UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2025

Date of reporting period: November 30, 2024

Item 1. Reports to Stockholders.

(a)

| | |

| Jensen Quality Growth ETF | |

JGRW (Principal U.S. Listing Exchange: NYSE Arca, Inc.NYSEArca) |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Quality Growth ETF (the “Fund”) for the period of August 12, 2024 (commencement of operations) to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)1

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Jensen Quality Growth ETF | $18 | 0.57% |

| 1 | Costs included are for the period August 12, 2024 (commencement of operations) through November 30, 2024. Costs would be higher if the full six month period was included. |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the period from August 12, 2024 (commencement of operations) to November 30, 2024, relative performance for the Jensen Quality Growth ETF was aided by overweight positions in the Information Technology and Industrials sectors and an underweight in the Energy sector. Stock selection benefited relative Fund performance in the Materials, Industrials and Health Care sectors. Relative performance was hindered by the Fund’s underweight positions in the Financials, Consumer Discretionary and Real Estate sectors and overweight positions in the Consumer Staples and Health Care sectors. Stock selection detracted from relative performance in the Consumer Discretionary, Consumer Staples, Financials, Information Technology and Communication Services sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 54.14% of Fund assets compared to 32.12% of the S&P 500 Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

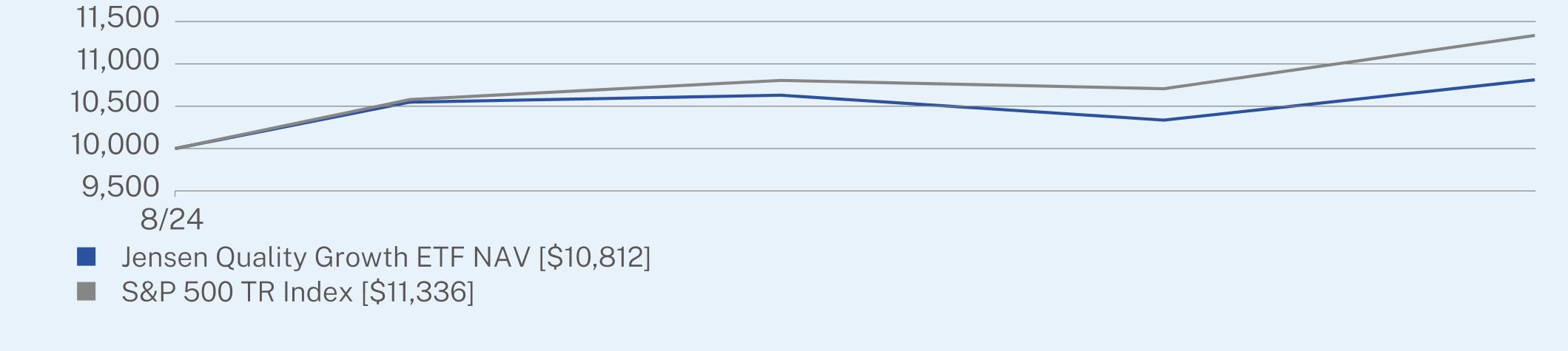

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Jensen Quality Growth ETF | PAGE 1 | TSR-SAR-89834G562 |

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(08/12/2024) |

Jensen Quality Growth ETF NAV | 8.12 |

S&P 500 TR Index | 13.36 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $68,326,974 |

Number of Holdings | 28 |

Portfolio Turnover | 10% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

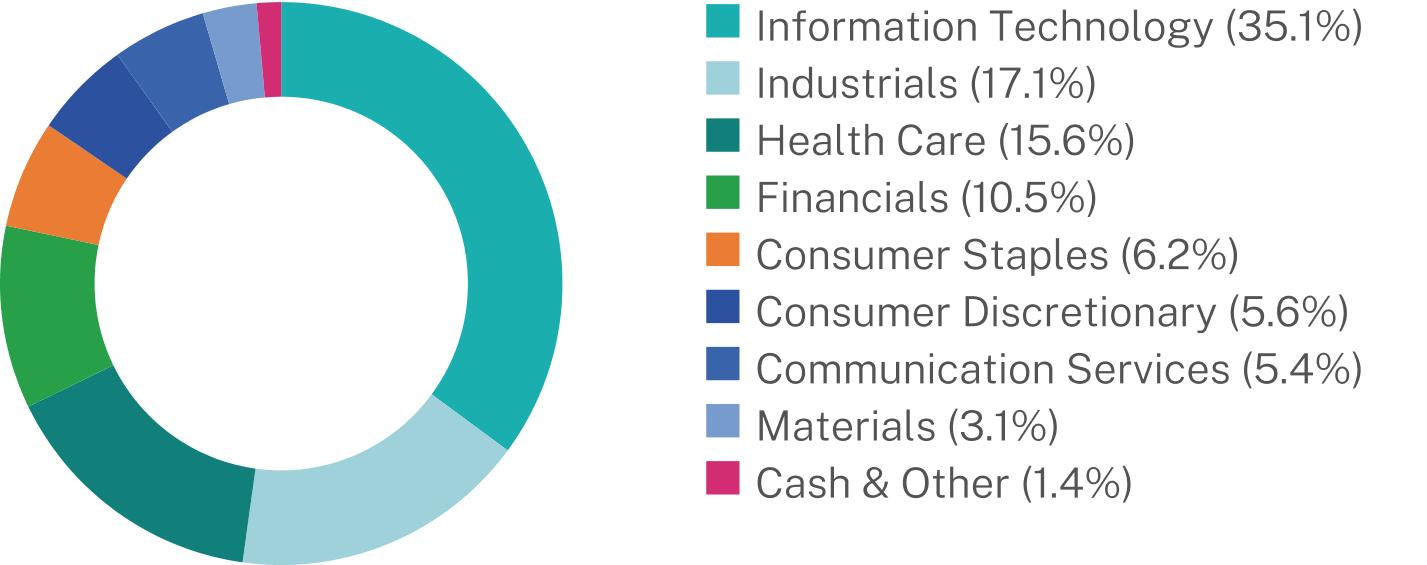

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Apple, Inc. | 7.4% |

Microsoft Corp. | 7.2% |

Accenture PLC | 7.1% |

Marsh & McLennan Cos., Inc. | 6.1% |

Stryker Corp. | 6.0% |

Intuit, Inc. | 5.5% |

Alphabet, Inc. | 5.4% |

Mastercard, Inc. | 4.4% |

Automatic Data Processing, Inc. | 4.4% |

UnitedHealth Group, Inc. | 3.9% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Quality Growth ETF | PAGE 2 | TSR-SAR-89834G562 |

1000010812100001133635.117.115.610.56.25.65.43.11.4

| | |

| Jensen Global Quality Growth Fund | |

| Class I | JGQIX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Global Quality Growth Fund (the “Fund”) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $53 | 1.02% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six-month period ended November 30, 2024, relative performance of the Jensen Global Quality Growth Fund was aided by overweight positions in the Information Technology and Industrials sectors and no positions in the Utilities, Real Estate and Materials sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Discretionary, Consumer Staples and Health Care sectors and underweight positions in the Financials and Energy sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 52.25% of Fund assets compared to 32.86% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $250,000 chart reflects a hypothetical $250,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $250,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(04/15/2020) |

Class I | 15.44 | 13.04 |

MSCI ACWI Net Total Return Index (USD) | 26.12 | 16.03 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Jensen Global Quality Growth Fund | PAGE 1 | TSR-SAR-89834G844 |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $62,643,711 |

Number of Holdings | 34 |

Portfolio Turnover | 8% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

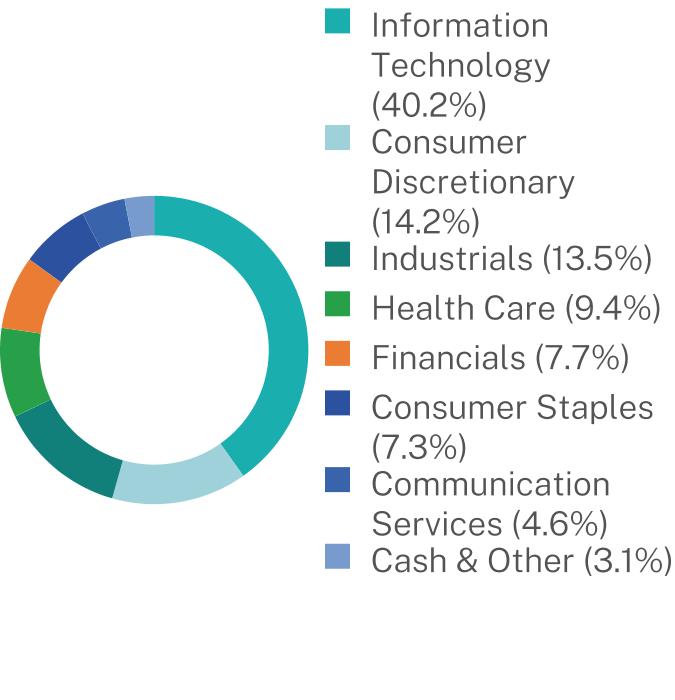

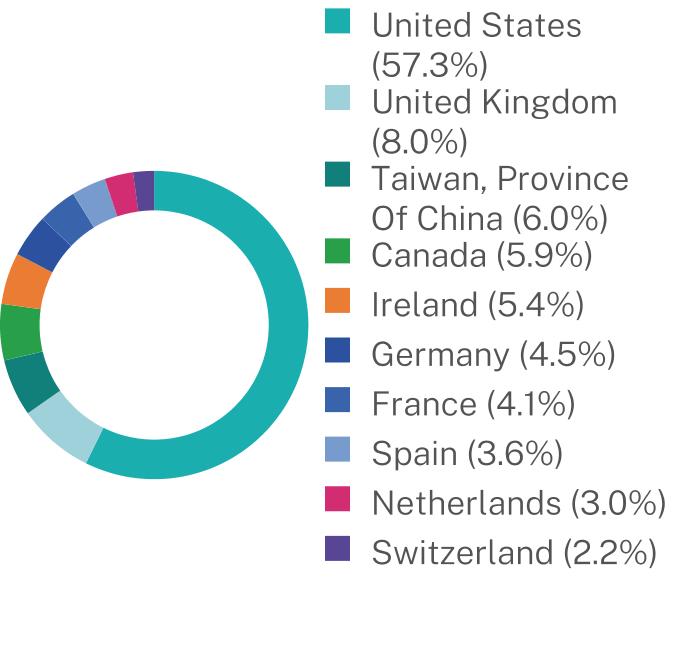

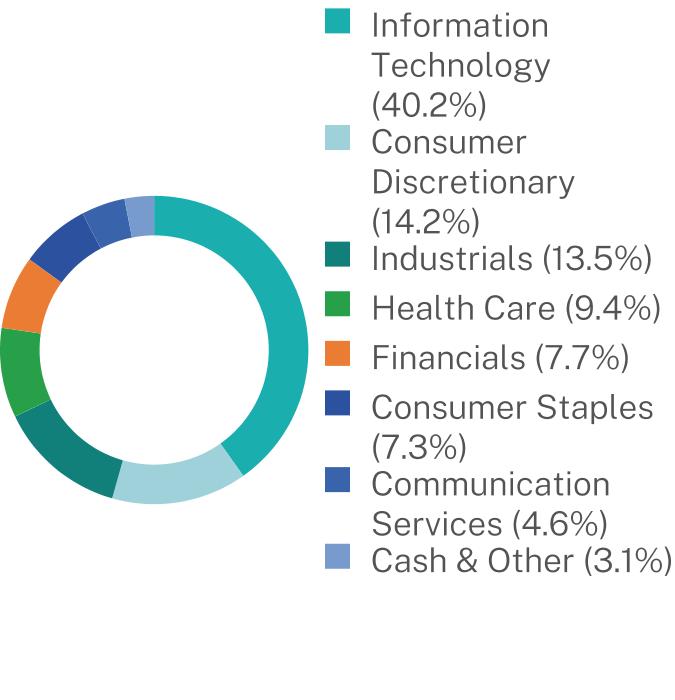

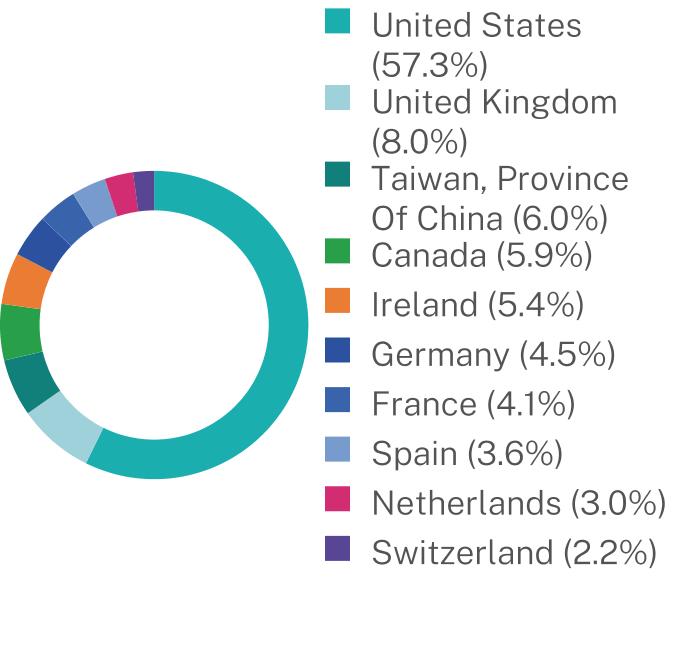

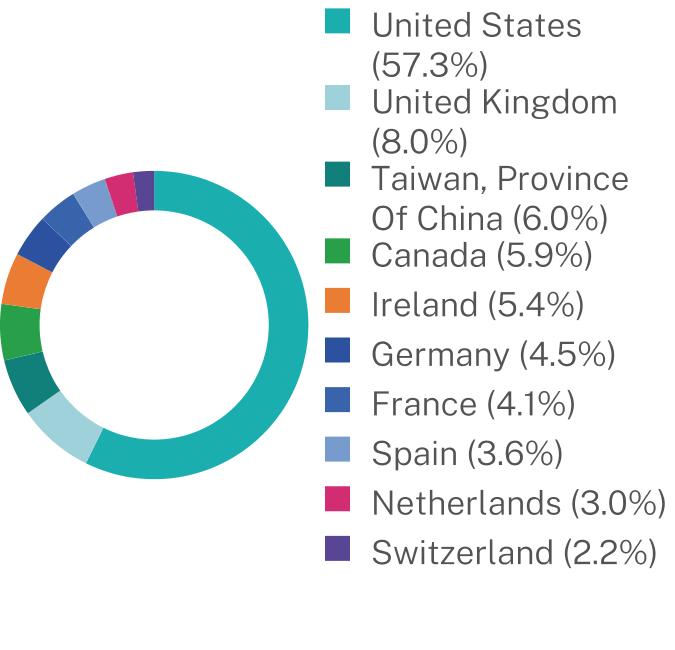

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Microsoft Corp. | 6.9% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 6.0% |

Aon PLC | 5.5% |

Accenture PLC | 5.4% |

Compass Group PLC | 4.8% |

Alphabet, Inc. | 4.6% |

Apple, Inc. | 4.5% |

SAP SE | 4.5% |

Amadeus IT Group SA | 3.6% |

PepsiCo, Inc. | 3.2% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund implemented a new investment policy consistent with the Fund’s name, of investing at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. and foreign equity securities of companies meeting the criteria for “quality” and “growth” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Global Quality Growth Fund | PAGE 2 | TSR-SAR-89834G844 |

25000027025035745034764336636740788425000027320338752636124336431645013640.214.213.59.47.77.34.63.157.38.06.05.95.44.54.13.63.02.2

| | |

| Jensen Global Quality Growth Fund | |

| Class J | JGQSX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Global Quality Growth Fund (the “Fund”) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class J | $65 | 1.25% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six-month period ended November 30, 2024, relative performance of the Jensen Global Quality Growth Fund was aided by overweight positions in the Information Technology and Industrials sectors and no positions in the Utilities, Real Estate and Materials sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Discretionary, Consumer Staples and Health Care sectors and underweight positions in the Financials and Energy sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 52.25% of Fund assets compared to 32.86% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

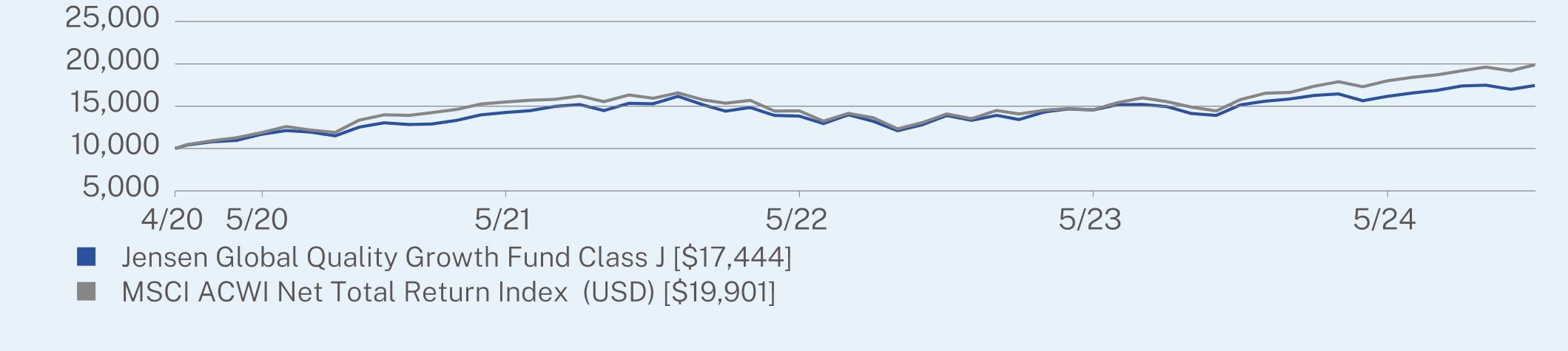

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(04/15/2020) |

Class J | 15.12 | 12.78 |

MSCI ACWI Net Total Return Index (USD) | 26.12 | 16.03 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Jensen Global Quality Growth Fund | PAGE 1 | TSR-SAR-89834G851 |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $62,643,711 |

Number of Holdings | 34 |

Portfolio Turnover | 8% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Microsoft Corp. | 6.9% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 6.0% |

Aon PLC | 5.5% |

Accenture PLC | 5.4% |

Compass Group PLC | 4.8% |

Alphabet, Inc. | 4.6% |

Apple, Inc. | 4.5% |

SAP SE | 4.5% |

Amadeus IT Group SA | 3.6% |

PepsiCo, Inc. | 3.2% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund implemented a new investment policy consistent with the Fund’s name, of investing at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. and foreign equity securities of companies meeting the criteria for “quality” and “growth” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Global Quality Growth Fund | PAGE 2 | TSR-SAR-89834G851 |

10000108101426313832145561617010000109281550114450145731800540.214.213.59.47.77.34.63.157.38.06.05.95.44.54.13.63.02.2

| | |

| Jensen Global Quality Growth Fund | |

| Class Y | JGQYX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Global Quality Growth Fund (the “Fund”) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $52 | 1.00% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six-month period ended November 30, 2024, relative performance of the Jensen Global Quality Growth Fund was aided by overweight positions in the Information Technology and Industrials sectors and no positions in the Utilities, Real Estate and Materials sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Discretionary, Consumer Staples and Health Care sectors and underweight positions in the Financials and Energy sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 52.25% of Fund assets compared to 32.86% of the MSCI ACWI Net Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(04/15/2020) |

Class Y | 15.46 | 13.07 |

MSCI ACWI Net Total Return Index (USD) | 26.12 | 16.03 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Jensen Global Quality Growth Fund | PAGE 1 | TSR-SAR-89834G869 |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $62,643,711 |

Number of Holdings | 34 |

Portfolio Turnover | 8% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Microsoft Corp. | 6.9% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 6.0% |

Aon PLC | 5.5% |

Accenture PLC | 5.4% |

Compass Group PLC | 4.8% |

Alphabet, Inc. | 4.6% |

Apple, Inc. | 4.5% |

SAP SE | 4.5% |

Amadeus IT Group SA | 3.6% |

PepsiCo, Inc. | 3.2% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund implemented a new investment policy consistent with the Fund’s name, of investing at least 80% of its net assets (plus any borrowings for investment purposes) in U.S. and foreign equity securities of companies meeting the criteria for “quality” and “growth” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Global Quality Growth Fund | PAGE 2 | TSR-SAR-89834G869 |

10000001081000143000513910451467272163377810000001092813155010514449731457262180054240.214.213.59.47.77.34.63.157.38.06.05.95.44.54.13.63.02.2

| | |

| Jensen Quality Mid Cap Fund | |

| Class I | JNVIX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Quality Mid Cap Fund (the “Fund”)(formerly, the Jensen Quality Value Fund) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class I | $43 | 0.82% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six months ended November 30, 2024, the Jensen Quality Mid Cap Fund’s performance relative to the Russell Midcap Index was aided by an overweight position in the Industrials sector and specific companies in the Consumer Staples and Health Care sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; an underweight in the Financials sector; and specific companies in the Consumer Discretionary, Information Technology, Industrials and Financials sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 44.33% of Fund assets compared to 22.15% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

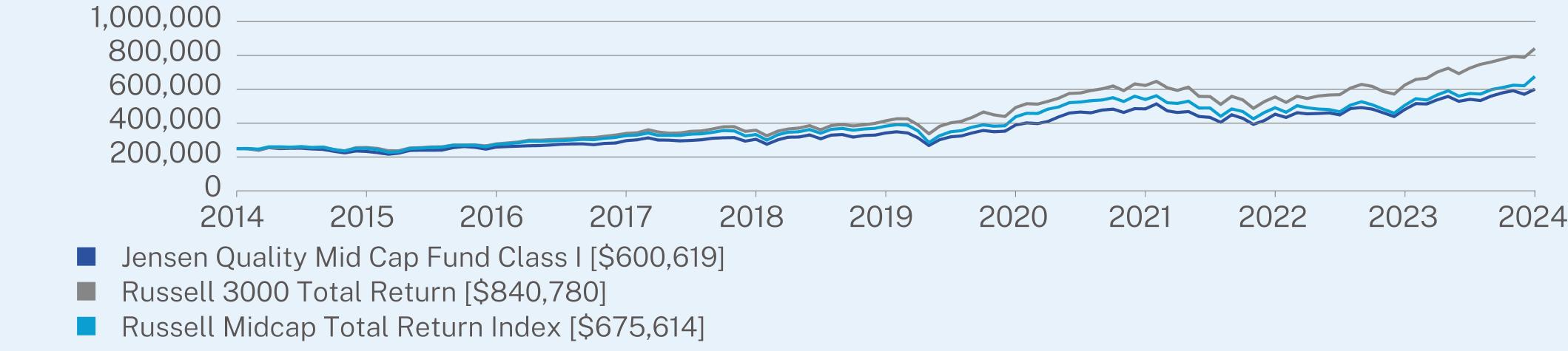

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $250,000 chart reflects a hypothetical $250,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $250,000)

| Jensen Quality Mid Cap Fund | PAGE 1 | TSR-SAR-89833W519 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class I | 24.92 | 11.93 | 9.16 |

Russell 3000 Total Return | 34.49 | 15.23 | 12.89 |

Russell Midcap Total Return Index | 33.66 | 12.05 | 10.45 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $215,347,810 |

Number of Holdings | 39 |

Portfolio Turnover | 18% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

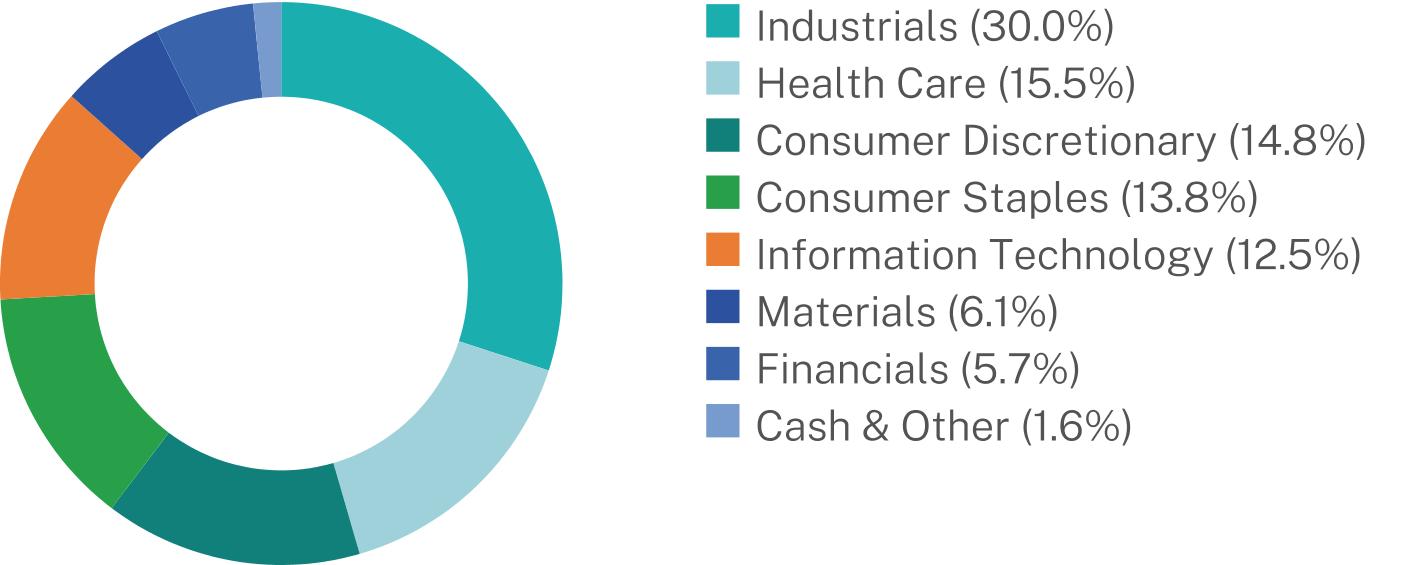

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Copart, Inc. | 4.4% |

Broadridge Financial Solutions, Inc. | 4.2% |

Labcorp Holdings, Inc. | 4.1% |

Genpact Ltd. | 3.9% |

Encompass Health Corp. | 3.9% |

Crown Holdings, Inc. | 3.9% |

Equifax, Inc. | 3.6% |

Kroger Co. | 3.4% |

Tractor Supply Co. | 3.3% |

Keysight Technologies, Inc. | 3.1% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund changed its name from the Jensen Quality Value Fund to the Jensen Quality Mid Cap Fund. In connection with the name change, the Fund incorporated into its principal investment strategies an investment policy of investing at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of companies meeting the criteria for “quality” and “mid-capitalization” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Quality Mid Cap Fund | PAGE 2 | TSR-SAR-89833W519 |

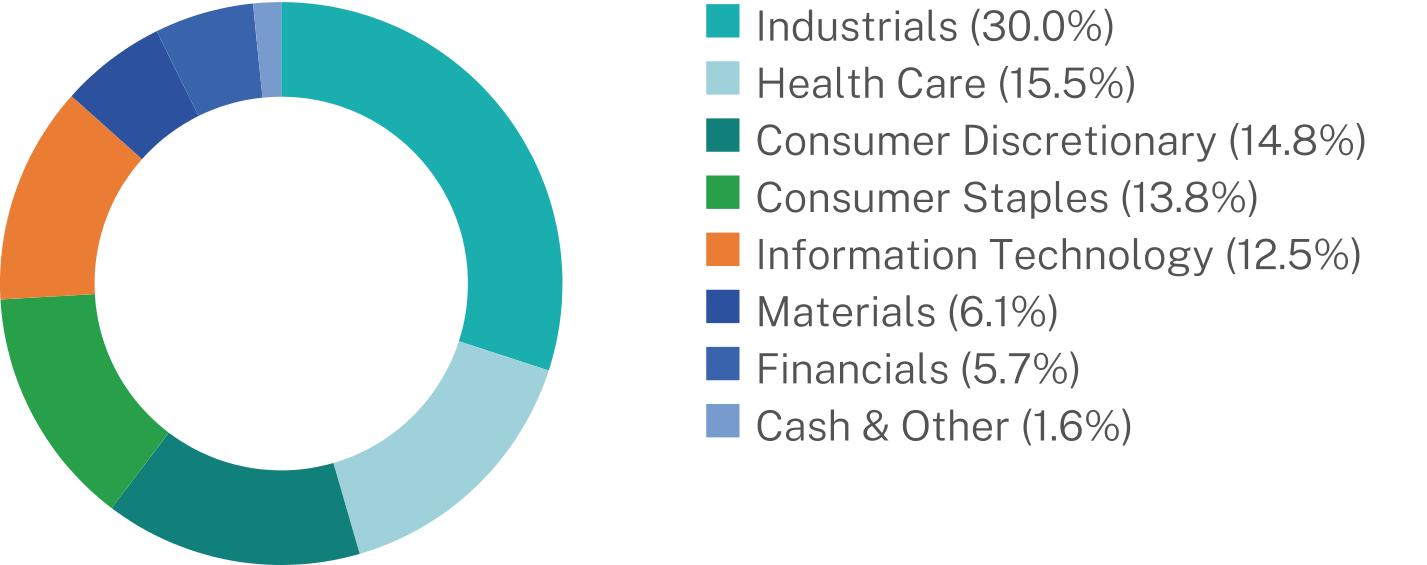

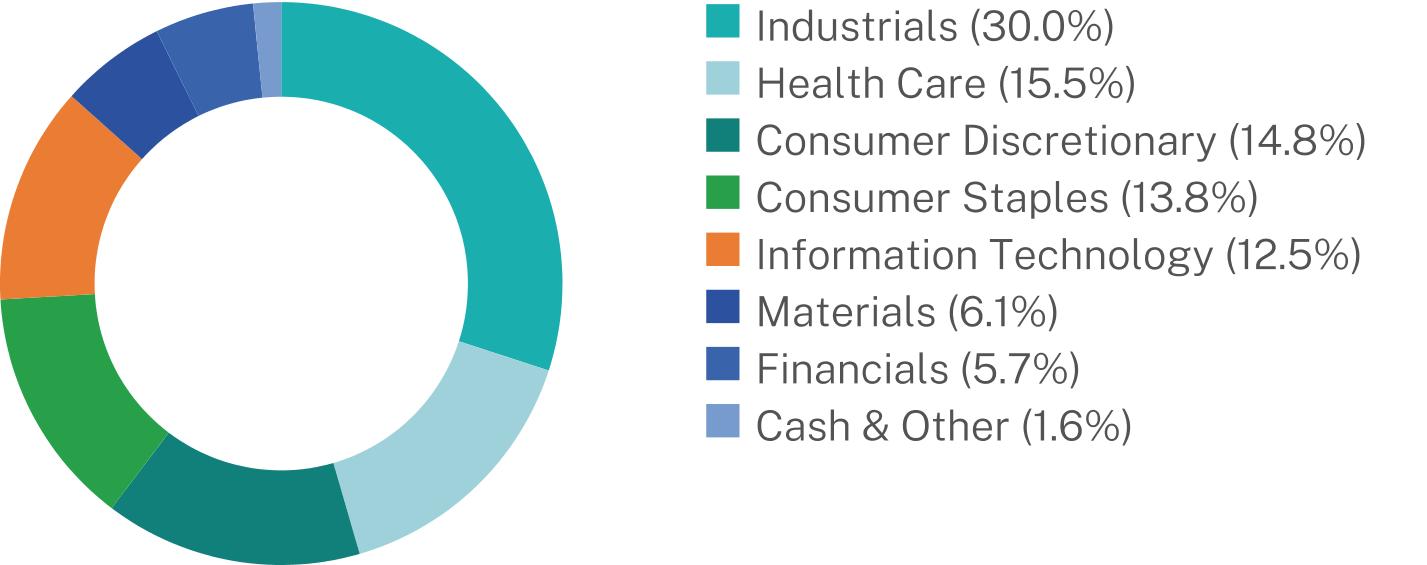

25000023329525859229690730510734195138931248444045287448079160061925000025645827776433962835839841391549265762241955518262518384078025000025115127502232661633279938257743777053973249104350545767561430.015.514.813.812.56.15.71.6

| | |

| Jensen Quality Mid Cap Fund | |

| Class J | JNVSX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Quality Mid Cap Fund (the “Fund”)(formerly, the Jensen Quality Value Fund) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class J | $56 | 1.05% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six months ended November 30, 2024, the Jensen Quality Mid Cap Fund’s performance relative to the Russell Midcap Index was aided by an overweight position in the Industrials sector and specific companies in the Consumer Staples and Health Care sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; an underweight in the Financials sector; and specific companies in the Consumer Discretionary, Information Technology, Industrials and Financials sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 44.33% of Fund assets compared to 22.15% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

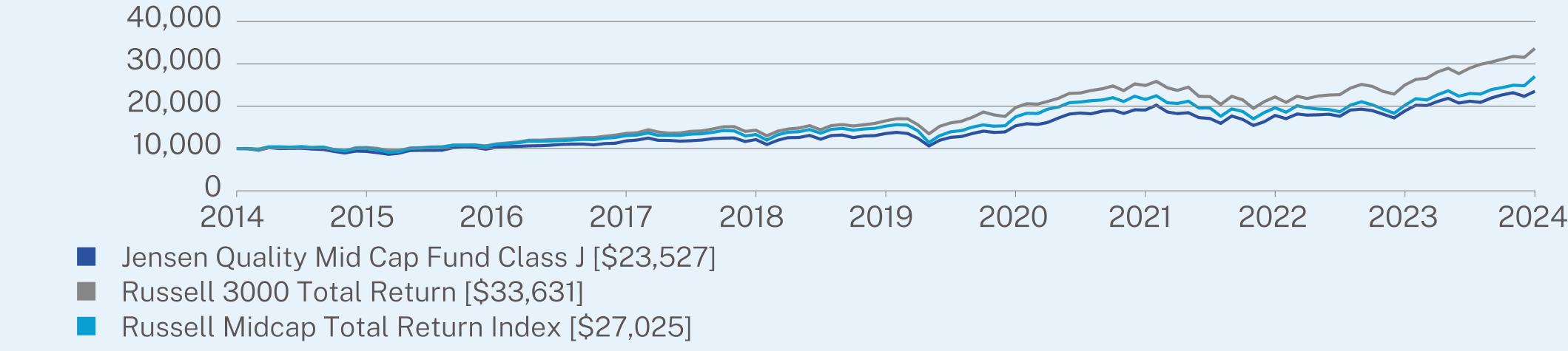

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Jensen Quality Mid Cap Fund | PAGE 1 | TSR-SAR-89833W527 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class J | 24.62 | 11.67 | 8.93 |

Russell 3000 Total Return | 34.49 | 15.23 | 12.89 |

Russell Midcap Total Return Index | 33.66 | 12.05 | 10.45 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $215,347,810 |

Number of Holdings | 39 |

Portfolio Turnover | 18% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Copart, Inc. | 4.4% |

Broadridge Financial Solutions, Inc. | 4.2% |

Labcorp Holdings, Inc. | 4.1% |

Genpact Ltd. | 3.9% |

Encompass Health Corp. | 3.9% |

Crown Holdings, Inc. | 3.9% |

Equifax, Inc. | 3.6% |

Kroger Co. | 3.4% |

Tractor Supply Co. | 3.3% |

Keysight Technologies, Inc. | 3.1% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund changed its name from the Jensen Quality Value Fund to the Jensen Quality Mid Cap Fund. In connection with the name change, the Fund incorporated into its principal investment strategies an investment policy of investing at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of companies meeting the criteria for “quality” and “mid-capitalization” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Quality Mid Cap Fund | PAGE 2 | TSR-SAR-89833W527 |

1000093161031911818121221354815388191001782518879235271000010258111111358514336165571970624897222072500733631100001004611001130651331215303175112158919642202182702530.015.514.813.812.56.15.71.6

| | |

| Jensen Quality Mid Cap Fund | |

| Class Y | JNVYX |

| Semi-Annual Shareholder Report | November 30, 2024 |

This semi-annual shareholder report contains important information about the Jensen Quality Mid Cap Fund (the “Fund”)(formerly, the Jensen Quality Value Fund) for the period of June 1, 2024 to November 30, 2024. You can find additional information about the Fund at https://www.jenseninvestment.com/reg-docs/. You can also request this information by contacting us at 1-800-992-4144. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class Y | $42 | 0.80% |

HOW DID THE FUND PERFORM OVER THE LAST SIX MONTHS AND WHAT AFFECTED ITS PERFORMANCE?

For the six months ended November 30, 2024, the Jensen Quality Mid Cap Fund’s performance relative to the Russell Midcap Index was aided by an overweight position in the Industrials sector and specific companies in the Consumer Staples and Health Care sectors. Relative performance was hindered by the Fund’s overweight positions in the Consumer Staples and Health Care sectors; an underweight in the Financials sector; and specific companies in the Consumer Discretionary, Information Technology, Industrials and Financials sectors.

During the period, the Fund continued its high allocation to high-quality companies, defined as those rated A+, A and A- by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to these highest-quality companies averaged 44.33% of Fund assets compared to 22.15% of the Russell Midcap Total Return Index. This significant overweight to quality detracted from the Fund’s relative returns during the period, which we believe were driven by increased investor risk appetite following the reductions to the U.S. federal funds rate.

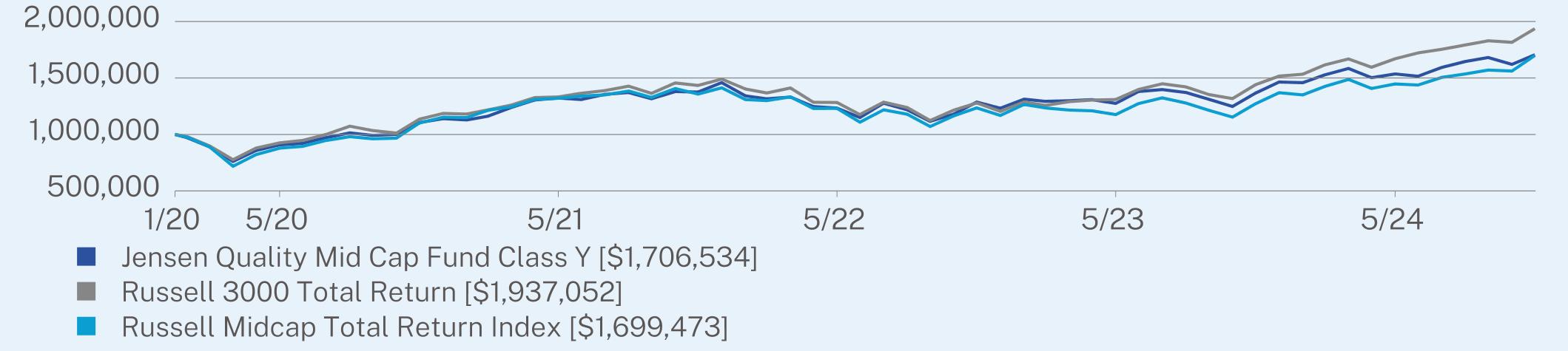

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $1,000,000 chart reflects a hypothetical $1,000,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees and shareholder servicing fees (as applicable), management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $1,000,000)

| Jensen Quality Mid Cap Fund | PAGE 1 | TSR-SAR-89834G877 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(01/15/2020) |

Class Y | 24.95 | 11.58 |

Russell 3000 Total Return | 34.49 | 14.52 |

Russell Midcap Total Return Index | 33.66 | 11.49 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $215,347,810 |

Number of Holdings | 39 |

Portfolio Turnover | 18% |

Visit https://www.jenseninvestment.com/reg-docs/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top 10 Issuers | |

Copart, Inc. | 4.4% |

Broadridge Financial Solutions, Inc. | 4.2% |

Labcorp Holdings, Inc. | 4.1% |

Genpact Ltd. | 3.9% |

Encompass Health Corp. | 3.9% |

Crown Holdings, Inc. | 3.9% |

Equifax, Inc. | 3.6% |

Kroger Co. | 3.4% |

Tractor Supply Co. | 3.3% |

Keysight Technologies, Inc. | 3.1% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus. Effective September 30, 2024, the Fund changed its name from the Jensen Quality Value Fund to the Jensen Quality Mid Cap Fund. In connection with the name change, the Fund incorporated into its principal investment strategies an investment policy of investing at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of companies meeting the criteria for “quality” and “mid-capitalization” as determined by the Adviser.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://www.jenseninvestment.com/reg-docs/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-992-4144, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Jensen Quality Mid Cap Fund | PAGE 2 | TSR-SAR-89834G877 |

10000009075891322579123356112747831535658100000092587413324401283354130946616706571000000878761132065112311861175615144729630.015.514.813.812.56.15.71.6

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Schedule of Investments

November 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS — 98.4%

| | | | | | |

Automobile Components — 2.5%

| | | | | | |

Gentex Corp. | | | 178,920 | | | $5,467,795 |

Building Products — 2.5%

| | | | | | |

Lennox International, Inc. | | | 8,200 | | | 5,470,466 |

Capital Markets — 5.7%

| | | | | | |

FactSet Research Systems, Inc. | | | 12,000 | | | 5,888,040 |

MSCI, Inc. | | | 10,350 | | | 6,309,671 |

| | | | | | 12,197,711 |

Chemicals — 2.2%

| | | | | | |

Air Products and Chemicals, Inc. | | | 13,900 | | | 4,647,187 |

Commercial Services & Supplies — 4.4%

| | | | | | |

Copart, Inc.(a) | | | 150,150 | | | 9,518,008 |

Communications Equipment — 2.7%

| | | | | | |

F5, Inc.(a) | | | 23,130 | | | 5,790,596 |

Consumer Staples Distribution & Retail — 3.4%

| | | | | | |

Kroger Co. | | | 120,630 | | | 7,368,080 |

Containers & Packaging — 3.9%

| | | | | | |

Crown Holdings, Inc. | | | 90,510 | | | 8,335,066 |

Distributors — 1.8%

| | | | | | |

Genuine Parts Co. | | | 30,330 | | | 3,843,721 |

Electronic Equipment, Instruments & Components — 4.1%

| | | | | | |

Amphenol Corp. - Class A | | | 31,110 | | | 2,260,142 |

Keysight Technologies, Inc.(a) | | | 39,010 | | | 6,664,468 |

| | | | | | 8,924,610 |

Food Products — 4.7%

| | | | | | |

General Mills, Inc. | | | 75,940 | | | 5,031,784 |

The Campbell’s Co. | | | 110,270 | | | 5,094,474 |

| | | | | | 10,126,258 |

Health Care Equipment & Supplies — 2.9%

| | | | | | |

Hologic, Inc.(a) | | | 31,400 | | | 2,496,300 |

IDEXX Laboratories, Inc.(a) | | | 9,020 | | | 3,804,185 |

| | | | | | 6,300,485 |

Health Care Providers & Services — 8.0%

| | | | | | |

Encompass Health Corp. | | | 81,730 | | | 8,413,286 |

Labcorp Holdings, Inc. | | | 36,590 | | | 8,824,045 |

| | | | | | 17,237,331 |

Health Care Technology — 2.7%

| | | | | | |

Veeva Systems, Inc. - Class A(a) | | | 25,211 | | | 5,744,326 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Household Products — 5.7%

| | | | | | |

Church & Dwight Co., Inc. | | | 56,010 | | | $6,168,381 |

Clorox Co. | | | 36,530 | | | 6,106,720 |

| | | | | | 12,275,101 |

Life Sciences Tools & Services — 1.9%

| | | | | | |

Bio-Techne Corp. | | | 54,760 | | | 4,126,714 |

Machinery — 4.4%

| | | | | | |

Donaldson Co., Inc. | | | 71,210 | | | 5,557,941 |

Toro Co. | | | 45,550 | | | 3,966,494 |

| | | | | | 9,524,435 |

Professional Services — 18.7%

| | | | | | |

Booz Allen Hamilton Holding Corp. | | | 44,370 | | | 6,574,747 |

Broadridge Financial Solutions, Inc. | | | 38,609 | | | 9,112,496 |

Equifax, Inc. | | | 30,000 | | | 7,846,800 |

Genpact Ltd. | | | 183,180 | | | 8,455,589 |

Maximus, Inc. | | | 44,220 | | | 3,294,390 |

Verisk Analytics, Inc. | | | 16,540 | | | 4,866,233 |

| | | | | | 40,150,255 |

Semiconductors & Semiconductor Equipment — 3.1%

| | | | | | |

Microchip Technology, Inc. | | | 46,850 | | | 3,193,764 |

ON Semiconductor Corp.(a) | | | 47,840 | | | 3,402,381 |

| | | | | | 6,596,145 |

Software — 2.6%

| | | | | | |

Manhattan Associates, Inc.(a) | | | 19,530 | | | 5,574,643 |

Specialty Retail — 8.9%

| | | | | | |

Best Buy Co., Inc. | | | 47,710 | | | 4,293,900 |

Ross Stores, Inc. | | | 35,970 | | | 5,570,674 |

Tractor Supply Co. | | | 25,230 | | | 7,156,994 |

Ulta Beauty, Inc.(a) | | | 5,380 | | | 2,080,123 |

| | | | | | 19,101,691 |

Textiles, Apparel & Luxury Goods — 1.6%

| | | | | | |

Levi Strauss & Co. - Class A | | | 200,970 | | | 3,508,936 |

TOTAL COMMON STOCKS

(Cost $162,988,626) | | | | | | 211,829,560 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS — 1.6%

| | | | | | |

Money Market Funds — 1.6%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.55%(b) | | | 3,426,550 | | | $3,426,550 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,426,550) | | | | | | 3,426,550 |

TOTAL INVESTMENTS — 100.0%

(Cost $166,415,176) | | | | | | $215,256,110 |

Other Assets in Excess of Liabilities — 0.0%(c) | | | | | | 91,700 |

TOTAL NET ASSETS — 100.0% | | | | | | $215,347,810 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of November 30, 2024. |

(c)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Global Quality Growth Fund

Schedule of Investments

November 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS — 97.0%

| | | | | | |

Canada — 5.9%

| | | | | | |

Alimentation Couche-Tard, Inc. | | | 9,400 | | | $549,948 |

Canadian National Railway Co. | | | 16,060 | | | 1,793,379 |

Constellation Software, Inc./Canada | | | 400 | | | 1,352,569 |

| | | | | | 3,695,896 |

France — 4.1%

| | | | | | |

Dassault Systemes SE | | | 18,480 | | | 637,870 |

Hermes International SCA | | | 890 | | | 1,942,534 |

| | | | | | 2,580,404 |

Germany — 4.5%

| | | | | | |

SAP SE | | | 11,780 | | | 2,797,341 |

Ireland — 5.4%

| | | | | | |

Accenture PLC - Class A | | | 9,390 | | | 3,402,654 |

Netherlands — 3.0%

| | | | | | |

ASML Holding NV | | | 2,700 | | | 1,844,930 |

Spain — 3.6%

| | | | | | |

Amadeus IT Group SA | | | 31,700 | | | 2,226,302 |

Switzerland — 2.2%

| | | | | | |

Nestle SA | | | 16,180 | | | 1,405,067 |

Taiwan — 6.0%

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 20,420 | | | 3,770,757 |

United Kingdom — 8.0%

| | | | | | |

AstraZeneca PLC | | | 9,970 | | | 1,349,377 |

Compass Group PLC | | | 87,650 | | | 3,003,200 |

Diageo PLC | | | 21,720 | | | 648,876 |

| | | | | | 5,001,453 |

United States — 54.3%(a)

| | | | | | |

Alphabet, Inc. - Class A | | | 16,950 | | | 2,863,702 |

Aon PLC - Class A | | | 8,830 | | | 3,457,298 |

Apple, Inc. - Class A | | | 11,860 | | | 2,814,734 |

Automatic Data Processing, Inc. | | | 6,230 | | | 1,912,174 |

Broadridge Financial Solutions, Inc. | | | 5,170 | | | 1,220,223 |

Copart, Inc.(b) | | | 23,500 | | | 1,489,665 |

Equifax, Inc. | | | 5,230 | | | 1,367,959 |

Intuit, Inc. | | | 2,790 | | | 1,790,427 |

KLA Corp. | | | 1,990 | | | 1,287,590 |

Marriott International, Inc./MD - Class A | | | 3,190 | | | 922,197 |

Mastercard, Inc. - Class A | | | 2,580 | | | 1,374,985 |

Microsoft Corp. | | | 10,140 | | | 4,293,884 |

NIKE, Inc. - Class B | | | 10,090 | | | 794,789 |

PepsiCo, Inc. | | | 12,150 | | | 1,985,918 |

Stryker Corp. | | | 3,260 | | | 1,278,409 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Global Quality Growth Fund

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

|

United States — (Continued)

|

Texas Instruments, Inc. | | | 5,750 | | | $1,155,923 |

UnitedHealth Group, Inc. | | | 2,640 | | | 1,610,928 |

Verisk Analytics, Inc. | | | 2,340 | | | 688,451 |

Zoetis, Inc. | | | 9,580 | | | 1,678,895 |

| | | | | | 33,988,151 |

TOTAL COMMON STOCKS

(Cost $45,772,327) | | | | | | 60,712,955 |

SHORT-TERM INVESTMENTS — 3.0%

| | | | | | |

Money Market Funds — 3.0%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.55%(c) | | | 1,903,376 | | | 1,903,376 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,903,376) | | | | | | 1,903,376 |

TOTAL INVESTMENTS — 100.0%

(Cost $47,675,703) | | | | | | $62,616,331 |

Other Assets in Excess of Liabilities — 0.0%(d) | | | | | | 27,380 |

TOTAL NET ASSETS — 100.0% | | | | | | $62,643,711 |

| | | | | | | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

NV - Naamloze Vennootschap

PLC - Public Limited Company

SA - Sociedad Anónima

SCA - Societe en commandite par actions

SE - Societas Europeae

(a)

| To the extent that the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is more likely to be impacted by events or conditions affecting the country or region.

|

(b)

| Non-income producing security.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of November 30, 2024.

|

(d)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Growth ETF

Schedule of Investments

November 30, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS — 98.5%

| | | | | | |

Beverages — 3.4%

| | | | | | |

PepsiCo, Inc. | | | 14,336 | | | $2,343,219 |

Chemicals — 1.8%

| | | | | | |

Sherwin-Williams Co. | | | 3,072 | | | 1,220,813 |

Commercial Services & Supplies — 4.8%

| | | | | | |

Copart, Inc.(a) | | | 20,272 | | | 1,285,042 |

Waste Management, Inc. | | | 8,704 | | | 1,986,427 |

| | | | | | 3,271,469 |

Containers & Packaging — 1.3%

| | | | | | |

Ball Corp. | | | 14,080 | | | 875,213 |

Electronic Equipment, Instruments & Components — 1.9%

| | | | | | |

Amphenol Corp. - Class A | | | 17,408 | | | 1,264,691 |

Financial Services — 4.4%

| | | | | | |

Mastercard, Inc. - Class A | | | 5,632 | | | 3,001,518 |

Health Care Equipment & Supplies — 6.0%

| | | | | | |

Stryker Corp. | | | 10,509 | | | 4,121,104 |

Health Care Providers & Services — 3.9%

| | | | | | |

UnitedHealth Group, Inc. | | | 4,352 | | | 2,655,590 |

Hotels, Restaurants & Leisure — 1.6%

| | | | | | |

McDonald’s Corp. | | | 3,584 | | | 1,060,900 |

Household Products — 2.8%

| | | | | | |

Procter & Gamble Co. | | | 10,496 | | | 1,881,513 |

Insurance — 6.1%

| | | | | | |

Marsh & McLennan Cos., Inc. | | | 17,920 | | | 4,179,482 |

Interactive Media & Services — 5.4%

| | | | | | |

Alphabet, Inc. - Class A | | | 21,814 | | | 3,685,475 |

IT Services — 7.1%

| | | | | | |

Accenture PLC - Class A | | | 13,325 | | | 4,828,580 |

Pharmaceuticals — 5.7%

| | | | | | |

Johnson & Johnson | | | 10,496 | | | 1,626,985 |

Zoetis, Inc. | | | 12,806 | | | 2,244,251 |

| | | | | | 3,871,236 |

Professional Services — 12.2%

| | | | | | |

Automatic Data Processing, Inc. | | | 9,728 | | | 2,985,816 |

Broadridge Financial Solutions, Inc. | | | 9,472 | | | 2,235,581 |

Equifax, Inc. | | | 6,921 | | | 1,810,257 |

Verisk Analytics, Inc. | | | 4,608 | | | 1,355,720 |

| | | | | | 8,387,374 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Growth ETF

Schedule of Investments

November 30, 2024 (Unaudited)(Continued)

| | | | | | | | |

COMMON STOCKS — (Continued)

| |

Semiconductors & Semiconductor Equipment — 6.1%

| | | | | | | |

KLA Corp. | | | 3,072 | | | $1,987,676 | |

Texas Instruments, Inc. | | | 10,810 | | | 2,173,134 | |

| | | | | | 4,160,810 | |

Software — 12.6%

| | | | | | | |

Intuit, Inc. | | | 5,888 | | | 3,778,507 | |

Microsoft Corp. | | | 11,581 | | | 4,904,091 | |

| | | | | | 8,682,598 | |

Specialty Retail — 1.8%

| | | | | | | |

Home Depot, Inc. | | | 2,816 | | | 1,208,430 | |

Technology Hardware, Storage & Peripherals — 7.3%

| | | | | | | |

Apple, Inc. - Class A | | | 21,300 | | | 5,055,129 | |

Textiles, Apparel & Luxury Goods — 2.3%

| | | | | | | |

NIKE, Inc. - Class B | | | 19,737 | | | 1,554,683 | |

TOTAL COMMON STOCKS

(Cost $65,926,284) | | | | | | 67,309,827 | | | |

SHORT-TERM INVESTMENTS — 1.5%

| | | | | | | |

Money Market Funds — 1.5%

| | | | | | | |

First American Treasury Obligations Fund - Class X, 4.55%(b) | | | 995,803 | | | 995,803 | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $995,803) | | | | | | 995,803 | |

TOTAL INVESTMENTS — 100.0%

(Cost $66,922,087) | | | | | | $68,305,630 | |

Other Assets in Excess of Liabilities — 0.0%(c) | | | | | | 21,344 | |

TOTAL NET ASSETS — 100.0% | | | | | | $68,326,974 | | | |

| | | | | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| The rate shown represents the 7-day annualized effective yield as of November 30, 2024.

|

(c)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets & Liabilities

November 30, 2024 (Unaudited)

| | | | | | | | | | |

Assets:

| | | | | | | | | |

Investments, at value (cost $166,415,176, $47,675,703 and $66,922,087) | | | $215,256,110 | | | $62,616,331 | | | $68,305,630 |

Income receivable | | | 199,879 | | | 59,595 | | | 43,064 |

Receivable for capital stock issued | | | 18,741 | | | 6,631 | | | — |

Other assets | | | 20,264 | | | 8,701 | | | — |

Total Assets | | | 215,494,994 | | | 62,691,258 | | | 68,348,694 |

Liabilities:

| | | | | | | | | |

Payable for capital stock redeemed | | | 967 | | | — | | | — |

Payable for 12b-1 fees - Class J | | | 13,317 | | | 3,123 | | | — |

Payable to adviser | | | 100,647 | | | 26,724 | | | 21,720 |

Payable to affiliates | | | 27,350 | | | 14,260 | | | — |

Accrued expenses and other liabilities | | | 4,903 | | | 3,440 | | | — |

Total Liabilities | | | 147,184 | | | 47,547 | | | 21,720 |

NET ASSETS | | | $ 215,347,810 | | | $62,643,711 | | | $68,326,974 |

Net Assets Consist of:

| | | | | | | | | |

Capital stock | | | $164,912,085 | | | $48,371,591 | | | $66,869,458 |

Total distributable earnings | | | 50,435,725 | | | 14,272,120 | | | 1,457,516 |

Total Net Assets | | | $ 215,347,810 | | | $62,643,711 | | | $68,326,974 |

Net Assets Consist of:

| | | | | | | | | |

Class J Shares:

| | | | | | | | | |

Net Assets | | | $32,275,220 | | | $2,637,402 | | | N/A |

Shares of beneficial interest outstanding | | | 1,618,052 | | | 153,389 | | | N/A |

Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | | | $19.95 | | | $17.19 | | | N/A |

Class I Shares:

| | | | | | | | | |

Net Assets | | | $103,633,644 | | | $3,066,115 | | | N/A |

Shares of beneficial interest outstanding | | | 5,210,099 | | | 178,279 | | | N/A |

Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | | | $19.89 | | | $17.20 | | | N/A |

Class Y Shares:

| | | | | | | | | |

Net Assets | | | $79,438,946 | | | $56,940,194 | | | N/A |

Shares of beneficial interest outstanding | | | 4,003,501 | | | 3,309,231 | | | N/A |

Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | | | $19.84 | | | $17.21 | | | N/A |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets & Liabilities

November 30, 2024 (Unaudited)(Continued)

| | | | | | | | | | |

Total Fund Shares:

| | | | | | | | | |

Net Assets | | | N/A | | | N/A | | | $68,326,974 |

Shares of beneficial interest outstanding | | | N/A | | | N/A | | | 2,530,000 |

Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | | | N/A | | | N/A | | | $27.01 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Operations

For the Six Months Ended November 30, 2024 (Unaudited)

| | | | | | | | | | |

Investment Income:

| | | | | | | | | |

Dividend income | | | $1,380,393 | | | $325,358(1) | | | $98,835 |

Interest income | | | 80,169 | | | 17,594 | | | 5,176 |

Total investment income | | | 1,460,562 | | | 342,952 | | | 104,011 |

Expenses:

| | | | | | | | | |

Investment management fees | | | 667,891 | | | 222,692 | | | 46,046 |

12b-1 fees - Class J | | | 38,827 | | | 3,242 | | | — |

Administration fees | | | 26,126 | | | 12,767 | | | — |

Federal and state registration fees | | | 24,870 | | | 31,188 | | | — |

Transfer agent fees | | | 23,241 | | | 22,692 | | | — |

Fund accounting fees | | | 22,134 | | | 14,346 | | | — |

Transfer agent expenses | | | 15,111 | | | 2,739 | | | — |

Trustees’ fees | | | 14,751 | | | 14,751 | | | — |

Reports to shareholders | | | 14,103 | | | 2,085 | | | — |

Legal fees | | | 12,303 | | | 7,905 | | | — |

Shareholder servicing fees - Class I | | | 9,885 | | | 299 | | | — |

Audit and tax fees | | | 9,552 | | | 10,101 | | | — |

Chief Compliance Officer fees | | | 6,222 | | | 6,222 | | | — |

Custody fees | | | 4,378 | | | 5,941 | | | — |

Insurance expense | | | 1,902 | | | 1,131 | | | — |

Other | | | 4,557 | | | 4,879 | | | — |

Total expenses | | | 895,853 | | | 362,980 | | | 46,046 |

Less waivers and reimbursements by Adviser (Note 4) | | | (25,121) | | | (62,375) | | | — |

Net expenses | | | 870,732 | | | 300,605 | | | 46,046 |

Net Investment Income | | | 589,830 | | | 42,347 | | | 57,965 |

Realized and Unrealized Gain (Loss) on Investments:

| | | | | | | | | |

Net realized gain (loss) on:

| | | | | | | | | |

Investments | | | (3,009,589) | | | 129,782 | | | 29,998 |

Foreign currency translations | | | — | | | (10,142) | | | — |

Change in unrealized appreciation (depreciation) on:

| | | | | | | | | |

Investments | | | 12,802,012 | | | 4,346,503 | | | 1,383,543 |

Foreign currency translations | | | — | | | (246) | | | — |

Net realized and unrealized gain on investments | | | 9,792,423 | | | 4,465,897 | | | 1,413,541 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $10,382,253 | | | $4,508,244 | | | $1,471,506 |

| | | | | | | | | | |

(1)

| Net of $12,897 in dividend withholding tax.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Changes in Net Assets

| | | | |

Operations:

| | | | | | |

Net investment income | | | $589,830 | | | $1,020,387 |

Net realized gain (loss) on investment transactions | | | (3,009,589) | | | 10,038,843 |

Change in unrealized appreciation on investments | | | 12,802,012 | | | 23,061,829 |

Net increase in net assets resulting from operations | | | 10,382,253 | | | 34,121,059 |

Capital Share Transactions:

| | | | | | |

Shares sold - Class J | | | 2,624,818 | | | 4,877,402 |

Shares sold - Class I | | | 7,269,578 | | | 23,201,589 |

Shares sold - Class Y | | | 1,322,459 | | | 7,384,040 |

Shares issued to holders in reinvestment of dividends - Class J | | | 1,781,368 | | | 127,590 |

Shares issued to holders in reinvestment of dividends - Class I | | | 5,844,111 | | | 615,383 |

Shares issued to holders in reinvestment of dividends - Class Y | | | 4,523,483 | | | 413,459 |

Shares redeemed - Class J | | | (3,783,382) | | | (8,497,401) |

Shares redeemed - Class I | | | (8,433,262) | | | (39,910,116) |

Shares redeemed - Class Y | | | (1,943,172) | | | (1,917,674) |

Net increase (decrease) in net assets from capital share transactions | | | 9,206,001 | | | (13,705,728) |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Net dividends and distributions to shareholders - Class J | | | (70,778) | | | (127,762) |

Net dividends and distributions to shareholders - Class I | | | (407,928) | | | (615,532) |

Net dividends and distributions to shareholders - Class Y | | | (325,112) | | | (413,459) |

Total dividends and distributions | | | (803,818) | | | (1,156,753) |

Increase in net assets | | | 18,784,436 | | | 19,258,578 |

NET ASSETS:

| | | | | | |

Beginning of period | | | $ 196,563,374 | | | $177,304,796 |

End of period | | | $ 215,347,810 | | | $196,563,374 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Changes in Net Assets

| | | | |

Operations:

| | | | | | |

Net investment income | | | $42,347 | | | $269,867 |

Net realized gain (loss) on:

| | | | | | |

Investments | | | 129,782 | | | (48,633) |

Foreign currency translations | | | (10,142) | | | (7,026) |

Change in unrealized appreciation (depreciation) on:

| | | | | | |

Investments | | | 4,346,503 | | | 4,941,399 |

Foreign currency translations | | | (246) | | | 740 |

Net increase in net assets resulting from operations | | | 4,508,244 | | | 5,156,347 |

Capital Share Transactions:

| | | | | | |

Shares sold - Class J | | | 13,167 | | | 352,493 |

Shares sold - Class I | | | 54,891 | | | 339,476 |

Shares sold - Class Y | | | 2,969,275 | | | 7,010,224 |

Shares issued to holders in reinvestment of dividends - Class J | | | 2,552 | | | 7,556 |

Shares issued to holders in reinvestment of dividends - Class I | | | 6,233 | | | 12,125 |

Shares issued to holders in reinvestment of dividends - Class Y | | | 115,976 | | | 231,210 |

Shares redeemed - Class J | | | (51,413) | | | (600,250) |

Shares redeemed - Class I | | | (28,391) | | | (22,254) |

Shares redeemed - Class Y | | | (432,299) | | | (936,710) |

Net increase in net assets from capital share transactions | | | 2,649,991 | | | 6,393,870 |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Net dividends and distributions to shareholders - Class J | | | (2,552) | | | (7,562) |

Net dividends and distributions to shareholders - Class I | | | (6,233) | | | (12,125) |

Net dividends and distributions to shareholders - Class Y | | | (115,977) | | | (231,209) |

Total dividends and distributions | | | (124,762) | | | (250,896) |

Increase in net assets | | | 7,033,473 | | | 11,299,321 |

NET ASSETS:

| | | | | | |

Beginning of period | | | $ 55,610,238 | | | $44,310,917 |

End of period | | | $62,643,711 | | | $55,610,238 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Changes in Net Assets

| | | | |

Operations:

| | | |

Net investment income | | | $57,965 |

Net realized gain on investment transactions | | | 29,998 |

Change in unrealized appreciation on investments | | | 1,383,543 |

Net increase in net assets resulting from operations | | | 1,471,506 |

Capital Share Transactions:

| | | |

Shares sold | | | 67,677,400 |

Shares redeemed | | | (807,942) |

Net increase in net assets from capital share transactions | | | 66,869,458 |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS:

| | | |

Net dividends and distributions to shareholders | | | (13,990) |

Total dividends and distributions | | | (13,990) |

Increase in net assets | | | 68,326,974 |

NET ASSETS:

| | | |

Beginning of period | | | $— |

End of period | | | $ 68,326,974 |

| | | | |

(1)

| The Fund commenced operations on August 12, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Financial Highlights

Class J

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $19.01 | | | $15.89 | | | $15.85 | | | $17.47 | | | $12.17 | | | $ 12.24 |

Income (loss) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.04 | | | 0.06 | | | 0.08 | | | 0.05 | | | 0.06 | | | 0.08 |

Net realized and unrealized gain (loss) on investments | | | 0.93 | | | 3.13 | | | 0.40 | | | (1.21) | | | 5.43 | | | 0.41 |

Total from investment operations | | | 0.97 | | | 3.19 | | | 0.48 | | | (1.16) | | | 5.49 | | | 0.49 |

Less distributions:

| | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.03) | | | (0.07) | | | (0.06) | | | (0.04) | | | (0.06) | | | (0.08) |

Distributions from net realized gain on investments | | | — | | | — | | | (0.38) | | | (0.42) | | | (0.13) | | | (0.48) |

Total distributions | | | (0.03) | | | (0.07) | | | (0.44) | | | (0.46) | | | (0.19) | | | (0.56) |

Net asset value, end of period | | | $19.95 | | | $19.01 | | | $15.89 | | | $15.85 | | | $17.47 | | | $ 12.17 |

Total return(2) | | | 11.02% | | | 20.14% | | | 3.12% | | | −6.98% | | | 45.37% | | | 3.72% |

Supplemental data and ratios:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 32,275 | | | $ 30,191 | | | $ 28,366 | | | $ 38,942 | | | $ 37,105 | | | $ 6,569 |

Ratio of expenses to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 1.07% | | | 1.08% | | | 1.10% | | | 1.11% | | | 1.25% | | | 1.57% |

After waivers and reimbursements of expenses(3) | | | 1.05% | | | 1.05% | | | 1.05% | | | 1.05% | | | 1.05% | | | 1.05% |

Ratio of net investment income to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 0.35% | | | 0.32% | | | 0.47% | | | 0.25% | | | 0.18% | | | 0.16% |

After waivers and reimbursements of expenses(3) | | | 0.37% | | | 0.35% | | | 0.52% | | | 0.31% | | | 0.38% | | | 0.68% |

Portfolio turnover rate(2) | | | 17.68% | | | 24.92% | | | 15.57% | | | 17.78% | | | 18.15% | | | 36.19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Per share amounts are calculated using the average shares outstanding method.

|

(2)

| Not annualized for periods less than one year.

|

(3)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Financial Highlights

Class I

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $18.98 | | | $15.86 | | | $15.81 | | | $17.43 | | | $12.13 | | | $ 12.18 |

Income (loss) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(1) | | | 0.06 | | | 0.10 | | | 0.12 | | | 0.09 | | | 0.09 | | | 0.12 |

Net realized and unrealized gain (loss) on investments | | | 0.90 | | | 3.13 | | | 0.40 | | | (1.21) | | | 5.42 | | | 0.39 |

Total from investment operations | | | 0.96 | | | 3.23 | | | 0.52 | | | (1.12) | | | 5.51 | | | 0.51 |

Less distributions:

| | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.05) | | | (0.11) | | | (0.09) | | | (0.08) | | | (0.08) | | | (0.08) |

Distributions from net realized gain on investments | | | — | | | — | | | (0.38) | | | (0.42) | | | (0.13) | | | (0.48) |

Total distributions | | | (0.05) | | | (0.11) | | | (0.47) | | | (0.50) | | | (0.21) | | | (0.56) |

Net asset value, end of period | | | $19.89 | | | $18.98 | | | $15.86 | | | $15.81 | | | $17.43 | | | $ 12.13 |

Total return(2) | | | 11.08% | | | 20.45% | | | 3.38% | | | −6.79% | | | 45.80% | | | 3.88% |

Supplemental data and ratios:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 103,634 | | | $ 94,339 | | | $ 93,813 | | | $ 104,867 | | | $ 44,113 | | | $ 2,491 |

Ratio of expenses to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 0.84% | | | 0.85% | | | 0.87% | | | 0.88% | | | 1.00% | | | 1.23% |

After waivers and reimbursements of expenses(3) | | | 0.82% | | | 0.82% | | | 0.82% | | | 0.82% | | | 0.82% | | | 0.82% |

Ratio of net investment income to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(3) | | | 0.58% | | | 0.54% | | | 0.70% | | | 0.50% | | | 0.42% | | | 0.51% |

After waivers and reimbursements of expenses(3) | | | 0.60% | | | 0.57% | | | 0.75% | | | 0.56% | | | 0.60% | | | 0.92% |

Portfolio turnover rate(2) | | | 17.68% | | | 24.92% | | | 15.57% | | | 0.18% | | | 18.15% | | | 36.19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Per share amounts are calculated using the average shares outstanding method.

|

(2)

| Not annualized for periods less than one year. |

(3)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Quality Mid Cap Fund

Financial Highlights

Class Y

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $18.93 | | | $15.82 | | | $15.78 | | | $17.39 | | | $12.11 | | | $13.38 |

Income (LOSS) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(2) | | | 0.06 | | | 0.11 | | | 0.12 | | | 0.09 | | | 0.10 | | | 0.04 |

Net realized and unrealized gain (loss) on investments | | | 0.90 | | | 3.12 | | | 0.39 | | | (1.20) | | | 5.40 | | | (1.28) |

Total from investment operations | | | 0.96 | | | 3.23 | | | 0.51 | | | (1.11) | | | 5.50 | | | (1.24) |

Less distributions:

| | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.05) | | | (0.12) | | | (0.09) | | | (0.08) | | | (0.09) | | | (0.03) |

Distributions from net realized gain on investments | | | — | | | — | | | (0.38) | | | (0.42) | | | (0.13) | | | — |

Total distributions | | | (0.05) | | | (0.12) | | | (0.47) | | | (0.50) | | | (0.22) | | | (0.03) |

Net asset value, end of period | | | $19.84 | | | $18.93 | | | $15.82 | | | $15.78 | | | $17.39 | | | $12.11 |

Total return(3) | | | 11.13% | | | 20.46% | | | 3.34% | | | −6.73% | | | 45.72% | | | −9.24% |

Supplemental data and ratios:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 79,439 | | | $ 72,033 | | | $ 55,126 | | | $ 57,196 | | | $ 50,693 | | | $ 35,326 |

Ratio of expenses to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | 0.82% | | | 0.83% | | | 0.85% | | | 0.86% | | | 1.05% | | | 1.52% |

After waivers and reimbursements of expenses(4) | | | 0.80% | | | 0.80% | | | 0.80% | | | 0.80% | | | 0.80% | | | 0.80% |

Ratio of net investment income to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | 0.60% | | | 0.56% | | | 0.73% | | | 0.50% | | | 0.40% | | | 0.23% |

After waivers and reimbursements of expenses(4) | | | 0.62% | | | 0.59% | | | 0.78% | | | 0.56% | | | 0.65% | | | 0.95% |

Portfolio turnover rate(3) | | | 17.68% | | | 24.92% | | | 15.57% | | | 17.78% | | | 18.15% | | | 36.19% |

| | | | | | | | | | | | | | | | | | | |

(1)

| Class Y shares commenced operations on January 15, 2020.

|

(2)

| Per share amounts are calculated using the average shares outstanding method.

|

(3)

| Not annualized for periods less than one year.

|

(4)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Global Quality Growth Fund

Financial Highlights

Class J

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 15.95 | | | $ 14.40 | | | $ 13.73 | | | $14.20 | | | $ 10.81 | | | $10.00 |

Income (LOSS) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss)(2) | | | (0.01) | | | 0.04 | | | 0.05 | | | 0.05 | | | 0.06 | | | 0.02 |

Net realized and unrealized gain (loss) on investments | | | 1.27 | | | 1.55 | | | 0.66 | | | (0.48) | | | 3.38 | | | 0.79 |

Total from investment operations | | | 1.26 | | | 1.59 | | | 0.71 | | | (0.43) | | | 3.44 | | | 0.81 |

Less distributions:

| | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.02) | | | (0.04) | | | (0.04) | | | (0.04) | | | (0.05) | | | — |

Total distributions | | | (0.02) | | | (0.04) | | | (0.04) | | | (0.04) | | | (0.05) | | | — |

Net asset value, end of period | | | $ 17.19 | | | $ 15.95 | | | $ 14.40 | | | $13.73 | | | $ 14.20 | | | $10.81 |

Total return(3) | | | 7.88% | | | 11.09% | | | 5.23% | | | −3.02% | | | 31.94% | | | 8.10% |

Supplemental data and ratios:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 2,637 | | | $ 2,482 | | | $ 2,526 | | | $2,145 | | | $ 1,700 | | | $454 |

Ratio of expenses to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | 1.46% | | | 1.52% | | | 1.61% | | | 1.64% | | | 2.68% | | | 33.40% |

After waivers and reimbursements of expenses(4) | | | 1.25% | | | 1.25% | | | 1.25% | | | 1.25% | | | 1.25% | | | 1.25% |

Ratio of net investment income to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | (0.30)% | | | 0.04% | | | 0.02% | | | (0.06)% | | | (0.92)% | | | (30.52)% |

After waivers and reimbursements of expenses(4) | | | (0.09)% | | | 0.31% | | | 0.38% | | | 0.33% | | | 0.51% | | | 1.63% |

Portfolio turnover rate(3) | | | 8.09% | | | 11.76% | | | 16.82% | | | 3.04% | | | 4.05% | | | 0.00% |

| | | | | | | | | | | | | | | | | | | |

(1)

| The Fund commenced operations on April 15, 2020. |

(2)

| Per share amounts are calculated using the average shares outstanding method. |

(3)

| Not annualized for periods less than one year. |

(4)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Global Quality Growth Fund

Financial Highlights

Class I

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 15.95 | | | $ 14.40 | | | $ 13.75 | | | $14.21 | | | $ 10.81 | | | $10.00 |

Income (LOSS) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(2) | | | 0.01 | | | 0.08 | | | 0.08 | | | 0.09 | | | 0.11 | | | 0.02 |

Net realized and unrealized gain (loss) on investments | | | 1.27 | | | 1.55 | | | 0.65 | | | (0.48) | | | 3.37 | | | 0.79 |

Total from investment operations | | | 1.28 | | | 1.63 | | | 0.73 | | | (0.39) | | | 3.48 | | | 0.81 |

Less distributions:

| | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.03) | | | (0.08) | | | (0.08) | | | (0.07) | | | (0.08) | | | — |

Total distributions | | | (0.03) | | | (0.08) | | | (0.08) | | | (0.07) | | | (0.08) | | | — |

Net asset value, end of period | | | $ 17.20 | | | $ 15.95 | | | $ 14.40 | | | $13.75 | | | $ 14.21 | | | $10.81 |

Total return(3) | | | 8.07% | | | 11.33% | | | 5.39% | | | −2.74% | | | 32.27% | | | 8.10% |

Supplemental data and ratios:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $ 3,066 | | | $ 2,813 | | | $ 2,249 | | | $2,350 | | | $ 1,842 | | | $227 |

Ratio of expenses to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | 1.23% | | | 1.29% | | | 1.36% | | | 1.42% | | | 2.11% | | | 33.49% |

After waivers and reimbursements of expenses(4) | | | 1.02% | | | 1.02% | | | 1.02% | | | 1.02% | | | 1.02% | | | 1.02% |

Ratio of net investment income to average net assets

| | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(4) | | | (0.07)% | | | 0.27% | | | 0.28% | | | 0.17% | | | (0.28)% | | | (30.60)% |

After waivers and reimbursements of expenses(4) | | | 0.14% | | | 0.54% | | | 0.62% | | | 0.57% | | | 0.81% | | | 1.87% |

Portfolio turnover rate(3) | | | 8.09% | | | 11.76% | | | 16.82% | | | 3.04% | | | 4.05% | | | 0.00% |

| | | | | | | | | | | | | | | | | | | |

(1)

| The Fund commenced operations on April 15, 2020. |

(2)

| Per share amounts are calculated using the average shares outstanding method. |

(3)

| Not annualized for periods less than one year. |

(4)

| Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Jensen Global Quality Growth Fund

Financial Highlights

Class Y

| | | | | | | |

Per Share Data:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $15.96 | | | $14.41 | | | $13.75 | | | $14.21 | | | $10.81 | | | $10.00 |

Income (LOSS) from investment operations:

| | | | | | | | | | | | | | | | | | |

Net investment income(2) | | | 0.01 | | | 0.08 | | | 0.08 | | | 0.09 | | | 0.11 | | | 0.03 |

Net realized and unrealized gain (loss) on investments | | | 1.27 | | | 1.55 | | | 0.66 | | | (0.48) | | | 3.37 | | | 0.78 |

Total from investment operations | | | 1.28 | | | 1.63 | | | 0.74 | | | (0.39) | | | 3.48 | | | 0.81 |

Less distributions:

| | | | | | | | | | | | | | | | | | |