Key sources of operating cash flows were our net income as adjusted for changes in deferred taxes, plus fair value adjustments on warrants, depreciation and amortization, less a gain on settlement of a financing arrangement in 2005. Contained within changes in operating assets and liabilities is the increase in receivables, which is typically offset by changes in due to sponsor bank and accounts payable. This offset occurs because our largest receivable is from our merchants and is primarily associated with the practice of having our sponsor bank advance interchange fees to most of our merchants. This practice results in our largest operating payable, “due to sponsor bank.” In August 2005, we began using a portion of our available cash to fund the advances of interchange fees to our merchants, thereby using operating cash to pay down our payable to our sponsor bank. In future periods, these advances to our merchants will be funded first with our available cash, then by incurring a payable to our sponsor bank when that cash has been expended. The payable to the sponsor bank is repaid at the beginning of the following month out of the fees we collect from our merchants.

The other major determinants of operating cash flow are increases in capitalized customer acquisition costs, which consume increasing amounts of operating cash as our new merchant installation activity rises, and payouts on the accrued buyout liability, which represent the costs of buying out residual commissions owned by our salespersons. See “— Critical Accounting Estimates — Capitalized Customer Acquisition Costs” and “— Critical Accounting Estimates — Accrued Buyout liability” for more information. Included in the amount of cash consumed by increases in capitalized customer acquisition costs are net signing bonus payments of $21.8 million, $20.1 million and $12.3 million, respectively, in 2005, 2004 and 2003. In 2005, 2004 and 2003, we reduced the accrued buyout liability by making buyout payments of $13.5 million, $2.2 million and $4.7 million, respectively. Included in the $13.5 million of buyout payments in 2005 was $3.8 million used by salespersons who participated in the PEPShares Plan to exercise their options to acquire 677,544 shares of our common stock.

During 2005, 2004 and 2003, we paid down financing arrangements and borrowings in the amounts of $7.5 million, $2.9 million and $4.1 million, respectively, including in 2005 a cash payment of $3.0 million to reacquire 2,400 merchant contracts and fully extinguish our obligations under a related financing arrangement and $2.9 million to repay credit facilities. In January 2004, we made the final payment of $250,000 on a note issued in a 2002 acquisition.

On January 8, 2004, a warrant holder elected to exercise their put option, and we redeemed half of the holder’s warrants, or 168,906 shares, at the deemed fair value of $6.25 per share. The exercise price of the warrants was $0.005 per warrant and net consideration paid by us was $1.1 million. On August 16, 2005, the closing date of our initial public offering, the warrant holder exercised its rights to acquire the remaining 168,904 shares at the exercise price of $0.005 per share.

On September 28, 2004, we redeemed six warrants totaling 2,000,000 shares of our common stock for net consideration of $5.25 million.

During 2005, employees exercised their Equity Incentive Plan stock options and PEPShares Plan options generating cash in the aggregate amount of $9.0 million. During 2004, employee exercises of stock options generated cash of $1.6 million.

Common Stock Repurchases. During 2005, we repurchased 22,000 shares of our common stock at an average price of $22.53 per share.

On January 13, 2006, our Board of Directors authorized management to repurchase up to the lesser of (a) 1,000,000 shares of our common stock or (b) $25,000,000 worth of our common stock in the open market. We intend to use the authorization to repurchase shares opportunistically as a means of offsetting dilution from the issuance of shares under our employee benefit plans. We have no obligation to repurchase shares under the authorization, and the specific timing and amount of the common stock repurchase will vary based on market conditions, securities law limitations and other factors. The common stock repurchase will be executed utilizing our cash resources including the proceeds received from the exercise of stock options.

Credit Facilities. On August 28, 2002, we signed a Loan and Security Agreement with KeyBank National Association for two loan instruments. We amended this Agreement on November 6, 2003, June 23, 2004, and May 26, 2005. The Agreement was amended twice to reflect changes we made in our accounting policies.

The first instrument was a revolver advance facility, which we had used solely to fund the buyouts of residual commissions from our salespersons. Borrowings on the revolver could not exceed $3,500,000. The revolver accrued interest at a rate equal to the prime rate and was secured by a lien against our assets. We repaid the entire outstanding principal balance of $2.1 million plus all accrued interest and fees on August 17, 2005 and the revolver expired in accordance with its terms.

The second instrument was a purpose and ability line of credit totaling $3.0 million, which was payable on demand. The line of credit accrued interest at the prime rate and was secured by a lien on our assets. We repaid the entire principal balance of $784,000 plus all accrued interest and fees on August 17, 2005 and the line of credit expired in accordance with its terms.

Contractual Obligations. The Visa and MasterCard associations generally allow chargebacks up to four months after the later of the date the transaction is processed or the delivery of the product or service to the cardholder. If the merchant incurring the chargeback is unable to fund the refund to the card issuing bank, we must do so. As the majority of our transactions involve the delivery of the product or service at the time of the transaction, a good basis to estimate our exposure to chargebacks is the last four months’ processing volume on our portfolio, which was $12.0 billion, $9.0 billion and $6.6 billion for the four months ended December 31, 2005, 2004 and 2003, respectively. However, during the four months ended December 31, 2005, 2004 and 2003, we were presented with $6.6 million, $5.6 million and $5.4 million, respectively, of chargebacks by issuing banks. In the 2005, 2004 and 2003, we incurred merchant credit losses related to chargebacks of $1,206,000, $940,000 and $605,000, respectively, on total dollar volume processed of $33.7 billion, $25.0 billion and $17.9 billion, respectively. These credit losses are included in processing and servicing expense in our consolidated statements of income.

48

The following table reflects our significant contractual obligations as of December 31, 2005:

| | Payments Due by Period as of December 31, 2005 | |

| |

| |

Contractual Obligations | | Total | | Less than

1 year | | 1 to 3 years | | 3 to 5 years | | More than

5 years | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | (in thousands) | |

Processing providers | | $ | 5,785 | | $ | 2,915 | | $ | 2,510 | | $ | 360 | | $ | — | |

Financing arrangement (expected payments, including interest) | | | 451 | | | 275 | | | 176 | | | — | | | — | |

Telecommunications providers | | | 7,129 | | | 3,702 | | | 3,427 | | | — | | | — | |

Office and equipment leases | | | 6,877 | | | 1,735 | | | 2,607 | | | 1,278 | | | 1,257 | |

Land, construction and equipment(a) | | | 3,045 | | | 2,838 | | | 207 | | | — | | | — | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 23,287 | | $ | 11,465 | | $ | 8,927 | | $ | 1,638 | | $ | 1,257 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

(a) | Amounts related to acquiring land and constructing our new Service Center in Jeffersonville, Indiana. Additional contractual commitments will be entered into as we progress with the development of this site. |

In addition, we record a payable to KeyBank each month in conjunction with our monthly processing activities. This amount was $34.5 million and $45.2 million as of December 31, 2005 and 2004, respectively. This amount is repaid on the first business day of the following month out of the fees collected from our merchants.

Off-Balance Sheet Arrangements

We have not entered into any transactions with third parties or unconsolidated entities whereby we have financial guarantees, subordinated retained interest, derivative instruments, or other contingent arrangements that expose us to material continuing risks, contingent liabilities, or other obligations other than for chargebacks and reject losses described under “— Critical Accounting Estimates.”

Quantitative and Qualitative Disclosures About Market Risk

Our primary market risk exposure is to changes in interest rates. During each month, KeyBank advances interchange fees to most of our merchants. We fund these advances first by applying a portion of our available cash and then by incurring a significant payable to KeyBank, bearing interest at the prime rate. At December 31, 2005, our payable to KeyBank was approximately $34.5 million. This payable is repaid on the first business day of the following month out of fees collected from our merchants. During the quarter ended December 31, 2005 the average daily interest-bearing balance of that payable was approximately $6.1 million. The outstanding balance of our payable to KeyBank is directly related to our processing volume and also will fluctuate depending on the amount of our available cash. A hypothetical 100 basis point change in short-term interest rates applied to our average payable to KeyBank would result in a change of approximately $61,000 in annual pre-tax income.

While the bulk of our cash and cash-equivalents are held in checking accounts or money market funds, we do hold certain fixed-income investments with maturities of up to three years. At December 31, 2005, a hypothetical 100 basis point increase in short-term interest rates would result in an increase of approximately $23,000 in annual pre-tax income from money market fund holdings, but a decrease in the value of fixed-rate investments of approximately $20,000. A hypothetical 100 basis point decrease in short-term interest rates would result in a decrease of approximately $23,000 in annual pre-tax income from money market funds, but an increase in the value of fixed-rate instruments of approximately $20,000.

We do not hold or engage in the trading of derivative financial, commodity or foreign exchange instruments. All of our business is conducted in U.S. dollars.

49

Recent Accounting Pronouncements

In December 2004, the FASB issued SFAS No. 123 (revised 2004), Share-Based Payment (‘‘SFAS No. 123 revised’’), a revision of SFAS No. 123, Accounting for Stock-Based Compensation. In April 2005, the SEC delayed the effective date for SFAS No. 123 revised until the first fiscal year beginning after June 15, 2005. The most significant change resulting from this statement is the requirement for public companies to expense employee share-based payments under fair value as originally introduced in SFAS No. 123. We adopted SFAS No. 123 revised on January 1, 2006. As an effect of adopting SFAS No. 123 revised, we will recognize compensation expense for the amortization of the fair value of stock options which were granted prior to January 1, 2006 and have service periods continuing into 2006 and beyond. The amount of compensation expense to be recognized in 2006 and beyond is approximately $ 1.3 million, of which approximately $0.8 million will be recognized as compensation expense in 2006.

ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Quantitative and Qualitative Disclosures About Market Risk.”

ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

Index to Consolidated Financial Statements

Heartland Payment Systems, Inc. and Subsidiary:

50

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| To the Board of Directors and Stockholders of |

| Heartland Payment Systems, Inc. |

| |

| We have audited the accompanying consolidated balance sheets of Heartland Payment Systems, Inc. and Subsidiary (the “Company”) as of December 31, 2005 and 2004, and the related consolidated statements of income, stockholders’ equity (deficit), and cash flows for each of the three years in the period ended December 31, 2005. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. |

| |

| We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. |

| |

| In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2005 and 2004, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2005 in conformity with accounting principles generally accepted in the United States of America. |

| |

| /s/ Deloitte & Touche LLP |

| |

| Princeton, New Jersey |

| March 10, 2006 |

51

Heartland Payment Systems, Inc. and Subsidiary

Consolidated Balance Sheets

(In thousands, except share data)

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

Assets | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | $ | 17,747 | | $ | 13,237 | |

Receivables, net | | | 93,756 | | | 64,325 | |

Investments | | | 2,141 | | | 1,100 | |

Inventory | | | 714 | | | 818 | |

Prepaid expenses | | | 1,979 | | | 2,151 | |

Current deferred tax assets, net | | | 1,492 | | | 2,129 | |

| |

|

| |

|

| |

Total current assets | | | 117,829 | | | 83,760 | |

Capitalized customer acquisition costs, net | | | 42,930 | | | 34,247 | |

Deferred tax assets, net | | | 3,477 | | | 4,651 | |

Property and equipment, net | | | 17,661 | | | 10,944 | |

Deposits and other assets | | | 186 | | | 324 | |

| |

|

| |

|

| |

Total assets | | $ | 182,083 | | $ | 133,926 | |

| |

|

| |

|

| |

Liabilities and stockholders’ equity | | | | | | | |

Current liabilities: | | | | | | | |

Due to sponsor bank | | $ | 34,530 | | $ | 45,153 | |

Accounts payable | | | 25,339 | | | 27,103 | |

Current portion of accrued buyout liability | | | 10,478 | | | 9,327 | |

Merchant deposits and loss reserves | | | 7,450 | | | 7,175 | |

Accrued expenses and other liabilities | | | 5,805 | | | 6,701 | |

Current portion of borrowings and financing arrangements | | | 261 | | | 5,286 | |

| |

|

| |

|

| |

Total current liabilities | | | 83,863 | | | 100,745 | |

Long-term portion of borrowings and financing arrangements | | | 173 | | | 7,808 | |

Long-term portion of accrued buyout liability | | | 17,996 | | | 17,708 | |

Warrants with mandatory redemption provisions | | | — | | | 1,566 | |

| |

|

| |

|

| |

Total liabilities | | | 102,032 | | | 127,827 | |

| |

|

| |

|

| |

Commitments and contingencies (Note 15) | | | — | | | — | |

Stockholders’ equity | | | | | | | |

Series A Senior Convertible Participating Preferred Stock, $80 million liquidation preference, $.001 par value, 10,000,000 shares authorized, 7,619,048 shares issued and outstanding at December 31, 2004 | | | — | | | 8 | |

Common Stock, $.001 par value, 100,000,000 shares authorized, 34,222,114 shares issued, 34,200,114 outstanding at December 31, 2005 and 16,437,760 issued and outstanding at December 31, 2004 | | | 34 | | | 8 | |

Additional paid-in capital | | | 96,417 | | | 41,065 | |

Accumulated other comprehensive loss | | | (26 | ) | | (10 | ) |

Accumulated deficit | | | (15,879 | ) | | (34,972 | ) |

Treasury stock, at cost (22,000 shares at December 31, 2005) | | | (495 | ) | | — | |

| |

|

| |

|

| |

Total stockholders’ equity | | | 80,051 | | | 6,099 | |

| |

|

| |

|

| |

Total liabilities and stockholders’ equity | | $ | 182,083 | | $ | 133,926 | |

| |

|

| |

|

| |

See accompanying notes to consolidated financial statements.

52

Heartland Payment Systems, Inc. and Subsidiary

Consolidated Statements of Income

(In thousands, except per share data)

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

Total Revenues | | $ | 834,577 | | $ | 602,749 | | $ | 422,237 | |

| |

|

| |

|

| |

|

| |

Costs of Services: | | | | | | | | | | |

Interchange | | | 611,736 | | | 438,738 | | | 302,057 | |

Dues and assessments | | | 31,491 | | | 23,348 | | | 15,945 | |

Processing and servicing | | | 87,668 | | | 70,232 | | | 50,805 | |

Customer acquisition costs | | | 28,025 | | | 18,908 | | | 13,380 | |

Depreciation and amortization | | | 5,685 | | | 3,912 | | | 2,571 | |

| |

|

| |

|

| |

|

| |

Total costs of services | | | 764,605 | | | 555,138 | | | 384,758 | |

General and administrative | | | 37,761 | | | 31,501 | | | 25,751 | |

| |

|

| |

|

| |

|

| |

Total expenses | | | 802,366 | | | 586,639 | | | 410,509 | |

| |

|

| |

|

| |

|

| |

Income from operations | | | 32,211 | | | 16,110 | | | 11,728 | |

| |

|

| |

|

| |

|

| |

Other income (expense): | | | | | | | | | | |

Interest income | | | 724 | | | 182 | | | 124 | |

Interest expense | | | (1,553 | ) | | (1,385 | ) | | (1,188 | ) |

Fair value adjustment for warrants with mandatory redemption provisions | | | (2,912 | ) | | (509 | ) | | (893 | ) |

Gain on settlement of financing arrangement | | | 5,140 | | | — | | | — | |

Other, net | | | 198 | | | 833 | | | (740 | ) |

| |

|

| |

|

| |

|

| |

Total other income (expense) | | | 1,597 | | | (879 | ) | | (2,697 | ) |

| |

|

| |

|

| |

|

| |

Income before income taxes | | | 33,808 | | | 15,231 | | | 9,031 | |

Provision for income taxes | | | 14,715 | | | 6,376 | | | (11,102 | ) |

| |

|

| |

|

| |

|

| |

Net income | | | 19,093 | | | 8,855 | | | 20,133 | |

Income allocated to Series A Senior Convertible Participating Preferred Stock | | | (4,728 | ) | | (4,263 | ) | | (9,843 | ) |

| |

|

| |

|

| |

|

| |

Net income attributable to Common Stock | | $ | 14,365 | | $ | 4,592 | | $ | 10,290 | |

| |

|

| |

|

| |

|

| |

Net income | | $ | 19,093 | | $ | 8,855 | | $ | 20,133 | |

Other comprehensive income, net of tax: Unrealized losses on investments | | | (16 | ) | | (13 | ) | | (14 | ) |

| |

|

| |

|

| |

|

| |

Comprehensive income | | $ | 19,077 | | $ | 8,842 | | $ | 20,119 | |

| |

|

| |

|

| |

|

| |

Earnings per common share: | | | | | | | | | | |

Basic | | $ | 0.62 | | $ | 0.28 | | $ | 0.65 | |

Diluted | | $ | 0.50 | | $ | 0.26 | | $ | 0.62 | |

Weighted average number of common shares outstanding: | | | | | | | | | | |

Basic | | | 23,069 | | | 16,408 | | | 15,932 | |

Diluted | | | 37,879 | | | 33,786 | | | 32,231 | |

See accompanying notes to consolidated financial statements.

53

Heartland Payment Systems, Inc. and Subsidiary

Consolidated Statements of Stockholders’ Equity (Deficit)

(In thousands)

| | Preferred Stock | | Common Stock | | | | |

| |

| |

| | | | |

| | Number of

Shares

Outstanding | | Amount | | Number of

Shares

Outstanding | | Amount | | Warrants | |

| |

| |

| |

| |

| |

| |

Balance, January 1, 2003 | | | — | | $ | — | | | 15,752 | | $ | 8 | | $ | 1,500 | |

Issuance of Common Stock for earnout and buyout liabilities | | | — | | | — | | | 267 | | | — | | | — | |

Issuance of Common Stock — options exercised | | | — | | | — | | | 2 | | | — | | | — | |

Repurchase of Common Stock | | | — | | | — | | | (2 | ) | | — | | | — | |

Accumulated other comprehensive loss | | | — | | | — | | | — | | | — | | | — | |

Net income for the year | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance December 31, 2003 | | | — | | $ | — | | | 16,019 | | $ | 8 | | $ | 1,500 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Reclassification of Series A Senior Convertible Participating Preferred Stock to Stockholders’ equity | | | 7,619 | | | 8 | | | — | | | — | | | — | |

Issuance of Common Stock — options exercised | | | — | | | — | | | 554 | | | — | | | — | |

Redemption of warrants issued in connection with Series A Senior Convertible Participating Preferred Stock | | | — | | | — | | | — | | | — | | | (1,500 | ) |

Repurchase of Common Stock | | | — | | | — | | | (135 | ) | | — | | | — | |

Deferred compensation on accelerated vesting of options | | | — | | | — | | | — | | | — | | | — | |

Accumulated other comprehensive loss | | | — | | | — | | | — | | | — | | | — | |

Net income for the year | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance, December 31, 2004 | | | 7,619 | | $ | 8 | | | 16,438 | | $ | 8 | | $ | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Issuance of Common Stock — options exercised | | | — | | | — | | | 1,523 | | | 2 | | | — | |

Issuance of Common Stock on initial public offering | | | — | | | — | | | 2,759 | | | 3 | | | — | |

Accumulated other comprehensive income | | | — | | | — | | | — | | | — | | | — | |

Conversion of preferred stock | | | (7,619 | ) | | (8 | ) | | 13,333 | | | 13 | | | — | |

Two for one stock split | | | — | | | — | | | — | | | 8 | | | — | |

Repurchase of Common Stock | | | — | | | — | | | (22 | ) | | — | | | — | |

Exercise of warrants | | | — | | | — | | | 169 | | | — | | | — | |

Net income for the year | | | — | | | — | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance, December 31, 2005 | | | — | | $ | — | | | 34,200 | | $ | 34 | | $ | — | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

(continued next page)

54

Heartland Payment Systems, Inc. and Subsidiary

Consolidated Statements of Stockholders’ Equity (Deficit) – (Continued)

(In thousands)

| | Additional

Paid-In

Capital | | Accumulated

Other Comprehensive

Income (Loss) | | Accumulated Deficit | | Treasury Stock | | Total

Stockholders’

Equity

(Deficit) | |

| |

| |

| |

| |

| |

| |

Balance, January 1, 2003 | | $ | — | | $ | 17 | | $ | (63,960 | ) | $ | — | | $ | (62,435 | ) |

Issuance of Common Stock for earnout and buyout liabilities | | | 998 | | | — | | | — | | | — | | | 998 | |

Issuance of Common Stock — options exercised | | | 11 | | | — | | | — | | | — | | | 11 | |

Repurchase of Common Stock | | | (8 | ) | | — | | | — | | | — | | | (8 | ) |

Accumulated other comprehensive loss | | | | | | (14 | ) | | — | | | — | | | (14 | ) |

Net income for the year | | | | | | — | | | 20,133 | | | — | | | 20,133 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance December 31, 2003 | | $ | 1,001 | | $ | 3 | | $ | (43,827 | ) | $ | — | | $ | (41,315 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Reclassification of Series A Senior Convertible Participating Preferred Stock to Stockholders’ equity | | | 43,393 | | | — | | | — | | | — | | | 43,401 | |

Issuance of Common Stock — options exercised | | | 1,584 | | | — | | | — | | | — | | | 1,584 | |

Redemption of warrants issued in connection with Series A Senior Convertible Participating Preferred Stock | | | (3,750 | ) | | — | | | — | | | — | | | (5,250 | ) |

Repurchase of Common Stock | | | (1,231 | ) | | — | | | — | | | — | | | (1,231 | ) |

Deferred compensation on accelerated vesting of options | | | 68 | | | — | | | — | | | — | | | 68 | |

Accumulated other comprehensive loss | | | — | | | (13 | ) | | — | | | — | | | (13 | ) |

Net income for the year | | | — | | | — | | | 8,855 | | | — | | | 8,855 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance, December 31, 2004 | | $ | 41,065 | | $ | (10 | ) | $ | (34,972 | ) | $ | — | | $ | 6,099 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Issuance of Common Stock — options exercised | | | 9,178 | | | — | | | — | | | — | | | 9,180 | |

Issuance of Common Stock on initial public offering | | | 41,709 | | | — | | | — | | | — | | | 41,712 | |

Accumulated other comprehensive loss | | | — | | | (16 | ) | | — | | | — | | | (16 | ) |

Conversion of preferred stock | | | (5 | ) | | — | | | — | | | — | | | — | |

Two for one stock split | | | (8 | ) | | — | | | — | | | — | | | — | |

Repurchase of Common Stock | | | — | | | — | | | — | | | (495 | ) | | (495 | ) |

Exercise of warrants | | | 4,478 | | | — | | | — | | | — | | | 4,478 | |

Net income for the year | | | — | | | — | | | 19,093 | | | — | | | 19,093 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Balance, December 31, 2005 | | $ | 96,417 | | $ | (26 | ) | $ | (15,879 | ) | $ | (495 | ) | $ | 80,051 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

See accompanying notes to consolidated financial statements.

55

Heartland Payment Systems, Inc. and Subsidiary

Consolidated Statements of Cash Flow

(In thousands)

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

Cash flows from operating activities | | | | | | | | | | |

Net income | | $ | 19,093 | | $ | 8,855 | | $ | 20,133 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | |

Amortization of capitalized customer acquisition costs | | | 24,636 | | | 18,811 | | | 12,467 | |

Other depreciation and amortization | | | 5,695 | | | 3,927 | | | 2,927 | |

Fair value adjustment for warrants with mandatory redemption provisions | | | 2,912 | | | 509 | | | 893 | |

Gain on settlement of financing arrangement | | | (5,140 | ) | | — | | | — | |

Deferred taxes | | | 1,811 | | | 4,687 | | | (11,467 | ) |

Other | | | 33 | | | 68 | | | 64 | |

Changes in operating assets and liabilities: | | | | | | | | | | |

Increase in receivables | | | (29,431 | ) | | (19,391 | ) | | (11,499 | ) |

Decrease in inventory | | | 104 | | | 147 | | | 349 | |

Payment of signing bonuses, net | | | (21,788 | ) | | (20,137 | ) | | (12,294 | ) |

Increase in capitalized customer acquisition costs | | | (11,531 | ) | | (10,600 | ) | | (7,623 | ) |

Decrease (increase) in prepaid expenses | | | 172 | | | (1,796 | ) | | 254 | |

Decrease in deposits and other assets | | | 1 | | | 262 | | | 95 | |

(Decrease) increase in due to sponsor bank | | | (10,623 | ) | | 10,928 | | | 7,906 | |

(Decrease) increase in accounts payable | | | (1,764 | ) | | 9,180 | | | 3,209 | |

(Decrease) increase in accrued expenses and other liabilities | | | (667 | ) | | 1,013 | | | 1,591 | |

Increase (decrease) in merchant deposits and loss reserves | | | 275 | | | 2,414 | | | (407 | ) |

Payouts of accrued buyout liability | | | (13,481 | ) | | (2,213 | ) | | (4,740 | ) |

Increase in accrued buyout liability | | | 14,920 | | | 11,263 | | | 10,179 | |

| |

|

| |

|

| |

|

| |

Net cash (used in) provided by operating activities | | | (24,773 | ) | | 17,927 | | | 12,037 | |

| |

|

| |

|

| |

|

| |

Cash flows from investing activities | | | | | | | | | | |

Purchase of investments | | | (1,544 | ) | | (120 | ) | | (310 | ) |

Maturities of investments | | | 487 | | | 362 | | | 469 | |

Purchases of property and equipment | | | (12,337 | ) | | (9,115 | ) | | (3,666 | ) |

Proceeds from disposal of property and equipment | | | 27 | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Net cash used in investing activities | | | (13,367 | ) | | (8,873 | ) | | (3,507 | ) |

| |

|

| |

|

| |

|

| |

Cash flows from financing activities | | | | | | | | | | |

Redemption of warrants issued in connection with debt financing | | | — | | | (1,055 | ) | | — | |

Redemption of warrants issued in connection with Series A Senior Convertible Participating Preferred Stock | | | — | | | (5,250 | ) | | — | |

Principal payments on borrowings and financing arrangements | | | (7,520 | ) | | (2,869 | ) | | (4,102 | ) |

Proceeds from issuance of debt | | | — | | | — | | | 500 | |

Proceeds from exercise of stock options | | | 8,953 | | | 1,584 | | | 11 | |

Repurchase of common stock | | | (495 | ) | | (1,231 | ) | | (8 | ) |

Net proceeds from sale of common stock | | | 41,712 | | | — | | | — | |

| |

|

| |

|

| |

|

| |

Net cash provided by (used in) financing activities | | | 42,650 | | | (8,821 | ) | | (3,599 | ) |

| |

|

| |

|

| |

|

| |

Net increase in cash and cash equivalents | | | 4,510 | | | 233 | | | 4,931 | |

Cash and cash equivalents at beginning of year | | | 13,237 | | | 13,004 | | | 8,073 | |

| |

|

| |

|

| |

|

| |

Cash and cash equivalents at end of year | | $ | 17,747 | | $ | 13,237 | | $ | 13,004 | |

| |

|

| |

|

| |

|

| |

Supplemental cash flow information: | | | | | | | | | | |

Cash paid during the year for: | | | | | | | | | | |

Interest | | $ | 1,581 | | $ | 1,387 | | $ | 1,164 | |

Income taxes | | | 11,742 | | | 851 | | | 116 | |

Supplemental schedule of non-cash activities: | | | | | | | | | | |

Amortization of other assets | | $ | 136 | | $ | 255 | | $ | 255 | |

Stock issued to satisfy buyout and earnout liabilities | | | — | | | — | | | 999 | |

See accompanying notes to consolidated financial statements.

56

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and Operations

Basis of Financial Statement Presentation — The accompanying consolidated financial statements include those of Heartland Payment Systems, Inc. (the “Company”) and its wholly-owned subsidiary, Heartland Payroll Company (“HPC”). The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America. All intercompany balances and transactions with the Company’s wholly-owned subsidiary have been eliminated upon consolidation.

The officers and directors of the Company represent a majority of the outstanding shares, and so control the Company.

Business — The Company provides payment-processing services related to bank card transactions for merchants throughout the United States. In addition, the Company provides certain other merchant services, including the sale and rental of terminal equipment and supplies. HPC provides payroll and related tax filing services throughout the United States.

Use of Estimates —The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America, requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Estimates include, among other things, the accrued buyout liability, capitalized customer acquisition costs, loss reserves, certain accounts payable and accrued expenses and certain tax assets and liabilities. Actual results could differ from those estimates.

Concentrations — The majority of the Company’s merchant processing activity has been processed by a single vendor. The Company believes that the vendor maintains appropriate backup systems and alternative arrangements to avoid a significant disruption of processing in the event of an unforeseen event.

Substantially all of the Company’s revenue is derived from processing Visa and MasterCard bank card transactions. Because the Company is not a ‘‘member bank’’ as defined by Visa and MasterCard, in order to process these bank card transactions the Company has entered into a sponsorship agreement with a bank. The agreement with the bank sponsor requires, among other things, that the Company abide by the by-laws and regulations of the Visa and MasterCard associations and maintain a certificate of deposit with the bank sponsor. If the Company breaches the sponsorship agreement, the bank sponsor may terminate the agreement and, under the terms of the agreement, the Company would have 180 days to identify an alternative bank sponsor. The Company is dependent on its bank sponsor, Visa and MasterCard for notification of any compliance breaches. As of December 31, 2005, the Company has not been notified of any such issues by its bank sponsor, Visa or MasterCard.

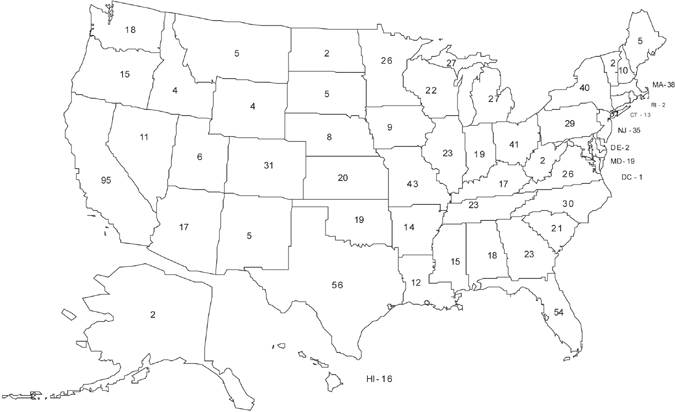

The Company processes for merchants throughout the United States. California represented 14.6% of the Company’s total processing volume in December 2005.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash and Cash Equivalents — The Company considers all highly liquid investments with original maturities of three months or less when purchased to be cash equivalents.

Receivables — The Company carries receivables from its merchants resulting from the practice of advancing interchange fees to most of its merchants during the month and collecting those fees from merchants at the beginning of the following month. During each month, the Company’s sponsor bank advances interchange fees to most of the Company’s merchants thereby creating a payable to the sponsor bank. In August 2005, the Company began using a portion of its available cash to fund these advances.

57

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In future periods, these advances to merchants will be funded first with cash available for investment, then by incurring a payable to the Company’s sponsor bank when that cash has been expended. The payable to the sponsor bank is repaid at the beginning of the following month out of the fees the Company collects from its merchants.

Investments—Investments consist of corporate and U.S. Government debt securities, fixed income bond funds and certificates of deposit. The Company classifies its investments as available-for-sale and records them at the fair value of the investments based on quoted market prices. Cost is determined on a specific identification basis.

Inventories—Inventories consist of point-of-sale terminal equipment held for sale to merchants, and are valued at the lower of cost or market price. Cost is arrived at using the first-in, first-out method. Market price is estimated based on current sales of equipment.

Capitalized Customer Acquisition Costs, net—Capitalized customer acquisition costs consist of (1) up-front signing bonus payments made to Relationship Managers and sales managers (the Company’s sales force) for the establishment of new merchant relationships, and (2) a deferred acquisition cost representing the estimated cost of buying out the commissions of vested sales employees. Pursuant to Staff Accounting Bulletin Topic 13, Revenue Recognition, and FASB Technical Bulletin No. 90-1, Accounting for Separately Priced Extended Warranty and Product Maintenance Contracts, capitalized customer acquisition costs represent incremental, direct customer acquisition costs that are recoverable through gross margins associated with merchant contracts. The capitalized customer acquisition costs are amortized using a method which approximates a proportional revenue approach over the initial three-year term of the merchant contract.

The up-front signing bonus is based on the estimated gross margin for the first year of the merchant contract. The signing bonus, amount capitalized, and related amortization are adjusted after one year to reflect the actual gross margin generated by the merchant contract during that year. The deferred customer acquisition cost asset is accrued over the first year of merchant processing, consistent with the build-up in the accrued buyout liability, as described below.

Management evaluates the capitalized customer acquisition costs for impairment at each balance sheet date by comparing, on a pooled basis by vintage month of origination, the expected future net cash flows from underlying merchant relationships to the carrying amount of the capitalized customer acquisition costs. If the estimated future net cash flows are lower than the recorded carrying amount, indicating an impairment of the value of the capitalized customer acquisition costs, the impairment loss will be charged to operations. The Company believes that no impairment has occurred as of December 31, 2005 or 2004.

Property and Equipment—Property and equipment are carried at cost, net of accumulated depreciation. Depreciation is computed straight-line over periods ranging from three to ten years for furniture and equipment. Leasehold improvements are amortized over the lesser of the economic useful life of the improvement or the term of the lease. The Company capitalizes the cost of computer software developed for internal use and amortizes such costs over an estimated useful life of three to five years.

Long-Lived Assets—The Company evaluates the potential for impairment when changes in circumstances indicate that undiscounted cash flows estimated to be generated by the related assets are less than the carrying amount. Management believes that no such changes in circumstances or impairment have occurred as of December 31, 2005 or 2004.

Merchant Deposits and Loss Reserves—Disputes between a cardholder and a merchant periodically arise due to the cardholder’s dissatisfaction with merchandise quality or the merchant’s service, and the disputes may not always be resolved in the merchant’s favor. In some of these cases, the transaction is ‘‘charged back’’ to the merchant and the purchase price is refunded to the cardholder by the credit card-issuing institution. If the merchant is unable to fund the refund, the Company is liable for the

58

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

full amount of the transaction. The Company may have partial recourse to the Relationship Manager originally soliciting the merchant contract, if the Relationship Manager is still receiving income from the merchant’s processing activities. During 2003, the Company adopted FASB Interpretation No. 45, Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others, (“FIN 45”). Under FIN 45, the Company’s obligation to stand ready to perform is minimal. The Company maintains deposits or the pledge of a letter of credit from certain merchants as an offset to potential contingent liabilities that are the responsibility of such merchants. The Company evaluates its ultimate risk and records an estimate of potential loss for chargebacks related to merchant fraud based upon an assessment of actual historical fraud loss rates compared to recent processing volume levels. The Company believes that the liability recorded as loss reserves approximates fair value.

Accrued Buyout Liability—Relationship Managers and sales managers are paid residual commissions based on the gross margin generated by monthly merchant processing activity. Until May 2004, Relationship Managers and sales managers had the contractual right to sell their portfolio equity. From May 2004 on, the Company has the right, but is not obligated, to buy out some or all of these commissions, and intends to do so periodically. Such purchases of the commissions are at a fixed multiple of the portfolio. Because of the Company’s intent and ability to execute purchases of the residual commissions, and the mutual understanding between the Company and the Relationship Managers and sales managers, the Company has accounted for this deferred compensation arrangement pursuant to the substantive nature of the plan. The Company therefore records the amount that it would have to pay (the ‘‘settlement cost’’) to buy out non-servicing related commissions (‘‘owned commissions’’) in their entirety from vested Relationship Managers and sales managers, and an accrual, based on their progress towards vesting, for those unvested Relationship Managers and sales managers who are expected to vest in the future. As noted above, as the liability increases over the first year of a merchant contract, the Company also records for currently vested Relationship Managers and sales managers a related deferred acquisition cost asset. The accrued buyout liability associated with unvested Relationship Managers and sales managers is not included in the deferred acquisition cost asset since future services are required in order to vest. Subsequent changes in the settlement cost, due to account attrition, same-store sales growth and changes in gross margin, are included in the same income statement caption as customer acquisition cost amortization expense.

The accrued buyout liability is based on the merchants under contract at the balance sheet date, the gross margin generated by those merchants over the prior 12 months, and the contractual buyout multiple. The liability related to a new merchant is therefore zero when the merchant is installed, and increases over the twelve months following the installation date. The same procedure is applied to unvested commissions over the expected vesting period, but is further adjusted to reflect the Company’s experience that 31% of unvested Relationship Managers and sales managers become vested.

The classification of the accrued buyout liability between current and non-current liabilities on the consolidated balance sheet is based upon the Company’s estimate of the amount of the accrued buyout liability that it reasonably expects to pay over the next twelve months. This estimate is developed by calculating the cumulative annual average percentage that total historical buyout payments represent of the accrued buyout liability. That percentage is applied to the period-end accrued buyout liability to determine the current portion.

Financing Arrangements—Pursuant to EITF Issue 88-18, Sales of Future Revenues, the Company recognizes the transfer of merchant contracts as financing arrangements included under Borrowings and Financing Arrangements, until such time as the conditions for recognizing the transfer as a sale are met. The interest rates on these financing arrangements are computed based on the expected cash flows resulting from these contracts, reduced by an expected annual volume attrition rate of 15% on these contracts. Any significant differences between actual future payments and expected payments will result in a change to that interest rate, which are applied prospectively.

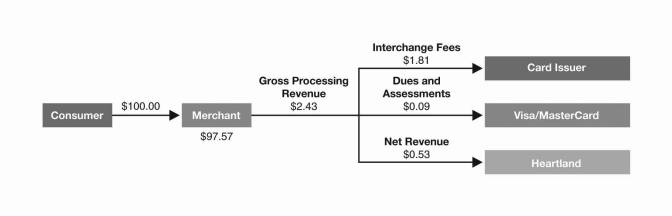

Revenues—Revenues are mainly comprised of gross processing revenue, payroll processing revenue and equipment-related income. Gross processing revenue primarily consists of discount fees and per-transaction and periodic (primarily monthly) fees from the processing of bank card transactions for merchants. Bank card transactions processed are primarily through Visa and MasterCard.

59

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company passes through to its customers any changes in interchange or association fees. Gross processing revenue also includes American Express and Discover fees, customer service fees, fees for processing chargebacks, termination fees on terminated contracts, and other miscellaneous revenue. Payroll processing revenue includes periodic and annual fees charged by HPC for payroll processing services. Revenue is recorded as bank card transactions are processed or payroll services are performed. Equipment-related income includes fees for the sale, rental, leasing and deployment of bank card terminals, net of their associated direct costs. These amounts are shown net of their associated direct costs, if any, and are recorded at the time the service is performed.

Income Taxes—The Company accounts for income taxes by recognizing deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the difference between the accounting and tax basis of assets and liabilities using enacted tax rates.

Stock Options—The Company accounts for its stock options using the intrinsic value method in which no compensation expense has been recognized for its stock-based compensation plan because the options are granted at an exercise price greater than or equal to the estimated fair value at the grant date.

The estimated fair value of options granted during 2003 was $0 due to the Company’s use of a 0% volatility factor as a private company. The weighted-average fair value of options granted during the years ended December 31, 2005 and 2004 were $5.48 and $2.74. The fair value of options for the periods ended December 31, 2005, 2004 and 2003 was estimated at the date of grant using a Black-Scholes option-pricing model with the following weighted average assumptions:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

Expected volatility | | | 50 | % | | 50 | % | | 0 | % |

Expected life | | | 3 years | | | 1 to 3 years | | | 1 to 3 years | |

Dividends | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | |

Risk-free interest rate | | | 3.73 | % | | 2.31 | % | | 1.82 | % |

For those periods prior to the filing of the Company’s initial August 2004 registration statement on Form S-1, the Company assumed a volatility factor of 0%, which was consistent with existing accounting literature pertaining to non-public companies. For those periods after filing the Company’s initial August 2004 registration statement on Form S-1, the Company assumed a volatility factor of 50%. The 50% volatility assumption was determined by referencing the average volatility assumed by six of the Company’s public company peers.

Basic earnings per share is computed and presented under the two-class method and is based on the weighted average number of common shares outstanding and assumes an allocation of net income to the Series A Senior Convertible Participating Preferred Stock (the ‘‘Convertible Preferred’’) for the period or portion of the period that the Convertible Preferred was outstanding. The Convertible Preferred automatically converted into 13,333,334 shares of the Company’s common stock upon the August 16, 2005 closing of the Company’s initial public offering.

Diluted earnings per share is computed based on the weighted average outstanding common shares plus equivalent shares assuming exercise of stock options, warrants and conversion of Series A Senior Convertible Participating Preferred Stock, where dilutive. Weighted average shares outstanding and dilutive securities have been adjusted for all periods presented to reflect a two-for-one stock split on July 26, 2005. The following table presents the effect on net income and basic and diluted net income per common share had the Company adopted the fair value method of accounting for stock-based compensation under SFAS No. 123 (in thousands, except per share data):

60

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

Net income | | $ | 19,093 | | $ | 8,855 | | $ | 20,133 | |

Deduct: Total stock-based employee compensation expense determined under fair-value-based method, net of related tax expense | | | 4,747 | | | 5,493 | | | — | |

| |

|

| |

|

| |

|

| |

Pro forma net income | | | 14,346 | | | 3,362 | | | 20,133 | |

Less: Income allocated to Series A Senior Convertible Participating Preferred Stock | | | 3,430 | | | 1,618 | | | 9,843 | |

| |

|

| |

|

| |

|

| |

Pro forma net income attributable to common stock | | $ | 10,916 | | $ | 1,744 | | $ | 10,290 | |

| |

|

| |

|

| |

|

| |

Earnings per share: | | | | | | | | | | |

As reported: | | | | | | | | | | |

Basic | | $ | 0.62 | | $ | 0.28 | | $ | 0.65 | |

Diluted | | $ | 0.50 | | $ | 0.26 | | $ | 0.62 | |

Pro forma: | | | | | | | | | | |

Basic | | $ | 0.47 | | $ | 0.11 | | $ | 0.65 | |

Diluted | | $ | 0.38 | | $ | 0.10 | | $ | 0.62 | |

New Accounting Pronouncements— In December 2004, the FASB issued SFAS No. 123 (revised 2004), Share-Based Payment (‘‘SFAS No. 123 revised’’), a revision of SFAS No. 123, Accounting for Stock-Based Compensation. In April 2005, the SEC delayed the effective date for SFAS No. 123 revised until the first firsal year beginning after June 15, 2005. The most significant change resulting from this statement is the requirement for public companies to expense employee share-based payments under fair value as originally introduced in SFAS No. 123. The Company will adopt SFAS No. 123 revised on January 1, 2006. As an effect of adopting SFAS No. 123 revised, the Company will recognize compensation expense for the amortization of the fair value of stock options which were granted prior to January 1, 2006 and have service periods continuing into 2006 and beyond. The amount of compensation expense to be recognized in 2006 and beyond is approximately $1.3 million, of which approximately $0.8 million will be recognized as compensation expense in 2006.

3. Receivables

A summary of receivables by major class is as follows at December 31, 2005 and 2004:

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

| | (In thousands) | |

Accounts receivable from merchants | | $ | 91,288 | | $ | 60,739 | |

Accounts receivable from others | | | 2,536 | | | 3,753 | |

| |

|

| |

|

| |

| | | 93,824 | | | 64,492 | |

Less allowance for doubtful accounts | | | (68 | ) | | (167 | ) |

| |

|

| |

|

| |

| | $ | 93,756 | | $ | 64,325 | |

| |

|

| |

|

| |

Included in accounts receivable from others are $1,519 and $3,582 which are due from employees at December 31, 2005 and 2004, respectively.

61

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

4. Investments

The cost, gross unrealized gains (losses) and estimated fair value for available-for-sale investments by major security type and class of security are as follows at December 31, 2005 and 2004:

| | Cost | | Gross

Unrealized

Gains | | Gross

Unrealized

Losses | | Estimated

Fair Value | |

| |

| |

| |

| |

| |

| | (In thousands) |

December 31, 2005 | | | | | | | | | | | | | |

Fixed income bond fund | | $ | 1,072 | | $ | — | | $ | (24 | ) | $ | 1,048 | |

Debt securities of the U.S. Government | | | 240 | | | — | | | (14 | ) | | 226 | |

Corporate debt securities | | | 314 | | | — | | | (8 | ) | | 306 | |

Certificates of deposit | | | 561 | | | — | | | — | | | 561 | |

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 2,187 | | $ | — | | $ | (46 | ) | $ | 2,141 | |

| |

|

| |

|

| |

|

| |

|

| |

December 31, 2004 | | | | | | | | | | | | | |

Debt securities of the U.S. Government | | $ | 195 | | $ | — | | $ | (1 | ) | $ | 194 | |

Corporate debt securities | | | 360 | | | 1 | | | (4 | ) | | 357 | |

Certificates of deposit | | | 549 | | | — | | | — | | | 549 | |

| |

|

| |

|

| |

|

| |

|

| |

| | $ | 1,104 | | $ | 1 | | $ | (5 | ) | $ | 1,100 | |

| |

|

| |

|

| |

|

| |

|

| |

As of December 31, 2005, all unrealized losses in investments were the result of increases in interest rates. These investments are not considered other-than-temporarily impaired because the Company has the ability and intent to hold these investments for a period of time sufficient for a forecasted recovery in value, which may be upon maturity.

The maturity schedule of all investments owned along with amortized cost and estimated fair value as of December 31, 2005 is as follows:

| | Amortized

Cost | | Estimated

Fair Value | |

| |

| |

| |

| | (In thousands) | |

Due in one year or less | | $ | 1,818 | | $ | 1,789 | |

Due after one year through five years | | | 369 | | | 352 | |

| |

|

| |

|

| |

| | $ | 2,187 | | $ | 2,141 | |

| |

|

| |

|

| |

62

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

5. Capitalized Customer Acquisition Costs, Net

A summary of the capitalized customer acquisition costs, net is as follows as of December 31, 2005 and 2004:

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

| | (In thousands) | |

Capitalized signing bonuses | | $ | 54,388 | | $ | 40,407 | |

Less accumulated amortization | | | (22,727 | ) | | (15,862 | ) |

| |

|

| |

|

| |

| | | 31,661 | | | 24,545 | |

| |

|

| |

|

| |

Capitalized customer deferred acquisition costs | | | 26,172 | | | 21,350 | |

Less accumulated amortization | | | (14,903 | ) | | (11,648 | ) |

| |

|

| |

|

| |

| | | 11,269 | | | 9,702 | |

| |

|

| |

|

| |

| | $ | 42,930 | | $ | 34,247 | |

| |

|

| |

|

| |

A summary of the activity in capitalized customer acquisition costs, net for the three years ended December 31, 2005, 2004 and 2003 was as follows:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| | (In thousands) | |

Balance at beginning of period | | $ | 34,247 | | $ | 22,321 | | $ | 14,871 | |

Plus additions to: | | | | | | | | | | |

Capitalized signing bonuses, net | | | 21,788 | | | 20,137 | | | 12,294 | |

Capitalized customer deferred acquisition costs | | | 11,531 | | | 10,600 | | | 7,623 | |

| |

|

| |

|

| |

|

| |

| | | 33,319 | | | 30,737 | | | 19,917 | |

| |

|

| |

|

| |

|

| |

Less amortization expense on: | | | | | | | | | | |

Capitalized signing bonuses, net | | | (14,673 | ) | | (11,093 | ) | | (8,173 | ) |

Capitalized customer deferred acquisition costs | | | (9,963 | ) | | (7,718 | ) | | (4,294 | ) |

| |

|

| |

|

| |

|

| |

| | | (24,636) | | | (18,811 | ) | | (12,467 | ) |

| |

|

| |

|

| |

|

| |

Balance at end of period | | $ | 42,930 | | $ | 34,247 | | $ | 22,321 | |

| |

|

| |

|

| |

|

| |

Net signing bonus adjustments from estimated amounts to actual were $(2.6) million, $(1.4) million and $(0.8) million, respectively, for the three years ended December 31, 2005, 2004 and 2003. Net signing bonus adjustments are netted against additions in the table above.

Fully amortized signing bonuses of $7.8 million, $7.2 million and $6.6 million respectively, were written off during the three years ended December 31, 2005, 2004 and 2003.

The Company believes that no impairment has occurred as of December 31, 2005 and 2004.

63

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

6. Property and Equipment, Net

A summary of property and equipment, net as of December 31, 2005 and 2004 is as follows:

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

| | (In thousands) | |

Computer hardware and software | | $ | 20,229 | | $ | 13,611 | |

Furniture, fixtures and equipment | | | 1,841 | | | 1,709 | |

Leasehold improvements | | | 3,626 | | | 1,601 | |

| |

|

| |

|

| |

| | | 25,696 | | | 16,921 | |

Less accumulated depreciation | | | (8,085 | ) | | (5,977 | ) |

| |

|

| |

|

| |

| | $ | 17,611 | | $ | 10,944 | |

| |

|

| |

|

| |

Depreciation expense for the three years ended December 31, 2005, 2004 and 2003 was $5.7 million, $3.7 million and $2.3 million, respectively.

Included in property and equipment at December 31, 2005 was $3.0 million representing the cost of assets not yet placed in service.

7. Borrowings and Financing Arrangements

A summary of borrowings and financing arrangements is as follows as of December 31, 2005 and 2004:

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

| | (In thousands) | |

Financing Arrangements | | $ | 434 | | $ | 10,241 | |

Revolver Advance Facility | | | — | | | 2,069 | |

Purpose and Ability Line of Credit | | | — | | | 784 | |

| |

|

| |

|

| |

| | | 434 | | | 13,094 | |

Less current portion | | | (261 | ) | | (5,286 | ) |

| |

|

| |

|

| |

Long-term portion of borrowings and financing arrangements | | $ | 173 | | $ | 7,808 | |

| |

|

| |

|

| |

Principal payments due on borrowings and financing arrangements for the next five years are as follows:

Twelve Months Ended

December 31, | | (In thousands) | |

| |

| |

2006 | | $ | 261 | |

2007 | | | 173 | |

Thereafter | | | — | |

64

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Financing Arrangements. On December 31, 1999 the Company signed a Merchant Services Purchase and Sale Agreement with National Processing Company, which was amended by a First Modification Agreement in December, 2000, and Amendment No. 1 to the First Modification Agreement in December, 2001. Under these agreements, the Company agreed to the transfer of merchant contracts generating a specified amount of net revenue to the transferee, and to pay all cash flows, net of servicing fees and chargeback losses, associated with specific lists of merchant contracts that were committed to the arrangement. This transaction has been treated as a financing arrangement, as discussed in Note 2. As a result, the Company had recorded a liability of $23.0 million on December 31, 1999, which was reduced by servicing payments and the value of converted contracts. The respective amendments of the agreements had the effect of triggering sale treatment for those contracts that were converted to the transferee’s systems in 2000, 2001 and 2002. Effective August 1, 2002, the Company signed a five-year servicing agreement with the transferee, in which the Company agreed to provide servicing to those merchants in a defined final pool that had not been converted to the transferee’s processing systems, and that no further conversions would be made. The servicing agreement is terminable by the transferee upon the occurrence of certain change in control events, upon material breach by the Company, if merchant losses exceed a specified threshold, or if the Company enters into bankruptcy, receivership or other like status, in which event the transferee will be responsible for the conversion of the remaining serviced merchants to their processing systems. The interest rate at December 31, 2005 was 4.26% and the balance outstanding was $434,000. The expected cash flows were based on the actual historical cash flows of the merchant contracts, reduced by an expected annual volume attrition rate of 15%. Any significant differences between actual future payments and expected payments will result in a change to that interest rate, which will be applied prospectively. In this later stage of the term of this financing arrangement, the calculation of the interest cost and remaining balance of the financing arrangement is relatively insensitive to changes in portfolio attrition.

On November 1, 2000, the Company signed a Merchant Portfolio Purchase Agreement and an associated Servicing Agreement with Certegy Inc., each of which was amended on January 16, 2002. Under these agreements, the Company paid all cash flows, net of servicing fees and chargeback losses, related to the transferred merchant contracts to the transferee. This transaction had been treated as a financing arrangement, as discussed in Note 2. As a result, the Company recorded a liability of $22.0 million on November 1, 2000, and the payments made through August 31, 2005 represented interest plus principal repayments. On September 23, 2005, the Company reacquired the remaining 2,400 merchant contracts from Certegy Inc. for a cash payment of $3.0 million, fully extinguishing its obligations under the financing arrangement. The outstanding balance of this financing arrangement at the time of extinguishment was $8.1 million, resulting in a pre-tax gain on the settlement of a financing arrangement of $5.1 million.

Loan and Security Agreement. On August 28, 2002, the Company signed a Loan and Security Agreement for two loan instruments; this Agreement was amended on November 6, 2003, June 23, 2004 and May 26, 2005.

The first instrument was a Revolver Advance Facility (‘‘Revolver’’), which was used solely to fund the buyout of residual commissions from Relationship Managers and sales managers. Borrowings on the Revolver could not exceed $3,500,000. The Revolver accrued interest at the prime rate. The entire outstanding principal balance of $2.1 million plus all accrued interest and fees was paid on August 17, 2005 and the Revolver expired in accordance with its terms.

The second instrument was a $3,000,000 Purpose and Ability Line of Credit Facility (‘‘Line of Credit’’). The Line of Credit accrued interest at the prime rate. The entire principal balance of $0.8 million plus all accrued interest and fees was paid on August 17, 2005 and the Line of Credit expired in accordance with its terms.

65

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

8. Merchant Deposits and Loss Reserves

The Company’s merchants have the liability for any charges properly reversed by the cardholder through a mechanism known as a chargeback. If the merchant is unable to pay this amount, the Company will be liable to the Visa and MasterCard associations for the reversed charges.

During 2003, the Company adopted FIN 45. Under FIN 45, the Company has determined that the fair value of the non-contingent obligation to stand ready to perform is minimal. The Company requires personal guarantees, merchant deposits and letters of credit from certain merchants to minimize its obligation. As of December 31, 2005 and 2004, the Company held merchant deposits totaling $7.0 million and $6.7 million, and letters of credit totaling $519,000 and $30,000, respectively.

The Visa and MasterCard associations generally allow chargebacks up to four months after the later of the date the transaction is processed or the delivery of the product or service to the cardholder. As the majority of the Company’s transactions involve the delivery of the product or service at the time of the transaction, a reasonable basis for determining an estimate of the Company’s exposure to chargebacks is the last four months’ processing volume on its portfolio, which was $12.0 billion and $9.0 billion for the four months ended December 31, 2005 and December 31, 2004, respectively. However, for the four months ended December 31, 2005 and December 31, 2004, the Company was presented with $6.6 million and $5.6 million, respectively, in chargebacks by issuing banks. In the years ended December 31, 2005 and 2004, the Company incurred merchant credit losses of $1.2 million and $0.9 million, respectively, on total dollar volume processed of $33.7 billion and $25.0 billion, respectively. These credit losses are included in processing and servicing costs in the Company’s consolidated statements of income.

The loss recorded by the Company for chargebacks associated with any individual merchant is typically small, due both to the relatively small size and the processing profile of the Company’s clients. However, from time to time the Company will encounter instances of merchant fraud, and the resulting chargeback losses may be considerably more significant to the Company. The Company has established a contingent reserve for estimated currently existing credit and fraud losses on its consolidated balance sheets, amounting to $485,000 on December 31, 2005 and $468,000 on December 31, 2004. This reserve is determined by performing an analysis of the Company’s historical loss experience applied to current processing volume and exposures.

A summary of the activity in the loss reserve for three years ended December 31, 2005, 2004 and 2003 was as follows:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| | (In thousands) | |

Beginning balance | | $ | 468 | | $ | 558 | | $ | 773 | |

Additions to reserve | | | 1,235 | | | 849 | | | 390 | |

Charges against reserve | | | (1,218 | ) | | (939 | ) | | (605 | ) |

| |

|

| |

|

| |

|

| |

Ending Balance | | $ | 485 | | $ | 468 | | $ | 558 | |

| |

|

| |

|

| |

|

| |

66

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

9. Accrued Buyout Liability

A summary of the accrued buyout liability is as follows as of December 31, 2005 and 2004:

| | December 31, | |

| |

| |

| | 2005 | | 2004 | |

| |

| |

| |

| | (In thousands) | |

Vested Relationship Managers and sales managers | | $ | 27,228 | | $ | 25,788 | |

Unvested Relationship Managers and sales managers | | | 1,246 | | | 1,247 | |

| |

|

| |

|

| |

| | | 28,474 | | | 27,035 | |

Less current portion | | | (10,478 | ) | | (9,327 | ) |

| |

|

| |

|

| |

Long-term portion of accrued buyout liability | | $ | 17,996 | | $ | 17,708 | |

| |

|

| |

|

| |

A summary of the activity in the accrued buyout liability for the three years ended December 31, 2005, 2004 and 2003 is as follows:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| | (In thousands) | |

Beginning balance | | $ | 27,035 | | $ | 17,985 | | $ | 12,546 | |

Increase in settlement obligation, net | | | 14,920 | | | 11,263 | | | 10,179 | |

Buyouts | | | (13,481 | ) | | (2,213 | ) | | (4,740 | ) |

| |

|

| |

|

| |

|

| |

Ending balance | | $ | 28,474 | | $ | 27,035 | | $ | 17,985 | |

| |

|

| |

|

| |

|

| |

The increase in settlement obligation is due to new merchant account signings, as well as same-store sales growth and changes in gross margin for existing merchant relationships, partially offset by the impact of merchant attrition. Included in the $13.5 million of buyout payments in the year ended December 31, 2005 was $3.8 million used by salespersons who participated in the PEPShares Plan to exercise their options to acquire 677,544 shares of the Company’s common stock.

In calculating the accrued buyout liability for unvested Relationship Managers and sales managers, the Company has assumed that 31% of the unvested Relationship Managers and sales managers will vest in the future, which represents the Company’s historical vesting rate. A 5% increase to 36% in the expected vesting rate would have increased the accrued buyout liability for unvested Relationship Managers and sales managers by $0.2 million at December 31, 2005 and 2004.

10. Stockholders’ Equity

On August 10, 2005, the Company’s Registration Statement on Form S-1 (Registration No. 333-118073), which registered shares of the Company’s common stock, $0.001 par value, under the Securities Act of 1933, as amended, was declared effective by the Securities and Exchange Commission. The offering consisted of 7,762,500 shares of the Company’s common stock, 2,758,546 of which were sold by the Company and 5,003,954 of which were sold by certain selling stockholders at a price to the public of $18.00 per share. Upon the closing of the offering on August 16, 2005, all outstanding shares of the Company’s Series A Senior Convertible Participating Preferred Stock were automatically converted into 13,333,334 shares of common stock.

All outstanding common shares, average common shares, earnings per common share and conversion amounts related to stock options, warrants and Series A Senior Convertible Participating Preferred Stock have been adjusted retroactively to reflect a two-for-one stock split on July 26, 2005. The Company’s Board of Directors and stockholders also increased the number of authorized shares of common stock to 100,000,000 and the number of shares authorized under the 2000 Equity Incentive Plan to 11,000,000.

67

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

On January 13, 2006, the Company’s Board of Directors authorized management to repurchase up to the lesser of (a) 1,000,000 shares of the Company’s common stock or (b) $25,000,000 worth of its common stock in the open market. Management intends to use the authorization to repurchase shares opportunistically as a means of offsetting dilution from the issuance of shares under the Company’s employee benefit plans. Management has no obligation to repurchase shares under the authorization, and the specific timing and amount of the common stock repurchase will vary based on market conditions, securities law limitations and other factors. The common stock repurchase will be executed utilizing the Company’s cash resources including the proceeds from the exercise of stock options.

Series A Senior Convertible Participating Preferred Stock. The Series A Senior Convertible Participating Preferred Stock (the ‘‘Convertible Preferred’’) automatically converted into 13,333,334 shares of the Company’s Common Stock upon the August 16, 2005 closing of the Company’s initial public offering. Prior to that automatic conversion, the Convertible Preferred was convertible by the holders at any time, participated equally in dividends and distributions with the Common Stock, paid no other dividends and had a liquidation preference of $80 million.

The holders of the Convertible Preferred previously held five-year warrants to purchase an additional 2,000,000 shares of the Company’s Common Stock at a price of $2.63 per share. These warrants were originally valued at $1.5 million. The Company redeemed these warrants on September 28, 2004 by paying the holders the net consideration of $5.25 million.

In August 2004, the Certificate of Designations of the Convertible Preferred was amended to eliminate after October 1, 2006 certain rights of the holders to treat a merger of the Company as a liquidation event. This amendment was in addition to amendments made in 2002 to the terms of the Certificate of Designations for the Convertible Preferred and the Shareholders’ Agreement by and among the holders of the Company’s Common Stock.

The Board of Directors is authorized to issue shares of preferred stock in one or more classes or series without any further action by the Company’s stockholders.

Warrants. On July 26, 2001, the Company signed a Loan and Security Agreement with BHC Interim Funding, L.P., and received a Term Loan (the ‘‘BHC Bridge Loan’’) in the amount of $4.76 million. The BHC Bridge Loan was repaid on October 11, 2001. In connection with this agreement, the Company issued 337,810 five-year mandatory redeemable warrants to purchase its Common Stock for $0.005, which were initially valued at $605,049. Commencing July 26, 2003, the holder could require the Company to redeem these warrants at their per share fair value. The Company recorded these warrants as debt at their estimated fair value.

On January 8, 2004, the warrant holder elected to cause the Company to redeem 168,906 shares at the fair value of $6.25 per share. On August 16, 2005, the closing date for the Company’s initial public offering, the Company exercised its right to require the warrant holder to exercise its remaining warrants for 168,904 shares at the exercise price of $0.005 per share.

The Company adjusted the carrying value of the warrants by $0.5 million during the year ended December 31, 2004 and by $2.9 million during the nine months ended September 30, 2005 to reflect the estimated fair value of $9.28 and $26.51 per share, respectively. Upon the exercise of the warrants, their full carrying value of $4.5 million was transferred to stockholders’ equity.

68

Heartland Payment Systems, Inc. and Subsidiary

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

11. Income Taxes

The provision for income taxes for the three years ended December 31, 2005, 2004 and 2003 consists of the following:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| | (In thousands) | |

Current | | | | | | | | | | |

Federal | | $ | 10,552 | | $ | 1,318 | | $ | 130 | |

State | | | 2,352 | | | 371 | | | 235 | |

Deferred | | | | | | | | | | |

Federal | | | 1,470 | | | 3,859 | | | (9,364 | ) |

State | | | 341 | | | 828 | | | (2,103 | ) |

| |

|

| |

|

| |

|

| |

Total provision for income taxes | | $ | 14,715 | | $ | 6,376 | | $ | (11,102 | ) |

| |

|

| |

|

| |

|

| |

The differences in federal income taxes provided and the amounts determined by applying the federal statutory tax rate of 35% to income before income taxes for the three years ended December 31, 2005, 2004 and 2003 are:

| | Year Ended December 31, | |

| |

| |

| | 2005 | | 2004 | | 2003 | |

| |

| |

| |

| |

| | % | | Amount | | % | | Amount | | % | | Amount | |

| |

| |

| |

| |

| |

| |

| |

| | | | | (In thousands) | | | | | (In thousands) | | | | | (In thousands) | |

U.S. federal income tax at statutory rate | | | 35.00 | % | $ | 11,833 | | | 35.00 | % | $ | 5,331 | | | 35.00 | % | $ | 3,161 | |

U.S. state and local income taxes, net | | | 5.36 | % | | 1,812 | | | 5.12 | % | | 779 | | | (13.44 | )% | | (1,214 | ) |