MANAGEMENT INFORMATION CIRCULAR/PROXY STATEMENT

This Management Information Circular/Proxy Statement (the "Circular") is furnished to shareholders of Intier Automotive Inc. (the "Corporation" or "Intier Automotive") in connection withthe solicitation by and on behalf of the management of the Corporation of proxies to be used at the Annual Meeting of Shareholders (the "Meeting") of the Corporation to be held at The Design Exchange, Toronto-Dominion Centre, 234 Bay Street, 2nd Floor, Toronto, Ontario, Canada, on Wednesday, May 5, 2004, commencing at 10:00 a.m. (Toronto time), and at any adjournment(s) or postponement(s) thereof, for the purposes set forth in the attached Notice of Annual Meeting of Shareholders (the "Notice").

This Circular, the Notice and the accompanying form of proxy are first being mailed to shareholders of the Corporation on or about April 7, 2004. The Corporation will bear all costs associated with the preparation and mailing of this Circular, the Notice and the accompanying form of proxy as well as the cost of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Corporation may also directly solicit proxies (but will not receive additional compensation for such activities) personally, by telephone, by telefax or by other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation material to their principals and to obtain authorizations for the execution of proxies and will be reimbursed for their reasonable expenses in doing so.

All amounts referred to in this Circular are presented in United States dollars, unless otherwise noted.

APPOINTMENT AND REVOCATION OF PROXIES

Registered Holders

The persons named in the accompanying form of proxy for the Class A Subordinate Voting Shares are officers or directors of the Corporation.A shareholder has the right to appoint a person (who need not be a shareholder of the Corporation) as nominee to attend and act for and on such shareholder's behalf at the Meeting other than the management nominees named in the accompanying form of proxy. This right may be exercised either by striking out the names of the management nominees where they appear on the front of the form of proxy and by inserting in the blank space provided the name of the other person the shareholder wishes to appoint as proxyholder, or by completing, signing and submitting another proper form of proxy naming such other person as proxyholder.

A shareholder who has given a proxy may, in addition to revocation in any other manner permitted by applicable Canadian law, revoke the proxy within the time periods described in this Circular, by an instrument in writing executed by the shareholder or by his/her attorney authorized in writing or, if the shareholder is a body corporate, by an officer or attorney thereof duly authorized.

Shareholders desiring to be represented at the Meeting by proxy or to revoke a proxy previously given, must deposit their form of proxy or revocation of proxy at one of the following locations: (i) the principal executive office of the Corporation at 521 Newpark Boulevard, Newmarket, Ontario, Canada L3Y 4X7; or (ii) the office of Computershare Trust Company of Canada, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, addressed to the Secretary of the Corporation, not later than 5:00 p.m. (Eastern Standard Time) on the last business day preceding the day of the Meeting, (or any adjournment(s) or postponement(s) thereof). If a shareholder who has completed a proxy attends the Meeting in person, any votes cast by such shareholder on a poll will be counted and the proxy will be disregarded.

Non-Registered Holders

Only registered shareholders, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, shares beneficially owned by a holder (a "Non-Registered Holder") are registered either:

| | (a) | In the name of an intermediary that the Non-Registered Holder deals with in respect of the shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of registered plans; or |

| | (b) | In the name of a depository (such as The Canadian Depository for Securities Limited) of which the intermediary is a participant. |

In accordance with the requirements of National Instrument 54-101 of the Canadian securities laws, the Corporation will be distributing copies of the Notice, this Circular, the accompanying form of proxy and the Intier Automotive 2003 Annual Report (collectively, the "meeting materials") to the depository and intermediaries for further distribution to Non-Registered Holders. National Instrument 54-101 requires intermediaries to forward the meeting materials to all Non-Registered Holders and receive voting instructions from them, unless a Non-Registered Holder has waived the right to receive the meeting materials. Intermediaries often use service companies to forward the meeting materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive the meeting materials will either:

| | (a) | Be given a voting instruction form which must be completed and signed by the Non-Registered Holder in accordance with the directions set out on the voting instruction form (which may, in some cases, permit the completion of the voting instruction form by telephone or the internet); or |

| | (b) | Less typically, be given a proxy which has already been signed by the intermediary (usually by way of a facsimile, stamped signature) which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise uncompleted. In this case, the Non-Registered Holder who wishes to submit the proxy should otherwise properly complete and deposit it with the Corporation or Computershare Trust Company of Canada, as described above. This proxy need not be signed by the Non-Registered Holder. |

In either case, the purpose of these procedures is to permit Non-Registered Holders to direct the voting of the shares which they beneficially own. Should a Non-Registered Holder who receives a proxy signed by the intermediary wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the name of the Non-Registered Holder (or such other person) in the blank space provided. A Non-Registered Holder who receives a voting instruction form should follow the corresponding instructions on the form.In either case, Non-Registered Holders should carefully follow the instructions of their intermediaries and their intermediaries' service companies.

VOTING OF PROXIES

The shares represented by any valid proxy in favour of the nominees named in the accompanying form of proxy will be voted for or withheld from voting (abstain) on the election of directors, the reappointment of the Auditors and the authorization of the Audit Committee of the Board of Directors to fix the remuneration of the Auditors, in accordance with any specifications or instructions made by a shareholder on the form of proxy. In the absence of any such specifications or instructions, such shares will be voted FOR the election as directors of the management nominees named in this Circular, and FOR the reappointment of Ernst & Young LLP as Auditors and the authorization of the Audit Committee of the Board of Directors to fix the Auditors' remuneration.

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice and with respect to such other business or matters which may properly come before the Meeting or any adjournments or postponements thereof. As of the date of this Circular, the Corporation is not aware of such amendments or any other matter to be addressed at the meeting.

RECORD DATE

The board of directors of the Corporation (the "Board") has fixed the close of business on March 25, 2004 as the record date (the "Record Date") for the Meeting. Only holders of record of Class A Subordinate Voting Shares and Class B Shares of the Corporation at the close of business on the Record Date are entitled to receive notice of and to attend and vote at the Meeting except that, in accordance with applicable law, a transferee of Class A Subordinate Voting Shares or Class B Shares acquired after the Record Date shall be entitled to vote at the Meeting if such transferee produces properly endorsed share certificates or otherwise establishes ownership of such shares and has demanded in writing not later than ten days before the Meeting that the name of such transferee be included in the list of shareholders entitled to vote at the Meeting.

VOTING SECURITIES AND THEIR PRINCIPAL HOLDERS

As at March 31, 2004 there were issued and outstanding 6,511,939 Class A Subordinate Voting Shares. Holders of Class A Subordinate Voting Shares as at the time of taking any vote on the date of the Meeting are entitled to cast one (1) vote per Class A Subordinate Voting Share held by them on each matter to be acted on at the Meeting.

As at March 31, 2004 there were issued and outstanding 42,751,938 Class B Shares. Holders of Class B Shares as at the time of taking any vote on the date of the Meeting are entitled to cast 20 (twenty) votes per Class B Share held by them on each matter to be acted on at the Meeting.

The following table sets forth information with respect to the only shareholders known to the directors or officers of the Corporation to own beneficially, directly or indirectly, or exercise control or direction over, more than ten per cent (10%) of the issued and outstanding Class A Subordinate Voting Shares or Class B Shares of the Corporation, as at March 31, 2004:

| | Class of

Shares | | Number

of Shares | | Percentage

of Class |

Magna International Inc. (1) | | Class B | | 7,324,932 | | | 17.13% | |

893898 Ontario Inc. (1) (2) | | Class B | | 7,882,961 | | | 18.44% | |

2004189 Ontario Inc. (1) (2) | | Class B | | 11,565,159 | | | 27.05% | |

989891 Ontario Inc. (1) (2) | | Class B | | 15,978,886 | | | 37.38% | |

Donald Walker | | Class A | | 700,000 | | | 10.75% | |

(1) | The Stronach Trust controls Magna International Inc. ("Magna") through its indirect ownership of 726,829 Class B shares of Magna, such shares representing 66.3% of the total votes attached to Magna's outstanding voting securities. Mr. Frank Stronach, the founder and Chairman of Magna, together with three other members of his family, is a trustee of the Stronach Trust. Mr. Stronach is also one of the members of the class of potential beneficiaries of the Stronach Trust. |

(2) | 893898 Ontario Inc., 2004189 Ontario Inc. and 989891 Ontario Inc. are wholly owned subsidiaries of Magna. |

FINANCIAL STATEMENTS AND AUDITORS' REPORT

Management, on behalf of the Board of Directors, will submit to the shareholders at the Meeting the Consolidated Financial Statements of the Corporation for the financial year ended December 31, 2003 and the Auditors' Report thereon, but no vote by the shareholders with respect thereto is required or proposed to be taken. The Consolidated Financial Statements and Auditors' Report are included in the Corporation's 2003 Annual Report which is being mailed to shareholders with the Notice and this Circular.

MATTERS TO BE ACTED ON AT THE MEETING

Election of Directors

Under the Articles of the Corporation, the Board is to consist of a minimum of three (3) and a maximum of fifteen (15) directors. A special resolution passed by the shareholders of the Corporation on May 31, 2001 authorized the directors to determine the number of directors of the Corporation from time to time. Pursuant to that resolution, the number of directors has been set at nine. The term of office of each director expires at the time of the Meeting unless successors are not elected, in which case the directors remain in office until their successors are elected by the shareholders of the Corporation.

Management proposes to nominate, and the persons named in the accompanying form of proxy will vote for (in the absence of specifications or instructions to abstain from voting on the proxy), the election of the nine (9) persons whose names are set forth below, but will not vote for a greater number of persons than the number of nominees named in the form of proxy.A shareholder may withhold his/her vote with respect to any individual nominee by striking a line through the particular nominee's name in the form of proxy. Management does not contemplate that any of the nominees will be unable to serve as a director. If, as a result of circumstances not now contemplated, any nominee shall be unavailable to serve as a director, the proxy will be voted either for the election of such other person or persons as management may select, or for the election of the remaining nominees named in the form of proxy if the Board further reduces the number of directors in accordance with applicab le law prior to the Meeting. Each director elected will hold office until the next annual meeting of shareholders of the Corporation, or until his respective successor is elected or appointed in accordance with applicable law and the Corporation's by-laws. The following table sets forth information with respect to each of the management nominees for director, including the number of the Class A Subordinate Voting Shares and Class B Shares beneficially owned, directly or indirectly, or over which control or direction is exercised by each such nominee, as at March 31, 2004:

Name of Nominee

|

Age

|

Director Since

|

Other Positions and Offices Presently Held WithCorporation

|

Principal Occupation

| Class A

Subordinate

Voting Shares/

Per Cent of

Class |

Class B

Shares/

Per Cent of

Class

|

Donald J. Walker (3) | 47 | May 31, 2001 | President, Chief Executive Officer and Chairman | President, Chief Executive Officer and Chairman of the Corporation | 700,000 / 10.75% | Nil |

Flavio Cotti | 64 | March 27, 2002 | None | Corporate Director | 1,206 (5) | Nil |

Neil G. Davis (2) (3) | 48 | August 9, 2001 | None | Partner, Davis Webb Schulze & Moon (Barristers and Solicitors) | 1,713 (5) | Nil |

Vincent J. Galifi (2) | 44 | February 23, 2004 | None | Executive Vice-President and Chief Financial Officer, Magna International Inc. | 34,427 (5) | Nil |

Louis E. Lataif (1) (2) (4) | 65 | August 9, 2001 | None | Dean of the School of Management of Boston University | 2,913 (5) | Nil |

Edward C. Lumley (1)(2) | 64 | August 9, 2001 | None | Vice-Chairman, BMO Nesbitt Burns (Investment and Corporate Banking) | 3,713 (5) | Nil |

Rudolf Streicher | 64 | August 9, 2001 | None | Consultant | 1,713 (5) | Nil |

Siegfried Wolf | 46 | March 27, 2002 | None | Executive Vice-Chairman, Magna International Inc. | 131,915 /

2.03% | Nil |

Lawrence Worrall (1)(3) | 60 | August 9, 2001 | None | Corporate Director | 2,213 (5) | Nil |

(1) | Member of the Audit Committee. |

(2) | Member of the Corporate Governance and Compensation Committee. |

(3) | Member of the Health and Safety and Environmental Committee. |

(4) | Lead Director of the Board of Directors. |

(5) | These shares represent less than 1% of the class. |

All of the management nominees were elected or appointed as of the dates indicated in the above table. Each of the nominees has held the principal occupation identified above for the past five years with the exception of the following individuals:

(1) | Donald Walker - Mr. Walker was appointed as Chairman on February 23, 2004 and as President and Chief Executive Officer of Intier Automotive effective on February 21, 2001. Prior to that time, Mr. Walker served as Magna's President and Chief Executive Officer. |

(2)

|

Flavio Cotti - Mr. Cotti is currently Chairman of the International Advisory Board of the Credit Suisse Group as well as a member of the Board of Directors of Fiat S.p.A. and Georg Fischer Ltd and a member of the Board of Trustees of the Jacobs Foundation. He was formerly the President of the Swiss Confederation in 1991 and 1998. He also served as the Swiss Minister of Home Affairs from 1988 to 1992 and Swiss Minister of Foreign Affairs from 1993 until April 1999.

|

(3)

|

Rudolf Streicher - Dr. Streicher, currently a consultant since 2000, was Chief Executive Officer of OIAG prior to that time in 1999 and part of 2000. He is the Chairman of the Supervisory Board of Voest-Alpine Stahl AG and Boehler Uddeholm AG. He has also previously served as the Austrian Minister for Economic Affairs and Transportation as well as the Managing Director and Chairman of the Board of Steyr-Daimler-Puch AG and Austria Metall AG.

|

(4)

|

Siegfried Wolf - Mr. Wolf is employed by certain European subsidiaries of Magna and, in addition to being a director of Magna and the Corporation, is currently the Executive Vice-Chairman of Magna (since May 9, 2002). Prior to that time, Mr. Wolf was Vice-Chairman of Magna (since January 14, 2002), prior to which he served as the President and Chief Executive Officer of Magna's Magna Steyr group (since February 21, 2001), the Vice-Chairman of Magna (since March 8, 1999) as well as the President of Magna Europe (since July 1, 1995).

|

(5)

|

Lawrence Worrall - Mr. Worrall, a Certified Management Accountant, is retired and worked for over 30 years in various financial and operational capacities at General Motors of Canada Limited. Prior to his retirement, Mr. Worrall was Vice-President, Purchasing, Strategic Planning and Operations as well as a member of the board of directors of General Motors of Canada Limited.

|

There are no contracts, arrangements or understandings between any management nominee and any other person (other than the directors and officers of the Corporation acting solely in such capacity) pursuant to which the nominee has been or is to be elected as a director.

All directors and officers of the Corporation as a group (17 persons) owned beneficially or exercised control or direction over 931,303 Class A Subordinate Voting Shares, or approximately 14.30% of the class, as at March 31, 2004.

Board

In accordance with its written mandate which was recently approved by the Board on March 25, 2004, the Board oversees the business and affairs of the Corporation, supervises senior management's day-to-day conduct of business, establishes or approves overall corporate policies where required and involves itself jointly with management in ensuring the creation of shareholder value and the preservation and protection of the Corporation's assets as well as in establishing the Corporation's strategic direction. The Board acts through regularly scheduled Board meetings, which are held on a quarterly basis, with additional meetings being scheduled when required. A separate strategic planning and business plan meeting is also held each year. There were six (6) meetings of the Board during fiscal 2003 and there have been an additional two (2) meetings thus far in 2004. In addition, there is continued communication between senior management and Board members between meetings both on an informal basis and through committee meetings.

Mr. Louis E. Lataif was appointed as Lead Director by the Board effective March 25, 2003. The Lead Director's duties include representing the Corporation's outside and unrelated directors in discussions with senior management of the Corporation and Magna as significant shareholder on corporate governance issues and other matters, assisting in identifying potential nominees to the Board, assisting in ensuring that the Board functions independently of management, assisting in the establishment of a Board self-assessment process and performing such other duties and responsibilities as are delegated by the Board from time to time.

Board Committees

The Board has established three (3) standing committees: the Audit Committee, the Corporate Governance and Compensation Committee and the Health and Safety and Environmental Committee, and has prescribed the responsibilities and mandates of such committees. The Corporation does not have an Executive Committee. Other committees may be established by the Board from time to time as circumstances require.

The Audit Committee, composed of Mr. Worrall (Chairman), Mr. Lataif and Mr. Lumley, operates under the Corporation's by-laws and applicable law in addition to its written mandate. This committee has general authority in relation to the Corporation's financial affairs as well as the specific responsibility to review the Corporation's quarterly and annual financial statements and other financial information and report thereon to the Board, to evaluate the performance of, review the independence of, review and approve the annual audit and non-audit related fees of, and to make recommendations to the shareholders as to the annual appointment of the Auditors. In addition, the committee reviews the Management's Discussion and Analysis of Results of Operations and Financial Condition prior to its inclusion in the Corporation's Annual Report and quarterly reports to shareholders, and has certain responsibilities relating to internal and external audits, the review of any alleged ill egal, improper or fraudulent behaviour, internal controls and procedures, the review of material off balance sheet transactions, the application of accounting principles, corporate integrity, risk assessment and other matters. The Audit Committee also annually reviews and reassesses the adequacy of its written charter (mandate) and receives and reviews with the Auditors the written disclosures and related letter from the Auditors and reviews and discusses the independence of the Auditors, including the extent of non-audit services provided by the Auditors to the Corporation.

The Health and Safety and Environmental Committee, composed of Mr. Davis (Chairman), Mr. Walker and Mr. Worrall, works directly with the Corporation's human resources management on health and safety and environmental matters. This committee ensures that a management system is in place in each of these areas and that there are audit and other controls in place to ensure the effectiveness of such systems. The committee meets semi-annually to review significant issues in each area with human resources management and reports to the Board as material matters arise, but not less than annually. The committee also conducts an annual review of the Corporation's Health, Safety and Environmental Policy and, following the completion of such review, provides to the Board its recommendations for changes to the Policy.

The Corporate Governance and Compensation Committee, composed of Mr. Lumley (Chairman), Mr. Davis, Mr. Galifi (who replaced Ms. Stronach) and Mr. Lataif (who was appointed as an additional member on March 25, 2004), operates under applicable law in addition to its written mandate. The Board has delegated to the Corporate Governance and Compensation Committee responsibility for developing the Corporation's approach to corporate governance issues, including assessing the effectiveness of the Corporation's system of corporate governance as a whole, monitoring the relationship between Board and management, assessing the effectiveness of the Board and each committee of the Board as a whole, recommending timely changes to the role, size and composition of the Board and the committees of the Board, overseeing the application of and compliance with the Corporation's Corporate Constitution, and for preparing the Corporation's response to the TSX Guidelines. This committee also admini sters compensation related plans, including the Corporation's stock option plan and the Canadian and U.S. pension plans; reviews management succession planning; reviews and makes recommendations to the Board regarding executive compensation, including the Chief Executive Officer's compensation, and provides its Report on Executive Compensation. See "Compensation of Directors and Executive Officers - Corporate Governance and Compensation Committee", "Report on Executive Compensation" and "Schedule "B" - Statement of Corporate Governance Practices" below.

Reappointment of Auditors

At the Meeting, the shareholders will be asked to reappoint Ernst & Young LLP as the Auditors of the Corporation, and both the Audit Committee and the Board recommend that the shareholders do so. The persons named in the accompanying form of proxy will therefore, in the case of a ballot and in the absence of specifications or instructions to abstain from voting on the form of proxy, vote for the reappointment of Ernst & Young LLP as the Auditors of the Corporation to hold office until the close of the next annual meeting of shareholders of the Corporation and to authorize the Audit Committee of the Board of Directors to fix the Auditors' remuneration.

Representatives of Ernst & Young LLP are expected to attend the Meeting and will have an opportunity to make a statement if they so desire. Such representatives are expected to be available to respond to appropriate questions.

AUDIT COMMITTEE AND AUDIT COMMITTEE REPORT

Audit Committee

The Audit Committee operates pursuant to the Corporation's by-laws and its written charter (mandate) as described under "Matters to be Acted on at the Meeting - Board Committees" above. The Audit Committee has reviewed its charter (mandate) and in December 2003 adopted a revised charter to reflect the changes to the Nasdaq Stock Market listing standards and all applicable United States Securities and Exchange Commission (the "SEC") rules issued pursuant to the Sarbanes-Oxley Act. A copy of the Audit Committee Charter is attached as Schedule "A" to the Circular. The Audit Committee met six (6) times during fiscal 2003 with representatives of the Auditors and, with the exception of one meeting, representatives of the Corporation's Internal Audit Department.

Each member of the Audit Committee is considered by the Corporation to be "unrelated" under the TSX Guidelines for Effective Corporate Governance, as referenced in Sections 472 to 474 of the TSX Company Manual, and to be "independent" under the existing Nasdaq Stock Market listing standards. The Corporation also considers each committee member to be "financially literate", and the Chairman of the Audit Committee to be an "audit committee financial expert", within the meaning of the rules of the SEC promulgated under the Sarbanes-Oxley Act.

Auditors' Independence

The Audit Committee has discussed with the Auditors their independence from management and the Corporation and has considered whether the provision of certain non-audit services is compatible with maintaining the Auditors' independence. Fees paid or payable to the Auditors for services provided in fiscal 2002 and fiscal 2003 (rounded to the nearest thousand dollars) were as follows:

| | | | Fiscal 2002 | | Fiscal 2003 | | |

| | | Audit services (1) | $ | 900,000 | | $ | 1,100,000 | | |

| | | Audit-related services (2) | $ | 140,000 | | $ | 203,000 | | |

| | | Tax services (3) | $ | 498,000 | | $ | 609,000 | | |

| | | Other services (4) | $ | 20,000 | | $ | Nil | | |

(1) | Includes all fees in respect of services performed in order to comply with generally accepted auditing standards ("GAAS"). In some cases, these may include an appropriate allocation of fees for tax services or accounting consultations, to the extent such services were necessary to comply with GAAS. |

(2) | Generally consists of fees paid in respect of assurance and related services (e.g., due diligence), including such things as employee benefit plan audits, accounting consultations and audits in connection with acquisitions, internal control reviews, attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards. |

(3) | Includes all fees paid in respect of services performed by the Auditors' tax professionals, except those services required in order to comply with GAAS which are included under "Audit services". Tax services include Canadian, U.S., Mexican, European and other international tax compliance, tax planning and tax advice. |

(4) | Consists of fees in respect of all services not falling under any of the foregoing categories. |

The Audit Committee established a process for the pre-approval by the Audit Committee of all non-audit services in 2002. Pursuant to this process, during 2003, the Audit Committee established certain permitted fee limits for fiscal 2004, subject to regular quarterly review of such thresholds.

Audit Committee Report

In connection with the Consolidated Financial Statements for the financial year ended December 31, 2003, the Audit Committee has (1) reviewed and discussed the Consolidated Financial Statements with senior management, (2) discussed with the Auditors the matters required to be discussed by the Canadian Institute of Chartered Accountants and the U.S. Statement on Auditing Standards No. 61 (Communication with Audit Committees) as amended, (3) received and reviewed with the Auditors the written disclosures and related letter from the Auditors required by the Canadian Institute of Chartered Accountants and U.S. Independence Standards Board Standard No. 1 (Independence Discussion with Audit Committees) and discussed with the Auditors the independence of the Auditors as auditors of the Corporation and (4) reviewed with the Auditors their Audit Report on the Consolidated Financial Statements.

Management is responsible for the Corporation's internal controls and the financial reporting process. Ernst & Young LLP is responsible for performing an independent audit on the Corporation's consolidated financial statements in accordance with Canadian generally accepted auditing standards and United States generally accepted auditing standards and issuing an auditors' report thereon. The Audit Committee's responsibility is to monitor and oversee these processes in accordance with its charter (mandate).

Based on these reviews and discussions and a review of the Audit Report, the Audit Committee has recommended to the Board, and the Board has approved, the inclusion of the Consolidated Financial Statements in the Corporation's 2003 Annual Report, and in the other forms and reports required to be filed by the Corporation with the applicable Canadian securities commissions, the SEC and applicable stock exchanges in respect of the financial year ended December 31, 2003.

The foregoing report is dated as of March 25, 2004 and is submitted by the Audit Committee of the Board:

Lawrence Worrall

(Chairman) | Louis E. Lataif | Edward C. Lumley |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth a summary of all annual, long-term and other compensation earned for services in all capacities to the Corporation, its subsidiaries and other entities in which the Corporation has an interest, in respect of its three most recently completed fiscal years since the Corporation became a reporting issuer with respect to individuals who were, as at December 31, 2003, the Chief Executive Officer and the four other most highly compensated executive officers (collectively, the "Named Executive Officers") of the Corporation.

| | |

Annual Compensation

| Long-Term

Compensation | |

Name and

Principal Position | Financial

Year |

Salary

|

Bonus

| Other Annual

Compensation(1) | Securities UnderOptions Granted | All Other

Compensation |

Donald J. Walker (2)

President, Chief Executive

Officer and Chairman | 2003

2002

2001 | $

$

$ | 315,000

315,000

236,250 | $

$

$ | 2,870,002

4,300,628

3,200,200 | -

- -

- - | 150,000

- -

1,000,000 | -

- -

- - |

Michael E. McCarthy

Executive Vice-President

and Chief Financial Officer | 2003

2002

2001 | $

$

$ | 110,000

110,000

110,000 | $

$

$ | 460,000

340,000

251,700 | -

- -

- - | 25,000

50,000

50,000 | -

- -

- - |

Scott Paradise (3)

Executive Vice-President,

Sales and Marketing | 2003

2002

2001 | $

$

$ | 100,000

100,000

100,000 | $

$

$ | 425,000

400,000

400,000 | -

- -

- - | 20,000

30,000

20,000 | -

- -

- - |

Karl Steiner (4)

Executive Vice-President,

Sales, Europe | 2003

2002

2001 | $

$

$ | 129,694

108,290

75,500 | $

$

$ | 288,421

242,722

272,000 | -

- -

- - | 8,000

20,000

20,000 | -

$204,783

- - |

Michael Sinnaeve (5)

Vice-President, Quality and

Operational Improvement | 2003

2002

2001 | $

$

$ | 110,000

110,000

64,167 | $

$

$ | 160,000

98,800

37,121 | -

- -

- - | 15,000

15,000

15,000 | -

- -

- - |

(1) | Perquisites and other personal benefits do not exceed the lesser of Cdn.$50,000 and 10% of the total annual salary and bonus for each of the designated Named Executive Officers. |

(2) | Mr. Walker commenced employment with the Corporation on February 21, 2001. Mr. Walker's employment contract provides that he is entitled to an annual cash bonus equal to 2% of the Corporation's pre-tax profits before profit sharing, social commitment and corporate bonus obligations, subject to a minimum bonus in 2001 and 2002 of eighty percent of the annual bonus he would have received under his former employment contract with Magna. |

(3) | Mr. Paradise was neither directly employed nor compensated by the Corporation during 2001, 2002 and 2003, but was compensated by a Detroit-based sales representation company. Mr. Paradise's compensation paid by the sales representation company has been fully apportioned to the Corporation as he provided (through the sales representation company) all his services to the Corporation and its subsidiaries during such years. |

(4) | Mr. Steiner was compensated in euros during 2002 and 2003. His compensation has been converted at the rate of euro 1.058 = $1.00 and euro 0.883 = $1.00, respectively, the average rate during those years. Mr. Steiner was compensated in Deutschemarks during 2001. His compensation has been converted at the rate of DM2.186 = $1.00, the average exchange rate during that year. |

(5) | Mr. Sinnaeve commenced employment with the Corporation on June 1, 2001. |

Under a life insurance policy assumed and maintained by the Corporation for Mr. Walker, which was originally provided by Magna in fiscal 1993, the Corporation is entitled to receive the accumulated cash value with respect to such policy and the specified death benefit payable under the policy on his death is to be paid to the beneficiaries designated by him.

Stock Option Plans, Grants and Exercises

Effective August 9, 2001, Intier Automotive adopted an incentive stock option plan in order to provide incentive stock options and stock appreciation rights in respect of its Class A Subordinate Voting Shares to eligible directors, officers and employees of the Corporation and its subsidiaries and to persons engaged to provide management or consulting services to the Corporation and its subsidiaries (the "Stock Option Plan"). Each option is exercisable in such manner as determined at the time of the grant, and the options granted will be for terms not exceeding ten years. Under the Stock Option Plan, the Corporation does not provide any financial assistance to participants in order to facilitate the purchase of Class A Subordinate Voting Shares thereunder. The maximum number of shares for which options and stock appreciation rights may be granted under the Stock Option Plan is six million Class A Subordinate Voting Shares, subject to certain adjustments. The option price is to be estab lished at the time of the grant, but cannot be less than the closing price of the Corporation's Class A Subordinate Voting Shares on the TSX (with respect to options denominated in Canadian dollars) or on the Nasdaq National Market ("Nasdaq") (with respect to options denominated in U.S. dollars) on the trading day immediately prior to the date of the grant.

As at December 31, 2003, options to purchase an aggregate of 3,545,600 Class A Subordinate Voting Shares at prices ranging from Cdn.$21.00 to Cdn.$29.40 and U.S.$13.72 to U.S.$18.78 per share were outstanding under the Corporation's Stock Option Plan. The vesting period for each grant to the Corporation's employees, officers and directors is 5 years, with the expiration dates ranging from July 31, 2010 to July 31, 2012.

The following table sets forth certain information with respect to the grant of options under the Stock Option Plan to the Named Executive Officers during the financial year ended December 31, 2003:

Options Granted During the Financial Year Ended December 31, 2003 to Named Executive Officers |

Name

| Class A

Subordinate

Voting Shares

Under OptionsGranted (#) |

% of Total

Options Granted

in the Financial

Year

|

Exercise Price

($/Security)

| Market Value of

Securities

Underlying Options on

the Date of Grant

($/Security) |

Expiration Date

|

Donald J. Walker | 150,000 | 31.81% | Cdn.$22.55 | Cdn.$22.00 | July 31, 2010 |

Michael E. McCarthy | 25,000 | 5.30% | Cdn.$22.55 | Cdn.$22.00 | July 31, 2010 |

Scott Paradise | 20,000 | 4.24% | U.S.$17.27 | U.S.$17.00 | July 31, 2010 |

Karl Steiner | 8,000 | 1.70% | U.S.$17.27 | U.S.$17.00 | July 31, 2010 |

Michael Sinnaeve | 15,000 | 3.18% | Cdn.$22.55 | Cdn.$22.00 | July 31, 2010 |

The following table provides certain information with respect to options for securities of the Corporation exercised by the Named Executive Officers during fiscal 2003 as well as the fiscal 2003 year end option values of all options granted to such persons up to December 31, 2003:

Named Executive Officers' Aggregate Option Exercises During the Financial Year Ended December 31, 2003

and Financial Year-End Option Values |

Name

| Class A

Subordinate

Voting Shares

Acquired on

Exercise

(#) |

Aggregate

Value

Realized

on Exercise

($)

|

Unexercised Options at

December 31, 2003 (1)

|

Value of Unexercised in-the-Money

Options at December 31, 2003 (2)

|

Exercisable

(#)

|

Unexercisable

(#)

|

Exercisable

($)

|

Unexercisable

($)

|

Donald J. Walker | Nil | Nil | 630,000 | 520,000 | Cdn.$1,251,300 | Cdn.$885,200 |

Michael E. McCarthy | Nil | Nil | 55,000 | 70,000 | Cdn.$64,350 | Cdn.$51,400 |

Scott Paradise | 3,500 | U.S.$14,980 | 24,500 | 42,000 | U.S.$55,805 | U.S.$70,100 |

Karl Steiner | Nil | Nil | 21,600 | 26,400 | U.S.$62,952 | U.S.$55,208 |

Michael Sinnaeve | Nil | Nil | 18,000 | 27,000 | Cdn.$20,070 | Cdn.$18,480 |

(1) | Class A Subordinate Voting Shares are the only securities for which options have been granted under the Corporation's Stock Option Plan. |

(2) | The Class A Subordinate Voting Share closing price on December 31, 2003 on the TSX was Cdn.$23.06 and on Nasdaq was U.S.$17.89. Options granted to date to Messrs. Walker, McCarthy and Sinnaeve are denominated in Canadian dollars and options granted to date to Messrs. Paradise and Steiner are denominated in U.S. dollars. |

Pension Plans

None of the executive officers, including the Named Executive Officers participate in any Magna or Corporation provided pension plans, including the Corporation's Canadian and U.S. defined benefit pension plans.

Employment Contracts

Prior to completion of the Corporation's initial public offering, the Corporation entered into an employment contract with Mr. Walker in connection with his agreement to serve as President and Chief Executive Officer of Intier Automotive commencing February 21, 2001 and continuing until terminated in accordance with its provisions. Mr. Walker's employment contract provides for a base salary of $315,000 per annum and an annual cash bonus equal to 2% of the Corporation's pre-tax profits before profit sharing, social commitment and corporate bonus obligations. His employment contract also provides for maintenance of the ownership of a declining minimum number of Intier Automotive Class A Subordinate Voting Shares by Mr. Walker, certain insurance and other fringe benefits, and certain confidentiality and non-competition obligations. The agreement also contains a termination provision permitting Mr. Walker's employment to be terminated by the Corporation by giving advance wri tten notice of termination for a prescribed period of time or by paying a retiring allowance to Mr. Walker. Mr. Walker may also voluntarily resign his employment with the Corporation with notice. No notice or severance payment is required for a termination for just cause or on the voluntary resignation of Mr. Walker.

The employment contracts or arrangements for Messrs. McCarthy and Sinnaeve generally provide for base salaries, annual cash bonuses based on a specified percentage of the pre-tax profits before profit sharing of the Corporation with, in certain cases, the provision for minimum fixed bonuses in certain periods, the maintenance of the ownership of a minimum number of Class A Subordinate Voting Shares, confidentiality obligations and non-competition restrictions. Each employment contract provides that employment may be terminated by the Corporation either by giving advance written notice of termination for a minimum time period or by paying a retiring allowance or making a payment in lieu thereof.

Mr. Steiner has an employment contract with a European subsidiary of the Corporation which provides for a base salary, an annual bonus based on a specified percentage of the adjusted earnings before interest and tax of Intier Automotive's European operations (with certain contractual guaranteed bonuses in respect of fiscal 2002 and 2003); the maintenance of the ownership of a minimum number of Class A Subordinate Voting Shares; the provision by the European subsidiary of a company car as well as life insurance and disability insurance benefits for Mr. Steiner, confidentiality obligations, and non-solicitation and non-competition restrictions. The employment contract also provides that the employment may be terminated by giving advance written notice of termination for a minimum time period during which time Mr. Steiner's salary and bonus will continue to be paid.

In his capacity as Executive Vice-President, Sales and Marketing, Mr. Paradise does not have any employment contract with, nor did he receive any direct remuneration from Intier Automotive during fiscal 2003, other than the 20,000 options to acquire Class A Subordinate Voting Shares of the Corporation referred to in the "Summary Compensation Table" above. Mr. Paradise was compensated during fiscal 2003, 2002 and 2001 by a Detroit-based sales representation company.

No payments are required to be made under any employment contracts with the Named Executive Officers in the event of a change in the control of the Corporation. The maximum total amount payable by the Corporation to the Named Executive Officers pursuant to such contracts for severance is approximately $7.5 million in the aggregate.

Directors' Compensation

For calendar 2003, each director who was neither an employee nor an officer of the Corporation or Magna or any of their respective affiliates (an "Eligible Director") was paid (or was eligible to be paid) as remuneration for his services as a director of the Corporation, the amounts set out below:

| | Annual Board Retainer (total) | $ | 20,000 | |

| | | Cash (maximum) | $ | 10,000 | |

| | | Class A Subordinate Voting Shares | $ | 10,000 | |

| | Lead Director Fee | $ | 8,000 | |

| | Annual Committee Retainer | $ | 2,500 | |

| | Annual Committee Chair Retainer | | | |

| | | Audit / Corporate Governance and Compensation Committees | $ | 8,000 | |

| | | Health and Safety and Environmental Committee | $ | 4,000 | |

| | Per Meeting Fee | | | |

| | | (Board and Committees) | $ | 1,000 | |

| | Written Resolutions Fee (per resolution) | $ | 250 | |

| | Board/Committee Work Day Fee | $ | 1,500 | |

| | Travel Day Fee (1) | $ | 1,500 | |

| | (1) Eligible Directors are also entitled to be reimbursed for travel and other expenses incurred by them in attending meetings of the Board or any committee. | |

In March 2004, the Board approved an amendment to the compensation payable to Eligible Directors to adjust such compensation to competitive levels and to reflect the responsibilities and risks involved in serving as a Board member, including the increasing demands being placed on directors' time and attention in general. Commencing January 1, 2004 each Eligible Director will be paid (or eligible to be paid) as remuneration for his services as a director of the Corporation, the amounts set out below:

| | Annual Board Retainer (total) | $ | 30,000 | |

| | | Cash (maximum) | $ | 15,000 | |

| | | Class A Subordinate Voting Shares | $ | 15,000 | |

| | Lead Director Fee | $ | 15,000 | |

| | Annual Committee Retainer | $ | 7,500 | |

| | Annual Committee Chair Retainer | | | |

| | | Audit / Corporate Governance and Compensation Committees | $ | 15,000 | |

| | | Health and Safety, and Environmental Committee | $ | 6,000 | |

| | Per Meeting Fee | | | |

| | | (Board and Committees) | $ | 1,500 | |

| | Written Resolutions Fee (per resolution) | $ | 250 | |

| | Board/Committee Work Day Fee | $ | 2,000 | |

| | Travel Day Fee (1) | $ | 2,000 | |

| | (1) Eligible Directors are also entitled to be reimbursed for travel and other expenses incurred by them in attending meetings of the Board or any committee. | |

Under the Corporation's Stock Option Plan described below, existing members of the Board of Directors who are not the Corporation's employees received a grant of options for 10,000 of the Corporation's Class A Subordinate Voting Shares effective upon election as a director and a new grant of options will be made following the completion of each five continuous years of service as a member of the Board of Directors. The director options vest 20% on the date of grant and 20% on each of the next four anniversary dates of the date of grant. Mr. Siegfried Wolf was also granted an additional 50,000 options to acquire Class A Subordinate Voting Shares at a price of U.S.$13.72 per share in conjunction with the Corporation's initial public offering in addition to the 10,000 options he received as a member of the Board.

Corporate Governance and Compensation Committee

The Corporate Governance and Compensation Committee of the Board is comprised of Mr. E.C. Lumley (Chairman), Mr. N.G. Davis, Mr. V.J. Galifi and Mr. L.E. Lataif, the majority of whom are not employees, officers or former officers of the Corporation or its affiliates. Mr. Lumley and Mr. Davis served on the committee during 2003, together with Ms. Stronach, who resigned in January 2004. Mr. Galifi replaced Ms. Stronach on February 23, 2004 and Mr. Lataif was appointed as an additional member on March 25, 2004. The committee meets as required to review and make recommendations to the Board on the compensation of, and material contractual matters involving, the President and Chief Executive Officer and to review recommendations of the President and Chief Executive Officer regarding compensation for the other executive officers of the Corporation. The committee also has certain other responsibilities including the administration of the Stock Option Plan an d the Canadian and U.S. pension plans, and is generally responsible for developing the Corporation's approach to corporate governance issues and assessing the effectiveness of the system of corporate governance at the Corporation as a whole, and other matters. A report on Intier Automotive's corporate governance practices, including certain aspects of its unique Corporate Constitution as well as Intier Automotive's application of the fourteen TSX Guidelines contained in Section 474 of Part IV of the TSX Company Manual, is set forth in Schedule "B" to this Circular.

Report on Executive Compensation

The Corporation's heritage as a Magna subsidiary means that it has adopted Magna's unique, entrepreneurial corporate culture which has evolved since Magna's founding approximately four decades ago. There are several key elements of this entrepreneurial culture. Firstly, the Corporation consistently emphasizes decentralization, which provides management with a high degree of autonomy at all levels of operation and which increases Intier Automotive's flexibility, customer responsiveness and productivity. Secondly, incentive-based compensation (such as variable profit-based bonuses and stock option grants) represents in most cases the majority of each senior manager's total compensation package. Under this variable compensation "risk and reward" philosophy, operational and corporate management have the incentive to emphasize consistent medium- and long-term profitability in order to provide such individuals with the potential to earn higher compensation than other management in comparable positions within the Corporation's industry peer group. In contrast, during periods of cyclical downturns, management compensation is reduced. The grant of stock options with longer term vesting provisions to senior corporate and operational management and the inclusion of minimum share maintenance provisions in their employment agreements also provide additional incentives to management to increase the Corporation's share price and create shareholder value. Finally, the Corporate Constitution attempts to balance the interests of shareholders, employees and management, defines the rights of employees (including management) and investors to participate in the Corporation's profits and growth and reflects certain of the entrepreneurial operational and compensation philosophies which attempt to align employee, management and shareholder interests. These operational and compensation philosophies and the Corporate Constitution enable the Corporation to maintain an entrepreneurial environment which encourages man agement and employee productivity, ingenuity and innovation.

It is the committee's objective to enable this entrepreneurial culture to continue to flourish, and it therefore intends to continue to apply Magna's long established compensation philosophies, which have been essential to Intier Automotive's continued success and its ability to attract, retain and motivate skilled, entrepreneurial employees at all levels of the Corporation's organization, as well as to maintain the alignment of shareholder and employee interests and create shareholder value.

In order to achieve this objective and consistent with the concepts reflected in the Corporate Constitution, certain managers who have senior operational or corporate responsibilities receive a remuneration package consisting of a base salary (which generally is lower than comparable industry standards) and an annual incentive bonus based on direct profit participation at the operating or corporate level at which such manager is involved. All other eligible Canadian, U.S., U.K. and Austrian employees of Intier Automotive historically participated in the Magna Employee Equity Participation and Profit Participation Program, which consists of a combination of a deferred profit sharing plan, employee pension plans in certain jurisdictions and cash payments to employees. Effective fiscal 2002, the Corporation established its own Employee Equity Participation and Profit Participation Program for such employees in lieu of their participation in the Magna program, whereby the Corporation contribut es or allocates ten per cent (10%) of the Corporation's Employee Pre-Tax Profits Before Profit Sharing to such program.

The committee applies the following criteria in determining or reviewing recommendations for compensation for executive officers:

| | Base Salaries. Base salaries should be at levels generally below base salaries for comparable positions within a comparator group of North American industrial companies which have global businesses and are not generally increased on an annual basis. Fixed compensation costs are therefore minimized in cyclical or other down periods, with financial rewards coming principally from variable incentive cash compensation and long-term incentive compensation. See "Summary Compensation Table" above. |

| | Incentive Compensation.The amount of direct profit participation of management and therefore the amount of compensation "at risk" increases with the level of performance and/or responsibility. Due to the variable nature of profit participation, incentive cash compensation is generally reduced in cyclical or other down periods due to reduced profits. As a result, senior management has an incentive to emphasize consistent growth in profitability over the medium- to long-term to ensure stable levels of annual compensation. Total cash bonuses for fiscal 2003 paid to the Named Executive Officers represented on average more than 75% of such individuals' total cash compensation and reflects the improved financial performance of the Corporation and the overall performance of management during fiscal 2003. |

| | Under the Corporate Constitution, the aggregate incentive bonuses paid and payable to "Corporate Management" (which includes the Named Executive Officers and other executive officers of the Corporation) in respect of any financial year shall not exceed 6% of the Corporation's Pre-Tax Profits Before Profit Sharing for such year. |

| | Long-Term Incentives. Minimum stock ownership has been required of all direct profit participators (including executive officers) for many years at Magna and has been continued at Intier Automotive. In addition, stock option grants to senior corporate and operating management have been made in order to encourage members of corporate and operational management to remain with Intier Automotive over the longer term, thereby promoting management stability, and further attempting to align management's interests with those of the Corporation's shareholders and encourage the enhancement of shareholder value. During fiscal 2003 the Corporation granted a total of 471,500 options to acquire Class A Subordinate Voting Shares of the Corporation to various officers of the Corporation and certain of its subsidiaries at an exercise price of Cdn.$22.55 or U.S.$17.27 per share (as applicable). Such options are exercisable until July 31, 2010 and vest in 20% installments ove r a period of five years. In addition, the stock option agreements for such options provide that a portion of the net after-tax gains on exercise be included for purposes of determining the optionees' minimum share ownership requirements under their employment contract. |

| | Written Employment Contracts. The Corporation generally utilizes written employment contracts with its executive officers to reflect the terms of their employment, including compensation, severance, stock maintenance, confidentiality and non-competition arrangements. Prior to the renewal and/or material amendment of each such agreement, the committee intends to review the executive officer's compensation in the context of the Corporation's historical compensation philosophies and policies, such officer's individual performance and relevant comparators, with the objective of ensuring that such compensation is commensurate with the Corporation's performance and is primarily "at risk" and incentive based. The committee will conduct a review every two years with its external compensation consultants of comparison compensation as well as its compensation criteria and overall approach to ensure the continued competitiveness of its total compensation and effective ness in achieving its compensation objectives. |

In respect of the year 2003, the Corporate Governance and Compensation Committee met on four (4) occasions to, among other matters:

(i) | receive the report of the President and Chief Executive Officer on 2003 compensation payable to senior management of the Corporation and certain of its subsidiaries; |

(ii) | review and consider the President and Chief Executive Officer's report on succession planning and senior management performance; |

(iii) | conduct a review of the adequacy and competitiveness of the compensation of senior management with reference to the report of a third party consultant; |

(iv) | review and approve the 2003 bonus amounts of certain members of senior management of the Corporation and its subsidiaries based on the recommendations of the Chief Executive Officer and the findings of the above-referenced compensation report; |

(v) | review and make recommendations regarding the grant of additional stock options to members of senior management of the Corporation and certain of its subsidiaries based on the recommendations of the Chief Executive Officer and the findings of the above-referenced compensation report; and |

(vi) | review and approve the Corporation's proxy materials relating to executive management and for its annual meeting to be held on May 5, 2004. |

The committee conducted an extensive review of the salary, bonus and benefits compensation of the Corporation's senior management, including the Named Executive Officers, with a view to assessing the adequacy and competitiveness of such arrangements. To aid in the work of the committee, the Corporation retained the services of a recognized external compensation consulting firm to conduct a comparative analysis of existing compensation arrangements against a cross section of industry comparables. The Corporation's external compensation consultants prepared a comparative report in respect of 2003 compensation for various members of senior management using a group of 29 North American companies which have a global business, including four Canadian and 25 U.S. automotive component suppliers or similar industrial component suppliers, adjusted to account for differences in revenues. Based upon a review and consideration of the report's findings and a consideration of th e Corporation's established compensation principles outlined above, the committee reviewed and approved the President and Chief Executive Officer's recommendations with respect to the 2003 bonus amounts of certain members of senior management of the Corporation including certain of the Named Executive Officers, and recommended the grant of stock options to such individuals as well as other members of senior management of the Corporation and its subsidiaries, as noted above. Having given effect to these recommendations, the committee is of the view that the 2003 compensation arrangements for such members of senior management are, in the aggregate, adequate and competitive with current industry standards.

The terms of Mr. Walker's annual compensation and other compensation referred to in the Summary Compensation Table reflect the compensation and benefits provided to him under his employment contract with the Corporation which was entered into in fiscal 2001 prior to the Corporation's initial public offering. The term of Mr. Walker's employment contract is of an indefinite duration. In December 2003 the committee, after reviewing the consultant's comparative report of 2003 compensation referred to above, recommended a grant to Mr. Walker of 150,000 options to purchase Class A Subordinate Voting Shares of the Corporation. Such options vest over a five year period and expire on July 31, 2010. The stock option grant was intended to provide Mr. Walker with total compensation competitive with the chief executive officers of the Corporation's comparator group and is consistent with the committee's long-term incentive philosophy of encouraging key members of senior management such as Mr. ;Walker to remain with the Corporation over the longer term and to further align his interests with those of the Corporation's shareholders.

The Corporation believes that its continued strong, profitable growth positions it for long-term growth in shareholder value, and justifies competitive financial rewards for executive officers which are primarily contingent on the continued profitability of the Corporation.

The foregoing report is submitted by the Corporate Governance and Compensation Committee of the Board:

Edward C. Lumley

(Chairman) | Neil G. Davis | Vincent J. Galifi | Louis E. Lataif |

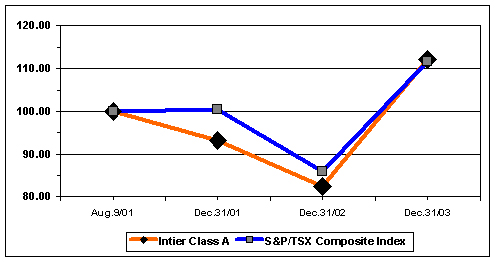

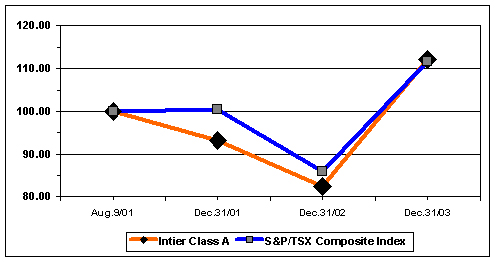

SHAREHOLDER PERFORMANCE REVIEW GRAPH

The following graph compares the total cumulative shareholder return (including dividends) until December 31, 2003 for Cdn.$100 invested in Class A Subordinate Voting Shares of the Corporation on August 9, 2001, being the date of the completion of the initial public offering, with the cumulative total return of the S&P/TSX Composite Index for the same period. The December 31, 2003 values of each investment are based on share price appreciation or depreciation plus dividend reinvestment.

Value of Cdn.$100 invested on August 9, 2001

| | | August 9,

2001 | December 31,

2001 | December 31,

2002 | December 31,

2003 |

| | Intier Automotive Class A Subordinate Voting Shares |

Cdn.$100.00

|

Cdn.$

|

93.16

| |

Cdn.$

|

82.39

| |

Cdn.$

|

112.09

| |

| | S&P/TSX Composite Index | Cdn.$100.00 | Cdn.$ | 100.45 | | Cdn.$ | 85.96 | | Cdn.$ | 111.66 | |

The total cumulative shareholder return for Cdn.$100 invested in the Class A Subordinate Voting Shares at December 31, 2003 was Cdn.$112.09 compared to Cdn.$111.66 for the S&P/TSX Composite Index.

INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS

Excluding routine indebtedness, none of the present or former directors, officers or employees of the Corporation or its subsidiaries or their respective associates were indebted at any time during fiscal 2003 to the Corporation or its subsidiaries in connection with the purchase of the Corporation's securities. The aggregate amount of indebtedness as at March 25, 2004 to the Corporation and its subsidiaries incurred other than in connection with the purchase of securities of the Corporation, excluding routine indebtedness, was approximately $67,100 in the case of present and former directors, officers and employees of the Corporation and its subsidiaries and their respective associates. None of such indebtedness is owed to the Corporation or its subsidiaries by a director, executive officer or senior officer of the Corporation or their respective associates.

INTERESTS OF MANAGEMENT AND OTHER INSIDERS IN CERTAIN TRANSACTIONS

Affiliation Agreements

Concurrently with the closing of the initial public offering of the Corporation on August 9, 2001, the Corporation and certain of its subsidiaries entered into new, or amended existing, affiliation agreements dated as of January 1, 2001 with Magna and certain of its subsidiaries to formalize certain aspects of Intier Automotive's relationship with Magna and provide for payment of affiliation fees. The affiliation agreements provide that Magna will:

| | ● | provide the Corporation and its subsidiaries with the right to identify themselves as part of the Magna group of companies by granting to the Corporation (and the applicable subsidiaries) a non-exclusive, worldwide licence to use trademarks which identify Magna and its goods, services and activities in order to identify Intier Automotive and its goods, services and activities as being affiliated with Magna; |

| | ● | provide the Corporation and its subsidiaries with access to Magna's core operating principles and to new policies and programs adopted by Magna from time to time; |

| | ● | provide the Corporation and its subsidiaries with access to Magna's senior management and make available details of any new management techniques and incentive programs as well as all marketing materials to the extent they are made available generally to Magna's other affiliates; and |

| | ● | grant the Corporation and its subsidiaries a sole and exclusive worldwide licence to use the "Intier" tradename and certain other trademarks used by the Corporation and its subsidiaries which are owned by Magna. The Corporation and its subsidiaries may not sublicense such tradenames and trademarks other than to their respective subsidiaries. |

The aggregate affiliation fees payable by the Corporation and certain subsidiaries to Magna in respect of each fiscal year will be an amount equal to:

| | ● | 1.5% of the first $3 billion of the Corporation's consolidated net sales for that year; |

| | ● | 1% of the next $3 billion of the Corporation's consolidated net sales for that year; and |

| | ● | 0.75% of the Corporation's consolidated net sales exceeding $6 billion; |

provided that sales from acquired businesses will not be subject to a fee until January 1 of the year following the date of the acquisition, and will be subject to a fee equal to 50% of the fee with respect to the Corporation's other sales in the calendar year following the date of the acquisition, and to the full fee in the second calendar year following the date of the acquisition and thereafter. The affiliation agreements also provide that in the event that certain of the benefits and/or services to be provided by Magna are in fact provided by another affiliate of Magna, Magna will reduce the affiliation fees by an equitable amount having regard to the fees paid for such benefits and/or services by Intier Automotive to such Magna affiliates. The aggregate affiliation fee in respect of fiscal 2003 was $60.8 million.

Under the affiliation agreements the Corporation and its subsidiaries and Magna and its subsidiaries have reciprocal rights to obtain non-exclusive licenses to each other's present and future intellectual property (other than tradenames and trademarks) upon normal commercial terms, to use any such intellectual property in a geographical area or field of use in which the Corporation and its subsidiaries or Magna and its subsidiaries, respectively, do not intend to use such intellectual property, and in respect of products which do not then compete with products produced or then intended to be produced by the Corporation and its subsidiaries; provided that the Corporation and its subsidiaries do not have the right to obtain any intellectual property of any subsidiary of Magna that is a public company. The affiliation agreements also provide that Intier Automotive will consult with Magna with respect to future research and development and marketing efforts.

The affiliation agreements with Magna provide that Magna is not liable to Intier Automotive for any loss or damages resulting from or arising out of any action taken (or not taken) by Magna in good faith under the affiliation agreements. In addition, Intier Automotive has agreed to indemnify Magna against claims of third parties with respect to the intellectual property of Magna used by the Corporation and its subsidiaries under the affiliation agreements.

The affiliation agreements with Magna are each effective for a fixed ten-year term ending July 31, 2011 and will thereafter be renewed automatically for further one-year terms unless terminated by Intier Automotive, Magna or their respective subsidiaries upon six months' notice prior to the applicable date of renewal. Intier Automotive's Corporate Constitution provides that the affiliation agreements may not be amended to increase the affiliation fees paid by Intier Automotive to Magna without the prior approval of the holders of the Corporation's Class A Subordinate Voting Shares and the Corporation's Class B Shares, each voting as a separate class. If the affiliation agreements are terminated for any reason, Magna is required to enter into a licence agreement with Intier Automotive pursuant to which Magna will, for a commercially reasonable royalty fee to be negotiated by Magna and the Corporation and paid by the Corporation to Magna, extend for 15 years from the date of such termin ation the Corporation's sole and exclusive, worldwide licence to the "Intier" tradename and trademarks (subject to Magna's rights with respect to licensing to the Corporation the use of these trademarks and tradenames, as described above). If the Corporation and Magna are unable to agree on the amount of such royalty fee, the dispute will be submitted to binding arbitration.

The affiliation agreements also provide that all programs established by Magna for the general benefit of Magna's employees (other than future contributions into the Magna employee equity participation and profit participation program now that the Corporation has established the Intier Automotive employee equity participation and profit participation program) will be made available to the Corporation's employees, and that Intier Automotive will pay its pro rata share of the costs of these programs. Such programs include the Employee Hot Line, the Employee Advocate, and the Employee Relations Advisory Board. Pursuant to the affiliation agreements, Magna will provide Intier Automotive with assistance in further developing the Corporation's employee equity participation and profit participation program.

Social Commitment Agreement

Intier Automotive's Corporate Constitution provides that a maximum of 2% of its pre-tax profits in each fiscal year shall be allocated to the promotion of social objectives. The Corporation entered into a social commitment agreement dated as of January 1, 2001 with Magna concurrently with the closing of the Corporation's initial public offering on August 9, 2001 that requires the Corporation to contribute 1.5% of its pre-tax profits in each fiscal year to social and charitable programs coordinated by Magna or other charitable or non-profit organizations on behalf of Magna and its affiliates, including the Corporation and its subsidiaries. The aggregate social commitment fee in respect of fiscal 2003 was $1.8 million.

Service Company

Prior to the completion of the Corporation's initial public offering, the Corporation entered into an agreement with a service company subsidiary of Magna for a term of one year to provide to the Corporation management and administrative services specifically agreed to by the parties, including legal services, environmental services, administrative, tax and internal audit staff, insurance, treasury, information systems, immigration, employee pension and benefit and employee relations services, in return for specific amounts negotiated between Intier Automotive and Magna subject to an aggregate maximum amount of $6.5 million, over the one-year term. The aggregate amount of such services provided by Magna to the Corporation was $3.6 million for fiscal 2003. This agreement may be extended upon the mutual agreement of the parties and has been for the past two years.

Master Precision Agreement

On December 19, 2003, a subsidiary of the Corporation entered into a purchase and sale agreement with a subsidiary of Magna whereby the Corporation's subsidiary agreed to acquire the capital assets related to the parking brake and pedal assembly business carried on by the Master Precision division of the Magna subsidiary for a purchase price of $2.1 million, subject to certain adjustments. Magna's subsidiary has also agreed to pay the Corporation's subsidiary up to $7.4 million for purchasing such business and incurring incremental costs associated with relocating the acquired assets and revalidating the business.

Registration Rights Agreement

Concurrently with the closing of the Corporation's initial public offering, the Corporation entered into a registration rights agreement with Magna in which it has agreed to register or qualify its Class A Subordinate Voting Shares held by Magna under United States securities laws and/or Canadian securities laws in order to facilitate the sale of such shares. The registration rights agreement restricts the number of times registration may be required to a total of four. The registration rights agreement also provides Magna with certain unlimited "piggy-back" rights to have its Class A Subordinate Voting Shares registered or qualified, including when the Corporation effects a treasury offering of its shares. In addition, if at any time the Corporation effects a treasury offering of Class A Subordinate Voting Shares, Magna may require that up to 35% of the shares offered be Class A Subordinate Voting Shares owned by Magna. Magna will bear all underwriters' commissions and discounts assoc iated with any shares it sells; however, the Corporation will bear the expenses (other than underwriters' commissions and discounts) associated with registrations effected under the registration rights agreement. The Corporation is not permitted to grant to any person registration rights which are superior in any fashion to those granted to Magna under the registration rights agreement without Magna's approval.

Intier Automotive Deferred Profit Sharing Plan

All of the Corporation's eligible Canadian, U.S., U.K. and Austrian employees are members of the Intier Employee Equity Participation and Profit Participation Program, which consists of separate Intier Automotive deferred profit sharing plans in Canada, the United States, the United Kingdom and Austria which invest primarily in the Corporation's Class A Subordinate Voting Shares, independent Intier Automotive employee pension plans in certain jurisdictions and cash payments to eligible Intier Automotive employees. Certain of Intier Automotive's eligible North American, U.K. and Austrian employees continue to participate in Magna's deferred profit sharing plan but only to the extent that units attributable to these persons which were held prior to the adoption of Intier Automotive's deferred profit sharing plan in 2002 remain in Magna's deferred profit sharing plan.

Purchases and Leases with Affiliated Companies

Intier Automotive buys and sells materials from Magna and its other affiliates on an ongoing basis in the normal course of its business. As such, Magna is both a supplier to and customer of Intier Automotive, and these transactions typically are on normal commercial terms after a competitive quoting process which would include third party participants. During fiscal 2003 Intier Automotive sales of materials to Magna and its affiliates were $14.5 million and Intier Automotive's purchases of materials from Magna and its affiliates were $21.8 million. Intier Automotive also leases various land and buildings used in its operations from MI Developments Inc., an affiliated company ultimately controlled by the Stronach Trust. Intier Automotive's lease payments to MI Developments Inc. and its affiliates in fiscal 2003 were approximately $12.5 million. These transactions were also typically on normal commercial terms.

DIRECTORS' AND OFFICERS' LIABILITY INSURANCE

The Corporation participates with Magna and its subsidiaries in the purchase of directors' and officers' liability insurance, which provides, among other things, coverage for executive liability of up to $255 million (per occurrence and in the aggregate for all claims made during the policy period of August 1, 2001 through August 1, 2004) for directors and officers of the Corporation and its subsidiaries, subject to a $250,000 aggregate deductible for executive indemnification. This policy does not provide coverage for losses arising from the breach of fiduciary responsibilities under statutory or common law or from the violation or enforcement of pollutant laws and regulations. Intier Automotive's allocation of the premium payable in respect of the second year of the policy period from August 1, 2002 to August 1, 2003 for the executive indemnification portion of this insurance policy is approximately Cdn.$232,217. Intier Automotive's allocation of the premium payable in respect of the third year of the policy period from August 1, 2003 to August 1, 2004 for the executive indemnification portion of this insurance policy is approximately Cdn.$287,568.

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the Annual Meeting of Shareholders to be held in calendar 2005 must be received by the Corporation at its principal executive offices for inclusion in its management information circular/proxy statement on or before March 7, 2005.

OTHER MATTERS

Management is not aware of any amendments or variations to matters identified in the Notice or of any other matters that are to be presented for action to the Meeting other than those described in the Notice.

Information stated in this Circular is dated as at March 31, 2004 except where otherwise indicated. The contents and the mailing of this Circular have been approved by the Board.

Donald J. Walker

President, Chief Executive Officer and Chairman | | Bruce R. Cluney

Secretary |

A copy of this Circular and the Annual Report containing the financial statements of the Corporation and Management's Discussion and Analysis of Results of Operations and Financial Condition, will be sent to any person upon request in writing addressed to the Secretary at the Corporation's principal executive offices set out in this Circular. Such copies will be sent to any shareholder without charge.

SCHEDULE "A"

AUDIT COMMITTEE CHARTER/MANDATE

Purpose |