UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-32594

HEARTLAND PAYMENT SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 22-3755714 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

90 Nassau Street, Princeton, New Jersey 08542

(Address of principal executive offices) (Zip Code)

(609) 683-3831

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange

on which registered |

| Common Stock, $0.001 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

(title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ YES x NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ YES x NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES ¨ NO

Indicate by check mark if disclosure of delinquent filer pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ YES x NO

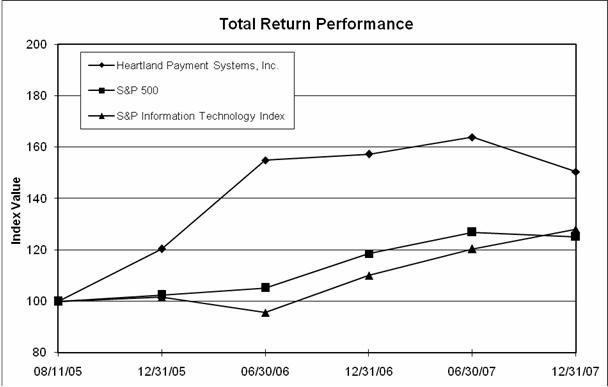

The aggregate market value of the voting common stock held by non-affiliates based on the last reported sale price on June 30, 2007: approximately $470 million.

As of March 1, 2008, there were 37,271,249 shares of the registrant’s Common Stock, $.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specifically identified portions of the registrant’s proxy statement for the 2008 annual meeting of shareholders are incorporated by reference in Part III of this Annual Report on Form 10-K for fiscal year ended December 31, 2007.

Heartland Payment Systems, Inc.

December 31, 2007 Form 10-K

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

Unless the context requires otherwise, references in this report to “the Company,” “we,” “us,” and “our” refer to Heartland Payment Systems, Inc. and our subsidiaries.

Some of the information in this Annual Report on Form 10-K may contain forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. You should understand that many important factors, in addition to those discussed elsewhere in this report, could cause our results to differ materially from those expressed in the forward-looking statements. These factors include, without limitation, our competitive environment, the business cycles and credit risks of our merchants, chargeback liability, merchant attrition, problems with our bank sponsor, our reliance on other bank card payment processors, our inability to pass increased interchange fees along to our merchants, the unauthorized disclosure of merchant data, economic conditions, system failures and government regulation.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 450 Fifth Street, N.W., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site,www.sec.gov.

In addition, certain of our SEC filings, including our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K can be viewed and printed from the investor information section of our website atwww.heartlandpaymentsystems.com, as soon as reasonably practicable after filing with the SEC. Certain materials relating to our corporate governance, including our senior financial officers’ code of ethics, are also available in the investor relations section of our website.

The information on the websites listed above, is not and should not be considered part of this Annual Report on Form 10-K and is not incorporated by reference in this document. These websites are, and are only intended to be, inactive textual references.

In May 2007, we submitted to the New York Stock Exchange the CEO certification required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual without qualification.

PART I

Overview of Our Company

Delaware Corporation

We were incorporated in Delaware in June 2000. Our headquarters are located at 90 Nassau Street, Princeton, NJ 08542, and our telephone number is (609) 683-3831.

Bank Card Payment Processing

Our primary business is to provide bank card payment processing services to merchants in the United States. This involves facilitating the exchange of information and funds between merchants and cardholders’ financial institutions, providing end-to-end electronic payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support and risk management. We also provide additional services to our merchants, such as payroll processing, gift and loyalty programs, and paper check processing, and we sell and rent point-of-sale devices and supplies.

According to The Nilson Report, in 2006 we were the 6th largest card acquirer in the United States ranked by purchase volume, which consists of both credit and debit Visa and MasterCard transactions. This ranking represented 2.3% of the total bank card processing market. At December 31, 2007, we provided our bank card payment processing services to approximately 154,750 active merchant locations, referred to as bank card merchants in this document, throughout the United States. In 2007, 2006 and 2005, our bank card processing volume was $51.9 billion, $43.3 billion and $33.7 billion, respectively.

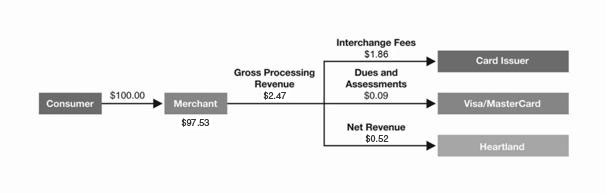

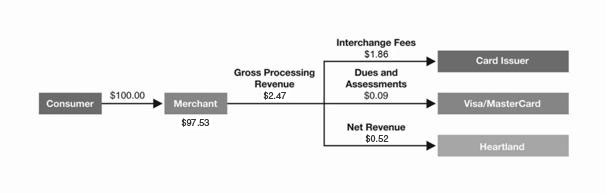

Our bank card processing revenue is recurring in nature, as we typically enter into three-year service contracts that, in order to qualify for the agreed-upon pricing, require the achievement of agreed bank card processing volume minimums from our merchants. Most of our revenue is from gross processing fees, which are primarily a combination of a percentage of the dollar amount of each Visa and MasterCard transaction we process plus a flat fee per transaction. We pay interchange fees to card issuing banks and dues and assessments to Visa and MasterCard, and we retain the remainder. For example, the allocation of funds resulting from a $100 transaction is depicted below.

We sell and market our bank card payment processing services through a nationwide direct sales force of 1,602 sales professionals. Through this sales force we establish a local sales and servicing presence, which we believe provides for enhanced referral opportunities and helps mitigate merchant attrition. We compensate our sales force solely through commissions, based upon the performance of their merchant accounts. We believe that our sales force and our experience and knowledge in providing payment processing services to small- and medium-size merchants gives us the ability to effectively evaluate and manage the payment processing needs and risks that are unique to these merchants. In 2007, our sales force generated over 62,500 bank card merchant applications and installed over 57,000 new bank card merchants. In 2006, our sales force generated over 55,000 bank card merchant applications and installed almost 51,000 new bank card merchants.

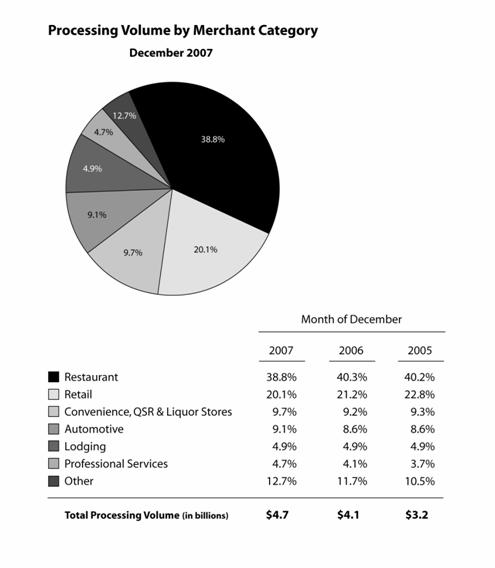

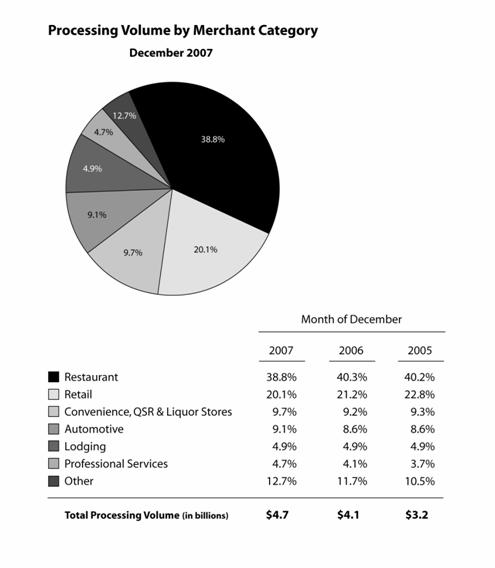

1

We focus our sales efforts on low-risk bank card merchants and have developed systems and procedures designed to minimize our exposure to potential losses. In 2007, 2006 and 2005, we experienced losses of 0.54 basis points (0.0054%), 0.45 basis points (0.0045%) and 0.36 basis points (0.0036%) of bank card processing volume, respectively. We have developed significant expertise in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These industries include restaurants, brick and mortar retailers, convenience and liquor stores, automotive sales, repair shops and gas stations, professional service providers, lodging establishments and other. As of December 31, 2007, approximately 30.2% of our bank card merchants were restaurants, approximately 20.2% were brick and mortar retailers, approximately 10.6% were convenience and liquor stores, approximately 8.9% were automotive sales, repair shops and gas stations, approximately 8.1% were professional service providers and approximately 3.7% were lodging establishments.

We believe that the restaurant industry will remain an area of focus, though its growth will likely approximate the growth in the overall portfolio. Restaurants represent an attractive segment for us: according to a report by the National Restaurant Association, restaurant industry sales are expected to reach approximately $558 billion in 2008, which would represent a 4% increase over projected industry sales for 2007 and the sixteenth consecutive year of growth. This steady growth profile, combined with the industry’s low seasonality, makes restaurant merchant bank card processing volume very stable and predictable. In addition, the incidence of chargebacks is very low among restaurants, as the service is provided before the card is used. Our industry focus not only differentiates us from other payment processors, but also allows us to forge relationships with key trade associations that attract merchants to our business. Our industry focus also allows us to better understand a merchant’s needs and tailor our services accordingly.

Since our inception, we have developed a number of proprietary Internet-based systems to increase our operating efficiencies and distribute our processing and merchant data to our three main constituencies: our sales force, our merchant base and our customer service staff. In 2001, we began providing authorization and data capture services to our bankcard merchants through our own front-end processing system, HPS Exchange. In 2006, we began providing clearing, settlement and merchant accounting services through our own internally developed back-end processing system, Passport, to substantially all of our bank card merchants. Passport enables us to customize these services to the needs of our Relationship Managers and merchants.

During the years ended December 31, 2007, 2006 and 2005, approximately 75%, 64% and 53%, respectively, of our transactions were processed through HPS Exchange, which has decreased our operating costs per transaction. At December 31, 2007 and 2006, approximately 98% of total bank card merchants were processing on Passport. At December 31, 2007, our internally developed systems are providing substantially all aspects of a merchant’s processing needs.

In December 2007, we signed a sales and servicing program agreement with American Express under which we will sign up and service new merchants on behalf of American Express. Under the terms of the agreement, we will add American Express Card acceptance to the payment processing services we offer to new bankcard merchants beginning in the second half of 2008. We will provide processing, settlement, customer support and reporting to merchants, in effect consolidating a merchant’s American Express Card acceptance into the services we currently provide for their Visa and Master Card transactions. The program will also be opened to our existing bankcard merchants who desire to add American Express Card acceptance, so that we will become their single point of contact for card processing.

While we will offer processing and support services to our bankcard merchants, American Express will retain the American Express Card acceptance contract with the merchants, continue to set merchant pricing, perform authorizations, and receive the same transactional information it currently receives.

Payroll Processing Services

Through our wholly-owned subsidiary, Heartland Payroll Company, we operate a full-service nationwide payroll processing service, including check printing, direct deposit, related federal, state and local tax deposits and providing accounting documentation. At December 31, 2007, 2006 and 2005, we processed payroll for 6,209, 4,216 customers and 2,664 customers, respectively.

2

Our nationwide direct sales force also sells our payroll processing services solely on a commission basis. Beginning in 2006, we began providing additional training regarding our payroll processing products and increased the focus of our sales force on selling these products. As a result, in 2007 and 2006, we installed 4,395 and 3,140 new payroll processing customers, respectively, compared to 1,117 new installs in 2005.

Our total merchants, which we define as bank card processing merchants plus payroll customers, increased to 160,959 at December 31, 2007 from 137,416 total merchants at December 31, 2006 and 113,164 total merchants at December 31, 2005.

Payment Processing Industry Overview

The payment processing industry provides merchants with credit, debit, gift and loyalty card and other payment processing services, along with related information services. The industry has grown rapidly in recent years as a result of wider merchant acceptance, increased consumer use of bank cards and advances in payment processing and telecommunications technology. According to The Nilson Report, total expenditures for all card type transactions by U.S. consumers were $3.0 trillion in 2006, and are expected to grow to $4.8 trillion by 2011. From 2001 to 2006, the compound annual growth rate of card payments was 12%, but this rate is expected to decline to 10% for 2007 to 2011. The proliferation of bank cards has made the acceptance of bank card payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. This use of bank cards, enhanced technology initiatives, efficiencies derived from economies of scale and the availability of more sophisticated products and services to all market segments has led to a highly competitive and specialized industry.

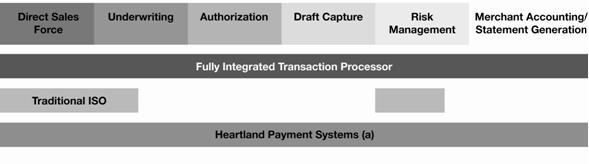

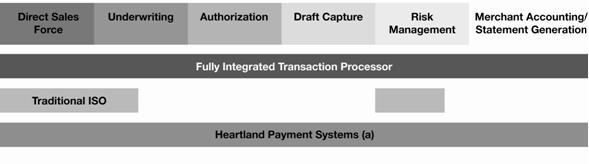

Segmentation of Merchant Service Providers

The payment processing industry is dominated by a small number of large, fully-integrated payment processors that handle the processing needs of the nation’s largest merchants. Large national merchants (i.e., those with multiple locations and high volumes of bank card transactions) typically demand and receive the full range of payment processing services at low per-transaction costs.

Payment processing services are generally sold to the small- and medium-sized merchant market segment through banks and Independent Sales Organizations that generally procure most of the payment processing services they offer from large payment processors. It is difficult, however, for banks and Independent Sales Organizations to customize payment processing services for the small- and medium-sized merchant on a cost-effective basis or to provide sophisticated value-added services. Accordingly, services to the small- and medium-sized merchant market segment historically have been characterized by basic payment processing without the availability of the more customized and sophisticated processing, information-based services or customer service that is offered to large merchants. The continued growth in bank card transactions is expected to cause small- and medium-sized merchants to increasingly value sophisticated payment processing and information services similar to those provided to large merchants.

The following table sets forth the typical range of services provided directly (in contrast to using outsourced providers) by fully integrated transaction processors, traditional Independent Sales Organizations and us.

| (a) | HPS Exchange: 79% of our bank card merchants |

Passport: 98% of our bank card merchants

3

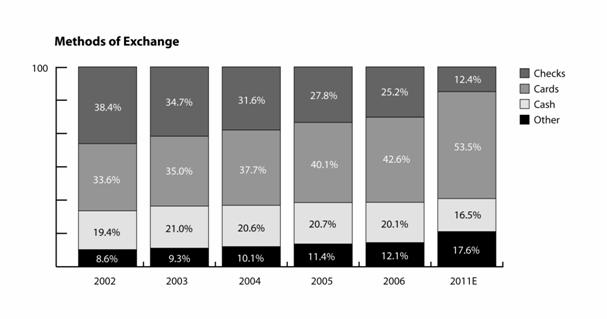

We believe that the card-based payment processing industry will continue to benefit from the following trends:

Growth in Card Transactions

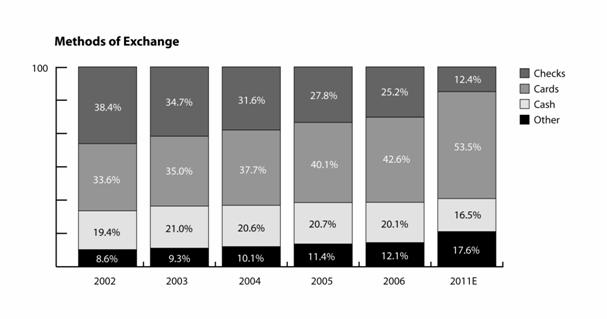

The proliferation in the uses and types of cards, including in particular debit and prepaid cards, the rapid growth of the Internet, significant technological advances in payment processing and financial incentives offered by issuers have contributed greatly to wider merchant acceptance and increased consumer use of such cards. The following chart illustrates the growth for card transactions for the periods indicated.

Source: The Nilson Report. Card purchase volume includes VISA / MasterCard (debit and credit), American Express, Discover and Diners Club.

Note: Percentages inside bar represent year-over-year growth.

According to The Nilson Report and the New York State Forum for Information Resource Management, sources of increased bank card payment volume include:

| | • | | increasing acceptance of electronic payments by merchants who previously did not do so, such as quick service restaurants, government agencies and businesses that provide goods and services to other businesses; |

| | • | | increasing consumer acceptance of alternative forms of electronic payments, as demonstrated by the dramatic growth of debit cards, electronic benefit transfer, and prepaid and gift cards; and |

| | • | | continued displacement of checks with the use of cards and other methods of payment, including electronic, at the point of sale, as shown below. |

4

Source: The Nilson Report

Technology

At present, many large payment processors provide customer service and applications via legacy systems that are difficult and costly to alter or otherwise customize. In contrast to these systems, recent advances in scalable and networked computer systems, and relational database management systems, provide payment processors with the opportunity to deploy less costly technology that has improved flexibility and responsiveness. In addition, the use of fiber optic cables and advanced switching technology in telecommunications networks and competition among long-distance carriers, and the dramatic increase in merchants’ use of the Internet to process their transactions, further enhance the ability of payment processors to provide faster and more reliable service at lower per-transaction costs than previously possible.

Advances in personal computers and point-of-sale terminal technology, including integrated cash registers and networked systems, have increasingly allowed access to a greater array of sophisticated services at the point of sale and have contributed to the demand for such services. These trends have created the opportunity for payment processors to leverage technology by developing business management and other software application products and services.

Consolidation

During the last decade, the payment processing industry has undergone significant consolidation. The costs to convert from paper to electronic processing, merchant requirements for improved customer service, the risk of merchant fraud, and the demand for additional customer applications have made it difficult for community and regional banks to remain competitive in the merchant acquiring industry. Many of these providers are unwilling or unable to invest the capital required to meet these evolving demands, and have steadily exited the payment processing business or otherwise found partners to provide payment processing for their customers. Despite this consolidation, the industry remains fragmented with respect to the number of entities selling payment processing services, particularly to small- and medium-sized merchants.

5

Our Competitive Strengths

We believe our competitive strengths related to Bank Card Payment Processing include the following:

Large, Experienced, Efficient, Direct Sales Force

While many of our competitors rely on Independent Sales Organizations that often generate merchant accounts for multiple payment processing companies simultaneously, we market our services throughout the United States through our direct sales team of 1,602 Relationship Managers, Servicing Managers and sales managers who work exclusively for us. Our Relationship Managers have local merchant relationships and industry-specific knowledge that allow them to effectively compete for merchants. Our Relationship Managers are compensated solely on commissions, receiving signing bonuses and ongoing residual commissions for generating new merchant accounts. These commissions are based upon the gross margin we estimate that we will receive from their merchants, calculated by deducting interchange fees, dues and assessments and all of our costs incurred in underwriting, processing, servicing and managing the risk of the account from gross processing revenue. Our Relationship Managers have considerable latitude in pricing a new account, but we believe that the shared economics motivate them to sign attractively priced contracts with merchants generating significant bank card processing volume. The residual commissions our Relationship Managers receive from their merchant accounts give them an incentive to maintain a continuing dialogue and servicing presence with their merchants; these relationships are also supported by our 240 Servicing Managers, who are focused on installing new merchants and responding to any ongoing servicing needs. We believe that our compensation structure is atypical in our industry and contributes to building profitable, long-term relationships with our merchants. Our sales compensation structure and marketing activities focus on recruiting and supporting our direct sales force, and we believe that the significant growth we have achieved in our merchant portfolio and bank card processing volume are directly attributable to these efforts.

Recurring and Predictable Revenue

We generate recurring revenue through our payment processing services. Our revenue is recurring in nature because we typically enter into three-year service contracts that require minimum volume commitments from our merchants to qualify for the agreed-upon pricing. Our recurring revenue grows as the number of transactions or dollar volume processed for a merchant increases or as our merchant count increases. In 2007, approximately 85.5% of our bank card processing volume came from merchants we installed in 2006 and earlier.

Internal Growth

While many of our competitors in the payment processing industry have relied on acquisitions to expand their operations and improve their profitability, from 2001 through 2007 we have grown our business primarily through internal expansion by generating new merchant contracts submitted by our own direct sales force. Every merchant we currently process was originally underwritten by our staff, and we have substantial experience responding to their processing needs and the risks associated with them. We believe this both enhances our merchant retention and reduces our risks. We believe that internally generated merchant contracts are of a higher quality and are more predictable than contracts acquired from third parties, and the costs associated with such contracts are lower than the costs associated with contracts acquired from third parties.

Strong Position and Substantial Experience in Our Target Markets

As of December 31, 2007, we were providing payment processing services to approximately 154,750 active small- and medium-sized bank card merchants located across the United States. We believe our understanding of the needs of small- and medium-sized merchants and the risks inherent in doing business with them, combined with our efficient direct sales force, provides us with a competitive advantage over larger service providers that access this market segment indirectly. We also believe that we have a competitive advantage over service providers of a similar or smaller size that may lack our extensive experience and resources and which do not benefit from the economies of scale that we have achieved.

Industry Expertise

We have focused our sales efforts on merchants who have certain key attributes and on industries in which we believe our direct sales model is most effective and the risks associated with processing are relatively low. These attributes include owners who are typically on location, interact with customers in person, value a local sales and servicing presence and often consult with trade associations and other civic groups to help make

6

purchasing decisions. Although we have historically focused significant sales and marketing efforts on the restaurant industry, our merchant base also includes a broad range of brick and mortar retailers, lodging establishments, automotive repair shops, convenience and liquor stores and professional service providers.

To further promote our products and services, we have entered into sponsoring arrangements with various trade associations, with an emphasis on state restaurant and hospitality groups. We believe that these sponsorships have enabled us to gain exposure and credibility within the restaurant industry and have provided us with opportunities to market our products to new merchants. In December 2007, the restaurant industry represented approximately 38.8% of our bank card processing volume and 53.3% of our transactions. In December 2006 and December 2005, the restaurant industry represented approximately 40.3% and 40.2% of our bank card processing volume and 54.8% and 54.3% of our transactions, respectively. We believe that the restaurant industry will continue to represent a significant portion of our bank card processing volume as the industry continues to experience sales growth and we continue to generate new restaurant merchants. According to a report by the National Restaurant Association, restaurant industry sales are expected to reach approximately $558 billion in 2008, which would represent a 4% increase over projected industry sales for 2007 and the sixteenth consecutive year of growth. This steady growth profile, together with the industry’s low seasonality, makes restaurant merchant bank card processing volume relatively stable and predictable.

Our historical focus on small- and medium-sized merchants has diversified our merchant portfolio and we believe has reduced the risks associated with revenue concentration. In 2007, no single merchant represented more than 0.44% of our total bank card processing volume. In 2006 and 2005, no single merchant represented more than 0.26% and 0.29% of our total bank card processing volume, respectively.

Merchant Focused Culture

We have built a corporate culture and established practices that we believe improve the quality of services and products we provide to our merchants. This culture spans from our sales force, which maintains a local market presence to provide rapid, personalized customer service, through our service center which is segmented into regionalized teams to optimize responsiveness, and to our technology organization, which has developed a customer management interface and information system that alerts our Relationship Managers to any problems a merchant has reported and provides them with detailed information on the merchants in their portfolio. Additionally, we believe that we are one of the few companies that discloses and adheres to our pricing policies to merchants. Visa and MasterCard alter their interchange fees once or twice per year; we believe that we are one of the few companies that does not use such adjustments to increase our own margins. We think this is the best approach to building long-term merchant relationships. During 2006, we developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants’ processing relationships. The Merchant Bill of Rights allows our sales team to differentiate our approach to bank card processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships. We believe that our culture and practices allow us to maintain strong merchant relationships and differentiate ourselves from our competitors in obtaining new merchants.

Scalable Operating Structure

Our scalable operating structure allows us to expand our operations without proportionally increasing our fixed and semi-fixed support costs. In addition, our technology platform, including both HPS Exchange and Passport, was designed with the flexibility to support significant growth and drive economies of scale with relatively low incremental costs. Most of our operating costs are related to the number of individuals we employ. We have in the past used, and expect in the future to use, technology to leverage our personnel, which should cause our personnel costs to increase at a slower rate than our bank card processing volume.

Advanced Technology

We employ information technology systems which use the Internet to improve management reporting, enrollment processes, customer service, sales management, productivity, merchant reporting and problem resolution.

7

In 2001, we began providing authorization and data capture services to our merchants through our internally-developed front-end processing system, HPS Exchange. This system incorporates real time reporting tools through, and interactive point-of-sale database maintenance via, the Internet. These tools enable merchants, and our employees, to change the messages on credit card receipts and to view sale and return transactions entered into the point-of-sale device with a few second delay on any computer linked to the Internet. During the years ended December 31, 2007, 2006 and 2005, approximately 75%, 64% and 53%, respectively, of our transactions were processed through HPS Exchange.

In 2005, we began providing clearing, settlement and merchant accounting services through our own internally developed back-end processing system, Passport. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. We completed converting substantially all of our bank card merchants to Passport during the second quarter of 2006. At December 31, 2007 and 2006, approximately 98% of total bank card merchants were processing on Passport. At December 31, 2007, our internally developed systems are providing substantially all aspects of a merchant’s processing needs for most of our merchants.

HPS Exchange, Passport and our other technology efforts have contributed to a reduction of our per-transaction processing costs and to a reduction of our costs of services as a percentage of our revenue. Many existing merchants will remain on TSYS Acquiring Solutions (“TSYS”) systems and those of our other third-party processors for front-end services for the duration of their relationship with us. However, we intend to install 85% to 95% of our new merchants on HPS Exchange, and to convert to HPS Exchange as many merchants on third party front ends as possible. Our Internet-based systems allow all of our merchant relationships to be documented and monitored in real time, which maximizes management information and customer service responsiveness. We believe that these systems help attract both new merchants and Relationship Managers and provide us with a competitive advantage over many of our competitors who rely on less flexible legacy systems.

Comprehensive Underwriting and Risk Management System

Through our experience in assessing risks associated with providing payment processing services to small- and medium-size merchants, we have developed procedures and systems that provide risk management and fraud prevention solutions designed to minimize losses. Our underwriting processes help us to evaluate merchant applications and balance the risks of accepting a merchant against the benefit of the bank card processing volume we anticipate the merchant will generate. We believe our systems and procedures enable us to identify potentially fraudulent activity and other questionable business practices quickly, thereby minimizing both our losses and those of our merchants. As evidence of our ability to manage these risks, we experienced losses of no more than 0.54 basis points of bank card processing volume for each of the years ended December 31, 2007, 2006 and 2005, which we believe is significantly lower than industry norms.

Proven Management Team

We have a strong senior management team, each with at least a decade of financial services and payment processing experience. Our Chief Executive Officer, Robert O. Carr, was a founding member of the Electronic Transactions Association, the leading trade association of the bank card acquiring industry. Our management team has developed extensive contacts in the industry and with banks and value-added resellers. Our sales leaders have all sold merchant services for us prior to assuming management roles, and many have been with us throughout most of our first decade of existence. We believe that the strength and experience of our management team has helped us to attract additional sales professionals and add additional merchants, thereby contributing significantly to our growth.

8

Our Strategy

Our current growth strategy is to increase our market share as a provider of payment processing services to small- and medium-size merchants in the United States. We believe that the increasing use of bank cards, combined with our sales and marketing approaches, will continue to present us with significant growth opportunities. Additionally, we intend to grow our payroll processing business, and develop and add new payment products such as Electronic Check Processing, Micro Payments and Campus Solutions. Key elements of our strategy include:

Expand Our Direct Sales Force

Unlike many of our competitors who rely on Independent Sales Organizations or salaried salespeople and telemarketers, we have built a direct, commission-only sales force. We have grown our sales force from 721 Relationship Managers as of December 31, 2005, to 952 and 1,117 Relationship Managers as of December 31, 2006 and 2007, respectively. We anticipate continued growth in our sales force in the next few years in order to increase our share of our target markets, and have targeted achieving a level of 2,000 Relationship Managers within the next four to five years. Our sales model divides the United States into 5 primary markets overseen by Executive Directors of Sales, and further into 17 primary geographic regions overseen by Regional Directors. The Regional Directors are primarily responsible for hiring Relationship Managers and increasing the number of installed merchants in their territory. Our Regional Directors’ compensation is directly tied to the compensation of the Relationship Managers in their territory, providing a significant incentive for them to grow the number and productivity of Relationship Managers in their territory.

Further Penetrate Existing Target Markets and Enter Into New Markets

We believe that we have an opportunity to grow our business by further penetrating the small- and medium-sized merchant market through our direct sales force and alliances with local trade organizations, banks and value-added resellers. During 2006, according to The Nilson Report, we processed approximately 2.3% of the dollar volume of all Visa and MasterCard transactions in the United States, up from approximately 2.2% in 2005, 1.8% in 2004, 1.4% in 2003 and 1.1% in 2002. In December 2007, the restaurant industry represented approximately 38.8% of our bank card processing volume and 53.3% of our transactions. Our bank card merchant base also includes a wide range of merchants, including brick and mortar retailers, lodging establishments, automotive repair shops, convenience and liquor stores and professional service providers. We believe that our sales model, combined with our community-based strategy that involves our Relationship Managers building relationships with various trade groups and other associations in their territory, will enable our Relationship Managers to continuously add new merchants. We intend to further expand our bankcard processing sales efforts into new target markets with relatively low risk characteristics, including markets that have not traditionally accepted electronic payment methods. These markets include governments, schools and the business-to-business market. In addition, the scale economies we have achieved by converting to our own platforms now allows us to profitably compete for the business of larger merchants, and we are now targeting merchants with annual processing volumes of up to $1 billion, compared to our prior maximum of $50-$100 million in processing volume.

Expand Our Services and Product Offerings

In recent years, we have focused on offering a broad set of payment-related products to our customers. In addition to payroll processing services (See “— Our Services and Products — Payroll Services” for a description of these services), our current product offerings include check processing services that allow merchants to electrify paper checks, and prepaid, gift and loyalty card product solutions. In 2006, we added electronic check services (See “— Our Services and Products — Electronic Check Processing Services” for a description of these services) and micropayment systems (See “— Our Services and Products — Micropayment Systems” for a description of these services) to our products. In 2007, we added Campus Solutions (See “— Our Services and Products — Campus Solutions” for a description of these services) to our products.

We also distribute products that will help our merchants reduce their costs and grow their businesses, such as age verification services that track driver’s license data to verify an individual’s age and identity. We may develop new products and services internally, enter into arrangements with third-party providers of these products or selectively acquire new technology and products. Many of these new service offerings are designed to work on the same point-of-sale devices that are currently in use, enabling merchants to purchase a greater volume of their services from us and eliminating their need to purchase additional hardware. We believe that these new products and services will enable us to leverage our existing infrastructure and create opportunities to cross-sell our products and services among our various merchant bases, as well as enhance merchant retention and increase processing revenue.

9

Leverage Our Technology

We intend to continue to leverage our technology to increase our operating efficiencies and provide real-time processing and account data to our merchants, Relationship Managers, Servicing Managers and customer service staff. Since our inception, we have been developing Internet-based systems to improve and streamline our information systems, including detailed customer-use reporting, management reporting, enrollment, customer service, sales management and risk management reporting tools. A significant current initiative will allow merchants to integrate their payment processing data into any of the major small business accounting software packages. We have also made significant investments in our payment processing capabilities, which we believe will allow us to offer a differentiated payment processing product that is faster and less expensive than many competing products.

Enhance Merchant Retention

By providing our merchants with a consistently high level of service and support, we strive to enhance merchant retention. While increased bank card use helps maintain our stable and recurring revenue base, we recognize that our ability to maintain strong merchant relationships is important to our continued growth. We believe that our practice of fully disclosing our pricing policies to our merchants creates goodwill. For example, in 2003, we believe we were one of the few companies that passed along to small- and medium-sized customers a reduction in debit interchange fees that resulted from the settlement of the so-called Wal-Mart lawsuit against Visa and MasterCard. During 2006, we developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants’ processing relationships. The Merchant Bill of Rights allows our sales team to differentiate our approach to bank card processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships.

As discussed in “— Sales,” we have built a group of Servicing Managers who are teamed with Relationship Managers and handle field servicing responsibilities. We have developed a customer management interface that alerts our Relationship Managers and Servicing Managers to any problems a merchant has reported and provides them with detailed information on the merchants in their portfolio. In addition, we believe that the development of a more flexible back-end processing capability, such as Passport provides, will allow us to tailor our services to the needs of our sales force and merchants, which we believe will further enhance merchant retention. Passport will also allow us to enhance the information available to our merchants, and to offer new services to them.

Pursue Strategic Acquisitions

Although we intend to continue to grow through the efforts of our direct sales force, we may also expand our merchant base or gain access to other target markets by acquiring complementary businesses, products or technologies, including other providers of payment processing. Our 2006 acquisition of Debitek, Inc. and 2007 acquisition of General Meters Corp, are examples of expanding by acquiring complementary businesses. We may also consider portfolio acquisitions, especially from commercial banks, which, in an effort to focus on their core competencies, often sell or outsource their payment processing operations.

Our Services and Products

Bank Card Payment Processing

We derive the majority of our revenues from fee income relating to Visa and MasterCard payment processing, which is primarily comprised of a percentage of the dollar amount of each transaction we process, as well as a flat fee per transaction. The percentage we charge is typically a fixed margin over interchange, which is the percentage set by Visa and MasterCard depending on the type of card used and the way the transaction is handled by the merchant. On average, the gross revenue we generate from processing a Visa or MasterCard transaction equals approximately $2.47 for every $100 we process. We also receive fees from American Express,

10

Discover, and JCB for facilitating their transactions with our merchants. Under our new agreement with American Express, our compensation from American Express will change for new merchants signed up to more closely resemble Visa and MasterCard in the second half of 2008.

We receive revenues as compensation for providing bank card payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant support and chargeback resolution. In prior years, we have arranged for certain of these services, particularly merchant accounting, clearing and settlement and a significant portion of our authorization and electronic draft capture services, to be performed by third-party processors (primarily TSYS Acquiring Solutions), while we performed the remaining services in-house. In 2005, we began providing clearing, settlement and accounting services through Passport, our own internally developed back-end processing system. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. At December 31, 2007 and 2006, approximately 98% of our bank card merchants were processing on Passport.

In addition, we sell and rent point-of-sale devices and supplies and provide additional services to our merchants, such as gift and loyalty programs, paper check authorization and chargeback processing. These payment- related services and products are described in more detail below:

Merchant Set-up and Training– After we establish a contract with a merchant, we create the software configuration that is downloaded to the merchant’s existing, newly purchased or rented point-of-sale terminal, cash register or computer. This configuration includes the merchant identification number, which allows the merchant to accept Visa and MasterCard as well as any other cards, such as American Express, Discover and JCB, provided for in the contract. The configuration might also accommodate check verification, gift and loyalty programs and allow the terminal or computer to communicate with a pin-pad or other device. Once the download has been completed by the Relationship Manager or Servicing Manager, we conduct a training session on use of the system. We also offer our merchants flexible low-cost financing options for point-of-sale terminals, including installment sale and monthly rental programs.

Authorization and Draft Capture– We provide electronic payment authorization and draft capture services for all major bank cards. Authorization generally involves approving a cardholder’s purchase at the point of sale after verifying that the bank card is not lost or stolen and that the purchase amount is within the cardholder’s credit or account limit. The electronic authorization process for a bank card transaction begins when the merchant “swipes” the card through its point-of-sale terminal and enters the dollar amount of the purchase. After capturing the data, the point-of-sale terminal transmits the authorization request through HPS Exchange or the third-party processor to the card-issuing bank for authorization. The transaction is approved or declined by the card-issuing bank and the response is transmitted back through HPS Exchange or the third-party processor to the merchant. At the end of each day, and, in certain cases, more frequently, the merchant will “batch out” a group of authorized transactions, transmitting them through us to Visa and MasterCard for payment.

We introduced HPS Exchange, our internally developed front-end processing system, in August 2001. During the years ended December 31, 2007, 2006 and 2005, approximately 75%, 64% and 53%, respectively, of our transactions were processed through HPS Exchange. The remainder of our front-end processing is outsourced to third-party processors, primarily TSYS, but also including First Data Corporation, Chase Paymentech Solutions and Global Payments Inc. Although we will continue to install new merchants on TSYS’ and other third-party processors’ systems, we anticipate that the percentage of transactions that are outsourced to third-party processors will decline as we install a high percentage of new merchants on HPS Exchange, and convert merchants on third party systems to HPS Exchange.

Clearing and Settlement– Clearing and settlement processes, along with Merchant Accounting, represent the “back-end” of a transaction. Once a transaction has been “batched out” for payment, the payment processor transfers the merchant data to Visa or MasterCard who then collect funds from the card issuing banks. This is typically referred to as “clearing.” After a transaction has been cleared, the transaction is “settled” by Visa or MasterCard by payment of funds to the payment processor’s sponsor bank the next day. The payment processor creates an electronic payment file in ACH format for that day’s cleared activity and sends the ACH file to its sponsor bank. The ACH payments system generates a credit to the merchants’ bank accounts for the value of the file. The merchant thereby receives payment for the value of the purchased goods or services, generally two business days after the sale.

11

Passport, our internally developed back-end system, enables us to customize these services to the needs of our merchants and Relationship Managers. For example, in January 2007 we commenced Next Day Funding for merchants who maintain a deposit relationship with Commerce Bank, N.A., in July 2007 we commenced Next Day Funding for merchants who maintain a deposit relationship with Bremer Bank and in December 2007 we commenced Next Day Funding for merchants who maintain a deposit relationship with Heartland Bank (an unrelated third party). Under Next Day Funding, these merchants are paid for their transactions one day earlier than possible when we were processing on a third party back-end platform.

Merchant Accounting– Utilizing Passport, we organize our merchants’ transaction data into various files for merchant accounting and billing purposes. We send our merchants detailed monthly statements itemizing daily deposits and fees, and summarizing activity by bank card type. These detailed statements allow our merchants to monitor sales performance, control expenses, disseminate information and track profitability. We also provide information related to exception item processing and various other information, such as volume, discounts, chargebacks, interchange qualification levels and funds held for reserves to help them track their account activity. Merchants may access this archived information through our customer service representatives or online through our intranet-based customer service reporting system.

Merchant Support Services– We provide merchants with ongoing service and support for their processing needs. Customer service and support includes answering billing questions, responding to requests for supplies, resolving failed payment transactions, troubleshooting and repair of equipment, educating merchants on Visa and MasterCard compliance and assisting merchants with pricing changes and purchases of additional products and services. We maintain a toll-free help-line 24 hours a day, seven days a week, which is staffed by our customer service representatives and during 2007 answered an average of approximately 303,000 customer calls per month. The information access and retrieval capabilities of our intranet-based systems provide our customer service representatives prompt access to merchant account information and call history. This data allows them to quickly respond to inquiries relating to fees, charges and funding of accounts, as well as technical issues.

Chargeback Services – In the event of a billing dispute between a cardholder and a merchant, we assist the merchant in investigating and resolving the dispute as quickly and accurately as possible with card issuers or the bank card networks, which determine the outcome of the dispute. In most cases, before we process a debit to a merchant’s account for the chargeback, we offer the merchant the opportunity to demonstrate to the bank card network or the card issuer that the transaction was valid. If the merchant is unable to demonstrate that the transaction was valid and the dispute is resolved by the bank card network or the card issuer in favor of the cardholder, the transaction is charged back to the merchant. After a merchant incurs three chargebacks in a year, we typically charge our merchants a $25 fee for each subsequent chargeback they incur.

Payroll Processing Services

Through our wholly-owned subsidiary, Heartland Payroll Company, we operate a full-service nationwide payroll processing service. Our payroll services include check printing, direct deposit, related federal, state and local tax deposits and providing accounting documentation. In addition, we offer a “Payday” card, which provides employees who may not have bank accounts with the opportunity to have their payroll deposited to a Visa debit card account. In order to improve operating efficiencies and ease-of-use for our customers and to decrease our own processing costs, we have implemented electronic and paperless payroll processing that allows an employer to submit its periodic payroll information to us via the Internet or through a personal computer-based, direct-connect option. If a customer chooses either of these online options, all reports and interactions between the employer and us can be managed electronically, eliminating the need for cumbersome paperwork. Over 49% of our payroll customers currently submit their information electronically. However, if a customer chooses not to submit their payroll data online, they may submit such information via phone or facsimile. As of December 31, 2007, 2006 and 2005, we provided payroll processing services to 6,209, 4,216 and 2,664 customers, respectively.

12

Electronic Check Processing Services

We offer electronic check processing services, which we refer to as Express Funds, to merchants. Express Funds allows our merchants to quickly and easily scan all of their checks at their place of business, using a scanner sold or rented by us, to capture the image of the front and back of the check, store those images, and transmit the image to us for clearing through banking channels. Our merchants do not have to change their local banking arrangements. We clear checks on their behalf, and deposit collected funds at their own bank as soon as the next banking day. Express Funds also performs security checks and ensures that the image file is balanced before it is sent to us. Merchants benefit from checks clearing a day faster and learning about return items as much as a week faster. The merchant no longer has to manually prepare a deposit slip, photocopy checks, balance all deposits by store, lane, and cashier, or go to the bank to make the deposit. We also offer a later deposit deadline and comprehensive reporting on the status of all checks and deposits. We are currently enhancing this product to automatically post check activity to the merchant’s small business accounting software, which we believe would represent significant improvement in work simplification, particularly for merchants with multiple deposits.

Micropayments

We began providing payment solutions within the small value transaction market in 2006. We also manufacture and sell electronic cash systems utilizing smart (chip) card and off-line magnetic stripe card technology. Our electronic cash systems serve coin-operated vending machines and cash registers within closed-loop environments, such as corporate and university food cafeterias and penitentiaries, and in multi-vendor/multi-application environments. These systems offer consumers convenient ways to either purchase or reload electronic cash cards, ways to spend the value on the card for small value purchases in both attended and unattended point of sale locations, and offer merchants financial settlement between the value (electronic cash card) issuer and the vendor/merchant who accepts the card as payment. We believe that there is increasing consumer demand for, and merchant interest in, card-based solutions for small denomination transactions, and expect to make additional investments in the future in developing solutions in this area.

Campus Solutions

We initiated our campus solutions product in 2007. Our campus solutions product establishes an open network payments solution for a campus to efficiently process electronic transactions. In addition to providing processing and tracking of electronic payments transactions, personal identification and access (including security), and data accumulation, our campus solutions are combined with our Give Something Back Network to offer convenient financial services to the students, faculty, staff and community merchants of an educational institution. The Give Something Back Network provides an Internet and phone accessible debit account to store funds. Our campus solution product uses improved technology to replace traditional plastic identification cards with a Give Something Back Network OneCard and a contactless cell phone tag. These cards and tags can be used to access meal plans, enter buildings, and make cashless payments at campus stores, vending machines, laundry machines, copiers, and at participating merchants in the community. We also manufacture elements of the equipment used in our campus solutions products.

In October 2007, we acquired the assets, business and campus customers of General Meters Corporation, a provider of multi-purpose card systems for college and university campuses. This acquisition provides us with a ready customer base of colleges and universities for our campus solutions product, as well as some of the software and systems required for a complete campus solutions product line.

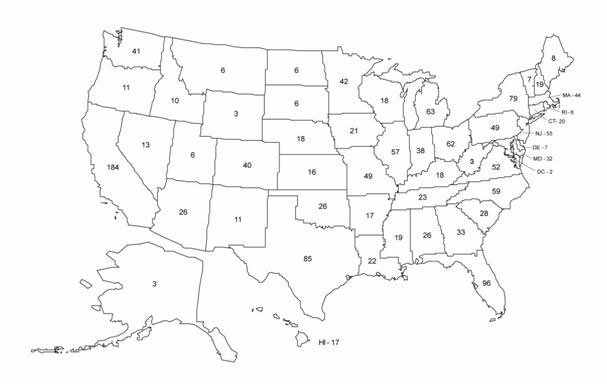

Sales

We sell and market our products and services to merchants through our sales force. As of December 31, 2007, we employed 1,602 Relationship Managers, Servicing Managers and sales managers in 50 states plus the District of Columbia. We have implemented a geographic sales model that divides the United States into 5 primary markets overseen by Executive Directors of Sales subdivided into 17 regions overseen by Regional Directors, who are primarily responsible for hiring Relationship Managers and increasing the number of installed merchants in their territory. Regional Directors may manage their territories through Division Managers and Territory Managers. Division Managers do not sell our products and services. Instead, their sole responsibility is to hire, train and manage Relationship Managers in their territory. In contrast, Territory Managers are Relationship Managers who are also responsible for hiring and training a small number of Relationship Managers in their territory. Our Relationship Managers employ a community-based strategy that involves cold

13

calling, obtaining referrals from existing merchants and building relationships with various trade groups, banks and value-added resellers to create sales opportunities.

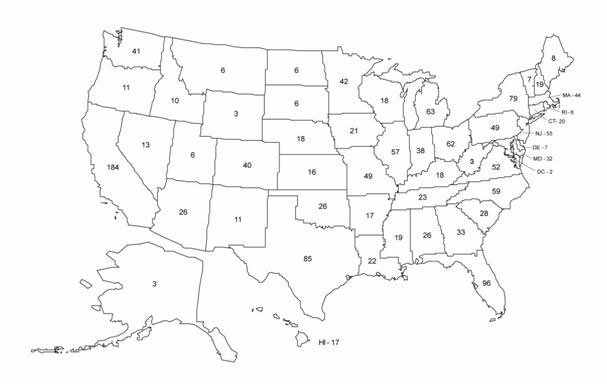

The following graphic sets forth the number of Relationship Managers, Servicing Managers and sales managers we employed by state as of December 31, 2007.

Our compensation structure is designed to motivate our Relationship Managers to establish profitable long-term relationships with low-risk merchants and create a predictable and recurring revenue stream. Compensation for Relationship Managers is entirely commission-based, as a percentage of sales, which are measured in terms of the gross margin we estimate we will receive from the merchant accounts installed, calculated by deducting interchange fees, dues and assessments and all of our costs incurred in underwriting, processing and servicing an account from gross processing revenues. Relationship Managers are permitted to price accounts as they deem appropriate, subject to minimum and maximum gross margin guidelines. The expected volume and pricing are entered into an online margin calculator, which calculates the estimated annual gross margin on the account.

We pay our Relationship Managers, Territory Managers, Division Managers, and Regional Directors a percentage of the gross margin we derive from the payments we process for the merchant accounts they generate and service. Typically, when a new merchant account is signed at an acceptable estimated gross margin level, the Relationship Manager will be paid a signing bonus equal to 50% of the first 12 months’ estimated gross margin. The Relationship Manager will also receive 15% of the gross margin generated from the merchant each month as residual commissions for as long as the merchant remains our customer, and in situations where there is no Servicing Manager assigned to the merchant account, 5% of gross margin is paid for the Relationship Manager’s continued servicing of the account. In addition, the Division Manager will receive an amount equal to 25% of the amount paid to the Relationship Manager, and the Regional Director will receive an amount equal to 25% of the amount paid to the Division Manager. For example, if a merchant account has $1,000 of estimated annual gross margin for the first twelve months and estimated monthly gross margin of $83.33, our sales force would be compensated as follows:

| | | | | | |

Signing Bonus | | | | | | |

Estimated Gross Margin for first 12 months | | $ | 1,000 | | | |

Signing bonus paid to: | | | | | | |

Relationship Manager | | $ | 500 | | 50.0 | % |

Division Manager | | $ | 125 | | 12.5 | % |

Regional Director | | $ | 31 | | 3.125 | % |

Residual Commission: | | | | | | |

Estimated monthly Gross Margin | | $ | 83.33 | | | |

Monthly residual commission paid to: | | | | | | |

Relationship Manager | | $ | 12.50 | | 15.00 | % |

Division Manager | | $ | 3.12 | | 3.75 | % |

Regional Director | | $ | 0.78 | | 0.94 | % |

14

In certain cases, no signing bonus will be paid to a Relationship Manager, but the residual commission is 30% (excluding the 5% servicing fee) of the ongoing monthly gross margin generated by such merchant. For newly hired Relationship Managers, a 75% signing bonus may be paid upon signing a new merchant, but the Relationship Manager will not receive any residual commissions on that merchant’s future processing.

When a Relationship Manager has established merchant relationships that generate the equivalent of $10,000 of monthly gross margin, he or she will be deemed to have a vested equity interest (known as portfolio equity), and will be guaranteed the “owned” portion (all but the 5% servicing portion) of the ongoing monthly gross margin generated by such merchants for as long as the merchant processes with us. See “Management’s Discussion And Analysis of Financial Condition And Results of Operations — Critical Accounting Policies — Accrued Buyout Liability” for more information regarding portfolio equity. At the end of the first 12 months of processing for a new merchant, we compare the actual gross margin generated from that merchant with the estimated gross margin used to calculate the signing bonus. If the merchant was more profitable than expected, we increase the signing bonus amount paid to the Relationship Manager. However, if the merchant was less profitable than anticipated, the Relationship Manager must return a pro-rata portion of his or her signing bonus to us. See “Management’s Discussion And Analysis of Financial Condition And Results of Operations — Critical Accounting Policies — Capitalized Customer Acquisition Costs” for more information regarding signing bonuses.

In 2007, we established the Executive Director of Sales position to provide additional infrastructure and senior sales management support. We created five specific Executive Director territories in the United States (South East, North East, South West/Central, Upper Mid-West / Great Lakes, and West Coast / Pacific Northwest). The Executive Directors have responsibility for executing our sales strategies, and recruiting and training new sales professionals in their respective territories. We compensate our Executive Directors’ on a commission-only basis. Commission levels are based on the year-over-year growth rates achieved in terms of installed gross margin.

Since late 2004, we have built a group of Servicing Managers who are teamed with one or more Relationship Managers to handle the new merchant installation requirements, as well as other servicing responsibilities, for those Relationship Managers. The majority of the Servicing Manager’s compensation represents a shift of the 5% servicing portion associated with the merchants he or she is servicing and is paid to the Servicing Manager in the form of a base salary and bonus. We believe that the creation of the Servicing Manager role allows the Relationship Managers to leverage his or her sales efforts, while allowing us to offer merchants two local relationship contacts including a Servicing Manager who is more attuned to the merchants’ service needs. At December 31, 2007 and 2006, we had 240 and 224 Servicing Managers, respectively.

15

In addition to our commission-based compensation structure, we use various sales contests to reward strong sales performance. Sales compensation in connection with these contests includes stock options, trips and incentive points. In 2007, we implemented a points based incentive program. Under this program, we award our sales persons and sales managers specific point values for achieving exemplary year-over-year sales growth in installed gross margin and for achieving targets for multi-product sales. These points are redeemable for custom rewards, such as travel, personal goods, and business tools. We also award stock options to our sales persons and sales managers who achieve significant, targeted growth in the realized gross margin in their territory. During the years ended December 31, 2007, 2006 and 2005, our Board of Directors authorized and issued options to purchase an aggregate of 49,233, 112,878 and 455,381 shares of our common stock, respectively, to some of our sales persons and sales managers as part of these contests. Options granted in connection with these contests in 2007 represented 15.6% of the total options awarded, in 2006 represented 53.1% of the total options awarded, and in 2005 represented 34.4% of the options awarded.

Marketing

Our marketing efforts have historically focused on industry verticals and marketing partnerships. We focus our marketing efforts on industries in which we believe our direct sales model is most effective and on merchants with certain key attributes. These attributes include owners who are typically on location, interact with customers, value a local sales presence, and consult with trade associations and other civic groups to make purchasing decisions. We also determine which additional markets to enter into based on the following criteria:

| | • | | average potential customer revenue; |

| | • | | number of locations to be serviced; |

| | • | | required technological upgrades. |

We have focused significantly on the hospitality industry and, in particular, independent restaurants. The number of independent restaurants to which we provide our products and services were 46,700 as of December 31, 2007 and 42,700 as of December 31, 2006. In December 2007, the restaurant industry represented approximately 38.8% of our bank card processing volume and 53.3% of our transactions. In December 2006 and December 2005, the restaurant industry represented approximately 40.3% and 40.2% of our bank card processing volume and 54.8% and 54.3% of our transactions, respectively. In addition to restaurants, our merchant base includes brick and mortar retailers, lodging establishments, automotive repair shops, convenience and liquor stores, and professional service providers.

We have historically had success in marketing our products and services through relationships with key trade associations, agent banks and value-added resellers.

Trade Associations

As of December 31, 2007, we had endorsement agreements with 130 trade associations, the majority of which are in the hospitality industry. Of these endorsements, over 30 are state restaurant associations and another 30 are state lodging associations. Our agreements with trade associations typically include our commitment to be a member of the association, a sponsor of the association’s events and an advertiser in the association’s publications. In exchange for an association’s endorsement of our products and services, upon the installation of a new merchant that is a member of the association we pay the trade association a portion of the signing bonus or residual payments that otherwise would be paid to the Relationship Manager responsible for that merchant. In 2007, several associations have migrated from that revenue sharing model to a business development model, under which we act as distribution for our association partner by selling their association memberships to our prospective merchants. In these cases, our Relationship Managers receive commissions for their successful sales efforts paid out of the first year membership dues paid to the association.

Agent Banks

Many community banks find it difficult to provide their merchant servicing personnel with the training and support they need to serve their customer base, and to assume transaction risk. As a result, some of these

16

banks enter into arrangements with payment processors to service their merchant portfolios. We currently provide these services to over 325 community banks in the United States. In exchange for a bank’s endorsement of our products and services, upon the installation of a new merchant referred by the bank we typically pay the bank a portion of the signing bonus or residual payment that otherwise would be paid to the Relationship Manager responsible for that merchant.

Additionally, we have entered into arrangements with Commerce Bank (Cherry Hill, NJ), Heartland Bank (St. Louis, MO) and Bremer Bank (St. Paul, MN) providing for the conversion of their merchant processing customers onto our processing systems. These relationships are cross-referral, so that we and the banks benefit from these arrangements by gaining access to new customers. The banks retain existing deposit relationships and add new deposit relationships as new merchants are signed up. Merchants who maintain deposit relationships with these banks gain Next Day Funding for their bankcard transaction processing. Under Next Day Funding, these merchants are paid for their transactions one day earlier than is typically available.

Value-Added Resellers and Third-Party Software Providers

In order to further market our products and services, we enter into arrangements with value-added resellers and third-party software developers. Value-added resellers typically sell complementary products and services such as hardware and software applications and point-of-sale hardware, software and communication network services to merchants in markets similar to ours. Our agreements with value-added resellers provide that, in exchange for their endorsement of our products and services and upon the installation of a new merchant referred by them we will pay the value-added reseller a portion of the signing bonus and residual payment that otherwise would be paid to the Relationship Manager responsible for that merchant. As we continue to expand our product offerings, we intend to introduce capabilities that will allow our systems to be compatible with those of our value-added resellers and other third-party software developers, enabling them to embed our payment modules within their systems. As of December 31, 2007, we had arrangements with over 1,200 value-added resellers and referral services providers, including agreements with many third-party developers in the hospitality industry. From time to time, we have also entered into direct alliances with original equipment manufacturers and vendors.

In 2007, in addition to the above-focused marketing efforts, we continued to enhance the visibility of The Merchant Bill of Rights, an advocacy initiative that educates business owners about the complexities and costs of card acceptance. In launching and endorsing The Merchant Bill of Rights in 2006, we committed to supporting full disclosure regarding pricing and the existence of any transaction middlemen, and for provision of dedicated customer support and high levels of security and fraud monitoring. This initiative has been very well received in the merchant community, and many organizations have endorsed its principles. We believe we are uniquely positioned to commit to such high customer service standards, and that our focus on this approach will continue fostering success at establishing a payment processing brand that is not easily duplicated by competitors using indirect sales models, or who do not match our focus.

Relationships with Sponsors and Processors

In order to provide payment processing services for Visa and MasterCard transactions, we must be sponsored by a financial institution that is a principal member of the Visa and MasterCard networks. The sponsor bank must register us with Visa as an Independent Sales Organization and with MasterCard as a Member Service Provider. We also contract with third-party processors to provide critical payment processing services.

Sponsor Banks

Our primary sponsor bank is KeyBank, National Association, referred to as “KeyBank” in this document. We currently have an agreement with KeyBank to sponsor us for membership in the Visa and MasterCard networks. Under this agreement, KeyBank settles bank card transactions for our merchants, and also funds our merchants the portion of our daily interchange expenses that we do not fund from our own cash. Either KeyBank or we can terminate the agreement if the other party materially breaches the agreement, including non-payment of fees due for processing our monthly settlement of transactions. The agreement may also be terminated if the other party enters bankruptcy or files for bankruptcy, if either party is required to discontinue

17

performing its services under the agreement based upon a final order of a state or federal court or regulatory body or if there is a change in the majority ownership of the other party. KeyBank may terminate the agreement with us if we breach the by-laws and regulations of Visa or MasterCard, if either our registration or KeyBank’s membership with Visa or MasterCard terminates, if any federal or state regulatory authority requests that the agreement be terminated or that KeyBank terminate its services or if applicable laws or regulations change to prevent KeyBank from performing its services under the agreement. Upon termination of the agreement for any reason, we will have 180 days to convert to another sponsor bank. Although we expect that we would be able to secure a new sponsor bank, the cost of entering into a new sponsorship agreement may be different than under our current agreement with KeyBank. We entered into the agreement with KeyBank on April 1, 1999 and it expires in March 2009.

In 2007, we entered into a second sponsor bank agreement, this one with Heartland Bank, which is based in Saint Louis, Missouri. Heartland Bank is not related to, or associated with Heartland Payment Systems. Our agreement with Heartland Bank involves substantially the same terms as apply with KeyBank. We expect to enter into additional sponsor bank relationships in the future.

Third-Party Processors

We have agreements with several third-party processors to provide to us on a non-exclusive basis payment processing and transmittal, transaction authorization and data capture services, and access to various reporting tools. These third-party processors include TSYS, First Data Corporation, Chase Paymentech Solutions and Global Payments, Inc. Our agreements with third-party processors require us to submit a minimum monthly number of transactions or volume for processing. If we submit a number of transactions or volume that is lower than the minimum, we are required to pay them the fees that they would have received if we had submitted the required minimum number or volume of transactions. The majority of our agreements with third-party processors may be terminated by the third-party processors if we materially breach certain sections of the agreements, including our failure to pay fees due, and we do not cure the breach within 30 days, if our registration with Visa or MasterCard terminates, or if we enter bankruptcy or file for bankruptcy.

Our Merchant Base

While restaurants represent a significant portion of our merchant base, we also provide payment processing services to a wide variety of merchants, primarily those merchants whose typical customer is present when using a bank card to pay for products or services. As of December 31, 2007, we provided bank card payment processing services to approximately 154,750 active bank card merchant locations across the United States, an increase of 16.2% from the approximately 133,200 merchant locations as of December 31, 2006. We focus primarily on small- and medium-sized merchants, which we define as generating annual Visa and MasterCard bank card processing volume between $50,000 and $5,000,000. With the added functionality and costs benefits that our back-end processing system, Passport, affords us, we have begun marketing to merchants with processing volume above $5,000,000.

18

The following chart summarizes our processing volume by merchant category for the month of December 2007, compared to the months of December 2006 and December 2005.