UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513)-520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2024

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

(a)

| | |

| CrossingBridge Low Duration High Income Fund | |

| Institutional Class | CBLDX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the CrossingBridge Low Duration High Income Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/low-duration-high-income-fund. You can also request this information by contacting us at 1-888-898-2780. This report describes changes to the Fund.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $90 | 0.86% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During the fiscal year, the Fund gained 8.51% on its Institutional Class shares while the ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index gained 11.82%, the ICE BofA 1-3 Year U.S. Corporate Bond Index gained 8.37% and the ICE BofA 0-3 Year U.S. Treasury Index gained 6.40%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad based securities market index, gained 11.57% over the same period.

Monthly investment results for the fiscal year ranged from 0.13% in June 2024 to 1.17% in December 2023. The Fund generated positive returns all twelve months during the fiscal year. The median monthly return for the period was 0.73% with an annualized standard deviation of 2.79%.

The Fund had positive contributions from interest income and had realized and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 7.30%. The Fund’s subsidized 30-day SEC yield was 7.77% and unsubsidized 30-day SEC yield was 7.77%. The total return for the fiscal year was positive. The Fund’s NAV increased from $9.66 on September 30, 2023 to $9.75 on September 30, 2024, this was offset by the Fund distributing $0.71 in income during the fiscal year.

As we have made reference to in all four CrossingBridge quarterly commentaries we published this past fiscal year (available on our website), credit spreads, both investment grade and high yield, have continued grinding tighter, recently hitting their tightest levels in 15 years. Even in the face of tight credit spreads and a highly uncertain interest rate market, we remain opportunistic and continue to pursue four main themes:

1) Floating rate debt – continuing to take advantage of the inverted yield curve

2) Foreign issuers – better credit characteristics with higher yields than U.S. counterparts

3) Event-driven debt – catalysts hold potential for higher rates of return

4) Higher credit quality issuers – leaning into investment grade opportunities

With this backdrop, throughout the fiscal year we had remained (and continue to remain) more defensively positioned, aiming to maintain attractive yields while leaning more toward investment grade debt. At the same time, we have maintained low durations and continue holding significant “dry powder” (cash/cash equivalents/pre-merger SPACs/maturities of 90 days or less) to 1) help protect capital while generating what we believe to be relatively attractive yields with the inverted yield curve, and 2) take advantage of opportunities as they arise.

As of September 30, 2024, the Fund’s net assets were weighted by category as follows: 31.6% in Short Term Securities, 4.6% in Event Driven, 16.9% in Interest Rate Sensitive, 34.9% in Core Value, 4.8% in Credit Opportunities, with the remaining 7.2% in cash and cash equivalents.

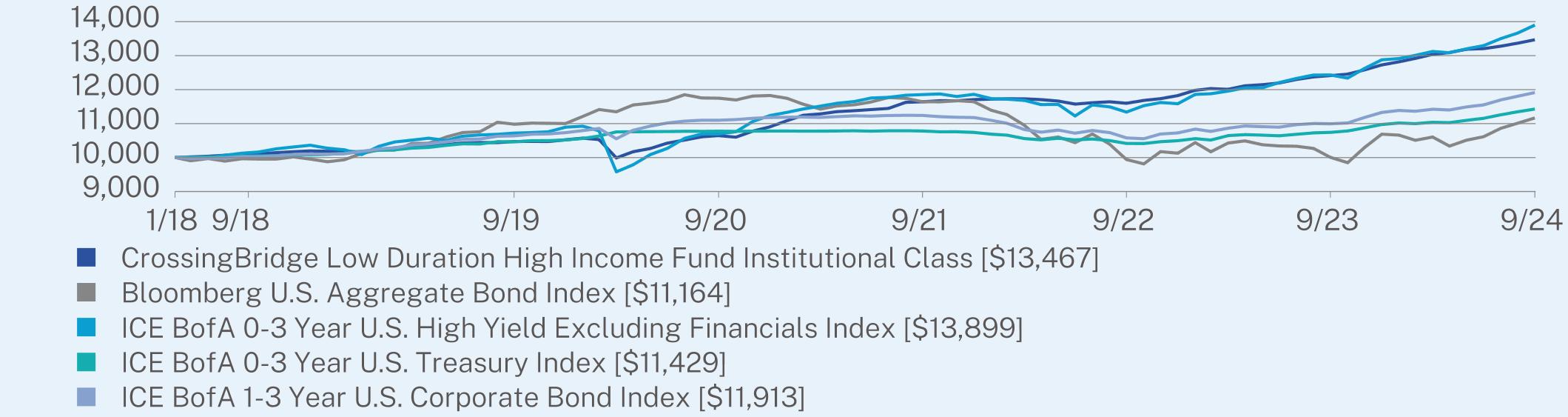

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shared noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

| CrossingBridge Low Duration High Income Fund | PAGE 1 | TSR-AR-89834G604 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(01/31/2018) |

Institutional Class | 8.51 | 5.16 | 4.57 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.67 |

ICE BofA 0-3 Year U.S. High Yield Excluding Financials Index | 11.82 | 5.34 | 5.06 |

ICE BofA 0-3 Year U.S. Treasury Index | 6.40 | 1.78 | 2.02 |

ICE BofA 1-3 Year U.S. Corporate Bond Index | 8.37 | 2.29 | 2.66 |

Visit https://www.crossingbridgefunds.com/low-duration-high-income-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $1,036,014,423 |

Number of Holdings | 135 |

Net Advisory Fee | $5,145,427 |

Portfolio Turnover | 124.47% |

Visit https://www.crossingbridgefunds.com/low-duration-high-income-fund for recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

First American Treasury Obligations Fund | 4.5% |

Connect Finco SARL | 3.4% |

BX Trust | 3.4% |

AbbVie, Inc. | 2.7% |

Ford Motor Credit Co. LLC | 2.6% |

Jabil, Inc. | 2.2% |

Infrabuild Australia Pty Ltd. | 2.2% |

Forum Energy Technologies, Inc. | 2.2% |

Sizzling Platter LLC | 2.2% |

TPC Group, Inc. | 2.0% |

| |

Security Type | |

Corporate Bonds | 57.0% |

Bank Loans | 10.0% |

Commercial Paper | 9.4% |

Mortgage-Backed Securities | 4.9% |

Asset-Backed Securities | 4.6% |

Money Market Funds | 4.5% |

Convertible Bonds | 3.7% |

Preferred Stocks | 1.0% |

Special Purpose Acquisition Companies (SPACs) | 0.4% |

Other | 4.5% |

How has the Fund changed?

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus.

| CrossingBridge Low Duration High Income Fund | PAGE 2 | TSR-AR-89834G604 |

Effective October 18, 2024, the Fund changed its name from the CrossingBridge Low Duration High Yield Fund to the CrossingBridge Low Duration High Income Fund. In connection with the name change, the Fund incorporated into its principal investment strategies a revised investment policy of investing at least 80% of its net assets (plus any borrowings for investment purposes) in portfolio of income producing fixed income securities. The Fund made additional changes to its principal investment strategies with respect to the types of fixed income instruments the Fund may invest in under its 80% policy and the target duration of the Fund’s fixed income portfolio.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/low-duration-high-income-fund.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| CrossingBridge Low Duration High Income Fund | PAGE 3 | TSR-AR-89834G604 |

10195104711064511642115971241113467995510980117471164299421000611164103631071810693118531133812430138991007710464107751078110415107421142910098106391109711239105781099311913

| | |

| CrossingBridge Responsible Credit Fund | |

| Institutional Class | CBRDX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the CrossingBridge Responsible Credit Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/responsible-credit-fund. You can also request this information by contacting us at 1-888-898-2780.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $93 | 0.90% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this fiscal year, the Fund gained 7.74% on its Institutional Class shares while the ICE BofA U.S. High Yield Total Return Index gained 15.66%, the ICE BofA U.S. Corporate Bond Index gained 14.13% and the ICE BofA 3-7 Year U.S. Treasury Index gained 9.07%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad based securities market index, gained 11.57% over the same period.

Monthly investment results for the fiscal year ranged from -0.50% in June 2024 to 1.70% in December 2023. The Fund generated positive returns for eleven out of the twelve months during the fiscal year. The median monthly return for the fiscal year was 0.62% with an annualized standard deviation of 2.69%.

The Fund had positive contributions from interest income and had realized capital gains and unrealized losses during the period. 100% of the income was distributed for a 1-year dividend yield of 7.89%. The Fund’s subsidized 30-day SEC yield was 8.14% and unsubsidized 30-day SEC yield was 7.48%. The total return for the period was positive. Although the Fund’s NAV decreased from $9.36 on September 30, 2023 to $9.33 on September 30, 2024, that decrease was more than offset as the Fund distributed $0.74 in income during the fiscal year.

As we have made reference to in all four CrossingBridge quarterly commentaries we published this past fiscal year (available on our website), credit spreads, both investment grade and high yield, have continued grinding tighter, recently hitting their tightest levels in 15 years. Even in the face of tight credit spreads and a highly uncertain interest rate market, we remain opportunistic and continue to pursue four main themes:

1) Floating rate debt – continuing to take advantage of the inverted yield curve

2) Foreign issuers – better credit characteristics with higher yields than U.S. counterparts

3) Event-driven debt – catalysts hold potential for higher rates of return

4) Higher credit quality issuers – leaning into investment grade opportunities

With this backdrop, throughout the fiscal year we had remained (and continue to remain) more defensively positioned, aiming to maintain attractive yields while leaning more toward investment grade debt. At the same time, we have maintained low durations and continue holding significant “dry powder” (cash/cash equivalents/pre-merger SPACs/maturities of 90 days or less) to 1) help protect capital while generating what we believe to be relatively attractive yields with the inverted yield curve, and 2) take advantage of opportunities as they arise.

As of September 30, 2024, the Fund’s net assets were weighted by category as follows: 16.96% in Short Term Securities, 7.18% in Event Driven, 25.84% in Interest Rate Sensitive, 38.17% in Core Value, 4.62% in Credit Opportunities, with the remaining 7.23% in cash and cash equivalents.

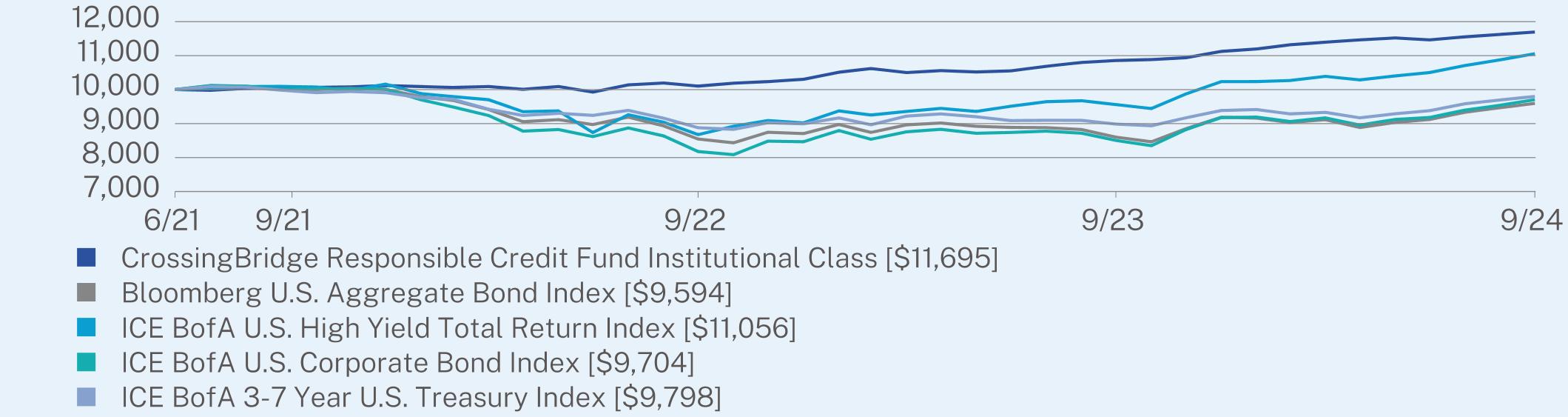

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shared noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

| CrossingBridge Responsible Credit Fund | PAGE 1 | TSR-AR-89834G810 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(06/30/2021) |

Institutional Class | 7.74 | 4.93 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | -1.27 |

ICE BofA U.S. High Yield Total Return Index | 15.66 | 3.14 |

ICE BofA U.S. Corporate Bond Index | 14.13 | -0.92 |

ICE BofA 3-7 Year U.S. Treasury Index | 9.07 | -0.62 |

Visit https://www.crossingbridgefunds.com/responsible-credit-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $40,698,309 |

Number of Holdings | 67 |

Net Advisory Fee | $18,314 |

Portfolio Turnover | 151.44% |

Visit https://www.crossingbridgefunds.com/responsible-credit-fund for recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

Forum Energy Technologies, Inc. | 4.5% |

First American Treasury Obligations Fund | 4.3% |

Uber Technologies, Inc. | 3.7% |

Ford Motor Credit Co. LLC | 2.9% |

Chobani LLC | 2.9% |

Connect Finco SARL | 2.9% |

Novedo Holding AB | 2.8% |

General Motors Financial Co., Inc. | 2.7% |

Expedia Group, Inc. | 2.6% |

Icahn Enterprises LP | 2.6% |

| |

Security Type | |

Corporate Bonds | 51.7% |

Bank Loans | 23.3% |

Commercial Paper | 10.3% |

Money Market Funds | 5.9% |

Convertible Bonds | 2.3% |

Asset-Backed Securities | 2.1% |

Preferred Stocks | 1.1% |

Common Stocks | 0.5% |

Real Estate Investment Trusts | 0.4% |

Other | 2.4% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/responsible-credit-fund.

| CrossingBridge Responsible Credit Fund | PAGE 2 | TSR-AR-89834G810 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| CrossingBridge Responsible Credit Fund | PAGE 3 | TSR-AR-89834G810 |

100571010210855116951000585448600959410094867595591105699948176850397049984887789839798

| | |

| CrossingBridge Ultra-Short Duration Fund | |

| Institutional Class | CBUDX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the CrossingBridge Ultra-Short Duration Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/ultra-short-duration-fund. You can also request this information by contacting us at 1-888-898-2780.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $93 | 0.90% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this fiscal year, the Fund gained 6.23% on its Institutional Class shares while the ICE BofA 0-1 Year U.S. Corporate Bond Index gained 6.33%, the ICE BofA 0-1 Year U.S. Treasury Index gained 5.65% and the ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index gained 7.35%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad based securities market index, gained 11/57% over the same period.

Monthly investment results for the fiscal year ranged from 0.27% in June 2024 to 0.81% in November 2023. The Fund generated positive returns for all twelve months during the fiscal year. The median monthly return for the fiscal year was 0.51% with an annualized standard deviation of 0.84%.

The Fund had positive contributions from interest income and had realized gains and unrealized losses during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 5.74%. The Fund’s subsidized 30-day SEC yield was 5.80% and unsubsidized 30-day SEC yield was 5.76%. The total return for the fiscal year was positive. The Fund’s NAV increased from $9.91 on September 30, 2023 to $9.94 on September 30, 2024. The Fund distributed $0.57 of income during the fiscal year.

As we have made reference to in all four CrossingBridge quarterly commentaries we published this past fiscal year (available on our website), credit spreads, both investment grade and high yield, have continued grinding tighter, recently hitting their tightest levels in 15 years. Even in the face of tight credit spreads and a highly uncertain interest rate market, we remain opportunistic and continue to pursue four main themes:

1) Floating rate debt – continuing to take advantage of the inverted yield curve

2) Foreign issuers – better credit characteristics with higher yields than U.S. counterparts

3) Event-driven debt – catalysts hold potential for higher rates of return

4) Higher credit quality issuers – leaning into investment grade opportunities

With this backdrop, throughout the fiscal year we had remained (and continue to remain) more defensively positioned, aiming to maintain attractive yields while leaning more toward investment grade debt. At the same time, we have maintained low durations and continue holding significant “dry powder” (cash/cash equivalents/pre-merger SPACs/maturities of 90 days or less) to 1) help protect capital while generating what we believe to be relatively attractive yields with the inverted yield curve, and 2) take advantage of opportunities as they arise.

As of September 30, 2024, the Fund’s net assets were weighted by category as follows: 47.8% in Short Term Securities, 6.8% in Event Driven, 12.9% in Interest Rate Sensitive, 26.0% in Core Value, 1.9% in Credit Opportunities, with the remaining 4.6% in cash and cash equivalents.

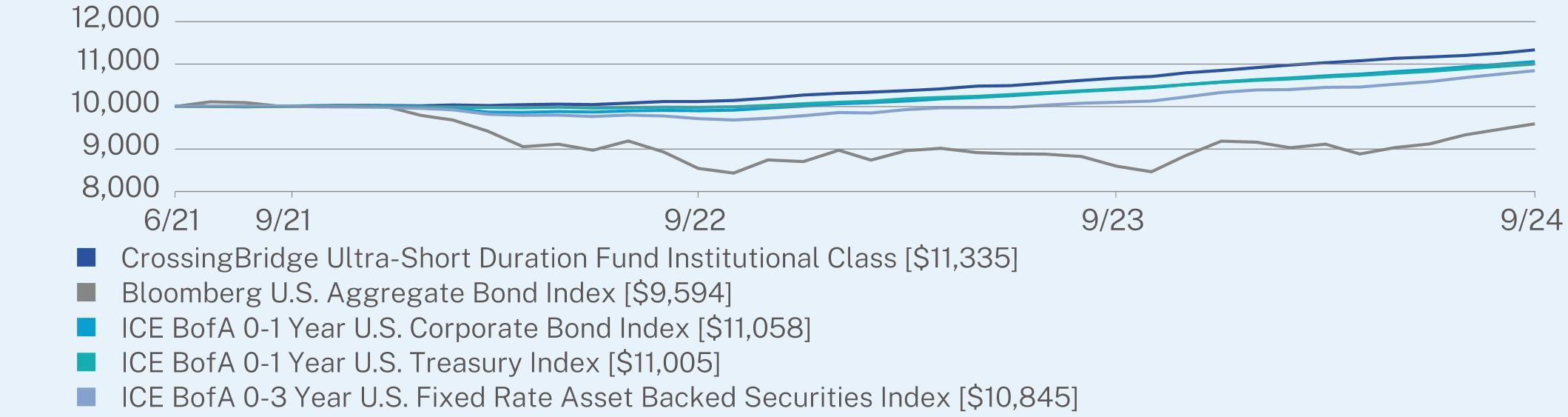

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shared noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

| CrossingBridge Ultra-Short Duration Fund | PAGE 1 | TSR-AR-89834G828 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(06/30/2021) |

Institutional Class | 6.23 | 3.93 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | -1.27 |

ICE BofA 0-1 Year U.S. Corporate Bond Index | 6.33 | 3.14 |

ICE BofA 0-1 Year U.S. Treasury Index | 5.65 | 2.99 |

ICE BofA 0-3 Year U.S. Fixed Rate Asset Backed Securities Index | 7.35 | 2.53 |

Visit https://www.crossingbridgefunds.com/ultra-short-duration-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $169,216,727 |

Number of Holdings | 82 |

Net Advisory Fee | $646,681 |

Portfolio Turnover | 154.21% |

Visit https://www.crossingbridgefunds.com/ultra-short-duration-fund for recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

BX Trust | 5.8% |

Carlisle Cos., Inc. | 2.9% |

Hewlett Packard Enterprise Co. | 2.7% |

Clear Channel International | 2.6% |

Qorvo, Inc. | 2.6% |

Uber Technologies, Inc. | 2.5% |

Zimmer Biomet Holdings, Inc. | 2.5% |

Sonoco Products Co. | 2.5% |

Connect Finco SARL | 2.5% |

First American Treasury Obligations Fund | 2.5% |

| |

Security Type | |

Corporate Bonds | 65.9% |

Mortgage-Backed Securities | 8.7% |

Bank Loans | 5.3% |

Commercial Paper | 4.8% |

Asset-Backed Securities | 4.6% |

Municipal Bonds | 2.5% |

Money Market Funds | 2.5% |

Convertible Bonds | 2.2% |

Warrants | 0.0% |

Other | 3.5% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/ultra-short-duration-fund.

| CrossingBridge Ultra-Short Duration Fund | PAGE 2 | TSR-AR-89834G828 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| CrossingBridge Ultra-Short Duration Fund | PAGE 3 | TSR-AR-89834G828 |

1000710119106701133510005854486009594100099902104001105810003998210417110051001297161010210845

| | |

| CrossingBridge Pre-Merger SPAC ETF | |

SPC (Principal U.S. Listing Exchange: NASDAQ Stock Market, LLCNASDAQ) |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the CrossingBridge Pre-Merger SPAC ETF (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/spac-etf. You can also request this information by contacting us at 1-888-898-2780.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| CrossingBridge Pre-Merger SPAC ETF | $89 | 0.87% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this fiscal year, the Fund had a NAV return of 4.54% and a market return of 4.40%. The Fund’s market return of 4.40% underperformed the ICE BofA 0-3 Year U.S. Treasury Index’s gain of 6.40% for the fiscal year, however, the Fund has outperformed the Index by 2.69% per year (annualized) since inception. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad-based securities market index, gained 11/57% during the fiscal year. The Fund had realized and unrealized gains during the fiscal year. The total return for the period was positive. Although the share price decreased from $20.72 on September 30, 2023 to $21.54 on September 30, 2024 and the NAV decreased from $21.69 to $21.54 for the fiscal year, this was more than offset by the distribution of $0.79 of income during the fiscal year.

Special Purpose Acquisition Companies (SPACs) behave like floating rate fixed income securities due to their IPO proceeds being placed in a trust account typically invested in ultra-short term U.S. government securities for the benefit of SPAC shareholders. As both short-term & longer-term U.S. Treasury rates fell over the fiscal year, pre-merger SPACs lagged both the short-term ICE BofA 0-3 Year U.S. Treasury Index, which is comprised of fixed rate Treasury securities with a slightly longer duration than the Fund, and the Bloomberg U.S. Aggregate Bond Index, which would be expected as the Bloomberg U.S. Aggregate Bond Index would benefit from having a significantly longer duration than the Fund. In addition, in this part of the cycle comprised of tight spreads and falling short-term Treasury rates, new deals have been being priced with less attractive terms then we have seen over the past few years.

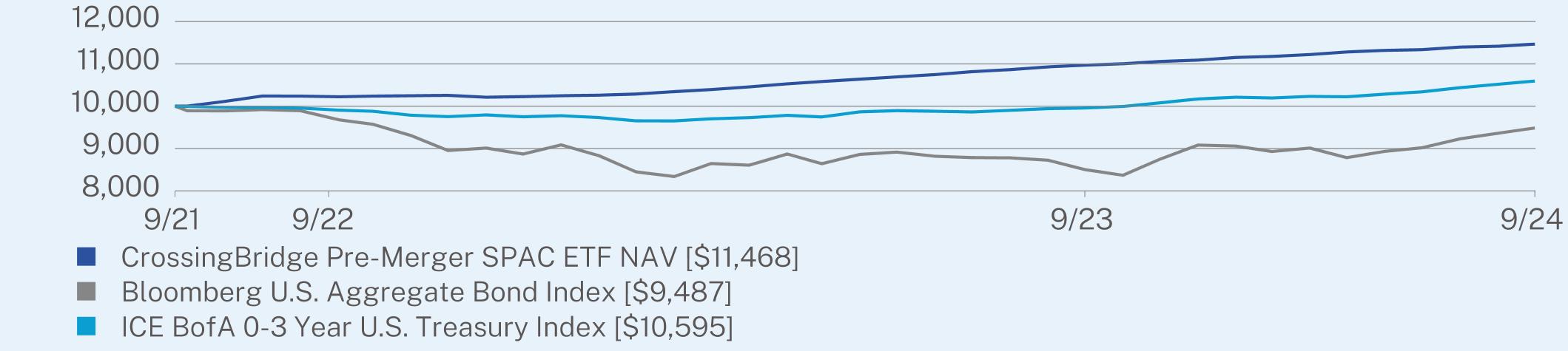

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including the management fee and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| CrossingBridge Pre-Merger SPAC ETF | PAGE 1 | TSR-AR-89834G778 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(09/20/2021) |

CrossingBridge Pre-Merger SPAC ETF NAV | 4.54 | 4.63 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | -1.72 |

ICE BofA 0-3 Year U.S. Treasury Index | 6.40 | 1.93 |

Visit https://www.crossingbridgefunds.com/spac-etf for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $68,932,710 |

Number of Holdings | 51 |

Net Advisory Fee | $559,345 |

Portfolio Turnover | 92.91% |

Visit https://www.crossingbridgefunds.com/spac-etf for recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

Cartesian Growth Corp. II | 5.2% |

ESH Acquisition Corp. | 5.1% |

Iron Horse Acquisitions Corp. | 4.8% |

Bowen Acquisition Corp. | 4.7% |

IB Acquisition Corp. | 4.6% |

AlphaVest Acquisition Corp. | 4.5% |

Slam Corp. | 4.4% |

Oak Woods Acquisition Corp. | 4.0% |

Keen Vision Acquisition Corp. | 4.0% |

Nabors Energy Transition Corp. II | 3.7% |

| |

Security Type | |

Special Purpose Acquisition Companies (SPACs) | 96.8% |

Money Market Funds | 1.5% |

Commercial Paper | 1.4% |

Rights | 0.2% |

Warrants | 0.1% |

Other | 0.0% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/spac-etf.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| CrossingBridge Pre-Merger SPAC ETF | PAGE 2 | TSR-AR-89834G778 |

10003102881097011468989384498503948799949655995810595

| | |

| Riverpark Strategic Income Fund | |

| Retail Class | RSIVX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Riverpark Strategic Income Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/riverpark-strategic-income-fund. You can also request this information by contacting us at 1-888-898-2780.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Retail Class | $135 | 1.29% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this fiscal year, the Fund gained 9.48% on its Retail Class shares while the ICE BofA U.S. High Yield Total Return Index gained 15.66%, the ICE BofA U.S. Corporate Bond Index gained 14.13% and the ICE BofA 3-7 Year U.S. Treasury Index gained 9.07%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad based securities market index, gained 11.57% over the same period.

Monthly investment results for the fiscal year for the Retail Class shares ranged from 0.15% in April 2024 to 1.50% in December 2023. The Retail Class shares generated positive returns all twelve months during the fiscal year. For the Retail Class shares, the median monthly return for the fiscal year was 0.76% with an annualized standard deviation of 5.03%.

The Fund had positive contributions from interest income and had realized losses and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 7.36% for Retail Class shares. For the Retail Class shares, the subsidized 30-day SEC yield was 7.81% and unsubsidized 30-day SEC yield was 7.81%. For the Retail Class shares, the total return for the fiscal year was positive. The Retail Class shares NAV increased from $8.56 on September 30, 2023 to $8.71 on September 30, 2024, while also distributing $0.63 in income during the fiscal year.

As we have made reference to in all four CrossingBridge quarterly commentaries we published this past fiscal year (available on our website), credit spreads, both investment grade and high yield, have continued grinding tighter, recently hitting their tightest levels in 15 years. Even in the face of tight credit spreads and a highly uncertain interest rate market, we remain opportunistic and continue to pursue four main themes:

1) Floating rate debt – continuing to take advantage of the inverted yield curve

2) Foreign issuers – better credit characteristics with higher yields than U.S. counterparts

3) Event-driven debt – catalysts hold potential for higher rates of return

4) Higher credit quality issuers – leaning into investment grade opportunities

With this backdrop, throughout the fiscal year we had remained (and continue to remain) more defensively positioned, aiming to maintain attractive yields while leaning more toward investment grade debt. At the same time, we have maintained low durations and continue holding significant “dry powder” (cash/cash equivalents/pre-merger SPACs/maturities of 90 days or less) to 1) help protect capital while generating what we believe to be relatively attractive yields with the inverted yield curve, and 2) take advantage of opportunities as they arise.

As of September 30, 2024, the Fund’s net assets were weighted by category as follows: 13.8% in Short Term Securities, 25.9% in Buy & Hold (“Money Good”), 6.2% in Priority Based (“Above the Fray”), 8.7% in (“Off the Beaten Path”), 27.0% in Interest Rate Resets (Floating Rate Debt, Cushion Bonds), 6.6% in Asset Backed Securities (ABS), 2.1% in Stressed, 1.2% in Distressed, 0.3% in Equity, -1.9% in Hedges, with the remaining 10.1% in cash and cash equivalents.

Terms used such as “Money Good”, “Off the Beaten Path”, and “Above the Fray” are internal terms used by the Adviser to categorize certain investments.” Money Good are securities that CrossingBridge believes hold limited credit risk and provide above market yields. Off the Beaten Path are securities that may be smaller issues, not widely followed issuers, or less liquid. Above the Fray are securities of issuers experiencing industry and/or credit stress, with restructuring a distinct longer-term possibility.

| Riverpark Strategic Income Fund | PAGE 1 | TSR-AR-89834G661 |

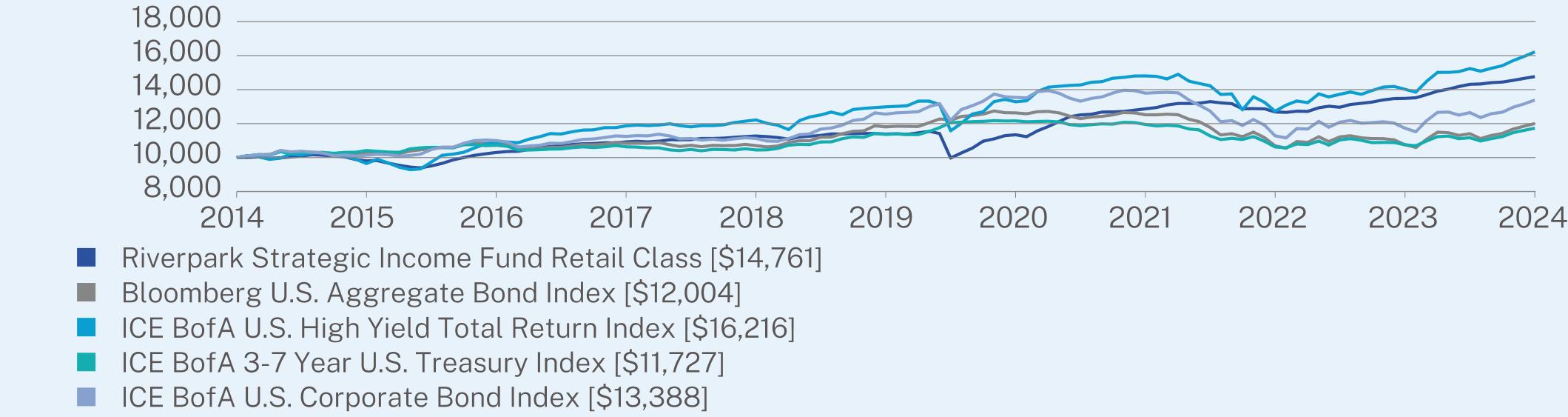

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Retail Class | 9.48 | 5.34 | 3.97 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA U.S. High Yield Total Return Index | 15.66 | 4.55 | 4.95 |

ICE BofA 3-7 Year U.S. Treasury Index | 9.07 | 0.64 | 1.61 |

ICE BofA U.S. Corporate Bond Index | 14.13 | 1.29 | 2.96 |

Visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $503,670,897 |

Number of Holdings | 127 |

Net Advisory Fee | $2,713,125 |

Portfolio Turnover | 116.98% |

Visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund for recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

First American Treasury Obligations Fund | 4.4% |

Connect Finco SARL | 3.7% |

Ford Motor Credit Co. LLC | 2.6% |

Forum Energy Technologies, Inc. | 2.6% |

First American Government Obligations Fund | 2.5% |

Bell Telephone Company of Canada | 2.4% |

United States Treasury Note/Bond | 2.4% |

Mangrove Luxco III Sarl | 2.3% |

Icahn Enterprises LP | 2.2% |

Expedia Group, Inc. | 2.2% |

| |

Security Type | |

Corporate Bonds | 46.7% |

Bank Loans | 19.6% |

Commercial Paper | 7.1% |

Money Market Funds | 6.8% |

Mortgage-Backed Securities | 5.1% |

Convertible Bonds | 4.6% |

U.S. Treasury Securities | 3.6% |

Asset-Backed Securities | 1.5% |

Common Stocks | 1.5% |

Other | 3.5% |

| Riverpark Strategic Income Fund | PAGE 2 | TSR-AR-89834G661 |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Riverpark Strategic Income Fund | PAGE 3 | TSR-AR-89834G661 |

100009802103001091911268113831134212866126841348414761100001029410829108361070511807126321251810691107601200410000964310879118651221412983132821480412723140201621610000104151072210630104481135712158119491062410751117271000010136109971124611123125541353813788112801173013388

| | |

| Riverpark Strategic Income Fund | |

| Institutional Class | RSIIX |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the Riverpark Strategic Income Fund (the “Fund”) for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.crossingbridgefunds.com/riverpark-strategic-income-fund. You can also request this information by contacting us at 1-888-898-2780.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $110 | 1.05% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

During this fiscal year, the Fund gained 9.76% on its Institutional Class shares while the ICE BofA U.S. High Yield Total Return Index gained 15.66%, the ICE BofA U.S. Corporate Bond Index gained 14.13% and the ICE BofA 3-7 Year U.S. Treasury Index gained 9.07%. The Bloomberg U.S. Aggregate Bond Index, the Fund’s broad based securities market index, gained 11.57% over the same period.

Monthly investment results for the fiscal year for the Institutional Class shares ranged from 0.17% in April 2024 to 1.52% in December 2023. The Institutional Class shares generated positive returns all twelve months during the fiscal year. For the Institutional Class shares, the median monthly return for the fiscal year was 0.79% with an annualized standard deviation of 5.03%.

The Fund had positive contributions from interest income and had realized losses and unrealized gains during the fiscal year. 100% of the income was distributed for a 1-year dividend yield of 7.85% for the Institutional Class shares. For the Institutional Class shares, the subsidized 30-day SEC yield was 8.06% and unsubsidized 30-day SEC yield was 8.06%. For the Institutional Class shares, the total return for the fiscal year was positive. The Institutional Class shares NAV increased from $8.54 on September 30, 2023 to $8.67 on September 30, 2024, while also distributing $0.67 in income during the fiscal year.

As we have made reference to in all four CrossingBridge quarterly commentaries we published this past fiscal year (available on our website), credit spreads, both investment grade and high yield, have continued grinding tighter, recently hitting their tightest levels in 15 years. Even in the face of tight credit spreads and a highly uncertain interest rate market, we remain opportunistic and continue to pursue four main themes:

1) Floating rate debt – continuing to take advantage of the inverted yield curve

2) Foreign issuers – better credit characteristics with higher yields than U.S. counterparts

3) Event-driven debt – catalysts hold potential for higher rates of return

4) Higher credit quality issuers – leaning into investment grade opportunities

With this backdrop, throughout the fiscal year we had remained (and continue to remain) more defensively positioned, aiming to maintain attractive yields while leaning more toward investment grade debt. At the same time, we have maintained low durations and continue holding significant “dry powder” (cash/cash equivalents/pre-merger SPACs/maturities of 90 days or less) to 1) help protect capital while generating what we believe to be relatively attractive yields with the inverted yield curve, and 2) take advantage of opportunities as they arise.

As of September 30, 2024, the Fund’s net assets were weighted by category as follows: 13.8% in Short Term Securities, 25.9% in Buy & Hold (“Money Good”), 6.2% in Priority Based (“Above the Fray”), 8.7% in (“Off the Beaten Path”), 27.0% in Interest Rate Resets (Floating Rate Debt, Cushion Bonds), 6.6% in Asset Backed Securities (ABS), 2.1% in Stressed, 1.2% in Distressed, 0.3% in Equity, -1.9% in Hedges, with the remaining 10.1% in cash and cash equivalents.

Terms used such as “Money Good”, “Off the Beaten Path”, and “Above the Fray” are internal terms used by the Adviser to categorize certain investments.” Money Good are securities that CrossingBridge believes hold limited credit risk and provide above market yields. Off the Beaten Path are securities that may be smaller issues, not widely followed issuers, or

| Riverpark Strategic Income Fund | PAGE 1 | TSR-AR-89834G679 |

less liquid. Above the Fray are securities of issuers experiencing industry and/or credit stress, with restructuring a distinct longer-term possibility.

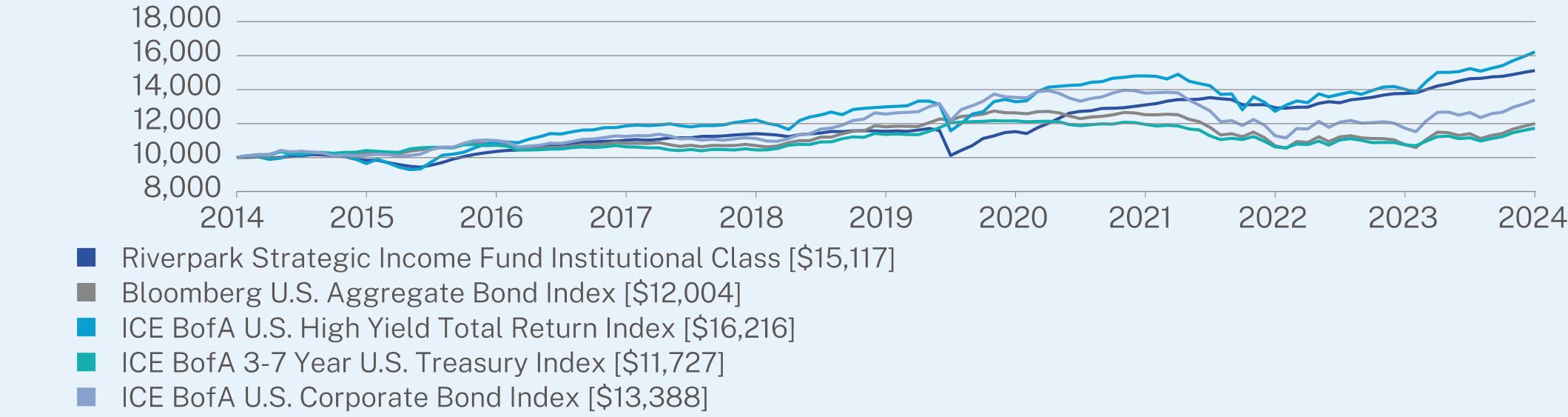

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shared noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Class | 9.76 | 5.55 | 4.22 |

Bloomberg U.S. Aggregate Bond Index | 11.57 | 0.33 | 1.84 |

ICE BofA U.S. High Yield Total Return Index | 15.66 | 4.55 | 4.95 |

ICE BofA 3-7 Year U.S. Treasury Index | 9.07 | 0.64 | 1.61 |

ICE BofA U.S. Corporate Bond Index | 14.13 | 1.29 | 2.96 |

Visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $503,670,897 |

Number of Holdings | 127 |

Net Advisory Fee | $2,713,125 |

Portfolio Turnover | 116.98% |

Visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund for recent performance information.

| Riverpark Strategic Income Fund | PAGE 2 | TSR-AR-89834G679 |

WHAT DID THE FUND INVEST IN? (% of net assets as of September 30, 2024)

| |

Top 10 Issuers | |

First American Treasury Obligations Fund | 4.4% |

Connect Finco SARL | 3.7% |

Ford Motor Credit Co. LLC | 2.6% |

Forum Energy Technologies, Inc. | 2.6% |

First American Government Obligations Fund | 2.5% |

Bell Telephone Company of Canada | 2.4% |

United States Treasury Note/Bond | 2.4% |

Mangrove Luxco III Sarl | 2.3% |

Icahn Enterprises LP | 2.2% |

Expedia Group, Inc. | 2.2% |

| |

Security Type | |

Corporate Bonds | 46.7% |

Bank Loans | 19.6% |

Commercial Paper | 7.1% |

Money Market Funds | 6.8% |

Mortgage-Backed Securities | 5.1% |

Convertible Bonds | 4.6% |

U.S. Treasury Securities | 3.6% |

Asset-Backed Securities | 1.5% |

Common Stocks | 1.5% |

Other | 3.5% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.crossingbridgefunds.com/riverpark-strategic-income-fund.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-888-898-2780, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Riverpark Strategic Income Fund | PAGE 3 | TSR-AR-89834G679 |

100009837103621102411406115401152713094129271377415117100001029410829108361070511807126321251810691107601200410000964310879118651221412983132821480412723140201621610000104151072210630104481135712158119491062410751117271000010136109971124611123125541353813788112801173013388

(b) Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is incorporated by reference to the Registrant’s Form N-CSR filed on December 10, 2018.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Akers and Lisa Zúñiga Ramírez are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 9/30/2024 | FYE 9/30/2023 |

| (a) Audit Fees | $125,800 | $121,000 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $17,500 | $27,950 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Co. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 9/302024 | FYE 9/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 9/30/2024 | FYE 9/30/2023 |

| Registrant | $ 0 | $ 0 |

| Registrant’s Investment Adviser | $ 0 | $ 0 |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The committee consists of the independent members of the entire Board.

(b) Not Applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

(b) Not Applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

CrossingBridge FUNDS

CrossingBridge Low Duration High Income Fund

(formerly known as the CrossingBridge Low Duration High Yield Fund)

Institutional Class (CBLDX)

CrossingBridge Responsible Credit Fund

Institutional Class (CBRDX)

CrossingBridge Ultra-Short Duration Fund

Institutional Class (CBUDX)

CrossingBridge Pre-Merger SPAC ETF

(SPC)

RiverPark Strategic Income Fund

Institutional Class (RSIIX)

Retail Class (RSIVX)

Core Financial Statements

September 30, 2024

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Investments

September 30, 2024

| | | | | | | | | | |

CORPORATE BONDS - 57.0%

|

Accommodation and Food Services - 2.2%

| | | | | | | | | |

Sizzling Platter LLC, 8.50%, 11/28/2025(a) | | | | | | $22,181,000 | | | $22,339,727 |

Administrative and Support and Waste Management and Remediation Services - 1.5%

| | | | | | | | | |

Equifax, Inc., 2.60%, 12/01/2024 | | | | | | 14,285,000 | | | 14,220,950 |

TWMA Group Ltd., 13.00%, 02/08/2027 | | | | | | 1,419,000 | | | 1,460,306 |

| | | | | | | | | 15,681,256 |

Construction - 0.4%

| | | | | | | | | |

Five Point Operating Co. LP, 10.50%, 01/15/2028(a)(b) | | | | | | 4,397,361 | | | 4,502,937 |

Consumer Discretionary -0.8%

| | | | | | |

Aider Konsern AS, 8.87% (Norway Interbank Offered Rate Fixing 3 Month + 4.15%), 09/05/2028 | | | NOK | | | 35,550,000 | | | 3,410,835 |

Gaming Innovation Group PLC, 10.74% (3 mo. EURIBOR + 7.25%), 12/18/2026 | | | EUR | | | 4,450,000 | | | 5,176,435 |

| | | | | | | | | 8,587,270 |

Finance and Insurance - 8.6%

| | | | | | |

Bank of America Corp., 6.50% to 10/23/2024 then 3 mo. Term SOFR + 4.44%, Perpetual | | | | | | 9,386,000 | | | 9,390,113 |

BGC Group, Inc., 3.75%, 10/01/2024 | | | | | | 6,515,000 | | | 6,515,000 |

Ford Motor Credit Co. LLC, 4.06%, 11/01/2024 | | | | | | 27,202,000 | | | 27,171,632 |

General Motors Financial Co., Inc.

| | | | | | | | | |

1.20%, 10/15/2024 | | | | | | 9,850,000 | | | 9,834,071 |

3.50%, 11/07/2024 | | | | | | 2,294,000 | | | 2,290,378 |

Goldcup 100865 AB, 9.23% (3 Month Stockholm Interbank Offered Rates + 5.50%), 07/11/2028 | | | SEK | | | 15,000,000 | | | 1,490,649 |

Icahn Enterprises LP

| | | | | | | | | |

6.25%, 05/15/2026 | | | | | | 3,676,000 | | | 3,650,461 |

5.25%, 05/15/2027 | | | | | | 11,098,000 | | | 10,644,388 |

Novedo Holding AB

| | | | | | | | | |

9.89% (3 Month Stockholm

Interbank Offered Rates +

6.50%), 11/26/2024 | | | SEK | | | 26,250,000 | | | 2,599,838 |

| | | | | | | | | | |

| | | | | | | | | | |

10.23% (3 Month Stockholm Interbank Offered Rates + 7.00%), 09/23/2027 | | | SEK | | | $56,250,000 | | | $5,621,760 |

Qflow Group AB, 8.67% (3 Month Stockholm Interbank Offered Rates + 5.50%), 09/25/2028 | | | SEK | | | 17,500,000 | | | 1,740,109 |

Stockwik Forvaltning AB, 11.25% (3 Month Stockholm Interbank Offered Rates + 8.00%), 03/20/2026 | | | SEK | | | 65,000,000 | | | 6,480,255 |

Storskogen Group AB, 6.33% (3 Month Stockholm Interbank Offered Rates + 3.25%), 10/03/2028 | | | SEK | | | 11,250,000 | | | 1,107,736 |

| | | | | | | | | 88,536,390 |

Health Care and Social Assistance - 0.9%

| | | | | | | | | |

ADDvise Group AB, 9.27% (SOFR + 4.25%), 04/04/2027 | | | | | | 2,000,000 | | | 2,028,228 |

Orexo AB, 9.66% (3 Month Stockholm Interbank Offered Rates + 6.50%), 03/28/2028 | | | SEK | | | 71,250,000 | | | 7,172,989 |

| | | | | | | | | 9,201,217 |

Industrials - 0.2%

| | | | | | | | | |

Booster Precision Components GmbH, 12.52% (3 mo. EURIBOR + 9.00%), 11/28/2026 | | | EUR | | | 1,977,000 | | | 2,200,701 |

Information - 11.9%

| | | | | | | | | |

Azerion Group NV, 10.46% (3 mo. EURIBOR + 6.75%), 10/02/2026 | | | EUR | | | 15,209,000 | | | 17,310,850 |

Cabonline Group Holding AB

| | | | | | | | | |

14.00%, 03/19/2026 | | | SEK | | | 77,770,274 | | | 7,752,502 |

14.00%, 03/19/2026 | | | SEK | | | 21,879,529 | | | 2,197,433 |

Connect Finco SARL

| | | | | | | | | |

6.75%, 10/01/2026(a) | | | | | | 29,479,000 | | | 29,479,000 |

9.00%, 09/15/2029(a) | | | | | | 6,220,000 | | | 6,029,570 |

Gaming Innovation Group PLC, 10.52% (3 Month Stockholm Interbank Offered Rates + 7.25%), 12/18/2026 | | | SEK | | | 30,625,000 | | | 3,148,950 |

Gannett Holdings LLC, 6.00%, 11/01/2026(a) | | | | | | 17,281,000 | | | 17,324,617 |

Go North Group AB

| | | | | | | | | |

10.89% (3 Month SOFR + 5.76%, includes 10.89% PIK), 02/09/2026 | | | | | | 7,400,691 | | | 6,586,615 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | | | | |

CORPORATE BONDS - (Continued)

|

Information - (Continued)

|

Go North Group AB

| | | | | | | | | |

15.00%, (includes 15.00% PIK) 02/09/2027 | | | | | | $3,216,065 | | | $1,768,836 |

15.00% (includes 15.00% PIK), 02/09/2027 | | | SEK | | | 13,919,669 | | | 788,098 |

15.00% (includes 15.00% PIK), 02/02/2028(c) | | | SEK | | | 5,474,131 | | | 0 |

Impala BondCo PLC, 12.00% (includes 12.00% PIK) | | | SEK | | | 12,346,540 | | | 844,917 |

INNOVATE Corp., 8.50%, 02/01/2026(a) | | | | | | 1,474,000 | | | 1,178,396 |

Lithium Midco II Ltd., 10.10% (3 mo. EURIBOR + 6.75%), 07/09/2025 | | | EUR | | | 10,459,000 | | | 11,642,456 |

PayPal Holdings, Inc.

| | | | | | | | | |

2.40%, 10/01/2024 | | | | | | 895,000 | | | 895,000 |

1.65%, 06/01/2025 | | | | | | 3,113,000 | | | 3,055,273 |

Warnermedia Holdings, Inc., 6.41%, 03/15/2026 | | | | | | 12,913,000 | | | 12,920,722 |

| | | | | | | | | 122,923,235 |

Manufacturing - 20.0%

| | | | | | | | | |

AbbVie, Inc., 2.60%, 11/21/2024 | | | | | | 27,616,000 | | | 27,525,666 |

Allegion US Holding Co., Inc., 3.20%, 10/01/2024 | | | | | | 17,145,000 | | | 17,145,000 |

Broadcom, Inc., 3.63%, 10/15/2024 | | | | | | 12,849,000 | | | 12,837,168 |

Cannabist Co. Holdings, Inc., 9.50%, 02/03/2026 | | | | | | 17,087,000 | | | 12,869,793 |

Carlisle Cos., Inc., 3.50%, 12/01/2024 | | | | | | 12,760,000 | | | 12,725,917 |

GE HealthCare Technologies, Inc., 5.55%, 11/15/2024 | | | | | | 7,322,000 | | | 7,325,229 |

Gilead Sciences, Inc., 3.65%, 03/01/2026 | | | | | | 8,847,000 | | | 8,777,966 |

HMH Holding BV, 9.88%, 11/16/2026 | | | | | | 14,906,000 | | | 15,458,139 |

Infrabuild Australia Pty Ltd., 14.50%, 11/15/2028(a) | | | | | | 22,540,000 | | | 22,808,001 |

Jabil, Inc.,

1.70%, 04/15/2026 | | | | | | 3,353,000 | | | 3,212,835 |

Neptune Bidco AS, 11.50% (Norway Interbank Offered Rate Fixing 3 Month + 6.75%), 06/28/2028 | | | NOK | | | 55,000,000 | | | 5,211,813 |

Prosomnus Sleep Technologies, Inc., 8.00%, 12/31/2026(c) | | | | | | 6,751,408 | | | 5,080,434 |

Qorvo, Inc., 1.75%, 12/15/2024 | | | | | | 2,633,000 | | | 2,612,692 |

Secop Group Holding GmbH, 11.75% (3 mo. EURIBOR + 8.40%), 12/29/2026 | | | EUR | | | 2,561,000 | | | 2,900,671 |

Sherwin-Williams Co., 3.95%, 01/15/2026 | | | | | | 8,847,000 | | | 8,791,357 |

| | | | | | | | | | |

| | | | | | | | | | |

Sonoco Products Co., 1.80%, 02/01/2025 | | | | | | $11,273,000 | | | $11,143,442 |

Stanley Black & Decker, Inc., 3.40%, 03/01/2026 | | | | | | 3,460,000 | | | 3,412,967 |

Tapestry, Inc.

| | | | | | | | | |

7.05%, 11/27/2025 | | | | | | 10,273,000 | | | 10,479,986 |

4.13%, 07/15/2027 | | | | | | 111,000 | | | 109,255 |

Zimmer Biomet Holdings, Inc., 1.45%, 11/22/2024 | | | | | | 17,018,000 | | | 16,922,647 |

| | | | | | | | | 207,350,978 |

Mining, Quarrying, and Oil and Gas Extraction - 2.0%

| | | | | | | | | |

CrownRock LP, 5.00%, 05/01/2029(a) | | | | | | 19,056,000 | | | 19,294,600 |

Mime Petroleum AS, 9.75%, 09/17/2026 | | | | | | 1,125,264 | | | 1,097,132 |

Tacora Resources, Inc.,

13.00%, (includes 13.00% PIK) 12/31/2024(a)(c)(i) | | | | | | 3,892,693 | | | 778,539 |

| | | | | | | | | 21,170,271 |

Professional, Scientific, and Technical Services - 2.2%

| | | | | | | | | |

Getty Images, Inc., 9.75%, 03/01/2027(a) | | | | | | 11,629,000 | | | 11,637,406 |

Infor, Inc., 1.75%, 07/15/2025(a) | | | | | | 5,057,000 | | | 4,911,568 |

Oracle Corp., 2.65%, 07/15/2026 | | | | | | 6,640,000 | | | 6,455,811 |

| | | | | | | | | 23,004,785 |

Real Estate and Rental and Leasing - 0.0%(d)

| | | | | | | | | |

REX - Real Estate Exchange, Inc., 6.00%, 03/15/2025(a) | | | | | | 374,999 | | | 373,424 |

Retail Trade - 0.3%

| | | | | | | | | |

Advance Auto Parts, Inc., 5.90%, 03/09/2026 | | | | | | 3,000,000 | | | 3,032,055 |

Transportation and Warehousing - 1.8%

| | | | | | | | | |

Delta Air Lines, Inc.,

2.90%, 10/28/2024 | | | | | | 5,855,000 | | | 5,841,495 |

Uber Technologies, Inc.

| | | | | | | | | |

8.00%, 11/01/2026(a) | | | | | | 8,067,000 | | | 8,084,788 |

7.50%, 09/15/2027(a) | | | | | | 4,425,000 | | | 4,518,235 |

| | | | | | | | | 18,444,518 |

Wholesale Trade - 4.2%

| | | | | | | | | |

CITGO Petroleum Corp., 7.00%, 06/15/2025(a) | | | | | | 17,512,000 | | | 17,532,892 |

TD SYNNEX Corp., 1.75%, 08/09/2026 | | | | | | 5,186,000 | | | 4,928,392 |

TPC Group, Inc., 13.00%, 12/16/2027(a) | | | | | | 20,279,111 | | | 20,569,711 |

| | | | | | | | | 43,030,995 |

TOTAL CORPORATE BONDS

(Cost $595,134,990) | | | | | | | | | 590,379,759 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | | | | |

BANK LOANS - 10.0%

|

Construction - 0.1%

| | | | | | | | | |

Lealand Finance (McDermott) First Lien, 7.96% (1 mo. Base Rate + 3.00%), 06/30/2027 | | | | | | $1,750,984 | | | $941,154 |

Energy - 0.0%(d)

| | | | | | | | | |

Lealand Finance Co. BV First Lien, 5.96% (1 mo. Base Rate + 1.00%), 12/31/2027 | | | | | | 38,376 | | | 14,698 |

Information - 2.6%

| | | | | | | | | |

Cengage Learning, Inc. First Lien, 9.54% (6 mo. Term SOFR + 4.75%), 07/14/2026 | | | | | | 6,222,405 | | | 6,243,405 |

Clear Channel International First Lien, 7.50%, 08/15/2027 | | | | | | 19,180,000 | | | 19,108,075 |

Lions Gate Capital Holdings LLC First Lien, 7.20% (1 mo. Term SOFR + 2.25%), 03/24/2025 | | | | | | 1,949,401 | | | 1,951,224 |

| | | | | | | | | 27,302,704 |

Manufacturing - 4.8%

| | | | | | | | | |

Chobani LLC, 8.21% (1 mo. Term SOFR + 3.25%), 10/23/2027 | | | | | | 2,455,243 | | | 2,465,064 |

Chobani LLC First Lien, 8.60% (1 mo. Term SOFR + 3.75%), 10/25/2027 | | | | | | 5,955,000 | | | 5,980,309 |

Elevate Textiles, Inc., 13.98% (3 mo. Term SOFR + 8.65%), 09/30/2027 | | | | | | 8,695,925 | | | 8,668,794 |

First Brands Group LLC First Lien, 10.51% (3 mo. Term SOFR + 5.00%), 03/30/2027 | | | | | | 1,468,224 | | | 1,455,377 |

Forum Energy Technologies, Inc., 11.00%, 12/08/2026 | | | | | | 22,722,082 | | | 21,813,199 |

K&N Parent, Inc.

| | | | | | | | | |

12.96% (3 Month SOFR + 8.00%), 02/14/2027 | | | | | | 7,952,655 | | | 7,912,892 |

8.21% (3 Month SOFR + 3.25%), 08/14/2027 | | | | | | 1,861,151 | | | 1,470,309 |

| | | | | | | | | 49,765,944 |

Professional, Scientific, and Technical Services - 0.3%

| | | | | | | | | |

Getty Images, Inc. First Lien, 8.85% (3 mo. Term SOFR + 4.50%), 02/19/2026 | | | | | | 3,024,345 | | | 3,013,019 |

Real Estate and Rental and Leasing - 0.9%

| | | | | | | | | |

Micromont, 8.00%, 11/15/2026(c) | | | | | | 9,021,214 | | | 9,021,214 |

| | | | | | | | | | |

| | | | | | | | | | |

Retail Trade - 0.3%

| | | | | | | | | |

The Container Store, Inc., 9.87% (3 mo. Term SOFR + 4.75%), 01/31/2026 | | | | | | $4,885,172 | | | $3,102,084 |

Utilities - 1.0%

| | | | | | | | | |

Solaris Energy Infrastructure, 11.10%, 09/11/2029 | | | | | | 10,351,000 | | | 10,131,041 |

TOTAL BANK LOANS

(Cost $107,614,148) | | | | | | | | | 103,291,858 |

MORTGAGE-BACKED SECURITIES - 4.9%

|

Finance and Insurance - 4.9%

|

BX Trust

| | | | | | | | | |

Series 2021-SOAR, Class A, 5.88%

(1 mo. Term SOFR + 0.78%), 06/15/2038(a) | | | | | | 1,884,986 | | | 1,874,093 |

Series 2021-SOAR, Class B, 6.08%

(1 mo. Term SOFR + 0.98%), 06/15/2038(a) | | | | | | 6,080,177 | | | 6,030,687 |

Series 2021-VINO, Class A, 5.86% (1 mo. Term SOFR + 0.77%), 05/15/2038(a) | | | | | | 5,770,490 | | | 5,741,550 |

Series 2021-VOLT, Class B, 6.16% (1 mo. Term SOFR + 1.06%), 09/15/2036(a) | | | | | | 6,110,000 | | | 6,057,107 |

Series 2021-VOLT, Class C, 6.31% (1 mo. Term SOFR + 1.21%), 09/15/2036(a) | | | | | | 4,700,000 | | | 4,653,893 |

Series 2024-BIO, Class A, 6.74% (1 mo. Term SOFR + 1.64%), 02/15/2041(a) | | | | | | 4,170,000 | | | 4,156,319 |

Series 2024-KING, Class A, 6.64% (1 mo. Term SOFR + 1.54%), 05/15/2034(a) | | | | | | 4,075,000 | | | 4,080,218 |

Series 2024-KING, Class B, 6.84% (1 mo. Term SOFR + 1.74%), 05/15/2034(a) | | | | | | 2,710,000 | | | 2,697,445 |

CAMB Commercial Mortgage Trust

| | | | | | | | | |

Series 2019-LIFE, Class A, 6.46% (1 mo. Term SOFR + 1.37%), 12/15/2037(a) | | | | | | 6,300,000 | | | 6,298,656 |

Series 2019-LIFE, Class B, 6.64% (1 mo. Term SOFR + 1.55%), 12/15/2037(a) | | | | | | 1,600,000 | | | 1,598,765 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | | | | |

MORTGAGE-BACKED SECURITIES - (Continued)

|

Finance and Insurance - (Continued)

|

Series 2019-LIFE, Class D, 7.14% (1 mo. Term SOFR + 2.05%), 12/15/2037(a) | | | | | | $5,143,000 | | | $5,139,743 |

Life Mortgage Trust US, Series 2021-BMR, Class A, 5.91% (1 mo. Term SOFR + 0.81%), 03/15/2038(a) | | | | | | 2,561,824 | | | 2,522,190 |

| | | | | | | | | 50,850,666 |

TOTAL MORTGAGE-BACKED SECURITIES (Cost $50,594,120) | | | | | | | | | 50,850,666 |

ASSET-BACKED SECURITIES - 4.6%

|

Finance and Insurance - 2.8%

| | | | | | |

Alterna Funding LLC, Series 2024-1A, Class A, 6.26%, 05/16/2039(a) | | | | | | 2,087,894 | | | 2,127,356 |

Coinstar Funding LLC, Series 2017-1A, Class A2, 5.22%, 04/25/2047(a) | | | | | | 21,296,328 | | | 18,945,013 |

HTS Fund LLC,

Series 2021-1, Class A, 1.41%, 08/25/2036(a) | | | | | | 4,548,636 | | | 3,743,278 |

RAM 2024-1 LLC, Series 2024-1, Class A, 6.67%, 02/15/2039(a) | | | | | | 3,646,346 | | | 3,683,216 |

| | | | | | | | | 28,498,863 |

Transportation and Warehousing - 1.8%

| | | | | | | | | |

Alaska Airlines, Inc., Series A, 4.80%, 08/15/2027(a) | | | | | | 1,265,122 | | | 1,264,909 |

Hawaiian Airlines 2013-1 Class A Pass Through Certificates, Series 2013-1, 3.90%, 01/15/2026 | | | | | | 18,250,221 | | | 17,830,575 |

| | | | | | | | | 19,095,484 |

TOTAL ASSET-BACKED SECURITIES

(Cost $47,266,396) | | | | | | | | | 47,594,347 |

CONVERTIBLE BONDS - 3.7%

|

Information - 2.0%

| | | | | | | | | |

BuzzFeed, Inc., 8.50%, 12/03/2026(a) | | | | | | 6,255,000 | | | 5,785,875 |

Chegg, Inc., 0.13%, 03/15/2025 | | | | | | 9,693,000 | | | 9,305,281 |

Leafly Holdings, Inc., 8.00%, 01/31/2025(c) | | | | | | 7,245,000 | | | 6,158,250 |

| | | | | | | | | 21,249,406 |

Manufacturing - 0.1%

| | | | | | | | | |

Forum Energy Technologies, Inc., 9.00%, 08/04/2025 | | | | | | 757,427 | | | 757,806 |

| | | | | | | | | | |

| | | | | | | | | | |

Transportation and Warehousing - 1.6%

| | | | | | | | | |

Delivery Hero SE

| | | | | | | | | |

1.00%, 04/30/2026 | | | EUR | | | $7,800,000 | | | $8,146,435 |

1.00%, 01/23/2027 | | | EUR | | | 8,400,000 | | | 8,489,342 |

| | | | | | | | | 16,635,777 |

TOTAL CONVERTIBLE BONDS

(Cost $39,005,032) | | | | | | | | | 38,642,989 |

| | | | | | | | | | |

PREFERRED STOCKS - 1.0%

|

Administrative and Support

and Waste Management

and Remediation Services - 1.0%

| | | | | | | | | |

SWK Holdings Corp. 9.00%, 01/31/2027 | | | | | | 412,897 | | | 10,508,229 |

TOTAL PREFERRED STOCKS

(Cost $10,322,970) | | | | | | | | | 10,508,229 |

SPECIAL PURPOSE ACQUISITION

COMPANIES

(SPACS) - 0.4%

|

Berenson Acquisition Corp. Founder Shares(c)(e) | | | | | | 19,099 | | | 0 |

Cartesian Growth Corp. II - Class A(e) | | | | | | 165,000 | | | 1,890,900 |

Legato Merger Corp. III(e) | | | | | | 178,600 | | | 1,820,827 |

Plum Acquisition Corp. III Founder Shares(e) | | | | | | 9,341 | | | 573 |

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES (SPACS) (Cost $3,650,993) | | | | | | | | | 3,712,300 |

REAL ESTATE INVESTMENT

TRUSTS - 0.3%

|

Real Estate and Rental and Leasing - 0.3% | | | | | | | | | |

Gladstone Land Corp. Series D, 5.00%, 01/31/2026 | | | | | | 119,309 | | | 2,923,070 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $2,755,523) | | | | | | | | | 2,923,070 |

| | | | | | | | | | |

| | | | | | | | | | |

MUNICIPAL BONDS - 0.2%

|

New York - 0.2%

| | | | | | | | | |

New York State Dormitory Authority, 6.20%, 05/01/2035 (Obligor: Pace University)(f) | | | | | | 2,175,000 | | | 2,175,000 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | | | | |

TOTAL MUNICIPAL BONDS

(Cost $2,175,000) | | | | | | | | | $2,175,000 |

| | | | | | | | | | |

| | | | | | | | | | |

COMMON STOCKS - 0.1%

|

Manufacturing - 0.1%

| | | | | | | | | |

Diebold Nixdorf, Inc.(e) | | | | | | 0 | | | 0 |

K&N Parent, Inc.(e) | | | | | | 152,899 | | | 344,023 |

Prosomnus Equity(c)(e)(j) | | | | | | 996,799 | | | 1,200,744 |

| | | | | | | | | 1,544,767 |

TOTAL COMMON STOCKS

(Cost $1,057,918) | | | | | | | | | 1,544,767 |

| | | | | | | | | | |

| | | | | | | | | | |

WARRANTS - 0.0%(d)

|

Finance and Insurance - 0.0%(d)

|

Legato Merger Corp. III, Expires 03/28/2029, Exercise Price $11.50(e) | | | | | | 89,300 | | | 15,623 |

Information - 0.0%(d)

| | | | | | | | | |

Leafly Holdings, Inc., Expires 11/07/2026, Exercise Price $11.50(e) | | | | | | 36,943 | | | 1,167 |

Mining, Quarrying, and Oil

and Gas Extraction - 0.0%(d)

| | | | | | | | | |

Tacora Resources, Inc., Expires 05/11/2025, Exercise Price $0.01(c)(e) | | | | | | 37,828,768 | | | 0 |

TOTAL WARRANTS

(Cost $14,087) | | | | | | | | | 16,790 |

| | | | | | | | | | |

| | | | | | | | | | |

SHORT-TERM INVESTMENTS - 13.9%

|

Commercial Paper - 9.4%

| |

Consumer Staples - 3.6%

| | | | | | | | | |

Bacardi-Martini BV, 5.99%, 10/03/2024(g) | | | | | | 19,570,000 | | | 19,561,514 |

Conagra Brands, Inc., 5.77%, 10/04/2024(g) | | | | | | 17,068,000 | | | 17,058,240 |

| | | | | | | | | 36,619,754 |

Finance and Insurance - 1.3%

| | | | | | |

Penske Truck Leasing Co. LP, 5.42%, 10/01/2024(g) | | | | | | 13,275,000 | | | 13,273,161 |

Health Care and Social Assistance - 1.0%

| | | | | | | | | |

Dentsply Sirona, Inc., 5.16%, 10/09/2024(g) | | | | | | 10,552,000 | | | 10,537,538 |

Technology - 3.5%

| | | | | | | | | |

Jabil, Inc., 5.17%, 10/04/2024(g) | | | | | | 19,786,000 | | | 19,773,769 |

| | | | | | | | | | |

| | | | | | | | | | |

Microchip Technology, Inc., 5.43%, 10/04/2024(g) | | | | | | $16,795,000 | | | $16,785,519 |

| | | | | | | | | 36,559,288 |

Total Commercial Paper (Cost $97,002,297) | | | | | | | | | 96,989,741 |

| | | | | | | | | | |

| | | | | | | | | | |

Money Market Funds - 4.5%

|

First American Treasury Obligations Fund - Class X, 4.79%(h) | | | | | | 46,772,811 | | | 46,772,811 |

Total Money Market Funds (Cost $46,772,811) | | | | | | | | | 46,772,811 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $143,775,108) | | | | | | | | | 143,762,552 |

TOTAL INVESTMENTS - 96.1%

(Cost $1,003,366,285) | | | | | | | | | 995,402,327 |

Other Assets in Excess of Liabilities - 3.9% | | | | | | | | | 40,612,096 |

TOTAL NET

ASSETS - 100.0% | | | | | | | | | $1,036,014,423 |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

Par amount is in USD unless otherwise indicated.

AB - Aktiebolag

NV - Naamloze Vennootschap

PIK - Payment in Kind

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

EUR - Euro

NOK - Norwegian Krone

SEK - Swedish Krona

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of September 30, 2024, the value of these securities total $361,480,304 or 34.9% of the Fund’s net assets. |

(b)

| Step coupon bond. The rate disclosed is as of September 30, 2024. |

(c)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $22,239,181 or 2.1% of net assets as of September 30, 2024. |

(d)

| Represents less than 0.05% of net assets. |

(e)

| Non-income producing security. |

(f)

| Coupon rate is variable or floats based on components including but not limited to reference rate and spread. These securities may not indicate a reference rate and/or spread in their description. The rate disclosed is as of September 30, 2024. |

(g)

| The rate shown is the effective yield as of September 30, 2024. |

(h)

| The rate shown represents the 7-day annualized effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Low Duration High Income Fund

Schedule of Forward Currency Contracts

September 30, 2024

| | | | | | | | | | | | | |

U.S. Bancorp Investments, Inc. | | | 10/03/2024 | | | SEK | | | 11,250,000 | | | USD | | | 1,112,705 | | | $(4,811) |

U.S. Bancorp Investments, Inc. | | | 10/15/2024 | | | USD | | | 55,431,299 | | | EUR | | | 50,240,000 | | | (530,056) |

U.S. Bancorp Investments, Inc. | | | 10/15/2024 | | | USD | | | 8,616,772 | | | NOK | | | 92,900,000 | | | (187,943) |

U.S. Bancorp Investments, Inc. | | | 10/15/2024 | | | USD | | | 40,733,934 | | | SEK | | | 420,800,000 | | | (732,037) |

Total Unrealized Appreciation (Depreciation) | | | $(1,454,847) |

| | | | |

SEK - Swedish Krona

USD - United States Dollar

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Responsible Credit Fund

Schedule of Investments

September 30, 2024

| | | | | | | |

CORPORATE BONDS - 51.7%

|

Administrative and Support and Waste

Management and Remediation Services - 2.6%

|

Expedia Group, Inc., 6.25%,

05/01/2025(a) | | | $1,069,000 | | | $1,071,787 |

Construction - 0.4%

|

Five Point Operating Co. LP, 10.50%, 01/15/2028(a)(b) | | | 175,474 | | | 179,687 |

Finance and Insurance - 18.0%

|

Bank of America Corp., 6.50% to 10/23/2024 then 3 mo. Term SOFR + 4.44%, Perpetual | | | 372,000 | | | 372,163 |

Esmaeilzadeh Holding AB, 11.13%

(3 Month Stockholm Interbank Offered Rates + 7.50%), 01/26/2025 SEK | | | 5,000,000 | | | 483,316 |

Ford Motor Credit Co. LLC, 4.06%, 11/01/2024 | | | 1,185,000 | | | 1,183,677 |

General Motors Financial Co., Inc., 1.20%, 10/15/2024 | | | 1,100,000 | | | 1,098,221 |

Icahn Enterprises LP

|

6.25%, 05/15/2026 | | | 500,000 | | | 496,526 |

9.75%, 01/15/2029(a) | | | 546,000 | | | 567,084 |

Novedo Holding AB, 10.23% (3 Month Stockholm Interbank Offered Rates + 7.00%), 09/23/2027 SEK | | | 11,250,000 | | | 1,124,352 |

Qflow Group AB, 8.67% (3 Month Stockholm Interbank Offered Rates + 5.50%), 09/25/2028 SEK | | | 2,500,000 | | | 248,587 |

Stockwik Forvaltning AB, 11.25%

(3 Month Stockholm Interbank Offered Rates + 8.00%), 03/20/2026 SEK | | | 8,750,000 | | | 872,342 |

StoneX Group, Inc.,

7.88%, 03/01/2031(a) | | | 827,000 | | | 881,412 |

| | | 7,327,680 |

Health Care and Social Assistance - 1.6%

|

Orexo AB, 9.66% (3 Month Stockholm Interbank Offered Rates + 6.50%), 03/28/2028 SEK | | | 6,250,000 | | | 629,210 |

Industrials - 2.5%

|

Mangrove LuxcoIII Sarl

|

8.67% (3 mo. EURIBOR + 5.00%), 07/15/2029(a) EUR | | | 607,000 | | | 678,278 |

8.67% (3 mo. EURIBOR + 5.00%), 07/15/2029 EUR | | | 300,000 | | | 335,228 |

| | | 1,013,506 |

Information - 11.4%

|

CabonlineGroup Holding AB

|

14.00%, 03/19/2026 SEK | | | 6,292,000 | | | 631,926 |

14.00%, 03/19/2026 SEK | | | 3,364,000 | | | 335,339 |

| | | | | | | |

| | | | | | | |

Calligo UK Ltd., 10.35% (includes 10.90% PIK) (3 mo. EURIBOR + 7.00%), 12/29/2028 EUR | | | $105,331 | | | $72,108 |

Connect Finco SARL, 6.75%, 10/01/2026(a) | | | 1,174,000 | | | 1,174,000 |

Go North Group AB

|

10.89% (3 Month SOFR + 5.76%, includes 10.89% PIK), 02/09/2026 | | | 320,394 | | | 285,151 |

15.00% (includes 15.00% PIK), 02/09/2027 | | | 197,390 | | | 108,565 |

15.00% (includes 15.00% PIK), 02/02/2028(c)(g) SEK | | | 237,135 | | | 0 |

Inteno Group AB, 10.95%

(3 mo. EURIBOR + 7.50%), 09/06/2026 EUR | | | 200,000 | | | 165,860 |

Lithium Midco II Ltd., 10.10%

(3 mo. EURIBOR + 6.75%), 07/09/2025 EUR | | | 401,000 | | | 446,374 |

Warnermedia Holdings, Inc., 6.41%, 03/15/2026 | | | 900,000 | | | 900,538 |

Ziff Davis, Inc., 4.63%, 10/15/2030(a) | | | 546,000 | | | 513,324 |

| | | 4,633,185 |

Manufacturing - 8.2%

|

Infrabuild Australia Pty Ltd., 14.50%, 11/15/2028(a) | | | 1,048,000 | | | 1,060,461 |

Phinia, Inc., 6.75%, 04/15/2029(a) | | | 546,000 | | | 564,276 |

Secop Group Holding GmbH, 11.75%

(3 mo. EURIBOR + 8.40%), 12/29/2026 EUR | | | 150,000 | | | 169,895 |

SLR Group GmbH, 10.71%

(3 mo. EURIBOR + 7.00%), 10/09/2027 EUR | | | 163,000 | | | 179,807 |

Tapestry, Inc., 4.25%, 04/01/2025 | | | 800,000 | | | 794,415 |

VF Corp., 2.40%, 04/23/2025 | | | 560,000 | | | 550,639 |

| | | 3,319,493 |

Mining, Quarrying, and Oil and Gas Extraction - 0.4%

|

Tacora Resources, Inc., 13.00% ,

(includes 13.00% PIK) 12/31/2024(a)(c)(g) | | | 757,525 | | | 151,505 |

Professional, Scientific, and Technical Services - 1.3%

|

Getty Images, Inc., 9.75%,

03/01/2027(a) | | | 541,000 | | | 541,391 |

Transportation and Warehousing - 5.3%

|

Uber Technologies, Inc., 8.00%, 11/01/2026(a) | | | 1,489,000 | | | 1,492,283 |

XPO, Inc., 6.25%, 06/01/2028(a) | | | 650,000 | | | 665,451 |

| | | 2,157,734 |

TOTAL CORPORATE BONDS

(Cost $21,353,253) | | | | | | 21,025,178 |

BANK LOANS - 23.3%

|

Information - 4.5%

|

Audacy Capital Corp., 0.00%, 11/18/2024(g) | | | 163,000 | | | 73,582 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CrossingBridge Responsible Credit Fund

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

BANK LOANS - (Continued)

|

Information - (Continued)

|

Cengage Learning, Inc. First Lien, 9.54% (6 mo. Term SOFR + 4.75%), 07/14/2026 | | | $504,735 | | | $506,439 |

Clear Channel International First Lien, 7.50%, 08/15/2027 | | | 537,000 | | | 534,986 |

Lions Gate Capital Holdings LLC First Lien, 7.20% (1 mo. Term SOFR + 2.25%), 03/24/2025 | | | 85,070 | | | 85,150 |

Magnite, Inc., 8.60% (1 mo. Term

SOFR + 3.75%), 02/06/2031 | | | 644,285 | | | 649,117 |

| | | 1,849,274 |

Manufacturing - 11.3%

|

Chobani LLC, 8.21% (1 mo. Term SOFR + 3.25%), 10/23/2027 | | | 492,327 | | | 494,297 |

Chobani LLC First Lien, 8.60% (1 mo. Term SOFR + 3.75%), 10/25/2027 | | | 682,570 | | | 685,471 |

Elevate Textiles, Inc., 13.98% (3 mo. Term SOFR + 8.565%), 09/30/2027 | | | 769,230 | | | 766,830 |

First Brands Group LLC First Lien, 10.51% (3 mo. Term SOFR + 5.00%), 03/30/2027 | | | 55,558 | | | 55,072 |

Forum Energy Technologies, Inc., 11.00%, 12/08/2026 | | | 1,898,412 | | | 1,822,475 |

Trulite Glass & Aluminum Solutions LLC, 10.59% (1 mo. Term SOFR + 6.00%), 02/15/2030 | | | 790,000 | | | 766,300 |

| | | 4,590,445 |

Materials - 1.4%

|

M2S Group Intermediate Holdings, Inc. First Lien, 9.85% (3 mo. Term

SOFR + 4.75%), 08/22/2031 | | | 575,000 | | | 553,438 |

Real Estate and Rental and Leasing - 2.1%

|