UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant’s telephone number, including area code

Date of fiscal year end: February 28, 2022

Date of reporting period: August 31, 2021

Item 1. Reports to Stockholders.

Semi-Annual Report

August 31, 2021

Snow Capital Small Cap Value Fund

Class A Shares (SNWAX)

Class C Shares (SNWCX)

Institutional Class Shares (SNWIX)

Snow Capital Long/Short Opportunity Fund

Class A Shares (SNOAX)

Class C Shares (SNOCX)

Institutional Class Shares (SNOIX)

Investment Adviser

Easterly Investment Partners LLC

138 Conant Street

Beverly, Massachusetts 01915

Phone: 1-877-SNOWFND (877-766-9363)

TABLE OF CONTENTS

Dear Fellow Shareholder:

Over the past six months ended August 31, 2021, equity returns spiked as vaccines and additional government stimulus gave investors hope of a return to normalization of economic activity and spending patterns. The continued strength of the recovery coupled with strong corporate earnings fueled appreciation in the broad markets with most major indices posting solid gains. Earlier in the period market leadership was largely driven by value stocks. More recently, growth has been outperforming.

Economic data released during the period was strong with consumer spending increasing and unemployment trending lower. The manufacturing and services segments of the economy are reporting positive data. The counterbalance to much of the good news is concerns over inflation. On account of disrupted supply chains, labor shortages, government spending and pent-up consumer demand, inflation metrics have been spiking. Clearly, inflation is in focus due to the effect it may have on the direction of interest rates. The Federal Reserve (Fed) continues to stand by its current policy stance of unchanged interest rates even as data shows prices increasing. In our view, acute increases in prices will ultimately lead the Fed to raise policy rates. We also expect the Fed and other central banks to signal their intentions to taper quantitative easing in the months ahead as job creation continues to improve. Amidst this backdrop, we propose that value stocks appear poised for relative strength, especially if volatility levels increase and interest rates rise.

The companies we own have strong balance sheets, proven management teams, and recurring cash flow streams. We expect these companies to be able to compound earnings over full market cycles. All told, we remain dedicated to delivering strong long-term performance and transparent communications to our shareholders. We believe these companies will be able to compound earnings over an extended period through both rising and declining markets. Thank you for your commitment and loyalty.

Snow Capital Small Cap Value Fund

How did the Fund perform?

For the six-month period ended August 31, 2021, the Snow Capital Small Cap Value Fund’s Institutional Class Shares recorded a return of 8.03% compared to a return of 8.93% for the Russell 2000® Value Total Return Index.

3

How is the Fund managed?

We employ a contrarian value process rooted in fundamental investing to build a portfolio of investments. The Snow Capital Small Cap Value Fund typically maintains a portfolio of between 40 and 60 U.S.-listed equities. We weight position sizes based on our assessment of upside potential and near-term catalysts. The Fund draws at least 80% of its investments, at cost, from companies with market capitalizations in the range of the Russell 2000 Value® Index which, as of August 31, 2021, was between $139 million and $24.2 billion.

Top Positive Contributors to the Fund’s Return

For the six-month period ended August 31, 2021, the Financials, Information Technology, Materials, Industrials, Consumer Staples, and Health Care sectors added to overall performance. In order of magnitude, the best performing stocks for the six months were:

WESCO International (WCC) based in Pittsburgh, PA, benefitted from both strong macro and company specific results. Levered to the distribution of electrical products and other industrial maintenance operating supplies, WCC showcased strong results driven by a boom in contractor and manufacturer activity. Positive execution on integration results following the acquisition of Anixter in June, 2020, re-set investor expectations for growth and set a path to higher sales, earnings, and free cash flow for the company. Commercial Metals Company (CMC), a producer of steel and other metal products based in Irving, Texas, outperformed driven by strong residential housing demand throughout their core southern U.S. markets and high production volumes in both North America and Europe. The company has a strong balance sheet and favorable demographic trends throughout their primary geographic markets, which should be a tailwind moving forward. The passing of any infrastructure package would also be meaningful to CMC. Domtar Corporation (UFS) was acquired by Paper Excellence Canada Holdings in May, 2021 for $3.0B, a 45% premium at the time of announcement. The Fund subsequently exited the position while the deal is expected to close in late 2021. Silicon Motion Technology Corporation (SIMO), a NAND controller vendor based in Zhubei City, Taiwan, outperformed as they were able to leverage global capacity shortages in the semiconductor supply chains into pricing power for their products, driving profitability higher. The company boasts a balance sheet with

4

no debt, $10 per share in cash, and has a return on invested capital of over 20%. Pilgrim’s Pride Corporation (PPC) added to performance following a proposal by majority shareholder JBS Foods to purchase the remaining 20% of the company at more than a 20% premium. The Fund exited the position following the proposal and positive stock reaction.

Top Detractors from the Fund’s Return

For the six-month period ended August 31, 2021, the Consumer Discretionary, Communication Services, and Energy sectors detracted from overall performance.

Delek US Holdings (DK), a petroleum refiner based in Brentwood, TN, detracted as fundamental conditions for refiners were difficult during the summer of 2021, including soft crack spreads and elevated RINs prices. Higher oil prices could lead to increased Permian crude production, which would favor inland refiners such as DK, while consolidation for smaller companies in this space seems likely over the long run. Cinemark Holdings (CNK) pulled back following a summer increase in COVID-19 Delta variant cases, which negatively impacted near-term expectations for consumer-oriented companies such as CNK. The company remains trending in the right direction, with all North American theaters operating at a positive EBITDA level during the most recent quarter. With higher quality content returning to the theaters in the upcoming quarters, we believe CNK will post improving results in 2022. Cooper-Standard Holdings (CPS) detracted as the company was heavily impacted by the global semiconductor shortage and related sporadic shutdowns by customers, including Ford Motor Company. We expect free-cash-flow to turn positive in late 2021 as volumes recover. JetBlue Airways (JBLU) negatively impacted performance as investors extrapolated the potential impacts on domestic travel that the COVID-19 Delta variant might have. The company remains well positioned with both macro and company specific catalysts, including the airline’s highly competitive transatlantic route to London finally embarking in August, 2021. NN Incorporated (NNBR), based in Charlotte, NC, pulled back as several auto customers idled facilities due to semiconductor shortages. The diversified industrial company with exposure to electrical, automotive, medical, and aerospace end markets has done well to improve working capital and set themselves up for margin expansion once demand stabilizes.

5

Were there significant changes to the portfolio?

Compared to the Russell 2000® Value Index, the Fund holds an above-average weight in the Information Technology, Consumer Discretionary, Financials, Communication Services, and Materials sectors, and a below-average weight in the Health Care, Industrials, and Energy sectors. The Fund maintained a zero percent weighting in the Real Estate, Consumer Staples, and Utilities sectors as of August 31, 2021.

We reduced our exposure to the Materials, Consumer Staples, Energy, Financials, and Health Care sectors and increased our investments in the Information Technology, Consumer Discretionary, Industrials, and Communication Services sectors during the period.

Comments on the Fund’s Five Largest Holdings

Acco Brands Corporation (ACCO)

One of the world’s largest designers, marketers, and manufacturers of branded academic, consumer, and business products, Acco Brands Corporation (ACCO) owns several recognizable brands such as Mead, Five-Star, and Rexel. Results have been ahead of expectations as schools and offices reopen, while a recent expansion into the video game space via a 2020 acquisition of PowerA provides a nice growth channel.

Cinemark Holdings (CNK)

Cinemark Holdings (CNK) is one of the most geographically diverse operators in the motion picture industry, boasting nearly 6,000 screens across more than 500 theatres throughout the U.S. and Latin America. Expectations for the company are highlighted by historically low valuation metrics while fundamentals remain intact, including a balance sheet that carries more than 25% of the company’s market capitalization in cash, providing downside protection.

CNO Financial Group (CNO)

CNO Financial Group (CNO) provides life insurance, annuity, and supplemental health insurance products to more than four million customers in

6

the United States primarily serving middle-income pre-retirees and retired Americans, which are underserved high growth markets. The company took recent actions to de-risk the investment portfolio, which should enable the management team flexibility looking for yield opportunities in the current environment.

Alliance Data Systems Corporation (ADS)

Based in Columbus, OH, Alliance Data Systems Corporation (ADS) provides data-driven marketing, loyalty, and payment solutions serving consumer-based businesses in a range of industries, primarily offering private label and co-branded retail credit card programs. Clients include major retailers such as IKEA, Victoria’s Secret, and Signet, as well as banks and other brands in large, consumer-based industries. The company also owns a Buy Now Pay Later company, Bread, which, while currently a small percent of the business is growing rapidly.

BankUnited Inc. (BKU)

BankUnited (BKU) is a bank holding company that provides a range of financial products and services including personal, commercial, and business banking. Over the years, BankUnited has built out a national or non-geographically focused platform and scaled up its banking operation through several acquisitions. The company is focused on reducing costs and improving efficiencies, increasing its low-cost deposit base, and growing the loan portfolio.

Snow Capital Long/Short Opportunity Fund

How did the Fund perform?

For the six-month period ended August 31, 2021, the Snow Capital Long/Short Opportunity Fund’s Institutional Class Shares recorded a return of 9.29% compared to a return of 9.76% for the blended index of 70% Russell 3000® Value Total Return Index and 30% ICE BofAML 3-Month T-Bill Index and a return of 14.13% for the Russell 3000 Value Total Return Index.

7

How is the Fund managed?

The Long/Short Opportunity Fund is an all-cap, contrarian value, liquid alternatives fund that uses a variety of hedging strategies to reduce the overall volatility of the Fund’s investment portfolio.

The Fund employs a fundamental value philosophy and a disciplined bottom-up investment process to select long equity positions. Thorough reviews are conducted on each company to ensure they are in line with our investment thesis and potential return target. The portfolio consists of our highest conviction companies as core holdings, along with short equity positions, long and short options, exchange-traded funds, and closed-end funds as hedging vehicles. The Fund is managed with a conviction-weighted long portfolio and an opportunistic, research-driven process for our short positioning with the goal of smoothing volatility of investment returns for our shareholders.

Top Positive Contributors to the Fund’s Return

For the six-month period ended August 31, 2021, the Financials, Industrials, Health Care, Information Technology, Consumer Discretionary, Materials, Energy, Consumer Staples, Communication Services, and Utilities sectors added to overall performance. In order of magnitude, the best performing stocks for the six months were:

WESCO International (WCC) based in Pittsburgh, PA, benefitted from both strong macro and company specific results. Levered to the distribution of electrical products and other industrial maintenance operating supplies, WCC showcased strong results driven by a boom in contractor and manufacturer activity. Positive execution on integration results following the acquisition of Anixter in June, 2020, re-set investor expectations for growth and set a path to higher sales, earnings, and free cash flow for the company. Hartford Financial Services Group (HIG) outperformed on takeover interest from Chubb Limited (CB). The company’s board of directors rejected the overture, implying further upside to current valuation levels. Company specific results have also been positive, with HIG showcasing improving combined ratios, lower expenses, and good investment performance throughout the period. NetApp, Inc (NTAP),

8

a storage and data management solution company based in Sunnyvale, CA, added to performance through solid execution including expanding margins, share gains, and prudent capital management, all of which have re-rated the multiple higher. The company is on track to generate more than $1.2B in free-cash-flow for the fiscal year, an impressive figure. Wells Fargo & Company (WFC) outperformed as the prospect for revenue growth improved over the period. Higher equity markets raised investor sentiment for the company’s wealth management and corporate banking segments, while the potential for loan growth, asset cap relief, expense saves, and a dividend boost suggest upside relative to peers with higher valuations. Pfizer Inc (PFE) added to performance driven not just by COVID-19 vaccine contribution, but solid execution within their core legacy business lines. Operational revenue growth remains strong even with pricing receding, implying strong momentum.

Top Detractors from the Fund’s Return

For the six-month period ended August 31, 2021, no one sector detracted from overall performance.

JetBlue Airways (JBLU) negatively impacted performance as investors extrapolated the potential impacts on domestic travel that the COVID-19 Delta variant might have. The company remains well positioned with both macro and company specific catalysts, including the airline’s highly competitive transatlantic route to London finally embarking in August, 2021. Las Vegas Sands Corp (LVS) detracted as expectations for the company’s Macau and Singapore operations pulled back with the emergence of the COVID-19 Delta variant. The Fund exited the position as the trajectory of the recovery in these markets deviated from initial projections. Vishay Intertechnology (VSH), a manufacturer of passive and discreet electronic components based in Malvern, PA, pulled back with investors concerned over the state of global supply chains and extended lead times. Shares of Tapestry Inc (TPR), a designer and marketer of clothing and accessories, paused after a great run with the stock tripling since Q3, 2020. Management remains bullish on the remainder of calendar year 2021 where they expect higher profitability while the street is concerned about the impact rising shipping costs may have. Suncor Energy (SU), an integrated energy company based in Calgary, Alberta, Canada, pulled back while hindered by operational disruptions that are not uncommon in oil

9

sands mining. We don’t see these delays altering the long term economics of the company and their projects, and have maintained a position in the company.

Were there significant changes to the portfolio?

Compared to the Russell 3000 Value Total Return Index, the Fund holds an above-average weight in the Consumer Discretionary, Energy, Financials, and Materials sectors, and a below-average weight in the Communication Services, Consumer Staples, Health Care, Utilities, Industrials, and Information Technology sectors. The Fund maintained a zero percent weighting in the Real Estate sector as of August 31, 2021.

We reduced our exposure to the Communication Services, Materials, Energy, and Financials sectors, and increased our investments in the Information Technology, Health Care, Industrials, Utilities, Consumer Discretionary, and Consumer Staples sectors during the period. As of the end of August, the portfolio held 51 core long positions and was approximately 74% net long.

The purchase and/or sale of short positions, options, exchange-traded funds, or other securities aim to serve as a hedge to our long equity portfolio. We are holding cash as a component of our strategies and to take advantage of any opportunities the market volatility may provide.

Comments on the Fund’s Five Largest Holdings

Wells Fargo & Company (WFC)

Wells Fargo & Company (WFC) is a diversified, community-based financial services company. Buoyed by an improving economy, the prospect of loan growth, asset cap relief, expense saves, and a dividend boost provides potential upside. WFC remains mispriced versus peers, the residual reputational discount left by the prior management team.

Truist Financial Corporation (TFC)

Regional powerhouse Truist Financial Corporation (TFC), based in Charlotte, NC, is a financial services company offering a wide range of business lines

10

including retail, small business and commercial banking, asset management, insurance, mortgage, and wealth management, among others. The result of a merger between BB&T and SunTrust, TFC is levered to some of the highest growth markets in the country and offers a best-of-breed management team.

WESCO International (WCC)

WESCO International (WCC) distributes electrical parts and other industrial maintenance, repair, and operating supplies through the world. The company also provides integrated supply services. The acquisition of Anixter in June, 2020, gives WCC material market share in a highly fragmented industry which should enable them to continue to drive outperformance.

Cardinal Health, Inc (CAH)

Cardinal Health (CAH) provides complementary products and services to healthcare providers and manufacturers. The company’s wide range of services include pharmaceutical distribution, health-care product manufacturing, distribution and consulting services, drug delivery systems development, pharmaceutical packings, automated dispensing systems manufacturing, and retail pharmacy franchising. A large cost savings plan recently initiated by management coupled with end-market growth channels provides strong upside for a company that is backboned by a significant amount of free-cash-flow generation.

The Hartford Financial Services Group (HIG)

One of the oldest life insurance companies in the U.S., The Hartford Financial Services Group (HIG) has benefitted from an improving economy and prudent capital management, including actively repurchasing their own shares. Recent takeover interest from Chubb Limited (CB) that was rebuffed by management has rebased the valuation higher, while management continues to target an ROE above the cost of capital through premium growth, capital allocation, and expense reduction.

Past performance is not a guarantee of future results.

The views expressed herein are solely the opinions of Easterly Investment Partners LLC. We make no representations as to their accuracy. This

11

communication is intended for informational purposes only and does not constitute a solicitation to invest money nor a recommendation to buy or sell certain securities. Equity investments are not appropriate for all investors. Individual investment decisions should be discussed with a financial advisor.

Mutual fund investing involves risk. Principal loss is possible. Investments in small- and medium-capitalization companies involve additional risks such as limited liquidity and greater volatility. Investments in foreign securities involve political, economic, and currency risks, greater volatility and differences in accounting methods. The Snow Capital Long/Short Opportunity Fund may invest in debt securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. The Snow Capital Long/Short Opportunity Fund may use options or futures contracts which have the risks of unlimited losses and the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of the securities prices, interest rates, and currency exchange rates. Investments in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to their net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. This investment may not be suitable for all investors.

Earnings growth is not representative of the Fund’s future performance.

Fund holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedules of Investments in this report for a complete list of fund holdings.

The Russell 2000® Value Total Return Index measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

12

The Russell 3000® Value Total Return Index measures the performance of the broad value segment of the U.S. equity value universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

The blended index of 70% Russell 3000 Value Total Return and 30% ICE BofAML 3-Month T-Bill Index is a weighted blend of the Russell 3000 Value, defined above, and the ICE BofAML 3-Month T-Bill Index, which is an unmanaged index that measures returns of three-month Treasury Bills.

Free cash flow (FCF) is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets, or the cash left over after a company pays for its operating expenses and capital expenditures.

Return on invested capital (ROIC) is the amount of money a company makes that is above the average cost it pays for its debt and equity capital. The calculation is used to assess a company’s efficiency at allocating the capital under its control to profitable investments.

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company’s overall financial performance.

Market Capitalization is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share.

The Snow Capital Family of Funds are distributed by Quasar Distributors, LLC.

13

Snow Capital Family of Funds

Expense Example (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (Class A shares only) and redemption fees, and (2) ongoing costs, including management fees, distribution (12b-1) and service fees (Class A and Class C shares only) and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (3/1/21-8/31/21).

Actual Expenses

The following table provides information about actual account values and actual expenses. If you purchase Class A shares of the Funds you will pay an initial sales charge of 5.25% when you invest. Class A shares are also subject to a contingent deferred sales charge of 0.50% for purchases made at the $1,000,000 breakpoint and redeemed within twelve months of purchase. A 1.00% contingent deferred sales charge is imposed on Class C shares redeemed within twelve months of purchase. In addition, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 0.50% of the net amount of the redemption if you redeem your shares of the Funds within 30 days of purchase. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent a Fund invests in shares of exchange-traded funds or other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which a Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, management fees, distribution (12b-1) and service fees, fund administration and accounting, custody and transfer agent fees. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

14

Fund Expense Examples (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Balance

3/1/21 | | | Ending

Account

Balance

8/31/21 | | | Expenses

Paid

During

Period

3/1/21-

8/31/21 | | | Annualized

Expense

Ratio | |

Long/Short Opportunity Fund | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,091.50 | | | $ | 9.12 | | | | 1.73 | % |

Class C | | | 1,000.00 | | | | 1,088.10 | | | | 12.42 | | | | 2.36 | % |

Institutional Class | | | 1,000.00 | | | | 1,092.90 | | | | 7.81 | | | | 1.48 | % |

Small Cap Value Fund | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,078.80 | | | | 7.91 | | | | 1.51 | % |

Class C | | | 1,000.00 | | | | 1,074.70 | | | | 11.77 | | | | 2.25 | % |

Institutional Class | | | 1,000.00 | | | | 1,080.30 | | | | 6.61 | | | | 1.26 | % |

| * | Expenses are equal to each Fund’s annualized expense ratio by class multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the 12-month period (365). |

Hypothetical Example for Comparison Purposes

The following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the information in this table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

15

| | | | | | | | | | | | | | | | |

| | | Beginning

Account

Balance

3/1/21 | | | Ending

Account

Balance

8/31/21 | | | Expenses

Paid

During

Period

3/1/21-

8/31/21 | | | Annualized

Expense

Ratio | |

Long/Short Opportunity Fund | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $

| 1,016.48

|

| | $ | 8.79 | | | | 1.73 | % |

Class C | | | 1,000.00 | | | | 1,013.31 | | | | 11.98 | | | | 2.36 | % |

Institutional Class | | | 1,000.00 | | | | 1,017.74 | | | | 7.53 | | | | 1.48 | % |

Small Cap Value Fund | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | 1,017.59 | | | | 7.68 | | | | 1.51 | % |

Class C | | | 1,000.00 | | | | 1,013.86 | | | | 11.42 | | | | 2.25 | % |

Institutional Class | | | 1,000.00 | | | | 1,018.85 | | | | 6.41 | | | | 1.26 | % |

| * | Expenses are equal to each Fund’s annualized expense ratio by class multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the 12-month period (365). |

16

Snow Capital Small Cap Value Fund

Investment Highlights (Unaudited)

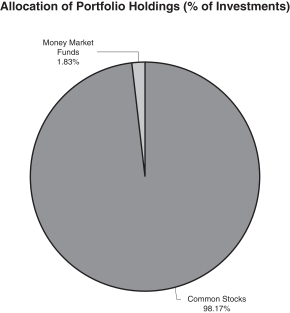

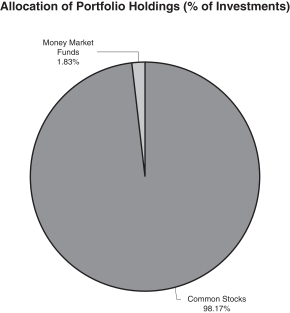

The investment objective of the Fund is long-term capital appreciation. To achieve its investment objective, under normal market conditions the Fund will invest at least 80% of its net assets, at cost, in equity securities of companies with market capitalizations in the range of the Russell 2000® Value Total Return Index (“small cap companies”). Easterly Investment Partners LLC (the “Adviser”) selects equity securities for the Fund using a bottom-up approach that seeks to identify small-cap companies that the Adviser believes are undervalued and are likely to experience a rebound in earnings due to an event or series of events that creates a price-to-earnings expansion that leads to higher stock price valuations. The Fund’s allocation of portfolio assets as of August 31, 2021 is shown below.

17

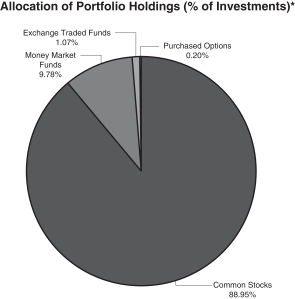

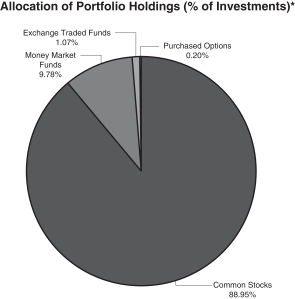

Snow Capital Long/Short Opportunity Fund

Investment Highlights (Unaudited) (Continued)

The investment objective of the Fund is long-term capital appreciation and protection of investment principal. The Fund seeks to achieve its investment objective by investing primarily in equity securities that Easterly Investment Partners LLC (the “Adviser”), the Fund’s investment adviser, believes are undervalued, selling short equity securities the Adviser believes are overvalued and selling short equity securities to hedge market risk. The Fund may also invest in options, futures contracts and options on futures contracts (collectively, “Derivative Instruments”) as a substitute for a comparable market position in the underlying equity security or to attempt to “hedge” or limit the exposure of the Fund’s position in an equity security. Long and short investments can include common and preferred stocks, convertible securities, shares of other investment companies and ETFs that invest in equity securities. With a long position, the Fund purchases a security outright, while with a short position, the Fund sells a security that it has borrowed. When the Fund sells a security short, it borrows the security from a third party and sells it at the then-current market price. The Fund is then obligated to buy the security on a later date so that it can return the security to the lender. The Fund may invest in securities of companies of any size and is not managed toward sector or industry weights. In addition to domestic securities, the Fund may have up to 25% of its net assets invested directly or indirectly in foreign securities, including investments in emerging markets. The Fund’s allocation of portfolio assets as of August 31, 2021 is shown below.

| * | Short Securities (10.08%); Options Written (0.67%), each as a percent of total net assets. |

18

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

Average Annual Returns as of August 31, 2021(1)

| | | | | | | | | | | | | | | | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since Inception

(11/30/10) | |

Snow Capital Small Cap Value Fund | | | | | | | | | | | | | | | | |

Class A (with sales charge) | | | 63.36% | | | | 9.75% | | | | 9.91% | | | | 10.01% | |

Class A (without sales charge) | | | 72.44% | | | | 10.95% | | | | 10.50% | | | | 10.57% | |

Class C (with sales charge) | | | 70.13% | | | | 10.12% | | | | 9.68% | | | | 9.75% | |

Class C (without sales charge) | | | 71.13% | | | | 10.12% | | | | 9.68% | | | | 9.75% | |

Institutional Class | | | 72.83% | | | | 11.23% | | | | 10.77% | | | | 10.84% | |

Russell 2000® Value Total Return Index | | | 59.49% | | | | 11.66% | | | | 12.14% | | | | 11.15% | |

| | | | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since Inception

(4/28/06) | |

Snow Capital Long/Short Opportunity Fund | | | | | | | | | | | | | | | | |

Class A (with sales charge) | | | 36.29% | | | | 8.41% | | | | 9.06% | | | | 5.60% | |

Class A (without sales charge) | | | 43.83% | | | | 9.58% | | | | 9.65% | | | | 5.97% | |

Class C (with sales charge) | | | 41.79% | | | | 8.78% | | | | 8.86% | | | | 5.20% | |

Class C (without sales charge) | | | 42.79% | | | | 8.78% | | | | 8.86% | | | | 5.20% | |

Institutional Class | | | 44.16% | | | | 9.86% | | | | 9.93% | | | | 6.23% | |

Russell 3000® Value Total Return Index | | | 37.78% | | | | 11.68% | | | | 12.95% | | | | 7.84% | |

70% Russell 3000® Value Total Return / 30% ICE BofA Merrill Lynch 3 Month U.S. Treasury Bill Blend Index | | | 25.55% | | | | 8.74% | | | | 9.36% | | | | 6.08% | |

| (1) | With sales charge returns reflect the deduction of the current maximum initial sales charge of 5.25% for Class A shares and the applicable contingent deferred sales charge for Class C shares. Returns without sales charges do not reflect the current maximum sales charges. Had the sales charges been included, the returns would have been lower. |

19

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-877-SNOWFND (877-766-9363). The Funds impose a 0.50% redemption fee on shares held 30 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Funds’ future performance, and an investment should not be made solely on returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

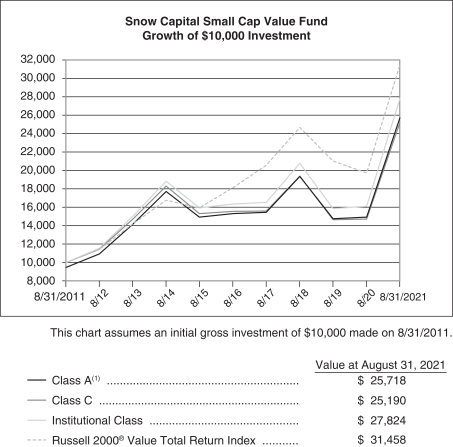

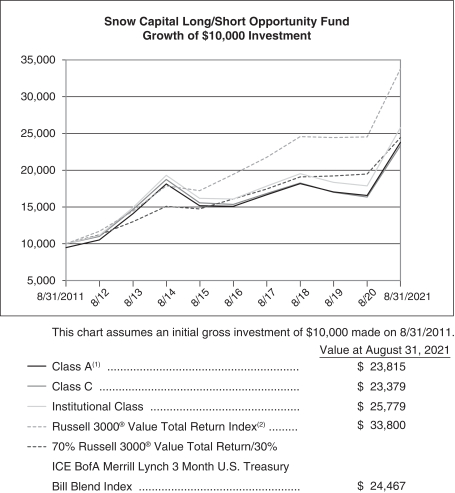

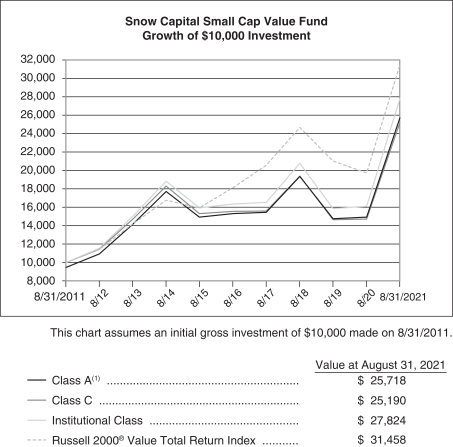

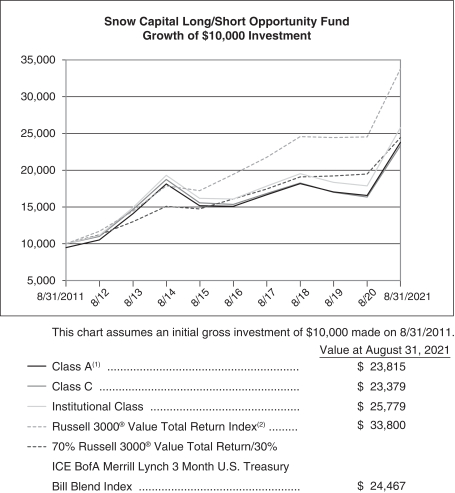

The returns shown in the table above and the following graphs assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The graphs below illustrate performance of a hypothetical investment made in the Funds and a broad- based securities index on each Fund’s inception date. The graphs do not reflect any future performance.

The Russell 2000® Value Total Return Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 3000® Value Total Return Index measures the performance of the broad value segment of U.S. equity value universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. The 70% Russell 3000® Value Total Return/30% ICE BofA Merrill Lynch 3 Month Treasury Bill Blend Index consists of 70% Russell 3000® Value Total Return Index and 30% ICE BofA Merrill Lynch 3 Month U.S. Treasury Bill Index. The ICE BofA Merrill Lynch 3 Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

20

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

| (1) | Reflects 5.25% initial sales charge. |

21

Snow Capital Family of Funds

Investment Highlights (Unaudited) (Continued)

| (1) | Reflects 5.25% initial sales charge. |

22

Snow Capital Small Cap Value Fund

Schedule of Investments

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - 96.35% | | | | | | | | |

Air Freight & Logistics - 0.81% | | | | | | | | |

Atlas Air Worldwide Holdings, Inc. | | | 2,536 | | | $ | 185,559 | |

| | | | | | | | |

Airlines - 2.81% | | | | | | | | |

JetBlue Airways Corp. | | | 42,665 | | | | 645,521 | |

| | | | | | | | |

Auto Components - 3.35% | | | | | | | | |

Cooper-Standard Holdings, Inc. | | | 8,940 | | | | 208,123 | |

Modine Manufacturing Co. (a) | | | 44,960 | | | | 559,303 | |

| | | | | | | | |

| | | | | | | 767,426 | |

| | | | | | | | |

Banks - 19.87% | | | | | | | | |

BankUnited, Inc. | | | 21,821 | | | | 917,136 | |

First Commonwealth Financial Corp. | | | 35,292 | | | | 477,148 | |

First Midwest Bancorp Inc. | | | 23,508 | | | | 440,305 | |

FNB Corp. | | | 62,501 | | | | 730,012 | |

OFG Bancorp (b) | | | 17,434 | | | | 415,104 | |

PacWest Bancorp | | | 17,142 | | | | 729,392 | |

Umpqua Holdings Corp. | | | 43,701 | | | | 850,857 | |

| | | | | | | | |

| | | | | | | 4,559,954 | |

| | | | | | | | |

Commercial Services & Supplies - 5.28% | | | | | | | | |

ACCO Brands Corp. | | | 115,905 | | | | 1,086,031 | |

Matthews International Corp. | | | 3,346 | | | | 123,902 | |

| | | | | | | | |

| | | | | | | 1,209,933 | |

| | | | | | | | |

Communications Equipment - 1.08% | | | | | | | | |

Lumentum Holdings, Inc. | | | 2,870 | | | | 248,657 | |

| | | | | | | | |

Consumer Finance - 2.39% | | | | | | | | |

Green Dot Corp. - Class A | | | 10,499 | | | | 548,468 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components - 1.83% | | | | | |

Vishay Intertechnology, Inc. | | | 19,143 | | | | 420,572 | |

| | | | | | | | |

Entertainment - 7.13% | | | | | | | | |

Cinemark Holdings, Inc. (a) | | | 53,566 | | | | 955,082 | |

Lions Gate Entertainment Corp. - Class A (a) | | | 52,624 | | | | 679,902 | |

| | | | | | | | |

| | | | | | | 1,634,984 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

23

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Health Care Equipment & Supplies - 1.36% | | | | | | | | |

Co-Diagnostics, Inc. | | | 28,914 | | | $ | 310,826 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 5.12% | | | | | | | | |

Bloomin’ Brands, Inc. (a) | | | 22,070 | | | | 591,255 | |

Brinker International, Inc. (a) | | | 9,033 | | | | 481,188 | |

Dave & Buster’s Entertainment, Inc. | | | 2,689 | | | | 100,622 | |

| | | | | | | | |

| | | | | | | 1,173,065 | |

| | | | | | | | |

Household Durables - 1.63% | | | | | | | | |

Taylor Morrison Home Corp. | | | 13,308 | | | | 373,822 | |

| | | | | | | | |

Insurance - 7.52% | | | | | | | | |

American Equity Investment Life Holding Co. | | | 17,253 | | | | 546,748 | |

Argo Group International Holdings Ltd. (b) | | | 4,516 | | | | 238,896 | |

CNO Financial Group, Inc. | | | 38,390 | | | | 939,019 | |

| | | | | | | | |

| | | | | | | 1,724,663 | |

| | | | | | | | |

IT Services - 4.04% | | | | | | | | |

Alliance Data Systems Corp. | | | 9,438 | | | | 925,962 | |

| | | | | | | | |

Machinery - 0.95% | | | | | | | | |

NN, Inc. | | | 40,062 | | | | 217,937 | |

| | | | | | | | |

Metals & Mining - 5.24% | | | | | | | | |

Alamos Gold, Inc. (b) | | | 14,082 | | | | 111,248 | |

B2Gold Corp. (b) | | | 99,961 | | | | 388,848 | |

Century Aluminum Co. (a) | | | 11,285 | | | | 144,674 | |

Commercial Metals Co. | | | 17,092 | | | | 557,541 | |

| | | | | | | | |

| | | | | | | 1,202,311 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels - 5.92% | | | | | | | | |

Cimarex Energy Co. | | | 7,262 | | | | 466,366 | |

Delek US Holdings, Inc. | | | 44,877 | | | | 767,845 | |

HollyFrontier Corp. | | | 3,833 | | | | 123,921 | |

| | | | | | | | |

| | | | | | | 1,358,132 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

24

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Semiconductors & Semiconductor Equipment - 5.33% | | | | | | | | |

Photronics, Inc. | | | 34,816 | | | $ | 524,677 | |

Silicon Motion Technology Corp. (b) | | | 9,336 | | | | 697,025 | |

| | | | | | | | |

| | | | | | | 1,221,702 | |

| | | | | | | | |

Software - 2.80% | | | | | | | | |

J2 Global, Inc. (a) | | | 4,665 | | | | 642,371 | |

| | | | | | | | |

Specialty Retail - 1.46% | | | | | | | | |

American Eagle Outfitters, Inc. | | | 3,088 | | | | 94,246 | |

Urban Outfitters, Inc. | | | 7,305 | | | | 241,211 | |

| | | | | | | | |

| | | | | | | 335,457 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals - 3.19% | | | | | | | | |

Super Micro Computer, Inc. | | | 20,057 | | | | 732,883 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods - 4.03% | | | | | | | | |

Carter’s, Inc. | | | 3,296 | | | | 337,444 | |

Skechers U.S.A., Inc. - Class A | | | 2,365 | | | | 119,267 | |

Vera Bradley, Inc. | | | 40,894 | | | | 468,645 | |

| | | | | | | | |

| | | | | | | 925,356 | |

| | | | | | | | |

Trading Companies & Distributors - 3.21% | | | | | | | | |

WESCO International, Inc. | | | 6,289 | | | | 735,939 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $19,955,462) | | | | | | | 22,101,500 | |

| | | | | | | | |

MONEY MARKET FUND - 1.80% | | | | | | | | |

Fidelity Investment Money Market Funds - Government Portfolio, Institutional Class, 0.010% (c) | | | 412,943 | | | | 412,943 | |

| | | | | | | | |

TOTAL MONEY MARKET FUND

(Cost $412,943) | | | | | | | 412,943 | |

| | | | | | | | |

Total Investments

(Cost $20,368,405) - 98.15% | | | | | | | 22,514,443 | |

Other Assets in Excess of Liabilities - 1.85% | | | | | | | 424,591 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 22,939,034 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

25

Snow Capital Small Cap Value Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. |

| (c) | Seven day yield as of August 31, 2021. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

26

Snow Capital Long/Short Opportunity Fund

Schedule of Investments

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - 87.11% | | | | | | | | |

Aerospace & Defense - 4.61% | | | | | | | | |

General Dynamics Corp. | | | 11,005 | | | $ | 2,204,412 | |

Lockheed Martin Corp. | | | 6,920 | | | | 2,489,815 | |

| | | | | | | | |

| | | | | | | 4,694,227 | |

| | | | | | | | |

Airlines - 1.51% | | | | | | | | |

JetBlue Airways Corp. (a) | | | 67,410 | | | | 1,019,914 | |

Southwest Airlines Co. | | | 10,330 | | | | 514,227 | |

| | | | | | | | |

| | | | | | | 1,534,141 | |

| | | | | | | | |

Banks - 10.96% | | | | | | | | |

Bank of America Corp. (b)(c) | | | 61,957 | | | | 2,586,705 | |

JPMorgan Chase & Co. (b)(c) | | | 16,540 | | | | 2,645,573 | |

Truist Financial Corp. | | | 49,045 | | | | 2,798,507 | |

Umpqua Holdings Corp. | | | 251 | | | | 4,887 | |

Wells Fargo & Co. | | | 68,095 | | | | 3,111,941 | |

| | | | | | | | |

| | | | | | | 11,147,613 | |

| | | | | | | | |

Biotechnology - 3.48% | | | | | | | | |

Amgen, Inc. (c) | | | 7,840 | | | | 1,768,155 | |

Biogen, Inc. (a)(c) | | | 5,234 | | | | 1,773,855 | |

| | | | | | | | |

| | | | | | | 3,542,010 | |

| | | | | | | | |

Capital Markets - 1.74% | | | | | | | | |

The Goldman Sachs Group, Inc. (b) | | | 4,275 | | | | 1,767,755 | |

| | | | | | | | |

Communications Equipment - 1.63% | | | | | | | | |

Lumentum Holdings, Inc. | | | 19,120 | | | | 1,656,557 | |

| | | | | | | | |

Consumer Finance - 0.52% | | | | | | | | |

American Express Co. (b) | | | 3,200 | | | | 531,072 | |

| | | | | | | | |

Diversified Telecommunication Services - 1.12% | | | | | | | | |

Lumen Technologies, Inc. | | | 92,610 | | | | 1,139,103 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components - 1.52% | | | | | | | | |

Vishay Intertechnology, Inc. | | | 70,500 | | | | 1,548,885 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

27

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Food Products - 1.71% | | | | | | | | |

Tyson Foods, Inc. - Class A | | | 22,120 | | | $ | 1,736,862 | |

| | | | | | | | |

Health Care Providers & Services - 4.37% | | | | | | | | |

Cardinal Health, Inc. (c) | | | 51,725 | | | | 2,715,046 | |

Centene Corp. (a) | | | 27,380 | | | | 1,724,392 | |

| | | | | | | | |

| | | | | | | 4,439,438 | |

| | | | | | | | |

Hotels, Restaurants & Leisure - 0.64% | | | | | | | | |

Norwegian Cruise Line Holdings Ltd. (a) | | | 25,175 | | | | 650,522 | |

| | | | | | | | |

Household Durables - 2.26% | | | | | | | | |

Mohawk Industries, Inc. (a) | | | 11,610 | | | | 2,295,994 | |

| | | | | | | | |

Independent Power and Renewable Electricity Producers - 1.04% | | | | | | | | |

Vistra Corp. | | | 55,210 | | | | 1,053,959 | |

| | | | | | | | |

Insurance - 9.39% | | | | | | | | |

Argo Group International Holdings Ltd. (d) | | | 42,390 | | | | 2,242,431 | |

CNO Financial Group, Inc. | | | 91,590 | | | | 2,240,291 | |

Hartford Financial Services Group, Inc. | | | 39,910 | | | | 2,682,751 | |

MetLife, Inc. (c) | | | 38,435 | | | | 2,382,970 | |

| | | | | | | | |

| | | | | | | 9,548,443 | |

| | | | | | | | |

Leisure Products - 2.41% | | | | | | | | |

Hasbro, Inc. | | | 24,950 | | | | 2,452,835 | |

| | | | | | | | |

Machinery - 1.44% | | | | | | | | |

Caterpillar, Inc. (b) | | | 2,000 | | | | 421,740 | |

PACCAR, Inc. | | | 12,680 | | | | 1,038,112 | |

| | | | | | | | |

| | | | | | | 1,459,852 | |

| | | | | | | | |

Metals & Mining - 4.17% | | | | | | | | |

Alamos Gold, Inc. (d) | | | 64,260 | | | | 507,654 | |

Commercial Metals Co. (b) | | | 54,500 | | | | 1,777,790 | |

Freeport-McMoRan, Inc. | | | 27,235 | | | | 991,082 | |

Rio Tinto PLC - ADR (b)(d) | | | 12,770 | | | | 958,644 | |

| | | | | | | | |

| | | | | | | 4,235,170 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

28

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

Multiline Retail - 2.09% | | | | | | | | |

Kohl’s Corp. (b) | | | 36,930 | | | $ | 2,119,782 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels - 9.58% | | | | | | | | |

BP PLC - ADR (d) | | | 61,268 | | | | 1,498,615 | |

Cimarex Energy Co. | | | 29,290 | | | | 1,881,004 | |

Marathon Petroleum Corp. (b)(c) | | | 44,760 | | | | 2,652,925 | |

Pioneer Natural Resources Co. | | | 12,860 | | | | 1,924,756 | |

Suncor Energy, Inc. (d) | | | 95,140 | | | | 1,774,361 | |

| | | | | | | | |

| | | | | | | 9,731,661 | |

| | | | | | | | |

Pharmaceuticals - 5.07% | | | | | | | | |

AbbVie, Inc. (c) | | | 21,524 | | | | 2,599,669 | |

Pfizer, Inc. | | | 55,430 | | | | 2,553,660 | |

| | | | | | | | |

| | | | | | | 5,153,329 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment - 0.77% | | | | | | | | |

Intel Corp. | | | 14,430 | | | | 780,086 | |

| | | | | | | | |

Software - 1.13% | | | | | | | | |

Check Point Software Technologies Ltd. (a)(d) | | | 9,110 | | | | 1,144,489 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals - 4.36% | | | | | | | | |

HP, Inc. | | | 66,630 | | | | 1,981,577 | |

NCR Corp. (b)(a) | | | 44,030 | | | | 1,870,394 | |

NetApp, Inc. (b) | | | 6,500 | | | | 578,045 | |

| | | | | | | | |

| | | | | | | 4,430,016 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods - 6.90% | | | | | | | | |

Carter’s, Inc. | | | 21,890 | | | | 2,241,098 | |

PVH Corp. | | | 24,291 | | | | 2,545,453 | |

Tapestry, Inc. | | | 55,190 | | | | 2,225,261 | |

| | | | | | | | |

| | | | | | | 7,011,812 | |

| | | | | | | | |

Trading Companies & Distributors - 2.69% | | | | | | | | |

WESCO International, Inc. (b)(a) | | | 23,350 | | | | 2,732,417 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $70,733,924) | | | | | | | 88,538,030 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

29

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | | | | | |

| | | Contracts | | | Notional

Value | | | Value | |

PURCHASED OPTIONS - 0.20% | | | | | | | | | | | | |

Exchange Traded Put Options - 0.20% | | | | | | | | | | | | |

iShares Russell 1000 Value ETF | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $135.000 | | | 130 | | | $ | 2,120,170 | | | $ | 17,550 | |

iShares Russell 2000 ETF | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $215.000 | | | 65 | | | | 1,468,480 | | | | 57,395 | |

SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: December, 2021, Exercise Price: $385.000 | | | 20 | | | | 903,120 | | | | 8,580 | |

Expiration: June, 2022, Exercise Price: $430.000 | | | 50 | | | | 2,257,800 | | | | 116,350 | |

| | | | | | | | | | | | |

TOTAL PURCHASED OPTIONS

(Cost $339,916) | | | | | | | | | | | 199,875 | |

| | | | | | | | | | | | |

| | | | | | | | |

| | | Shares | | | | |

EXCHANGE TRADED FUNDS - 1.05% | | | | | | | | |

VanEck Vectors Junior Gold Miners ETF | | | 24,800 | | | | 1,069,128 | |

| | | | | | | | |

TOTAL EXCHANGE TRADED FUNDS

(Cost $992,677) | | | | | | | 1,069,128 | |

| | | | | | | | |

MONEY MARKET FUND - 9.58% | | | | | | | | |

Fidelity Investments Money Market Funds - Government Portfolio, Institutional Class, 0.010% (e) | | | 9,733,204 | | | | 9,733,204 | |

| | | | | | | | |

TOTAL MONEY MARKET FUND

(Cost $9,733,204) | | | | | | | 9,733,204 | |

| | | | | | | | |

Total Investments

(Cost $81,799,721) - 97.94% | | | | | | | 99,540,237 | |

Other Assets in Excess of Liabilities - 2.06% | | | | | | | 2,095,889 | |

| | | | | | | | |

TOTAL NET ASSETS - 100.00% | | | | | | $ | 101,636,126 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

30

Snow Capital Long/Short Opportunity Fund

Schedule of Investments (Continued)

August 31, 2021 (Unaudited)

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | All or a portion of this security may be subject to call options written. |

| (c) | All or a portion of this security is pledged as collateral for securities sold short. |

| (d) | Foreign issued security. |

| (e) | Seven day yield as of August 31, 2021. |

Abbreviations:

| ADR | American Depositary Receipt |

| Ltd. | Limited Liability Company. |

| PLC | Public Limited Company. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

31

Snow Capital Long/Short Opportunity Fund

Schedule of Securities Sold Short

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

SECURITIES SOLD SHORT - (10.08)% | | | | | | | | |

EXCHANGE TRADED FUNDS - (10.08)% | | | | | | | | |

Invesco QQQ Trust Series 1 | | | (3,600 | ) | | $ | (1,367,820 | ) |

iShares Russell 1000 Value ETF | | | (27,270 | ) | | | (4,447,464 | ) |

iShares Russell 2000 ETF | | | (9,440 | ) | | | (2,132,685 | ) |

SPDR S&P 500 ETF Trust | | | (5,080 | ) | | | (2,293,925 | ) |

TOTAL EXCHANGE TRADED FUNDS

(Proceeds: $6,744,960) | | | | | | | (10,241,894 | ) |

| | | | | | | | |

Total for Shares Sold Short

(Proceeds: $6,744,960) | | | | | | $ | (10,241,894 | ) |

| | | | | | | | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

32

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written

August 31, 2021 (Unaudited)

| | | | | | | | | | | | |

| | | Contracts | | | Notional

Value | | | Value | |

EXCHANGE TRADED CALL OPTIONS | | | | | | | | | | | | |

American Express Co. | | | | | | | | | | | | |

Expiration: October, 2021, Exercise Price: $175.00 | | | (32 | ) | | $ | (531,072 | ) | | $ | (6,624 | ) |

Bank of America Corp. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $45.00 | | | (126 | ) | | | (526,050 | ) | | | (17,892 | ) |

Caterpillar, Inc. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $260.00 | | | (20 | ) | | | (421,740 | ) | | | (60 | ) |

Commercial Metals Co. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $34.00 | | | (157 | ) | | | (512,134 | ) | | | (6,280 | ) |

iShares Russell 1000 Value ETF | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $165.00 | | | (65 | ) | | | (1,060,085 | ) | | | (32,500 | ) |

Expiration: January, 2022, Exercise Price: $170.00 | | | (65 | ) | | | (1,060,085 | ) | | | (16,412 | ) |

iShares Russell 2000 ETF | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $245.00 | | | (65 | ) | | | (1,468,480 | ) | | | (24,538 | ) |

JPMorgan Chase & Co. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $165.00 | | | (30 | ) | | | (479,850 | ) | | | (2,550 | ) |

Kohl’s Corp. | | | | | | | | | | | | |

Expiration: October, 2021, Exercise Price: $62.50 | | | (100 | ) | | | (574,000 | ) | | | (13,200 | ) |

Marathon Petroleum Corp. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $65.00 | | | (80 | ) | | | (474,160 | ) | | | (22,240 | ) |

NCR Corp. | | | | | | | | | | | | |

Expiration: October, 2021, Exercise Price: $50.00 | | | (106 | ) | | | (450,288 | ) | | | (3,180 | ) |

The accompanying notes are an integral part of these financial statements.

33

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | | | | | |

| | | Contracts | | | Notional

Value | | | Value | |

NetApp, Inc. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $85.00 | | | (65 | ) | | $ | (578,045 | ) | | $ | (29,250 | ) |

Rio Tinto Plc | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $94.72 | | | (56 | ) | | | (420,392 | ) | | | (280 | ) |

SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: December, 2021, Exercise Price: $430.00 | | | (20 | ) | | | (903,120 | ) | | | (61,080 | ) |

Expiration: June, 2022, Exercise Price: $475.00 | | | (50 | ) | | | (2,257,800 | ) | | | (72,400 | ) |

The Goldman Sachs Group, Inc. | | | | | | | | | | | | |

Expiration: October, 2021, Exercise Price: $380.00 | | | (14 | ) | | | (578,914 | ) | | | (53,620 | ) |

WESCO International, Inc. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $125.00 | | | (42 | ) | | | (491,484 | ) | | | (32,550 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | (394,656 | ) |

| | | | | | | | | | | | |

EXCHANGE TRADED PUT OPTIONS | | | | | | | | | | | | |

B&G Foods, Inc. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $30.00 | | | (170 | ) | | | (516,120 | ) | | | (46,325 | ) |

Carters, Inc. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $75.00 | | | (60 | ) | | | — | | | | (6,450 | ) |

Centene Corp. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $55.00 | | | (85 | ) | | | (535,330 | ) | | | (85 | ) |

Freeport-McMoRan, Inc. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $30.00 | | | (170 | ) | | | (618,630 | ) | | | (26,010 | ) |

The accompanying notes are an integral part of these financial statements.

34

Snow Capital Long/Short Opportunity Fund

Schedule of Options Written (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | | | | | |

| | | Contracts | | | Notional

Value | | | Value | |

HP, Inc. | | | | | | | | | | | | |

Expiration: November, 2021, Exercise Price: $28.00 | | | (188 | ) | | $ | (559,112 | ) | | $ | (15,416 | ) |

Expiration: January, 2022, Exercise Price: $27.00 | | | (139 | ) | | | (413,386 | ) | | | (16,402 | ) |

Intel Corp. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $52.50 | | | (98 | ) | | | (529,788 | ) | | | (29,890 | ) |

Expiration: June, 2022, Exercise Price: $50.00 | | | (100 | ) | | | (540,600 | ) | | | (37,600 | ) |

Kohl’s Corp. | | | | | | | | | | | | |

Expiration: January, 2022, Exercise Price: $45.00 | | | (113 | ) | | | (648,620 | ) | | | (24,408 | ) |

Lumentum Holdings, Inc. | | | | | | | | | | | | |

Expiration: December, 2021, Exercise Price: $65.00 | | | (83 | ) | | | (719,112 | ) | | | (6,225 | ) |

Mohawk Industries, Inc. | | | | | | | | | | | | |

Expiration: November, 2021, Exercise Price: $170.00 | | | (31 | ) | | | (613,056 | ) | | | (12,090 | ) |

Nordstrom, Inc. | | | | | | | | | | | | |

Expiration: October, 2021, Exercise Price: $30.00 | | | (176 | ) | | | (503,536 | ) | | | (48,576 | ) |

Norwegian Cruise Line Holdings Ltd. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $20.00 | | | (225 | ) | | | (581,400 | ) | | | (2,025 | ) |

Ulta Beauty, Inc. | | | | | | | | | | | | |

Expiration: September, 2021, Exercise Price: $260.00 | | | (19 | ) | | | (735,889 | ) | | | (285 | ) |

Zimmer Biomet Holdings, Inc. | | | | | | | | | | | | |

Expiration: November, 2021, Exercise Price: $140.00 | | | (37 | ) | | | (556,665 | ) | | | (12,950 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | (284,737 | ) |

| | | | | | | | | | | | |

Total Options Written

(Premiums received $1,190,781) | | | | | | | | | | $ | (679,393 | ) |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

35

Snow Capital Family of Funds

Statements of Assets and Liabilities

August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Snow Capital

Small Cap Value

Fund | | | Snow Capital

Long/Short

Opportunity

Fund | |

ASSETS | | | | | | | | |

Investments, at value: (Cost $20,368,405 and $81,799,721 respectively) | | $ | 22,514,443 | | | $ | 99,540,237 | |

Dividends and interest receivable | | | 13,975 | | | | 330,439 | |

Receivable from Adviser | | | 16,155 | | | | — | |

Receivable for investments sold | | | 460,076 | | | | 4,090,655 | |

Receivable for Fund shares sold | | | 7,863 | | | | — | |

Deposits at Broker | | | — | | | | 9,904,325 | |

Other assets | | | 17,556 | | | | 25,905 | |

| | | | | | | | |

TOTAL ASSETS | | | 23,030,068 | | | | 113,891,561 | |

| | | | | | | | |

|

| |

LIABILITIES | | | | | | | | |

Short securities, at value (premiums received of $0 and $6,744,960 respectively) | | | — | | | | 10,241,894 | |

Written options, at value (premiums received of $0 and $1,190,781 respectively) | | | — | | | | 679,393 | |

Payable for investments purchased | | | — | | | | 1,029,653 | |

Payable for Fund shares redeemed | | | 4,727 | | | | — | |

Payable to affiliates | | | 46,762 | | | | 72,765 | |

Payable to Adviser | | | — | | | | 142,372 | |

Payable for distribution fees | | | 4,465 | | | | 33,273 | |

Payable for shareholder servicing fees | | | 1,715 | | | | 2,255 | |

Accrued expenses and other liabilities | | | 33,365 | | | | 53,830 | |

| | | | | | | | |

TOTAL LIABILITIES | | | 91,034 | | | | 12,255,435 | |

| | | | | | | | |

NET ASSETS | | | 22,939,034 | | | | 101,636,126 | |

| | | | | | | | |

|

| |

Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 23,550,305 | | | $ | 77,623,339 | |

Total distributable earnings (losses) | | $ | (611,271 | ) | | $ | 24,012,787 | |

| | | | | | | | |

NET ASSETS | | $ | 22,939,034 | | | $ | 101,636,126 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

36

Snow Capital Family of Funds

Statements of Assets and Liabilities (Continued)

August 31, 2021 (Unaudited)

| | | | | | | | |

COMPUTATION OF

NET ASSET VALUE | | Snow Capital

Small Cap Value

Fund | | | Snow Capital

Long/Short

Opportunity

Fund | |

CLASS A SHARES | | | | | | | | |

Net assets | | $ | 9,845,921 | | | $ | 50,083,814 | |

Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) | | | 207,344 | | | | 1,457,708 | |

Net asset value, redemption price and offering price per share | | $ | 47.49 | | | $ | 34.36 | |

Maximum offering price per share (Net Asset Value per share divided by 0.9475)(2)(3) | | $ | 50.12 | | | $ | 36.26 | |

|

| |

CLASS C SHARES | | | | | | | | |

Net assets | | $ | 1,733,199 | | | $ | 3,811,962 | |

Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) | | | 39,779 | | | | 117,757 | |

Net asset value, redemption price and offering price per share(1)(3) | | $ | 43.57 | | | $ | 32.37 | |

|

| |

INSTITUTIONAL CLASS SHARES | | | | | | | | |

Net assets | | $ | 11,359,914 | | | $ | 47,740,350 | |

Shares of beneficial interest outstanding (unlimited shares authorized, $0.001 par value) | | | 232,499 | | | | 1,375,492 | |

Net asset value, redemption price and offering price per share | | $ | 48.86 | | | $ | 34.71 | |

| (1) | If applicable, redemption price per share may be reduced by a 0.50% redemption fee for shares redeemed within thirty days of purchase. |

| (2) | A contingent deferred sales charge (“CDSC”) of 0.50% may be charged on Class A share purchases of $1,000,000 or more that are redeemed within. twelve months of purchase and a CDSC of 1.00% may be charged on Class C shares redeemed within twelve months of purchase. |

| (3) | Reflects a maximum sales charge of 5.25%. |

The accompanying notes are an integral part of these financial statements.

37

Snow Capital Family of Funds

Statements of Operations

For the Six Months Ended August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Snow Capital

Small Cap Value

Fund | | | Snow Capital

Long/Short

Opportunity

Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividend income | | $ | 156,254 | | | $

|

1,133,630 |

|

Interest income | | | 27 | | | | 591 | |

Other income | | | — | | | | 1,918 | |

| | | | | | | | |

TOTAL INVESTMENT INCOME | | | 156,281 | | | | 1,136,139 | |

| | | | | | | | |

EXPENSES | | | | | | | | |

Management fees | | | 120,627 | | | | 414,938 | |

Administration fees | | | 61,824 | | | | 91,836 | |

Transfer agent fees and expenses | | | 30,734 | | | | 52,939 | |

Federal and state registration fees | | | 21,528 | | | | 21,252 | |

Audit and tax fees | | | 17,664 | | | | 19,044 | |

Distribution fees - Class A | | | 12,552 | | | | 63,296 | |

Legal fees | | | 8,188 | | | | 14,628 | |

Distribution fees - Class C | | | 6,976 | | | | 15,028 | |

Chief Compliance Officer fees | | | 6,256 | | | | 6,256 | |

Trustees’ fees | | | 5,336 | | | | 5,336 | |

Custody fees | | | 3,680 | | | | 6,072 | |

Reports to shareholders | | | 3,036 | | | | 17,020 | |

Shareholder servicing fees - Class C | | | 2,325 | | | | 2,584 | |

Insurance expense | | | 1,564 | | | | 2,024 | |

Accounting expense | | | 1,196 | | | | 2,208 | |

Interest expense | | | 778 | | | | — | |

Broker fees | | | — | | | | 46,036 | |

Dividends on short positions | | | — | | | | 60,774 | |

Other expenses | | | 1,656 | | | | 1,840 | |

| | | | | | | | |

TOTAL EXPENSES | | | 305,920 | | | | 843,111 | |

| | | | | | | | |

Recoupment (or waivers) by Adviser (Note 4) | | | (124,570 | ) | | | 5,003 | |

| | | | | | | | |

NET EXPENSES | | | 181,350 | | | | 848,114 | |

| | | | | | | | |

NET INVESTMENT INCOME (LOSS) | | | (25,069 | ) | | | 288,025 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

38

Snow Capital Family of Funds

Statements of Operations (Continued)

For the Six Months Ended August 31, 2021 (Unaudited)

| | | | | | | | |

| | | Snow Capital

Small Cap Value

Fund | | | Snow Capital

Long/Short

Opportunity

Fund | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investments | | $ | 3,786,427 | | | $ | 10,040,184 | |

Securities sold short | | | — | | | | (111,937 | ) |

Purchased options | | | — | | | | (101,133 | ) |

Written options | | | — | | | | 266,999 | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (2,399,633 | ) | | | (675,153 | ) |

Securities sold short | | | — | | | | (1,265,575 | ) |

Purchased options | | | — | | | | (144,723 | ) |

Written options | | | — | | | | 513,906 | |

Foreign currency translation | | | — | | | | 53 | |

| | | | | | | | |

NET REALIZED AND UNREALIZED GAIN | | | 1,386,794 | | | | 8,522,621 | |

| | | | | | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 1,361,725 | | | $ | 8,810,646 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

39

Snow Capital Family of Funds

Snow Capital Small Cap Value Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | Six Months Ended

August 31, 2021

(Unaudited) | | | Year Ended

February 28, 2021 | |

FROM OPERATIONS | | | | | | | | |

Net investment income (loss) | | $ | (25,069 | ) | | $ | 39,927 | |

Net realized gain (Loss) on: | | | | | | | | |

Investments | | | 3,786,427 | | | | (2,615,951 | ) |

Net change in unrealized appreciation (depreciation) Investments | | | (2,399,633 | ) | | | 7,327,960 | |

| | | | | | | | |

Increase in Net Assets from Operations | | | 1,361,725 | | | | 4,751,936 | |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold - Class A | | | 61,195 | | | | 762,129 | |

Proceeds from shares sold - Class C | | | 16,623 | | | | 26,902 | |

Proceeds from shares sold - Institutional Class | | | 9,338,167 | | | | 1,855,569 | |

Payments for shares redeemed - Class A | | | (162,646 | ) | | | (3,392,010 | ) |

Payments for shares redeemed - Class C | | | (159,017 | ) | | | (1,642,191 | ) |

Payments for shares redeemed - Institutional Class(1) | | | (6,412,557 | ) | | | (3,912,190 | ) |

| | | | | | | | |

Net Increase (Decrease) from capital share transactions | | | 2,681,765 | | | | (6,301,791 | ) |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 4,043,490 | | | | (1,549,855 | ) |

NET ASSETS | | | | | | | | |

Beginning of Period | | $ | 18,895,544 | | | $ | 20,445,399 | |

| | | | | | | | |

End of Period | | $ | 22,939,034 | | | $ | 18,895,544 | |

| | | | | | | | |

| (1) | Net of redemption fees of $330 and $524 for the six months ended August 31, 2021 and the year ended February 28, 2021, respectively. |

The accompanying notes are an integral part of these financial statements.

40

Snow Capital Family of Funds

Snow Capital Long/Short Opportunity Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | Six Months Ended

August 31, 2021

(Unaudited) | | | Year Ended

February 28, 2021 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 288,025 | | | $ | 556,501 | |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | 10,040,184 | | | | (1,521,881 | ) |

Securities sold short | | | (111,937 | ) | | | 547,537 | |

Purchased options | | | (101,133 | ) | | | 81,538 | |

Written options | | | 266,999 | | | | 972,738 | |

Net change in unrealized appreciation (depreciation) | | | | | | | | |

Investments | | | (675,153 | ) | | | 19,114,442 | |

Securities sold short | | | (1,265,575 | ) | | | (3,413,948 | ) |

Purchased options | | | (144,723 | ) | | | (280,707 | ) |

Written options | | | 513,906 | | | | 249,351 | |

Foreign currency translation | | | 53 | | | | 291 | |

| | | | | | | | |

Increase in Net Assets from Operations | | | 8,810,646 | | | | 16,305,862 | |

| | | | | | | | |

FROM DISTRIBUTIONS | | | | | | | | |

Net investment income - Class A | | | — | | | | (585,909 | ) |

Net investment income - Institutional Class | | | — | | | | (767,052 | ) |

| | | | | | | | |

Net decrease in net assets resulting from distributions paid | | | — | | | | (1,352,961 | ) |

| | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold - Class A | | | 113,417 | | | | 4,486,792 | |

Proceeds from shares sold - Class C | | | 4,500 | | | | 2,200 | |

Proceeds from shares sold - Institutional Class | | | 123,199 | | | | 520,121 | |

Net asset value of shares issued to shareholders in payment of distributions declared - Class A | | | — | | | | 130,502 | |

Net asset value of shares issued to shareholders in payment of distributions declared - Class C | | | — | | | | — | |

Net asset value of shares issued to shareholders in payment of distributions declared - Institutional Class | | | — | | | | 636,641 | |

Payments for shares redeemed - Class A | | | (846,662 | ) | | | (15,482,406 | ) |

Payments for shares redeemed - Class C | | | (478,029 | ) | | | (6,736,652 | ) |

Payments for shares redeemed - Institutional Class(1) | | | (1,952,130 | ) | | | (8,430,534 | ) |

| | | | | | | | |

Net Decrease from capital share transactions | | | (3,035,705 | ) | | | (24,873,336 | ) |

| | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 5,774,941 | | | | (9,920,435 | ) |

NET ASSETS | | | | | | | | |

Beginning of Period | | $ | 95,861,185 | | | $ | 105,781,620 | |

| | | | | | | | |

End of Period | | $ | 101,636,126 | | | $ | 95,861,185 | |

| | | | | | | | |

| (1) | Net of redemption fees of $- and $11 for the six months ended August 31, 2021 and the year ended February 28, 2021, respectively. |

The accompanying notes are an integral part of these financial statements.

41

Snow Capital Small Cap Value Fund - Class A

Financial Highlights

Per Share Data for a Share Outstanding Throughout Each Period

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Six Months Ended

August 31, 2021

(Unaudited) | | | Year Ended

February 28,

2021 | | | Year Ended

February 29,

2020 | | | Year Ended

February 28,

2019 | | | Year Ended

February 28,

2018 | | | Year Ended

February 28,

2017 | |

Net Asset Value, Beginning of Period | | $ | 44.01 | | | $ | 26.39 | | | $ | 31.57 | | | $ | 32.36 | | | $ | 30.61 | | | $ | 23.62 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.06 | ) | | | 0.09 | | | | 0.01 | | | | (0.06 | ) | | | (0.16 | ) | | | (0.19 | ) |

Net realized and unrealized gain (loss) on investments | | | 3.54 | | | | 17.53 | | | | (5.19 | ) | | | (0.73 | ) | | | 1.91 | | | | 7.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 3.48 | | | | 17.62 | | | | (5.18 | ) | | | (0.79 | ) | | | 1.75 | | | | 6.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees (Note 2) | | | — | | | | — | | | | — | | | | — | | | | 0.00 | (2) | | | 0.00 | (2) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ | 47.49 | | | $ | 44.01 | | | $ | 26.39 | | | $ | 31.57 | | | $ | 32.36 | | | $ | 30.61 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Return(3)(4) | | | 7.88 | % | | | 66.81 | % | | | -16.41 | % | | | -2.44 | % | | | 5.72 | % | | | 29.59 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets at End of Period (000’s Omitted) | | $ | 9,846 | | | $ | 9,223 | | | $ | 10,071 | | | $ | 12,948 | | | $ | 15,236 | | | $ | 21,013 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(5)(6) | | | 2.49 | % | | | 3.84 | % | | | 2.41 | % | | | 2.14 | % | | | 2.14 | % | | | 2.05 | % |

After waivers and reimbursements of expenses(6)(7) | | | 1.51 | % | | | 1.51 | % | | | 1.51 | % | | | 1.50 | % | | | 1.64 | %(8) | | | 1.71 | % |

Ratio of net investment income (loss) to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

Before waivers and reimbursements of expenses(6) | | | (1.23 | )% | | | (2.00 | )% | | | (0.90 | )% | | | (0.83 | )% | | | (1.02 | )% | | | (1.02 | )% |