UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 629-8104

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2022

Date of reporting period: November 30, 2021

Item 1. Reports to Stockholders.

Letter from the Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Value Fund (the “Fund”)—Class Y Shares—posted a return of 4.01% for the six months ended November 30, 2021, compared to a return of 2.80% for the Russell Midcap Total Return Index and a return of -1.01% for the Russell 2500 Total Return Index. Please see pages 11 through 13 of this report for complete standardized performance information for the Fund.

After the volatility of calendar year 2020, which arose from the onset of the pandemic followed by a rally in early 2021 that was fueled by some $2 trillion of additional federal stimulus, the domestic stock markets produced somewhat more muted returns over the six-month period ended November 30, 2021. Overall returns remained quite positive as investors were encouraged by a strong rebound in corporate profitability. The recovery in corporate earnings was widespread across nearly every sector, signaling a level of economic normalization as the worst of the pandemic began to fade.

Also contributing to returns was ultra-accommodative monetary policy from the U.S. Federal Reserve, which maintained the historically low Fed Funds Rate reinstituted in March 2020 along with heightened quantitative easing designed to support the domestic economy during the pandemic. The combination of easy monetary policy and unprecedented fiscal stimulus succeeded in bolstering the economic rebound, although we believe this has also contributed to a sharp increase in inflation.

Consumer sentiment rose as vaccinations became commonplace, lifting the business results of many companies, which were reflected in ongoing positive market performance. The Jensen Quality Growth Fund exceeded the market’s positive returns over the last six months as the resilience of the business models of many of the companies held in the Fund became apparent. Such strength was impressive given increasing pressures from the aforementioned inflation, together with associated supply chain disruptions, labor shortages and rising wage costs that were further exacerbated by the newer strains of COVID-19 including the Delta and Omicron variants. We believe such outperformance is an indication of the quality of the businesses and the competitive advantage profiles that provide tools, such as scale, pricing power and brand equity, to mitigate the pressures noted above.

For the six months ended November 30, 2021, the Fund’s performance relative to the Russell Midcap Total Return Index was supported by an underweight position in the Communications and Health Care sectors and specific companies in the Financial, Industrial, Consumer Staples, and Consumer Discretionary sectors. Performance was negatively impacted by an overweight in the Consumer Staples, Consumer Discretionary, and Industrial sectors, an underweight in the Information Technology, Real Estate, and Energy sectors, and specific companies in the Health Care, Materials, and Information Technology sectors.

Relative to the Russell 2500 Total Return Index, the Fund’s performance during the period was aided by an underweight position in the Health Care and Communication sectors, as well as specific companies in most sectors excluding Materials. Performance was hindered by the Fund’s overweight

| | |

Semi-Annual Report | Jensen Quality Value Fund | 1 |

to the Consumer Staples and Consumer Discretionary sectors, its underweight to the Energy and Real Estate sectors, and specific companies in the Materials sector.

During the six-month period ended November 30, 2021, the strategy continued its high allocation to quality companies, as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s portfolio allocation to the highest quality companies, those rated A+, A, and A-, averaged 51% of portfolio assets, compared to 19% of the Russell Midcap Total Return Index and 10% of the Russell 2500 Total Return Index. This significant overweight to quality added to relative returns during the period, which we believe was driven by the market volatility caused by new coronavirus variants, inflation, and potential interest rate increases. While low-quality businesses can outperform in some periods, we believe that over the full market cycle investors in higher-quality businesses have the potential to be rewarded with better returns and lower volatility.

Top and Bottom Contributors

The top contributor to Fund performance for the six months ended November 30, 2021, was FactSet Research Systems (FDS), a software company providing tools for financial and banking professionals. During the period, FactSet reported revenue and earnings ahead of investor expectations, driven by strong growth in new clients and share gains with existing clients. FactSet was selected for the Jensen Quality Value Fund because of its compelling valuation at the time of purchase and its positive fundamental attributes, including a best-in-class product, solid growth opportunities, high customer switching costs, and a robust balance sheet.

Other notable companies that contributed positively to portfolio performance were Hill-Rom Holdings (HRC), a medical equipment company specializing in hospital beds, surgical tables, and patient monitoring devices, Verisk Analytics (VRSK), a software company primarily targeting the property and casualty insurance markets, Equifax (EFX), a provider of credit reports and related services, and Copart (CPRT), an operator of salvage-title automobile auctions and storage facilities.

The largest negative contributor to Fund performance for the six-month period was Encompass Health (EHC), an operator of patient recovery, rehabilitation, and hospice centers. The company reported solid revenue and earnings growth during the period, but high labor costs and reduced elective procedures during the pandemic kept results below the expectations of many investors. Encompass was selected for the Jensen Quality Value Fund due to its attractive valuation at the time of purchase and its compelling fundamental attributes, which include favorable demographic growth drivers, a leading market position, demonstrable cost effectiveness, high quality of care, and high barriers to entry.

Other notable holdings that weighed on relative performance included Scott’s Miracle-Gro (SMG), a fertilizer and gardening products company, MillerKnoll (MLKN), an office and home furniture manufacturer and distributor, Maximus (MMS), a provider of outsourcing and consulting services for federal, state, and local governments, and Lennox (LII), a manufacturer and marketer of heating, ventilating, and air conditioning equipment.

| | |

2 | Jensen Quality Value Fund | Semi-Annual Report |

During the six-month period ended November 30, 2021, the investment team continued to purchase the shares of companies we consider undervalued and sell the shares of companies we believe to be overvalued. New companies to the portfolio included Pool Corp (POOL), the U.S.’s only nationwide distributor of pool and spa supplies and parts, Resmed (RMD), a vertically integrated medical device company focused on treating, diagnosing, and managing respiratory disorders including sleep-disordered breathing, chronic obstructive pulmonary disease, neuromuscular disease, and other chronic illnesses, and United Rentals (URI), the largest tool and equipment rental company in the U.S.

During the period, the investment team sold Hill-Rom Holdings (HRC) due to the valuation of its shares following the announcement that the company would be acquired by Baxter International, a competing health care company. As of November 30, 2021, the Jensen Quality Value Fund held 37 companies.

As we look forward to 2022, we maintain a more cautious outlook for market returns in the coming year as we recognize that several factors make any forecast challenging. They include, but are not limited to, higher inflation, the specter of rising interest rates and ongoing cost pressures from the labor markets and supply chains, substantially lower fiscal spending in support of the domestic economy and the ongoing evolution of the pandemic with new treatments and rising vaccination rates offset by new variants.

In addition to the factors stated above, we note that business performance of companies and recent market return patterns could influence the outlook for the coming year.

Earnings growth for many companies is forecast to slow meaningfully in 2022 due to (1) challenging base year comparisons, (2) a waning positive impact from fiscal spending, and (3) the likelihood of more hawkish U.S. monetary policy to counter inflationary pressures. According to Strategas, fiscal policy stimulus is forecast to decline in 2022 such that it produces a “$1.5 trillion fiscal drag” on gross domestic product and the U.S. Federal Reserve has already communicated its intent for as many as three increases in the Fed Funds rate next year. This will likely produce additional pressure on companies and their business performance. Further, 2022 market performance will follow three exceptionally strong years in 2019, 2020, and 2021.

We certainly recognize that the market is forward-looking, but we remain mindful that many of the factors we have noted are unlikely to subside for some time, causing overall uncertainty to continue. Consequently, the path forward may continue to be uneven and thus potentially unnerving for investors. However, we believe uncertainty can provide opportunities for higher quality, more resilient businesses to garner favor from investors looking for lower volatility in the face of the issues discussed here. For example, we view pricing power to mitigate inflation and financial flexibility to cope with likely higher interest rates as advantages of the businesses in which we invest. We consider that our ongoing active management of the Fund has enabled us to upgrade the quality and growth outlook of the portfolio while maintaining an adequate margin of safety producing an attractive option to manage future volatility.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 3 |

Whatever happens moving forward, the Jensen Investment Team remains confident in the strategy and process guiding our management of the Fund. Our goal remains the ownership of a portfolio of companies positioned to grow and accrue business value. We seek to participate in this value creation as investors via the long-term ownership of fairly priced, high-quality stocks. Our focus remains on identifying businesses with sustainable competitive advantages, resilient financial results, and attractive long-term growth opportunities. We believe these attributes allow companies to generate business returns consistently above their cost of capital, ultimately resulting in shareholder value creation.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our partners and fellow shareholders.

We invite you to seek additional information about The Jensen Quality Value Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

The Jensen Quality Value Investment Team

| | |

4 | Jensen Quality Value Fund | Semi-Annual Report |

This discussion and analysis of the Fund is as of November 30, 2021 and is subject to change, and any forecasts made cannot be guaranteed and should not be considered investment advice. Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk. Mutual fund investing involves risk, and principal loss is possible. The Fund invests in mid- and smaller-capitalization companies, which involve additional risks such as limited liquidity and greater volatility. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Russell Midcap Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000 Index. The Russell 2500 Total Return Index is a market cap weighted index that includes the smallest 2,500 companies covered in the Russell 3000 universe of United States-based listed equities. The index is unmanaged, and you cannot invest directly in an index. S&P Quality Rankings. S&P ranks index constituents from A+ through C based on trailing earnings and dividend consistency. We consider stocks rated A- and above as high quality and those rated B+ and below as low quality. Earnings Growth: The annual rate of growth of earnings typically measured as Earnings Per Share Growth. Margin of Safety: A principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. Must be preceded or accompanied by a prospectus for the Jensen Quality Value Fund. The Jensen Quality Value Fund is distributed by Quasar Distributors, LLC. |

| | |

Semi-Annual Report | Jensen Quality Value Fund | 5 |

Letter from the Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Global Growth Fund (the “Fund”) — Class Y Shares — returned 7.36% for the six-month period ended November 30, 2021, compared to a return of 2.83% for the MSCI ACWI Index over the period. Please see pages 15 through 17 of this report for complete standardized performance information for the Fund.

After a sharp rally in early 2021, returns from global stocks moderated, but remained positive, for the six-month period ended November 30, 2021. Investors were encouraged by a widespread rebound in corporate profitability, signaling economic normalization as the worst of the pandemic began to fade and countries emerged from emergency lockdown measures. Additionally, stock market returns were boosted by easy monetary policy and unprecedented fiscal stimulus. We believe these policy efforts were successful in stabilizing the global economy but have contributed to a sharp increase in inflationary pressures.

Due in part to a global COVID-19 vaccination effort, consumer sentiment rose and lifted business performance and the share prices of global companies. The Jensen Quality Global Growth Fund exceeded the market’s positive returns during the past six months due to the resilience of the business models of companies held in the Fund. We are pleased with this relative strength, as we believe it reflects the portfolio companies were well-equipped to offset inflationary pressures caused by supply chain disruptions, labor shortages, and rising wages. We also consider that this outperformance is an indication of the quality of the businesses held in the Fund, as competitive advantages such as economies of scale, pricing power, and brand equity can help quality businesses mitigate inflationary headwinds.

During the period, specific stock selection added value in the Communication Services and Industrials sectors, while detracting from returns primarily in the Technology sector. From a sector perspective, the overweight position in the Industrials and Consumer Staples sectors detracted from performance, while the Fund’s relative overweighting to the Information Technology sector and the low exposure to the Financials sector added value.

From a geographic perspective, the Fund’s relative overweight and security selection in North America was the largest contributor to relative performance. Low exposure to businesses in emerging markets also benefited the Fund’s performance. Security selection in the Emerging Asia Pacific region was the largest geographic detractor to Fund performance.

Leading individual contributors to performance during the period were Microsoft (MSFT) and Pfizer (PFE).

Microsoft is an enterprise and consumer software company, with a host of well‐known products including Windows, Microsoft Office, and Azure. The company produced strong business results during the six-month period, and its financial outlook indicated continued strength as it benefited

| | |

6 | Jensen Global Quality Growth Fund | Semi-Annual Report |

from strong demand for its cloud-enabled products whether from traditional office environments or work-from-home. In our view, competitive advantages for Microsoft include the network effect derived from the ubiquitous nature of its products, brand equity, and high customer switching costs. We also believe in the company’s ongoing growth potential and consequently, Microsoft remains a top portfolio holding.

Pfizer is a diversified, global pharmaceutical company. Its financial results during the period were buoyed by strong performance of Comirnaty, its COVID-19 vaccine, and solid results across many of the company’s major drug franchises. In November, based on promising clinical results, Pfizer submitted its application for regulatory approval for Paxlovid, a COVID-19 antiviral treatment. Further, we are confident in the company’s efforts to deploy excess cash generated from its COVID-19 vaccine into strategic acquisitions to bolster its drug pipeline and long-term growth prospects.

Leading detractors from the Fund’s performance for the period included 3M (MMM) and Tencent (0700.HK).

3M is a global industrial conglomerate serving a diverse set of end markets including Industrial, Healthcare, Consumer, Safety, and Electronics. Business results during the period were solid at both the divisional and geographic segments. However, share price weakness reflected short-term concerns over supply chain disruptions, raw material costs, and litigation exposure. We retain a positive view on 3M’s long-term prospects and believe the stock price weakness underappreciates the short-cycle nature of many of the company’s end markets and overstates the potential financial impact from ongoing litigation. Our valuation model discounts short-term margin pressure from supply chain bottlenecks and raw materials costs, but we remain confident in 3M’s long-term business prospects.

Tencent is a Chinese multinational conglomerate with leading products in gaming, financial services, and communications. The company reported double-digit growth in revenues and earnings during the period, but a deluge of regulatory uncertainty weighed on investor sentiment. Strong operating performance was driven by continued domestic growth of FinTech in mainland China and a growing presence in international gaming franchises. However, the stock came under pressure as the Chinese government and regulatory bodies cracked down on dominant Chinese technology companies, including Tencent, to curb potential antitrust concerns, limit youth gaming activity, and address growing inequality within its society.

We continue to hold a position in Tencent shares due to the company’s dominant position in the Chinese economy and believe Tencent remains a highly-advantaged business levered to attractive growth areas of global gaming, social media, Fintech, and cloud services. However, we recognize the fundamental uncertainty created by the capricious actions of the Chinese regulators. We manage this geopolitical risk by maintaining a lower portfolio weighting in Tencent shares.

We are constantly evaluating all of the businesses owned by the Fund, as well as other investment candidates, to determine whether better opportunities exist within the Jensen Quality Universe. Such determinations ultimately reflect a combination of fundamental considerations, valuation opportunities, and overall risk profiles for the companies.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 7 |

During the period, the Jensen Global Investment Team did not execute any wholesale portfolio changes. However, we did make a number of trims and adds to existing positions based on our view of business fundamentals and security valuation.

The largest addition was in shares of Amadeus IT Group SA (AMS.MC), a leading provider of technology solutions and services for the global travel industry. Headquartered in Spain, Amadeus maintains a leading position in indirect travel bookings, helping facilitate complex transactions between travel providers, including airlines and hotels, and travel sellers, such as online and offline travel agencies and metasearch providers (e.g., KAYAK). The company is also the global leader in the fast-growing industry of direct distribution, where it hosts mission-critical direct selling platforms and inventory management systems for airlines and hotels, including Southwest.com and Marriott International. We expect strength in the direct distribution business to drive revenue and earnings growth for Amadeus for many years to come.

The largest decrease was in shares of GlaxoSmithKline PLC (GSK.L). Glaxo is a global healthcare company with businesses in pharmaceuticals, vaccines, and consumer healthcare. We reduced the Fund’s position Glaxo shares due to execution concerns in its vaccine business and the potential distraction from the spin-off of its consumer healthcare business. We believe Glaxo’s competitive advantages – brand equity, global distribution, and intellectual property – remain intact. However, its relatively low portfolio weight reflects our longer term concerns about growth prospects from the company’s drug pipeline.

We maintain a cautious outlook for market returns in 2022 due to expectations of lower corporate earnings growth, higher inflation, rising interest rates, cost pressures from global labor markets and supply chain disruptions, and intermittent economic disruption from the evolution of the COVID-19 pandemic.

We recognize that the market is forward-looking, but we remain mindful that many of these factors are unlikely to resolve for some time, causing overall uncertainty to continue. Consequently, the path forward may continue to be uneven and thus potentially unnerving for investors.

However, we believe uncertainty can provide opportunities for higher quality, more resilient businesses to garner favor from investors seeking lower volatility in the face of the issues discussed here. For example, we view pricing power to mitigate inflation and financial flexibility to manage likely higher interest rates as advantages of high-quality businesses. We also believe that our ongoing active management of the Fund has enabled us to upgrade the quality and growth outlook of the portfolio while maintaining an adequate margin of safety, that produces an attractive option to manage future volatility.

Whatever happens moving forward, the Jensen Global Quality Growth Investment Team remains confident in the strategy and process guiding our management of the Fund. Our goal remains steadfast in the ownership of a portfolio of companies positioned to grow and accrue business value. We seek to participate in this value creation as investors via the long-term ownership of fairly priced, high-quality stocks. Our focus remains on identifying businesses with sustainable competitive

| | |

8 | Jensen Global Quality Growth Fund | Semi-Annual Report |

advantages, resilient financial results, and attractive long-term growth opportunities. We believe these attributes allow companies to generate business returns consistently above their cost of capital, ultimately resulting in shareholder value creation.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our partners and fellow shareholders.

We invite you to seek additional information about The Jensen Global Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

The Jensen Global Investment Team

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 9 |

This discussion and analysis of the Fund is as of November 30, 2021 and is subject to change, and any forecasts made cannot be guaranteed and should not be considered investment advice. Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. The MSCI All Country World Index (ACWI) is a stock index designed to track broad global equity-market performance. Maintained by Morgan Stanley Capital International (MSCI), the index is comprised of the stocks of about 3,000 companies from 23 developed countries and 26 emerging markets. One cannot invest directly in an index. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk. Mutual fund investing involves risk, and principal loss is possible. The Fund invests in global large capitalization companies, which involve additional risks such as the inability to respond quickly to new competition in the market and the inability to attain high growth rates as opposed to smaller companies. The Fund is non-diversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. Earnings Growth: The annual rate of growth of earnings typically measured as Earnings Per Share Growth. Margin of Safety: A principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. For use only when preceded or accompanied by a current prospectus for the Fund. The Jensen Global Quality Growth Fund is distributed by Quasar Distributors, LLC. |

| | |

10 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Jensen Quality Value Fund - Class J (Unaudited)

| | | | | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | | | | Since Inception

(3/31/2010) |

Jensen Quality Value Fund - Class J | | | | | |

Russell Midcap® Total Return Index* | | | | | |

Russell 2500® Total Return Index* | | | | | |

| |

| The Russell Midcap® Total Return Index replaced the Russell 2500® Total Return Index as the Fund's primary benchmark. The Adviser believes the new index better represents the investable opportunity set for the Fund. |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The Russell 2500® Total Return Index is a market capitalization weighted index that includes the smallest 2,500 companies covered in the Russell 3000® universe of United States-based listed equities.

The chart at the top of the page assumes an initial gross investment of $10,000 made on November 30, 2011. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 11 |

Jensen Quality Value Fund - Class I (Unaudited)

| | | | | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | | | | Since Inception

(3/31/2010) |

Jensen Quality Value Fund - Class I | | | | | |

Russell Midcap® Total Return Index* | | | | | |

Russell 2500® Total Return Index* | | | | | |

| |

| The Russell Midcap® Total Return Index replaced the Russell 2500® Total Return Index as the Fund's primary benchmark. The Adviser believes the new index better represents the investable opportunity set for the Fund. |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The Russell 2500® Total Return Index is a market capitalization weighted index that includes the smallest 2,500 companies covered in the Russell 3000® universe of United States-based listed equities.

The chart at the top of the page assumes an initial gross investment of $250,000 made on November 30, 2011. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

12 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund - Class Y (Unaudited)

| | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | Since Inception

(01/15/2020) |

Jensen Quality Value Fund - Class Y | | |

Russell Midcap® Total Return Index* | | |

Russell 2500® Total Return Index* | | |

| |

| The Russell Midcap® Total Return Index replaced the Russell 2500® Total Return Index as the Fund's primary benchmark. The Adviser believes the new index better represents the investable opportunity set for the Fund. |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The Russell 2500® Total Return Index is a market capitalization weighted index that includes the smallest 2,500 companies covered in the Russell 3000® universe of United States-based listed equities.

The chart at the top of the page assumes an initial gross investment of $1,000,000 made on January 15, 2020, the inception date for Class Y shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 13 |

Jensen Quality Value Fund

Investments by Sector as of November 30, 2021

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/

or is the exclusive property of MSCI, Inc. and Standard & Poors Financial

Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been

licensed for use by U.S. Bancorp Fund Services, LLC doing business as U.S.

Bank Global Fund Services.

| | |

14 | Jensen Quality Value Fund | Semi-Annual Report |

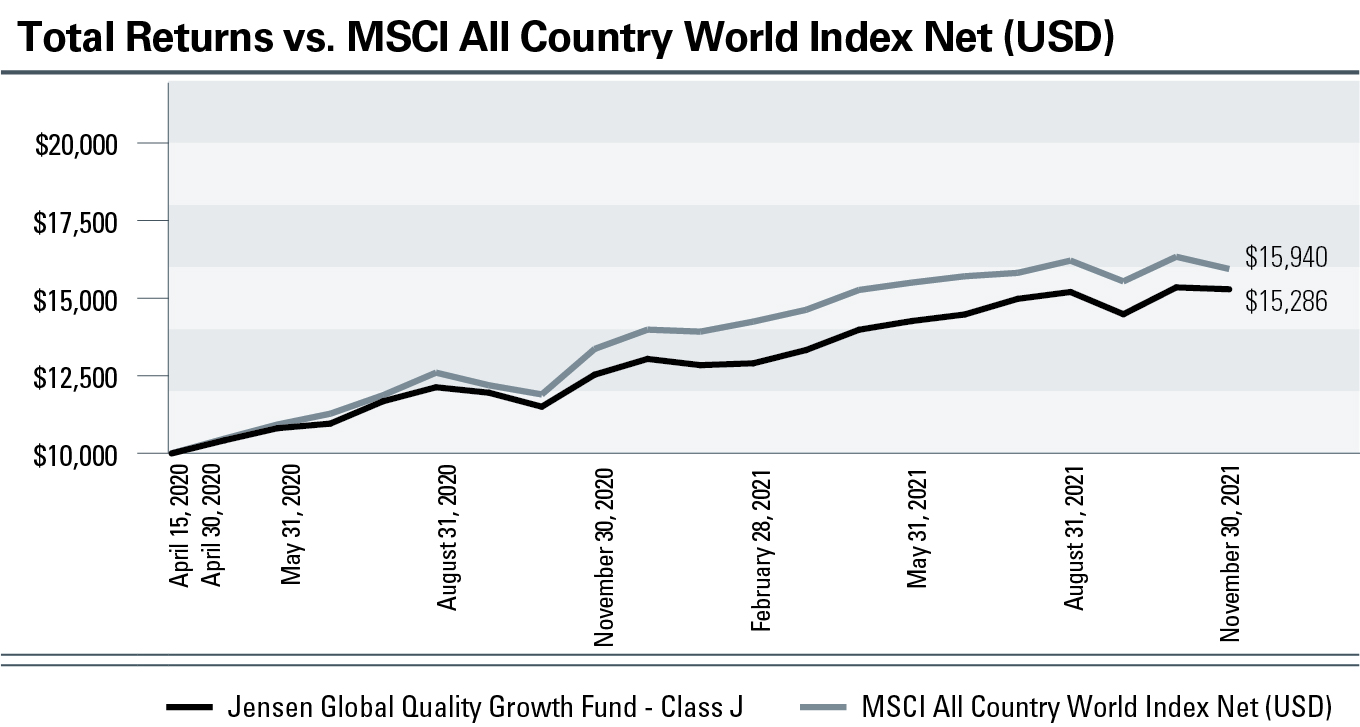

Jensen Global Quality Growth Fund - Class J (Unaudited)

| | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | Since Inception

(4/15/2020) |

Jensen Global Quality Growth Fund - Class J | | |

MSCI All Country World Index Net (USD) | | |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $10,000 made on April 15, 2020, the inception date for Class J shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 15 |

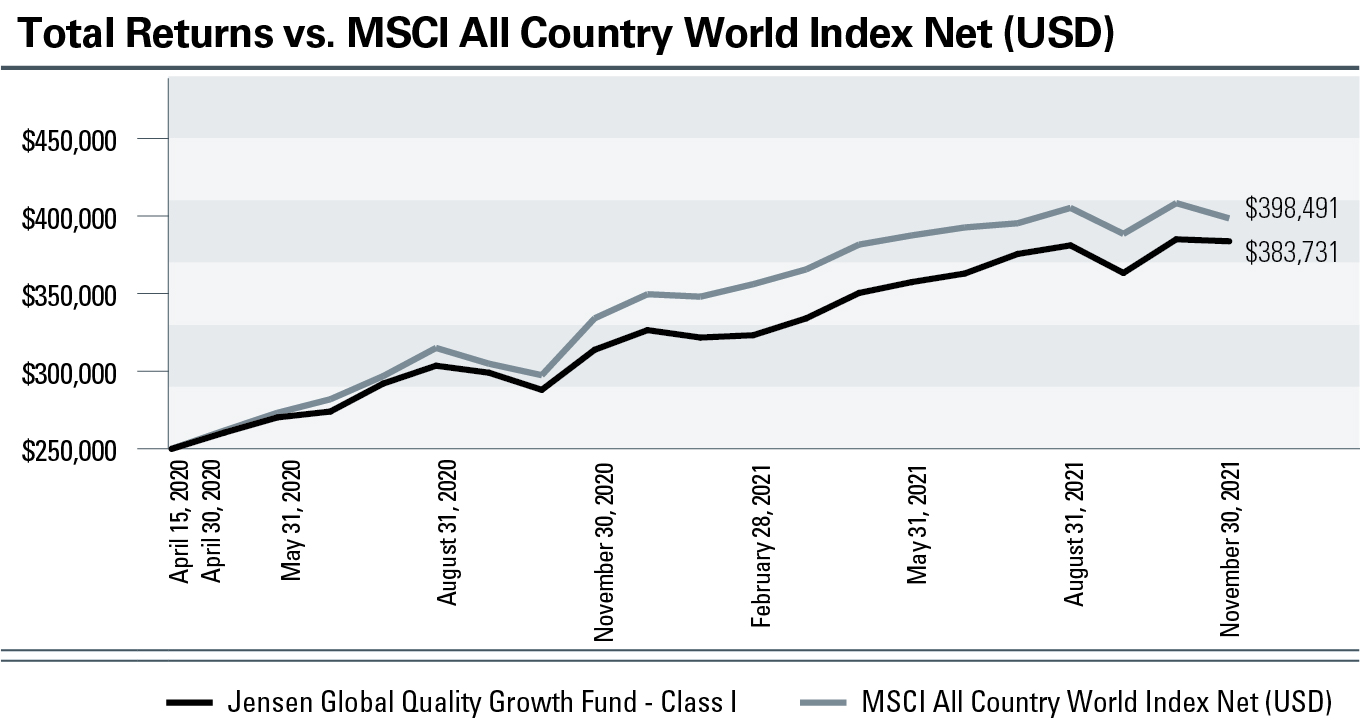

Jensen Global Quality Growth Fund - Class I (Unaudited)

| | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | Since Inception

(4/15/2020) |

Jensen Global Quality Growth Fund - Class I | | |

MSCI All Country World Index Net (USD) | | |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $250,000 made on April 15, 2020, the inception date for Class I shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

16 | Jensen Global Quality Growth Fund | Semi-Annual Report |

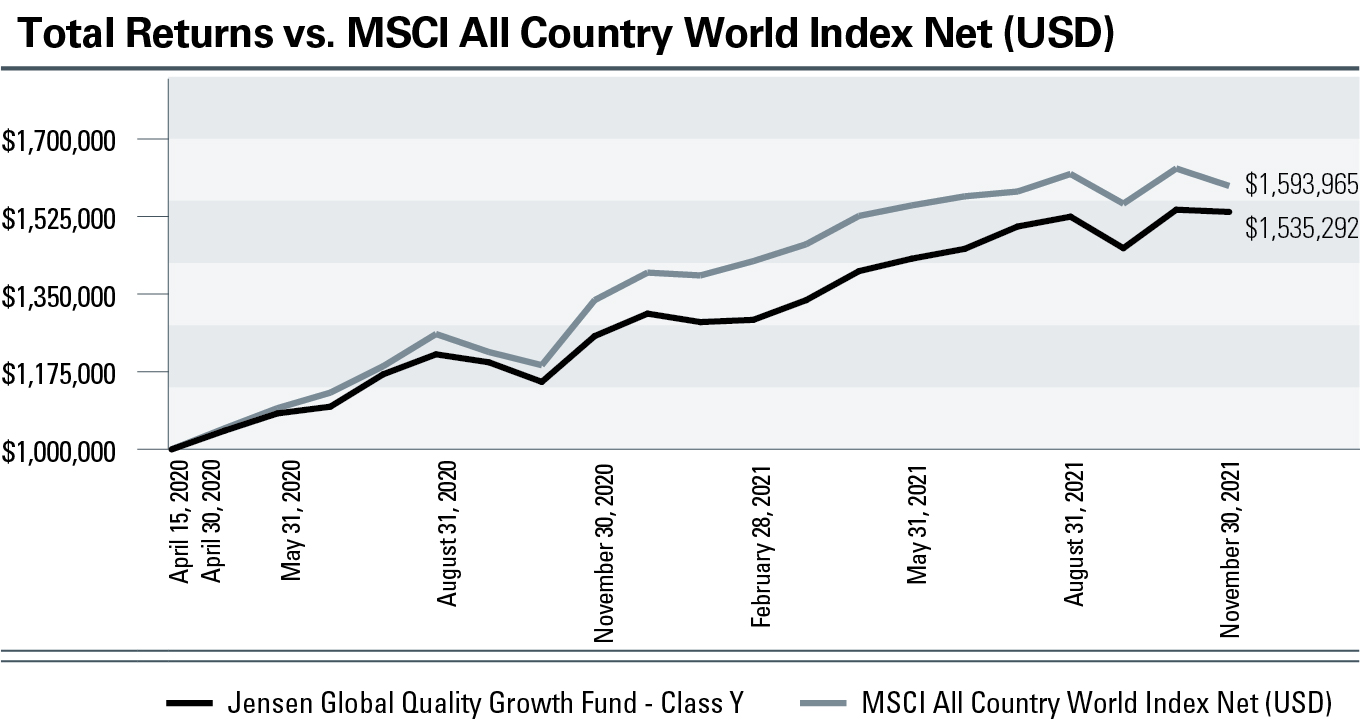

Jensen Global Quality Growth Fund - Class Y (Unaudited)

| | |

Average Annual Total Returns – For periods ended November 30, 2021 (Unaudited) | | Since Inception

(4/15/2020) |

Jensen Global Quality Growth Fund - Class Y | | |

MSCI All Country World Index Net (USD) | | |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $1,000,000 made on April 15, 2020, the inception date for Class Y shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 17 |

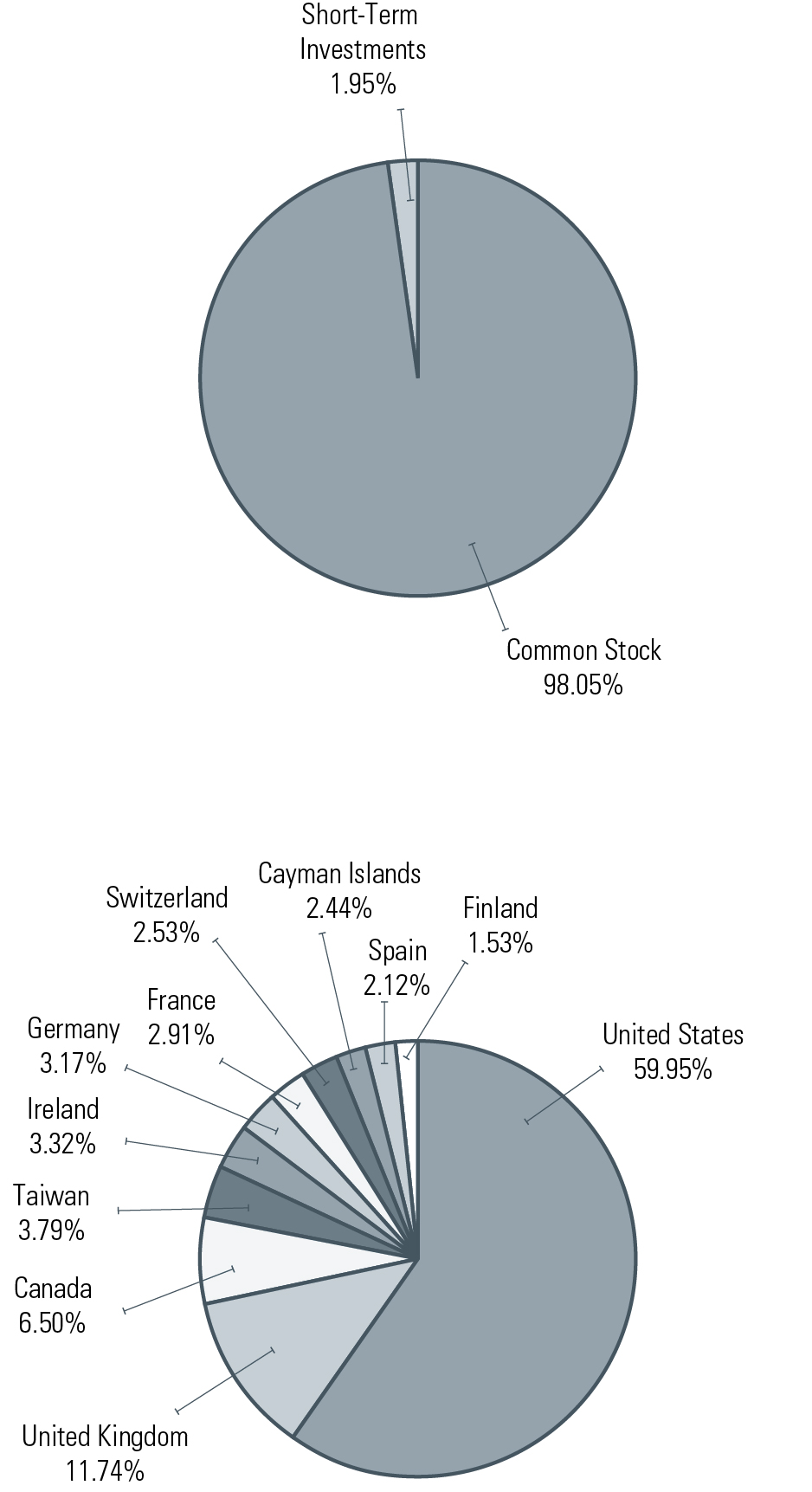

Jensen Global Quality Growth Fund

Allocation of Portfolio Holdings as of November 30, 2021

(as a Percentage of Total Investments) (Unaudited)

| | |

18 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Statements of Assets & Liabilities

November 30, 2021 (Unaudited)

| | | | | | | |

| | Jensen

Global Quality

Growth Fund |

Investments, at value (cost $146,051,290 and $29,204,877) | | | | | | |

| | | | | | |

Receivable for capital stock issued | | | | | | |

Receivables for investments sold | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Payable for capital stock redeemed | | | | | | |

Payable for 12b-1 fees - Class J | | | | | | |

| | | | | | |

Payable for investments purchased | | | | | | |

| | | | | | |

Accrued expenses and other liabilities | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Total distributable earnings | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Shares of beneficial interest outstanding | | | | | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(unlimited number of shares authorized, $.001 par value) | | | | | | |

| | | | | | |

| | | | | | |

Shares of beneficial interest outstanding | | | | | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(unlimited number of shares authorized, $.001 par value) | | | | | | |

| | | | | | |

| | | | | | |

Shares of beneficial interest outstanding | | | | | | |

Net Asset Value, Offering Price and Redemption Price Per Share

(unlimited number of shares authorized, $.001 par value) | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | 19 |

Jensen Quality Value Fund

Schedule of Investments

November 30, 2021 (Unaudited)

| | |

| Air Freight & Logistics - 3.44% | |

| Expeditors International of Washington, Inc. | |

| | |

| Building Products - 2.23% | |

| Lennox International, Inc. | |

| | |

| | |

| FactSet Research Systems, Inc. | |

| | |

| Commercial Services & Supplies - 5.86% | |

| | |

| | |

|

| | |

| Communications Equipment - 3.37% | |

| | |

| | |

| Containers & Packaging - 3.94% | |

| | |

| | |

| Electronic Equipment, Instruments & Components - 2.10% | |

| | |

The accompanying notes are an integral part of these financial statements.

| | |

20 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2021 (Unaudited)

| | |

| Food & Staples Retailing - 3.42% | |

| | |

| | |

| Health Care Equipment & Supplies - 1.04% | |

| | |

| | |

| Health Care Providers & Services - 7.19% | |

| | |

| Laboratory Corporation of America Holdings (a) | |

|

| | |

| Household Products - 3.69% | |

| | |

| | |

| | |

| Broadridge Financial Solutions, Inc. | |

| | |

| | |

|

| | |

| Professional Services - 8.29% | |

| | |

| | |

|

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 21 |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2021 (Unaudited)

| | |

| Real Estate Management & Development - 2.04% | |

| CBRE Group, Inc. - Class A (a) | |

| | |

| Semiconductors & Semiconductor Equipment - 4.68% | |

| Microchip Technology, Inc. | |

| ON Semiconductor Corp. (a) | |

|

| | |

| Textiles, Apparel & Luxury Goods - 4.83% | |

| | |

| Levi Strauss & Co. - Class A | |

|

| | |

| Trading Companies & Distributors - 1.79% | |

| | |

| | |

|

The accompanying notes are an integral part of these financial statements.

| | |

22 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2021 (Unaudited)

Short-Term Investments - 1.85%

| | |

| | |

| First American Treasury Obligations Fund - Class X, 0.013% (b) | |

| |

Total Short-Term Investments | |

| |

| |

| |

(Cost $146,051,290) - 99.76% | |

Other Assets in Excess of Liabilities - 0.24% | |

TOTAL NET ASSETS - 100.00% | |

Percentages are stated as a percent of net assets.

| |

| Non-income producing security. |

| Seven day yield as of November 30, 2021. |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 23 |

Jensen Global Quality Growth Fund

Schedule of Investments

November 30, 2021 (Unaudited)

| | |

| | |

| Alimentation Couche-Tard, Inc. - Class B | |

| Canadian National Railway Co. | |

|

| | |

| Taiwan, Province of China - 3.79% | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | |

The accompanying notes are an integral part of these financial statements.

| | |

24 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Jensen Global Quality Growth Fund

Schedule of Investments continued

November 30, 2021 (Unaudited)

| | |

| | |

| | |

| Alphabet, Inc. - Class A (a) | |

| | |

| Automatic Data Processing, Inc. | |

| | |

| Broadridge Financial Solutions, Inc. | |

| | |

| | |

| | |

| | |

| Mastercard, Inc. - Class A | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 25 |

Jensen Global Quality Growth Fund

Schedule of Investments continued

November 30, 2021 (Unaudited)

Short-Term Investments - 1.95%

| | |

| | |

| First American Treasury Obligations Fund - Class X, 0.013% (b) | |

| |

Total Short-Term Investments | |

| |

| |

| |

(Cost $29,204,877) - 99.97% | |

Other Assets in Excess of Liabilities - 0.03% | |

TOTAL NET ASSETS - 100.00% | |

Percentages are stated as a percent of net assets.

| |

| Non-income producing security. |

| Seven day yield as of November 30, 2021. |

| |

| American Depositary Receipt |

| Public Limited Company is a publicly traded company which signifies that shareholders have limited liability. |

| An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability. |

| Societas Europaea is a term for a European Public Liability Company. |

The accompanying notes are an integral part of these financial statements.

| | |

26 | Jensen Global Quality Growth Fund | Semi-Annual Report |

For the Six Months Ended November 30, 2021 (Unaudited)

| | | | | | | |

| | Jensen

Global Quality

Growth Fund |

| | | | | | (1) |

| | | | | | |

| | | | | | |

| | | | | | |

Investment management fees | | | | | | |

| | | | | | |

Federal and state registration fees | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Chief Compliance Officer fees | | | | | | |

Shareholder servicing fees - Class I | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Less waivers and reimbursements by Adviser (Note 4) | | | | | | |

| | | | | | |

| | | | | | |

Realized and Unrealized Gain (Loss) on Investments:

| | | | | | |

Net realized gain (loss) on:

| | | | | | |

| | | | | | |

Foreign currency translations | | | | | | |

Change in unrealized appreciation (depreciation) on:

| | | | | | |

| | | | | | |

Foreign currency translations | | | | | | |

Net realized and unrealized gain on investments | | | | | | |

Net Increase In Net Assets Resulting From Operations | | | | | | |

| |

| (1) | Net of $4,097 in dividend withholding tax. |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | 27 |

Statements of Changes in Net Assets

| | |

| Jensen Quality Value Fund |

| Six Months Ended

November 30, 2021

(Unaudited) | |

| | |

Net realized gain on investments | | |

Change in unrealized appreciation on investments | | |

Net increase in net assets resulting from operations | | |

Capital Share Transactions:

| | |

| | |

| | |

| | |

Shares issued to holders in reinvestment of dividends - Class J | | |

Shares issued to holders in reinvestment of dividends - Class I | | |

Shares issued to holders in reinvestment of dividends - Class Y | | |

Shares redeemed - Class J | | |

Shares redeemed - Class I | | |

Shares redeemed - Class Y | | |

Net increase in net assets from capital share transactions | | |

Dividends And Distributions to Shareholders:

| | |

Net dividends and distributions to shareholders - Class J | | |

Net dividends and distributions to shareholders - Class I | | |

Net dividends and distributions to shareholders - Class Y | | |

Total dividends and distributions | | |

| | |

| | |

| | |

| | |

The accompanying notes are an integral part of these financial statements.

| | |

28 | Jensen Quality Value Fund | Semi-Annual Report |

Statements of Changes in Net Assets

| | |

| Jensen Global Quality Growth Fund |

| Six Months Ended

November 30, 2021

(Unaudited) | |

| | |

Net realized gain (loss) on:

| | |

| | |

Foreign currency translations | | |

Change in unrealized appreciation (depreciation) on:

| | |

| | |

Foreign currency translations | | |

Net increase in net assets resulting from operations | | |

Capital Share Transactions:

| | |

| | |

| | |

| | |

Shares issued to holders in reinvestment of dividends - Class J | | |

Shares issued to holders in reinvestment of dividends - Class I | | |

Shares issued to holders in reinvestment of dividends - Class Y | | |

Shares redeemed - Class J | | |

Shares redeemed - Class I | | |

Shares redeemed - Class Y | | |

Net increase in net assets from capital share transactions | | |

Dividends and Distributions to Shareholders:

| | |

Net dividends and distributions to shareholders - Class J | | |

Net dividends and distributions to shareholders - Class I | | |

Net dividends and distributions to shareholders - Class Y | | |

Total dividends and distributions | | |

| | |

| | |

| | |

| | |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 29 |

Jensen Quality Value Fund - Class J

| | | | | | |

| six months

ended

November

30, 2021

(unaudited) | | | | | |

Net asset value, beginning of period | | | | | | |

Income from investment

operations: | | | | | | |

| | | | | | |

Net realized and unrealized

gain on investments | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Dividends from net

investment income | | | | | | |

Distributions from net realized

gain on investments | | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Supplemental data and ratios: | | | | | | |

Net assets, end of period (000’s) | | | | | | |

Ratio of expenses to average

net assets | | | | | | |

Before waivers and

reimbursements of expenses(3) | | | | | | |

After waivers and

reimbursements of expenses(3) | | | | | | |

Ratio of net investment

income to average net assets | | | | | | |

Before waivers and

reimbursements of expenses(3) | | | | | | |

After waivers and

reimbursements of expenses(3) | | | | | | |

Portfolio turnover rate(2) | | | | | | |

| |

| (1) | Per share amounts are calculated using the average shares outstanding method. |

| (2) | Not annualized for periods less than one year. |

| (3) | Annualized for periods less than one year. |

| (4) | Effective September 30, 2017, the expense cap for Class J shares was decreased from 1.00% to 0.80% excluding Rule 12b-1 fees of 0.25%. |

The accompanying notes are an integral part of these financial statements.

| | |

30 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund - Class I

| | | | | | |

| six months

ended

November

30, 2021

(unaudited) | | | | | |

Net asset value, beginning of period | | | | | | |

Income from investment

operations: | | | | | | |

| | | | | | |

Net realized and unrealized

gain on investments | | | | | | |

Total from investment operations | | | | | | |

| | | | | | |

Dividends from net

investment income | | | | | | |

Distributions from net realized

gain on investments | | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Supplemental data and ratios: | | | | | | |

Net assets, end of period (000’s) | | | | | | |

Ratio of expenses to average

net assets | | | | | | |

Before waivers and

reimbursements of expenses(3) | | | | | | |

After waivers and

reimbursements of expenses(3) | | | | | | |

Ratio of net investment

income to average net assets | | | | | | |

Before waivers and

reimbursements of expenses(3) | | | | | | |

After waivers and

reimbursements of expenses(3) | | | | | | |

Portfolio turnover rate(2) | | | | | | |

| |

| (1) | Per share amounts are calculated using the average shares outstanding method. |

| (2) | Not annualized for periods less than one year. |

| (3) | Annualized for periods less than one year. |

| (4) | Effective September 30, 2017, the expense cap for Class I shares was decreased from 1.00% to 0.80% excluding shareholder servicing fees of up to 0.10%. |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Quality Value Fund | 31 |

Jensen Quality Value Fund - Class Y

| | | |

| six months

ended

November

30, 2021

(unaudited) | | period ended

May 31, 2020(1) |

Net asset value, beginning of period | | | |

Income from investment operations: | | | |

| | | |

Net realized and unrealized gain (loss) on investments | | | |

Total from investment operations | | | |

| | | |

Dividends from net investment income | | | |

Distributions from net realized gain on investments | | | |

| | | |

Net asset value, end of period | | | |

| | | |

Supplemental data and ratios: | | | |

Net assets, end of period (000’s) | | | |

Ratio of expenses to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Ratio of net investment income to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Portfolio turnover rate(3) | | | |

| |

| (1) | Class Y shares commenced operations on January 15, 2020. |

| (2) | Per share amounts are calculated using the average shares outstanding method. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

| | |

32 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Global Quality Growth Fund - Class J

| | | |

| six months

ended

November

30, 2021

(unaudited) | | period ended

May 31, 2020(1) |

Net asset value, beginning of period | | | |

Income from investment operations: | | | |

| | | |

Net realized and unrealized gain on investments | | | |

Total from investment operations | | | |

| | | |

Dividends from net investment income | | | |

| | | |

Net asset value, end of period | | | |

| | | |

Supplemental data and ratios: | | | |

Net assets, end of period (000’s) | | | |

Ratio of expenses to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Ratio of net investment income (loss) to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Portfolio turnover rate(3) | | | |

| |

| (1) | The Fund commenced operations on April 15, 2020. |

| (2) | Per share amounts are calculated using the average shares outstanding method. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 33 |

Jensen Global Quality Growth Fund - Class I

| | | |

| six months

ended

November

30, 2021

(unaudited) | | period ended

May 31, 2020(1) |

Net asset value, beginning of period | | | |

Income from investment operations: | | | |

| | | |

Net realized and unrealized gain on investments | | | |

Total from investment operations | | | |

| | | |

Dividends from net investment income | | | |

| | | |

Net asset value, end of period | | | |

| | | |

Supplemental data and ratios: | | | |

Net assets, end of period (000’s) | | | |

Ratio of expenses to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Ratio of net investment income (loss) to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Portfolio turnover rate(3) | | | |

| |

| (1) | The Fund commenced operations on April 15, 2020. |

| (2) | Per share amounts are calculated using the average shares outstanding method. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

| | |

34 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Jensen Global Quality Growth Fund - Class Y

| | | |

| six months

ended

November

30, 2021

(unaudited) | | period ended

May 31, 2020(1) |

Net asset value, beginning of period | | | |

Income from investment operations: | | | |

| | | |

Net realized and unrealized gain on investments | | | |

Total from investment operations | | | |

| | | |

Dividends from net investment income | | | |

| | | |

Net asset value, end of period | | | |

| | | |

Supplemental data and ratios: | | | |

Net assets, end of period (000’s) | | | |

Ratio of expenses to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Ratio of net investment income (loss) to average net assets | | | |

Before waivers and reimbursements of expenses(4) | | | |

After waivers and reimbursements of expenses(4) | | | |

Portfolio turnover rate(3) | | | |

| |

| (1) | The Fund commenced operations on April 15, 2020. |

| (2) | Per share amounts are calculated using the average shares outstanding method. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

The accompanying notes are an integral part of these financial statements.

| | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 35 |

Notes to Financial Statements

November 30, 2021 (Unaudited)

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Jensen Quality Value Fund, formerly known as the Jensen Value Fund, and the Jensen Global Quality Growth Fund (each, a “Fund,” and together, the “Funds”), each represent a distinct series with its own investment objective and policies within the Trust. The investment objective of the Jensen Quality Value Fund and the Jensen Global Quality Growth Fund is long-term capital appreciation. The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. The assets of the Funds are segregated, and a shareholder’s interest is limited to the Fund in which shares are held. The Class J and Class I shares of the Jensen Quality Value Fund became effective and commenced operations on March 31, 2010. The Class Y shares of the Jensen Quality Value Fund became effective and commenced operations on January 15, 2020. The Jensen Global Quality Growth Fund commenced investment operations on April 15, 2020 for Class J, Class I, and Class Y shares. For both Funds, Class J shares are subject to a 0.25% distribution (Rule 12b-1) and shareholder servicing fee and Class I shares are subject to a shareholder servicing fee of up to 0.10%. Each class of shares has identical rights and privileges except with respect to the distribution (Rule 12b-1) and shareholder servicing fees, and voting rights on matters affecting a single share class. Costs incurred by the Funds in connection with the organization, registration and the initial public offering of shares were paid by Jensen Investment Management, Inc. (the “Adviser”), the Funds’ investment adviser.

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services–Investment Companies.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

(a) Investment Valuation – Each equity security owned by the Funds that is listed on a securities exchange, except those listed on the NASDAQ Stock Market LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. If a security is listed on more than one exchange, the Funds will use the price of the exchange that the Funds generally consider to be the principal exchange on which the stock is traded.

Fund securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security is valued at (i) the mean between the most recent quoted bid

| | |

36 | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | Semi-Annual Report |

and asked prices at the close of the exchange or (ii) the latest sales price on the Composite Market for the day such security is being valued. “Composite Market” means a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets, as published by an approved independent pricing service (“Pricing Service”).

Foreign securities will be priced in their local currencies as of the close of their primary exchange or market or as of the time a Fund calculates its net asset value (“NAV”), whichever is earlier. Foreign securities, currencies and other assets denominated in foreign currencies are then translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar, as provided by a Pricing Service or reporting agency. All assets denominated in foreign currencies will be converted into U.S. dollars using the applicable currency exchange rates as of the close of the New York Stock Exchange (“NYSE”), generally 4:00 p.m. Eastern Time.

Foreign securities are traded on foreign exchanges which typically close before the close of business on each day on which the NYSE is open. Each security trading on these exchanges may be valued utilizing a systematic fair valuation model provided by a Pricing Service. The valuation of each security that meets certain criteria in relation to the valuation model is systematically adjusted to reflect the impact of movement in the U.S. market after the foreign markets close and are classified as Level 2 securities. Securities that do not meet the criteria, or that are principally traded in other foreign markets, are valued as of the last reported sale price at the time the respective Fund determines its NAV, or when reliable market prices or quotations are not readily available, at the mean between the most recent bid and asked quotations as of the close of the appropriate exchange or other designated time.

Debt securities, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and the asked prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. In the absence of available quotations, the securities will be priced at fair value, as described below. Any discount or premium is accreted or amortized using the constant yield method until maturity.

Redeemable securities issued by open-end, registered investment companies are valued at the NAV of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined. Money market mutual funds are valued at cost. If cost does not represent current market value the securities will be priced at fair value.

When market quotations are not readily available, any security or other financial instrument is valued at its fair value as determined under procedures approved by the Trust’s Board of Trustees. These fair value procedures will also be used to price a security when corporate events, events in the securities market or world events cause the Adviser to believe that a security’s last sale price may not reflect its actual fair value. The intended effect of using fair value pricing procedures is to ensure that the Funds are accurately priced.

| | |

Semi-Annual Report | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | 37 |

FASB Accounting Standards Codification, “Fair Value Measurements and Disclosures” Topic 820 (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be necessary to estimate fair value. ASC 820 also requires enhanced disclosure regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for each class of investments. These inputs are summarized in the three broad levels listed below:

| |

| Quoted prices in active markets for identical securities. |

| Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| Significant unobservable inputs (including a Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value each Fund’s investments carried at fair value as of November 30, 2021:

| | | | | |

Jensen Quality Value Fund | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | |

Jensen Global Quality Growth Fund | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) For further information regarding security characteristics, please see the Schedules of Investments.

The Funds did not hold any investments during the six months ended November 30, 2021 with significant unobservable inputs which would be classified as Level 3. The Funds did not hold financial derivative instruments during the six months ended November 30, 2021.

(b) Foreign Securities and Currency – Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions.

The Funds do not isolate the portion of the results of operations from changes in foreign exchange rates on investments from those resulting from the changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales

| | |

38 | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | Semi-Annual Report |

and maturities of short-term securities, sales of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Funds’ books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, including investments in securities at fiscal period end, resulting from changes in the exchange rate.

Investments in foreign securities entail certain risks. Individual foreign economies of certain countries may differ favorably or unfavorably from the U.S. economy in such respects as growth of gross national product, rate of inflation, capital reinvestment, resource self-sufficiency, diversification and balance of payments position. The internal politics of certain foreign countries may not be as stable as those of the United States. Since foreign securities normally are denominated and traded in foreign currencies, the value of a Fund’s assets may be affected favorably or unfavorably by currency exchange rates, currency exchange control regulations, foreign withholding taxes, and restrictions or prohibitions on the repatriation of foreign currencies. There may be less information publicly available about a foreign issuer than about a U.S. issuer, and foreign issuers are not generally subject to accounting, auditing, and financial reporting standards and practices comparable to those in the United States. The securities of some foreign issuers are less liquid and at times more volatile than securities of comparable U.S. issuers.

(c) Federal Income Taxes – The Funds intend to comply with the requirements of Subchapter M of the Internal Revenue Code necessary to qualify as regulated investment companies and to make the requisite distributions of income and capital gains to their shareholders sufficient to relieve them from all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided.

As of and during the six months ended November 30, 2021, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to uncertain tax benefits as income tax expense in the Statements of Operations. During the six months ended November 30, 2021, the Funds did not incur any interest or penalties. The Funds have no examinations in progress. The Funds are also not aware of any tax provisions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

(d) Distributions to Shareholders – The Funds will declare and distribute any net investment income quarterly. The Funds will distribute any net realized long- or short-term capital gains at least annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Funds may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. The Funds may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction.

| | |

Semi-Annual Report | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | 39 |

(e) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

(f) Share Valuation – The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by each Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for each Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the NYSE is closed for trading.

(g) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of each Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Distribution (12b-1) and shareholder servicing fees are expensed at 0.25% of average daily net assets of Class J shares. Shareholder servicing fees are expensed at up to 0.10% of the average daily net assets of Class I shares. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means.

(h) Other – Investment transactions are recorded on the trade date. The Funds determine the gain or loss from investment transactions using the specific identification method by comparing the original cost of the security lot sold with the net sale proceeds. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

Withholding taxes on foreign dividends, net of any reclaims, have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

The tax character of distributions paid during the fiscal years or periods ended May 31, 2021 and May 31, 2020 were as follows:

| | ; | | | | | |

Jensen Quality Value Fund | | |

| | | | | | |

| | | | | | |

| | ; | | | | | |

Jensen Global Quality Growth Fund | | |

| | | | | | |

| | | | | | |

(1) The Jensen Global Quality Growth Fund commenced operations on April 15, 2020.

| | |

40 | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | Semi-Annual Report |

The components of distributable earnings on a tax basis as of May 31, 2021 were as follows:

| | | | | | | |

| | Jensen Global

Quality Growth Fund |

Cost basis of investments for federal income tax purposes | | | | | | |

Gross tax unrealized appreciation | | | | | | |

Gross tax unrealized depreciation | | | | | | |

Net tax unrealized appreciation | | | | | | |

Undistributed ordinary income | | | | | | |

Undistributed long-term capital gain | | | | | | |

| | | | | | |

| | | | | | |

Total distributable earnings | | | | | | |

The difference between book basis and tax basis of investments is primarily attributable to the deferral of losses on wash sales.

At May 31, 2021, the Jensen Global Quality Growth Fund had short-term capital loss carryovers of $32,448.

Additionally, GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent difference relates to tax equalization.

On the Statements of Assets and Liabilities, the following adjustments were made for permanent tax adjustments:

| | | | | | | |

| | Jensen Global

Quality Growth Fund |

Total Distributable Earnings | | | | | | |

| | | | | | |

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Adviser to furnish investment advisory services to the Funds. Under the terms of the Agreement, the Funds compensate the Adviser for its management services at the annual rate of 0.65% and 0.75% of each Fund’s average daily net assets for the Jensen Quality Value Fund and Jensen Global Quality Growth Fund, respectively.

The Adviser has contractually agreed to waive its management fee and/or reimburse a Fund’s other expenses at least through the expiration dates listed below, to the extent necessary to ensure that the Fund’s total operating expenses (exclusive of front-end or contingent deferred sales loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage (i.e., any expenses incurred in connection with borrowings made by the Fund), interest (including interest incurred in connection with bank and custody overdrafts), brokerage commissions and other transactional expenses,

| | |

Semi-Annual Report | Jensen Quality Value Fund, Jensen Global Quality Growth Fund | 41 |