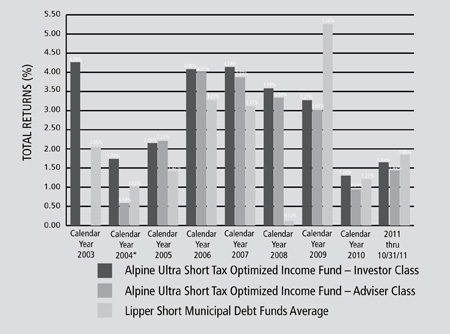

top quartile of the Lipper Analytical rankings for the one-year period.

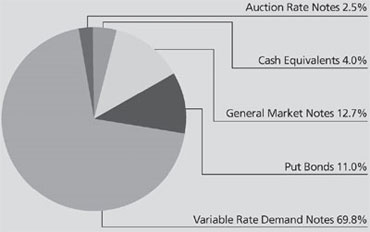

Upon examining the fundamentals of the municipal marketplace over the past ten months, we saw three key factors that formulated our investment strategy. These included historically low interest rates, deteriorating credit quality and a supply/demand imbalance of tax exempt securities. When we took all three of these variables into consideration, we concluded based on our objective of the fund that it would be advantageous to keep our average weighted maturity short and take a more defensive position. As a result, the fund’s average maturity fell to 71 days at the end of October. With short-term rates so low we currently intend to stay in this maturity range until rates move higher. We overweighed the portfolio in near-cash or short-term bonds that mature within a year with over 50% of the fund in variable rate demand notes (VRDN). VRDN’s have been a big component of the fund for the last several years as they have provided the fund with an attractive yield relative to longer maturing securities and the ability to sell at par on a daily or weekly basis depending on the specific type. Lately, we have seen a dramatic increase in the yields of these securities that have a European bank either providing a letter of credit or acting as a liquidity provider. We are very conscious of the volatility overseas and have limited our exposure to no more than seven days in any one security. We have also noticed that many of the issues that we own with these European credit enhancements have or are being refinanced and we continue to seek out opportunities that we believe will be called at a future date. We believe such opportunities provide an above average yield and relative safety of principal.

Other Fund investments included purchasing put bonds in the three to 12-month range, general market notes and tax-exempt commercial paper (CP). Most of our purchases of tax-exempt CP were similar in nature to our VRDN purchases with European bank credit enhancements. We were able to capitalize on a very disjointed market and purchase securities with abnormally high yields with one to two day maturities. Eventually, the issuers waived the white flag and changed the letters of credit to other banks to lower their financing costs resulting in us selling the bonds. Overall, these three different types of securities helped us to balance out the portfolio by extending ever so slightly on the yield curve.

ALPINE MUNICIPAL MONEY MARKET FUND

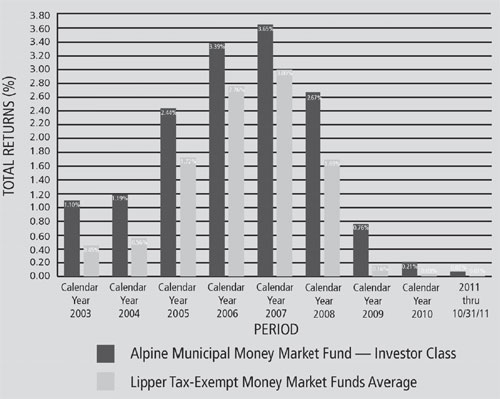

All money market rates continue to be closely tied to the Federal Reserve’s fed funds target rate of 0.00% to

0.25%. With volatile financial markets, the European debt crisis, uncertainty over U.S. debt obligations, and a sputtering economy all serving as a backdrop, many investors showed a preference for the safety and quality that money funds provide. The result has been a continuing push to lower rates in money markets.

Municipal money markets continue to follow the pattern of the broader money markets. Rates across the municipal yield curve are lower by about 15 basis points (100 basis points equal one percent) compared with six months ago. At the close of this reporting period overnight rates averaged 0.16% while seven-day rates averaged 0.27%. Thirty-day commercial paper rates averaged 0.15%, while one-year note yields averaged 0.27%.

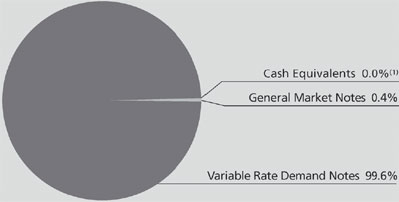

Credit quality remains a primary focus in the portfolio-in terms of both the municipal issuers themselves and the various bank guarantors that provide liquidity support to municipal debt. Since much of the short-term municipal market requires some form of bank support, we look only to Tier-1 banks for such backing. Furthermore, we have continued to maintain a significant portion of the fund in variable rate demand notes which has enabled us to keep our average maturity very short. At the close of our reporting period, our average weighted maturity was 12 days versus 32 days for our peer group.

The Federal Reserve has communicated to the market that it intends to maintain the current fed funds target rate well into 2013. For money fund investors, the prospect for higher income continues to be deferred. Still, we believe investors rely on their fund investments as a source of stability in uncertain markets and a ready source of liquidity. Our focus on such goals remains unchanged throughout this challenging period.

OUTLOOK

While we are pleased with the improved performance and sentiment towards municipal bonds, we acknowledge that the credit and economic environment for municipalities is likely to remain challenging. The slow economic recovery, the housing market downturn and high unemployment have reduced tax revenues collected by states and local governments from their peaks. Municipal bond defaults, which have historically been rare, could increase moderately. Defaults thus far have mostly been limited to the small issuers in the riskiest sectors, such as land-backed, multifamily housing, or hospitals. Income and sales tax have shown signs of increasing, providing support for state governments. On the other hand, cutbacks in state

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

support and persisting declines in property tax revenues will likely keep local municipal issuers vulnerable.

We will continue to monitor the economic landscape closely and make adjustments as needed. As always, we are on the lookout for attractively valued bonds by issuers with good fundamentals.

Sincerely,

Steven C. Shachat

Portfolio Manager

| |

| | |

Mutual fund investing involves risk. Principal loss is possible. The Alpine Municipal Money Market Fund is subject to the following risks: |

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in value resulting from changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

Liquidity Risk – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to under perform when compared to other funds with similar investment goals.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Municipal Securities Concentration Risk – From time to time the Fund may invest a substantial amount of its assets in municipal securities whose interest is paid solely from revenues of similar projects. If the Fund concentrates its investments in this manner, it assumes the economic risks relating to such projects and this may have a significant impact on the Fund’s investment performance.

Municipal Securities Risk – Municipal securities risks include the ability of the issuer to repay the obligation, the relative lack of information about certain issuers of municipal securities, and the possibility of future legislative changes which could affect the market for and value of municipal securities. Certain municipal securities, including private activity bonds, are not backed by the full faith, credit and taxing power of the issuer. Additionally, if events occur after the security is acquired that impact the security’s tax-exempt status, the Fund and its shareholders could be subject to substantial tax liabilities.

Redemption Risk – The fund may experience heavy redemptions, particularly during periods of declining or illiquid markets, that could cause the fund to liquidate its assets at inopportune times or at a loss or depressed value and that could affect the fund’s ability to maintain a $1.00 share price. In addition, the fund may suspend redemptions when permitted by applicable regulations.

Regulatory Risk – The SEC recently amended the rules governing money market funds. In addition, the SEC continues to review the regulation of such funds. Any further changes by the SEC or additional legislative developments may affect the Alpine Municipal Money Market Fund’s operations, investment strategies, performance and yield.

43

| |

Alpine Ultra Short Tax Optimized Income Fund /

Alpine Municipal Money Market Fund |

|

| | |

Variable Rate Demand Obligations Risks – Variable rate demand obligations are floating rate securities that combine an interest in a long-term municipal bond with a right to demand payment before maturity from a bank or other financial institution. There is the possibility that because of default or insolvency the right to demand payment from the bank or other financial institution may not be honored. If the bank or financial institution is unable to pay, the Fund may lose money. The absence of an active market for these securities could make it difficult for the Fund to dispose of them if the issuer defaults. During periods of declining interest rates, a Fund’s yield on a VRDO will decrease and its shareholders will forego the opportunity for capital appreciation.

The Alpine Ultra Short Tax Optimized Income Fund is subject to the following risks:

Derivative Securities Risk – The Fund may invest in municipal derivative securities which are subject to structural risks that could cause the Fund to receive taxable income or to lose money.

Fixed Income Securities Risk – Fixed income securities are subject to issuer risk, interest rate risk and market risk.

Interest Rate Risk – Interest rates may rise resulting in a decrease in the value of the securities held by the Fund, or may fall resulting in an increase in the value of such securities. Securities having longer maturities generally involve a greater risk of fluctuations in value resulting from changes in interest rates.

Issuer Risk – Changes in the financial condition of the issuer of an obligation, changes in general economic conditions, or changes in economic conditions that affect the issuer may impact its actual or perceived willingness or ability to make timely payments of interest or principal.

Liquidity Risk – Some securities held by the fund may be difficult to sell, or illiquid, particularly during times of market turmoil. Illiquid securities may also be difficult to value. If the fund is forced to sell an illiquid asset to meet redemption requests or other cash needs, the fund may be forced to sell at a loss.

Management Risk – The Adviser’s security selections and other investment decisions might produce losses or cause the Fund to under perform when compared to other funds with similar investment goals.

Market Risk – The price of a security held by the Fund may fall due to changing market, economic or political conditions.

Portfolio Turnover Risk – High portfolio turnover necessarily results in greater transaction costs which may reduce Fund performance.

Mortgage Related and Asset Backed Securities Risk – These securities are subject to prepayment risk, which is the risk that the borrower will prepay some or all of the principal owed to the owner. This could reduce the Fund’s share price and its income distributions.

Tax Risk – Changes in tax laws or adverse determinations by the Internal Revenue Service may make the income from some municipal obligations taxable. Additionally, maximizing after-tax income may require trade-offs that reduce pre-tax income. The Fund’s tax-efficient strategies may reduce the taxable income of the Fund’s shareholders, but will not eliminate it. There can be no assurance that taxable distributions can always be avoided or that the Fund will achieve its investment objective.

Variable Rate Demand Obligations Risks – Variable rate demand obligations are floating rate securities that combine an interest in a long-term municipal bond with a right to demand payment before maturity from a bank or other financial institution. There is the possibility that because of default or insolvency the right to demand payment from the bank or other financial institution may not be honored. If the bank or financial institution is unable to pay, the Fund may lose money. The absence of an active market for these securities could make it difficult for the Fund to dispose of them if the issuer defaults. During periods of declining interest rates, a Fund’s yield on a VRDO will decrease and its shareholders will forego the opportunity for capital appreciation.

Please refer to page 6 for other important disclosures and definitions.

44

|

Alpine Dynamic Dividend Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—97.4% | | | | |

Brazil—8.7% | | | | |

| 443,586 | | Anhanguera Educacional

Participacoes SA | | $ | 6,523,893 | |

| 560,000 | | Brazil Pharma SA (a) | | | 4,468,649 | |

| 520,500 | | Estacio Participacoes SA | | | 6,075,557 | |

| 719,826 | | International Meal Co.

Holdings SA (a) | | | 4,758,730 | |

| 310,322 | | Kroton Educacional SA (a) | | | 3,470,415 | |

| 1,048,400 | | MRV Engenharia e

Participacoes SA | | | 7,388,904 | |

| 1,682,500 | | PDG Realty SA Empreendimentos

e Participacoes | | | 7,418,543 | |

| | | | | | | |

| | | | | | 40,104,691 | |

| | | | | | | |

Canada—1.4% | | | | |

| 48,748 | | Goldcorp, Inc. | | | 2,380,852 | |

| 89,512 | | Potash Corp. of

Saskatchewan, Inc. | | | 4,236,603 | |

| | | | | | | |

| | | | | | 6,617,455 | |

| | | | | | | |

China—3.0% | | | | |

| 14,415,000 | | Daqing Dairy Holdings, Ltd. (a) | | | 3,486,681 | |

| 6,286,000 | | Dongyue Group | | | 4,812,269 | |

| 133,400 | | Giant Interactive Group,

Inc.—ADR | | | 518,926 | |

| 3,738,100 | | Great Wall Motor Co., Ltd.—

Series H | | | 5,038,268 | |

| 26,456 | | Sun Art Retail Group, Ltd. (a) | | | 34,258 | |

| | | | | | | |

| | | | | | 13,890,402 | |

| | | | | | | |

Denmark—1.0% | | | | |

| 69,100 | | FLSmidth & Co. A/S | | | 4,376,324 | |

| | | | | | | |

Finland—0.9% | | | | |

| 111,800 | | Metso OYJ | | | 4,324,627 | |

| | | | | | | |

Hong Kong—2.8% | | | | |

| 5,442,800 | | Brilliance China Automotive

Holdings, Ltd. (a) | | | 5,869,295 | |

| 2,393,300 | | Haier Electronics Group Co.,

Ltd. (a) | | | 2,275,540 | |

| 281,300 | | Hong Kong Exchanges and

Clearing, Ltd. | | | 4,757,899 | |

| | | | | | | |

| | | | | | 12,902,734 | |

| | | | | | | |

Norway—1.9% | | | | |

| 271,700 | | Seadrill, Ltd. | | | 8,922,373 | |

| | | | | | | |

Russia—0.3% | | | | |

| 271,857 | | LSR Group—GDR (b) | | | 1,302,195 | |

| | | | | | | |

Singapore—1.5% | | | | |

| 199,664 | | Avago Technologies, Ltd. | | | 6,742,653 | |

| | | | | | | |

Sweden—1.4% | | | | |

| 315,865 | | Tele2 AB—B Shares | | | 6,651,578 | |

| | | | | | | |

Switzerland—2.4% | | | | |

| 75,389 | | Novartis AG—ADR | | | 4,257,217 | |

| 114,934 | | Transocean, Ltd. | | | 6,568,478 | |

| | | | | | | |

| | | | | | 10,825,695 | |

| | | | | | | |

United Kingdom—4.6% | | | | |

| 71,247 | | Ensco PLC—ADR | | | 3,538,126 | |

| 231,222 | | GlaxoSmithKline PLC—ADR | | | 10,356,434 | |

| 423,100 | | Xstrata PLC | | | 7,047,385 | |

| | | | | | | |

| | | | | | 20,941,945 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

United States—67.5% | | | | |

| 45,083 | | Alpha Natural Resources,

Inc. (a) | | $ | 1,083,795 | |

| 74,963 | | American Tower Corp.—

Class A (a) | | | 4,130,461 | |

| 81,339 | | Baker Hughes, Inc. | | | 4,716,849 | |

| 48,716 | | Barrick Gold Corp. | | | 2,411,442 | |

| 31,684 | | BorgWarner, Inc. (a) | | | 2,423,509 | |

| 64,835 | | Carnival Corp. | | | 2,282,840 | |

| 53,350 | | Caterpillar, Inc. | | | 5,039,441 | |

| 186,525 | | CBS Corp.—Class B | | | 4,814,210 | |

| 45,256 | | Chevron Corp. | | | 4,754,143 | |

| 205,844 | | Citigroup, Inc. | | | 6,502,612 | |

| 90,222 | | Coach, Inc. | | | 5,870,746 | |

| 190,141 | | Comcast Corp.—Class A | | | 4,458,806 | |

| 24,728 | | Cummins, Inc. | | | 2,458,705 | |

| 221,790 | | CVS Caremark Corp. | | | 8,050,977 | |

| 56,607 | | Edison International | | | 2,298,244 | |

| 29,298 | | FedEx Corp. | | | 2,397,455 | |

| 31,695 | | Flowserve Corp. | | | 2,937,810 | |

| 156,108 | | Foot Locker, Inc. | | | 3,412,521 | |

| 112,500 | | Freeport-McMoRan Copper &

Gold, Inc. | | | 4,529,250 | |

| 100,059 | | Halliburton Co. | | | 3,738,204 | |

| 120,528 | | Hasbro, Inc. | | | 4,587,296 | |

| 260,641 | | Healthcare Services Group, Inc. | | | 4,522,121 | |

| 146,769 | | Hewlett-Packard Co. | | | 3,905,523 | |

| 301,767 | | Intel Corp. | | | 7,405,362 | |

| 62,756 | | International Business

Machines Corp. | | | 11,586,640 | |

| 126,479 | | ITC Holdings Corp. | | | 9,192,494 | |

| 111,523 | | Johnson & Johnson | | | 7,180,966 | |

| 279,868 | | JPMorgan Chase & Co. | | | 9,728,212 | |

| 299,678 | | KKR & Co. Guernsey LP | | | 4,039,659 | |

| 127,476 | | Kraft Foods, Inc.—Class A | | | 4,484,606 | |

| 222,300 | | Kronos Worldwide, Inc. | | | 4,932,837 | |

| 100,034 | | McDonald’s Corp. | | | 9,288,157 | |

| 183,566 | | Merck & Co., Inc. | | | 6,333,027 | |

| 238,425 | | Meridian Bioscience, Inc. | | | 4,344,103 | |

| 138,527 | | Microchip Technology, Inc. | | | 5,009,136 | |

| 80,429 | | Microsoft Corp. | | | 2,141,824 | |

| 342,565 | | Morgan Stanley | | | 6,042,847 | |

| 72,719 | | Norfolk Southern Corp. | | | 5,380,479 | |

| 53,587 | | Occidental Petroleum Corp. | | | 4,980,376 | |

| 249,907 | | Och-Ziff Capital Management

Group, LLC—Class A | | | 2,726,485 | |

| 241,445 | | Oracle Corp. | | | 7,912,153 | |

| 74,761 | | PepsiCo, Inc. | | | 4,706,205 | |

| 247,370 | | Pfizer, Inc. | | | 4,764,346 | |

| 152,949 | | QUALCOMM, Inc. | | | 7,892,168 | |

| 150,199 | | Regal Entertainment Group—

Class A | | | 2,168,874 | |

| 116,824 | | Ryder System, Inc. | | | 5,951,015 | |

| 398,900 | | Sara Lee Corp. | | | 7,100,420 | |

| 86,119 | | Schlumberger, Ltd. | | | 6,327,163 | |

| 89,256 | | Snap-On, Inc. | | | 4,790,370 | |

| 40,690 | | Target Corp. | | | 2,227,778 | |

| 128,386 | | The Boeing Co. | | | 8,446,515 | |

| 135,950 | | The Coca-Cola Co. | | | 9,288,104 | |

| 46,898 | | The Estee Lauder Cos., Inc.—

Class A | | | 4,617,108 | |

| 19,485 | | The Goldman Sachs Group, Inc. | | | 2,134,582 | |

The accompanying notes are an integral part of these financial statements.

45

|

Alpine Dynamic Dividend Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

United States—continued | | | | |

| 63,258 | | The Mosaic Co. | | $ | 3,704,388 | |

| 69,026 | | The Procter & Gamble Co. | | | 4,416,974 | |

| 71,330 | | Union Pacific Corp. | | | 7,102,328 | |

| 67,370 | | United Technologies Corp. | | | 5,253,513 | |

| 128,504 | | Walgreen Co. | | | 4,266,333 | |

| 239,439 | | Wells Fargo & Co. | | | 6,203,864 | |

| 103,190 | | Yum! Brands, Inc. | | | 5,527,888 | |

| | | | | | | |

| | | | | | 310,926,259 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $433,377,603) | | $ | 448,528,931 | |

| | | Total Investments

(Cost $433,377,603)—97.4% (c) | | | 448,528,931 | |

| | | Other Assets in Excess of

Liabilities—2.6% | | | 11,936,842 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 460,465,773 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| | |

(a) | Non-income producing security. |

| | |

(b) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 0.3% of the Fund’s net assets. |

| | |

(c) | Includes securities pledged as collateral for line of credit outstanding on October 31, 2011. |

| | |

AB—Aktiebolag is the Swedish equivalent of the term corporation. |

| | |

ADR—American Depositary Receipt |

| | |

AG—Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

| | |

A/S—Aktieselskab is the Danish term for a stock-based corporation. |

| | |

GDR—Global Depositary Receipt |

| | |

OYJ—Osakeyhtio is the Finnish equivalent of a limited company.

PLC—Public Limited Company |

| | |

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

46

|

Alpine Accelerating Dividend Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—91.7% | | | | |

Aerospace & Defense—1.6% | | | | |

| 650 | | United Technologies Corp. | | $ | 50,687 | |

| | | | | | | |

Beverages—3.6% | | | | |

| 950 | | Anheuser-Busch InBev NV—ADR | | | 52,697 | |

| 1,000 | | PepsiCo, Inc. | | | 62,950 | |

| | | | | | | |

| | | | | | 115,647 | |

| | | | | | | |

Biotechnology—1.4% | | | | |

| 800 | | Amgen, Inc. | | | 45,816 | |

| | | | | | | |

Capital Markets—1.5% | | | | |

| 300 | | BlackRock, Inc. | | | 47,337 | |

| | | | | | | |

Chemicals—2.8% | | | | |

| 660 | | Air Products & Chemicals, Inc. | | | 56,852 | |

| 700 | | Potash Corp. of

Saskatchewan, Inc. | | | 33,131 | |

| | | | | | | |

| | | | | | 89,983 | |

| | | | | | | |

Commercial Banks—5.2% | | | | |

| 2,000 | | Comerica, Inc. | | | 51,100 | |

| 9,000 | | First Commonwealth

Financial Corp. | | | 41,490 | |

| 8,000 | | Grupo Financiero Banorte

SAB de CV | | | 27,283 | |

| 9,000 | | Huntington Bancshares, Inc. | | | 46,620 | |

| | | | | | | |

| | | | | | 166,493 | |

| | | | | | | |

Communications Equipment—3.1% | | | | |

| 2,675 | | Cisco Systems, Inc. | | | 49,568 | |

| 950 | | QUALCOMM, Inc. | | | 49,020 | |

| | | | | | | |

| | | | | | 98,588 | |

| | | | | | | |

Computers & Peripherals—1.2% | | | | |

| 1,425 | | Hewlett-Packard Co. | | | 37,919 | |

| | | | | | | |

Construction & Engineering—1.4% | | | | |

| 5,000 | | Aecon Group, Inc. | | | 45,147 | |

| | | | | | | |

Diversified Financial Services—2.4% | | | | |

| 1,000 | | Citigroup, Inc. | | | 31,590 | |

| 170 | | CME Group, Inc. | | | 46,845 | |

| | | | | | | |

| | | | | | 78,435 | |

| | | | | | | |

Electric Utilities—1.0% | | | | |

| 1,500 | | EDP—Energias do Brasil SA | | | 32,327 | |

| | | | | | | |

Energy Equipment & Services—4.2% | | | | |

| 850 | | Bristow Group, Inc. | | | 42,313 | |

| 750 | | Schlumberger, Ltd. | | | 55,102 | |

| 1,200 | | Seadrill, Ltd. | | | 39,407 | |

| | | | | | | |

| | | | | | 136,822 | |

| | | | | | | |

Food & Staples Retailing—1.6% | | | | |

| 1,575 | | Walgreen Co. | | | 52,290 | |

| | | | | | | |

Food Products—3.2% | | | | |

| 1,280 | | General Mills, Inc. | | | 49,318 | |

| 700 | | The J.M. Smucker Co. | | | 53,914 | |

| | | | | | | |

| | | | | | 103,232 | |

| | | | | | | |

Gas Utilities—1.5% | | | | |

| 1,700 | | UGI Corp. | | | 48,739 | |

| | | | | | | |

Health Care Equipment & Supplies—2.9% | | | | |

| 600 | | Becton, Dickinson & Co. | | | 46,938 | |

| 1,400 | | Hill-Rom Holdings, Inc. | | | 47,138 | |

| | | | | | | |

| | | | | | 94,076 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Health Care Providers & Services—2.5% | | | | |

| 1,200 | | Aetna, Inc. | | $ | 47,712 | |

| 680 | | UnitedHealth Group, Inc. | | | 32,633 | |

| | | | | | | |

| | | | | | 80,345 | |

| | | | | | | |

Hotels, Restaurants & Leisure—1.4% | | | | |

| 1,275 | | Carnival Corp. | | | 44,893 | |

| | | | | | | |

Household Durables—1.7% | | | | |

| 18,000 | | Pace PLC | | | 22,851 | |

| 7,000 | | PDG Realty SA Empreendimentos

e Participacoes | | | 30,864 | |

| | | | | | | |

| | | | | | 53,715 | |

| | | | | | | |

Household Products—1.6% | | | | |

| 800 | | The Procter & Gamble Co. | | | 51,192 | |

| | | | | | | |

Industrial Conglomerates—1.0% | | | | |

| 415 | | 3M Co. | | | 32,793 | |

| | | | | | | |

Insurance—1.1% | | | | |

| 1,700 | | Alterra Capital Holdings, Ltd. | | | 36,856 | |

| | | | | | | |

IT Services—3.1% | | | | |

| 300 | | International Business

Machines Corp. | | | 55,389 | |

| 470 | | Visa, Inc.—Class A | | | 43,832 | |

| | | | | | | |

| | | | | | 99,221 | |

| | | | | | | |

Machinery—2.3% | | | | |

| 800 | | Dover Corp. | | | 44,424 | |

| 530 | | Snap-On, Inc. | | | 28,445 | |

| | | | | | | |

| | | | | | 72,869 | |

| | | | | | | |

Media—4.4% | | | | |

| 1,599 | | CBS Corp.—Class B | | | 41,270 | |

| 2,400 | | Comcast Corp.—Class A | | | 56,280 | |

| 1,675 | | SES SA | | | 42,782 | |

| | | | | | | |

| | | | | | 140,332 | |

| | | | | | | |

Metals & Mining—1.4% | | | | |

| 1,750 | | Vale SA—ADR | | | 44,468 | |

| | | | | | | |

Multi-Utilities—3.3% | | | | |

| 1,000 | | OGE Energy Corp. | | | 51,740 | |

| 2,100 | | Xcel Energy, Inc. | | | 54,285 | |

| | | | | | | |

| | | | | | 106,025 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—7.4% | | | | |

| 470 | | Chevron Corp. | | | 49,374 | |

| 750 | | ConocoPhillips | | | 52,237 | |

| 1,700 | | El Paso Corp. | | | 42,517 | |

| 1,400 | | El Paso Pipeline Partners LP | | | 46,662 | |

| 520 | | Occidental Petroleum Corp. | | | 48,329 | |

| | | | | | | |

| | | | | | 239,119 | |

| | | | | | | |

Personal Products—0.5% | | | | |

| 3,100 | | Hypermarcas SA | | | 16,684 | |

| | | | | | | |

Pharmaceuticals—3.1% | | | | |

| 950 | | Abbott Laboratories | | | 51,177 | |

| 1,200 | | Teva Pharmaceutical Industries,

Ltd.—ADR | | | 49,020 | |

| | | | | | | |

| | | | | | 100,197 | |

| | | | | | | |

Professional Services—1.2% | | | | |

| 1,600 | | VSE Corp. | | | 38,912 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

47

|

Alpine Accelerating Dividend Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Real Estate Investment Trusts—2.3% | | | | |

| 1,900 | | American Capital Mortgage

Investment Corp. | | $ | 34,542 | |

| 2,800 | | Colony Financial, Inc. | | | 41,076 | |

| | | | | | | |

| | | | | | 75,618 | |

| | | | | | | |

Road & Rail—1.5% | | | | |

| 495 | | Union Pacific Corp. | | | 49,287 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—5.2% | | | | |

| 1,750 | | Avago Technologies, Ltd. | | | 59,098 | |

| 2,250 | | Intel Corp. | | | 55,215 | |

| 1,600 | | Linear Technology Corp. | | | 51,696 | |

| | | | | | | |

| | | | | | 166,009 | |

| | | | | | | |

Software—2.7% | | | | |

| 2,000 | | Microsoft Corp. | | | 53,260 | |

| 2,000 | | Totvs SA | | | 33,200 | |

| | | | | | | |

| | | | | | 86,460 | |

| | | | | | | |

| | | | | | | |

Specialty Retail—1.6% | | | | |

| 1,550 | | Guess?, Inc. | | | 51,135 | |

| | | | | | | |

| | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Textiles, Apparel & Luxury Goods—3.2% | | | | |

| 540 | | NIKE, Inc.—Class B | | $ | 52,029 | |

| 360 | | VF Corp. | | | 49,759 | |

| | | | | | | |

| | | | | | 101,788 | |

| | | | | | | |

Wireless Telecommunication Services—0.6% | | | | |

| 350 | | American Tower Corp.—

Class A (a) | | | 19,285 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $2,847,517) | | | 2,950,741 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—15.2% | | | | |

| 491,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 491,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $491,000) | | | 491,000 | |

| | | | | | | |

| | | Total Investments

(Cost $3,338,517)—106.9% (b) | | | 3,441,741 | |

| | | Liabilities in Excess of Other

Assets—(6.9)% | | | (223,545 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | | $3,218,196 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| | |

(a) | Non-income producing security. |

| | |

(b) | Includes securities pledged as collateral for line of credit outstanding on October 31, 2011. |

| | |

ADR—American Depositary Receipt |

| | |

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| | |

PLC—Public Limited Company |

| | |

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

| | |

SAB de CV—Sociedad Anonima Bursátil de Capital Variable. Is the Spanish equivalent to Variable Capital Company. |

The accompanying notes are an integral part of these financial statements.

48

|

Alpine Dynamic Financial Services Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—107.6% | | | | |

Capital Markets—17.1% | | | | |

| 20,000 | | BGC Partners, Inc.—Class A | | $ | 137,000 | |

| 52,033 | | Cowen Group, Inc.—Class A (a) | | | 141,530 | |

| 30,902 | | Edelman Financial Group, Inc. | | | 214,460 | |

| 18,500 | | GFI Group, Inc. | | | 79,920 | |

| 30,000 | | Gleacher & Co., Inc. (a) | | | 38,400 | |

| 13,000 | | JMP Group, Inc. | | | 96,460 | |

| 25,100 | | MF Global Holdings, Ltd. (a)(b)(c) | | | 251 | |

| 2,000 | | Och-Ziff Capital Management

Group, LLC—Class A | | | 21,820 | |

| 65,259 | | Rodman & Renshaw Capital

Group, Inc. (a) | | | 48,291 | |

| 20,000 | | The Blackstone Group LP | | | 294,200 | |

| | | | | | | |

| | | | | | 1,072,332 | |

| | | | | | | |

Commercial Banks—54.4% | | | | |

| 45,165 | | 1st United Bancorp, Inc. (a) | | | 233,955 | |

| 3,000 | | American River Bankshares (a) | | | 14,940 | |

| 53,940 | | Bank of Commerce Holdings | | | 186,093 | |

| 55,712 | | Bank of Virginia (a) | | | 53,233 | |

| 13,428 | | Barclays PLC | | | 41,626 | |

| 15,000 | | California United Bank (a) | | | 152,250 | |

| 4,000 | | Cardinal Financial Corp. | | | 42,960 | |

| 80,000 | | Carolina Trust Bank (a) | | | 240,000 | |

| 23,800 | | Centerstate Banks, Inc. | | | 135,184 | |

| 34,337 | | Citizens First Corp. (a) | | | 211,859 | |

| 7,000 | | Columbia Banking System, Inc. | | | 133,490 | |

| 7,095 | | Comerica, Inc. | | | 181,277 | |

| 4,700 | | Community National Bank of the

Lakeway Area (a)(d) | | | 18,800 | |

| 4,000 | | First Business Financial

Services, Inc. | | | 64,320 | |

| 80,000 | | First California Financial

Group, Inc. (a) | | | 261,600 | |

| 1,000 | | FirstMerit Corp. | | | 14,010 | |

| 3,200 | | KeyCorp. | | | 22,592 | |

| 21,000 | | Mitsubishi UFJ Financial

Group, Inc. | | | 91,265 | |

| 37,000 | | National Bank of Greece SA—

ADR (a) | | | 20,032 | |

| 10,200 | | New Century Bancorp, Inc. (a) | | | 28,458 | |

| 400 | | North Valley Bancorp (a) | | | 4,040 | |

| 2,375 | | Old Point Financial Corp. | | | 23,655 | |

| 4,000 | | Oriental Financial Group, Inc. | | | 42,360 | |

| 22,042 | | Pacific Mercantile Bancorp (a) | | | 67,008 | |

| 18,276 | | Pacific Premier Bancorp, Inc. (a) | | | 119,160 | |

| 75,000 | | Republic First Bancorp, Inc. (a) | | | 122,250 | |

| 3,120 | | Rurban Financial Corp. (a) | | | 9,672 | |

| 38,750 | | Southern National Bancorp of

Virginia, Inc. (a) | | | 236,762 | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Commercial Banks—continued | | | | |

| 3,000 | | Sumitomo Mitsui Financial

Group, Inc. | | $ | 83,854 | |

| 6,000 | | Summit State Bank | | | 34,590 | |

| 3,810 | | SunTrust Banks, Inc. | | | 75,171 | |

| 152,347 | | Synovus Financial Corp. | | | 228,520 | |

| 5,000 | | The Savannah Bancorp, Inc. (a) | | | 28,000 | |

| 2,551 | | Valley Commerce Bancorp (a) | | | 17,666 | |

| 32,000 | | VTB Bank OJSC—GDR (e) | | | 153,984 | |

| 1,974 | | Yadkin Valley Financial Corp. (a) | | | 4,185 | |

| | | | | | | |

| | | | | | 3,398,821 | |

| | | | | | | |

Consumer Finance—2.2% | | | | |

| 1,000 | | Green Dot Corp.—Class A (a) | | | 32,670 | |

| 25,000 | | Imperial Holdings, Inc. (a) | | | 56,250 | |

| 9,000 | | Netspend Holdings, Inc. (a) | | | 51,750 | |

| | | | | | | |

| | | | | | 140,670 | |

| | | | | | | |

Diversified Financial Services—17.0% | | | | |

| 7,124 | | BM&F Bovespa SA | | | 42,532 | |

| 1,000 | | CBOE Holdings, Inc. | | | 26,130 | |

| 665 | | CME Group, Inc. | | | 183,247 | |

| 162,000 | | Dubai Financial Market (a) | | | 45,132 | |

| 3,715 | | IntercontinentalExchange,

Inc. (a) | | | 482,504 | |

| 4,000 | | NYSE Euronext | | | 106,280 | |

| 7,000 | | The NASDAQ OMX Group,

Inc. (a) | | | 175,350 | |

| | | | | | | |

| | | | | | 1,061,175 | |

| | | | | | | |

Industrial Conglomerates—1.9% | | | | |

| 7,000 | | General Electric Co. | | | 116,970 | |

| | | | | | | |

Insurance—0.7% | | | | |

| 3,500 | | Assured Guaranty, Ltd. | | | 44,590 | |

| | | | | | | |

Thrifts & Mortgage Finance—14.3% | | | | |

| 24,641 | | Alliance Bancorp, Inc. of

Pennsylvania | | | 239,511 | |

| 1,700 | | Astoria Financial Corp. | | | 14,110 | |

| 5,000 | | Central Federal Corp. (a) | | | 4,375 | |

| 2,144 | | Fidelity Bancorp, Inc. | | | 17,752 | |

| 5,895 | | First Pactrust Bancorp, Inc. | | | 74,159 | |

| 40,000 | | Flagstar Bancorp, Inc. (a) | | | 31,200 | |

| 8,823 | | HopFed Bancorp, Inc. | | | 53,203 | |

| 50,000 | | Provident Financial

Holdings, Inc. | | | 458,500 | |

| | | | | | | |

| | | | | | 892,810 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $10,085,512) | | | 6,727,368 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

49

|

Alpine Dynamic Financial Services Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Preferred Stocks—2.4% | | | | |

Commercial Banks—2.4% | | | | |

| 13,500 | | Banco ABC Brasil SA | | $ | 90,034 | |

| 13,000 | | Banco Industrial e Comercial SA | | | 59,138 | |

| | | | | | | |

| | | | | | 149,172 | |

| | | | | | | |

| | | Total Preferred Stocks

(Cost $190,158) | | | 149,172 | |

| | | | | | | |

| | | Total Investments

(Cost $10,275,670)—110.0% (f) | | | 6,876,540 | |

| | | Liabilities in Excess of Other

Assets—(10.0)% | | | (625,648 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 6,250,892 | |

| | | | | | | |

| | |

| | |

Percentages are stated as a percent of net assets. |

|

(a) | Non-income producing security. |

|

(b) | Security fair valued in accordance with procedures approved by the Board of Trustees. This security comprised less than 0.05% of the Fund’s net assets. |

|

(c) | Bankrupt security. |

|

(d) | Illiquid security. |

|

(e) | Restricted under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by the Board of Trustees. Liquid securities restricted under Rule 144A comprised 2.5% of the Fund’s net assets. |

|

(f) | Includes securities pledged as collateral for line of credit outstanding on October 31, 2011. |

| |

ADR—American Depositary Receipt |

|

GDR—Global Depositary Receipt |

|

OJSC—Open Joint Stock Company |

|

PLC—Public Limited Company |

|

SA—Generally designates corporations in various countries, mostly those employing the civil law. |

The accompanying notes are an integral part of these financial statements.

50

|

Alpine Dynamic Innovators Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—103.7% | | | | |

Auto Components—1.5% | | | | |

| 2,000 | | BorgWarner, Inc. (a) | | $ | 152,980 | |

| | | | | | | |

Biotechnology—2.4% | | | | |

| 12,500 | | ARIAD Pharmaceuticals, Inc. (a) | | | 145,375 | |

| 5,000 | | Myriad Genetics, Inc. (a) | | | 106,400 | |

| | | | | | | |

| | | | | | 251,775 | |

| | | | | | | |

Chemicals—2.6% | | | | |

| 20,000 | | Zagg, Inc. (a) | | | 269,800 | |

| | | | | | | |

Commercial Banks—1.5% | | | | |

| 8,000 | | SunTrust Banks, Inc. | | | 157,840 | |

| | | | | | | |

Communications Equipment—0.9% | | | | |

| 5,000 | | DG FastChannel, Inc. (a) | | | 93,200 | |

| | | | | | | |

Computers & Peripherals—1.3% | | | | |

| 5,000 | | Hewlett-Packard Co. | | | 133,050 | |

| | | | | | | |

Diversified Financial Services—2.1% | | | | |

| 800 | | CME Group, Inc. | | | 220,448 | |

| | | | | | | |

Electrical Equipment—3.6% | | | | |

| 20,000 | | LSI Industries, Inc. | | | 134,600 | |

| 57,000 | | PowerSecure International,

Inc. (a) | | | 242,250 | |

| | | | | | | |

| | | | | | 376,850 | |

| | | | | | | |

Electronic Equipment, Instruments

& Components—8.8% | | | | |

| 21,000 | | FLIR Systems, Inc. | | | 552,300 | |

| 7,000 | | Itron, Inc. (a) | | | 257,530 | |

| 6,975 | | MOCON, Inc. | | | 108,601 | |

| | | | | | | |

| | | | | | 918,431 | |

| | | | | | | |

Health Care Equipment & Supplies—7.9% | | | | |

| 5,000 | | Alere, Inc. (a) | | | 130,300 | |

| 1,400 | | Intuitive Surgical, Inc. (a) | | | 607,404 | |

| 2,000 | | MAKO Surgical Corp. (a) | | | 76,900 | |

| | | | | | | |

| | | | | | 814,604 | |

| | | | | | | |

Health Care Providers & Services—10.5% | | | | |

| 17,000 | | Bio-Reference Labs, Inc. (a) | | | 340,680 | |

| 9,000 | | HMS Holdings Corp. (a) | | | 219,960 | |

| 8,000 | | MEDNAX, Inc. (a) | | | 526,400 | |

| | | | | | | |

| | | | | | 1,087,040 | |

| | | | | | | |

Health Care Technology—2.7% | | | | |

| 6,428 | | Allscripts Healthcare

Solutions, Inc. (a) | | | 123,096 | |

| 4,000 | | Quality Systems, Inc. | | | 155,640 | |

| | | | | | | |

| | | | | | 278,736 | |

| | | | | | | |

Household Durables—1.0% | | | | |

| 3,000 | | iRobot Corp. (a) | | | 101,580 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Internet & Catalog Retail—14.8% | | | | |

| 40 | | Amazon.com, Inc. (a) | | $ | 8,540 | |

| 3,000 | | priceline.com, Inc. (a) | | | 1,523,160 | |

| | | | | | | |

| | | | | | 1,531,700 | |

| | | | | | | |

Internet Software & Services—4.0% | | | | |

| 700 | | Google, Inc.—Class A (a) | | | 414,848 | |

| | | | | | | |

Life Sciences Tools & Services—5.3% | | | | |

| 1,000 | | Bio-Rad Laboratories, Inc.—

Class A (a) | | | 99,550 | |

| 11,000 | | Life Technologies Corp. (a) | | | 447,370 | |

| | | | | | | |

| | | | | | 546,920 | |

| | | | | | | |

Machinery—16.7% | | | | |

| 4,900 | | Flowserve Corp. | | | 454,181 | |

| 3,391 | | Middleby Corp. (a) | | | 285,794 | |

| 32,857 | | Westport Innovations, Inc. (a) | | | 991,561 | |

| | | | | | | |

| | | | | | 1,731,536 | |

| | | | | | | |

Pharmaceuticals—1.4% | | | | |

| 8,000 | | The Medicines Co. (a) | | | 149,760 | |

| | | | | | | |

Semiconductors & Semiconductor Equipment—1.5% | | | | |

| 6,000 | | Veeco Instruments, Inc. (a) | | | 160,140 | |

| | | | | | | |

Software—13.2% | | | | |

| 16,400 | | ANSYS, Inc. (a) | | | 891,504 | |

| 6,000 | | Interactive Intelligence

Group (a) | | | 166,500 | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 208,266 | |

| 1,600 | | Rovi Corp. (a) | | | 79,264 | |

| 8,000 | | Scientific Learning Corp. (a) | | | 27,840 | |

| | | | | | | |

| | | | | | 1,373,374 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $9,130,528) | | | 10,764,612 | |

| | | | | | | |

| | | Total Investments

(Cost $9,130,528)—103.7% (b) | | | 10,764,612 | |

| | | Liabilities in Excess of Other

Assets—(3.7)% | | | (381,209 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 10,383,403 | |

| | | | | | | |

| | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| | |

(a) | Non-income producing security. |

| | |

(b) | Includes securities pledged as collateral for line of credit outstanding on October 31, 2011. |

The accompanying notes are an integral part of these financial statements.

51

|

Alpine Dynamic Transformations Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—86.9% | | | | |

Air Freight & Logistics—4.5% | | | | |

| 3,100 | | Atlas Air Worldwide

Holdings, Inc. (a) | | $ | 119,412 | |

| 2,000 | | FedEx Corp. | | | 163,660 | |

| | | | | | | |

| | | | | | 283,072 | |

| | | | | | | |

Auto Components—1.2% | | | | |

| 5,000 | | Amerigon, Inc. (a) | | | 76,700 | |

| | | | | | | |

Chemicals—3.7% | | | | |

| 500 | | New Market Corp. | | | 97,070 | |

| 10,000 | | Zagg, Inc. (a) | | | 134,900 | |

| | | | | | | |

| | | | | | 231,970 | |

| | | | | | | |

Commercial Banks—1.7% | | | | |

| 1,000 | | PNC Financial Services

Group, Inc. | | | 53,710 | |

| 1,991 | | Wells Fargo & Co. | | | 51,587 | |

| | | | | | | |

| | | | | | 105,297 | |

| | | | | | | |

Diversified Financial Services—3.7% | | | | |

| 10,000 | | Bank of America Corp. | | | 68,300 | |

| 600 | | CME Group, Inc. | | | 165,336 | |

| | | | | | | |

| | | | | | 233,636 | |

| | | | | | | |

Energy Equipment & Services—1.9% | | | | |

| 8,000 | | ION Geophysical Corp. (a) | | | 60,960 | |

| 1,000 | | Transocean, Ltd. | | | 57,150 | |

| | | | | | | |

| | | | | | 118,110 | |

| | | | | | | |

Health Care Equipment & Supplies—9.9% | | | | |

| 2,000 | | Edwards Lifesciences Corp. (a) | | | 150,840 | |

| 1,000 | | Intuitive Surgical, Inc. (a) | | | 433,860 | |

| 1,500 | | Volcano Corp. (a) | | | 37,395 | |

| | | | | | | |

| | | | | | 622,095 | |

| | | | | | | |

Health Care Technology—0.4% | | | | |

| 1,428 | | Allscripts Healthcare

Solutions, Inc. (a) | | | 27,346 | |

| | | | | | | |

Hotels, Restaurants & Leisure—2.7% | | | | |

| 4,000 | | Starbucks Corp. | | | 169,360 | |

| | | | | | | |

Household Durables—7.4% | | | | |

| 6,500 | | Helen of Troy, Ltd. (a) | | | 188,045 | |

| 4,000 | | Tempur-Pedic

International, Inc. (a) | | | 272,240 | |

| | | | | | | |

| | | | | | 460,285 | |

| | | | | | | |

Industrial Conglomerates—4.7% | | | | |

| 16,000 | | Cookson Group PLC | | | 122,985 | |

| 10,300 | | General Electric Co. | | | 172,113 | |

| | | | | | | |

| | | | | | 295,098 | |

| | | | | | | |

Internet & Catalog Retail—6.5% | | | | |

| 800 | | priceline.com, Inc. (a) | | | 406,176 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Internet Software & Services—1.9% | | | | |

| 200 | | Google, Inc.—Class A (a) | | $ | 118,528 | |

| | | | | | | |

Machinery—20.1% | | | | |

| 2,400 | | Cummins, Inc. | | | 238,632 | |

| 4,000 | | Gardner Denver, Inc. | | | 309,320 | |

| 40,000 | | Industrea, Ltd. | | | 53,655 | |

| 3,000 | | Pall Corp. | | | 153,510 | |

| 3,000 | | Snap-On, Inc. | | | 161,010 | |

| 10,000 | | Wabash National Corp. (a) | | | 69,000 | |

| 9,037 | | Westport Innovations, Inc. (a) | | | 273,370 | |

| | | | | | | |

| | | | | | 1,258,497 | |

| | | | | | | |

Metals & Mining—3.1% | | | | |

| 5,000 | | Globe Specialty Metals, Inc. | | | 83,350 | |

| 1,500 | | Walter Energy, Inc. | | | 113,475 | |

| | | | | | | |

| | | | | | 196,825 | |

| | | | | | | |

Multiline Retail—2.6% | | | | |

| 2,000 | | Dollar Tree, Inc. (a) | | | 159,920 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—0.6% | | | | |

| 372 | | Apache Corp. | | | 37,062 | |

| | | | | | | |

Real Estate Investment Trusts (REITs)—0.4% | | | | |

| 1,095 | | Walter Investment

Management Corp. | | | 27,769 | |

| | | | | | | |

Software—9.9% | | | | |

| 20,600 | | Mitek Systems, Inc. (a) | | | 208,266 | |

| 5,000 | | Nuance Communications, Inc. (a) | | | 132,400 | |

| 5,000 | | Oracle Corp. | | | 163,850 | |

| 4,000 | | SolarWinds, Inc. (a) | | | 115,440 | |

| | | | | | | |

| | | | | | 619,956 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $4,226,709) | | | 5,447,702 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | | | | | |

| | | | | | | |

Short-Term Investments—18.7% | | | | |

$ | 1,168,000 | | State Street Eurodollar

Time Deposit, 0.01% | | | 1,168,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $1,168,000) | | | 1,168,000 | |

| | | | | | | |

| | | Total Investments

(Cost $5,394,709)—105.6% (b) | | | 6,615,702 | |

| | | Liabilities in Excess of Other

Assets—(5.6)% | | | (348,776 | ) |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 6,266,926 | |

| | | | | | | |

| | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| | |

(a) | Non-income producing security. |

| | |

(b) | Includes securities pledged as collateral for line of credit outstanding on October 31, 2011. |

| | |

PLC—Public Limited Company |

The accompanying notes are an integral part of these financial statements.

52

|

Alpine Dynamic Balance Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—65.2% | | | | |

Aerospace & Defense—1.3% | | | | |

| 15,000 | | Honeywell International, Inc. | | $ | 786,000 | |

| | | | | | | |

Auto Components—2.9% | | | | |

| 30,500 | | Autoliv, Inc. | | | 1,761,985 | |

| | | | | | | |

Beverages—0.4% | | | | |

| 5,000 | | Anheuser-Busch InBev NV—ADR | | | 277,350 | |

| | | | | | | |

Capital Markets—1.7% | | | | |

| 25,900 | | State Street Corp. | | | 1,046,101 | |

| | | | | | | |

Chemicals—2.8% | | | | |

| 3,200 | | Air Products & Chemicals, Inc. | | | 275,648 | |

| 20,000 | | E.I. duPont de Nemours & Co. | | | 961,400 | |

| 12,000 | | Eastman Chemical Co. | | | 471,480 | |

| | | | | | | |

| | | | | | 1,708,528 | |

| | | | | | | |

Commercial Banks—4.6% | | | | |

| 5,000 | | PNC Financial Services Group, Inc. | | | 268,550 | |

| 7,869 | | Southside Bancshares, Inc. | | | 161,865 | |

| 35,000 | | Sun Bancorp, Inc. (a) | | | 103,950 | |

| 7,293 | | Susquehanna Bancshares, Inc. | | | 52,947 | |

| 33,075 | | Valley National Bancorp | | | 396,900 | |

| 10,000 | | Washington Trust Bancorp, Inc. | | | 234,800 | |

| 69,501 | | Webster Financial Corp. | | | 1,365,000 | |

| 10,432 | | Wells Fargo & Co. | | | 270,293 | |

| | | | | | | |

| | | | | | 2,854,305 | |

| | | | | | | |

Computers & Peripherals—0.6% | | | | |

| 14,000 | | Hewlett-Packard Co. | | | 372,540 | |

| | | | | | | |

Consumer Finance—0.3% | | | | |

| 4,568 | | Capital One Financial Corp. | | | 208,575 | |

| | | | | | | |

Containers & Packaging—0.3% | | | | |

| 30,000 | | Boise, Inc. | | | 181,500 | |

| | | | | | | |

Diversified Financial Services—5.4% | | | | |

| 63,041 | | Bank of America Corp. | | | 430,570 | |

| 14,367 | | Citigroup, Inc. | | | 453,854 | |

| 2,600 | | CME Group, Inc. | | | 716,456 | |

| 45,600 | | JPMorgan Chase & Co. | | | 1,585,056 | |

| 10,406 | | Medallion Financial Corp. | | | 123,831 | |

| | | | | | | |

| | | | | | 3,309,767 | |

| | | | | | | |

Electric Utilities—0.6% | | | | |

| 8,200 | | First Energy Corp. | | | 368,672 | |

| | | | | | | |

Electrical Equipment—2.7% | | | | |

| 22,500 | | AMETEK, Inc. | | | 889,200 | |

| 8,700 | | Preformed Line Products Co. | | | 559,845 | |

| 4,000 | | Regal-Beloit Corp. | | | 212,520 | |

| | | | | | | |

| | | | | | 1,661,565 | |

| | | | | | | |

Food & Staples Retailing—2.0% | | | | |

| 15,000 | | CVS Caremark Corp. | | | 544,500 | |

| 20,000 | | Walgreen Co. | | | 664,000 | |

| | | | | | | |

| | | | | | 1,208,500 | |

| | | | | | | |

Food Products—0.9% | | | | |

| 10,000 | | H.J. Heinz Co. | | | 534,400 | |

| | | | | | | |

Health Care Equipment & Supplies—1.1% | | | | |

| 8,600 | | Becton, Dickinson & Co. | | | 672,778 | |

| | | | | | | |

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Common Stocks—continued | | | | |

Hotels, Restaurants & Leisure—0.8% | | | | |

| 10,000 | | Darden Restaurants, Inc. | | $ | 478,800 | |

| | | | | | | |

Household Durables—0.8% | | | | |

| 28,000 | | Lennar Corp.—Class A | | | 463,120 | |

| | | | | | | |

Household Products—1.4% | | | | |

| 4,000 | | Colgate-Palmolive Co. | | | 361,480 | |

| 7,000 | | Kimberly-Clark Corp. | | | 487,970 | |

| | | | | | | |

| | | | | | 849,450 | |

| | | | | | | |

Industrial Conglomerates—3.3% | | | | |

| 10,000 | | 3M Co. | | | 790,200 | |

| 74,600 | | General Electric Co. | | | 1,246,566 | |

| | | | | | | |

| | | | | | 2,036,766 | |

| | | | | | | |

Insurance—0.5% | | | | |

| 5,000 | | Chubb Corp. | | | 335,250 | |

| | | | | | | |

IT Services—3.0% | | | | |

| 10,000 | | International Business

Machines Corp. | | | 1,846,300 | |

| | | | | | | |

Leisure Equipment & Products—0.6% | | | | |

| 10,000 | | Hasbro, Inc. | | | 380,600 | |

| | | | | | | |

Machinery—1.8% | | | | |

| 5,000 | | Caterpillar, Inc. | | | 472,300 | |

| 15,000 | | Lincoln Electric Holdings, Inc. | | | 546,000 | |

| 10,000 | | Wabash National Corp. (a) | | | 69,000 | |

| | | | | | | |

| | | | | | 1,087,300 | |

| | | | | | | |

Media—0.3% | | | | |

| 7,692 | | CBS Corp.—Class B | | | 198,531 | |

| | | | | | | |

Oil, Gas & Consumable Fuels—6.3% | | | | |

| 6,000 | | Cenovus Energy, Inc. | | | 205,200 | |

| 59,000 | | CONSOL Energy, Inc. | | | 2,522,840 | |

| 8,000 | | El Paso Pipeline Partners LP | | | 266,640 | |

| 8,000 | | Hess Corp. | | | 500,480 | |

| 20,000 | | Penn Virginia Corp. | | | 121,800 | |

| 7,547 | | World Fuel Services Corp. | | | 300,748 | |

| | | | | | | |

| | | | | | 3,917,708 | |

| | | | | | | |

Pharmaceuticals—3.4% | | | | |

| 7,000 | | Abbott Laboratories | | | 377,090 | |

| 27,000 | | Johnson & Johnson | | | 1,738,530 | |

| | | | | | | |

| | | | | | 2,115,620 | |

| | | | | | | |

Real Estate Investment Trusts—11.2% | | | | |

| 13,000 | | Boston Properties, Inc. | | | 1,286,870 | |

| 100,000 | | CBL & Associates Properties, Inc. | | | 1,538,000 | |

| 13,804 | | DDR Corp. | | | 176,829 | |

| 4,286 | | DuPont Fabros Technology, Inc. | | | 89,106 | |

| 20,000 | | Invesco Mortgage Capital, Inc. | | | 315,600 | |

| 5,669 | | ProLogis, Inc. | | | 168,710 | |

| 10,000 | | Sabra Health Care REIT, Inc. | | | 102,700 | |

| 23,823 | | Simon Property Group, Inc. | | | 3,059,826 | |

| 20,000 | | Two Harbors Investment Corp. | | | 187,000 | |

| | | | | | | |

| | | | | | 6,924,641 | |

| | | | | | | |

Road & Rail—1.2% | | | | |

| 10,000 | | Norfolk Southern Corp. | | | 739,900 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

53

|

Alpine Dynamic Balance Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Shares | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Common Stocks—continued | | | | |

Textiles, Apparel & Luxury Goods—1.5% | | | | |

| 5,000 | | PVH Corp. | | $ | 372,050 | |

| 4,000 | | VF Corp. | | | 552,880 | |

| | | | | | | |

| | | | | | 924,930 | |

| | | | | | | |

Thrifts & Mortgage Finance—0.7% | | | | |

| 75,600 | | Federal National Mortgage

Association (a) | | | 18,673 | |

| 31,500 | | New York Community

Bancorp, Inc. | | | 419,265 | |

| | | | | | | |

| | | | | | 437,938 | |

| | | | | | | |

Trading Companies & Distributors—0.8% | | | | |

| 3,000 | | WW Grainger, Inc. | | | 513,930 | |

| | | | | | | |

| | | Total Common Stocks

(Cost $42,134,574) | | | 40,203,350 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | |

Bonds—22.1% | | | | |

U.S. Treasury Bonds—22.1% | | | | |

$ | 6,000,000 | | 6.000%, 02/15/2026 | | $ | 8,360,628 | |

| 4,000,000 | | 5.250%, 11/15/2028 | | | 5,285,000 | |

| | | | | | | |

| | | | | | 13,645,628 | |

| | | | | | | |

| | | Total Bonds

(Cost $11,995,697) | | | 13,645,628 | |

| | | | | | | |

Short-Term Investments—7.6% | | | | |

| 4,725,000 | | State Street Eurodollar Time

Deposit, 0.01% | | | 4,725,000 | |

| | | | | | | |

| | | Total Short-Term Investments

(Cost $4,725,000) | | | 4,725,000 | |

| | | | | | | |

| | | Total Investments

(Cost $58,855,271)—94.9% | | | 58,573,978 | |

| | | Other Assets in Excess of

Liabilities—5.1% | | | 3,127,219 | |

| | | | | | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 61,701,197 | |

| | | | | | | |

| | |

| | |

| | |

Percentages are stated as a percent of net assets. |

| | |

(a) | Non-income producing security. |

| | |

ADR—American Depositary Receipt |

NV—Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

REIT—Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

54

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

Schedule of Portfolio Investments

October 31, 2011

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | |

Municipal Bonds—96.7% | | | | |

Alabama—6.6% | | | | |

$ | 2,370,000 | | Birmingham Airport Authority | | | | |

| | | Airport Revenue (CS: AMBAC) | | | | |

| | | 5.000%, 07/01/2012 | | $ | 2,421,619 | |

| 5,000,000 | | Chatom Industrial Development | | | | |

| | | Board Gulf Opportunity Zone | | | | |

| | | Revenue, Powersouth Energy | | | | |

| | | Cooperative—Series A, VRDN | | | | |

| | | (SPA: National Rural Utilities | | | | |

| | | Finance) | | | | |

| | | 1.000%, 11/15/2038 (a) | | | 5,000,000 | |

| 2,000,000 | | Chatom Industrial Development | | | | |

| | | Board Pollution Control | | | | |

| | | Revenue, Electric—Series C, | | | | |

| | | VRDN | | | | |

| | | (SPA: National Rural Utilities | | | | |

| | | Finance) | | | | |

| | | 1.000%, 12/01/2024 (Putable | | | | |

| | | on 12/01/2011) (a) | | | 2,000,200 | |

| 1,410,000 | | Madison Industrial Development | | | | |

| | | Board Revenue, WL Halsey | | | | |

| | | Grocery Co., VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.590%, 04/01/2016 (Putable | | | | |

| | | on 11/07/2011) (a) | | | 1,410,000 | |

| 5,915,000 | | Mobile Downtown | | | | |

| | | Redevelopment Authority | | | | |

| | | Revenue, Lafayette Plaza Hotel | | | | |

| | | Project—Series A, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.100%, 05/01/2032 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 5,915,000 | |

| 20,000,000 | | Mobile Industrial Development | | | | |

| | | Board Pollution Control | | | | |

| | | Revenue, Alabama Power Co., | | | | |

| | | Barry Plant, VRDN | | | | |

| | | (CS: Alabama Power Co.) | | | | |

| | | 0.750%, 07/15/2034 (Putable | | | | |

| | | on 08/22/2012) (a) | | | 20,009,600 | |

| 5,795,000 | | The Health Care Authority for | | | | |

| | | Baptist Health—Series A, VRDN | | | | |

| | | (CS: Baptist Health) | | | | |

| | | 6.125%, 11/15/2036 (Putable | | | | |

| | | on 05/15/2012) (a) | | | 5,908,350 | |

| 2,450,000 | | The Health Care Authority for | | | | |

| | | Baptist Health—Series B, ARN | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 0.700%, 11/15/2037 (a) | | | 2,450,000 | |

| 2,355,000 | | The Medical Clinic Board of the | | | | |

| | | City of Gulf Shores Revenue, | | | | |

| | | Colonial Pinnacle MOB Project, | | | | |

| | | VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.000%, 07/01/2034 (Putable | | | | |

| | | on 11/07/2011) (a) | | | 2,355,000 | |

| 60,400,000 | | The Southeast Alabama Gas | | | | |

| | | District Revenue, Supply | | | | |

| | | Project—Series A, VRDN | | | | |

| | | (SPA: Societe Generale) | | | | |

| | | 2.450%, 08/01/2027 (Putable | | | | |

| | | on 11/01/2011) (a) | | | 60,400,000 | |

| | | | | | | |

| | | | | | 107,869,769 | |

| | | | | | | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | |

Municipal Bonds—continued | | | | |

Arizona—2.2% | | | | |

$ | 14,400,000 | | Cochise County Pollution Control | | | | |

| | | Corp., Revenue, Arizona Electric | | | | |

| | | Power Cooperative, Inc., Project, | | | | |

| | | VRDN | | | | |

| | | (CS: National Rural Utilities | | | | |

| | | Corp.) 1.000%, 09/01/2024 | | | | |

| | | (Putable on 03/01/2012) (a) | | $ | 14,402,016 | |

| 4,120,000 | | Coconino County Pollution | | | | |

| | | Control Corp., Revenue, | | | | |

| | | Arizona Public Services | | | | |

| | | Navajo—Series A | | | | |

| | | (CS: Arizona Public Service Corp.) | | | | |

| | | 3.625%, 10/01/2029 | | | | |

| | | (Putable on 07/13/2013) | | | 4,204,460 | |

| 325,000 | | Flagstaff, Aspen Place Sawmill | | | | |

| | | Improvement District | | | | |

| | | (CS: Flagstaff Arizona Revenue) | | | | |

| | | 5.000%, 01/01/2013 | | | 326,066 | |

| 3,300,000 | | Maricopa County Pollution | | | | |

| | | Control Corp., Arizona Public | | | | |

| | | Services Co.—Series B | | | | |

| | | (CS: Arizona Public Service Corp.) | | | | |

| | | 5.500%, 05/01/2029 | | | | |

| | | (Putable on 05/01/2012) | | | 3,372,567 | |

| 8,250,000 | | Navajo County Pollution Control | | | | |

| | | Corp.—Series A | | | | |

| | | (CS: Arizona Public Service Corp.) | | | | |

| | | 5.000%, 06/01/2034 | | | | |

| | | (Putable on 06/01/2012) | | | 8,438,100 | |

| 5,075,000 | | Scottsdale Industrial Development | | | | |

| | | Authority Hospital Revenue, | | | | |

| | | Scottsdale Healthcare— | | | | |

| | | Series F, ARN | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 0.760%, 09/01/2045 (a) | | | 5,075,000 | |

| 400,000 | | University Medical Center Corp., | | | | |

| | | Hospital Revenue | | | | |

| | | 3.000%, 07/01/2012 | | | 404,060 | |

| | | | | | | |

| | | | | | 36,222,269 | |

| | | | | | | |

Arkansas—0.9% | | | | |

| 5,180,000 | | Pulaski County Public Facilities | | | | |

| | | Board Revenue, Anthony | | | | |

| | | School, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.100%, 06/01/2033 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 5,180,000 | |

| 4,350,000 | | Pulaski County Public Facilities | | | | |

| | | Board Revenue, Valley Heights | | | | |

| | | Apartments II—Series C, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.490%, 04/01/2040 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 4,350,000 | |

| 5,200,000 | | State Development Finance | | | | |

| | | Authority, Capri Apartments— | | | | |

| | | Series F, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.490%, 10/01/2030 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 5,200,000 | |

| | | | | | | |

| | | | | | 14,730,000 | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

55

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | |

California—7.0% | | | | |

$ | 280,000 | | ABAG Finance Authority for | | | | |

| | | Nonprofit Corp., Revenue, | | | | |

| | | Episcopal Senior Communities | | | | |

| | | 3.000%, 07/01/2012 | | $ | 280,742 | |

| 5,000,000 | | Los Angeles County Schools | | | | |

| | | Pooled Financing Program | | | | |

| | | Participation Certificates, Tax & | | | | |

| | | Revenue Anticipation Notes— | | | | |

| | | Series A-3 | | | | |

| | | 2.000%, 03/30/2012 | | | 5,021,100 | |

| 10,425,000 | | Palomar Pomerado Health Care— | | | | |

| | | Series A, ARN | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 0.800%, 11/01/2036 (a) | | | 10,425,000 | |

| 1,200,000 | | Palomar Pomerado Health Care— | | | | |

| | | Series B, ARN | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 0.750%, 11/01/2036 (a) | | | 1,200,000 | |

| 12,600,000 | | Palomar Pomerado Health Care— | | | | |

| | | Series C, ARN | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 0.800%, 11/01/2036 (a) | | | 12,600,000 | |

| 7,500,000 | | Sacramento City Unified School | | | | |

| | | District, Tax & Revenue | | | | |

| | | Anticipation Notes | | | | |

| | | 2.250%, 11/02/2011 | | | 7,500,150 | |

| 1,400,000 | | State Health Facilities Financing | | | | |

| | | Authority Revenue, Community | | | | |

| | | Program for Persons with | | | | |

| | | Developmental Disabilities— | | | | |

| | | Series A | | | | |

| | | (CS: A Home for Life LLC) | | | | |

| | | 4.000%, 02/01/2012 | | | 1,408,512 | |

| 10,475,000 | | State Municipal Finance Authority | | | | |

| | | Revenue, St. Andrews Parish, | | | | |

| | | VRDN | | | | |

| | | (LOC: Allied Irish Bank PLC) | | | | |

| | | 5.500%, 09/01/2036 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 10,475,000 | |

| 15,485,000 | | State Municipal Finance Authority | | | | |

| | | Revenue, Vacaville Christian | | | | |

| | | Schools, VRDN | | | | |

| | | (LOC: Allied Irish Bank PLC) | | | | |

| | | 4.350%, 08/01/2037 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 15,485,000 | |

| 7,600,000 | | State Municipal Finance Authority | | | | |

| | | Solid Waste Revenue, Republic | | | | |

| | | Services Inc., VRDN | | | | |

| | | (CS: Republic Services, Inc.) | | | | |

| | | 0.900%, 09/01/2021 | | | | |

| | | (Putable on 01/03/2012) (a) | | | 7,600,076 | |

| 25,100,000 | | State Pollution Control Finance | | | | |

| | | Authority Solid Waste Revenue, | | | | |

| | | Republic Services, Inc.—Series A, | | | | |

| | | VRDN | | | | |

| | | (CS: Republic Services, Inc.) | | | | |

| | | 1.450%, 08/01/2023 | | | | |

| | | (Putable on 02/01/2012) (a) | | | 25,100,000 | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

California—continued | | | | |

$ | 1,800,000 | | State Pollution Control Finance | | | | |

| | | Authority Solid Waste Revenue, | | | | |

| | | Republic Services, Inc.—Series B, | | | | |

| | | VRDN | | | | |

| | | (CS: Republic Services, Inc.) | | | | |

| | | 1.130%, 08/01/2024 | | | | |

| | | (Putable on 02/01/2012) (a)(b) | | $ | 1,800,000 | |

| 10,000,000 | | Twin Rivers Unified School District, | | | | |

| | | School Facilities Boarding | | | | |

| | | Program | | | | |

| | | (CS: Assured Guaranty) | | | | |

| | | 3.500%, 06/01/2027 | | | | |

| | | (Putable on 05/31/2013) | | | 10,001,300 | |

| 5,000,000 | | 3.500%, 06/01/2035 | | | | |

| | | (Putable on 05/01/2013) | | | 4,999,850 | |

| | | | | | | |

| | | | | | 113,896,730 | |

| | | | | | | |

Colorado—1.6% | | | | |

| 6,520,000 | | Denver City & County Airport | | | | |

| | | Revenue—Series A | | | | |

| | | (CS: AMBAC) | | | | |

| | | 6.000%, 11/15/2011 | | | 6,531,997 | |

| 20,005,000 | | State Health Facilities Authority | | | | |

| | | Hospital Revenue, NCMC, Inc., | | | | |

| | | Project—Series A, VRDN | | | | |

| | | (LOC: Compass Bank) | | | | |

| | | 0.340%, 05/15/2030 | | | | |

| | | (Putable on 11/01/2011) (a) | | | 20,005,000 | |

| | | | | | | |

| | | | | | 26,536,997 | |

| | | | | | | |

Connecticut—1.9% | | | | |

| 6,500,000 | | State Development Authority, | | | | |

| | | Light & Power—Series A, VRDN | | | | |

| | | (CS: Connecticut Light & Power) | | | | |

| | | 1.250%, 05/01/2031 | | | | |

| | | (Putable on 04/02/2012) (a) | | | 6,499,935 | |

| 18,080,000 | | State Housing Finance Authority | | | | |

| | | Revenue, Housing Mortgage | | | | |

| | | Finance Program— | | | | |

| | | Subseries C-2, VRDN | | | | |

| | | (SPA: KBC Bank N V) | | | | |

| | | 0.800%, 05/15/2034 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 18,080,000 | |

| 6,250,000 | | Town of Hamden, General | | | | |

| | | Obligation Bond, Anticipation | | | | |

| | | Notes—Lot A | | | | |

| | | 3.000%, 08/23/2012 | | | 6,354,938 | |

| | | | | | | |

| | | | | | 30,934,873 | |

| | | | | | | |

Florida—4.4% | | | | |

| 1,000,000 | | Arcadia Housing Authority, | | | | |

| | | Arcadia Oaks Associated, Ltd. | | | | |

| | | (CS: TransAmerica Life | | | | |

| | | Insurance Co.) | | | | |

| | | 4.250%, 01/01/2012 | | | 1,000,620 | |

| 7,920,000 | | Broward County Housing Finance | | | | |

| | | Authority, Golf View Gardens | | | | |

| | | Apartments, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 4.250%, 11/01/2043 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 7,920,000 | |

The accompanying notes are an integral part of these financial statements.

56

|

Alpine Ultra Short Tax Optimized Income Fund |

| |

Schedule of Portfolio Investments—Continued

October 31, 2011

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Florida—continued | | | | |

$ | 22,850,000 | | Citizens Property Insurance Corp., | | | | |

| | | Coastal Account Revenue, | | | | |

| | | Senior Secured Notes—Series A-2 | | | | |

| | | (CS: Citizens Property Ins. Corp) | | | | |

| | | 2.000%, 06/01/2012 | | $ | 23,039,427 | |

| 6,700,000 | | Citizens Property Insurance Corp., | | | | |

| | | Revenue, High-Risk Account—A-1 | | | | |

| | | (CS: Citizens Property Ins. Corp) | | | | |

| | | 5.000%, 06/01/2012 | | | 6,862,609 | |

| 500,000 | | Lakeland Hospital System Revenue, | | | | |

| | | Refunding Regional Health System | | | | |

| | | 2.000%, 11/15/2011 | | | 500,230 | |

| 5,305,000 | | Lee County Housing Finance Authority | | | | |

| | | Revenue, Heron Pond Apartments, | | | | |

| | | VRDN (LOC: Regions Bank) | | | | |

| | | 4.250%, 12/01/2043 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 5,305,000 | |

| 11,870,000 | | Miami-Dade County Aviation | | | | |

| | | Revenue, Miami International | | | | |

| | | Airport—Class A, VRDN | | | | |

| | | (LOC: Societe General) | | | | |

| | | 0.650%, 10/01/2029 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 11,870,000 | |

| 7,760,000 | | Miami-Dade County Industrial | | | | |

| | | Development Authority Revenue, | | | | |

| | | Airbus Service Co., Inc.—Series A, | | | | |

| | | VRDN (LOC: Calyon Bank) | | | | |

| | | 2.000%, 04/01/2030 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 7,760,000 | |

| 1,000,000 | | Miami-Dade County Industrial | | | | |

| | | Development Authority Revenue, | | | | |

| | | Waste Management, Inc., VRDN | | | | |

| | | (CS: Waste Management, Inc.) | | | | |

| | | 2.625%, 08/01/2023 | | | | |

| | | (Putable on 08/01/2014) (a) | | | 997,220 | |

| 5,185,000 | | Miami-Dade County State | | | | |

| | | Aviation—Series C (CS: MBIA) | | | | |

| | | 5.250%, 10/01/2012 | | | 5,201,488 | |

| 900,000 | | Saint Johns County Industrial | | | | |

| | | Development Authority, | | | | |

| | | Coastal Health Care Investor, | | | | |

| | | VRDN (LOC: SunTrust Bank) | | | | |

| | | 2.750%, 12/01/2016 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 900,000 | |

| | | | | | | |

| | | | | | 71,356,594 | |

| | | | | | | |

Georgia—2.8% | | | | |

| 7,190,000 | | Albany-Dougherty County Hospital | | | | |

| | | Authority, Refunding Anticipation | | | | |

| | | Certificates, Phoebe Putney | | | | |

| | | Memorial—Series B, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 0.800%, 09/01/2032 | | | | |

| | | (Putable on 11/01/2011) (a) | | | 7,190,000 | |

| 11,240,000 | | Burke County Development | | | | |

| | | Authority Revenue, Georgia | | | | |

| | | Power Company Plant | | | | |

| | | Vogtle Project—Series A | | | | |

| | | (CS: Oglethorpe Power Corp) | | | | |

| | | 2.500%, 01/01/2040 | | | | |

| | | (Putable on 03/01/2013) | | | 11,399,046 | |

| | | | | | | |

Principal

Amount | | Security

Description | | Value | |

| | | | | | |

| | | | | | | |

Municipal Bonds—continued | | | | |

Georgia—continued | | | | |

$ | 1,300,000 | | Douglas County Development | | | | |

| | | Authority Revenue, Electrical | | | | |

| | | Fiber Systems, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.590%, 12/01/2021 | | | | |

| | | (Putable on 11/07/2011) (a) | | $ | 1,300,000 | |

| 2,405,000 | | Gainesville & Hall County | | | | |

| | | Development Authority | | | | |

| | | Tax-Exempt Revenue, | | | | |

| | | Atex, Inc., Project, VRDN | | | | |

| | | (LOC: Regions Bank) | | | | |

| | | 1.540%, 09/01/2023 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 2,405,000 | |

| 11,900,000 | | Gwinnett County Housing | | | | |

| | | Authority Multi-Family | | | | |

| | | Housing Revenue, Palisades | | | | |

| | | Apartments Project, VRDN | | | | |

| | | (LOC: SunTrust Bank) | | | | |

| | | 0.360%, 03/01/2041 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 11,900,000 | |

| 1,850,000 | | Rome-Floyd County Development | | | | |

| | | Authority Revenue, Steel King | | | | |

| | | Industries Inc., VRDN | | | | |

| | | (LOC: Bank Of Montreal) | | | | |

| | | 0.780%, 07/01/2020 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 1,850,000 | |

| 9,430,000 | | Walker Dade & Catoosa Counties | | | | |

| | | Hospital Authority, Anticipation | | | | |

| | | Certificates, Hutcheson Medical, | | | | |

| | | VRDN (LOC: Regions Bank) | | | | |

| | | 1.000%, 10/01/2028 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 9,430,000 | |

| | | | | | | |

| | | | | | 45,474,046 | |

| | | | | | | |

Illinois—7.3% | | | | |

| 26,760,000 | | Crestwood Tax Increment Revenue, | | | | |

| | | 135th & Cicero Redevelopment, | | | | |

| | | VRDN (LOC: Fifth Third Bank) | | | | |

| | | 1.500%, 12/01/2023 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 26,760,000 | |

| 4,400,000 | | Springfield Airport Authority, | | | | |

| | | Allied-Signal Inc., VRDN | | | | |

| | | (CS: Honeywell Int.) | | | | |

| | | 6.500%, 09/01/2018 | | | | |

| | | (Putable on 11/07/2011) (a) | | | 4,400,000 | |

| 8,850,000 | | State Finance Authority Industrial | | | | |

| | | Development Revenue, Lutheran | | | | |