Mr. Malik has a written employment agreement with the Company, and Messrs. Chesser and Marshall have ongoing employment arrangements with the Company. Mr. Malik’s employment agreement was for a three-year period ending November 10, 2007; however, the term has been automatically extended for a one-year period, and will continue to be automatically extended for one-year periods unless either we or Mr. Malik give 60 days notice prior to the expiration of the then-current term.

The agreement provides for additional compensation if Mr. Malik’s employment is terminated without “Cause” by the Company, or if Mr. Malik terminates his employment for “Good Reason.” This additional compensation is three times Mr. Malik’s annual base salary, the current year’s annual incentive (prorated through the termination date), and three times the average annual incentive compensation paid during the three most recent fiscal years (or such shorter period as Mr. Malik shall have been employed).

The agreement further provides for additional compensation if Mr. Malik is terminated upon disability or following his death. If Mr. Malik’s employment is terminated by him or the Company as a result of his disability, he would receive his current salary for three months following termination or the period until disability benefits commence under any insurance provided by the Company, and his incentive compensation, if any, prorated through the end of the month when the disability occurred. If Mr. Malik’s employment was terminated because of his death, his beneficiary or estate would receive his current salary, through then end of the month in which his death occurred and his incentive compensation, if any, prorated through the end of the month when his death occurred.

Mr. Malik’s employment agreement defines “Cause” as a:

We have also agreed to certain compensation arrangements with Messrs. Chesser and Marshall at the time of their employment. For Mr. Chesser, if he is terminated without cause prior to age 63, he will be paid a severance amount equal to three times his annual salary and bonus; if terminated without cause between the age of 63 and 65, he will be paid a severance amount equal to the aggregate of his annual salary and bonus. In addition, Mr. Chesser is credited with two years of service for every one year of service earned under our pension plan, with such amount payable under our SERP.

If Mr. Marshall is terminated without cause, he will be paid a severance amount equal to the target payment under the annual incentive plan plus two times his annual base salary. Mr. Marshall is also credited with two years of service for every one year of service earned under our pension plan, with such amount payable under our SERP. Please see “Payments under Other Compensation Arrangements,” beginning on page 45, for additional information, including definitions of key terms, regarding these employment arrangements. Our NEOs have also entered into Change in Control Severance Agreements. Please see “Potential Payments Upon Termination or Change-in-Control,” beginning on page 41 for a description of these agreements.

Base salaries for our NEOs are set by our Board, upon the recommendations of our Compensation and Development Committee. For 2007, the base salaries were: Mr. Chesser, $725,000; Mr. Downey, $470,000; Mr. Bassham, $325,000; Mr. Malik, $440,000; and Mr. Marshall, $335,000. Our NEOs also participate in our health, welfare and benefit plans, our annual and long-term incentive plans, our pension and SERP plans (except for Mr. Malik), our non-qualified deferred compensation plan and receive certain other perquisites and personal benefits, such as car allowances, club memberships, executive financial planning services, parking, spouse travel, personal use of company tickets, and matched charitable donations.

Awards

Restricted Stock

During 2007, our Board made two awards of restricted stock to each of the NEOs, except Mr. Malik. One award of restricted stock is consistent with the Company’s equity incentive compensation practices in 2006, and will vest on February 6, 2010. These awards were: Mr. Chesser, 8,507 shares; Mr. Downey, 4,228 shares; Mr. Bassham, 2,161 shares; and Mr. Marshall, 2,227 shares. The second, special, award of restricted stock was made to recognize performance in 2006 and to ensure the NEOs’ continued focus and commitment to the Company’s core business, projects and the proposed acquisition and subsequent operational integration of Aquila, Inc. with the Company. Half of the special award of restricted stock will vest on February 6, 2009, and the remaining half will vest on February 6, 2010. Restricted stock awards include the right to vote. Dividends paid on the restricted stock are reinvested in stock through our DRIP, and carry the same restrictions as the underlying awards. The special awards were: Mr. Chesser, 80,000 shares; Mr. Downey, 45,000 shares; Mr. Bassham, 25,000 shares; and Mr. Marshall, 25,000 shares.

Performance Shares

The Board also granted performance shares for the period 2007-2009 to the NEOs. Performance shares are payable in our stock at the end of the performance period, depending on the achievement of specified measures. For our NEOs except Mr. Malik, the performance share measure is our total shareholder return for the period compared against the EEI index of electric utilities. For Mr. Malik, the measures are the same as for the Strategic Energy 2007-2009 long-term incentive plan discussed in our CD&A(cumulative pre-tax net income, return on invested capital, total shareholder return, and MWhs under management by December 31, 2009). The number of shares awarded can range from 0% to 200% of the target amount, as adjusted for the change in fair market value of our shares between the time of grant and the end of the award period. Dividends will be paid in cash at the end of the period on the number of shares earned. The following table describes the potential payout percentages for the total shareholder return measure:

36

| Total Shareholder | |

| Return Percentile Rank | Percentage Payout |

| 81st and Above | 200% |

| 65th to 80th | 150% |

| 50th to 64th | 100% |

| 35th to 49th | 50% |

| 34th and Below | 0 |

Performance shares were awarded to our NEOs (except Mr. Malik) for the performance period of 2005-2007. As discussed in our CD&A, threshold performance was not achieved for the performance shares granted to Messrs. Chesser and Bassham, and 85% performance was achieved for the performance shares granted to Messrs. Downey and Marshall, who thus received 5,507 and 4,482 shares, respectively, of our stock.

Cash-Based Long-Term Incentives

Mr. Malik’s long-term incentives that were earned and granted in 2007 under long-term incentive plans comprised time-based restricted stock (described above) and cash based on performance. The performance is based on Strategic Energy’s long-term goals, as discussed in our CD&A.

Annual Incentives

Under the annual incentive plans for 2007, our NEOs were eligible to receive up to 200% of a target amount set as a percentage of their respective base salaries, as follows: Mr. Chesser, 100%; Mr. Downey, 70%; Mr. Bassham, 50%; Mr. Malik, 60%; and Mr. Marshall, 50%. There were no payouts under the 2007 annual incentive program because the threshold core earnings level was not achieved. The tables on pages 23 and 24 summarize the 2007 annual incentive plan, year-end results, and payout levels for Great Plains Energy, KCP&L, and Strategic Energy.

Based upon performance in 2007, no annual incentives were paid.

Salary and Bonus in Proportion to Total Compensation

As we discuss in our CD&A, one objective of our compensation program is to align management interests with those of our shareholders. The Compensation and Development Committee believes that a substantial portion of total compensation for its officers should be delivered in the form of equity-based incentives. In 2007, 75% of the long-term incentive grants to Messrs. Chesser, Downey, Bassham, and Marshall were in the form of performance shares which, if earned after three years based on total return to shareholders, will be paid in Company stock. To mitigate potential volatility in payouts and provide a retention device, the remaining 25% of the long-term grant was in time-based restricted shares. For Mr. Malik, 50% of his long-term grant was in time-based performance shares, with the remaining portion of his long-term grant eligible to be paid in cash.

In 2007, we determined cash and equity incentive grants (excluding the special grants of restricted stock discussed in the CD&A) using the following proportions of base salary:

37

| Annual Cash | Long-term Cash | Long-term Equity |

| Name | Incentive at Target | Incentive at Target | Incentive at Target |

| Mr. Chesser | 100% | - | 150% |

| Mr. Downey | 70% | - | 115% |

| Mr. Bassham | 50% | - | 85% |

| Mr. Malik | 60% | 75% | 75% |

| Mr. Marshall | 50% | - | 85% |

The following table provides information regarding the outstanding equity awards held by each of the NEOs as of December 31, 2007. We have omitted from the table the columns titled “Number of securities underlying unexercised options, unexercisable” and “Equity incentive plan awards: Number of securities underlying unexercised unearned options,” because there are no unexercisable options.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| Option Awards | Stock Awards |

| | | | | | | Equity |

| | | | | | | Incentive Plan |

| | | | | Market | Equity | Awards: |

| Number of | | | Number of | Value of | Incentive Plan | Market or |

| Securities | | | Shares of | Shares of | Awards: | Payout Value |

| Underlying | | | Stock That | Stock That | Number of | of Unearned |

| Unexercised | Option | Option | Have Not | Have Not | Shares That | Shares That |

| Option (#) | Exercise | Expiration | Vested | Vested | Have Not | Have Not |

| Name | Exercisable | Price ($) | Date | (#)(1) | ($)(2) | Vested (#)(3) | Vested ($)(2) |

| (a) | (b) | (e) | (f) | (g) | (h) | (i) | (j) |

| Mr. Chesser(4) | - | - | - | 103,221 | 3,026,440 | 51,450 | 1,508,514 |

| 20,000 | 25.55 | 2/6/11 | - | - | - | - |

| Mr. Downey(5) | 20,000 | 24.90 | 2/5/12 | 57,166 | 1,676,107 | 26,447 | 775,426 |

| 5,249 | 27.73 | 8/5/13 | - | - | - | - |

| Mr. Bassham(6) | - | - | - | 41,812 | 1,225,928 | 13,264 | 388,900 |

| Mr. Malik(7) | - | - | - | 12,092 | 354,537 | 10,325 | 302,729 |

| Mr. Marshall(8) | - | - | - | 55,123 | 1,616,206 | 14,029 | 411,330 |

| (1) | | Includes reinvested dividends on restricted stock that carry the same restrictions. |

| (2) | | The value of the shares is calculated by multiplying the number of shares by the closing market price ($29.32) as of December 31, 2007. |

| (3) | | The payment of performance shares is contingent upon achievement of specific performance goals over a stated period of time as approved by the Compensation and Development Committee of the Company’s Board of Directors. The number of performance shares ultimately paid can vary from the number of shares initially granted, depending on Company performance, based on internal and external measures, over stated performance periods. |

| (4) | | Mr. Chesser received a restricted stock grant on February 7, 2006 for 8,643 shares that vest February 7, 2009. He also received a performance share grant on February 7, 2006 for 25,930 shares, at target, for the three-year period ending December 31, 2008. He received a restricted stock grant on February 6, 2007 for 80,000 shares, of which 40,000 shares vest on February 6, 2009 and 40,000 shares vest on February 6, 2010. He received a restricted stock grant on February 6, 2007 for 8,507 shares that vest on February 6, 2010. He received a performance share grant on February 6, 2007 for 25,520 shares, at target, for a three-year period ending December 31, 2009. |

| (5) | | Mr. Downey received a restricted stock grant on February 7, 2006 for 4,587 shares that vest February 7, 2009. He also received a performance share grant of 13,763 shares, at target, for the three-year period ending December 31, 2008. He received a restricted stock grant on February 6, 2007 for 45,000 shares, of which 22,500 shares vest on February 6, 2009 and 22,500 shares vest on February 6, 2010. He also received a restricted stock grant on February 6, 2007 for 4,228 shares, which vest on February 6, 2010. He received a performance share grant on February 6, 2007 for 12,684 shares, at target, for a three-year period ending December 31, 2009. |

| (6) | | Mr. Bassham received a restricted stock grant on March 28, 2005 for 9,083 shares that vest on March 28, 2008. He received a restricted stock grant on February 7, 2006 for 2,260 shares that vest February 7, 2009. He also received a performance share grant on February 7, 2006 for 6,781 shares, at target, for the three-year period ending December 31, 2008. He received |

38

| | a restricted stock grant on February 6, 2007 for 25,000 shares, of which 12,500 shares vest on February 6, 2009 and 12,500 shares vest on February 6, 2010. He also received a restricted stock grant on February 6, 2007 for 2,161 shares that vest on February 6, 2010. He also received a performance share grant on February 6, 2007 for 6,483 shares, at target, for the three-year period ending December 31, 2009. |

| (7) | | Mr. Malik received a restricted stock grant on February 1, 2005 for 4,956 shares that vested February 1, 2008. He received a restricted stock grant on February 7, 2006 for 5,585 shares that vest February 7, 2009. He also received a performance share grant on February 7, 2007 for 10,325 shares, at target, for the three-year period ending December 31, 2009. |

| (8) | | Mr. Marshall received a restricted stock grant on May 25, 2005 for 20,275 shares that vest on May 25, 2008. He received a restricted stock grant on February 7, 2006 for 2,449 shares that vest February 7, 2009. He also received a performance share grant of 7,347 shares for the three-year period ending December 31, 2008. He received a restricted stock grant on February 6, 2007 for 25,000 shares, of which 12,500 shares vest on February 6, 2009 and 12,500 shares vest on February 6, 2010. He also received a restricted stock grant on February 6, 2007 for 2,227 shares that vest on February 6, 2010. He also received a performance share grant on February 6, 2007 for 6,682 shares, at target, for the three-year period ending December 31, 2009. |

OPTION EXERCISES AND STOCK VESTED

We have omitted the “Option award” columns from the following table, because none of our NEOs exercised options in 2007.

| Number of Shares Acquired | Value Realized |

| Name | on Vesting (#) | on Vesting ($) |

| (a) | (d) | (e) |

| Mr. Chesser(1) | 15,079 | 436,386 |

| Mr. Downey(2) | 16,474 | 474,445 |

| Mr. Bassham | - | - |

| Mr. Malik(3) | 10,777 | 332,399 |

| Mr. Marshall(4) | 4,482 | 127,827 |

| (1) | | Restricted stock of 12,135 shares, plus 2,944 DRIP shares vested on October 1, 2007. The value realized on vesting is the closing price of $28.94 on October 1, 2007, multiplied by the number of shares vested. |

| (2) | | Restricted stock of 8,826 shares, plus 2,141 DRIP shares vested on October 1, 2007. The value realized on vesting is the closing price of $28.94 on October 1, 2007, multiplied by the number of shares vested. Mr. Downey earned 5,507 shares pursuant to a performance share grant for the period of 2005-2007, which were issued in February 2008. The value realized on vesting is the closing price of $28.52 on February 5, 2008, multiplied by the number of shares awarded. |

| (3) | | Mr. Malik had a restricted stock grant of 4,956 shares, plus 577 DRIP shares, vest on February 1, 2007. The value realized on vesting is the closing price of $31.51 on February 1, 2007, multiplied by the number of shares vested. Mr. Malik had a restricted stock grant of 4,445 shares, plus 799 DRIP shares, vest on November 10, 2007. The value realized on vesting is the closing price of $30.14 on November 10, 2007, multiplied by the number of shares vested. |

| (4) | | Mr. Marshall earned 4,482 shares pursuant to a performance share grant for the period of 2005-2007, which were issued in February 2008. The value realized on vesting is the closing price of $28.52 on February 5, 2008, multiplied by the number of shares awarded. |

The following discussion of the pension benefits for the NEOs reflects the terms of the Company’s Management Pension Plan (the “Pension Plan”) and SERP, and the present value of accumulated benefits, as of December 31, 2007. As discussed in the CD&A, management employees were given a one-time election to either remain in these existing plans or choose a new retirement program effective January 1, 2008. We have omitted the column titled “Payments during the last fiscal year,” because no payments were made in 2007.

39

PENSION BENEFITS

| | Number of Years | Present Value of |

| Name | Plan Name | Credited Service (#) | Accumulated Benefit ($) |

| (a) | (b) | (c) | (d) |

| Mr. Chesser(1) | Management Pension Plan | | 4.5 | 151,705 |

| Supplemental Executive Retirement Plan | | 9 | 971,165 |

| Mr. Downey | Management Pension Plan | | 7.5 | 298,123 |

| Supplemental Executive Retirement Plan | | 7.5 | 454,691 |

| Mr. Bassham | Management Pension Plan | | 2.5 | 41,663 |

| Supplemental Executive Retirement Plan | | 2.5 | 27,177 |

| Mr. Malik(2) | Management Pension Plan | | - | - |

| Supplemental Executive Retirement Plan | | - | - |

| Mr. Marshall(1) | Management Pension Plan | | 2.5 | 81,382 |

| Supplemental Executive Retirement Plan | | 5 | 209,435 |

| (1) | | Messrs. Chesser and Marshall are credited with two years of service for every one year of service earned under our pension plan, with such amount payable under our SERP. Without this augmentation, Messrs. Chesser and Marshall would have accrued $409,703 and $64,026, respectively, under the SERP. |

| (2) | | Mr. Malik does not participate in either the Management Pension Plan or SERP. |

Our NEOs, excluding Mr. Malik, participate in the Pension Plan and the SERP. The Pension Plan is a funded, tax-qualified, noncontributory defined benefit pension plan. Benefits under the Pension Plan are based on the employee’s years of service and the average annual base salary over a specified period. Employees who retire after they reach 65, or whose age and years of service add up to 85, are entitled to a total monthly annuity for the rest of their life (a “single life” annuity) equal to 50% of their average base monthly salary for the period of 36 consecutive months in which their earnings were highest. The annuity will be proportionately reduced if years of credited service are less than 30 or if age and years of service do not add up to 85. Employees may elect other annuity options, such as joint and survivor annuities or annuities with payments guaranteed for a period of time. The present value of each annuity option is the same; however, the monthly amounts payable under these options are less than the amount payable under the single life annuity option. Employees also may elect to receive their retirement benefits in a lump sum equal to the actuarial equivalent of a single life pension under the Pension Plan. Of our NEOs, only Mr. Downey is eligible for early retirement benefits under the Pension Plan. His early retirement benefits would be a monthly annuity equal to 10.9% of his average base month salary during the period of 48 consecutive months in which his earnings were highest. The compensation covered by the Pension Plan excludes any bonuses or other compensation. The amount of annual earnings that may be considered in calculating benefits under the Pension Plan is limited by law. For 2007, the annual limitation is $220,000.

The SERP is unfunded and provides out of general assets an amount substantially equal to the difference between the amount that would have been payable under the Pension Plan in the absence of tax laws limiting pension benefits and earnings that may be considered in calculating pension benefits, and the amount actually payable under the Plan. It also adds an additional 1/3% of highest average annual base salary for each year of credited service when the executive was eligible for supplemental benefits, up to 30 years. As mentioned, Messrs. Chesser and Marshall are credited with two years of service for every one year of service earned under our Pension Plan, with such amount payable under the SERP.

In the table above, the present value of the current accrued benefits with respect to each listed officer is based on the following assumptions: retirement at the earlier of age 62 or when the sum of age and years

40

of service equal 85; full vesting of accumulated benefits; a discount rate of 5.9%; and use of the Pension Plan’s mortality and lump sum tables.

As discussed in the CD&A, employees (including NEOs) were given a choice in 2007 to either continue accruing benefits in the Pension Plan as described above, or accrue slightly less benefits starting in 2008 with an enhanced benefit under our 401(k) plan. Messrs. Bassham and Marshall have made the latter election. Starting in 2008, their accrual rate under the Pension Plan will be 1.25% per year, compared to 1.67% in prior years.

We have omitted from the following table the column titled “Aggregate withdrawals/distributions,” because there were no withdrawals or distributions in 2007 to our NEOs.

NONQUALIFIED DEFERRED COMPENSATION

| Executive | Registrant | | |

| Contribution in Last | Contributions in Last | Aggregate Earnings | Aggregate Balance at |

| FY(1) | FY(2) | in Last FY(3) | Last FYE |

| Name | ($) | ($) | ($) | ($) |

| (a) | (b) | (c) | (d) | (f) |

| Mr. Chesser | 108,750 | 15,001 | 86,525 | 1,136,871 |

| Mr. Downey | 94,000 | 7,350 | 121,502 | 1,498,306 |

| Mr. Bassham | 12,000 | 3,000 | 9,991 | 136,816 |

| Mr. Malik | 112,967 | - | 58,283 | 765,211 |

| Mr. Marshall | 167,500 | 5,025 | 65,796 | 885,859 |

| (1) | | Amounts in this column are included in the “Salary” column in the Summary Compensation Table. |

| (2) | | Amounts in this column are included in column (B) of the first table located in footnote (4) of the Summary Compensation Table. |

| (3) | | Only the above-market earnings are reported in the Summary Compensation Table. The above-market earnings were: Chesser, $31,341; Downey, $44,011; Bassham, $3,619; Malik, $21,111; and Marshall, $23,833. |

Our deferred compensation plan is a nonqualified and unfunded plan. It allows selected employees, including our NEOs, to defer the receipt of up to 50% of base salary and 100% of awards under annual incentive plans. The plan provides for a matching contribution in an amount equal to 50% of the first 6% of the base salary deferred by participants, reduced by the amount of the matching contribution made for the year to the participant’s account under our Employee Savings Plus Plan, as described in our CD&A. An earnings rate is applied to the deferral amounts. This rate is determined annually by the Compensation and Development Committee and is generally based on the Company’s weighted average cost of capital. The rate was set at 9.0% for 2007. Interest is compounded monthly on deferred amounts. Participants may elect prior to rendering services for which the compensation relates when deferred amounts are paid to them: either at a specified date, or upon separation from service. For our NEOs who elect payment on separation of service, amounts are paid the first business day of the seventh calendar month following their separation from service.

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE-IN-CONTROL

Our NEOs are eligible to receive lump sum payments in connection with any termination of their employment. The Company believes that severance protections, particularly in the context of a change in control transaction, can play a valuable role in attracting and retaining key executive officers.Accordingly, we provide such protections for our NEOs. The Compensation Committee evaluates the

41

level of severance benefits to provide a NEO on a case-by-case basis, and in general, considers these severance protections an important part of an executive’s overall compensation and consistent with competitive practices. Payments made will vary, depending on the circumstances of termination, as we discuss below.

Payments under Change in Control Severance Agreements

We have Change in Control Severance Agreements (“Change in Control Agreements”) with our NEOs, specifying the benefits payable in the event their employment is terminated within two years of a “Change in Control” or within a “protected period.” Generally, a “Change in Control” occurs if:

- Any person (as defined by SEC regulations) becomes the beneficial owner of at least 35% of ouroutstanding voting securities;

- A change occurs in the majority of our Board; or

- A merger, consolidation, reorganization or similar transaction is consummated (unless ourshareholders continue to hold at least 60% of the voting power of the surviving entity), or aliquidation, dissolution or a sale of substantially all of our assets occurs or is approved by ourshareholders.

A “protected period” starts when:

- We enter into an agreement that, if consummated, would result in a Change in Control;

- We, or another person, publicly announces an intention to take or to consider taking actionswhich, if consummated, would constitute a Change in Control;

- Any person (as defined by SEC regulations) becomes the beneficial owner of 10% or more of ouroutstanding voting securities; or

- Our Board, or our shareholders, adopt a resolution approving any of the foregoing matters orapproving a Change in Control.

Mr. Malik’s Change in Control Agreement also defines “Change in Control” to include the occurrence of these events at Strategic Energy.

The protected period ends when the Change in Control transaction is consummated, abandoned or terminated.

The Company also believes that the occurrence, or potential occurrence, of a change in control transaction will create uncertainty regarding the continued employment of our executive officers. This uncertainty results from the fact that many change in control transactions result in significant organizational changes, particularly at the senior executive level. We believe these change of control arrangements effectively create incentives for our executive team to build stockholder value and to obtain the highest value possible should we be acquired in the future, despite the risk of losing employment and potentially not having the opportunity to otherwise vest in equity awards which are a significant component of each executive’s compensation. These agreements are designed to encourage our NEOs to remain employed with the Company during an important time when their prospects for continued employment following the transaction could be uncertain. Because we believe that a termination by the executive for good reason may be conceptually the same as a termination by the Company without cause, and because we believe that in the context of a change in control, potential acquirors would otherwise have an incentive to constructively terminate the executive’s employment to avoid paying severance, we believe it is appropriate to provide severance benefits in these circumstances.

42

Our change of control arrangements are “double trigger,” meaning that acceleration of vesting is not awarded upon a change of control, unless the NEO’s employment is terminated involuntarily (other than for cause) within 2 years of a Change in Control or protected period. We believe this structure strikes a balance between the incentives and the executive hiring and retention effects described above, without providing these benefits to executives who continue to enjoy employment with an acquiring company in the event of a change of control transaction. We also believe this structure is more attractive to potential acquiring companies, who may place significant value on retaining members of our executive team and who may perceive this goal to be undermined if executives receive significant acceleration payments in connection with such a transaction and are no longer required to continue employment to earn the remainder of their equity awards.

The benefits under the Change in Control Agreements depend on the circumstances of termination. Generally, benefits are greater if the employee is not terminated for “Cause,” or if the employee terminates employment for “Good Reason.” “Cause” includes:

- A material misappropriation of any funds, confidential information or property;

- The conviction of, or the entering of, a guilty plea or plea of no contest with respect to a felony(or equivalent);

- Willful damage, willful misrepresentation, willful dishonesty, or other willful conduct that canreasonably be expected to have a material adverse effect on the Company; or

- Gross negligence or willful misconduct in performance of the employee’s duties (after writtennotice and a reasonable period to remedy the occurrence).

An employee has “Good Reason” to terminate employment if:

- There is any material and adverse reduction or diminution in position, authority, duties orresponsibilities below the level provided at any time during the 90-day period before the“protected period”;

- There is any reduction in annual base salary after the start of the “protected period”;

- There is any reduction in benefits below the level provided at any time during the 90-day periodprior to the “protected period”; or

- The employee is required to be based at any office or location that is more than 70 miles fromwhere the employee was based immediately before the start of the “protected period.”

Our Change in Control Agreements also have covenants prohibiting the disclosure of confidential information and preventing the employee from participating or engaging in any business that, during the employee’s employment, is in direct competition with the business of the Company within the United States (without prior written consent which, in the case of termination, will not be unreasonably withheld).

Change in Control with Termination of Employment

The following table sets forth our payment obligations under the Change in Control Agreements under the circumstances specified upon a termination of employment. The table is based on the assumptions that the termination took place on December 31, 2007, that all vacation was taken during the year, and the NEO was paid for all salary earned through the date of termination. The table does not reflect amounts that would be payable to the NEOs for benefits or awards that already vested.

43

| Mr. | Mr. | Mr. | Mr. | Mr. |

| Chesser | Downey | Bassham | Malik | Marshall |

| Benefit | ($) | ($) | ($) | ($) | ($) |

| Two Times or Three Times Salary(1) | 2,175,000 | 1,410,000 | 650,000 | 1,320,000 | 670,000 |

| Two Times or Three Times Bonus(2) | 1,859,143 | 832,358 | 409,418 | 958,928 | 529,897 |

| Annualized Pro Rata Bonus(3) | 619,714 | 277,453 | 204,709 | 319,643 | 264,949 |

| SERP/Pension Plan(4) | 1,629,334 | 651,673 | 364,549 | - | 535,971 |

| Health and Welfare(5) | 29,716 | 28,589 | 28,848 | 20,264 | 18,428 |

| Performance Incentives(6) | 1,508,514 | 775,426 | 388,900 | 1,105,229 | 411,330 |

| Performance Share Dividends(7) | 128,451 | 66,749 | 33,275 | 17,140 | 35,484 |

| Acceleration of Performance Share Pay-Out(8) | - | 838 | - | 2,195 | 674 |

| Restricted Stock(9) | 738,927 | 408,644 | 231,842 | 31,282 | 259,686 |

| Restricted Stock and Option Dividends(10) | 44,937 | 35,292 | 14,835 | 3,811 | 19,290 |

| Unvested 401(k) Employer Match | 8,345 | - | - | - | - |

| Unvested Deferred Plan Employer Match | 17,378 | - | 2,616 | - | 14,745 |

| Tax Gross-Up(11) | 4,029,906 | 2,048,492 | 1,015,022 | 1,661,035 | 1,258,936 |

| Total | 12,789,365 | 6,535,514 | 3,344,014 | 5,439,527 | 4,019,390 |

| (1) | | Messrs. Chesser, Downey, and Malik receive three times their highest annual base salary immediately preceding the fiscal year in which the Change in Control occurs. Messrs. Bassham and Marshall receive two times their highest annual base salary immediately preceding the fiscal year in which the Change in Control occurs. |

| (2) | | Messrs. Chesser, Downey, and Malik receive three times their highest average annualized annual incentive compensation awards during the five fiscal years (or, if less, the years they were employed by the company) immediately preceding the fiscal year in which the Change in Control occurs. Messrs. Bassham and Marshall receive two times their highest average annualized annual incentive compensation awards. |

| (3) | | The annualized pro rata bonus amount is at least equal to the average annualized incentive awards paid to the NEO during the last five fiscal years of the Company (or the number of years the NEO worked for the Company) immediately before the fiscal year in which the Change-in-Control occurs, pro rated for the number of days employed in that year. |

| (4) | | Mr. Chesser is credited with two years for every one year of credited service under the Pension Plan, plus six additional years of credited service. Mr. Downey is credited for three additional years of service. Mr. Marshall is credited for two years for every one year of credited service under the Pension Plan, plus four additional years of credit service. Mr. Bassham is credited for two additional years of service. Mr. Malik does not participate in the Pension Plan or SERP. |

| (5) | | The amounts include medical, accident, disability, and life insurance and are estimated based on our current COBRA premiums for medical coverage and indicative premiums for private insurance coverage for the individuals. |

| (6) | | In the event of a Change in Control (which is generally consistent with the definition of a Change in Control in the Change in Control Agreements, except that the beneficial ownership threshold percentage is lower), our LTIP provides that all performance share grants (unless awarded less than six months prior to the change in control) are deemed to have been fully earned. As discussed in the CD&A, above, a portion of Mr. Malik’s performance incentives are paid in cash. |

| (7) | | Performance Share Dividends are the cash dividends paid on the Performance Shares. |

| (8) | | Acceleration of Performance Share Pay-Out is the value of receiving the pay-out on December 31, 2007, instead of February, 2008, the usual time of payout. |

| (9) | | In the event of a Change in Control (which is generally consistent with the definition of a Change in Control in the Change in Control Agreements, except that the beneficial ownership threshold percentage is lower), our LTIP provides that all restrictions on restricted stock grants are removed. |

| (10) | | In the event of a Change in Control (which is generally consistent with the definition of a Change in Control in the Change in Control Agreements, except that the beneficial ownership threshold percentage is lower), our LTIP provides that: all outstanding stock options outstanding are fully exercisable and all limited stock appreciation rights are automatically exercised; and all restrictions on restricted stock grants are removed. |

| (11) | | The Change in Control Agreements generally provide for an additional payment to cover excise taxes imposed by Section 4999 of the Internal Revenue Code (“Section 280G gross-up payments”). We have calculated these payments based on the estimated payments discussed above, as well as the acceleration of equity awards that are discussed below. In calculating these payments, we did not make any reductions for the value of reasonable compensation for pre-Change in Control period and post-Change in Control period service, such as the value attributed to non-compete provisions. In the event that payments are due under Change in Control Agreements, we would perform evaluations to determine the reductions attributable to these services. |

44

Change in Control without Termination of Employment

Upon a Change in Control, all restrictions on outstanding unvested restricted stock and unvested restricted stock options granted prior to the May 2007 amendments to our LTIP held by our NEOs would vest. As well, all outstanding performance share grants would be deemed to have been fully earned. All of the outstanding restricted stock, stock options and performance shares were granted prior to the amendments. These grants would become payable, and it is expected that Mr. Malik’s long-term cash incentives would become payable, even if the NEO continues employment throughout the protected period. The following table sets forth the amounts payable to our NEOs assuming a Change in Control, without termination of the NEO's employment.

| Mr. Chesser | Mr. Downey | Mr. Bassham | Mr. Malik | Mr. Marshall |

| $3,879,555 | $2,281,004 | $1,401,441 | $1,441,816 | $1,784,061 |

Retirement, Resignation, Death or Disability

Upon retirement or resignation, the NEO would receive all accrued and unpaid salary and benefits, including the retirement benefits discussed above. In the event of death or disability, the NEO (or his beneficiary) would receive group life insurance proceeds or group disability policy proceeds, as applicable. In addition, these events would have the following effects on outstanding LTIP awards: (i) if employment is terminated by either the Company or the NEO, all restricted stock and performance share awards would be forfeited; (ii) if the NEO retires, becomes disabled or dies, restricted stock and performance share awards would be prorated for service during the applicable periods; (iii) if the NEO retires, outstanding options expire three months from the retirement date; (iv) if the NEO resigns or is discharged, outstanding options terminate; and (v) if the NEO becomes disabled or dies, outstanding options terminate twelve months after disability or death. Mr. Malik’s employment agreement also provides for additional compensation, should his employment terminate as a result of his death or disability. Please see “Payments under Other Compensation Arrangements,” below, and “Narrative Analysis of Summary Compensation Table and Plan-Based Awards Table” on page 35 for additional information regarding his employment agreement.

Outstanding Stock Options

Mr. Downey holds stock options that are currently exercisable. He has limited stock appreciation rights on 45,249 option shares, which entitle him to receive cash in an amount equal to the difference between the fair market value of the shares underlying the stock appreciation rights exercised on the date of exercise, over the aggregate base or exercise price. Assuming Mr. Downey’s limited stock appreciation rights were exercised on December 31, 2007, he would have received $167,446, less applicable withholding taxes.

Payments under Other Compensation Arrangements

Three of our NEOS have compensation arrangements in addition to those discussed above, as follows:

Mr. Chesser. Mr. Chesser’s employment arrangement with the Company provides that if he is terminated without cause, he will receive three times annual salary and bonus (if terminated prior to age 63), or onetime salary and bonus (if terminated between age 63 and before age 65). If Mr. Chesser were terminated without cause as of December 31, 2007 (and assuming that the Change in Control Agreement was not applicable), he would have received $4,350,000 under this arrangement.

45

Mr. Marshall. Mr. Marshall’s employment arrangement with the Company provides that if he is terminated without cause, he will receive a severance amount equal to the target payment under the annual incentive plan plus two times his annual base salary. If Mr. Marshall were terminated without cause as of December 31, 2007 (and assuming that the Change in Control Agreement was not applicable), he would have received $837,500 under this arrangement.

Mr. Malik. Mr. Malik is the only NEO with an employment agreement. The agreement provides for additional compensation if Mr. Malik’s employment is terminated without “Cause” by the Company, or if Mr. Malik terminates his employment for “Good Reason.” This additional compensation is three times Mr. Malik’s annual base salary, the current year’s annual incentive (prorated through the termination date), and three times the average annual incentive compensation paid during the three most recent fiscal years (or such shorter period as Mr. Malik shall have been employed). Mr. Malik’s agreement also provides for additional compensation, should his employment terminate as a result of his death or disability. Please see “Narrative Analysis of Summary Compensation Table and Plan-Based Awards Table” on page 35 for additional information regarding his employment agreement.

If Mr. Malik would have been terminated without Cause, or terminated employment for Good Reason as of December 31, 2007 (and assuming that the Change in Control Agreement was not applicable), he would have received $3,061,847under his employment agreement. If Mr. Malik’s employment terminated on December 31, 2007 due to disability that occurred on December 31, 2007, his additional compensation would have been $507,222, assuming disability payments commenced in the first three months. If his employment terminated on December 31, 2007 due to his death on the same day, his beneficiary or estate would have received $495,000.

OTHER BUSINESS

Great Plains Energy is not aware of any other matters that will be presented for shareholder action at the Annual Meeting. If other matters are properly introduced, the persons named in the accompanying proxy will vote the shares they represent according to their judgment.

| By Order of the Board of Directors |

|

| Barbara B. Curry |

| Senior Vice President-Corporate Services and Corporate |

| Secretary |

Kansas City, Missouri

March 26, 2008

46

|

GREAT PLAINS ENERGY INCORPORATED

1201 WALNUT STREET

KANSAS CITY, MO 64106 |

| VOTE BY INTERNET -www.proxyvote.com |

| Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on May 5, 2008. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| |

ELECTRONIC DELIVERY OF FUTURE SHAREHOLDER

COMMUNICATIONS |

| If you would like to reduce the costs incurred by Great Plains Energy Incorporated in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access shareholder communications electronically in future years. |

| |

| VOTE BY PHONE - 1-800-690-6903 |

| Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on May 5, 2008. Have your proxy card in hand when you call and then follow the instructions. |

| |

| VOTE BY MAIL |

| Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Great Plains Energy Incorporated, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | GRTPL1 | | KEEP THIS PORTION FOR YOUR RECORDS |

| | DETACH AND RETURN THIS PORTION ONLY |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

| GREAT PLAINS ENERGY INCORPORATED |

| | |

| | The Board of Directors recommends a vote FOR

Items 1 and 2. | |

| Vote on Directors | |

| Item 1. | | Election of Directors |

| | Nominees: |

| | 01) | D.L. Bodde | 06) | L.A. Jimenez | |

| | 02) | M.J. Chesser | 07) | J.A. Mitchell | |

| | 03) | W.H. Downey | 08) | W.C. Nelson | |

| | 04) | M.A. Ernst | 09) | L.H. Talbott | |

| | 05) | R.C. Ferguson, Jr. | 10) | R.H. West | |

| | | |

| | | | | | | | |

| | | | | | | |

| | | | | | | | |

For

All | Withhold

All | For All

Except | | To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below. | | | |

| |

| |

| o | o | o | |

| | |

| |

| | Vote on Proposal | | For | Against | Abstain |

| |

| | Item 2. | | Ratification of appointment of Deloitte & Touche LLP as independent auditors for 2008. | | o | o | o |

| |

| | | | | |

| | |

| Please be sure to sign and date this Proxy. | | |

| | | |

| | | |

| For comments, please check this box and write them on the back where

indicated. | o | |

| | | | | |

| | MATERIALS ELECTION | | | | |

| As of July 1, 2007, Securities and Exchange Commission rules permit companies to send you a notice that proxy information is available on the Internet, instead of mailing you a complete set of materials. Check the box to the right if you want to receive a complete set of future proxy materials by mail, at no cost to you. If you do not take action you may receive only a notice. | o | | | |

| | | |

| | | |

| |

| | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | | Signature (Joint Owners) | Date | |

THANK YOU FOR VOTING!

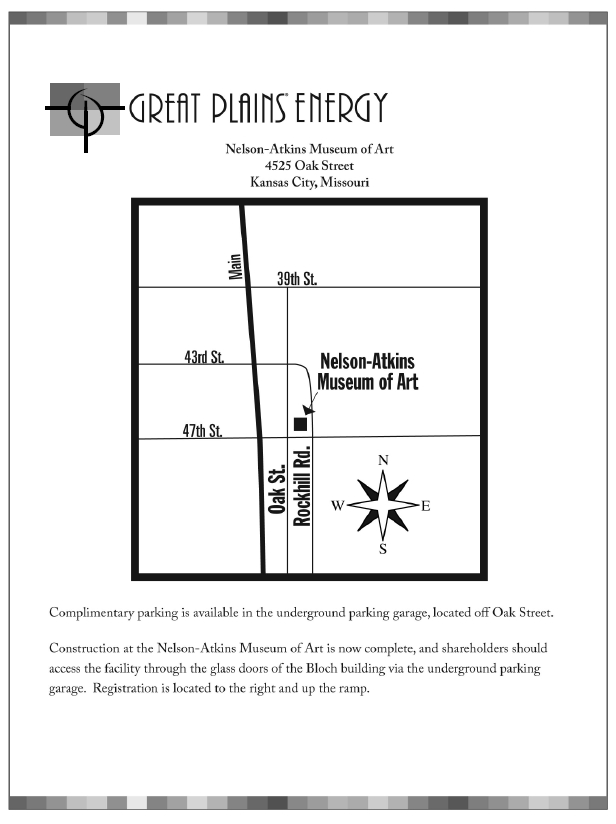

Great Plains Energy Incorporated

Annual Meeting of Shareholders

May 6, 2008

10:00 a.m. Central Daylight Time

The Nelson-Atkins Museum of Art

4525 Oak Street

Kansas City, MO 64111

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting:

The Notice, Proxy Statement and Annual Report are available at www.proxyvote.com.

GREAT PLAINS ENERGY INCORPORATED

1201 Walnut Street, Kansas City, Missouri 64106

This Proxy is solicited on behalf of the Board of Directors for the Annual Meeting of Shareholders

to be held on Tuesday, May 6, 2008. The Board of Directors recommends a vote FOR Items 1 and 2.The undersigned hereby appoints M. J. Chesser and W. H. Downey, and each or either of them, proxies for the undersigned with power of substitution, to vote all the shares of common stock of Great Plains Energy Incorporated that the undersigned is entitled to vote at the Annual Meeting of Shareholders to be held on Tuesday, May 6, 2008, and any adjournment or postponement of such meeting, upon the matters set forth on the reverse side of this card, and in their discretion upon such other matters as may properly come before the meeting.

This Proxy, if signed and returned, will be voted as directed on the reverse side. If this card is signed and returned without direction, such shares will be voted FOR the Items.

Confidential Voting Instructions to Fidelity Management Trust Company, and its successors, as Trustee under

Great Plains Energy Incorporated’s Employee Savings Plus Plan

I hereby direct that the voting right pertaining to shares of Great Plains Energy Incorporated held by the Trustee and attributable to the account in the Employee Savings Plus Plan shall be exercised at the Annual Meeting of Shareholders on May 6, 2008, or at any adjournment or postponement of such meeting, in accordance with the instructions on the reverse side of this card, to vote upon Items 1 and 2 and on any other business that may properly come before the meeting.

(If you noted any comments above, please mark corresponding box on the reverse side.)CONTINUED AND TO BE SIGNED ON THE REVERSE SIDE