UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2021

Date of reporting period: June 30, 2021

EX.99.IND.PUB.ACCT

Item 1. Reports to Stockholders.

(a)

Marketfield Fund

Semi-Annual Report

June 30, 2021

Investment Adviser

Marketfield Asset Management LLC

369 Lexington Avenue

3rd Floor

New York, New York 10017

www.marketfield.com

Table of Contents

Marketfield Fund Semi-Annual Report 2021

Chairman’s Report

Marketfield Fund Class I shares generated a return of 5.72% for the six months ended June 30, 2021, compared to a total return of 15.25% for the S&P 500 (SPX) Index. The 2nd quarter started strongly, but from mid-May onwards cyclical exposure lost ground while growth equities broke out to the upside. Absent actually losing money, this is the worst combination for our portfolio, which remains positioned towards strong cyclical activity in the U.S. and elsewhere. Although this view is expressed through a variety of different sectors and geographic exposure this was a very broad divide between winners and losers, with the June performance of the Russell 1000 Growth Index outperforming the Russell 1000 Value Index by the largest amount in 20 years. We do not ourselves target “value” as a concept in our portfolio, but many of the cyclical equities that we own are included in the category, as are most of the country benchmarks that we are exposed to, while our index hedges on the short side gained ground during the last few weeks of the 2nd quarter.

It is hard to point to a clear fundamental catalyst behind the shift in performance, other than the swing of momentum forcing new funds down a very well defined path that generally bypassed our own exposure. Looking ahead, we do not expect this to continue, particularly if earnings once again make clear the power of corporate performance is in cyclically focused sectors. We believe that we are still fairly early in the resurgence of activity centered around durable goods production and consumption, and that the reflationary forces being generated are likely to remain in place for much longer than consensus expects. However, this view is at odds with far more influential voices than our own, particularly that of the Federal Reserve. This institution has thus far managed to keep the debate around monetary policy centered around the concept of “transitory” inflationary pressures, or put another way, a short window of excess profitability for sectors that stand to benefit from them. This means that P/E valuations in many cases (particularly extractive industries and homebuilders) remain quite modest, since current earnings are not expected to persist much longer. If we are correct, and durable goods spending proves to be surprisingly “durable”, then a rerating of many of these sectors should follow in due course.

As to specific performance, we would note that Energy bucked the deterioration during late-May and June, probably reflecting the lower positioning in the average portfolio. We have used periods of weakness to add to this sector, mostly by increasing the size of existing positions, and ended the 2nd quarter with 6.7% of exposure to the sector. Materials overall performed well, but made most of the return early in the 2nd quarter and lagged thereafter. Homebuilders were little changed overall, but again saw the same split between early and late 2nd quarter performance, and Industrial exposure generated a small loss, caused mostly by a sharp decline in machinery and transportation equities late in the 2nd quarter. As far as geographic exposure was concerned, overall U.S. performance was slightly negative, while Japan and Europe were virtually unchanged. Emerging market performance was positive, helped by materials exposure in Brazil and Russia.

On the short side, the portfolio suffered losses in its index hedges and also its Commercial Real Estate exposure. As far as the former is concerned, the hedges did their job during periods of general weakness, but the narrowing of performance later in the 2nd quarter meant that the long side of the portfolio was unable to compensate for the drag of hedging. For Commercial Real Estate, we have been surprised at the market’s willingness to look through the obvious deterioration of market fundamentals, and also the widespread use of the sector as an “inflation hedge” that ignores the long term nature of most office lease obligations. We did therefore trim positions significantly during the 2nd quarter and will wait for a more opportune moment to reengage.

July 8, 2021

Michael Shaoul

Chairman, CEO & Portfolio Manager

1

Chief Investment Officer’s Report

Transflation

This most recent cycle in monetary and economic affairs will likely be remembered not only for the Federal Reserve Board’s generosity but also for its linguistic expansion that features “transitory” as a critical descriptor of the 2021 version of inflation.

Inflation is said to appear in a wide variety of flavors that warrant an array of prefixes and descriptors. These include hyper, dis, low, de, structural, stubborn, Latin American style and persistent. Adding transitory to the mix is either self-evident or self delusional, depending upon one’s level of cynicism.

All phenomena in the known universe are transitory. That does not mean that they can be dismissed.

Economic conditions, as with all else, are subject to unrelenting change. The designation of transitory inflation (or “transflation”, as we prefer), as well as belaboring the obvious, implies a rationale for ignoring price data and persisting with emergency policy measures that have no emergency to address.

We have said for many years that the Federal Reserve Board can dismiss or massage incoming inflation data and do as it pleases with extreme policy measures until obvious, direct and disturbing consequences arise. These can appear in a number of forms.

At first glance, it might appear the adverse reactions might originate in the fixed income markets. The general assumption holds that bonds are directly responsive to changes in realized and expected inflation rates. There is also widespread belief in some quarters that bonds are a reliable leading indicator of activity, i.e., a strong high-grade bond market indicates impending economic slack.

Current circumstances undermine whatever initial validity each of these assumptions might hold. With the Federal Reserve absorbing about two-thirds of issuance, bonds have about the same prognostic content as tea leaves. Their sensitivity to investors’ considerations about inflation and credit demand is similarly diminished.

Bonds have been relegated to a role similar to that of gold in the days when the price of the latter was fixed by government mandates. The urge to devalue during the deflationary morass of the early 1930s prompted an overnight revaluation of gold from $20.67 to $35 and a simultaneous decree outlawing private ownership of gold to prevent speculative gains from the sudden, mandated price jump. Four decades later, the stubborn adherence to a $35 gold price during the building inflation of the late 1960s and early 1970s forced the U.S. to abandon the last vestiges of a gold exchange standard for the dollar in 1971. Gold prices rose from $35 to $850 over the next decade.

If bonds yields are being held down at artificially low levels by government interventions, the challenge for investors is to discern the primary and secondary consequences.

In direct terms, it is becoming clear that a yield of 1 or 2 percent for intermediate and long-term bonds almost guarantees a negative real return and diminished purchasing power over the life of the instrument. The fact that a meaningful number of investors are not dissuaded by the prospect of negative real returns is not surprising. During the great inflation that began in the 1960s, personal savings rates rose relentlessly despite almost no nominal yield, deeply negative real yields and accelerating inflation. The ratio of saving to disposable income did not begin to decline until the final acceleration in inflation rates to double digits.

2

Investors may have rational expectations, but they are nonetheless usually incorrect in assessing macroeconomic prospects.

The effects of artificially suppressed interest rates are more clearly manifest in the willingness to borrow rather than aversion to lend.

Households are increasingly willing to borrow in order to acquire homes, which are appreciating rapidly as construction costs and delivery times rise steadily. Total mortgage debt owed by U.S. households has exceeded the peak level of the 2003-2008 housing mania. It stands well above $10 trillion at present.

The private credit expansion, taking advantage of the enormous advantages given borrowers at the expense of savers and lenders has its epicenter in mortgages, as would be expected. They are the cheapest, most accessible and largest scale form of credit available to household borrowers and are utilized to acquire a highly durable and increasingly scarce asset that provides real economic value to the owner in the form of shelter and relatively stable costs.

Every episode of credit expansion has focal points in different asset types. Price cycles in general commence at points in the economic system where favorable supply/demand balances exist. Storable commodities and durable goods where fundamental imbalances set the stage for steady appreciation become increasingly seductive to those with access to cheap credit or the excess liquidity spawned by it.

Localized price rises in one or another sector, e.g., energy, agricultural products, commercial property, transportation equipment, residential structures and so forth are transmitted throughout the economy in direct proportion to the generosity of money and credit at the time.

If monetary policy is neutral, price increases in one sector of the economy force diminished spending in others, as total spending power is reasonably stable. This is not dissimilar to a family budget where one major expense has risen substantially. If the family income is relatively stable and borrowing is not a practical option, other expenditures will have to be cut in order to maintain solvency.

Inflationary troubles arise when monetary policy is sufficiently accommodative to simply allow the absorption of specific cost increases without any corresponding cutbacks elsewhere. This dynamic was evident during the destructive inflationary wave of the 1970s. In that circumstance, oil supplies and price shocks prompted by OPEC export embargoes provoked the Federal Reserve to rapidly expand money and credit in order to cushion the effects of dramatically higher energy costs on overall purchasing power.

In attempting to preempt any widespread belt-tightening to offset the massive increase in energy expenditures, the Federal Reserve simply allowed the inflationary impulse to spread across a broader swath of the economy and ultimately provoke pandemic speculation and a flight from financial assets. The destruction of value for savers and lenders rapidly expanded from real to nominal losses as fixed income holdings and stocks sensitive to interest rates collapsed.

The shift from inflation-adjusted losses of purchasing power to outright nominal declines usually marks the beginning of the acute phase of serious inflationary cycles.

As stated previously, bonds and shorter-dated fixed income instruments may or may not respond to unambiguous indicia of inflation. The response can be distorted by central bank interventions that vacuum up any excess supplies at the first signs of trouble. In most cases, this tact will be thwarted by reactions in the foreign exchange value of the currency in which the interventions are occurring, as they only serve to further inject liquidity into a system that is already displaying symptoms of overfeeding.

3

Exchange rate depreciation as a means of discipline for monetary authorities is attenuated by the currency in question enjoying the benefits of reserve status. Market responses will be further distorted when there is collusion among nearly all central banks to coordinate their policies to eliminate any discernable bastions of responsibility that might offer alternative stores of value in their orbits.

Coordination of expansive policy among developed world’s central banks has been a notable feature of this cycle. Even the Swiss National Bank, long looked upon as a paragon of monetary restraint, has engineered a near eightfold expansion of its balance sheet in the past dozen years. They have no intention of allowing the Franc to serve as a haven for restless liquidity.

The official notion of current inflationary pressures being “transitory” (meaning temporary), strikes us as the latest and greatest in a long history of presumptuous declarations by the Federal Reserve and its cohort.

Businesses of all types have been sufficiently chastened in the past decade to think twice before adding capacity and embarking on major expenditures with long payback periods. Even in cases where new physical infrastructure is contemplated, bottlenecks in the production, transportation and operation of capital goods have lengthened delivery times and pushed backlogs to record levels.

Planned infrastructure initiatives by the federal government will only add fuel to the fires. A ten-year program of physical infrastructural enhancement involving expenditures in excess of $100 billion annually will either run into a wall of shortages or pay far enough above market rates for materials and labor to crowd out private, profit-conscious businesses.

Labor shortages are unlikely to ease significantly once the supplemental benefits offered during the pandemic are withdrawn. Governments are making it much easier to live reasonably without working and, if earned income is a necessity, lower tier service workers are increasingly likely to seek casual, off-the-books situations that do not undermine one’s ability to collect government benefits or retirement income.

Once central banks have unleashed the four horsemen of credit expansion, asset inflation, speculation and consumer price inflation, they will struggle mightily to keep them from seriously undermining the public’s willingness to hold monetary and fixed income assets. The academic, theoretical designation of “inflation expectations” as a primary regulator of private investors’ inclination to play along with central bankers’ assurances is mistaken.

People will shift allocations in response to return expectations, not some amorphous concept of future inflation rates. The driving force behind a preference shift from A to B is either avoiding losses in A, reaping a superior return from B, or some combination thereof. In any event, the relative appeal of B is sufficiently greater than that of A, so as to provoke a shift from A to B.

The problem for central bankers is when A, the holding from which people are beginning to flee, is an integral aspect of the monetary or financial infrastructure. It may be leveraged equities, as was the case in 1929, currency as with Weimar Germany in 1922 and much of Latin America in the 1970s or high-grade fixed income assets as in the late 1970s.

Assets benefitting from the flight away from certain savings and investment media eventually become objects of intense, leveraged speculation when the monetary environment allows for easy access to underpriced credit.

At this point in the process, the newly favored objects of inflationary speculation replace the traditional assets from which investors and savers fled as critical lynchpins underlying the collateral structure of

4

an ever-increasing proportion of the financial system. When they have grown in market capitalization to such an extent that there is almost no level of central bank liquidity that can adequately support them, the focal point of the next deflationary crisis is defined.

The classic, recent example occurred with the speculative mania in single-family homes following the Federal Reserve’s extraordinary ease in response to the bursting of the technology craze in 2001-2002. Houses became the key collateral element underlying the financial system and, in only four years went from highly favorable fundamental supply and demand metrics at very affordable prices to an historic glut of supply at prices that were clearly beyond the means of the majority of purchasers, particularly after the Federal Reserve undertook a long series of rate hikes.

Because speculation in single-family homes and the complete shrouding of risk in extraordinarily complex and opaque mortgage-backed securities, the Federal Reserve had no precedents to feed its econometric models to help them assess the systemic risks. They were asleep at the switch when the calamity unfolded.

The status of the present credit and price cycle is similarly without specific precedent. Extraordinarily inflated sectors are grazing on the monetary plains like thousand ton dinosaurs. Crypto-currency is a multi-trillion dollar alternative to visible financial assets, institutions have swallowed millions of single-family homes to convert into fixed income assets through long-term leasing, dollar holdings of international institutions and individuals continue to climb to record levels as money pours into U.S. technology companies. These now constitute a far greater share of domestic market capitalization than energy stocks did at their peak in 1980.

All signs in the economy are pointing to continued strength in demand and no easing of supply chain constraints or labor shortages and accelerating wages. Very few indications of credit risk or scarcity are to be found.

Our sense is that the Federal Reserve has lashed itself to the mast and is going to maintain course come Hell or high water. It is unlikely that there will be any overt moves toward tightening for another year, at the least. The major risk is likely in the opposite direction.

If a bout of illiquidity and distress (or panic) strikes one of the engorged sectors that hold significant proportions of personal and institutional wealth, the Federal Reserve may well intervene to restore stability and support nominal values even in the face of a real economy that is strengthening and threatened mainly by upward price pressures in a large number of crucial sectors.

Any moves by the Federal Reserve or another major central bank in that direction would be an admission that price stability has flown the coop as a meaningful influence on policy decisions and prompt an acceleration in the flight from sectors and assets most at risk from non-transitory, accelerating inflation.

August 4, 2021

Michael C. Aronstein

President, CIO & Portfolio Manager

The foregoing represents the opinions of the Chairman, CEO & Portfolio Manager and of the President, CIO & Portfolio Manager, respectively, and are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

5

Definitions:

Russell 1000® Growth Index: Measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Value Index: Measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

P/E is the price-to-earnings ratio. The ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

The S&P 500® Index is a trademark of McGraw Hill Financial Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. The securities holdings and volatility of the Fund differ significantly from the stocks that make up the S&P 500 Index. An investment cannot be made directly into an index.

A mortgage-backed security (MBS) is an investment similar to a bond that is made up of a bundle of home loans bought from the banks that issued them. Investors in MBS receive periodic payments similar to bond coupon payments.

An investment cannot be made directly in an index.

Past performance does not guarantee future results

The Marketfield Fund is managed by Marketfield Asset Management LLC (the “Adviser”) and distributed by Quasar Distributors, LLC.

Must be preceded or accompanied by a current prospectus.

Mutual fund investing involves risk. Principal loss is possible. Before considering an investment in the Fund, you should understand that you could lose money.

The Fund regularly makes short sales of securities, which involves the risk that losses may exceed the original amount invested. The Fund may invest in derivatives, which may increase the volatility of the Fund’s net asset value (“NAV”) and may result in a loss to the Fund. The Fund may also use options and futures contracts, which have the risks of unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates, and currency exchange rates. However, a mutual fund investor’s risk is limited to the amount invested in a fund. Investments in absolute return strategies are not intended to outperform stocks and bonds during strong market rallies. Investments in exchange-traded funds are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its NAV, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact the Fund’s ability to sell such shares.

Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. These risks may be greater for emerging markets. Investing in smaller companies involves special risks, including higher volatility and lower liquidity. Investing in mid-cap stocks may carry more risk than investing in stocks of larger, more well-established companies. This risk is usually greater for longer term debt securities. Investment by the Fund in lower rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities involve additional risks such as credit risk, prepayment risk, possible illiquidity and default, and increased susceptibility to adverse economic developments. Investing in the Fund involves the risk that the macroeconomic trends identified by portfolio management will not come to fruition and their advantageous duration may not last as long as portfolio management forecasts.

6

MARKETFIELD FUND

Expense Example

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (as applicable), and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from January 1, 2021 to June 30, 2021.

This example illustrates the Fund’s ongoing costs in two ways:

The first lines of the following tables provide information about actual account values and actual expenses. If you purchase Class A shares of the Fund you will pay an initial sales charge of up to 5.50% when you invest. A contingent deferred sales charge (“CDSC”) may be imposed on certain redemptions of Class A shares redeemed within twelve months of purchase. Class C shares are subject to a CDSC of 1.00% for shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of exchange-traded funds or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example. The example includes, but is not limited to, management fees, fund administration and accounting, custody and transfer agent fees. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the fourth column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | Hypothetical | | Example for Comparison Purposes |

The second lines of the tables below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second lines of the tables are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

7

MARKETFIELD FUND

Expense Example (continued)

(Unaudited)

| | | | | | | | | | | | |

| | | Class A

| |

| | | Beginning

Account Value

January 1, 2021

| | | Ending

Account Value

June 30, 2021

| | | Expenses Paid

During Period

January 1, 2021 -

June 30, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,055.60 | | | $ | 11.26 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,013.84 | | | $ | 11.03 | |

| | * | | Expenses are equal to the Class A shares’ annualized expense ratio of 2.21%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Class C

| |

| | | Beginning

Account Value

January 1, 2021

| | | Ending

Account Value

June 30, 2021

| | | Expenses Paid

During Period

January 1, 2021 -

June 30, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,052.20 | | | $ | 15.01 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,010.17 | | | $ | 14.70 | |

| | * | | Expenses are equal to the Class A shares’ annualized expense ratio of 2.95%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

| | | | | | | | | | | | |

| | | Class I

| |

| | | Beginning

Account Value

January 1, 2021

| | | Ending

Account Value

June 30, 2021

| | | Expenses Paid

During Period

January 1, 2021 -

June 30, 2021*

| |

Actual | | $ | 1,000.00 | | | $ | 1,057.20 | | | $ | 10.05 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.03 | | | $ | 9.84 | |

| | * | | Expenses are equal to the Class A shares’ annualized expense ratio of 1.97%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. |

8

MARKETFIELD FUND

Investment Highlights

(Unaudited)

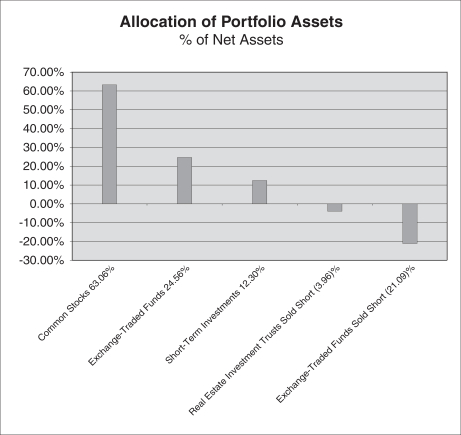

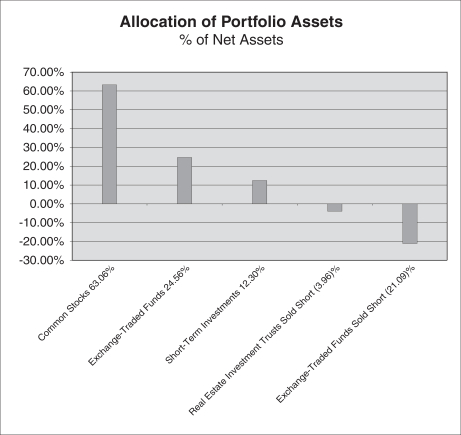

The investment objective of the Fund is capital appreciation. The Fund seeks to achieve its investment objective by allocating the Fund’s assets among investments in equity securities, fixed-income securities, and other investment companies, including exchange-traded funds (“ETFs”), in proportions consistent with Marketfield Asset Management LLC’s (the “Adviser”) evaluation of their expected risks and returns. In making these allocations, the Adviser considers various factors, including macroeconomic conditions, corporate earnings at a macroeconomic level, anticipated inflation and interest rates, consumer risk and the Adviser’s perception of the outlook of the capital markets as a whole. The Adviser may allocate the Fund’s investments between equity securities and fixed-income securities at its discretion, without limitation. The Fund may also engage in short sales of securities or other derivative type transactions. The Fund’s allocation of portfolio assets as of June 30, 2021 is shown below.

| * | | Valued at the net unrealized appreciation (depreciation). |

9

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

Average Annual Total Returns as of June 30, 2021

| | | | | | | | | | | | | | | | | | | | |

Class

| | Sales Charge

| | | | 1 Year

| | | 5 Years

| | | 10 Years

| | | Since

Inception

(7/31/2007)

| |

Class A(1) | | Maximum 5.5% Initial Sales Charge | | With sales charge | | | 19.72 | % | | | 7.68% | | | | 3.83 | % | | | 5.05 | % |

| | | | | Excluding sales charge | | | 26.70 | % | | | 8.90% | | | | 4.42 | % | | | 5.48 | % |

Class C(1) | | Maximum 1% CDSC if Redeemed | | With sales charge | | | 24.78 | % | | | 8.06% | | | | 3.63 | % | | | 4.68 | % |

| | | within One Year of Purchase | | Excluding sales charge | | | 25.78 | % | | | 8.06% | | | | 3.63 | % | | | 4.68 | % |

Class I(2) | | No Sales Charge | | | | | 27.00 | % | | | 9.16% | | | | 4.66 | % | | | 5.73 | % |

S&P 500 Index | | | | | | | 40.79 | % | | | 17.65% | | | | 14.84 | % | | | 10.37 | % |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (800) 311-MKTD (6583) or is available in the Fund’s website at www.marketfieldfund.com.

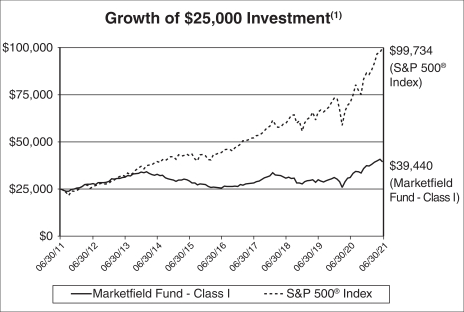

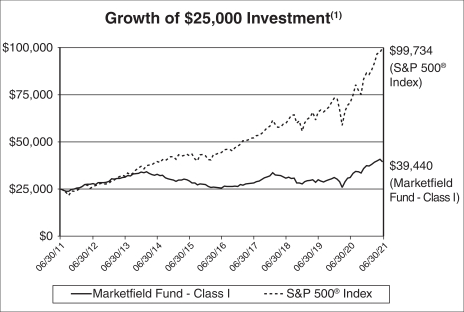

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and certain broad-based securities indices on the Fund’s inception date. The graph does not reflect any future performance.

The Total Annual Fund Operating Expenses in the Prospectus dated April 30, 2021 are 2.91%, 3.62% and 2.63% for Class A, Class C and Class I shares, respectively.

The S&P 500® Index is a broad-based measurement of changes in stock market conditions based on a capitalization-weighted average of 500 leading companies representing all major industries in the U.S. economy. It is not possible to invest directly in an index.

| (1) | | Performance figures for Class A and Class C shares, first offered on October 5, 2012, include the historical performance of Class I shares through October 4, 2012 and are adjusted to reflect differences in fees and expenses. Performance data for the classes varies based on differences in their fee and expense structures. The Fund commenced operations on July 31, 2007. Unadjusted, the performance for the newer classes would likely have been different. |

| (2) | | Performance figures for Class I shares prior to April 8, 2016 reflect the historical performance of the then-existing shares of the MainStay Marketfield Fund, a series of MainStay Funds Trust (the predecessor to the Fund, which was subject to a different fee structure, and for which the Adviser served as the investment sub-adviser) for periods from October 5, 2012 to April 8, 2016. The performance figures also reflect the historical performance of the then-existing shares of the predecessor fund to the MainStay Marketfield Fund (which was subject to a different fee structure, and for which a predecessor entity to the Adviser served as the investment adviser) for periods prior to October 5, 2012. |

10

MARKETFIELD FUND

Investment Highlights (continued)

(Unaudited)

| (1) | | The minimum investment for Class I shares is $25,000 for individual investors. There is no minimum investment for Class I shares for institutional investors. The graph does not illustrate performance for a hypothetical investment made in Class A or Class C shares. If shown, the growth of the investment of Class A or Class C shares would have been lower than Class I shares to the extent those classes have lower minimum investments and sales loads. |

11

MARKETFIELD FUND

Schedule of Investments

June 30, 2021 (Unaudited)

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| COMMON STOCKS — 63.06% | | | | | | | | |

| | |

| Auto Components — 0.29% | | | | | | | | |

Continental AG(a) | | | 3,250 | | | $ | 477,779 | |

| | | | | | |

|

|

|

| Building Products — 1.22% | | | | | | | | |

TOTO Ltd.(a) | | | 38,086 | | | | 1,971,236 | |

| | | | | | |

|

|

|

| Chemicals — 2.18% | | | | | | | | |

The Sherwin-Williams Co. | | | 12,936 | | | | 3,524,413 | |

| | | | | | |

|

|

|

| Electrical Equipment — 3.60% | | | | | | | | |

Eaton Corp PLC | | | 16,905 | | | | 2,504,983 | |

Rockwell Automation, Inc. | | | 11,234 | | | | 3,213,149 | |

Siemens Energy AG(a)(b) | | | 3,440 | | | | 103,687 | |

| | | | | | |

|

|

|

| | | | | | | | 5,821,819 | |

| | | | | | |

|

|

|

| Electronic Equipment, Instruments & Components — 2.63% | | | | | | | | |

Keyence Corp.(a) | | | 8,424 | | | | 4,251,620 | |

| | | | | | |

|

|

|

| Energy Equipment & Services — 2.05% | | | | | | | | |

Schlumberger Ltd. | | | 103,495 | | | | 3,312,875 | |

| | | | | | |

|

|

|

| Food & Staples Retailing — 3.98% | | | | | | | | |

Costco Wholesale Corp.(c) | | | 16,279 | | | | 6,441,112 | |

| | | | | | |

|

|

|

| Health Care Equipment & Supplies — 3.56% | | | | | | | | |

Intuitive Surgical, Inc.(b) | | | 6,268 | | | | 5,764,304 | |

| | | | | | |

|

|

|

| Hotels, Restaurants & Leisure — 0.65% | | | | | | | | |

Dalata Hotel Group PLC(a)(b) | | | 233,172 | | | | 1,060,313 | |

| | | | | | |

|

|

|

| Household Durables — 8.19% | | | | | | | | |

DR Horton, Inc.(c) | | | 59,316 | | | | 5,360,387 | |

Lennar Corp. — Class A | | | 33,377 | | | | 3,316,005 | |

PulteGroup, Inc.(c) | | | 83,746 | | | | 4,570,019 | |

| | | | | | |

|

|

|

| | | | | | | | 13,246,411 | |

| | | | | | |

|

|

|

| Industrial Conglomerates — 2.42% | | | | | | | | |

Honeywell International, Inc. | | | 12,859 | | | | 2,820,621 | |

Siemens AG(a) | | | 6,879 | | | | 1,089,906 | |

| | | | | | |

|

|

|

| | | | | | | | 3,910,527 | |

| | | | | | |

|

|

|

| Machinery — 7.99% | | | | | | | | |

Caterpillar, Inc. | | | 17,831 | | | | 3,880,561 | |

Cummins, Inc. | | | 16,650 | | | | 4,059,436 | |

Deere & Co. | | | 14,124 | | | | 4,981,676 | |

| | | | | | |

|

|

|

| | | | | | | | 12,921,673 | |

| | | | | | |

|

|

|

| Metals & Mining — 11.70% | | | | | | | | |

Barrick Gold Corp. — (a)(c) | | | 153,162 | | | | 3,167,390 | |

Compania de Minas Buenaventura SAA — ADR(b) | | | 110,203 | | | | 997,337 | |

MMC Norilsk Nickel PJSC — ADR | | | 106,950 | | | | 3,643,787 | |

Newmont Corp.(c) | | | 58,548 | | | | 3,710,772 | |

Rio Tinto PLC — ADR(c) | | | 40,808 | | | | 3,423,383 | |

Vale SA — ADR | | | 174,879 | | | | 3,988,990 | |

| | | | | | |

|

|

|

| | | | | | | | 18,931,659 | |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

12

MARKETFIELD FUND

Schedule of Investments (continued)

June 30, 2021 (Unaudited)

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| Oil, Gas & Consumable Fuels — 3.18% | | | | | | | | |

Devon Energy Corp. | | | 74,590 | | | $ | 2,177,282 | |

EOG Resources, Inc. | | | 19,738 | | | | 1,646,939 | |

Golar LNG Ltd.(a)(b) | | | 99,489 | | | | 1,318,229 | |

| | | | | | |

|

|

|

| | | | | | | | 5,142,450 | |

| | | | | | |

|

|

|

| Real Estate Management & Development — 1.33% | | | | | | | | |

The St. Joe Co. | | | 48,366 | | | | 2,157,607 | |

| | | | | | |

|

|

|

| Road & Rail — 6.55% | | | | | | | | |

Norfolk Southern Corp.(c) | | | 22,588 | | | | 5,995,081 | |

Union Pacific Corp. | | | 20,942 | | | | 4,605,774 | |

| | | | | | |

|

|

|

| | | | | | | | 10,600,855 | |

| | | | | | |

|

|

|

| Semiconductors & Semiconductor Equipment — 1.54% | | | | | | | | |

Intel Corp. | | | 44,441 | | | | 2,494,918 | |

| | | | | | |

|

|

|

TOTAL COMMON STOCKS (Cost $50,524,964) | | | | | | | 102,031,571 | |

| | | | | | |

|

|

|

| EXCHANGE-TRADED FUNDS — 24.56% | | | | | | | | |

iShares MSCI Australia ETF(c) | | | 278,126 | | | | 7,225,713 | |

iShares MSCI Japan ETF(c) | | | 80,324 | | | | 5,425,083 | |

iShares MSCI United Kingdom ETF | | | 220,540 | | | | 7,211,658 | |

SPDR S&P Homebuilders ETF(c) | | | 61,143 | | | | 4,478,113 | |

SPDR S&P Oil & Gas Exploration & Production ETF | | | 25,539 | | | | 2,469,366 | |

VanEck Vectors Gold Miners ETF(c) | | | 143,172 | | | | 4,864,985 | |

VanEck Vectors Russia ETF | | | 83,010 | | | | 2,405,630 | |

WisdomTree Japan Hedged Equity Fund(c) | | | 92,821 | | | | 5,663,937 | |

| | | | | | |

|

|

|

TOTAL EXCHANGE-TRADED FUNDS (Cost $33,363,263) | | | | | | | 39,744,485 | |

| | | | | | |

|

|

|

| SHORT-TERM INVESTMENTS — 12.30% | | | | | | | | |

U.S. Bank Money Market Deposit Account, 0.003%(d) | | | 19,899,717 | | | | 19,899,717 | |

| | | | | | |

|

|

|

| TOTAL SHORT TERM INVESTMENTS (Cost $19,899,717) | | | | | | | 19,899,717 | |

| | | | | | |

|

|

|

| Total Investments (Cost $103,787,944) — 99.92% | | | | | | | 161,675,773 | |

| Other Assets in Excess of Liabilities — 0.08% | | | | | | | 125,918 | |

| | | | | | |

|

|

|

| TOTAL NET ASSETS — 100.00% | | | | | | $ | 161,801,691 | |

| | | | | | |

|

|

|

| (a) | | Foreign issued security. |

| (b) | | Non-income producing security. |

| (c) | | All or a portion of this security is pledged as collateral for securities sold short with an aggregate fair value of $37,226,240 as of June 30, 2021. |

| (d) | | Seven day yield as of June 30, 2021. |

Abbreviations:

| | |

| ADR | | American Depositary Receipt |

| AG | | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e. owned by shareholders. |

| Ltd. | | Limited is a term indicating a company is incorporated and shareholders have limited liability. |

| PLC | | Public Limited Company is a publicly traded company which signifies that shareholders have limited liability. |

| PJSC | | An abbreviation used by many countries to signify an open joint-stock company. |

| SA | | An abbreciation used by many countries to signify a stock company whereby shareholders have limited liability. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

13

MARKETFIELD FUND

Schedule of Securities Sold Short

June 30, 2021 (Unaudited)

| | | | | | | | |

| | |

| | | Shares

| | | Value

| |

| SECURITIES SOLD SHORT — (25.05)% | | | | | | | | |

| | |

| EXCHANGE-TRADED FUNDS — (21.09)% | | | | | | | | |

Invesco QQQ Trust Series 1 | | | (40,891 | ) | | $ | (14,492,997 | ) |

iShares Expanded Tech-Software Sector ETF | | | (23,976 | ) | | | (9,351,599 | ) |

iShares Russell 2000 ETF | | | (44,797 | ) | | | (10,275,088 | ) |

| | | | | | |

|

|

|

TOTAL EXCHANGE-TRADED FUNDS (Proceeds $26,567,262) | | | | | | | (34,119,684 | ) |

| | | | | | |

|

|

|

| REAL ESTATE INVESTMENT TRUSTS — (3.96)% | | | | | | | | |

AvalonBay Communities, Inc. | | | (3,701 | ) | | | (772,362 | ) |

Boston Properties, Inc. | | | (10,565 | ) | | | (1,210,643 | ) |

Equity Residential | | | (11,100 | ) | | | (854,700 | ) |

SL Green Realty Corp. | | | (30,125 | ) | | | (2,410,000 | ) |

Vornado Realty Trust | | | (25,065 | ) | | | (1,169,784 | ) |

| | | | | | |

|

|

|

TOTAL REAL ESTATE INVESTMENT TRUSTS (Proceeds $7,526,132) | | | | | | | (6,417,489 | ) |

| | | | | | |

|

|

|

Total Securities Sold Short (Proceeds $34,093,394) | | | | | | $ | (40,537,173 | ) |

| | | | | | |

|

|

|

The accompanying notes are an integral part of these financial statements.

14

MARKETFIELD FUND

| | |

| Statement of Assets & Liabilities | | |

| |

| | | June 30, 2021 (Unaudited) |

| | | | |

| Assets | | | | |

Investments in securities, at value (cost $103,787,944) | | $ | 161,675,773 | |

Receivables: | | | | |

Fund shares sold | | | 107,376 | |

Dividends and interest | | | 86,505 | |

Dividend tax reclaim | | | 160,898 | |

Deposits at brokers(1) | | | 40,868,572 | |

Other assets | | | 21,148 | |

| | |

|

|

|

Total Assets | | | 202,920,272 | |

| | |

|

|

|

| Liabilities | | | | |

Securities sold short, at value (proceeds received $34,093,394) | | | 40,537,173 | |

Payables: | | | | |

Fund shares redeemed | | | 212,595 | |

To affiliates | | | 51,054 | |

To distributor | | | 26,060 | |

For shareholder servicing fees | | | 18,534 | |

To adviser | | | 157,445 | |

Dividends and interest on short positions | | | 49,316 | |

Accrued expenses and other liabilities | | | 66,404 | |

Total Liabilities | | | 41,118,581 | |

| | |

|

|

|

| Net Assets | | $ | 161,801,691 | |

| | |

|

|

|

Net assets consist of: | | | | |

Paid-in capital | | | 490,581,497 | |

Accumulated deficit | | | (328,779,806 | ) |

| | |

|

|

|

| Net Assets | | $ | 161,801,691 | |

| | |

|

|

|

| |

| Class A | | | | |

Net assets | | | $43,574,976 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 2,067,794 | |

Net asset value, minimum offering, and redemption price per share | | | $21.07 | |

Maximum offering price per share (net asset value per share divided by 0.945)(2) | | | $22.30 | |

| |

| Class C | | | | |

Net assets | | | $25,821,939 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 1,306,915 | |

Net asset value, offering, and redemption price per share(3) | | | $19.76 | |

| |

| Class I | | | | |

Net assets | | | $92,404,776 | |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 4,307,845 | |

Net asset value, offering, and redemption price per share | | | $21.45 | |

| (1) | | Serves as collateral for securities sold short. |

| (2) | | Reflects a maximum sales charge of 5.50%. |

| (3) | | A contingent deferred sales charge (“CDSC”) of 1.00% may be charged on shares redeemed within twelve months of purchase. |

The accompanying notes are an integral part of these financial statements.

15

MARKETFIELD FUND

| | |

| Statement of Operations |

| |

| | | For the Six Months Ended June 30, 2021 (Unaudited) |

| | | | |

| Investment Income | | | | |

Dividend income(1) | | $ | 1,444,312 | |

Interest income | | | 212 | |

| | |

|

|

|

Total Investment Income | | | 1,325,626 | |

| | |

|

|

|

| Expenses | | | | |

Management fees | | | 1,156,083 | |

Dividend expense | | | 339,159 | |

Broker Interest Expense | | | 118,898 | |

Transfer agent fees and expenses | | | 104,575 | |

Distribution fees — Class C | | | 102,731 | |

Administration and accounting fees | | | 98,473 | |

Distribution fees — Class A | | | 54,638 | |

Federal and state registration fees | | | 27,235 | |

Audit and tax fees | | | 23,291 | |

Custody fees | | | 15,941 | |

Reports to shareholders | | | 14,696 | |

Legal fees | | | 13,988 | |

Shareholder servicing fees — Class C | | | 13,427 | |

Trustees’ fees | | | 7,403 | |

Chief Compliance Officer fees | | | 5,973 | |

Insurance expense | | | 1,810 | |

Pricing fees | | | 905 | |

Other expenses | | | 2,534 | |

| | |

|

|

|

Total Expenses | | | 2,101,760 | |

| | |

|

|

|

Less waivers and reimbursement by Adviser (Note 4) | | | (168,159 | ) |

| | |

|

|

|

Net Expenses | | | 1,933,601 | |

| | |

|

|

|

| Net Investment Loss | | | (489,077 | ) |

| | |

|

|

|

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | 30,241,803 | |

Securities sold short | | | (4,853,260 | ) |

Foreign currency translations | | | (3,750 | ) |

Purchased options | | | (331,538 | ) |

| | |

|

|

|

| | | | 25,053,255 | |

| | |

|

|

|

Net change in unrealized depreciation on: | | | | |

Investments | | | (13,567,438 | ) |

Securities sold short | | | (1,993,590 | ) |

Foreign currency translations | | | (27,911 | ) |

| | |

|

|

|

| | | | (15,588,939 | ) |

| | |

|

|

|

| Net Realized and Unrealized Gain on Investments and Foreign Currency | | | 9,464,316 | |

| | |

|

|

|

| Net Increase in Net Assets From Operations | | $ | 8,975,239 | |

| | |

|

|

|

| (1) | | Net of $42,242 in foreign withholding taxes and issuance fees. |

The accompanying notes are an integral part of these financial statements.

16

MARKETFIELD FUND

| | | | | | | | |

| Statements of Changes in Net Assets | |

| | |

| | | Six Months Ended

June 30, 2020

(Unaudited)

| | | Year Ended

December 31, 2020

| |

| From Operations | | | | | | | | |

Net investment loss | | $ | (489,077 | ) | | $ | (1,523,743 | ) |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | 30,241,803 | | | | 15,655,650 | |

Futures contracts | | | — | | | | (672,822 | ) |

Securities sold short | | | (4,853,260 | ) | | | (4,160,854 | ) |

Foreign currency translations | | | (3,750 | ) | | | 127,092 | |

Purchased options | | | (331,538 | ) | | | 647,908 | |

Written options | | | — | | | | (5,405 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (13,567,438 | ) | | | 12,845,267 | |

Futures contracts | | | — | | | | (63,577 | ) |

Securities sold short | | | (1,993,590 | ) | | | 2,856,674 | |

Foreign currency translations | | | (27,911 | ) | | | 27,741 | |

Purchased options | | | — | | | | 17,769 | |

Written options | | | — | | | | 41,082 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 8,975,239 | | | | 25,792,782 | |

| | |

|

|

| |

|

|

|

| From Capital Share Transactions | | | | | | | | |

Proceeds from shares sold — Class A | | | 1,394,293 | | | | 7,888,190 | |

Payments for shares redeemed — Class A | | | (2,673,710 | ) | | | (9,859,664 | ) |

Proceeds from shares sold — Class C | | | 17,553 | | | | 87,440 | |

Payments for shares redeemed — Class C | | | (3,727,573 | ) | | | (15,551,868 | ) |

Proceeds from shares sold — Class I | | | 4,200,966 | | | | 5,056,654 | |

Payments for shares redeemed — Class I | | | (8,589,673 | ) | | | (33,458,225 | ) |

Proceeds from shares sold — Class R6(1) | | | — | | | | 44,645 | |

Payments for shares redeemed — Class R6(1) | | | — | | | | (1,887,622 | ) |

| | |

|

|

| |

|

|

|

Net decrease in net assets from capital share transactions | | | (9,378,144 | ) | | | (47,680,450 | ) |

| | |

|

|

| |

|

|

|

| Total Decrease in Net Assets | | | (402,905 | ) | | | (21,887,668 | ) |

| | |

| Net Assets: | | | | | | | | |

Beginning of Period | | | 162,204,596 | | | | 184,092,264 | |

| | |

|

|

| |

|

|

|

End of Period | | $ | 161,801,691 | | | $ | 162,204,596 | |

| | |

|

|

| |

|

|

|

| (1) | | Class R6 shares of the Fund were liquidated as of the close of business on November 30, 2020. See Note 1 to the financial statements. |

The accompanying notes are an integral part of these financial statements.

17

MARKETFIELD FUND — CLASS A

| | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year/Period | |

| | | | | | |

| | | Six Months

Ended

June 30,

2021

(Unaudited)

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| | | Year Ended

December 31,

2016

| |

| Net Asset Value, Beginning of Period | | $ | 19.96 | | | $ | 16.65 | | | $ | 14.92 | | | $ | 17.23 | | | $ | 14.26 | | | $ | 14.79 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.06 | ) | | | (0.16 | ) | | | 0.04 | | | | (0.05 | ) | | | (0.11 | ) | | | (0.22 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.17 | | | | 3.47 | | | | 1.73 | | | | (2.26 | ) | | | 3.08 | | | | (0.31 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.11 | | | | 3.31 | | | | 1.77 | | | | (2.31 | ) | | | 2.97 | | | | (0.53 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Less distributions paid: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions paid | | | — | | | | — | | | | (0.04 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Period | | $ | 21.07 | | | $ | 19.96 | | | $ | 16.65 | | | $ | 14.92 | | | $ | 17.23 | | | $ | 14.26 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2)(3) | | | 5.56 | % | | | 19.88 | % | | | 11.87 | % | | | -13.41 | % | | | 20.83 | % | | | -3.58 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 43,575 | | | $ | 42,483 | | | $ | 37,761 | | | $ | 46,183 | | | $ | 75,929 | | | $ | 101,876 | |

| | | | | | |

Ratio of expenses to average net

assets:(4) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(5) | | | 2.59 | % | | | 2.75 | % | | | 2.94 | % | | | 2.73 | % | | | 2.72 | % | | | 2.88 | % |

After waivers and reimbursements of expenses(6) | | | 2.36 | % | | | 2.47 | % | | | 2.70 | % | | | 2.52 | % | | | 2.54 | % | | | 2.84 | %(9) |

| | | | | | |

Ratio of net investment income (loss) to average net assets:(4)(7) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (0.84 | )% | | | (1.23 | )% | | | 0.02 | % | | | (0.51 | )% | | | (0.90 | )% | | | (1.60 | )% |

After waivers and reimbursements of expenses | | | (0.61 | )% | | | (0.95 | )% | �� | | 0.26 | % | | | (0.30 | )% | | | (0.72 | )% | | | (1.56 | )% |

| | | | | | |

Portfolio turnover rate(3)(8) | | | 14 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % | | | 86 | % |

| (1) | | Per share net investment income (loss) was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Not annualized for periods less than one year. |

| (4) | | Annualized for periods less than one year. |

| (5) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.03% for the six months ended June 30, 2021 and 2.08%, 2.04%, 2.01%, 1.98%, and 1.87% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively. |

| (6) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.80% for the six months ended June 30, 2021 and 1.80%, 1.80%, 1.80%, 1.80%, and 1.83% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively. |

| (7) | | The net investment income (loss) ratios include dividend and interest expense on short positions. |

| (8) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | | Effective after the close of business on April 8, 2016, Class A shares were subject to an expense limitation cap of 1.80%. |

The accompanying notes are an integral part of these financial statements.

18

MARKETFIELD FUND — CLASS C

| | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year/Period | |

| | | | | | |

| | | Six Months

Ended

June 30,

2021

(Unaudited)

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| | | Year Ended

December 31,

2016

| |

| Net Asset Value, Beginning of Period | | $ | 18.78 | | | $ | 15.79 | | | $ | 14.22 | | | $ | 16.56 | | | $ | 13.80 | | | $ | 14.43 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss(1) | | | (0.13 | ) | | | (0.28 | ) | | | (0.08 | ) | | | (0.17 | ) | | | (0.22 | ) | | | (0.31 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.11 | | | | 3.27 | | | | 1.65 | | | | (2.17 | ) | | | 2.98 | | | | (0.32 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 0.98 | | | | 2.99 | | | | 1.57 | | | | (2.34 | ) | | | 2.76 | | | | (0.63 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Period | | $ | 19.76 | | | $ | 18.78 | | | $ | 15.79 | | | $ | 14.22 | | | $ | 16.56 | | | $ | 13.80 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2)(3) | | | 5.22 | % | | | 18.94 | % | | | 11.04 | % | | | -14.13 | % | | | 20.00 | % | | | -4.37 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 25,822 | | | $ | 28,077 | | | $ | 38,675 | | | $ | 55,958 | | | $ | 92,518 | | | $ | 123,651 | |

| | | | | | |

Ratio of expenses to average net assets:(4) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(5) | | | 3.18 | % | | | 3.46 | % | | | 3.69 | % | | | 3.49 | % | | | 3.48 | % | | | 3.65 | % |

After waivers and reimbursements of expenses(6) | | | 3.10 | % | | | 3.20 | % | | | 3.46 | % | | | 3.30 | % | | | 3.30 | % | | | 3.59 | %(9) |

| | | | | | |

Ratio of net investment loss to average net assets:(4)(7) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (1.45 | )% | | | (2.00 | )% | | | (0.76 | )% | | | (1.27 | )% | | | (1.67 | )% | | | (2.36 | )% |

After waivers and reimbursements of expenses | | | (1.37 | )% | | | (1.74 | )% | | | (0.53 | )% | | | (1.08 | )% | | | (1.49 | )% | | | (2.30 | )% |

| | | | | | |

Portfolio turnover rate(3)(8) | | | 14 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % | | | 86 | % |

| (1) | | Per share net investment loss was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Not annualized for periods less than one year. |

| (4) | | Annualized for periods less than one year. |

| (5) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.63% for the six months ended June 30, 2021 and 2.83%, 2.80%, 2.76%, 2.75%, and 2.65% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016 respectively. |

| (6) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 2.55% for the six months ended June 30, 2021 and 2.57%, 2.57%, 2.57%, 2.57%, and 2.59% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively. |

| (7) | | The net investment loss ratios include dividend and interest expense on short positions. |

| (8) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | | Effective after the close of business on April 8, 2016, Class C shares were subject to an expense limitation cap of 2.57%. |

The accompanying notes are an integral part of these financial statements.

19

MARKETFIELD FUND — CLASS I

| | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights | |

|

| Per Share Data for a Share Outstanding Throughout Each Year/Period | |

| | | | | | |

| | | Six Months

Ended

June 30,

2021

(Unaudited)

| | | Year Ended

December 31,

2020

| | | Year Ended

December 31,

2019

| | | Year Ended

December 31,

2018

| | | Year Ended

December 31,

2017

| | | Year Ended

December 31,

2016

| |

| Net Asset Value, Beginning of Period | | $ | 20.29 | | | $ | 16.88 | | | $ | 15.14 | | | $ | 17.44 | | | $ | 14.39 | | | $ | 14.89 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.04 | ) | | | (0.12 | ) | | | 0.08 | | | | (0.02 | ) | | | (0.07 | ) | | | (0.19 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 1.20 | | | | 3.53 | | | | 1.75 | | | | (2.28 | ) | | | 3.12 | | | | (0.31 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from investment operations | | | 1.16 | | | | 3.41 | | | | 1.83 | | | | (2.30 | ) | | | 3.05 | | | | (0.50 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Less distributions paid: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | — | | | | — | | | | (0.09 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions paid | | | — | | | | — | | | | (0.09 | ) | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net Asset Value, End of Period | | $ | 21.45 | | | $ | 20.29 | | | $ | 16.88 | | | $ | 15.14 | | | $ | 17.44 | | | $ | 14.39 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Total return(2)(3) | | | 5.72 | % | | | 20.20 | % | | | 12.13 | % | | | -13.25 | % | | | 21.20 | % | | | -3.36 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | $ | 92,405 | | | $ | 91,645 | | | $ | 105,998 | | | $ | 163,260 | | | $ | 302,439 | | | $ | 376,791 | |

| | | | | | |

Ratio of expenses to average net assets:(4) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(5) | | | 2.34 | % | | | 2.47 | % | | | 2.68 | % | | | 2.47 | % | | | 2.48 | % | | | 2.61 | % |

After waivers and reimbursements of expenses(6) | | | 2.12 | % | | | 2.20 | % | | | 2.44 | % | | | 2.27 | % | | | 2.30 | % | | | 2.56 | %(9) |

| | | | | | |

Ratio of net investment gain (loss) to average net assets:(4)(7) | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses | | | (0.58 | )% | | | (0.98 | )% | | | 0.25 | % | | | (0.29 | )% | | | (0.64 | )% | | | (1.38 | )% |

After waivers and reimbursements of expenses | | | (0.36 | )% | | | (0.71 | )% | | | 0.49 | % | | | (0.09 | )% | | | (0.46 | )% | | | (1.33 | )% |

| | | | | | |

Portfolio turnover rate(3)(8) | | | 14 | % | | | 12 | % | | | 17 | % | | | 40 | % | | | 5 | % | | | 86 | % |

| (1) | | Per share net investment income (loss) was calculated using average shares outstanding. |

| (2) | | Total return in the table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Based on net asset value, which does not reflect the applicable sales charges. |

| (3) | | Not annualized for periods less than one year. |

| (4) | | Annualized for periods less than one year. |

| (5) | | Expense ratios of expenses to average net assets before waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.78% for the six months ended June 30, 2021 and 1.83%, 1.80%, 1.76%, 1.74%, and 1.61% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively. |

| (6) | | Expense ratios of expenses to average net assets after waivers and reimbursements of expenses excluding dividend and interest expense on short positions were 1.56% for the six months ended June 30, 2021 and 1.56%, 1.56%, 1.56%, 1.56%, and 1.56% for the years ended December 31, 2020, 2019, 2018, 2017, and 2016, respectively. |

| (7) | | The net investment income (loss) ratios include dividend and interest expense on short positions. |

| (8) | | Consists of long-term investments only; excludes securities sold short and derivative instruments. |

| (9) | | Effective after the close of business on April 8, 2016, Class I shares were subject to an expense limitation cap of 1.56%. |

The accompanying notes are an integral part of these financial statements.

20

MARKETFIELD FUND

Notes to Financial Statements

June 30, 2021

(Unaudited)

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Marketfield Fund (the “Fund”) represents a distinct series with its own investment objective and policies within the Trust. The investment objective of the Fund is capital appreciation. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Fund are segregated, and a shareholder’s interest is limited to the Fund in which shares are held.

The Fund currently offers three classes of shares. Class I shares commenced operations on July 31, 2007. Class A and Class C shares commenced operations on October 5, 2012. Class R6 shares commenced operations on June 17, 2013. Class R6 shares of the Fund were liquidated as of the close of business on November 30, 2020. Effective as of the close of business on August 15, 2016, the Fund converted its Investor Class shares into Class A shares of the Fund. Effective as of the close of business on August 15, 2016, the Fund converted its Class R2 and Class P shares into Class I shares of the Fund. Class A shares are subject to an initial maximum sales charge of 5.50% imposed at the time of purchase. The sales charge declines as the amount purchased increases in accordance with the Fund’s prospectus. A contingent deferred sales charge (“CDSC”) of 1.00% may be imposed on certain redemptions of Class A shares made within 12 months of the date of purchase of Class A shares. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on redemptions made within 12 months of the date of purchase of Class C shares. Class I shares are offered at NAV and are not subject to a sales charge. In addition, you generally may elect on a voluntary basis to convert your Class A or Class C shares that are no longer subject to a CDSC into Class A or Class I shares of the Fund, subject to satisfying the eligibility requirements of Class A or Class I shares, as applicable. Class C shares of the Fund automatically convert to Class A shares after 10 years. The three classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that Class C shares are subject to higher distribution and/or service (Rule 12b-1) fee rates than Class A shares under a distribution plan pursuant to Rule 12b-1 under the 1940 Act. Class I shares are not subject to a distribution and/or service (Rule 12b-1) fee.

Pursuant to a reorganization that took place after the close of business on April 8, 2016 (the “Reorganization”), the Fund is the successor to the MainStay Marketfield Fund, a series of MainStay Funds Trust (the “Predecessor Fund”). The Predecessor Fund and the Fund have the same investment objectives and substantially the same strategies and investment policies.

The Fund is an investment company and accordingly follows the investment accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

| (2) | | Significant Accounting Policies |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of these schedules of investments. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Each security owned by the Fund that is listed on a securities exchange, except securities listed on the NASDAQ Stock Market, LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. Swap agreements, such as credit default swaps, interest rate swaps and currency swaps, are priced by an approved independent pricing service (“Pricing Service”). Forward foreign currency contracts are valued at the mean between the bid and asked prices by a Pricing Service. Commodities futures

21

MARKETFIELD FUND

Notes to Financial Statements, continued

June 30, 2021

(Unaudited)

contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading.

If the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the security is traded. Portfolio securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at the mean between the most recent bid and ask prices at the close of the exchange on such day, or the security shall be valued at the latest sales price on the “composite market” for the day such security is being valued. The composite market is defined as a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets as published by a Pricing Service for the day such security is being valued.

If market quotations are not readily available, any security or other asset will be valued at its fair value as determined under fair value pricing procedures approved by the Trust’s Board of Trustees. These fair value pricing procedures will also be used to price a security when corporate events, events in the securities market and/or world events cause Marketfield Asset Management, LLC (the “Adviser”) to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund’s shares are accurately priced. The Board of Trustees will regularly evaluate whether the Fund’s fair value pricing procedures continue to be appropriate in light of the specific circumstances of the Fund and the quality of prices obtained through the application of such procedures by the Trust’s valuation committee.

Redeemable securities issued by open-end, registered investment companies are valued at the NAVs of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined as described above. All exchange-traded funds are valued at the last reported sale price on the exchange on which the security is principally traded. In the event market quotations are not readily available, such security’s fair value will be determined.

Debt securities, including short-term instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and ask prices, matrix pricing method or other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. Fixed income securities purchased on a delayed-delivery basis are typically marked to market daily until settlement at the forward settlement date. Any discount or premium is accreted or amortized using the constant yield method until maturity.

Money market funds, demand notes and repurchase agreements are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

Exchange-traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given business day, composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. Over-the-counter (“OTC”) option contracts on securities, currencies and other financial instruments with less than 180 days remaining until their expiration shall be valued at the evaluated price provided by the broker-dealer with which the option was traded. Option contracts on securities, currencies and other financial instruments traded in the OTC market with 180 days or more remaining until their expiration shall be valued at the prices provided by a recognized

22

MARKETFIELD FUND

Notes to Financial Statements, continued

June 30, 2021

(Unaudited)

independent broker-dealer. Futures contracts and options thereon are valued at the last settlement price at the closing of trading on the relevant exchange or board of trade. Futures or options on futures positions for which reliable market quotations are not readily available shall be valued at a price supplied by a Pricing Service.