|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

FORM N-CSR |

|

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

|

Investment Company Act file number 811-10405 |

|

|

|

| Alpine Series Trust |

|

|

| |

| (Exact name of registrant as specified in charter) |

|

|

615 East Michigan Street |

3rd Floor |

Milwaukee, WI 53202 |

(Address of principal executive offices) (Zip code) |

|

Samuel A. Lieber |

Alpine Woods Capital Investors, LLC |

2500 Westchester Avenue, Suite 215 |

Purchase, NY 10577 |

(Name and address of agent for service) |

|

1-888-785-5578 |

Registrant’s telephone number, including area code |

Date of fiscal year end: 10/31/2008

Date of reporting period: 10/31/2008

Item 1. Reports to Stockholders.

EQUITY & INCOME FUNDS

Annual Report

October 31, 2008

Alpine Dynamic Innovators Fund

Alpine Dynamic Balance Fund

Alpine Dynamic Transformations Fund

Alpine Dynamic Dividend Fund

Alpine Municipal Money Market Fund

Alpine Dynamic Financial Services Fund

Alpine Ultra Short Tax Optimized Income Fund

|

TABLE OF CONTENTS |

|

|

|

|

EQUITY MANAGER REPORTS |

|

|

|

|

|

|

|

| 6 |

| |

|

|

|

|

| 9 |

| |

|

|

|

|

| 17 |

| |

|

|

|

|

| 21 |

| |

|

|

|

|

| 24 |

| |

|

|

|

|

|

|

| |

|

|

|

|

| 28 |

| |

|

|

|

|

| 30 |

| |

|

|

|

|

| 34 |

| |

|

|

|

|

| 51 |

| |

|

|

|

|

| 53 |

| |

|

|

|

|

| 55 |

| |

|

|

|

|

| 62 |

| |

|

|

|

|

| 70 |

| |

|

|

|

|

| 80 |

| |

|

|

|

|

| 81 |

|

|

|

|

|

|

|

|

|

| Alpine’s Investment Outlook |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dear Investor:

We are currently afflicted by a crisis of confidence which has deflated asset values, constrained capital markets, and threatened the livelihoods of millions of Americans. Wealth and prosperity have rapidly eroded. Employment and retirement prospects are diminished. Fear of a prolonged downturn has paralyzed many corporate, municipal and individual investment initiatives. Our government’s capital injections or ‘bailouts’, have been the initial response aimed at a coherent public/private sector program which can tackle immediate problems, as well as support long term solutions. If properly designed, this could be an investment in the potential, the ingenuity and the entrepreneurial spirit of America. If rapidly deployed, it could begin to restore investor confidence, rally capital markets and commence a rational reflation of long term asset values.

The credit crisis has reduced our economy’s potential capital availability. Investors’ worst fears are largely discounted in prices of stocks and bonds alike. This reflects the inability of the world’s financial institutions to fend off the contagion of crisis on their own. Into the breach have stepped the world’s Central Banks and sovereign Treasuries to save the day, if they can! The government’s use of capital injections, perceived by the market as ‘bailouts’, have called into question the proper role of government both through regulation and ownership of our entrepreneurial free market system. Some view bailouts as a necessary intrusion into our capital market system, others view them as inappropriate in the evolution of market forces even though it might avert a depression. These disparate views appear to have created an element of paralysis evidenced by our present Administration’s inability to seize the day with a comprehensive plan. Perhaps the next Administration will be inspired to do more. We need to jump-start our Nation’s capacity to reinvigorate itself when called upon by crisis. The ability to energize our collective dynamism has been a hallmark of our society and economy, in part historically positioning the U.S. for global leadership.

WHAT CAUSED THE FOURTH QUARTER CAPITAL MARKETS MELTDOWN?

September and October of 2008 will likely be remembered by economic historians as a time when the defenses protecting our banking system succumbed to a hundred year flood of fear and uncertainty. Globalization and excessive risk tolerance has exposed weaknesses in the structure of the global credit delivery system, both precipitating and exacerbating an erosion of confidence. While underlying problems in the U.S. have been brewing for 15 months since the subprime mortgage valuation problem arose, the current state of rampant risk avoidance became a global pandemic following the bankruptcy of Lehman Brothers on September 15. As a result, capital has become scarce and credit for even the most creditworthy has become very expensive. Potential corporate debt maturities and covenant limitations were scrutinized from all angles, forcing major discounts of stock prices. In effect, corporate deleveraging is being forced on many public companies by eroding share prices.

While relative stability was maintained into early 2008, there were still deflationary waves of capital erosion during which liquidity was sucked out of the global capital markets. This was most prominent as the price of oil and other commodities soared to record levels by mid-year. Commodity producing countries made plans for great expansion just as the historic 77% collapse in the price of oil forced the closure of steel mills, mines and production facilities. At the same time, the maelstrom induced by the collapse of Lehman Brothers, froze certain investments in bankruptcy proceedings, which led several major money market funds to ‘break the buck’. In turn, this induced capital flight and maximum risk avoidance by both institutional and individual investors, accelerating the de-leveraging, de-risking process. Thus, foreign currencies, emerging market equities, and financial commodities were dumped as investors around the world sought safe haven in U.S. Treasury bills, actually pushing 90-day Treasury bill yields to 0.06% two days after Lehman’s bankruptcy! Now, central banks around the world are using massive injections of capital and

1

|

sovereign guarantees to stabilize money markets and induce bank lending.

Even though subprime home mortgages in the U.S. were the proverbial ‘straw which broke the camel’s back’, real estate has not been the root of the problem in the sense that excess supply has not necessarily created an overhang. Rather, excess liquidity which stimulated demand beyond historical levels is the root of the problem. Home price appreciation, slack investment standards and minimal risk premiums enabled Wall Street to engineer both the origination and distribution mechanisms which created even more liquidity. Alas, these distribution systems were interlaced into critical contact with weak links in our financial system. It is safe to assume that there will be less capital available over the near term even after a successful stabilization of the markets. This should lead to reduction in the development of new capacity or excess supply of products or even raw materials. Over time, this will likely offset diminution of demand resulting from the economic impact on business staffing or expansion. Longer term, it should be an important stimulus to price levels as growth returns to the economy in ensuing years, limiting new supply to meet rising demand.

WHAT MIGHT A RECOVERY LOOK LIKE?

In assessing investment strategy to identify potential outperformance from these beaten down equity markets, the most important questions are, first, whether the current effort to revitalize our stricken credit delivery system will be effective; second, what long-term changes will be needed to revitalize the interbank lending system and the flawed debt-securitization process; third, what will be the impact on global liquidity over the next few years; fourth, how will this crisis impact both consumer and investor confidence over time; and fifth, how can we best position the portfolio to take advantage of opportunities created by this unprecedented global crisis?

We are confident that the current effort to stabilize the global banking system is well in hand. The recapitalization process should permit banks over the next couple of years to either dispose of, or work out of, impaired loans. Unfortunately, the prospective near term continuation of global economy weakness will likely lead to further asset devaluation and income degradation, bringing additional pressures to delever corporate balance sheets. This may create more poor performing loans. Thus, it might be a while before we see a strong, competitive lending environment. Meanwhile, we anticipate that banks will extend credit to their largest and strongest existing relationships, amplifying the

ongoing consolidation within the banking system itself. We expect banks will require higher margins with more limited lending. Thus, capital for new business creation and or expansion will probably have to come from nontraditional financial investors who require a significantly higher return on invested capital than traditional bank debt. Clearly, risk premiums required for future capital will likely be more expensive.

Banks’ future requirement of higher net interest margins should over time permit them to take on greater risk, albeit not at the level of the past decade when they faced considerable competition from the capital markets. Over the next several years, flawed asset-backed debt securitizations will come to maturity and require refinancing. In many cases the future cost of refinancing will be much higher. The requirements for interest coverage and excess collateral value will likely be greater than has historically been the norm.

Many of the debt securitizations which dominated the real estate finance environment over the past five years will be subject to recapitalizations or workouts over the next few years. These should be not only more expensive for the issuers, but they should provide lower returns for ongoing investors in these investment vehicles. It is likely that significant investment capital will be tied up for an extended period of time with relatively low return on investment. When, or if, investment bankers can devise a new and improved debt securitization process which instills a measure of confidence in wary investors, securitization could once again offer a competitive source of capital.

Consumer and investor confidence will likely be restored over time. However, the combination of elevated risk avoidance and expensive if albeit limited, liquidity suggests that the range of returns required as investors move up the risk spectrum, will likely be significantly higher. Thus, the discount rates and growth assumptions used in assessing projected investment returns suggests that venture capital will also be constrained. Funding for major capital initiatives such as real estate development, plant expansions and new infrastructure projects should also be curtailed unless confidence inducements can be supplied, such as a governmental guarantee or the strongest of corporate covenants.

Given prospects for a world in which capital has become dear and very selectively distributed, the world of investment opportunities has narrowed. The investment decision process will probably lead to an initial market focus on large and strong companies with solid cash flow and controlled capital requirements. The handful of small companies with a good business model and

2

|

important niche markets or dominant positions in regions of strong growth potential will probably attract significant capital. In between these two categories, there will likely be a range of companies in the process of transforming their business model to adapt to the emerging economic environment which could provide significant investment opportunity if they are successful. We would anticipate a number of different investment opportunities over the next few years.

ECONOMIC PROSPECTS: POTENTIAL SCENARIOS FROM MOST LIKELY, TO MOST OPTIMISTIC, TO MOST PESSIMISTIC

Given the great uncertainty over future government economic stimulus packages and housing stimulus or relief, around the world, as well as the potential impact of such capital injections or inducements upon employment, incomes, investment, lending, and currencies, we have chosen to incorporate an overview of the prospective potential for what could prove to be likely scenarios for economic activity. Our most likely best case, is for the U.S. economy to stabilize towards year-end 2009 as home prices begin to improve in certain markets, unemployment stabilizes at a level under 9%, along with the prospect of a modest lift in U.S. GDP. By then, China’s economy should have also turned the corner after a period of working down expensive inventories of raw materials and refocusing its economic activity, permitting both margin expansion and lower priced products for their export market. Then, India and Brazil should also start to see greater growth as global GDP begins to grow at a rate faster than the flat to negative first six months. We anticipate considerable interest rate reductions to accelerate this trend, in the emerging markets.

Our optimistic scenario has the global economy start to pick up mid-year 2009 as a result of a tremendous boost from both fiscal and monetary stimulus to the world’s major economies. Under such a scenario, home prices should begin bottoming by late in the second quarter in the U.S., and we would expect domestic unemployment to peak below 8%. We believe the significant increase in investment flowing into the equity markets in response to the positive stimulus to the economy would in itself help to stimulate renewed capital investment patterns. All of this could provide a sustained lift for the global economy. The pressure on the new Democrat controlled government to fix our economy could lead to such a powerful stimulus plan for the traditional drivers of our economy; cars and housing, that a short-term bounce can be engineered. Similar efforts may also be made abroad.

Our least likely scenario could occur if too few or ineffective stimulus programs failed to impact the economy, resulting in a prolonged and deeper downturn with potential double-digit unemployment rates in the U.S. lasting through 2010, a negative feedback loop of declining consumption, leading to higher unemployment to increased mortgage foreclosures and business failures, could further erode our country’s capital base. Such a deflationary spiral of negative consequence would weigh on global consumption patterns, limit the recovery of the banking system and perhaps destabilize governments and trade alliances, reversing many of the benefits of globalization. We believe that this risk is apparent to pragmatists in central banks and governments around the world, so every effort will likely be made to avoid such decline.

FINAL THOUGHTS: ADJUSTING TO A NEW WORLD

During preceding sections we have discussed how this “hundred year flood” of economic distress has upended the order of things related to both the capital and credit markets. Such traumatic events often lead to investment opportunities. We would like to share our thoughts regarding some of those opportunities as we structure our investment portfolios, discussing how this event has led us, as the Funds’ managers, to initiate new efforts in an attempt to protect the Fund against possible future economic tsunamis.

We believe the consolidation in the banking sector should create a selective group of large capitalization companies with strong balance sheets and entrepreneurial management teams, who have enhanced returns in the past, could be rewarded with premium share prices as well as access to capital markets. Large companies which have poor financial structure, management team or business focus will likely be forced to restructure in an attempt to transform their business to meet current economic demands. The likelihood is that only a few will succeed, and those which fail will be forced to sell assets or portfolios, to the better capitalized premier companies. Smaller companies which have good growth opportunities and solid management may find that capital is very expensive. Some should be able to expand their portfolios in spite of higher cost capital and eventually earn premium recognition from the marketplace.

Since the structured finance markets will probably take between two to four years to restructure and, or, cleanse themselves of poor performing loans, we suspect there will not be significant low cost funding for leveraged buy-outs during this period in the U.S. and Europe. Asia and Latin America present a different scenario as we

3

|

believe their economic growth rates should be sustained at higher levels than growth potential of developed markets enhancing prospective values. Furthermore, they did not receive significant capital from the structured finance underwriters on Wall Street, so there should be very little overhang in those markets. Thus, as the dust settles over the next year, we believe it will become increasingly clear to investors that emerging market trends are still intact for the long term and that development of the capital markets would be required to meet economic demand. In the U.S. and Europe, we believe it will be a slower march back, with investment potential coming from relatively cheap equity valuations and companies’ abilities to transform their business models to position themselves for capital expansion.

Given the current valuation of many real estate, industrial, commodity and financial equities at historic trough levels not seen since 1990, and in some extremes even further back towards the 1970’s, we suspect that the potential for historically strong recovery of valuations off a low basis is present. If equities prove to be cyclically attractive over the next year or two, and stock markets around the world have thoroughly discounted their decline, then we look forward to positioning our portfolios not just for a rebound potential, but also for long term growth potential.

As companies transform their business models, we believe that evolution of our management process is also important and thus we are focusing on adjustments to our existing investment methodologies. In an attempt to protect our portfolios against future extreme price

movement, we would hope to reduce the sort of downside risk which has impacted our portfolios this year. Unlike previous years, broad portfolio diversification failed to cushion the downside for our international portfolios in particular. In response, we are gradually concentrating portfolios to a greater degree, favoring the sort of investment opportunities which we believe might outperform during this period of uncertainty and potential transformation.

While the market is certainly closer to a bottom than just a few months ago, and may have hit its nadir on November 21st, the risk of an extended downturn remains. Thus, we will err on the side of caution, while still hunting for undervalued recovery opportunities and transformational value situations. Anticipating a two to three year investment holding period, many of the downtrodden values of today may become great recoveries or even market leaders for the future.

We appreciate your support and interest. Alpine has been investing in our people, processes and systems in an effort to invest most effectively. We hope to enhance results for you in the New Year.

Sincerely,

Samuel A. Lieber

President, Alpine Mutual Funds

|

The letter and those that follow represent the opinions of Alpine Funds management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Cash Flow measures the cash generating capability of a company by adding non-cash charges (e.g., depreciation) and interest expense to pretax income.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk.

4

EQUITY MANAGER REPORTS

|

|

| Alpine Dynamic Balance Fund |

|

|

| Alpine Dynamic Dividend Fund |

|

|

| Alpine Dynamic Financial Services Fund |

|

|

| Alpine Dynamic Innovators Fund |

|

|

| Alpine Dynamic Transformations Fund |

|

|

|

| ||||||||||

| ||||||||||

| ||||||||||

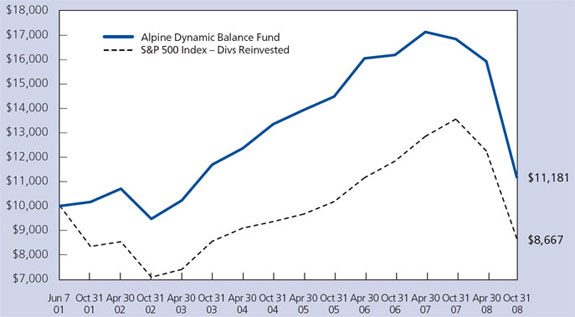

Value of a $10,000 Investment | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Mixed-Asset Target Allocation Growth Funds Average is an average of Funds that, by portfolio practice, maintain a mix of between 60%–80% equity securities, with the remainder invested in bonds, cash, and cash equivalents. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index and the Lipper Mixed-Asset Target Allocation Growth Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Balance Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Comparative Annualized Returns as of 10/31/08 | |||||||||||

| |||||||||||

|

| 6 Months (1) |

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

|

Alpine Dynamic Balance Fund |

| -29.81 |

| -33.63 |

| -8.27 |

| -0.90 |

| 1.52 |

|

S&P 500 Index |

| -29.28 |

| -36.10 |

| -5.21 |

| 0.26 |

| -1.91 |

|

Lipper Mixed Asset Target Allocation Growth Funds Average |

| -25.71 |

| -30.82 |

| -3.95 |

| 0.71 |

| -0.14 |

|

Lipper Mixed Asset Target Allocation Growth Fund Ranking |

| — |

| 480/666 |

| 525/551 |

| 354/420 |

| 44/309 |

|

| |||||||||||

(1) Not annualized. FINRA does not recognize rankings for less than one year.

6

|

|

Alpine Dynamic Balance Fund |

|

|

|

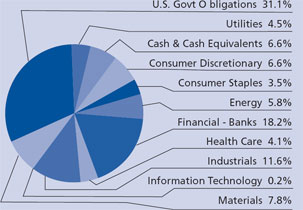

Portfolio Distributions* (Unaudited) | Top 10 Holdings* (Unaudited) |

|

|

|

|

|

|

|

1. | U.S. Treasury Bond, |

|

|

|

| 5.250%, 11/15/2028 |

| 16.03 | % |

2. | U.S. Treasury Bond, |

|

|

|

| 6.000%, 02/15/2026 |

| 6.44 | % |

3. | U.S. Treasury Bond, |

|

|

|

| 6.250%, 08/15/2023 |

| 4.31 | % |

4. | U.S. Treasury Note, |

|

|

|

| 5.000%, 08/15/2011 |

| 4.12 | % |

5. | CONSOL Energy, Inc. |

| 3.19 | % |

6. | Johnson & Johnson |

| 3.12 | % |

7. | Allegheny Energy, Inc. |

| 2.90 | % |

8. | General Electric Co. |

| 2.52 | % |

9. | JPMorgan Chase & Co. |

| 2.33 | % |

10. | CVS Caremark Corp. |

| 2.31 | % |

|

|

* | Portfolio holdings and sector distributions are as of 10/31/08 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. |

| |

|

Commentary |

Dear Investor:

The Alpine Dynamic Balance Fund had a -33.66% total return in the fiscal year ended October 31, 2008. This compares with a -36.10% for the Standard & Poor’s 500 Index and -30.82% for the Lipper Mixed-Asset Target Allocation Growth Funds Average. Notwithstanding this most negative year for the Fund’s performance, its performance since inception in 2001 remains superior to those of the indices used for comparison. Total return since inception is 11.81%.

Portfolio performance was strengthened by adherence to the basic balanced strategy and utilization of U.S. Treasury obligations. Fiscal year-end U.S. Treasury obligations totaled 30.9% of assets and total fixed income and short term obligations were 37.5% of the portfolio.

The majority of the Fund was invested in equities which were selected for underlying strong asset values, earnings growth potential and yield emphasis. In line with the general trends of equities in this period, returns were disappointing. Only a small, diverse group of equities showed positive performance during the fiscal year. They ranged from a community bank in Tyler, Texas, Southside Bancshares, up 17.3% to Norfolk Southern, the railroad company, with a gain of 17.8%. Long term gains realized during the fiscal year included Allegheny Energy, Simon Property and Union Pacific Corp., up 308.0%, 132.80% and 111.0%, respectively. Gains were realized in a number of other issues in the course of the fiscal year including Goldman Sachs, Chevron Corp, Lennar Corp and Redecard S.A. Additionally, gains were realized in long-term U.S.

Treasury Bonds sold at a market peak, which the Fund subsequently reinvested.

The bulk of the portfolio holdings which held up well during most of the fiscal year (as reported at mid-year), declined during the waves of selling in September and October. There were a few banks which resisted the heavy selling as their industry sharply declined, with a modest 9.0% decline in JPMorgan Chase and 10.9% decline in New York Community Bancorp. The energy group, which had through mid-year benefited from rising prices and consequent intense investor interest, encountered sharp reversals; leaving the position in Hess Corp. down 15.6% for the fiscal year, Chevron Corp. down 16.2% and Diamond Offshore Drilling off 17.0%.

Major real estate investment trusts with strong yields had resisted much of the market decline, but were swept down as Boston Properties was off 28.3% and Simon Property Group down 33.3%. The portfolio’s worst performers were Wachovia Corp., Guarantee Financial Group, AMBAC Financial Group and Fannie Mae, each caught up in the fearful decline of the mortgage banking markets. Fannie Mae, the largest holding of the group, lost virtually all of its value with a U.S. Treasury Department decision to place it in a conservatorship while vastly diluting its equity with government monies. Major declines developed for many issues which had been strong portfolio leaders in its previous growth, ranging from pharmacy operator CVS Caremark to restaurateur Darden Restaurants, and retailer JC Penney.

The extent of the losses in these many well managed companies with excellent records and demonstrably

7

|

|

Alpine Dynamic Balance Fund |

|

strong long-term prospects raised questions about the underlying position of the equity markets. The traditional concept of the economic values of individual businesses seemed to be challenged on an almost daily basis, especially in the final months of the fiscal year. The combination of frequent warnings from Washington featuring the words “financial crisis” and the incessant negativism of hedge fund short-selling seemed to transform market values. Short-term anxiety replaced long-term confidence. Pressure to unload potentially risky assets increased just as Treasury and Federal Reserve statements about shrinking credit availability and illiquidity became the main themes of the financial market. To this background was added evidence of declining retail sales, inventory shrinkage and then accelerating unemployment. Together they generated significant elements of a ‘perfect storm’ equity investment market environment.

The reestablishment of confidence in equity values will, we believe, emerge only with evidence of restored financial liquidity on a broad basis and with demonstration of continued corporate operating strength. For the broader goal of enhanced liquidity, the nation is clearly depending upon government intervention, the widening scale of which is currently suggested by spokespersons in Congress and by the President-Elect. Any corporate demonstration of strength should be reflected by earnings reports of individual companies and, importantly, dividend payment trends. We were encouraged, just after the fiscal year, to see several reaffirmations of dividend strength or increases. Most notable was General Electric Co.’s assertion that it has positioned its financing subsidiaries so that its dividend can be sustained through 2009. Selected holdings such as Lincoln Electric Holdings Co. and Sysco Corp. have lately provided significant dividend increases.

Looking ahead to a recession continuation in 2009, we will sustain our program of investment in companies whose business is not cyclical, and likely to encounter expanded demand, with strong financials characterized by high cash positions and a tradition of regular dividend increases. Among companies so characterized recent commitments include shares of Becton Dickinson, the medical supplies specialist, RPM International, convenience chemical and spray paint supplier, Sysco Corp., food distributor and State Street Corp., the largest trust servicing bank.

The Fund benefited significantly from the search for secure income in the U.S. Treasury obligations. In the present framework of Federal Reserve credit ease, we think it appropriate to maintain the allocation of approximately one-third of assets to U.S. Treasury obligations. Over the months ahead we will try to keep this balanced approach dynamic, reflecting possible changes in interest rates and in economic stimulus programs. That stimulus may positively impact the financial institutions and companies held in the portfolio together with our small group of homebuilder holdings whose profits revival could occur with the restoration of liquidity throughout the financial system.

The equity portfolio is now one of considerable diversity, oriented to both the search for current undervaluation and long-term growth potential. While recognizing that it will have to be modified as conditions change, we are concentrating on the fundamental aim of searching for both quality and growth opportunity in companies with basic financial strength and industry leadership.

Sincerely,

Stephen A. Lieber

Samuel A. Lieber

Co-Portfolio Managers

|

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. |

Investing in this fund involves special risks, including but not limited to, options and futures transactions. Please refer to the prospectus for further details. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. Each Lipper average represents a universe of Funds with similar invest objectives. Rankings for the periods shown include dividends and distributions reinvested and do not reflect sales charges.

8

|

|

|

| ||||||||||

| ||||||||||

| ||||||||||

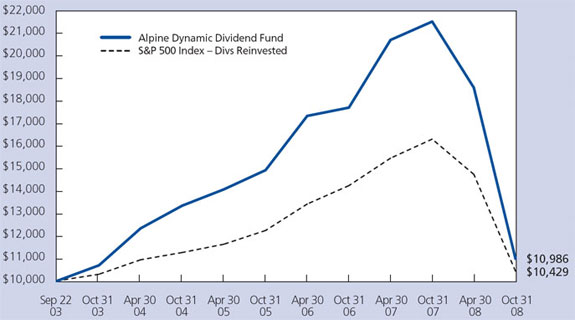

Value of a $10,000 Investment | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

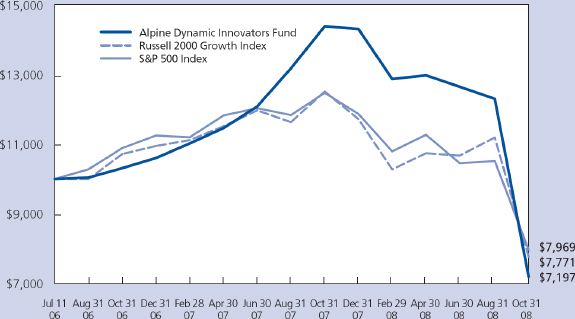

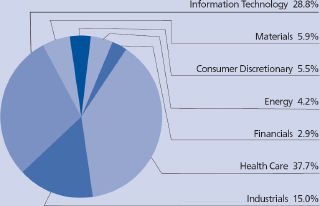

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The S&P 500 Index and the Lipper Equity Income Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Dividend Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Comparative Annualized Returns as of 10/31/08 | |||||||||||

| |||||||||||

|

| 6 Months (1) |

| 1 Year |

| 3 Years |

| 5 Years |

| Since Inception |

|

Alpine Dynamic Dividend Fund |

| -40.98 |

| -49.05 |

| -9.73 |

| 0.55 |

| 1.86 |

|

S&P 500 Index |

| -29.28 |

| -36.10 |

| -5.21 |

| 0.26 |

| 0.83 |

|

Lipper Equity Income Fund Average |

| -27.41 |

| -33.84 |

| -4.24 |

| 1.48 |

| 2.36 |

|

Lipper Equity Income Fund Ranking |

| — |

| 277/283 |

| 212/228 |

| 115/174 |

| 104/169 |

|

| |||||||||||

(1) Not annualized. FINRA does not recognize rankings for less than one year.

9

|

|

Alpine Dynamic Dividend Fund |

|

|

|

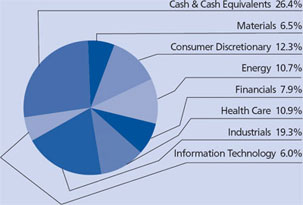

Portfolio Distributions*(Unaudited) | Top 10 Holdings* (Unaudited) |

|

|

|

|

|

|

1. | De La Rue PLC |

| 3.53% |

2. | Time Warner Cable, Inc. - |

|

|

| Class A |

| 3.27% |

3. | Abbott Laboratories |

| 3.22% |

4. | The J.M. Smucker Co. |

| 3.14% |

5. | Diamond Offshore Drilling, Inc. |

| 3.12% |

6. | Regal Entertainment Group - |

|

|

| Class A |

| 2.45% |

7. | The Procter & Gamble Co. |

| 2.43% |

8. | Healthcare Services Group, Inc. |

| 2.33% |

9. | ITC Holdings Corp. |

| 2.29% |

10. | Molson Coors Brewing Co. |

| 2.18% |

|

|

* | Portfolio holdings and sector distributions are as of 10/31/08 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. |

|

Commentary |

Dear Investor:

The Alpine Dynamic Dividend Fund (ADVDX) completed a very difficult fiscal year 2008 by achieving its primary objective of distributing an attractive dividend income, but falling well short of our secondary objective of strong capital appreciation and total return. We were extremely disappointed by the decline in our asset value within the context of these challenging markets conditions and it is our goal to regain our track record of outperforming the broad major averages and our equity income peer group in 2009.

ADVDX declined by 49.05% including dividend reinvestments for the fiscal year ended October 31, 2008 versus a 36.10% decline for S&P 500 Stock Index and a 33.84% decline for the Lipper Equity Income Fund average for the same time period. Since inception on September 22, 2003, ADVDX has produced an annualized return of 1.86%, which compares to a return of 0.83% for the S&P 500 Index and a 2.36% annualized return for the Lipper Equity Income Fund average. We would attribute our underperformance to three major factors: our exposure to international equities, our investments in companies that we believed would benefit from global growth, such as industrials and energy, and our exposure to both financial and non-financial companies that had relied on healthy capital markets for their growth.

International markets have significantly underperformed the U.S. in fiscal 2008

ADVDX has a relatively larger exposure to overseas markets, which have significantly underperformed the

U.S. over the past fiscal year, in comparison to the S&P 500 and our equity income peers. In addition to our multi-strategy and multi-cap approach, we invested on average approximately 25-35% of ADVDX’s assets in international equities where we had found attractive growth opportunities and significantly larger dividend payouts than we see in the U.S. We do not actively manage our country weightings - we pick our holdings on a stock by stock basis based on dividend potential and total return. This bottoms-up approach had taken a large portion of our international holdings to the Euro region. However, the stocks in many European countries were hit particularly hard in fiscal 2008 by much higher interest rates than the US, the abrupt collapse of oil prices, and the overall slowdown in the global economies brought on by the crisis in the global financial markets.

Based on the deteriorating outlook for European stocks throughout fiscal 2008 and the turnaround in the dollar after several years of decline, we steadily repositioned the portfolio back to U.S. assets. As of fiscal year end October 31, 2008, ADVDX had only 15.8% of total assets in international equities based in 12 different countries, the majority of which would be considered mature countries. Following the United States, our current top countries are Britain, Norway, Israel, Japan and Sweden. The average dividend yield for the major indices in these five countries is currently 5.47% compared with a 3.25% yield on the S&P 500 Index.

Despite the pain that has been endured this year in the U.S. equity markets, the S&P 500 has actually been one of the best performing major global equity markets

10

|

|

Alpine Dynamic Dividend Fund |

|

over the past year. This is due largely to the timing of the aggressive rate cuts and fiscal packages presented by our Fed versus the other Asian and European central banks and the extensive policy responses by the U.S. government to try to avert a deeper recession and financial crisis. For example, the Dow Jones STOXX Index, which is a broad representation of 600 companies in the European region, has declined by 60% in US dollar terms from its high on 11/1/07 through its low on 11/21/08 versus a 53% decline for the S&P 500 Index from its high on 10/11/07 through its low on 11/21/08. Calendar 2008 was the worst year for global equities since 1970, with countries like Italy down 74%, Norway down 67%, and Ireland down 65% in calendar 2008 versus the S&P 500 Index down 38%.

The rising dollar was also a negative for the currency translation of our international holdings. For example, the dollar strengthened by 20.7% versus the Euro in just a few months, from mid-July 2008 through our fiscal year end on 10/31/08. Beginning in December, 2008 the dollar has started to decline versus the Euro as the U.S. has slashed interest rates well below any other major country. We will monitor the outlook for the dollar as the recent declines will now help the translation of our foreign holdings.

The financial crisis attributed to a rapid decline in global growth and the companies that we owned that supply that growth

As we headed into fiscal 2008, we were concerned about the slowdown in the U.S. economy, but we believed that the strength being exhibited in the economies of Asia and Europe would be able to support the performance of global growth. European and Asian growth was so strong in first half fiscal 2008 that the ECB was raising interest rates because of inflations concerns. But as the year progressed it became increasing clear that the world economies are linked more than ever, particularly financial markets. However, we did not anticipate the severity and velocity of the collapse in demand for commodities such as oil, coal, iron ore, and fertilizer. As we now know, the collapse of Lehman Brothers in mid-September 2008 had dire unanticipated consequences in the global financial markets.

The result has been a global de-leveraging of financial balance sheets and the withdrawal of credit. Without this credit, it is very difficult for businesses to fund working capital or growth projects or acquisition strategies. This has put an abrupt halt in many sectors of global industrial production in a matter of just a few months. This can be illustrated by the collapse in price of many global commodities. The CRB Commodity Price Index declined by an astounding 43.2% in just a few months, from its high on 7/3/08 through our fiscal year end on 10/31/08.

Based on our fundamental work which indicated significant supply constraints, increasing worldwide demand from emerging economies, and very strong backlogs and dayrates, we had remained bullish on industry leaders in commodity, energy, and industrial stocks. Again, we did not anticipate how quickly these backlogs and dayrates could deteriorate as the financial crisis intensified. We are continuously doing our homework and we have lightened up on our exposure to companies in these sectors where we see increasing earnings risk from a rapidly slowing global economy. However, in some cases we believe that the market has oversold some great companies that now offer tremendous value and we will ride out the near term turbulence and take a long term view for our investors.

Also aggravating these massive sell offs have been the large redemptions coming from hedge funds that were heavily overweighted in many of these global growth stories. As redemptions accelerated, many funds were forced to sell their winners in many of the global growth names or other stocks that were liquid. This forced selling became a negative feedback loop as more declines in stock prices continued to fuel more redemptions and selling. We view the negative returns in the hedge fund community in 2008 and the redemption selling as a potential continued risk in early 2009 as funds that ended the year with negative results may be forced to close down and liquidate in 2009. However, there is also a lot of cash that has been sitting on the sidelines at major hedge funds in addition to risk averse capital that has been invested in treasuries that could be redeployed to equities in 2009 if we see confidence return, which would be positive.

Many of our companies were impacted by the sudden deterioration in credit and capital markets that are needed to fund growth

The genesis of the global financial crisis problem was the collapse of the U.S. residential housing market that began in 2007. But like any wildfire that is not contained, the U.S. housing problem was not properly addressed and the flames began to spread due to the global nature of financial markets today. We would say that the far-reaching inferno that the U.S. Fed was trying to fight turned into a global meltdown when Lehman Brothers was allowed to go bankrupt in mid-September 2008.

While ADVDX did not have any direct exposure to the subprime mortgage industry, we did have exposure to some high-yielding global financial companies in early fiscal 2008. However, as we saw the flames spreading, we repositioned ADVDX to have limited direct exposure to the growing bank problems as illustrated in the decline in our financial sector exposure from 16.9% on 10/31/07 to 6.0% on 10/31/08.

11

|

|

Alpine Dynamic Dividend Fund |

|

We also took a hit with our investments in some non-financial companies where the businesses relied on open credit and capital markets to support growth and acquisitions or where their balance sheets had been leveraged for growth. We have worked to eliminate most of these companies from our portfolio as we expect challenging credit conditions to continue in the near term.

Throughout fiscal 2008, we have strived to better balance our portfolio to better weather this economic storm. With the tides and undercurrents changing rapidly, it has been an extremely difficult environment to be a long-only dividend investor that has to have a significant portion of assets invested at all times in order to generate our high dividend yield. However, we have worked to reposition the portfolio to be more diversified and more balanced to handle the turbulence with a barbell approach. By this we mean that we have kept our cyclical names where we feel the stocks offer tremendous long term value and are positioned to benefit from a better outlook for growth in late 2009 and beyond. And we have also added to our more defensive positions in sectors like healthcare, consumer staples, utilities, and telecom which should outperform if global growth continues to be weak. We will discuss this more in our 2009 Outlook below.

Our number one priority continues to be to provide our investors with a very attractive dividend yield and to improve and grow our capital returns.

ADVDX provides a very attractive dividend yield with a high level of qualified dividend income for investors

We did succeed in providing our investors with a high level of 100% earned dividend income throughout these difficult markets. For the twelve months ended October 31, 2008, ADVDX paid $1.64 in dividend income, with a large percentage of the distribution estimated to be qualified for the maximum taxable rate of 15%. For the twelve-months ended October 31, 2007, the Fund paid a total of $1.78 in dividend income. Based on a closing NAV price of $5.72 on 10/31/08, the $1.64 dividend payout represents a trailing twelve-month dividend yield of over 28% for the Fund. Since inception, ADVDX has paid a total of $7.72 in dividends, of which 100% was earned dividend income.

ADVDX pays a regular monthly minimum dividend of $0.07 per share. In addition, in the third month of each quarter the Fund distributes excess dividend income that has been earned and accumulated during the quarter.

Our distinct investment approach combines three sub-strategies: Dividend Capture, Value, and Growth

ADVDX combines three research-driven investment strategies – Dividend Capture, Value, and Growth – to maximize the amount of distributed dividend income

that is qualified for reduced Federal income tax rates and to identify companies with the potential for dividend increases and capital appreciation. The Fund also offers some global diversification since a portion of the portfolio is invested in international dividend-paying equities. We scan the globe looking for what we feel are the best dividend opportunities for our investors, employing a multi-cap, multi-sector, and multi-style investment approach.

Our “Dividend Capture Strategy” enhances the qualified dividend income generated by the Fund

We run a portion of our portfolio with a dividend capture strategy, where we invest in typically high dividend yielding stocks or in special situations where large cash balances are being returned to shareholders as one-time special dividends. We seek to enhance the dividend return of this portfolio by electively rotating a portion of our high yielding holdings after the 61-day ownership period required to obtain the maximum 15% dividend tax rate

Three of our top ten holdings as of October 31, 2008 were companies that announced special dividend payments associated with restructurings and/or excess cash, and we believe there is additional upside value to be realized following their dividend payments.

Our top holding, De La Rue plc (DLAR LN), is the world’s largest private printer of paper money for over 150 countries, in addition to its smaller businesses in passports and other document printing that require security features. DLAR has experienced an increase in countries that have looked to outsource their currency printing based on issues such as the costs associated with increased technological threats of counterfeiting. The 150-year old company recently sold its automated teller machine business for $700 million in order to focus on its more profitable banknote production and returned the cash to shareholders as a special one time dividend of over 35%. With extremely high barriers to entry, high returns on capital, and strong backlogs and visibility, we expect continued strong earnings growth at DLAR plus its management team has committed to returning excess cash to shareholders.

Time Warner Cable (TWC) and The J.M Smucker Company (SJM) are two other top holdings that recently announced large special dividend payments. TWC is in the process of being spun off from its parent company, Time Warner Inc, to be able to pursue growth opportunities in the cable industry and to focus on its core business. A one-time dividend payment of $10.27 per share is being paid to TWC shareholders when the deal closes, which is expected in first quarter 2009. Time Warner Cable is the second largest cable operator in the U.S. with over 13 million subscribers including the New York and Los Angeles markets. Cable television demand

12

|

|

Alpine Dynamic Dividend Fund |

|

is expected to remain relatively stable while TWC’s growth will be driven by its triple-play service offering, its recent Adelphia acquisition and launch of its small and medium-size enterprise business. We believe that TWC’s current discounted price already reflects economic and competitive concerns and offers an attractive valuation at current levels.

J.M. Smucker Company (SJM) is a food manufacturer of leading brands such as Smucker’s jelly, Jif peanut butter, Pillsbury pie crusts, Crisco cooking oil, and Folgers coffee. We view Smuckers as an attractive defensive growth story as consumers are trading down to more value-oriented meals and coffee choices at home. In addition, Smucker generates only a small percentage of sales internationally so it is more shielded from currency fluctuations versus many large cap food companies. In addition, moderating commodity costs and savings associated with the recent $3 billion Folgers acquisition should allow for attractive margin expansion and cash flow growth. As part of the Folgers transaction, Smucker shareholders received a one-time special dividend of $5 per share in September 2008.

Our “Growth and Income Strategy” targets capital appreciation in addition to yield

Our second strategy identifies core growth and income stocks that may have slightly lower but still attractive current dividend yields and predictable earnings streams plus a catalyst for capital appreciation and dividend increases. In our top 10 holdings, we would group Abbot Laboratories, Proctor and Gamble, Healthcare Services Group, and ITC Holdings in this category. Each company is a leader in its industry and experiencing strong earnings and dividend growth. We would expect additional dividend increases to match earnings growth in 2009.

Two of our top growth and income holdings are considered more defensive stocks with attractive earnings outlooks that are less tied to economic growth. Abbott Laboratories (ABT) is a diversified healthcare company with principal business lines in global pharmaceuticals and nutritional and medical products. We believe that Abbot’s five year growth outlook is one of the most attractive in the healthcare sector based on the strength of its new cholesterol products as well as its Humira arthritis and Xience drug stent franchises. We see 10-15% sustainable EPS growth over the next several years supported by limited generic risk relative to its peer group and strong earnings visibility in uncertain economic times. In addition, ABT is committed to increasing dividends and currently has a growing 2.6% dividend yield. Proctor and Gamble (PG) is one of the world’s largest diversified consumer products company that is also benefiting from international expansion and strength in its core domestic brands. PG is benefiting from declines in input costs and relatively stable pricing which is increasing margins and cash flow. PG is

also committed to dividend increases and recently raised its annual dividend by 14.3% to $1.60 per share.

Healthcare Services Group (HCSG) provides housekeeping, laundry/linen, and food outsourcing services to nursing homes and hospitals. The company’s business is in a favorable demographic with the aging U.S. population and the trend toward cost cutting and quality improvements through outsourcing. HCSG’s strong management has a solid track record of delivering sustainable growth while generating substantial free cash. This has enabled the company to maintain a debt-free balance sheet with over $2 per share in cash. HCSG has raised its dividend by one penny every quarter, providing a 4.5% current dividend yield. The company is overcoming some cost issues in 2008 and is expected to return to strong 20% EPS growth in 2009.

Lastly, ITC Holdings (ITC) owns and operates approximately 6,800 miles of high voltage electric transmission stations and wires in the Midwest U.S. ITC transmits electricity from power plants to local substations where the voltage is then lowered for distribution to customers. We believe that ITC is well positioned to benefit from the upgrade and buildout of the electric transmission grid that fits well within the clean energy and infrastructure plans of the new administration. A robust grid is needed to tap the nation’s clean energy resources such as wind, solar, and natural gas. ITC has strong regulated double digit EPS growth driven by substantial investment needs and favorable regulation. We believe concerns about ITC’s capital spending plans are overblown and we view the current share price as attractive for longer-term oriented investors seeking both growth and a current 3.1% dividend yield.

Our “Value/Restructuring Strategy” looks for attractively valued or restructuring dividend payers

Our third major strategy is what we call “value with a catalyst or restructuring strategy”, where our internal research points to under-valued or mis-priced equity opportunities for companies with attractive dividend yields. We also look for turnaround situations or depressed earnings where we believe there is a catalyst for an earnings recovery or a restructuring or major corporate action that is expected to add value. The key characteristic for this strategy is low valuations relative to historical averages and above average dividend yields for a combined objective of capital appreciation and high qualified dividend income. We would categorize three of our top holdings in this strategy; Diamond Offshore Drilling, Regal Entertainment, and Molson Coors Brewing.

Diamond Offshore Drilling (DO), based in Houston, Texas, is one of the largest operators of mid-deepwater rigs and it is seeing strong demand for its services as oil

13

|

|

Alpine Dynamic Dividend Fund |

|

is getting harder to find and exploration is moving further out to sea. This is resulting in substantial increases on rates for its long term contracts and the expectation of a doubling of earnings in the next two-three years. DO is generating significant free cash flows and has been returning it to shareholders as regular annual special dividends and has recently moved to quarterly special dividends of $1.25. We would expect the continuation of large cash returns in 2009 as the company is committed to paying out about 80% of earnings as dividends.

Regal Entertainment (RGC) with an 11.6% dividend yield is the largest theater owner in the U.S., generating 20% of total U.S. box office revenue. It is currently enjoying a rebound in theater attendance based on what has been perceived as higher quality movie selections. We expect the large-scale rollout of enhanced 3-D technology to theaters beginning in 2009 to act as a catalyst for an additional increase in movie attendance and an enhanced margin opportunity for Regal as 3-D movies command premium ticket prices.

Molson Coors Brewing (TAP) was formed through the merger of Coors Brewing & Molson Inc in early 2005. TAP is the world’s fifth-largest global brewer, with a leading market share in Canada and the UK and is the No. 3 player in the US. We believe TAP is well positioned for strong double digit earnings growth based on solid organic growth, more aggressive pricing discipline, industry share gains, moderating input costs, and rising cash flows. Beer fundamentals look positive as economic concerns are resulting in market share gains versus wines and spirits. Also, drinker are trading down to domestic premium beers where TAP has a high market share. Its 2008 sales and distribution joint venture with SABMiller in the US is expected to generate $500 million in cost synergies which are now expected to begin by early 2009. TAP raised its dividend by 25% in 2008 and offers an attractive 2.0% current yield and we would expect additional dividend increases as cash flow continues to improve.

Outlook for 2009: Cautious But Optimistic That 2009 Will Likely Be A Better Year for Equities

The Japanese word for “crisis” is comprised of two symbols which separately translate into “danger” and “opportunity”. As we begin fiscal 2009 with the global financial “crisis” continuing to roil the equity markets, we can see both dangers and opportunities for investors in the global markets. The dangers of a potential deep and long global recession are certainly looming as a worldwide de-leveraging cycle plays out. In addition, as earnings estimates for 2009 are being cut globally, so is the risk that dividend payments decrease in line with earnings. However, we also see opportunities and several positive catalysts for equities and we remain optimistic

that we should be able to continue to find attractive dividend opportunities for our investors. These positives include massive fiscal stimulus packages from the new Obama administration and from governments around the world, improved household balance sheets from an eventual stabilization in housing prices and declining inflation, and generally attractive equity valuations.

The developed economies of the U.S., Europe and Japan are facing their first coordinated recessions since World War II. To meet this challenge, governments around the world have responded with massive monetary and fiscal responses. Interest rates have been slashed globally and fiscal policy stimulus programs seemed to be announced every week with more likely to come in 2009. In the U.S., we are expecting President Obama and the Democratic Congress to work quickly in calendar 2009 to implement a variety of fiscal measures that should help to stimulate economic growth and should provide a floor for equity valuations. These include tax rebates for the middle class, payroll tax cuts for corporations, grants to local governments, an extension in unemployment benefits, and a pledge for the biggest U.S. public works plan, since the 1950���s, on infrastructure. Eventually, these massive global fiscal and monetary responses should work to loosen credit markets and stimulate economic growth, with our best hope for a rebound in US GDP growth by the second half of 2009 and return to moderate growth in 2010. The equity markets will likely begin to soon discount these efforts and we are cautiously optimistic that we should see equities stronger in 2009.

In addition, we are hopeful that 2009 will be a better environment for ADVDX’s investment strategy as we expect the markets to continue to transition from a momentum and credit driven speculation to a more fundamentally based and conservative investment model that should bode well for high quality and high dividend payers in our universe. The days of free-and-easy credit growth that drove performance in the prior few years are over for at least the near term. We believe high quality companies with strong balance sheets and cash flow will outperform riskier companies until credit conditions get materially better and the de-leveraging process is largely complete, which is not likely to occur within fiscal 2009.

Another positive is that equity valuations have corrected to the point where many stocks are pricing their businesses as cheaply today as we saw back in the bear market of 1974, with many P/E ratios in our portfolio at single digit multiples. Particularly, within our value strategy, we are looking to take advantage of sharp price declines to invest in still very strong companies with solid fundamentals and attractive dividend yields at more attractive valuations. In addition, with global interest rates approaching zero, we would expect capital to search for sustainable yield opportunities in equities which was the case coming out of the bear

14

|

|

Alpine Dynamic Dividend Fund |

|

market in the mid-70’s. While we certainly do expect additional headline risks particularly in the financial sector and economic data in early 2009, we will continue to search attractive global growth companies that we believe should weather the economic storm and are committed to returning cash to shareholders.

We see great long term values in the market, but we need to see confidence restored to the global equity markets. We believe confidence will begin to come into the system when see some meaningful improvements in the credit and housing markets. For example, LIBOR and mortgage rate have begun to decline but corporate bond spreads are still at extremely high levels and treasury yields are at all-time lows. This still signals extreme caution and risk aversion. We would hope that legislation would be supported in Congress in early 2009 to stabilize foreclosures and housing prices and stimulate demand for home purchases. In addition, significant declines in food and energy prices and overall inflation levels should be additional good news for equities and should help result in a reduction in volatility and begin to restore some confidence.

One of the biggest drags on sentiment and the overall economy will likely continue to be rising unemployment. The US posted its highest jobless claims reading since 1982 in November 2008 and we expect unemployment to rise through most of 2009. However, unemployment is a lagging indicator and the equity markets traditionally will bottom well before unemployment starts to decline. The Fed and Treasury have made tremendous efforts to avert a complete financial meltdown, but in the end, the key to revitalizing household cash flows must be centered on solutions for housing and unemployment

We Will Maintain Our Balanced Barbell Approach As We Head Into Early 2009

Our goal is to keep our portfolio balanced and maintain a “barbell” approach to our stock selections. What we mean is that a portion of the portfolio will continue to be invested in more defensive companies with strong and sustainable earnings and cash flow growth with the potential for increasing dividends. These are companies in sectors like healthcare, consumer staples, telecom, and utilities where earnings and dividend growth should be more resilient in economic downturns. On the other end of the barbell, we are searching for extreme value opportunities in some strong companies in the more cyclical sectors like energy and consumer discretionary and domestically oriented industrials whose stocks have been overly punished this year and where we believe long term growth prospects are still attractive.

If we use the analogy that we are the pilots of our fund and we had the wings on our aircraft too much angled toward the global growth story in fiscal 2008. This

included many names in the commodity, energy and material sectors and that had hurt our performance in addition to our international exposure. We were drawn to these stocks based on strong long term secular trends and high free cash flow yields. However, short term sentiment trumped the long term math in this environment and we have been on the wrong side of an overcrowded this year. Now, as we head through these continuing storm clouds into calendar 2009, we believe the best strategy for our investors is to keep our wings balanced to better handle the turbulence that we are experiencing.

On the defensive side of the barbell, healthcare is one of the only private sectors that is seeing job gains, aided by the aging world demographics. We have been adding to our healthcare positions as we find attractive companies with earnings growth that is not tied to economic growth and where we see accelerating cash flow and dividend increases. We still remain cautious on the large pharmaceutical companies where there are legislative and generic drug risks. We prefer to look for interesting opportunities in smaller cap niche healthcare which is being stimulated by demographic trends and advances in biotechnology and yet there is no generic threat.

We had also increased our weightings in consumer staple stocks as the fundamentals have improved with declining input costs and price increases being maintained. If the dollar continues to weaken in 2009 then we would expect some attractive margin and cash flow improvement in this group. We have also increased our in weighting in Utilities which we have not historically favored due to their high valuations. But the group has come down with the overall market and is looking more attractive based on long term sustainable growth outlooks. We have lowered our exposure to international telecoms where we saw country risk in places like Russia and Latin America but we have maintained our domestic telecom holdings.

On the value side of the barbell, we have maintained our weighting in the energy sector and some materials and domestically-oriented industrials where our company’s earnings and cash flows still look strong within the context of the recent collapse of commodity prices. Many of these stocks have been decimated with valuations that are extremely attractive based on the long term secular growth story for energy with constrained supply and growing global demand. For example, coal stocks have been amongst our worst performers yet the longer term fundamentals demand picture remains positive. China alone has built the coal fired generating capacity equivalent of three Germanys in the past five years. We will continue to be nimble in these volatile yet potentially highly profitable sectors and we would look for attractive entry and exit points and we are aware of the impact of shorter term seasonal trading pattern.

15

|

|

Alpine Dynamic Dividend Fund |

|

At this time, we continue to remain cautious on the financial sector, as we believe there is still more write-downs on mortgage-related assets, plus we have the rising risk of defaults on commercial loans and consumer-related credit cards and auto loans. This should all lead to continued downward earnings revisions. In addition, we believe the need to recapitalize balance sheets and the outlook for a reduction in high margin business opportunities will continue to dampen earnings outlooks beyond more write-downs. Our strategy during the financial markets turmoil has been to add to the higher quality financial stocks on dips where we believe valuation have become very attractive. But overall we would not look to increase our weightings substantially until we believe that the downside risk is quantifiable and that the upside reward is meaningful.

Another sector that we remain cautious on at this time is consumer discretionary, but we would be more inclined to start building positions in some of these companies where valuations have become extremely oversold. As we have mentioned above, declines in energy and food costs and potentially lower mortgage rates in 2009 should put additional cash in the pockets of those Americans who will not be subject to the unemployment lines. Even a small amount of marginal spending could provide a boost to the oversold consumer discretionary companies and we are looking to be opportunistic in this area.

Lastly, we have added to our technology holdings since our mid-year update based on the more attractive dividend yields and value opportunities that we see in some of the mega-cap technology names. However, we are continually underweight technology stocks relative to the broad market averages due to their relatively low levels of dividend yields.

In summary, our approach during these uncertain economic times is to remain broadly diversified within the dividend-paying universe while actively looking for undervalued opportunities and high quality cash flow generators. We are confident that we will be able to continue to distribute attractive dividend payouts to our shareholders by capitalizing on our research driven approach to identifying attractive situations as well as through our active management of the portfolio. We are also hopeful that we will be able to experience a better equity environment in 2009 and we hope to be able to return ADVDX to its history of strong capital appreciation and total return.

Thank you for your participation and we look forward to a better and more prosperous year in 2009 and beyond.

Sincerely,

Jill K. Evans and Kevin Shacknofsky

Co-Portfolio Managers

|

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Current and future portfolio holdings are subject to risk. |

Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks. Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Free cash flow: Cash not required for operations or for reinvestment. Often defined as earnings before interest (often obtained from the operating income line on the income statement) less capital expenditures less the change in working capital.

Earnings per share (EPS): Calculated by taking the total earnings divided by the number of shares outstanding.

Dividend Yield: The yield a company pays out to its shareholders in the form of dividends. It is calculated by taking the amount of dividends paid per share over a specific period of time and dividing by the stock’s price.

P/E ratio: A valuation ratio of a company’s current share price compared to its per-share earnings. Calculated as market value per share / earnings per share. The P/E is sometimes referred to as the “multiple”, because it shows how much investors are willing to pay per dollar of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay $20 for $1of current earnings.

The CRB Commodity Price Index is an arithmetic average of 19 commodity futures prices with monthly rebalancing.

16

|

|

|

| ||||||||||

| ||||||||||

| ||||||||||

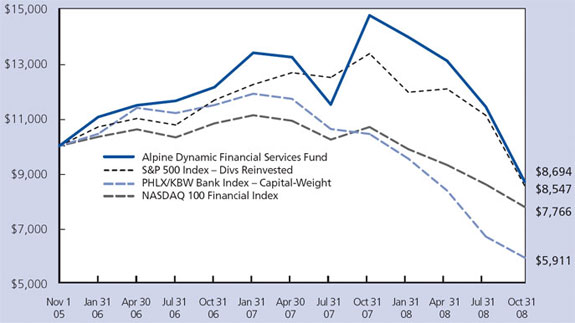

Value of a $10,000 Investment | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

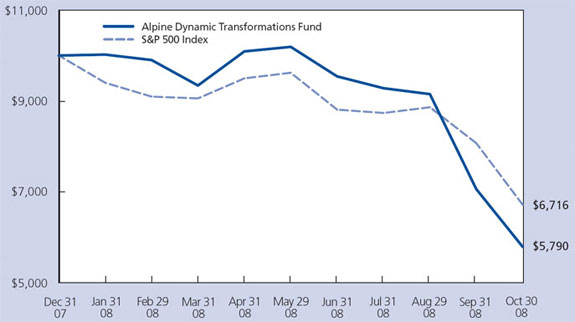

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 1-888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 2 months. If it did, total returns would be reduced.

The NASDAQ 100 Financial Index is a capitalization-weighted index of the 100 largest financial companies, as well as foreign issues, including American Depository Receipts (ADRs), traded on the NASDAQ National Market System (NASDAQ/NMS) and SmallCap Market. The PHLX/KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Financial Services Funds Average is an average of funds whose primary objective is to invest primarily in equity securities of companies engaged in providing financial services. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The NASDAQ 100 Financial Index, the PHLX/KBW Bank Index, the S&P 500 Index and the Lipper Financial Services Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Financial Services Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

|

|

|

|

|

|

|

|

|

| ||||||||

| |||||||||||||||||

Comparative Annualized Returns as of 10/31/08 |

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

| ||||||||||

|

| 6 Months (1) |

| 1 Year |

| Since Inception |

| ||||||||||

Alpine Dynamic Financial Services Fund |

| -33.69 |

|

| -41.16 |

| -4.56 |

|

| ||||||||

NASDAQ 100 Financial Index |

| -16.50 |

|

| -27.35 |

| -8.09 |

|

| ||||||||

PHLX/KBW Bank Index |

| -29.33 |

|

| -43.36 |

| -16.09 |

|

| ||||||||

S&P 500 Index |

| -29.28 |

|

| -36.10 |

| -5.10 |

|

| ||||||||

Lipper Financial Services Funds Average |

| -31.88 |

|

| -42.80 |

| -13.92 |

|

| ||||||||

Lipper Financial Services Fund Ranking |

| — |

|

| 35/92 |

| 6/70 |

|

| ||||||||

| |||||||||||||||||

(1) Not annualized. FINRA does not recognize rankings for less than one year.

17

|

|

Alpine Dynamic Financial Services Fund |

|

|

|

|

|

|

|

|

| ||||

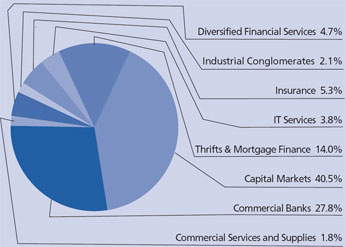

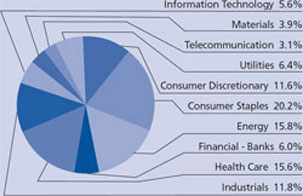

Portfolio Distributions*(Unaudited) | Top 10 Holdings*(Unaudited) | ||||

| 1. |

| IntercontinentalExchange, Inc. | 5.53 | % |

2. |

| Alliance Bancorp, Inc. | 5.09 | % | |

3. |

| The Goldman Sachs Group, Inc. | 4.16 | % | |

4. |

| Sanders Morris Harris Group, Inc. | 3.94 | % | |

5. |

| The NASDAQ OMX Group, Inc. | 3.40 | % | |

6. |

| Allied Capital Corp. | 3.28 | % | |

7. |

| JMP Group, Inc. | 3.17 | % | |

8. |

| CME Group, Inc. | 2.81 | % | |

9. |

| Banco Estado Rio Grande Sul SA | 2.77 | % | |

10. |

| Blackstone Group LP | 2.74 | % | |

|

|

|

|

| |

|

| ||||

* | Portfolio holdings and sector distributions are as of 10/31/08 and are subject to change. Portfolio holdings are not recommendations to buy or sell any securities. Top 10 Holdings do not include short-term investments. Portfolio Distributions percentages are based on total investments and Top 10 Holdings percentages are based on total net assets. |

| |||

|

|

|

|

|

|

|

Commentary |

Dear Investor: