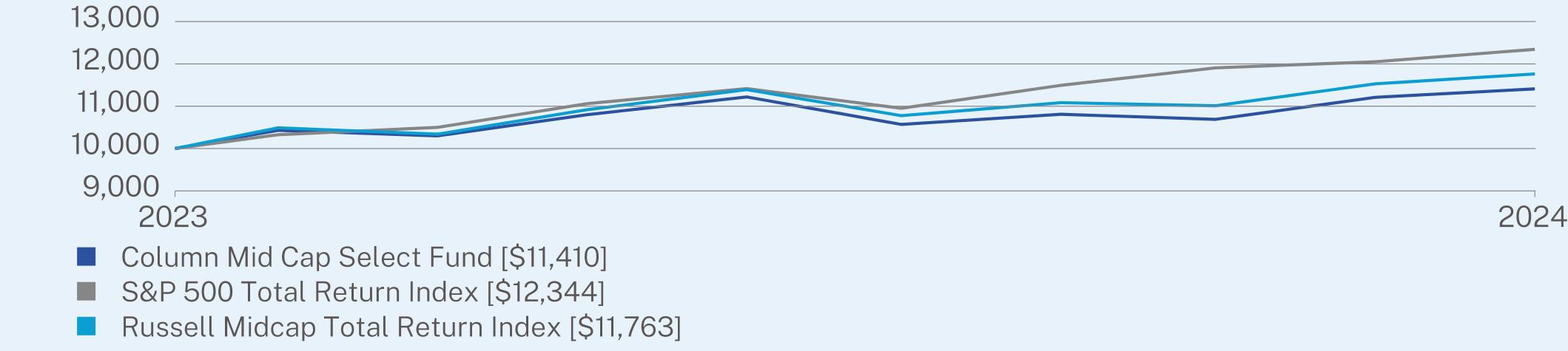

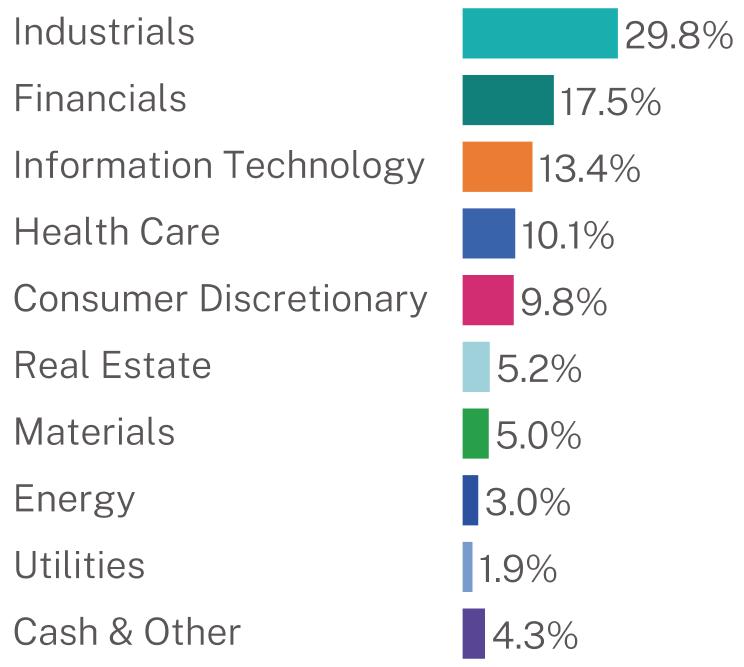

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Column Mid Cap Select Fund | PAGE 1 | TSR-AR-89834G596 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(12/11/2023) |

Column Mid Cap Select Fund | 14.10 |

S&P 500 Total Return Index | 23.44 |

Russell Midcap Total Return Index | 17.63 |

Visit https://columnfunds.com/performance for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $2,049,216,985 |

Number of Holdings | 212 |

Net Advisory Fee | $4,124,279 |

Portfolio Turnover | 16% |

WHAT DID THE FUND INVEST IN? (% of investments as of August 31, 2024)

| |

Top Holdings | (%) |

First American Government Obligations Fund | 2.7% |

Houlihan Lokey, Inc. | 2.3% |

AMETEK, Inc. | 2.2% |

Equifax, Inc. | 1.7% |

Ross Stores, Inc. | 1.6% |

Lennox International, Inc. | 1.5% |

Cooper Cos., Inc. | 1.4% |

HEICO Corp. - Class A | 1.4% |

Masco Corp. | 1.4% |

Broadridge Financial Solutions, Inc. | 1.4% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://columnfunds.com/literature

| Column Mid Cap Select Fund | PAGE 2 | TSR-AR-89834G596 |

11410123441176329.817.513.410.19.85.25.03.01.94.3

| | |

| Column Mid Cap Fund | |

| CFMCX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Column Mid Cap Fund for the period of December 11, 2023 (inception date), to August 31, 2024. You can find additional information about the Fund at https://columnfunds.com/literature. You can also request this information by contacting us at 1-866-950-4644.

WHAT WERE THE FUND COSTS FOR THE PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Column Mid Cap Fund | $56* | 0.52% |

| * | Amount shown reflects the expenses of the Fund from inception date through August 31, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM DURING THE PERIOD AND WHAT AFFECTED ITS PERFORMANCE?

From its December 11, 2023 inception through August 31, 2024, the Column Mid Cap Fund returned 15.70%, underperforming the 17.63% return of the Russell Midcap Total Return Index, the benchmark we believe best represents the market in which the Fund invests due to its focus on medium-sized U.S. companies. The Fund also lagged the 23.44% return of its broad-based benchmark index, the S&P 500 Total Return Index, as large companies outperformed medium-sized companies. Due to the Fund’s initial small size early in the period, expenses detracted notably from returns, a temporary headwind that was resolved when the Fund saw significant net inflows starting in mid-January 2024.

Relative to the Russell Midcap Total Return Index, both the Fund’s sector allocation and stock selection experienced headwinds during the period. A strategic underweight to utilities and real estate detracted from performance, as did stock selection in areas such as financials and consumer-related sectors. The Fund’s overweight to and stock selection within industrials was a strong contributor. Invesco Advisers, Inc.’s Mid Cap Growth strategy was the best performer driven by strong stock selection and a favorable climate for the momentum risk factor. Kayne Anderson Rudnick Investment Management, LLC’s Mid Cap Core strategy trailed other Fund sub-advisers’ returns primarily due to stock selection struggles in a relatively concentrated portfolio. One of its top positions, Lamb Weston Holdings, Inc., was the largest individual detractor for the strategy and the Fund, as the company faced operational challenges that lowered its near-term financial outlook.

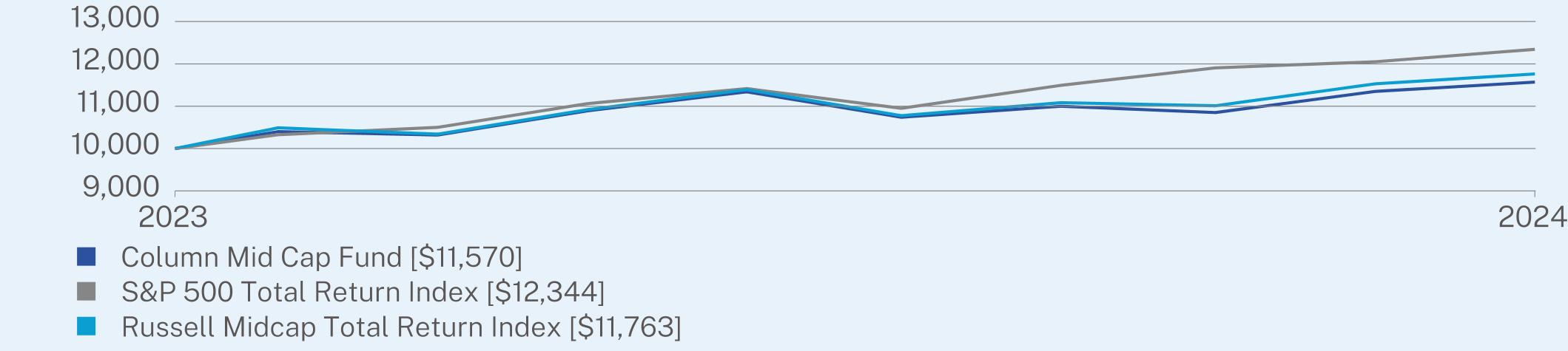

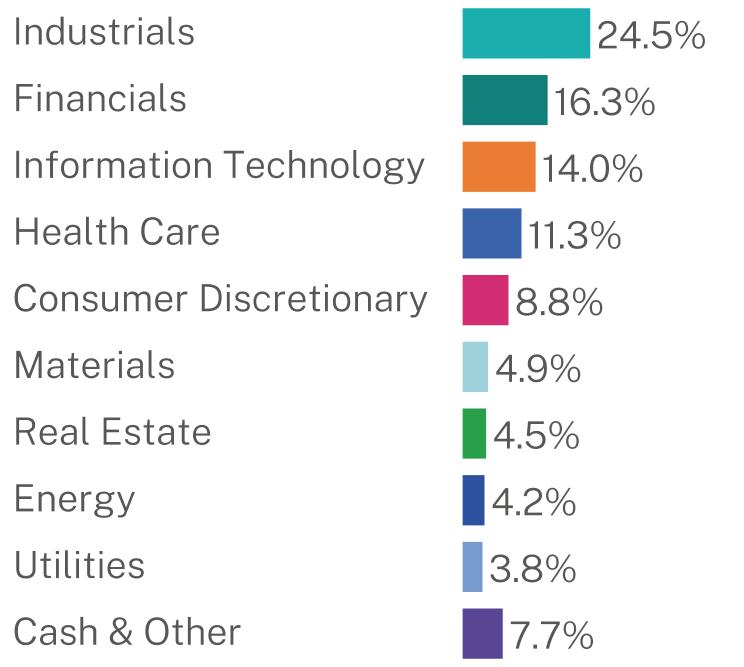

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Column Mid Cap Fund | PAGE 1 | TSR-AR-89834G588 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(12/11/2023) |

Column Mid Cap Fund | 15.70 |

S&P 500 Total Return Index | 23.44 |

Russell Midcap Total Return Index | 17.63 |

Visit https://columnfunds.com/performance for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $921,893,354 |

Number of Holdings | 705 |

Net Advisory Fee | $1,760,377 |

Portfolio Turnover | 28% |

WHAT DID THE FUND INVEST IN? (% of investments as of August 31, 2024)

| |

Top Holdings | (%) |

First American Government Obligations Fund | 2.2% |

Monolithic Power Systems, Inc. | 1.2% |

Houlihan Lokey, Inc. | 1.1% |

AMETEK, Inc. | 1.1% |

Cooper Cos., Inc. | 1.1% |

Equifax, Inc. | 1.0% |

Westinghouse Air Brake Technologies Corp. | 0.9% |

Cencora, Inc. | 0.8% |

Lennox International, Inc. | 0.8% |

Ross Stores, Inc. | 0.8% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor. |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://columnfunds.com/literature

| Column Mid Cap Fund | PAGE 2 | TSR-AR-89834G588 |

11570123441176324.516.314.011.38.84.94.54.23.87.7

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Akers and Lisa Zúñiga Ramírez are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 8/31/2024 | FYE 8/31/2023 |

| (a) Audit Fees | $66,000 | $0 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $12,000 | $0 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 8/31/2024 | FYE 8/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 8/31/2024 | FYE 8/31/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Column Small Cap Select Fund

Column Small Cap Fund

Column Mid Cap Select Fund

Column Mid Cap Fund

Annual Report

August 31, 2024

Investment Adviser

Mason Street Advisors, LLC

720 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

COMMON STOCKS — 93.5%

| | | | | | |

Aerospace & Defense — 2.3%

| | | | | | |

AeroVironment, Inc.(a) | | | 6,026 | | | $ 1,227,858 |

Axon Enterprise, Inc.(a) | | | 13,259 | | | 4,839,137 |

BWX Technologies, Inc. | | | 25,395 | | | 2,615,685 |

Curtiss-Wright Corp. | | | 9,782 | | | 3,089,743 |

Embraer SA - ADR(a) | | | 75,153 | | | 2,497,334 |

Leonardo DRS, Inc.(a) | | | 71,110 | | | 2,029,479 |

Loar Holdings, Inc.(a) | | | 14,485 | | | 1,074,208 |

Mercury Systems, Inc.(a) | | | 52,097 | | | 1,974,476 |

Moog, Inc. - Class A | | | 7,179 | | | 1,417,135 |

V2X, Inc.(a) | | | 58,711 | | | 3,325,978 |

| | | | | | 24,091,033 |

Automobile Components — 0.4%

| | | |

Fox Factory Holding Corp.(a) | | | 9,061 | | | 366,789 |

Modine Manufacturing Co.(a) | | | 29,568 | | | 3,593,991 |

| | | | | | 3,960,780 |

Banks — 6.9%

| | | | | | |

Banc of California, Inc. | | | 133,770 | | | 1,902,209 |

Bank of Hawaii Corp. | | | 8,794 | | | 583,658 |

Cadence Bank | | | 106,790 | | | 3,447,181 |

Comerica, Inc. | | | 88,630 | | | 5,061,659 |

Community Financial System, Inc. | | | 19,651 | | | 1,201,855 |

Cullen/Frost Bankers, Inc. | | | 9,069 | | | 1,017,814 |

Customers Bancorp, Inc.(a) | | | 19,308 | | | 1,000,541 |

Dime Community Bancshares, Inc. | | | 311,455 | | | 8,100,945 |

First Financial Bankshares, Inc. | | | 22,486 | | | 822,313 |

Glacier Bancorp, Inc. | | | 19,274 | | | 911,660 |

Huntington Bancshares, Inc./OH | | | 208,217 | | | 3,117,008 |

Independent Bank Corp/MI | | | 106,390 | | | 3,604,493 |

Lakeland Financial Corp. | | | 7,311 | | | 498,245 |

National Bank Holdings Corp. -

Class A | | | 73,602 | | | 3,224,504 |

Popular, Inc. | | | 88,230 | | | 9,043,575 |

Prosperity Bancshares, Inc. | | | 134,381 | | | 9,887,754 |

Stock Yards Bancorp, Inc. | | | 8,374 | | | 507,464 |

Texas Capital Bancshares,

Inc.(a) | | | 48,833 | | | 3,282,554 |

United Bankshares, Inc./WV | | | 87,565 | | | 3,403,652 |

United Community Banks, Inc./GA | | | 24,329 | | | 741,305 |

Western Alliance Bancorp | | | 90,302 | | | 7,375,867 |

Zions Bancorp NA | | | 96,620 | | | 4,788,487 |

| | | | | | 73,524,743 |

Beverages — 0.3%

| | | | | | |

Coca-Cola Consolidated, Inc. | | | 2,628 | | | 3,527,827 |

Biotechnology — 3.8%

| | | | | | |

Apogee Therapeutics, Inc.(a) | | | 44,922 | | | 2,298,659 |

Avidity Biosciences, Inc.(a) | | | 22,649 | | | 996,556 |

Blueprint Medicines Corp.(a) | | | 9,716 | | | 928,267 |

CareDx, Inc.(a) | | | 162,734 | | | 5,000,816 |

| | | | | | | |

| | | | | | | |

Crinetics Pharmaceuticals,

Inc.(a) | | | 103,444 | | | $ 5,488,739 |

Halozyme Therapeutics, Inc.(a) | | | 90,254 | | | 5,762,718 |

Insmed, Inc.(a) | | | 3,578 | | | 273,610 |

Krystal Biotech, Inc.(a) | | | 6,282 | | | 1,225,744 |

Kymera Therapeutics, Inc.(a) | | | 40,110 | | | 1,939,719 |

Merus NV(a) | | | 31,170 | | | 1,589,358 |

Natera, Inc.(a) | | | 23,782 | | | 2,812,459 |

Nuvalent, Inc. - Class A(a) | | | 19,401 | | | 1,651,607 |

Rhythm Pharmaceuticals, Inc.(a) | | | 12,735 | | | 602,238 |

Ultragenyx Pharmaceutical,

Inc.(a) | | | 37,394 | | | 2,123,231 |

Vaxcyte, Inc.(a) | | | 49,547 | | | 4,001,416 |

Xenon Pharmaceuticals, Inc.(a) | | | 77,730 | | | 3,135,628 |

| | | | | | 39,830,765 |

Building Products — 1.8%

| | | | | | |

AAON, Inc. | | | 67,620 | | | 6,458,386 |

Armstrong World Industries, Inc. | | | 3,577 | | | 453,421 |

CSW Industrials, Inc. | | | 6,056 | | | 2,044,688 |

Hayward Holdings, Inc.(a) | | | 48,236 | | | 715,822 |

Janus International Group,

Inc.(a) | | | 326,495 | | | 3,588,180 |

JELD-WEN Holding, Inc.(a) | | | 83,230 | | | 1,185,195 |

Resideo Technologies, Inc.(a) | | | 207,076 | | | 4,174,652 |

Simpson Manufacturing Co.,

Inc. | | | 2,999 | | | 548,997 |

| | | | | | 19,169,341 |

Capital Markets — 2.6%

| | | | | | |

Artisan Partners Asset Management, Inc. - Class A | | | 79,390 | | | 3,301,830 |

BGC Group, Inc. - Class A | | | 1,523,822 | | | 15,055,361 |

Evercore, Inc. - Class A | | | 13,497 | | | 3,316,753 |

Hamilton Lane, Inc. - Class A | | | 4,475 | | | 683,959 |

Houlihan Lokey, Inc. | | | 6,204 | | | 971,670 |

Perella Weinberg Partners | | | 227,965 | | | 4,456,716 |

| | | | | | 27,786,289 |

Chemicals — 3.7%

| | | | | | |

Ashland, Inc. | | | 71,496 | | | 6,398,892 |

Aspen Aerogels, Inc.(a) | | | 69,220 | | | 1,985,922 |

Axalta Coating Systems Ltd.(a) | | | 96,565 | | | 3,524,622 |

Chemours Co. | | | 157,410 | | | 3,060,050 |

Element Solutions, Inc. | | | 355,208 | | | 9,498,262 |

Kronos Worldwide, Inc. | | | 312,794 | | | 3,615,899 |

Rayonier Advanced Materials, Inc.(a) | | | 1,357,446 | | | 10,832,419 |

| | | | | | 38,916,066 |

Commercial Services & Supplies — 1.3%

| | | |

Casella Waste Systems, Inc. - Class A(a) | | | 4,518 | | | 487,312 |

Clean Harbors, Inc.(a) | | | 8,247 | | | 2,027,937 |

Enviri Corp.(a) | | | 210,311 | | | 2,513,216 |

MSA Safety, Inc. | | | 2,812 | | | 513,556 |

OPENLANE, Inc.(a) | | | 144,560 | | | 2,505,225 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | | |

COMMON STOCKS — (Continued)

| |

Commercial Services & Supplies — (Continued)

| |

Rollins, Inc. | | | 17,989 | | | $ 902,688 | |

Tetra Tech, Inc. | | | 21,529 | | | 5,118,304 | |

| | | | | | 14,068,238 | |

Communications Equipment — 1.2%

| | | | |

Ciena Corp.(a) | | | 99,127 | | | 5,714,672 | |

Ribbon Communications, Inc.(a) | | | 641,423 | | | 2,187,252 | |

Viasat, Inc.(a) | | | 217,835 | | | 3,420,009 | |

Viavi Solutions, Inc.(a) | | | 141,595 | | | 1,219,133 | |

| | | | | | 12,541,066 | |

Construction & Engineering — 2.7%

| | | | |

Arcosa, Inc. | | | 208,518 | | | 19,077,312 | |

Comfort Systems USA, Inc. | | | 6,205 | | | 2,193,592 | |

EMCOR Group, Inc. | | | 2,926 | | | 1,150,093 | |

Sterling Infrastructure, Inc.(a) | | | 13,111 | | | 1,567,158 | |

Valmont Industries, Inc. | | | 16,933 | | | 4,838,774 | |

| | | | | | 28,826,929 | |

Construction Materials — 0.4%

| | | | | | | |

Eagle Materials, Inc. | | | 7,816 | | | 2,014,574 | |

Knife River Corp.(a) | | | 31,302 | | | 2,468,789 | |

| | | | | | 4,483,363 | |

Consumer Finance — 1.2%

| | | | | | | |

Bread Financial Holdings, Inc. | | | 19,918 | | | 1,158,630 | |

FirstCash Holdings, Inc. | | | 91,985 | | | 11,046,479 | |

| | | | | | 12,205,109 | |

Consumer Staples Distribution

& Retail — 0.7%

| | | | |

Grocery Outlet Holding Corp.(a) | | | 212,653 | | | 4,027,648 | |

Sprouts Farmers Market, Inc.(a) | | | 30,561 | | | 3,179,872 | |

| | | | | | 7,207,520 | |

Containers & Packaging — 0.6%

| | | | |

AptarGroup, Inc. | | | 7,527 | | | 1,153,061 | |

Avery Dennison Corp. | | | 22,941 | | | 5,089,461 | |

| | | | | | 6,242,522 | | | |

Distributors — 0.1%

| | | | | | | |

Pool Corp. | | | 4,000 | | | 1,406,480 | |

Diversified Consumer Services — 0.7%

| | | | |

Bright Horizons Family Solutions, Inc.(a) | | | 15,394 | | | 2,166,244 | |

Stride, Inc.(a) | | | 57,427 | | | 4,728,539 | |

| | | | | | 6,894,783 | |

Electric Utilities — 0.8%

| | | | | | | |

ALLETE, Inc. | | | 30,559 | | | 1,942,024 | |

IDACORP, Inc. | | | 4,734 | | | 482,442 | |

Portland General Electric Co. | | | 134,379 | | | 6,464,974 | |

| | | | | | 8,889,440 | |

| | | | | | | | |

| | | | | | | |

Electrical Equipment — 0.2%

| | | | | | |

Babcock & Wilcox Enterprises, Inc.(a) | | | 244,145 | | | $ 288,091 |

Bloom Energy Corp. - Class A(a) | | | 80,579 | | | 959,696 |

Enovix Corp.(a) | | | 110,045 | | | 1,047,628 |

| | | | | | 2,295,415 |

Electronic Equipment, Instruments

& Components — 3.1%

| | | |

Advanced Energy Industries,

Inc. | | | 5,932 | | | 629,326 |

Badger Meter, Inc. | | | 6,806 | | | 1,408,434 |

Celestica, Inc.(a) | | | 69,006 | | | 3,513,785 |

Coherent Corp.(a) | | | 66,047 | | | 5,148,364 |

Fabrinet(a) | | | 18,426 | | | 4,489,495 |

Innoviz Technologies Ltd.(a) | | | 210,506 | | | 138,723 |

Insight Enterprises, Inc.(a) | | | 18,730 | | | 4,065,721 |

IPG Photonics Corp.(a) | | | 13,037 | | | 891,340 |

Itron, Inc.(a) | | | 35,227 | | | 3,600,904 |

Littelfuse, Inc. | | | 6,579 | | | 1,790,804 |

Napco Security Technologies,

Inc. | | | 25,700 | | | 1,191,966 |

nLight, Inc.(a) | | | 50,248 | | | 599,961 |

Novanta, Inc.(a) | | | 5,841 | | | 1,070,538 |

OSI Systems, Inc.(a) | | | 17,010 | | | 2,549,289 |

Rogers Corp.(a) | | | 4,879 | | | 523,321 |

Teledyne Technologies, Inc.(a) | | | 3,772 | | | 1,632,522 |

| | | | | | 33,244,493 |

Energy Equipment & Services — 1.4%

| | | |

Cactus, Inc. - Class A | | | 11,624 | | | 691,861 |

Dril-Quip, Inc.(a) | | | 35,711 | | | 582,446 |

Oceaneering International,

Inc. (a) | | | 31,717 | | | 856,042 |

Patterson-UTI Energy, Inc. | | | 259,854 | | | 2,393,255 |

TechnipFMC PLC | | | 202,581 | | | 5,437,274 |

TETRA Technologies, Inc.(a) | | | 431,228 | | | 1,371,305 |

Tidewater, Inc.(a) | | | 30,111 | | | 2,670,846 |

Transocean Ltd.(a) | | | 81,120 | | | 384,509 |

| | | | | | 14,387,538 |

Entertainment — 0.2%

| | | | | | |

Lions Gate Entertainment Corp. - Class B(a) | | | 299,342 | | | 2,071,447 |

Financial Services — 0.4%

| | | | | | |

Cannae Holdings, Inc. | | | 29,974 | | | 600,080 |

Federal Agricultural Mortgage Corp. - Class C | | | 10,518 | | | 2,076,989 |

Jack Henry & Associates, Inc. | | | 4,189 | | | 724,823 |

Shift4 Payments, Inc. -

Class A (a) | | | 7,644 | | | 635,216 |

| | | | | | 4,037,108 |

Food Products — 1.8%

| | | | | | |

Freshpet, Inc.(a) | | | 24,768 | | | 3,368,448 |

Hain Celestial Group, Inc.(a) | | | 121,577 | | | 972,616 |

Nomad Foods Ltd. | | | 634,005 | | | 11,919,294 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Food Products — (Continued)

|

TreeHouse Foods, Inc.(a) | | | 52,085 | | | $ 2,140,173 |

Utz Brands, Inc. | | | 26,199 | | | 442,501 |

| | | | | | 18,843,032 |

Gas Utilities — 0.5%

| | | | | | |

Atmos Energy Corp. | | | 20,790 | | | 2,718,085 |

Chesapeake Utilities Corp. | | | 540 | | | 63,947 |

New Jersey Resources Corp. | | | 57,336 | | | 2,655,230 |

| | | | | | 5,437,262 |

Ground Transportation — 0.4%

| | | | | | |

RXO, Inc.(a) | | | 128,872 | | | 3,667,697 |

Saia, Inc.(a) | | | 2,147 | | | 806,907 |

| | | | | | 4,474,604 |

Health Care Equipment & Supplies — 4.6%

|

Accuray, Inc.(a) | | | 295,047 | | | 643,202 |

AtriCure, Inc.(a) | | | 45,888 | | | 1,202,725 |

Avanos Medical, Inc.(a) | | | 49,781 | | | 1,205,696 |

CytoSorbents Corp.(a) | | | 6,648 | | | 6,980 |

Enovis Corp.(a) | | | 312,576 | | | 14,566,042 |

Glaukos Corp.(a) | | | 28,489 | | | 3,814,392 |

Globus Medical, Inc. - Class A(a) | | | 58,995 | | | 4,288,937 |

Haemonetics Corp.(a) | | | 56,523 | | | 4,272,008 |

Integer Holdings Corp.(a) | | | 15,719 | | | 2,044,570 |

Integra LifeSciences Holdings Corp.(a) | | | 43,489 | | | 884,566 |

Lantheus Holdings, Inc.(a) | | | 10,896 | | | 1,160,097 |

OraSure Technologies, Inc.(a) | | | 180,879 | | | 810,338 |

QuidelOrtho Corp.(a) | | | 3,589 | | | 151,635 |

RxSight, Inc.(a) | | | 14,415 | | | 812,862 |

Tandem Diabetes Care, Inc.(a) | | | 25,699 | | | 1,117,907 |

TransMedics Group, Inc.(a) | | | 50,709 | | | 8,522,155 |

UFP Technologies, Inc.(a) | | | 3,703 | | | 1,263,575 |

Varex Imaging Corp.(a) | | | 62,884 | | | 784,792 |

Zimvie, Inc.(a) | | | 65,507 | | | 1,135,891 |

| | | | | | 48,688,370 |

Health Care Providers & Services — 3.1%

| | | |

Acadia Healthcare Co., Inc.(a) | | | 107,080 | | | 8,773,064 |

AMN Healthcare Services,

Inc. (a) | | | 56,390 | | | 2,990,362 |

Chemed Corp. | | | 3,104 | | | 1,819,472 |

CorVel Corp.(a) | | | 1,817 | | | 582,766 |

HealthEquity, Inc.(a) | | | 45,475 | | | 3,617,991 |

Molina Healthcare, Inc.(a) | | | 7,660 | | | 2,679,391 |

Patterson Cos., Inc. | | | 72,156 | | | 1,622,789 |

Tenet Healthcare Corp.(a) | | | 63,741 | | | 10,570,808 |

| | | | | | 32,656,643 |

Hotels, Restaurants & Leisure — 2.7%

| | | |

Cava Group, Inc.(a) | | | 23,107 | | | 2,635,122 |

Dutch Bros, Inc. - Class A(a) | | | 57,774 | | | 1,790,994 |

International Game Technology PLC | | | 239,678 | | | 5,366,390 |

| | | | | | | |

| | | | | | | |

Krispy Kreme, Inc. | | | 62,996 | | | $ 709,965 |

Life Time Group Holdings,

Inc.(a) | | | 81,222 | | | 1,910,342 |

PlayAGS, Inc.(a) | | | 524,505 | | | 5,937,397 |

Red Rock Resorts, Inc. -

Class A | | | 60,930 | | | 3,551,000 |

Sweetgreen, Inc. - Class A(a) | | | 66,749 | | | 2,109,936 |

Texas Roadhouse, Inc. | | | 9,841 | | | 1,660,669 |

United Parks & Resorts, Inc.(a) | | | 18,482 | | | 909,684 |

Wingstop, Inc. | | | 5,844 | | | 2,256,427 |

| | | | | | 28,837,926 |

Household Durables — 1.5%

| | | | | | |

Champion Homes, Inc.(a) | | | 67,681 | | | 6,322,083 |

Installed Building Products, Inc. | | | 23,345 | | | 5,189,827 |

Meritage Homes Corp. | | | 5,859 | | | 1,160,492 |

Tempur Sealy International, Inc. | | | 43,977 | | | 2,305,714 |

Whirlpool Corp. | | | 5,328 | | | 534,345 |

| | | | | | 15,512,461 |

Household Products — 0.1%

| | | | | | |

Church & Dwight Co., Inc. | | | 4,164 | | | 424,228 |

WD-40 Co. | | | 3,462 | | | 909,952 |

| | | | | | 1,334,180 |

Independent Power and Renewable Electricity Producers — 1.1%

| | | |

Ormat Technologies, Inc. | | | 72,759 | | | 5,422,728 |

Vistra Corp. | | | 78,180 | | | 6,678,918 |

| | | | | | 12,101,646 |

Insurance — 4.3%

| | | | | | |

AMERISAFE, Inc. | | | 12,143 | | | 608,607 |

Baldwin Insurance Group, Inc. - Class A(a) | | | 54,114 | | | 2,537,405 |

Fidelis Insurance Holdings Ltd. | | | 517,554 | | | 9,585,100 |

First American Financial Corp. | | | 78,775 | | | 5,025,845 |

Hagerty, Inc. - Class A(a) | | | 28,627 | | | 341,806 |

HCI Group, Inc. | | | 13,042 | | | 1,249,815 |

Kemper Corp. | | | 272,715 | | | 17,047,415 |

Oscar Health, Inc. - Class A(a) | | | 79,759 | | | 1,459,590 |

Palomar Holdings, Inc.(a) | | | 13,305 | | | 1,320,122 |

RLI Corp. | | | 8,189 | | | 1,261,925 |

Selective Insurance Group, Inc. | | | 36,115 | | | 3,285,743 |

Skyward Specialty Insurance Group, Inc.(a) | | | 34,375 | | | 1,404,906 |

Stewart Information Services Corp. | | | 8,063 | | | 595,936 |

White Mountains Insurance Group Ltd. | | | 215 | | | 396,512 |

| | | | | | 46,120,727 |

Interactive Media & Services — 0.8%

| | | |

Cars.com, Inc.(a) | | | 388,136 | | | 6,924,346 |

MediaAlpha, Inc. - Class A(a) | | | 49,082 | | | 873,660 |

QuinStreet, Inc.(a) | | | 31,302 | | | 598,181 |

| | | | | | 8,396,187 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

IT Services — 1.0%

| | | | | | |

Kyndryl Holdings, Inc.(a) | | | 230,674 | | | $ 5,464,667 |

Unisys Corp.(a) | | | 259,950 | | | 1,437,524 |

Wix.com Ltd.(a) | | | 23,065 | | | 3,843,090 |

| | | | | | 10,745,281 |

Life Sciences Tools & Services — 0.6%

| | | |

Bio-Techne Corp. | | | 22,465 | | | 1,662,185 |

Charles River Laboratories International, Inc.(a) | | | 9,155 | | | 1,810,401 |

ICON PLC(a) | | | 3,338 | | | 1,075,036 |

Standard BioTools, Inc.(a) | | | 239,040 | | | 509,155 |

Stevanato Group SpA | | | 25,480 | | | 557,503 |

West Pharmaceutical Services, Inc. | | | 2,344 | | | 735,149 |

| | | | | | 6,349,429 |

Machinery — 3.2%

| | | | | | |

Alamo Group, Inc. | | | 16,760 | | | 3,107,304 |

Allison Transmission Holdings, Inc. | | | 16,321 | | | 1,513,773 |

Crane Co. | | | 19,380 | | | 3,069,405 |

Enerpac Tool Group Corp. | | | 12,043 | | | 496,653 |

Enpro, Inc. | | | 2,918 | | | 469,302 |

Esab Corp. | | | 11,877 | | | 1,246,729 |

ESCO Technologies, Inc. | | | 6,280 | | | 753,035 |

Federal Signal Corp. | | | 57,586 | | | 5,441,301 |

Franklin Electric Co., Inc. | | | 20,155 | | | 2,093,298 |

Graco, Inc. | | | 9,179 | | | 765,070 |

Helios Technologies, Inc. | | | 24,307 | | | 1,074,126 |

Hillman Solutions Corp.(a) | | | 53,333 | | | 530,663 |

Kadant, Inc. | | | 5,440 | | | 1,746,947 |

Lindsay Corp. | | | 5,233 | | | 649,154 |

Markforged Holding Corp.(a) | | | 173,905 | | | 43,650 |

Nordson Corp. | | | 2,941 | | | 754,543 |

Omega Flex, Inc. | | | 2,582 | | | 121,870 |

RBC Bearings, Inc.(a) | | | 6,795 | | | 2,023,891 |

SPX Technologies, Inc.(a) | | | 25,267 | | | 4,122,058 |

Standex International Corp. | | | 6,001 | | | 1,072,079 |

Stratasys Ltd.(a) | | | 230,291 | | | 1,582,099 |

Toro Co. | | | 13,072 | | | 1,210,467 |

| | | | | | 33,887,417 |

Marine Transportation — 0.6%

| | | | | | |

Kirby Corp.(a) | | | 53,350 | | | 6,397,732 |

Media — 1.0%

| | | | | | |

Criteo SA - ADR(a) | | | 160,336 | | | 7,604,736 |

Magnite, Inc.(a) | | | 76,092 | | | 1,049,309 |

Nexstar Media Group, Inc. | | | 9,200 | | | 1,572,096 |

TechTarget, Inc.(a) | | | 9,495 | | | 253,042 |

| | | | | | 10,479,183 |

Metals & Mining — 1.7%

| | | | | | |

ATI, Inc.(a) | | | 31,229 | | | 1,994,909 |

Carpenter Technology Corp. | | | 8,509 | | | 1,231,848 |

| | | | | | | |

| | | | | | | |

Cleveland-Cliffs, Inc.(a) | | | 192,457 | | | $ 2,513,488 |

ERO Copper Corp.(a) | | | 348,729 | | | 7,166,381 |

Materion Corp. | | | 30,720 | | | 3,564,749 |

Pan American Silver Corp. | | | 101,454 | | | 2,050,385 |

| | | | | | 18,521,760 |

Multi-Utilities — 0.3%

| | | | | | |

Northwestern Energy Group,

Inc. | | | 48,530 | | | 2,639,547 |

Oil, Gas & Consumable Fuels — 2.8%

| | | |

Antero Resources Corp.(a) | | | 59,730 | | | 1,612,113 |

Cameco Corp. | | | 60,901 | | | 2,487,197 |

CNX Resources Corp.(a) | | | 124,377 | | | 3,441,512 |

Devon Energy Corp. | | | 75,192 | | | 3,367,098 |

International Seaways, Inc. | | | 64,357 | | | 3,335,623 |

Kosmos Energy Ltd.(a) | | | 1,318,706 | | | 6,422,098 |

Matador Resources Co. | | | 35,780 | | | 2,029,442 |

Murphy Oil Corp. | | | 45,490 | | | 1,695,867 |

Permian Resources Corp. | | | 160,305 | | | 2,282,743 |

Sitio Royalties Corp. - Class A | | | 41,178 | | | 915,387 |

Texas Pacific Land Corp. | | | 488 | | | 424,018 |

Uranium Energy Corp.(a) | | | 292,845 | | | 1,531,579 |

Viper Energy, Inc. | | | 12,607 | | | 600,093 |

| | | | | | 30,144,770 |

Personal Care Products — 0.4%

| | | |

BellRing Brands, Inc.(a) | | | 34,146 | | | 1,909,786 |

Coty, Inc. - Class A(a) | | | 298,480 | | | 2,799,742 |

| | | | | | 4,709,528 |

Pharmaceuticals — 0.9%

| | | | | | |

Amneal Pharmaceuticals,

Inc.(a) | | | 195,796 | | | 1,695,593 |

Amphastar Pharmaceuticals,

Inc.(a) | | | 10,872 | | | 529,901 |

Edgewise Therapeutics, Inc.(a) | | | 17,721 | | | 332,269 |

Innoviva, Inc.(a) | | | 187,107 | | | 3,626,134 |

Intra-Cellular Therapies, Inc.(a) | | | 16,662 | | | 1,220,991 |

Structure Therapeutics, Inc. - ADR(a) | | | 45,229 | | | 1,724,582 |

| | | | | | 9,129,470 |

Professional Services — 3.2%

| | | | | | |

Alight, Inc. - Class A(a) | | | 159,392 | | | 1,189,064 |

CBIZ, Inc.(a) | | | 5,967 | | | 439,171 |

Clarivate PLC(a) | | | 2,007,246 | | | 13,769,708 |

Conduent, Inc.(a) | | | 616,400 | | | 2,354,648 |

CRA International, Inc. | | | 3,969 | | | 669,173 |

Exponent, Inc. | | | 15,631 | | | 1,692,368 |

FTI Consulting, Inc.(a) | | | 4,117 | | | 939,952 |

KBR, Inc. | | | 94,786 | | | 6,574,357 |

Kforce, Inc. | | | 40,695 | | | 2,669,185 |

Korn Ferry | | | 15,630 | | | 1,141,772 |

Parsons Corp.(a) | | | 24,019 | | | 2,292,854 |

| | | | | | 33,732,252 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Real Estate Management &

Development — 0.7%

| | | |

Colliers International Group, Inc. | | | 2,182 | | | $ 314,775 |

Compass, Inc. - Class A(a) | | | 177,583 | | | 911,001 |

Cushman & Wakefield PLC(a) | | | 363,865 | | | 4,730,245 |

FirstService Corp. | | | 10,004 | | | 1,801,220 |

| | | | | | 7,757,241 |

Semiconductors & Semiconductor Equipment — 5.1%

| | | |

Amkor Technology, Inc. | | | 30,231 | | | 994,600 |

Camtek Ltd./Israel | | | 13,418 | | | 1,221,306 |

CEVA, Inc.(a) | | | 34,271 | | | 820,448 |

Credo Technology Group Holding Ltd.(a) | | | 92,754 | | | 3,238,042 |

indie Semiconductor, Inc. - Class A(a) | | | 127,425 | | | 528,814 |

Lattice Semiconductor Corp.(a) | | | 28,768 | | | 1,362,452 |

MACOM Technology Solutions Holdings, Inc.(a) | | | 34,699 | | | 3,790,172 |

MaxLinear, Inc.(a) | | | 41,600 | | | 631,488 |

MKS Instruments, Inc. | | | 6,937 | | | 827,099 |

Onto Innovation, Inc.(a) | | | 16,603 | | | 3,540,092 |

Power Integrations, Inc. | | | 22,304 | | | 1,496,598 |

Rambus, Inc.(a) | | | 123,314 | | | 5,514,602 |

Semtech Corp.(a) | | | 97,312 | | | 4,264,212 |

Silicon Motion Technology Corp. - ADR | | | 48,566 | | | 3,087,341 |

SiTime Corp.(a) | | | 7,087 | | | 1,025,205 |

SMART Global Holdings, Inc.(a) | | | 149,476 | | | 3,097,143 |

Tower Semiconductor Ltd.(a) | | | 240,899 | | | 10,645,327 |

Veeco Instruments, Inc.(a) | | | 201,915 | | | 7,165,963 |

Wolfspeed, Inc.(a) | | | 107,574 | | | 1,048,846 |

| | | | | | 54,299,750 |

Software — 6.4%

| | | | | | |

8x8, Inc.(a) | | | 3,105,423 | | | 5,838,195 |

Adeia, Inc. | | | 160,774 | | | 2,025,752 |

Alkami Technology, Inc.(a) | | | 33,114 | | | 1,104,021 |

Appfolio, Inc. - Class A(a) | | | 7,504 | | | 1,740,853 |

Aspen Technology, Inc.(a) | | | 5,438 | | | 1,273,253 |

Box, Inc. - Class A(a) | | | 45,048 | | | 1,468,565 |

Clearwater Analytics Holdings, Inc. - Class A(a) | | | 50,521 | | | 1,251,910 |

Cognyte Software Ltd.(a) | | | 263,533 | | | 2,018,663 |

CommVault Systems, Inc.(a) | | | 21,166 | | | 3,289,196 |

Computer Modelling Group Ltd. | | | 29,434 | | | 273,442 |

CyberArk Software Ltd.(a) | | | 10,593 | | | 3,037,437 |

Elastic NV(a) | | | 4,083 | | | 311,084 |

Fair Isaac Corp.(a) | | | 1,354 | | | 2,342,785 |

Manhattan Associates, Inc.(a) | | | 9,002 | | | 2,380,399 |

Monday.com Ltd.(a) | | | 11,684 | | | 3,106,659 |

Nutanix, Inc. - Class A(a) | | | 13,193 | | | 833,666 |

OneSpan, Inc.(a) | | | 78,965 | | | 1,272,916 |

| | | | | | | |

| | | | | | | |

Ooma, Inc.(a) | | | 306,600 | | | $ 3,188,640 |

Qualys, Inc.(a) | | | 11,969 | | | 1,498,160 |

Radware Ltd.(a) | | | 52,578 | | | 1,146,200 |

Silvaco Group, Inc.(a) | | | 163,171 | | | 2,520,992 |

SPS Commerce, Inc.(a) | | | 14,932 | | | 2,982,518 |

Teradata Corp.(a) | | | 155,697 | | | 4,396,883 |

Terawulf, Inc.(a) | | | 200,684 | | | 874,982 |

Tyler Technologies, Inc.(a) | | | 2,323 | | | 1,365,622 |

UiPath, Inc. - Class A(a) | | | 41,370 | | | 532,846 |

Varonis Systems, Inc.(a) | | | 59,335 | | | 3,358,361 |

Verint Systems, Inc.(a) | | | 305,754 | | | 9,646,539 |

Vertex, Inc. - Class A(a) | | | 55,979 | | | 2,165,827 |

Xperi, Inc.(a) | | | 127,238 | | | 1,122,239 |

| | | | | | 68,368,605 |

Specialty Retail — 2.5%

| | | | | | |

Abercrombie & Fitch Co. - Class A(a) | | | 10,162 | | | 1,499,606 |

American Eagle Outfitters, Inc. | | | 39,541 | | | 813,754 |

Asbury Automotive Group,

Inc.(a) | | | 6,961 | | | 1,709,900 |

Boot Barn Holdings, Inc.(a) | | | 6,166 | | | 827,292 |

Caleres, Inc. | | | 41,280 | | | 1,739,126 |

Carvana Co.(a) | | | 19,506 | | | 2,937,994 |

Floor & Decor Holdings, Inc. - Class A(a) | | | 9,432 | | | 1,060,534 |

Lithia Motors, Inc. | | | 5,331 | | | 1,605,057 |

ODP Corp.(a) | | | 42,772 | | | 1,319,516 |

Signet Jewelers Ltd. | | | 17,845 | | | 1,500,765 |

Tractor Supply Co. | | | 3,393 | | | 907,797 |

Valvoline, Inc.(a) | | | 68,233 | | | 2,879,433 |

Warby Parker, Inc. - Class A(a) | | | 122,505 | | | 1,827,775 |

Wayfair, Inc. - Class A(a) | | | 119,585 | | | 5,088,342 |

Winmark Corp. | | | 2,079 | | | 749,687 |

| | | | | | 26,466,578 |

Textiles, Apparel & Luxury

Goods — 1.6%

| | | |

Gildan Activewear, Inc. | | | 346,695 | | | 15,819,693 |

Under Armour, Inc. - Class C(a) | | | 184,066 | | | 1,373,132 |

| | | | | | 17,192,825 |

Trading Companies & Distributors — 3.8%

| | | |

AerCap Holdings NV | | | 62,441 | | | 6,083,002 |

Air Lease Corp. | | | 239,640 | | | 11,088,143 |

Applied Industrial Technologies, Inc. | | | 6,305 | | | 1,293,282 |

Beacon Roofing Supply, Inc.(a) | | | 60,815 | | | 5,509,839 |

FTAI Aviation Ltd. | | | 37,414 | | | 4,781,883 |

GATX Corp. | | | 18,915 | | | 2,668,906 |

McGrath RentCorp | | | 26,775 | | | 2,895,716 |

Richelieu Hardware Ltd. | | | 14,317 | | | 416,625 |

Rush Enterprises, Inc. -

Class A | | | 64,775 | | | 3,413,643 |

SiteOne Landscape Supply,

Inc.(a) | | | 3,957 | | | 561,340 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Select Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Trading Companies & Distributors — (Continued)

|

Transcat, Inc.(a) | | | 5,182 | | | $ 639,770 |

Watsco, Inc. | | | 2,927 | | | 1,391,554 |

| | | | | | 40,743,703 |

Water Utilities — 0.0%(b)

| | | | | | |

American States Water Co. | | | 3,100 | | | 252,402 |

TOTAL COMMON STOCKS

(Cost $887,587,943) | | | | | | 993,828,806 |

REAL ESTATE INVESTMENT TRUSTS — 3.2%

|

AGNC Investment Corp. | | | 344,485 | | | 3,517,192 |

Brixmor Property Group, Inc. | | | 381,060 | | | 10,437,233 |

Equity Commonwealth(a) | | | 500,539 | | | 10,145,926 |

MFA Financial, Inc. | | | 233,310 | | | 2,921,041 |

NNN REIT, Inc. | | | 77,450 | | | 3,639,375 |

STAG Industrial, Inc. | | | 89,460 | | | 3,630,287 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $30,797,295) | | | | | | 34,291,054 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS — 3.2%

| | | |

Money Market Funds — 3.2%

| | | | | | |

First American Government Obligations Fund - Class X, 5.22%(c) | | | 34,096,025 | | | $34,096,025 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $34,096,025) | | | | | | 34,096,025 |

TOTAL INVESTMENTS — 99.9%

(Cost $952,481,263) | | | | | | $1,062,215,885 |

Other Assets in Excess of Liabilities - 0.1% | | | | | | 559,557 |

TOTAL NET

ASSETS — 100.0% | | | | | | $1,062,775,442 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Adviser.

ADR - American Depositary Receipt

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

(a)

| Non-income producing security.

|

(b)

| Represents less than 0.05% of net assets.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

COMMON STOCKS — 94.7%

| | | | | | |

Aerospace & Defense — 1.8%

| | | | | | |

AAR Corp.(a) | | | 8,175 | | | $ 537,751 |

Babcock International Group PLC | | | 109,043 | | | 751,710 |

BWX Technologies, Inc. | | | 7,720 | | | 795,160 |

CAE, Inc.(a) | | | 28,924 | | | 517,462 |

Embraer SA - ADR(a) | | | 7,840 | | | 260,523 |

Hexcel Corp. | | | 9,713 | | | 614,736 |

Leonardo DRS, Inc.(a) | | | 19,608 | | | 559,612 |

Melrose Industries PLC | | | 82,170 | | | 524,759 |

Mercury Systems, Inc.(a) | | | 10,398 | | | 394,084 |

Moog, Inc. - Class A | | | 1,519 | | | 299,851 |

QinetiQ Group PLC | | | 286,900 | | | 1,821,873 |

Senior PLC | | | 317,578 | | | 690,404 |

| | | | | | 7,767,925 |

Air Freight & Logistics — 0.3%

| | | | | | |

Air Transport Services Group, Inc.(a) | | | 6,614 | | | 111,512 |

GXO Logistics, Inc.(a) | | | 15,636 | | | 782,582 |

Hub Group, Inc. - Class A | | | 6,893 | | | 324,867 |

| | | | | | 1,218,961 |

Automobile Components — 1.1%

| | | | | | |

American Axle & Manufacturing Holdings, Inc.(a) | | | 13,181 | | | 84,754 |

Dana, Inc. | | | 15,775 | | | 178,100 |

Fox Factory Holding Corp.(a) | | | 51,169 | | | 2,071,321 |

Gentherm, Inc.(a) | | | 8,784 | | | 443,943 |

Goodyear Tire & Rubber Co.(a) | | | 28,326 | | | 249,835 |

Holley, Inc.(a) | | | 143,835 | | | 464,587 |

LCI Industries | | | 4,296 | | | 506,241 |

Motorcar Parts of America,

Inc.(a) | | | 1,574 | | | 10,436 |

Patrick Industries, Inc. | | | 1,890 | | | 244,226 |

Phinia, Inc. | | | 5,399 | | | 258,936 |

Standard Motor Products, Inc. | | | 1,794 | | | 57,964 |

Stoneridge, Inc.(a) | | | 2,330 | | | 33,412 |

Visteon Corp.(a) | | | 2,226 | | | 225,338 |

| | | | | | 4,829,093 |

Automobiles — 0.3%

| | | | | | |

Harley-Davidson, Inc. | | | 12,570 | | | 470,621 |

Thor Industries, Inc. | | | 2,576 | | | 276,301 |

Winnebago Industries, Inc. | | | 5,730 | | | 341,852 |

| | | | | | 1,088,774 |

Banks — 10.2%

| | | | | | |

1st Source Corp. | | | 773 | | | 47,497 |

ACNB Corp. | | | 668 | | | 28,069 |

Amalgamated Financial Corp. | | | 1,815 | | | 59,877 |

Amerant Bancorp, Inc. | | | 2,129 | | | 46,966 |

Ameris Bancorp | | | 4,820 | | | 297,057 |

Arrow Financial Corp. | | | 1,187 | | | 36,192 |

Associated Banc-Corp. | | | 10,060 | | | 230,173 |

| | | | | | | |

| | | | | | | |

Atlantic Union Bankshares

Corp. | | | 10,948 | | | $ 434,417 |

Axos Financial, Inc.(a) | | | 4,138 | | | 287,301 |

Banc of California, Inc. | | | 36,994 | | | 526,055 |

BancFirst Corp. | | | 25 | | | 2,660 |

Bancorp, Inc.(a) | | | 8,563 | | | 448,701 |

Bank of Hawaii Corp. | | | 4,950 | | | 328,531 |

Bank of Marin Bancorp | | | 923 | | | 19,743 |

Bank of NT Butterfield & Son

Ltd. | | | 3,631 | | | 138,886 |

Bank OZK | | | 8,659 | | | 375,368 |

BankUnited, Inc. | | | 5,040 | | | 193,687 |

Banner Corp. | | | 2,340 | | | 139,394 |

Bar Harbor Bankshares | | | 953 | | | 30,553 |

BayCom Corp. | | | 438 | | | 10,087 |

Berkshire Hills Bancorp, Inc. | | | 2,711 | | | 74,661 |

BOK Financial Corp. | | | 797 | | | 83,645 |

Bridgewater Bancshares, Inc.(a) | | | 765 | | | 11,031 |

Brookline Bancorp, Inc. | | | 5,515 | | | 56,418 |

Business First Bancshares, Inc. | | | 1,960 | | | 47,863 |

Byline Bancorp, Inc. | | | 2,079 | | | 57,692 |

C&F Financial Corp. | | | 123 | | | 7,136 |

Cadence Bank | | | 32,470 | | | 1,048,132 |

Camden National Corp. | | | 10,757 | | | 430,065 |

Capital Bancorp, Inc. | | | 382 | | | 9,772 |

Capital City Bank Group, Inc. | | | 856 | | | 29,549 |

Carter Bankshares, Inc.(a) | | | 1,424 | | | 24,635 |

Cathay General Bancorp | | | 4,726 | | | 207,897 |

Central Pacific Financial Corp. | | | 1,922 | | | 52,874 |

Chemung Financial Corp. | | | 162 | | | 7,562 |

ChoiceOne Financial Services, Inc. | | | 568 | | | 17,693 |

City Holding Co. | | | 20 | | | 2,375 |

CNB Financial Corp./PA | | | 1,526 | | | 37,097 |

Coastal Financial Corp./WA(a) | | | 707 | | | 37,945 |

Colony Bankcorp, Inc. | | | 628 | | | 9,426 |

Columbia Banking System, Inc. | | | 74,272 | | | 1,870,169 |

Comerica, Inc. | | | 26,950 | | | 1,539,114 |

Community Financial System, Inc. | | | 3,975 | | | 243,111 |

Community Trust Bancorp, Inc. | | | 1,100 | | | 55,550 |

Community West Bancshares | | | 426 | | | 8,690 |

ConnectOne Bancorp, Inc. | | | 2,576 | | | 64,400 |

CrossFirst Bankshares, Inc.(a) | | | 2,964 | | | 51,574 |

Cullen/Frost Bankers, Inc. | | | 1,821 | | | 204,371 |

Customers Bancorp, Inc.(a) | | | 2,735 | | | 141,728 |

Dime Community Bancshares, Inc. | | | 2,761 | | | 71,814 |

Eagle Bancorp, Inc. | | | 1,978 | | | 43,061 |

Eastern Bankshares, Inc. | | | 2,458 | | | 41,712 |

Enterprise Financial Services Corp. | | | 7,806 | | | 413,015 |

Esquire Financial Holdings, Inc. | | | 481 | | | 29,596 |

Evans Bancorp, Inc. | | | 201 | | | 7,137 |

FB Financial Corp. | | | 50 | | | 2,411 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Banks — (Continued)

|

Fidelity D&D Bancorp, Inc. | | | 329 | | | $ 17,759 |

Financial Institutions, Inc. | | | 1,179 | | | 30,678 |

First BanCorp/Puerto Rico | | | 50,305 | | | 1,075,521 |

First Bancorp/Southern Pines NC | | | 15,137 | | | 643,020 |

First Bancshares, Inc. | | | 38 | | | 1,302 |

First Bank/Hamilton NJ | | | 1,610 | | | 24,778 |

First Busey Corp. | | | 3,646 | | | 98,624 |

First Business Financial Services, Inc. | | | 559 | | | 25,362 |

First Commonwealth Financial Corp. | | | 73,291 | | | 1,262,071 |

First Financial Bancorp | | | 5,907 | | | 156,358 |

First Financial Bankshares,

Inc. | | | 4,507 | | | 164,821 |

First Financial Corp./IN | | | 764 | | | 34,151 |

First Foundation, Inc. | | | 66 | | | 465 |

First Interstate BancSystem,

Inc. - Class A | | | 45,210 | | | 1,403,770 |

First Merchants Corp. | | | 4,030 | | | 157,170 |

First Mid Bancshares, Inc. | | | 1,408 | | | 56,714 |

First of Long Island Corp. | | | 696 | | | 8,888 |

Flushing Financial Corp. | | | 1,703 | | | 24,864 |

FNB Corp./PA | | | 24,141 | | | 361,632 |

FS Bancorp, Inc. | | | 253 | | | 11,089 |

Fulton Financial Corp. | | | 11,858 | | | 229,452 |

German American Bancorp, Inc. | | | 13,825 | | | 554,521 |

Glacier Bancorp, Inc. | | | 3,898 | | | 184,375 |

Great Southern Bancorp, Inc. | | | 702 | | | 41,811 |

Hancock Whitney Corp. | | | 6,700 | | | 359,991 |

Hanmi Financial Corp. | | | 2,235 | | | 44,275 |

HarborOne Bancorp, Inc. | | | 59 | | | 779 |

HBT Financial, Inc. | | | 457 | | | 10,246 |

Heartland Financial USA, Inc. | | | 2,566 | | | 143,080 |

Heritage Commerce Corp. | | | 4,001 | | | 40,730 |

Heritage Financial Corp./WA | | | 2,301 | | | 52,555 |

HomeStreet, Inc. | | | 24 | | | 384 |

HomeTrust Bancshares, Inc. | | | 999 | | | 36,424 |

Hope Bancorp, Inc. | | | 7,690 | | | 98,355 |

Horizon Bancorp, Inc./IN | | | 2,971 | | | 47,595 |

Huntington Bancshares,

Inc./OH | | | 41,747 | | | 624,953 |

Independent Bank Corp. | | | 2,737 | | | 173,279 |

Independent Bank Corp./MI | | | 1,675 | | | 56,749 |

International Bancshares Corp. | | | 4,105 | | | 259,354 |

Kearny Financial Corp./MD | | | 76 | | | 518 |

Lakeland Financial Corp. | | | 1,478 | | | 100,726 |

Mercantile Bank Corp. | | | 1,209 | | | 55,590 |

Metrocity Bankshares, Inc. | | | 1,332 | | | 40,826 |

Metropolitan Bank Holding Corp.(a) | | | 738 | | | 38,162 |

Mid Penn Bancorp, Inc. | | | 976 | | | 29,485 |

Midland States Bancorp, Inc. | | | 1,681 | | | 38,276 |

| | | | | | | |

| | | | | | | |

MidWestOne Financial Group, Inc. | | | 651 | | | $ 19,022 |

MVB Financial Corp. | | | 672 | | | 14,112 |

National Bank Holdings

Corp. - Class A | | | 10,942 | | | 479,369 |

National Bankshares, Inc. | | | 209 | | | 6,312 |

Northeast Bank | | | 475 | | | 33,730 |

Northfield Bancorp, Inc. | | | 2,447 | | | 29,658 |

Northrim BanCorp, Inc. | | | 428 | | | 29,519 |

Northwest Bancshares, Inc. | | | 7,200 | | | 99,720 |

OceanFirst Financial Corp. | | | 3,769 | | | 67,352 |

OFG Bancorp | | | 3,977 | | | 182,902 |

Old National Bancorp/IN | | | 22,819 | | | 452,957 |

Old Second Bancorp, Inc. | | | 3,088 | | | 52,589 |

Orange County Bancorp, Inc. | | | 178 | | | 10,226 |

Origin Bancorp, Inc. | | | 1,997 | | | 66,840 |

Orrstown Financial Services,

Inc. | | | 1,120 | | | 40,096 |

Pathward Financial, Inc. | | | 1,760 | | | 121,123 |

Peapack-Gladstone Financial Corp. | | | 1,094 | | | 31,245 |

Penns Woods Bancorp, Inc. | | | 73 | | | 1,640 |

Peoples Bancorp, Inc./OH | | | 16,066 | | | 514,112 |

Peoples Financial Services

Corp. | | | 433 | | | 20,615 |

Popular, Inc. | | | 8,531 | | | 874,427 |

Premier Financial Corp. | | | 2,483 | | | 62,224 |

Primis Financial Corp. | | | 1,683 | | | 20,448 |

Prosperity Bancshares, Inc. | | | 22,753 | | | 1,674,166 |

QCR Holdings, Inc. | | | 1,174 | | | 90,551 |

RBB Bancorp | | | 1,252 | | | 28,746 |

Red River Bancshares, Inc. | | | 162 | | | 8,604 |

Republic Bancorp,

Inc./KY - Class A | | | 583 | | | 37,254 |

S&T Bancorp, Inc. | | | 2,499 | | | 107,382 |

Sandy Spring Bancorp, Inc. | | | 14,664 | | | 458,983 |

Seacoast Banking Corp. of Florida | | | 22,243 | | | 608,568 |

ServisFirst Bancshares, Inc. | | | 41,554 | | | 3,368,367 |

Shore Bancshares, Inc. | | | 1,871 | | | 26,568 |

Simmons First National

Corp. - Class A | | | 7,585 | | | 162,471 |

SmartFinancial, Inc. | | | 996 | | | 29,113 |

South Plains Financial, Inc. | | | 846 | | | 29,534 |

Southern First Bancshares, Inc.(a) | | | 504 | | | 16,370 |

Southern Missouri Bancorp, Inc. | | | 616 | | | 35,623 |

Southside Bancshares, Inc. | | | 40 | | | 1,369 |

SouthState Corp. | | | 16,230 | | | 1,575,771 |

Stellar Bancorp, Inc. | | | 63 | | | 1,718 |

Stock Yards Bancorp, Inc. | | | 1,728 | | | 104,717 |

Synovus Financial Corp. | | | 5,217 | | | 240,608 |

Texas Capital Bancshares,

Inc.(a) | | | 10,540 | | | 708,499 |

Timberland Bancorp, Inc./WA | | | 279 | | | 8,713 |

Towne Bank/Portsmouth VA | | | 4,381 | | | 151,802 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Banks — (Continued)

|

TriCo Bancshares | | | 16,462 | | | $ 748,363 |

Triumph Financial, Inc.(a) | | | 37,700 | | | 3,166,046 |

TrustCo Bank Corp. NY | | | 1,255 | | | 43,724 |

Trustmark Corp. | | | 3,873 | | | 129,010 |

UMB Financial Corp. | | | 2,859 | | | 296,164 |

United Bankshares, Inc./WV | | | 26,625 | | | 1,034,914 |

United Community Banks, Inc./GA | | | 4,919 | | | 149,882 |

Unity Bancorp, Inc. | | | 290 | | | 9,840 |

Univest Financial Corp. | | | 1,879 | | | 53,476 |

Valley National Bancorp | | | 31,309 | | | 271,762 |

Veritex Holdings, Inc. | | | 3,654 | | | 92,044 |

WaFd, Inc. | | | 5,736 | | | 210,339 |

Washington Trust Bancorp, Inc. | | | 1,171 | | | 38,409 |

Webster Financial Corp. | | | 6,257 | | | 296,769 |

West BanCorp, Inc. | | | 973 | | | 19,411 |

Westamerica BanCorp | | | 1,868 | | | 96,744 |

Western Alliance Bancorp | | | 21,175 | | | 1,729,574 |

Wintrust Financial Corp. | | | 428 | | | 46,566 |

WSFS Financial Corp. | | | 27,987 | | | 1,532,008 |

Zions Bancorp NA | | | 29,510 | | | 1,462,516 |

| | | | | | 43,676,959 |

Beverages — 0.3%

| | | | | | |

Coca-Cola Consolidated, Inc. | | | 800 | | | 1,073,920 |

MGP Ingredients, Inc. | | | 3,385 | | | 303,262 |

| | | | | | 1,377,182 |

Biotechnology — 2.1%

| | | | | | |

ADMA Biologics, Inc.(a) | | | 40,082 | | | 693,819 |

Alkermes PLC(a) | | | 24,771 | | | 704,735 |

Arcutis Biotherapeutics, Inc.(a) | | | 20,094 | | | 218,623 |

Biohaven Ltd.(a) | | | 7,176 | | | 282,734 |

Blueprint Medicines Corp.(a) | | | 4,893 | | | 467,477 |

Bridgebio Pharma, Inc.(a) | | | 12,617 | | | 351,384 |

Celldex Therapeutics, Inc.(a) | | | 5,848 | | | 241,698 |

Centessa Pharmaceuticals

PLC - ADR(a) | | | 16,055 | | | 216,743 |

Crinetics Pharmaceuticals,

Inc.(a) | | | 5,404 | | | 286,736 |

Cytokinetics, Inc.(a) | | | 4,506 | | | 257,203 |

Emergent BioSolutions, Inc.(a) | | | 6,562 | | | 54,530 |

Entrada Therapeutics, Inc.(a) | | | 719 | | | 12,726 |

Halozyme Therapeutics, Inc.(a) | | | 18,850 | | | 1,203,573 |

Insmed, Inc.(a) | | | 9,918 | | | 758,430 |

Keros Therapeutics, Inc.(a) | | | 4,061 | | | 184,166 |

Madrigal Pharmaceuticals,

Inc.(a) | | | 1,546 | | | 382,063 |

Mineralys Therapeutics, Inc.(a) | | | 12,845 | | | 159,406 |

Natera, Inc.(a) | | | 7,579 | | | 896,293 |

Puma Biotechnology, Inc.(a) | | | 4,822 | | | 12,055 |

REVOLUTION Medicines,

Inc.(a) | | | 7,761 | | | 330,851 |

Twist Bioscience Corp.(a) | | | 4,998 | | | 216,114 |

| | | | | | | |

| | | | | | | |

Vaxcyte, Inc.(a) | | | 7,077 | | | $ 571,539 |

Vera Therapeutics, Inc.(a) | | | 5,381 | | | 203,509 |

Viking Therapeutics, Inc.(a) | | | 3,752 | | | 240,578 |

Voyager Therapeutics, Inc.(a) | | | 334 | | | 2,191 |

XBiotech, Inc.(a) | | | 876 | | | 5,606 |

| | | | | | 8,954,782 |

Broadline Retail — 0.9%

| | | | | | |

Dillard’s, Inc. - Class A | | | 6 | | | 2,034 |

Kohl’s Corp. | | | 14,506 | | | 281,271 |

Macy’s, Inc. | | | 31,054 | | | 483,511 |

Nordstrom, Inc. | | | 10,770 | | | 240,602 |

Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 28,771 | | | 2,576,730 |

Savers Value Village, Inc.(a) | | | 33,020 | | | 292,227 |

| | | | | | 3,876,375 |

Building Products — 3.3%

| | | | | | |

AAON, Inc. | | | 63,833 | | | 6,096,690 |

Apogee Enterprises, Inc. | | | 2,374 | | | 158,536 |

Armstrong World Industries, Inc. | | | 722 | | | 91,521 |

AZEK Co., Inc.(a) | | | 21,403 | | | 912,410 |

CSW Industrials, Inc. | | | 1,228 | | | 414,610 |

Fortune Brands Innovations,

Inc. | | | 9,680 | | | 768,689 |

Hayward Holdings, Inc.(a) | | | 64,069 | | | 950,784 |

Insteel Industries, Inc. | | | 7,490 | | | 257,656 |

Janus International Group,

Inc.(a) | | | 118,353 | | | 1,300,699 |

JELD-WEN Holding, Inc.(a) | | | 73,809 | | | 1,051,040 |

Quanex Building Products

Corp. | | | 3,539 | | | 97,783 |

Resideo Technologies, Inc.(a) | | | 41,772 | | | 842,123 |

Simpson Manufacturing Co.,

Inc. | | | 604 | | | 110,568 |

UFP Industries, Inc. | | | 7,468 | | | 908,631 |

| | | | | | 13,961,740 |

Capital Markets — 2.8%

| | | | | | |

Artisan Partners Asset Management, Inc. - Class A | | | 24,140 | | | 1,003,983 |

BGC Group, Inc. - Class A | | | 102,721 | | | 1,014,883 |

Donnelley Financial Solutions, Inc.(a) | | | 11,784 | | | 785,521 |

Evercore, Inc. - Class A | | | 2,080 | | | 511,139 |

FactSet Research Systems, Inc. | | | 3,905 | | | 1,651,190 |

Hamilton Lane, Inc. - Class A | | | 6,008 | | | 918,263 |

Houlihan Lokey, Inc. | | | 1,254 | | | 196,401 |

Morningstar, Inc. | | | 15,117 | | | 4,743,261 |

Oppenheimer Holdings,

Inc. - Class A | | | 365 | | | 19,236 |

Patria Investments Ltd. -

Class A | | | 51 | | | 588 |

StoneX Group, Inc.(a) | | | 2,060 | | | 170,692 |

Victory Capital Holdings,

Inc. - Class A | | | 15,832 | | | 863,952 |

| | | | | | 11,879,109 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Chemicals — 2.5%

| | | | | | |

AdvanSix, Inc. | | | 1,860 | | | $ 54,982 |

Ashland, Inc. | | | 7,231 | | | 647,174 |

Aspen Aerogels, Inc.(a) | | | 15,540 | | | 445,843 |

Avient Corp. | | | 18,579 | | | 912,786 |

Axalta Coating Systems Ltd.(a) | | | 29,365 | | | 1,071,822 |

Cabot Corp. | | | 6,382 | | | 670,812 |

Chemours Co. | | | 59,229 | | | 1,151,412 |

Core Molding Technologies, Inc.(a) | | | 402 | | | 7,176 |

Element Solutions, Inc. | | | 98,821 | | | 2,642,474 |

Elementis PLC | | | 436,669 | | | 930,074 |

Hawkins, Inc. | | | 2,353 | | | 298,055 |

Huntsman Corp. | | | 18,100 | | | 399,105 |

Intrepid Potash, Inc.(a) | | | 1,040 | | | 25,667 |

LSB Industries, Inc.(a) | | | 5,554 | | | 44,043 |

Mativ Holdings, Inc. | | | 5,663 | | | 107,370 |

NewMarket Corp. | | | 10 | | | 5,738 |

Olin Corp. | | | 1,360 | | | 59,391 |

Orion SA | | | 6,551 | | | 122,176 |

Rayonier Advanced Materials, Inc.(a) | | | 5,378 | | | 42,916 |

Stepan Co. | | | 1,910 | | | 148,273 |

Tronox Holdings PLC | | | 69,735 | | | 971,409 |

| | | | | | 10,758,698 |

Commercial Services & Supplies — 1.7%

| | | | | | |

ABM Industries, Inc. | | | 7,781 | | | 444,684 |

ACCO Brands Corp. | | | 1,732 | | | 9,491 |

Acme United Corp. | | | 469 | | | 20,678 |

Aris Water Solutions,

Inc. - Class A | | | 2,093 | | | 35,204 |

BrightView Holdings, Inc.(a) | | | 27,017 | | | 431,462 |

Casella Waste Systems,

Inc. - Class A(a) | | | 8,845 | | | 954,022 |

Civeo Corp. | | | 1,273 | | | 36,217 |

Clean Harbors, Inc.(a) | | | 4,738 | | | 1,165,074 |

Driven Brands Holdings, Inc.(a) | | | 9,738 | | | 139,643 |

Ennis, Inc. | | | 2,615 | | | 62,525 |

Enviri Corp.(a) | | | 44,254 | | | 528,835 |

HNI Corp. | | | 16,971 | | | 913,888 |

Interface, Inc. | | | 7,638 | | | 144,205 |

OPENLANE, Inc.(a) | | | 29,034 | | | 503,159 |

Rollins, Inc. | | | 3,636 | | | 182,455 |

Steelcase, Inc. - Class A | | | 12,892 | | | 182,293 |

Stericycle, Inc.(a) | | | 7,636 | | | 452,509 |

Tetra Tech, Inc. | | | 1,817 | | | 431,974 |

UniFirst Corp./MA | | | 2,371 | | | 449,755 |

Virco Mfg. Corp. | | | 1,822 | | | 28,296 |

| | | | | | 7,116,369 |

Communications Equipment — 0.9%

| | | | | | |

Ciena Corp.(a) | | | 19,996 | | | 1,152,769 |

Extreme Networks, Inc.(a) | | | 25,121 | | | 395,656 |

Harmonic, Inc.(a) | | | 41,201 | | | 595,354 |

| | | | | | | |

| | | | | | | |

Lumentum Holdings, Inc.(a) | | | 5,906 | | | $ 340,245 |

NETGEAR, Inc.(a) | | | 2,917 | | | 47,343 |

Ribbon Communications, Inc.(a) | | | 129,407 | | | 441,278 |

Viasat, Inc.(a) | | | 43,882 | | | 688,947 |

Viavi Solutions, Inc.(a) | | | 28,929 | | | 249,079 |

| | | | | | 3,910,671 |

Construction & Engineering — 2.3%

| | | | | | |

Ameresco, Inc. - Class A(a) | | | 4,088 | | | 124,479 |

Arcosa, Inc. | | | 21,687 | | | 1,984,144 |

Argan, Inc. | | | 1,629 | | | 129,196 |

Construction Partners,

Inc. - Class A(a) | | | 9,112 | | | 601,210 |

Fluor Corp.(a) | | | 12,384 | | | 620,067 |

Great Lakes Dredge & Dock Corp.(a) | | | 5,774 | | | 57,451 |

IES Holdings, Inc.(a) | | | 841 | | | 156,872 |

Limbach Holdings, Inc.(a) | | | 1,236 | | | 79,883 |

MasTec, Inc.(a) | | | 5,155 | | | 583,185 |

MDU Resources Group, Inc. | | | 21,081 | | | 541,571 |

MYR Group, Inc.(a) | | | 2,499 | | | 251,899 |

Orion Group Holdings, Inc.(a) | | | 4,051 | | | 30,625 |

Primoris Services Corp. | | | 20,176 | | | 1,138,733 |

Tutor Perini Corp.(a) | | | 3,612 | | | 86,580 |

Valmont Industries, Inc. | | | 7,289 | | | 2,082,905 |

WillScot Holdings Corp.(a) | | | 32,265 | | | 1,243,493 |

| | | | | | 9,712,293 |

Construction Materials — 0.4%

| | | | | | |

Eagle Materials, Inc. | | | 1,590 | | | 409,822 |

Summit Materials,

Inc. - Class A(a) | | | 27,437 | | | 1,111,199 |

| | | | | | 1,521,021 |

Consumer Finance — 0.8%

| | | | | | |

Bread Financial Holdings, Inc. | | | 16,764 | | | 975,162 |

EZCORP, Inc. - Class A(a) | | | 3,639 | | | 44,469 |

FirstCash Holdings, Inc. | | | 16,520 | | | 1,983,887 |

LendingClub Corp.(a) | | | 5,572 | | | 67,700 |

Navient Corp. | | | 5,925 | | | 100,310 |

OneMain Holdings, Inc. | | | 177 | | | 8,746 |

PROG Holdings, Inc. | | | 1,866 | | | 87,254 |

SLM Corp. | | | 16,342 | | | 360,504 |

World Acceptance Corp.(a) | | | 210 | | | 24,748 |

| | | | | | 3,652,780 |

Consumer Staples Distribution & Retail — 0.7%

| | | | | | |

Andersons, Inc. | | | 4,169 | | | 212,494 |

Grocery Outlet Holding Corp.(a) | | | 41,910 | | | 793,775 |

Ingles Markets, Inc. - Class A | | | 1,638 | | | 121,212 |

Natural Grocers by Vitamin Cottage, Inc. | | | 1,745 | | | 46,452 |

PriceSmart, Inc. | | | 17,677 | | | 1,583,506 |

SpartanNash Co. | | | 3,974 | | | 87,786 |

Sprouts Farmers Market, Inc.(a) | | | 246 | | | 25,596 |

United Natural Foods, Inc.(a) | | | 5,344 | | | 80,855 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Column Small Cap Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

Consumer Staples Distribution & Retail — (Continued)

|

Village Super Market,

Inc. - Class A | | | 945 | | | $ 30,382 |

Weis Markets, Inc. | | | 1,459 | | | 98,599 |

| | | | | | 3,080,657 |

Containers & Packaging — 0.5%

| | | | | | |

AptarGroup, Inc. | | | 3,394 | | | 519,927 |

Avery Dennison Corp. | | | 4,629 | | | 1,026,944 |

Graphic Packaging Holding Co. | | | 20,711 | | | 619,880 |

| | | | | | 2,166,751 |

Distributors — 0.1%

| | | | | | |

Pool Corp. | | | 819 | | | 287,977 |

Diversified Consumer Services — 1.0%

| | | | | | |

ADT, Inc. | | | 94,121 | | | 686,142 |

American Public Education, Inc.(a) | | | 2,009 | | | 33,590 |

Bright Horizons Family Solutions, Inc.(a) | | | 1,456 | | | 204,888 |

Duolingo, Inc.(a) | | | 1,633 | | | 347,127 |

Frontdoor, Inc.(a) | | | 2,625 | | | 126,210 |

Perdoceo Education Corp. | | | 6,934 | | | 155,599 |

Stride, Inc.(a) | | | 32,431 | | | 2,670,369 |

Universal Technical Institute, Inc.(a) | | | 4,315 | | | 75,297 |

| | | | | | 4,299,222 |

Diversified Telecommunication Services — 0.0%(b)

| | | | | | |

ATN International, Inc. | | | 1,084 | | | 29,008 |

Frontier Communications Parent, Inc.(a) | | | 340 | | | 9,792 |

| | | | | | 38,800 |

Electric Utilities — 1.0%

| | | | | | |

ALLETE, Inc. | | | 18,228 | | | 1,158,389 |

IDACORP, Inc. | | | 7,779 | | | 792,758 |

Portland General Electric Co. | | | 50,423 | | | 2,425,851 |

| | | | | | 4,376,998 |

Electrical Equipment — 0.6%